Beskæftigelsesudvalget 2012-13

BEU Alm.del

Offentligt

-1-

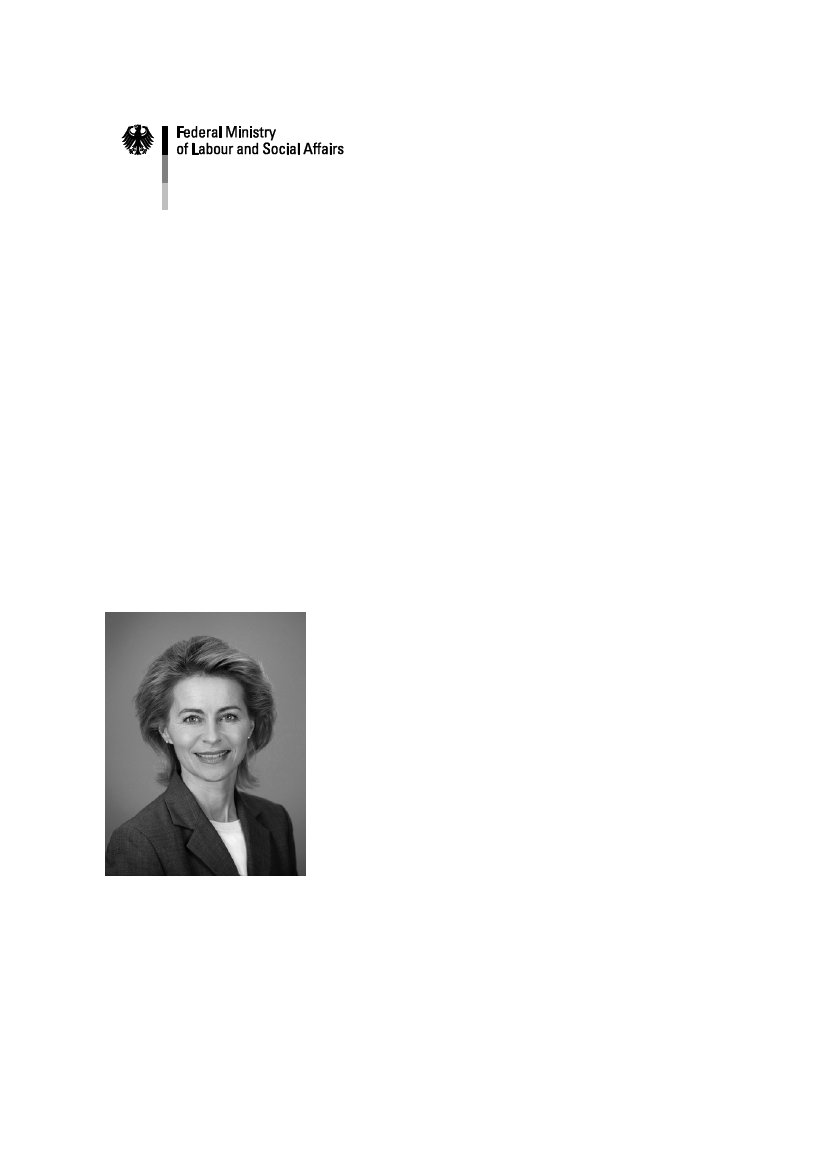

Preface“The Federal Republic of Germany is a democratic and social federalstate.”Article 20 (1) of the German Basic LawGermany is strong because it operates as a social state.The German social security system is one of the best inthe world. It is a locational factor in business because itsupports industry and creates opportunities, not just foremployment and but for participation in society as awhole.

Many generations of women and men have fought hard toachieve what we now take for granted. To ensure thissocial safety net remains tightly meshed, I see it as ourcommon duty to maintain it and adapt it to changing socialconditions.

The social state and the social market economy characterise the Federal Republic ofGermany, make its name ring true around the world and provide a better life for thosewho live here. I want us to work together to ensure it stays that way.

Dr. Ursula von der LeyenFederal Minister of Labour and Social Affairs

-2-

-3-

ContentsChild benefit, federal parental benefit, parental leave,maintenance advance, supplementary child allowanceKindergeld, Bundeselterngeld, Elternzeit, Unterhaltsvorschuss, Kinderzuschlag

Protection of working mothersMutterschutz

Promotion of employmentArbeitsförderung

Basic security benefits for job-seekers(Unemployment Benefit II/Social Assistance)Grundsicherung für Arbeitssuchende

Labour lawArbeitsrecht

Industrial democracyBetriebsverfassung

Co-determinationMitbestimmung

Minimum wageMindestlohn

Health and safety at workArbeitsschutz, Unfallverhütung

Occupational accident insuranceUnfallversicherung

Rehabilitation and integration of people withdisabilitiesRehabilitation und Teilhabe von Menschen mit Behinderung

‘Jobs Without Barriers’ and Job4000Jobs ohne Barrieren, Job4000

Health insurance and the electronic health cardKrankenversicherung und elektronische Gesundheitskarte

-4-

Long-term care insurancePflegeversicherung

Pension insuranceRentenversicherung

Promotion of additional provision for old ageFörderung der zusätzlichen Altervorsorge

Compensation and assistance for war victimsSoziale Entschädigung und Kriegsopferversorgung

Social assistanceSozialhilfe

Housing benefitWohngeld

International social securityInternationale Sozialversicherung

The social courtsSozialgerichtsbarkeit

Social security data protectionSozialdatenschutz

Publisher’s informationImpressum

-5-

Child benefit, federal parental benefit, parental leave,maintenance advance, supplementary child allowanceKindergeld, Bundeselterngeld, Elternzeit, Unterhaltsvorschuss, KinderzuschlagChildren are a wonderful gift, but they do cost money. Food, clothes, education and toysall have to be paid for. Child benefit (Kindergeld) helps parents afford them. It is grantedas a tax refund, primarily to meet the constitutional rule that income is untaxable up to achild’s subsistence level. Any child benefit awarded over and above this amount is paidto support the family.

Your rightsAnyone with children who lives in Germany can claim child benefit. Foreign citizens are also entitled, aslong as they have a valid permanent settlement permit (Niederlassungserlaubnis) or temporary, purpose-specific residence permit (Aufenthaltserlaubnis). Under certain circumstances and according to strictcriteria, mothers and fathers living abroad for a period, say for job-related reasons, can also receive childbenefit, although (as ever, with some exceptions) the state only pays the benefit for children living onGerman soil, in an EU member state or in Switzerland.Important: Only one person can receive child benefit for each child. Parents can choose which of themclaims child benefit for the children living in their household.If the parents are separated or divorced, child benefit is paid to the parent the child lives with. In the caseof children who do not live with their parents, child benefit is usually paid to the person in whosehousehold the children live, or who primarily supports them.

Children you can claim forYou can also claim child benefit for:Your spouse’s children if they live in your householdFoster children if they live in your household, are long-term members of your family, and theirparents no longer have custody over themGrandchildren, if you have taken them into your household. Do you meet any of these criteria? Ifso, you can certainly claim child benefit for any children aged 18 or less.The age limit is 25 for the following:Young people in education or training. A child aged 18 or over in education or training cannormally be claimed for until completion of a first vocational qualification or first degree. Inaddition, child benefit can be claimed, for example, for a child who is still in vocational trainingand does not regularly engage in paid work for more than 20 hours a week. A short breakbetween two education or training stages still counts as education or training.Young people doing a year of voluntary community or environmental service under the YouthVoluntary Service Act (Jugendfreiwilligendienstgesetz), voluntary service in the EU Youth ActionProgramme, other voluntary service abroad under Section 14b of the Civilian Alternative ServiceAct (Zivildienstgesetz), “weltwärts” development service in accordance with the Federal Ministryof Economic Cooperation and Development directive of 1 August 2007, ‘all generations’ voluntaryservice under Book VII of the Social Code, § 2 Section 1a, international youth voluntary service inaccordance with the Federal Ministry for Family Affairs, Senior Citizens, Women and Youthdirective of 20 December 2010 (GMBl. 2010 p. 1778) or federal voluntary service in accordancewith the Federal Voluntary Service Act (Bundesfreiwilligendienstgesetz).Young people unable to start or continue vocational training for want of a training place.Up to the age of 21, young people without employment and registered as job seekers with anEmployment Agency.

Special casesIn certain circumstances, parents can continue to claim child benefit when their children are over 25.

