Transportudvalget 2013-14

TRU Alm.del Bilag 111

Offentligt

SJ – from Public Authorityto Limited liability companyStockholm, December 3rd, 2013Jonas Nilsson, Head Public Affairs

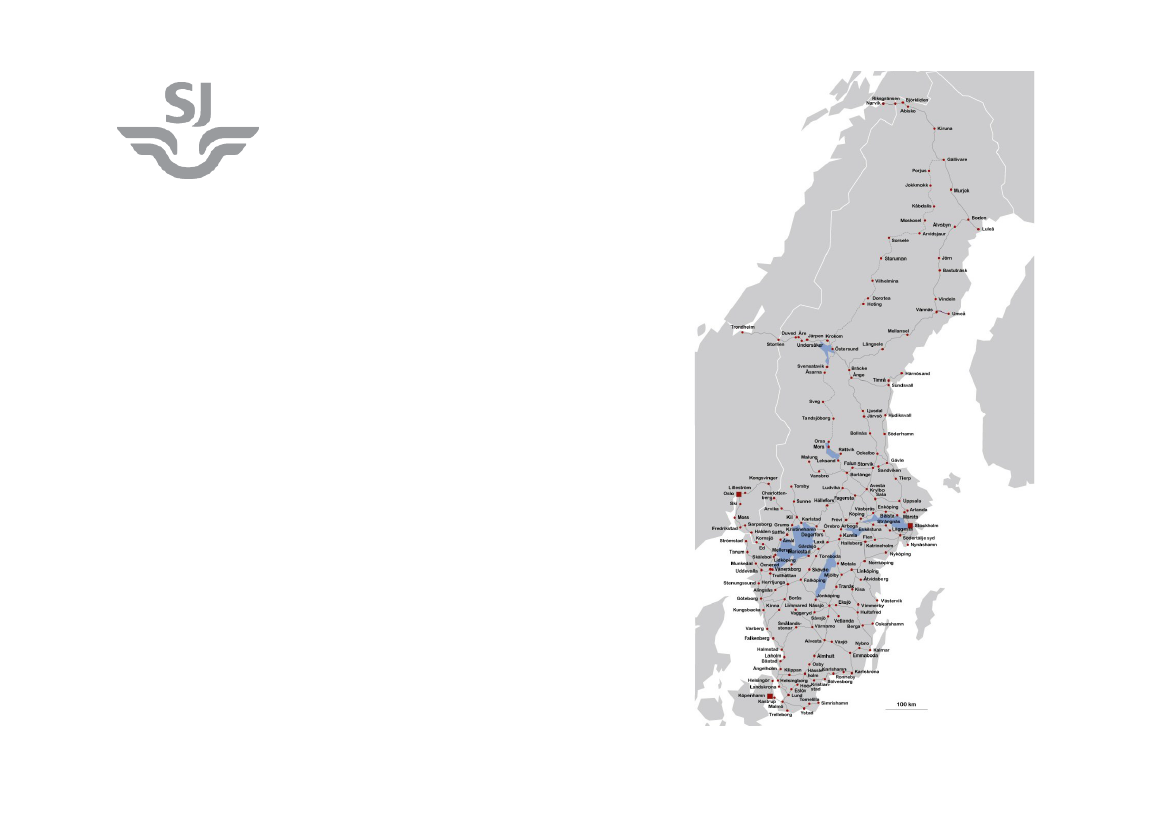

Rail traffic in SwedenSweden has more than

12,000 km of railway track– 2,000 double tracks– 10,000 single tracks

SJ has a 55% share of the

total Swedish rail marketSJ operates 90% of rail

passenger services inSweden exceeding 100 km

2

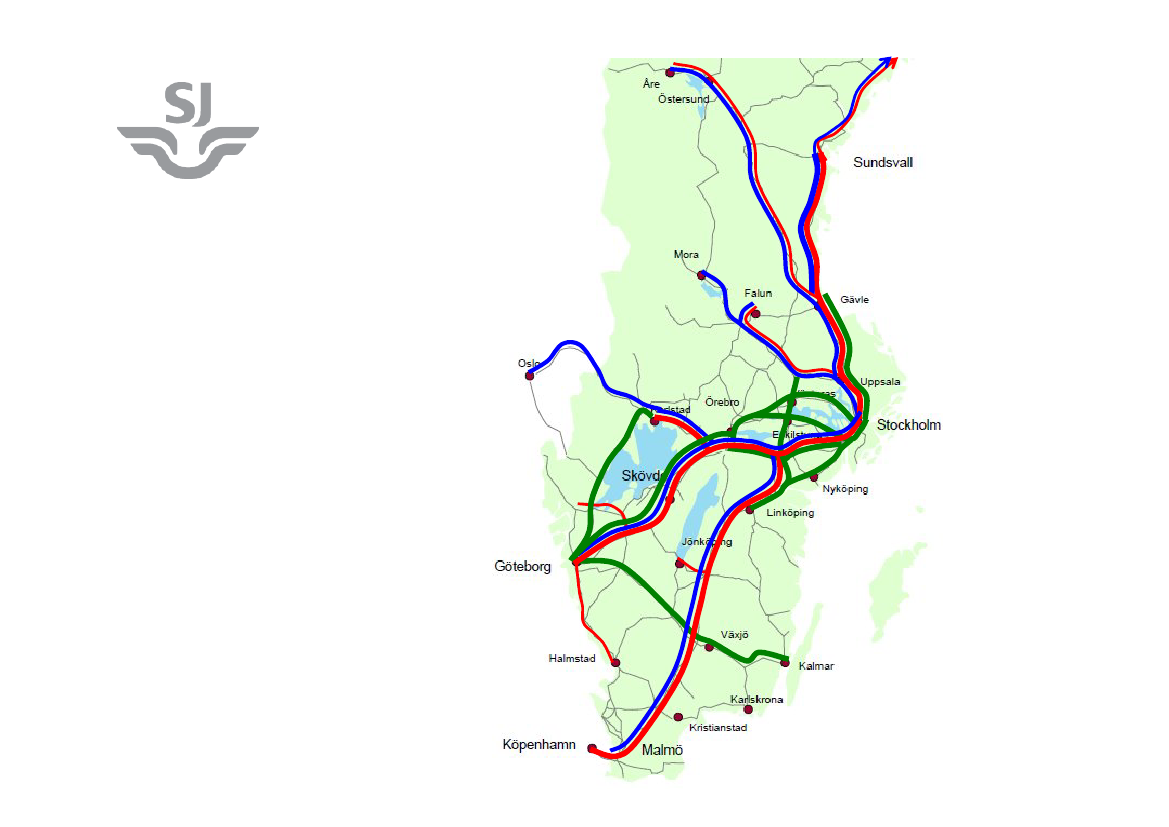

Umeå/Luleå/Narvik

•SJ Regional•SJ High speed•SJ InterCity & SJ Night

SJ ABLimited liability company

owned by the Swedish stateThe mandate

• To operate passenger railservices•both in competition and inco-operation with othersThe requirement

• To be profit-making• 10% return on equity

4

SJ’s objective:- A modern, profitable and customer oriented travel company -Approx. 4,000 employeesSales of SEK 8.5 billion in 2012Limited liability company

owned by the Swedish state

110,000 passengers per dayTravel services under our own

brandContract rail services for

regional transport authoritiesDokumentnamn SJ2004-04-19

Pre modern milestones

Busses1960/70 Buss operations in municipal organisations1967 Stockholm Local transport was formed1978 Local/regional transport organisations(Trafikhuvudmannalagen)Legal tenders buss operationTrains1950/1990 continuous economic crises in train transportation(1958 state subsidies)1979 “Trafikhuvudmän” gets responsibility for non profitablelines1985 state gets increased responsibility of infrastructure1988 vertical separation – infrastructure and transport1989/90 BK Tåg (private) wins first legal tender (Krösatåg)BLS-visit

6

2009-07-09

Modern milestones thatchanged operations1988Separation of operations

• Banverket - infrastructure• SJ - passenger operation2001SJ AB was founded

• from Public Authorityto Limited liability companyRefined business

• Green Cargo, Jernhusen,Euromaint, Swemaint AB,EDB, Unigrid, TraffiCarebecame separate operations

7

SJ as a limited liability Company- modern history2001:-49 millions SEK2002:-994 millions

• ”Bancrupcy”2003: millions

• 1,8 billions in owner contributionto stay in business (tax payers)• New business model

Turn around2004: 192 millions

• New price model– dynamic pricing• 40 new trains are ordered (X40)2005: 1,2 billions

• Dynamic pricing in both2 Class and 1 Class2006: 368 millions

Consolidation2007: 507 millions

• Internet auctions2008: 543 millions

• 20 new fast trains are ordered (2 billions SEK)2009: 460 millions2010: 294 millions2011: 38 millions2012: 498 millions2004-2012: 4,1 billions

Parameters of successInstitutions of limited liability companies– means operations on sound economic grounds

Dynamic pricingEnvironmental thinking becomes share of mindInter city-operations is easy travellingModern segmentation of customersRegional clusters of comuting

