Udenrigsudvalget 2013-14, Klima-, Energi- og Bygningsudvalget 2013-14

URU Alm.del Bilag 13, KEB Alm.del Bilag 31

Offentligt

AnnuAlRepoRt2012

AnnuAlRepoRt2012

ouR pARtneRSMembers States• Australia• Cambodia• Costa Rica• Denmark• Ethiopia• Guyana• Indonesia• Kiribati• Mexico• Norway• Papua New Guinea• Paraguay• The Philippines• Qatar• Republic of Korea• United Arab Emirates• United Kingdom• Vietnam

Project-specific donors• Bundesministerium fürUmwelt, Naturschutz undReaktorsicherheit (BMU),Germany• Government of Norway• Swiss Agency for Developmentand Cooperation (SDC),Switzerland• Department for InternationalDevelopment (DFID), UnitedKingdom

Partner Institutions• Asian Development Bank• ASEM SME Eco-Innovation Center• Climate & Development KnowledgeNetwork (CDKN)• Climate Works• Cheju Halla University• Danfoss• Deutsche Gesellschaft für InternationaleZusammenarbeit (GIZ)• Energy Research Institute of the NationalDevelopment and Reform Commission ofPeople’s Republic of China (ERI)• European Bank for Reconstruction andDevelopment• National Research Council for Economics,Humanities and Social Sciences• Organisation for Economic Co-operationand Development (OECD)• Oxford Economics• Peterson Institute for InternationalEconomics• POSCO• Stockholm Environment Institute (SEI)• United Nations Environment Programme(UNEP)• United Nations Economic and SocialCommission for Asia and the Pacific(UNESCAP)• United Nations Industrial DevelopmentOrganization• UNEP Risø Centre• Vestas Wind Systems A/S• World Bank• World Economic Forum

Table of Contents

Letter from the Chair of the CouncilConversion into an International OrganizationGGGI ProgramsGreen Growth Planning and ImplementationResearchPublic-Private CooperationFinancial Statements (IO-GGGI)Financial Statements (K-GGGI)

46101133424967

Letter from the Chairof the Council

Dear Members and Friends of the Global Green Growth Institute:The year 2012 was a milestone in the history of GGGI. The organizationentered the year as a non-profit foundation under Korean law and byOctober had transformed itself into a treaty-based international organization– the world’s only international organization dedicated solely to developingand diffusing green growth theory and practice.For this enormous accomplishment, we owe thanks to the extraordinary leadership and momentumcreated by the founding member states, including the Republic of Korea along with Australia,Cambodia, Costa Rica, Denmark, Ethiopia, Guyana, Indonesia, Kiribati, Mexico, Norway, Papua NewGuinea, Paraguay, the Philippines, Qatar, United Arab Emirates, the United Kingdom, and Vietnam.The countries which signed the GGGI Establishment Agreement in Rio de Janeiro at the UnitedNations Conference on Sustainable Development (Rio+20) in June declared their commitment toenvironmentally sustainable development of developing and emerging countries, including the poorestand the least developed countries, through green growth strategies that deliver poverty reduction, jobcreation and social inclusion.After the required number of countries ratified the Establishment Agreement on October 18, 2012GGGI officially became an international organization.As an international organization, GGGI has an important role in promoting sustainable developmentby supporting and diffusing green growth. GGGI targets key aspects of economic performanceand resilience, poverty reduction, job creation and social inclusion. GGGI also targets aspects ofenvironmental sustainability such as climate change mitigation and adaptation, biodiversity protectionand securing access to affordable, clean energy, clean water and land. GGGI seeks to improve theeconomic, environmental and social conditions of developing countries through partnerships between

04

developed and developing countries and the public and private sectors.In 2012, GGGI adhered to its mission and helped bring key aspects of green growth to more countriesthan ever. GGGI’s core program activity – Green Growth Planning & Implementation, through whichGGGI provides expert technical assistance and capacity building to developing countries – expandedin 2012 to include engagements in nearly every continent on the globe. GGGI’s Research programscaled up to include multiple comprehensive projects, including two of the largest research initiativesin the field of green growth – the Green Growth Best Practices Initiative and the Green GrowthKnowledge Platform. Additionally, GGGI’s Public-Private Cooperation platform grew to become a moresignificant aspect of GGGI’s green growth efforts, with further growth to come.Although GGGI made progress in 2012, GGGI has not yet reached its potential. In order to helptransform the paradigm of economic growth, GGGI must continue to expand its impact and presencein the world. GGGI must continue to actively increase the number of cooperative relationships ithas with both developed and developing countries as well as continue to produce real, measureableresults. GGGI’s mission has been ambitious from the moment the organization was founded.However, with the progress made in 2012 and with the groundbreaking new work GGGI is currentlyengaged in, I am more confident than ever that GGGI is now well poised to shift the developmentparadigm toward green growth.Thank you for your support and dedication to GGGI.

Lars Løkke RasmussenChair of the Council of the Global Green Growth Institute

05

Conversion intoan International Organization

Two-thousand twelve was a significant year for the Global Green Growth Institute.Over the course of just one year, the organization nearly doubled in size in terms ofthe number of programs it runs, the number of experts it employs, and the number ofcountries with which it has as partners. Perhaps most significantly, GGGI became a treaty-based international organization in 2012 – one of only a few in Asia and the world’s onlyinternational organization focused exclusively on green growth.

GGGI grew out of the green growth experience of the Republic of Korea. Launched by President LeeMyung-bak on June 16, 2010, GGGI began as a non-for-profit foundation with the mission to createan international platform for evidence-based learning and policy innovation for the twin imperativesof economic development and environmental sustainability. Through its developing country, industryand research activities, GGGI was founded to serve as a bridge between developed and developingcountries, the public and private sectors, and practitioners and scholars, respectively. From itsinception the overall goal has been to channel GGGI’s knowledge-base, networks and experience toprovide the best technical assistance and support to developing countries promoting and implementingtheir own rigorous green growth economic development strategies.GGGI was initially structured as a non-profit foundation under Article 32 of the Civil Code of theRepublic of Korea. It converted into an international organization in accordance with an agreementamong its major partner governments in October 2012 following the ratification of the organization’sEstablishment Agreement by several member country governments. On October 23, 2012, GGGI heldinaugural meetings of its Assembly and Council in Seoul as part of the organization’s new internationalgovernance structure. This came after a signing ceremony for the Establishment Agreement, held in

06

Rio de Janeiro at the United Nations Conference on Sustainable Development (Rio+20) in June 2012.These events, attended by representatives of the organization’s 18 founding member countries, werekey milestones in GGGI’s history and evolution to becoming an international organization. The 18founding member countries includes 11 participating members: Australia, Cambodia, Costa Rica,Denmark, Ethiopia, Guyana, Indonesia, Kiribati, Mexico, Norway, Papua New Guinea, Paraguay,Republic of Korea, the Philippines, Qatar, United Arab Emirates, the United Kingdom and Vietnam.The organization’s objectives and activities are spelled out in the Establishment Agreement assupporting developing and emerging countries, including the poorest communities and least developedcountries, in designing and implementing green growth plans, supporting and spearheading researchinitiatives that advance practical and theoretical aspects of green growth, and facilitating cooperationbetween the public and private sectors to help create an investment environment favorable to greengrowth. GGGI also seeks to raise global awareness of green growth through public outreach initiativesand other activities, such as conferences, seminars, and workshops.Membership to GGGI is open to any member state of the United Nations that subscribes to theorganizations goals and objectives. Regional integration organizations – bodies consisting ofsovereign states of a given region – are also eligible for GGGI membership.Upon converting into an international organization, GGGI adopted a new governance structure, whichconsists of an Assembly, a Council, an Advisory Committee, and a Secretariat.The Assembly is composed of GGGI members and meets every two years. The functions of theAssembly include advising on the overall direction of GGGI and review the organization’s progressin meeting its stated objectives. The Assembly also elects Council members, appoints a Director-General, and reviews the organization’s progress in meeting its stated objectives.

07

The Council serves as the executive organ of GGGI and thus approves the organization’s strategy, budget,admission of new members, and criteria for green growth planning and implementation programs. TheCouncil consists of no more than seventeen members, among which are contributing and participatingmembers, non-state actors, the host country, as well as the Director-General without a voting right.The Agreement calls for the Advisory Committee to be a consultative organ of GGGI, consistingof leading, relevant experts and non-state actors. It is responsible for advising on the strategy andactivities of GGGI and serves as a public-private cooperation forum for green growth.The Secretariat acts as the chief operational organ of the Institute and is headed by the Director-General, who, under the guidance of the Council and Assembly, represents GGGI externally andprovides strategic leadership for the organization to carry out its objectives.At GGGI’s Inaugural meetings of the Assembly and Council on October 23-24, 2012, theAssembly convened to elect Australia, Costa Rica, Denmark, Ethiopia, Indonesia, Kiribati, Mexico,Norway, Qatar, Republic of Korea and the United Arab Emirates to the Council. The four non-state representatives elected were GGGI Chair and former Prime Minister of Denmark Lars LøkkeRasmussen and GGGI members Lord Nicholas Stern, Chairman of the Grantham Research Instituteon Climate Change and the Environment at the London School of Economics, Kim Sang-hyup, then-Senior Secretary for Green Growth of Korea, and Montek Ahluwalia, Deputy Chairman of the PlanningCommission of the Government of India. The Assembly also elected the Honorable Bharrat Jagdeo,former President of Guyana, to be President of the Assembly.Below is a list of members of the Assembly and the Council of the Global Green Growth Institute:President of the Assembly• Guyana – H.E. Mr. Bharrat JagdeoMembers of the Assembly• Australia• Cambodia• Costa Rica• Denmark• Ethiopia• Guyana• Indonesia• Kiribati• Mexico• Norway• Papua New Guinea• Paraguay• The Philippines• Qatar• Republic of Korea• United Arab Emirates• United KingdomChair of the Council• H.E. Mr. Lars Løkke RasmussenMembers of the Council• Australia• Costa Rica• Denmark• Ethiopia• Indonesia• Kiribati• Mexico• Norway• Qatar• Republic of Korea• United Arab EmiratesNon-state actor members of the Council• H.E. Mr. Montek Singh Ahluwalia• Mr. Kim Sang-hyup• H.E. Mr. Lars Løkke Rasmussen• Lord Nicholas Stern