-6-

Child benefit is paid for sons over 25 who are still in education or training and have completedcompulsory military or civilian service, or a period of equivalent service (for example as a developmentworker). The age limit of 25 is then raised by the length of their statutory basic military or civilian service.For example, parents whose son has completed nine months of basic military service can claim childbenefit until he is 25 years and 9 months old.You can continue to claim child benefit for disabled children over 25 if theybecame disabled before this age and cannot support themselves.Orphans receive€184in child benefit a month if no one else can claim childbenefit or equivalent payments for them. The same applies for children whodo not know where their parents are.

How to claimTo claim child benefit, you mustapply for it.The family benefits department(Familienkasse)at your localEmployment Agency(Agenturfür Arbeit)will be pleased tohelp – or if you are in publicservice, your employer’s familybenefits department.The Federal EmploymentAgency(Bundesagentur fürArbeit)website(www.bundesagentur-fuer-arbeit.de) contains a wideselection of forms for downloadand lists the addresses of localfamily benefit offices(Familienkassen).

The lawThe law on child benefit is set out in the Income Tax Act(Einkommensteuergesetz) and the Federal Child Benefit Act(Bundeskindergeldgesetz).

InformationIf you have any questions about child benefit, please contact theFamilienkasse (family benefits department) at your local Arbeitsagentur(Employment Agency).

Tax-free allowance for children and tax-free allowance for child-care,child-raising and vocational trainingIf the child benefit payments do not reach the untaxable subsistence levelfor a child, a tax-free allowance for children (€4,368 a year) and a tax-freeallowance for child-care, child-raising and vocational training (€2,640 a year)are deducted from the parents’ taxable income. The tax relief from theseallowances is decreased by the amount of child benefit already paid out.Whether the total tax relief comes up to the amount required by theconstitution is determined in the course of income tax assessment.

How much child benefityou receiveChild benefit is paid monthly asfollows–€184for each of the first twochildren–€190for the third child–€215for the fourth and eachadditional childChild benefit is paid regardless ofthe parents’ income. Under asystem of tax relief for families,child benefit takes the form of atax refund, a tax-free allowancefor children and a tax-freeallowance for child-care, child-rearing or vocational training.Child benefit is paid throughoutthe year. When assessingincome tax, the tax office checksthat the amount of child benefitpaid satisfies the constitutionalrule on tax relief (in other words,that the parents have receivedenough child benefit to cover thetax refund due to them). If not,their tax bill is reduced by the tax-free allowance for children andthe tax-free allowance for child-care, child-rearing and vocationaltraining, less the child benefitthey have already received. If thiscalculation comes out to theparents’ advantage, the childbenefit payments are left as theystand.Child benefit is paid out by thefamily benefits department oflocal employment agencies andpublic sector employers.

Supplementary child benefitClaimants who have built or purchased their own home can claimsupplementary child benefit (Kinderzulage) for up to eight years, in additionto the normal child benefit, as part of the grants paid to encourage homeownership. Owner-occupiers of homes for which the contract of sale wassigned or which the claimants began building before 1 January 2004 receive€767a year for each child. Claimants who purchased or began buildingsince then but not later than 31 December 2005 receive€800.Because taxconcessions for home owners (Eigenheimzulage) were abolished on 1January 2006, supplementary child benefit is no longer paid to claimantswho build or purchase their own homes. Claimants who were previouslygranted the tax concession for home owners will continue to receivesupplementary child benefit for the remainder of the eight-year period.

Parental leaveParents can only take parental leave (Elternzeit) if they are already inemployment.If they wish, both parents can take parental leave simultaneously for all orpart of the maximum term of three years each per child. Alternatively,

-7-parents may choose to use it solely for the partner months allowed in conjunction with parental benefit(Elterngeld). However, if both parents claim their entitlement at the same time it must be remembered thatthis does not constitute an entitlement to welfare benefit, i.e. the parents must ensure that they canprovide for themselves during the period of joint parental leave. With their employer’s consent, either orboth parents can put off up to a year of their respective parental leave to between the child’s third andeighth birthday. Parents who meet the conditions may work up to 30 hours a week while on parentalleave. Parents are entitled to work part-time for between 15 and 30 hours a week if they have been withtheir employer for more than six months, the employer regularly employs more than 15 people, thereduction in working time to the stated number of hours is to be for at least two months, and there are nocompelling operational grounds opposing the arrangement. Parents have the right to reinstatement oftheir prior working hours on termination of parental leave. The employer must be given seven weeks’notice before the beginning of parental leave. The entitlement to take a reduction in working hours mustbe claimed by giving notification no later than seven weeks before beginning part-time work.Special protection from dismissal begins eight weeks before parental leave starts, or on the date ofnotification if the employer is notified less than eight weeks in advance. It continues until the end of thereported parental leave.

The lawThe law on parental benefit and parental leave is set out in a German-language brochure, ‘Elterngeld undElternzeit’ (‘Parental Benefit and Parental Leave’). Further information is available by calling the serviceline run by the Federal Ministry for Family Affairs, Senior Citizens, Women and Youth, on 030 20179130(9 am to 6 pm).

Maintenance advanceBenefits and conditionsBy way of special help for single parents, the Maintenance Advance Act (Unterhaltsvorschussgesetz)stipulates that a minimum level of child maintenance, less child benefit for the first child, will be paid frompublic funds where children receive no maintenance or no regular maintenance from the other parent.Maintenance advance (Unterhaltsvorschuss) is available for children up to 12 years old, and is paid for amaximum of 72 months. The amount paid is the standard rate of maintenance (as stipulated in Section1612a (1) of the German Civil Code (BGB) less half the child-benefit rate for a first child.Accordingly, the monthly maintenance advance as of 1 January 2010 is as follows:For children aged under 6 years:€133For children aged 6 to 11 inclusive:€180Important: You are barred from claiming maintenance advance as a single parent if you fail to giveinformation about the other parent, or fail to help identify the father or locate the other parent. Thiscontinues to apply if you still live with the other parent or if you remarry.

Supplementary child allowanceParents are entitled to supplementary child allowance (Kinderzuschlag) for each child up to age 25 if:They claim child benefit for the child;They earn at least the minimum income threshold of€900before deductions for a couple or€600before deductions for a single parent;They do not exceed the maximum income limit;The supplementary child allowance prevents need of assistance as defined in Book II of theSocial Code.Supplementary child allowance is limited to€140per child. Supplementary child allowance and the€184a month child benefit together meet the average needs of a child. At the applicable income levels,housing needs are covered by housing benefit.

-8-If the parents’ income or assets just meet their personal subsistence level, the supplementary childallowance is paid in full. Deduction of income from supplementary child allowance begins on reaching theassessment limit. For incomes between the minimum income limit and the assessment limit,supplementary child allowance is normally paid in the full amount. Once the parents’ income reaches theassessment limit, the supplementary child allowance is reduced by 50 percent of the amount by whichtheir earned income – and by 100 percent of the amount by which any other income they may have –exceeds the assessment limit. The extent to which income and assets are taken into account is mostlydetermined as for unemployment benefit II.Children’s income is always deducted in full from the supplementary child allowance.From 1 January 2011, in addition to the maximum of€140per child in cash benefit, recipients ofsupplementary child allowance are also entitled to seven types of education and participation assistance:Single-day school/daycare centre outings (actual cost)Multiple-day school/daycare centre trips (actual cost)Personal school supplies (€100 per year in total)Pupils’ transportation to/from school (actual cost)Learning support (actual cost)Participation in school/daycare centre communal meals (grant)Participation in the social and cultural life of the community, such assports clubs and music lessons (€10 per month)A German-languagepamphlet on parental benefitand parental leave(Elterngeld und Elternzeit) isavailable free of charge from:Publikationsversand derBundesregierung,Postfach 481009,18132 Rostock, Germany.Further information isAvailable at: www.bmfsfj.de

The package includes cash and non-cash assistance. The non-cash parts of the package guarantee thatthe assistance reaches those it is meant for, as assistance for the individual child or adolescent. Theassistance is handled by a single local government agency in each area, ensuring that it is locallyadministered in a targeted, accessible and unbureaucratic way. This ensures that it gets to the childrenwho need it.Supplementary child allowance is applied for in writing from the local family benefits department.The legal provisions are contained in the Federal Child Benefit Act (Bundeskindergeldgesetz).If you have further questions, please contact the family benefits department at your local employmentagency.

