Udenrigsudvalget 2013-14

URU Alm.del Bilag 220

Offentligt

Report No.

AUS2922

W

EST

B

ANK AND

G

AZA

Area C and the Future of the Palestinian

Economy

October 2, 2013

Poverty Reduction and Economic Management Department

Middle East and North Africa Region

Document of the World Bank

PDF to HTML - Convert PDF files to HTML files

Acronyms and Abbreviations

CPI

DOP

FDI

GDP

GOI

ICA

ICL

IPCC

ISP

IT

ITU

JTC

JWC

LRC

MCM

MoF

OCHA

PA

PCBS

PLO

UNESCO

USD

Consumer Price Index

Declaration of Principles

Foreign Direct Investment

Gross Domestic Product

Government of Israel

Israeli Civil Administration

Israeli Chemicals Ltd

International Peace and Cooperation Centre

Internet Service Providers

Information Technology

International Telecommunication Union

Joint Technical Committee

Joint Water Committee

Land Research Center

Million Cubic Meter

Ministry of Finance

United Nations Office for the Coordination of Humanitarian

Affairs

Palestinian Authority

Palestinian Central Bureau of Statistics

Palestinian Liberation Organization

United Nations Educational Scientific and Cultural

Organization

United States Dollars

Vice President:

Country Director:

Sector Director:

Sector Manager:

Task Team Leader:

Inger Andersen

Mariam J. Sherman

Manuela V. Ferro

Bernard Funck

Orhan Niksic

PDF to HTML - Convert PDF files to HTML files

Contents

Executive Summary

.................................................................................................................................................................. vii

Direct Benefits

........................................................................................................................................................................... viii

Indirect Benefits

.......................................................................................................................................................................... ix

CHAPTER 1: The Palestinian Economy, Israeli Restrictions and the Potential of Area c

.................................. 1

The Palestinian economy: volatility, distorted growth and uncertain prospects

..................................................... 1

Restrictions on movement and access, and the stunted potential of Area C

............................................................. 3

CHAPTER 2: AREA C – Output Potential OF Key Sectors of the Palestinian Economy

.................................. 7

I.

Agriculture

............................................................................................................................................................................. 7

Area C Restrictions and the Decline of Palestinian Agriculture

........................................................................ 9

Agricultural Potential

..................................................................................................................................................... 10

II. Dead Sea Minerals

............................................................................................................................................................ 11

Potential for Developing Dead Sea Minerals

......................................................................................................... 13

III. Stone Mining and Quarrying

......................................................................................................................................... 13

Potential in Marble and Stone Industries

................................................................................................................. 15

IV. Construction and Real Estate

......................................................................................................................................... 15

Restrictions on Access and Development

................................................................................................................ 15

Land and House Price Inflation

.................................................................................................................................. 19

Construction Potential

.................................................................................................................................................... 20

V. Tourism and the Dead Sea

.............................................................................................................................................. 20

Area C and the Dead Sea

.............................................................................................................................................. 21

Value Added to Tourism

............................................................................................................................................... 23

VI. Telecommunications.........................................................................................................................................................

24

Access and Permits

......................................................................................................................................................... 25

Telecommunications Potential

.................................................................................................................................... 28

VII. Cosmetics

............................................................................................................................................................................ 28

CHAPTER 3: Indirect Beneficiaries

................................................................................................................................... 30

Secondary Costs and Benefits Related to Infrastructure

............................................................................................... 30

Movement

.................................................................................................................................................................................... 30

Water and Wastewater

............................................................................................................................................................. 30

Telecommunications

................................................................................................................................................................ 31

ii

PDF to HTML - Convert PDF files to HTML files

Institutional Infrastructure

...................................................................................................................................................... 32

Secondary Costs and Benefits Related to Spill-Over Effects

...................................................................................... 33

Potential Indirect Benefits

...................................................................................................................................................... 34

Potential Fiscal Benefits

.......................................................................................................................................................... 34

ANNEX 1: Methodological Notes

....................................................................................................................................... 36

ANNEX 2: Agriculture Section Tables.

............................................................................................................................. 47

ANNEX 3: Relevant Legal Agreements

............................................................................................................................ 51

ANNEX 4: Bibliography

........................................................................................................................................................ 56

List of Tables

Table 1: Significance of Area C in Terms of Natural Resources ................................................................... 6

Table 2: Palestinian Permits in Rural Areas and in Area C .......................................................................... 16

Table 3: Estimated Population Growth and Area C Restrictiveness in the West Bank Governorates 17

Table 4: Selected Dead Sea Tourism Indicators for Jordan and Israel ......................................................... 23

Table 5: The Number of Tourists Has Been Growing Around the World and Is Expected to Continue with

Strong Growth by 2020 Worldwide and in the Middle East ........................................................................ 23

Table 6: Revenues Collected from West Bank Sites Managed and Operated by the Israeli Nature and Parks

Authority....................................................................................................................................................... 24

List of Boxes

Box 1: Limited access to education for Palestinians who live in Area C ....................................................... 5

Box 2: Agriculture in Israeli Settlements in Area C exemplifies the sector’s potential in the Area ............ 10

Box 3: Fighting the current restrictions to develop a new city ..................................................................... 18

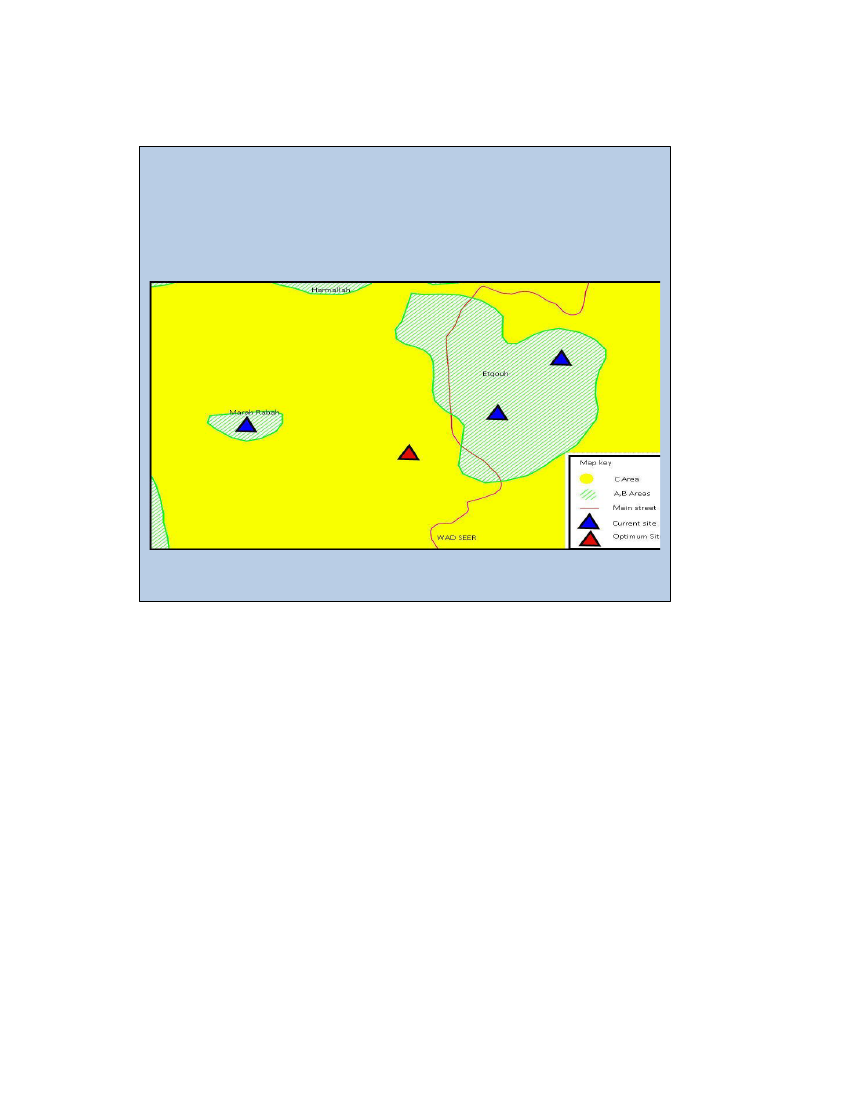

Box 4: Serving the Residents of Marah Rabah and Teqou in Area B .......................................................... 26

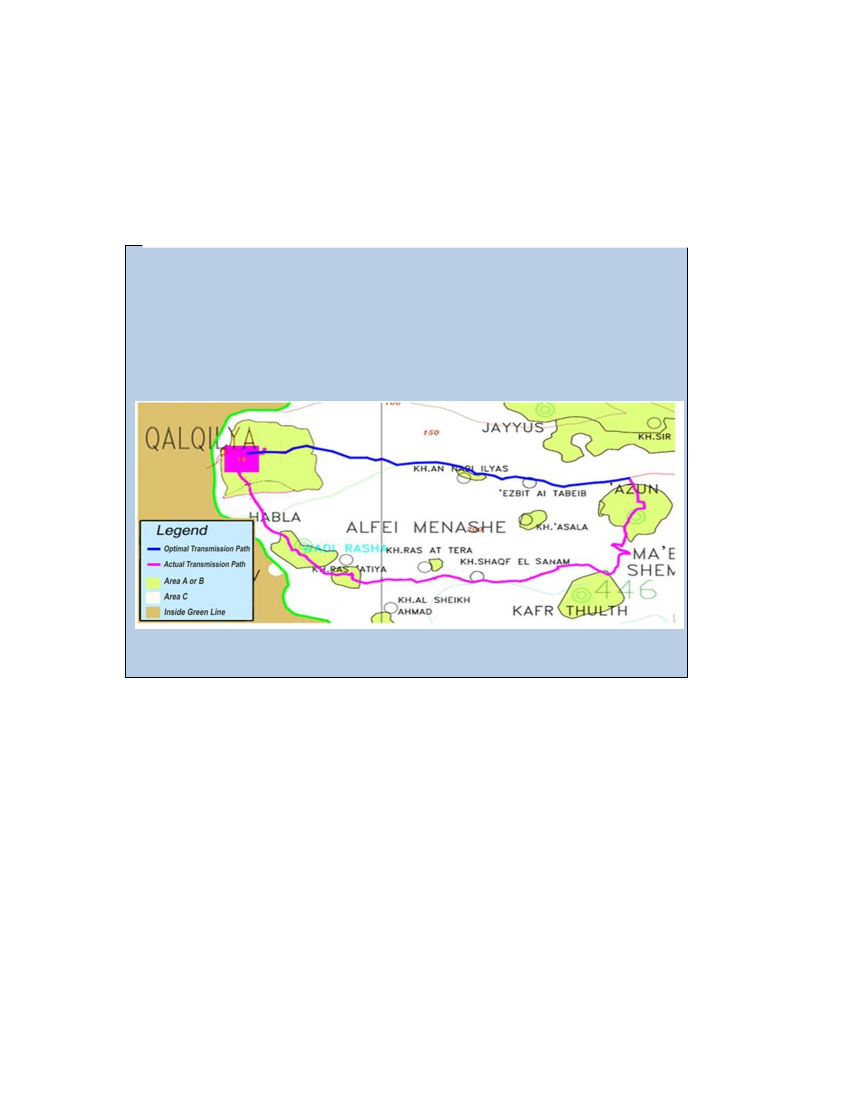

Box 5: Suboptimal Transmission paths ........................................................................................................ 27

List of Figures

Figure 1: Real GDP Growth Rate 1999-First Half 2013 ................................................................................ 1

Figure 2: The Decline in The Tradable Sectors .............................................................................................. 2

Figure 3: Agriculture Value Added in the West Bank (constant 2004 USD m, percentage of GDP) ............ 7

Figure 4: Share of Agriculture in Total Employment, West Bank ................................................................. 8

Figure 5: West Bank Labor Productivity (value added/worker, and relative to the overall economy) .......... 8

Figure 6: Potash Price and Demand Projections, 2012-2025 ....................................................................... 12

Figure 7: World Production of Bromine (in metric tons) ............................................................................. 12

iii

PDF to HTML - Convert PDF files to HTML files

Figure 8: While stone and mineral exports have increased in nominal terms, their share in total exports

dropped despite a meager overall export growth .......................................................................................... 14

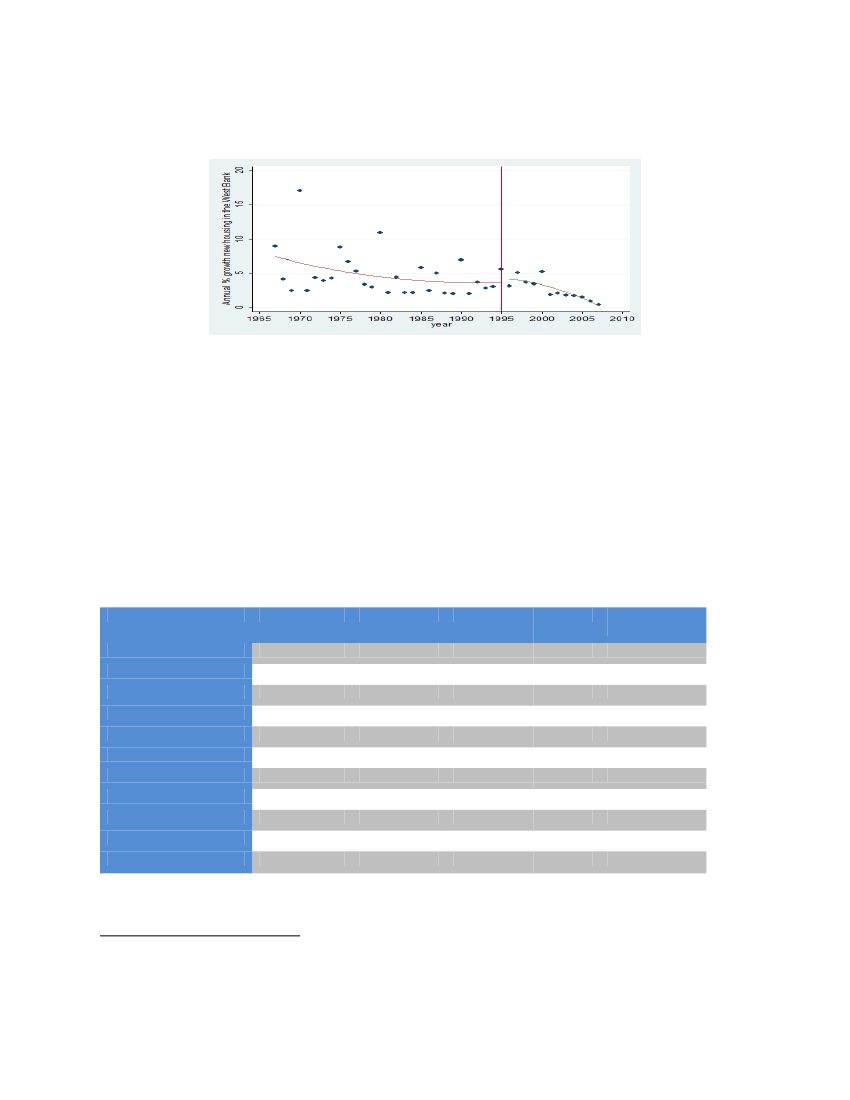

Figure 9: Growth in Housing Construction in the West Bank, 1967-2007 .................................................. 17

Figure 10: Housing Prices and Palestinian CPI, 1996-2012 (1996=100) ..................................................... 19

Figure 11: Following the intifada, the employment in the hotel and restaurants sector (a good proxy for

tourism) doubled ........................................................................................................................................... 20

Figure 12: Following the intifada years, the number of hotels increased only modestly, but hotel activity

increased dramatically .................................................................................................................................. 20

Figure 13: Number of International Tourist Arrivals in the Palestinian territories (1000) ........................... 21

Figure 14: Telecommunications Sector Output Purchased by Other Sectors of the Economy .................... 32

Figure 15: Palestinian Tourism's Reliance on Inputs from Agriculture and Agro-processing ..................... 33

iv

PDF to HTML - Convert PDF files to HTML files

Acknowledgments

This report was prepared and written by a team of World Bank staff led by Orhan Niksic, Senior

Economist (MNSED) and also included Nur Nasser Eddin, Economist (MNSED) and

Massimiliano Cali, Economist (PRMTR). Duja Michael, a consultant, assisted the Bank team in

conducting research and analysis for the report.

