Udenrigsudvalget 2012-13

URU Alm.del Bilag 208

Offentligt

Ministry of Foreign Affairs of DenmarkDanida

MULTI-DONOR BUDGET SUPPORTPHASE II (2010- 2014)PROJECT DOCUMENT

November 2010Ref No.104.Ghana.50-200

COVER PAGECountry:Title:Implementing Partner:Starting Date:Duration:Total Budget:Component 1 – MDBS:Component 2 – GIFMIS:Reviews, Audits, Studies etc.:GhanaMulti Donor Budget Support Phase IIMinistry of Finance and Economic PlanningNovember 20102010 – 2014DKK 357.0 millionDKK 325.0 millionDKK 27.0 millionDKK 5.0 million

On behalf of Government of Ghana

On behalf of Government of Denmark

------------------------------------------------------Hon. Dr. Kwabena Duffuor(Minister of Finance and Economic Planning)26thNovember 2010

----------------------------------------------Stig Barlyng(Ambassador)

Executive SummaryThis second phase of Multi Donor Budget Support (MDBS II) has the objective of supportingthe implementation of Ghana’s medium term growth and poverty reduction agenda withfinancial resources, policy dialogue and regular monitoring in a manner which is harmonisedwith other development partners to reduce transaction costs. The objective of the publicfinance component is to improve the effectiveness of scarce resources and assure anaccountable, more effective and transparent government.The justification for continued provision of MDBS is based on assessment of the 10 DanishBudget Support principles – which highlights the good progress made in terms of positivetrends in development outcomes generally; the improvements in respect of human rights,democracy, poverty reduction, and harmonisation; while pinpointing areas of slow pace ofreforms and drawing attention to areas of caution including the need for strengthened publicfinancial management and monitoring. The justification indicates Ghana’s need for support inkey infrastructure areas to accelerate growth and reduce poverty; it also portrays expectations ofprogress in human development. The strategic approach and design for MDBS Phase II is toprovide funding support of DKK357 million over 2011- 2014, through two components –DKK325 million for general budget support; complemented by DKK27 million contributionto strengthening Public Finance Management (PFM) at the strategic level with a residualamount of DKK5 million for reviews/studies and audits. The MDBS disbursements areplanned to be front-loaded to complement the flow of oil revenues.As part of continuous efforts to improve the MDBS mechanism, measures have been put inplace to strengthen the policy dialogue, including broadening national participation, inter-ministerial level collaboration, all operating within the scope of a stronger Progress AssessmentFramework (PAF), which will be responsive to both immediate shocks and medium to longerterm outcome targets. Critical policy issues within this MDBS include management of oilrevenues and in the context of provision of GBS, GoG’s management of the economyincluding a sound fiscal and regulatory framework for oil and gas, higher national per capitaincomes, strengthening economic governance structures and also a possible exit when oilrevenues are well established. Cross-cutting issues of importance to Danida are also addressed.On management and organisation, the MDBS has introduced new measures to improve itsefficiency, including the structure and timing of reviews. Denmark will apply a new 80-20 splitbetween base and performance tranche, underlining the importance of a holistic assessment ofthe economy rather than a narrow focus on a few indicators. On financial management, thisprogramme stresses the criticality of a strong public financial management system. Reporting,monitoring and evaluation issues are highlighted for attention to ensure that there is muchmore stringent oversight of implementation.The risks of supporting this new phase of the programme include challenges of new oilrevenues and possibility of mismanagement, possibility of slow pace of public financemanagement reforms, possible dilution of the policy dialogue with entry of new substantial1

funding from BRICK countries (Brazil, Russia, India, China and Korea), the risk that rapideconomic growth will not lead to equally strong poverty reduction and improved progresstowards the MDGs. There is the need to build capacity of government and to undertakenecessary reforms including decentralisation to improve service delivery at the local level andultimately achieve the goals of the Ghana Shared Growth and Development Agenda and theMillennium Development Goals.

Justification for Provision of General Budget SupportThe decision to continue provision of general budget support to Ghana is based on theassessment of performance in the ten Danish budget support principles and from twoperspectives – the backward look, (performance) – assessing the track record and overall trendsin development outcomes including the current state of affairs; and secondly, the outlook (needand expectations of progress in critical areas). Two main factors – oil revenues with expectedhigher national income and the rebasing of the national accounts which has resulted in upwardrevision of the Gross Domestic Product (GDP) and a higher income per capita – will likelychange the need and expectations of progress in the medium term. Denmark’s decision toprovide a new programme of general budget support (GBS) is also influenced by an assessmentof the engagement between GoG and its MDBS partners and adherence to the FrameworkMemorandum principles signed on between GoG and its partners.From the performance perspective – trends in development outcomes – Ghana’s performanceis deemed satisfactory. In the period 2003 to 2008, economic growth was strong, with annualGDP growth higher on average (5.7 percent) than during the previous six years (1996-2001) of4.1 percent. In the recent past, though, the economy experienced some degree ofmacroeconomic instability triggered by i.a. the international financial crisis and overspending inthe run up to the December 2008 elections. However in January 2009, a framework was agreedbetween the new Government and IMF, which included tight fiscal and monetary policy toreduce deficits, stem rising inflation, stabilize the rapidly depreciating currency and accumulatereserves to two months of import cover. As a resultofthese stabilisation efforts,by the end ofthe first half of 2010, the deficit/GDP ratio was down to 3.2 percent of GDP; and inflationdown to 9.46 percent. Subsequently, the Bank of Ghana’s monetary policy rate was reduced to13.5 percent in July which has led a reduction of commercial banks’ lending rates. The foreignexchange market continues to gain in depth and the Ghana Cedi remains stable. Theexpectation is that the combination of these positive economic developments will boostbusiness and consumer confidence and lead to resurgence in economic activity in 2011.Ghana has also made good progress in a number of MDGs – reducing extreme poverty,improving nutrition and reducing hunger, increasing school enrolments, gender equality,reducing child mortality and improving access to water. Poverty incidence was significantlyreduced from 39 percent in 1999 to 28.5 percent in 2006. However, there are disparities in therate of reduction of poverty across geographical areas, economic sectors and across gender; andthese remain a source of concern. Government of Ghana has stated its commitment to povertyreduction by protecting the share of pro-poor expenditures in annual budgets.2

With respect to governance, Ghana’s maturity in the transfer of political power makes it anoteworthy example in the sub-region. The country has a good human rights record; andthough perceptions of corruption persist, the new Government is addressing the corruptionissue by investigating and prosecuting such cases. With regard to public financial management,the 2009 results from Public Expenditures and Financial Accountability (PEFA) and the 2009External Review of Public Financial Management (ERPFM) assessments point to slow progresswith reform and some weakness in financial management (for which safeguards are outlined inthe risk assessment section). For audit and procurement, systems adhere broadly tointernational standards. The backlog of audits of consolidated funds which needs Parliamentaryscrutiny is being addressed. On procurement, the challenge remains with getting more DPS touse country systems. Overall, in response to these highlighted weaknesses in PFM systems,Government has indicated its re-commitment to strengthening its financial management by re-vitalising the PFM framework especially the Medium Term Expenditure Framework and thenew Ghana Integrated Financial Management System (GIFMIS), which is ready for take-off.In the terms of outlook – the need for general budget support and expectation of progress –two factors mentioned earlier, oil revenues and increased income per capita, will affect the paceof development and the type of development assistance given to Ghana in the medium term.Ghana’s proven oil reserves are modest by international comparison with a field life of 25 to 30years. It is estimated that production from the Jubilee field would largely substitute for oilimports, except in 2011-15, when an exportable surplus is projected. Expected oil revenueswould therefore create new fiscal space but on a relatively modest scale.The increased per capita income from the rebasing of Ghana’s national accounts is likely tohave implications for Ghana’s access to concessional financing and to its ability to receive aid.Ghana’s per capita income of US$1318 in 2010 means the country has passed the middleincome threshold earlier than anticipated. This scenario points to the possibility of a differentpartnership between Denmark and Ghana by the end of the upcoming phase increasinglyfocusing on expanding the commercial and political cooperation. GoG however, continues toexpress a need for development assistance especially GBS because of its flexibility andsupportiveness of Ghana’s development agenda which continues to focus both on economicgrowth and poverty reduction.Providing general budget support continues to make good political sense. Continuing generalbudget support would provide opportunities for promoting development and povertyreduction through dialogue. GOG would be supported to continue to implement its mediumterm development agenda, which supports both economic growth and poverty reduction goalswithin a strategic framework. The final medium term development policy framework – theGhana Shared Growth and Development Agenda(GSGDA) (2010 - 2013) – is planned to beapproved by Parliament this September after consultations at the Consultative Group meetingwith its development partners in September 2010. The intention is for the 2011 budgetaryallocations to be based on the new framework.The current PAF is strong, having flexibility, a longer term focus and some shorter termactions. Support by Denmark and other DPs around a strong PAF will help keep new priorities3

