SUB-SOVEREIGN

CREDIT OPINION

5 August 2021

Government of Faroe Islands (Denmark)

Update to credit analysis

Summary

The credit profile of the

Government of Faroe Islands

(Faroe Islands, Aa2 stable) reflects the

fiscal autonomy, resulting in a high level of financial flexibility, combined with a track record

of prudent budgeting. The credit profile also takes into account the government's very large

liquidity buffer, which mitigates any refinancing risk. Following significant financial surpluses

over the last four years, a financing deficit was posted in 2020, which should continue in

2021 due to the economic impact from the pandemic. Debt metrics have deteriorated in

2020 but we expect these will return to a declining trend over the next two years. We also

take into account a strong likelihood that the

Government of Denmark

(Aaa stable) will

provide support if the Faroe Islands were to face acute liquidity stress.

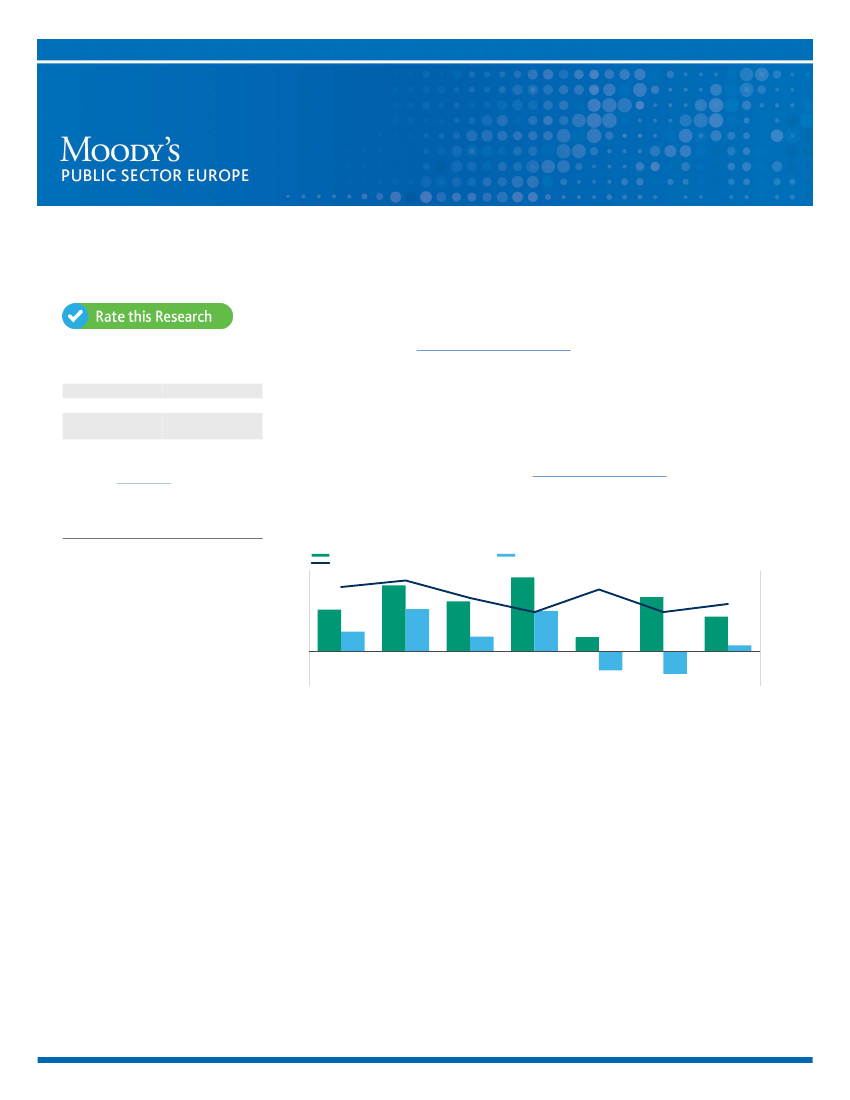

Exhibit 1

RATINGS

Faroe Islands, Government of

Domicile

Long Term Rating

Type

Outlook

Denmark

Aa2

LT Issuer Rating - Fgn

Curr

Stable

Please see the

ratings section

at the end of this report

for more information. The ratings and outlook shown

reflect information as of the publication date.

The impact of the coronavirus pandemic led to an increase in debt

Contacts

14%

Gross operating balance/Operating revenue (%) (LHS)

Net Direct and Indirect Debt/Operating revenue (%) (RHS)

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

2016

2017

2018

2019

2020

2021B

2022 E

Cash financing surplus (Requirement)/Total revenue (%) (LHS)

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Gjorgji Josifov

+420.23.474.7531

AVP-Analyst

Sam McDonald

+44.20.7772.1401

Associate Analyst

Massimo Visconti,

+39.02.9148.1124

MBA

VP-Sr Credit Officer/Manager

CLIENT SERVICES

Americas

Asia Pacific

Japan

EMEA

1-212-553-1653

852-3551-3077

81-3-5408-4100

44-20-7772-5454

B - budget; E - Moody's estimate

Source: Issuer, Moody's Investors Service

Credit strengths

»

»

»

Fiscal autonomy and stable relationship with the Government of Denmark

Structurally sound balance and large liquidity buffer

Debt metrics deteriorated during the pandemic, but will recover in 2021-22

Credit challenges

»

»

Faroese economy is narrow and relatively exposed to the fishing industry

High investment requirements stemming from the growing population