Udenrigsudvalget 2013-14

URU Alm.del Bilag 41

Offentligt

Travel Expense Policy

April 9, 2012

TABLE OF CONTENTS

1. Overview……………………………………………………………………………..……..32. Definition………………………………………………………………………..…….…43. Mission Travel Request………………………………………………………..…….….44. Mission Travel Report……………………………………………………………….….45. Calculation of Travel Expenditure………………………………………………….….46. Accommodation Expenses……………………………………………………………....57. Terminal Allowances………………………………………………………………….…58. International Mission Trip………………………………………………………………59. Daily Subsistence Allowances…………………………………………………….…..…710. Domestic Mission Trip……………………………………………………………..…....711. Limitation of Travel Expenditures………………………………………………..….…812. Payment and Reimbursement of Travel Expenditures…………………………....….813. Travel Expenditures of Non-GGGI Personnel…………………………………..……814. Travel Expenditures for Employees on Leave or Retired………………….….……..915. Miscellaneous Reimbursable Expenses……………………………………….…...9ANNEX I : Travel Per Diem Rates ………………………………………….……………10

This policy shall enter into effect as of APR 9, 2012

1. OVERVIEW1.1 ObjectiveA Mission trip is fundamental to performing the official functions of GGGI and achieving itsmission. However, GGGI shall seek to balance the time of GGGI employees devoted to missiontrips and personal or family circumstances.GGGI’s policy strives for the appropriate balance between the following goals:

Ensure our policies and tools support employees in performing at their best in the office andwhile traveling on business.Mitigate the impact of travel on our employees, and support them in integrating and managingtheir work and personal lives.Ensure that our policies are appropriate relative to the sectors in which we work, includinggrantees, other international Organizations, and nonprofit organizations.

1.2 General GuidelinesWhere indicated, pre-approval of expenses is required. Failure to obtain pre-approval by theappropriate approver may result in expenses not being reimbursed, becoming the personalliability of the employee.

GGGI will reimburse reasonable business-related out-of-pocket expenses incurred byemployees.GGGI will not reimburse expenses extending beyond what is required for businesspurposes.In order to ensure compliance with the local tax regulations, we must ensure thatqualified “business related deductions” such as travel related expenses are “ordinaryand necessary” and directly related to or associated” with the active conduct ofbusiness.This policy is intended to assist in determining reimbursable expenses. For itemsincluding, but not limited to, unusual expenses, interpretation and situations notspecified in this policy, please contact your expense approver prior to incurringexpenses, or such expenses not be reimbursed.Submit expenses on timely basis. Expenses over 60 days old may require detailedexplanation.All outstanding claims for expenses should be submitted as soon as possible, but nolater than four weeks after the employee’s termination date. Claims for expensessubmitted more than four weeks after the employee’s termination date may not bereimbursed.Policy exceptions are subject to final approval by the Chief Administrative Officer.

3

2. Definition2.1Any Employee traveling on duty on behalf of the Organization under a travel order outsidethe duty station to a domestic or international destination shall be entitled to reimbursementof travel expenditures incurred for this purpose (hereinafter referred to as “mission(s)”),unless the expenses actually occurred are reimbursed by a Government or by any otherauthority, or if such expenses can be met by virtue of a right acquired by the appointment.For the purposes of this article, the term “travel expenditures” means “travel expenses, workexpenses, accommodation expenses and meal expenses” for GGGI Employees and non-GGGI Employee defined inRule 11.1in this Article during the period of a mission.All Employees undertaking mission trip shall strictly abide by this policy and conductthemselves in a manner appropriate to their status.

2.2

2.3

3.3.1

Mission Travel RequestMission trip is undertaken only with approval of the relevant Director in charge.Any Employee expected to take a mission shall submit a MissionRequest for approval to theDirector concerned. In exceptional cases, Employees may be authorized to travel on oralorders, but such oral authorization shall require written confirmation. The Employee shall beresponsible for ascertaining that he or she has the proper authorization before commencingtravel.Mission Request shall contain information of the travelling person, location, duration,purpose, itinerary, and calculation of total expenses.

3.2

4. Mission Travel Report4.1(i)(ii)(iii)(iv)The Employee returned from a mission shall submit, within seven (7) calendar days ofcompletion of the journey:a mission report;the counterfoils of the tickets used (e.g. boarding pass) showing that the authorized journeyhas been made;accommodation receipts or equivalent supporting voucher for the proof of stay; andPurchase Approval Forms with receipts where additional reimbursement is necessary as setforth in this Article.