on track, help GoG maintain its focus in spite of competing interests, and protect povertyspending. In addition, the continued dialogue made possible through GBS will ensurecontinuation of other reforms such as decentralisation and public sector reforms enablingDenmark and other DPs discuss areas and sectors of governance even where Denmark has nospecific engagement. It has been proven that budget support is an efficient means of reducingaid dependence at sector level. Currently, Denmark provides sector budget support to thehealth sector; financial support directly to districts for water supply, sanitation and rural feederroads; and district capacity building in performance audits to strengthen accountability. It alsosupports private sector development and good governance institutions; all complemented bygeneral budget support. Continuing GBS will also provide funding for the comprehensivecapacity building needed across GoG to support oil revenue planning and prudent managementof oil revenues. This could be a strategic policy aspect of the MDBS dialogue.On the performance of the MDBS itself, the mechanism has improved predictability ofresource flows, has had low levels of transaction costs in relation to other modalities and hasfacilitated increased ownership and responsibility for the development policy dialogue on theside of Government. In respect of harmonisation, the MDBS has facilitated implementation ofthe principles of the Paris Declaration and Accra Agenda for Action. Denmark will, through itsparticipation in the MDBS, continue to use its leverage to pursue harmonization among otherDPs and alignment to GoG systems. In the midterm review of the Ghana Joint AssistanceStrategy, Denmark’s total score indicated a strong resolve to pursuing the harmonisationagenda and an adherence to the core principles of aid effectiveness, which will be continued inthis new phase of the programme.Ghana has used development assistance provided through the MDBS and other modalitiesprudently and achieved tangible development results. Though the emergence of oil will affectrevenues and aid flows, it is important to note that the resource requirements for fullachievement of the MDGs and Ghana’s infrastructure needs are yet to be met. Estimates ofresource requirement have indicated that Ghana would be no more ahead in its budget resourceenvelope with oil alone without aid. Even with no saving prospects, the oil revenue stream willhardly be enough to meet Ghana’s development needs. Also, actual revenue flows in the earlyyears, 2011-2014, are likely to fall below the average because of high exploration anddevelopment cost recovery. Maintaining budget support in the short to medium-term wouldessentially be scaling up the resource envelope to support growth needs, infrastructurerequirements, and the pursuit of the MDGs. There is also a clearly expressed need from GoGto continue to receive GBS despite its future oil “wealth”. Most importantly, GoG has provenits commitment to sound macro-economic management and good public policy,implementation of agreed reforms and a strong determination to battle poverty.For Denmark, and other development partners, staying engaged over the short to medium termthrough budget support facilitates access and legitimacy in voicing concerns on developmentissues. Enhancing the efficiency and quality of spending will be a critical issue for the dialoguebetween DPs and Government and one that Denmark can contribute to in a valuable waybased on its long-standing experience in the areas of decentralization and service delivery inGhana. Any risk of maintaining budget support for a time period longer than necessary, can be4

addressed through a re-assessment of Denmark’s budget support by the year 2012 or 2013when there would be more information about the prospects of recoverability of reserves, andwith it a better picture of the potential stream of government revenues. Denmark will stayflexible and pragmatic about options/modalities in its development assistance, the level ofassistance, but communicate firm expectations of what government should do in return,especially in relation to processes for improved transparency and domestic accountability andissues of poverty reduction.Denmark will, based on the above analysis, continue support to the implementation of Ghana’sMTDP through general budget support of DKK 350 million in the period 2010 to 2014. Theanalysis of the ten budget support principles as basis for provision of general budget supportindicate mostly satisfactory progress (see Annexes). Special cautions in specific areas areoutlined in the risk assessment such as the need for strengthened economic managementespecially clearance of domestic arrears and attaining stability, the need for stronger PFM, and amore transparent management of natural resources, stronger focus on results, politicaleconomy aspects of decentralization and public sector reform and capacity issues. Areas ofweak performance are addressed through the Risk Mitigation measures (see Risk assessmentsection).

Strategic Approach and Design-Funding levels and disbursementsGiven the positive outlook for the Ghanaian economy with regard to potential new revenuesfrom oil, wide-ranging discussions are on-going among DPs on the appropriate aid modality tobe used in the medium term. Most MDBS DPs are maintaining their current levels of supportShould these levels remain unchanged, the MDBS as a group will provide about US$400million per annum in support of GoG’s development agenda equivalent to about 11 percent oftotal revenues and grants.For this new phase of MDBS, Denmark will contribute DKK 357 million (the equivalent ofabout US$58.52 million) to be disbursed between years 2010 - 2014. The programme has twocomponents, DKK325 million for the MDBS and DKK 27 million for PFM. A residualamount of DKK 5 million is reserved for short term consultancies, reviews and audits.The disbursements for MDBS will be front-loaded reflecting the complementarity of generalbudget support to expected increasing oil revenues from 2011. The disbursement profile forMDBS will be DKK 100 in 2011, DKK 90 in 2012, DKK 80 in 2013 and DKK 56 in 2014.Funds will be disbursed in a single annual transfer comprising a base tranche and aperformance-related tranche. Disbursement decisions will be derived from the joint annualMDBS review. Denmark will use an 80/20 split (formerly a 50/50 split) between base andperformance-related tranches, reflecting the recommendation contained in the revised Danida’sGuidelines for Programme Management. The increased proportion assigned to the basepayment reflects the importance given to the overall assessment of progress with regard topoverty reduction and economic growth which looks beyond individual sectoral indicators.5

The Danish general budget support component will support the GSGDA and using thestrengthened PAF, be responsive to both shocks/emergencies, as well as to medium and longerterm outcomes such as the MDGs. This split also follows trends shown by other DPs in theMDBS partnership, signifying a wish for harmonisation for increased leverage in the dialoguewith government.For the Ghana Integrated Financial Management Information System, the objective is osupport Government of Ghana to improve the effectiveness of service delivery and theallocation of scarce resources and assure an accountable, more effective and transparentgovernment. Danish support is intended to strengthen public finance management at a strategiclevel. The rationale for the Embassy to engage in GIFMIS is to participate in the politicaldialogue around the PFM reforms and seek to influence the process.-Dialogue, Critical Policy Issues and ApproachThe MDBS partnership has initiated measures to strengthen the MDBS dialogue. Theparticipation of national stakeholders in the dialogue is being broadened to includeparliamentarians, CSOs, and independent governance institutions. Denmark, together withother DPs, is pushing for more regular dialogue and greater inter-ministerial dialogue andcollaboration. More regular interactions are planned to facilitate a continuous dialogue betweenthe different Sector Working Groups (SWGs) and the MDBS Core Group (the centralcoordinating forum on the DPs side) and on cross sectoral issues and for annual reviews toinclude issues of a cross cutting nature. The Embassy will also pursue a merger of annualreviews processes of the MTDP and MDBS to reduce transaction costs and promotedevelopment partner alignment.At the Heads of Cooperation/Heads of Mission levels, the Embassy is actively pursuing theinvolvement of relevant government representatives in the dialogue with a view of promotinggovernment ownership. Where the Embassy chairs/co-chairs SWGs, it will push for full GoGleadership. Other key dialogue fora include the Annual Consultative Group meetings – wherethe Embassy seeks to influence the agenda for the dialogue, and the biannual High LevelConsultation with GoG. Besides these multi donor fora, the Embassy has regular dialogue withkey members of government, civil society and religious bodies to ensure the necessary in-depthpolitical economy understanding of issues e.g. regular contact with the Ministers/deputyministers of Finance, Health, Trade and Industry, Environment and Local Government, theChief Imam and NGO leaders.Critical policy issues for consideration in the provision of GBS include effectiveness of GoG’smanagement of the macro economy, focus on results and a strengthened PFM system.Increasing revenues from oil production heightens the need for prudent management of theeconomy. To support efficient macroeconomic management, there is currently an IMFarrangement in place. The presence of the IMF programme brings a high degree of comfort toGBS providers due to the strong complementary/advisory role the IMF plays in themanagement of the economy. As a result of its quarterly monitoring arrangements and regulardialogue with GoG in respect of its economic programme, the IMF provides regular updatesand insights on the management of the economy to the MDBS Core Group and Heads of6

Cooperation forum. In addition, in respect of monitoring of pro-poor expenditures, MDBSDPs expect to benefit from updates both from Government and the planned benchmarking onlevels of poverty expenditures as a share of GDP under the next IMF programme.In the area of capacity building, a joint approach by EU DPs has been flagged as a priority.Options proposed include a better integration of capacity assessments into sectoral strategiesand pooled technical assistance funds managed by counterparts and more analysis on whatapproaches work in what context. Denmark will encourage a comprehensive approach tocapacity development. The GIFMIS programme has as one of its priorities, capacitydevelopment in agencies of Government with responsibility for public finance management.Support will also be provided for audits, consultancies and studies. To improve theeffectiveness of budget support resources, MDBS disbursements may be structured to rely ontriggers that signify progress public financial management and improvements in governanceinstitutions that are essential for transparency and accountability. Denmark and other DPs willcontinue the dialogue with Government on a sound regulatory and fiscal framework for oil andgas, i.a., at the regular Heads of Missions and Heads of Cooperation meetings with the Ministerof Finance for updates on progress. Denmark will also dialogue with Government, bothbilaterally and together with other DPs, on considering exits when oil revenues are wellestablished.