The report benefited considerably from overall guidance and comments provided by Mariam

Sherman, The World Bank Country Director for West Bank and Gaza, Manuela Ferro, Director

(LCRVP), Bernard Funck, Sector Manager (MNSED). The following peer reviewers also

provided most valuable comments: Dr. Salam Fayyad, former Prime Minister of the Palestinian

Authority, Kaspar Richter, Lead Economist (ECA PREM), John Nasir, Economic Adviser

(OPSPQ), Tracey Lane, Senior Economist (SASGP). Furthermore, much gratitude for time and

efforts to enhance the quality of this report is owed to Shanta Devarajan, Chief Economist

(MNACE), Nigel Roberts, (former West Bank and Gaza Country Director), Tara Vishwanath,

Lead Economist (MNSED), Nandini Krishnan, Economist (MNSED), Ranan Ibrahim Rafat

Mutfahar, Operations Officer, (MNCGZ). Undoubtedly, this report could not have been produced

without the data, information and insights provided by colleagues in the Palestinian Central

Bureau of Statistics, Ministry of Tourism and Antiquities of the Palestinian National Authority,

Ministry of Planning of the Palestinian National Authority, Nicola Harrison (UNRWA), Rana

Hannoun (FAO), Bader Rock, Private Sector and Trade Adviser (Office of the Quartet

Representative), and several prominent representatives of the Palestinian private sector.

v

PDF to HTML - Convert PDF files to HTML files

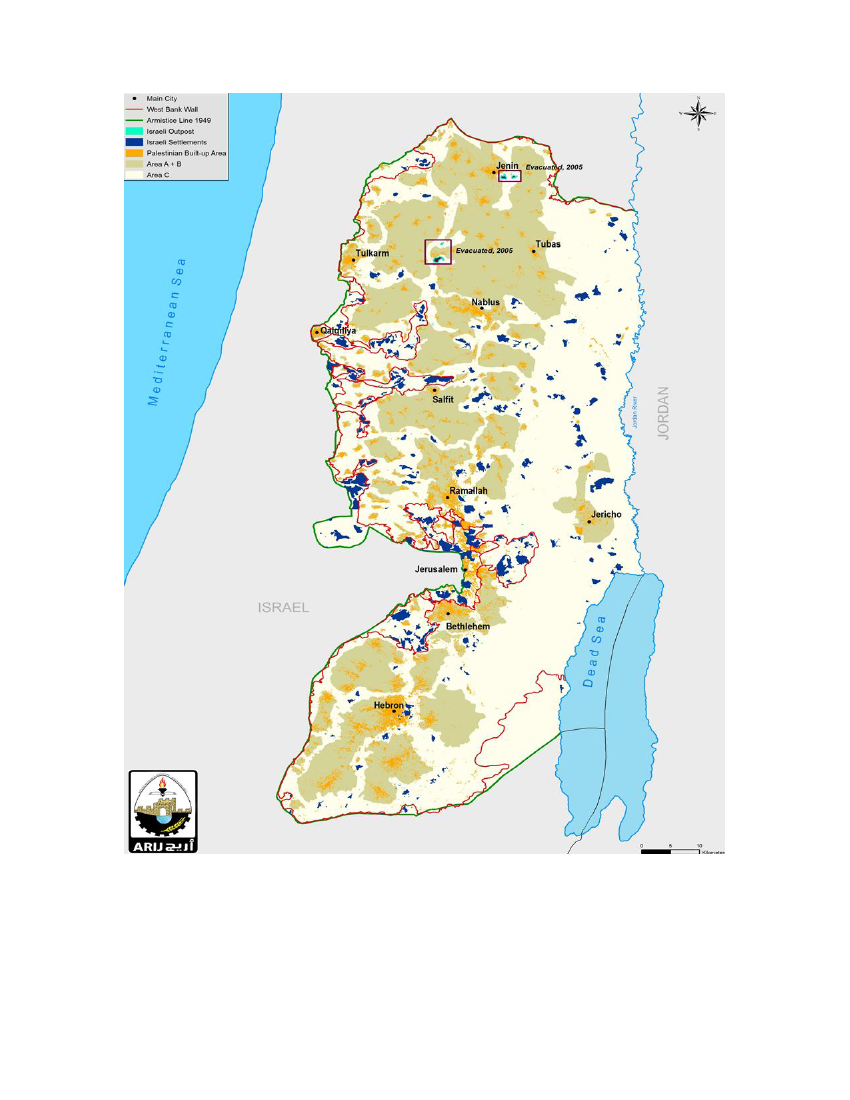

Source: ARIJ

vi

PDF to HTML - Convert PDF files to HTML files

EXECUTIVE SUMMARY

i.

Restrictions on economic activity in Area C of the West Bank have been particularly detrimental to the

Palestinian economy.

Area C constitutes about 61 percent of the West Bank territory and was defined

under the Oslo Peace Accords as the area that would be gradually transferred to the Palestinian Authority

within a period of 5 years, except for the parts to be agreed upon within the final settlement agreement.

1

The gradual transfer has not yet taken place and, in the meantime, access to this area for most kinds of

economic activity has been severely limited. Yet, the potential contribution of Area C to the Palestinian

economy is large. Area C is richly endowed with natural resources and it is contiguous, whereas Areas A

and B are smaller territorial islands. The manner in which Area C is currently administered virtually

precludes Palestinian businesses from investing there.

ii.

Mobilizing the Area C potential would help a faltering Palestinian economy.

The Palestinian economy

has experienced strong growth in recent years, fuelled by large inflows of donor budget support, some

easing of the Israeli movement restrictions that intensified during the second intifada, and a PA reform

program. By 2012, however, foreign budget support had declined by more than half, and GDP growth

has fallen from 9 percent in 2008-11 to 5.9 percent by 2012 and to 1.9 percent in the first half of 2013

(with negative growth of - 0.1 percent in the West Bank).

iii.

This slowdown has exposed the distorted nature of the economy and its artificial reliance on donor-

financed consumption.

For a small open economy, prosperity requires a strong tradable sector with the

ability to compete in the global marketplace. The faltering nature of the peace process and the persistence

of administrative restrictions as well as others on trade, movement and access have had a dampening

effect on private investment and private sector activity. Private investment has averaged a mere 15

percent of GDP over the past seven years, compared with rates of over 25 percent in vigorous middle

income countries. The manufacturing sector, usually a key driver of export-led growth, has stagnated

since 1994, its share in GDP falling from 19 percent to 10 percent by 2011. Nor has manufacturing been

replaced by high value-added service exports like Information Technology (IT) or tourism, as might have

been expected. Much of the meager investment has been channeled into internal trade and real estate

development, neither of which generates significant employment. Consequently, unemployment rates

have remained very high in the Palestinian territories and are currently about 22 percent – with almost a

quarter of the workforce employed by the Palestinian Authority, an unhealthy proportion that reflects the

lack of dynamism in the private sector. While the unsettled political environment and internal Palestinian

political divisions have contributed to investor aversion to the Palestinian territories, Israeli restrictions on

trade, movement and access have been seen as the dominant deterrent.

iv.

Area C is key to future Palestinian economic development.

The decisive negative economic impact of

Israeli restrictions has been analyzed in many reports produced by the World Bank and other development

agencies over the past decade, and Israel’s rationale for them – that they are necessary to protect Israeli

citizens – is also well-known. Within this setting, Area C is particularly important because it is either off

limits for Palestinian economic activity, or only accessible with considerable difficulty and often at

prohibitive cost. Since Area C is where the majority of the West Bank’s natural resources lie, the impact

of these restrictions on the Palestinian economy has been considerable. Thus, the key to Palestinian

prosperity continues to lie in the removal of these restrictions with due regard for Israel’s security. As

1

The Israeli-Palestinian Interim Agreement on the West Bank and the Gaza Strip (“Oslo 2”— 9/28/95).

vii

PDF to HTML - Convert PDF files to HTML files

this report shows, rolling back the restrictions would bring substantial benefits to the Palestinian economy

and could usher in a new period of increasing Palestinian GDP and substantially improved prospects for

sustained growth.

v.

This report examines the economic benefits of lifting the restrictions on movement and access as well

as other administrative obstacles to Palestinian investment and economic activity in Area C.

It focuses

on the economic potential of Area C and does not prejudge the status of any territory which may be

subject to negotiations between Palestinians and Israelis. We examine potential direct, sector-specific

benefits, but also indirect benefits related to improvements in physical and institutional infrastructure, as

well as spillover effects to other sectors of the Palestinian economy. The sectors we examine are

agriculture, Dead Sea minerals exploitation, stone mining and quarrying, construction, tourism,

telecommunications and cosmetics. To do so, we have assumed that the various physical, legal, regulatory

and bureaucratic constraints that currently prevent investors from obtaining construction permits, and

accessing land and water resources are lifted, as envisaged under the Interim Agreement. We then

estimate potential production and value added, using deliberately conservative assumptions – and avoid

quantification where data are inadequate (as with cosmetics, for example, or for tourism other than that of

Dead Sea resorts). It is understood that realizing the full potential of such investments requires other

changes as well – first, the rolling back of the movement and access restrictions in force outside Area C,

which prevent the easy export of Palestinian products and inhibit tourists and investors from accessing

Area C; and second, further reforms by the Palestinian Authority to better enable potential investors to

register businesses, enforce contracts, and acquire finance.

Direct Benefits

vi.

Neglecting indirect positive effects, we estimate that the potential additional output from the sectors

evaluated in this report alone would amount to at least USD 2.2 billion per annum in valued added

terms – a sum equivalent to 23 percent of 2011 Palestinian GDP.

2

The bulk of this would come from

agriculture and Dead Sea minerals exploitation.

o

In the case of

agriculture,

the key issues are access to fertile land, and the availability of water to

irrigate it. We have omitted from our calculations the 187,000 dunums that fall under the control of

Israeli settlements. To irrigate the 326,400 dunums of other agricultural land notionally available to

Palestinians in Area C would require some 189 MCM of water per year. Current Palestinian

allocations under the Oslo Accords are 138.5 MCM, or 20 percent of the estimated availability – a

share to be revisited at Final Status negotiations. Irrigating this unexploited area as well as accessing

additional range and forest land could deliver an additional USD 704 million in value added to the

Palestinian economy – equivalent to 7 percent of 2011 GDP.

The Dead Sea abounds in valuable

minerals,

principally large deposits of potash and bromine. Israel

and Jordan together derive some USD 4.2 billion in annual sales of these products, and account for 6

percent of the world’s supply of potash and fully 73 percent of global bromine output. Demand for

both these products is projected to remain strong, with the Dead Sea a cheap and easily exploited

source. There is no reason to suppose that Palestinian investors along with prospective international

partners would not be able to reap the benefits of this market, provided they were able to access the

resource. Taking as a benchmark the average value added by these industries to the Jordanian and the

Israeli economies, the Palestinian economy could derive up to USD 918 million per annum – equal to

9 percent of 2011 GDP, almost equivalent to the size of the entire Palestinian manufacturing sector.

o

2

Sensitivity of these estimates to different assumptions on key variables is shown in ANNEX 1.

viii

PDF to HTML - Convert PDF files to HTML files

o

Area C is also rich in stone, with estimated deposits of some 20,000 dunums of quarryable land.

Palestinian

stone mining and quarrying

is already Palestinian territories’ largest export industry with

exports based on the famous “Jerusalem Gold Stone”. However, this is a struggling industry, due to

an inability to obtain permits to open new quarries, and with most existing quarries in Area C unable

to renew their licenses. If these restrictions are lifted, we estimate that the industry could double in

size, increasing value added by some USD 241 million – and adding 2 percent to 2011 Palestinian

GDP.

The

construction

industry is in acute need of additional land to expand housing and make it more

affordable. Areas A and B are already very densely populated and built-up. UNOCHA analysis

suggests that less than one percent of the land in Area C is currently available to Palestinians for

construction; permit data also shows that it is almost impossible to obtain permission to build in Area

C. Less than 6 percent of all requests made between 2000 and 2007 secured approval. This situation

applies not only to housing but to public economic infrastructure (roads, water reservoirs, waste

treatment plants) and industrial plant, and to the access roads and utility lines needed to connect Areas

A and B across Area C. These factors have led to much suppressed growth in the construction sector

and to an average increase in housing prices in the West Bank over the past two decades that is some

24 percent above what would otherwise be expected. We estimate that lifting the tight restrictions on

the construction of residential and commercial buildings alone (excluding infrastructure projects)

could increase West Bank construction sector value added by some USD 239 million per annum – or

2 percent of 2011 Palestinian GDP.

Area C has major global

tourism

potential, but for Palestinians this remains largely unexploited due

to a large degree to current restrictions on access and investment, in particular around the Dead Sea.

Palestinian Dead Sea tourism development was envisaged in the Interim Agreement, but has not yet

emerged. If current restrictions are lifted and investment climate in the West Bank improves, it is

reasonable to assume that, in due course, Palestinian investors would be able to create a Dead Sea

hotel industry equivalent to Israel’s, producing value added of some USD 126 million per annum – or

1 percent of 2011 Palestinian GDP. Investments to develop other attractive tourism locations in Area

C could generate substantial additional revenues.

The development of the Palestinian

telecommunications

sector is also constrained by Area C

restrictions, which prevent the construction of towers for mobile service and have impeded the laying

of landlines and ADSL cable. Only limited 2G frequencies have been provided to the two Palestinian

mobile operators, while access to the 3G spectrum has not been granted at all. Importation of

equipment has also been difficult. As a result, Palestinian telecommunications costs are high, and

coverage and service quality are less than optimal. The 3G restrictions in particular threaten the

industry’s very viability, particularly since Israeli competitors have been allowed to develop

infrastructure in Area C. We estimate that removing today’s restrictions would not only remove a

serious threat to the viability of this industry, but also add some USD 48 million in value to the sector

– equal to 0.5 percent of Palestinian 2011 GDP.

o

o

o

Indirect Benefits

vii.

In addition to the direct benefits discussed in Chapter 2, the indirect benefits of removing the

restrictions in Area C would be significant.

Indirect costs and benefits can be divided into those related

to physical and institutional infrastructure, and spillover-related costs and benefits. The first set of costs

and benefits are driven by the impact of Israeli restrictions on the

quality

and

cost

of infrastructure; the

impact of the restrictions in this instance is difficult to measure, and no attempt to do so is made here.

Nonetheless, the effects are considerable and are alluded to below. The second set derives from the fact

ix

PDF to HTML - Convert PDF files to HTML files

that sectors are linked, with one using the outputs of another as production inputs – and those effects can

be quantified.

viii.

The quality and cost of infrastructure are impacted considerably by the restrictions present in Area C.

All Palestinian industries are to some extent dependent on the quality of transportation, electricity, water,

and telecommunications infrastructure. Transportation infrastructure is particularly problematic as

Palestinian use of roads in Area C is highly restricted, and travel times can be inordinate; the Palestinian

Authority has also been unable to develop roads, airports or railways in or through Area C. Restrictions in

Area C have impeded the development of “soft” institutional infrastructure such as banking services,

which are hamstrung by the inability to open and service branches, and the inability in practice to use land

in Area C as collateral. Insecurity and the difficulty of policing Area C also deter investors. These

impediments create significant uncertainty and reduce the expected returns on potential investments.

ix.

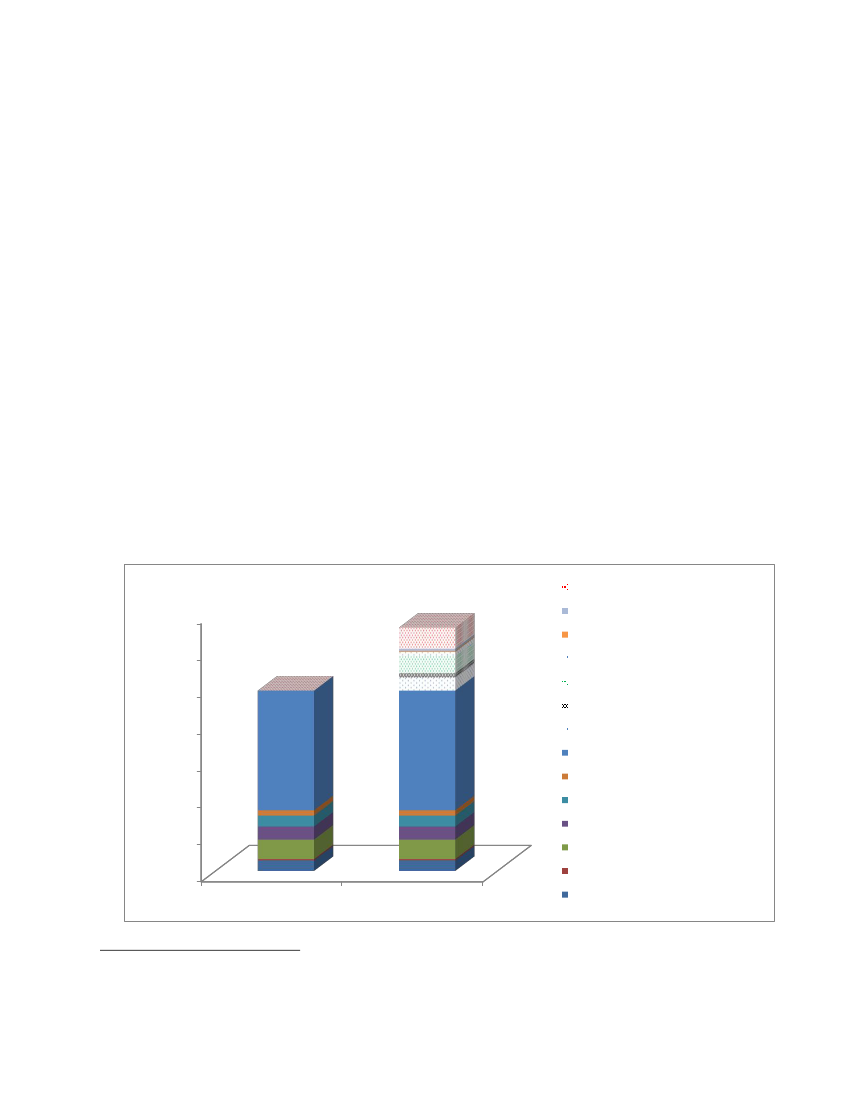

Addressing the constraints on the evaluated sectors would have sizeable effects on the demand for

output in other related sectors.

Despite the relative lack of diversification of the Palestinian economy and

the undeveloped nature of its domestic supply chains, these linkages are important. The potential

spillover effects for the rest of the Palestinian economy emanating from the expansion of these sectors

was calculated by using data on inter-sectoral linkages produced recently by the Palestinian Central

Bureau of Statistics. The overall multiplier effect emerging from this exercise is 1.5 – a figure calculated

without reliance on a general equilibrium model, and very probably an underestimate.

3

Applying this

multiplier, the total potential value added from alleviating today’s restrictions on access to, and activity

and production in Area C is likely to amount to some USD 3.4 billion -- or 35 percent of Palestinian GDP

in 2011.

