Det Udenrigspolitiske Nævn 2012-13

UPN Alm.del Bilag 258

Offentligt

Increasing lending to the economy:implementing the EIB capital increase andjoint Commission-EIB initiatives

Joint Commission-EIB reportto the European Council,27-28 June 2013

Increasing lending to the economy:implementing the EIB capital increase and jointCommission-EIB initiativesEXECUTIVE SUMMARY

Following the capital increase agreed by the European Council in 2012, the EuropeanInvestment Bank (EIB) has significantly boosted its activity with a counter-cyclicalimpact on the European economy.Although the ultimate impact of EIB activity can only be assessed a few years fromnow, significant results are already visible. Substantial increases in signatures andnew lending initiatives, and a strengthened emphasis on SMEs and vulnerablecountries will generate increased investment and employment where it is mostneeded. It is essential to continue our joint efforts to ensure that the availableresources are effectively channelled to the real economy. To this end, the EuropeanCommission and the EIB are closely cooperating to develop new joint initiatives tosupport SMEs. Blending EU funds and EIB resources strengthens the impact of EIBlending where it is most needed.

ContextFollowing the decision of the European Council in 2012, the capital increase is beginning todemonstrate its effectiveness as a powerful mechanism to enhance the countercyclicalinvestment activity of the EIB, contributing to restore lending to the economy in support ofgrowth and employment. The favourable lending conditions that the EIB can offer in all EUMember States (owing to its status as prime issuer in the capital markets) provide anessential support to offset market fragmentation in Europe with a particular focus on the mostvulnerable countries.Under the umbrella of the Growth and Employment Facility, up to EUR 60 bn will be added tothe lending activity of the EIB in the EU in the period 2013-2015 representing a 49% increasecompared to lending that was planned for the EU before the capital increase. The additionalvolume hinges on continued significant access to capital markets, relying on the sustainedability to cater to both EU and non-EU investors.The EIB’s additional activity is expected to unlock around EUR 180 bn of additionalinvestments across the EU. The additional lending will support viable projects in all MemberStates with a particular focus on (i) Innovation and skills, (ii) SME access to finance; (iii)Resource efficiency; and (iv) Strategic infrastructures.The combined effect of the EIB increased lending capacity, the specialised activities of theEuropean Investment Funds (EIF) and the joint Commission-EIB financial instruments –including new initiatives under the next Multiannual Financial Framework (MFF) – representsan important contribution to growth and employment for the years to come.

1

The results of EIB activities in the first half of 2013In the first five months of 2013, one can clearly see how the capital increase is unleashingadditional lending capacity of the Bank. Across all Member States, signatures in the EU haveincreased on average by 66% (including special efforts in programme countries) compared tothe corresponding period in 2012. Increased volumes are complemented with additionalproducts. For example, in Greece the new Trade Finance facility (signed at the beginning ofJune) is expected to mobilise up to EUR 1.5 bn of resources and the first operationsunderpinned by the Greece Guarantee Fund were signed in January 2013.The reinforced capital base has allowed the EIB to adapt its risk tolerance, which is expectedto further evolve with economic conditions. Own risk operations with higher risk in the EU -Special Activities - are targeted to increase to EUR 7.8 bn in 2013, of which EUR 5.5 bn onthe EIB balance sheet (compared to EUR 1.5 bn in 2012).The increase in lending activity in the EU has been particularly focused on support to SMEsas the main driver of European growth and employment: the initial target of EUR 13.6 bn inlending to SMEs for 2013 is currently being revised up to EUR 15.9 bn compared to EUR10.7 bn in 2012. Together with the EIF more than EUR 19.1 bn in SMEs lending is expectedto be signed in the EU.The impact on new employment and the preservation of existing jobs is significant: the EIBexpects that its lending to infrastructure, resource efficiency and knowledge economyprojects in 2013 alone will directly generate employment for around half a million people. Inaddition, SMEs and mid-caps benefitting from EIB and EIF financing sustain employment foran estimated 2 million people every year.

Joint Commission – EIB initiativesThe Commission and the EIB have closely cooperated to develop and implement risk-sharing instruments which leverage resources from the EU budget with EIB lending. TheProject Bond Initiative is one of the most visible examples with already 9 projects approved in6 countries. Similar instruments have been deployed in cooperation with the EIF in support ofSMEs and mid-sized businesses.The use of financial instruments is expected to increase during the next MFF underprogrammes such as the Connecting Europe Facility, COSME, Horizon 2020, as well asunder European Structural and Investment Funds (ESIF). All the above has been initiatedduring the last year and, whereas the initial signs of improvement are already visible, a moresignificant impact for the economy can be expected in the next years.

What can be done to further enhance impact?The EIB initiative “Skills and Jobs – Investing in Youth” will provide SMEs with better accessto finance related to investments in training, job-related skills and on-the-job-training.Coupled with the frontloading of the Commission Youth Employment Initiative and anacceleration of investments in young people through the European Social Fund, this isexpected to further foster youth employment in Europe.The Commission and the EIB are exploring joint risk-sharing mechanisms under the newMultiannual Financial Framework (MFF) which would allow Member States to voluntarilyearmark part of the Structural Funds for this purpose. In particular, a joint-instrumentblending EU funds available under COSME and Horizon 2020 and EUR 10 bn of ESIFdedicated resources in cooperation with EIB/EIF is proposed in view of generating additionallending to SMEs. Three options have been proposed by the Commission which could, in the

2

period 2014-2020, leverage up to EUR 100 bn depending on the scale of participation byMember States, the adjustments made in the draft European Structural and InvestmentFunds legislation and on the timing and the response of the financial markets.The EIB and EIF together with the Commission and the European Central Bank (ECB) areanalysing the best ways of enhancing funding to SMEs, revitalising the securitisation marketas a channel to mobilise more resources and redistribute risks across the economy in asustainable way.