08

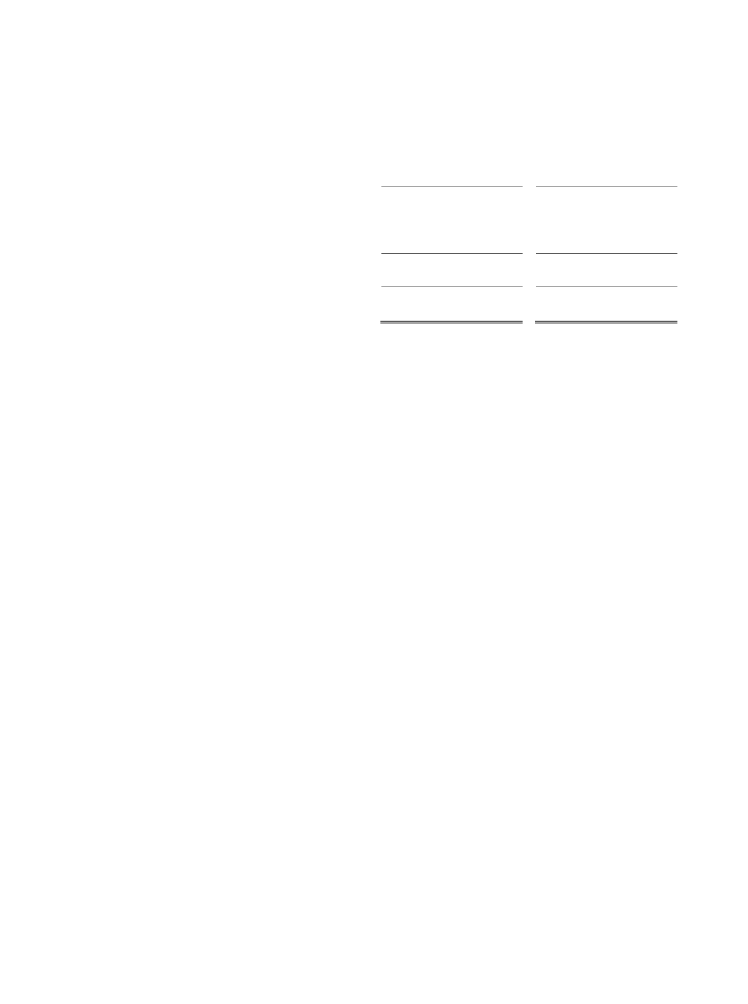

Governance Structure of the GGGIAssembly• Supreme Organ• Composed of memberstates• Elects member states tothe Council• Advises on the overalldirection of GGGI’s work• Reviews progressin meeting GGGI’sobjectives• Receives reports fromthe Secretariat

Council• Executive organ• Composed of 1/3 ofeach contributing,participating membersand experts or non-stateactors, as well as a hostcountry and the Director-General

Advisory Committee• Consultative andadvisory organ• Composed of leading,relevant non-state actors• Serves as a forumfor public-privatecooperation on greengrowth

• Nominates a Director-General to the Assembly• Appoints experts ornon-state actors to theCouncil• Responsible for directingGGGI’s activities• Approves annualwork program budgetand audited financialstatements• Approves AdvisoryCommittee membership

• Considers and adviseson the strategy andactivities of GGGI

Secretariat

• Operational organ• Headed by a Director-General, who shall be responsible to the Assembly and the Council

09

GGGIProGrams• Green Growth Planning & Implementation• Research• Public-Private Cooperation

10

GGGI PROGRamS

Green GrowthPlanning &Implementation

The largest component of GGGI’s activities relates to its green growth planning andimplementation platform. In 2012, the organization significantly grew its in-country greengrowth projects in both size and scope. At the end of 2011, GGGI was performing greengrowth planning work in nine countries. By the end of the 2012, the organization wasactively involved or doing scoping in nearly twenty countries, spanning three continentsand one subcontinent. GGGI also invested heavily in existing projects by significantlyadding the number of directly employed in-country teams in places such as in Ethiopia,Indonesia, and the United Arab Emirates. Additionally, many of the programs begun in2012, like those in Mongolia and Rwanda, were rapidly scaled up and have achievedtangible progress toward green growth implementation by year’s end.Presented in this section is a broad description of GGGI’s green growth philosophy andbrief summaries of the GGP&I work the organization performed in 2012.

our workGGGI supports emerging and developing countries that seek to develop rigorous green growtheconomic development strategies in order to achieve their economic and development objectives. Itdoes so by placing the best available analytical tools at their disposal, building their institutional

11

capacity to apply these tools, and engaging them in an international process of mutual learning withother countries on a similar journey. It also supports the implementation of green growth plans byadvising on institutional structures and policy as well as by engaging private investors and publicdonors in their successful execution.In order to stimulate a South-South dynamic of collective learning and refinement of green growthplan (GGP) methodology, the Institute’s country research series has an open architecture designedto facilitate the exchange of experience and knowledge by policymakers and experts engaged inGGP development around the world, whether or not such plans have been directly supported byGGGI. The overall aim is to facilitate a virtuous circle of experimentation and evidence-based learningby which developing and emerging countries accelerate the creation of a new approach to economicdevelopment that leapfrogs the resource-intensive and environmentally unsustainable strategypursued by advanced countries in an earlier era.The precise scope of work for a GGP in each developing country depends on the starting conditionsand specific challenges. At the most general level of GGP design, GGGI conducts a comprehensivediagnosis of a country’s green growth potential and its internal and external challenges in the contextof the core economics and development planning. The diagnosis involves assessing territorial andsocio-economic conditions as well as the potential in aligning development needs with required actionsto avoid irreversible impacts of climate change, water scarcity, natural resource depletion, etc. Basedon the result of the diagnosis, GGGI supports its governmental partners in developing a vision for thecountry on green growth, refining the policy options available for the GGP and sketching the implicationsfor implementation in the context of the broader green growth strategy. More specifically, GGGI workswith partners to identify opportunities for national alignment around priority sectors and to prepare acorresponding green growth implementation roadmap, particularly for developing partner countries.Critical sectors include: energy security/efficiency, water, resources management, green technologyand industries, green infrastructure and urban infrastructure. But each GGP prioritizes sectorsaccording to the country’s individual situation and development needs.GGGI’s services are flexible to reflect its clients’ needs and capacity. In selected developing countriesGGGI aims to employ a full-service approach by cultivating in-country presence, by working with in-countrypartners, and by developing tailor-made GGPs that carefully consider the circumstances and needs ofeach country. This level of engagement is developed gradually, building trust and political buy-in over time.

12

Green Growth Planning &Implementation

CambodiaIn 2010, the Cambodian government worked with internationalorganizations and experts to draw up a green growth roadmap.Drawing in part on the fundamentals of this roadmap, GGGI andits partners assisted the government in constructing the NationalGreen Growth Master Plan (NGGMP), a set of comprehensivepolicy recommendations and strategic implementation plans for thegovernment to adopt. Part of this process was producing detailedreports including a legal framework for green growth, a policyframework, and a green growth index. Based on consultations withGGGI, the Cambodian government established the National Council onGreen Growth led by the Prime Minister in Oct 2012. In early 2013, thegovernment will formally adopt the Master Plan as the National Policyon Green Growth and National Strategic Plan for Green Growth.A key aspect of the Master Plan is facilitating private sectordevelopment for green growth. As an example of this, GGGI with itspartners, including local NGOs and ASEIC ASEM SMEs Eco-InnovationCenter, have piloted a solar cooker business project in Takeo Province,Southwest Cambodia.Upon completion, the Master Plan and its full implementation isexpected to help boost economic growth significantly and allocate bothhuman and natural resources in more efficient and effective ways. Inaddition, Cambodia’s legal and regulatory systems will be altered to beadaptive and receptive to future environmental and economic eventsand developments.

overall Program Goals• Develop the National GreenGrowth Master Plan• Support the establishmentof a green growth legalframework• Promote green job creationand increase green growthpublic awarenessPrincipal Partners• National Council on GreenGrowth (NCGG), GeneralSecretariat on Green Growth(GSGG) and SupremeNational Economic Council(SNEC)• UNESCAP, UNIDO andUNDP• Korea Legislation ResearchInstitute (KLRI) and KoreaInstitute for InternationalEconomic Policy (KIEP)• ASEM SMEs Eco-InnovationCenter (ASEIC) andNeighbor of Cambodia

13

Green Growth Planning &Implementation

China(Yunnan Province)Yunnan is a low-income province with a per capita GDP of roughlyUSD 2,500. The province was selected as one of the five pilotprovinces for low carbon development by the central government.GGGI is assisting Yunnan in pursuing green growth in line with theprovince’s 12th five-year development plan. GGGI’s scoping workfor identifying green growth needs for Yunnan province was carriedout in the first half of 2012. In the scoping phase, three green growthrelated plans of Yunnan province were reviewed: 1) The 12th Five-YearPlan in Yunnan Province (2011 - 2015); 2) Low-Carbon DevelopmentPlans of Yunnan (2011 - 2020); and 3) Colorful Yunnan EcologicalCivilization Construction Plans (2009 - 2020). Several sectoral greengrowth projects were proposed and prioritized from the scoping work.Based on this outcome and consultation with the local governmentand stakeholders, GGGI is planning to conduct the development ofgreen growth five-year action plan as well as waste management andtransport sector projects in 2013.

