Skatteudvalget 2013-14

SAU Alm.del Bilag 11

Offentligt

Car taxes in the Netherlands

Structure of this presentation:• Facts & figures• Political context in the Netherlands• ANWB serving its members‟ interests

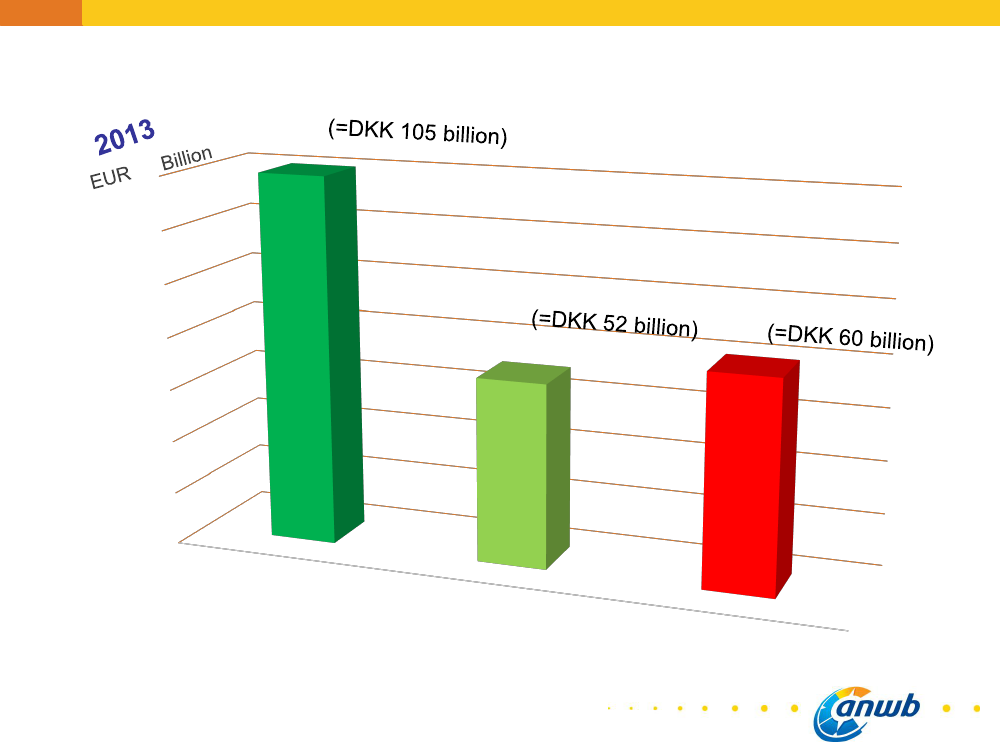

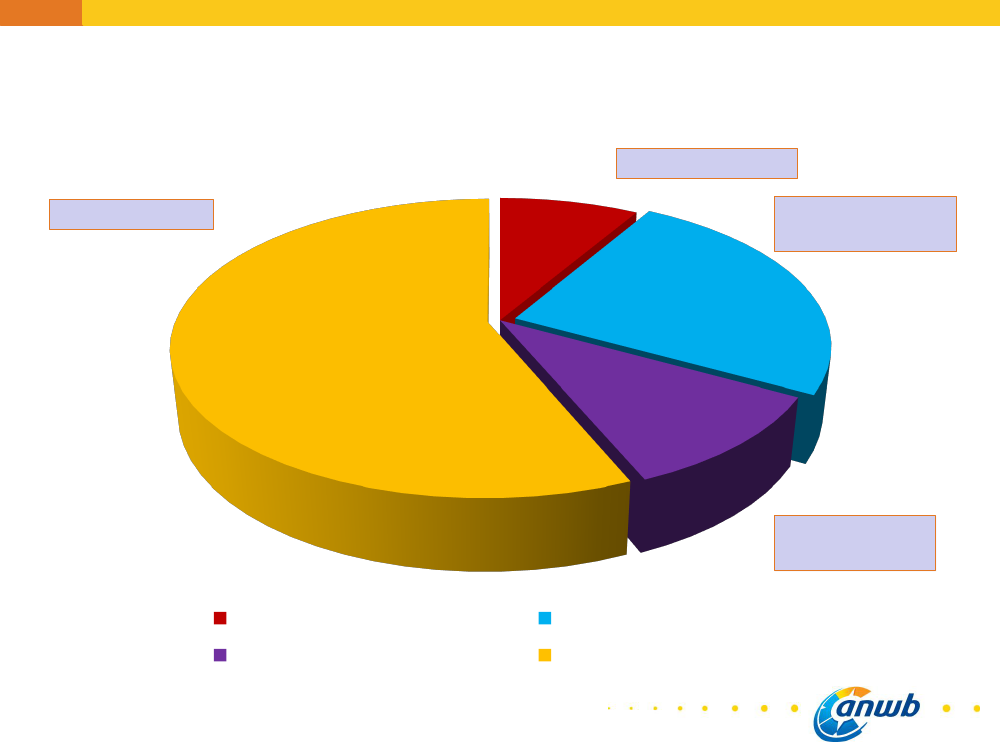

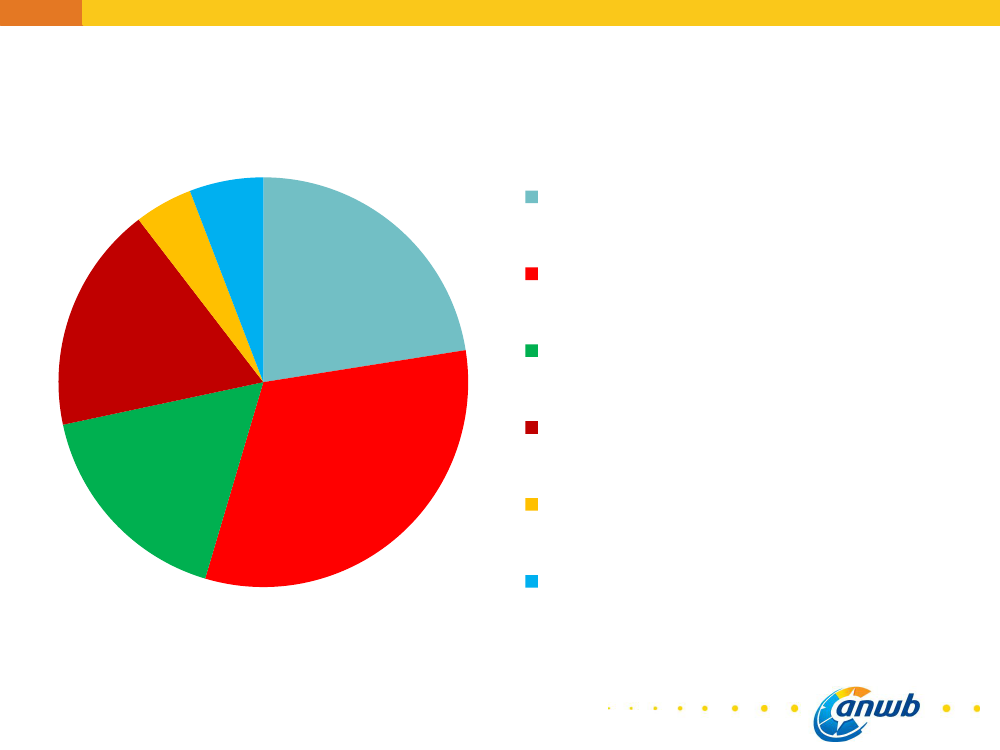

What comes in & what goes out?1414121086

7

8

420

Direct revenues

Additional revenuesDirect expenditure

Car taxes(=DKK 105 billion)Direct taxes: EUR 14 billionPurchase tax; 1,2Excise duties; 8Motor vehicle tax;3,5

Provincialsurcharges; 1,5

Purchase taxProvincial surcharges

Motor vehicle taxExcise duties

Car taxesAdditonal taxes: EUR 7 billion, including:(=DKK 52 billion)VAT on otherelements; 3Personal incometax on businesscars; 2