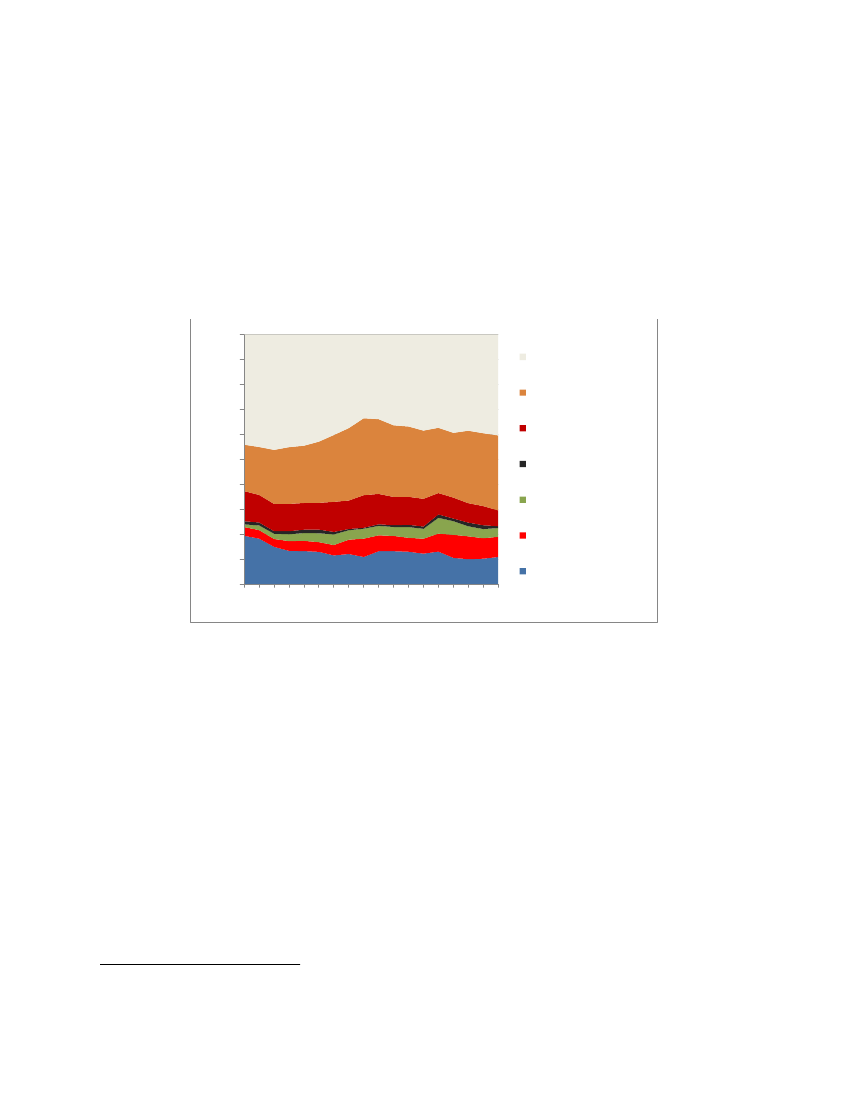

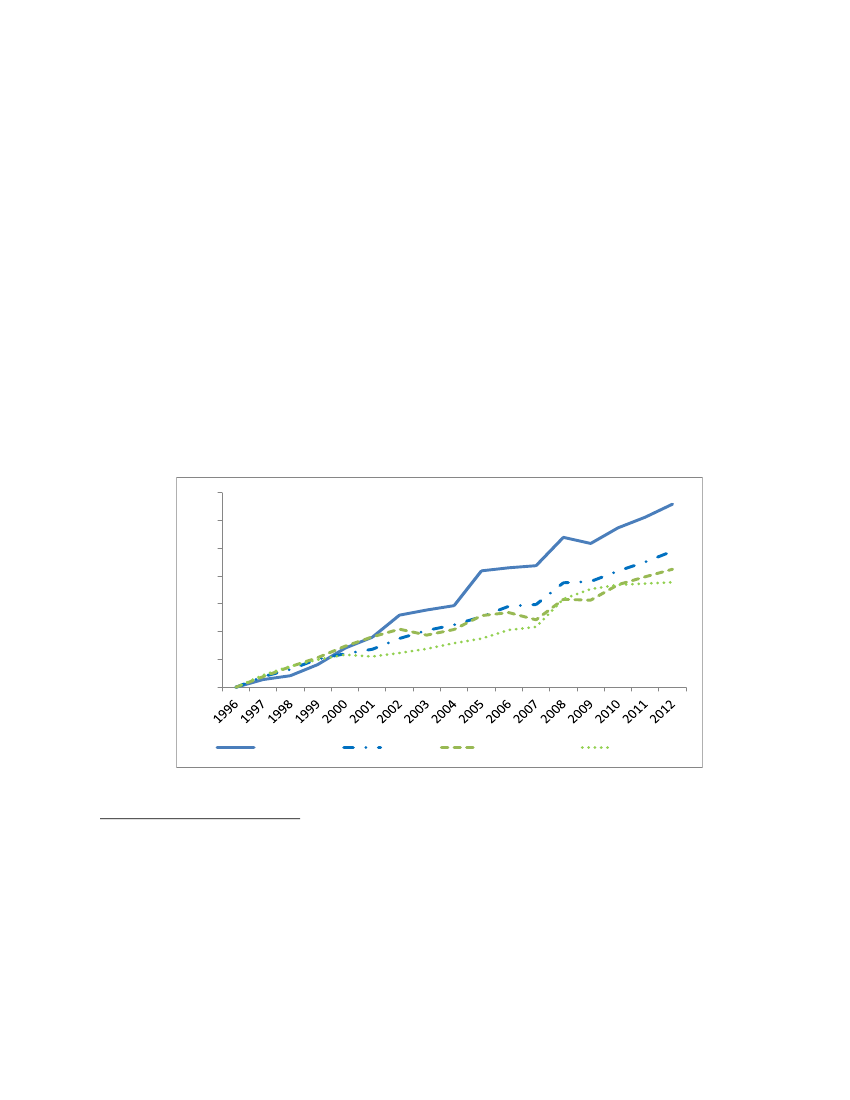

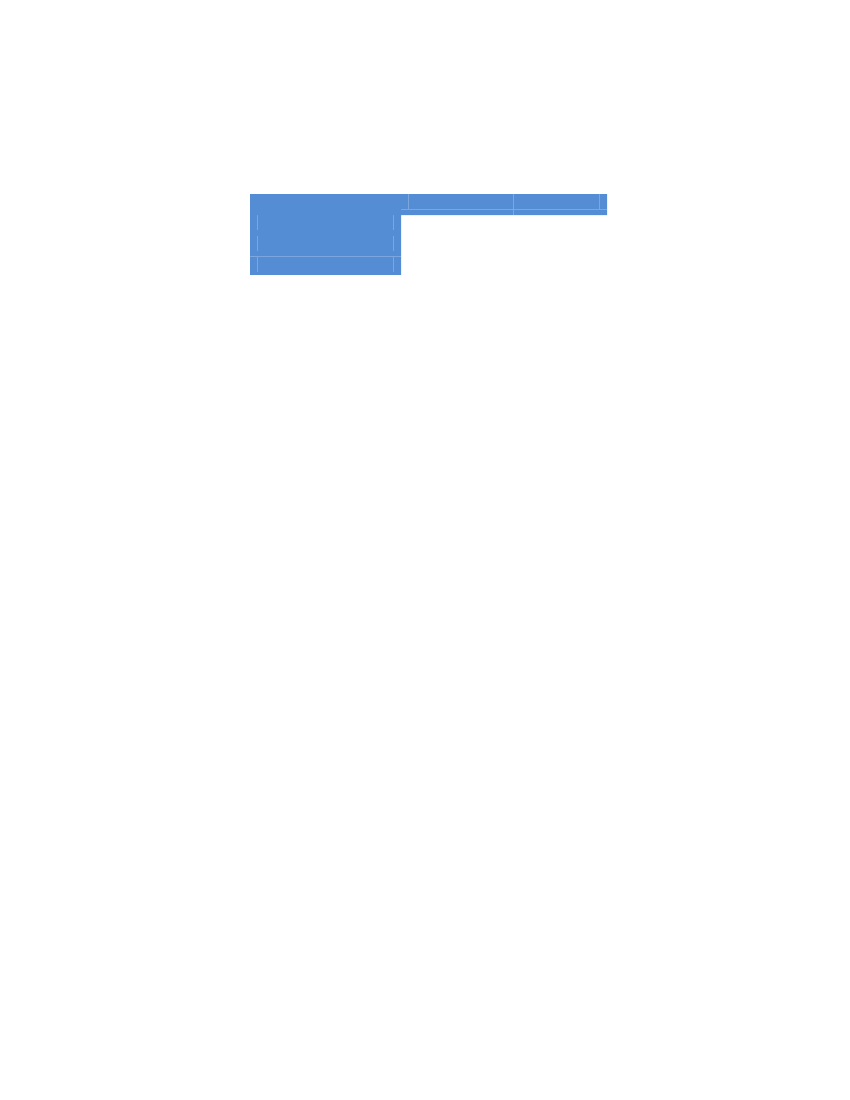

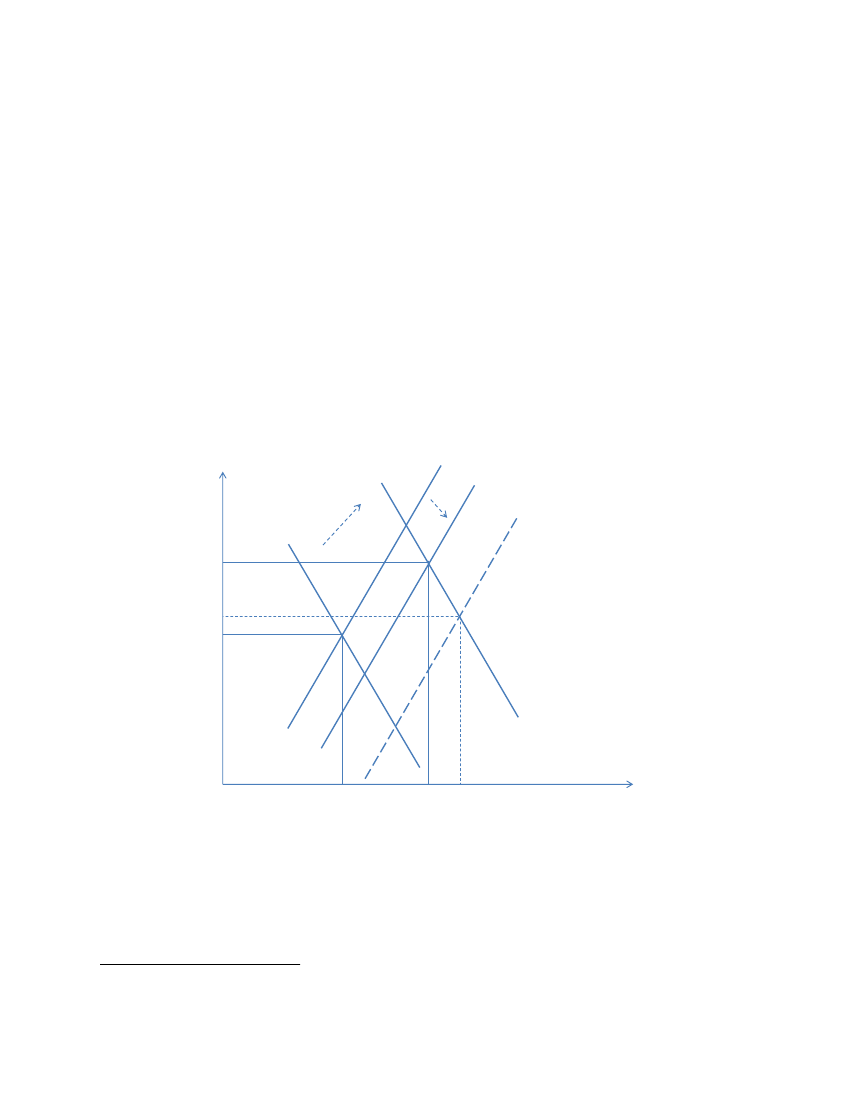

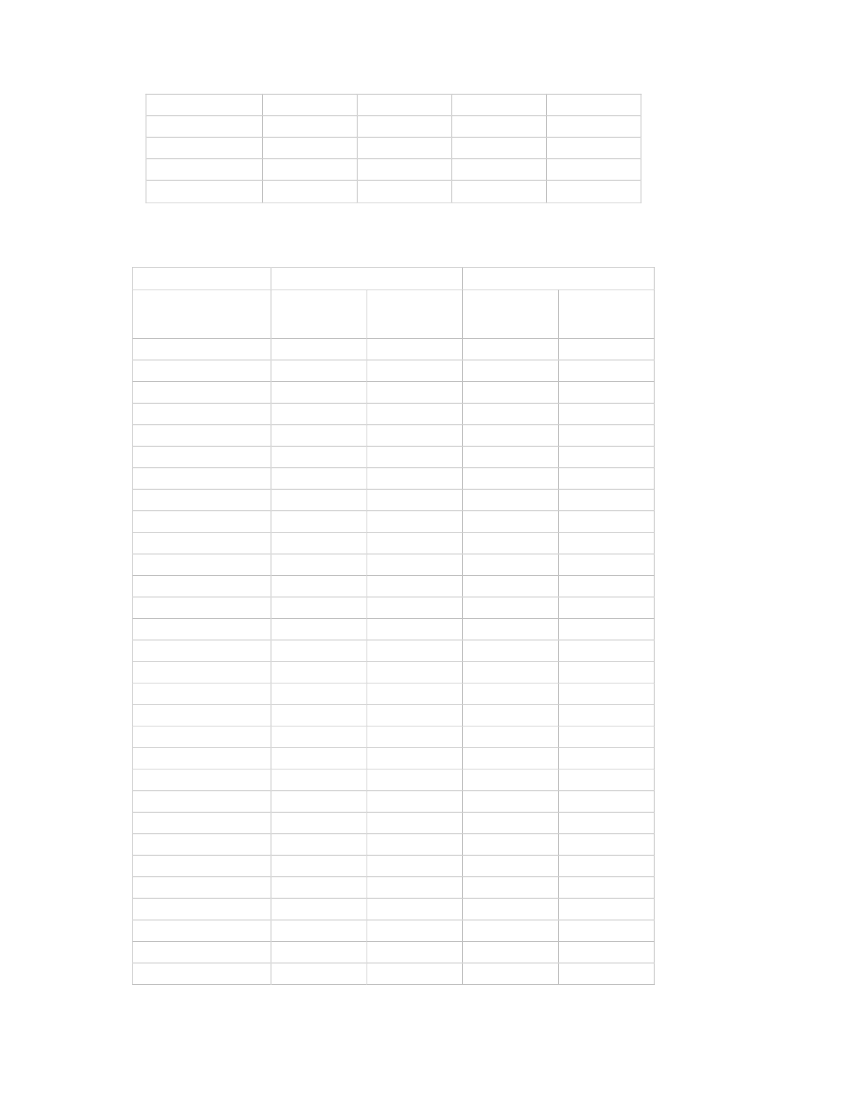

Figure I: Growth generated through the lifting of restrictions in selected sectors could increase potential

Palestinian value added by USD 3.4 billion

Spillover multiplier effect (1.5)

14000

12000

10000

USD million

8000

6000

4000

2000

0

Potential increase in

value added:

USD 3.4 billion

Incremental tourism

Incremental telecommunications

Incremental construction

Incremental Dead Sea mineral processing

Incremental stone mining, quarrying and

processing

Incremental agriculture

Other sectors and activities

Tourism

Information and communication

Construction

Manufacturing

Mining and quarrying

Current GDP

Potential GDP

Agriculture, forestry and fishing

Source:

Palestinian Central Bureau of Statistics (PCBS) National Accounts data (2011) and World Bank staff calculations.

3

A general equilibrium model would capture third round effects, the effects of infrastructure development in Area C and other

indirect effects, which our calculation did not capture. Such a model would also capture price effects, which in the short and

medium term would have a negative impact on demand, but would adjust in the long run, which allows for capacity adjustments.

x

PDF to HTML - Convert PDF files to HTML files

x.

Tapping this potential output could dramatically improve the PA’s fiscal position.

Even without any

improvements in the efficiency of tax collection, at the current rate of tax/GDP of 20 percent the

additional tax revenues associated with such an increase in GDP would amount to some USD 800 million.

Assuming that expenditures remain at the same level, this extra resource would notionally cut the fiscal

deficit by half – significantly reducing the need for donor recurrent budget support.

4

This major

improvement in fiscal sustainability would in turn generate significant positive reputational benefits for

the PA and would considerably enhance investor confidence.

xi.

The impact on Palestinian livelihoods would be impressive.

An increase in GDP equivalent to 35 percent

would be expected to create substantial employment, sufficient to put a significant dent in the currently

high rate of unemployment. If an earlier estimated one-to-one relationship between growth and

employment was to hold, this increase in GDP would lead to a 35 percent increase in employment. This

level of growth in employment would also put a large dent in poverty, as recent estimates show that

unemployed Palestinians are twice as likely to be poor as their employed counterparts.