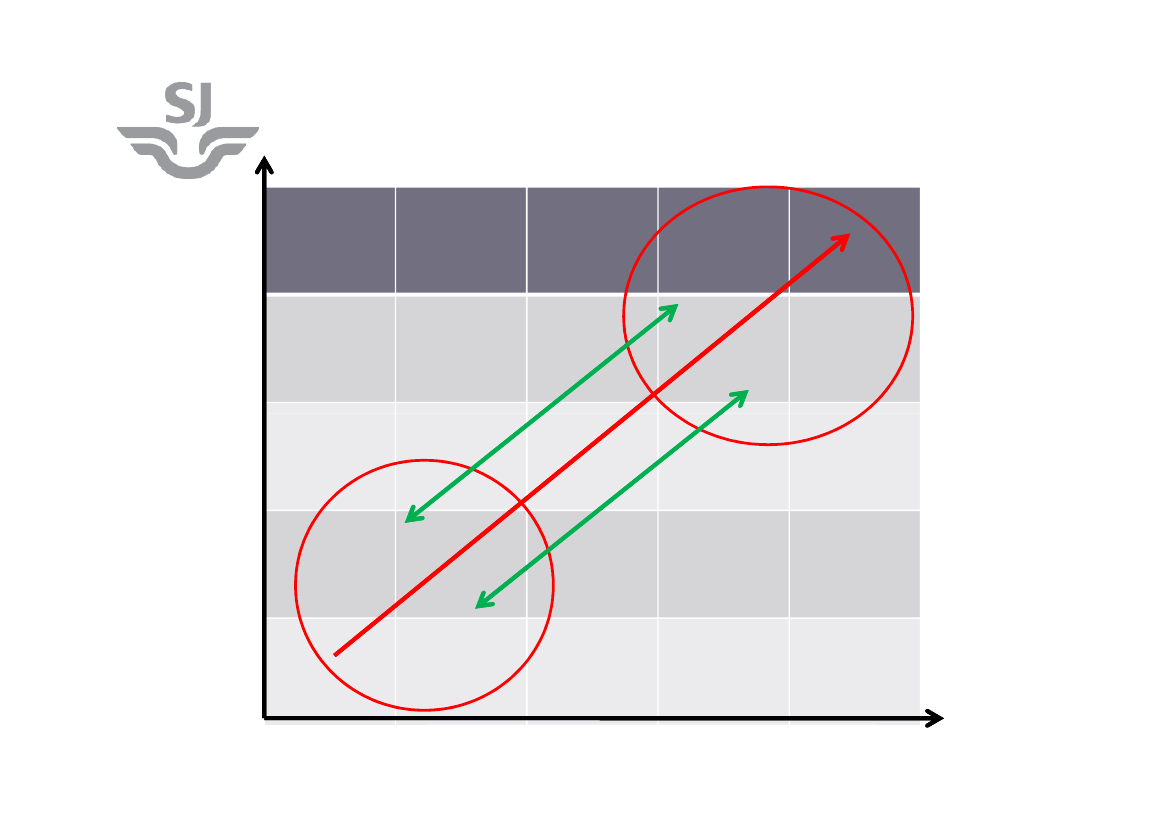

Dynamic pricing1000Excess demandExcess demand

1000:-800:-600:-300:-100:-

1000:-800:-500:-200:-100:-

1000:-700:-400:-100:-100:-

1000:-600:-300:-100:-100:-

Seats booked

900:-700:-500:-95:-

Excess supply

Time to departure, 3 months

Dynamic pricing

1000Seats booked

1000:-800:-600:-300:-100:-

1000:-800:-500:-200:-100:-

1000:-700:-400:-100:-100:-

1000:-600:-300:-100:-100:-

900:-700:-500:-95:-

Time to departure, 3 months

Dynamic pricing

Price index train tariffs1985-19951995-20052005-2010101%48%4%

Inflation66%10%12%

Dynamic pricing2005 – 2012Price indextrain tariffs2005 - index200620072008200920102011201200-6-7-4+1+4+4

Inflation0+1+4+7+7+8+11+12

MarketsGtb-Sto20012012Train49%69%Air51%31%Train Air30%66%70%34%Karlstad-Sto20012012Malmö-Sto20012012Train Air66%90%Train23%30%34%10%Air77%70%

Sundsvall-Sto20012012

16

Deregulation in three stepsTimetable

1.2.3.

July 2009 – opening of weekend trafficOctober 2009 – opening of international traffic (cabotage)October 2010 – opening of all markets, general access

The free market argument

Beneficial for passengersTriggers development and increases efficiencyAlso domestic markets should be openedAbolish monopolies, avoid concessions/restrictions

18