Skatteudvalget 2023-24

SAU Alm.del Bilag 54

Offentligt

VAT in digital age – deemed supplier

regime

eu travel tech

13 November 2023

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

eu travel tech, the voice

of the industry

FULL MEMBERS

ASSOCIATE MEMBERS

STRATEGIC PARTNER

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

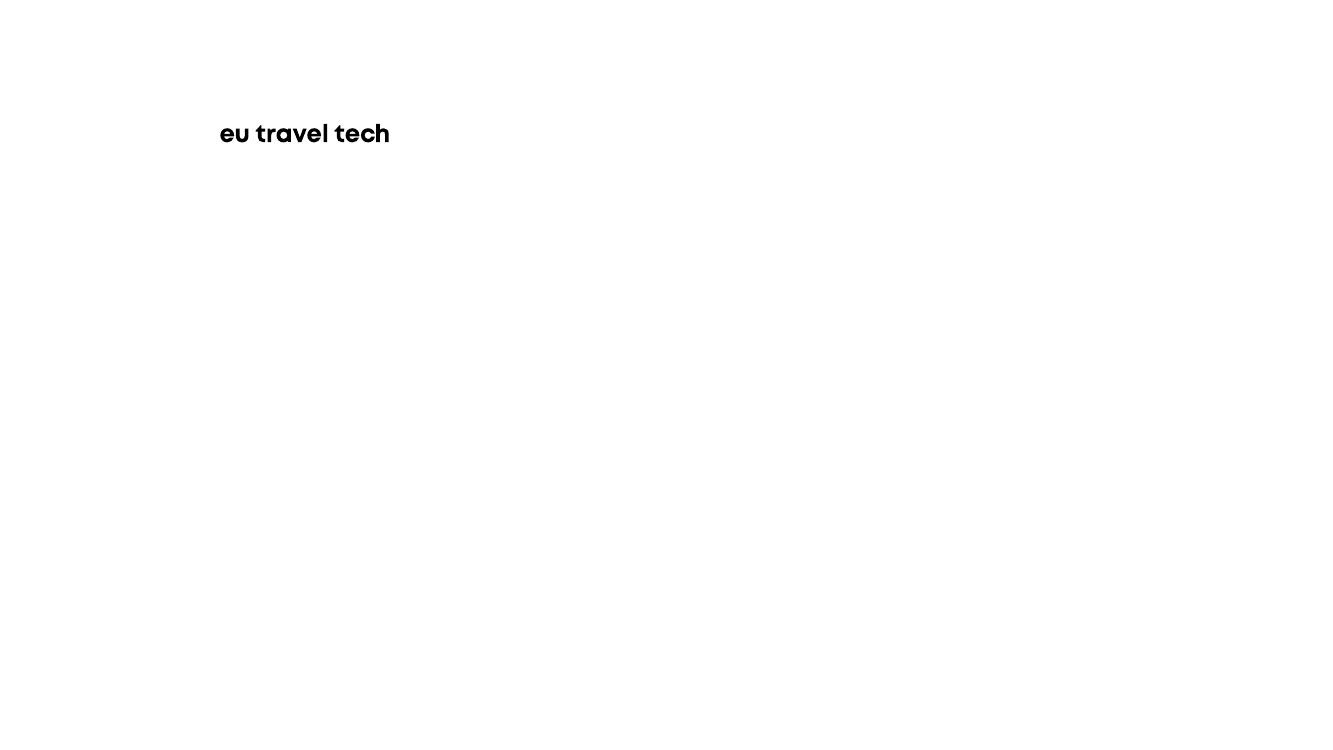

ViDA Study – Flawed and Incomplete

The study associated with ViDA is incomplete and not based on full and accurate data.

It even contradicts other analyses by the Commission. An example:

800

700

600

500

400

300

200

100

0

Sources:

1.

2.

VAT in the digital age, Final Report - The VAT treatment of the digital

economy, Figure 7, p. 38

STR Regulation Impact Assessment SWD(2022) 350 final, p. 168

NUMBER OF ACTIVE STR PLATFORMS IN THE EU

710

Number of active STR platforms in the EU

62

According to ViDA

Study

According to STR

Regulation Study

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

STRs are not Hotels

A fundamental assumption in the ViDA proposals is that short-term accommodation rentals are similar to hotels and even

operate in the market. According to consumer survey data, this is false:

83% agreed that

73% agreed that

72%* agreed that

“I would not have

picked a vacation

rental if it was

available in the same

location”