overall Program Goals• Support the developmentof a five-year action plan ongreen growth policy• Implementation of sectoralprojects and capacity buildingprograms that are tailoredto Yunnan’s imminent greengrowth needsPrincipal Partners• Korea Environment Institute(KEI)• Korea National DiplomaticAcademy (KNDA)• Yunnan Academy ofEconomy (YAE)

14

Green Growth Planning &Implementation

ethiopiaFollowing the UNFCCC summit in Copenhagen in 2009, Ethiopia tooksubstantive steps to tackle the challenge and seize the opportunitythat climate change presents. To do this, the country established theClimate Resilient Green Economy (CRGE) Initiative. Underpinning theCRGE is the vision that Ethiopia will achieve a middle-income economyby 2025, one that is resilient to climatic shocks and produces no moreemissions than Ethiopia’s economy today. The CRGE Initiative is dueto be completed in 2025. The vision was launched in late 2012. GGGIis supporting the Government of Ethiopia in both the Green Economyand Climate Resilient components of the CRGE as well as thedesigning and scoping of a Sector Reduction Mechanism, which willserve as the principal vehicle through which the CRGE, and thereforeemissions reduction, will be put into action.In 2012 when the Ethiopian Government launched the CRGE,it also unveiled the first building block in the initiative, the GreenEconomy Strategy. GGGI was closely involved with the drafting ofthe GE Strategy, which charts the scale and roadmap to boostinggrowth through low carbon solutions. Also in 2012, GGGI assistedin developing the Climate Resilient Strategy, which will be formallylaunched in mid 2013. The next major step in the CRGE Initiativeis the Sector Reduction Mechanism (SRM) Process. The SRM willtranslate the high-level goals of the Strategies into action, through acomprehensive process of investment planning. Ultimately, the SRMwill be integrated into the broader national economic growth plan – theGrowth & Transformation Plan (GTP). The GTP is due to be completedin 2015. The CRGE Initiative will gradually be fully integrated into theGTP to create a green national economic growth plan.

overall Program Goals• Develop the Green Economy(GE) Strategy• Develop the Climate Resilient(CR) Strategy• Design and implementationof the Sector ReductionMechanism (SRM)• Build the capacity of theEthiopian Government todesign and implement acomprehensive measuring,reporting and verificationsystem for monitoring climateresults.• Help put in place an effectivesystem for leveraging andspending climate finance.Principal Partners• Environmental ProtectionAuthority (EPA)• Ethiopian DevelopmentResearch Institute (EDRI)• Climate DevelopmentKnowledge Network (CDKN)• United Nations DevelopmentProgram (UNDP)

15

By adopting green growth and climate resilient development, Ethiopiaexpects the following impacts. First, the country will be less vulnerableto climate shocks. This in turn will protect millions from hunger in theface of floods and droughts. Second, the country will accelerate growth,creating jobs and opportunities. This in turn will help lift millions outof poverty – through increased incomes, improved energy accessand more productive agriculture. Third, through the CRGE Initiativethe country expects to be able to attract additional investment toEthiopia. The country aims to leverage up to $500 million of additionalinvestment a year by 2025.

16

Green Growth Planning &Implementation

IndiaGGGI is developing a comprehensive green growth strategy for theIndian state of Karnataka, the first major initiative in India to examineand prioritize green growth developmental options, including climateresilience and social inclusion strategies.In 2012, GGGI performed scoping work. Beginning in 2013, GGGI willconduct comprehensive analysis in the following core areas:1) Green economy strategy – focusing on development according toa low-emission pathway that optimizes the value of Karnataka’senvironmental assets2) Climate resilience strategy – analyzing current and future climateimpacts and sector vulnerability3) Financing strategy – assessing the financing needs of a greengrowth transition and identifying national and international sourcesof financing4) Synthesis – drawing together all of the analysis to define an optimalgreen growth pathway

overall Program Goals• Develop Karnataka GreenGrowth PlanPrincipal Partners• Bangalore Climate ChangeInitiative—Karnataka(BCCI-K) –a consortiumof local and internationalinstitutions and organizationsincluding: Indian Institute ofScience (IISc), University ofAgricultural Sciences (UAS),London School of Economicsand Political Science(LSE), Institute for Socialand Economic Change(ISEC), Indian Institute ofTechnology-Delhi (IIT-D), andCenter for Study of Science,Technology and Policy(CSTEP).

Green Growth Planning &Implementation

IndonesiaDeforestation has emerged as a top priority for the governmentof Indonesia whose economy is heavily dependent on extractiveindustries and exploiting natural resources. The government recognizesthat in order to meet its growth targets without destroying one of itsmain growth engines, a new paradigm of growth is needed.GGGI has been supporting green growth initiatives in Indonesia since2010. By working closely with the central government and with the

17

overall Program Goals• Develop national greengrowth plan• Develop provincial greengrowth plans• Support REDD+ Readinessin East and CentralKalimantan• Develop REDD+ FundingMechanismPrincipal Partners• National DevelopmentPlanning Agency(BAPPENAS)• Provincial DevelopmentPlanning Agencies(BAPPEDA)• Coordinating Ministry forEconomic Affairs• Ministry of Finance• Ministry of Energy andMineral Resources• President’s Delivery Unit forDevelopment Monitoring andOversight• REDD+ Taskforce

provincial governors of East and Central Kalimantan, GGGI has helpedidentify and prioritize green growth opportunities along a number ofcriteria related to both economic growth and greenhouse gas emissionreduction potential. More specifically, GGGI has assisted with REDD+Readiness, the development of provincial green growth strategies,and capacity building for local officials and others to implement andmaintain green growth policies.Since working in East Kalimantan, GGGI has helped developdetailed economic analysis for three of the highest priority abatementinitiatives in the realm of REDD+ Readiness. GGGI also supported thedevelopment of the province’s green growth strategy and supported thedesign, organizational structure, staffing, budgeting, and policy agendaof the DDPI – the Provincial Council on Climate Change. In CentralKalimantan GGGI supported the development of detailed economicanalysis with the objective to use the results to identify and designGHG abatement pilot projects.In 2013, GGGI will embark on a major expansion of work in the countryin partnership with several government ministries at the nationaland local level. GGGI’s principal partner is the Ministry of NationalDevelopment Planning, which acts as the focal point for the Institute’sgreen growth planning nationwide.GGGI and the Ministry are forming a joint secretariat for oversight ofthe overall program, which consists of three major components:1) Greening the Economic Master Plan – designed to mainstreamthe value of natural capital and inclusive growth in the economicplanning and decision making process2) REDD+ Policy and Finance – aimed at supporting the developmentof a funding mechanism that disburses REDD+ finance to catalyzegreen growth3) Provincial Engagement – continued support for key provincialgovernments in prioritizing and implementing green growth

18

Green Growth Planning &Implementation

JordanJordan has significant economic growth potential but is also facingequally significant environmental challenges and climate changeexposure. Among the most pressing challenges are water scarcity,limited energy access, and issues surrounding waste management.To this end, the Jordanian Ministry of Environment is exploring thebenefits of a green growth project with GGGI and the German FederalMinistry for the Environment.Extensive multilateral discussions were held in 2012 about the potentialfor GGGI to partner with Jordan and others for green growth planning.Scoping will continue into 2013.

overall Program Goals• Develop a comprehensive,cross-sector policyframework for green growthin the country• Build capacity for Jordan’spublic sector to implementand sustain green growthpoliciesPrincipal Partners• Ministry of Environment(MoENV)• United Nations Economicand Social Commission forWestern Africa (UN ESCAW)• German InternationalDevelopment Agency (GIZ)

Green Growth Planning &Implementation

KazakhstanIn recent years, Kazakhstan has demonstrated strong macroeconomicperformance, however it faces large long-term developmentimbalances due, in large part, to the country’s dependence on oil asits primary industry and commodity export. Kazakhstan has also beenidentified as being highly vulnerable to the impacts of climate change.As such, the government launched the Astana Green Bridge Initiative(AGBI), which aims to promote green economic policies throughknowledge sharing and green investment facilitation by bridgingEurope and Asia. As part of this initiative, GGGI has partnered withthe European Bank for Reconstruction and Development (EBRD) to

19

overall Program Goals• Identify potential keysectors for green growth inKazakhstan and developstrategic policy directions forgreen growth implementation• Draft a national water sectordevelopment program thatseeks to facilitate private-public cooperation in thewater sector• Provide guidance ongovernment policies relatedto energy efficiency andrenewable energyPrincipal Partners• Ministry of EnvironmentProtection (MEP)• Ministry of Industry and NewTechnologies (MINT)• Kazakhstan PPP (Public-Private Partnership) Center• European Bank forReconstruction andDevelopment

help the government develop its Strategy for Kazakhstan’s Transitionto Green Economy(Strategy). Additionally, GGGI has teamed up withcertain government ministries for work in the water and energy sectors.GGGI contributed multiple components to the Strategy for Kazakhstan’sTransition to Green Economy, including analyzing Kazakhstan’s greengrowth potential in an array of sectors, such as agriculture, oil and gas,mining, manufacturing, power, water, and construction. Based on thefindings, GGGI provided examples of strategic policy directions forgreen growth, which included greening existing assets, promoting newgrowth engines through industry restructuring, and building solid policyfoundations for sustainable growth. GGGI’s work on the Strategy finishedat the end of 2012.GGGI’s water sector work in 2012 consisted of producing threecomprehensive reports on the status of Kazakhstan’s water sector,international case studies of water sector reform, and recommendationsto improve the investment climate in the sector, particularly in relationto public-private cooperation potential. In 2013, GGGI will complete twomore water sector reports – a feasibility study and an action plan.Lastly, GGGI contributed to the Kazakhstan National Sustainable EnergyPlan. The Institute offered technical guidance to assist the government inintroducing the Voluntary Agreement, establishing the Energy EfficiencyInstitute, offering support for the development of secondary legislationon energy efficiency, and providing guidelines on performing energyaudits in industrial sectors. GGGI also assisted with the development ofa renewable energy action plan, which provided scenarios for the properrenewable energy mix to meet Kazakhstan’s renewable energy targetsby 2020 and examined of policy options to meet the country’s rural off-grid energy demand. This work concluded in 2012.