3

Joint Commission-EIB report to the European CouncilIncreasing lending to the economy: implementing the EIB capitalincrease and joint Commission-EIB initiatives1.Introduction

In June 2012 the European Council launched a Compact for Growth and Jobs comprising arange of policies aimed at stimulating smart, sustainable, inclusive, resource-efficient andjob-creating growth.Given the concurrent need to get lending flowing to the economy, one of the measuresagreed in the Compact by the European Council was to increase the EIB's capital by EUR10bn. This capital increase is designed to strengthen the EIB's capital base and thusincrease its lending for 2013-2015 by up to EUR 60bn, and thereby unlock up to EUR 180bnin additional investment. This increased lending capacity shall be spread across the wholeEuropean Union, including in the most vulnerable countries.As part of this important effort to increase the funding of the economy, synergies between theEIB and the EIF have been enhanced with the latter reinforcing the development of itsactivity in liaison with public financial institutions in Member States, in particular to promoteventure capital and assist in the re-launch of the securitisation market in Europe.At the same time the EIB and the Commission have been asked to develop new instrumentsto leverage the EIB’s support for growth and jobs across Europe.In June 2013 the European Council will assess the implementation of the Compact with aparticular emphasis on measures aimed at job creation and boosting the financing of theeconomy to enable fast-acting growth measures. The Commission and the EIB were invitedto report on how the Compact, including the EIB capital increase, would be used.2.Economic and financial environment

While significant advances have been achieved in terms of crisis resolution and institutionalstrengthening in Europe, economic conditions remain challenging. The easing of financialmarket stress has not fully fed through to the real economy. Investments in the EU havebeen contracting for the past seven quarters with an accelerated fall at the end of 2012. Atthe same time, the need to ensure debt sustainability limits the room for national counter-cyclical policies in highly-indebted Member States. Labour market conditions in the EU andthe euro area have continued to worsen since the end of 2012, on the back of weakeconomic activity and labour market adjustments.Credit markets remain fragmented and actual credit volumes to non-financial corporationshave contracted over recent years in many Member States, with significant cross-countrydifferences. Lending spreads seem to relate not only to the credit quality of the borrower butalso to geographical location, suggesting a wide divergence in financing conditions forcompanies in the Single Market. In parallel to the cross-country divergence in bank lendingrates, the spreads between interest rates on small compared to large enterprises have alsoincreased since end-2011.The Compact for Growth and Jobs is an important response to the challenges facing the EU.The EIB capital increase and an enhanced recourse to joint Commission-EIB risk sharinginstruments, coupled with synergies between EIB and EIF specialized activities, are keyelements for its success.

4

With the launch of the Growth and Employment Facility (GEF), EIB has further strengthenedits commitment to monitor the employment and growth impact of the projects it finances. TheEIB will also regularly report to its Board on the outcome of these projects.The EIB continues to focus its financing on projects with high economic rates of return, whichensure that individual investment projects contribute strongly to economic growth.The wider impact on the EU economy, through the indirect effects of investments, will bemuch greater and is expected to be the strongest in those Member States that currently facevery high levels of unemployment.

Examples of projectsInnovation & SkillsA Spanish world-leader in renewable energy technologies, notably in thermo-solarpower, benefits from an innovative credit risk sharing scheme jointly set up by theCommission and the EIB. The EIB financing allows the company to continue thedevelopment of the next generation of equipment to improve the capacity to store thecaptured energy and its conversion into electricity. The project will directly employabout 750 R&D staff in Spain and involve a large number of suppliers throughout theEU.In Ireland, the EIB supports a project covering a total of 49 schools that will increaseschool places and improve education facilities across the country. This project willdirectly benefit more than 30.000 pupils and improve learning facilities where mostneeded. Buildings will comply with the highest energy-efficiency standards. Theproject will generate labour demand for about 2,400 person-years, which will benefitmostly smaller construction companies. This investment in education is essential torespond to the demographic challenges of Ireland and to provide children with thoseskills necessary for an evolving economic environment.In France, the EIB has funded a major automotive manufacturer to invest in electricvehicle technology that will reduce the impact that travel has on the environment. EIBfinance will support R&D and help develop a new generation of efficient andaffordable electric and hybrid-electric vehicles. The new vehicle platform will feature asimpler and significantly less expensive powertrain (engine and gearbox) as well as alight-weight body. The investment will generate direct demand for about 3,200person-years of highly skilled engineers and scientists.

The EIB is backing the construction of new teaching and research buildings, as wellas the refurbishment and upgrading of research and teaching facilities of tenuniversities outside the greater Helsinki area, which hosts around 100 000 students.This project seeks to revolutionise teaching by designing new premises that bestsupport learning, studying and the creation of new knowledge. The various projectsaimed at modernising the existing facilities will also help to improve usability as wellas bringing savings on running costs. Estimated CO2 emission savings as a result ofthe upgrades are in the order of 10%.EIB is providing support to a leading integrated Italian energy group with activities inthe chemicals sector, to support the conversion of an old and loss-making

5

petrochemical site located in Sardinia into a modern green chemistry productionplans and R&D site. The project would help preserving 676 jobs in a regioncharacterised by high unemployment rates and progressive de-industrialisation whileproducing also other positive externalities. It is a flagship project based on thedeployment of innovative process and product technologies, including Key EnablingTechnologies (KETs). The project will strengthen the competitiveness of a Europeanmid-cap promoter, contributing to safeguarding employment opportunities in Europeand to enhancing Europe’s position as a major technology provider.

