Udenrigsudvalget 2013-14, Finansudvalget 2013-14, Klima-, Energi- og Bygningsudvalget 2013-14

URU Alm.del Bilag 42, FIU Alm.del Bilag 26, KEB Alm.del Bilag 74

Offentligt

OppdragsbeskrivelsenGGGI oppdraget inneholder følgende delprosjekter og avtalte kontrollhandlinger:

Delprosjekt 1:

Seoul/Sør Korea

Hovedprodukt vil være en rapport på engelsk som evaluerer GGGIs system for økonomiforvaltning, herunderforbedringer på områder hvor det tidligere er påvist svakheterRapporteringsfrist 30. November 2013

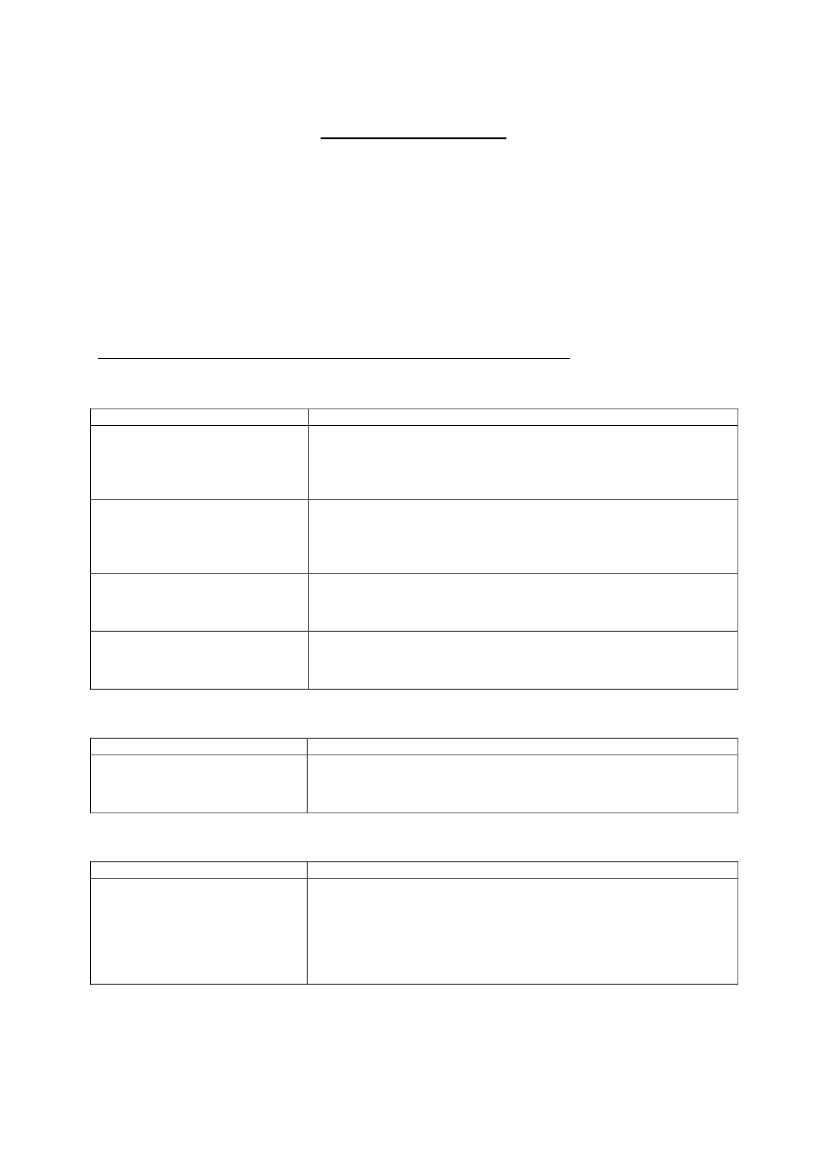

Agreed-upon procedure on the review of follow-up measures by GGGI over BAI’s audit findingsWork plan for the review of follow-up measures by GGGI over BAI’s audit findings.1)GGGI compensationregulationsWork planConfirm renewal of staff regulations has been appropriately approved at the CouncilReview that revised staff regulations are adequately implemented byusing sampling techniqueeducationConfirm renewal of staff regulations has been appropriately approved at the CouncilReview that revised staff regulations are adequately implemented byusing sampling techniqueInquire of any instances of paymentReview the G/L related to transportation, meeting and etc. for any exceptionReview the status of development of the secondment policyConfirm the new policy (if developed) has been reviewed and approved, any exception is managed according to the policy

Area of audit findingsHousing allowance

Subsidy forexpenses and

child

Allowancemeeting

for

participation

of

Secondee allowances

2)

Corporatevehicle management regulationsWork planConfirm that the related regulation is setup and approvedReview that vehicle usage log is maintained appropriately