The lawThe relevant law is contained in the Federal Child Benefit Act of 28 January 2009 (BGBl. I, 142, 3177) aslast amended by Article 9 of the Act dated 7 December 2011 (BGBI. I p. 2592).

InformationInformation is provided by the Federal Employment Agency’s family benefits offices (Familienkassen).This is also where applications are made. A German-language leaflet on supplementary child allowance,“Kinderzuschlag”, is available free of charge from the Federal Ministry for Family Affairs, Senior Citizens,Women and Youth, 53107 Bonn, Germany.

Federal parental benefitParental benefit is an important source of support for families in the first twelve (or fourteen) months oftheir child’s life. The benefit cushions the loss of earnings after the birth of a child. Parental benefitconsequently makes it easier for mothers and fathers to take a break from or cut down on paid work inorder to take time for a child.

-9-

Conditions for claimingMothers and fathers can claim parental benefit if they:Look after and raise their children from birth themselvesDo not do more than 30 hours’ paid work a weekLive with their children in one householdHave a place of residence or are normally resident in GermanySpouses and civil partners who look after a child from birth can receive parental benefit under the sameconditions even if the child is not their own.Parental benefit is also paid for up to 14 months for adopted children and children taken in with a view toadoption. The 14-month period begins when the child is taken into the household. Any remainingentitlement lapses with the child’s eighth birthday. In the event of the parents’ severe illness, severedisability or death, parental benefit can be claimed by first, second and third-degree relatives (brothersand sisters, uncles and aunts, grandparents and great-grandparents) and by their spouses or civilpartners.There is no entitlement to parental benefit for parents or otherwise entitled couples whose joint taxableincome exceeded€500,000in the calendar year before the birth of the child. For single parents, theentitlement ceases at upwards of€250,000.Under EU law, nationals of other EU/EEA member states and Switzerland can generally claim parentalbenefit if they live or work in Germany.Other foreign nationals can claim parental benefit if their stay is likely to be long-term based on the type ofresidence permit they hold and whether they are allowed to work. Holders of a permanent settlementpermit (Niederlassungserlaubnis) satisfy the conditions for claiming automatically. Holders of a residencepermit (Aufenthaltserlaubnis) only meet the conditions for claiming if they have a German work permit orhave already legally worked in Germany. Holders of a residence permit issued in case of hardship, for theholder’s temporary protection, under a stay of deportation or because of circumstances preventing theholder’s departure can only claim parental benefit if they have been resident in Germany for at least threeyears and are in employment or receiving unemployment benefit.

Benefit amount and durationParental benefit cushions the loss of the income that the parent looking after a child had in the yearpreceding the child’s birth and no longer has following the birth. The benefit replaces 65 percent of a priormonthly income of€1,240or higher, 66 percent of a prior monthly income of€1,220and 67 percent of aprior monthly income of between€1,000and€1,200.For low earners with a monthly income of less than€1,000prior to the child’s birth, the percentage rises up to 100 percent on a sliding scale: the lower theincome, the higher the percentage. The minimum amount of parental benefit is€300and the maximumamount is€1,800.The minimum amount of€300is paid to all entitled parents, even if they were not in employment prior tothe child’s birth. Families with two or more children can receive a bonus equal to 10 percent of theirparental benefit entitlement, or€75,whichever is greater. For multiple births, parental benefit increasesby€300a month for the second and each additional multiple birth child.Each individual parent can claim a minimum of two and a maximum of twelve months’ benefit. A child’stwo parents can claim a total of twelve months’ benefit between them. The benefit is paid for months ofthe child’s life (as opposed to calendar months). The entitlement is supplemented by two additionalmonths’ benefit if both parents claim and their earned income is reduced for two of the months for whichbenefit is claimed.Parental benefit is deducted in full, as income, from unemployment benefit II, social assistance andsupplementary child allowance. However, parents who receive these benefits but were in employmentprior to the birth of their child are entitled to an exempt amount. The exempt amount corresponds to theprior income subject to a maximum limit of€300per month. Up to this amount, parental benefit is notdeducted from these benefits and so remains at the parents’ disposal.

- 10 -

InformationResponsibility for administering parental benefit under the act lies with agencies designated by theGerman states (Länder):Baden-Württemberg: Landeskreditbank Baden-WürttembergBavaria: the local Zentrum Bayern Familie und Soziales (pensions and family welfare centre)Mecklenburg-West Pomerania and Hessen: the local Versorgungsamt (war pensions office)Berlin and Rhineland-Palatinate: the local Jugendamt (youth welfare office)Brandenburg: the Landkreise (district administrations)Hamburg: the local Einwohneramt (citizens registration office)Bremen: the Amt für Soziale Dienste (social services office)Bremerhaven: the Amt für Familie und Jugend (family and youth welfare office)Lower Saxony: the local councilNorth Rhine-Westphalia, Saxony, Saxony-Anhalt and Thuringia: the Kreise/Landkreise andkreisfreie Städte (district administrations and urban municipalities)Saarland: the Elterngeldstelle (parental benefit office) at the Ministry of Labour, Families,Prevention, Social Affairs and SportSchleswig-Holstein: the local offices of the Landesamt für Soziale Dienste (state social services)Further information on parental benefit is provided in a German-languagebrochure, ‘Elterngeld und Elternzeit’ (‘Parental Benefit and Parental Leave’).This is available free of charge from Publikationsversand der Bundesregierung,Postfach 48 10 09, 18132 Rostock, Germany. Email:[email protected]The legal framewor forparental benefit and parentalleave is the Federal ParentalBenefit and Parental LeaveAct (Bundeselterngeld- undElternzeitgesetz). Informationon this is set out in aGerman-language brochure,‘Elterngeld und Elternzeit’(‘Parental Benefit andParental Leave’). Furtherinformation is available bycalling the service line run bythe Federal Ministry forFamily Affairs, SeniorCitizens, Women and Youth,on 030 20179130 (9 am to 6pm).

- 11 -

Protection of working mothersMutterschutzDuring pregnancy, working women and their children need extra protection againstdangers, overwork and workplace health hazards. This protection is provided by theProtection of Working Mothers Act, which forms an essential part of the law on healthand safety. Alongside federal parental benefit and parental leave, the protection ofworking mothers is also an important part of family and social policy.

OverviewAs a working expectant mother, you enjoy special protection from workplace hazards and are protectedfrom dismissal from the beginning of your pregnancy to four months after the birth. Statutory maternityleave of six weeks before and eight weeks after confinement means you can dedicate yourself to yourfamily and recover without the added burden of employment. The statutory period of maternity leave isextended to 12 weeks after a multiple birth and longer after a premature birth (e.g. birth weight under2,500 g) (the portion of leave ‘lost’ due to a premature birth is added to the 12 week extension period).The eight-week statutory leave period is also extended by the portion of leave lost through an earlydelivery.Under certain circumstances, you may receive maternity benefit and the employer’s contribution tomaternity benefit during this period. Eligibility for maternity benefit depends on the type and scope of yourhealth insurance cover. From the birth of the child, parents can claim parental benefit and parental leave(at the same time if so desired). For more information on this topic, please see the Child Benefit, FederalParental Benefit, Parental Leave, Maintenance Advance and Supplementary Child Allowance chapter.With the exception of maternity benefit and the employer’s maternity benefit top-up payment, statutorybenefits for the child are provided as of the birth. If you find yourself in need while pregnant, visit yournearest pregnancy advice centre (Schwangerenberatungsstelle), where you can apply for help from thenational mother and child foundation, Bundesstiftung Mutter und Kind (help is conditional on a theapplication being made before the birth).

