Udenrigsudvalget 2013-14, Klima-, Energi- og Bygningsudvalget 2013-14

URU Alm.del Bilag 13, KEB Alm.del Bilag 31

Offentligt

2011ANNUAL REPORT

GLObALGREEN GROwThINsTITUTE

2011ANNUAL REPORT

GLObALGREEN GROwThINsTITUTE

2011ANNUAL REPORT

GLObALGREEN GROwThINsTITUTE

Date of IssuePublIsheR ContaCt tel

30 April 2012Global Green Growth InstituteGlobal Green Growth Institute19the Floor Jeongdong Bldg. 15-5 Jeong-dong Jung-gu, Seoul, Korea 100-78482 70 7117 9965www.gggi.org

2011ANNUAL REPORT

GLObALGREEN GROwThINsTITUTE

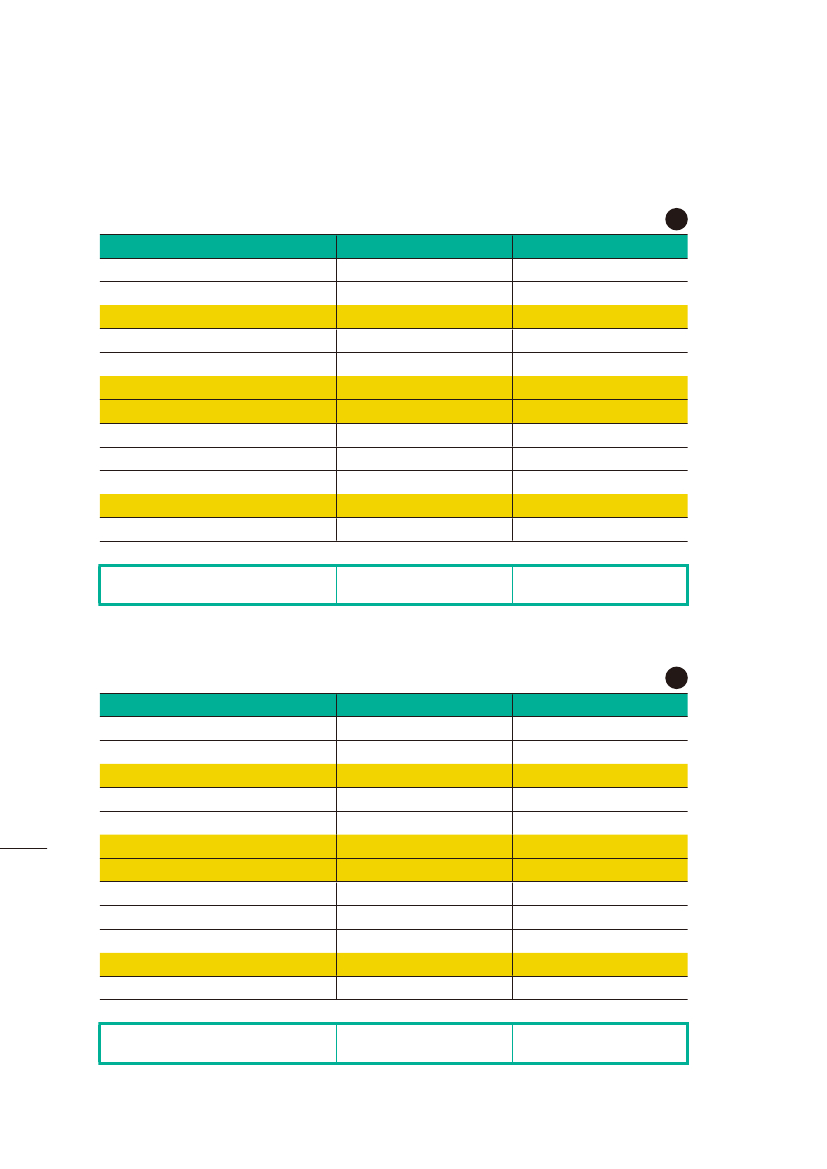

OUR PARTNERsCore Donors• MOFAT, South Korea• DANIDA, Denmark• Ministry of Foreign Affairs, United Arab Emirates• AUSAID, Australia

Partner Countries• Brazil• Indonesia• Thailand• Cambodia• Kazakhstan• Philippines• Ethiopia• Mongolia• United Arab Emirates

Project-specific Donors• BMU, Germany• DFID, United Kingdom• Japan

Partner Institutions• Asian Development Bank• Danfoss• European Bank for Reconstruction and Development• Global Green Growth Forum• Global Reporting Initiative• Green Growth Knowledge Platform• KOICA (Korean International Cooperation Agency)• London School of Economics• National Research Council for Economics, Humanities and Social Sciences• Organisation for Economic Co-operation and Development• Oxford Economics• Peterson Institute for International Economics• POSCO• Presidential Committee on Green Growth (Korea)• SEMARNAT (Secretariat of the Environment and Natural Resources – Mexico)• United Nations Economic and Social Commission for Asia and the Pacific• United Nations Environment Programme• United Nations Industrial Development Organization • Vestas Wind Systems A/S• World Economic Forum

TAbLEOFCONTENTs

MESSAGE FROM THE CHAIRMANMESSAGE FROM THE EXECUTIVE DIRECTORMESSAGE FROM PARTNER COUNTRYGGGI’S STRATEGYPART

681012

1

REPORT ON PROGRESS AND RESULTS (2011)1. Green Growth Planning & Implementation– Program ResultsEthiopiaIndonesiaBrazilCambodiaUnited Arab EmiratesKazakhstanThailand2 Green Growth Research – Program ResultsResearch Program3 Public-Private Cooperation – Program Results192022242629283032343638

Public-Private Cooperation Program

PART

2

Strategy & Finances1 oRGanIZatIonal DeVeloPMent2 Independent auditor's ReportStatementsFinancial PositionComprehensive IncomeChanges in equityCash flownotes to the financial statementsOUR BOARD4648495052644244

MEssAGEFROMThE ChAIRMAN

To the GGGI Board of Directors and the Public:The past year provided us with a stark reminder of the paramount and multifaceted challenges that we face today. From crippling droughts to devastating floods, catastrophic climate events have underlined the increasingly alarming impacts of climate change. These climate anomalies have magnified wide-spread environmental degradation and resource pressures. Meanwhile, as Europe’s economy teetered on the brink and growth rates elsewhere stuttered our capacity to manage such challenges have been severely hampered.A general consensus now exists among policymakers that we need to transition towards a new develop-ment paradigm, green growth, in order to pave new pathways for global sustainability. As an inclusive framework that dispels the dichotomy between economy and environment, green growth integrates am-bitions for economic growth, and environmental and climatic sustainability. By advancing the theory and practice of green growth, our mission at the Global Green Growth Institute is to enable this paradigm shift. In our first full year of operation in 2011, GGGI focused on three major objectives that are essential to achieving this mission. First, our green growth planning work has strived to design and implement ef-fective green growth plans in collaboration with our partner governments including Ethiopia, Indonesia, Brazil, Thailand, Cambodia, Kazakhstan, and the United Arab Emirates. Second, GGGI’s research program aimed to establish a strong theoretical basis for green growth to provide policymakers with relevant, high-quality analysis. To this end, GGGI launched a number of research initiatives in 2011 with multiple partners such as the OECD, World Bank, UNIDO, and the Peterson Institute for International Economics to expand our research portfolio and enhance knowledge sharing. Third, under GGGI’s public-private cooperation initiative, we have partnered with the Danish government to co-sponsor the Global Green Growth Forum (3GF), and an active network of global private sector leaders is being developed to form a Corporate Advisory Group on green growth. These processes are aimed at promoting global public-private partnerships to catalyze green growth related investment and innovation.

06

GGGI Board Chairman Dr. Han Seung-soo.

GGGI has also expanded its operational presence through offices in Copenhagen, Abu Dhabi and Lon-don, whilst continuing to boost our internal institutional and human capacity. As GGGI plans to convert itself into a full-fledged international organization by the end of this year, we are dedicated to working tirelessly with our partner governments and institutions to ensure that green growth becomes a shared, global effort. With the strong support of our Board of Directors, donors and partners, I am confident that we will succeed. Thank you for your commitment to GGGI.Sincerely,

Dr. han seung-sooChairman of the Board of DirectorsGlobal Green Growth Institute

07

MEssAGEFROM ThE EXECUTIVEDIRECTOR

To Our Partners and Stakeholders:2011 was a formative and ultimately very productive year for GGGI. We established the major, initial activities of our three core programs: green growth economic develop-ment planning, research and public-private cooperation. We expanded our presence to Copenhagen, Abu Dhabi, and London and grew from about 30 employees to over 50 by year’s end. And we tripled our annual resources through commitments of five additional donors. In little more than a year, our Institute has assumed a position at the center of some of the most im-portant green growth cooperation and research in the world through a series of partnerships with key international organizations, governments, academic institutions and companies. As a result, I believe we are well on our way toward establishing GGGI as an indispensable asset for the international community – a truly unique platform for catalyzing a new paradigm of economic growth through country-led and industry-led innovation and cooperation.In particular, I am pleased to report that during 2011 our initial country green growth planning projects were well received by the governments of Ethiopia, Brazil and East Kalimantan, Indonesia. Each is in the midst of carrying forward the strategies that our analyses have supported, and each has recently re-quested a continuation of our support. In addition, we initiated new green growth planning projects in Cambodia, Kazakhstan and the United Arab Emirates and began to scope future projects in a number of other countries, including India, the Amazon basin and the Philippines. 08

With respect to our research agenda, we formed the Green Growth Knowledge Platform, a partnership with the World Bank, United Nations Environment Program and OECD, that was formally launched in January 2012. We expect the GGKP, whose secretariat GGGI will manage, to become the leading green growth research hub in the world as well as the principal agenda-shaping, community-building and communications platform for researchers and practitioners alike. In another notable development, our Board approved a major research program into the economic contours and implications of the transition to green growth in partnership with the Grantham Institute at the London School of Economics.We also took our first important step in elevating the importance of green growth public-private coop-eration on the international agenda by partnering with the government of Denmark in the design of the first Global Green Growth Forum. Co-sponsored by the governments of the Republic of Korea and Mexico, the Forum was widely deemed a success in part because it combined not only high-level political

(Korean President Lee Myung-bak and GGGI Executive Director Richard Samans Celebrate the opening of GGGI CopenhagenOffice (May 2011)

engagement, including the presence of UN Secretary General Ban Ki-moon and six heads of international organizations, but also tangible outcomes for companies in the form of new or expanded public-private partnerships in the areas of energy efficiency, renewable energy integration into national and regional grids, trade in sustainable energy products and services and sustainable transport systems. The Danish Prime Minister has confirmed that her government will convene the Forum again in 2012 in association with GGGI.GGGI also underwent considerable institutional development in 2011. For example, we greatly diversi-fied our relationships with private sector and other institutional partners, built a financial management system that conforms to international practice and recruited significant additional international talent. While we have plenty of further work to do during 2012 to build our internal systems and capacity to world class standards, we are making rapid progress and will complete work on our results-based man-agement systems, core operating processes and medium-term strategic plan in 2012. On the strength of all of this progress, we began in the fall of 2011 to develop a strategy to meet the goal set for us by the Republic of Korea President Lee Myung-bak of becoming a treaty-based international organization by the end of 2012. In December, the Board approved the framework for subsequent inter-governmental consultations on the structure of the new organization, and an initial group of member governments has confirmed their intention to sign GGGI’s Establishment Agreement at the Rio+20 con-ference in June 2012. In summary, our progress has been rapid; however, the challenges and opportunities for green growth are even greater. We will only fulfill the promise of our young, path-breaking organization if we maintain the strong spirit of partnership and creativity exemplified by President Lee in launching the Institute in 2010 and by our Board in guiding the institution since then. I and my colleagues are committed to doing so in 2012 and beyond, and we thank all of GGGI’s partners for their continuing leadership and support.Sincerely yours,

09

Richard samansExecutive Director

MEssAGEFROM PARTNERCOUNTRY

10

11

GGGI’ssTRATEGY

Introduction

It is widely acknowledged that the traditional economic growth model is unsustainable in a world of ris-ing prosperity and population, and there is a need to innovate “green growth” pathways to faster and broader economic progress. This is GGGI’s mission – to transform the prevailing resource-intensive para-digm of economic growth and development by supporting the emergence of a critical mass of successful examples that convincingly demonstrate to the world that green growth is both feasible and desirable. Few governments or businesses have taken truly decisive steps to shift to a “green growth” path. Fears of environmental damage, or even of future economic losses, have not proved sufficient to drive this transi-tion. Many developing countries, in particular, see injustice in any proposition that they should not be able to follow the development paths already taken by today’s economically advanced countries.