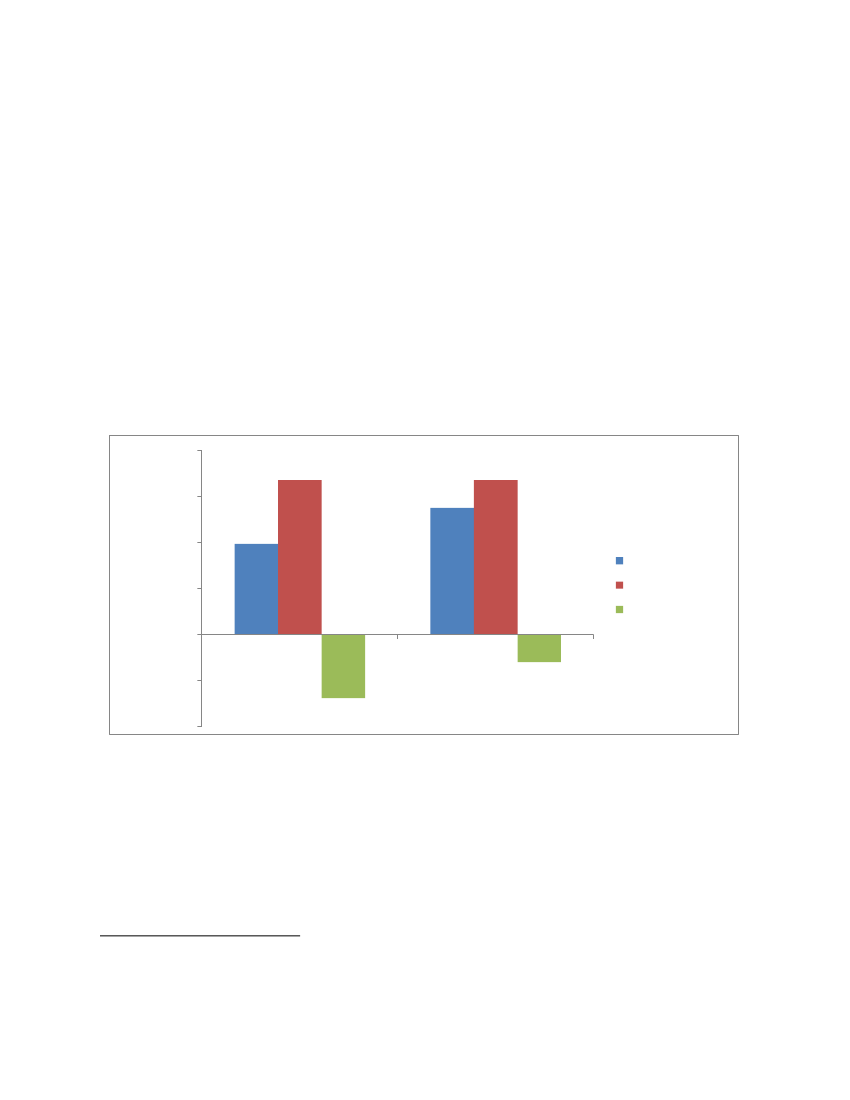

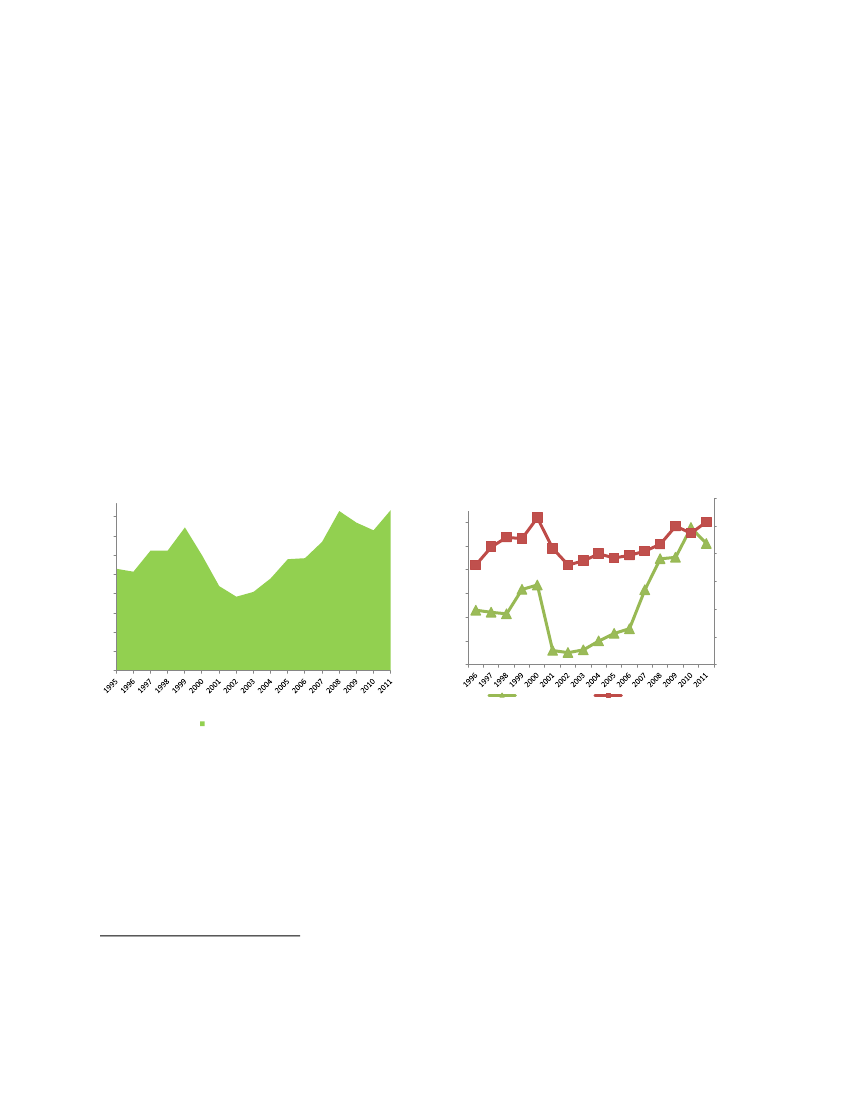

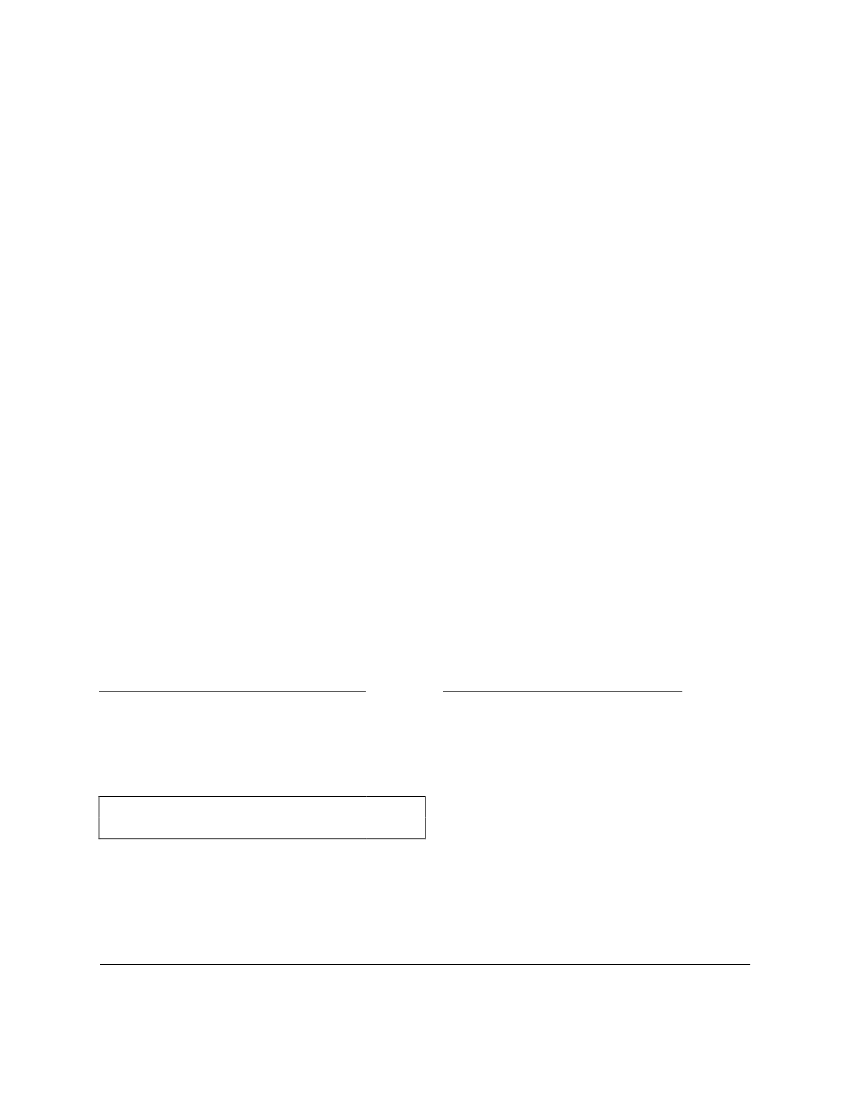

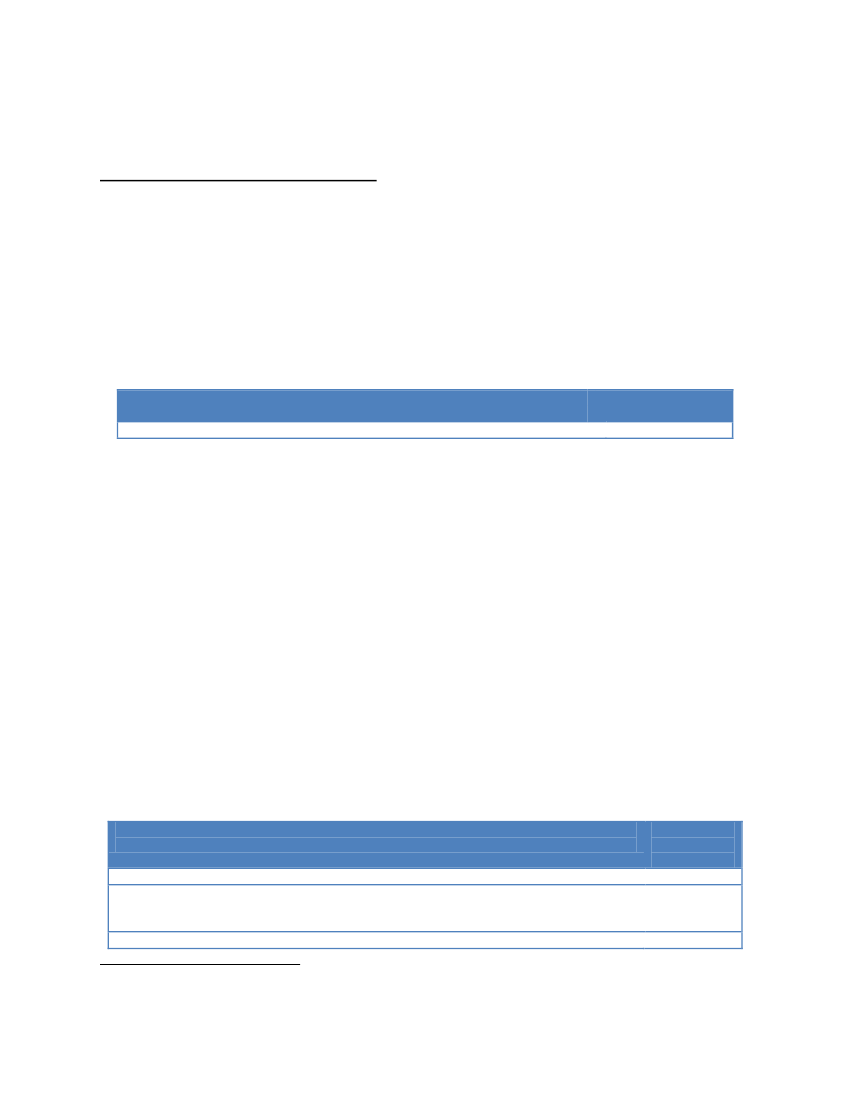

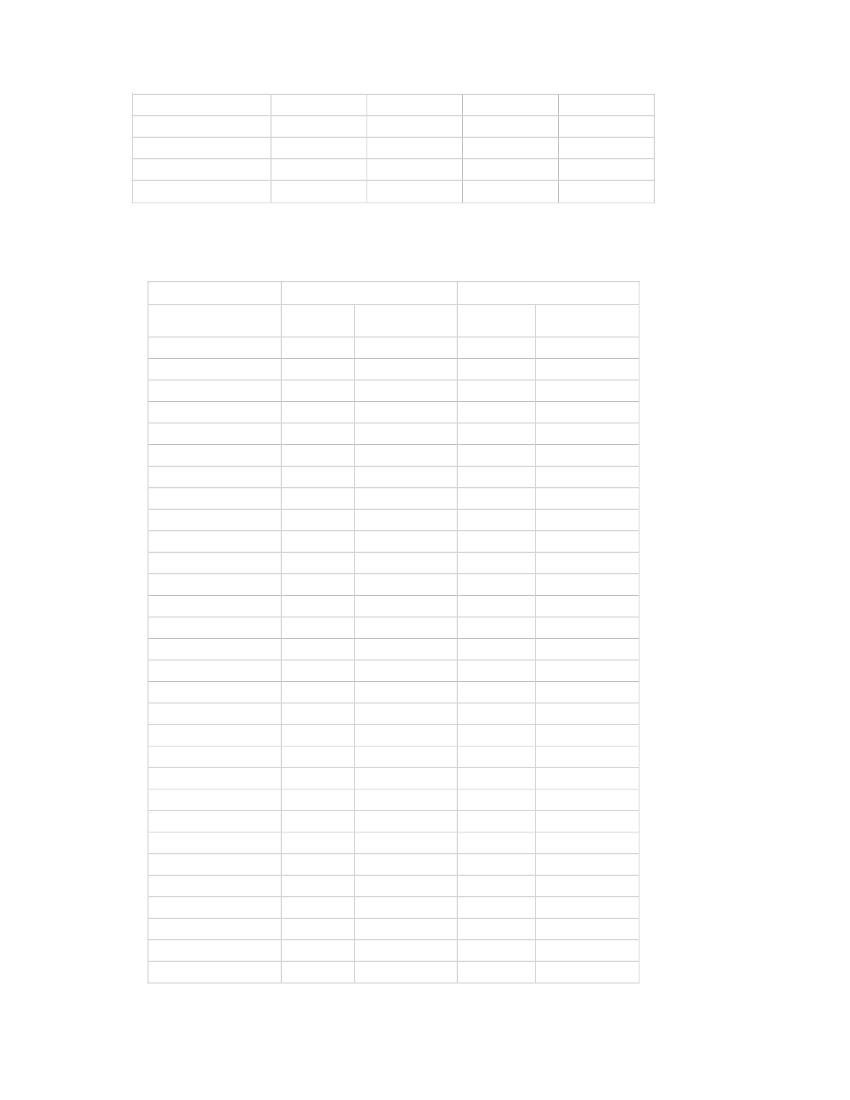

Figure II: If the output potential associated with lifting the restrictions materializes, the fiscal deficit of the

PA is reduced by 56 percent and the need for external budget support greatly declines

4000.0

3000.0

2000.0

PA revenues

1000.0

0.0

Status Quo

-1000.0

-2000.0

Source: Ministry of Finance of Palestinian authority fiscal data (2012) and World Bank staff calculations.

USD million

PA expenditures

PA deficit

Potential

56% reduction in

defict

xii.

Access to Area C will not cure all Palestinian economic problems – but the alternative is bleak.

Without

the ability to conduct purposeful economic activity in Area C, the economic space of the West Bank will

remain crowded and stunted, inhabited by people whose daily interactions with the State of Israel are

characterized by inconvenience, expense and frustration.

4

In reality, the lifting of restrictions on Area C would probably lead to an increase in public investments to develop infrastructure

there. These investments would increase public expenditures, but they would also contribute to growth and the net effect is

uncertain. Thus, for the sake of this report no change in the level of public expenditures associated with the lifting of Area C

restrictions was assumed.

xi

PDF to HTML - Convert PDF files to HTML files

CHAPTER 1: THE PALESTINIAN ECONOMY, ISRAELI RESTRICTIONS AND THE

POTENTIAL OF AREA C

The Palestinian economy: volatility, distorted growth and uncertain prospects

1.

Palestinian economic growth since 1994 has been volatile and unpredictable.

The Oslo peace

process and the establishment of the PA ushered in an era of rapid growth, driven by the return of the

Palestinian Diaspora, periods of relative tranquility and large inflows of public and private capital.

Average real GDP increased by 8.4 percent per annum between 1994 and 1999. The outbreak of the

second Intifada in 2000 interrupted this trend, bringing increased violence and uncertainty – and most

significantly, the intensification by Israel of a complex set of security-related restrictions that impeded the

movement of people and goods and fragmented the Palestinian territories into small enclaves lacking

economic cohesion. In the ensuing recession, GDP contracted by an average of 9 percent per annum in

2000-2002. An initial period of recovery was interrupted by the turmoil surrounding the internal divide

between Fatah and Hamas in mid-2007 before a sustained period of growth between 2007-11, in which

Palestinian reforms were accompanied by large inflows of donor assistance and some easing of movement

restrictions.