VAT on exciseduty; 1

ExpenditureEUR 8 billion(DKK 60 billion), including:• Road constr./maintenance, state• Road constr./maintenance, municipal auth.• Road constr./maintenance, provincial auth.• Civil service• Traffic measures and enforcement• Environment• Road safety2.8billion2.5billion1.2billion900million500million100million40million

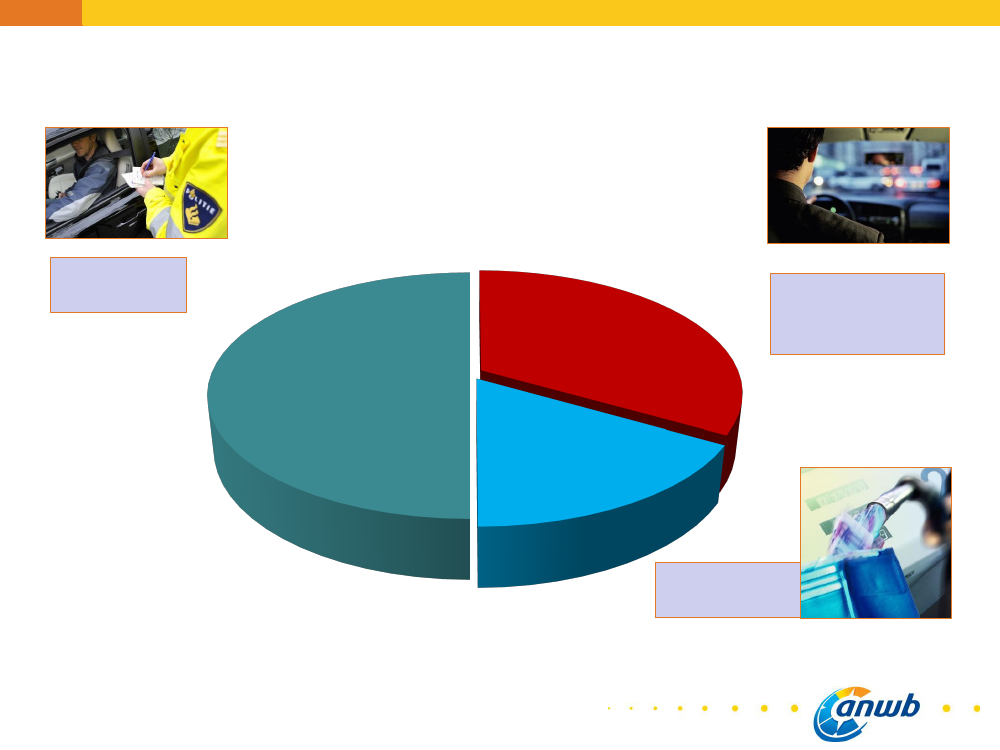

Who pays how much?1%13%7%Private carsBusiness cars

18%

61%

Lorries andtrucksVans

Motorcycles

Who costs how much?19% %Private carsBusiness cars

25%

50%

Lorries andtrucksVansMotorcycles

13%

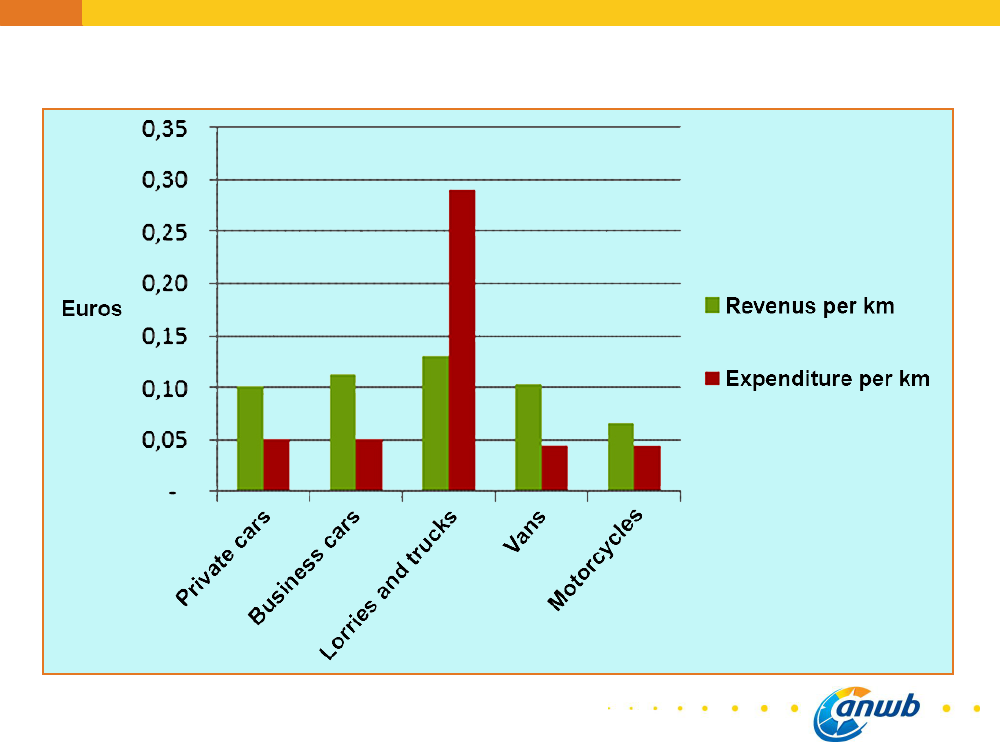