12

GGGI’s theory of change leads it to focus on three major outcomes that we feel are essential to achiev-ing the mission: adoption and implementation of rigorous green growth plans that form the core of national and provincial economic development strategies; research which builds a strong theoretical and empirical basis for green growth, while providing concrete options and guidance for policymakers; and public-private partnerships that strengthen incentives for the scaling of resource-efficient investment, in-novation and practice as well as for the engagement of companies in the implementation of national and subnational green growth plans.To this end, over the next three years GGGI is planning to provide direct support to a diverse group of developing and emerging country governments for the development of green growth strategies through its Green Growth Planning & Implementation Program, aiming for at least 10 of them to be adopted as policy and enter implementation within this timeframe. As part of the program, it will facilitate a South-South process of dialogue and cross-fertilization of experience among these and other countries in order to deepen understanding of green growth planning, and it will create a major green growth capacity building program incorporating both in-country and global dimensions. GGGI’s Research Program will conduct and sponsor work covering several economic dimensions of green growth, including macro-modeling, methodology, empirical evidence, sectoral approaches and technol-ogy, trade, fiscal, labor, financial and other policy. It will also create an international research infrastruc-ture for green growth in order to strengthen collaboration and intellectual exchange among researchers and practitioners. GGGI’s Public-Private Cooperation Program will connect countries or provinces that have developed rig-orous green growth plans with potential providers of capital and technology by rendering these policy plans into specific investment plans in key sectors that enable access to public and private sources of fi-nance in an optimal manner. At the same time, it will work at the global level to elevate the importance

theory of Change

political and business leaders attach to the role of public-private cooperation in strengthening incentives for the internalization of environmental externalities in core business strategies and the scaled deploy-ment of resource-efficient technologies and practices.The specific outcomes and outputs targeted by GGGI are summarized in Figure 1.

Figure 1_GGGI’sTheory of change

• ision:World makes a paradigm shift to "green growth", a model of economic growth that simultaneously achieves Vpoverty reduction, job creation, social inclusion as well as environmental sustainability and resource security• Mission:Advance the practice and theory of green growth by helping to develop, implement, and deepen understanding of green growth strategies

Green growth plans and otherinitiatives are adopted and implemented by local governments and other stakeholders with adequate financing and technical expertise

Relevant, high quality research is available and used to explore green growth and guide policymakers and others

Private sector is engaged in promoting green growth plans and initiatives

• GPs and other initiatives Gdeveloped• upporting legal and institutional Sframework designed• Key local actors involved• Investment plans developed• Sources of financing identified• raining (including on-the-job) Tprovided to local stakeholders• rocess organized to cross-Pfertilize experience, expertise among GGGI partner countries and refine methodology

• heoretical support for green Tgrowth developed and published• deas on green growth tested in Icollaboration with GGGI partner countries• olicy guidance developed and Ppublished• Research results shared• Global GG research network

• xisting and new forums used to Ereduce information, policy and investment barriers to green growth• roducts, policies and standards Pproduced to expand private sector involvement in green growth• Investment plans developed

13

Green Growth Planning Program

Research Program

PPP Program

Reflecting the relative importance of, and “unmet need” in, each of its three areas of planned work, GGGI proposes to invest 65-70% of its program resources in its Green Growth Planning Program, 15-20% in its Research Program and 10-15% in its Public-Private Partnership Program.GGGI role is that of a trusted, neutral partner of the government that requests its services, helping that government to fashion the strategy it decides best suits its circumstances. As such, GGGI is not an agent of any individual or group of donors. Nor does it espouse any particular planning tool or methodology. Rather, it is platform for gathering different resources and technical capabilities, putting them freely at the service of developing country governments and cross-fertilizing learning from these experiences in order to serve these and partner governments even more effectively.

Support for green growth technical and institutional capacity buildingGGGI considers capacity building an integral element of the green growth planning services it provides to partner governments. To this end, as part of every green growth planning engagement it asks partner govern-ments to identify a domestic institutional partner, such as an economic research institute or planning ministry, with which GGGI can work and build permanent technical and managerial capacity. Each such engagement has a dedicated, medium-term capacity building component that is integrated with the analytical assistance that is mobilized.

Support for green growth implementationGGGI plans to support implementation of green growth plans particularly by providing technical assistance to 14

governments to mobilize funds for plan implementation. Specifically, once the plan has been adopted by the government, GGGI’s model is to deploy a team of investment experts to work with the governmental body at the highest level of responsibility for plan implementation. The team will assist in conducting the necessary financial analysis to develop regional and sectoral investment plans outlining opportunities for public and private investment. These plans will highlight opportunities where public funds can be used optimally, in the form of grants, concessional financing, loan guarantees and other risk mitigation products, to attract private funds. The target audience for these regional and sectoral investment plans will include the government’s own finance ministry, multilateral and bilateral development finance institutions, private financial institutions both domestic and foreign, sovereign wealth funds and dedicated climate funds and facilities. Far too often, general interest in funding green infrastructure and industry within the donor and institutional investment community fails to be translated into disbursements and deals because of the lack of concrete investment analysis of the type is actionable by such investors. The key to overcoming this hurdle is making this kind of analysis a bona fide part of the green growth planning process, recognizing that this requires a

different set of professional skills than economic analysis and institutional capacity building, and framing it as a roadmap for how available public funds could be structured in the manner most likely to “crowd in” private investors, both domestic and foreign.

Supporting South-South policy dialogue and experience sharingFinally, in addition to providing support for green growth planning and implementation within individual coun-tries, GGGI is creating an open, global platform for the sharing of experience and insight among countries that are pursuing rigorous green growth strategies, whether or not these have been prepared with GGGI’s assist-ance. GGGI seeks to build a community of senior policymakers having responsibility for the design and imple-mentation of green growth plans within their countries from which they derive mutual, ongoing benefit. This community can serve as a forum for peer exchange and advice, a global pool of expertise for other policymak-ers whose countries are contemplating green growth, a feedback mechanism for the comparative analysis and continuous improvement of green growth planning methodologies and an informal group of global ambassa-dors for the new development paradigm that is being forged out of their collective experience. The group will also be invited to provide guidance on GGGI’s research agenda, thereby helping to ensure that our work is of the greatest possible relevance to green growth practitioners operating at the cutting edge of the field.

A new kind of international organizationGGGI is planning to convert from its present Korean non-profit foundation status into an intergovernmental organization pursuant to an agreement among founding member states by the end of 2012. Conversion into an IGO will represent a key milestone toward successful culmination of GGGI’s founding vision and enable it to achieve a higher level of flexibility in its governance and operations. In particular, conversion to an inter-national organization will help GGGI mobilize and manage international funding and talent more easily and thereby advance green growth more effectively. GGGI is building a new kind of international organization – interdisciplinary, multistakeholder and driven by the priorities of emerging and developing countries. While only states will be eligible for membership, the or-ganization’s board will remain public-private and balanced between advanced and developing countries. GGGI is a purpose-built plurilateral organization that combines North and South, East and West as well as public, private and academic competencies in a way that is distinct from and complementary to its primary multilateral partners: UNEP, OECD, World Bank, MDBs, etc. The utility and legitimacy of our positioning as the world’s specialized enabling institution for green growth in developing and emerging countries has been vali-dated by the concrete working relationships we have established with these and other important institutions.15

1PART

REPORTON PROGREssANDREsULTs2011

The Global Green Growth Institute experienced adefining year in 2011 across all of our major platforms.The organization made substantive progress in puttinggreen growth into action.

Green Growth Planning & ImplmentationObjective• o improve governmental understanding and adoption of green growth plans, sector strategies Tand policies developed in collaboration with local stakeholders• o increase human and institutional capacity within developing countries to plan and implement Tgreen growth initiatives

achievement highlights• upported the analysis underlying green growth strategies adopted by the Governments of SEthiopia and East Kalimantan, Indonesia• nitiated work with the Governments of Cambodia, Kazakhstan and the United Arab Emirates to Idevelop national green growth strategies• upported the development and launch of sectoral green growth plans in BrazilS• uilt institutional and human capacity of local government bodies and stakeholders in Cambo-Bdia, Ethiopia and Indonesia• stablished a regional capacity building hub at Abu Dhabi to promote green growth efforts in EMiddle Eastern countries as well as North Africa

Green Growth ResearchObjective• o make available relevant, high quality research and guide policymakers and other decision-Tmakers toward green growth

achievement highlights• repared the launch of the Green Growth Knowledge Platform (GGKP) to identify and ad-Pdress major knowledge gaps in green growth theory and practice with the Organisation for Co-operation and Development (OECD), the World Bank, and the United Nations Environment Pro-gramme (UNEP)• tructured a major research partnership with the London School of Economics on several di-Smensions of green growth• aunched a trade policy research project with the Peterson Institute of International Economics Land the International Centre for Trade and Sustainable Development (ICTSD) on approaches to a Sustainable Energy Trade Agreement.• ublished Progressing Towards Post-2012 Carbon Markets with UNEP RisoeP

18

Public- Private CooperationObjective• o mobilize key stakeholders, especially governments and companies to pursue green growthT

achievement highlights• artnered with the Government of Denmark to co-sponsor and design the first international Pforum focusing on the public-private oartnership dimension of green growth, the Global Green Growth Forum (3GF), held in Copenhagen in October 2011• acilitated partnerships with leading private sector companies, including Danfoss, Vestas and FPOSCO, to launch projects that explore improvements in the enabling environment for green in-dustry

1

Green Growth Planning &Implementation– Program Results

REPORT ON PROGRESS AND RESULTS (2011)