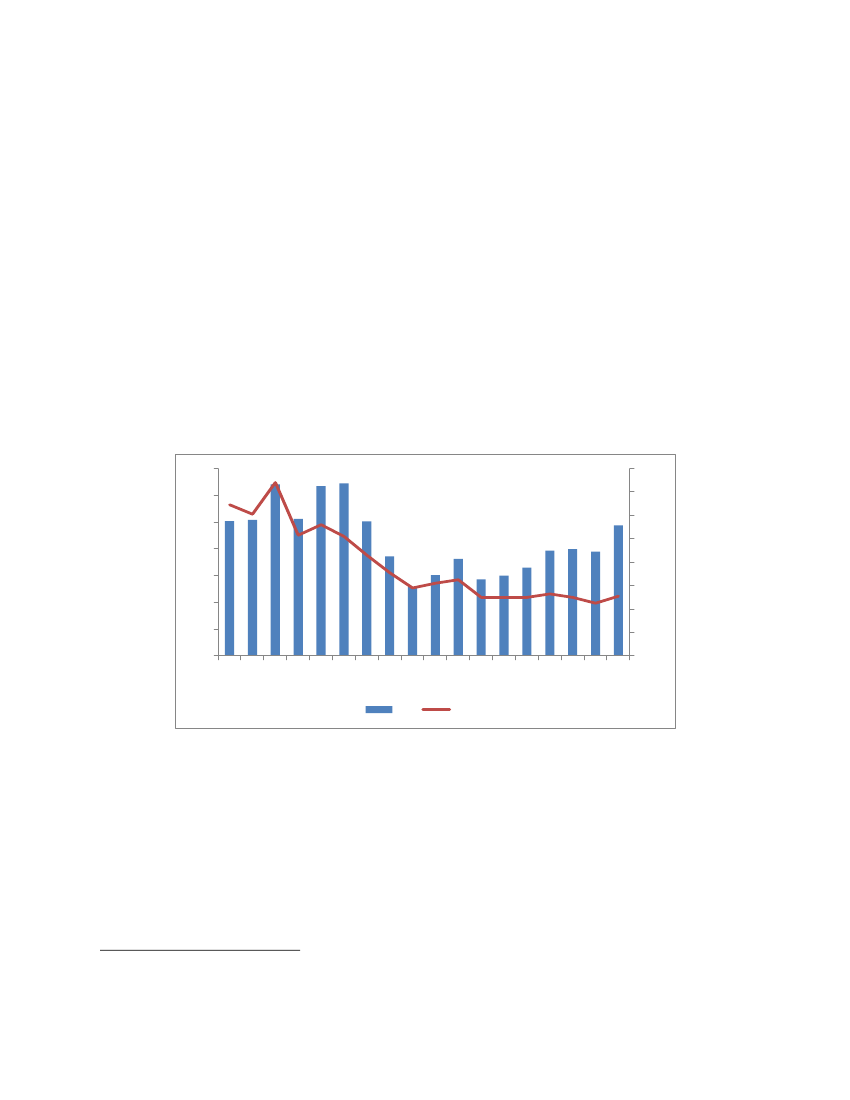

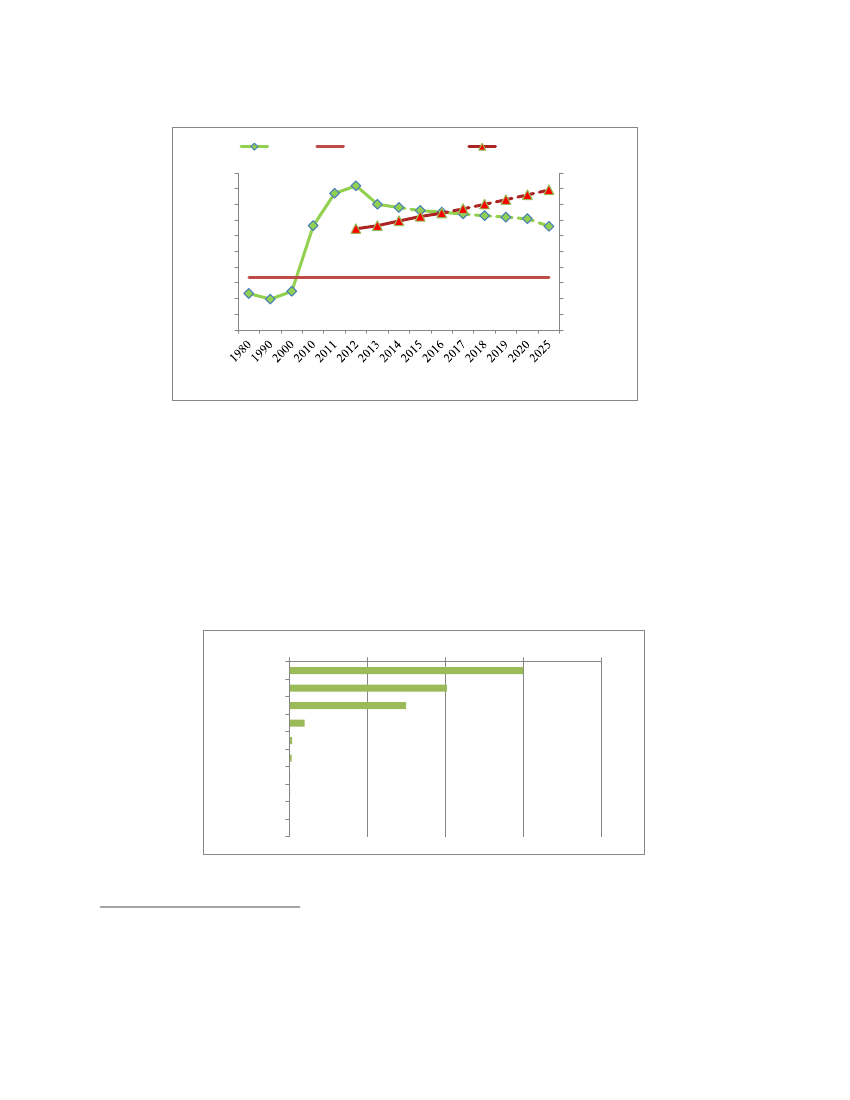

Figure 1: Real GDP Growth Rate 1999-First Half 2013

30

20

10

0

-10

-20

Palestinian territories

-30

Source:

PCBS National Accounts data.

*Based on preliminary data for the first half of 2013.

WB

Gaza

2.

Recent growth rates are proving unsustainable, however.

Growth in recent years has been

driven largely by extraordinary levels of donor budget support, which amounted to USD 1.8 billion, or 29

percent of GDP, in 2008. This fuelled a significant expansion in consumption, particularly the

consumption of valuable public services such as policing, education and health (the share of public

administration, education, and healthcare in GDP increased from 19 to 26 percent between 1994 and

2011). By 2012, however, budget support had decreased by more than half, and growth rates had

declined from 9 percent in 2008-11 to 5.9 percent by 2012 and 1.9 percent in the first half of 2013 (-0.1

percent in the West Bank).

1

PDF to HTML - Convert PDF files to HTML files

3.

The reduction in budget support and the resultant contraction in Palestinian growth have

exposed the distorted nature of the Palestinian economy.

For a small open economy, prosperity requires

a strong tradable sector with the ability to compete in the global marketplace. The faltering nature of the

peace process and the persistence of restrictions on trade, movement and access have had a dampening

effect on private investment and private sector activity. The manufacturing sector, usually a key driver of

export-led growth, has stagnated since 1994, its share in GDP falling from 19 percent to 10 percent by

2011. Nor has manufacturing been replaced by high value-added service exports like Information

Technology (IT) or tourism, as might have been expected. Stagnation and declining competitiveness are

also apparent in the agriculture sector where employment doubled from 53,000 in 1995 to 99,000 in 2011

while productivity, or output per worker, declined by half.

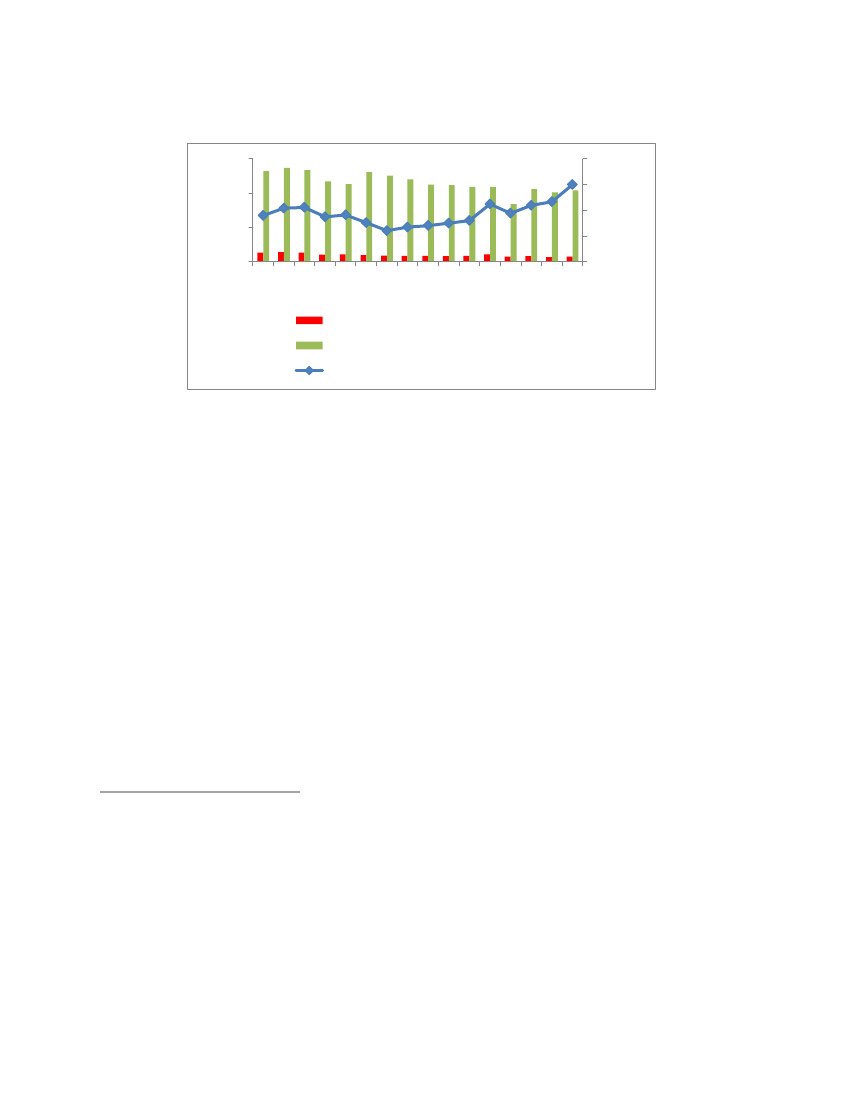

Figure 2: The Decline in the Tradable Sectors

100.0

90.0

80.0

70.0

60.0

Other private sector

services

Hotels and Restaurants

Financial services

Transport and

communications

Manufacturing

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Other

Public sector services

50.0

40.0

30.0

20.0

10.0

0.0

Source:

PCBS National Accounts data.

4.

Private investment rates have remained low, with the bulk channeled into relatively

unproductive activities that generate insufficient employment.

Private investment has averaged around

15 percent of GDP over the past seven years, as compared with rates of over 25 percent in fast-growing

middle income economies, and with Foreign Direct Investment (FDI) averaging a mere 1 percent of GDP,

which is also very low in comparison to most fast growing economies. Much of this investment is also

channeled into internal trade and real estate development, neither of which generates significant

employment. Consequently, unemployment rates have remained very high in the Palestinian territories.

After initial post-Oslo rates of about 9 percent in the mid-1990s, unemployment rose to 28 percent of the

labor force in 2000 with the onset of the second intifada and the imposition of severe movement and

access restrictions; it has remained high ever since and is currently about 22 percent.

5

What is more,

almost 24 percent of the workforce is employed by the PA, an uncommonly high proportion that reflects

the lack of dynamism in the private sector. While internal Palestinian political divisions have contributed

to investor aversion to the Palestinian territories, Israeli restrictions on trade, movement and access are

clearly the binding constraint to investment: these restrictions substantially increase the cost of trade and

make it impossible to import many production inputs into the Palestinian territories, as illustrated, for

instance, on the example of the telecommunications sector. For Gaza, the restrictions on import and

5

The overall unemployment figure for WBG masks significant regional divergences. Unemployment in the West Bank stood at

19 percent in the first half of 2013 compared to 30 percent in Gaza.

2

PDF to HTML - Convert PDF files to HTML files

export are in particular severe. In addition to the restrictions on labor movement between the Palestinian

territories, the restrictions on movement of labor within the West Bank have been shown to have a strong

impact on employability, wages, and economic growth. Israeli restrictions render much economic activity

very difficult or impossible to conduct on about 61 percent of the West Bank territory, called Area C.

Restrictions on movement and access, and the stunted potential of Area C

5.

The complex system of restrictions on movement and access imposed by Israel is the most

significant impediment to Palestinian private sector growth.

The decisive economic impact of Israeli

restrictions has been analyzed in many Bank reports and reports prepared by other development agencies

over the past decade, and Israel’s rationale for them – that they are necessary to protect Israeli citizens – is

also well-known. The movement of people and goods into and out of the Palestinian territories, and

within the West Bank, is severely limited by a multi-layered system of physical, institutional, and

administrative impediment.

6

Physical barriers are compounded by unpredictable regulatory measures and

practices – notably the large list of “dual use”

7

items that cannot be imported because Israel regards them

as a security risk -- and by limited access to water and to the electromagnetic spectrum.

6.

Restrictions on economic activity specific to Area C of the West Bank have been particularly

detrimental to the Palestinian economy.

The potential contribution of Area C to the Palestinian

economy is enormous. It constitutes about 61 percent of the West Bank

8

and is home to around 180,000

Palestinian people, or approximately 6.6 percent of the Palestinian West Bank population.

9

7.

It is richly endowed with natural resources; and it is contiguous, whereas Areas A and B are

territorial islands.

The manner in which Area C is currently administered virtually precludes Palestinian

businesses from investing there. Relieving these restrictions would have substantial positive effects on the

Palestinian economy, as Chapters 2 and 3 will demonstrate.

8.

The division of the West Bank into Areas A, B and C dates back to the 1995 Interim Agreement

between the Palestinian Liberation Organization and the Government of Israel.

Area A includes most

major pre-existing Palestinian urban areas, covers 18 percent of the West Bank and is under full

Palestinian security and civil control. Area B consists largely of peri-urban areas and small towns,

comprises 21 percent of the West Bank and is under Palestinian civil control and Israeli security control.

10

Area C was defined under the Interim Agreement as “areas of the West Bank outside Areas A and B,

which, except for the issues that will be negotiated in the permanent status negotiations, will be gradually

6

Access to Gaza remains highly controlled, and only consumer goods and construction material for donor supervised projects are

allowed in. Exports from Gaza to the West Bank and Israeli markets, traditionally Gaza’s main export destinations, are prohibited

(according to Gisha, an Israeli non-profit organization founded in 2005 to protect the freedom of movement of Palestinians,

especially Gaza residents, 85 percent of Gaza products were exported to Israel and the West Bank prior to 2007, at which point

Israeli restrictions were tightened). The only shipments of agricultural and manufactured products exiting Gaza to third country

markets today are negligible amounts exported under the aegis of donor-financed projects.

7

The “dual use” list contains goods, raw materials and equipment that in addition to their civilian use could be used for military

purposes, and therefore cannot be imported by Palestinian businesses. Dual use trade restrictions are not uncommon

internationally and may serve legitimate security concerns. However, the list of dual use items whose import to West Bank and

Gaza is banned by GoI is unusually extensive. These restrictions raise the cost of inputs and force Palestinian businesses to use

inefficient input mixes -- and in some cases, to drop product lines. Most Palestinian industries are affected by the dual use list --

particularly food and beverages, pharmaceuticals, textiles, information technology, agriculture and metal processing. The “dual

use” list does not apply to Israeli importers. It is reported that Palestinian businesses can sometimes procure these goods from

Israeli businesses.

8

The vague definition of Area C in the Interim Agreement made it difficult to identify its exact boundaries; consequently Area C

has come to be defined as all West Bank territory that is not part of Areas A and B.

9

The Area C population figure comes from personal communications with Bimkom, an Israeli non-profit organization. This

figure is not precise because data for the distribution of population between Area C and Areas A & B is not available, and since

two-thirds of towns and villages fall partly in Area C and partly in Areas A & B.

10

World Bank AHLC Report, September 2008. “Palestinian Economic Prospects: Aid, Access, and Reform”.

3

PDF to HTML - Convert PDF files to HTML files

transferred to Palestinian jurisdiction in accordance with this Agreement”

11

– i.e. within five years,

except for certain areas to be agreed upon as part of final settlement negotiations. This gradual transfer

has not yet taken place.

9.

Only a very small part of Area C is accessible to Palestinian economic agents, and is fully

subject to Israeli military control

12 .

Less than 1 percent of Area C, which is already built up, is

designated by the Israeli authorities for Palestinian use; the remainder is heavily restricted or off-limits to

Palestinians,

13

with 68 percent reserved for Israeli settlements,

14

c. 21 percent for closed military zones,

15

and c. 9 percent for nature reserves (approximately 10 percent of the West Bank, 86 percent of which

lies in Area C). These areas are not mutually exclusive, and overlap in some cases. In practice it is

virtually impossible for Palestinians to obtain construction permits for residential or economic purposes,

even within existing Palestinian villages in Area C: the application process has been described by an

earlier World Bank report (2008) as fraught with “ambiguity, complexity and high cost”.

16

The same is

true for the extraction of natural resources and development of public infrastructure.

11

The 1995 Israeli-Palestinian Interim Agreement on the West Bank and Gaza Strip, Chapter 2, Article XI, 3c; available on the

Israeli Ministry of Foreign Affairs website:

http://www.mfa.gov.il/MFA/Peace+Process/Guide+to+the+Peace+Process/THE+ISRAELI-

PALESTINIAN+INTERIM+AGREEMENT+-+Annex+VI.htm

12

The Israeli Civil Administration, subordinate to Israeli Defence Force’s Coordinator of Government Activities in the

Territories, or COGAT, administers civilian affairs in the West Bank.

13

OCHA, 2009. “Restricting Space: The Planning Regime Applied by Israel in Area C of the West Bank.”

14

Much of the territory controlled by the settlements is land that has been declared by the Israeli government to be “state land”,

through the application of the Ottoman Land Law – and this includes land which Israel also considers to be private Palestinian

land. B’tselem found that 21 percent of the built-up area of the settlements is classified as Palestinian private property – see

B’tselem, 2010. “By Hook and by Crook: Israeli Settlement Policy in the West Bank”. See also B’tselem, 2011. “Taking Control

of Land.” Published on http://www.btselem.org/.