20

Green Growth Planning &Implementation

mongoliaMongolia has a high per capita greenhouse gas emissions rate relativeto other nations at its level of economic development, and its emissionsintensity per unit of GDP is among the world’s highest. This is in largepart due to Mongolia’s cold continental climate and long heatingseasons, as well as its reliance on fossil fuels –particularly coal –forheating and electricity generation. Intense coal use has also made airpollution a significant problem in municipalities, including Ulaanbaatar,the capital and largest city, where the problem is especially acute. Tohelp address these problems, the government created the NationalGreen Development Committee, headed by the Prime Minister, whichserves as a body to coordinate and manage green development andstrategy in the country.GGGI and the Ministry of Environment and Green Development(MEGD) of Mongolia signed a Memorandum of Understanding (MoU)in November 2011 to cooperate in programs and joint activities thatfoster the promotion of green growth. Sector-specific green growthprojects in the transport and energy sectors were launched in 2012.GGGI further seeks to contribute in developing Mongolia’s nationalgreen growth strategies in 2013 along with next stages of the sectoralgreen growth projects.After initial scoping work and a Consultation Workshop in February2012, the transport and energy sectors emerged as priority areas onwhich to focus green growth planning. As a result, the Strategies forGreen Public Transport and Strategies for Green Energy Systemsprojects were launched.The transport project is centered on the capital city, Ulaanbaatar, andwill include recommendations to the government on effective andfeasible clean energy technologies for the city’s public transportationsystem and enhanced inspection rules and regulations for vehicleemissions. A weeklong Capacity building program was held, conveningtransport experts and officials to discuss and share technicalknowledge on sustainable transport.

overall Program Goals• Support green growthstrategies in the transportsector• Support green growthstrategies in the energysector• Assist the government indeveloping the NationalStrategy on GreenDevelopment and ActionPlansPrincipal Partners• Ministry of Environment andGreen Development (MEGD)• Ministry of Energy• Ministry of Roads andTransportation• The Korea Transport Institute(KOTI)• Stockholm EnvironmentInstitute US Center (SEI-US)• DEBUHDE Co., Ltd.

21

The energy project assesses the current status of the Mongolianenergy sector, identifies and evaluates key energy scenarios for thecountry, and will propose green energy solutions to reduce GHGemissions. GGGI and the Stockholm Environment Institute (US Center)jointly organized a capacity building program in Ulaanbaatar in March2013 to help provide Mongolian government officials and experts withtraining opportunities for energy scenarios planning tools.Both the transport and energy projects are scheduled to concludein 2013. GGGI aims to continue assist the Mongolian government ingreen growth activities, particularly with respect to its National Strategyon Green Development and Action Plans.

22

Green Growth Planning &Implementation

PeruDeforestation continues to be an important environmental and socio-economic issue in Peru and a significant contributor to nationalgreenhouse gas emissions. However, there is political recognition inthe country of the importance of the forests and the need to improvetheir management and transition to a more sustainable economicmodel. GGGI’s work in Peru aims to help implement green growth byfostering the development of an economically viable forestry sector thatgenerates socially-inclusive benefits and optimal ecosystem services,while at the same time preserving natural capital.Due to the importance of the forest sector in Peru, there are alreadyseveral high-level national forest strategies and multiple forest-relatedpolicies in place. GGGI is focusing on aligning the various existingforest initiatives behind a single master plan, which will then serve asthe basis for the legally mandated National Forestry Plan. Developinga master plan will entail estimating the economic importance offorest-based eco-system services and the potential for sustainabledevelopment in the forest sector; assessing development barriers;identifying and prioritizing effective government interventions to achievethis development potential, and laying out a realistic roadmap forimplementation over the next 5 to10 years. An additional key objectiveof the plan is to improve coordination and strengthen technicalcapabilities in the forest sector within the national government, regionalgovernments, and society at large. The development of the Plan willbe overseen by a Steering Committee composed of three ministries(Agriculture, Environment, and Economy and Finance), the NationalStrategic Planning Center (CEPLAN), and representation from regionalgovernments.

overall Program Goals• Support the government ofPeru in the development ofa National Green GrowthImplementation Plan in theforest sectorMajor Partners• Ministry of Agriculture• Ministry of Environment• Ministry of Economy andFinance• National Strategic PlanningCenter• Regional governmentrepresentatives

23

Green Growth Planning &Implementation

The PhilippinesThe Philippines is one of the most vulnerable countries to climatechange impacts due to its location and its status as an archipelago.In an ambitious effort to mitigate and adapt to climate change, thegovernment has adopted the National Climate Change Action Plan.GGGI has teamed up with the Climate Change Commission – ClimateChange Office (CCC – CCO), numerous local governments andexperts, and the Korea Environment Institute to work on an aspect ofthis plan –the Ecotown Framework Project. The project is made upof municipalities located within and around boundaries of critical keybiodiversity areas at high risk to the effects of climate change. Theproject is designed to help these at-risk communities be ecologicallystable and economically resilient to climate change.GGGI and its partners are developing a Local Ecotown ManagementPlan for the municipalities of Del Carmen, San Isidro, Pilar, and SanBenito in the province of Surigao del Norte and for San Vicente in theprovince of Palawan, which will assess the vulnerabilities and risks of theecosystems surrounding the municipalities, identify adaptation measuresfor them, conduct feasibilities studies on adaptation measures, andassess methods to climate-proof existing local economic developmentplans. GGGI will also help the towns implement these ManagementPlans as wells as conduct multiple activities to build local capacity.In 2012, GGGI helped complete ground activities for all projectcomponents for the Siargao Island sites, including vulnerabilityassessments (VA) reports and geographical information systems(GIS) mapping. In addition an Environment and Natural ResourcesAccounting (ENRA) Inception and Assessment Report was developedfor Palawan. In 2013, based on the results of various VA, GIS, andENRA reports, GGGI will assist in identifying numerous climate changeadaptation measures for the municipalities, such as developingmicro-grids, installing small-scale renewable energy systems, andestablishing rainwater management/harvesting facilities. Additionally,a National Conference on Ecotown Best Practices will be held in late2013 presenting all of GGGI and CCC’s project results.

overall Program Goals• Implementation of theEcotown Framework Projectin the Municipalities of DelCarmen, San Isidro, Pilar andSan Benito in Surigao delNorte and in the Municipalityof San Vicente in Palawan• Develop and implementLocal Ecotown ManagementPlan• Build capacity integratedecosystem-basedmanagement approach onproject sitesPrincipal Partners• Climate Change Commission– Climate Change Office(CCC – CCO)• Ministry of Energy• Local Government Units(LGUs)• Korea Environment Institute(KEI)

24

Green Growth Planning &Implementation

RwandaIn recent years, Rwanda has become a leading country for GreenGrowth in Africa and has demonstrated a high degree of ambitionand political support for sustainable urban and housing development.As part of the country’s foremost national development blueprint, theEconomic Development and Poverty Reduction Strategy (EDPRS)2013-2018, the Government of Rwanda is placing a high priorityon issues surrounding urbanization. Rwanda seeks to transformits economic geography by managing urbanization and promotingsecondary cities as poles of green growth and green economy.Affordable housing is also a key issue in Kigali, the Capital, as well asin secondary cities, as the urban population in the country has beenincreasing at a rate of 9 percent per annum.To assist with urban and housing policy in Rwanda, GGGI has beenworking with the Ministry of Infrastructure and numerous other entities,the Rwanda Housing Authority in particular, to develop a NationalTerritorial Vision and Strategy for Green Growth (NTVSGG). TheNTVSGG aims to develop strategic guidelines for a sustainable urbannetwork across the country to be combined with principal infrastructure,such as transportation, energy, water, habitat and urban development.GGGI is also working on an R&D project on resource efficient andclimate resilient housing with a particular focus on the development oflow cost construction material (non-burnt brick) as well as the designof climate resilient housing. GGGI is also supporting the developmentof a green building code designed to contribute to mainstream energyefficiency and climate resilience measures into housing policies andbuilding practices.

overall Program Goals• Develop the NationalTerritorial Vision and Strategyfor Green Growth• Develop and diffuse locally-constructed material foraffordable housing• Propose guidelines for thedevelopment of a RwandanBuilding CodePrincipal Partners• Ministry of Infrastructure(MININFRA)• Rwanda Housing Authority(RHA)• Energy, Water and SanitationAuthority (EWSA)• Rwanda TransportDevelopment Agency (RTDA)• Ministry of Natural Resources(MINIRENA)• Rwanda Natural ResourcesAuthority (RNRA)• Rwanda EnvironmentManagement Authority(REMA)• Ministry of Local Government(MINALOC), Kigali City,Provinces and Districts,Academia and privatestakeholders• Korea Research Institute forHuman Settlements (KRIHS)• Korea Institute of ConstructionTechnology (KICT)• Architecture and UrbanResearch Institute (AURI).