Revenues & expenditure per km

Tax burden on private carsPetrol-driven carDiesel-driven car

36%taxes

39%taxes

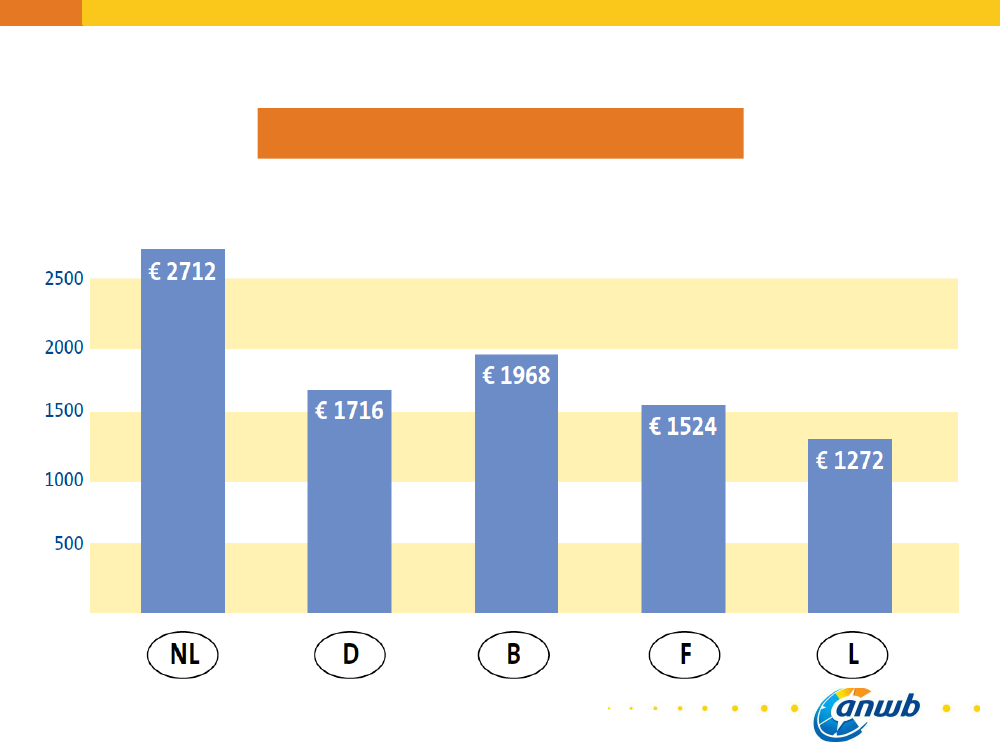

What do the neighbours do?Annual tax onpetrol-drivencars

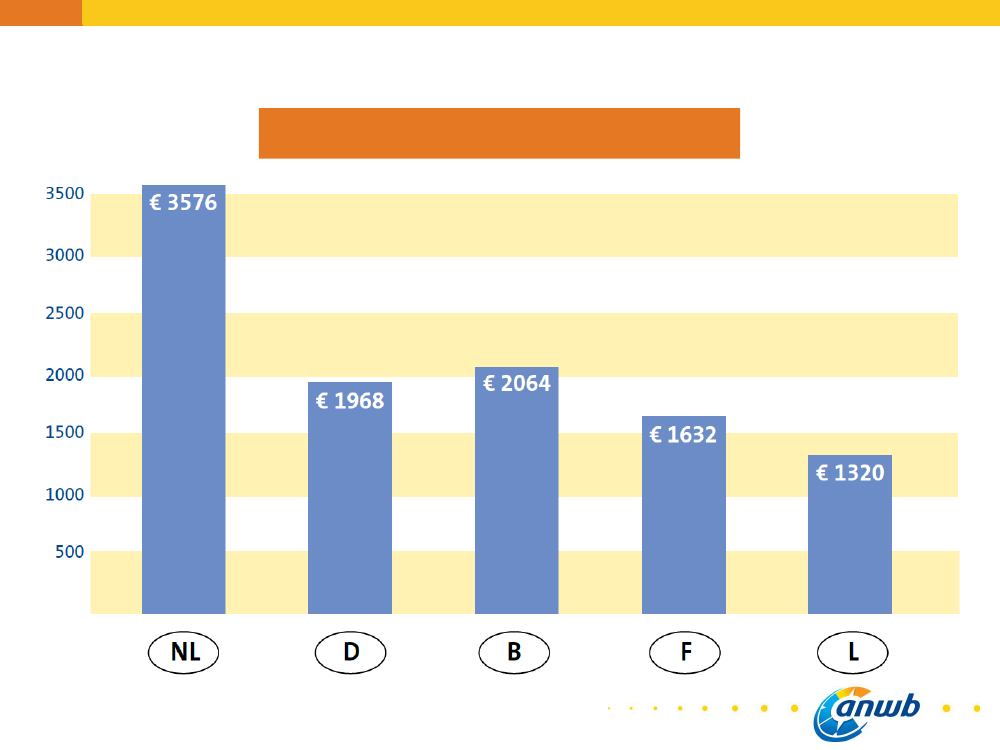

What do the neighbours do?Annual tax ondiesel-drivencars

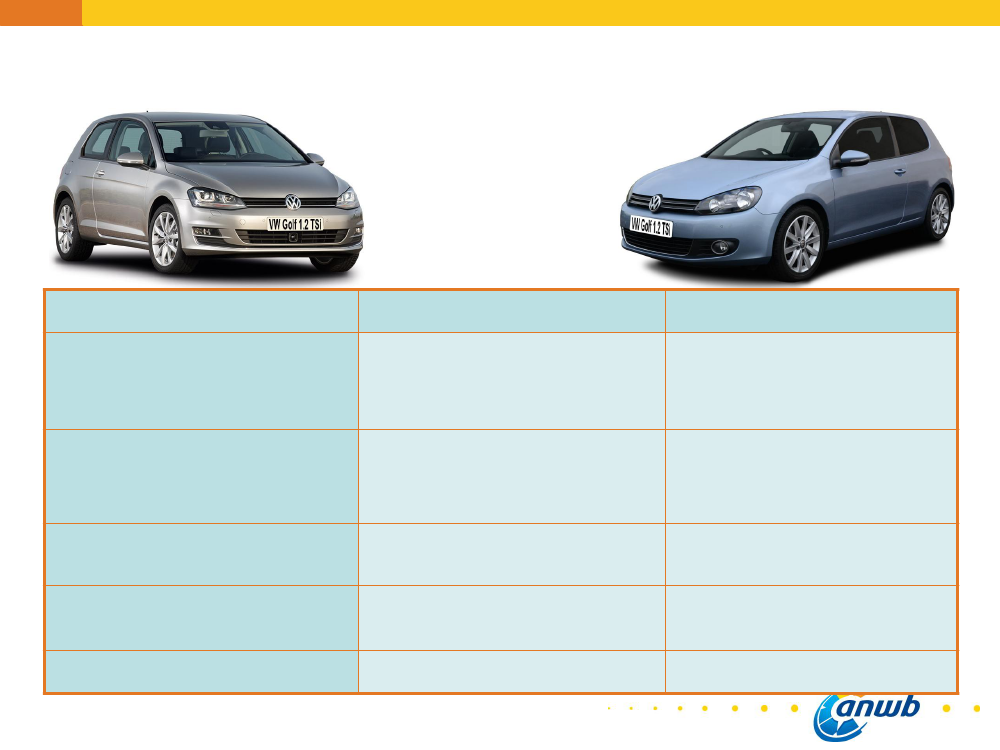

Denmark versus the Netherlands

DenmarkPurchase tax

Netherlands

105% or DKK 15,500 + 180% Carbon emissionson the remainder€ 30.180,00€ 19.900,00Fuel consumption, weightWeight, type of fuel used,region (province)€ 389,00€ 2.280,0074.7 eurocents/litre€ 11.168,75€ 33.348,75

Tax on ownership ofprivate car

Excise duty, unleadedpetrolTotale price petrol(20.000 km a year)Totale

59.3 eurocents/litre€ 10.712,50€ 41.281,50

Political context• Annual changes over the past five years as part of „taxgreening‟ → our members find it hard to make the rightchoices• Major system changes lead to fierce political debate(road pricing, abolishing commuting allowance)• Result: status quo/no major system changes• Present Cabinet‟s policy: no road pricing

Political context• Minor increases in tax burden go unnoticed(no opposition to raise in excise duty on diesel)• All „minor‟ increases add up to almost 900 million euros inadditional revenues from 2014 onwards(6.7 billion Danish crowns)• Expenditure for road traffic will go down by 400 millioneuros from 2014 onwards (3 billion Danish crowns)• New policies for the 2016 – 2020 period adopted in 2014

How do our members feel?• Many are unaware• Dissatisfaction about accumulation of taxes,criticism about government spending• Sense of being powerless• Hard to make the right decisions because things changeeach year

• ANWB‟s role: watching out for tax hikes• Need for fairness, justice and equality