Development objectivesThe objective of providing development assistance, especially general budget support is to providesupport – financial resources and policy dialogue - for the implementation Ghana’s pro-poorgrowth and poverty reduction agenda, in a manner that improves the predictability of funding andreduces transaction costs. It takes due cognisance of the need to make progress with the MDGs.The key elements of the provision of budget support – a combination of financial resources,dialogue and regular monitoring are to:i.Provide budgetary resources in addition to those raised domestically directly toGovernment for the implementation of the MTDPF and finance fiscal actions aimed atpromoting sustainable economic growth, alleviating poverty and achieving theMillennium Development Goals (MDGs);Increase aid effectiveness by harmonising DPs policies and procedures through theminimisation of transactions costs and by fostering Government ownership, alignment,management for results and mutual accountability;Enhance the performance and accountability of the Government of Ghana’s publicfinancial management systems;Facilitate the strengthening of institutional capacity for designing and executingdevelopment policies;Promote the accelerated implementation of policy reforms and enhanced performancein service delivery in order to achieve development objectives; andFoster domestic accountability and transparency.7

ii.iii.iv.v.vi.

Ghana’s Development StrategyDetails of Government of Ghana’s development strategy for the current period are contained inthe Ghana Shared Growth Development Agenda (GSGDA) 2010 – 2013. The GSGDAbenefited from extensive consultations with the various stakeholders across government, theprivate sector, civil society, Parliament and Development Partners. The strategy is expected to befinalised in September 2010, to be adopted soon after by Parliament.The GSGDA has two broad objectives – achieving the MDGs and attaining Middle IncomeStatus, and focusing on education and skill development, improved access to health, malariacontrol and HIV/AIDS prevention and treatment, social protection, access to water andsanitation, housing and slum upgrading and population management. Unlike the GPRS Iiwhich was developed in a robust economic climate and during a political rule which favouredmarkets and emphasized private-led growth approach to reducing poverty, the GSGDA on theother hand, stresses the need for Government to focus on agriculture, fisheries, SMEs,sanitation and the Savannah region for poverty reduction. The GSGDA stresses theimportance of macroeconomic stabilization to provide the fiscal space for investing in policies,programmes and projects which will enhance Ghana’s private sector competitiveness,accelerated agricultural development and natural resource management, improvedinfrastructure development, human resource development and job creation. It also highlightsthe need to strengthen transparency, accountability and efficiency in government. Given thecontextual difference also, in relation to the new found oil, the GSGDA also considers thechallenges and opportunities related to the exploitation of oil and gas reserves starting in 2011as far as growth, job creation, the environment and the non-oil sector are concerned.Feasibility of the GSGDA is difficult to establish without the detailed macro framework andthe costs which are not available at this time. In terms of touching on critical areas fordevelopment, the GSGDA appears to be on track. And based on past experience withdevelopment plans in Ghana, the finalised GSGDA is likely to be of good quality, though itmay not be wholly affordable. In the President’s State of the Nation Address in February 2010,he stated that his government would use the oil and gas revenues to transform the economy ofGhana from the present over-dependence on primary raw materials to a more diversified,prosperous, 21stcentury industrial nation. This provides an idea of the extent of theinterventions planned. Oil revenues will definitely impact on the breadth of the national planand its affordability. In the preliminary proposal for the management of the oil and gasrevenue, Government indicates that it aims to spend oil revenues through the national budget,with allocations to established priorities i.e. investment in human resource development andproductive infrastructure – roads, water supply etc. To better manage these revenues, twofunds will also be established – a heritage fund and stabilization fund

Background: Macro Economy, Fiscal Situation and DevelopmentThe Ghanaian economy experienced strong growth in the mid to late 2000s, with annual GDPbeing higher on average (5.7 percent) from 2003 - 2008 than during the previous six years(1996-2001) of 4.1 percent. In 2008, the economy grew at a two-decade high of 7.3 percent8

reflecting expansionary policies, and combined increased private sector activity based on strongcredit expansion, strong growth agriculture yields and in remittances. However as a result of acombination of a number of factors including the twin exogenous shocks of food and fuelprice increases, strong domestic demand and fiscal slippages by 2009, the fiscal deficit was 14.5percent of GDP, inflation had reached 20 percent, and the Ghanaian currency had depreciatedby 50 percent against the dollar. In addition there was an accumulation of domestic arrearsfrom 2008.In response to these difficult macroeconomic circumstances, the new Government began adialogue with the IMF which resulted in a new Extended Credit Facility (ECF) of US$602.6million in July 2009 with the main goal of eliminating Ghana’s large fiscal imbalances by 2011and to put in place strengthened institutions for public financial management. The ECFincludes structural fiscal reform measures ahead of Ghana’s move to oil producer status. Thepillars of the current programme with the IMF are to restore macroeconomic stability andeliminate the most pressing obstacle to continued strong growth and poverty reduction. At thesame time, fiscal consolidation is expected to create the necessary room for manoeuvre, so thatwhen oil revenues come on stream in 2011, they can be dedicated to new growth-promotingand poverty-reducing investments that benefit future generations, rather than being diverted tounproductive recurrent spending.Medium Term Macroeconomic FrameworkThe GoG’s programme for the medium term has the objective of ensuring macroeconomicstability with sustained growth. This objective is expected to be accomplished primarily bypursuing prudent macroeconomic policies; modernisation of agriculture; provision ofinfrastructure including for Information and Communication Technology; development of theprivate sector and development of the oil and gas industry. The growth objective is expected toenable an 8 percent growth over the medium term, with inflation target of less than 10 percent,gross international reserves of not less than 3 months of import cover for goods and servicesand an overall budget deficit of about 3.0 percent of GDP. In line with the 2009 DSA, theupdated DSA continues to assess Ghana’s risk of debt distress as moderate. GoG has stated itsintent of exercising prudent management of debt to ensure sustainable debt levels, implementsocial interventions to reduce poverty and unemployment and embark on a vigorous anti-corruption campaign.Government intends to continue with fiscal consolidation in the medium term and expand theresource envelope to finance critical investments for growth. With the move to oil productionin 2011, real GDP is projected to rise by about 20 percent, subsequently easing to about 6percent. According to the IMF however, the medium-term fiscal framework suggests that onlyaround one-third of projected oil revenues of 5½ percent of GDP could be spent on newprograms in 2011–12 without jeopardizing the planned fiscal consolidation. The available fiscalspace would increase significantly in 2013, as arrears repayments come to an end.Structural reforms to support fiscal policy will be continued. Following the consolidation of thethree revenue agencies into the Ghana Revenue Authority, additional measures will beinstituted to enhance revenue mobilization. The new system for financial management, the9

Ghana Integrated and Management Information System (GIFMIS) forms a part of themeasures for improving expenditure management.. To improve liquidity management, aTreasury Single Account (TSA) has been opened to link all government accounts to ensureefficient monitoring and use of cash balances. All the accounts of the statutory funds will bemaintained at the Bank of Ghana and consolidated.Medium Term Budget OutlookAs indicated in the GoG Letter of Intent to the IMF, the government is targeting a furtherreduction of the fiscal deficit through 2011 – 12, to slow the growth of public debt and bringdown the share of the budget devoted to debt service. Oil revenues will provide new fiscalspace starting in 2011, but there will be many competing demands for these resources. Theseinclude the need to clear a residual stock of domestic expenditure arrears projected at about 5percent of GDP at end–2010. In addition, even though every effort will be made to strengthenthe non-oil budget through tight expenditure management and reinforced revenueadministration, a portion of oil revenues may need to be dedicated to reducing the fiscal deficit.Until the outlook for oil incomes is better defined, and pending an assessment of revenue yieldsin 2010, the government intends to avoid committing to using oil revenues for specific projectsfor the near term. Notwithstanding this, a list of potential projects is being drawn up, and theirrespective contributions to Ghana’s future development are being assessed, to guide any futurescaling up of infrastructure and social spending.A number of risks and vulnerabilities have been identified by the IMF in relation to theeconomic programme. The key risk is the possibility of slippage in fiscal performance. On theexpenditure front, the public sector wage bill is a source of concern being high in relation to taxrevenues and tending to exceed its budget. Implementation of the new Single Spine paystructure needs to be closely monitored. Domestically financed investments are set very lowand could easily exceed the targets set. The high cost of public administration could crowd outthe fiscal space achieved by oil.

Specific measures to address cross-cutting issues and priority themesGender issues were mainstreamed into the GPRS; the GSGDA does the same. There is a fairlycomprehensive policy and legal framework for gender equality and women’s empowerment inGhana. Government considers gender equality a priority, shown by its continuing support forgender responsive budgeting (GRB). The MDBS dialogue, through the Sector Working Groupon Gender, monitors progress with gender equality. The Annual Progress Reports alsorequires reporting using gender disaggregated data, wherever possible.The Human Rights record of Ghana is positive. The current Government has emphasized itscommitment to the rule of law and the protection of human rights. There is an indication ofsupport to the independent governance institutions.In the area of HIV/AIDS, Ghana is in a fortunate position compared to other Africancountries. The national HIV prevalence rate has stabilised at approximately 1.9%. Monitoringof the national response is being strengthened and GoG support for funding the National10

Strategy is through the payment of the administrative costs of the GAC. District Assemblies arealso required to contribute 0.5% of their District Assemblies Common Fund to supportHIV/AIDS programmes at the local level.In terms of addressing environmental issues, Ghana has a robust environmental institutionalframework and considerable capacities to set environmental management standards. Theinstitutional framework is defined by the 1991 National Environmental Policy, the 1992National Environmental Action Plan, and the Environmental Protection Agency Act of 1994.The MDBS dialogue has a focus on the environment and regularly monitors targets in this areaand will remain so especially in the oil era.