Access to Finance for SMEs and Mid-CapsA cooperation agreement between the EIB and BPI France (Banque Publique d’Investissement) leverages the combined forces of national and European support forSMEs, channelled through an extensive local French network close to the customers.The Bank’s first ever trade finance facility was developed that will increase liquidity,restore trade flows and reduce Greek SMEs financing costs in the import-exportsector. This short-term lending instrument will support a volume of transactions of theorder of EUR 1.5 billion per year at a time when trade has a significant role to play ineconomic recovery for Greece.In Portugal an agreement between EIB and Millennium bcp was reached to supportthe economic development of small and medium-sized business in Portugal. This willhave a positive impact on economic activity and job creation in the country as it willprovide financing for smaller projects in the areas of industry, tourism, services,including research and innovation, energy and environmental protection.The EIF increased its EIB-funded risk capital resources mandate with EUR 1 billionthat particularly focuses on higher risk mezzanine financing as part of the joint EIB-EIF actions to tackle financing constraints for new innovation and growth plans ofEuropean mid-sized businesses.In Italy, the European Investment Fund (EIF) has signed two transactions with BancoPopolare and Cassa di Risparmio di Cento which will make available up to EUR 160million of loans to innovative SMEs. These operations were concluded under theRisk-Sharing Instrument (RSI) initiative, a joint pilot guarantee scheme of the EIF, EIBand the European Commission (DG Research & Innovation) which aims atencouraging banks to lend to SMEs and small mid-caps (with fewer than 500employees) in need of investment financing and/or operating capital to supportresearch, development and innovation activities.

Resource efficiencyA credit facility to the promotional bank of Slovenia will co-finance energy efficiencyand renewable energy projects. The small-scale investments carried out both byprivate and public sector promoters will have large economic benefits and generatesignificant local employment effects throughout the country. The EIB financing iscrucial to fill the financing gap due to the scaling down of public grant funding.

6

Support for a large wind farm with 80 turbines in the German part of the North Seawill have a total generating capacity of 288 MW. Off-shore wind farms are needed tohelp Germany meet its ambitious plans to boost green-electricity production.The Bank is providing support to the construction of the central section of Warsaw’snew metro line, thereby promoting the development of sustainable public transport inone of the most congested cities in Europe. The support for the Warsaw metro willimprove the quality of public transport service in terms of speed, comfort andreliability. The estimated reduction of CO2 emissions is some 42 000 tonnes per year.Besides the environmental benefits, this EIB-supported project will also trigger growthin jobs, as the planned increase in metro operations will require additional drivers,maintenance workers and office staff.The EIB is supporting the implementation of an integrated solid waste managementsystem in Sofia, Bulgaria, including a sanitary landfill, a mechanical-biologicaltreatment plant and bio-waste and green waste composting plants.

Strategic InfrastructureEIB is financing the development of a new container terminal at the port of Savona(Italy) which is one of Europe’s major port projects. The new terminal is aimed atlarge global shipping companies operating in the Mediterranean Sea and will facilitateEuropean trade. It will result in the creation of about 2,400 person-years ofemployment during construction and will generate around 400 direct jobs duringoperation in Italy. It will also help facilitate European trade and logistic activities andin doing so reducing costs of production and distribution for the industry.

EIB finance for investment in new rolling stock for the London Overground willsupport 1,300 person-years of employment in existing manufacturing facilities. It willsignificantly improve the quality of public transport, reduce congestion in the greaterLondon region and thereby facilitate accessibility for the benefit of the widereconomy.Financial backing of Lithuania’s vital rail transport corridors will allow the acquisition of590 new freight wagons and nine new passenger trains. Passenger numbers havebeen growing steadily, to reach 4.8 million in 2012, and the nine new passengertrains can support this trend of using public transport. The 590 new freight wagonswill mainly be used for cross border railway traffic between Lithuania and itsneighbouring countries to the East, and will be quieter and lighter than the outgoingequipment. In 2012, a total of 49.5 million tonnes of freight was carried on Lithuania’srail network.

7

3.

Implementation of the EIB capital increase and joint EU-EIB risk sharinginstruments