Program DescriptionGGGI’s Green Growth Planning & Implementation Program helps emerging and developing countries design and implement rigorous green growth strategies that enable them to achieve their growth and development objectives. It provides partner countries with world-class analytical tools, building their institutional capacity to apply these tools, and engaging them in an international process of mutual learning with other countries that have made similar policy choices. The program also supports the im-plementation of green growth plans by advising on suitable institutional frameworks in government and policy execution.The main objective of the program is to design and implement successful green growth plans that can be examples of a changed paradigm of economic growth. To this end, GGGI has entered into projects with a range of countries, regions and cities. GGGI supports partner countries from project scoping and setup, all the way through implementation of the green growth model. While GGGI’s focus is to carry out comprehensive green growth plans, we also respond to country requests for specific technical assistance when these can lead to a more comprehensive approach to green growth.During 2010, GGGI launched work in its first three countries of operation: Brazil, Ethiopia, and Indonesia. We continued green growth planning in these countries during 2011, while launching new programs in Cambodia, Kazakhstan, Thailand and the United Arab Emirates. In 2012, green growth planning projects are being scoped in several other countries, including the Philippines, India, China, Mongolia, Vietnam, and the Amazon Region.

targeted Results• C untry Green Growth Plans (GGPs) and supporting initiatives are developedo• upporting legal and institutional frameworks are set upS• ey local actors involvedK• Investment plans developed• Sources of financing identified for investment plans• Training provided to local stakeholders • orums organized to share experience among GGGI partner countries and othersF

19

Green growth plans and other initiatives are adopted and implemented by governments andother stakeholders with finance and technical expertise

EThIOPIA

sUMMARY OF REsULTs

Green Growth outcomes forethiopiaAt the COP 17 Summit, heldin Durban in November 2011,Ethiopia officially launchedits Climate-Resilient GreenEconomy (CRGE) strategy,identifying green growthinitiatives designed to help thecountry achieve its economicdevelopment goals while limiting2030 greenhouse gas emissions.GGGI Contribution• Identified sector-level greengrowth opportunities for theNational CRGE strategy,prioritizing them againstmultiple criteria, in linewith Ethiopia’s Growth andTransformation Plan• Supported the establishmentof planning and advisorycommittees to integrateEthiopian governmentstakeholders in the greengrowth planning process• Built capacity withingovernment to continue theanalysis on green growth

20

In 2009, the Ethiopian Government announced the development of a green growth strategy in order to achieve sustainable growth in Ethiopia and meet its target to become a middle-income country by 2025. In 2010, GGGI joined the development process, led by the Prime Minister’s Office, and collaborated with a local partner, the Ethiopian Development Research Institute (EDRI), to develop an Ethiopian-owned fact base and feasibility models to inform the CRGE strategy. The CRGE strategy recommends a suite of sector-level greenhouse gas abatement initiatives for the most important economic sectors in the country. Between 2008 and 2030, annual Ethiopian CO2 emissions are expected to increase from 155 MtCO2e to roughly 400 MtCO2e; GGGI’s recommendations could help to reduce greenhouse CO2 emissions by up to 30 percent from the projected level while maintaining targeted economic growth. The recommendations were based on a thorough analysis of potential for sustainable economic growth, greenhouse gas emission levels, business-as-usual projections until 2030, and abatement potential in the identified sectors. The identified initiatives were then evaluated and prioritized based on their growth potential and abatement cost in line with the objectives laid out in Ethiopia’s Growth and Transformation Plan. The resulting sector-level strategies guided the National Climate Resilient Green Economy strategy, which was officially announced by the Ethiopian Government at the COP17 Summit in 2011. The sector-level strategies captured in the document identified opportunities for green growth in forestry, industry, livestock and power with a total potential for reduction of approximately 230 MtCO2e by 2030.Under the business-as-usual scenario, emissions from the forestry sector are expected to increase from 53 MtCO2e in 2010 to 88 MtCO2e in 2030. The analysis identified nine greenhouse gas abatement levers, with an abatement potential of up to 120 MtCO2e. Identified levers include a recommended set of agricultural practices, a wide range of efficient cooking tech ologies, re or st on and forest nf e atimanagement techniques.Also under business-as-usual assumptions, greenhouse gas emissions caused by heavy industry are expected to increase from around 2 MtCO2e in 2010 to 66 MtCO2e in 2030. The low-carbon growth scenario identified 37 abatement levers for 12 industry segments, with a total gross abatement potential of 38 MtCO2e in 2030. The vast majority of this potential is from the cement industry, which has a gross abatement potential of 32 MtCO2e.Livestock is a significant contributor to growth in Ethiopia. Likewise, it is a sector that produces a large amount of

greenhouse gas emissions. To prevent the projected doubling of livestock-related emis ions by 2030, while allowing this ssector to grow, a number of levers were identified to offer a potential abatement of 45 MtCO2e at a cost of US$ 2.5 billion. Some identified abatement levers are diversification of animal mix to increase poultry consumption relative to beef, and improving value-chain efficiency for livestock.Ethiopia’s low-carbon growth scenario proposes a planned build-out of domestic power production capacity, combined with a successful implementation of energy efficiency measures, to create opportunities for power exports to countries in the region. Pro ected domestic supply-and-jdemand balance indicates an export potential for power that could result in an annual abatement of 24 MtCO2e by 2030. The most significant barriers to implementation were identified as financing and import demand from neighboring countries.The green growth planning process in Ethiopia has generated substantial knowledge transfer to local institutions responsible for the strategy’s implementation. A Ministerial Steering Committee was created to enable alignment across ministries, buy-in for the fact base at the highest level, and accountability for progress. A Technical Committee, at the DG level from across ministries, was set up for day-to-day planning. In addition, a set of technical sub-committees was assembled to develop the sectoral green economy strategies. Green growth planning tools, expertise on emissions data and lever evaluation methodologies were shared with the technical sub-committees. GGGI supported the technical sub-committees and equipped them with knowledge and tools to enable them to carry out complex economic analysis independently. Additional research was conducted to support green growth planning in specific topics, such as irrigation. Agriculture in Ethiopia provides approximately 46 percent of GDP and jobs for 80 percent of the working population. However, most agricultural lands are rain-fed and highly sensitive to climate change risks. To address this risk, a study on the potential of household irrigation technologies was carried out by GGGI and other partners, along with the Ethiopian Ministries of Agriculture and Water Resources. The plan identifies household irrigation technologies and distribution mechanisms that can potentially lift 5 million people out of poverty, irrigate half a million hectares of land, create 30,000 new jobs beyond agriculture, and add US$ 600 million to the Ethiopian economy. The next step involves garnering policy support from local implementation bodies such as the Agricultural Transformation Agency of Ethiopia to facilitate buy-in to the plan’s adoption and implementation.

wAY FORwARD

Analysis on climate resiliencehas started on the agriculturalsector and will be expandedto incorporate the remainingsectors of the economy. Theimplementation process,focused on developinginvestment plans across theinitiatives identified in thestrategy and named ‘iPlan’,is being developed to helptransform the CRGE strategyinto actual investment on theground.

21

A Household Irrigation Factory (HIT) in Ethiopia

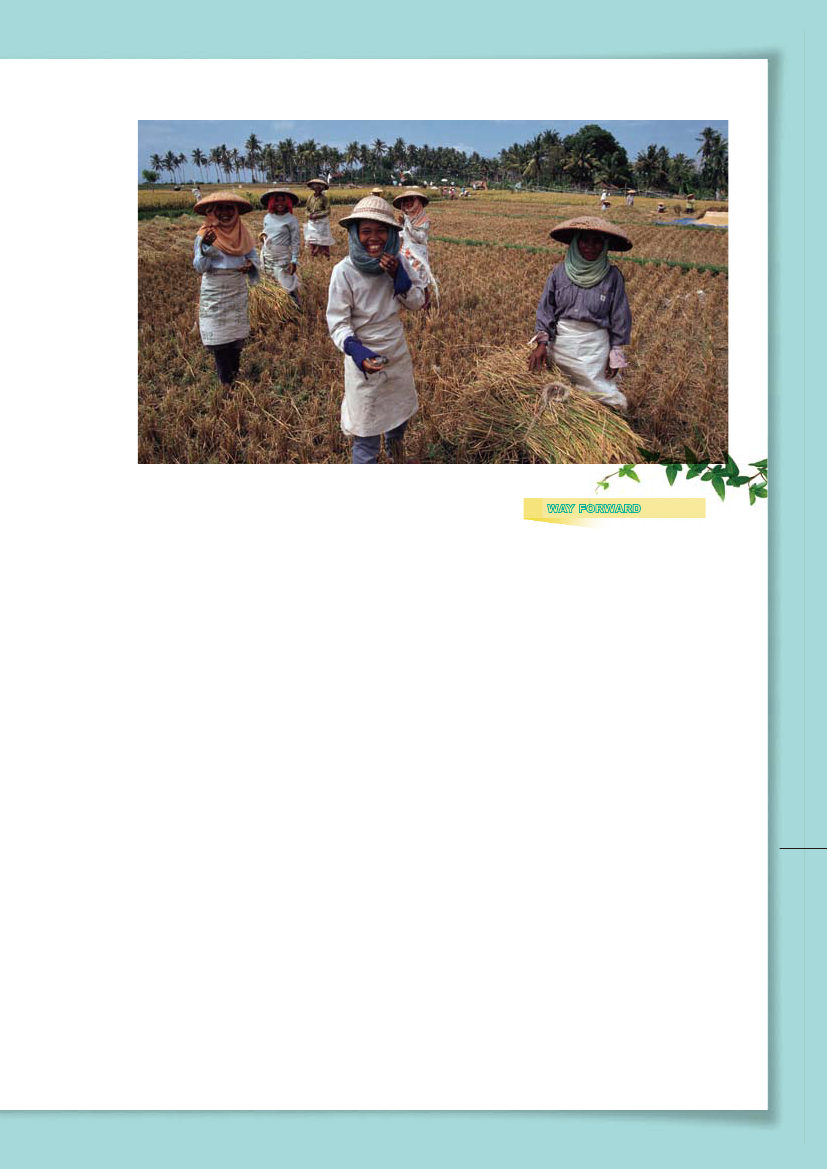

INDONEsIA

sUMMARY OF REsULTs

Green Growth In IndonesiaIn May 2011, the Governor ofEast Kalimantan in Indonesiaendorsed the adoption of theprovincial-level green growthstrategy supported by GGGI,designed to reduce provincialemissions by more than 70percent by 2030. After CentralKalimantan was chosen as thepilot province for the REDD+process, GGGI was askedby government to extend itssupport to this province.GGGI Contribution• Defined a green growthstrategy for East Kalimantanthat was officially adopted byits governor in 2011• Advised on the setup of theProvincial Council on ClimateChange and building itscapacity• Conducted detailed feasibilityanalyses for three REDDinitiatives in East Kalimantanand extended the program toCentral Kalimantan