63%* agreed that

60% agreed that

“I already know what

type of

accommodation I’m

looking for before I

start searching

accommodation to

book”

“Hotels and

vacation

properties offer

guests different

types of

experiences”

“

Hotels and vacation

rentals are not

interchangeable –

each is better suited

for different trips”

“I would not have

picked a hotel if it

was available in

the same

location”

*of respondents who

stayed at a hotel for

their most recent trip

*of respondents who

stayed at a vacation rental for the most

recent trip

Source:

Survey was conducted by a 3rd party in October 2023; 2,000 respondents >18 yo, who reside in the EU and have travelled (and booked their own paid for accommodation) within the EU in the last 12months; respondents were asked about their general views of travel and specifically

about their most recent trip accommodation; 96% of the respondents travelled for Leisure/ holidays and stayed in hotels (56%)/ vacation rentals (whole property) (20%)/ B&B (9%)/ aparthotels (11%)

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

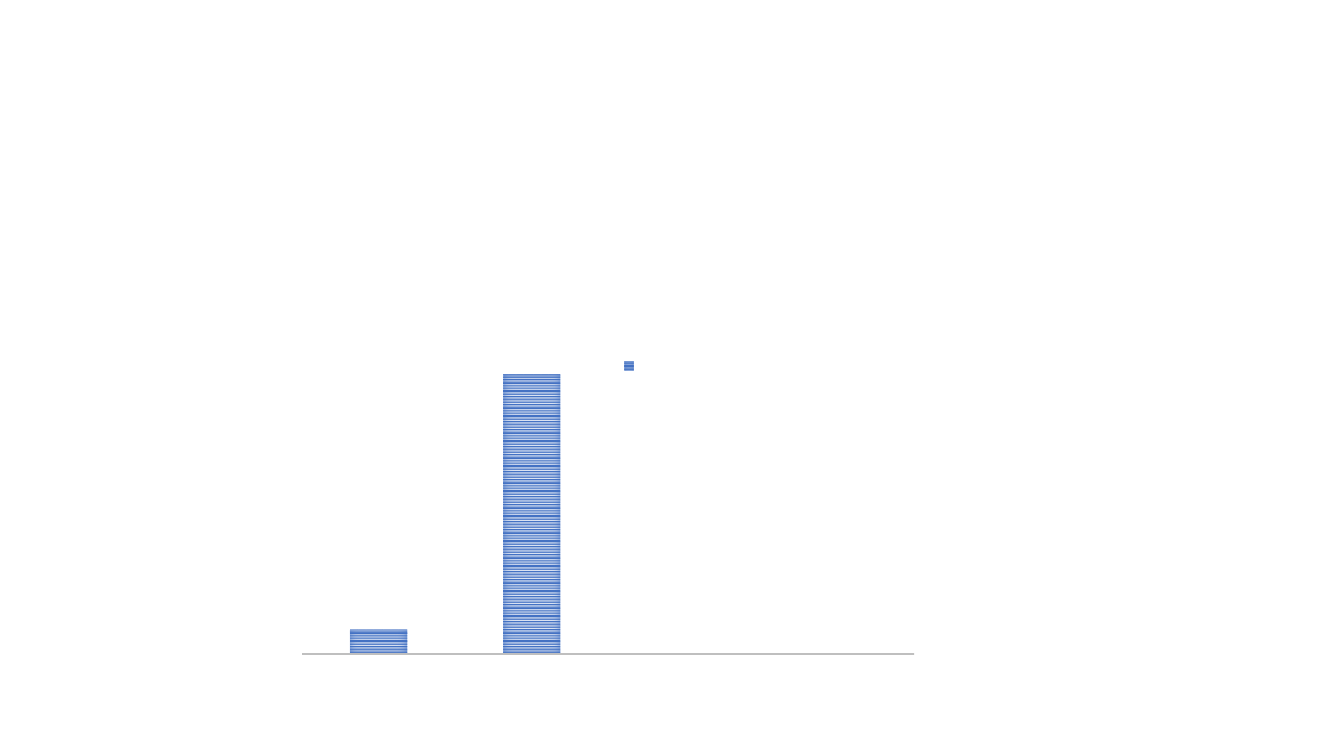

VAT neutrality principle ignored

Status quo – VAT registered providers

Deemed supplier regime

Collects and remits

VAT from invoice

paid by STR provider

STR provider

Collects and remits VAT

from guest. Receives

refund on VAT paid to

supplier

Pays for STR

service,

including VAT

Guest

Collects and remits

VAT from paid by STR

provider

Supplier

Status quo – VAT exempt providers

STR provider

VAT is collected and

remitted by platform.

