Skatteudvalget 2013-14

SAU Alm.del Bilag 11

Offentligt

Automotive taxationin the Netherlands

The effects of fiscal measures on passenger car sales in theNetherlands

RAI VerenigingTrade Association for the automotive industry inthe NetherlandsSince 1893

More than 500 membersPassenger cars, light commercial vehicles, trucks, spareparts, garage-equipment, bicycles, motorcycles, mopeds,trailers, coaches etc.

The Dutch Car ParkBackground dataPassenger car park 8,1 million vehiclesAnnual new car sales approximately 500,000 vehicles

Average annual distance driven 13,317 km(petrol 10,877 km and diesel 23,806 km)Passenger car park by fuel typeDiesel17,10%

LPG2,51%

Hybrid1,12%

Average new car price: € 25,627Petrol cars have dominant market share

Electric0,02%CNG0,04%Biofuel0,03%Hydrogen0,00%

Petrol79,18%

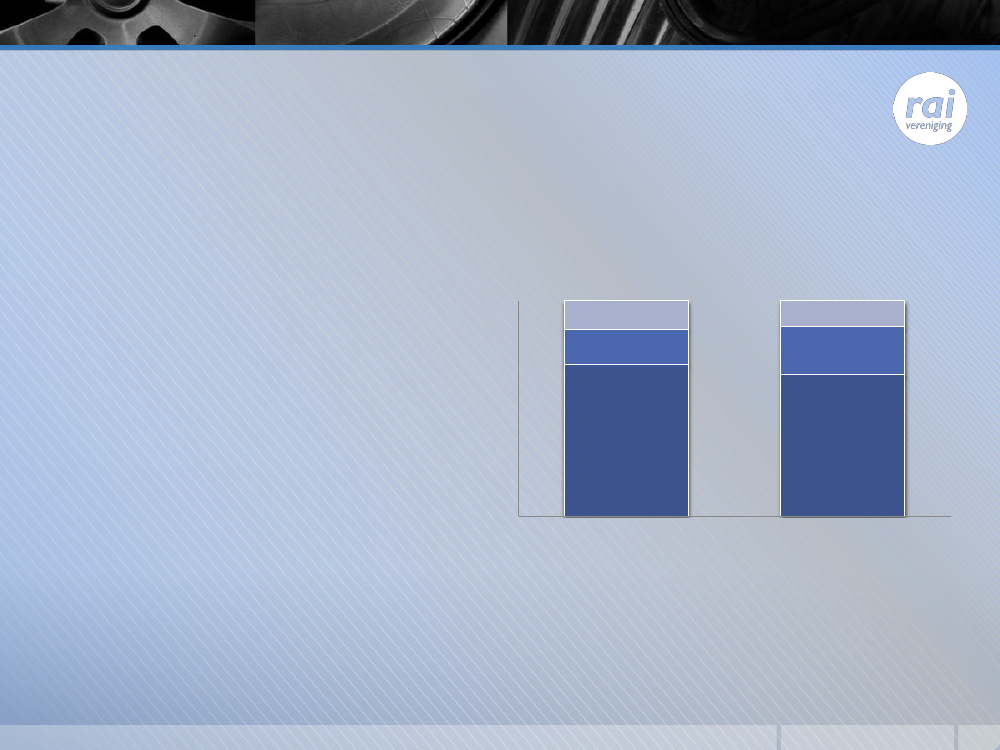

Car related taxes in the NetherlandsVarious car related taxes:Motorrijtuigenbelasting(annual road tax)Price breakdown of passenger cars100%90%80%70%60%50%VAT; 13%BPM; 16%VAT; 12%BPM; 22%

BTW(VAT, 21%)BPM(special vehicle purchase tax)

40%30%20%10%0%

Net list price; 70%

Net list price; 66%

Bijtelling(Benefits in kind, applicable forprivate use of company cars)

petrol

diesel

BPMSince 19931993 – 2008: BPM is based on nett catalogue price of car2006: introduction of bonus – malus scheme for fuel efficient cars (with labelling)2008: gradual conversion from list price to CO2emission as base for BPM2013: BPM fully based on CO2emission