15

These include areas allocated to military training, military bases, secured areas around settlements, land between the West

Bank Separation Barrier and the Green Line and a security strip along the Jordanian border– see OCHA, 2009, op. cit.

16

World Bank, 2008. “The Economic Effects of Restricted Access to Land in the West Bank.” The complexity of the procedures

is mainly attributed to GoI suspension of planning and land registration in 1968, which made it difficult and costly to prove

ownership.

4

PDF to HTML - Convert PDF files to HTML files

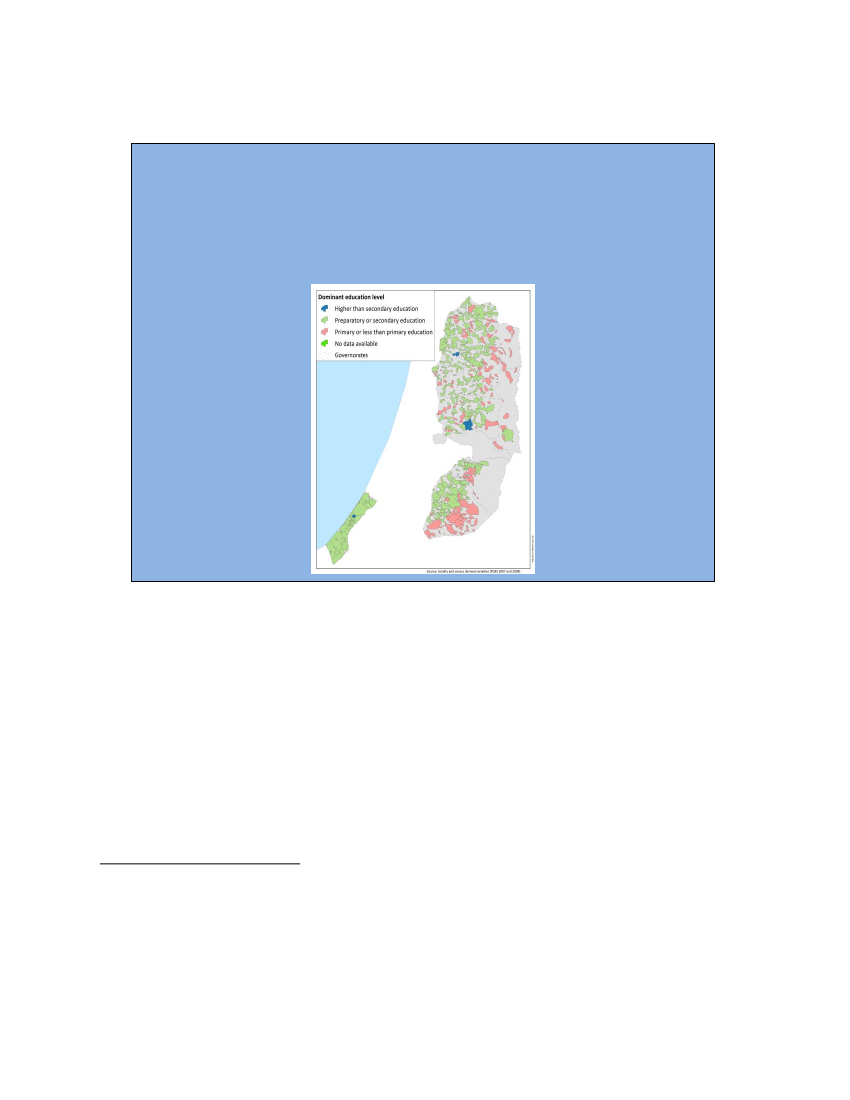

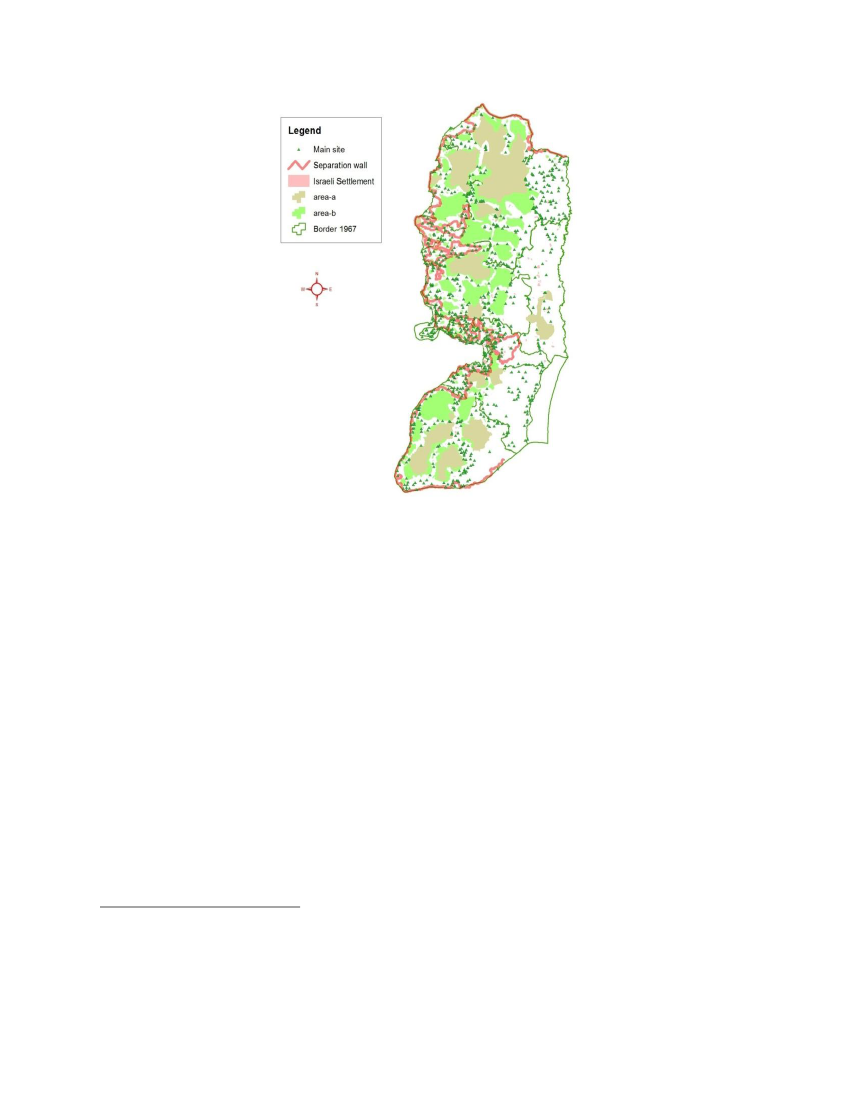

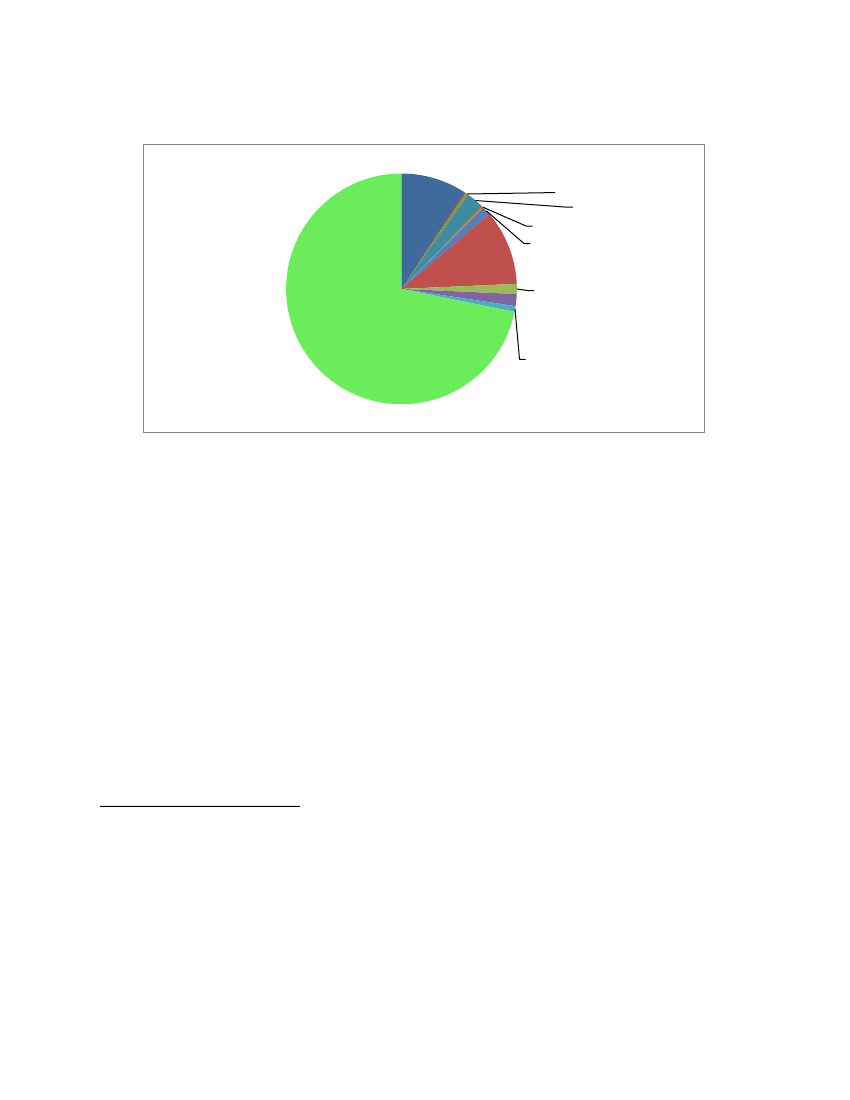

Box 1: Limited access to education for Palestinians who live in Area C

increases their chance of being poor

An example which illustrates the vulnerability of communities falling in area C directly relates to the lack

of basic services. The map below plots the most frequent level of education reported by heads of

household for each locality. A few pockets of high levels of average education (higher than secondary) are

plotted in blue and also correspond to localities with low levels of poverty. In contrast, localities where

many heads of household have primary education or less (in pink) are on average more likely to be very

poor. The latter are predominantly in the eastern part of the West Bank, overlapping with area C, where

access to education services may be very limited.

10.

The proportion of Area C available for Palestinian economic development is being constricted

by the expansion of Israeli settlements.

The Israeli settler population in the West Bank grew from

111,600 in 1993 to 328,423 by 2011, and the proportion of Area C devoted to their settlements has

expanded rapidly.

17

Settlement areas grew by 35 percent between 2000 and 2011 and now cover almost

3.25 percent of the West Bank.

18

The territory actually controlled by settlements far exceeds this, and

according to Israeli sources amounts to fully 68 percent of Area C.

19

In addition to built-up areas, this

includes the settlements’ municipal boundaries, development master plan areas and road networks, all of

which are usually off limits to Palestinians. Reports by the Israeli Ministry of Defense in 2012 further

state that an additional 10 percent of Area C has been earmarked for settlement expansion.

20

The

perceived need to protect Israeli settlers is seen by some observers as the key driver behind many of the

restrictions imposed on Palestinians in Area C.

21

17

18

Source of data for settlement population: Foundation for Middle East Peace.

The Applied Research Institute in Jerusalem (ARIJ) database, 2012.

19

B’tselem, 2010. “By Hook and By Crook: Israeli Settlement Policy in the West Bank.” The total area of the West Bank is

approximately 5.661 million dunums, or 1.398 million acres.

20

Haaretz, March 30 2012. Found at:

http://www.haaretz.com/news/diplomacy-defense/israel-defense-ministry-plan-earmarks-10-percent-of-west-bank-for-

settlement-expansion-1.421589

21

See for example World Bank, 2007. “Movement and Access Restrictions in The West Bank: Uncertainty and Inefficiency in

The Palestinian Economy”.

