Transportudvalget 2012-13

TRU Alm.del Bilag 133

Offentligt

The Austrian Scheme ofFinancing the RailInfrastructure29 October 2012Federal Ministry for Transport, Innovation and TechnologyViennaAustria

1

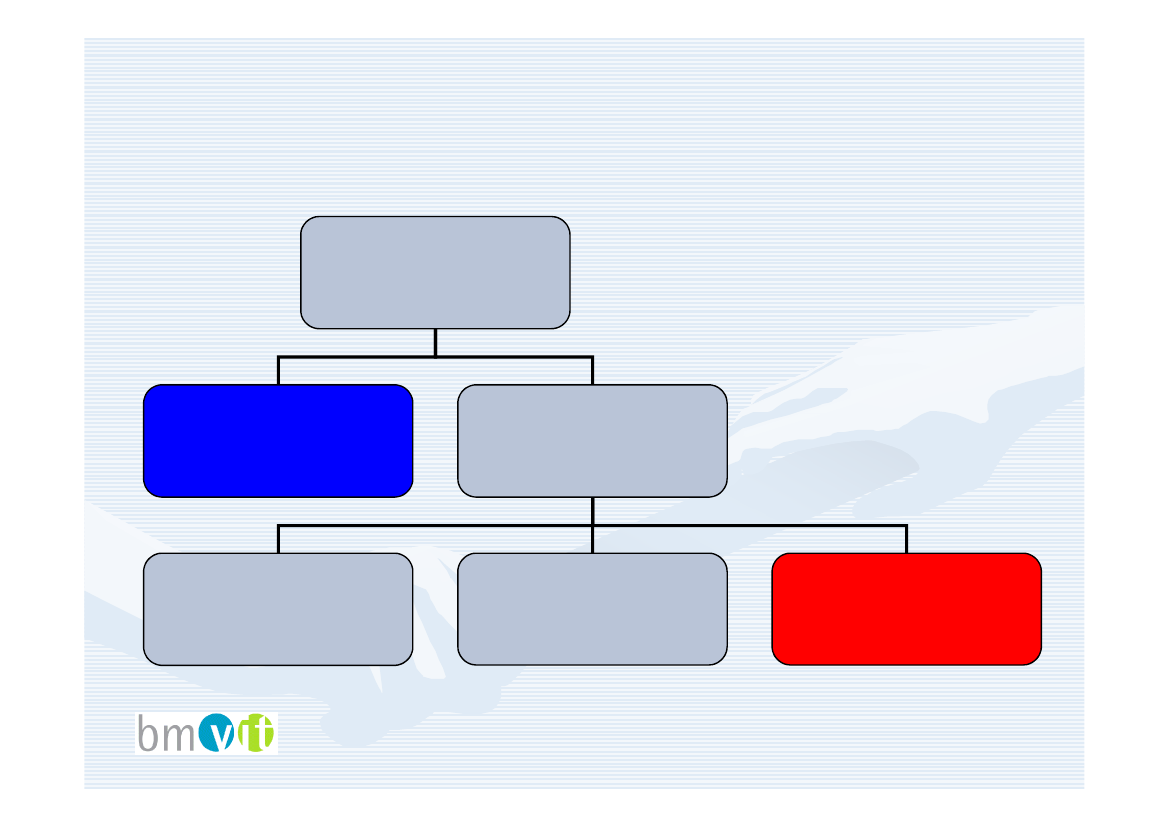

Basic Organizational Structure (1)•The responsibility for the construction, operation and financingof the Austrian high-level rail infrastructure lies with a privatelyhigh-organized stock company.•The federal government owns 100% of this company.ÖBB-ÖBB-Infrastruktur AGÖBB Infrastructure CorporationÖBB = Österreichische BundesbahnenAustrian Federal Railways

2

Basic Organizational Structure(2)Federal Republic

ASFINAG

ÖBB-Holding AG

ÖBBPersonenverkehr AG

RailCargo Austria AG

ÖBBInfrastruktur AG

3

Current government programme –Rail sector•Commitment to modernization of rail infrastructure.•Continuation of the “Rail Infrastructure Campaign”.

4

General overviewRoad•Bundesstraßengesetz(Federal Highway Act)

Rail•Target network 2025+•Investment programme(6-(6-year framework plan)

•Investment programme(6-(6-year construction programme)

•Toll financing

•Grant contract

5

Strategic objectives for railinfrastructure – Target- networkTarget-2025+•••••Network functionFurther development of safetyIntegrated timetableHigh-High-quality services for freight trafficImprovement of economic efficiency