Your rights under the Protection of Working Mothers ActProtection from dismissalYour employer cannot normally dismiss you while you are pregnant or within four months of your child’sbirth.Dismissal is only possible in exceptional cases, subject to prior approval of the relevant supervisory body(usually the labour or health and safety inspectorate).Full protection against dismissal was introduced for home helps in 1997.Only the employer is prevented from giving notice. You yourself are free to terminate your employment atany time during pregnancy and the statutory period of maternity leave after the birth. You do not have toserve a notice period, and the termination of employment is effective from the end of the statutory leaveperiod. If you want to terminate your employment at an earlier or later date, however, you must observethe statutory or agreed period of notice.You have further protection from dismissal if you take parental leave at the end of the statutory leaveperiod. This protection begins eight weeks before parental leave starts – or on the notice date if you notifythe employer less than eight weeks in advance – and ends with your parental leave. Exceptions may beallowed in special circumstances. You yourself can terminate your employment in either of two ways:Either with three months’ notice to the end of your parental leaveOr at any time during or after your parental leave, provided that you observe the statutory,collectively agreed or contractual period of notice

- 12 -

Workplace facilitiesAs an expectant or nursing mother you are entitled to a workplace in which youand your child are adequately protected against health and safety hazards. Youremployer must ensure this protection against health and safety risks byproviding you with appropriate workplace facilities, including safe machinery,equipment and tools, and by taking any other precautionary measures that maybe necessary.For example, if you are an expectant or nursing mother and your job requiresthat you stand all the time, under the Protection of Working Mothers Act youremployer must provide you with a place for you to sit down from time to time. If,on the other hand, you are required to sit all the time, your employer must allowyou to take short breaks.

Who is entitled toprotection?The Protection of WorkingMothers Act covers all(expectant) mothers; that is:Full-time workersPart-time workersHome helpsHome workersPublic service part-timeemployeesPeople in marginalemploymentTraineesYour nationality is irrelevant.The only requirement is thatyour place of work must be inGermany.Housewives and self-employed women are notentitled to protection underthe Act (though they canclaim maternity benefit at thesame rate as sickness benefitif they have paid sufficientvoluntary contributions into astatutory health insurancefund). Housewives and self-employed women can,however, claim parentalbenefit (see the Child Benefit,Federal Parental Benefit,Maintenance Advance andSupplementary ChildAllowance chapter). Specialprovisions apply for tenuredcivil servants and soldiers.

Protection has priorityExpectant and nursing mothers are not allowed to perform certain tasks at work.The Act lists a number of generally prohibited activities.Generally, expectant and nursing mothers may not:Perform heavy physical workPerform tasks that expose them to health risks from noxioussubstances, radiation, dust, gases, vapours, heat, cold, dampness,vibration or noiseDo pieceworkDo any other work where pay is linked to working speedDo assembly-line work involving a set working speedPerform tasks that involveRegularly moving or transporting loads over 5 kg, or occasionallymoving or transporting loads over 10 kg, without mechanical aidFrequent and considerable stretching or bendingContinual squatting or stoopingHeightened risk of accident from slipping, tripping or fallingExposure to risks of occupational diseaseWork on machinery or equipment (such as foot-operated machines)whose operation places heavy strain on the feetWork more than 8½ hours a day or 90 hours in any two consecutive weeksWork at night (between 8 pm and 6 am)Work on Sundays or public holidays

There are exceptions to the general ban on night and Sunday working (see ‘Special provisions’, below).Regular work driving transport vehicles is not allowed after the third month of pregnancy. For example,you cannot then drive a bus, lorry or taxi. This also applies to sales representatives who spend more thanhalf their working hours on the road. After the fifth month of pregnancy you may not do work that requiresyou to stand for more than four hours a day unless broken up by periods of sitting or walking.You may also be personally banned from performing certain tasks on medical grounds. Besides theprohibited activities listed above, you cannot continue to perform your usual work without making anychanges if a medical examination shows that doing so would endanger your health or that of your child.Your employer might then assign you other work on the same pay. In certain cases, a reduction inworking time may suffice.A ban on medical grounds is different from a sick note. You will not lose any pay, because you areentitled to maternity pay from your employer (not to be confused with maternity benefit and theemployer’s contribution to maternity benefit during the statutory period of maternity leave), which in mostcases is at the same rate as your average take-home pay. Your employer is refunded this expenditure(pay during maternity leave and the employer’s contribution to maternity benefit) out of contributions paidby all employers.

- 13 -

The lawThe law on the protection of working mothers is set out in the Protection of Working Mothers Act(Mutterschutzgesetz) and in Book V of the Social Code (SGB V). The Farmers Health Insurance Act(Gesetz über Krankenversicherung für Landwirte) also has provisions on maternity benefit. These lawsare implemented by state supervisory authorities.

InformationA German language pamphlet on the protection of working mothers (Leitfadenzum Mutterschutz) is available from the Federal Ministry for Family Affairs,Senior Citizens, Women and Youth, and can be downloaded from theministry’s website at www.bmfsfj.de. Information on protection of workingmothers is also available by calling the service line operated by the FederalMinistry for Family, Senior Citizens, Women and Youth, on 01801 907050from Monday to Thursday (9 am to 6 pm).

A German-languagepamphlet on the protection ofworking mothers (Leitfadenzum Mutterschutz) isavailable free of charge from:Publikationsversand derBundesregierung,Postfach 48 10 09,18132 Rostock, Germany.Further information isAvailable at: www.bmfsfj.de

If you are not insured, please contact the Bundesversicherungsamt (Federal Insurance Office), Friedrich-Ebert-Allee 38, 53113 Bonn; Tel. 0228 619-1888. If you are unemployed, your local employment agency(Agentur für Arbeit) is available to provide information and advice.Depending on your income, you may be able to claim help under the legal aid system from the local court(Amtsgericht).

- 14 -

Promotion of employmentArbeitsförderung

Book III of the German Social CodeAs many people as possible should have work. The employment promotion policies enacted in Book III ofthe Social Code aim to achieve this by improving the earnings prospects of people without work and bymatching up supply and demand on the labour market. These policies are implemented by the FederalEmployment Agency in Nuremberg (Bundesagentur für Arbeit) and its local employment agencies(Agenturen für Arbeit).

Tasks and benefitsThe main tasks of the Federal Employment Agency are:Careers guidance and orientationAdvice on the jobs market in generalJob and traineeship placementImproving people’s chances on the jobs marketIntegrating people into employment in other waysIncome replacement benefitsEmployer guidanceThe Federal Employment Agency provides services both to employees and employers.You are entitled to some of these services whether or not you have paid unemployment insurancecontributions. These include careers guidance and orientation, and job and traineeship placement. Toreceive other help—such as unemployment benefit—you need to have been in work and paying statutoryinsurance contributions in the past.

Advice and placementCareers guidanceCareers guidance targets both young people and adults. It involves the provision of advice andinformation concerning career choice, occupations and the respective requirements, funding options forvocational education and training, important developments in the working world, the situation andexpected trends in the jobs market, and finding a training place or permanent job.For young people wanting to study at college or university, the careers advice officers at localemployment agencies provide a specially designed advisory service for those leaving school with acertificate of higher education (Abitur). They advise on choosing a course of academic study, explain theacceptance requirements and what is expected of students on particular courses, outline the jobopportunities and go through the various funding options. They work with young people to identify theirpersonal goals, employment options and possible alternatives.

Career orientationSystematic career orientation can help people in choosing an occupation and thus positively influence thecareer paths of young and old alike. It can also aid the careers guidance process by providing in-depthinformation on issues concerning career choice, occupations, job requirements and opportunities, routesinto a chosen career path, funding for vocational training and education, and work-related developmentsin business, local administrations and the jobs market in general. The service includes visits to schools totalk with 12th and 13th graders, career orientation events in careers information centres(Berufsinformationszentren, or BIZ) and online and print media published by the Federal EmploymentAgency (BA).

- 15 -

Labour Market Advisory ServiceThe labour market advisory service provided by the local employment agencies targets employers and isdesigned to support them in filling trainee places and vacant positions. Employers are informed about thecurrent situation in the labour market, expected trends and available occupations. They are schooled injob structuring, employment conditions, working hours, on-the-job training and education, and integrationof hard-to-place trainees and employees.

Vocational training and work placementAnyone seeking work can use the services of an employment agency, whether they are unemployed, areabout to lose their job or are looking for a career change. Young people seeking vocational training arealso entitled to assistance. Work placement is the employment agencies’ main task. The remainingbenefits and assistance services for employment promotion are only provided where long-term integrationinto the labour market or the vocational training market cannot succeed without them.As soon as you know when your current employment will come to an end, you are automatically requiredto register in person at your local employment agency. Registration must take place at least three monthsbefore your employment is due to end. If the time between receiving your notice and your last day of workis shorter than three months, you must report to the employment agency no later than three days afterreceiving your notice. To comply with the deadline, you may register by telephone on the condition thatyou make an appointment to register personally afterwards.