5

PDF to HTML - Convert PDF files to HTML files

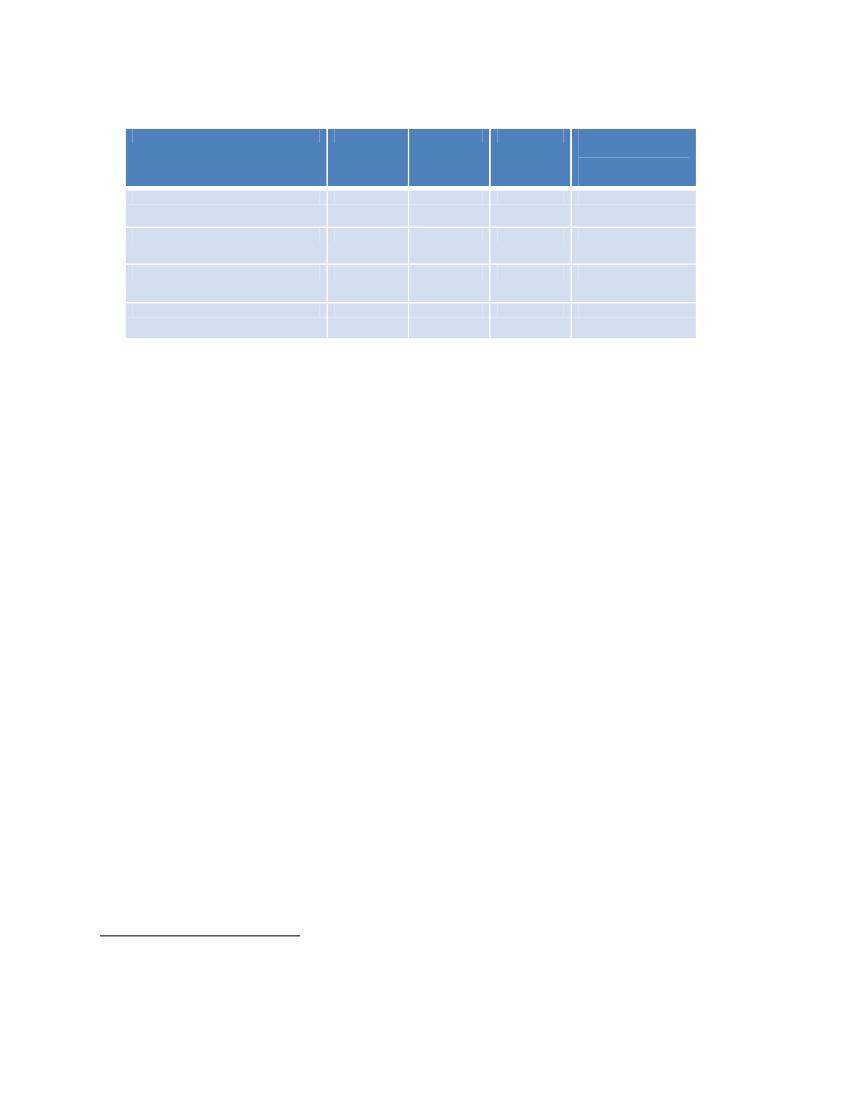

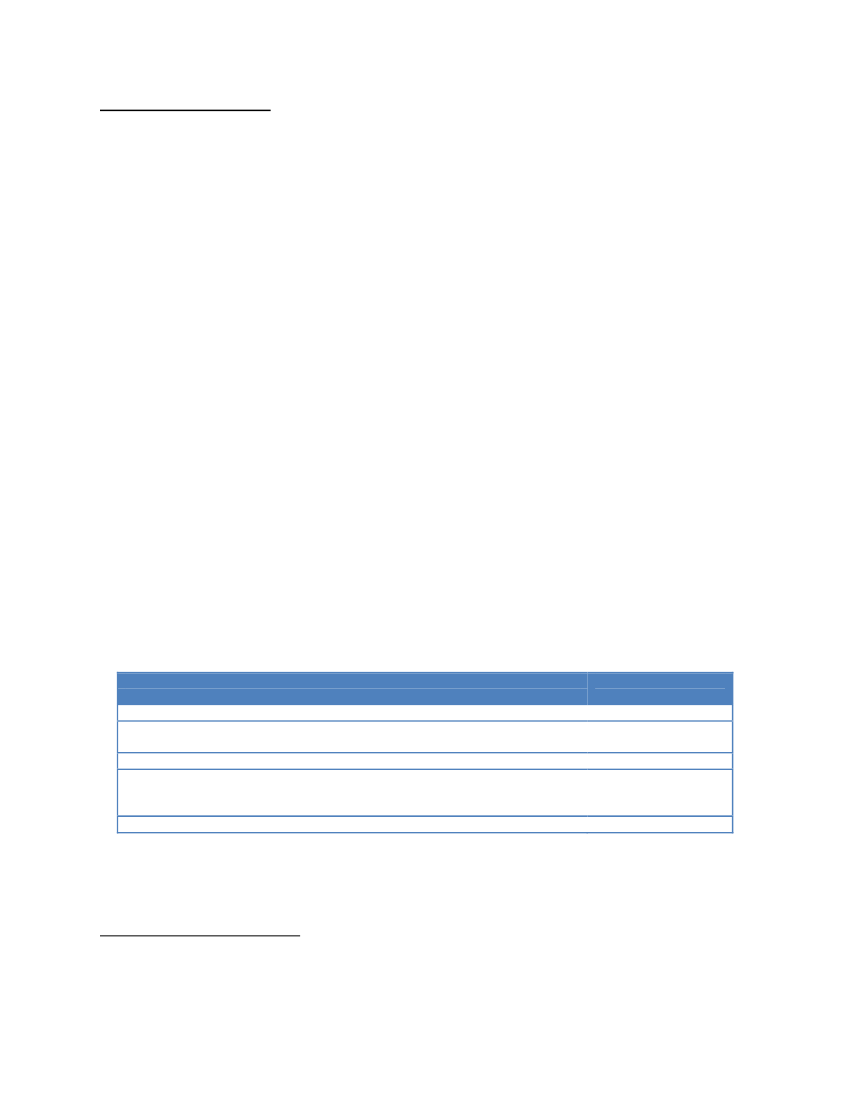

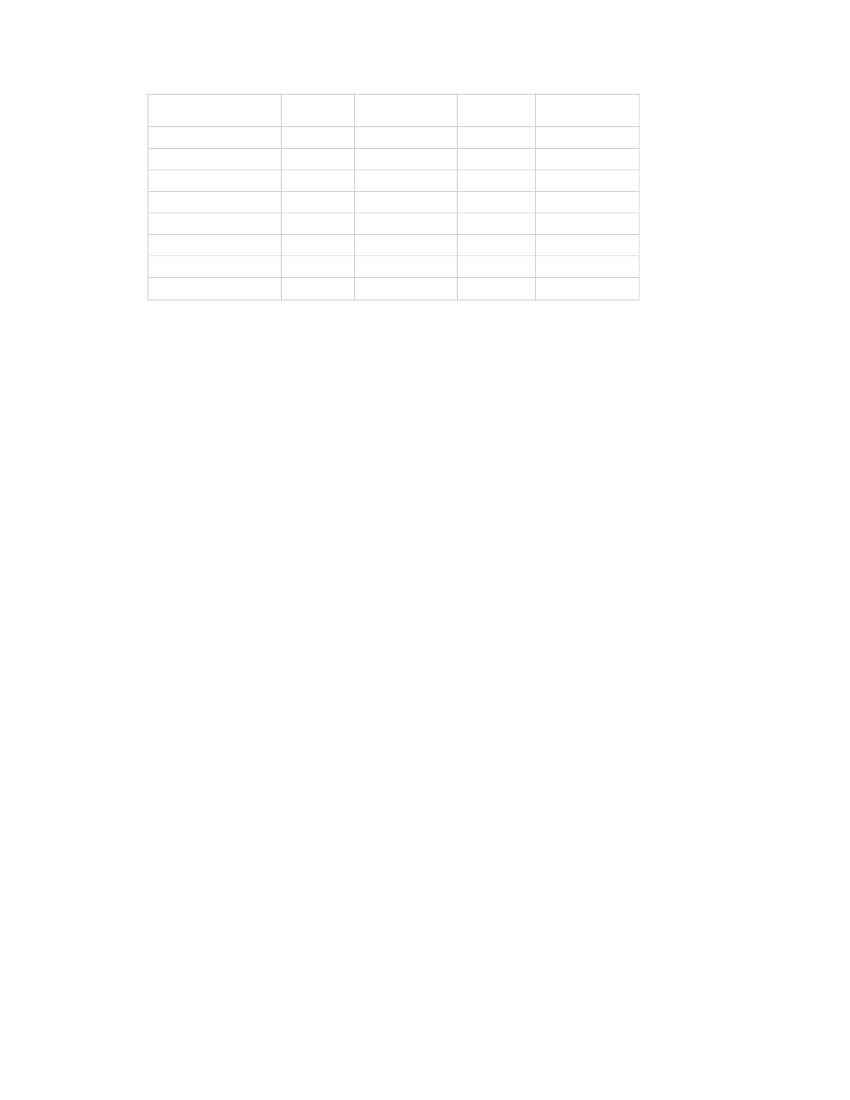

Table 1: Significance of Area C in Terms of Natural Resources

Natural resource

In Area A

In Area B

In Area C

Natural resource in

Area C as a

percentage of total

in West Bank (%)

86

91

48

37

Nature reserves (dunums

22

)

Forests (dunums)

Wells

Springs

52,300

7,000

223

70

42,600

9,000

87

122

607,730

59,016

287

23

112

Source:

Applied Research Institute in Jerusalem (ARIJ), 2013.

11.

Much fuller Palestinian economic access to Area C, as envisaged in the Interim Agreement,

would – if accompanied by a major reduction in general movement and access restrictions -- have a

decisive impact on Palestinian economic prospects.

The paper will illustrate this by estimating the

economic costs to the Palestinian economy of today’s restrictions, and the potential benefits of relieving

them and it does not prejudge the status of any territory which may be subject to negotiations between

Palestinians and Israelis. Chapter 2 will look at the direct costs to the two sectors with the greatest upside

potential – agriculture, and Dead Sea minerals production -- and will also reference the income foregone

in stone mining & quarrying, construction, tourism and telecommunications. Chapter 3 will then

calculate the indirect benefits that could accrue to the Palestinian economy as a whole from an expansion

of Palestinian economic activity in Area C. As will become clear, these benefits not only include a

significant reduction in unemployment and the prospect of vigorous levels of private sector-led growth –

they would also lead to a significant reduction of current Palestinian dependence on donor-financed

budget support. It is understood that a drastic roll-back of today’s regime of movement and access

restrictions is likely to require a new and more positive bilateral dynamic between Israel and the

Palestinians, which will among other things address the Israeli security concerns.

22

23

1 dunum is approximately equal to 0.25 acre.

The figure for Area C is relatively low and its value can probably be attributed to Area C restrictions, which preclude the

exploration and opening of new wells in Area C. Thus, it is probable that this figure significantly underestimates the true number

of wells in the Area.

6

PDF to HTML - Convert PDF files to HTML files

CHAPTER 2: AREA C – OUTPUT POTENTIAL OF KEY SECTORS OF THE

PALESTINIAN ECONOMY

12.

The alleviation of today’s restrictions on Palestinian investment, movement and access in Area

C could bring about significant expansion of many sectors of the Palestinian economy.

This chapter

examines the direct impact of the restrictions – and the benefits of alleviating them – for a number of

important sectors of the Palestinian economy. Relatively conservative estimates show that the direct

gains, in terms of potential value added in these sectors, would amount to at least USD 2.2 billion,

equivalent to some 23 percent of 2011 Palestinian GDP.

I.

Agriculture

13.

West Bank agriculture’s contribution to the Palestinian economy is declining.

As Figure 3

shows, agriculture contributed over 14 percent of West Bank GDP in the mid-1990s, but only 5.1 percent

in 2011. Real value added has also fallen considerably from its 1999 peak.

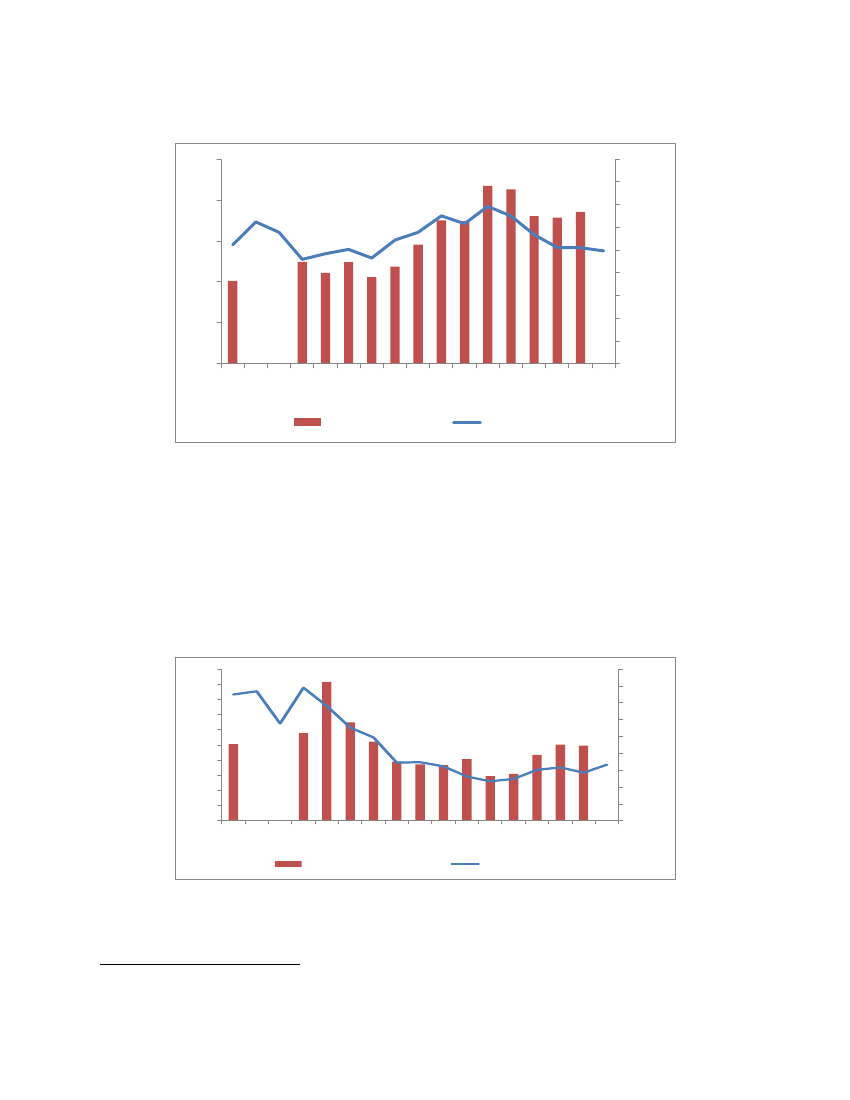

Figure 3: Agriculture Value Added in the West Bank (constant 2004 USD m, percentage of GDP)

350

300

250

200

150

16%

14%

12%

10%

8%

6%

100

50

0

4%

2%

0%

1998

2005

1994

1995

1996

1997

1999

2000

2001

2002

2003

2004

2006

2007

2008

2009

2010

VA

Source: PCBS (2012a).

% GDP

14.

At the same time, though, the number of West Bankers employed in agriculture more than

doubled between 1995 and 2006.

The decreasing importance of agriculture has not been accompanied by

any corresponding movement of workers out of agriculture into more productive sectors, as would be

typical in a modernizing economy.

24

24

See, for example, Berdegue, J.A., E. Ramirez, T. Reardon, and G. Escobar, 2001. “Rural Nonfarm Employment and Incomes

in Chile”, and Lanjouw, P., and A. Shariff, 2002. “Rural Nonfarm Employment in India: Access, Income, and Poverty Impact.”

The World Bank Working Paper No. 81.

7

2011

PDF to HTML - Convert PDF files to HTML files

Figure 4: Share of Agriculture in Total Employment, West Bank

25%

90,000

80,000

70,000

60,000

20%

15%

10%

5%

0%

50,000

40,000

30,000

20,000

10,000

0

2006

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2007

2008

2009

2010

Number (right axis)

Share in total

Note:

The share is calculated for the residents of the West Bank whose place of work is the West Bank (workers

in Israeli settlements or in Israel are excluded).

Source:

PCBS Labour Force surveys (various years).

15.

Consequently, agricultural labor productivity in the West Bank is in significant decline.

This

trend has been particularly apparent since the end of the 1990s, as Figure 5 demonstrates. The decline is

even more striking when compared to the rest of the West Bank economy – as the blue line in the figure

shows, the ratio of labor productivity in agriculture relative to the economy as a whole fell by more than

50 percent between 1995 and 2011. The wage dynamics in the West Bank show that this productivity

decline has meant a reduction in agricultural earnings relative to work in the economy as a whole.

25

Figure 5: West Bank Labor Productivity (value added/worker, and relative to the overall economy)

1.00

0.90

0.80

0.70

0.60

0.50

0.40

0.30

0.20

0.10

0.00

18000

16000

2011

14000

12000

10000

8000

6000

4000

2000

0

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

VA/worker (right axis)

VA shr in emp shr

Note:

The sampling weights are not correct in the Labor Force surveys for 1996 and 1997, which prevents the

computation of the VA/worker in those years.

Source: PCBS (2012a) and PCBS Labor Force surveys (various years).

25

The median nominal daily wage (MNDW) in agriculture (which was lower than in the rest of the economy to start with) grew

20% more slowly than the MNDW in the economy as a whole between 1997 and 2011.

8

2011

PDF to HTML - Convert PDF files to HTML files

16.

These abnormal trends are explained by the various restrictions on Palestinian access to and

investment in the land and water resources of the West Bank, predominantly those restrictions

operating in Area C.

The fact that workers have not abandoned agriculture and that the sector has not

witnessed any appreciable intensification speaks to the difficulties of developing alternative economic

activities as well as to the limitations placed on agriculture itself. As discussed below, these restrictions

impede access to large swathes of fertile land and essential water sources as well as constrain the

development of the infrastructure needed for modern market-oriented agriculture.

Area C Restrictions and the Decline of Palestinian Agriculture

17.

Area C includes almost all the land of the West Bank suitable for agricultural production -- a

delineation inherent in Interim Agreement’s zoning system, in which Area C comprises the territories

beyond Palestinian urban and peri-urban areas.

Palestinian access to much of this land though, is either

prohibited or severely restricted, as was described in the first Chapter. The Land Research Center (LRC)

has estimated that almost half a million dunums of land suitable for agriculture in Area C is not cultivated

by Palestinians.

26

Some of this cannot be cultivated because of restricted access

27

-- LRC estimates that

187,000 dunums are cultivated or occupied by Israeli settlements – and some of it cannot be cultivated

due to lack of water. In addition, another 1 million dunums could be used for rangeland or forestry were

current restrictions lifted. Although of lower economic potential, this land could generate useful income,

as discussed below.

18.

While most of the West Bank’s aquifer and spring water is located in Area C, Palestinians have

not been able to draw their agreed allocation of 138.5 MCM per annum.

There are three underground

aquifers in the West Bank: the Eastern, the Western, and the North-eastern aquifers. They are located

either entirely in Area C (the Eastern Aquifer) or are shared with Israel (the North-eastern and Western

Aquifers). Out of the 138.5 MCM annual allocation in 2011, for example, only 87 MCM was abstracted

by the Palestinians.

28

Digging wells or building water conveyance and wastewater treatment and reuse

infrastructures requires approval by the Israeli Civil Administration (ICA) as well as by the Joint Water

Committee if Area C is implicated, which is almost always the case.

29

Selby (2012)

30

argues that these

requirements have severely restricted the number of additional wells: new Palestinian wells drilled since

the Oslo Agreement provide only 13 MCM/year – below the 20.5 MCM/year allocated under the Interim

Agreement for the five-year transitional period, and considerably less than the additional 70-80

MCM/year identified for Palestinian “future needs”

31

. What is more, half of Palestinian wells have dried

up over the last twenty years

32

-- with the result that total Palestinian water production in the West Bank

has dropped by 20 MCM/year since 1994. This decline has been partially offset by an increase in water

purchases from Israel of over 100 percent between 1995 and 2010.

33

Even so, per capita water access has

declined by more than 30 percent.

34

These restrictions on water availability limit Palestinian irrigation

possibilities and thereby constrain potential agricultural production.

26

Land Research Center, 2010. “Land Suitability for Reclamation April 2010 and Development in the West Bank. Hebron,

Palestine.”

27

The World Bank, 2010. “The Underpinnings of the Future Palestinian State: Sustainable Growth and Institutions.” The report

notes that in 2010, while “the Israeli military removed some 80 roadblocks that impeded vehicular access for limited numbers of

farmers to agricultural land in Area C, no improvement was observed regarding access to much larger agricultural areas”.

28

Palestinian Water Authority, 2012. “National Water Strategy for Palestine, Ramallah.”

29

World Bank, 2009. “Assessment of Restrictions on Palestinian Water Sector Development,” Sector Note.

30

Selby, Jan, 2013. “Cooperation, Domination and Colonisation: The Israeli-Palestinian Joint Water Committee”, Water

Alternatives 6(1): 1-24.

31

See Interim Agreement, Annex III, Article 40: 6.

32

PCBS (2009b), Water Statistics in the Palestinian Territory Annual Report, 2008, Ramallah, Palestine.

33

Selby et al, op. cit.

34

By 2007 the Palestinian population had access to only about one quarter of the ration of their Israeli counterparts: West Bank

Palestinians consumed about 123 liters per capita per day while Israelis about 544 liters per day. See World Bank, 2009.

“Assessment of Restrictions on Palestinian Water Sector Development.” Sector Note.

9

PDF to HTML - Convert PDF files to HTML files

19.

Aside from access to land and water, other impediments prevent Palestinian agriculture

production from approaching its potential.

Permission to create the infrastructure needed to intensify

agricultural production -- water reservoirs, feeder roads, processing facilities – has been very difficult to

obtain.

35

The Separation Barrier has cut off many farmers from their agricultural fields, many of which

are located in Area C.

36

Agricultural Potential

20.

Current restrictions on Palestinian access to and use of the land and water resources of Area C

reduce both the amount of land that can be cultivated and its productivity, largely as a consequence of

restricted water availability.

Estimating the potential value added of removing these restrictions is

difficult and would involve many arguable assumptions – so we have taken a very conservative approach

based mostly on an expansion of Palestinian irrigated land in Area C (see

Annex 1

to this report for a

more detailed discussion of the methodology used). The settlement areas are excluded from this

discussion.

21.

Irrigating the approximately 326,400 dunums of arable land notionally available for

Palestinian cultivation in Area C would increase Palestinian Area C production by USD 1.068 billion.

With potential additional rain fed land added and current Palestinian Area C production of USD 316

million discounted, the value of annual production would increase by some USD 890 million. This would

require around 189 MCM of water per year, using the current Palestinian irrigation average of 579 litres

of water per year per dunum

37

. Discussing access to this additional water is beyond the scope of this

report, but it should be noted that substantial investments would be necessary.

Box 2: Agriculture in Israeli Settlements in Area C exemplifies the

Sector's Potential in the Area

38

Recent estimates suggest that the area cultivated by the settlements in the West Bank has expanded

rapidly, growing by 35 percent since 1997 and reaching around 93 thousand dunums in 2012. The

cropping pattern of settler agriculture suggests good access to water and consequently higher

productivity. In 2012, only 5 percent of the agricultural land cultivated by the settlements in the

West Bank was devoted to olives production, one of the cultivations with the least water

requirement. This minimal water requirement is one of the main reasons why almost half of the

agricultural land cultivated by the Palestinians in the Palestinian territory is devoted to olive trees.