VAT deduction is not

possible

Pays for STR

service,

including VAT

Guest

Supplier

Collects and remits

VAT from invoice

paid by STR provider

STR provider

Neither remits

nor deducts

VAT

Pays for STR

service,

excluding VAT

Guest

Supplier

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

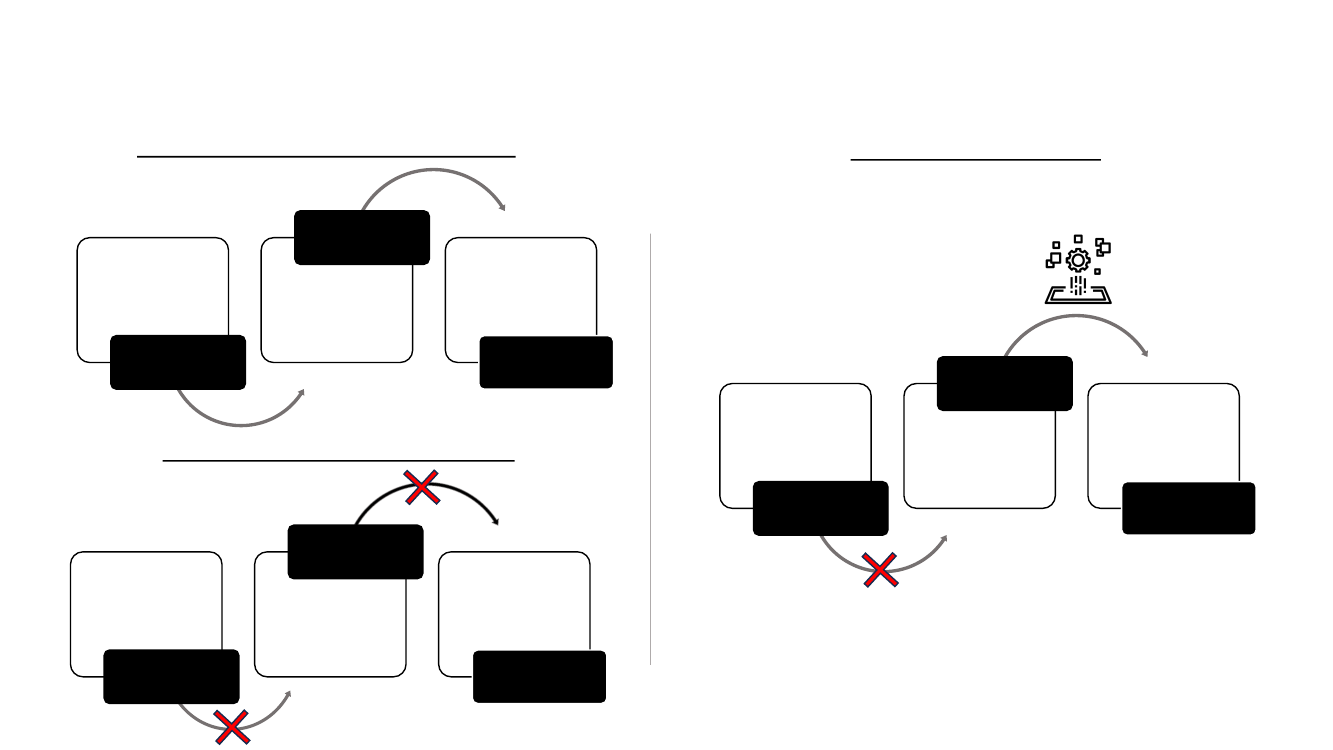

Small providers caught between rock and hard place

Provider accepts

increased

consumer prices

Offer is no longer

competitive

against VAT

registered

providers

VAT-exempt

provider offers

STR via

platform

DSR obligates

platform to add

VAT to price (7%-

21%)

!