Placement assistancePlacement budgetPlacement guidance and assistance provided via the placement budget take a flexible, targeted andneeds-oriented approach to removing potential obstacles while also taking account of the specific needsof people looking for work or vocational training. It is designed to help people looking for a trainingplacement, those facing unemployment and those out of work to find and take up insurable employment.The placement budget thus offers broad scope in promoting individual employment or training prospectsto ensure the right type of assistance is provided in each case. Accordingly, rather than applications forassistance being governed by detailed legal requirements, placement and advisory staff look at eachcase individually to assess the specific type of support and assistance that can be applied for from theplacement budget.Conditions under which placement assistance may be approved:You are facing unemployment, seeking work or are unemployed and wish to take up insurableemploymentYou are looking for a training placement that provides insurable vocational trainingYou are receiving basic security benefits for job-seekers and are wanting to improve youreducational qualificationsYou are eligible to receive assistanceYou need help in overcoming obstacles in seeking and taking up insurable employment orvocational trainingThe amount claimed from the placement budget is commensurate with the services providedThe employer does not provide similar assistanceOther public agencies are not legally obliged to provide similar servicesYou apply for placement assistance before costs are incurredYou understand and acknowledge that placement assistance is a discretionary service to whichyou have no legal right

Guidance and placement assistance may also be provided to help in searching for or taking up a trainingplacement or offer of work in another EU member state, in a Signatory State to the Agreement on theEuropean Economic Area (EEA) or in Switzerland. This is based on the condition of a minimum of 15hours of training or work per week.

- 16 -

Improving prospects for integrationThese measures include training courses and practical activities that aim to improve the prospects ofthose seeking vocational training, the unemployed and those facing unemployment and seeking newwork for integration into the labour market. They can be used to assess a person’s readiness and abilityto work, to identify, alleviate and reduce obstacles to their entering the labour market, to place them in anemployment relationship in which they pay compulsory contributions, assist them in becoming self-employed or stabilise their employment prospects.Costs of taking part in the measures are paid for up to a reasonable amount. Unemployment benefitcontinues to be paid if the person is entitled to it.The duration of the measures provided must be commensurate with their purpose and content. Themeasures may also be provided by employers, either in whole or in part, up to a maximum period of sixweeks.Participation is proposed or approved by the local employment agency. The employment agency cancommission providers to carry out measures directly or issue the entitled person with an activation andplacement voucher. The decision is made by the employment agency based on the aptitude and personalcircumstances of the entitled individual and the measures available in the local area. In somecircumstances, unemployed persons are entitled to an activation and placement voucher allowing them touse a private job placement service at the employment agency’s expense.

Help becoming self-employedStart-up grantsHow to claimWorkers who end their unemployment by taking up self-employment as a main occupation may receive astart-up grant (Gründungszuschuss) to cover living expenses and social insurance contributions for thefirst few months of self-employment.The start-up grant can be made available to workers who still have at least 150 days’ entitlement tounemployment benefit on entering self-employment. To qualify for the grant, applicants must demonstratethat they have the necessary knowledge and skills to carry out the occupation concerned. They must alsopresent to the employment agency a statement from a knowledgeable authority that their self-employment is potentially sustainable. This statement can be provided by various bodies, includingchambers of commerce, guilds, industry associations and banks.A start-up grant is not made available if there are or would be grounds for the applicant’s entitlement tounemployment benefit to be suspended under sections 156-159 of Book III of the German Social Code(SGB III). Claimants who reach pensionable age for a standard old-age pension while still receiving thegrant cease to receive it from the beginning of the next month. The grant is not available for 24 monthsafter the end of a grant of assistance with entering into self-employment under SGB III.

Amount and durationThe start-up grant is paid out in two phases. For the first six months, self-employed start-ups can receivea grant matching their last unemployment benefit to cover living expenses plus€300a month for socialinsurance. The€300a month for social insurance can be paid for a further nine months if the claimantcan demonstrate that they are actively trading and working for the business on a self-employed basis astheir main occupation.

Initial financial supportIndividuals who are entitled to assistance and claim basic security benefits for job-seekers under Book IIof the Social Code (SGB II) can receive initial financial support (Einstiegsgeld) to help them enter self-employment as a primary occupation or an employment relationship in which they pay compulsorycontributions. The support is provided by the local job centre.

- 17 -

How to claim/amountThe initial financial support can be granted as a supplement to basic security benefits for job-seekers ontaking up self-employment as a primary occupation or an employment relationship in which compulsorycontributions are paid. There must be reasonable grounds to expect that the employment or self-employment will remove the need for assistance.The amount of initial financial support is based on factors such as the length of unemployment and thesize of the claimant’s household. The amount therefore varies from case to case. The grant is made for amaximum of 24 months. There is no legal entitlement to initial financial support.

Other assistance for self-employed individualsIndividuals who are entitled to assistance and who take up self-employment as a primary occupation canalso receive loans or grants for the purchase of material resources (grants are limited to a maximum of€5,000).The material resources must be necessary and reasonable for the form of self-employment inquestion. Individuals who are entitled to assistance and are self-employed can also receive assistance forexternal advice and training in order, for example, to place the self-employed business on a more stablefooting or to effect a change in focus. The assistance is, however, subject to the self-employment beingeconomically viable. There is no legal entitlement to the assistance.

Choice of occupation and vocational trainingPromotion under Book III of the Social Code (SGB III)Choosing the right occupation is a difficult challenge for young people. Support in the choice of career istherefore decisive in ensuring a successful transition from school to vocational training and work. Initialvocational training in particular is becoming increasingly important in the jobs market due to the sharpdrop in the number of jobs available for unskilled and semi-skilled workers. Employment promotionpolicies thus offer a variety of opportunities to assist young people in their search for vocational training:

Career orientation eventsEvents can be held to provide secondary schools students with in-depth career orientation and help withpreparing to choose a career. At least 50 percent of the cost must be met from another source. For fourweeks in the school holidays, students can gain a detailed insight into the various occupations, what theyrequire and their prospects. When planning the events, it must be ensured that they meet requirementsfor students with special educational needs and severe disabilities.

Integration supportSeamless transition from school to vocational training is the best start to working life. Providing one-on-one support, integration assistants help secondary school students with support needs for a periodbeginning two years prior to the date of school leaving exams and usually ends six months aftervocational training begins. If the transition into training takes longer, the support is extended up to amaximum of 24 months after the student leaves school. To enable as many young people as possible tomake this transition, the German government’s Act to Improve the Chances of Integration in the LabourMarket (Gesetz zur Verbesserung der Eingliederungschancen am Arbeitsmarkt) makes an integrationprogramme initially run as a pilot scheme at some 1,000 secondary schools available nation-wide andpart of an indefinite service to be provided under Book III of the Social Code. The program is nowestablished as a transition aid for secondary school students with support needs.In light of the fact that responsibility for integration support is shared between the Federal and Länder(state) governments, third-party co-financing in the amount of 50 percent will be needed in future,whereby the German states will be largely responsible in this regard.

- 18 -

Pre-vocational training schemes (BvB)Young people who are unable to enter into vocational training for whatever reason can be given grants byemployment agencies to take part in pre-vocational training schemes. These serve career orientation,career choice and targeted preparation for vocational training.In future, co-financing of small-scale, production-oriented measures will be available for pre-vocationaltraining schemes.Under the pre-vocational training scheme, young people who have left school have a right to receivesupport in pursuing further education to attain a school leaving certificate (Hauptschulabschluss).

Entry qualificationsEntry qualifications received in initial practical training give young people with limited placementopportunities new perspectives for entering into vocational training. They also build bridges for youngpeople who do not yet have the skills required for entry into a vocational training or who have learningdifficulties or are socially disadvantaged.

Type of scope of promotionUnder the programme, employers who take on young workers in a pre-vocational training position forbetween six and twelve months receive€216per month plus a combined amount for social insurance.

Vocational training grants (BAB)RequirementsYoung people taking part in pre-vocational training schemes and those in vocational training may receivea vocational training grant if the resources they need to cover their living expenses are not alreadyprovided elsewhere. This support is similar to Federal Education Assistance (BAföG) but is financed fromsocial insurance contributions. The Federal Employment Agency offers vocational training grants(Berufsausbildungsbeihilfe) to trainees who are unable to live at home with their parents during theirtraining because the training venue is too far away.Under certain circumstances, vocational training grants (BAB) may be provided for a subsequent courseof vocational training where it is considered appropriate. Despite having completed their vocationaltraining and possessing the associated qualifications, some young people still lack employmentopportunities in their chosen occupation. A second course of vocational training that would improve theiremployment prospects should not be jeopardised because a young trainee or apprentice lacks thefinancial means to cover their living expenses.Since 1 January 2009, foreigners who have a temporary suspension of deportation (‘Duldung’) and areresident in Germany may receive assistance while receiving on-the-job vocational training with anemployer provided that they have been in the country either legally or subject to permission to remain(‘Aufenthaltsgestattung’) or to temporary suspension of deportation for at least four years withoutinterruption.