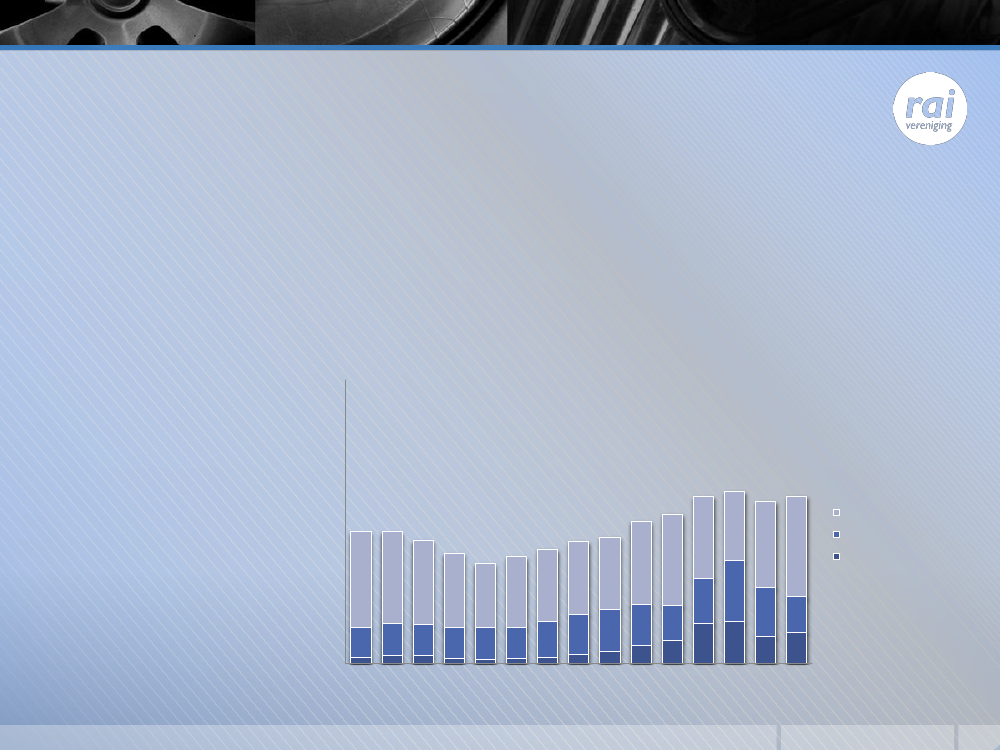

BPMMain effects of conversion from nett catalogue pricebased BPM to CO2emission based BPM1. Rapid downsizing of new car sales,Market shares A & B fuel efficiency labels in new car sales100%90%80%70%60%50%40%30%20%10%0%2001200220032004200520062007200820092010201120122013

A

B

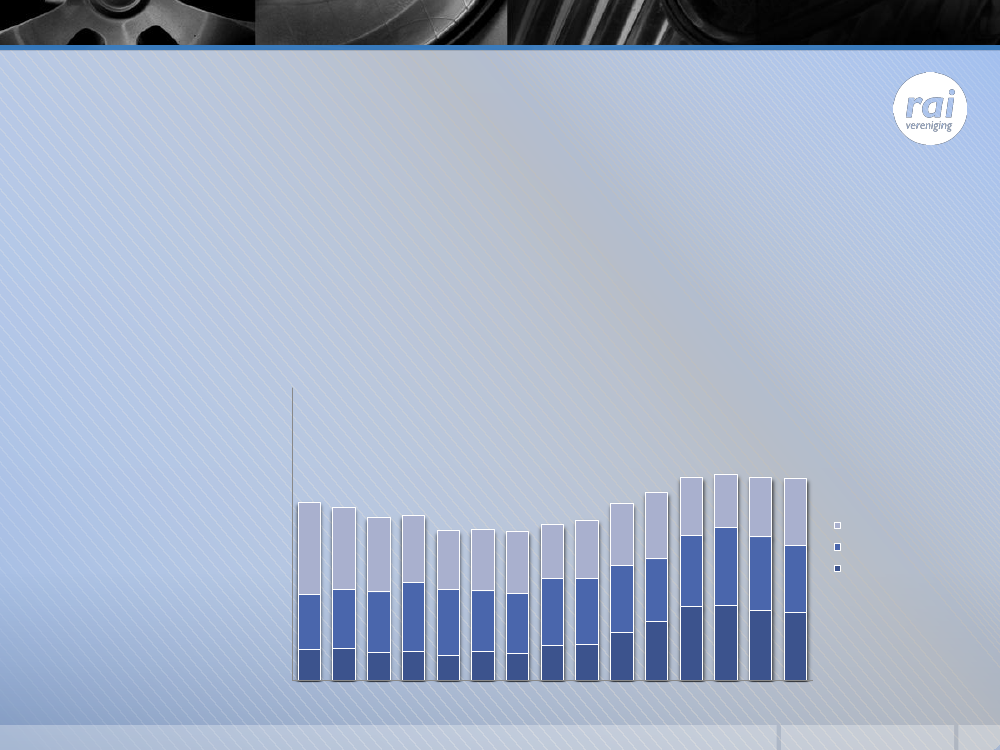

BPMMain effects of conversion from nett catalogue pricebased BPM to CO2emission based BPM1. Rapid downsizing of new car salesMarket share of small cars in new car sales100%90%

80%70%60%50%32%40%30%20%10%11%0%19992000200120022003200420052006200720082009201020112012201311%10%10%8%10%9%12%12%19%28%25%23%20%21%21%18%21%23%20%