Additional VAT

cannot be

compensated or

recovered

Provider lowers

prices to remain

competitive

Provider’s

margin is

significantly

reduced or

eliminated

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

Consequences for national tax authorities

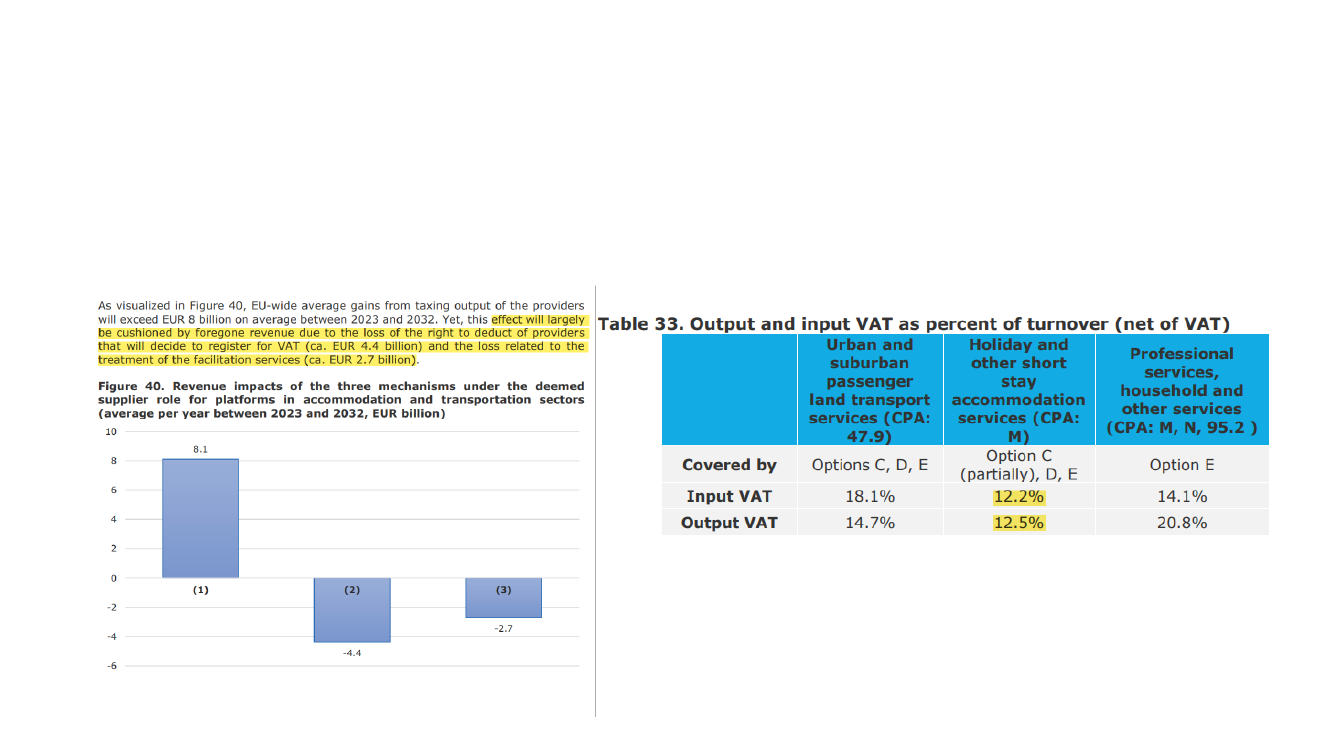

The ViDA study concedes that the deemed supplier regime would only lead to 0.3% additional VAT revenue, but would confront

national tax authorities with potentially (hundreds of) thousands homeowners who will VAT register and begin deducting VAT

Source: VAT in the digital age, Final Report - The VAT treatment of the digital economy, Table 33, p. 146

Source: VAT in the digital age, Final Report - The VAT treatment of the digital economy, Figure 40, p. 138

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

Channel neutrality harmed

Lack of Channel Neutrality under the Deemed Supplier Regime

Assuming a 100 DKK / night vacation rental in Denmark (25% VAT) advertised via different channels

Vacation rental distributed via

Offline (phone, office, repeat customer)

Very small online platform (VAT exempt)

Online platform

Meta-search platform or social media

Price/Night for guest

100 DKK / night

100 DKK / night

125 DKK / night

100 DKK / night

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

ViDA Deemed Supplier Regime - Conclusion

In its proposed form, the deemed supplier regime:

Harms small and private providers seeking to supplement their income

Raises prices across the tourism sector

Unfairly disadvantages services sold through platforms

Is incompatible with basic principle of VAT neutrality

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

Advocating jointly for a reconsideration of the deemed

supplier regime

SAU, Alm.del - 2023-24 - Bilag 54: Baggrundsmateriale til Skatteudvalgets udvalgsrejse til Bruxelles den 12. og 13. november 2023

Thank you!

Emmanuel Mounier

SECRETARY GENERAL

Avenue Marnix 17

B – 1000 Brussels

www.eutraveltech.eu

@eutraveltech

M +32 499 80 13 74

T +32 2 669 42 53

emounier@eutraveltech.eu