Udenrigsudvalget 2013-14

URU Alm.del Bilag 129

Offentligt

DIRECTORATE-GENERAL FOR EXTERNAL POLICIES

POLICY DEPARTMENT

IN-DEPTH ANALYSIS

The European Union’s trade policy,five years after the Lisbon TreatyAuthor: Roberto BENDINI

AbstractDespite the global economic crisis of 2008 and the spectacular rise of new emerging powers,the European Union (EU) remains one of the world's leading economies. Today more thanever, the EU is deeply reliant on trade and, in particular, on exports. In this post-crisis period,when demand for European products remains weak, both within the internal market and inother traditional markets, securing its presence in traditional markets and conquering newones are priorities for the EU.The EU's trade policy has fundamentally changed in recent years. One of the founding andmost influential members of the World Trade Organisation (WTO), the EU has beencompelled to acknowledge that the multilateral approach that it had adopted for many yearshas not yielded genuine progress. In response, the EU launched a new strategy in 2006(called ‘Global Europe’) to combine its multilateral approach with renewed efforts to forgebilateral trade deals. This strategy has been largely described by the ‘Europe 2020’ tradestrategy of the European Commission.The Commission has launched three major legislative reforms in recent years: the revision ofthe Generalised System of Preferences (GSP), the reform of its Trade Defence Instruments(TDIs – antidumping and countervailing duties) and the ’reciprocity instrument’ intended tosecure EU goods and services fairer and more symmetrical access to public procurementmarkets in third countries.The traditionally technocratic approach of the EU’s trade policy was radically changed by theentry into force of the Lisbon Treaty in 2009; with this treaty, the Commission lost itsunilateral control in the domain, while the European Parliament gained an important voice.Although it is still early to assess to what extent the Parliament’s input has modified EU’strade policy, the only democratically elected European institution has certainly played a keyrole in defending the incorporation of EU values (human rights, labour rights andenvironment protection) in the Union’s trade policy and bringing it closer to the people.

DG EXPO/B/PolDep/Note/2014_76PE 522.329

March 2014EN

Policy Department, Directorate-General for External Policies

This in-depth analysis is an initiative of the Policy Department, DG EXPO

AUTHOR:

Roberto BENDINIDirectorate-General for External Policies of the UnionPolicy DepartmentWIB 06 M 055rue Wiertz 60B-1047 BrusselsEditorial Assistant: Györgyi MÁCSAI and Jakub PRZETACZNIK

CONTACT:

PUBLICATION:

English-language manuscript completed on 3 March 2014.�European Union, 2014Printed inBelgiumThis Policy Briefing is available on the intranet site of the Directorate-General for External Policies, in theRegions and countriesorPolicy Areassection.

DISCLAIMER:

Any opinions expressed in this document are the sole responsibility of theauthor and do not necessarily represent the official position of theEuropean Parliament.Reproduction and translation, except for commercial purposes, areauthorised, provided the source is acknowledged and provided thepublisher is given prior notice and supplied with a copy of the publication.

2

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

Table of contents123456789Introduction‘Global Europe’ (2006): An epochal shift in the EU trade policy45

‘Trade, growth and world affairs’ (2010): EU trade policy back ontrack8Trade and external relations after LisbonA new trade and investment policyThe multilateral approach at riskFrom a multilateral to a bilateral approach:Second-generation FTAsEnforcement and implementationPublic consultation and impact assessment9101718232627

10 Conclusions

3

Policy Department, Directorate-General for External Policies

1

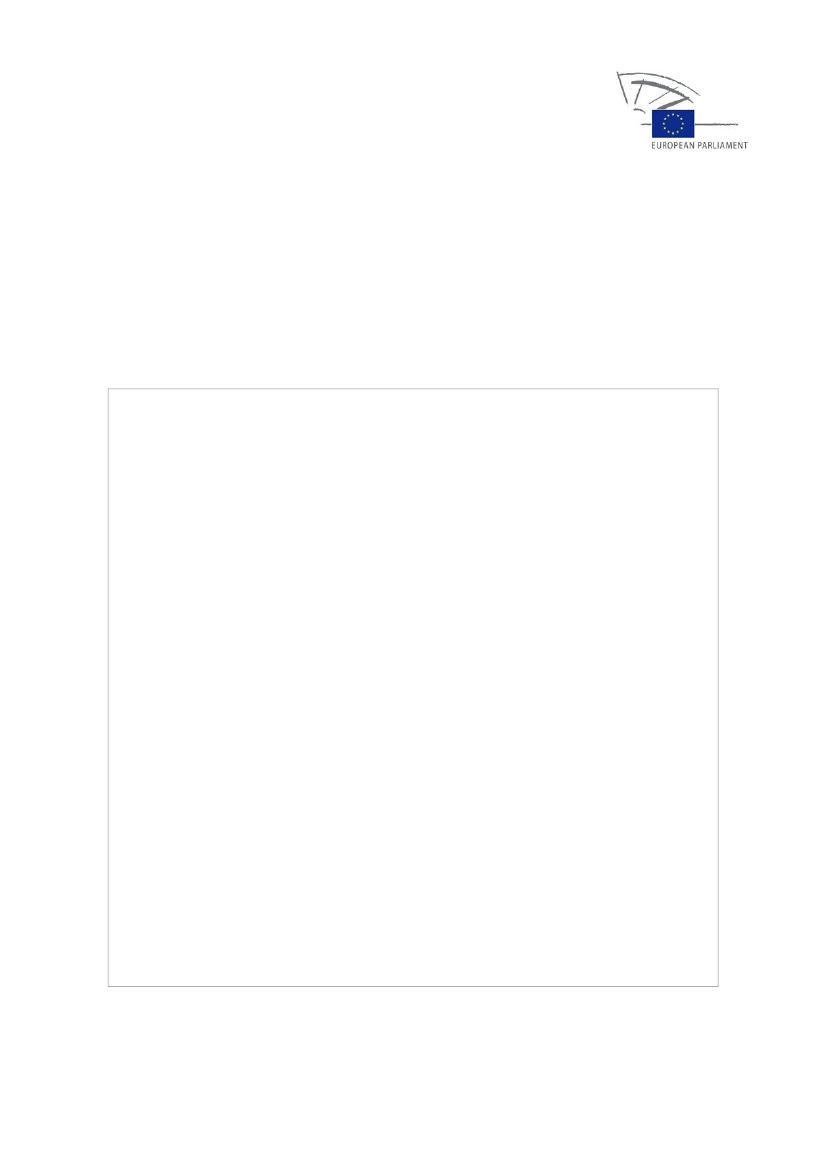

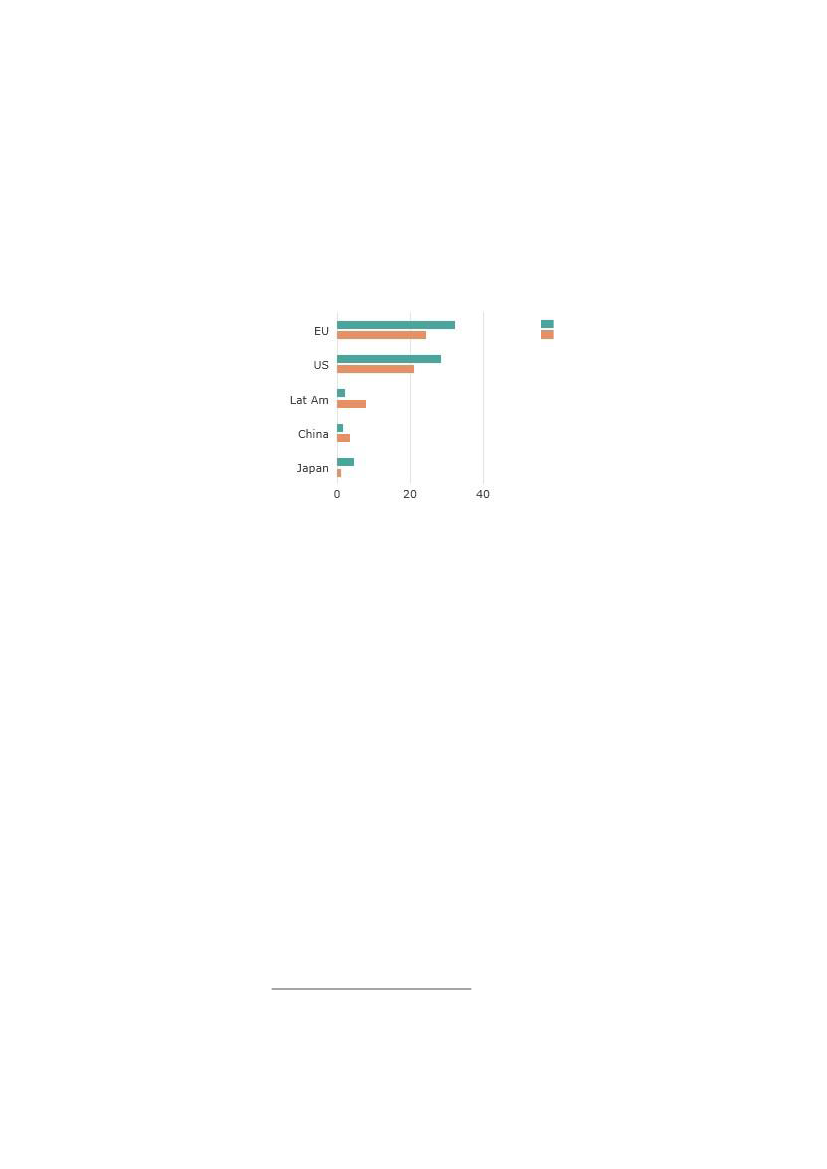

IntroductionDespite the spectacular rise of new, emerging powers, the EU remains one ofthe world's leading economies, one deeply reliant on trade and, in particular,on exports. In 2012 Europe imported 15.3 % and exported 14.6 % of theworld's traded goods, with EU transactions valued at more than EUR 3.47trillion. Two thirds of goods imported into the EU were manufactures, aquarter were fuels and mining products, and the remainder agriculturalgoods. The purchasing power of the nearly 500 million people living in the 28countries that make up the EU – which has a total gross domestic product(GDP) of over EUR 12.9 trillion – is one important factor underlying the cloutof Europe's trade policy. Likewise, the vast scale of Europe's exports to andinvestments in the rest of the world provide the EU with a strong interest incommercial conditions abroad1.