18%

20%

23%C Lower Family segmentB City segment

20%24%23%21%27%25%23%

A Small segment

20%

21%

23%

23%

21%

23%

23%

20%17%20%

25%

26%

24%

23%

BPMMain effects of conversion from nett catalogue pricebased BPM to CO2emission based BPM1. Rapid downsizing of new car sales

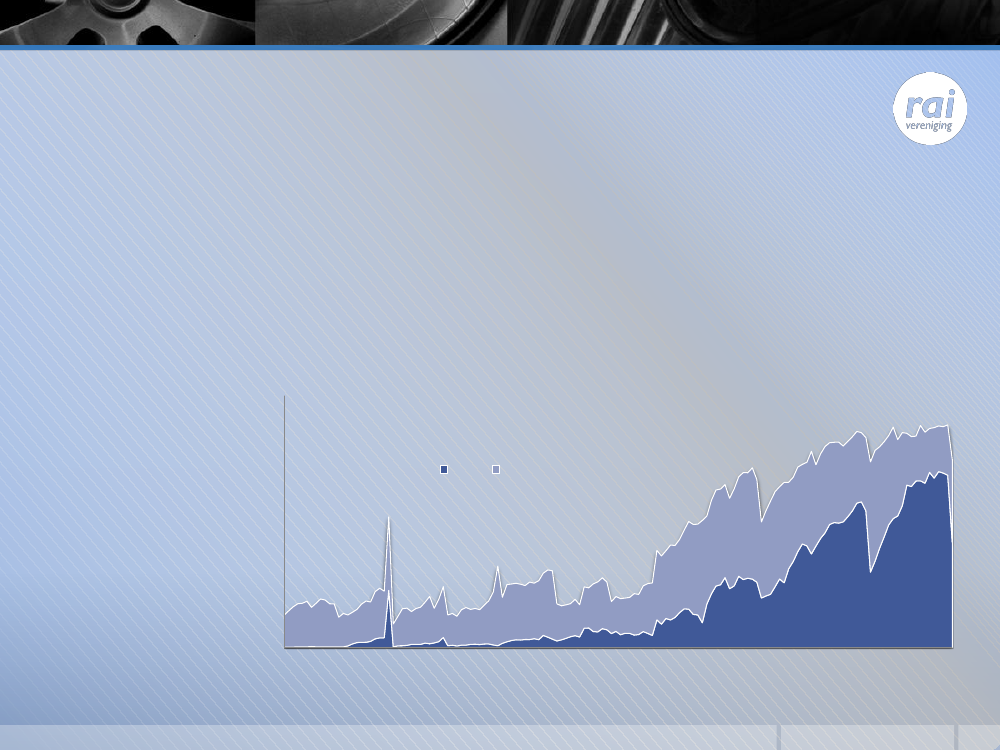

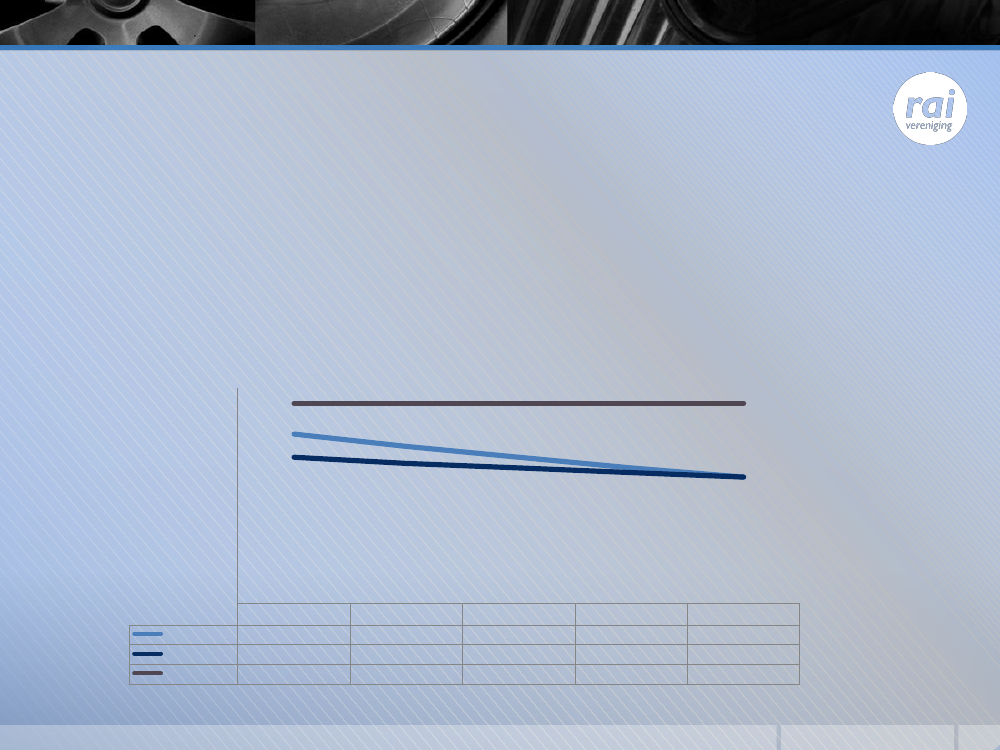

2. Rapid decline of BPM tax revenues(2012 target € 2.1 billion,realisation € 1.7 billion)€ 3.500.000.000€ 3.000.000.000€ 2.500.000.000€ 2.000.000.000