Type and scope of promotionThe amount of the grant depends on the type of accommodation involved, the amount of pay the traineereceives and the annual income earned by the trainee’s parents, spouse or civil partner. In some cases,living expenses, travel expenses, child care costs and outlay for educational materials and workingclothes can be taken into consideration on a lump-sum basis.Vocational training grants are also used to promote participation in pre-vocational training schemes. Insuch cases, course costs, travel expenses, child care costs and outlay for educational materials andworking clothes are reimbursed directly regardless of how much the trainee earns.

- 19 -

Educational supportIn certain circumstances, trainees can receive additional educational support in the form of additionaltuition or social education assistance during vocational training in a company or while working towardsentry qualifications.

Vocational training in training institutesYoung people who for reasons relating to their own person are unable to enter into a traineeship with acompany can receive additional help in commencing and even completing vocational training in a state-recognised training occupation at a training institute and thus gain a recognised vocational qualification.

Promotion of further vocational trainingHow to claimIf you take part in further training activities, you can claim a vocational training grant ifYou are unemployed and further vocational training will assist your integration into the labourmarket, is necessary to avoid possible unemployment or if it becomes apparent that training isneeded to compensate for a lack of initial vocational training.You have taken part in an advisory session at the employment agency prior to trainingThe training measures are approved and the training provider is accredited.

Type and Scope of PromotionEducation vouchers (Bildungsgutschein) are issued to all entitled workers. The voucher is usuallyallocated for a specific educational goal and is limited to a particular geographic area. It allows anyoneinterested in further training to choose an accredited training provider offering the appropriate form oftraining. The employment agency provides information on available occupational training measures (forexample via the KURSNET online database). Selection of the actual accredited training provider liessolely with the voucher holder. The education voucher must be handed over to the training provider whobills the employment agency directly.If you enter into further training, the employment agency can assume the following costs:Course costs (course fees, including the costs of educational materials, working clothes, examfees for state or generally recognised interim and final exams, partial exams) and any costsarising from having to take part in aptitude testing (say a health check) prior to starting thetraining course.Travel expensesAccommodation and meals expenses at a training centre that is too far away for you to live athome.Child care costs (€130 per child).

Special vocational training schemes are also in place for people already in work.

1. Further on-the-job training for low-skilled and older workers (WeGebAU) isavailable for:Low-skilled workers with no school qualifications or with school qualifications but who were eithertrained on the job or perform unskilled work and have done so for at least four years and can nolonger work in the job they originally trained for. Periods in unemployment, child-rearing or caringfor a relative are taken into account.Workers aged 45 and over who are employed by an employer with a workforce of less than 250provided that the employer continues to pay wages for the duration of the training.Until the end of 2014, all other workers who are employed by an employer with a workforce ofless than 250 provided that the employer both continues to pay wages and also meets at least 50percent of the cost of the training.

- 20 -

Further training measures can involve those which:Provide knowledge and skills which can generally be used in the employment marketLead to a recognised occupationConclude with a certified partial qualification or a cross-industry or cross-sectoral qualificationEmployees wishing to take advantage of the scheme receive education vouchers which allow them tochoose from recognised further education and training courses.Assistance takes the form of the cost of training being met in full or part. In the case of low-skilled workerswho are released from work with full pay, the employer receives a grant to help cover the employee’s pay.

2. Training while receiving transfer short-time allowanceThe Federal Employment Agency can make use of European Social Fund resources to meet the cost ofparticipation in training for workers receiving transfer short-time allowance. The facility is provided forclaimants of transfer short-time allowance who are registered with their local Employment Agency asseeking work and for whom skills deficits have been identified in measures to determine integrationprospects.The cost of training courses is funded provided it is reasonable and the employer makes a suitablecontribution towards funding. If travel costs are incurred, trainees can be granted a travel allowance of€3each per day of training provided that the employer/transfer entity takes charge of accounting and payout.Further information about this training scheme is available from the employers’ service office at localemployment agencies.

Labour market support for people with migrant backgroundsAll forms of integration assistance under Book II and Book III of the Social Code are generally available topeople with migrant backgrounds provided the legal requirements are met for being allowed to take upemployment. To provide people with migrant backgrounds with better access to labour market policyinstruments, the Federal Ministry of Labour and Social Affairs, the Federal Ministry of Education andResearch and the Federal Employment Agency began in mid-2011 to expand the “Integration durchQualifikation (IQ)” (“Integration through Training”) funding programme into a national structure of regionalnetworks. One of the main tasks of the regional networks is to provide training to enhance the interculturaland immigration-related skills of counselling staff at local services (such as employment agencies and jobcentres) and to link up the various forms of assistance available in each region into a process chain. Theregional networks also provide a supporting framework for implementation of new legislation to improvethe assessment and recognition of foreign occupational qualifications that entered into force on 1 April2012. This involves the creation of regional points of contact to provide initial information, to help peopleseeking recognition of their qualifications find the recognition authority responsible for them, and to referthem to other local advice services.

Advancing the labour market participation of people with disabilitiesUnder Book III of the German Social Code, people with disabilities are individuals whose prospects ofparticipating or continuing to participate in the labour market are substantially impaired, other thantemporarily, on account of a disability as defined in Section 2 (1) of Book IX of the German Social Codeand who consequently need help participating in the labour market, including people with learningdisabilities. People at risk of disability with like consequences are deemed equivalent to people withdisabilities. Under Section 2 (1) of Book IX of the German Social Code, a person has a disability if theirphysical ability, mental capacity or psychological health is likely to be impaired for longer than six monthsto the extent that they deviate from that typical for the person’s age and thus hinder their participation insociety. They are deemed at risk from disability if such impairment is anticipated.The range of general support provided under SGB III with regard to labour market participation of peoplewith disabilities comprises:Activation and occupational integration assistancePre-training and vocational training support, including vocational training grants

- 21 -Occupational further training supportHelp becoming self-employed

Provision is also made for special measures promoting the participating of disabled people in working lifewhere needed due to the nature or severity of disability or to ensure that integration is successful. Forexample, initial and further vocational training can be provided in specially equipped rehabilitationcentres. Under Book III of the German Social Code, promotion of initial and further vocational trainingmay also take place in a workshop for the disabled.Employers can receive support in helping disabled and severely disabled people to integrate:Integration subsidy (see the Integration Subsidies section) and subsidies to reimburse the costsof vocational trainingTrial or pre-employmentWork aids

With Germany’s Supported Employment Act of 22 December 2008, a new instrument was introduced topromote the integration of disabled and severely disabled persons into the jobs market.Individuals who because of their disability and despite making use of all available support to compensatefor their disadvantages are unable to enter into vocational training, supported employment can result inthem being placed in work. Under supported employment, disabled persons with special assistanceneeds are placed in new job opportunities that meet their abilities and leanings. In line with the principle of‘placement first, training second’, they are trained and supported on the job with the ultimate aim of thembecoming permanently employed with the respective employer. This provides new opportunities on thegeneral employment market.The benefits and services governed by Section 38a SGB IX take in individual in-house training andsupported employment. In-house training is possible for a period of two and no more than three years.The provision of non-work-related learning materials, key skills and measures towards personaldevelopment are integral components of the training provided. Participants are covered under the socialinsurance scheme. Contributions are paid by the integration services, usually the employment agency. Ifcontinued support is necessary following integration into an employment relationship in which theemployee pays compulsory contributions, it is usually provided by the integration offices in the form ofsupported employment.