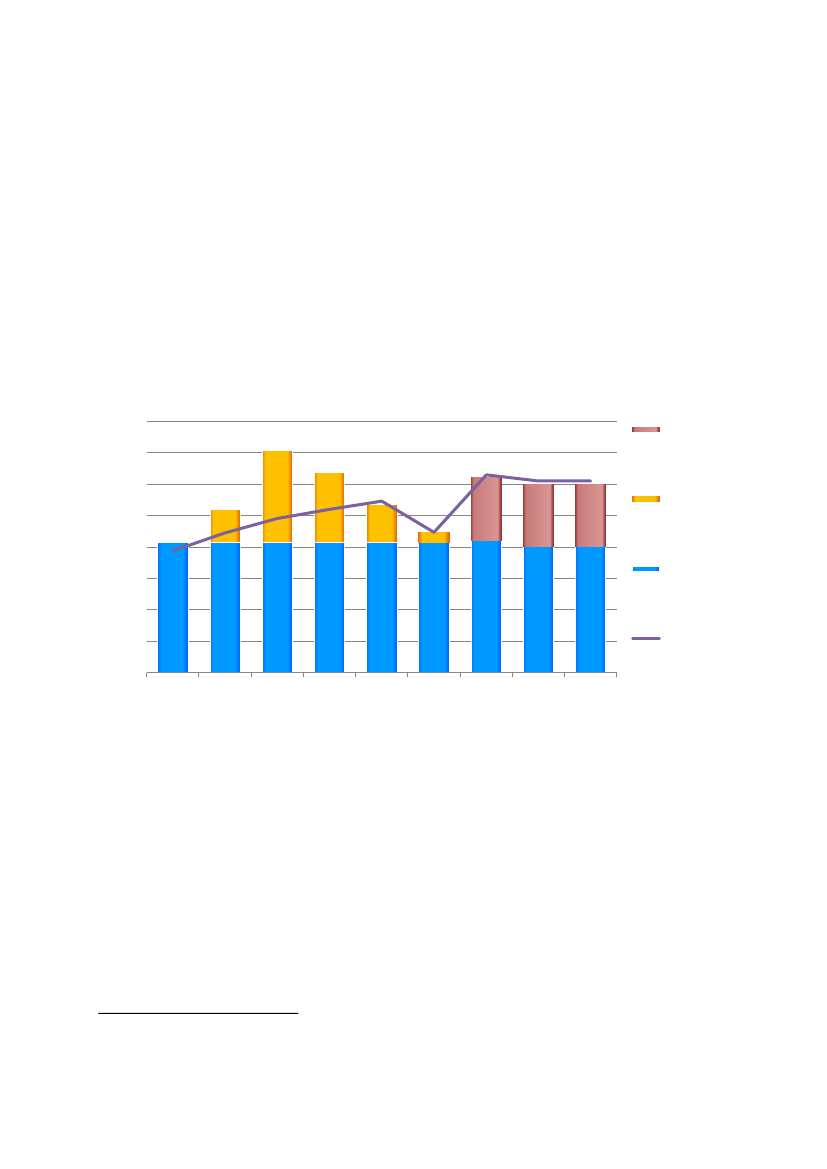

3.1 Implementation of the EIB capital increaseBy the end of 2012, EU Member States had unanimously approved the capital increase atthe EIB's Board of Governors. The capital injected significantly improved the EIB risk ratios,1contributing to the strengthening of the EIB’s credit standing and status as prime issuer onthe capital markets. This is essential for the EIB to be able to continue providing financialvalue added to its shareholders’ economies.From an operational side, the capital increase allowed for increased lending targets in the EUof EUR 62bn (+/-10%) in 2013 and overall lending targets for 2013-2015 of EUR 182bn.

Evolution of the EIB Lending Programme807060AdditionalCapacityenabled bythe capitalincrease

2911453949

2252

6355

61

61

50EUR bn4030201002007

20345

12

20

20

Signatures inexcess ofPre-Crisislevel

41

41

41

41

41

41

42

40

40

2008

2009

2010

2011

2012

2013

2014

2015

BaseSignaturelevel as perOperationalPlan 2012-2014Disbursements, 2007-12actuals and2013-15ceilings

All additional lending is targeted at the EU, with up to EUR 60bn or 49% expansion in thelending targets in the EU over the three year period 2013-2015 compared to the pre-capitalincrease business plan. A similar enhanced lending programme was achieved at the onset ofthe economic and financial crisis. Based on average co-financing rates, this additionallending will support total investments in the range of EUR 180bn.The EIB is working closely with the Commission, and Member States to implement thecapital increase in the priority areas which reflect Europe 2020 objectives and country-specific recommendations of the European Semester. Under the umbrella of the Growth andEmployment Facility (GEF), the additional lending enabled by the capital increase issupporting viable projects within all Member States with a particular focus on (i) Innovationand skills; (ii) SME access to finance; (iii) Resource efficiency; and (iv) Strategicinfrastructure. In order to adequately address the increasingly diverse economicenvironments in individual EU countries, tailored funding strategies are designed to target1

As a result of the capital increase, the EIB’s capital adequacy ratio increased from 23.1% end of 2012 to 28.0%at end March 2013, and the leverage ratio improved from 976% to 821% in the same period

8

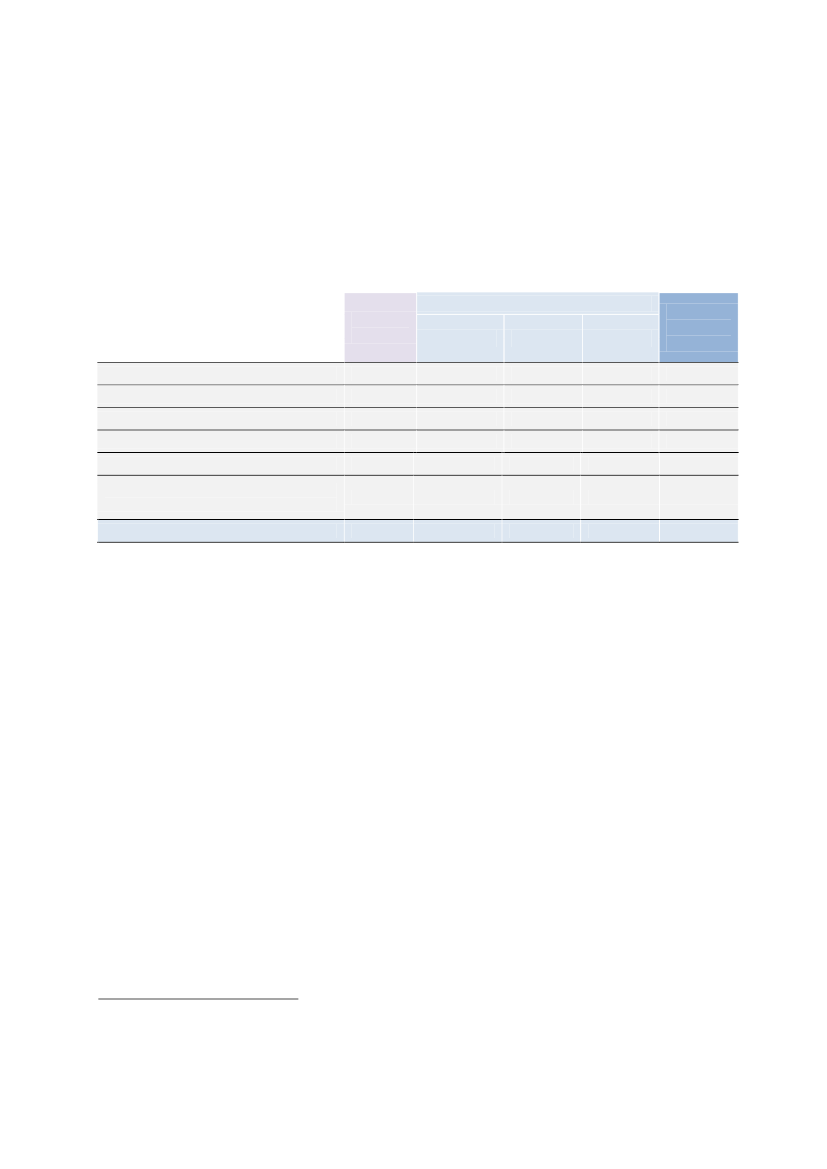

regions and sectors where financial constraints are the most severe and where investmentcan be unlocked rapidly.By developing and offering targeted financial products (including guarantees, venture capitaland microfinance), the EIF enhances crucial access to finance for SMEs across the EU andfosters employment, growth and competitiveness through entrepreneurship, innovation,research and development.EIB's lending is distributed across the different policy areas in the following table, which alsoprovides indicative2signature figures for the coming three years.Indicative EIB lending inside the EU by policy areas (figures in EUR bn)OrientationsPublic Policy Objectives(Inside EU)Support to SMEsKnowledge EconomyTransport(TENs, sustainability)Energy(TENs, renewable and efficiency)Urban and healthEnvironment and non-transversal*climate and convergenceTotal (inside EU)