•68%favour paying for car use

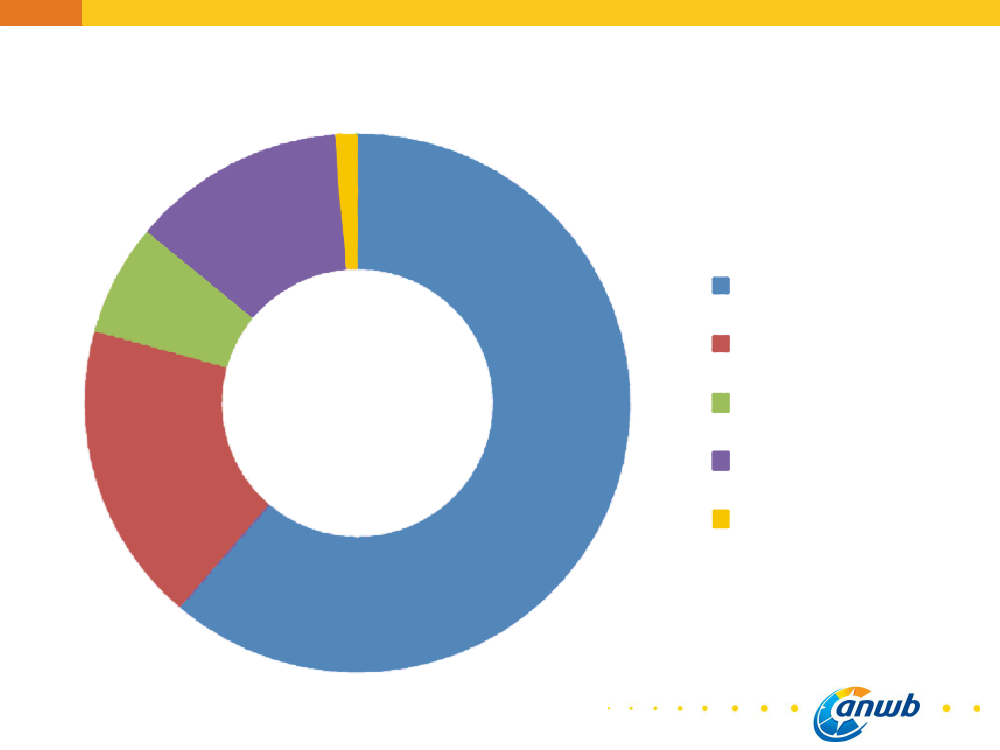

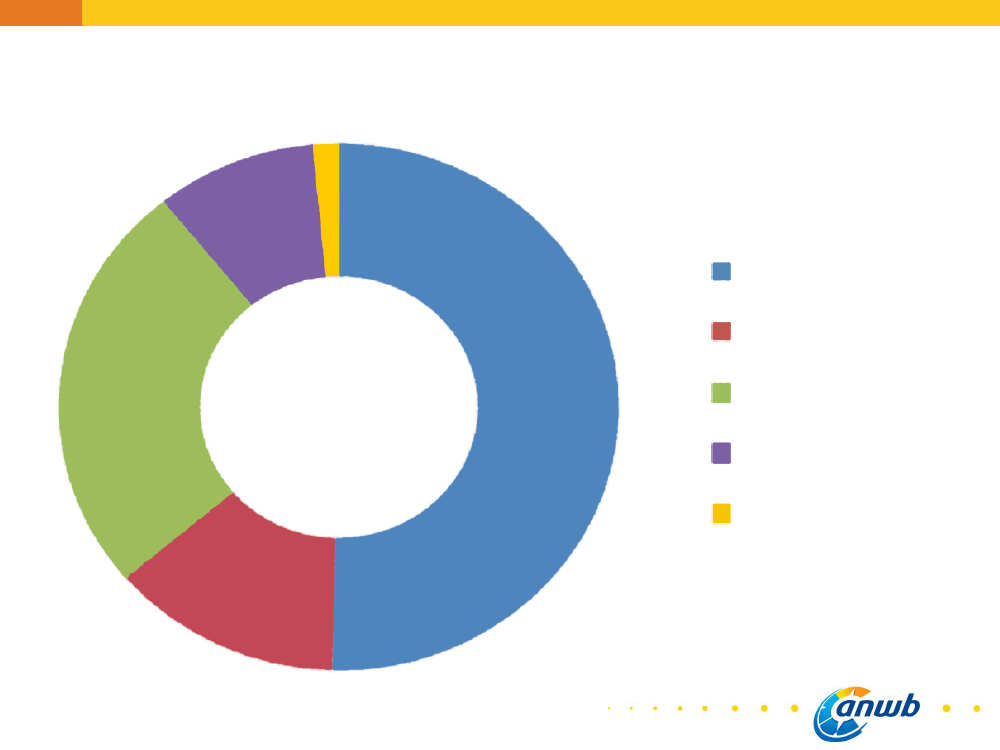

Members’ views on car taxes, 2011 - 20131454Opposed to higher car taxes43In favour of fair car tax systemOpposed to abolishing discountschemes4177Closer attention to environmentallyfriendly fuelsIn favour of separate taxesOpposed to high fuel prices

11

What does ANWB want?“ANWB wants car taxes to befair,affordableandfutureproof”

But how?Fair taxes:• Balanced revenues and expenditure (purpose-driven tax)• Each motor vehicle pays on a pro rata basis

Affordable taxes:• Perspective of behaviour: taxing use rather than purchaseand ownership• Lowering tax burden on passenger cars

But how?Future proof taxes:• Contributing to fuel-efficient, clean and safe car driving• „Europe proof‟

• Consistent and predictable

Any questions?