Skatteudvalget 2013-14

SAU Alm.del Bilag 11

Offentligt

Vehicle taxes in theNetherlands

23 September 2013

Contents•••••

Green tax revenuesVehicle taxesRecent developmentsEurovignetteFuel excise duties

23 September 2013

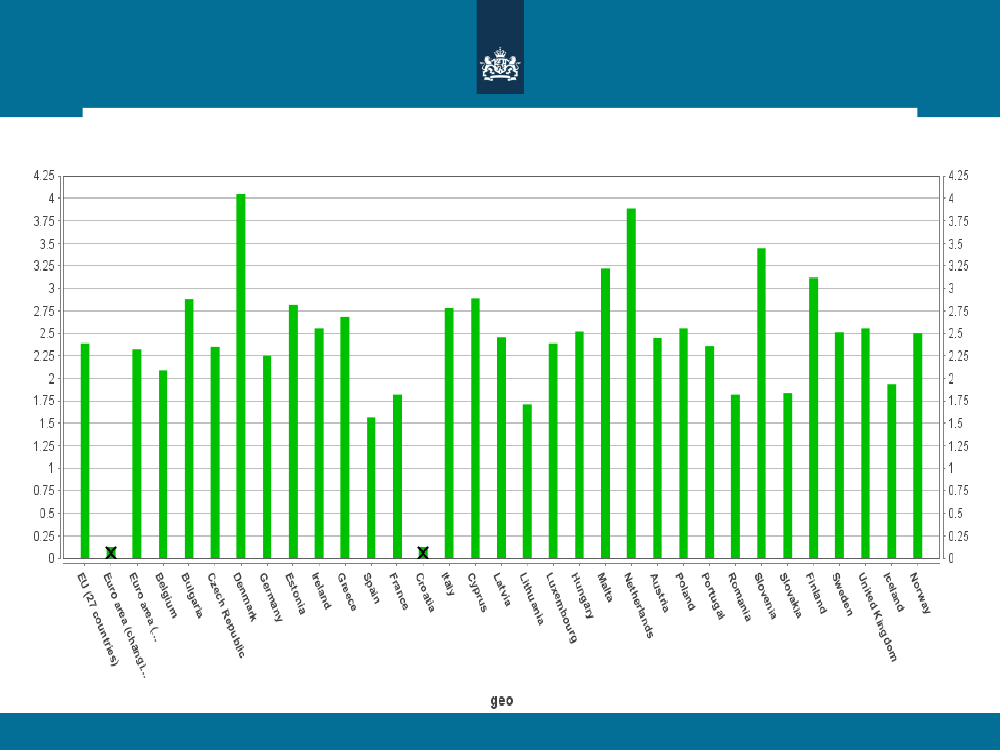

Environmental tax revenues in percentage of GDP

Source: Eurostat, 2011

23 september 2013

Greening taxesVehicle taxesare a good exampleof greening taxesooooRegistration taxTaxation of private use of a company carMotor vehicle taxTax on heavy goods vehicles (Eurovignette) road toll fortrucks of minimum 12 tons

4

23 September 2013

Taxation of motor vehicles in the NetherlandsDutch taxes for motor vehicles are relatively highDutch passenger car fleet in 2012: almost 8 million cars•Registration tax (BPM)Levied for passenger cars, motor cycles and private vansRevenue 2007: € 3.6 billionRevenue 2012: € 1.8 billion

Motor vehicle tax (MRB)Tax on car ownership, based on dead-weight of the carRevenue 2007: € 2.8 billionRevenue 2012: € 3.6 billion•Declining revenue of registration tax (BPM):oShift to lighter, more fuel-efficient carsoUnfinished shift from BPM to MRB; was meant as prelude to km-charge(canceled by former government)•523 September 2013

Car registration tax (passenger cars)Gradually shifted from a tax based on the vehicle price, rate 45,2%(2007), to a tax based on absolute CO2-emission in 2013•Tax base 2013CO2emission of the passenger carProgressive ratesFor each gram of CO2per kilometer a certain amount is due•ExemptionIf emission is 95 g/km CO2or lower for petrol cars, resp. 88 g/kmCO2for diesel cars, an exemption is grantedAdjustment over the yearsThresholds for rates and exemption will be tightened regularly as carsbecome more fuel efficient every year623 September 2013