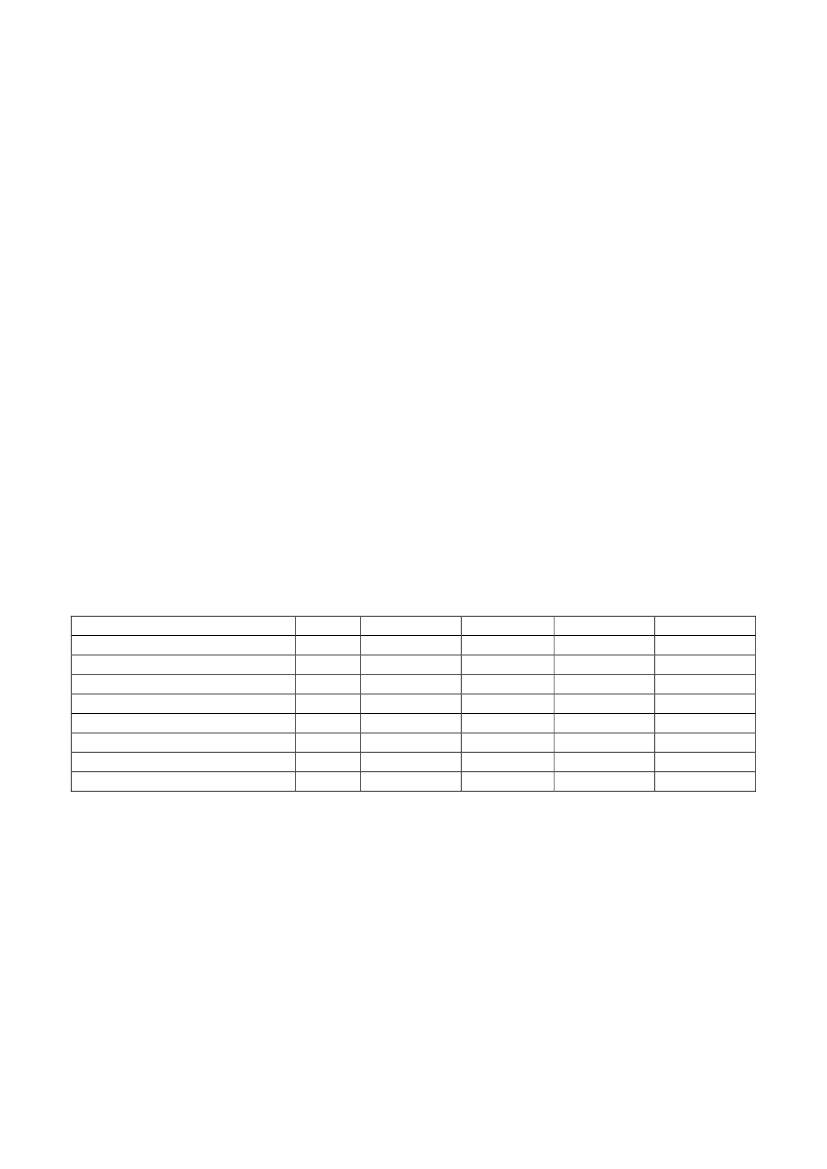

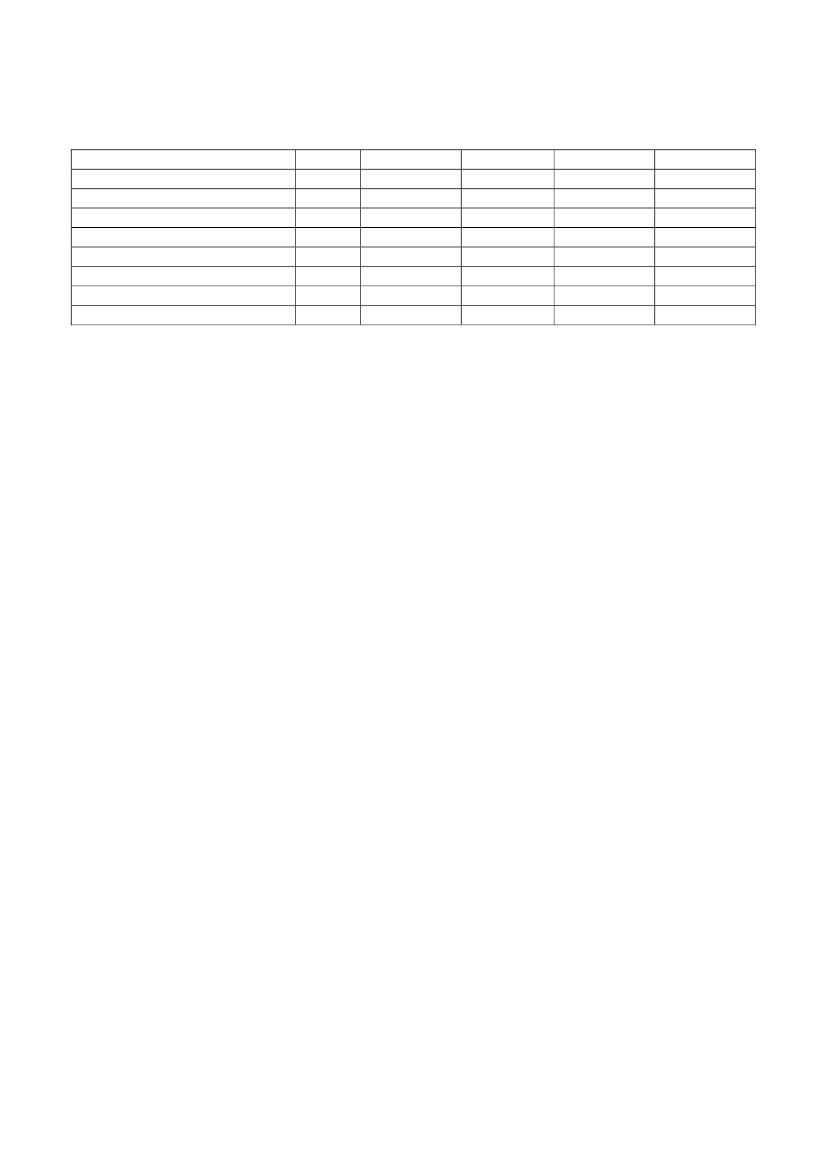

BudgetDenmark will disburse an amount of DKK 357 million over the period 2010 – 2014, to twocomponents – MDBS (DKK 325m) and PFM (DKK 27m). A residual amount of DKK 5mwill be used for reviews, studies, audits and short term consultancies. The MDBS will bedisbursed in a single annual transfer comprising a base payment and a performance-relatedpayment indicated in the table below which assumes a 100% of the performance-relatedpayment is disbursed each year. Actual disbursements of the performance-related componentcould be less than the amounts shown. There will be an 80/20 split between base andperformance-related tranches. For the MDBS component, disbursements will be front-loaded,starting with DKK 100 million in 2011 reducing to DKK 55 million by 2014.Budget (million DKK)Million DKKMDBS Base trancheMDBS Performance trancheTotal MDBS (annual)GIFMISAudits, studies/reviews etc.Total Annual DisbursementTotal Cumulative2010201180201007.01.5108.5115.520127218907.01.598.5214.020136416806.01.087.0301.0201440155501.056.0357.0

7.07.07.0

From the group of MDBS partners, actual disbursements amounted to approximately US$525million for 2009. Pledges for 2010 signalled the end of the 2009 review indicated that for 2010,an amount of US$451.5 would be disbursed. Planned disbursements from MDBS partners forthe 2011 – 2013 period are not all available as a number of partners are in the process ofcompleting existing or developing new programmes and are therefore unable to provideindications of outer year allocations at this time.