The EU remains theworld's biggest tradingblock.

Figure 1:

The EU in world trade incomparison with the US,China and Japan (in %,excluding intra-EU trade)Source: DG Trade based on WTO and Eurostat data

In this post-crisis period, when demand in the EU and in other traditionalmarkets for European products remains weak, conquering new markets andsecuring a presence in traditional ones are priorities for the EU. In recentyears, the EU has embarked on a new wave of free trade agreement (FTA)negotiations. After the successful conclusion of the deal with South Korea in2009, the EU finalised FTAs with Colombia and Peru and Singapore. An FTAwill soon be concluded with Canada, and Association Agreements, includingstrong trade chapters, will be signed with Central America, Moldova andGeorgia. These agreements no longer focus solely on trade in goods, but alsoinclude meaningful chapters on trade in services and investments. Otherimportant issues included are intellectual property right (IPR) protection, anti-competitive practices, public procurement, health and industrial standards,and labour and environmental norms. The EU is also negotiating twoambitious FTAs with Japan and the United States (the Transatlantic Trade andInvestment Partnership, or TTIP) and has recently opened talks for a deal onforeign investment protection with the People's Republic of China. The EU1

European Commission, DG Trade Statistical Pocket Guide (2013).

4

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

has also engaged in a series of ambitious FTA talks with ASEAN countries.In conjunction with other major trading partners, the EU has participated innegotiations on the new generation of ‘WTO plus’ sectoral agreements, suchas the Anti-Counterfeiting Trade Agreement (ACTA) and the Trade in ServicesAgreement (TISA).The Commission has launched three major legislative reforms in recent years:the revision of the Generalised System of Preferences (GSP) mechanism, thereform of its Trade Defence Instruments (TDIs – antidumping andcountervailing duties) and the ’reciprocity instrument’ intended to secure EUgoods and services fairer and more symmetrical access to publicprocurement markets in third countries.The traditionally technocratic approach of the EU’s trade policy was radicallychanged by the entry into force of the Lisbon Treaty in 2009; with this treaty,the Commission lost its unilateral control in the domain, while the EuropeanParliament gained new important responsibilities, especially in the field offoreign direct investments and IPR protection. The European Parliament hasbecome a co-legislator on (almost) equal footing with the Council.Although it is still early to assess to what extent the Parliament’s input hasmodified EU trade policy, the only democratically elected EU institution hascertainly played a key role in defending the incorporation of EU values(human rights, labour rights and environment protection) in the Union’strade policy and bringing it closer to the people. The Parliament rejectedACTA, for example, on the grounds that it might infringe upon thefundamental rights of European citizens; the rejection underscored theParliament’s readiness to exert its new powers.

The Treaty of Lisbon hassignificantly changed theEU’s CommonCommercial Policy andmade the EuropeanParliament co-legislatoron equal footing with theCouncil.

2

‘Global Europe’ (2006): An epochal shift in the EU trade policyLaunched at the end of 2006, the European Commission's ‘Global Europe:Competing in the World’2communication was intended to codify asignificant shift in the EU's international trade strategy and contribute to thesuccessful implementation of the Lisbon Agenda for Growth andEmployment (2000).‘Global Europe’ arrived at a moment when the newly-appointed leaders ofthe Commission, headed by President José Manuel Barroso, realised that theLisbon Agenda was not progressing at the expected pace and chose to adopta modified approach, correcting those aspects of the Agenda which hadproved ineffective or become outdated.In fact, the original Lisbon Agenda did not focus on external aspects of EUcompetitiveness, but rather on the internal policies intended to enhance thecompetitiveness of the European economy, create new jobs and guaranteethat economic growth in the EU would outpace the relatively modest rateregistered at the end of the last decade.2

‘Global Europe’ linkedinternal competitivenessto external tradeperformance for the firsttime.

European Commission, ‘Global Europe, Competing in the world’ (2006)5

Policy Department, Directorate-General for External Policies

The Lisbon Agenda included relatively few provisions on international trade –suggesting that coordination within the European Commission was notoptimal. In the era of globalisation, it was unwise to overlook the hugechallenges posed by the growth of China, Brazil, India and other emergingeconomies. That said, the Commission was not inactive in the field ofinternational trade during the 2000-2005 period; it simply failed tocoordinate internal and external policies in one coherent strategy.For many years, the EUstrongly privileged themultilateral approach ofthe World TradeOrganisation (WTO) tobilateral preferentialtrade agreements.This failure can be attributed to two principal factors.1. For one, the EU in general and the European Commission inparticular (the Union’s executive arm, conducting tradenegotiations) had a clear and avowed preference for multilateralagreements over bilateral or regional ones, barring exceptional andnon-trade factors, such as enlargement or political relationshipswith neighbours. This meant that the negotiation of bilateralagreements with potentially interesting trade partners wassignificantly delayed. In comparison to the US, for example, the EUlagged in negotiating with third countries such as Singapore, SouthKorea and some Latin American countries (notably Colombia andPeru). When compared with other countries exploring two-wayagreements – South Korea, Australia or even China – the EU provedeven slower.The new cycle of WTO negotiations, which began in Doha in 2001,was expected to end the stalemate of the 1998 talks in Seattle. Acertain degree of optimism was justified in the post-September 11period; a new and ambitious WTO deal, with a strong developmentcomponent, appeared within reach.2. The second factor that proved the undoing of the Commission’sapproach was the rise of new economic powers, which graduallychallenged the US-EU dyad that had dominated the world economyand commerce since the creation of General Agreement on Tariffsand Trade (GATT) in 1947.In 2005, the Commission was at last compelled to accept that WTO talks werenot proceeding as expected and that the role of emerging countries in theworld economy was growing much faster than initially foreseen. Revising itsoverall strategy, the Commission advanced a new set of external policies,coordinated with the revision of the Lisbon Agenda undertaken by PresidentBarroso.Along with the obvious commitment to conclude WTO negotiations quickly,the Commission proposed the following priorities:

The failure to concludethe WTO’s DohaDevelopment Round andthe global shift ofeconomic powerprompted the EU to alterits strategy.

6

launching a new generation of bilateral and regional FTAs andcompleting the active negotiations;renewing its strategy for trade with China as part of an effort to create abroad strategy for a fair partnership;better protecting IPRs, with an emphasis on enforcement and co-

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

operation with third countries;

‘Global Europe’ did notproduce the expectedresults, and the EU’sreorientation of its tradepolicy only advancedslowly.

adopting a new strategy on market access to identify and remove non-tariff barriers to trade, in key countries and sectors;advancing new proposals for opening public procurement marketsabroad;reforming the EU's trade defence instruments;prioritising access to resources (energy and raw materials) while beingmore attentive to climate change and environmental issues.

‘Global Europe’ represented an important advance towards a coherent andgrowth-oriented external trade policy. Yet its results were much like those ofthe ‘Lisbon Strategy for Growth and Employment’, from which it evolved.Launched with great fanfare and depicted as a decisive step towards a morecompetitive and stronger Europe, ‘Global Europe’ produced results farweaker than those anticipated by stakeholders and economic operators.What is more, economic conditions meant that the strategy proved a greaterdisappointment than previous efforts. Following a devastating economic andfinancial crisis – which had severely damaged industrialised countries whilelargely sparing emerging countries like China – the EU’s failure to implementa successful external-oriented set of trade policies was a serious setback.The accomplishments of ‘Global Europe’ can be summarised as follows:

one FTA signed with a middle-sized industrialised country (SouthKorea) known for its pro-active policy on free trade agreements;some tactical progress towards the suppression of unfair marketrestrictions, anda long series of ‘wishful thinking’ objectives.

The Commission’s own evaluation of the strategy’s successes was hardlymore laudatory: ‘notwithstanding the progress made since 2006 inaccomplishing the ‘Global Europe’ agenda, important experiences have beenacquired and lessons learned which will feed into the future EU strategy’.Experience may be the greatest accomplishment of ‘Global Europe’, althoughmany expected more concrete results at the outset.The burden of responsibility does not, however, lie entirely on theCommission's shoulders. In fact, divided Member States supporting divergentinterests, coupled with internal fights between the ‘free-traders’ and’protectionists’ within the Commission, weakened the EU’s position abroadand prevented the Commission from developing a coherent policy withwidespread backing.