Wage replacement benefitsUnemployment BenefitTo receive unemployment benefit (Arbeitslosengeld), you must:be unemployedhave personally registered as unemployedhave completed the qualifying periodbe actively seeking work and be available for work.You are classed as unemployed if you have no work at all or if you work for less than 15 hours a week foran employer or on a self-employed basis.To register as unemployed you must visit the employment agency in person and report that you havebecome unemployed; you cannot register by phone or by post. You can register for a maximum of threemonths, and must renew your registration before it expires if you are likely to remain unemployed.To complete the qualifying period, you must accumulate at least twelve months (360 days) of FederalEmployment Agency contributions, either by working or otherwise (for example, by claiming sicknessbenefit), within the timeframe of the last two years.From 1 February 2006, anyone who provides home nursing care for a dependant, is self-employed for atleast 15 hours per week or is employed outside Germany in a non-EU country or in a country notassociated with the EU, may make voluntary unemployment insurance contributions. This gives people

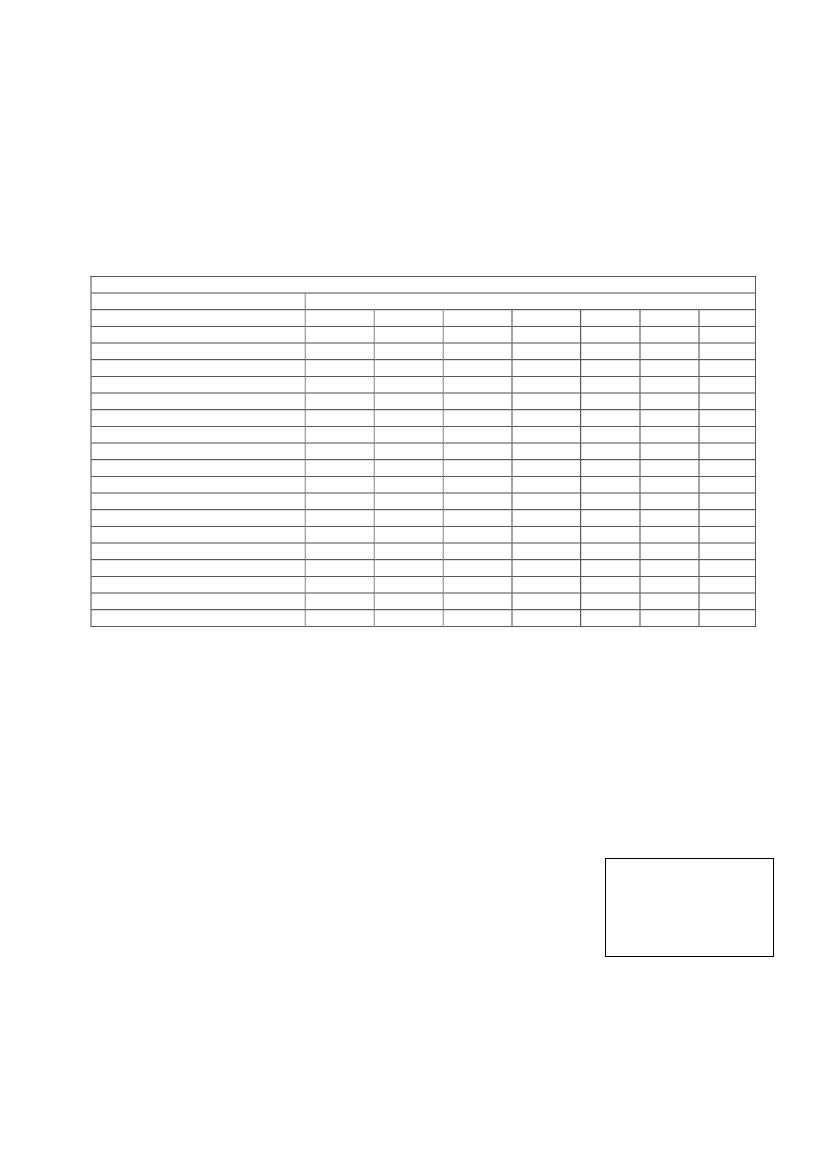

- 22 -who are not required to pay mandatory contributions the opportunity to pay a voluntary contribution tosafeguard their entitlement to unemployment benefit. The applicant must, however, have paid mandatorycontributions at an earlier date.The amount of unemployment benefit you receive is based on your average weekly pay on whichstatutory insurance contributions were levied in the last year before becoming eligible to claim (theassessment period).The resulting gross earnings figure (gross assessed earnings) is then subject to deductions at a fixedrate. These deductions take the form of social insurance contributions in an amount of 21 percent of yourgross assessed earnings, income tax and solidarity tax.Your unemployment benefit is 67 percent of your net assessed earnings (gross assessed earnings afterdeductions) if you have at least one child who you can claim tax relief for, and 60 percent if you do not.How long you can claim unemployment benefit for depends on your age and how long you have been incontributory employment within the reference period (which has been extended by three years) and yourage at the time you became unemployed.Entitlement periods:Minimum time payingcontributions12 months16 months20 months24 months30 months36 months48 monthsAgePeriod of entitlement6 months8 months10 months12 months15 months18 months24 months

505558

Any entitlement to unemployment benefit expires if you complete anotherqualifying period. Any remaining entitlement is then added to the newentitlement, up to the maximum period for your age.While you are drawing unemployment benefit, the employment agency pays your statutory healthinsurance, long-term care insurance and pension contributions. The benefit is transferred at the end ofeach month onto a bank account you specify.

Short-time allowanceIf an employer temporarily cuts working hours and puts the workforce on short time because business isslack or due to an unavoidable event, the local employment agency pays a short-time allowance(Kurzarbeitergeld) subject to the meeting of statutory requirements. The main purpose of short-timeallowance is to keep workers in employment and avoid redundancies despite a lack of work.You can claim the short-time allowance if:You are on reduced pay or receive no pay at all due to a cut in working hoursThe cut in working hours is temporary and substantialPersonal requirements have been met (especially in the case of non-terminated, insurableemployment)The employer or works council reported the cut in hours in writing without delay to the localemployment agency

A cut in working hours is deemed substantial if:It is caused by economic reasons, such as an economic slowdown, or an unavoidable event(such as flooding)It is temporaryIt is unavoidable

- 23 -During the period of eligibility (the current calendar month), at least one-third of the employees inthe company concerned received 10 percent less pay due to a cut in working hours. The loss ofpay can also amount to 100 percent of the monthly gross wage.

A cut in working hours is temporary if there is a certain probability of a return to full-time working withinthe period for which the allowance is granted.A cut in working hours is deemed avoidable if:It is normal for the sector or workplace or is seasonal, or is solely for organisational reasonsIt can be avoided by granting paid leave, provided that it does not conflict with higher-priorityemployee preferences regarding when to take leaveIt can be avoided by exploiting flexible working hours arrangements permitted at the workplace inquestionThe allowance is usually paid out by the employer and refunded by the local employment agency onapplication by the employer or works council.The size of the short-time allowance is based on the amount of pay lost, net of deductions. You normallyreceive 60 percent of the net pay lost. If at least one child lives in your household, the short-timeallowance is 67 percent of the net pay lost. The difference in net pay is calculated on the basis of thegross pay that would have been received had there not been a cut in working hours and the actual grosspay received as a result of short-time work and in line with the provisions of applicable law (Verordnungüber die pauschalierten Nettoentgelte für das Kurzarbeitergeld). The difference between both netamounts is paid out as short-time allowance in amount of 67 or 60 percent. The calculation does not takeaccount of any changes in the agreed working hours made under collectively bargained guaranteedworking hour agreements.The allowance is granted for a statutory period of six months. This can be extended by order of theFederal Ministry of Labour and Social Affairs. For claims submitted on or before 31 December 2013, theperiod of entitlement is 12 months.How to claimShort-time allowance is paid at the request of the employer or the works council. The application must besubmitted to the responsible Employment Agency within a period of three months. The three-monthperiod begins at the end of the calendar month (entitlement period) containing the days for which short-time allowance is claimed.

Insolvency allowanceInsolvency allowance (Insolvenzgeld) is paid if your employer becomes insolvent and you have notreceived all outstanding pay.You can claim insolvency allowance if you are owed pay from the last three months you worked: beforeinsolvency proceedings started, before a petition to start insolvency proceedings was dismissed onaccount of insufficient assets, or if your employer has not filed for insolvency and manifestly does nothave sufficient assets to do so, before your employer finally ceased trading in Germany.Insolvency allowance covers outstanding net pay if your gross earnings do not exceed your grossassessed earnings (2013:€5,800in western Germany and€4,900in eastern Germany). The employmentagency also pays outstanding mandatory social insurance contributions (health, pension and long-termcare insurance) and unemployment contributions for the last three months.