11

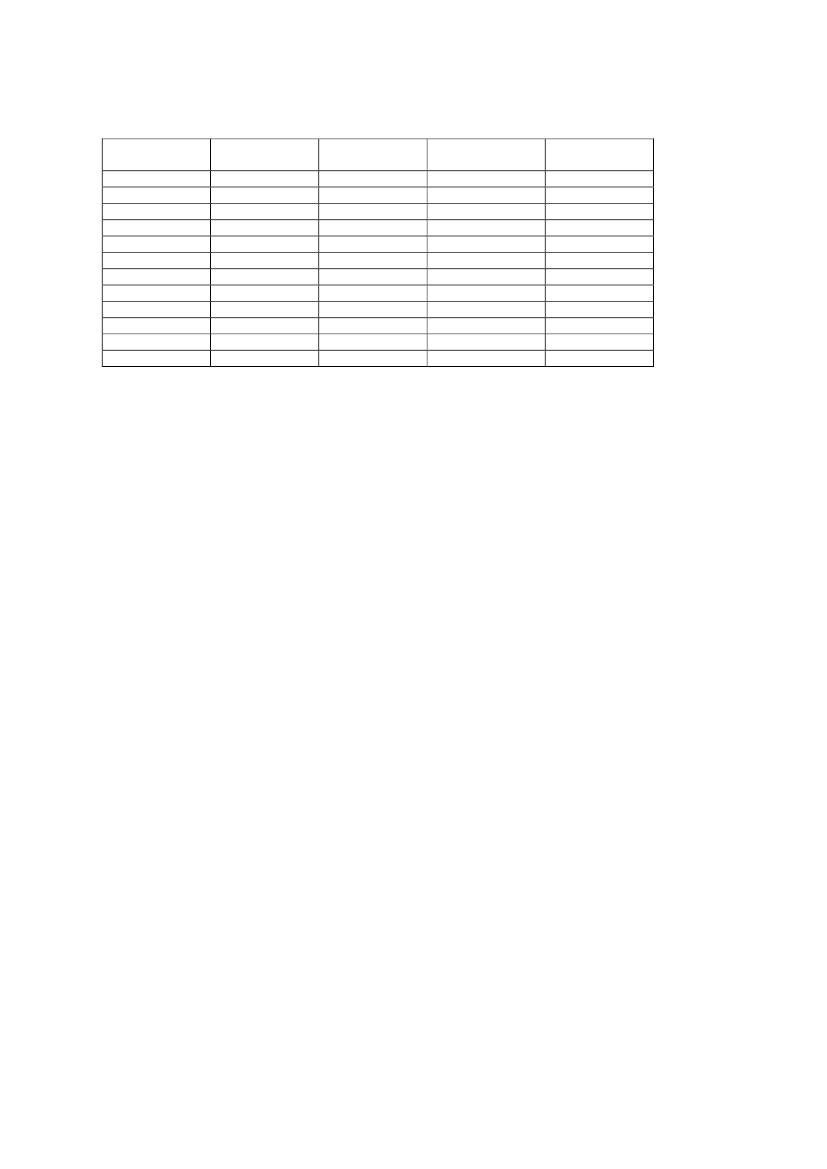

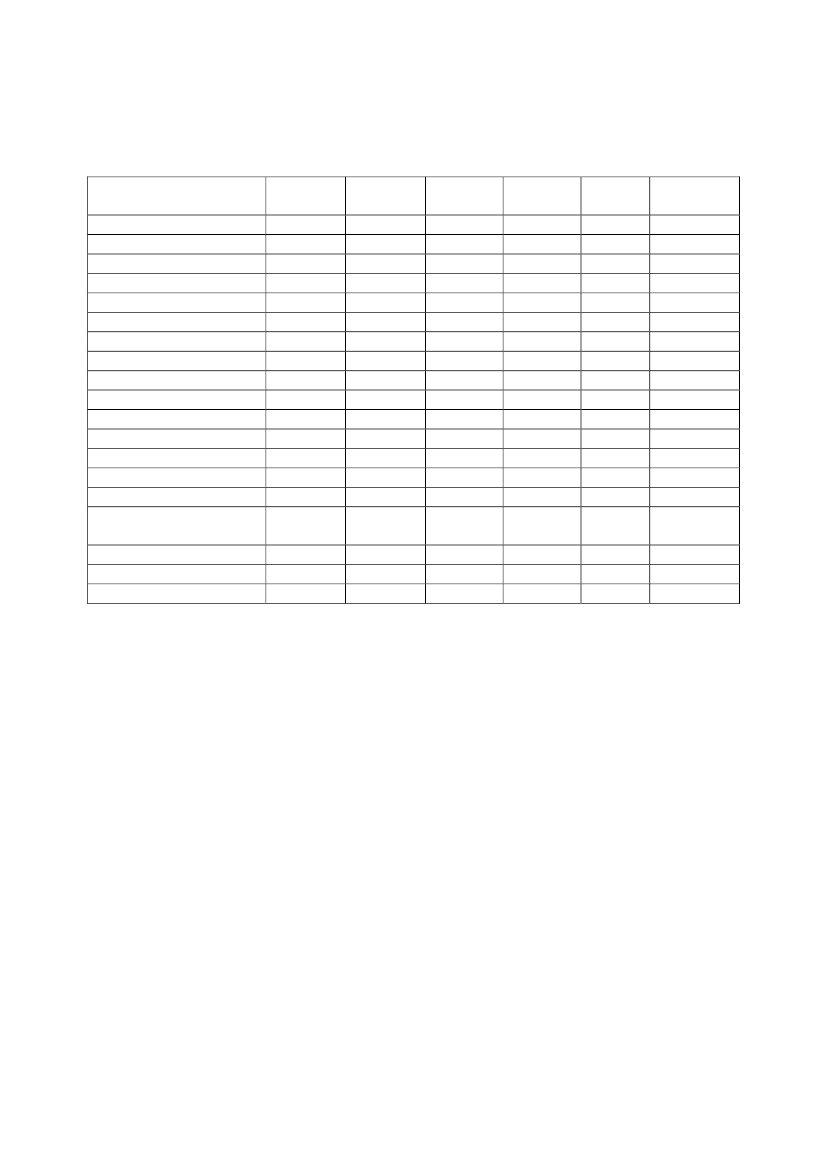

Planned disbursements for 2010 – 2013 by MDBS partners (in millions US$)DPAFDBCanadaDenmarkECFranceGermanyJapanNetherlandsSwitzerlandUKWorld BankTotal1.2.3.4.2010 PlannedDisbursement15.7018.4212.6053.298.0335.334.0125.508.5373.70343.0598.112011 IndicativeAllocation47.1019.2016.3935.709.5623.954.1725.509.47tbc100.00289.672012 IndicativeAllocation47.1019.1914.7542.078.9212.754.1825.50tbctbc100.00274.462013 IndicativeAllocation47.1019.1913.1142.078.92tbc4.18tbctbctbctbc134.57

AFDB: Allocations assume an equal disbursement over 3 yearsDFID: No agreed programme is in place for 2011 onwards. Agreement expected by end of 2010Switzerland: An agreement is in force for 2009 – 2011. Indicative allocations for 2012 and 2013, subject to theconclusion of a new bilateral agreementJapan: Allocation for 2011 is indicative and subject to approval of Govt of Japan, although current levels ofallocation is foreseen. Level is allocation for 2012 – 2013 purely speculative at this point

Management and organisationCurrently, there are eleven partners in the MDBS: African Development Bank, Canada,Denmark, European Commission, France, Germany, Japan, Netherlands, Switzerland, UnitedKingdom and World Bank. Management of the MDBS is through the MDBS Core Groupwhose counterpart in Government of Ghana is the Minister of Finance and EconomicPlanning (MoFEP). The Core Group is chaired by a permanent co-chair – the World Bank, arotating co-chair and a rotating vice co-chair. The co- and vice co-chairmanship is rotated onan annual basis amongst the DP members, with new leadership beginning after the annualreview of the progress assessment framework (PAF). Day-to-day exchanges and operationalmatters are organised through the MDBS Secretariat based at MoFEP, under the overallresponsibility of the Chief Director.A set of growth and poverty reduction objectives, development indicators and policy reformmeasures, drawn from the poverty reduction strategy, is mutually agreed by GoG and DPs asthe Progress Assessment Framework (PAF) and is used by all signatories of the MDBSFramework Memorandum (attached). These development indicators and policy reformmeasures are referred to as 'targets'. Targets are expected to be result-oriented, time-bound,specific, measurable, realistic, within the power of the GoG to achieve, and limited in number.Targets included in the PAF are generally drawn from within the objectives of PRS. Together,GoG and DPs decide on the means of verification of the targets, including the necessarydocumentation. The achievement of a subset of the targets, known as 'triggers', will determinethe extent to which the single component or the performance component is disbursed.The review process for MDBS is common for all DPs on an agreed schedule and aligned withthe budget cycle and the poverty reduction strategy. The Annual Review is organised and12

chaired by MoFEP and includes representatives of the GoG and the MDBS partners (includingobservers). The review process is guided by the work of sector groups, including theconclusions from existing sector-level reviews. The MDBS uses information gathered throughthese and other ongoing processes to ensure that DPs do not set up duplicative reviews. Thereview includes an assessment of overall progress in implementing the MTDPF, includingmacroeconomic performance, as well as progress against the PAF. The assessment ofsatisfactory macroeconomic performance is guided by an IMF instrument or arrangement. Ifthe GoG is broadly on track in both areas, this 'holistic assessment' is considered to be positive.In addition, the documentation for the review includes, among others, regular reports onbudget execution and poverty-reducing expenditures; existing PFM reviews, including an auditof selected flows; the annual budget statement, and the agreed documentary evidence forprogress achieved in the PAF. The GoG and DPs endeavour to have joint and regularcommunication with external stakeholders at key stages in the MDBS dialogue, includingdissemination of the final PAF and outcomes of the annual review.The MDBS is disbursed in a single annual transfer comprising a base payment and aperformance-related payment derived from the joint annual MDBS review. The base paymentis disbursed using an “all or nothing” assessment of satisfactory performance in the “holisticassessment” which looks at overall progress with implementation of PRS and macro-economicmanagement. The performance-related payment is based on an assessment of progress made inimplementing a number of targets suggested by Government and agreed by MDBSdevelopment partners to serve as performance triggers. Disbursement decisions are left to thediscretion of each individual DP, however DPs try to reach a joint position. Most MDBS DPsuse the same agreed triggers for disbursement.In order to improve the effectiveness of the MDBS instrument, ensure its alignment to nationalbudget processes as well as reduce transaction costs, a review of the timing and structure of theannual reviews will be undertaken. Annual Reviews will focus more on the “holistic”assessment as opposed to concentrating predominantly on individual sectoral analyses.This phase of general budget support will continue to be based on the MDBS FrameworkMemorandum signed on 19thMay 2008. To broaden participation, from this year, non-stateactors including Parliamentarians, CSO and the media will participate in selected sessionsduring the Annual Review. This is expected to improve oversight and domestic accountability.The MDBS Secretariat is the focal point on the GoG side for MDA involvement in the AnnualReview process. And will be responsible for follow up with MDAs on timely submission of allinformation needed to produce stated inputs, consolidating the PAF and providing finalcomments on the end of review Aide-memoire.

