Finanstilsynet

HVID

J.nr.

/ERO

Public Consultation questionnaire [Denmark]

Ensuring effective implementation of the exist-

ing rules

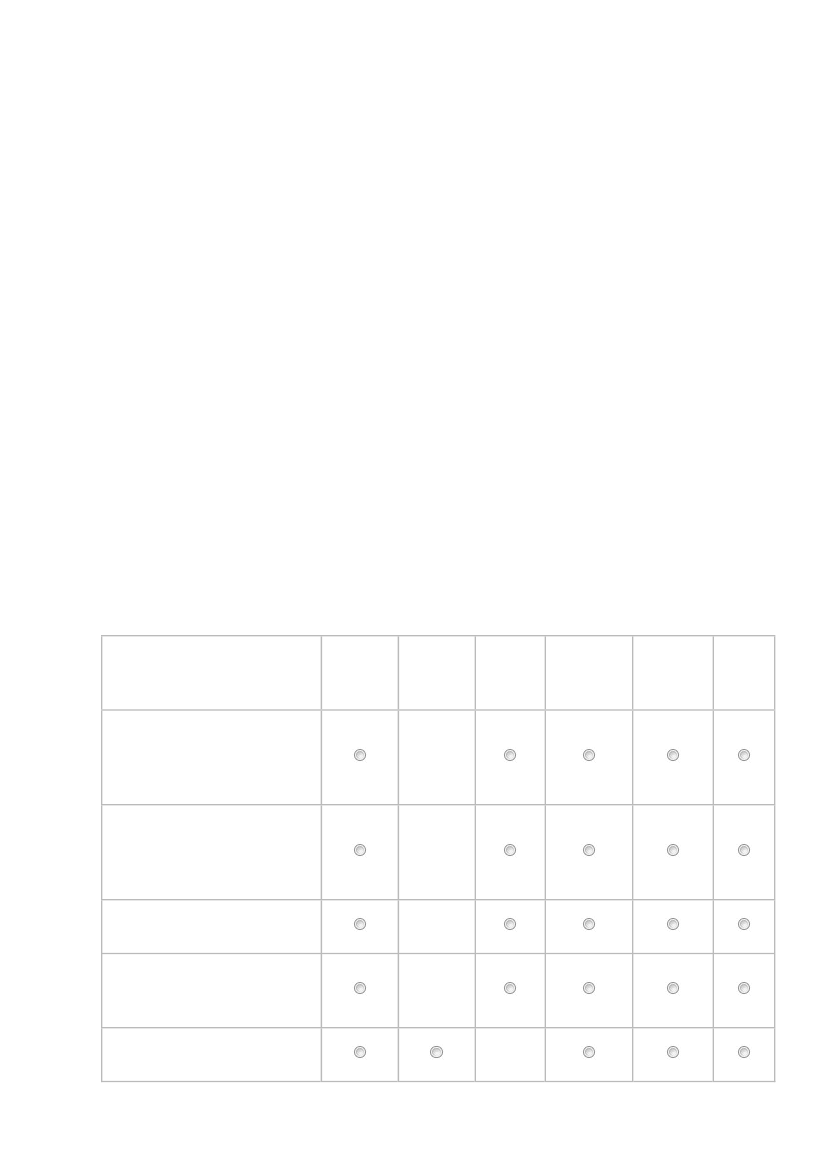

How effective are the following existing EU tools to ensure application and enforce-

ment of anti-money laundering / countering the financing of terrorism rules?

Very

ef-

Rather

fective

Infringement proceedings for

failure to transpose EU law or

incomplete/incorrect transposi-

tion

Country-specific recom-

mendations in the con-

text of the European

Semester

effective

Neutral

Rather in-

effective

Not ef-

fective

at all

Don't

know

X

X

Action following complaint by

the public

Breach of Union law investiga-

tions by the European Banking

Authority

New powers granted to the

European Banking Authority

x

x

X

1