Thus, better access to water would enable a similar shift in the cropping pattern and increased

productivity of agriculture in the Palestinian economy. There is no publicly available information

to estimate the value of agricultural production in Israeli settlements. A conservative estimate,

which relies on the current Palestinian productivity level of irrigated land in the West Bank,

suggests that the potential agricultural value of the settlements’ land used for agriculture is at least

USD 251 million, equivalent to USD 196 million in value added. This large potential is confirmed

by the fact that the settlements currently provide most of the pomegranates exported to Europe and

Russia, in addition to 22 percent of the almonds and 12.9 percent of the olives among others. The

Jordan Valley settlements produce 60 percent of the dates destined to Israel and 40 percent of the

exported dates.

35

Interviews with farmers in the Jordan Valley indicate that there are around 300 packing facilities for agricultural products in

the Jordan Valley, of which only two are Palestinians, while the rest of the facilities belong to the settlements.

36

According to B’tselem, 2010, the Palestinian land which has remained west of the barrier and thus inaccessible to most

residents of the West Bank, amounts to 119,500 dunums.

37

Glover, S, Hunter, A, 2010. “Meeting Future Palestinian Water Needs.” Palestinian Policy Research Institute (MAS).

38

Source of data for the box: Karem Navot, 2013. “Israeli settler agriculture: as a means of land takeover in the West Bank.”

10

PDF to HTML - Convert PDF files to HTML files

22.

Area C also contains rangeland and forests which could be exploited in the absence of access

and usage restrictions.

The total potential value of this rangeland, measured in terms of fodder that could

be produced annually with unrestricted access, amounts to just over USD 7 million per year, of which

only just over some USD 1 million is currently realized.

39

Access to forests in Area C and their

sustainable exploitation would also add value to the Palestinian economy, but we lack adequate

information to estimate this.

23.

The total additional production thus amount to USD 896 million per year. Using the 78 percent

ratio of agriculture value added to output applied in the Palestinian National Accounts, this translates

into USD 704 million in value added.

40

This represents 9.5 percent of West Bank GDP in 2011, and 7

percent of total 2011 Palestinian GDP, and is almost certainly an underestimate of the true figure: it

concentrates almost solely on irrigated potential and uses as benchmarks levels of Palestinian production

that are themselves repressed by movement and access restrictions.

II.

Dead Sea Minerals

24.

Proven vast mineral deposits exist in the Dead Sea, offering major potential for the Palestinian

economy.

As the large international corporation Israeli Chemicals, Ltd. (ICL) notes in its 2012 annual

report, “The Dead Sea is a vast (practically inexhaustible) and highly concentrated source of reserves of

potash, bromine, magnesium and salt”.

41

Access to this resource endowment would permit the emergence

of several large industrial activities based on the extraction of potash, bromine and magnesium, as well as

salts and secondary industries such as cosmetics. As yet, though, the Palestinian economy is unable to

benefit from this potential due to restricted access, permit issues and the uncertainties of the investment

climate. This contrasts sharply with the experience of Israel and Jordan.

25.

Israel and Jordan are benefiting considerably from the Dead Sea mineral endowment.

Both

countries have developed industries that contribute substantial value added, exports, and jobs to their two

economies. Israeli companies generate around USD 3 billion annually from the sale of Dead Sea

minerals (primarily potash and bromine) and from other products, which are derived from Dead Sea

Minerals. Jordanian Dead Sea mineral industries are smaller but still generate about USD 1.2 billion in

sales (equivalent to 4 percent of Jordan’s GDP).

42

Potash extraction and processing industries alone

contribute roughly USD 2.3 billion in sales earnings to the economies of Israel and Jordan, most of it in

the form of foreign exchange from exports.

43

Between them, Israel and Jordan accounted in 2010 for

about 6 percent of world potash production, and this capacity is growing – as is demand. The

International Fertilizer Association forecasts a sharp increase in potash demand between 2012 and 2017,

from about 50 to 70 million tons per year.

44

39

Assuming that only 15 per cent of the rangelands in Area C are currently accessible to Palestinians – see Dudeen, B.A., 2002.

“Land Degradation in Palestine: Main Factors, Present Status and Trends.” Land Research Center, Hebron.

40

PCBS, 2009.

41

ICL Periodic Report for 2012. p. 12.

42

Staff estimates based on data from Israeli and Jordanian official statistics, annual reports of the Arab Potash Company PLC,

Israeli Chemicals Ltd. (ICL) and data on the cosmetic industries in both countries.

43

Potash is the common name given to various potassium salts. It is an important plant nutrient and is used for fertilizer.

44

See ICL Periodic Report for 2012, p. 38. The ICL report and several other online sources show significantly higher current

potash consumption and demand forecast than that shown by the Food and Agriculture Organization of the United Nations in its

“Current World Fertilizer Trends and Outlook to 2016.”

11

PDF to HTML - Convert PDF files to HTML files

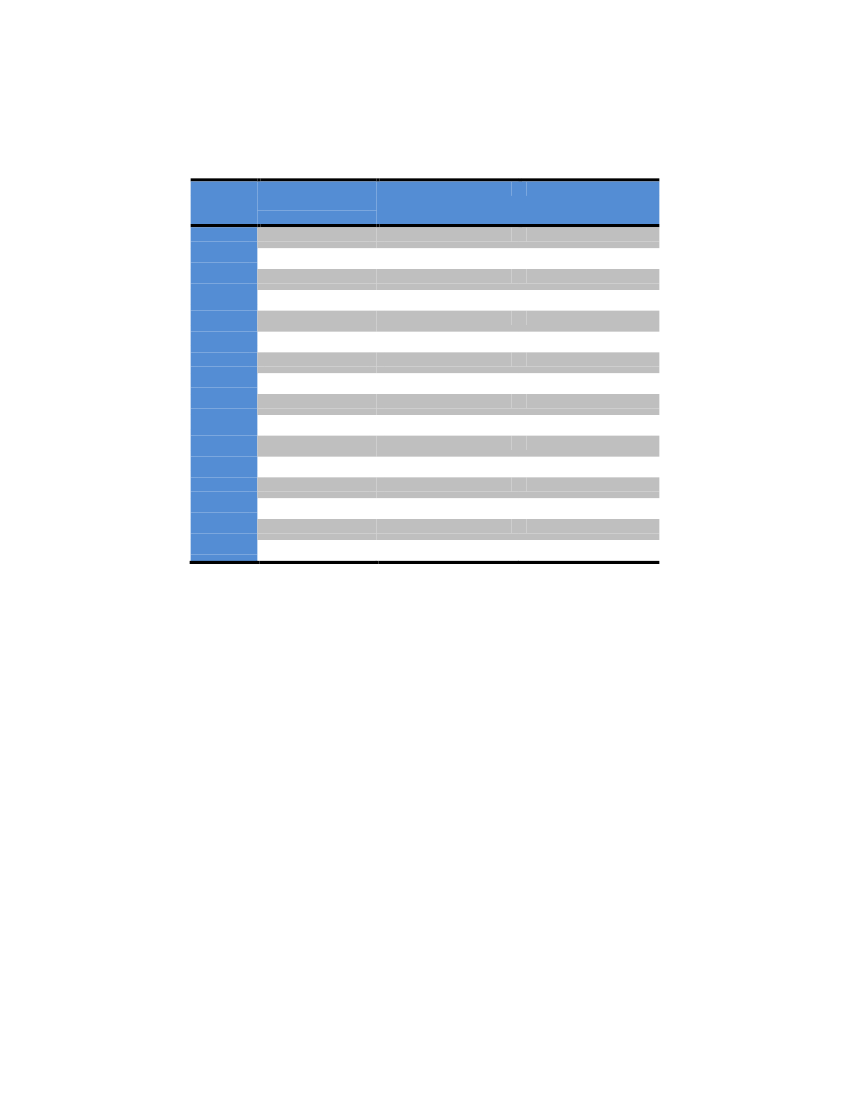

Figure 6: Potash Price and Demand Projections, 2012-2025

$/mT

500

450

400

350

300

250

200

150

100

50

0

past 40-year average

Potash demand

50000

45000

40000

35000

30000

25000

20000

15000

10000

5000

0

Axis Title

Note:

FAO appears to significantly underestimate potash demand, as its estimate is roughly 25 percent lower than the industry

estimates available in different sources. Potash demand forecast beyond 2016 is a staff estimate, assuming annual growth beyond

2016 equal to average annual growth between 2012 and 2016.

Source:

World Bank Development Prospects Group, “Commodity Price Forecast Update”, and Food and Agriculture

Organization (FAO) of the United Nations, “Current World Fertilizer Trends and Outlook to 2016”.

26.

Israel and Jordan also account for some 73 percent of global bromine production, all of it

from the Dead Sea.

While the deposits of bromine in China (the third largest producer) are being

depleted, the Dead Sea offers a “virtually inexhaustible” source, according to ICL: “Due to the high

concentration of bromine in the Dead Sea, bromine production is the easiest, most economically feasible

and stable in the world”.

45

Continued growth of the Dead Sea bromine industry is almost guaranteed, as

the global demand is growing while alternative supply sources are very limited.

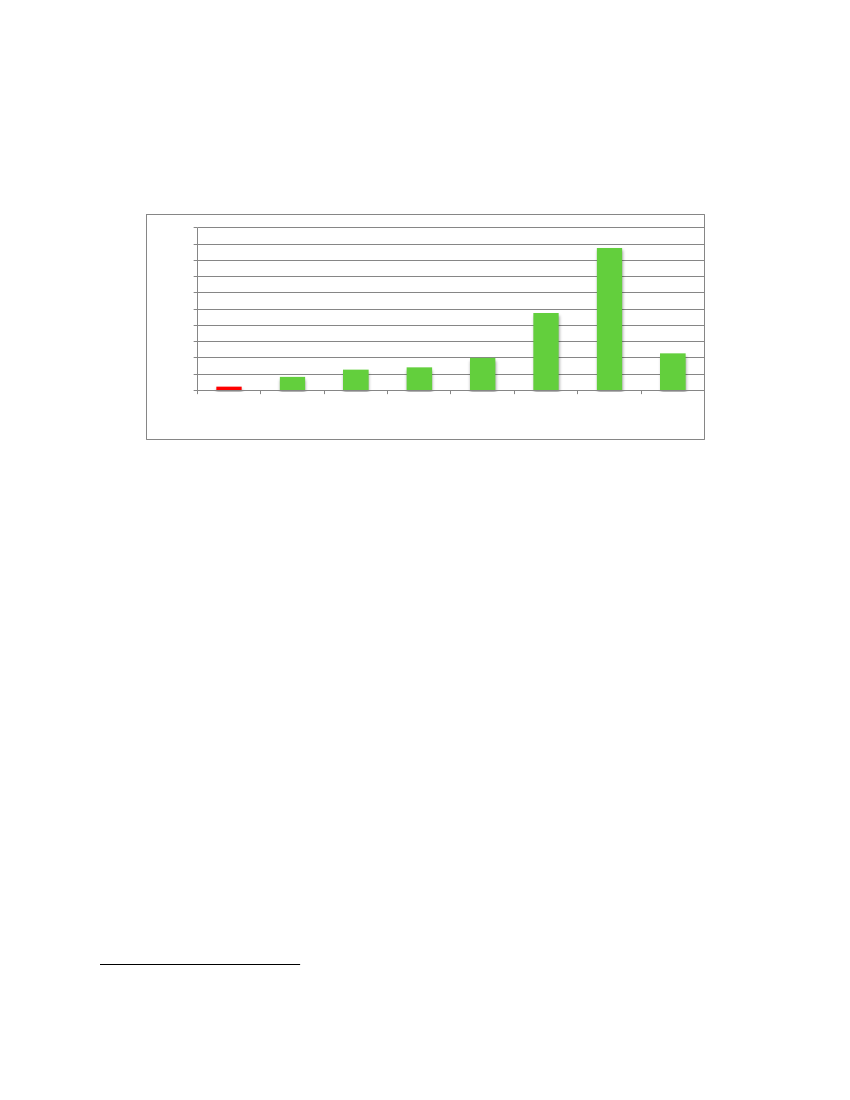

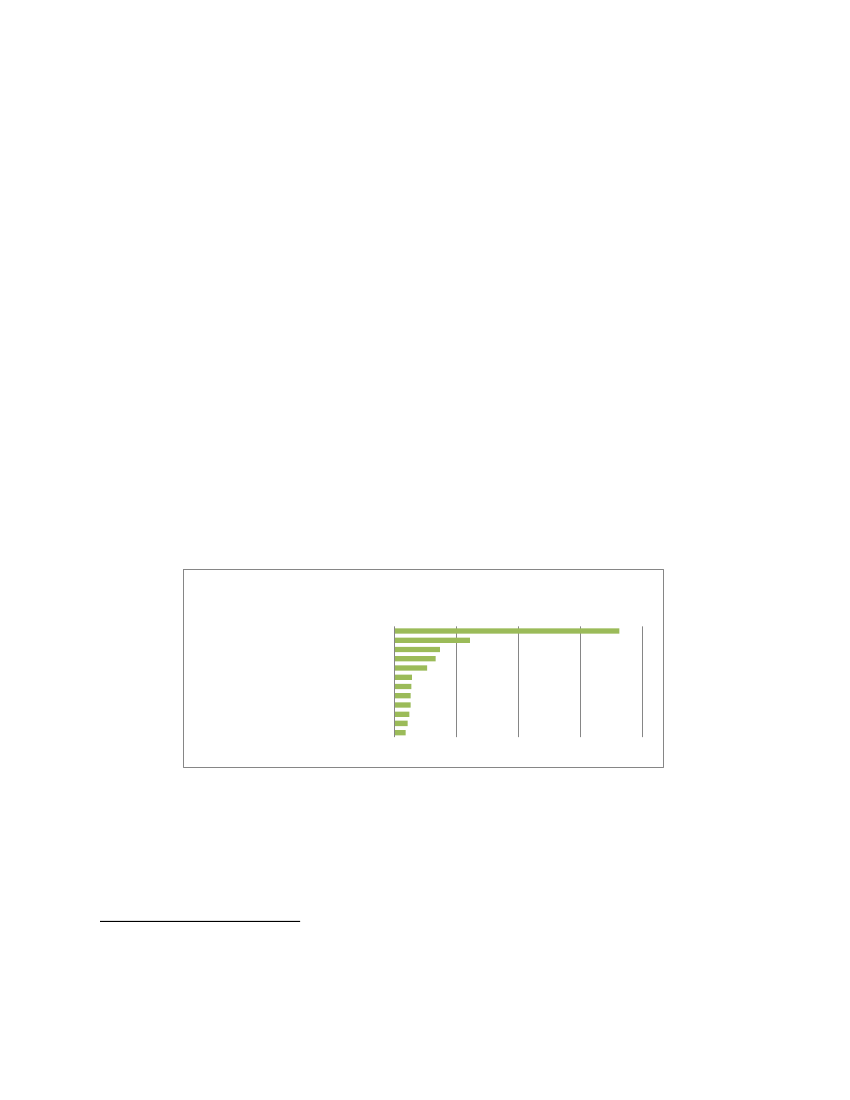

Figure 7: World Production of Bromine (in metric tons)

0

100,000

200,000

300,000

400,000

Jordan

Israel

China

Japan

Ukraine

Azerbaijan

Germany4

India

Turkmenistan

Spain

Source:

46

based on 2011 data found on:

http://www.indexmundi.com/en/commodities/minerals/bromine/bromine_t6.html

45

46

ICL Periodic Report for 2012. P.59.

The data on bromine production in Jordan shown on the chart is significantly larger (by about 100,000 tons) than the

production of the Jordan Bromine Company Limited, which is used to calculate bromine revenues in Jordan. The US Geological

Survey, 2011 “Minerals Yearbook” also estimates bromine production in Jordan at 300,000 tons. It is thus possible that there are

other producers of bromine in Jordan and that we have underestimated the revenues and value added generated by bromine

production in Jordan.

12

Demand (ooo mT)

Price (US$)

PDF to HTML - Convert PDF files to HTML files

Potential for Developing Dead Sea Minerals

27.

The Palestinian economy could benefit enormously if it were able to attract the investment

needed to develop mineral processing industries comparable to those in Jordan and Israel.

As

unequivocally argued by ICL in its annual report, access to the Dead Sea mineral resources is the key

competitive advantage in the potash and bromine industries: “The ability to compete in the market is

dependent mainly on production costs and logistics”.

47

According to ICL, the scale of requisite

investment is the main barrier to entry into the potash market, but given the availability of cost effective

and enormous reserves, this barrier should not be insurmountable to Palestinian entrepreneurs and their

potential foreign business partners.

28.

The potential incremental value added to the Palestinian economy from the production and

sales of potash, bromine and magnesium has been conservatively estimated at USD 918 million per

annum, or 9 percent of GDP.

This is almost equivalent to the contribution of the entire manufacturing

sector of Palestinian territories today. In calculating this figure, we have taken the average of the value

added generated in Israel and in Jordan for these three products and their derivatives (see

Annex 1

for

methodological detail). We estimate that potash could generate around USD 642 million in value added,

and bromine/magnesium another USD 276 million.

III.

Stone Mining and Quarrying

29.

Stone mining and quarrying is the largest Palestinian industry.

It contributes about 15,000 jobs

and about 2 percent of total value added, or USD 250 million, to Palestinian GDP.

48

The industry is by

far the largest Palestinian exporter, accounting for about 17 percent of the total value of exported goods.

49

Exports are based on significant endowments of the internationally renowned “Jerusalem Gold Stone”,

and on production know-how that has evolved over a long period.

30.

The stone industry faces restrictions which impede its development and growth.

These include

“dual list” prohibitions on the import of some production machinery, the complex and costly requirements

required for export and the general political and security environment that inhibits large capital

investment of the type needed in this industry. Area C is particularly affected. According to the Union of