5. Calculation of Travel Expenditures5.1Travel expenditures shall be calculated based on the customary direct route and usual modeof transport, taking into account cost-effectiveness, safety, time and convenience for theEmployee concerned. Travel expenditures may, however, be calculated based on the actualroute, provided that it is difficult to calculate the expenditures based on the customary directroute and usual mode of transport due to various unavoidable factors such as the nature of atask, budgetary circumstances or force of nature.

4

5.2

Travel expenditures shall be deemed to cover all the expenses liable to be incurred by anEmployee traveling on duty, except expenses of the nature mentioned hereunder, for whichadditional reimbursement may be claimed;Postal, telegraphic, internet and long-distance telephone expenses incurred for officialpurpose. (Refer to GGGI Telecommunication Policy)Exceptional and unforeseen expenses incurred under force majeure in the interest of theOrganization and resulting in disbursement out of reasonable proportion to the allowanceprovided.Transportation or additional stopover costs to locations Employee may wish to visit forpersonal reasons in conjunction with a mission are at the expense of the Employee concerned.

(i)(ii)

5.3

6.6.1

Accommodation ExpensesAccommodation expenses shall be calculated based on the number of nights of lodgingduring the period of mission.Accommodation expenses shall not be provided by the Organization while on airplane, over-night ship or train journey; or for number of nights the accommodation is provided by theGovernment, conference/workshop/meeting host Organization, any other authorities or otherofficial sources.

6.2

7. Terminal Allowance7.1For all official travel, terminal allowance of up to USD 70.00 shall be reimbursed perMission country (per cities where applicable) in addition to the Daily Allowance regardlessof the destination upon submission of the relevant receipts. In any case where taxi receiptsare not issued, signed written explanation shall be sufficient for reimbursements. Terminalexpenses shall be deemed to cover all expenditures for transportation and incidental changebetween the airport and other point of arrival or departure.

8.8.1

International Mission tripsWherever possible, the air ticket issued shall be at a price less than the fulleconomy/business/first class fare for the customary direct route. The Organization shall bearthe cost of any fare increase resulting from a change in travel dates, duly justified by theofficial and on grounds duly approved by the Director concerned.Business class may be authorized for International flights more than seven (7) hours actualairtime.For any more than two mission trips within thirty (30) day period, from the second missiontrip for flights over five (5) hours, business class may be authorized.(Senior ProgramManagers only).Changes to approved itineraries may require re-approval, please submit and process changesby updating the existing request form.