2012Achieved10.78.99.37.22.36.144.7

201313.611.112.512.52.99.562.0

201413.310.611.812.52.79.160.0

201513.310.611.812.52.79.160.0

2013-2015Average13.410.712.012.52.89.360.7

* Projects that are not eligible under any of the main COP objectives, but can be accepted purely eligibility criteriaunder either Convergence or Climate action

As of 31 May 2013, year-to-date loan commitments signed by the EIB totalled EUR 13.8bn,(66% higher than on 31 May 2012). The EIB expects annual lending targets to besubstantially met.The following table shows the evolution of EIB signatures in those Member States which arecurrently receiving financial assistance and who have agreed a macro-economic adjustmentprogramme with the Commission. Despite the difficult financial and economic context, theEIB maintained a sustained level of activity in programme countries. In 2013, it is expectedthat more than EUR 3.5 bn will be invested in programme countries out of an overall EUtarget of EUR 62bn.EIB signatures in programme countries(in EUR m, own resources)2011GreeceIrelandPortugalCyprus860475197018020125505058713982013 expected15006501200200

2

Figures in the table for 2013-2015 are purely indicative, as they have been derived from available forecasts forEIB operations in Europe (including Candidate and Potential Candidate Countries) by applying a proportionalreduction, based on the expected ratio of (i) lending in the EU to (ii) total lending in Europe

9

Over the first half of 2013, the aggregate level of disbursements to programme and exprogramme countries3materially increased with respect to the corresponding period of 2012(from EUR 1.4 bn to EUR 1.9 bn) for a total increase of approximately 36%.The EIB has undertaken a series of measures since the 2012 proposals concerning thecapital increase in order to facilitate as much as possible the achievement of the new lendingtargets in the difficult economic environment.The EIB has implemented a package of measures to adapt its risk tolerance andpricing to the changed environment and to continue operating in all Member States.In addition, the EIB is reprioritising its lending, giving greater weight to those projectsthat heavily impact employment.The EIB has stepped up its support for SMEs and Mid-caps through numerousmeasures.oIt has increased its lending volumes to SMEs in the EU considerably. In 2012signatures for SMEs increased to reach EUR 10.7bn. The 2013 target forsignatures for SMEs is EUR 13.6 bn. The current forecast is even higher ataround EUR 15.9bn (which would represent an increase of about 49% on2012). Including EIF activities and third-party funds, the total amount of thisyear’s funding to support SMEs and mid-caps is expected to be around EUR19.1 bn.It is developing new security structures and products and is launching newinitiatives. For example, it developed and concluded in May 2013 a EUR 500mtrade finance facility for the first time to support a trade volume of EUR 1.5bnper year in Greece and is studying similar facilities in other countries wherefunds are not available from other sources on reasonable terms.In responding to the gap left by the withdrawal of institutional investors, theRisk Capital Mandate was reinforced and established as an open ended, EUR7bn revolving fund managed by the EIF on behalf of the EIB.Following the European Council conclusions on the Compact, the EIF isstrengthening partnerships with national institutions to deliver a variety ofequity and debt solutions through a wide range of financial partners across theEU.

o

o

o

-

In the EU, the EIB has increased its lending target for Special Activities4in 2013 toEUR 7.8bn, EUR 5.5bn of which will be on the EIB’s balance sheet.

3.2 Joint EIB-EU risk sharing instrumentsThe Commission and the EIB have worked together closely on blended risk-sharinginstruments leveraging the EU budget with the EIB lending capacity to finance further SpecialActivities in EU priority areas. Such instruments are particularly effective in vulnerable andprogramme countries or high-risk sectors such as research and development (wherepromoters face difficulty in finding alternative long-term sources of financing). The RiskSharing Finance Facility (RSFF), the Loan Guarantee for TEN-Transport (LGTT) and theRisk Sharing Instrument (RSI) managed by the EIF fall into this category.In November 2012, the Commission and the EIB launched the Project Bond initiative tosupport the role of capital markets in financing long-term infrastructure investments. Underthis innovative instrument, the EIB Board of Directors has already approved nine TEN-T andTEN-E projects in six different Member States. This includes motorway projects in SK, DE,3

4

In addition to Cyprus, Greece, Ireland, Portugal this includes Hungary, Latvia, RomaniaSpecial Activities are operations embedding a credit risk higher than under EIB standard internal provisions

10

BE and UK), grid connections to offshore wind farms in DE and UK and gas storage facilitiesin ES and IT. The first financial closures of these projects are expected in the second half of2013.The endorsement of the Commission proposal to modify the structural funds regulations andthe subsequent re-programming exercise, led to the creation of a new scheme to supportSMEs in Greece (in addition to the trade finance facility described above). Under thisscheme, unutilised Structural Funds were used to set up a Guarantee Fund dedicated to EIBlending to SMEs, structured on a portfolio first-loss basis. The first operations underpinnedby the Fund were signed in early 2013. A complementary proposal regarding certain financialmanagement provisions for Programme Countries has also been issued by the Commission.The deployment of joint risk-sharing instruments is expected to grow during the next MFFunder programmes such as the Connecting Europe Facility, Horizon 2020, as well as underthe European Structural and Investment Funds (ESIF).4.The way forward