BPM revenues versus car sales600.000

500.000400.000300.000

€ 1.500.000.000

BPMCar sales

€ 1.000.000.000€ 500.000.000€-200820092010201120122013(forecast)

200.000100.000-

BPMDutch CO2emission policy more strict than European norm

BPM exemptionCO2 emission in grammes/km140120100806040200PetrolDieselEuropean norm

2012-111095130

2012-210291130

20139588130

20148885130

20158282130

BPMPetrolexempt from BPM1 tariff group2 tariff group3 tariff group4 tariff groupDieselexempt from BPM1 tariff group2 tariff group3 tariff group4 tariff groupTariff for every gram CO2per km1 tariff group2 tariff group3 tariff group4 tariff group2012-1≤110111-180181-270≥ 2712012-2≤102103-159160-237238-242≥ 2432012-2≤ 9192-143144-211212-225≥ 2262012-2€ 101€ 121€ 223€ 5592012-2€ 40,682013≤ 9596-140141-208209-229≥ 2302013≤ 8889-131132-192193-215≥ 2162013€ 122€ 145€ 270€ 5392013€ 54,922014≤ 8889-124125-182183-203≥ 2042014≤ 8586-120121-175176-197≥ 1982014€ 101€ 121€ 228€ 4562014€ 70,172015≤ 8283-110111-160161-180≥ 1812015≤ 8283-110111-160161-180≥ 1812015€ 88€ 106€ 205€ 4112015€ 81,36

2012-1≤ 9596-155156-232≥ 233

2012-1€ 94€ 280€ 654

2012-1Diesel surcharge for every gram CO2per km > 70 gram€ 40,68

BijtellingBijtelling is a form of income taxThe private use of a company car (> 500 km per year) is seenas a benefit in kindIf the private use of the company car is limited to less than500 km per year than there is no ‘bijtelling’0%, 14%, 20% or 25% of the list price of the company car is tobe added to the annual incomePercentage of the bijtelling is based on the CO2emission ofthe company car

BijtellingCompany cars dominate the new car salesApproximately 60% of new car sales are company carsMarket share company cars in new car sales1999 - 2013100%90%80%70%60%50%40%30%20%10%0%

BijtellingMain effects of conversion from nett catalogue price based Bijtellingto CO2emission based Bijtelling1. Rapid downsizing of new company carsMarket shares A & B fuel efficiency labels in new company cars100%90%

80%70%60%50%40%30%20%10%0%2007

B

A

2008

2009

2010

2011

2012

2013

BijtellingMain effects of conversion from nett catalogue price based Bijtellingto CO2emission based Bijtelling1. Rapid downsizing of new company carsMarket share of small cars in new company cars100%

90%80%70%60%50%29%C Lower Family segment24%30%35%29%32%22%17%15%10%13%11%B City segmentA Small segment