7

Policy Department, Directorate-General for External Policies

3

‘Trade, growth and world affairs’ (2010): EU trade policy back on trackThe European Commission's communication ‘Trade, growth and worldaffairs’ was launched in November 2010. ‘Trade, growth and world affairs’(TGWA) builds on the ‘Europe 2020 - A strategy for smart, sustainable andinclusive growth’ communication published by the Commission on 3 March20103. The new trade strategy effectively replaced ‘Global Europe’4.As mentioned above, ‘Global Europe’ had attempted to fill an important gapin the Lisbon Strategy for Growth and Jobs, which had largely disregardedthe challenges that trade liberalisation and globalisation presented theEuropean economy. Unfortunately, the revised Lisbon Strategy (launched in2005) was unable to meet its main objectives, while ‘Global Europe’ did notsubstantially strengthen the EU’s position in the rapidly changing landscapeof global trade.The new Europe 2020 strategy gives more emphasis to the EU’s externaleconomic relations, regarded as a potential catalyst for growth and jobcreation, and recognises the need to coordinate the EU’s internal andexternal policies. In the chapter dedicated to external policy instruments, theCommission confirms its commitment to an open and liberal internationaltrading system and stresses the new opportunities that global growth wouldoffer European companies.The Commission committed itself to asserting the EU ‘more effectively on theworld stage’ by actively contributing to shaping ‘the future global economicorder’ and defending ‘the European interest’ worldwide. To this end, theEurope 2020 strategy advanced two distinct lines of action:(a) improving the external aspects of EU's internal policies (such asenergy, transport, agriculture, research and development), and(b) ensuring that trade and international macroeconomic policies bepursued in a more coordinated and efficient manner.In the communication, the Commission acknowledged that a serious effortwas required to ensure that EU goods and services with a comparativeadvantage benefit from free and fair access to emerging countries' markets,where the post-crisis economic growth was expected to be more sustained.This implied the EU would adopt a more aggressive market access strategyand a dedicated approach to issues such as regulatory dialogues and otherinitiatives to remove non-tariff, behind-the-border barriers.TGWA placed significantly less emphasis on the WTO than had ‘GlobalEurope’. The EU commitment to concluding the Doha Round andstrengthening the WTO remained unchanged, but multilateral negotiationswere overshadowed by the new generation of free-trade agreements thatEuropean Commission, ‘Europe 2020, A strategy for smart, sustainable and inclusivegrowth (2010)’4European Commission, ‘Trade, Growth and World Affairs. Trade policy as a corecomponent of the EU’s Europe 2020 strategy’ (2010)3

‘Trade, Growth andWorld Affairs’ (TGWA)was more than acosmetic touch-up to‘Global Europe’.

The Europe 2020 strategyaims to make the EUmore competitive andmore effective on theworld’s stage.

8

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

the Commission planned to conclude.Finally, according to the Commission, TGWA represented a key element ofthe Europe 2020 strategy, embodying a ‘clear statement of Europe'sintentions to play an active and assertive role in promoting the trade policyagenda in the G 20 and all other relevant global fora’. In this context, soundtrade practices and combatting protectionism were considered necessarypreconditions to a return to strong, sustainable and balanced growth, asinvoked by G20 leaders5.

4

Trade and external relations after LisbonThe European Commission has said, ‘our aim is for the EU to play a role inforeign affairs and global management commensurate with our economicweight’ under the cap of the EU's external action, to be conducted incoherence with the other areas thereof (foreign policy, development, etc.).This objective, unfortunately, can hardly be said to have been achieved. TheEU – often depicted as an ‘economic giant and a political dwarf’ – has notalways defended its interests and values in the world. EU Member Statesoften have diverging, if not outright contradictory, foreign policy objectives,and finding a viable compromise has not always been possible.Article 207 of the Treaty of Lisbon (TEU) mandates that ‘the commoncommercial policy shall be conducted in the context of the principles andobjectives of the Union's external action’. This is an important innovation —the recognition, for the first time, that, external policies and internationaltrade are strictly linked.

The Treaty of Lisbonmakes the CommonCommercial Policy (CCP)part of the EU's foreignpolicy.

The unansweredquestion is whether theCCP should serve theEU's internalcompetitivenessobjectives or Europe'sforeign policy goals.

But this innovation also has some evident challenges. The main questionhere is whether the EU's Common Commercial Policy should be applied tobolster the EU’s foreign policy or to support the Union’s internal (industrial)goals. The EU trade policy may help meet the objectives of the Europe 2020Strategy and contribute to the creation of a coherent industrial policy in theEU or it may be used as an incentive for foreign initiatives. But it cannotmanage all these objectives simultaneously. Part of the Parliament's newpower involves deciding (in conjunction with the Council) how to prioritisethe use of this residual ‘soft power’, which once characterised EU foreignpolicy.The conundrum the EU is facing can be illustrated by an example. In 2010Pakistan was severely hit by flooding. On 16 September 2010, the Councilmandated the European Commission to present a proposal to unilaterallysuspend import duties levied on certain goods originating in Pakistan. In itspresentation to the Parliament, the Commission described theseautonomous trade preferences as exceptional measures responding to theflood. The measures entered into force after a long and difficult debate in late2012, and the Commission explained in TGWA that this line of action wouldRoberto Bendini (EP Policy Department), ‘Trade Growth and World Affairs: A brief outline’(2011)5

9

Policy Department, Directorate-General for External Policies

be the rule rather than the exception in similar cases in the future.This new approach has important ramifications. Political or security (andhumanitarian) considerations are likely to prevail over economic orcommercial ones in the foreseeable future. Yet the application of thesevalues may undermine the EU’s efforts to adopt a coherent approach tointernational trade. If the economic situation of the EU were to decline,unconditional trade concessions may not only be expensive (concessions arenot free and are likely to be paid by workers or farmers in the EU) but alsodangerous; these concessions may affect the rationale underlying ‘GSP plus’and other similar initiatives, which make trade concessions conditional onthe respect of basic international conventions on human and social rights.

5

A new trade and investment policyIn TGWA, trade in services, foreign direct investment (FDI) and publicprocurement are privileged.Services

were already ranked high in the EU’s list of priorities before TGWA.For example, the EU-South Korea FTA (whose negotiations started in 2007)essentially provides an easier market access for Korean industrial products –and notably vehicles – in exchange for enhanced access for EU serviceproviders. The commitments contained in the General Agreement on Tradein Services (GATS) date to the mid-1990s, but are very heterogeneous, withmost countries largely uncommitted or unbound in their schedules ofservices liberalisation. In general, trade in services has not been liberalised tothe same extent as trade in goods, for both political and technical reasons(certain sectors have only become ‘tradable’ thanks to recent technologicalprogress). The global picture of barriers to services' trade is therefore blurryand protections are not consistently implemented.Given that the EU is the world’s service leader, the Union expected that gainsfrom liberalising the trade in services would be higher than those fromliberalising the trade in manufactured goods. Yet the EU’s strategy – whichprivileged efforts to liberalise services over those to further free up the tradein goods – places a supplemental burden on the EU’s declining industrialsector. Such an approach was adopted in FTA agreements negotiated by theEU after the Korea agreement, and their content was largely inspired by theearlier deal. Like other developed countries, the EU has recognised the lack ofprogress in the WTO’s services negotiations and is participating innegotiations for a plurilateral agreement on services known as ‘TISA’6.Foreign direct investment

(FDI) became an exclusive competence of the EUafter the entry into force of the Lisbon Treaty. On 7 July 2010 the Commission

Procurement, trade inservices and FDI havebecome priorities underthe EU's revised tradestrategy.

Pasquale De Micco (EP Policy Department), ‘The Plurilateral Agreement on Services: At thestarting gate’ (2013).6

10

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

Foreign directinvestments havebecome an exclusivecompetence of the EU,which must oversee the 1200 bilateral dealspreviously negotiated byMember States.

published a communication titled ‘Towards a comprehensive Europeaninternational investment policy’7. The communication was accompanied by alegislative proposal8aiming to introduce a comprehensive new investmentpolicy for the Union and to regulate the bilateral investment agreements thatMember States had signed in the past years.The EU is the largest source and destination of FDI in the world (measured byeither stocks or flows). In 2010, the Union accounted for almost 33 % of theglobe’s outward investment and 24 % of inward investments (see tablebelow).outward stockinward stock

Figure 2

Share of world FDI in 2010(%)Source: DG Trade

The EU’s foreign direct investments are in general secured through bilateralinvestment treaties (BITs). BITs provide guarantees on the conditions ofinvestment in Member States and in third countries in the form of specificcommitments that are binding under international law. Althoughagreements remain binding for the Member States as part of publicinternational law, the entry into force of the Lisbon Treaty and the EU's newexclusive competence on foreign direct investment has meant that MemberStates' investment agreements have had to be reconsidered. In the absenceof an explicit transitional regime in the TFEU clarifying the status of BITs, theEC put forward a regulation specifying the terms, conditions and proceduresunder which Member States are authorised to maintain, amend or concludebilateral investment agreements with third countries.The debate on investment before the European Parliament (EP) and theCouncil was rather intense. The EP in particular was interested in introducingnon-economic elements (references to human rights, development andsocial and labour conventions) in the proposed regulation, while the Councilpreferred a restrictive reading of the TFEU to reduce the competences

European Commission, ‘Towards a comprehensive European international investmentpolicy’ (2010).8European Commission, ‘Proposal for a Regulation of the European Parliament and of theCouncil establishing transitional arrangements for bilateral investment agreementsbetween Member States and third countries’ (2010).7

11

Policy Department, Directorate-General for External Policies

effectively transferred to the EU. In the end, a deal was struck, and a revisedregulation entered into force on 20 December 20129.The Commission also suggested updating the FDI chapter in the negotiatingmandate with Canada10, India and Singapore, and proposed launchingnegotiations for a stand-alone investment agreement with other countries (inparticular China and Russia). In particular, the deal reached with Canadacontains innovative clauses dealing with FDIs and represents a significantadvance in the field of investment protection. Negotiations for an agreementon investment with China11were officially launched on the occasion of theEU-China Summit in Beijing on 21 November 2013, and the first round ofnegotiations was held in Beijing on 23-24 January 201412.The EC tried to reshapeaccess to EU publicprocurement markets byintroducing a systembased on reciprocity.Public procurement

is another area of significance for the EU. In ‘GlobalEurope’, the EC projected that it would launch initiatives in the field of publicprocurement in order to make public procurement procedures in thirdcountries more open and competitive. Stressing the importance of publicprocurement for the EU economy, the Commission concluded that ‘this isprobably the biggest trade sector remaining sheltered from multilateraldisciplines’, and that ‘the challenge is to find new ways of opening up majorforeign procurement markets without closing our own’.Despite its public commitment to open public procurement markets abroad,the Commission has not dealt with this issue for a number of years. Itsinactivity was apparently due to serious political disagreement betweenvarious services of the European Commission regarding which actions wouldsecure better and fairer access to foreign government procurementprocedures. Some Member States also declared their opposition to a systembased on reciprocity.The publication of TGWA in 2010 reopened the debate on publicprocurement. In its text, the Commission suggested it would introduce a newlegislative proposal creating an EU instrument to guarantee an appropriatelevel of symmetry in third countries’ public procurement markets. Theproposal was finally published on 21 March 2013 and submitted to the EPand Council for consideration13.As expected, the Commission's proposals have faced opposition from thosetrading partners who have so far enjoyed relatively free access to the EUmarkets while protecting their own procurement procedures with laws and