4.1 SME InitiativesThe Commission and the EIB are also working with the ECB to develop an EU strategy toalleviate the financing constraints for SMEs. The discussions focus on options for revivingthe structured credit markets to support SME lending in particular (but not limited to) themore vulnerable Member States.Collaboration is directed at covering two dimensions (i) sufficient funding for the bankingsector directed specifically to SME lending and (ii) credit enhancement of existing or newSME loan pools so as to reduce distorted credit margins and attract institutional investors inlarge SME loan pools alleviating important supply constraints for investments.Beyond analysing a possible short-term asset driven EIB-ECB initiative, the Commission andthe EIB are exploring a joint risk-sharing mechanism to be developed under the new MFF byblending EU budget resources (COSME, Horizon 2020) and ESIF resources with the lendingcapacity of the EIB, EIF and national promotional banks. Joining forces in this way wouldachieve the economies of scale provided by EU-wide arrangements and create greaterleverage for all participating Member States. The instruments would be designed to provideassurance that the amount of funds contributed by a particular Member State from its ESIFprogrammes would generate loans to a value of several times the amount through lending toSMEs in that Member State for the benefit of the respective programme areas.The key to unlocking the leverage effects for such Joint Instruments is the widest possibleparticipation by Member States. While participation through contributions from ESIFprogrammes would necessarily be voluntary, all Member States would be stronglyencouraged to contribute to the Joint Instruments from their ESIF allocations, in theknowledge that their contributions would support increased lending to SMEs on their territory,while increasing the leverage effects for all.The Commission has developed three broad options for Joint Instruments5. Given the needto create critical mass around a core EU Joint Instrument that would leverage the EU-EIBresources and potentially link to ECB decisions, the options below are presented asalternatives. Any such Joint instrument would of course co-exist with multiple initiativessupported by ESIF at regional or national level and would not exclude the creation of

5

See the annex for a more detailed description

11

additional parallel Joint Instruments in other EU policy areas as currently envisaged by thedraft Common Provisions Regulation for the ESIF.The indicative scale of €10 bn6proposed is a fraction of the total EUR 400 bn ESIF budgetand a relatively small percentage of the total of ESIF resources that Member States andregions plan to attribute to SME support measures. A more detailed assessment of theimpact of the proposed instruments would be carried out before implementation. It is worthrecalling that in 2007-2011 alone EUR 23 bn was used by Member States in operationalprogrammes in direct support to SMEs and a further EUR 25 bn benefited SMEs indirectly. Inthe next MFF all Member States have declared their intention to increase their supportthrough financial instruments particularly for SMEs.Finally the implementation and absorption of the instrument will depend on developments inother policy areas which are being tackled in parallel. Financial regulation issues can havefor example a particular impact on the development of a securitisation market in Europe andare addressed in the Commission Green Paper consultation that expires on 25 June.1) Joint SME guarantee instrument combined with a Joint securitisation instrument fornew loansUnder this instrument, funds would be pooled from COSME, Horizon 2020 and the ESIFfunds and combined with the resources of the EIB and EIF to provide a combination of:a) guarantees for new SME lending by financial intermediaries to SMEs under a JointGuarantee Instrument.b) guarantees for portfolios of new SME loans for the purposes of securitisation. Suchportfolios would need to be built up by the banks in a specified time period (2-3 years)with a view to being securitised.Under this option, which blends 75% of guarantees with 25% of securitisation, EUR 10 bnfrom ESIF and EUR 420 m from COSME & Horizon 2020 would be allocated to generatelending to SMEs of an estimatedEUR 55-58 bn (a leverage ratio of roughly 1:5),benefiting580 000 SMEs.This option does not require changes in the draft Common ProceduresRegulation (CPR).2) Joint securitisation instrument allowing for securitisation of both new and existingSME loan portfoliosUnder such a joint securitisation instrument, public funds (ESIF, COSME, Horizon 2020, EIF,EIB, national promotional banks) would be combined for the securitisation of portfolios ofSME loans. There would be requirements for the financial intermediary to finance new loansto SMEs proportional to the amount covered by the Joint Instrument. The securitisation ofportfolios of existing loans would increase the impact and immediacy of this instrumentcompared with option 1.Under this option, EUR 10 bn from the ESIF and EUR 420 m from COSME & Horizon 2020would be allocated to generate lending to SMEs of an estimatedEUR 65 bn (a leverageratio of roughly 1:6),benefiting around650 000 SMEs.In this case, a limited change to thedraft CPR would be necessary to extend eligibility of SMEs loans to include existing loansand review eligibility of working capital, thereby facilitating the development of the instrumentand its distribution.

6

Additional to the other proposed blending facilities (PBI, RSFF, RSI, etc.)

12

3) Joint securitisation instrument allowing for securitisation of new and existing SMEloan portfolios and risk poolingThis Option would be similar to Option 2 but would include the possibility to pool risks andwould extend eligibility criteria to include existing SMEs loans and review eligibility of workingcapital, while ensuring that the on-lending intermediary would generate new loans to SMEsto a value several times higher than the amount set aside by that Member State for thebenefit of the respective programme areas. The pooling of risks allows for a better portfoliodiversification resulting in much higher leverage than under the previous options. Moreover, itallows providing immediate capital relief and liquidity to banks which facilitates the swiftprovision of new loans to SMEs.Under this option, EUR 10 bn from the ESIF and EUR 420 m from COSME & Horizon 2020would be allocated to generate lending to SMEs for an estimated amount ofEUR 100 bn (aleverage ratio of roughly 1:10),benefiting around1 000 000 SMEs.This option wouldrequire the same changes to the draft CPR as in Option 2.The EIB will work with the Commission in the development of the proposed instrument and inthe necessary work to prepare the required changes with its market and businessexperience. The leverage will depend on the final choices made by Member States and onthe take up by private sector financial institutions.