25

Green Growth Planning &Implementation

26

Green Growth Planning &Implementation

United arab Emirates

The government of the United Arab Emirates has set ambitious targetsto diversify its energy sources, including placing an emphasis onrenewable energy with a target of 30 percent of electrical power inAbu Dhabi coming from low carbon sources by 2020. As part of theseeconomic diversification efforts, the UAE signed a Memorandum ofUnderstanding (MoU) with GGGI in March 2011 with the aim to supportthe Institute’s goals of disseminating Green Growth in the Middle Eastand North Africa (MENA) through a regional GGGI office in Abu Dhabi’sMasdar City. The MoU also calls on both the UAE and GGGI to worktogether to develop a national strategy and policy framework for the

27

overall Program Goals• Develop a green growthplan that allows the UAE togrow in a competitive andsustainable manner.• The Green Growth Planwill consist of four mainareas of focus: 1) Policyand Governance; 2) DataManagement; 3) CapacityBuilding; and 4) RenewableEnergy based Micro-gridsPrincipal Partners• Ministry of Environment andWater• Ministry of Foreign Affairs• Prime Minister’s Office• Korea Legislation ResearchInstitute (KLRI),• Greenhouse Gas Inventoryand Research Centre ofKorea (GIR• Korea Environment Institute(KEI)• Research Institute ofIndustrial Science andTechnology (RIST)• UNEP Risoe Centre onEnergy, Climate andSustainable Development

introduction and implementation of Green Growth in the UAE.The partnership between GGGI and the UAE has deepened sincethe regional office was established in July 2011. One of the majordevelopments was elevating green growth onto the UAE’s nationalagenda. H.H. Shaikh Mohammad Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai formallylaunched ‘UAE Strategy for Green Development’ — a national, nine-year initiative to develop a sustainable economy — in January 2012.The Prime Minister’s initiative also incorporates a business planjointly developed by GGGI and the UAE Ministry of Foreign Affairsin 2011. Backed by the Prime Minister’s announcement, the projectofficially scaled up to a fully national initiative covering all the sevenemirates in the UAE and led by Ministry of Environment and Water andcollaborated by Prime Minister’s Office and Ministry of Foreign Affairs.Most of GGGI’s work in the UAE in 2011 was focused on establishingan office in Abu Dhabi and developing a business plan that outlinedphase-by-phase the programs required for green growth planning.Throughout 2012, the Institute and its partners held numerousknowledge sharing workshops and events to develop the governancestructure for the National Green Growth Strategy (NGGS), which wasformally launched at the World Future Energy Summit in Abu Dhabiin January 2013. In support of the NGGS, GGGI performed two initialstudies in 2012, including a situation analysis that reviewed existingEmirate institutional mandates and policy approaches and suppliedrecommendations. GGGI also performed a benchmark study thatdetailed best practices for green growth on a global level. The NGGSwill be further developed over the course of 2013 with the supportof GGGI. It will identify low carbon green growth opportunities in keysectors of the UAE economy, such as oil and gas, water, transport,construction and waste. It will also cover land use and biodiversity.Implementation of the NGGS will begin in 2014.

28

Green Growth Planning &Implementation

VietnamLike many Southeast Asian nations, Vietnam has experiencedsignificant economic growth in recent years while at the same timerecognizing the threat climate change poses to that growth. Inresponse, the government of Vietnam is attempting to successfullytransition to a more sustainable development path and cut GHGemissions while maintaining healthy economic growth. GGGI has beenworking with Vietnam to help establish and implement the VietnamGreen Growth Strategy (VGGS) of 2011 – 2020, which, among otherthings, seeks to achieve low carbon growth, implement clean orgreen industrialization policies, and promote sustainable consumptionpatterns among the populace.In 2012, GGGI, with Vietnam’s official editing board, conducted acomprehensive review of the draft VGGS and gave specific input onan array of sectors, including water resources, waste management,and transportation, as well as on VGGS implementation strategies.GGGI also held a series of workshops consisting of knowledge andexperience sharing among policymakers and experts from Mekongcountries and other international academic researchers. The Institutehas also supported green growth training sessions on sustainabledevelopment strategies for cities in Da Nang and Ho Chi Minh City.In 2013, GGGI will issue reports on Analytical Tools and Guidelines forGreen Growth Investment and Green Growth Led City DevelopmentStrategy of Da Nang. GGGI will also organize the Green GrowthInvestment Forum in Quang Nam in June and a knowledge-sharingworkshop on VGGS implementation strategies in November. Vietnam’sgreen growth strategy is intended to roll out over the course of the nextdecade and GGGI intends to be a strong partner in this process.

overall Program Goals• Implement Vietnam GreenGrowth Strategy (VGGS)• Develop Green GrowthInvestment Plan• Develop Green Growth ledCity Development Strategy(GG-CDS)Principal Partners• Ministry of Planning andInvestment (MPI)• People’s Committee of DaNang• Da Nang Institute for Socio-Economic Development(DISED)• People’s Committee ofQuang Nam• Vietnam Academy of SocialSciences (VASS)• United Nations HumanSettlements Program (UN-Habitat)

29

Green Growth Planning &Implementation

mekong River ProjectGGGI is working with Cambodia, Laos, and Vietnam to establisha Green Growth Framework for Sustainable Water ResourcesManagement in the Mekong River Basin, based in large part on thevision and mission of the Mekong River Commission for SustainableDevelopment to promote an economically prosperous, socially just,and environmentally sound region.The project began at the end of 2012 with the 1st GGGI-MekongWater and Green Growth Consultation Workshop held in Seoul. Therewill be several additional workshops in 2013. Research is also beingconducted in Vietnam, Cambodia and Laos. GGGI will release a reportbased on the preliminary findings from the research in 2013.

overall Program Goals• Establish a green growthframework for sustainablewater resourcesmanagement in the MekongRiver Basin• Advise regional stakeholdersto set up their regionaland national green growthstrategies and action plans/priority activities for sustainablewater resources managementin the Mekong River BasinPrincipal Partners• Cambodia National MekongCommittee (CNMC)• Viet Nam National MekongCommittee (VNMC)• Lao National MekongCommittee (LNMC)

Green Growth Planning &Implementation

aral Sea Basin ProjectGGGI is collaborating with multiple Central Asia regional organizationsto establish the Green Growth Framework for Water Security in theAral Sea Basin in an attempt to address the socioeconomic challengescaused by the shrinking of the Aral Sea. The project is in line withthe larger Third Aral Sea Basin Program (ASBP-3) organized by theInternational Fund for Saving the Aral Sea (IFAS), an organizationadministered by the five basin countries – Kazakhstan, KyrgyzRepublic, Tajikistan, Turkmenistan, and Uzbekistan.This project formally began in early 2013 with the GGGI-Central AsiaWater and Green Growth Consultation Workshop in Seoul. GGGI plansto further develop this project in 2013.

overall Program Goals• Establish a green growthframework for water securityin the Aral Sea Basin basedon the understanding of theregionPrincipal Partners• Global Water Partnership forCentral Asia and Caucasus(GWP-CACENA)• Scientific-Information Centerof the Interstate Coordinationof Central Asia (SIC-ICWC)

30

Green Growth Planning &Implementation

Capacity BuildingProgramsCapacity building or development is a process by whichindividuals, groups, organizations and institutions furtherimprove their abilities to perform core functions, solveproblems, define and achieve objectives while also dealing withtheir development needs in a broad context in a sustainablemanner. It is a fundamental aspect of GGGI’s Green GrowthPlanning and Implementation work. As such, GGGI hasorganized a number of capacity building programs designedto further integrate its green growth planning work. The maingoal of the capacity building programs in GGGI is to tackle theproblems related to the development and implementation ofa green growth plan while considering the potential limits andneeds of the people of the country concerned.Presented is a list of capacity building programs organizedby GGGI in 2012 across various country programs inchronological order.

31

CountryChina(Yunnan)MongoliaChina(Yunnan)ThePhilippinesCambodia

DateFebruary 16, 2012February 27-March 1, 2012April 10, 2012April 15-18, 2012April 18-19, 2012

TopicThe 1st GGGI-Yunnan Cooperation WorkshopThe 1st GGGI-Mongolia Consultation WorkshopThe 2nd GGGI-Yunnan Cooperation WorkshopCross Visit : Philippines Ecotown Framework ProjectThe 3rd GGGI-Cambodia Consultative Workshop on BuildingGreen Growth Pathway for Cambodia: Sharing Knowledge andShaping Policies for Cambodia’s Green FutureDDPI Kickoff meetingThe 1st Knowledge Sharing Session: Energy Efficient Housingand Urban Planning Guideline for Green Growth in RwandaLCGS Methodology Training WorkshopDefining Agri-Ecological Zones (AEZ), Gender, Vulnerabilityassessment using GIS mapping, Impact analysis for forestry,crop and livestock, appraising adaptation optionsJoint Capacity Building Conference on Green Growth in theMekong Sub-region

LocationKunming, YunnanProvince, ChinaSeoul,Republic of KoreaSeoul,Republic of KoreaSeoul,Republic of KoreaSiem Reap,CambodiaDDPI, IndonesiaKigali, RwandaDDPI, EastKalimantanAddis Ababa,EthiopiaDa Nang,VietnamSiargao Island,Surigao del Norte,The Philippines

IndonesiaRwandaIndonesiaEthiopia

April 24-25, 2012May 30-31, 2012May 31, 2013June 2012-March 2013July 24, 2012

VietnamThePhilippinesVietnamEthiopia

August 14-16, 2012 Vulnerability Assessment Result Validation Workshop

August 22-24, 2012 Capacity Building to Develop Climate Change Response toward Ho Chi Minh City,Green Growth/ Low Carbon Ho Chi Minh City (HCMC)VietnamSeptember 17-20,2012September 25-26,2012October 14-17,2012November 26-30and December 3-7,2012December 5-8,2012Resilience capacity building, covering: using climate data,vulnerability assessments, appraising adaptation options anddrafting resilience strategies.Mekong as a Green Growth Hub in Asia-PacificLeadership training for Sustainable City Development Strategyof Da NangThe 2nd Knowledge Sharing Session: National TerritorialVision and Strategy for Green Growth & Energy Efficient andAffordable Housing in RwandaLeadership training for Sustainable City Development Strategyof HCMCAddis Ababa,EthiopiaHalong, VietnamDa Nang,VietnamSeoul,Republic of KoreaHo Chi Minh City,Vietnam

VietnamVietnamRwanda

Vietnam

32

GGGI PROGRamS

Research

GGGI’s research platform, its second pillar of activity, grew dramatically in 2012. Newprojects and partnerships were launched, and many of the fledgling programs from theyear prior gained momentum and began producing real results. With the launch of theGreen Growth Knowledge Platform and the Green Growth Best Practice initiative, GGGIis now helping to lead two of the largest and most comprehensive cooperative researchinitiatives in the field of green growth. At this stage, most projects are in partnership withother major organizations, however as GGGI grows and attracts more experts, moreresources will continue to be invested in this essential pillar of the organization and moreof the Institute’s research efforts will directly complement and reinforce its green growthplanning country work.