East Kalimantan is a prominent province in Indonesia, with the second-highest GDP per capita in the country and a relatively large US$ 11.3 billion economy, as of 2008. In 2011, East Kalimantan set up a Provincial Council on Climate Change supported by GGGI and began its green growth planning program. The program entailed the development of a fact-based, provincial-level green growth strategy and supported the set-up and capacity building of local implementing bodies. The green growth planning program also supported research on existing climate change-related initiatives, particularly Reduced Emissions from Deforestation and Rainforest Degradation (REDD+) readiness activities. The provincial green growth strategy identified potential for green growth initiatives for all 14 districts of the East Kalimantan region. The study estimated that aggregated emissions will continue to grow under the business-as-usual scenario, reaching an estimated 303 MtCO2e in 2020, and 331 MtCO2e in 2030 – a 32 percent total increase from 2010 levels. Major opportunities that would foster economic growth and reduce emissions were identified across the five priority industrial sectors, totaling 184 MtCO2e at a moderate implementation cost of fewer than US$ 5 per ton of CO2e on average. Green growth syndication ‘road shows,’ presenting the strategy to government and civic officials in all 14 East Kalimantan districts, were conducted to ensure that it was a multi-stakeholder driven process. The green growth strategies were formally endorsed by the Governor of East Kalimantan in May 2011. In parallel, a Provincial Council on Climate Change was established under the governor’s decree in East Kalimantan in January 2011 with the capacity building support extended by GGGI to implement green growth initiatives, including defining its organizational structure, job descriptions, and staffing plans. In order to support existing green initiatives in East Kalimantan, research and pilot studies were conducted to improve the

22

effectiveness of REDD activities in the region. REDD is an effort being pursued by Indonesia in East Kalimantan to create financial value for the carbon stored in forests and to invest in low-carbon paths to sustainable development. REDD readiness initiatives with the highest potential to reduce carbon emissions were identified, and three of the five most promising initiatives were selected for further assessment of viability to develop pilot projects. For example, the land use optimization analysis identified some 500,000 hectares of degraded land in East Kalimantan that could be leveraged economically. GGGI’s work on green growth planning in East Kalimantan was extended to the province of Central Kalimantan, chosen as the government’s pilot province for REDD+, in 2011. The green growth strategy development for Central Kalimantan is at an early phase. Data collection, identification of stakeholders and capacity building at the provincial level have already began. The upcoming work in Central Kalimantan will concentrate on analyzing the baseline data collected by conducting an assessment of projected greenhouse gas emissions, identifying and prioritizing emission mitigation opportunities, developing a set of recommendations for land use optimization, and analyzing selected economic sectors of the region. Throughout the process of support to provincial governments, GGGI consulted closely with the central government, through its REDD+ Task Force. This allowed GGGI to keep close to the development of the financing mechanisms to support forestry related projects.

wAY FORwARD

The work in Indonesia in 2012will involve both support to thecentral REDD+ Task Force inJakarta as well as moving tothe implementation phase atthe provincial-level with greengrowth pilots in both for bothCentral Kalimantan and EastKalimantan.

23

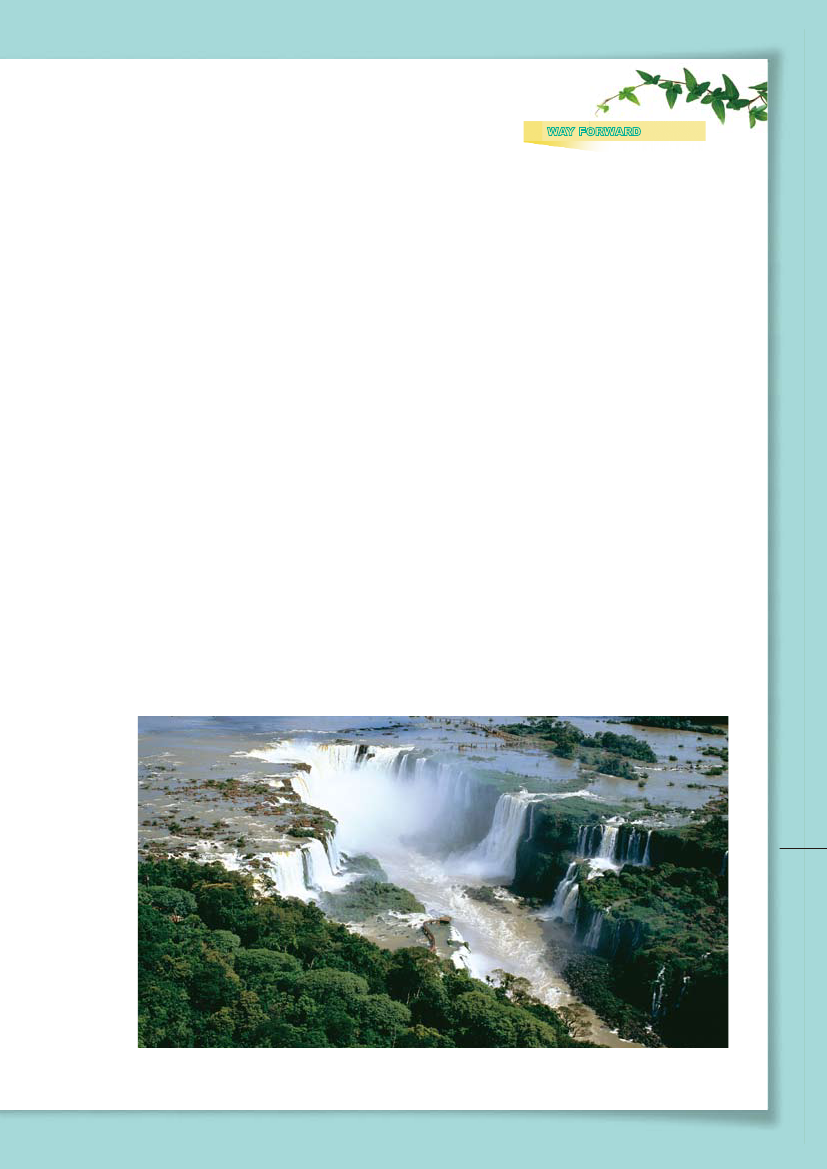

bRAzIL

Although it is one of the five largest greenhouse gas emitters countries in the world—due in large part to deforestation emissions—Brazil has made significant progress in reducing deforestation in recent years and has historically had one of the cleanest electricity generation matrices in the world. Green growth planning in Brazil supported efforts by Brazil’s Finance Ministry and Environment Ministry to help the country meet its greenhouse gas abatement targets for 2020 in other sectors, such as agriculture, steel, power and transportation. The long-term objectives of this project were to support the definition of low-carbon options for all key greenhouse gas emitting sectors, to develop a climate adaptation strategy and to assist in the efforts of developing a carbon-financing framework for the country. During the green growth planning process, a variety of government agencies, including the Ministries of Finance, Environment, Industry and Trade, and Agriculture, were directly involved in the green growth planning process to ensure the strategies were coordinated across government. The highest greenhouse gas emitting sectors in the country were identified and analyzed in cooperation with relevant ministries to develop sector-specific strategies. Low-cost greenhouse gas abatement strategies were prioritized according to both the feasibility of potential greenhouse gas abatement as well as their overall impact on economic growth and development objectives for Brazil. The initiatives identified could reduce around 60 percent of 2.7 GtCO2e, the projected national greenhouse emissions in the business as usual (BAU) scenario by 2030.The forestry sector was identified as the largest emitter in Brazil, with 54 percent of all greenhouse gas emissions, or 1200 MtCO2e in 2005. The low-carbon growth options analyzed identified reforestation value chain activities in the Amazon areas that have the potential to create approximately 460,000 new direct and 390,000 indirect jobs in sustainable activities, in addition to capturing up to 1500 MtCO2e in newly reforested areas. With the recent reduction in deforestation rates, agriculture was identified as one of the highest greenhouse gas emitting sectors in the next 20 years. Emissions from the agricultural sector are estimated to grow from 484 MtCO2e in 2005 to approximately 600 MtCO2e by 2030. The bulk of agriculture and livestock emissions—approximately 60 percent of total sector emissions—are the result of livestock enteric fermentation, due to the large amount of beef produced using low-tech cattle grazing systems. The green growth scenario

sUMMARY OF REsULTs

Green Growth In brazilIn 2011 GGGI supported thegreen growth planning processfirst in the Brazilian FinanceMinistry and later in theMinistry of Environment todefine low-carbon options forkey greenhouse gas emittingsectors and to develop a climateadaptation strategy and carbonfinancing framework for Brazil’sNational Plan on ClimateChange, launched in 2008.GGGI ContributionSupported the development oflow-carbon growth diagnosticsfor four priority economicsectors to support the futuredevelopment of emissionsabatment and carbon financingframeworks for the country.

24

identified 13 low-cost abatement initiatives for the livestock and agriculture sectors, which, if implemented, are expected to reduce greenhouse gas emissions by 165 MtCO2e by 2030.With 85 percent of Brazil’s power sector already depending on renewable sources, we looked at the potential for all new electricity capacity built after 2013 to be renewable, thus reducing 55 MtCO2e by 2030. This could be achieved with limited economic burden to the country. Estimates indicate that adding system reliability to the electricity grid could add US$ 6-15 per ton of CO2e avoided. However, even in this case, the switch to renewable sources would still be cost competitive to the country.The steel sector is responsible for only 3 percent of total greenhouse gas emissions in Brazil, but accounts for 35 to 40 percent of the country’s industrial emissions. Steel sector CO2 emissions are expected to increase by 200 percent, from 65 MtCO2e in 2010 to 195 MtCO2e in 2030. The low-carbon growth scenario identified 60 measures to reduce the CO2e intensity of the industry, which, if implemented, could reduce greenhouse gas emissions by 58 percent from 195 MtCO2e in the business-as-usual scenario to 81 MtCO2e in 2030.The project will continue support for low-carbon plans for the remaining sectors – transportation, chemicals, cement, waste and building. This aims to support the Brazilian Government’s objective to develop a comprehensive low-carbon growth diagnostic. Potential next steps include focused support on adaptation and sub-national efforts, as well as to carbon finance architecture planning.

wAY FORwARD

GGGI is committed to furthersupporting the adoption andimplementation phase of work,and is exploring potentialopportunities to cooperatewith the Brazilian Governmentand with the relevant localstakeholders and partners.