Area of audit findingsInappropriate dispatch (or use) ofvehicle

3)

CorporatecreditcardregulationWork plancorporateConfirm that the corporate credit card guidelines are setup and approvedObtain the corporate card usage status and review the usage has been adequately accounted for and be reconciled against the budget on asample basis

Area of audit findingsInappropriate use ofcredit card

Side 1 av 4

4)

GGGI procurementregulationWork planofConfirm procurement regulations & guidelines have been appropriately reviewed and approved at the CouncilReview the status of hire of procurement officerConfirm the standard contract form is used on a sample basis, for any exception, confirm that legal department reviewed and approved the exceptionReview the procurement officer’s monitoring activities and the trackrecords of such activitiesReview how M&E system works in GGGI

Area of audit findingsInappropriatemanagementprocurement.

5)

Business management methodWork planofInquire the current process of project managementReview the PMU organization and its control activitiesReview the appropriateness of COP review by taking samplesReview the CRC’s activities and the track records of such activitiesReview how M&E system works in GGGI

Area of audit findingsInappropriatemanagementprojects.

6)

Reinforcementofinternalcontrol systemWork plancontrolReview the hire process of internal auditorReview the works and organization (the job description, recent activities and any internal audit reports) of internal auditorInquire the current stage of various policies development and its adoption in ERP (high level inquiries)