33

our workGGGI’s research program focuses on exploring the nature of a new green growth paradigm indeveloping countries by conducting economic research into various aspects of green growth theoryand practice, with a particular focus on the potential of key economic and development factors.Currently, GGGI’s research is primarily focused on knowledge sharing and efforts at further definingand refining real-world applications and practices of green growth. The Institute is also engaged inmacro-level issues, such as green job creation and poverty, and micro-level solutions, such as greentechnology applications in developing countries Further, we are looking at the issue of adaptationthrough a green growth lens.Ultimately, the main targeted outcome from GGGI’s Research Program is relevant, high-qualityresearch that explores the potential of green growth and provides practical guidance to policymakers,especially in developing and emerging countries.

34

Research

Green Growth BestPractice (GGBP)

The GGBP initiative was launched in October 2012 and is supported by Global Green Growth Institute(GGGI), Climate Development and Knowledge Network (CDKN), and European Climate Foundation(ECF). GGGI serves as the execution agency. The initial period of the initiative is 18 months, lastinguntil February 2014.GGBP is an effort to assess green growth planning and implementation practices around the worldand find what works best under what circumstances in order to assist policymakers and practitionersprmarily in developing countries to improve the quality of green growth efforts.In 2012 and into early 2013, the GGBP Project Team has outlined the priority topics through aconsultation process with over 100 stakeholders, recruited over 70 authors from around the world toparticipate in the green growth best practice assessment, established partnerships with more than 20major international organizations and institutes, and conducted policy dialogues in key internationalevents such as at the eighteenth session of the Conference of the Parties to the UNFCCC (COP18)and the Global Green Growth Forum (3GF) in Copenhagen.The assessment result will inform the content of a range of products including a synthesis report, aliving handbook, briefing papers and other outputs tailored to users’ needs to be made available fromNovember 2013.

35

Topics for the assessment are determined in consultation with more than 100 green growth policymakers and practitioners from around the world and refined by GGBP experts. They include:work streamsPlanningandCoordinationTopics1. Planning and Coordination Processes – What green growth planning approaches can best/haveproven to achieve long-term transformation, government agency and stakeholder buy-in, andmainstreaming with development programs?2. Monitoring and Evaluation – What are best practices with design and implementation of greengrowth monitoring and evaluation programs and feeding evaluation results into policy learningand implementation?3. National and Sub-National Integration – What approaches have proven most effective foradvancing green growth through coordinated programs at national and sub-national levels andacross governments?4. Benefits and Building Support- What approaches have been most/proven effective in buildinga case for a country or region to embark on a green growth plan and in evaluating andcommunicating development benefits to build decision-maker and stakeholder support?5. Option Analysis – What methods and tools are available and have proven of greatest value inevaluating the costs and benefits of alternative green growth options, including the opportunitiesfor enhanced economic competitiveness and other impacts?6. Goals and Baselines – What are the most successful approaches that countries have used inestablishing well defined GG goals and baselines and using these goals to drive design of greengrowth programs?7. Policy Design - What types of green growth policies and approaches to implementation haveproven to be most effective at achieving concrete benefits through near-term wins and long-termsocial and economic transformation through green growth?8. Public and Private Collaboration – what approaches have been most successfully used in greengrowth planning and implementation to engage with the private sector and to mobilize privatesector leadership and action?9. Financing Strategies - What measures are/proven most effective at mobilizing finance fromdomestic, international, and private sector sources for green growth?

Analysis andFraming

Policies andPrograms

36

Research

Green GrowthKnowledge Platform(GGKP)

GGGI has joined the World Bank, UNEP and the OECD to create a global network of researchersand development experts with the aim to identify and address major knowledge gaps in green growththeory and practice. The Platform will then use this to provide policymakers with the necessary toolsto facilitate the transition to a model of green economic growth. GGKP hosted its inaugural conferencein January 2012, in Mexico City, in partnership with the Instituto Nacional De Ecología Y CambioClimático.GGKP’s mission is to enhance and expand efforts to identify and address major knowledge gapsin green growth theory and practice and to help countries design and implement policies to movetowards a green economy.At the inaugural conference in 2012 Mexico City, three research programs were identified for furtherdevelopment: Green Growth Metrics and Indicators, Innovation and the Adaptation and Diffusion ofGreen Technologies, and Green Growth, Trade, and Competitiveness.Since then, two additional, affiliated programs have been brought under the GGKP umbrella: GGBPand Data + Decision-Making Tools for Green Growth, which is to be launched in 2013.These five programs are hosted by partnerinstitutions and can take advantage theresources provided by the network of greengrowth experts that GGKP is in the processof building.GGKP’s mission, philosophy, and structuretook shape in 2012. In 2013, the network ispoised to expand and the research projectswill begin to produce results.For more information about GGKP, seeggkp.org.Innovation +GreenTechnologyTrade andCompetitivenessMetrics+IndicatorsBest PracticesData+ Decision-MakingTools

“Hub”AnalyticalStrategy &Framework

37

Research

Green Growthand the New IndustrialRevolution

This program, undertaken by GGGI and the Grantham Research Institute at the London Schoolof Economics, is a two-year research project that sets out to better understand the link betweenenvironmental protection, growth, and development. It aims to strengthen the analytical and empiricalunderpinnings of green growth in both developed and developing countries. The program is brokendown into four projects:1) Macroeconomic issues: Jobs, Poverty and Green Growth;2) Studies of the impact of innovation and other climate-change policies;3) Evidence from economic history about the sources of growth and the role of policy; and4) Growth and adaptation to climate change.The program, which was launched in the third quarter of 2012, will produce a number of policypapers around the four topics listed above and will seek to publish its results in peer-reviewedscientific journals. It will also work closely with the GGGI teams to ensure that the research remainsrelevant to our country work and is shared with partners on the knowledge platforms that GGGI hashelped establish. Finally, in 2012, the program commissioned a number of distinguished mainstreameconomists from around the developed and developing world a series of papers on green growth toexplore the different views existing in the community on the nature and scope of the green growthagenda.Papers from this project will be published as they become available on the GGGI website at gggi.org.

38

Research

Green Growthmethodology

Green growth planning is still in its early stages. There is still a large gap between theory and practice.In an effort to close this gap, GGGI has undertaken a Green Growth Planning Methodology (GGM)Project, designed to develop a methodological framework for green growth planning and analysis aswell as identify concrete methods for monitoring green growth performance and evaluating programsand projects in developing countries. The project will engage experts from leading research institutesto ensure best practices and optimal research results.In 2012, GGGI began work on identifying a set of diagnostic indicators designed to manage data sets,clarify policy objectives, and set priorities in the green growth planning process. In 2013, the GGGIteam aims to harmonize its work with existing environmental, sustainable and green growth indicatorsdeveloped by other members of the Green Growth Knowledge Platform, of which GGGI is a foundingmember.

39

Research

Sustainable EnergyTrade agreement

GGGI launched the Sustainable Energy Trade Agreement research project in cooperation with thePeterson Institute for International Economics and the International Centre for Trade and SustainableDevelopment. The aim of the project is to analyze the feasibility of a Sustainable Energy TradeAgreement and develop a detailed set of policy options, which could serve as the basis for such anagreement. The concept for the agreement involves creating a sectoral free trade arrangement wheresustainable energy products and services are traded among country participants without tariff andnon-tariff barriers. GGGI and its partners believe that a similar arrangement could help to stimulate thediffusion and innovation of energy efficient products and technologies. The process was launched witha symposium in Washington at the Peterson Institute for International Economics in November 2011.Over the course of 2012 the project produced five research papers listed as follows:• International Technology Diffusion in a Sustainable Energy Trade Agreement• Trade Law Implications of Procurement Practices in Sustainable Energy Goods and Services• Governing Clean Energy Subsidies: What, Why, and How Legal?• Legal Options for a Sustainable Trade Agreement• Issues and Considerations for Negotiating a Sustainable Energy Trade AgreementAll papers are available on the GGGI website at gggi.org

40

Research

GreenTechnology

In 2012, GGGI partnered with the Brookings Institution for a project which seeks to examineinternational mechanisms for green technology innovation in developing countries and to helpdevelopment an international architecture for the diffusion of technological innovation. The researchproject will:• Survey and map ongoing initiatives and proposals to enhance research development anddeployment (RD&D) capacity for green growth related technology in the developing world;• Identify approaches to enhance developing country access to intellectual property;• Identify stages of this process that are currently under-supported;• Review precedents for international intellectual property development and sharing in other fields andassess how lessons can be deployed in green growth innovation;• Outline the components of a potential international initiative. This proposal would consider thebalance between international cooperation and funding in support of potential networks, technologydevelopment and/or acquisition of IP; and• Outline a series of options with criteria for their assessment.In November 2012, GGGI and Brookings released a report entitledGreen Growth Innovation: NewPathways for International Cooperation,which is available at gggi.org.

41

Research

GGGI PROGRamS

Public-PrivateCooperation

GGGI’s third main pillar is Public-Private Cooperation. This type of workoften overlaps or is contained withinthe organization’s Green GrowthPlanning & Implementation work. In2012, GGGI scaled up its PPC effortsby strengthening its primary globalPPC vehicle, the Global Green GrowthForum (3GF) engaging other platforms,such as the Green Growth Alliance andthe World Economic Forum, and beganaltogether new projects in the area. Thispart of GGGI is still in its infancy, but itis expected to grow significantly in thenear future as more and more privatesector interests see the necessity forincorporating green growth.