25

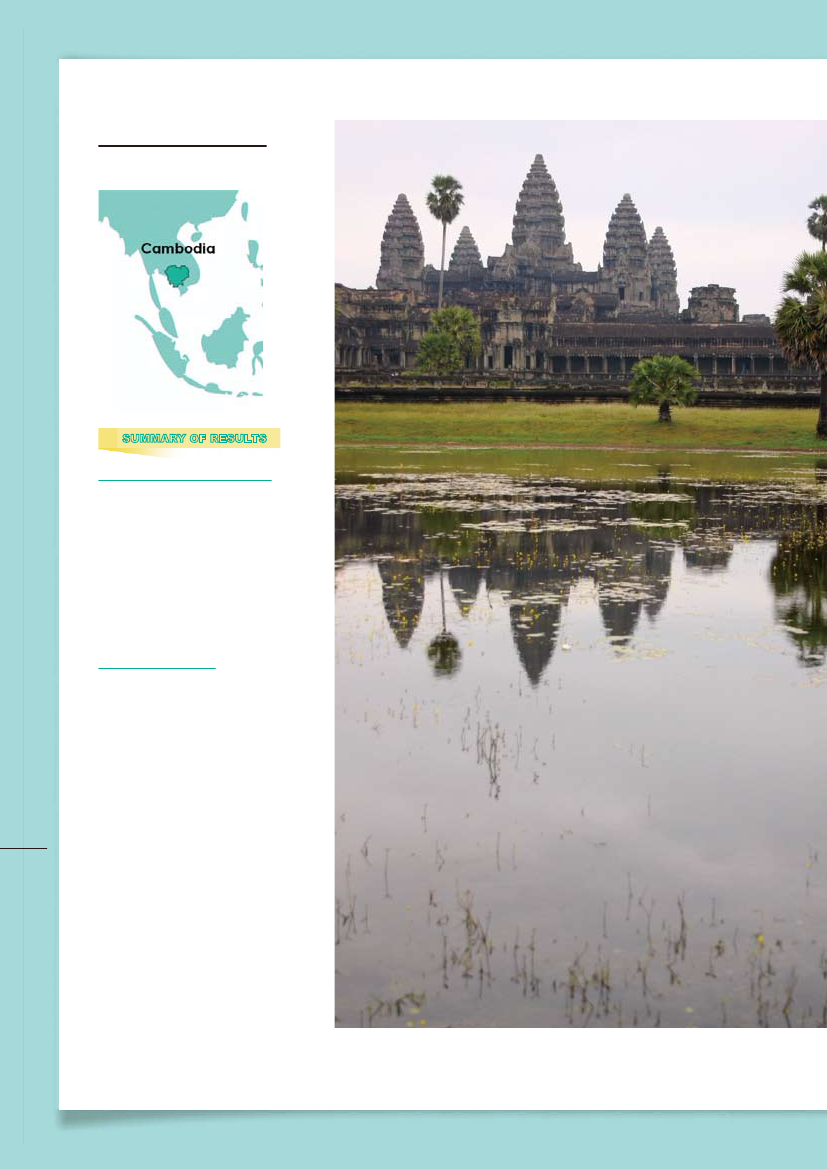

CAMbODIA

sUMMARY OF REsULTs

Green Growth In CambodiaIn 2010, Cambodia endorseda national green growth roadmap to begin its transitioninto a green economy. In 2011,the country began creating anational Green Growth MasterPlan to support its ambitions.GGGI Contribution• Suggested a strong legal andinstitutional framework thatwould support green growthreforms.• Conducted consultativeworkshops with governmentstakeholders to design theinitial framework of theNational Green GrowthMaster Plan.• Piloted green growth programson the ground with local actorsto guide sectoral strategies andsupport policy advocacy.

26

In May 2011, GGGI launched a Green Growth Planning & Implementation Program to help the Cambodian Green Growth Secretariat and the Ministry of Environment develop a National Green Growth Master Plan for the country and establish institutional frame orks to support its implementation. The wmain objectives of the program in Cambodia were to formulate a Green Growth Master Plan and build a strong framework for its implementation. Other objectives included promoting local participation in and garnering policy support for green growth initiatives in the water, waste, agriculture and forestry sectors. The first step in the development of the green growth master plan for the country was the set-up of an initial legal and institutional framework to integrate green growth into national economic planning. With support from GGGI, the country is now in the process of establishing the National Committee on Green Growth (NCGG), drawing heavily on experience from the Presidential Committee on Green Growth (PCGG), a governmental organization in Korea with similar aims. The design and direction of Cambodia’s Master Plan was guided by multiple consultative workshops with government stakeholders. Going forward, the resulting framework will be used to conduct a comprehensive diagnosis of Cambodia’s green growth potential while formulating a five-year Green Growth Economic Plan in consultation with the Inter-Ministerial Green Growth Working Group. Collaborative relationships with local Cambodian green growth counterparts were facilitated to set up pilot studies and programs in forestry, tourism, and waste management. The results of these programs are expected to inform sector-level strategies and push policy support for public and private participation. For example, GGGI partnered with prominent energy consultancy EN3EN Co Ltd to streamline existing waste management policies to promote more effective recycling, including resource recycling and waste-to-energy measures in Baribour District, Kampong Chhanng Province. A partnership with the ASEM SME Eco-Innovation Center helped establish a small business model for solar cookers in Takeo Province as well as pilot projects on solar crop dryers and waste incinerators in rural communities.

wAY FORwARD

GGGI’s efforts in Cambodia in2012 will focus on launchinga fully established NationalCommittee on Green Growth,developing a seven-sector greengrowth strategy, and makingpolicy recommendationsto support the country’sgreen growth efforts in thewaste management, forestry,ecotourism and green jobindustries.

A solar cooker under construction in Cambodia

27

KAzAKhsTAN

sUMMARY OF REsULTs

Green Growth In KazakhstanThe Government of Kazakhstanrecently launched the AstanaGreen Bridge Initiative topromote green economies acrossEurope and the Asia-Pacificregion.GGGI Contribution• Launched a cross-governmentalworking group to support thedevelopment of Kazakhstan’sNational Green Growth Plan• Performed macro-economicanalysis of the potentialeconomic impact of a greengrowth policy28wAY FORwARD

Through 2012, the projectwill produce a comprehensiveKazakhstan National GreenGrowth Plan document, inaddition to a Water SectorDevelopment Program and aNational Sustainable EnergyPlan.

GGGI began work with Kazakhstan’s Ministry of Environment Protection, among other partners, in 2011 to help develop its National Green Growth Plan. GGGI, in partnership with the European Bank for Reconstruction and Development (EBRD) and in close cooperation with the Kazakhstan Ministry of Environment Protection, has successfully established the country’s green growth planning process. The process in Kazakhstan is being co-led by a working group comprising officials from across the government. This working group has close links to the president and works with the GGGI project team on development of the Kazakhstan National Green Growth Plan. Local capacity building among government officials and key stakeholders is continuously facilitated through workshops and consultations..With regard to green growth planning, preliminary macroeconomic analysis has been conducted in Kazakhstan in order to identify the green growth potential of its economy and priority sectors. This analysis is expected to help the Kazakhstan government combat the internal inertia surrounding the pursuit of green growth, to form the basis for ongoing analysis and to shape the approach for the Kazakhstan National Green Growth Plan and sector-specific initiatives in 2012. While Kazakhstan’s overall planning process is expected to encompass a large number of priority sectors, two subtasks will look in more detail at the energy efficiency and water sectors to develop specific programs and projects. The interim results from the two subtasks included current status analyses of water sector performance and renewable energy resource development in Kazakhstan, as well as benchmark studies in each sector respectively. These will be a cornerstone supporting further analysis and recommendations for enforceable policy measures. The policy measures aim to promote public-private cooperation in the water sector and the establishment of the Renewable Energy Action Plan in Kazakhstan. Furthermore GGGI’s support for energy efficiency improvement has been refined to assist Kazakhstan’s government in introducing Voluntary Agreement systems, establishing an energy efficiency institute and proceeding with secondary legislation of energy efficiency.

In March 2011, GGGI, in partnership with the UAE government began the process of developing the UAE Green Growth Initiative, a mid- to long-term national plan for the nation’s transformation into a regional green growth and clean energy powerhouse. During six workshops between March and September 2011, GGGI and UAE stakeholders collaborated on a business plan, discussing objectives, milestones, timelines, deliverables and the project team. The business plan set out integrated, synergistic programs for phase-by-phase green growth planning – starting from a national strategy, to a roadmap and a rolling implementation plan complemented by the establishment of a greenhouse gas inventory system and intensive capacity building programs. The finalized business plan was reported to the UAE Cabinet, reviewed, assessed, and finally integrated into the National Initiative launched by His Highness Mohammed Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, in January 2012.The UAE’s green growth plan will be designed jointly by GGGI and a UAE team consisting of all relevant Ministries and stakeholders, and will be developed over a three-year period following the project launch. A further five-year implementation plan will run from 2014 to 2018. The green growth planning program in the UAE will engage numerous local and international partners with an objective of enabling the transfer of green growth knowledge within and between borders. In-country, the GGGI project team in Abu Dhabi will work closely with the UAE Ministry of Foreign Affairs, Masdar, the Masdar Institute of Science and Technology, the International Renewable Energy Agency, and other stakeholders in Abu Dhabi to strengthen existing environmental initiatives. GGGI opened its Abu Dhabi office in July 2011 to establish a UAE hub for sharing green growth best practices internationally and providing a regional example of a green growth model in the Middle East and North Africa (MENA).

UNITED ARAbEMIRATEs

sUMMARY OF REsULTs

Green Growth In united arabemiratesIn January 2012, His HighnessShaikh Mohammad Bin RashidAl Maktoum, Vice-Presidentand Prime Minister of the UAEand Ruler of Dubai, announcedthe launch of a Strategy forGreen Development, a nine-yearnational initiative to develop asustainable economy by 2020.GGGI Contribution• Launched a regional officein Abu Dhabi in July 2011 toserve as a hub for capacitybuilding and knowledgedissemination in the region• Began the process of three-to five-year national greengrowth planning with the UAEgovernmentwAY FORwARD

29

In 2012, GGGI aims to launchformally a sectoral green growthanalysis that will form thefoundation of the UAE’s greengrowth strategy.

ThAILAND

The Thailand Greenhouse Gas Management organization was set up to promote low-carbon economic activities, facilitate investment in emission reductions, and review Clean Development Mechanism (CDM) projects in the country. GGGI’s work in Thailand supports the Thailand Greenhouse Gas Management Organization as it launches a program to help the country meet its goal of reducing greenhouse gas production and developing a voluntary carbon market through the establishment of a Voluntary Emission Reduction (T-VER) system. The program is also supported by the Korea Energy

sUMMARY OF REsULTs

Green Growth In thailandThe Royal Thai governmentadopted The Strategic Plan onClimate Change (TSPCC) in2008, which included greenhousegas mitigation as one of theprimary issues to address withregard to climate change. TheThailand Greenhouse GasManagement Organization wassubsequently established as animplementing agency.GGGI Contribution• Supported the set-up of avoluntary carbon market inThailand through the VoluntaryEmission Reduction (VER)program• Set up and conducted VERpilot projects in seven, leadingindustrial companies in Thailand.• Established an IT systemthat enables the registration,monitoring and verification ofVER projects• Enhanced capacity to developand manage the VER programby providing training tospecialized personnel for projectvalidation/verification, as wellas to relevant policy-makers

30

Management Corporation. The green growth planning program in Thailand has been carried out in three stages and has established the infrastructure necessary to launch a successful Voluntary Emission Reduction program. Accordingly, the first stage has involved support for VER pilot projects to measure the most effective method of implementing the program. Pilot projects based on the Korea Voluntary Emission Reduction (K-VER) program were set up to test the actual operation and potential for emission reduction. Major activities of the pilots include the greenhouse gas inventory establishment and energy audits in seven of Thailand’s leading industrial companies: Thai Oil, Cementhai Energy Conservation, IRPC, Sahaviriya Steel Industries, Bangchak Petroleum, EGAT, and Dan Chang Bio Energy. During the energy audit processes, patterns of energy use and causes of energy loss were analyzed and recommendations were made to lower the energy consumption. The second phase involved capacity building and training programs on the establishment and operation of the T-VER system. GGGI has conducted four capacity building programs, targeted to Thai personnel and policy-makers, on energy auditing and project verification. The third and final stage involved the IT system development necessary to operationalize the T-VER program. The GGGI team established an IT system that technically enables various activities required for the program process. The Thai Greenhouse Gas Management Organization introduced the T-VER Development Plan, which included stakeholder consultations, trading schemes and procedures designed for the registration system, in October 2011. The official adoption of the T-VER system is an essential step for Thailand in seriously reducing its carbon emissions.

wAY FORwARD

In 2012, T-VER infrastructurewill be developed further, morespecifically through regulatoryrecommendations to relevantstakeholders in the country. Inaddition, GGGI in the scopingprocess for a broader greengrowth planning project in thecountry.