Regulation (EU) No 1219/2012 of the European Parliament and of the Council of 12December 2012 establishing transitional arrangements for bilateral investment agreementsbetween Member States and third countries.10European Commission, Investment Provisions in the EU-Canada free trade agreement(CETA) (2013)11European Commission, EU and China begin investment talks (2013).12European Commission, The EU's bilateral trade and investment agreements – where arewe? (2013)13European Commission, Proposal for a Regulation of the European Parliament and of theCouncil on the access of third-country goods and services to the Union’s internal market inpublic procurement and procedures supporting negotiations on access of Union goods andservices to the public procurement markets of third countries (2012)9

12

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

regulations discriminating against foreign potential bidders. Opponents ofthe proposal argued that the EU'sde jureopen public procurement marketbelies itsde factorelatively protected market.Strong political support within the EU is a necessary precondition for thisinnovative initiative to succeed. However not all MS have welcomed theCommission's new approach. On the contrary, some have criticised theprinciple of ‘symmetry’ proposed by the EC. The EP’s own response to theEC’s proposal was also rather lukewarm. This ultimately delayed the originalbill, which is today – in a watered-down form – still pending before the EP.Such a reluctance to commit to fairer procurement markets abroad mayundermine the EC’s entire strategy and condemn it to failure.The EU's only, limited accomplishment in the field to date has been theinclusion of an extended public procurement chapter in its second-generation FTAs. The Commission has not yet succeeded in convincing Chinato make an ambitious offer and finally become a member of the WTO'sGeneral Procurement Agreement (GPA) – as was foreseen in the Chineseprotocol accession to the WTO.The Commission has also proposed revising the WTO’s 1996 InformationTechnology Agreement (ITA) by extending its scope and removingburdensome non-tariff barriers. In 2010 the EC published a study prepared byCopenhagen Economics14highlighting possible improvements to the ITA,but international talks have not yet produced a new deal – a failure that alsoderives from the Beijing’s intransigent position on product coverage15.The soon-to-be-launched talks on a Green Goods & Services Agreement,which are to be held under the aegis of the WTO (with most-favoured nationapplication), demonstrate that the EC is willing to address sectorial issuesoutside the WTO’s ‘single undertaking’ (in which ‘nothing is agreed untileverything is agreed’).More generally, TGWA acknowledged the growing relevance of regulatoryissues to international trade. In this respect, the EC advanced two proposals:reinforcing regulatory cooperation with third countries (promoting theequivalence or convergence of standards and reducing costs worldwide),and strengthening links between internal and external regulatory actions.These initiatives, which build on the EU’s single market principles, maypotentially help the EU perform better abroad by removing unnecessary andexpensive regulatory barriers. Third countries have often requested that theEU reduce the standards of protection for consumers and other stakeholderscurrently guaranteed within the internal market. These requests are usuallymade by those EU trading partners who find it difficult or expensive tocomply with the EU’s strict rules.

After tariff barriers weredismantled, regulatoryissues became the mostserious limit to free trade.

Copenhagen Economics, Expanding the Information Technology Agreement (ITA)Economic and trade impacts - Final report (2010)15The Diplomat, China, US Clash Kills IT Trade Agreement (2013)14

13

Policy Department, Directorate-General for External Policies

One of the most interesting and challenging issues of the coming years willbe whether the EU internal market rules will be kept in place or modified toplease third country producers and European importers. Whatever theoutcome, a better understanding among industrialised countries – andnotably with the US – would improve the level of protection for consumerswhile dramatically reducing the costs of duplicate testing procedures andcertification practices. The EC has also repeatedly stressed that more has tobe done in order to ‘leverage the effectiveness of internal and externalpolicies’.Another interesting point in Chapter 2 of TGWA concerns the liberalisation ofwhat the WTO labels ‘Mode 4’ services – those involving people who movefrom one country to another. The Commission correctly argued that thetemporary movement of managers and experts is likely to boost internationalexchanges and investments, and suggested that executives’ movement wasoften hampered by domestic legislation. According to the Commission, theproposed16, if it had been adopted, would have helped to clarify the issue atthe EU level and might serve as a platform for negotiating similar concessionswith third countries. The Commission is currently working with MemberStates to try to identify constructive ways to offer to third countriescommitments on transparency and harmonised procedures for visas in FTAsand plurilateral talks.Development issueswere integrated into theEU trade strategy, butpreferential agreementswith African, Caribbeanand Pacific countrieshave not been rapidlyconcluded.Unlike ‘Global Europe’, TGWA attaches great importance to development.Besides reforming the EU’s GSP system and negotiating an economicpartnership agreement (EPA) with African, Caribbean and Pacific (ACP)countries, the EC expressed its intention to adopt a communication on tradeand development17. The communication, published in 2012, includesprovisions on unilateral trade concessions to be provided when naturaldisasters affect developing countries (seeabove on autonomous tradepreferences for Pakistan).This communication is likely a response to the criticism that many non-governmental organisations (NGOs), developing countries' governments andother stakeholders have levied at the Commission's trade policies (inparticular its EPAs) with traditional ACP partners. International trade cancertainly help poorer countries to find their way to growth, but developmentand business objectives often diverge. The same can be said for EUdevelopment and trade policies. Yet, while it is important to ensure greaterclarity and coordination between these two essential aspects of the EU’sexternal action, the Communication does not involve revolutionary changes.Some updates take into consideration the progress of developing countriesin the era of globalisation, but the essential separation remains in place.On 15 May 2011, the Commission published a set of proposals to reform theEU’s preferential import schemes for developing countries. The legislative

Directive on conditions of admission of third country nationals in the framework of anintra-corporate transfer17European Commission, Trade, Growth and Development (2012)16

14

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

text was finally adopted in October 2012 and entered into force on 1 January2014. The new GSP scheme introduces some interesting changes to thecurrent regime. It significantly reduces the number of beneficiaries (from 176to 80), reinforces the enforcement aspects of the instrument and furtherpromotes the core human rights and social rights principles enshrined in theGSP18.The impact of the new regulation is likely to be significant for a restrictednumber of countries, which will either lose preferential access to the EU orreceive benefits previously denied (this is the case for new ‘GSP plus’beneficiaries). The new regulation may provide a general advantage (the so-called preference consolidation) for those countries that remain eligible –particularly for developing countries and least developed countries (LDCs).EPA negotiations with the ACP group – essentially composed of formerEuropean colonies – have proven to be more difficult than originallyexpected. The European Union's preferential trade regime for ACP countriesadopted in the Lomé Conventions (and the subsequent Cotonou Agreement)was found to be in breach of the rules governing international trade, and theWTO requested that the regime be repealed and replaced with a WTO-consistent version. In recent years, the EU also had to acknowledge that theextensive funding and preferential trade regime accorded by the EU did notalleviate poverty or secure sustainable development in the ACP region.The EPA process was launched in the framework of the 2000 CotonouAgreement and an extension (waiver) of the old regime was granted by theWTO until 31 December 200719. This period was supposed to be sufficient tonegotiate the new bilateral agreements that would replace the old traderegime. However, negotiations proved slower and more thorny thanexpected. To cope with the deadline and to avoid disrupting trade when thepreferential trade regime ended, the EU pushed for interim EPAs coveringonly trade in goods. The majority of ACP countries – which were not leastdeveloped countries (and could therefore profit from alternative forms ofprivileged market access to the EU, such as the ‘Everything But Arms’initiative) – agreed to either initial or sign such interim agreements. Since2007, negotiations on EPAs have progressed very slowly; their conclusion isstill not within reach20. To convince ACP countries to take the necessary stepsto ratify EPAs or conclude comprehensive regional negotiations, the ECproposed suspending preferential access to the EU market for thosecountries that had not signed or ratified their agreements. The newregulation will enter into force on 1 October 201421.TGWA acknowledged that globalisation has negative effects on certainSee the GSP page at the EP site.For more details on the EPA background and possible outcome please refer to thebooklet on ‘Economic Partnership Agreements EU-ACP, Facts and Key issues’ prepared forthe Office for the promotion of Parliamentary Democracy (2012).20At the time of closing this note, only one full-fledged EPA (the one with CARIFORUM) hadentered into force. Other ACP countries signed or initialled an interim EPA covering onlytrade in goods. See attached table prepared by DG Trade.21See more on the ‘Market Access regulation’ (ref. 2011/0260(COD)) at the EP page.1819