Policy 2008-2013

•

Why registration tax on CO2•Easier to explain to consumers than the systemthat existed (combination of bonus/malus,vehicle price and surcharge)•Principle of ‘the polluter pays’•Better environmental effects than former system.Additional reduction in CO2-emissions > 0,9Mton.23 September 2013

Policy 2008-2013

Overview measures registration tax 2012-20151 January 2012Base percentage registration tax (of valuevehicle)Discount for petrolFixed diesel surchargeDiesel surcharge based on carbon dioxideemission (> 70 gr/km)Carbon dioxide emission limits for petrol(gr/km)First tax bracketSecond tax bracketThird tax bracketFourth tax bracketCarbon dioxide emission limits for diesel(gr/km)First tax bracketSecond tax bracketThird tax bracketFourth tax bracketRate first tax bracketRate second tax bracketRate third tax bracketRate fourth tax bracket11,1%-4501900-1 July 201211,1%-450-40,681 January 20130%--54,921 January 20140%--70,171 January 20150%--81,36

110180270-

102159237242

95140208229

88124182203

82110160180

95155232-94280654-

91143211225101121223559

88131192215125148276551

85120175197105126237474

8211016018091*110*213*427*

* This rate will be adjusted for inflation

23 September 2013

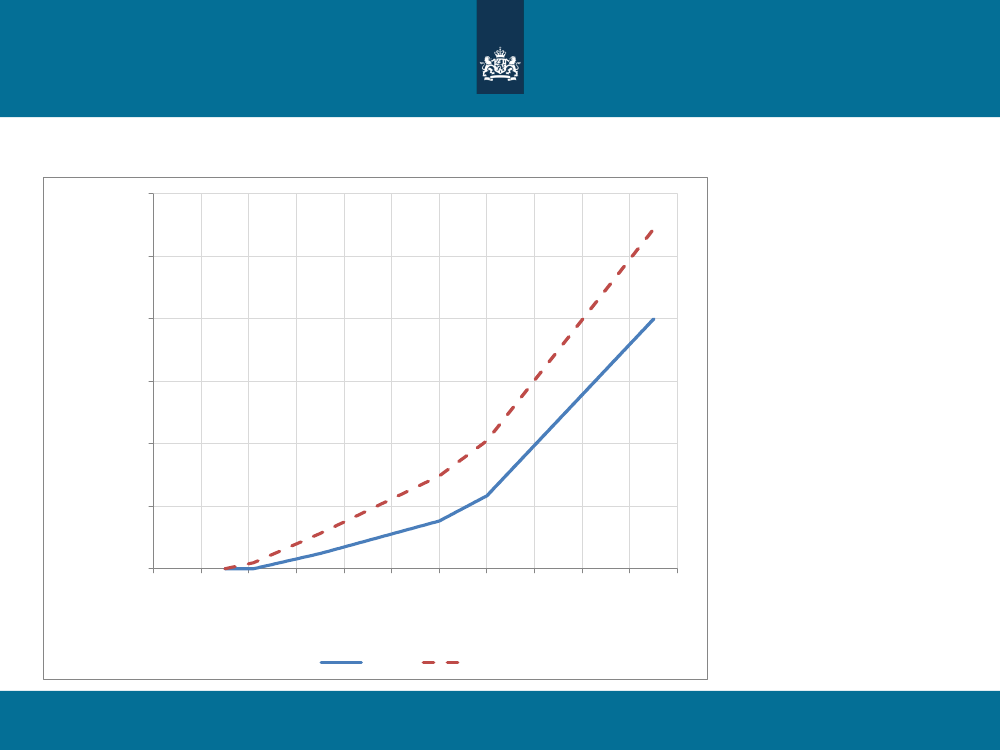

Progressive registration tax rate structure in 201560.000Red line: diesel carsBlue line: petrol cars

