Erhvervs-, Vækst- og Eksportudvalget 2013-14

ERU Alm.del

Offentligt

ERHVERVS- OGVÆKSTMINISTEREN

11. marts 2014

Besvarelse af spørgsmål 124 alm. del stillet af Erhvervs-, Vækst- og

Eksportudvalget den 10. februar 2014 efter ønske fra Kim Andersen

(V) og Preben Bang Henriksen (V).

Spørgsmål:

Ministeren anmodes om at oversende den omtalte følsomhedsanalyse, derer tilgået køberne.Svar:

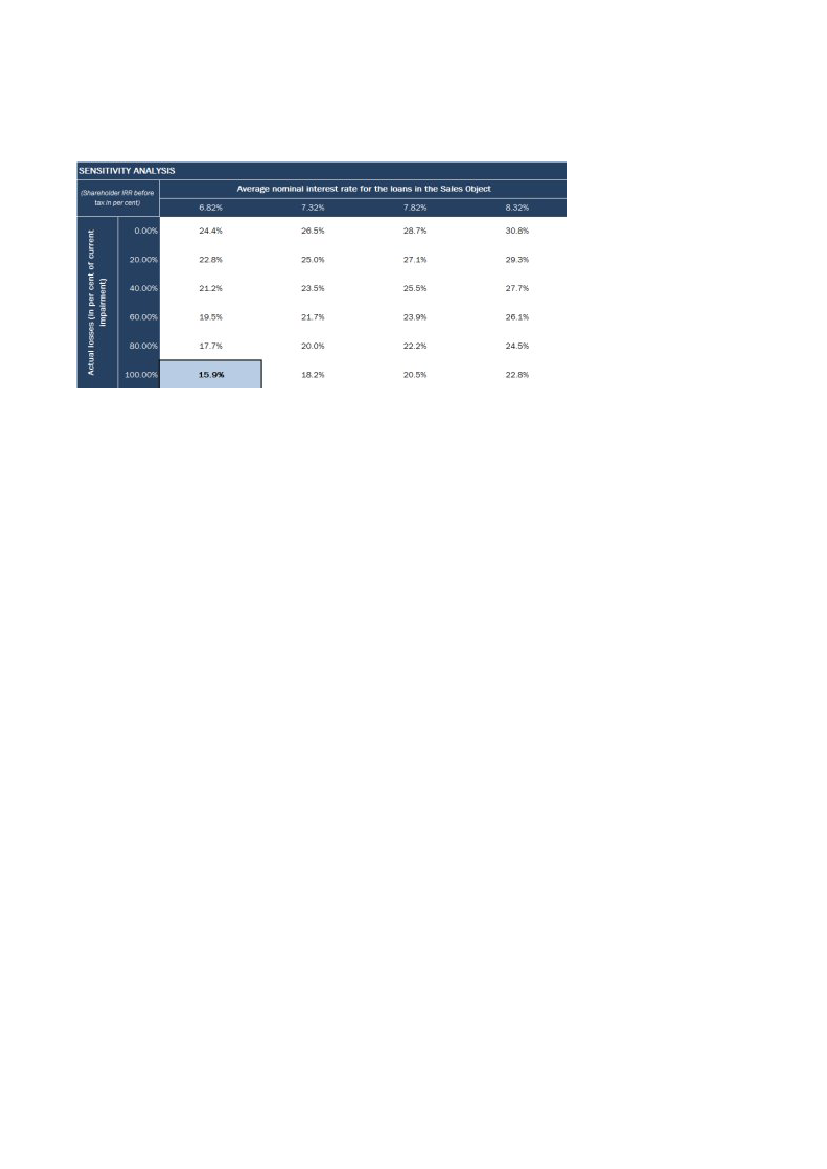

Følsomhedsanalysen, som viser effekten af en rentestigning på investor-afkastet under nogle nærmere angivne forudsætninger, fremgår nedenfor.Det er blevet fremført, at det materiale, som er blevet udarbejdet i forholdtil følsomhedsanalysen, kunne opfattes som en opfordring til at hæve ren-ten. Finansiel Stabilitet A/S har over for mig oplyst, at det ikke er usæd-vanligt at præsentere sådanne analyser i et salgsmateriale til professionel-le forhandlingspartere, og at det ikke er udtryk for en opfordring til atgennemføre en rentestigning.For yderligere at sikre mod eventuelle misopfattelser i forbindelse medfremtidige salg har Finansiel Stabilitet A/S tilkendegivet, at selskabet vedfremtidige udbud vil ændre analysen, så effekten vises for både lavere oghøjere renter.“SENSITIVITY ANALYSISTable 17 shows the effect on the illustrative investor IRR (before tax) from changesin the average rate of interest paid by the customers in the Sales Object as well aschanges in actual losses relative to current impairment charges recognised for theSales Object. The actual loss percentage applied in table 17 below shows how muchof the current impairment charges are assumed to become actual losses. All as-sumptions used to prepare table 17 are the same as those outlined on page 15.Only the average nominal interest rate and the actual loss percentage have beenchanged in the sensitivity analysis.Table 17. Sensitivity analysis – changes in average nominal rate of interest andannual loss ratioERHVERVS- OGVÆKSTMINISTERIET

Slotsholmsgade 10-121216 København K

Tlf.Fax

33 92 33 5033 12 37 78

2/2

As can be seen from table 17, even a relatively low increase in the average nominalinterest rate will have a significant positive effect on the calculated IRR. Neverthe-less any price change should be based on a sound credit evaluation including thecustomer’s ability to honour a different / higher rate of interest in light of the dura-tion of the loan. As previously stated the buyer will be obligated to adhere to theExecutive Order on Good Business Practice for Financial Undertakings, investmentassociations etc.But the buyer’s ability to avoid current impairment charges (DKK 86 million) frombecoming actual losses will have an even more significant effect on the IRR. Table17 illustrates as an example that if the average nominal interest rate is increased by1.0 percentage point to 7.82% and if only 60% of the current impairment chargesbecome actual losses, the illustrative IRR before tax will increase from 15.9% to23.9%.”