8.2

8.3

5

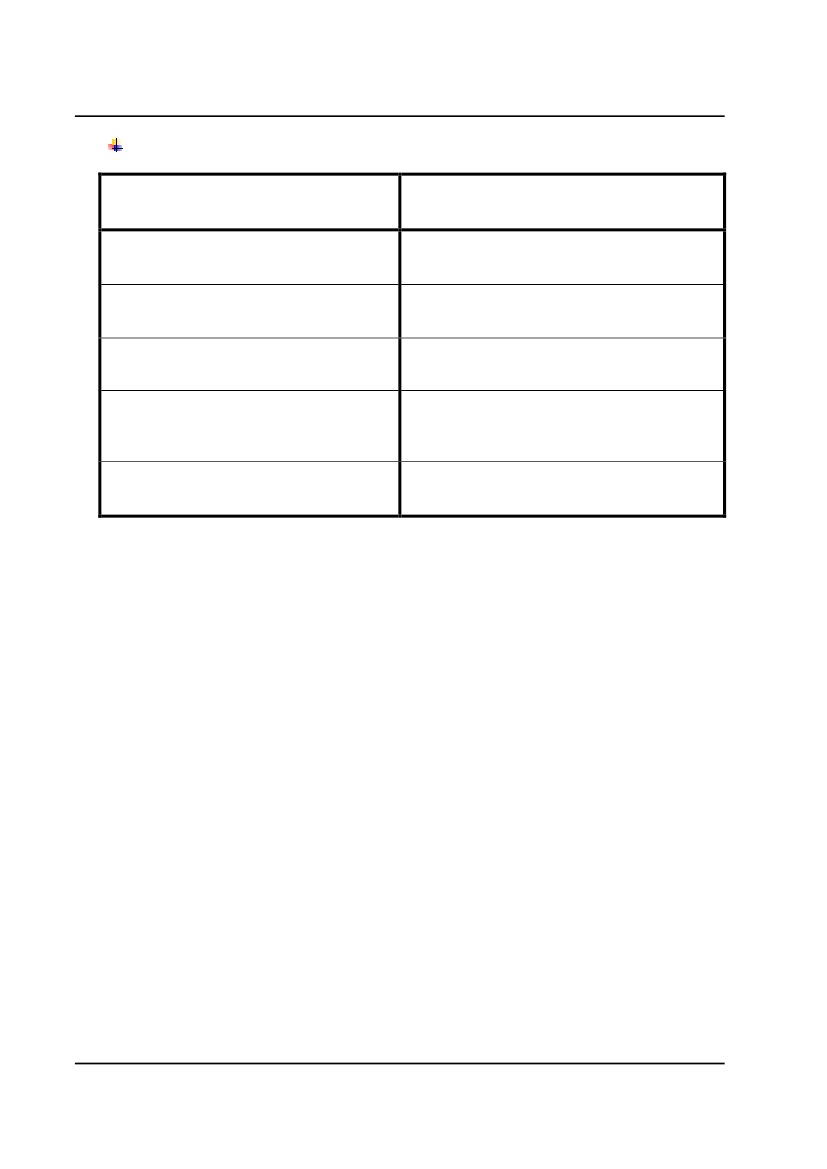

International Air travel classification

Staff Category

Airline class

Chairman of the Board of Directors

First class

Members of the Board of Directors

First class/Business Class

ED/DED/DirectorsSenior Program Managers(Senior Fellows)Program ManagersProgram OfficersIntern/ PA

Business ClassBusiness class for flights over 7 hours ANDBusiness class for two or more Mission tripswithin 30day period for flights over 5 hours(from second trip)Economy class

9.9.1

Daily Subsistence Allowance (DSA)Any Employee on an international Mission shall receive work and meal expenses(collectively referred to as “Daily subsistence Allowance”) in accordance with the ratesbased on the location as set out in Annex I. For Mission destination not covered by Annex I,the mid-rate between highest and lowest rates for the destination concerned shall beapplicable.The full rate of Daily Allowance shall be paid from the first day at the Mission destination,until the day before Employee’s return trip.The Daily Allowance shall not be paid for the day of return, or for the time spent travellingback to duty station. However, when the Employee’s return flight is scheduled to depart afterfour o’clock on the afternoon (4:00pm), the applicable daily allowance will be paid in full.

9.2

9.3

10.Domestic Mission Trips10.1The total amount of travel expenditures granted to Employees on a domestic mission tripshall be calculated in accordance with Annex II and be paid to the Employee in a fixedamount prior to departure.When an Employee’s car is used for domestic business trips, Employee shall be entitled totravel expenses tantamount to those of bus or train calculated in accordance with the tablebelow. Employee shall be responsible for making arrangements regarding insurance and maynot claim against the Institute in respect of any damage caused to their vehicles.

10.2

6

10.3

Domestic airfares may be reimbursed, if using airplanes is unavoidable due to the urgency ofa task or distance to the destination.Travel expenditures for a domestic business trip within forty (40) kilometers or within aplace to which the round trip can be made in one (1) day shall be calculated excludingaccommodation expenses, unless an overnight stay is unavoidable due to the nature of a task.Travel expenditures for a domestic business trip within twelve (12) kilometers in the vicinityof the workplace shall be calculated on the basis of actual costs.