40%30%20%10%0%11%2%11%3%11%3%11%2%34%32%

30%

26%

23%

25%

26%

26%

25%

16%12%2%14%3%15%4%14%6%12%8%14%

11%1%

11%2%

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Bijtelling

10.000

12.000

14.000

16.000

18.000

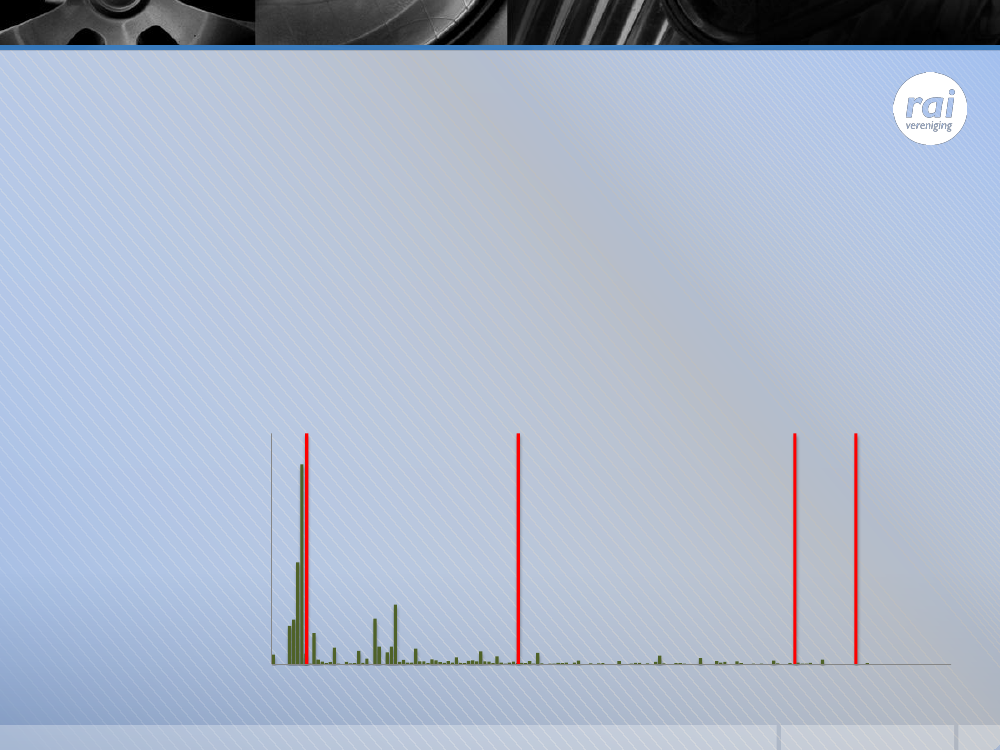

1. Rapid downsizing of new company cars

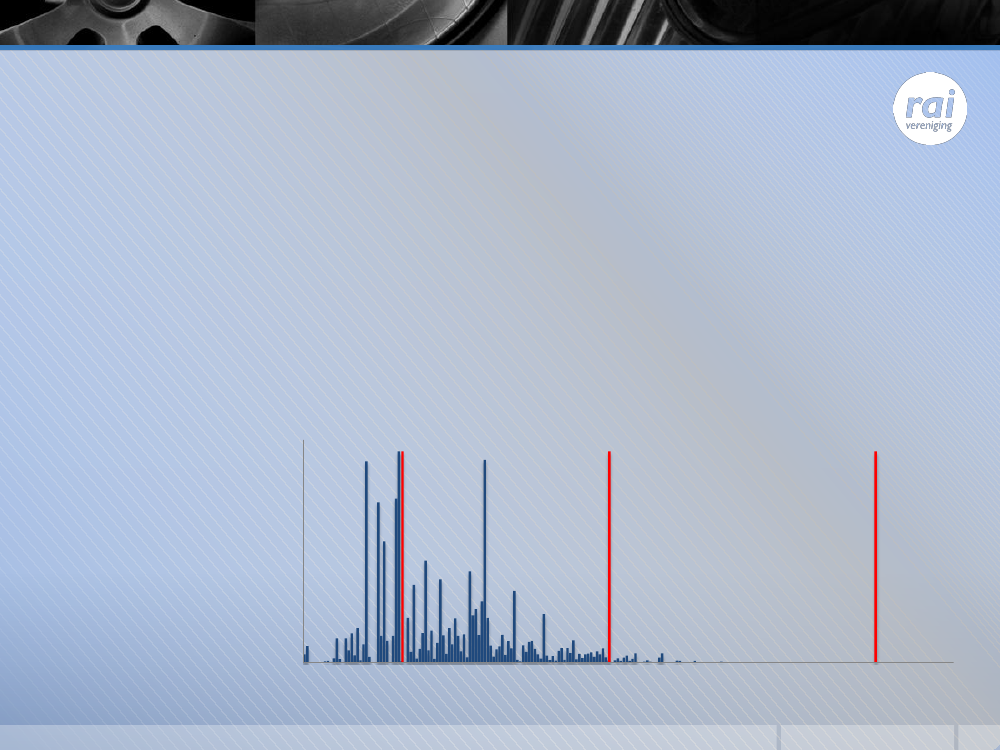

2. Emission limits have major impact on company car sales

Main effects of conversion from list price based Bijtelling to CO2emission basedBijtelling

2.000

4.000

6.000

8.000

-

New company car sales by CO2emission2012 - 1 petrol

0 g/km53 g/km85 g/km90 g/km94 g/km98 g/km102 g/km106 g/km110 g/km114 g/km118 g/km122 g/km126 g/km130 g/km134 g/km138 g/km142 g/km146 g/km150 g/km154 g/km158 g/km162 g/km166 g/km170 g/km174 g/km178 g/km182 g/km186 g/km190 g/km194 g/km198 g/km202 g/km206 g/km210 g/km214 g/km218 g/km222 g/km226 g/km230 g/km234 g/km238 g/km242 g/km246 g/km250 g/km254 g/km258 g/km262 g/km266 g/km270 g/km274 g/km278 g/km282 g/km288 g/km292 g/km296 g/km

Bijtelling

1. Rapid downsizing of new company cars

2. Emission limits have major impact on company car sales

Main effects of conversion from list price based Bijtelling to CO2emission basedBijtelling