Financial management and procurementThere is a fairly well developed regulatory framework for public finance and procurementthough implementation and enforcement have faced some challenges notable among them isthe weaknesses in financial reporting. The most recent information indicates that about 50% ofDPs use country systems, while more are in the process of adjusting their corporate rules to13

permit greater ease of use of systems. For Denmark, the procedures for financial managementand procurement are generally those of the GoG and are used not only in the disbursement ofgeneral budget support, but also for its sector budget support programme.In terms of financial management, the usual safeguards – clearly spelt out procedures fordisbursement, procurement, financial reporting and audit – will be applied. To strengthen PFM,Denmark is actively supporting the new GIFMIS through the provision of a DKK27 millionfund into the DP pool with grant funds from MDBS phase I. Adherence to the procedures forproper financial management in the Framework Memorandum regarding obligations of bothGoG and DPs and the Government to Government Agreement accompanying this newProgramme of Support will be monitored. As an additional safeguard, the Auditor General ofDenmark may exercise its right to carry out an audit or inspection regarding the use of theDanish funds in question, as provided for in the Government to Government Agreementbetween Ghana and Denmark.

Monitoring, reporting, reviews and evaluationsTwo institutions at the centre of Government are responsible for monitoring of developmentresults –the National Development Planning Commission, supported by various sector MDAsin data collection and analysis and the Ghana Statistical Service. The mandates of these twoinstitutions regarding monitoring are backed by law. According to the FrameworkMemorandum of the MDBS, the Annual Progress Report (APR) prepared by the NationalDevelopment Planning Commission will be used during the Annual Reviews to provide acomprehensive assessment of the achievements and challenges in the implementation of thecountry’s growth and poverty reduction strategy.. The MDBS uses country monitoring systemsto measure progress made on indicators of the PAF.A comprehensive national M&E plan has been developed which provides a coherentframework for tracking progress towards the achievement of agreed national objectives. Theframework outlines the institutional arrangements to guide the monitoring and evaluationprocess. The M&E plan covers the key M&E activities to be undertaken, how the output willbe used to influence policy at the national, sector and district levels, and the mechanismdesigned to disseminate the findings. It also defines the roles and responsibilities of allstakeholders at each stage of the monitoring and evaluation process.

14

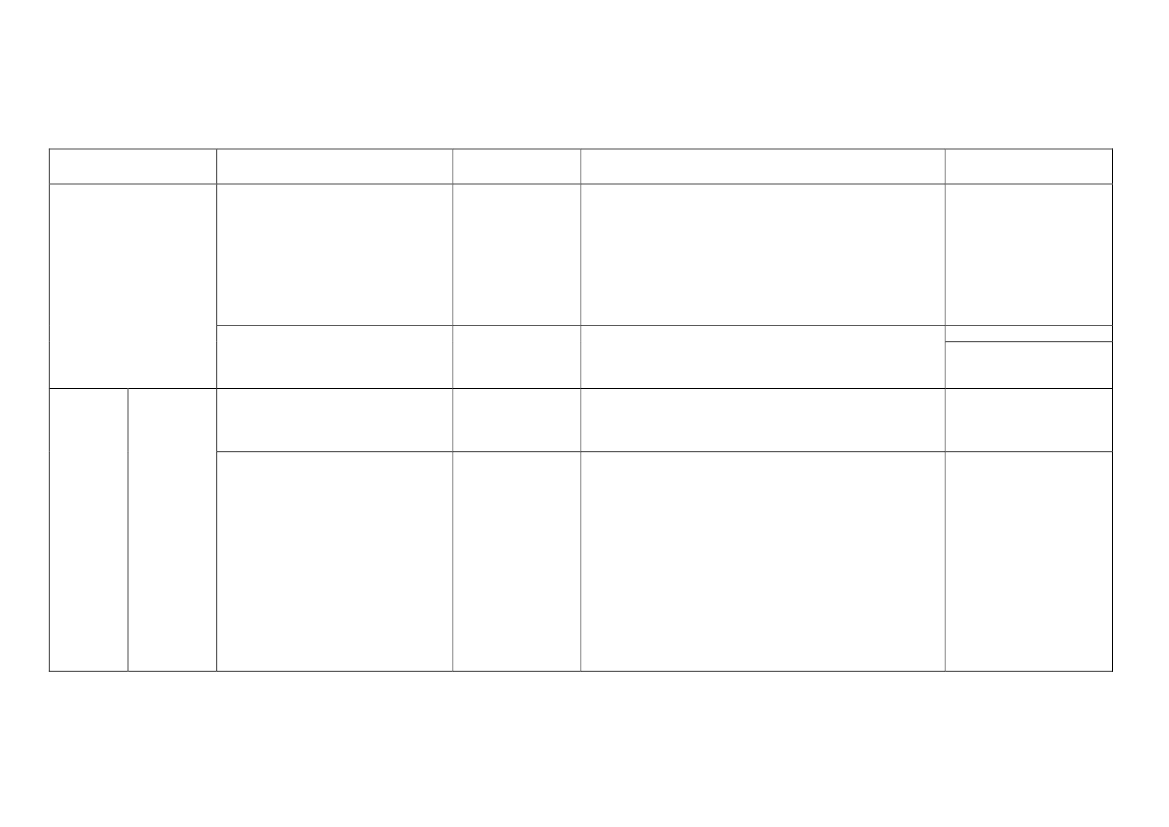

Key Assumptions, Risks and SafeguardsA risk analysis is undertaken to identify the potential risk areas and necessary safeguards are also outlined in the attached matrix:Risk categories1.Fiduciary risksRisks IdentifiedThe recent accumulation of arrears,though being corrected, points to theneed for strong public financialmanagementsystemsandmoretransparency in the management ofresources. New oil revenue bringsadditional challenges to the publicfinance management systemIncreasing corruption due to lack ofpolitical will to undertake neededconcrete short term actions and/or morelong term reformsTransparency and rule of law notimproving especially with regard to useof oil revenues. Incentive for oilrevenues to lead to increased patronageIneffectiveness - risk that economicgrowth will not lead to poverty reductionand improved progress towards theMDGs. There is slow progress withdecentralisation reforms, meaning thecapacity of sub-national government toimplement and undertake necessaryreforms is weak.Risk Assessment –Likelihood/impactLess likely/MajorExamples of SafeguardsThis risk is being addressed through the renewed focus ofGovernment and DPs on PFM: introduction of a number ofsafeguards including the GIFMIS supported under thisprogramme, the upcoming oil and gas regulatory frameworkwhich will include an Extractive Industries TransparencyInitiative (EITI) in the oil sector, the Freedom of InformationBill, increased spending for independent governance institutionsand CSOs including the Serious Fraud Office – to build capacityto act as watchdogs over government spending.Government is addressing corruption – the Attorney General ispreparing cases for prosecution. Denmark provides support to:CHRAJ, GAS, GIFMIS, audits of selected flows, performanceaudits at district level, value-for-money audits.The Petroleum Revenue Management Bill; Increased spendingfor independent governance institutions to build capacity to actas watchdogs over oil revenues, Freedom of Information BillThis challenge is recognised and is being addressed. Ghana hasa good track record of addressing poverty and there is politicalwill in continuing this trend as evidenced in the policies of thenew Medium Term Development Policy Framework. Capacitydevelopment of government is stressed in the new Ghana AidPolicy including reforms including decentralisation to improveservice delivery at the local level and ultimately achieve theMillennium Development Goals. There is also a strong andvibrant civil society increasingly able to hold government toaccount to these issues, with support from developmentpartners, including Denmark. Influencing the choice of targetsto be discussed and monitored in annual MDBS reviews is oneof the ways that development partners hold Governmentaccountable to this path.Responsible Unit(Embassy/MFA)Embassy