Insolvency allowance must be applied for at the relevant local employment agency within a limitationperiod of two months after before insolvency proceedings started, before a petition to start insolvencyproceedings was dismissed on account of insufficient assets, or if your employer has not filed forinsolvency or before your employer finally ceased trading.

- 24 -

Seasonal short-time allowance: Promoting all-year work in the building tradeSeasonal short-time allowance can be claimed by employees during the bad-weather season (1December to 31 March) if:They work for a building and construction companyThe reduction in working hours is significantBoth company and individual requirements for eligibility are metThe cut in working hours has been reported to the responsible Employment Agency

A building and construction company is a company which primarily provides commercial building andconstruction services in the building and construction sector. Building and construction services are allservices involved in the construction, maintenance, repair, modification and demolition of buildings andother structures. Eligible companies and non-eligible companies are listed in the regulations on winteremployment in the building and construction sector (Baubetriebe-Verordnung). Eligible companies includethe primary building and construction trade, the roofing trade, the scaffolding trade and the landscapegardening trade.To be eligible, a company must employ at least one employee.A cut in working hours is deemed significant when it is of temporary nature and cannot be avoided due tobad weather, economic reasons or an unexpected event beyond the company’s control.Avoidable cuts in working hours include:Those caused solely as a result of business administrationThose which could be avoided by granting paid holiday where the employee’s primary holidayplans remain unaffectedThose which could be avoided if the company made use of authorized fluctuations in workinghours

If, since the last bad weather season, credits on flexible working hour accounts which are less than a yearold have been used for other purposes than to compensate for loss of pay due to a cut in working hourscaused by bad weather or because an employee was released from work for training reasons, cuts inworking hours equal to the amount accrued on the flexible working hour account are deemedunavoidable. Cuts in working hours which are customary in the industry or the company or are weather-related are deemed unavoidable.Weather-related cuts in working hours occur when the cut is exclusively caused by serious weatherevents and at least one hour of regular working time is lost in a given working day.Employees wanting to claim seasonal short-time allowance must fulfil the individual requirements.Seasonal short-time allowance is paid for the duration of the cut in working hours during the bad weatherseason (1 December to 31 March), meaning for a maximum period of four (4) months.Periods in which an employee receives seasonal short-time allowance are not counted towards the periodof eligibility for short-time allowance. Nor are they counted as a break which would lead to the start of anew eligibility period.The amount of seasonal short-time allowance is subject to the provisions which apply to short-timeallowance.Seasonal short-time allowance is paid out on application from the employer or works council. Applicationsmust be submitted within three months to the responsible Employment Agency. The three-month periodbegins as soon as the month containing the days for which seasonal short-time allowance is claimed hasthexpired. Seasonal short-time allowance should ideally be claimed no later than the 15 of the followingmonth. Applications must be submitted to the Employment Agency in the district in which the employer’spayroll office is located.

- 25 -Apart from an entitlement to seasonal short-time allowance, employees may also claim supplementarybenefit in the form of an additional winter allowance (Zuschuss-Wintergeld) and a winter expensesallowance (Mehraufwands-Wintergeld). Building and construction workers may claim a refund of theemployers’ social insurance contributions where such payments are made from a transfer fund. Thesupplementary benefits are not paid from contributions to the unemployment insurance fund, and are onlypaid in relation to employment relations that cannot be terminated on grounds of bad weather during thebad weather season. This means that supplementary benefits may be paid to trade employees, but not towhite-collar workers or polishers.Additional winter allowance (Zuschuss-Wintergeld) is paid in amount up to€2.50per lost hour of work ifthe employee’s flexible working time account is used to compensate for the lost hours and a claim forseasonal short-time allowance is avoidedWinter expenses allowance (Mehraufwangs-Wintergeld) is paid in an amount of€1.00for each eligibleworking hour worked by trade employees working at a weather-dependent location between 15December and the last day of February. Up to 90 working hours can be claimed in December, and up to180 hours in January and February.The employees’ contribution to social insurance for recipients of seasonal short-time allowance may bereimbursed upon application. The supplementary benefits are paid on application by the employer or theworks council. The period of eligibility begins immediately the calendar month containing the days forwhich supplementary benefits are claim has expired. Supplementary benefits should ideally be claimedthon or before the 15 of the following month. Applications should be submitted to the Employment Agencyin the district in which the employer’s payroll office is located.

Transfer benefitsTransfer benefits provide support during workforce adjustments following changes in a business. Thepurpose of transfer benefits is to improve the prospects of finding new employment for employeesaffected by layoffs. The aim is preferably a transfer directly from job to job without an intervening periodclaiming unemployment benefit.The decision to deploy transfer payments is the responsibility of the employer and the works council, andis taken in negotiations on a reconciliation of interests or social plan. Generally, the purpose of a socialplan is to agree on financial compensation for the losses to employees resulting from changes in abusiness (severance pay etc.).Transfer benefits aim to incentivise employers, alongside severance payments, to take an active part inthe process of reintegrating employees at risk of unemployment. Employment promotion policies makeprovision for two types of support for this purpose: Transfer programmes and transfer short-timeallowance.Entities administering transfer programmes and transfer companies in which transfer-short-timeallowance is paid must obtain authorisation as providers of benefits under Book II of the Social Code byor before 1 January 2013. Employers who establish an internal transfer company under their ownadministration do not need this authorisation.

Transfer programmesUse is made of the notice period to prepare employees affected by a change in their employer’s businessfor transfer to subsequent employment. Transfer programmes include aptitude assessment, outplacementadvice, application training, short training courses, and advice and support for becoming self-employed.Workers at risk of unemployment due to a change in their employer’s business or on completion ofvocational training are entitled to funding to take part in a transfer programme if:The employer and the works council have obtained advice from the employment agency beforedeciding to establish a transfer programmeThe programme is carried out by a third party and the employer makes a suitable financialcontribution

- 26 -The purpose of the programme is to help integrate workers into the labour marketIt is ensured that the programme will be put into effect

The employer’s commitment to provide funding can be made under a social plan or by other collective orindividual agreement. Support is generally provided for all employees, with no minimum size restriction onthe establishment in which they are employed.A grant is made in the amount of 50 percent of necessary and appropriate programme costs up to amaximum of€2,500per case. Other forms of active employment promotion assistance with similarobjectives cannot be granted during participation in a transfer programme. From 1 April 2012 to 31December 2014, programme costs can include a lump-sum success fee for placement in employmentthat lasts at least six months and in which mandatory contributions are payable. The success fee cannotexceed€1,000and is payable only once per supported employee.

Transfer short-time allowanceThe objective of transfer short-time allowance (Transferkurzarbeitergeld) is to enable workers to betransferred from their existing employment to other employment without an intervening period ofunemployment.Transfer short-time allowance can generally be granted with employees remaining under the sameemployer or under an external (transfer) company (Transfergesellschaft). For reasons concerning labourlaw, the external solution is usually preferred. Employees affected by layoffs are brought under a transfercompany under a three-party contract.While claiming transfer short-time allowance, the transfer company or employer must offer the employeesother work opportunities and if appropriate must take action to improve their integration opportunities (forexample by providing training). The cost of training measures may be subsidised with the aid of theEuropean Social Fund (ESF).The amount of transfer short-time allowance is the same as that of short-time allowance. The maximumperiod of entitlement is 12 months. Transfer short-time allowance is generally paid out by the transfercompany or employer and refunded by the responsible employment agency on application from theemployer or works council.General requirementsWorkers are entitled to transfer short-time allowance if:A major change in their employer’s business causes them to suffer a sustained unavoidable lossof working time and payCertain organisational and individual requirements are metThe employer and the works council have obtained advice from the employment agency beforedeciding to claim transfer short-term allowanceThe sustained loss of working time is reported to the employment agency by the employer orworks council

There is no entitlement if employees are merely temporarily brought under an organisationallyindependent unit before occupying a position in the same or another workplace belonging to the sameenterprise or, if the enterprise is part of a group, in a workplace belonging to another group company.Public-sector employees are also excluded with the exception of employees of enterprises incorporatedas independent entities and run on a for-profit basis.

Individual requirementsWorkers are only entitled to transfer short-time allowance if:They are under threat of unemployment

- 27 -After commencement of the loss of working time and pay, they continue an employmentrelationship in which they pay mandatory contributions or take up such employment at the end oftheir vocational trainingAre not excluded from claiming short-time allowanceBefore being transferred to an organisationally independent unit, have registered with theemployment agency as looking for work and have taken part in a measure to assess theirintegration prospects