Udenrigsudvalget 2012-13, Skatteudvalget 2012-13

URU Alm.del Bilag 66, SAU Alm.del Bilag 78

Offentligt

Invitation to Concord Denmark High Level Conference

Tackling Tax Havens and Illicit Financial Flows- How the EU and Nordic Countries can take the leadIllicit financial flows, such as tax evasion, tax avoidance and lack of transparency in tax havens, are majorconcerns for all countries – developing and developed.Concord Denmark’s high level conference“Tackling Tax Havens and Illicit Financial Flows – How the EU andNordic Countries can take the lead”gather international capacities in the area of taxation and developmentsuch asthe EU Commissioner for Taxation Mr. Algirdas Šemeta, International Director of Tax JusticeNetwork Mr. John Christensen,Director of the OECD Centre for Tax Policy and Administration Mr. PascalSaint-Amans,andNorway’s State Secretary for International Development, Mr. Arvinn Gadgil,along withthe Danish Ministers;The Minister for Taxation, Mr. Holger K. Nielsenandthe Minister for DevelopmentCooperation Mr. Christian Friis Bachto discuss how the EU, Denmark and the Nordic countries in generalcan take the lead in tackling tax havens and illicit financial flows.Every year approximately 1000 billion dollars escape developing countries through illicit capital flight, witha large proportion ending up in tax havens. If these funds were taxed they would give developing countriesan income 1.5 times greater than the total global development assistance. Similarly, a new report from theTax Justice Network estimates that at least 21.000 billion dollars from wealthy individuals and corporationsare hidden untaxed in tax havens. Needless to say, taxation of these funds would provide a significantincome for both rich and poor countries.On December 6, the EU Commissioner for Taxation, Algirdas Šemeta, presented an action plan forstrengthening the fight against tax fraud and tax evasion. Key elements are to define and black list taxhavens and measures to strengthen exchange of tax information both within the EU and with tax havens.These tax initiatives from the European Commission are of particular interest in a Danish context becauseaccording to the government programme Denmark willtake the lead in closing tax loopholes, addressingillegal capital flows and taxing natural resources in poor countries.Moreover, the Danish Government aimsto strengthen coherence between EU policies in the full range of sectors that affect developing countries.At the global level, the OECD has by the mandate of the G20 engaged in a peer review process in order tostrengthen tax cooperation. Furthermore, Norway has taken important initiatives, particularly to supportdeveloping countries in curtailing capital flight and dealing with tax havens.However, there is still a great need for mutual inspiration between Denmark, the Nordic countries and theEU on how to curtail illicit capital flows and close tax havens, especially in the light of the needs ofdeveloping countries. In particular, a discussion on how Denmark can take the lead in the area and push theagenda forward in the EU is very important.

Time of the conference: 28thof January 2013, at 10:30-16:00.Venue of the conference: Børssalen, Slotsholmsgade 1, entrance B, 1217 Copenhagen