42

Research

our workGGGI’s Public-Private Cooperation (PPC) program is designed to facilitate the engagement of theresources and expertise of the private sector, both domestically and internationally, in the implementationof green growth strategies in its developing partner countries. GGGI works to accelerate the worldeconomy’s transition to green growth by facilitating industry-government cooperation to scale resourceefficient investment, innovation and management best practice within the private sector.GGGI’s PPC program facilitates such public-private cooperation at two levels:• Linking companies to developing country governments that are seeking private sector finance, technologyand expertise to accelerate implementation of their green growth economic development plans; and• Building intra- and cross-industry programs of cooperation, and linking them to relevant intergovernmentalprocesses, to expand markets in developing and emerging countries for resource-efficient products,services and industrial processes.

43

Public-Private Cooperation

Global Public-Private CooperationInitiatives

1. Global Green Growth Forum (3GF)Initiated by the Danish government with the support of Korea and Mexico and developed with theGlobal Green Growth Institute, 3GF is an annual event centered on public-private cooperation in thefield of green growth in developing countries. Its aim is to become the leading international venue forthe demonstration of leadership and cooperation by top-level global decision-makers in the field ofgreen growth.In 2012 the Institute played a key role in the organization and development of the second annual GlobalGreen Growth Forum (3GF). The theme for the second 3GF was Resource Efficiency and Growth. TheForum brought together over 250 business, public and civil society leaders committed to green growth.At 3GF 2012, GGGI developed with international partners sessions on Energy Efficiency Indicators,Energy Efficiency Finance, and Power System Transformation. These sessions were designed to serveas a springboard for two GGGI-led Public-Private Cooperation Initiatives: Resource Efficiency Indicatorsand Energy Efficiency, Green Growth and Buildings, which will be further developed in 2013.

2. world Economic FormIn 2012, GGGI partnered with the World Economic Forum on green growth and climate changeinitiatives, specifically for work on blending public and private funds to advance new models of greengrowth finance. Additionally, GGGI is broadening its green growth partnerships through the WEF’sengagement with the Water Resources Group and Green Growth Action Alliance.

3. Green Growth Action Alliance (G2A2)The Green Growth Action Alliance is an initiative aimed to address the shortfall in green infrastructureinvestment, estimated at up to $1 trillion per year. The Alliance looks to deploy public money to unlockand utilize private sector investment, and identify innovative financing and de-risking structures,support pilots testing new models and market frameworks, and feed results into key internationalprocesses into clean energy, transport, agriculture and other green growth investments in developingcountries. The Alliance, launched at the Business 20 (B20) Summit in Los Cabos, Mexico in June2012, is comprised of nearly 50 of the world’s largest energy companies, international financialinstitutions, and development finance institutions.*

44

In 2012, GGGI joined the Green Growth Action Alliance and has been particularly focusing on thepromotion of free trade in green goods and services, green financing and innovation in end userfinancing for renewable energy.

4. water Resources Group (wRG)The Water Resources Group is a unique public-private-civil society partnership that helps governmentwater officials and other water sector specialists accelerate reforms that will ensure sustainable waterresource management for the long-term development and economic growth of their country. It doesso by helping to change the “political economy” for water reform in the country through convening awide range of actors and providing water resource analysis in ways that are digestible for politiciansand business leaders. A cornerstone of WRG’s work in any country is an emphasis on coordinationof effort. WRG is designed to work with and through existing national water programs, platforms orexpert institutions already focusing on water resource management by providing extra assistance tohelp build and strengthen their capacity. WRG acts as an independent entity and offers no political,partisan or national nuance to its advice.**In 2012, GGGI was invited to be a member of the Governing Council of the Water Resources Group,and GGGI will collaborate with WRG on creating synergies in green growth in the water sector byengaging private sector actors.

5. Clean Energy Ministerial (CEM)GGGI has joined the US National Renewable Energy Laboratories (NREL) to advance the Public-Private Leadership Forum (PPLF), a component of the overall 21st Century Power Partnership(21CPP), which aims to accelerate the transition to clean, efficient, reliable and cost-effective powersystems. The 21CPP is a multilateral effort of the Clean Energy Ministerial (CEM) and serves as aplatform for multilateral collaboration to advance integrated policy, regulatory, financial, and technicalsolutions for the large-scale deployment of renewable energy in combination with deep energyefficiency and smart grid solutions.

*Source - Fact Sheet: The Green Growth Action Alliance**Source - The Water Resources Group: Background, Impact and the Way Forward

45

Public-Private Cooperation

CorporateEngagement

GGGI is building a corporate community of industry champions in green growth.Facilitating cooperation between the public and private sectors to strengthen the enabling environmentfor innovation, investment and diffusion of resource-efficient corporate practice constitutes one of theInstitute’s three main pillars of activity. To that end, GGGI welcomes companies of various industriesand regions to engage in its industry-led and public-private work through specific projects. TheInstitute invites a select number of companies to help steer and resource these and other activitiesthrough membership in its Corporate Council.GGGI’s Corporate Council is an invitation-only, geographically diverse group of up to 20 the world’sleading green growth corporations from different economic sectors. These are companies that shareGGGI’s vision and wish to help shape its ambitious strategy to advance the practice and theory ofgreen growth through the creation of sound policy in individual countries and provinces (i.e. rigorousgreen growth economic development plans), a stronger foundation of empirical, policy and theoreticaleconomic research; and bottom-up frameworks of public-private cooperation that remove impedimentsto the scaling of resource-efficient investment, innovation and commerce.

1. DanfossDanfoss, one of the biggest industry companies in Denmark is playing an active and leading role inGGGI’s public-private cooperation work, including with respect to energy efficiency initiatives.

2. VestasVestas Wind Systems A/S, one of the biggest Danish industrial companies as well as a global leaderin the renewable energy industry has been active in discussions with policymakers regarding theneed to create a more conducive enabling environment for the scaling of investment in clean energysolutions.

46

In this context, Vestas is contributing GGGI’s Sustainable Energy Trade Agreement (SETA) researchprojects to support for the creation of a sectoral free trade arrangement for sustainable energyproducts and services that would eliminate tariffs, coordinate standards and perhaps begin todiscipline domestic fossil fuel subsidies. The purpose of SETA project would be to create a tangible,positive incentive within the international trading system for the development and proliferationof low-carbon goods and services, thereby helping to accelerate progress on the mitigation ofgreenhouse gas emissions while promoting economic growth. Among the project partners are thePeterson Institute for International Economics (PIIE), International Center for Trade and SustainableDevelopment (ICTSD) and POSCO Research Institute.

3. PoSCoPOSCO, one the biggest steelmakers in the world, has built an environmental management systembased on ISO 14001 and announced the vision of “Global Green Growth Leader” and CO2 reduction.POSCO wishes to play an active and leading role in a sustainable global development and developingcountry where social responsibility, environmental climate and green growth considerations go hand inhand with sound business developments.GGGI and POSCO aim to cooperate in promoting a transformation toward green growth economyand business in both developing and developed countries. GGGI the company advises in the areasof renewable energy development, smart grid solution development and integration, and greeninfrastructure.In 2012, POSCO and GGGI began working with the Masdar Institute of Science and Technology tobuild a viable model of a micro-grid system in U.A.E.

47

Public-Private Cooperation

InternationalPublic-Private Network

GGGI is broadening its Public-Private Cooperation partnerships with like-minded internationalinstitutions.

Japan Renewable Energy Foundation / SoftbankJapan Renewable Energy Foundation (JREF) is a public interest foundation established in Tokyo, Japanto contribute to the large-scale, urgent and efficient deployment of renewable energy technologies inJapan, Asia and the World with the support of Chairman and CEO of SoftBank, Mr. Masayoshi Son.The mission of JREF is to contribute to an economically efficient deployment of renewable energy,allowing public participation in the development and implementation of energy policies in order toimprove environmental and economic performance of the energy system.GGGI and JREF are to cooperate in joint works on policies and business models for utilization ofrenewable energy, and on international trade in sustainable energy, in particular the infrastructure fortrade in sustainable renewable electricity in order to realize a long-term regional integration of Asiangrid networks.

48

FinancialStatementS(IO-GGGI)December 31, 2012(With Independent auditors’ Report Thereon)49