Less likely/Major

Embassy

Non-financialrisks

Governance

Unlikely /Major

Embassy

LessModerate

likely/

Embassy

15

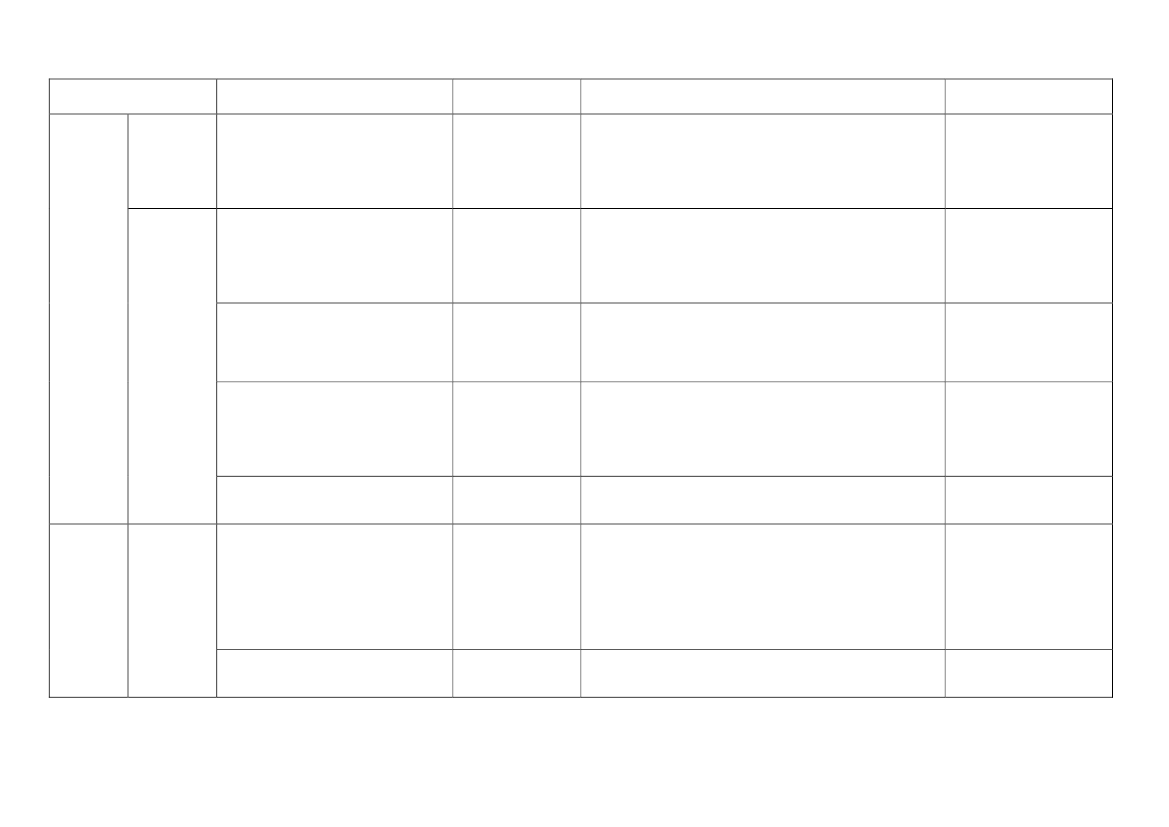

Risk categories

Risks IdentifiedGSGDA - the limited fiscal spacesuggests the need to focus on moreefficient resource use, better quality, andmore equality with regard in theprovision of services within already on-going initiatives.There is some vulnerability of theGhanaian economy given its dependenceon commodity price fluctuations and thedifficult global economic environmentthough stabilisation efforts have startedshowing results, there is still.There is a risk that oil revenue inflowswould increase the value of the cedibenefitting importers but harmingexports, leading to the condition knownas “Dutch Disease”.Easy access to funding with lessconsequences such as BRICK countries,FDI, Bonds with less cumbersomerequirements and less governanceoversight provides disincentive forGovernment to undertake reformsDevelopment partners reduce GBS dueto own declining economiesThe proposed GIFMIS is a technicallycomplex system, whose aim ofdecentralising finances to lower levels ofgovernment represents a moderate risk –considering the time span of four yearsand the capacity levels of some districtoffices. There could be slowimplementation and delays.The relationship between MinisterMOFEP and other MDAs deterioratesand its effects on MDBS process.

Risk Assessment –Likelihood/impactLess likely/moderate

Examples of SafeguardsClose monitoring and continuous dialogue on spendingpriorities during implementation will be undertaken. Thedialogue will focus on decentralization and public sectormanagement issues in the MDBS dialogue.The IMFprogramme, allows for monitoring of fiscal situation.Mitigation measures are the continued successfulimplementation of the IMF’s programme with governmentwhich provides a strong signal to external markets anddevelopment partners of Government’s intention to continuewith the stabilisation programme.Measures to address Dutch Disease include strengtheningGhanaian private sector to respond to production incentives.

Responsible Unit(Embassy/MFA)Embassy

Macro-economic

Low/major.

Embassy

Possible/moderate

Embassy

Possible/minor

Strengthen dialogue, DPs forum include BRICKS, strengthenCSOs/IGIs on

Embassy

Unlikely/moderate.Possible/Moderate

GoG is committed to adjust its programmes downward, shouldthe unlikely scenario occur.Mitigation of this risk is through competency development ofstaff involved in implementation. The project will undertakemajor capacity building activities to build the capacity of staff.Government also intends to implement a national capacitydevelopment strategy which would target such critical staff.These will be monitored.MDBS Secretariat is improving their management of the inputsfrom MDAs to achieve the desired results.

MFAEmbassy

Institutionalcapacity

Lesslikely/Moderate

Embassy

16

Component 2: Support for Ghana Integrated FinancialManagement Information SystemDanish support of DKK 27 million will be provided as a component of the second phase of theMulti Donor Budget Support as part of a joint pool with three other development partners: theDepartment for International Development (United Kingdom), European Union and the WorldBank,to the funding and implementation ofthe Ghana Integrated Management InformationSystem (GIFMIS). The original pool of USD55.76 million from the above-mentioned partnershas been expanded to include the Denmark’s contribution of DKK 27 million, making a total ofUS$60.2ObjectiveThe objective of providing Danish contribution to the Ghana Integrated FinancialManagement Information System (GIFMIS) pooled fund is to support Government of Ghanato improve the effectiveness of service delivery and the allocation of scarce resources andassure an accountable, more effective, and transparent government.BackgroundGhana’s public finance management reform efforts have gained momentum in recent years,with improvements in comprehensiveness of the budget, transparency and public access tobudgetary and financial information and effectiveness of tax collections. Procurement reformsare broadly on track and institutional improvement in internal audit and timeliness of auditreporting is noted. However, in respect of transfers to provinces and districts, there is limitedtransparency. The main critical weakness of the PFM system is low fiscal discipline whichimpacts negatively on the strategic allocation of resources and efficient delivery of services. Themonitoring of commitments and stock of expenditures has also been difficult, which means thelink between approved budgets and budget execution is not clear, leading to overspending ofbudgets and low budget credibility. This situation has deteriorated over time, allowing theaccumulation of payment arrears and inefficient use of resources affecting overall servicedelivery.JustificationDanish support is intended to strengthen public finance management at a strategic level. Dueto the importance of strong financial management systems for general budget support andsector budget support (Denmark’s default mode of providing support), Denmark intends toincrease its support for this area. The rationale for the Embassy to engage in the PFM supportto implement GIFMIS is to participate in the political dialogue around the PFM reforms andseek to influence the process. Support from Denmark and other participating DPs is matchedby Government’s strong support for GIFMIS which evidenced by the high level GoGcommitment for the PFM reform agenda, including chairing of the project steering committeeby the Deputy Minister of Finance, the stated intention of GoG to fund the recurrent costs ofGIFMIS in annual budgets, the proposed implementation of the national capacity buildingstrategy which will strengthen the ability of critical staff to deliver on national objectives,including for PFM. Denmark is already active in the Public Finance Management SectorWorking Group which includes Government and development partners. Denmark has been17

providing funds for the audits of selected flows within Ministries, Departments and Agenciessince 2006 under the general budget support mechanism. Support is also provided for audits atthe district level, through the Local Service Delivery Programme. Independent oversightfunctions within the state, civil society and media are supported under the GovernanceProgramme. The proposed support to GIFMIS and the channelling of funds to the jointpooled arrangement with WB, DFID and EU is in line with Danish strategies and priorities forsupport to PFM activities.Programme descriptionThe GIFMIS project will be implemented under the direction of a Project Directorate alreadyestablished in the Controller and Accountant General’s Department (CAGD). The firstcomponent of GIFMIS, PFM information systems, has sub-components (a) FinancialAccounting, Budgeting, and Reporting Systems, (b) HR and Payroll Systems and, (c) BudgetPlanning Tools and Systems; and the second component, Business Processes and FinancialControls provides necessary structures to ensure system functionality is appropriately used bygovernment ministries departments and agencies (MDAs). The third component is the ProjectDirectorate.When fully implemented, GIFMIS will serve as the single source system for official budgetcreation and management, cash and treasury management, and financial control and reportingfor the country as a whole. The GIFMIS system will utilize a new harmonized chart ofaccounts for all financial transactions throughout the country. A modern technicalinfrastructure will be upgraded to implement the new system. This infrastructure includeselectronic data transmission systems (WAN/LAN) as well as environments for servers anddesktop PCs and related storage and disaster recovery systems.SustainabilityThe GIFMIS project sustainability is assured by Government’s continued high levelcommitment to the Public Finance Management evidenced by the Deputy Minister of Financechairing of the GIFMIS Steering Committee and active participation in PFM reform activitiesgenerally. GoG also has committed to providing the recurrent costs of the project, afterimplementation, in its national annual budgets; and the establishment of an exit strategy fordevelopment partner support. Government has ensured through project design, that GIFMISproject is managed by public servants, with support from consultants only when necessary.This will ensure the building of internal capacity and continued availability of staff to move onwith the reforms, even after project completion.Proposed outputs/outcomes and indicators1. Improved macro-fiscal discipline and management as shown by budget ceilings linked toouter year forecasts for all MDA spending (% of total budget)2. Improved MDA and sectoral management shown by MDAs that implement annualclassification of program, sub-program and activity classification (number)3. Improved financial management, control and efficiency shown by (a) completion ofreview and update of FM legislative and operational framework; (b) Reduction ofdomestic payment arrears (c) Internal Audit Staff trained in Computer Aided Audit18

