UKS Side 4463

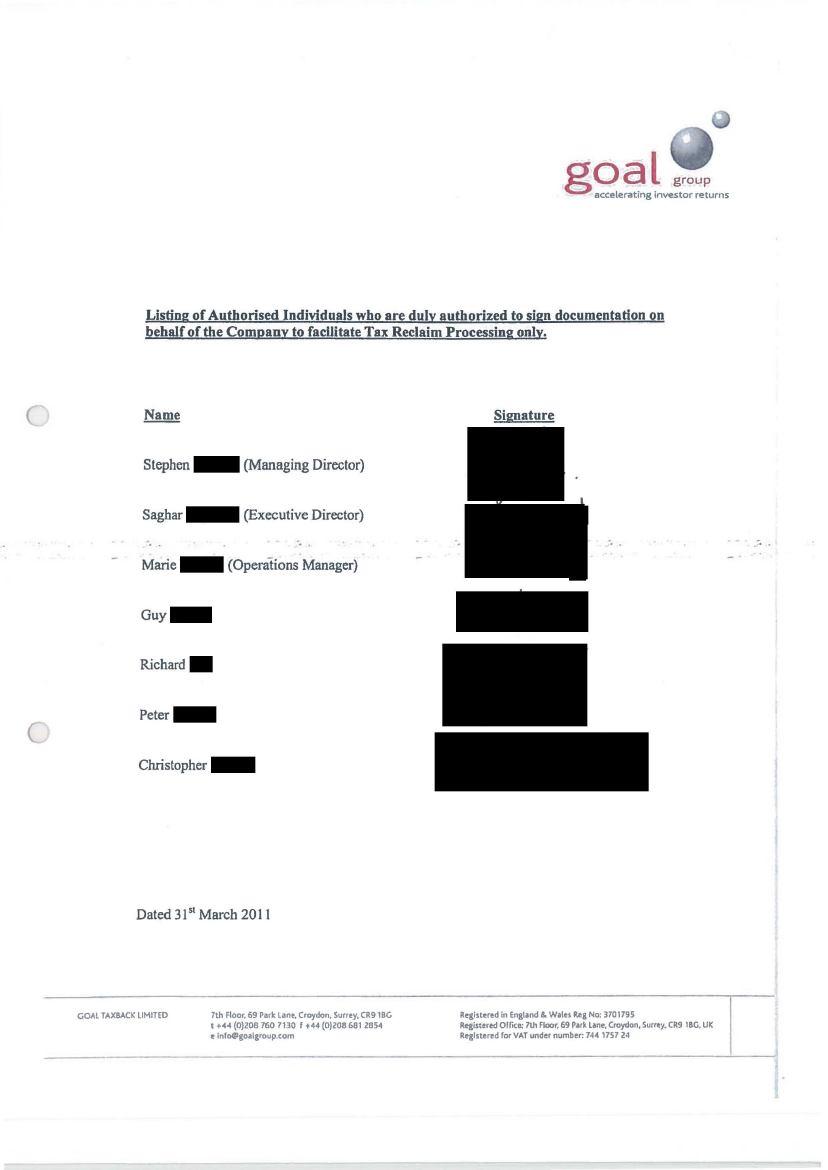

Listing of Authorised lndividuals who are duly authorized to sign documentadon

on

behalf of the Company to facilitate Tax Reclaim Processing only.

Signature

Stephen

Saghar

Marie

Guy

(Managing Director)

(Executive Director)

{Operations Manager)

KS

R•gistered in Engl1nd & W1los

~g

No:

3701795

~istared Olficø: 7lh Floor, 69 P..-k Lane, Croydon, Surrey. CR9 18G. UK

R•glsterod for VAT und•r number: 744 1757 24

.:.

Richard

Peter

Christopher

Dated 31

st

March 2011

GOAL TAXBACK LIMITED

U

7th Floor, 69 Park Lano, Croydon, Surr•y, CR91BG

I

+44

(0)208 760 7130 f +44 (0)208 681 2854