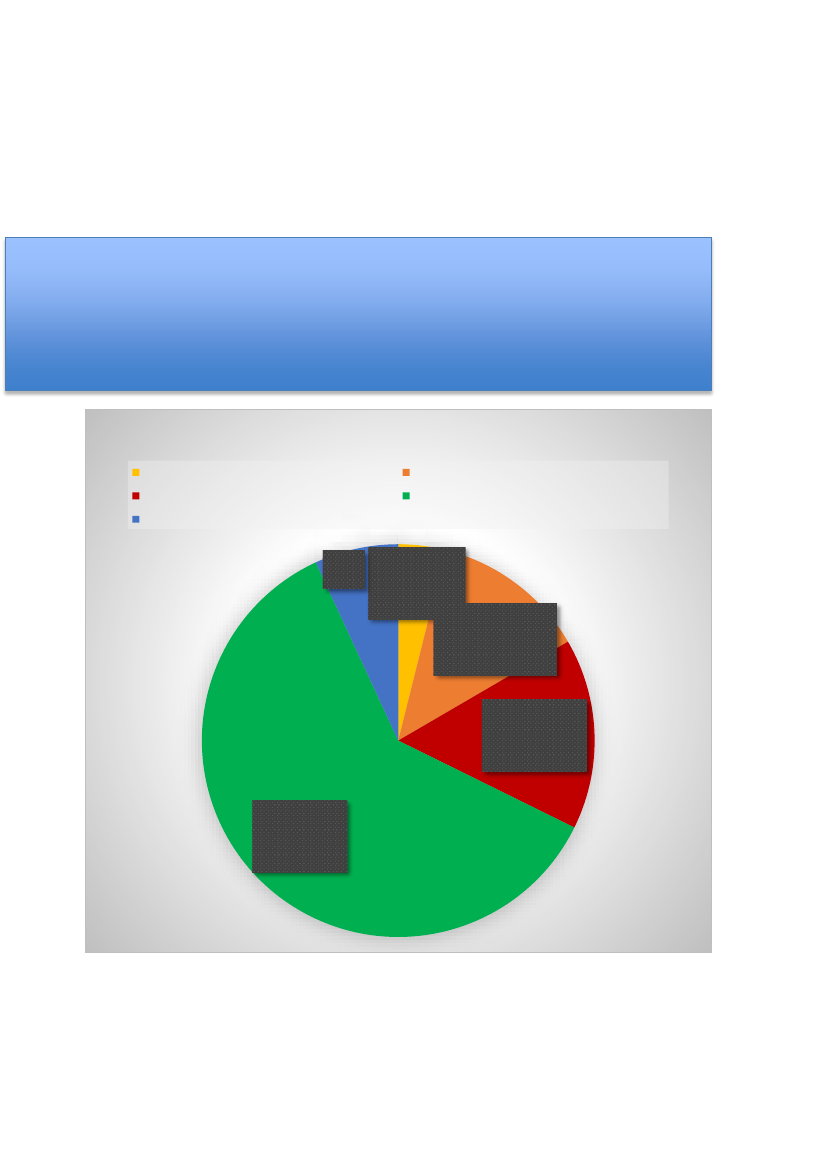

To Combat Borderline Tobacco Products:

60.8% of Health and Tobacco Policy Experts

support the Additional Prevention Tax (APT)

Q8: Which option would you choose? (%)

Maintaining EU Directive 2011/64/EU

Adopting the RAMBOLL report conclusions

Other

Updating the tobacco product category definitions

Adopting an Additonal Prevention Tax

Other Maintaining EU

Directive

7%

2011/64/EU

4%

Updating the

tobacco product

category definitions

12%

Adopting the

RAMBOLL report

conclusions

16%

Adopting an

Additonal

Prevention Tax

61%

Figure 1: Question 8 of Elite Opinion Poll among 102 top experts on Health and Tobacco Policy, p. 8.

Brussels, June 2017

0