10.000

12.000

14.000

18.000

16.000

2.000

4.000

6.000

8.000

-

New company car sales by CO2emission2012 - 2 petrol

0 g/km53 g/km85 g/km90 g/km94 g/km98 g/km102 g/km106 g/km110 g/km114 g/km118 g/km122 g/km126 g/km130 g/km134 g/km138 g/km142 g/km146 g/km150 g/km154 g/km158 g/km162 g/km166 g/km170 g/km174 g/km178 g/km182 g/km186 g/km190 g/km194 g/km198 g/km202 g/km206 g/km210 g/km214 g/km218 g/km222 g/km226 g/km230 g/km234 g/km238 g/km242 g/km246 g/km250 g/km254 g/km258 g/km262 g/km266 g/km270 g/km274 g/km278 g/km282 g/km288 g/km292 g/km296 g/km

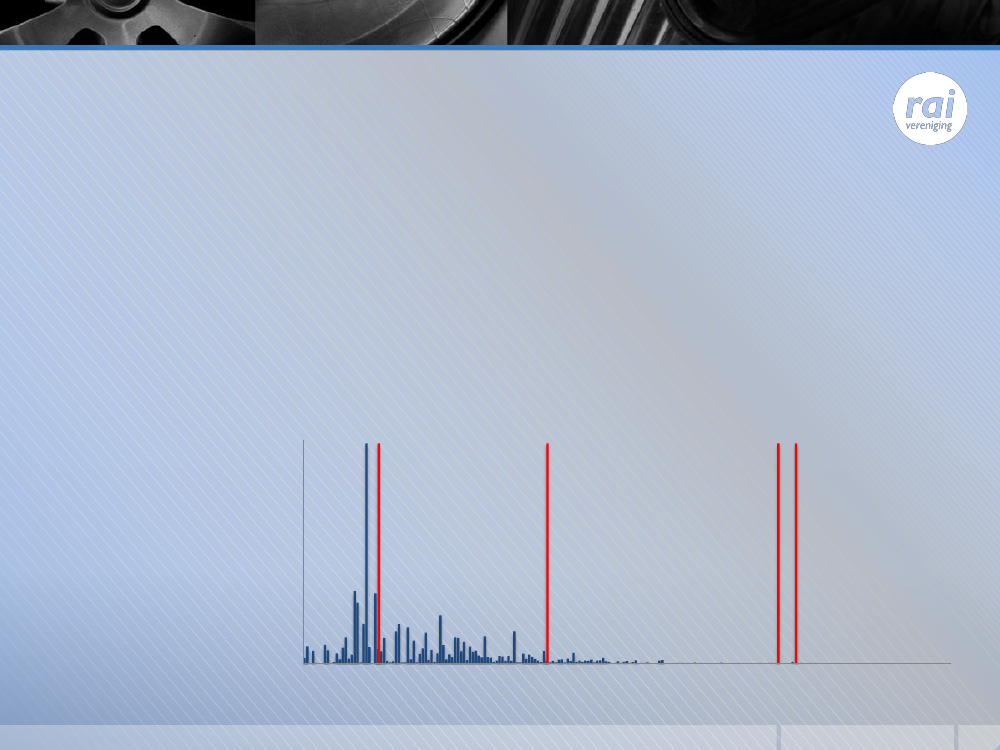

Bijtelling

10.000

12.000

1. Rapid downsizing of new company cars

2. Emission limits have major impact on company car sales

Main effects of conversion from nett catalogue price based Bijtellingto CO2emission based Bijtelling

2.000

4.000

6.000

8.000

-

New company car sales by CO2emission2012 - 1 diesel

0 g/km86 g/km89 g/km93 g/km96 g/km99 g/km102 g/km105 g/km108 g/km111 g/km114 g/km117 g/km120 g/km123 g/km126 g/km129 g/km132 g/km135 g/km138 g/km141 g/km144 g/km147 g/km150 g/km153 g/km156 g/km159 g/km162 g/km165 g/km168 g/km171 g/km174 g/km177 g/km180 g/km183 g/km186 g/km189 g/km192 g/km195 g/km198 g/km201 g/km204 g/km207 g/km210 g/km213 g/km216 g/km219 g/km222 g/km225 g/km228 g/km231 g/km234 g/km237 g/km240 g/km243 g/km246 g/km249 g/km

Bijtelling

10.000

12.000

1. Rapid downsizing of new company cars

2. Emission limits have major impact on company car sales

Main effects of conversion from nett catalogue price based Bijtellingto CO2emission based Bijtelling

2.000

4.000

6.000

8.000

-

New company car sales by CO2emission2012 - 2 diesel

0 g/km86 g/km89 g/km93 g/km96 g/km99 g/km102 g/km105 g/km108 g/km111 g/km114 g/km117 g/km120 g/km123 g/km126 g/km129 g/km132 g/km135 g/km138 g/km141 g/km144 g/km147 g/km150 g/km153 g/km156 g/km159 g/km162 g/km165 g/km168 g/km171 g/km174 g/km177 g/km180 g/km183 g/km186 g/km189 g/km192 g/km195 g/km198 g/km201 g/km204 g/km207 g/km210 g/km213 g/km216 g/km219 g/km222 g/km225 g/km228 g/km231 g/km234 g/km237 g/km240 g/km243 g/km246 g/km249 g/km