31

2REPORT ON PROGRESS AND RESULTS (2011)

Green Growth Research –Program Results

Program DescriptionThe main objectives of GGGI’s research program are to capture empirical evidence from its country-level green growth planning, to advance the theory of green growth economic modeling and to provide guid-ance to policymakers. In 2011, GGGI began to invest heavily in its research portfolio and will continue to develop it further in partnership with leading research institutions across developing and developed countries and with the active involvement of an expanding in-house GGGI research team.GGGI’s research focuses on the economic aspects of green growth in which there is the greatest need for additional research particularly as perceived by senior economic policymakers and leading growth economists. This is the community that ultimately will need to be persuaded if the prevailing growth and development model is to be transformed. Thus, research on purely or primarily environmental topics will be left to other institutions to pursue. GGGI has identified the following priority topic areas for its research:• Green growth planning tools and methodology• Lessons from in-country green growth planning experience• Economic theory and policy of green growth• esource-efficiency and green growth, including sectoral opportunities and approachesR• echnological innovation and green growth T• mployment and poverty reductionE• ocial innovation and welfare and political economy dimensions of green growthS• nternational economic cooperation and green growthI

targeted Results• Theoretical support for green growth developed and published • Ideas on green growth explored in collaboration with GGGI partners • Policy guidance developed and published • Research results shared

32

Relevant, high-quality research is available and used to validate green growth andguide policymakers and others

While the Institute’s research portfolio is still nascent,it will be developed further in partnershipwith leading research institutions across developing anddeveloped countries and with the activeinvolvement of an in-house GGGI research team.

33

REsEARChPROGRAM

sUMMARY OF REsULTs

• Co-launched the GreenGrowth Knowledge Platformto identify major knowledgegaps in green growth theory.• Supported Green Growth BestPractice workshops to sharelearnings from green growthprograms• Co-authored, with UNEP,the research publicationProgressing Towards Post-2012 Carbon Markets toprovide policy guidance andrecommendations to supportcarbon markets• Developed partnerships withleading economic researchorganizations on specificresearch projects

34

GGGI is uniquely positioned to act as global hub for researchers on green growth. For this reason, in 2011 GGGI negotiated an agreement to become the lead secretariat for the Green Growth Knowledge Platform (GGKP), a partnership project with the World Bank, Organization for Economic Development and Cooperation (OECD) and United Nations Environment Program (UNEP). Our aim for GGKP is that it should become the core platform where the global research agenda on green growth is shaped, the research community is built and researchers and practitioners access and debate the implications of the latest research findings. GGKP is designed to achieve this through its research committees of leading academics and affiliated networks of researchers and practitioners in various sub-disciplines. The successful operationalization of this project is an institutional priority in 2012. In 2011, GGGI also participated in the development of the Green Growth Best Practice project, which will study and capture best practice in green growth planning and implementation during 2012 – 13. In early 2012, GGGI was awarded the lead secretariat role in this initiative, which will be cofounded by the European Climate Foundation and Climate Development Knowledge Network. GGBP will be an affiliated program of the Green Growth Knowledge Platform. Its first workshop was held at UNEP in Paris in 2011. The workshop convened experts from international organizations, governments and institutions, including Steering Committee members, the Children’s Investment Fund Foundation, Climate and Development Knowledge Network, OECD, World Bank, UNEP, United Nations Development Program, United Nations Economic Commission for Latin America, the Global Green Growth Institute, and independent experts from the Ministry of Environment Chile, INE Mexico, the African Climate Policy Centre, and the Indian Institute of Management. GGGI also partnered with the UNEP Risoe Centre in preparing “Perspectives 2011: Progressing towards post-2012 carbon markets,” a publication focused on the role of the carbon markets in contributing to low-carbon development. “Perspectives 2011” presented 10 articles that address key questions regarding carbon markets post-2012, in the absence of a legally binding agreement on emissions reductions. Bringing together international experts with various perspectives, the research looks at policy and existing and new instruments. The report also explores how carbon markets at national, regional, and global levels can be developed to sustain the private sector in leveraging finance and to provide innovative solutions to reduce greenhouse gas emissions.

GGGI also partnered with the Asian Development Bank (ADB)to organize a workshop that brought together experts and senior policymakers, many from ministries of planning and finance in various developing countries. It was one of the first of its kind to focus on the social dimensions of climate change in the water, energy and green employment sectors. The organizers produced a follow-up policy brief on this aspect of climate change adaptation, water, energy and green employment.To take forward its research portfolio in 2012, GGGI has entered into research partnerships with leading economic institutions of the world, including the a major economic research partnership with the Grantham Institute of the London School of Economics, a trade research project with the Peterson Institute for International Economics and International Centre for Trade and Sustainable Development, Oxford Economics, UNIDO, and others.

35

3REPORT ON PROGRESS AND RESULTS (2011)

Public-Private Cooperation –Program Results

Program DescriptionGGGI aims to play two very specific and important roles in fostering public-private cooperation. First, GGGI connects countries or provinces that have developed rigorous green growth plans with poten-tial providers of capital and technology by rendering these economic plans into specific investment plans in key sectors that help to tap domestic and external as well as public and private sources of finance in an optimal manner. This is often the missing link in infrastructure and climate finance more generally, as developing countries typically lack the expertise to build “bankable” investment cases and project prepa-ration plans, leading to a situation in which committed official funds either go undisbursed or applied in a fashion that fails to tap the larger amounts of private investment which are potentially available. The development finance community has historically underinvested in such specialized in-country technical assistance and capacity building and appears likely to continue to do so. GGGI will be well positioned to help fill this gap by virtue of its familiarity with the country’s green growth economic development plan, the trusted, strategic relationship it builds with government in helping to design their plans, and its neu-trality in the sense of not being part of a financing agency or bilateral political relationship. Second, GGGI is working at the global level to elevate the importance political and business leaders at-tach to the role of public-private cooperation in strengthening incentives for the internalization of envi-ronmental externalities in core business strategies, including by building the Global Green Growth Forum into a major, agenda-setting event on the international calendar and catalyzing or expanding at least six major global initiatives that reduce information, policy or behavioral barriers to the scaling of green growth investment, innovation and best practice. GGGI aims to put green growth at the center of the international economic policy agenda, so that governments attach greater importance to adopting and implementing policies, agreements and cooperative arrangements that facilitate the flow of private in-vestment and technology to those places where they are needed for green growth to happen.

36

targeted Results• Global public-private partnerships facilitated to reduce information, policy and investment barriers critical to green growth• Products, policies and standards produced to expand private sector investment in green growth initia- tives• Sources of financing identified for investment plans related to national and provincial green growth strategies developed with GGGI’s support

Private sector is engaged in promoting green growth plans and initiatives

GGGI helped initiate the first high-level political debateon green growth among key public and private stakeholders throughthe launch of the Global Green Growth Forum (3GF).GGGI has begun a process to shift the international political agendaby engaging with other major international global forums. Incooperation with leading private companies GGGI is also launchingindependent projects to facilitate private investment in green growth.

37

PUbLIC-PRIVATECOO-PERATIONPROGRAM

sUMMARY OF REsULTs

• Co-launched the firstinternational forum on greengrowth, held in Copenhagen inOctober 2011.• Developed an active networkof global private sector leadersto form a Corporate AdvisoryGroup on green growth.• Facilitated partnershipswith leading private sectorcompanies to create anenabling environment forgreen industry.

In October 2011, GGGI and the Danish Government co-launched the Global Green Growth Forum (3GF) as a global public-private partnership to bring together world economic leaders in the cause of furthering green growth and designing the architecture for a green economy. The core purpose of the 3GF was to stimulate a deliberate, international thought proc-ess about various government and public-private approaches that could trigger progress in green growth-related industries, and to spur further application by like-minded coalitions of industry and government actors. GGGI has provided ongoing institutional support to the Forum, the first of which took place in Copenhagen in October 2011. This forum was attended by the UN Secretary-General, OECD Secretary-General, the Prime Ministers of Denmark, Ethiopia and Kenya, 50 global corpo-rate leaders, ministers and deputy ministers, UN leaders, and world-leading civil society organizations and experts. Comple-menting the annual Green Growth Summit in Seoul, which is designed to place heavier emphasis on country advisory and technical assistance and research work, GGGI anticipates the Forum to be the annual, high-level outlet for the programs and activities of its public-private pillar. The next 3GF will take place in Copenhagen in October 2012.

38

GGGI has developed partnerships with key private companies and international think tanks to expand markets for resource-efficient products, services and industrial processes. In May 2011, Danfoss became an official corporate partner of the Institute. Danfoss is one of Denmark’s largest energy efficiency com-panies, with a strong commitment to corporate social responsibility and sustainable global development. Danfoss plays an active and leading role in GGGI’s public-private cooperation work and will continue to do so through the Corporate Advisory Group. In October 2011, GGGI signed a formal agreement to work with Vestas Wind Systems to inform policymakers about the need to create a more enabling environment for the scaling of investment in clean energy solutions. The partnership with Vestas will focus specifically on the Sustainable Energy Trade Agreement research project, which sprang from discussions at the 3GF in Copenhagen. The research project was launched with Vestas in cooperation with the Peterson Institute for International Economics and the International Centre for Trade and Sustainable Development. The project aims to analyze the feasibility of a Sustainable Energy Trade Agreement and to develop a detailed set of policy options that could serve as the basis for an agreement. These options include a sectoral free trade arrangement where sustainable energy products and services are traded among country partici-pants without tariff and non-tariff barriers. GGGI and its partners believe that such an arrangement could help stimulate innovation in energy and diffuse efficient products and technologies.Finally, through a partnership with the World Economic Forum, GGGI provided support for and partici-pated in the G20’s work with business leaders on green growth, resulting in a series of recommendations for leaders at their November, 20111 in Cannes, France.

GGGI Executive Director Richard Samans (left) moderates a session at the Global Green Growth Forum 2011 (Photo courtesy of the Ministry of Foreign Affairs of Denmark)

39

2PART

sTRATEGY &FINANCEs

The Global Green Growth Institute is poised fortremendous growth in the coming years. Theorganization has set ambitious, yet realistic goalsfor implementing and promoting green growth to becarried out with the cooperation of our expandingnumber of partners.

1STRATEGY & FINANCES

ORGANIZATIONALDEVELOPMENT

our PresenceGGGI was launched in July 2010 and over the following year, the organization expanded its global reach significantly through partnerships with 11 countries, including Brazil, China, Cambodia, Ethiopia, India, Indonesia Kazakhstan, Mongolia, Philippines, Thailand, and the UAE. GGGI has also expanded its operational presence beyond its headquarters in Seoul to Copenhagen, London, and Abu Dhabi. Seoul will continue to lead GGGI’s global efforts while the Copenhagen, London, and Abu Dhabi offices pioneer its programs in Public Private Cooperation, Research, and Capacity Building respectively.

our PeopleGGGI has increased its internal staff capacity throughout 2011. Today GGGI has total staff strength of over 50 people. GGGI staff is now representative of approximately ten countries and brings together substantial experience from a broad range of academic and professional backgrounds. Moving forward in 2012-13, GGGI aims to expand its staff capacity by over 50 percent and in particular to build its internal research and analytical capacity, recruiting international experts with core skills and experience in economic modeling and sector specific analysis.