Techniques (CAATs) (number); (d) Treasury sites connected to GIFMIS (number); and(e) MDAs preparing budgets on Oracle platform (number)Cross cutting issuesThe GIFMIS project does not integrate the three cross cutting issues directly into it. However,its implementation will enable better reporting on both outputs and outcomes. Ministry ofFinance is currently leading a trial with gender based budgeting and lessons learned will bemade available for the GIFMIS programme.BudgetThe budget shown below, indicates contributions from four participating partners in the jointpool arrangement, will be disbursed without earmarking, based on the annual work programme.Contributing partnerUnited KingdomEuropean UnionWorld BankDenmarkTotalAmount (DKK millions) Amount (USD Millions)74.8512.2791.8115.05173.4828.4427.04.43367.1660.2% Contribution20.425.047.27.4100.0

Management and OrganisationThe four participating development partners will pool their contributions to finance projectactivities without earmarking. The details of the pooling arrangements, funds flow, and relatedcoordination arrangements such as joint monitoring of progress, common financialreporting/procedures for procurement, commitment, disbursement and audit have beendefined in a Memorandum of Understanding. GoG has approved Denmark’s participation andDenmark will shortly sign an Addendum to this MOU with GoG, as part of procedures forjoining the GIFMIS joint pool.Institutional and implementation arrangements for GIFMIS build on and strengthen existingstructures. The GoG has set up a PFM Reforms (Revenue and expenditure) SteeringCommittee (GSC) whose role is to provide strategic and policy direction on the implementationof the GIFMIS project. Membership of the Committee will include the four participating DPs.The Committee will have general powers to oversee project policies, reviewing of proposals forGIFMIS roll-out, capacity building and reform sustainability arrangements, and post-completion activities.There will also be a Project Director who will head the GIFMIScomponent implementation at the CAGD. He will have adequate devolved powers to ensurethat project implementation runs smoothly and is coordinated (between components; betweenMDAs, MMDAs and Districts) and implementation is well sequenced and not held up byadministrative bottlenecks. In coordination with the Director of Budget and the Controller andAccountant General, the Project Director will lead eight thematic implementation teams. Aspart of teams directly supporting the project director in his overall coordination of the project’simplementation, the project will draw upon independent consultants, along with a CAGD teamof experienced technical advisors who will be providing advice.

19

Monitoring, Reporting, Reviews and EvaluationsProgress will be assessed on a semi-annual basis with annual progress reports measuring resultsagainst development objectives frameworks. Appraisal of the joint pooled fund account will becarried out through annual audits of the financial records of the participating developmentpartners’ contributions and joint external independent performance audits.

Risks, Probability and Mitigation MeasuresRisksProbability/ImpactMitigation Measures

Ambitious objectives to be Possible/implemented at lower levels of moderategovernment with weak capacity, ina short time span, possibly delayingimplementation.

Government’s commitment to Possible/PFM, while strong, risks being Moderateweakened if the current politicaldrive and commitment is notsustained.Less adequate PFM Laws, Possible/Regulations, and procedures.Minor

Mitigation of this risk is through competencydevelopment of staff involved in implementation. Amajor part of the GIFMIS project involves buildingtechnical capacity of staff at all levels, having recognizedthat the slow pace of past reforms in this area (includingBPEMS) has been mainly the result of the humanelement not receiving the required attention. In addition,GoG intends to implement a national capacitydevelopment strategy which would target such criticalstaff. This activity will bewell monitored during the projectlifetime. Project management skills/capacity of theimplementing unit will be monitored throughout projectlife.As project implementation across MDAs is planned tobe completed within the current democratic politicalcycle, the risk of roll-back will be mitigated particularlywith the expected visibility of benefits to thegovernment.GIFMIS provides for a review of some PFM Laws,Regulations, and Procedures that have a bearing on thesuccessful implementation of the project – removingconflicting provisions.

20

Annex A – BudgetMillion DKKMDBS Base trancheMDBS Performance trancheTotal MDBS (annual)GIFMISAudits, studies/reviews etc.Total Annual DisbursementTotal Cumulative2010201180201007.01.5108.5115.520127218907.01.598.5214.020136416806.01.087.0301.0201440155501.056.0357.0

7.07.07.0

21

Annex BProgramme budget by component and by calendar year in US$

2010Component – MDBS- Denmark- Partners1- OthersComponent – PFM- Denmark- Partners2- OthersTechnical assistance- Denmark- OthersSubtotalUnallocated fundsOther costs (reviews,etc.)ContingenciesGrand totalNotesExchange rate of DKK 6.1 = USD1.1 This table does not reflect the full flow of funds from MDBS DPs. Some DPs are in the process of developingprogrammes which are yet to be approved by their headquarters. (Denmark expects approval by October 2010. For DFID,there is no agreed programme in place for 2011 onwards; agreement expected by end of 2010. AFDB allocations assume anequal disbursement over 3 years. For Switzerland: an agreement is in force for 2009 – 201; indicative allocations for 2012and 2013, subject to the conclusion of a new bilateral agreement. For Japan, the allocation for 2011 is indicative and subjectto approval of Govt of Japan, although current levels of allocation is foreseen. Level is allocation for 2012 – 2013speculative at this point.2 This assumes an even flow of funds from GIFMIS contributing DPs over the four year implementation period. Fundsflow will however be based on a GIFMIS annual work plans.

201116.4273.3

201214.75259.7

201313.11121.5

20149.01n/a

Total53.27654.5

1.1476.97

1.14713.94

1.14713.94

1.013.94

06.97

4.4355.76

0.25

0.25

0.16

0.16

0.82

8.117

305.037

289.787

149.71

16.14

768.78

22

List of supporting documentsEmbassy of Denmark, Accra: Concept Note – General Budget Support to Ghana, Phase II(2011 – 2014), November 2009International Monetary Fund: Staff Report for Article Four Consultations and Request for aThree Year Arrangement under the Poverty Reduction and Growth facility, IMF CountryReport No. 09/256, August 2009International Monetary Fund: Ghana – Notes on 1stand 2ndReview, March 31, 2010International Monetary Fund: Ghana – Assessment Letter for the World Bank and otherDevelopment Partners, March 31, 2010Republic of Ghana, GIFMIS Project Team: Presentation to IMF Mission, February 2, 2010Republic of Ghana, National Development Planning Commission: Draft Policy Matrix forMedium Term Development Framework (2010 – 2013), August 2009http://www.ndpc.gov.gh/GPRS/Policy%20Matrix%20for%20MTDFramework%202010-2013.pdfRepublic of Ghana, National Development Planning Commission: Implementation of Growth& Poverty Reduction Strategy (GPRS II – 2006 – 2009), 2009 Annual Progress Report,upcomingRepublic of Ghana, National Development Planning Commission: Implementation of Growth& Poverty Reduction Strategy (GPRS II – 2006 – 2009), 2008 Annual Progress Report,September 2009http://www.ndpc.gov.gh/GPRS/AnnualProgressReport-2008.pdfRepublic of Ghana, National Development Planning Commission: Implementation of Growth& Poverty Reduction Strategy (GPRS II – 2006 – 2009), 2007 Annual Progress Report, May2008http://www.ndpc.gov.gh/GPRS/Final%202007%20APR.pdfRepublic of Ghana, National Development Planning Commission: Implementation of Growth& Poverty Reduction Strategy (GPRS II – 2006 – 2009), 2006 Annual Progress Report, March2007http://www.ndpc.gov.gh/GPRS/Annual_Progress_Report_2006.pdfRepublic of Ghana: Public Expenditure and Financial Accountability 2009 - Public FinancialManagement Performance Assessment Report - Volume I: Central Government, ECORYSMacro Group, Rotterdam January 2010World Bank: Implementation Completion and Results Report on Three Programmatic Creditsto the Republic of Ghana for Poverty Reduction Support Credits, ICR 0000, March 2010World Bank: External Review of Ghana 2009 Public Expenditures and Financial Management,Volume 1 Main Report, PREM 4 Africa Region, May 200923

World Bank: Economy-wide Impact of Oil Discovery in Ghana, June 30, 2009. PREM 4 AfricaRegionWorld Bank: International Development Association Programme Document for the SeventhPoverty Reduction Support Credit in the amount of USD200 million to the Republic of Ghana,September, 2010

24