Area of audit findingsInappropriateinternalsystem

Side 2 av 4

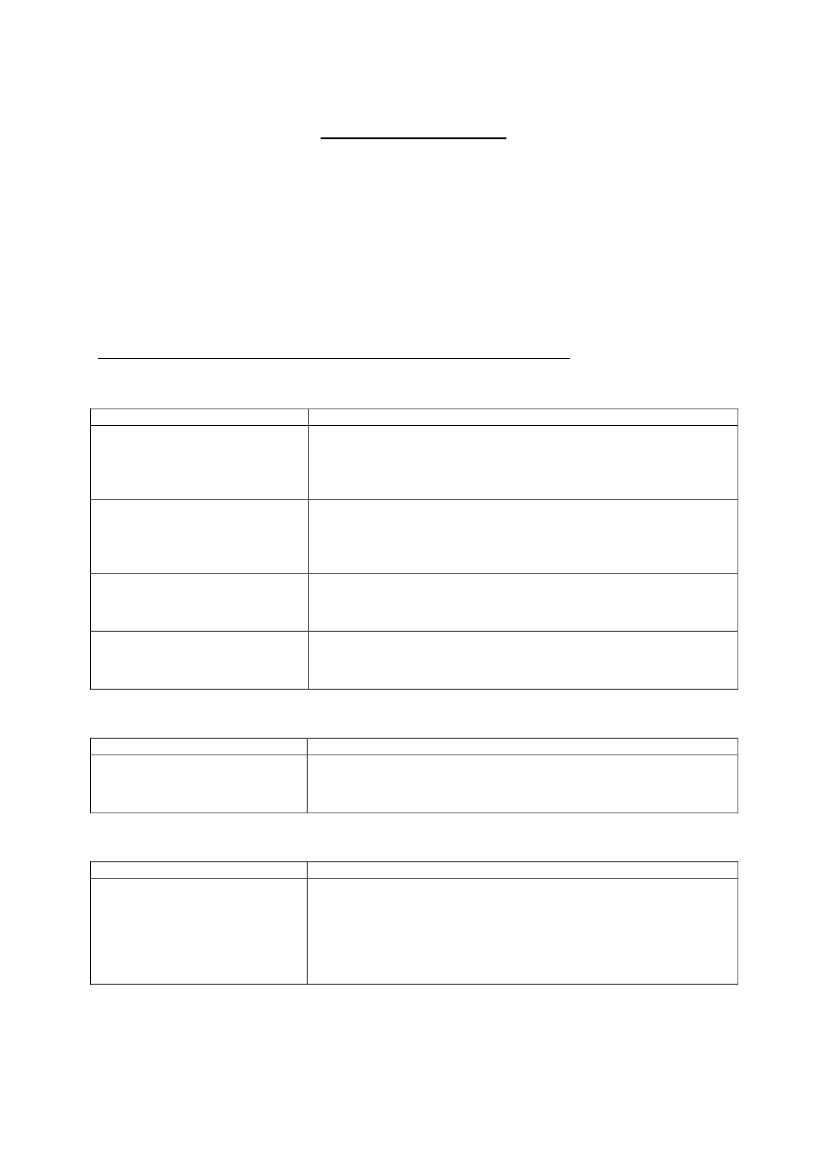

Delprosjekt 2 Etiopia og delprosjekt 3) IndonesiaHovedprodukt vil være en rapport på engelsk som omfatter:1) Funn mht prosjekt revisjon av GGGI regnskapsrapport/financial statement for gjeldende prosjektet2) vurdering av eksisterende system og rutiner i bruk for forvaltningen av ambassadens bidrag tilprosjektet og forslag til evt sikringstiltak inntil GGGIs nye generelle finansforvaltningssystem er påplass.

Rapporteringsfrist 22. Desember 2013A.Budgeted versus actual amounts and activities

1.Obtain the following documentation/reportsa)Agreement between the Norwegian MFA and GGGIb)half year accounts/financial statements,c)approved budget andd)budget versus actual analysis for the period in scopeReconcile amounts included in the budget versus actual analysis to half year accounts/financial statementsand approved budgets for the period in scope.Conduct a variance analysis of budgeted versus actual amounts/utilization anda)Determine the causes of the significant variances by conducting interview with relevant person anddocumentation reviewb)Determine whether all budgeted activities have been performed based on interview with relevantproject/program manager and budget versus actual assessmentc)Determine the causes of why budgeted activities have not been performed based on interview withrelevant person and validate by conducting applicable follow-up proceduresAssess the adequacy of the internal control procedures regarding:a)Budget management including: communication, approvals, documentation, monitoring andreporting including reporting of weaknesses and recommended improvement pointsb)Procurement including: appropriateness of supplier choice, procurements are project related,approvals, documentation etc.c)Cash management including: bank accounts in use for funded project, authorized persons,reconciliations and reviews performed, approval procedures, cash handling etc.d)Other relevant internal controls

2.

3.

4.

B.Adequacy of accounting function and internal control systems

1.2.3.4.5.6.Obtain an organizational chart of GGGI including a detailed overview of the accounting/financeorganizationAssess the adequacy of segregation of duties within the accounting/finance functionAssess whether the accounting/finance function includes adequate competence to perform required tasks.Identify the accounting systems determine whether these systems are commonly used accounting systemsthat are considered to be more than able to perform the accounting tasks required.Obtain half year accounts/financial statements, trial balance, general ledger and main sub-ledgersReconcile the half year accounts/financial statements, trial balance, general ledger and main sub-ledgers todetermine internal consistency.