10.4

10.5

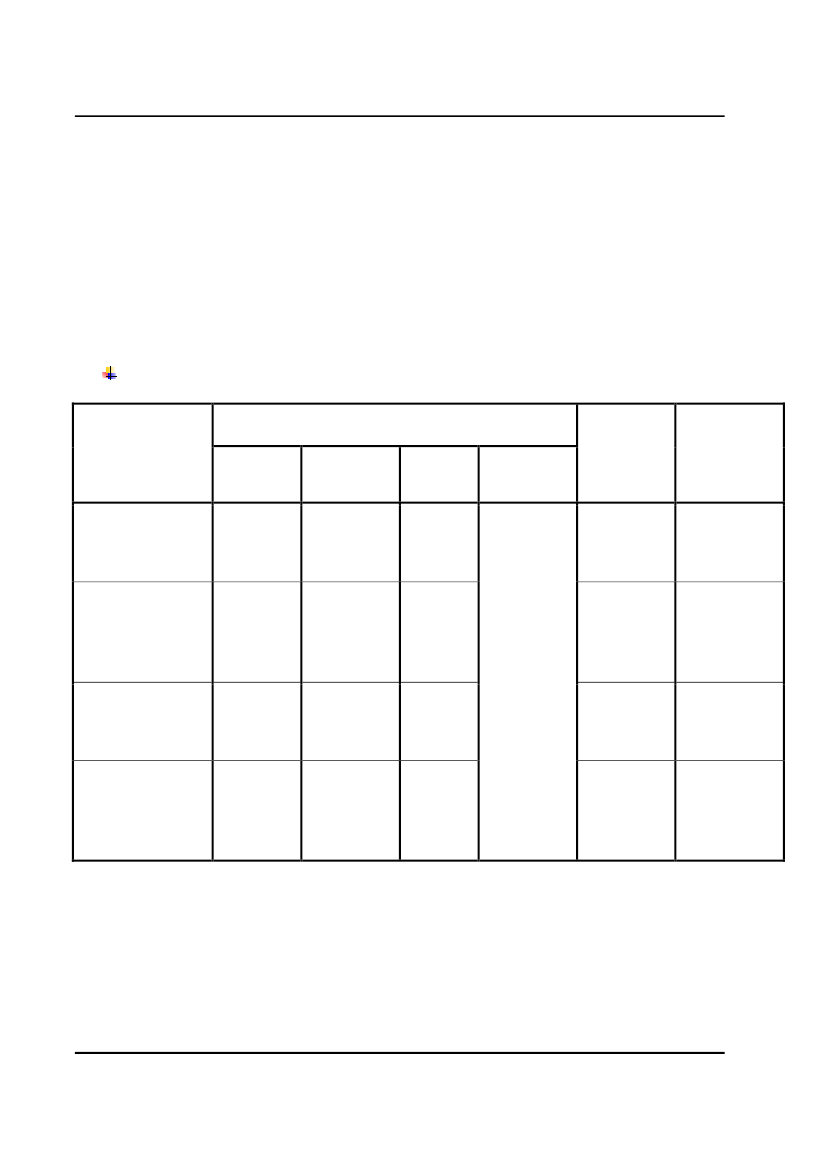

Domestic travel classification (Daily Allowances in KRW)

Mode of TransportationStaffCategoryRailAirShipCar

Work &Meal

Expenses

LodgingExpenses

Chairman ofthe Board ofDirectorsMembers of theBoard ofDirectorsED, DED,CAO,CFO,DirectorsManagers(SPM, PM)

Specialclass

1stclass

1stclass

ActualExpense

ActualExpense

Specialclass

Businessclass

2ndclassActualAmount

45,000

ActualExpense

Standardclass

Economyclass

3rdclass

40,000

ActualExpense

Staff(PO,PA,Intern)

Standardclass

Economyclass

3rdclass

40,000

ActualExpense

7

11. Limitation of Travel Expenditures11.1The Chief Administrative Officer/Chief Finance Officer may make an increase of up to ten(10) percent of the total amount of travel expenditures granted to staff members, if they willbe on an international business trip for longer than fifteen (15) days.

12. Payment and Reimbursement of Travel Expenditures12.1Daily Allowance shall be paid to the Employee in a fixed amount before his/her departure ona Mission trip.

12.2 The cost of air, train and ship tickets shall be remitted directly to the operating company ortravel agency, unless purchase at site is unavoidable due to force of nature, nature of a task,or unexpected circumstances.12.3Accommodation expenses shall in principle be paid to the accommodation or to the travelagency. When accommodation expenses are paid by corporate cards, the Employee shallretain the receipts and submit to the Finance Department via established procedure at thetime. If the accommodations expenses are paid from the Employee’s own expense, he/sheshall request for reimbursement according to correct procedures for reimbursement at thetime.

12.4 The Organization shall insure all Employees against personal property losses and illness oraccident while on Mission trip.12.5Provided that the period of the mission is extended or reduced due to unavoidable reasons,thetravel expenditures for the extended/reduced period may be reimbursed to the Employeeor be returned to the Organization after the mission and upon a report to the relevant Directorand the Chief Finance Officer.Reimbursement of travel expenditures incurred during the extended period of the Missiontrip shall be made on the basis of credit card receipts evidencing payment of travelexpenditures. In exceptional cases, however, the credit card receipts may be replaced byother documents evidencing payment of travel expenditures.