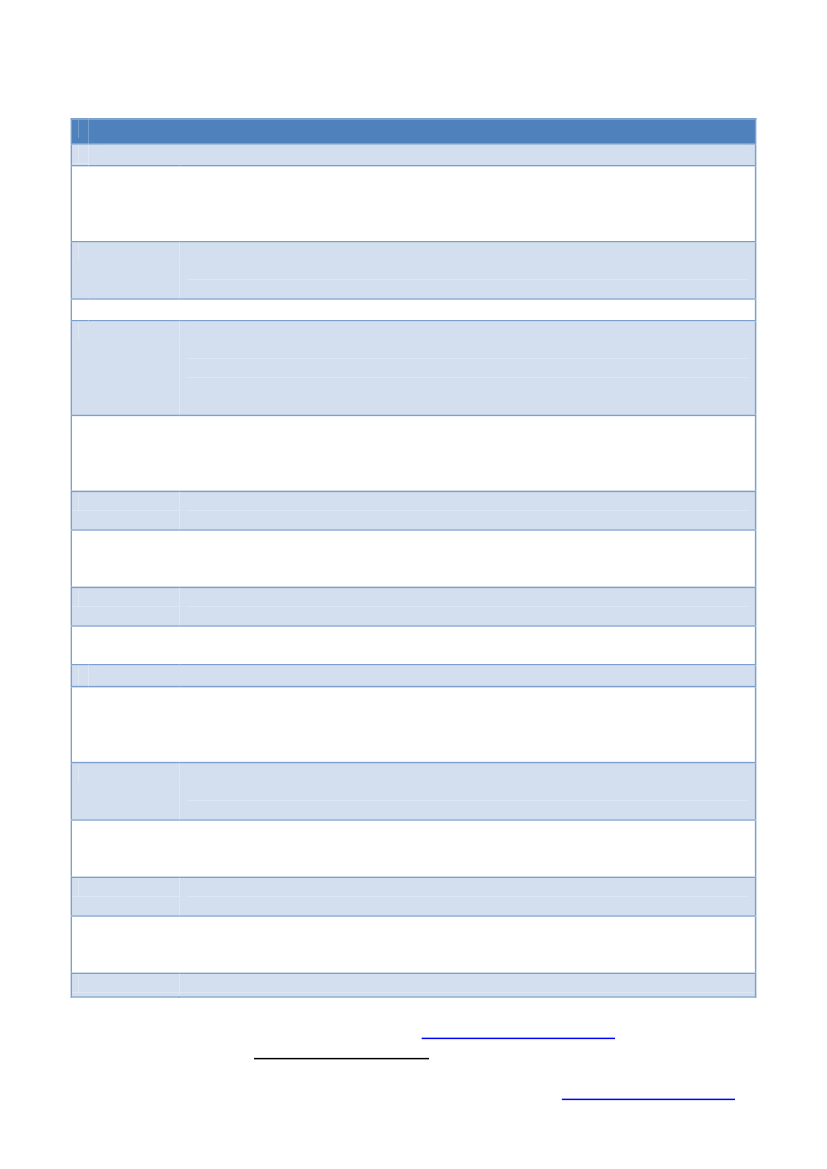

Programme for the ConferenceSession one: Setting the agenda10.30-10.40:Welcomeby Mr. Nils Brøgger Jakobsen, Head of Policy and Campaign, MS Action AidDenmark and president of Concord Denmark and Mr. Thomas Ravn-Pedersen, moderatorof the conference, journalist and Head of Secretariat of The World’s Best News.Tax havens and illicit financial flows – the scope of the problem.By Mr. John Christensen,Director of the International Secretariat of Tax Justice Network.

10.40-11.00:

Session two: How EU initiatives can tackle tax havens and illicit financial flows11:00-11:30:How the new tax initiatives from the EU can create sustainable societies by tackling taxhavens and illicit financial flows – presentation of the EU initiatives on tax havens and taxavoidance.Key note speech by Mr. Algirdas Šemeta, the EU Commissioner for Taxation,Customs Union, Anti-Fraud and Audit.The EU initiatives on tax havens and illicit financial flows seen from a developmentperspective – presentation of Concord Denmark analysis of the new EU initiatives.By Mr.Lars Koch, Head of Policy, IBIS, and vice-president of Concord Denmark.Lunch breakHow the EU and the OECD can join forces on tackling tax havens and illicit financial flows.By Mr. Pascal Saint-Amans, Director of the OECD Centre for Tax Policy and Administration.Panel discussion with Q/A: Speakers from this session and the former session.Coffee break

11:30-11:45:

11:45-12:30:12:30-12:45:

12:45-13.30:13.30-13:45

Session three: How Denmark and the Nordic countries can take lead13:45-14:05:How Denmark will take the lead in closing tax loopholes and addressing illicit financialflows – presentation of Danish tax initiatives and response to the new EU initiatives in thearea.By the Danish Minister for Taxation, Mr. Holger K. Nielsen.How to strengthen policy coherence between tax and development – in Denmark andglobally.By Danish Minister for development cooperation Mr. Christian Friis Bach.Joint Nordic effort to combat tax havens and illicit financial flows – in the EU and beyond.By Mr. Arvinn Gadgil, State Secretary for International Development, Norway.Coffee breakPanel discussion with Q/A: Speakers from the session and members of the DanishParliament:Jesper Petersen (SF), Lone Loklindt (R) and Jakob Ellemann-Jensen (V).Closing remarksby Concord Denmark.

14:05-14:20:

14:20-14:35:

14:35-14:55:14:55-15:55:

15:55-16:00:

Register for the conference atDeadline for registration: 23rdof January 2013If you have any questions please contact Sarah Kristine Johansen at