C.Overview of income received

1.2.3.4.Request list of bank accounts used for the for the donor funded project.Obtain bank account statements for the bank accounts used for the project.Scan bank account statements to determine and report whether the project funded by the MFA has its ownseparate program bank account or if the accounts are used for multiple projects/purposesScan income/revenue account details and identify and list all donors related to the donor funded project.

Side 3 av 4

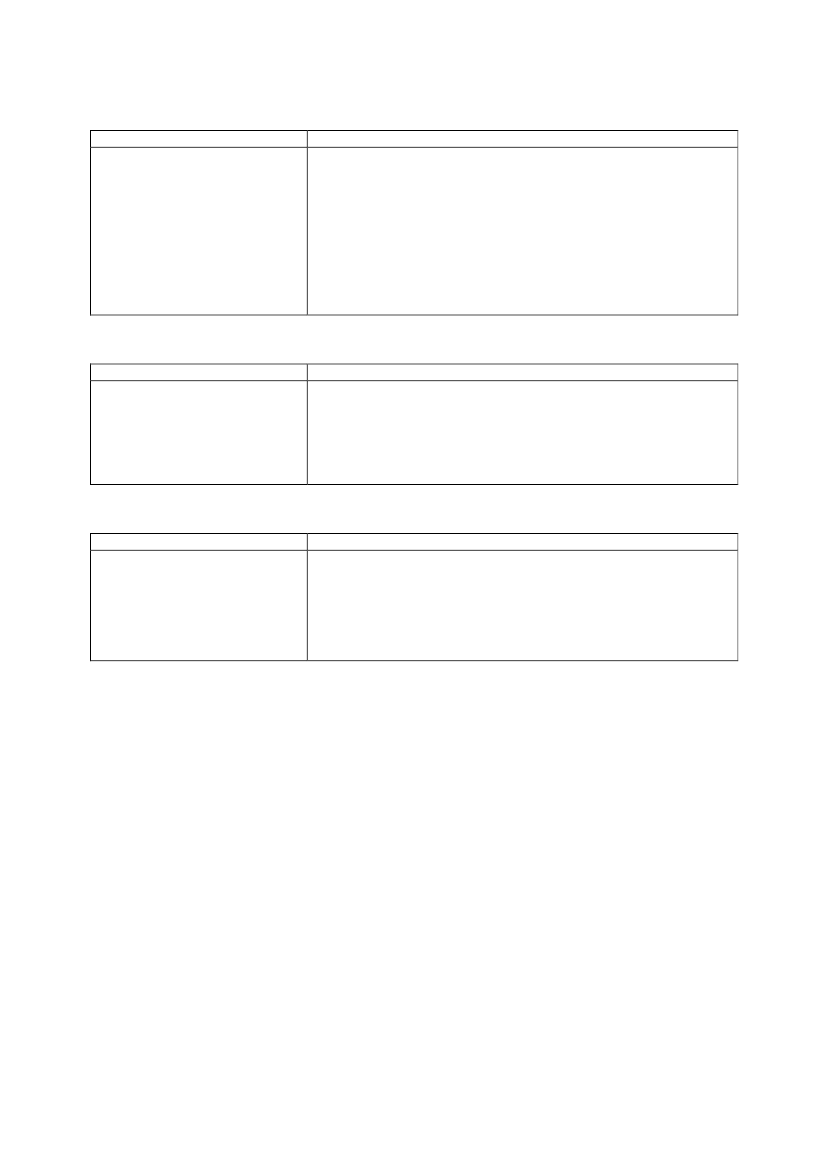

D.Review of expensesand balance sheet accounts

1.2.Based on professional judgment, select relevant expense and balance sheet accounts for detail testingPerform an analysis of relevant expenses and balance sheet items through reconciliation with relevantsupporting documents (invoices, receipts, bank statements, observationetc)

Side 4 av 4