SUB-SOVEREIGN

CREDIT OPINION

28 February 2019

Government of Faroe Islands

Update to credit analysis

Summary

The credit profile of the

Government of Faroe Islands (Aa3, stable)

reflects its fiscal

autonomy resulting in a high level of revenue and expense flexibility combined with a track

record of prudent budgeting. The stable and historical relationship with the

Government of

Denmark (Aaa, stable),

with joint matters clearly defined under the 1948 Home Rule Act,

is also credit positive. While the Faroese economy has a high dependence on the fishing

industry, this is somewhat offset by regular fish stock control and a push to diversify the

country's trade partners. The rating also takes into account the government's very strong

liquidity buffer, which mitigates refinancing risk. Debt metrics are on a moderate level but

declining.

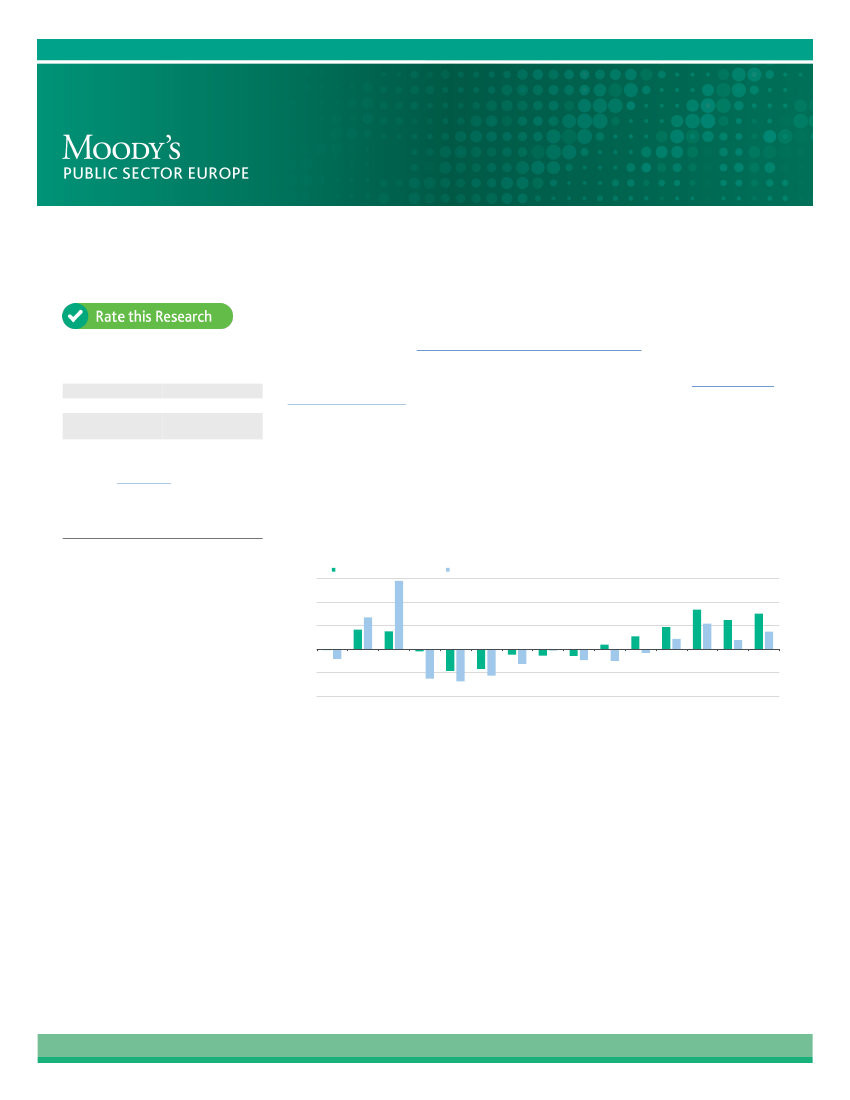

Exhibit 1

RATINGS

Faroe Islands, Government of

Domicile

Long Term Rating

Type

Outlook

Denmark

Aa3

LT Issuer Rating - Fgn

Curr

Stable

Please see the

ratings section

at the end of this report

for more information. The ratings and outlook shown

reflect information as of the publication date.

Financial surplus to be reported

Contacts

Harald Sperlein

+49.69.7073.0906

VP-Senior Analyst

Joe Griffin

+44.207.772.1098

Associate Analyst

Sebastien Hay

+34.91.768.8222

Senior Vice President/Manager

CLIENT SERVICES

Americas

Asia Pacific

Japan

EMEA

1-212-553-1653

852-3551-3077

81-3-5408-4100

44-20-7772-5454

Gross operating balance and financing result (in DKK million)

Gross operating balance (in DKK mn.)

1500

Financing result (surplus or deficit) (in DKK mn.)

1000

500

0

-500

-1000

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018p

2019b

Note: 2018 is preliminary data (Moody's adjusted); 2019 shows budget data

Source: Gjaldstovan; Moody's Investors Service,

Credit strengths

»

»

»

Fiscal autonomy and flexibility allow for reform implementation

Stable relationship with the Kingdom of Denmark

Financing surpluses and large liquidity buffer

Credit challenges

»

»

»

Faroese economy's dependence on fishing and fish farming sector

Moderate debt levels and some off-balance liabilities

Some refinancing risk due to debt structure