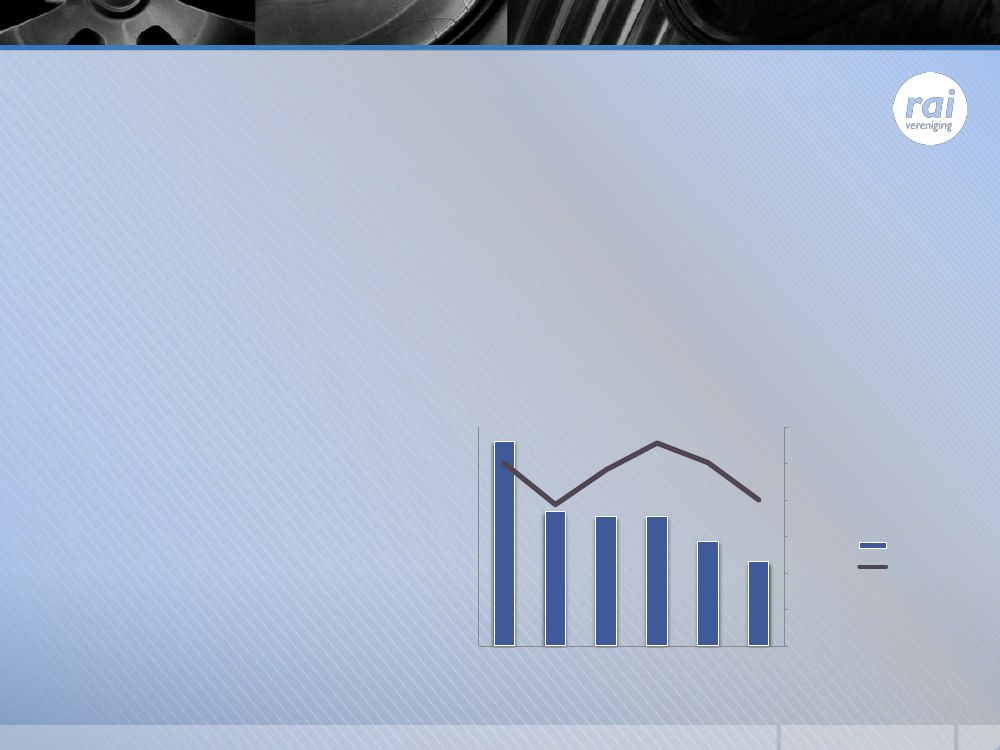

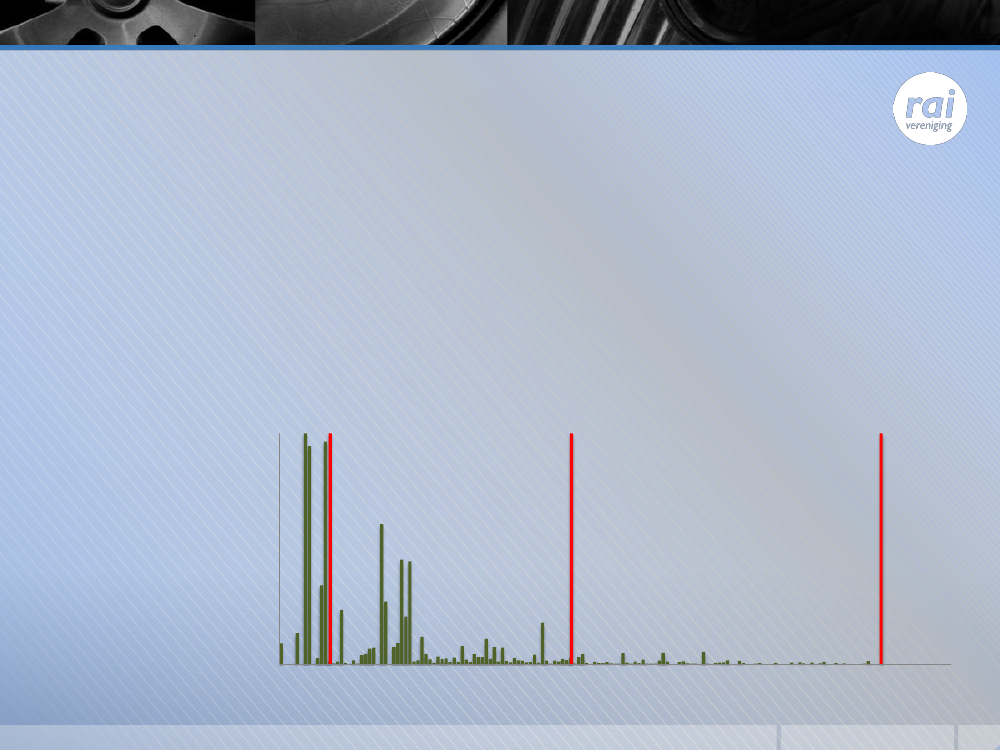

BijtellingMain effects of conversion from nett catalogue price based Bijtellingto CO2emission based Bijtelling1. Rapid downsizing of new company cars