15

Policy Department, Directorate-General for External Policies

domestic sectors exposed to international competition (especially whenmeasured in terms of job losses), despite the generally positive effect for theEU economy. Yet the Commission’s response was tepid. The text pointed tothe European Globalisation Adjustment Fund (EGF), which had provideduseful, though limited, relief for the victims of globalisation. For the 2014-2020 period, the EGF’s beneficiaries will be expanded and the fund will besimplified, but the link between trade policy and labour force seems still tobe missing. The EGF is still seen as a tool to support workers in times of globaleconomic crisis, rather than as a tool to help them in transition from sectorshurt by a FTA to sectors likely to grow in the future.No new financial programmes or support schemes were proposed by TGWA.The issue of job loss was, in fact, more extensively debated in theCommission’s earlier, ‘Global Europe’ communication.The EC has introduced some changes related to trade and the environment.An EC proposal would remove barriers for environment-friendly goods andservices, although the Commission rejected the idea of introducing borderadjustment measures. More generally, the EC acknowledged that trade policyhas a central role in supporting and promoting green growth and said thatchapters on ‘implementation of sustainable development’ would be includedin all new FTAs. Those with South Korea, Central America, Colombia and Peruand Singapore contain provisions on trade and sustainable development.The requirements instituted include adhering to key international labour andenvironment standards and agreements, using natural resources (such astimber and fish) prudently, and promoting practices favouring sustainabledevelopment, such as corporate social responsibility.In 2008, the Commission published a communication titled ‘The rawmaterials initiative – meeting our critical needs for growth and jobs inEurope’22, highlighting the importance of a safe and reliable supply of rawmaterials and energy for the EU. In 2011 the Commission published a secondcommunication, titled ‘Tackling the challenges in commodity markets and onraw materials’23, in which it reiterated its views on trade in energy and rawmaterials and insisted that a coherent raw material strategy figure among theEU’s external priorities. The EU is, in fact, heavily dependent on imports of rawmaterials and energy, and any disruptions of its supply sources may havedisastrous effects on its industrial output and economic performance ingeneral. On the other hand, the enforcement tools available to the EU arelimited and not always very efficient. A new communication on raw materialsmay be released during the current year.

The EC published acoordinated strategy in2011 to secure fair accessof raw materials andenergy.

European Commission, ‘The raw materials initiative — meeting our critical needs forgrowth and jobs in Europe’ (2008).23European Commission, Tackling the challenges in commodity markets and on rawmaterials (2011)22

16

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

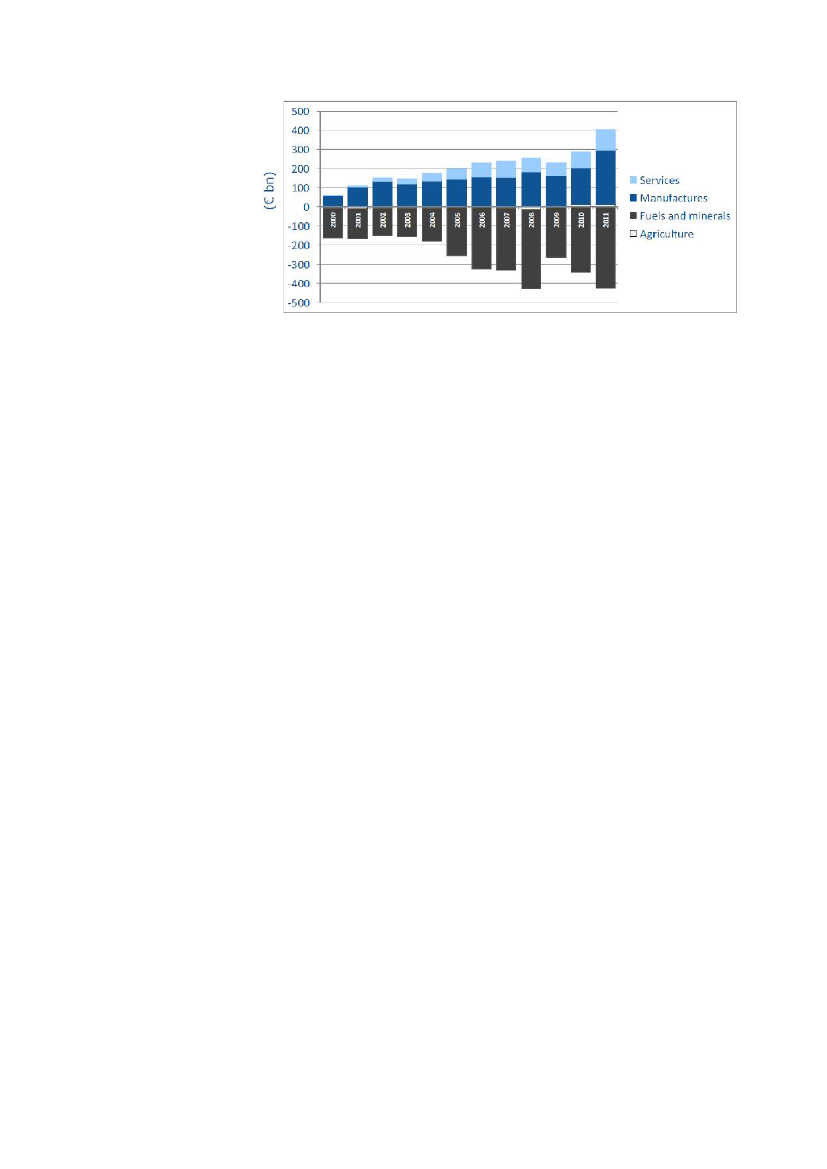

Figure 3

The EU is heavilydependent on imports ofraw materials and energywhile it is a net exports ofgoods and servicesSource: DG Trade

The EC has, however, invested considerable energy in securing bettertransparency in the financial markets. Commodity markets are often murkyand dominated by a handful of multinationals. According to the Commission,‘increased transparency of financial as well as physical trading activitiesshould allow regulators and market participants to better understand theinteraction between financial and physical commodity markets, a help toprevent abusive practices’.

6

The multilateral approach at riskThe state of the global economy and trade relations has radically changedsince the Doha Development Round (DDA) was launched in 2001. Evenbefore the start of the crisis, industrialised countries had lost significantground to emerging and developing countries. Today, the ‘club’ that hadgoverned world trade and economy for 50 years (dominated by the US, theEU and Japan) is no longer able to impose its views on other parties. Newtrading powers have emerged, and world trade has become more‘democratic’ but also more difficult to govern.The WTO has proven, on the whole, rather effective, bringing some order tothe otherwise chaotic world of trade business. Dispute settlement rules haveavoided a number of dangerous and disruptive trade wars of the sort thatonce undermined entire economies and the welfare of nations. The WTO hasalso kept protectionist temptations at bay, notably through peer pressure(Trade Policy Reviews) and reporting to the G-20. Despite all this, certainaspects and rules of the Geneva-based institution are outdated and requirerevision.In recent years the EU has lost the control and the influence it once enjoyedwithin the WTO. Despite huge and often painful concessions, the EU hasbeen unable to secure a working compromise in Geneva and has beenlargely marginalised since a 2008 confrontation between the US and India.The recent agreement at the Ninth WTO Ministerial meeting in Bali, reachedat the very last moment, has been lauded as the institution’s first success inyears. The active role of mediation played by the European Unioncontributed to the meeting’s outcome. However, the deal does not solve the17

Despite some limitedprogress in the WTO’sBali Ministerial meeting,the end of the DohaDevelopment Round isfar from imminent.

Policy Department, Directorate-General for External Policies

most contentious issues, such as agriculture. The Bali consensus was, rather,built around a few ‘deliverables’ that were considered easier to achieve. Mostof the stumbling points that have so far prevented the conclusion of theDoha Round are still in place, and they are unlikely to be removed in theforeseeable future; the Ministerial’s success does not necessarily pave theway to a successful conclusion of the Doha Round. This, in turn, means thatthe WTO is likely to face a serious dilemma: either maintain its current,outdated configuration or move towards a new approach that accounts forthe changes that have occurred since the Uruguay Round agreements weresigned in 1994. The WTO’s core rules should also reflect recent progressmade at the bilateral and multilateral level (on services, ‘Singapore’ issues,energy, etc.)In TGWA, the EC proposed launching a reflection on the reform of the WTO.Poor timing and unsuitable economic and political conditions have so farprevented the launch of this initiative. This serves as further demonstrationthat no new meaningful reform of the only international trade institution iswithin reach. The rush to conclude new bilateral trade agreements is likely tocontinue in the coming years.

7

From a multilateral to a bilateral approach: Second-generation FTAsThe EU negotiating agenda has been influenced by two distinct factors. Thefailure of the Doha Round negotiations, which are now entering their tenthyear, and the activities of other major trading partners, whose negotiations ofa new generation of international trade agreements began well before theEU’s.

