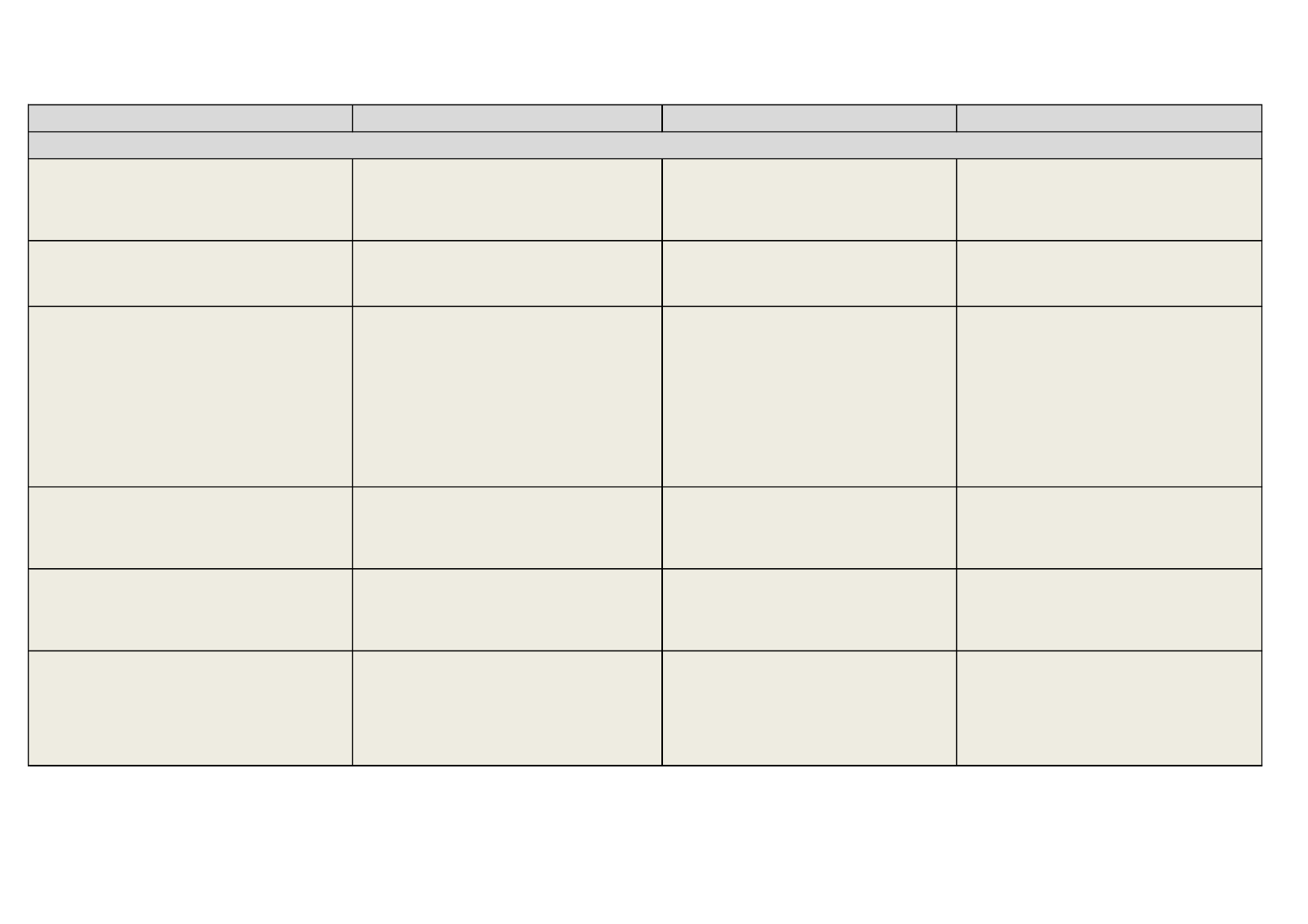

Danish simplification proposals regarding the CAP

Policy matter/subject/issue

Weighting

factor for catch crops and short rotation coppice

Description of the issue/Justification/Reasoning

In order to reduce and simplify the complex EFA

requirements for farmers the mandatory weighting factors

should be the same. Similar types of EFA (nitrogen-fixing

crops, catch crops and short rotation coppice) should have

the same value.

Farmers risk getting their green payment reduced as there is

a large risk that one of the two crops may outperform the

other. Also, it is difficult to control which again increases the

risk to the farmer.

Today, each greening requirement must be controlled at a

minimum rate of 5 %, which makes it impossible to carry out

only one control visit to a farmer and also increases the risk

for the timely payment for the farmer. It should be made

possible to perform the on- the-spot checks of all greening

requirements during the same inspection. Inspections

should be made similar to the inspections of cross

compliance, where everything that can possibly be

controlled at the time of inspection, is controlled.

Proposed solution

The mandatory weighting factors for catch crops and

short rotation coppice should be the same as for the

nitrogen-fixing crops.

Timing of solution (short, medium og long term)

Short term

- concerns delecated act (EU) 639/2014, Annex II)

Direct Payments, together with the corresponding elements in the Horizontal regulation

Abolish the requirement that EFA-catch crops must be

established as a mixture

Abolish requirement for establishing EFA-catch crops as a short term

mixture of crop spices.

- concerns delegated act (EU) 639/2014, Art. 45 (9)

Only one control visit for basic payment and greening

It should be possible to undertake similar inspections

short term

such as for cross compliance at the same time . Where

- concerns implementing act (EU) 809/2014, Art. 31

everything that can possibly be controlled at the time of

inspection is controlled.

Reduction of the control rate for greening

It should be possible for Member states as regards greening Member States discretion

to reduce the minimum level of on-the-spot checks carried

out each year to 3 %. There should be only one control rate

for the basic payment scheme and greening.

It is an administrative burden and superfluously to demand

that the EFA-layer should contain all potential types of EFAs

chosen by the Member State including non stable elements

like fallow land expected to remain for at least 3 years.

Delete this rule in the commissions guidance document

on the establishment of the EFA-layer referred to in

article 70 (2) of regulation (EU) 1306/2013

(DSCG/2014/31 Rev2-FINAL)

short term

- concerns implementing act (EU) No 809/2014, art. 36

EFA-layer with non stable elements

short term

- concerns the Commissions guidance document

DSCG/2014/31 Rev2-FINAL

Payment for young farmers

Payment for young farmers should also be granted to legal Clarify or delete the requirement regarding access to a

persons. However, the inclusion of legal persons as eligible legal person to the payment for young farmers.

young farmers sinificantly increases the complexity of the

scheme. The rules in the regulations are not designed to

legal persons which create ambiguities in the administration

of the payment.

medium term, concerns delegated act (EU) No 649/2014.

Art. 49