2. Emission limits have major impact on company car sales3. Rapid decline of tax revenues

BijtellingMain effects of conversion from nett catalogue price based Bijtellingto CO2emission based Bijtelling1. Rapid downsizing of new lease cars2. Emission limits have major impact on company car sales3. Rapid decline of tax revenues4. “Winner takes all”New company car registrations201120122013

Renault MeganeVolkswagen PassatFiat Punto

3.8424.4983.533

15.0913.162841

4.19230377

Position RAI Vereniging on taxation(1)Taxation should not be local but on an EU basisCurrently, the Netherlands is among the countries in the EUwith the highest car taxation.Automotive taxes should be efficient and should not causeunnecessary administrative burdensAutomotive taxes should have broad support in politics andsociety and should beeasy to explain

Automotive taxes must bepredictableand robustIn the long run, automotive taxes should be technology neutral

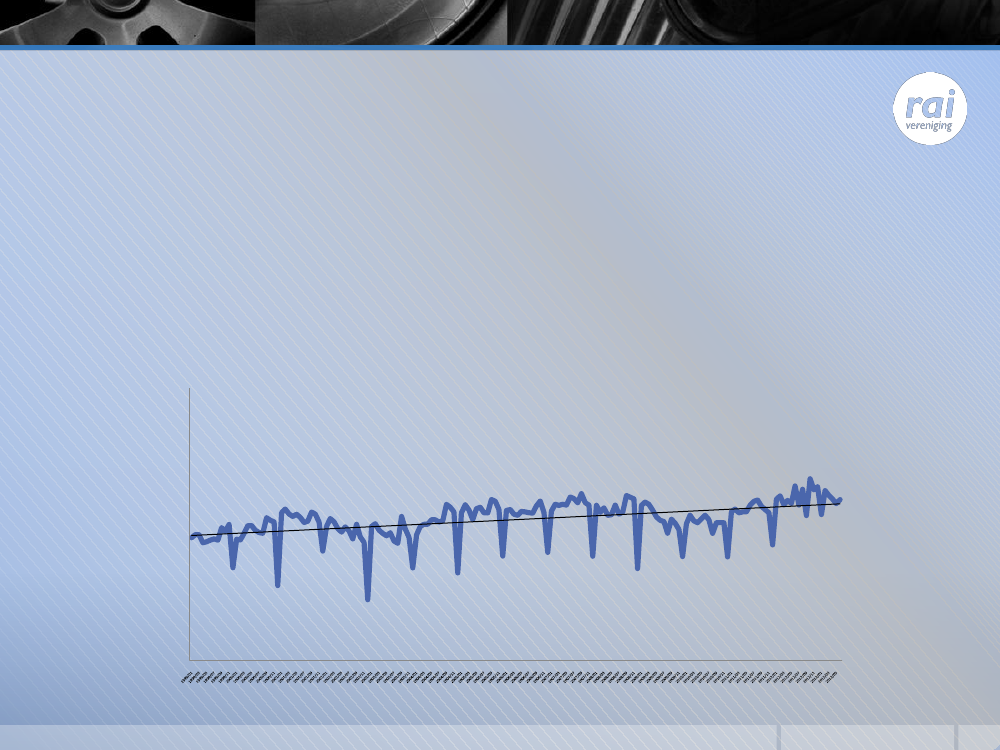

Position RAI Vereniging on taxation(2)The current ‘greening’ of the BPM, annual road tax and ‘bijtelling’has disproportional and undesirable effects on the car market.Small differences in CO2emissions can have major consequences.The different treatment of fuels in taxation delays the introductionof alternative fuelsThe BPM, annual road tax and bijtelling are taxes based on thepurchase or possession of the car. In the long run, taxation of theuse of the car is the only 'sustainable' way of taxation.Anders Betalen voor Mobiliteit(Introduction of a form of road tax)is RAI Vereniging’s solution for sustainable automotive taxation

Anders Betalen voor MobiliteitSystem of variable taxationBased on the use of cars instead of ownershipTariff per kilometre

Tariff differentiates by:timeplaceemission

Benefits:better accessibilitycleaner environment

positive impuls on new car sales

Anders Betalen voor MobiliteitCritical factors for successSystem should be simple and explicableSystem must be future-proofSystem must not cause major market distortions(new and used cars)System should encourage replacement of older cars for new carsSystem should take into account the development of alternative fuelsand drive systems

Public opinionProThe principle of paying for the use of the car, not ownership(‘the polluter pays’)

ContraDistrust of government(‘car as cash cow’and recent experiences with failed major infrastructure projects)