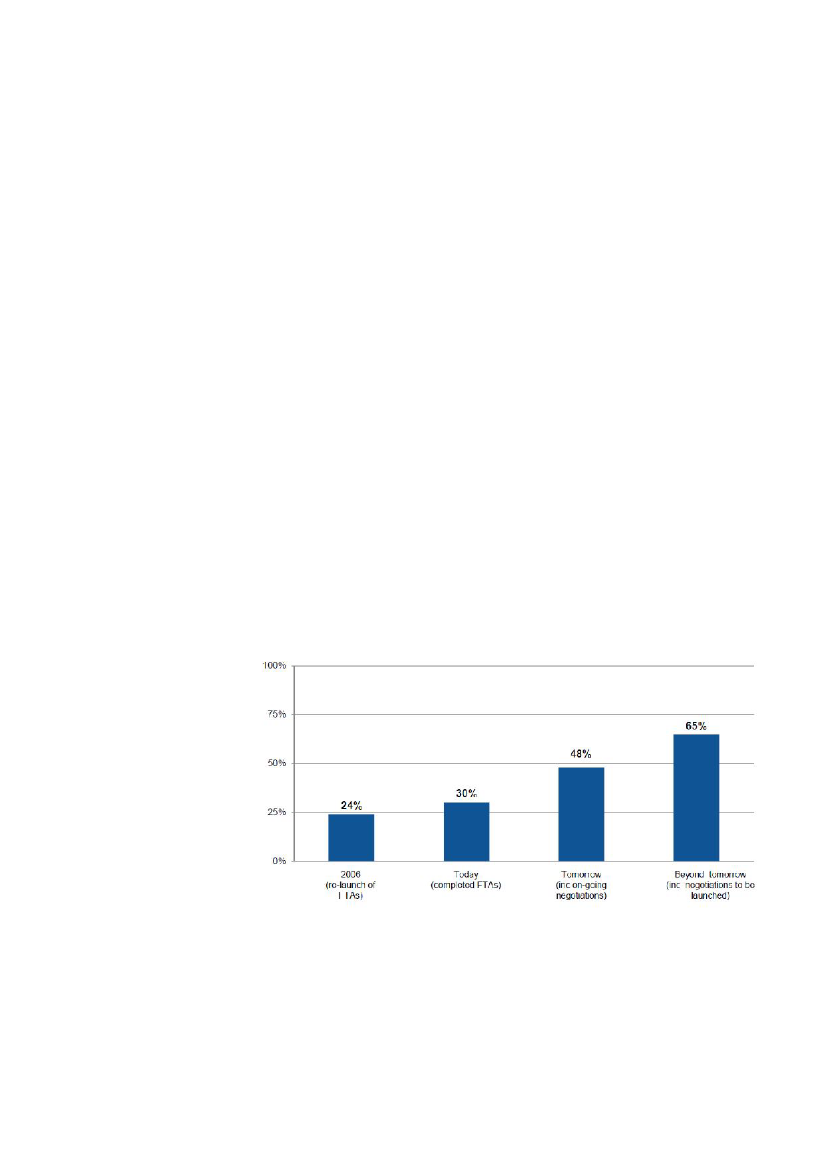

After some hesitation,the EU adopted a morecoherent approach tobilateral tradeagreements.Figure 4:

Share of Trade coveredby free trade agreements(FTAs)

Source: DG trade

The wording used in TGWA differs from that of ‘Global Europe’. ‘GlobalEurope’ relayed some optimism about the successful conclusion of the DohaRound, while TGWA refers to multilateral negotiations only in a succinct andunconvincing manner. This tone reflects the ‘fresh start’ sought by the tradecommissioner, who proposed establishing a group of eminent experts fromdeveloped and developing countries to make proposals to reform the WTO.Essentially, having bet and lost on multilateral negotiations (and specifically18

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

the Doha Round), the EU had no choice but to seek alternatives to guaranteebetter access to third countries' markets. A renewed strategy had alreadybeen announced in ‘Global Europe’: introducing a new generation of FTAsgoing beyond tariff cuts and liberalising trade in goods. But initial effort toforge these new agreements was long and produced only modest results. Infour years of intense negotiations, only the FTA with South Korea wasfinalised (and recently ratified). Significant progress was made withColombia, Peru and Central American countries. The EU also opened separatenegotiations with individual ASEAN members (notably Singapore, Vietnamand Malaysia) after a regional deal proved impossible to reach24.TGWA mentions a handful of negotiations that the Commission expected toconclude within a reasonable period of time. While talks with Canadaresulted in a political deal in late 2013 and are today close to beingconcluded, negotiations with India have lagged behind, and those with theGulf Cooperation Council (GCC) and Mercosur – supposed to be reopenedafter a brief stalemate – remain at an impasse.Deep andComprehensive FreeTrade Agreements(DCFTAs) with EasternEuropean andMediterranean countriesconstitute an effort toassert the EU’s influencein neighbouring areas.Deep and Comprehensive Free Trade Agreements (DCFTAs) within theframework of the Eastern Partnership and the Euro-MediterraneanPartnership were also EU priorities over the last decade. DCFTAs are second-generation trade agreements that significantly extend the scope ofAssociation Agreements. They typically include trade in services, governmentprocurement, competition, intellectual property rights, energy and thegradual integration of the third country’s economy into the EU single marketby legal and regulatory approximation – for example, in areas such asindustrial standards and technical regulations or sanitary and phytosanitarymeasures. DCFTAs aim not only to remove traditional tariffs but also todiminish regulatory differences, dismantle unjustified non-tariff barriers, andimprove the investment and business climates of the partner country.The Commission successfully concluded negotiations for DCFTAs withUkraine, Georgia, Armenia and Moldova. The EU and Ukraine concludedbilateral negotiations in December 2011. However, Ukraine chose to suspendpreparations for the agreement in late 2013, and it is no longer clear if orwhen the process may be resumed, given the country’s complex politicalsituation. The official initialling of the Association Agreements with Moldovaand Georgia took place during the Eastern Partnership Summit held on 29November 2013 in Vilnius. Armenia's decision to join the Eurasian CustomsUnion – a move incompatible with the DCFTA – has halted its EUnegotiations.The EU’s Eastern Partnership strategy has not been welcomed by Russia,The EC has always expressed its preference for regional agreements over bilateral ones. Inthis spirit, the Commission began negotiating with ASEAN as a single block. ASEANcountries have, however, reached different levels of development and do not always sharethe same economic and commercial objectives. This, coupled with some substantialpolitical obstacles (e.g. the situation in Myanmar), ultimately led to the failure ofnegotiations. The Commission then resumed talks on bilateral basis with those countriesthat had expressed their interest in pursuing meaningful trade negotiations with the EU(including Singapore, Vietnam and Malaysia).24

19

Policy Department, Directorate-General for External Policies

which chose not to participate in the group. Moscow considers that the EU’sexpanded sphere of influence – essentially in Russia’s ‘back yard’ –constitutes a threat to its own security and economy. The Eurasian Union(composed of Belarus, Kazakhstan and Russia) is Moscow’s ‘alternative’ to theEU – a competing political and economic project. So far, the Eurasian Unionconsists essentially of a customs union for three former Soviet Unionrepublics, responding to Moscow’s need to enlarge the market for Russianoutput and rally otherwise lost associates. But Russia has also engaged otherformer Commonwealth of Independent States (CIS) countries in the process:Armenia has officially announced it will join, and Tajikistan and Kyrgyzstanare weighing accession.Russia can offer massive economic assistance in support of its neighbours'economies – as it did, for example, when it promised to cut’s Ukraine energyprices and provide a loan of up to USD 15 billion. But Moscow has alsoproven willing to apply economic blackmail against dissenting countries – aswhen it banned imports of on wine and spirits from Moldova and Georgia.Under these conditions, it is not surprising that the Ukrainian and Armeniangovernments have hesitated to side with the EU.The ‘Arab Spring’ gave new impetus to discussions about a morecomprehensiveEuro-Mediterraneanpartnership.ThesouthernMediterranean countries (Algeria, Egypt, Israel, Jordan, Lebanon, Morocco,Palestinian Authority, Syria25and Tunisia) are already connected to the EUthrough an extensive grid of Association Agreements that includemeaningful FTA chapters. The EU has entered DCFTA negotiations withMorocco (the third round took place in January 2014), and the Commissionhas received a mandate to launch a similar process with Tunisia, Egypt andJordan. FTA talks with Libya, on the other hand, are currently suspended, andit is unclear when they will be resumed. As far as the Mediterranean region isconcerned, the EU has tried to assist its southern neighbours (mainly withgoals that are more political than economic), but the current instability andeconomic crises affecting most of these countries26has effectively delayedthe conclusion of deals that might have had a positive – if limited – impact onthe southern Mediterranean economies.TGWA did not anticipatethat negotiations withthe US and Japan wouldbe opened.In TGWA, the Commission stressed that EU trade policy should pay particularattention to the US, China, Russia and Japan. However, this statement did notlead to formal commitments to opening FTA negotiations with thesepartners. TGWA did not focus on China – which had been the object of aseparate communication coinciding with ‘Global Europe’ – and did notsuggest significant changes in trade relations with the US. The results of theTransatlantic Economic Council (TEC) were below expectations, anddialogues with China did not significantly advance issues of interest to theEU.Trade provisions of the agreement with Syria are currently not applied.The significant drop in the EU's domestic demand and a decrease in the investments fromEurope have also inevitably affected the fragile economies of southern Mediterraneancountries.2526