4.2 Youth employmentFollowing the Commission’s Youth Employment Package of December 2012, the EuropeanCouncil agreed on 7-8 February to create a Youth Employment Initiative with a budget ofEUR 6bn for the period 2014-20. The initiative would particularly support young peoplebetween 15 and 24 not in education, employment or training in the Union's regions with youthunemployment rates in 2012 above 25% by integrating them into the labour market. Otherinitiatives have also been announced by several Member States.The Youth Employment Initiative complements other Commission instruments in theeducation and social field and which have a significant potential on reducing youthunemployment. In particular, new financial instruments are proposed under the next MFF inrelation to student loans (guarantees for student loans under ‘Erasmus +’), microfinance(guarantees, microcredit and equity through institutions that invest or lend to entrepreneurs,especially those furthest from the labour market) and social enterprise development.In view of the forthcoming European Council, the Commission issued on 19 June 2013 aCommunication on Youth Employment setting out the immediate priorities for combatingyouth unemployment, including an agreement on the next MFF and the accompanyingprogrammes, the frontloading of the Youth Employment Initiative and the implementation ofthe relevant Country-Specific Recommendations and the Youth Guarantee at national level.Jointly with the Commission and Member States, the EIB proposes to complement theCommission’s and Member States’ efforts with a dedicated "Skills and Jobs - Investing forYouth" programme to help counteract high and rising youth unemployment. The programmeunderlines the Bank´s commitment to utilize its increased resources and target them towardsthe EU´s political priorities. The EIB´s programme has two components:(i) "Jobs for Youth" - providing SMEs with better access to finance; and(ii) "Investments in Skills" - providing lending to projects investing in the skills of youngpeople, including investments in education infrastructure, training, student loans andmobility.

13

In the context of Jobs for Youth, the EIB is exploring - together with partner banks - optionsto further increase its lending to SMEs – the main employer of young people – in order tosupport employment. The investments targeted under "Investing in Skills" include the EIB’sestablished financing of investments in schools and universities as well as a broad range oftraining schemes, notably programmes that scale up and improve the quality of vocationaltraining in Europe. The focus on job-related skills from secondary to tertiary education isseen as having the biggest impact on improving the employability of young people and offersthe best protection against unemployment. The supported measures also comprise thesupport of mobility schemes for students and employees across the EU.Beyond supporting the Commission with a fast implementation of the Youth EmploymentInitiative, the EIB, with its own resources, will focus on helping Member States to acceleratetheir national and regional programmes that tackle youth unemployment.While these initiatives are expected to further focus EIB investments on areas with highimpact on youth employment and vocational training, an enhanced availability of EUresources for blended instruments in this field may allow for a more targeted and strongerimpact of EIB lending.

4.3. Achieving a stronger impactMember States, the Commission and EIB are considering further measures to enable theEIB to continue playing a significant role in those markets and sectors where credit is scarceand where funds are not available from other sources on reasonable terms. Such measureswould need to enable the EIB to significantly expand its operations in support of SMEs and invulnerable and programme countries, where the EIB's lending should be further developed.Among possible additional measures, the EIB is considering the reinforcement of the EIF tosupport new initiatives to be carried out on behalf of the EIB taking advantage of thespecialised experience of the EIF. A special mandate between the EIB and EIF has beenreached to mobilise lending by means of an ABS instrument worth EUR 4.5 bn in the period2013-2015. An extension of the Trade Finance Facility, under implementation in Greece, toother countries is also being analysed.Should the overall EU economic conditions improve together with the financial stability of theeuro area, the EIB could analyse ways to further engage in high value added activities whereEIB support is most needed, within the limits of a sound financial management approach.In addition, the EIB is looking at further means to strengthen its lending and advisoryactivities to help project delivery, speed up disbursements and real investment as well asincrease Member States capacity to absorb EU resources.Finally, the Commission and the EIB will continue to cooperate and network with otherEuropean, national or regional public investment institutions, and banks, as well as theprivate sector, with a view to maximising the synergies and capacity which are necessary forimplementing and leveraging with additional resources lending and credit enhancementoperations initiated and co-financed by the Commission and the EIB.5.Conclusion

The Compact for Growth and Jobs is one of the key elements of the EU response to thecrisis. As an integral part of the Compact, the EIB capital increase enables the EIB tosignificantly contribute to supporting sustainable growth and employment in the face of veryserious economic challenges.

14

The development of joint financial instruments by the Commission, EIB and Member Statesaims at leveraging private sector and capital market investment in SMEs and infrastructure,thereby reducing reliance on sovereign (backed) financing of such priority investments.The fragmentation of credit markets and the high dispersion of interest rates across MemberStates for bank lending to corporates undermine the resilience of banks and financialsystems, and reduce the availability and increase the cost of capital for companies andconsumers. This thus constitutes a major impediment to growth and employment. As one ofthe few institutions issuing debt on a European level at AAA financing conditions, the EIB canhelp to alleviate the problems of fragmentation in EU financial markets. The targetedprovision of long-term financing to banks with the aim of supporting access to finance ofSMEs fills an important gap that cannot be addressed through central banks and alleviatesimportant supply constraints for investments.Bringing forward economically and financially viable infrastructure projects can have asignificant countercyclical effect and is instrumental in creating employment during theconstruction phase, especially in segments of the workforce that are hardest hit by the crisis.At the same time, infrastructure that is aimed at improving market access helps boostexports.The EIB will continue to use its catalytic capacity to attract resources from capital markets torespond to long-term financing requirements in Europe. At the same time, it will reinforce itscooperation with public investment banks in Member States, as this will allow the EIB toextend the reach of its activity, in the light of the greater distribution networks and additionalrisk-taking capacity warranted by national public banks. Those efforts will be in line with andcomplement the Commission’s work to sustain long term investment in Europe, ashighlighted in the Commission’s Green Paper on the long term financing of the Europeaneconomy of 25 March 2013.To ensure that EIB interventions will be effective, it is important that enabling conditionscontinue to improve on the EU and national levels. Structural reforms can help address theroot causes of internal and external imbalances and boost the employment effect of EIBinvestments.Given the widely different economic and financial conditions throughout the EU, the EIB isdeveloping, in close cooperation with Member States, result-driven investment strategies thatare properly tuned to national, regional and local growth priorities, taking into due accountthe horizontal priorities of the Commission’s Annual Growth Survey and the EuropeanSemester of economic governance.The months and years ahead will certainly be challenging. The Commission and the EIBremain highly committed to exploring new paths to help the Union revive growth andemployment.