12.6

13. Travel Expenditures for Non-GGGI Personnel13.1Travel expenditures for non-standing Directors, external advisors, secondees and any non-GGGI personnel invited by GGGI to go on a mission shall be paid partly or fully by GGGI inaccordance with Annex I, provided that they have been paid partly or not been paid by theiremploying Organizations. In case that they have been fully paid by their employingOrganizations, travel expenditures shall not be provided by GGGI.

8

13.2

In case that the person does not have a designated job position in the Organization,calculation of travel expenditure shall be based on the interpretation of his position at currentemployer to GGGI system, authorized by the relevant director and the Chief AdministrativeOfficer.

14. Travel Expenditures for a Staff Member on Leave or Retired14.1When an Employee who is on leave or has retired is requested by the Organization to go on amission for the Organization’s operations, travel expenditures of the mission shall becalculated on the basis of his/her current or previous position at the Organization.

15. Miscellaneous Reimbursable Expenses15.1Employees are urged to exercise at all times the same care in incurring reimbursableexpenses that a prudent person would exercise in travelling at his/her own expense.

15.2 In addition to expenses covered by the travel expenses, the Organization may reimburse forother legitimate and reasonable expenses that they incur. The Employee shall submit therequired supporting documents and receipts for the miscellaneous expenses set out below;(i)(ii)(iii)(iv)(v)(vi)(vii)(viii)Vaccination required or recommended for the country of destination;Visas required for the country of destination;Travel insurance expenses;Excess luggage for the transport of documents or equipment required for official purposes.Photocopying and reproduction of official documents;Excess luggage for personal items in case of travel over extended periods of time;Significant foreign currency commissions;Such other item of expenditure which is directly related to the mission.

ANNEX I Travel Per Diem Rates

9

Travel Per Diem Rates – Effective from Apr 09, 2012(USD)CountryCodeAFALDZAOARAMAWAUATBHBDBBBEBMBTBOBRBGBIKHCMCACLCNCOCRHRCUCYDKECEGEECountry2012

AfghanistanAlbaniaAlgeriaAngolaArgentinaArmeniaArubaAustraliaAustriaBahrainBangladeshiBarbadosBelgiumBermudaBhutanBoliviaBrazilBulgariaBurundiCambodiaCameroonCanadaChileChinaColombiaCosta RicaCroatiaCubaCyprusDenmarkEcuadorEgyptEstonia

85.00105.00144.00118.00101.0086.00113.00164.00176.00117.0076.00109.00175.00170.0042.0055.00102.0058.0081.0092.00120.00146.0088.00133.0086.0096.00115.0079.00134.00157.0089.0094.00120.00

10

Travel Per Diem RatesCountryCodeCountry2012

ETFJFIFRGMDEGHGRGTHNHKHUINIDIRIEILITJMJPKZKELALUMOMKMGMYMXMNMZNPNLNZ

EthiopiaFijiFinlandFranceGambiaGermanyGhanaGreeceGuatemalaHondurasHong KongHungaryIndiaIndonesiaIranIrelandIsraelItalyJamaicaJapanKazakhstanKenyaLaosLuxembourgMacauMacedoniaMadagascarMalaysiaMexicoMongoliaMozambiqueNepalNetherlandsNew Zealand

83.0089.00129.00159.0088.00161.0081.00157.0092.0072.00144.00115.00109.0095.00126.00157.00123.00177.0084.00218.00130.0095.00111.00118.00108.0089..0092.0078.00111.0065.0097.0068.00166.00124.00

11

Travel Per Diem RatesCountryCodeCountry2012

NGNOOMPKPEPHPLPTQARORUKGLSASGSKZAKRESLKCHTWTHTNTRGBUSAEUZVN

NigeriaNorwayOmanPakistanPeruPhilippinesPolandPortugalQatarRomaniaRussian Fed.RwandaSaudi ArabiaSingaporeSlovakiaSouth AfricaSouth KoreaSpainSri LankaSwitzerlandTaiwanThailandTunisiaTurkeyUnited KingdomUSAUnited Arab. EmirUzbekistanVietnam

116.00153.00143.0062.0097.0090.00101.00117.00111.00126.00105.0071.00104.00162.00108.00109.00129.00166.0081.00203.00140.0089.0094.0083.00128.00115.00145.0061.0072.00

12