20

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

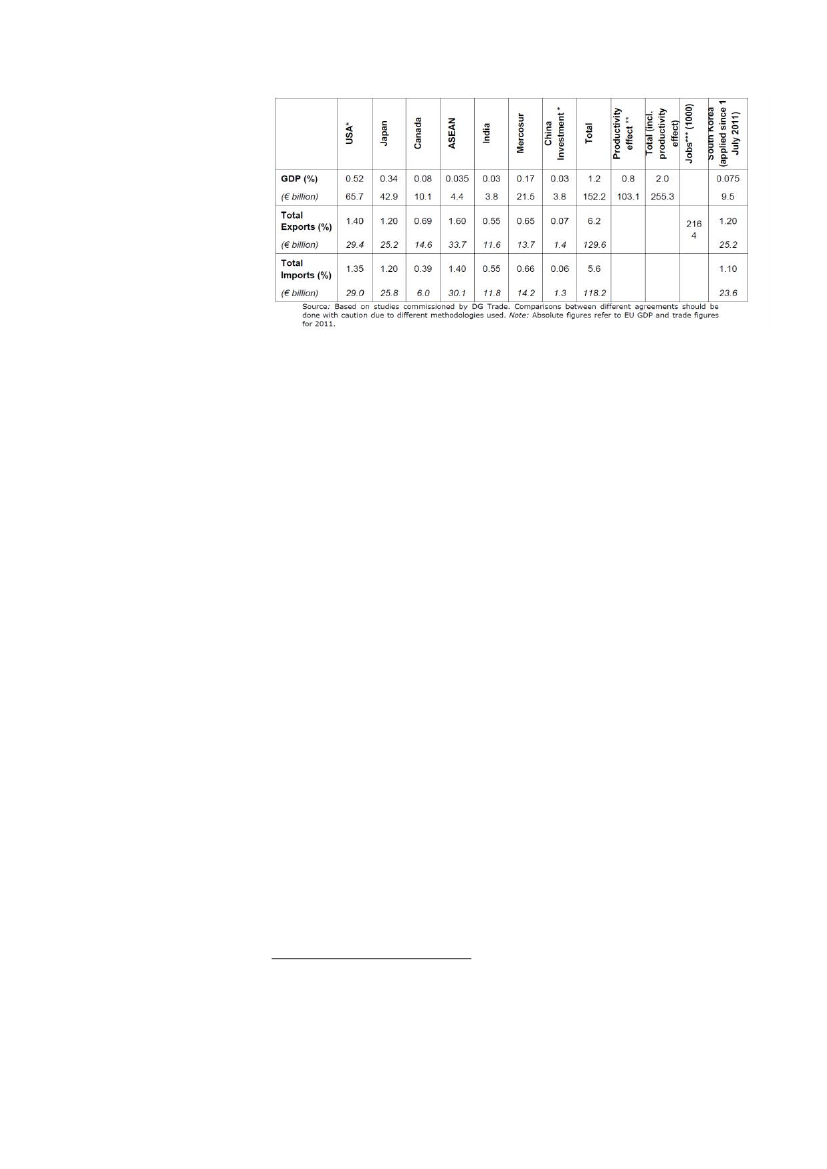

Figure 5

Potential impact of tradeagreements on GDP,exports and jobs inEuropeThe situation changed dramatically shortly after the publication of TGWA. Atthe EU-US Summit held on 28 November 201127, it was decided to establish aHigh-Level Working Group on Jobs and Growth, chaired by US TradeRepresentative Ron Kirk and EU Trade Commissioner Karel De Gucht. TheWorking Group was charged with identifying policies and measures toincrease bilateral trade and investment, in order to support job creation,economic growth and international competitiveness. The Working Groupwas also asked to recommend practical ways to implement any policymeasures identified. These could include a range of possible initiatives, fromenhanced regulatory cooperation to the negotiation of one or more bilateraltrade agreements.The Working Group published an interim report in June 2012 and a finalreport on 13 February 2013. The HLWG strongly recommended proceedingwith a comprehensive agreement addressing a broad range of bilateral tradeand investment issues, including regulatory issues, and contributing to thedevelopment of global rules. These recommendations were accepted andpaved the way to launching negotiations on a US-EU Transatlantic Trade andInvestment Partnership agreement (TTIP).The EU expects to gain substantial advantage from the TTIP28. However, ifconcluded, the effects of the EU-US deal are likely to go beyond the creationof a transatlantic market. Despite their recent decline, the two tradingpartners have maintained their leading positions in the global trade in goodsand services and in foreign direct investment. An enhanced transatlanticrelationship is therefore likely to redefine the shape of the global economy asa whole and contribute to instituting new technical standards on anunprecedented, global scale.The TTIP, when concluded, is likely to mark a cornerstone in 21st-centuryEuropean Commission, EU-US Summit: Fact sheet on High-Level Working Group on Jobsand Growth (2010)28An independent study mandated by the Commission suggested that an ambitiousagreement could result in substantial savings to companies and create hundreds ofthousands of jobs. The study calculated that each European household would gain anaverage of EUR 545 annually, as the EU economy would be boosted by 0.5% of GDP,corresponding to EUR 120 billion annually, once fully implemented.27

The US-EU TransatlanticTrade and Investment

21

Policy Department, Directorate-General for External Policies

Partnership agreement(TTIP) could pave the wayto an integratedtransatlantic market andset global standards.

international trade relations. On one hand, the topics under negotiations arenot new to the transatlantic dialogue – or to any trade negotiators – but theagreement’s degree of ambition is high, and its potential scope enormous.Any deal between the EU and the US would have major internationalconsequences, both political and commercial, by setting precedents, rulesand standards for other countries to follow if they wish to trade with the EUand the US.Negotiations have only just started on the TTIP. Despite a few early tiffs aboutthe scope and the depth of the deal, the current political situation and theapparent good will of both parties mean that the conclusion of the ambitiousdeal is not unrealistic. Still, negotiations are not going to be concluded infewer than two years – i.e. by the end of 2014 – as suggested byCommissioner De Gucht.More problematic for the EU is the fact that the US was largely responsible foropening the TTIP talks. In ‘Global Europe’, the Commission had beencompelled to acknowledge that, ‘despite some progress’, finding a commonunderstanding on non-tariff barriers with the US had ‘proven to be difficultterritory and a further injection of momentum is necessary’. TGWA does notmention a possible launch of FTA talks with the US. According to the EC, ‘ourpriority should be squarely on the avoidance of future barriers, and inparticular in the innovation, energy efficiency and hi-tech sectors, a pointwhich comes out clearly in our public consultation exercise’. This suggeststhat the decision to launch TTIP talks was only reached after TGWA waspublished, and that the initiative was essentially taken by the US aftermodifying their previous more restrictive approach to EU-US tradecooperation.The EU may be judged to be lagging elsewhere as well: while the US isadvancing on two fronts – the Atlantic, with the TTIP, and the Pacific, with theTrans-Pacific Partnership (TPP) – the EU’s strategy on the Asia-Pacific regionhas been less coordinated.Japan presents a particular problem. The EU attitude towards a trade dealwith Japan has been lukewarm. Despite the fact that the Asian countryremains the world’s third economy and represents an interesting market forEU products and services, trade relations with Japan have declined over thelast ten years as the EU has faced – and lost – to new competitors. Coupledwith massive and well-known behind-the-border barriers, EU negotiators hasbeen discouraged from initiating trade talks with Japan. While TGWArecognised Japan as a ‘strategic partner’, it did not advance any proposals fora full-fledged FTA with the country. In the past, Tokyo has adopted a tradepolicy that – like the EU’s – tended to privilege the WTO and a multilateralapproach rather than a network of a bilateral FTAs. The Japanesegovernment only revised its trade strategy when faced with persistent, weakinternal growth and the rise of China and South Korea. These factors, morethan a deep-seated enthusiasm, paved the way to opening talks on an EU-Japan FTA and to Japan’s accession to the US-led TPP.Before opening trade negotiations, the EU asked Japan to seriously reduce its

Negotiations with Japanon a free tradeagreement (FTA) wereopened with stringentconditions.

22

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

almost impenetrable system of non-tariff barriers – a condition the EU hadrarely imposed in the past. The proposed negotiating mandate issued by theCouncil included the provision that if Japan did not deliver non-tariff barrierroadmaps within a year, negotiations would be halted. Such roadmaps hadalso been imposed to ensure that European tariffs were only phased out inparallel Japanese regulatory barriers29.

8

Enforcement and implementationWhile the Commission made some serious efforts in ‘Global Europe’,enforcement and implementation were the Achilles' heel of the 2006communication. To rectify this, TGWA introduced closer monitoring ofcompliance and advocated a more systematic implementation of tradeagreements. The EU had also made intermediate efforts, notably with its2007 ‘Market Access Strategy’, which marked the beginning of a new andmore pro-active phase in defending EU commercial interests abroad. Sincethe strategy was announced, 33 market access teams have been created inthird countries and at the EC's headquarters in Belgium.Market access teams led to more concerted action with Member States andbusiness representatives; they have produced appreciable – though limited –results in tackling non-tariff barriers faced by EU exports. Notwithstandingsome dimensional limits, the EU ‘Market Access Strategy’ has demonstratedthat the EU has a central role to play in fighting illegal trade barriers.When it was published, TGWA proposed improving the services offered tostakeholders and called for better coordination between the EC, MemberStates’ diplomatic representatives and EU companies. The communicationwarned that resources were limited and that it wasde factoimpossible toaddress all barriers denounced by exporters. Yet, since 2009 the EC hasconducted more comprehensive ‘key barriers exercises’, and these haveidentified 220 barriers in 32 markets that the EC should consider priorities.Additionally, the EC regularly published two reports on the progress of itsmarket access initiatives30. The combination of these efforts has yieldedpositive results, and the EU has demonstrated the success of applyingcoordinated pressure on countries breaching their WTO or bilateralobligations31.Negotiations on the Anti-Counterfeiting Trade Agreement (ACTA) began in2006 and were concluded in 2010, a few months before TGWA (April 2011).

The 2007 ‘Market AccessStrategy’ produced somegood results, but bettercooperation between theCommission andMember States isneeded.

Marika Armanovica, (EP Policy Department), ‘Trade and economic relations with Japan:Assessing the hurdles to the FTA’ (June 2012).30European Commission, Trade and Investment Barriers Report 2013 (28 February 2013)and Tenth Report on potentially trade-restrictive measures identified in the context of thefinancial and economic crisis (1 May 2012 – 31 May 2013), September 2013.31The TGWA, however, lacks punch in areas where EC and MS interventions have provenincapable of obtaining the withdrawal of the measures at stake. The WTO DisputeSettlement procedure is relatively long and expensive – like actions before national courts.The EC is currently exploring future options to introduce faster and more efficient disputeresolution tools in new FTAs, but the results have been so far limited.29

23

Policy Department, Directorate-General for External Policies

The European Parliamentrejected the Anti-Counterfeiting TradeAgreement (ACTA) forallegedly breaching basicliberties. The rejectionhas prevented the EUfrom ensuring betterenforcement ofintellectual propertyrights.