50.000

40.000

BPM

30.000

20.000

10.000

0406080100120140160180200220240260

gr CO2/kmBenzineDiesel

23 September 2013

Vehicle registration Tax – level 2015Brand, design, typeRenault Twingo1.2 16V ffkW3-d dynamiquePeugeot 1071.0 50 kW5-d XRVW Polo1.2 TDI 55 kW bluemotion5-d trendlineSeat Ibiza1.4 63 kW3-d styleVW Golf1.6 TDI 77 kW5-d comfortlineRenault Megane Estate1.4 TCE 96kW dynamiqueVW Passat Variant1.4 TSI 90 kWDSG comfortlineBMW 320d120 kW efficient dynamicsedition 4-dBMW 523i150 kW4-d executive automaticPorsche CayenneVolvo XC903.2 MomentumFuelPetrolPetrolDieselPetrolDieselPetrolPetrolDieselPetrolPetrolPetrolCarbon dioxideemission10910387139107145140109178270269Net catalogueprice8.3117.77314.23510.54318.98716.43424.48127.10939.00899.22045.338Registrationtax 20151.1316964803.5802.7974.1003.6843.1317.11633.89633.492

23 September 2013

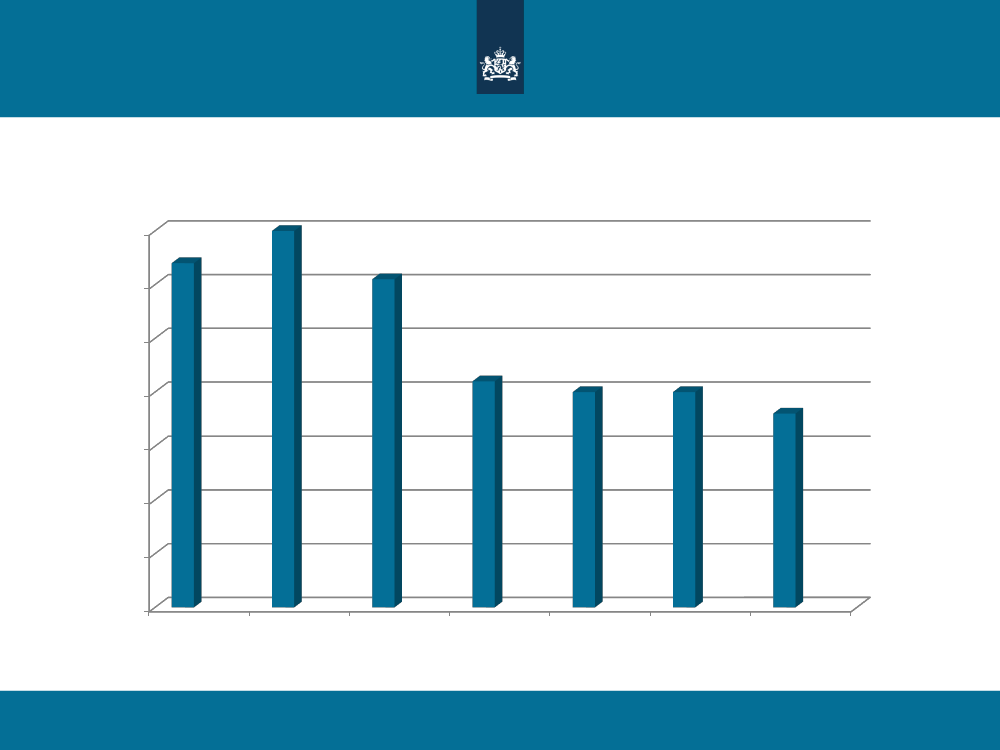

Development registration tax revenue3,5

3

2,5

2

1,5

1

0,5Billion0euro

Year2006200720082009201020112012

1123 September 2013

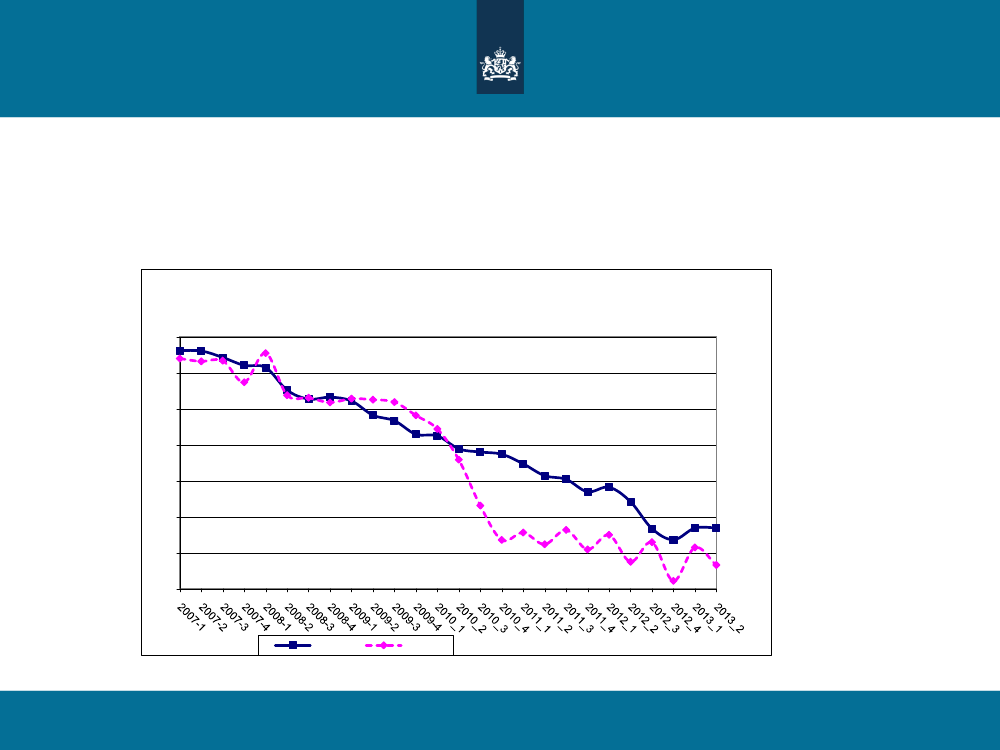

Average CO2–emission developmentNew passenger carsAverage CO2-emission170160CO2-uitstoot150140130

120110100

petrol

diesel

1223 September 2013

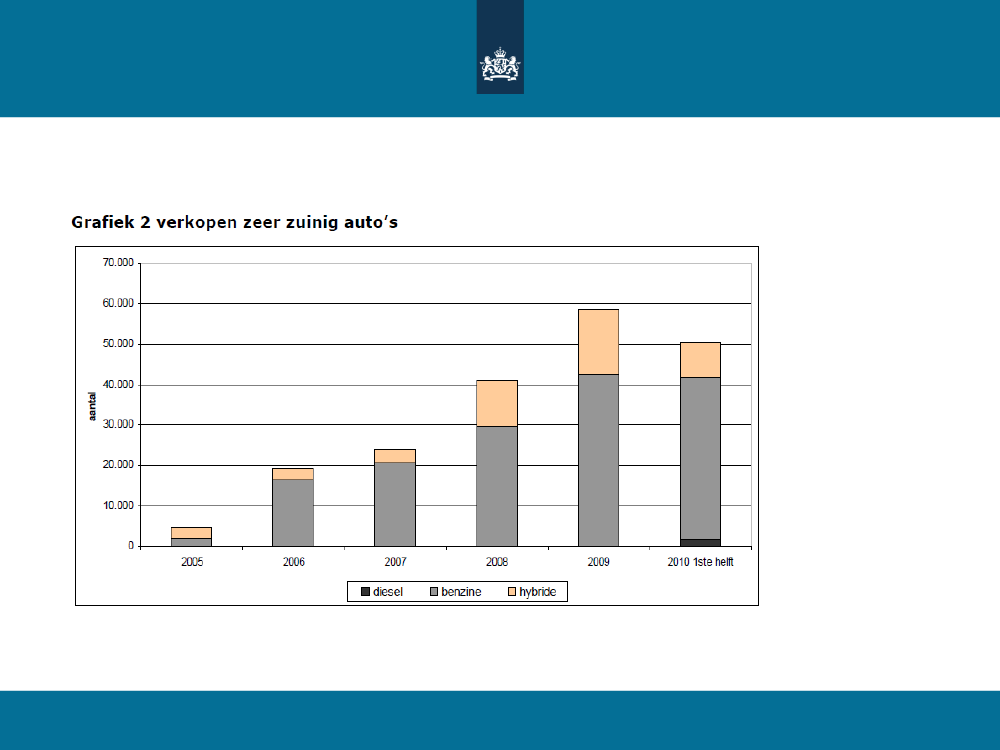

Sales figures very fuel-efficient cars

Yellow= hybrid carsGrey= petrolBlack= diesel

23 September 2013

Sales figures new cars 2011-2013Sale new cars per kindof fuelPetrolDieselLPGElectricCNGE-85Hybrid totalHybrid 0-50 gr/kmcarbon dioxide emission