50

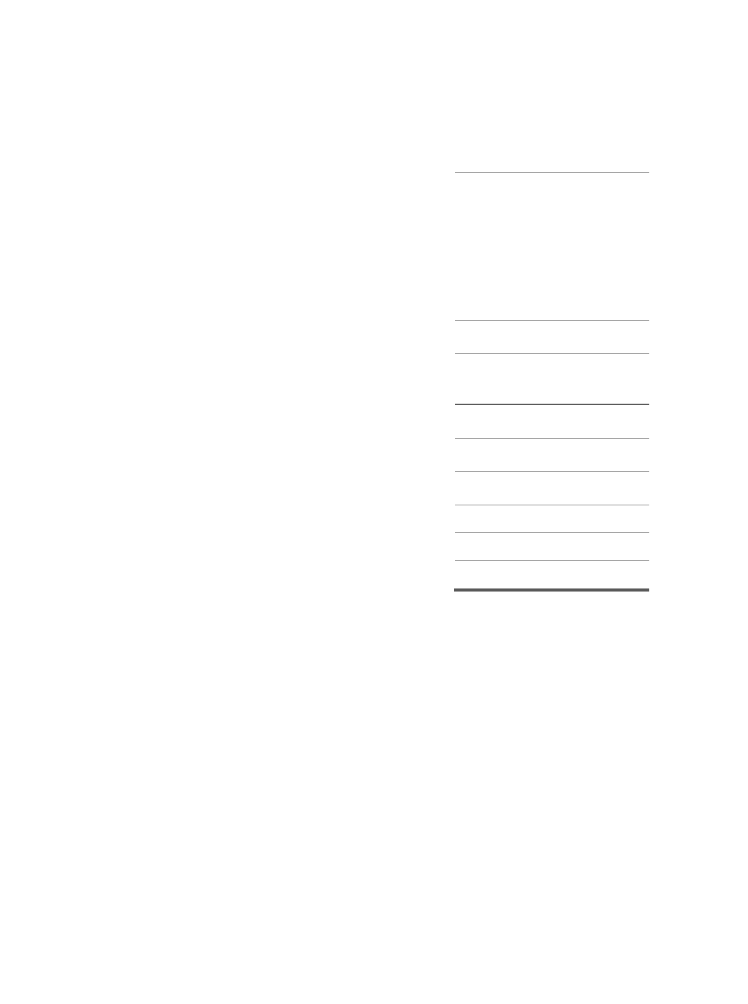

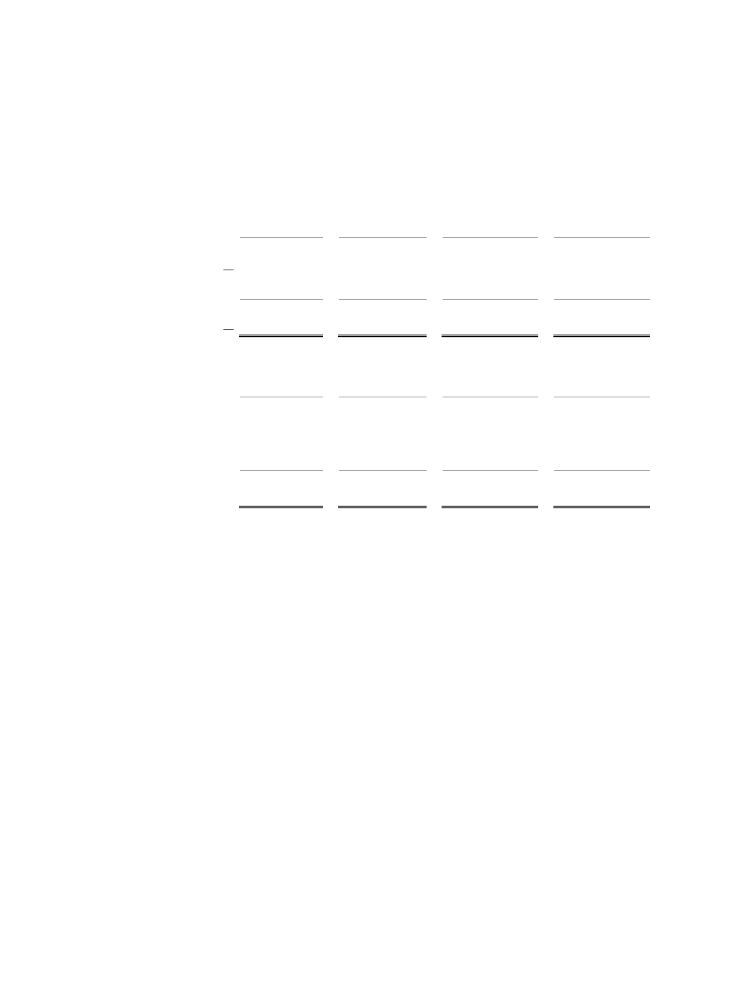

Global Green Growth InstituteAs of December 31, 2012(In USD)

Statement of Financial Position

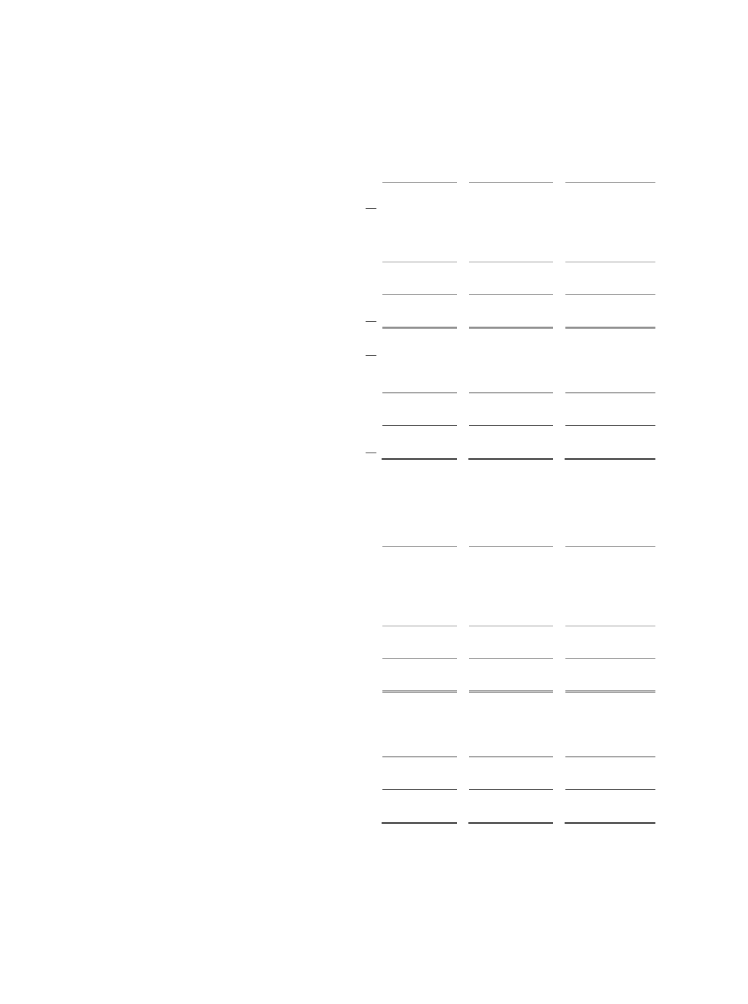

Global Green Growth InstituteAs of December 31, 2012AssetsCash and cash equivalents(In USD)Short-term financial instrumentsAccounts receivableAssetsAccrued incomeCash and cash equivalentsOther current assetsShort-term financial instrumentsTotal current assetsAccounts receivableAccrued incomeProperty and equipment, netOther current assetsIntangible assetsTotal current assetsLeasehold depositsTotal non-current assetsProperty and equipment, netIntangible assetsTotal assetsLeasehold depositsTotal non-current assetsLiabilitiesAccounts payableTotal assetsOther current liabilitiesTotal current liabilitiesLiabilitiesAccounts payableEmployee benefitsOther current liabilitiesTotal non-current liabilitiescurrent liabilitiesTotal liabilitiesEmployee benefitsTotal non-current liabilitiesEquityRetained earningsTotal liabilitiesTotal equityEquityTotal liabilities andRetained earningsequityTotal equityTotal liabilities and equity

Statement of Financial Position

Note

2012

4,5Note5554,51255561275675

$

2012

$

$13,665,673700,2158,197684,399$13,665,673138,420700,21515,196,9048,197684,399564,731138,420113,69115,196,904510,0751,188,497564,731113,69116,385,401510,0751,188,4973,311,01716,385,4012,337,5705,648,5873,311,01736,9292,337,57036,9295,648,5875,685,51636,92936,92910,699,8855,685,51610,699,885

5125812

8

$

16,385,40110,699,88510,699,88516,385,401

$

See accompanying notes to the financial statements.2See accompanying notes to the financial statements.51

2

Global Green Growth Institute

Statement of Financial PositionAs of DecemberGrowth InstituteGlobal Green31, 2012(In USD)

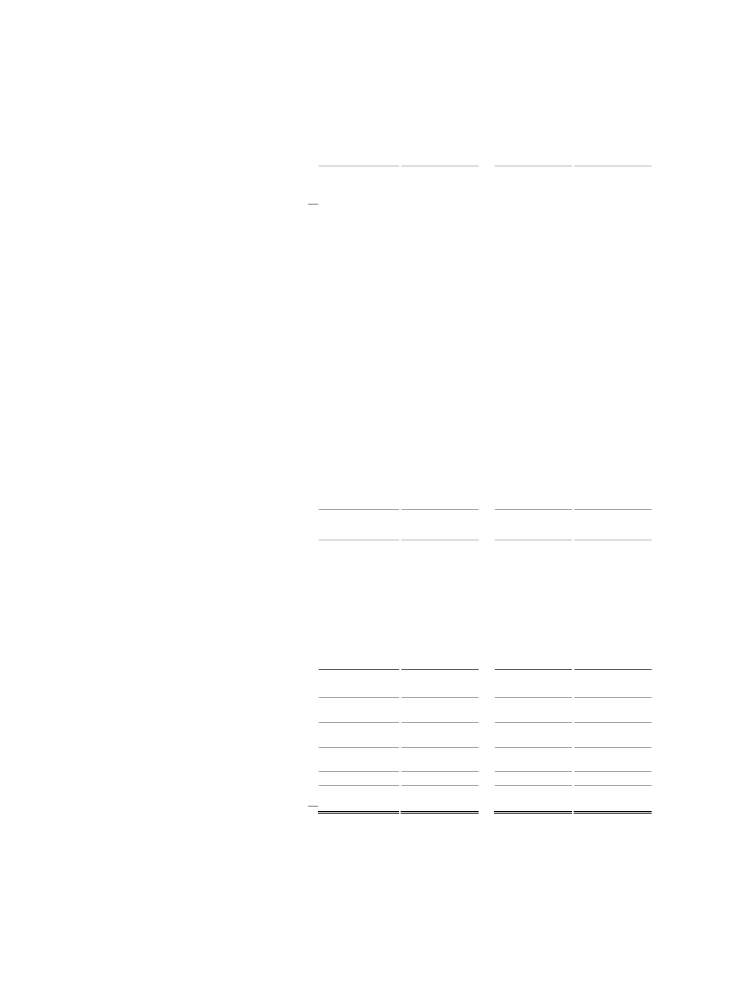

Statement of Comprehensive Income

Note

2012