Streamline enforcement on IPRs was a main objective for the EU, given thatits economy has maintained a comparative advantage in up-market, brandedand design products protected by IPRs32. ACTA built on the WTO’sAgreement on Trade Related Aspects of Intellectual Property Rights (TRIPs)and aimed to introduce new international standards for enforcing IPRs.According to the Commission, ACTA offered the opportunity to advance inkey sectors of interest to the EU (such as IPR protection) in which there waslittle or no chance of reaching a general understanding in the WTO. In fact,the deal was negotiated by a handful of (mostly) industrialised countries –with the notable exception of Morocco – and did not include China or otheremerging economies known for their poor compliance with IPR protection.Negotiations on ACTA proceeded relatively smoothly, and an agreement wasreached in a short period of time.Yet a number of concerns arose in the EU (as well as in other participatingcountries) about the lack of transparency in ACTA negotiations and over theagreement’s compatibility with theacquis communautaireand the TRIPsAgreement. Although criticisms focused on the treaty's internet provisions,and although many stakeholders agreed that the IPRs of physical goodsshould be better enforced (and better coordinated internationally), the EPrejected the treaty in July 201233.ACTA was not, unfortunately for the Commission, the only EU trade reform tofail. In 2007, trade defence instruments (TDIs) strongly backed byCommissioner Mandelson proved a fiasco. In this domain at least, theCommission then seemed to adopt a more cautious approach. TGWA did notinclude projects for further reforming investigations into antidumping andcountervailing duties, although the communication did promise to launch areflection on ‘whether and how to further update and modernize our tradedefence instruments [...] in the light of the changes brought about by theLisbon Treaty and/or the future results achieved in the Doha Round underthe ‘Rules’ chapter’34.Less than two years issuing TGWA, the Commission changed its mind andrevisited TDIs ‘with a view to updating them, but also bearing in mind thatthe multilateral WTO framework will not change in the foreseeable future’. Inother words, the new proposal for reform had not been prompted by theentry into force of the Treaty of Lisbon, but by the (rather unsurprising)observation that the Doha Round had stalled. The Commission’s proposals –advanced in 2013, after consultations and a study on TDIs in Europe – weremore balanced than those of Commissioner Mandelson had attempted to

The proposed reform oftrade defenceinstruments has provendifficult for theCommission.

For the European Union, protecting EU intellectual property rights (IPR) is of the utmostimportance, as future EU competitiveness essentially depends on the Union’s ability tomove into higher value added activities, for which strong IPR enforcement is essential.33European Parliament, ACTA before the Parliament (2012). See also: Pasquale De Micco (EPPolicy Department), Does ACTA still matter? Protecting intellectual property rights ininternational trade (January 2013).34Trade, Growth and World Affairs.32

24

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

introduce a few years earlier. The 2013 versions redefined the scope of the‘lesser duty rule’35, modified the ‘shipping clause’36and tweaked the rules onreimbursing duties when measures were terminated37.The debate on the reform of TDIs is on-going (at the moment this note isbeing finalised). The discussions have highlighted a persistent gap betweenthe positions held, on the one hand, by southern and eastern EU MemberStates – who tend to be more supportive of their national industries and donot accept a dilution of TDIs – and, on the other hand, by Nordic MemberStates – who tend to privilege an import-oriented approach. An inter-institutional gap has also appeared: the EP has privileged a more ‘defensive’approach than the Council appears ready to accept38.Another exercise the EC planned to launch concerns competition and stateaid rules, which have proven almost completely ineffective in many thirdcountries. At the moment, the EC has yet to present new initiatives on thistopic39.The EC has, on the other hand, launched a new communication on small andmedium-sized enterprises (SMEs) and foreign trade. Titled ‘Small Business,Big World — a new partnership to help SMEs seize global opportunities’40,the communication aims to facilitate SMEs’ internationalisation. SMEsrepresent more than 97 % of all companies operating in the EU, althoughthey export relatively little. The Commission’s proposal was intended tocorrect,inter alia,one of the major flaws affecting ‘Global Europe’: therelatively scant attention that the 2006 communication had accorded SMEsand its privileging of bigger companies and multinationals. Initiated by DGEnterprise, ‘Small Business, Big World’ focused on how to support those SMEswilling to enter foreign or third markets. Yet the Commission itself has proveddivided on the project. Some Commissioners favour more hands-on supportfor SMEs, while others prefer to allow the private sector to identify andgenerate business opportunities in third countries. DG Trade’s contributionto this debate has lacked ambition and resulted in largely ‘cosmetic’proposals, such as an SME helpdesk. No evidence suggests that theCommission has actually reoriented its negotiating agenda or tactics, its talkswith trade partners on trade/investment barriers, or its anti-dumping/anti-subsidies measures to favour European SMEs in recent years.Finally, TGWA touched on another significant domain: the pendingregulation on origin marking. The communication described future initiativesEuropean commission, Types of Trade Defence Measures (2013)Swedish National Board of Trade, The Shipping Clause in Trade Defence Investigations(2013)37European Commission, Communication from the Commission to the Council and theEuropean Parliament on Modernisation of Trade Defence Instruments. Adapting tradedefence instruments to the current needs of the European economy (10 April 2013).38See the procedural page of the TDI reform at the EP website.39However, FTAs that are part of the new generation (see e.g. the one with Republic ofKorea) include a chapter on state aid and competition that is likely to be generalised toother trade deals in the coming years.40European Commission, ‘Small Business, Big World — a new partnership to help SMEsseize global opportunities’ (2011)3536

25

Policy Department, Directorate-General for External Policies

to ensure better consumer safety in cooperation with third partners. Theproposed regulation set out requirements for labelling and marking productsand their packaging with a ‘Madein’mark, referring to the country-of-origin,according to the applicable EU non-preferential rules of origin. The proposalwas approved by the EP on 21 October 2010 but was not upheld by Council.Then, in February 2013, the EC announced it would withdraw the proposalbecause it had been deemed inconsistent with the EU’s WTO obligationsfollowing the Appellate Body’s decision (in the US ‘Certain Country of OriginLabelling’ – ref. WT/DS/384)41.

9

Public consultation and impact assessmentIn TGWA the EC reiterated its firm commitment to ensuring that civil societyand key stakeholders would be properly consulted when the Commissionwas drafting policy or considering action. This approach had been initiatedby the EC with its introduction of regular civil society dialogues on trade afew years previously.The EC also committed in TGWA to producing impact assessments andevaluations of trade policy. Sustainable Impact Assessments (SIAs)42arenormally prepared for each new FTA, and internal impact assessments fornew internal legislative proposals (under ordinary legislative procedure). TheEC proposed extending this approach to ‘all new trade initiatives withpotentially significant economic, social and environmental impact’ for the EUand its partners.The Commission also committed to systematically producingex postevaluations. This commitment represents a real step forward for EC tradepolicy;ex postassessments may better shape EU trade policy, avoidingexpensive and dangerous errors in negotiations with third parties.The EC has consistently implemented its own guidelines forex anteandsustainability impact assessments. Although the quality is not alwayshomogenous, SIAs and the EC's impact assessments represent an advance intransparency and the definition of priorities. The EC has yet to published anex postimpact assessment.

Thanks to pressure fromthe EP, the CCP isgradually becomingmore open andtransparent.

Hogan and Hovels, No EU Regulation for ‘Made In’ Labelling in Sight – Commission Set toWithdraw Proposal (February 2013). The EC decision was not unanimously welcomed bythe Parliament, which considered the decision to be the Commission’s elimination of aninconvenient file, which had been submitted to legislators more than seven years beforeand for which no agreement was manifestly possible.42European Commission page on Sustainability Impact Assessment.41

26

The European Union’s trade policy, five years after the entry into force of the Lisbon Treaty

10

ConclusionsFor many years, the EU's Common Commercial Policy was technocratic andfar from transparent. As acknowledged by some scholars, the system, basedon the two pillars of the European Commission and the Council, ‘facilitatedefficiency by keeping trade policy at arm's length from political andprotectionist forces. National and EU policy interests were based on largelyinformal contacts with the private sector interests’.43Over the years, EU tradepolicy has become less defensive and more open to the world. The EU was astrong supporter of a rule-based multilateral system and largely contributedto the consolidation of the WTO.In the last decade, the EU has faced a number of new challenges.Globalisation, delocalisation and the surge of integrated supply chains haveradically changed Europe’s economic structure. The rise of new economicpowers, the unprecedented growth of international exchanges and thegradual opening of trade in services obliged Europe to reflect deeply on therole and nature of its trade policy. The improvements introduced by theTreaty of Lisbon have been substantial. Foreign investments are now a fullcompetence of the Union, and the Parliament has become co-legislator on(almost) equal footing with the Council. Since the treaty’s entry into force, theEuropean Parliament has demonstrated great moderation; the Parliamenthas endorsed most Commission proposals while continuing to work to makeEU trade more ‘democratic’ and less technocratic.

The EU trade policyremains in a phase ofmodernisation and hasyet to fully integrate thechanges made by theTreaty of Lisbon.

Defining objectives at theEU level is difficult giventhe often-divergentinterests of MemberStates and stakeholders.

EU trade policy has also had to adapt to ‘accommodate’ a wider range ofinterests. The positions of the EU’s Member States could generally bedescribed in terms of two main ‘blocks’: the post-industrial, liberal north, andthe industrial, more cautious and more defensive south. But over the years,more voices have joined the debate on international trade and globalisation,meaning the discussion is no longer confined to small groups of officials andstakeholders. The rejection of ACTA served as a clear demonstration of thisshift: an unprecedented mobilisation of activists ultimately resulted in thetreaty’s rejection.The Commission had not immediately understood how the rules of the gamehad changed; the institution was slow to realise that its trade diplomacyneeded to be refreshed and made more open and transparent. Today,soliciting the participation of stakeholders (including NGOs and human rightactivists) has become standard in the EU's international trade negotiations.The European Parliament has been very vocal in demanding that the Union’strade policy grow from a meaningful debate among civil society membersand respond to citizens' expectations. This process of ‘democratisation’ willnot weaken an otherwise efficient and results-oriented policy; rather,democratisation will make the EU’s position stronger and more resilient.It is not easy to reconcile alternative and often diverging trade priorities.Stephen Woolcock, European Union trade policy: domestic institutions and systemicfactors (April 2011)43

27

Policy Department, Directorate-General for External Policies