2011

2012

2013 (on basis ofJanuary-June)286.18093.2702.8156956212926.3904.143

374.791(67,4%)156.819 (28,2%)7.140 (1,3%)861 (0,2%)493 (0,1%)835 (0,2%)14.870 (2,7%)711

323.361 (64,4%)142.781 (28,4%)8.779 (1,7%)828 (0,2%)776 (0,2%)411 (0,1%)25.506 (5,1%)4.238

Hybrid >50 g/kmcarbon dioxide emission

14.159

21.268

22.247

Total

555.809

502.442

410.000Source: RDC InMotiv

23 September 2013

Taxation of private use of a company car•••Normally the value for income taxation is 25% of the catalogueprice, including VAT and registration taxLower rate in 2008 introduced, to stimulate the choice of a fuel-efficient car14% of the price for very fuel efficient cars (diesel < =88 g/kmand petrol <=95 g/km CO2-emission)

••••

20% of the price for fuel efficient cars (diesel > 88 <= 112 g/kmand petrol > 95 <= 124 g/km CO2-emission)For <=50 g/km CO2-emission vehicles 0% of the price (until2014); as of January 1, 2014:zero emission 4% of the price<=50 g/km CO2-emission7% of the price

23 September 2013

Motor vehicle tax•CharacteristicsoLevied periodically from car ownersoTax depends on dead weight of the caroSurcharge for diesel cars (lower excise duty)oProvincial surtax•Example tax rates(including provincial surcharge for theprovince of Zuid-Holland)oPassenger car 1000kg:petrol € 420 per year; diesel € 928 per yearoPassenger car 2000kg:petrol € 1396 per year; diesel € 2396 per year

23 September 2013

Motor vehicle tax / environmental tax incentives•Exemption for very fuel efficient passenger cars- (CO2-emission petrol <= 110 g/km; diesel <= 95 g/km)-As of January 1, 2014 exemption if CO2-emission <= 50g/km- Exemption will expire in 2016

23 September 2013

Motor vehicle tax /Old timer exemption•Exemption for old timersfor vehicles from the age of 25years will be abolished as of 1-1-2014

- Only vehicles from the age of 40 years will still be exemptfrom tax- Transitional arrangement (25% of the regular rate but € 120max. per year) applies to petrol cars from 26 up to 40 yearsold, if certain conditions are met

23 September 2013

Motor vehicles registered in other countries•Both taxes due(registration tax and motor vehicle tax)for cars used byinhabitants•Exemption for non inhabitants:maximum 1 year, will beshortened to 6 months; compliance will get more attention•Temporary usein The Netherlands of EU/EER-car (rented,leased, borrowed): both taxes levied time proportionally•Refundof part registration tax for cars exported to another EU/EER-country, also used for cars transported tothird countries subsequently; growing negative effect onrevenue

23 september 2011

Eurovignette•Tolling system for heavy goods vehicles< 12 tons(future <3.5 tons?); also applies to third country vehicles•Eurovignette Treaty:Belgium, Denmark, Luxemburg,Netherlands, Sweden (and non active: Germany); officials ofboth Transport and Tax ministries from the six Member Statesmeet ca. twice a year in coordinating commission COCOM•Dutch coalition agreed upondifferentiatingthe Eurovignettemore according to the emission level of vehicles; however,difficult to gain support from all Member States•Plans forkilometre chargein Belgium (and until recentlyalso in Denmark and The Netherlands) seem to beincompatible with updating the Eurovignette•Coalition does no intend to introduce a kilometre charge inThe Netherlands; little support, both political and in society,and high costs23 september 2011

Excise duty on petrol, diesel and LPGRates 2013:Petrol€ 746,55/1000 LDiesel€ 440,28/1000 LLPG€ 180,04/1000 kg

As of 1-1-2014 the Dutch excise duty rate will be:Petrol€ 759,24/1000 L is the highest in the EUDiesel€ 477,76/1000 L one of the highest in the EULPG€ 322,17/1000 kg one of the highest in the EU

The difference in excise duty rates is compensated with a diesel/LPGsurcharge for passenger cars in the Motor vehicle tax

23 September 2013

•

Thank you for yourattention.Questions?

•

23 September 2013