15

Annex

Alternative options on the joint SMEs initiative

1) Joint SME guarantee instrument combined with a Joint securitisation instrument fornew loansUnder this instrument, funds would be pooled from COSME, Horizon 2020 and the ESIFfunds and combined with the resources of the EIB and EIF to provide a combination of:a) guarantees for new SME lending by financial intermediaries to SMEs under a JointGuarantee Instrument. This instrument would provide guarantees to banks which inturn will lend to SMEs. Banks will benefit from partial capital relief for new loansthrough uncapped portfolio guarantees. Nevertheless banks would keep at least 20%of the risks, to ensure alignment of interest.b) guarantees for portfolios of new SME loans for the purposes of securitisation. Suchportfolios would need to be built up by the banks in a specified time period (2-3 years)with a view to being securitised. The capital relief and the additional liquidity wouldmaterialise in the future once the portfolios are fully created and securitised.It is worth noting that these two instruments will be operated in parallel and not cumulativelyto avoid double funding by ESIF. The proposed allocation is 75/25% to smoothen budgetconsumption

Leverage(2014-2020)Advantages

EUR10 bn from European Structural and Investment Funds (ESIF) + EUR420 m from COSME & Horizon 2020 =>EUR 55- 58 bn in SME lendingsupported, benefiting580 000 SMEs (a leverage ratio of roughly 1:5)Provides incentives for new SME lending through partial capital relieffor new portfolios of SME lendingCan be delivered without significant modifications to the draft CommonProvisions Regulation for the ESIF.Member States' ESIF funds would be used exclusively to provide loansfor and to meet losses incurred with respect to SMEs in their territory incorresponding programmes.The combination of 2 instruments would help SMEs and help revitalisethe SME backed securitisation market in around 3 years' time.Any securitisation can only take place in the 2-3 years after new SMEloan portfolios have been built up.For both instruments banks would need to mobilise their own capitalupfront to make loans to SMEs. In the current phase of deleveragingand cleaning up of bank balance sheets to prepare for SSM andBanking Union this limits the speed at which new portfolios could bebuilt up.

Disadvantages

16

No role for private/ institutional investors in the next 2-3 years, hencehigh reliance on public funds.Technically complex to operate under shared management withrespect to allocation by category of region.No risk pooling limits portfolio diversification and hence leverage effect.

2) Joint securitisation instrument allowing for securitisation of both new and existingSME loan portfoliosUnder such a joint securitisation instrument, public funds (ESIF, COSME, Horizon 2020, EIF,EIB, national promotional banks) would be combined for the securitisation of portfolios ofSME loans. This means that loans to SMEs would be bundled and guaranteed to providecapital relief to the intermediary in the case of unfunded securitisation. In case the tranchesare sold on to institutional investors (funded securitisation), they will also generate immediateliquidity for banks to use to create new loans for SMEs. There would be requirements for thefinancial intermediary to finance new loans to SMEs proportional to the amount covered bythe joint instrument. The securitisation of portfolios of existing loans would increase theimpact and immediacy of this instrument compared with option 1.

Leverage(2014-20)Advantages

EUR 10 bn from ESIF + EUR 420 m from COSME & Horizon 2020 =>EUR 65 bn in SME lendingsupported, benefiting650 000 SMEs (aratio of roughly 1:6)Partner banks would not need to mobilise new capital to make newloans. This would accelerate the creation of new SME loans.Attracts private money from institutional investors purchasingsecuritised assets. This in turn reduces the demands on public money,which would be freed up for other uses. It will also make EuropeanSMEs less reliant on banks for their financingMember States' ESIF funds would be used to deliver new loans forSMEs and to meet losses incurred with respect to SME loans on theirterritory.Would help revive the commercial securitisation market, which wouldopen up new non-bank sources of finance for SMEs that currentlydepend almost entirely on bank financing.Securitisation of existing SME loan portfoliosmodification of draft Common Provisions Regulation.wouldrequire

Disadvantages

Complex structure to set up and – as for Option 1 – sharedmanagement structure adds to technical complexity.No risk pooling limits portfolio diversification and hence leverage effect.

17

3) Joint securitisation instrument allowing for securitisation of new and existing SMEloan portfolios and risk poolingThis option would have all the advantages and requirements of Option 2 but add thepossibility to pool risks , while ensuring that the on-lending intermediary would generate newloans to SMEs to a value several times higher than the amount set aside by that MemberState for the benefit of the respective programme.

Leverage(2014-20)Advantages

EUR 10 bn from ESIF + EUR 420 m from COSME & Horizon 2020 =>EUR 100 bn in SME lendingsupported, benefiting1 000 000 SMEs(roughly 1:10)Partner banks would not need to mobilise new capital to make newloans. This would accelerate the creation of new SME loans.Attracts private money from institutional investors purchasingsecuritised assets. This in turn reduces the demands on public money,which would be freed up for other uses.Pooling of risks allows for greater portfolio diversification and leverageeffects.Centrally managed structure offers economies of scale in terms of feesand costs and less complexity than shared management structure.Member States' ESIF funds will achieve a minimum leverage at leastas in option 2 but will benefit from even higher lending volumes in theirregions due to the pooling of risk at EU levelThe use of ESIF funds for guarantees for securitisation of existing SMEloan portfolios involving other Member States would require additionalmodification of the draft Common Provisions Regulation.The achievement of the potential of the instrument will depend upon awidespread participation by Member States.

Disadvantages

18