42

Results-based Management.One of GGGI’s key organizational development achievements in 2011 has been the development and implementation of Results-Based Management (RBM) across its core programs. GGGI recognizes that effective RBM is crucial in allowing an organization to achieve results through fine-tuning its operations to achieve, measure against, and adjust towards these results. GGGI has now developed a logical framework and a corresponding performance management framework, which clearly defines key targets and indicators, each program activity is effectively linked to the overarching outputs and outcomes and organizational mission that they are working to achieve. Consequently, GGGI has also worked to strengthen its core operating processes, recognizing this as an immediate imperative of developing a world-class operating model that enables it to function as a results-based organization that is efficient, effective, and highly responsive to beneficiary and donor needs.

Transition to an InternationalOrganizationBy 2012, GGGI plans to fully convert itself into an intergovernmental organization. In order to become such an organization, GGGI has made efforts to scale up by strengthening in-house capabilities, promote active country and research programs as well as expanded international donors and partners. GGGI has attracted international funding from Korea, Denmark, UAE, Japan, Germany and Australia, expanded its in-country programs, and formalized partnerships with numerous international organizations. This international outreach, combined with strengthened in-house capabilities and processes and growing research and public-private cooperation programs, has placed GGGI in a strong position in 2012 to convert into an intergovernmental organization and realize its vision of helping to catalyze a bottom-up transformation of the very nature of economic growth through practical acts of country and industry leadership.

43

2STRATEGY & FINANCES

IndependentAuditor's Report★Based on a report originally issued in Korean

The Board of Directors Global Green Growth Institute:We have audited the accompanying statements of financial position of Global Green Growth Institute ("GGGI") as of December 31, 2011 and 2010, and the related statements of comprehensive income, changes in equity and cash flows for the year ended December 31, 2011 and for the period from May 14, 2010 (inception) through December 31, 2010, and notes, comprising a summary of significant accounting policies and other explanatory information.Management is responsible for the preparation and fair presentation of these financial statements in ac-cordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.Our responsibility is to express an opinion on these financial statements based on our audits. We con-ducted our audits in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on our judgment, including the assess-ment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's in-ternal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presen-tation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.In our opinion, the financial statements give a true and fair view of the financial position of GGGI as of December 31, 2011 and 2010 and of its financial performance and its cash flows for the year ended December 31, 2011 and for the period from May 14, 2010 (inception) through December 31, 2010 in ac-cordance with International Financial Reporting Standards.

44

Seoul, Korea March 15, 2012

This report is effective as of March 15, 2012, the audit report date. Certain subsequent events or circumstances, which may occur between the audit report date and the time of reading this report, could have a material impact on the accompanying financial statements and notes thereto. Accordingly, the readers of the audit report should understand that the above audit report has not been updated to reflect the impact of such subsequent events or circumstances, if any.

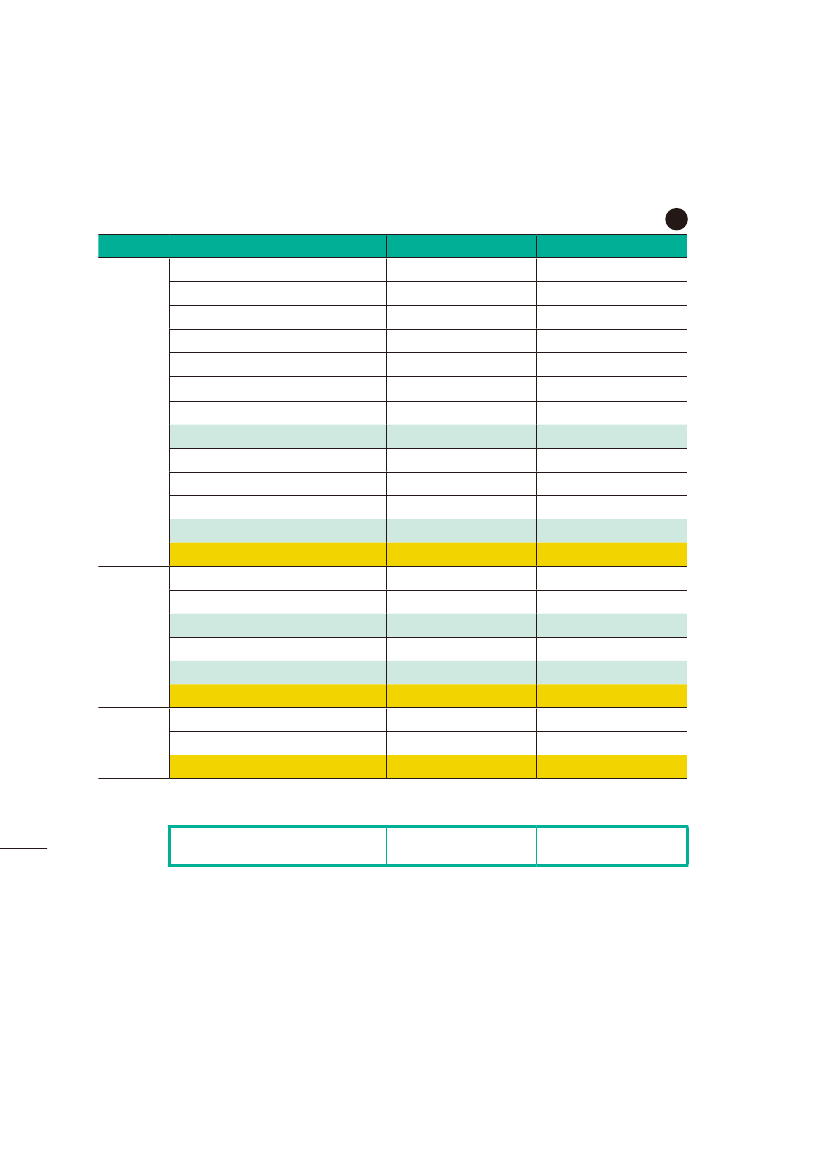

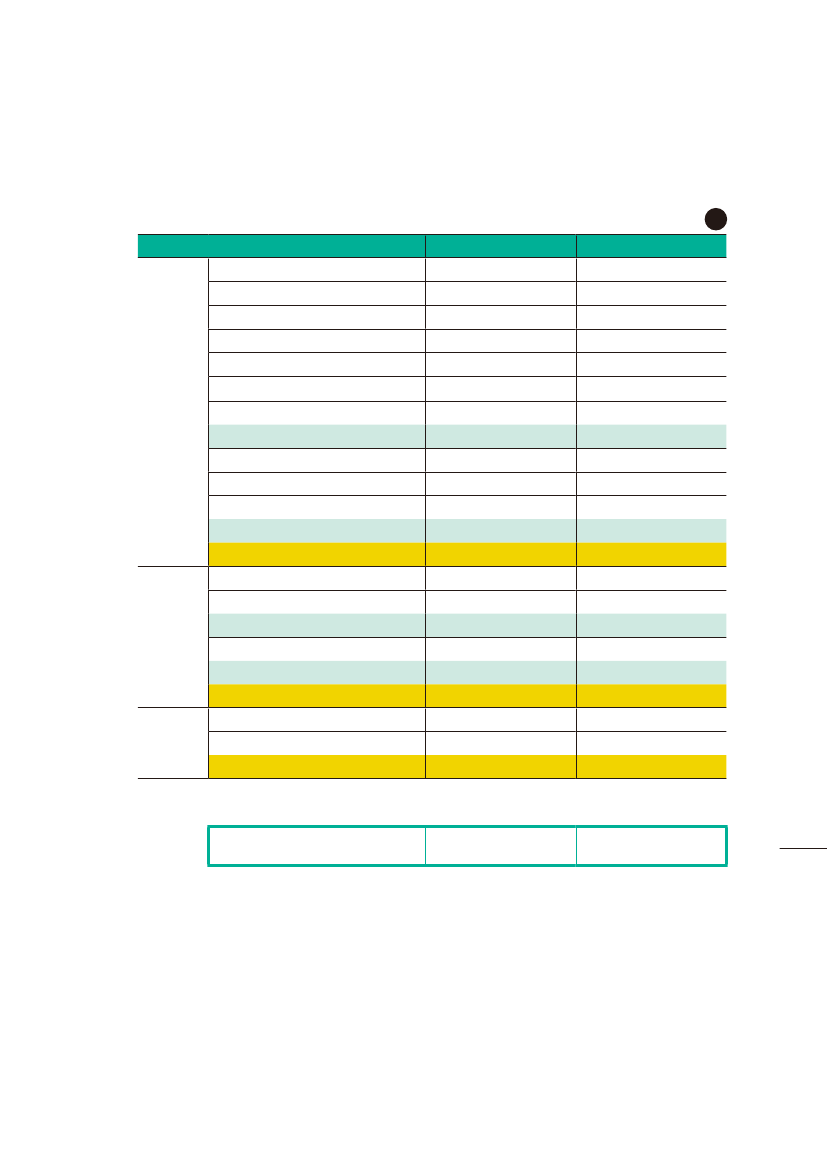

sTATEMENTsFINANCIAL OVERVIEwGGGI receives financial contributions from numerous national governments.The Institute uses these funds to support its ongoing programs in greengrowth planning, research, and public-private cooperation,as well as for the day-to-day operations of the organization. Presented beloware GGGI’s audited financial statements for 2010 and 2011.The statements are presented in Korean won (KRW), as this was thecountry in which the audit was conducted. Following the auditor’s note, thestatements are presented in U.S. dollars (USD) for reference. The financialstatements were audited by KPMG who confirmed that they contain nomaterial misstatements and comply with international accounting policies.

45

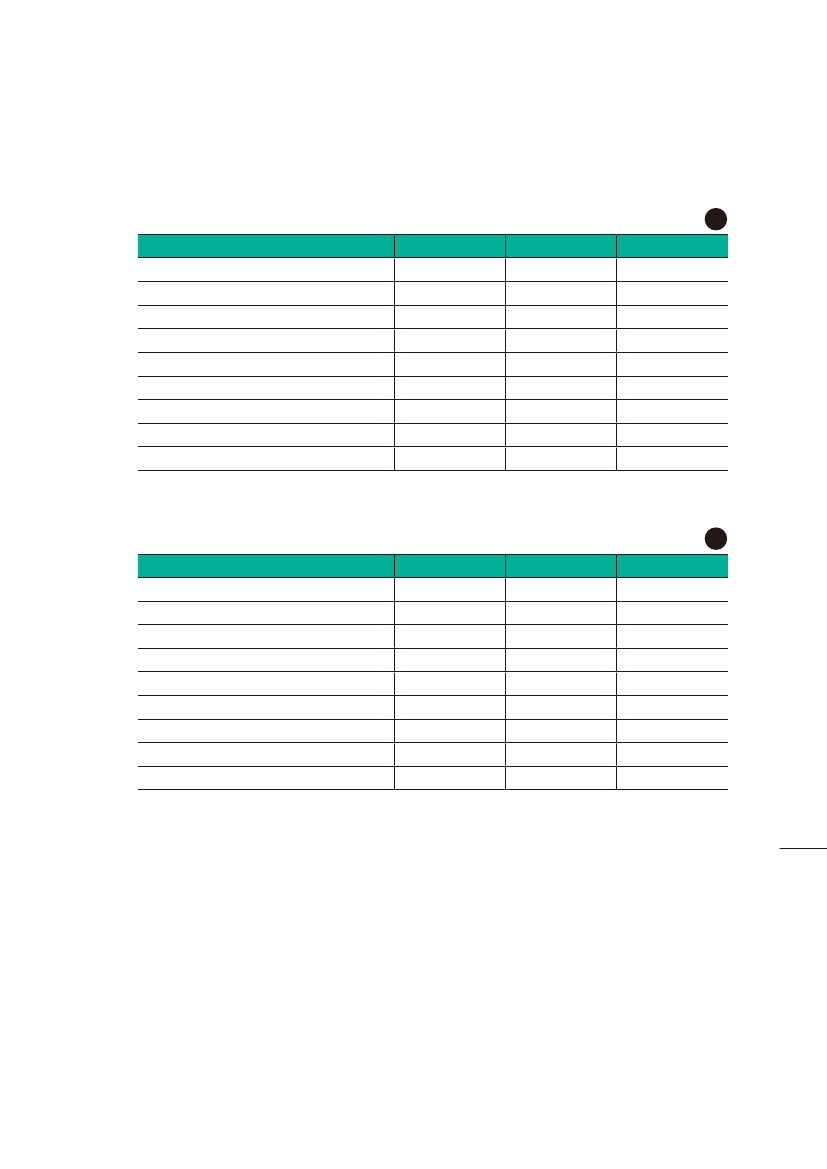

Financial PositionDecember 31, 2011 and 2010

Classification2011

In Korean won 2010

\

Cash and cash equivalentsShort-term financial instrumentsAccounts receivable Accrued income Advance payments Prepaid expenses

13,225,942,457750,000,0001,650,000420,117,63549,685,00090,929,6581,343,54314,539,668,2931,570,462,22713,765,662827,885,4102,412,113,29916,951,781,5926,659,129,97972,064,2716,731,194,250179,788,512179,788,5126,910,982,762500,000,0009,540,798,83010,040,798,830

7,400,054,857-45,474,390--60,854,150

assets

Prepaid value added tax total current assetsProperty and equipment, netIntangible assetsLeasehold depositstotal non-current assetstotal assetsAccounts payableWithholdings

7,506,383,3971,602,744,9913,739,175462,825,7032,069,309,8699,575,693,2665,760,272,61594,100,6905,854,373,30532,429,09732,429,0975,886,802,402500,000,0003,188,890,8643,688,890,864

Liabilities

Total current liabilitiesEmployee benefitsTotal non-current liabilitiesTotal liabilitiesBasic properties

equity

Retained earningstotal equity

46

Total liabilities andequity

16,951,781,592

9,575,693,266

Classification20112010

In USD U$

Cash and cash equivalentsShort-term financial instrumentsAccounts receivable Accrued income Advance payments Prepaid expenses

11,467,912650,3081,430364,27443,08178,8431,16512,607,0131,361,71211,936717,8402,091,48814,698,5015,773,97962,4855,836,464155,890155,8905,992,354433,5398,272,6088,706,147

6,416,418-39,430--52,765

assets

Prepaid value added tax total current assetsProperty and equipment, netIntangible assetsLeasehold depositstotal non-current assetstotal assetsAccounts payableWithholdings

6,508,6131,389,7033,242401,3061,794,2518,302,8644,994,60081,5935,076,19328,11828,1185,104,311433,5392,765,0143,198,553

Liabilities

Total current liabilitiesEmployee benefitsTotal non-current liabilitiesTotal liabilitiesBasic properties

equity

Retained earningstotal equity

Total liabilities andequity

14,698,501

8,302,864

47

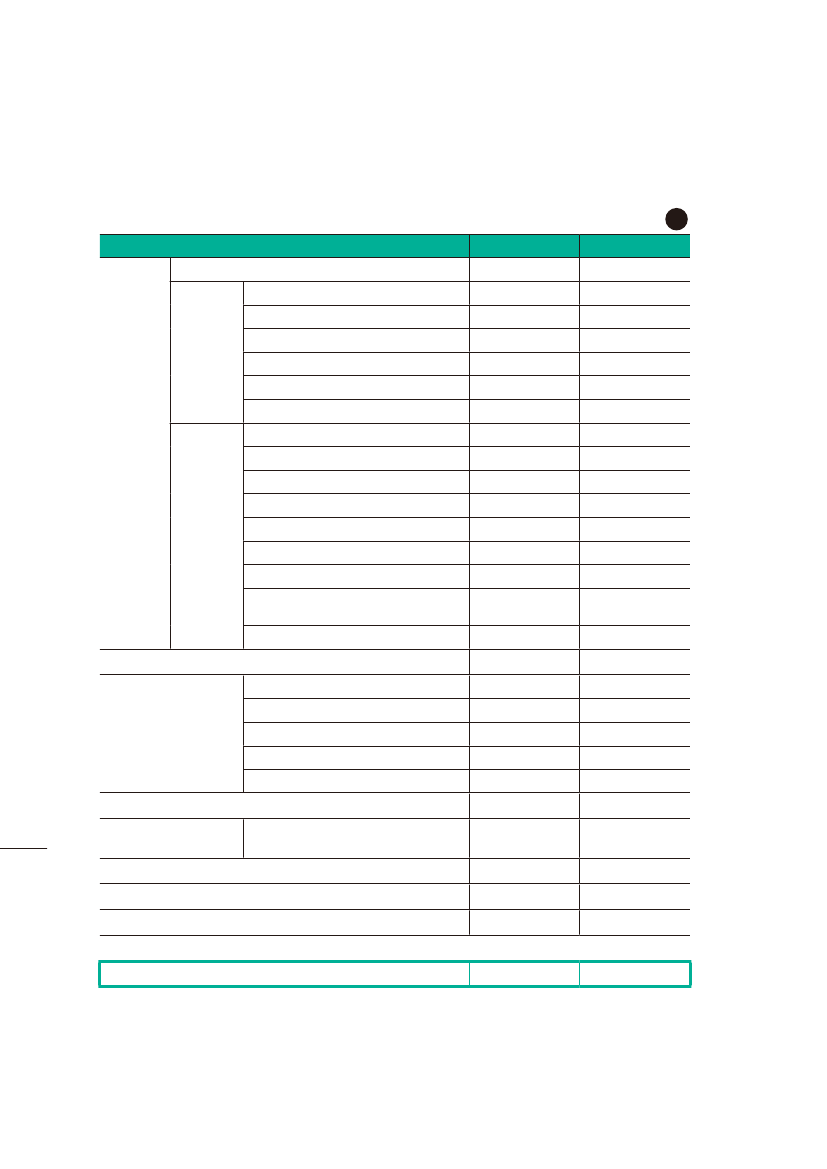

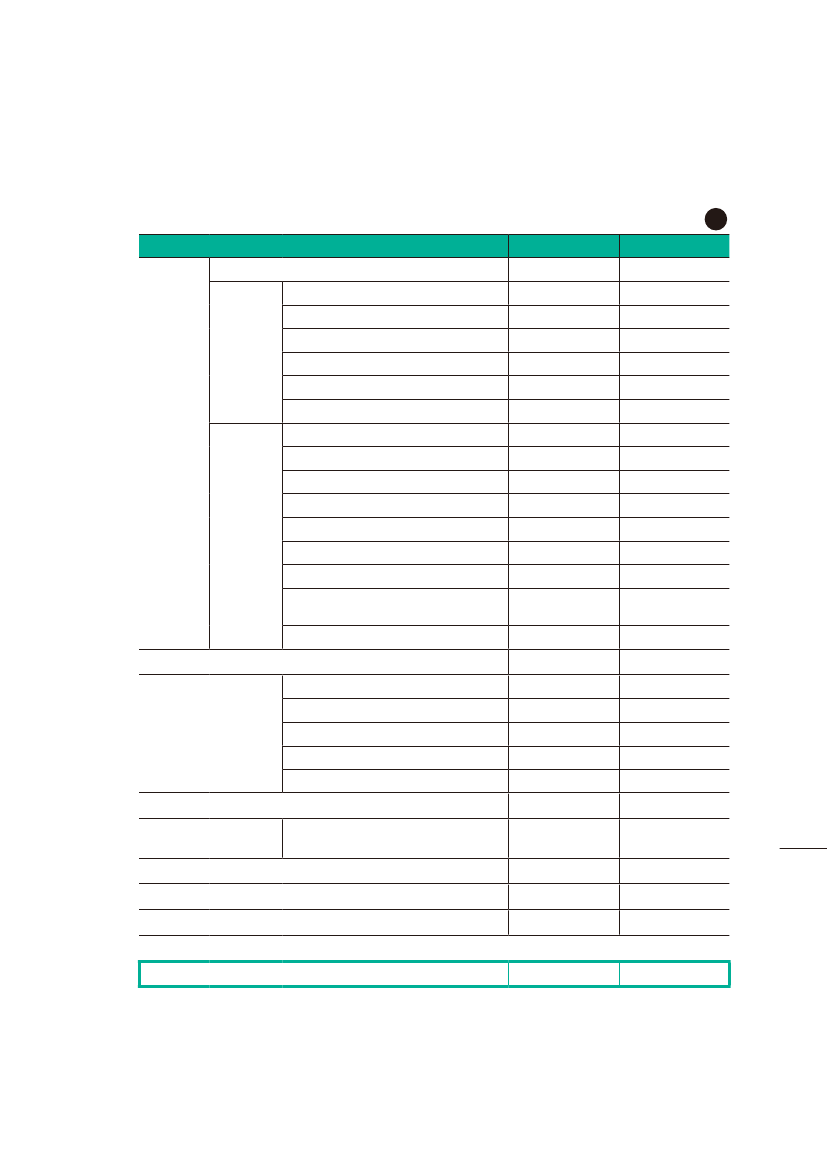

Comprehensive IncomeFor the year ended December 31, 2011 and for the period from May 14, 2010 (inception) throughDecember 31, 2010

2011

In Korean won 2010

\

Contributions for non-profit businessOther revenuetotal RevenueResearch and operation expensesOther expensesTotal ExpensesOperating incomeFinance incomeFinance costsOther non-operating income (loss)Profit for the yearOther comprehensive income (loss)

20,818,200,000420,117,63521,238,317,63514,868,889,933420,117,63515,289,007,5685,949,310,067549,899,511147,113,79354,4766,352,150,261(242,295)

11,363,000,000

11,363,000,0008,282,884,378-8,282,884,3783,080,115,622108,774,883-3593,188,890,864-

total comprehensive incomefor the year

6,351,907,966

3,188,890,864

20112010

In USD U$

Contributions for non-profit businessOther Total ContributionResearch and operation expensesOther 48

18,050,984364,27418,415,25812,892,474364,27413,256,7485,158,510476,806127,559475,507,804(210)

9,852,597

9,852,5977,181,899-7,181,8992,670,69894,316--2,765,014-