6

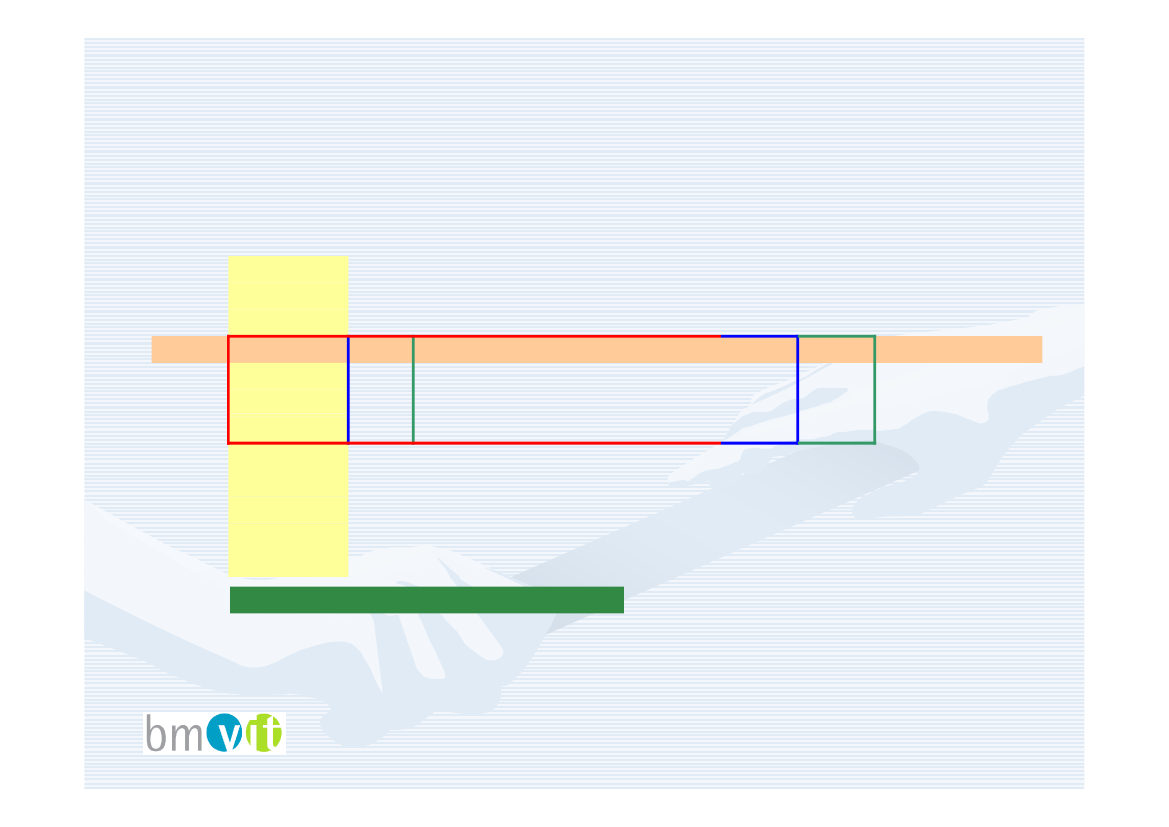

Investment programme - rail•Objective of the investment programme: Networks to be strivenfor are coordinated between the federal government and thecompany (target network).•The objectives are operationalized by investment programmes,based on a time-frame of 6 years.time-•The programmes are controlled on the basis of the yearly sum ofthe investment programmes as well as on project level (doublecontrol).

7

Presentation of theInvestment Programmes - railInvestment programme nyear 1project 1project 2project 3project 47975095249Annual sumyear 2301180103year 329722111Investment programme n+1year 428699109year 5285421104year 627433699Investment programme n+2year 7005080year 8…………221Sum per project

Sum of the investment programme per year

8

ÖBB Framework Plan 2013 – 2018 (1)•The Framework Plan of 2012 – 2017 was updated for the period2013 – 2018 and passed by the Austrian government on 16October 2012.•The total volume of the new Framework Plan 2013 – 2018amounts to approximately 12.7 billion Euro.•The Framework Plan includes:– New construction and upgrading of existing railways– Railway stations and freight terminals– Reinvestment in in the existing railway infrastructure

9

ÖBB Framework Plan 2013 – 2018 (2)Ad new construction and upgrading of existing railways:Southern railway (Semmering Base Tunnel, Koralm)(SemmeringKoralm)Western railwayBrenner axis including Brenner Base TunnelMost of these relations are TEN-priority projects (especiallyTEN-Western railway, Brenner axis)All of them are going to be included in the new TEN-T coreTEN-network.

10

Principles of Financing of theFramework Plan•The company raises the capital for its investments on the capitalmarket.•In order to create credit conditions on favourable terms stateliabilities are provided for the company.•Financing is NOT based on the principles of project financingbut on the principles of corporate financing.•Financing is based on pre-financing with income from long-termpre-long-refinancing.•Long-term investment agreements are concluded between theLong-federal government and the company. Hereby the state subsidiesare defined on a concrete basis.

11

RefinancingRoad•Toll revenues as well as otherrevenues.Rail•Revenues from infrastructurecharging (rail infrastructurecharging) as well as otherrevenues.•State subsidies

•No state subsidies from thefederal government

12

Grant contract (I)•The refinancing of the investments in the rail sector is carriedout through state subsidies.•Contract under private law between ÖBB InfrastructureCorporation and Ministry of Transport.•Legal basis: § 42 of the Federal Railway Act as well as budgetarylaws (“Vorbelastungsgesetze”) containing financial precautions(“Vorbelastungsgesetze”)over the entire construction- and financing periodconstruction-•Controlling by key performance indicators

13

Grant contract (II)•Grants on an annuity basis for: New construction and upgradingof existing railways, railway stations and freight terminals as wellas the reinvestment in the existing railway infrastructure, whichare included in the ÖBB Framework Plan.•Grants on a cash basis for: Maintenance and operation of theinfrastructure (which are not included in the ÖBB FrameworkPlan), if not covered by track access charge.

14

General conditions (1)•Planning security– entire project duration– re-investment/ maintenancere-

•Stability concerning time and costs•Existing network has priority over new constructionand extension.

15

General conditions (2)

•Monitoring– Supervisory board– bmvit– SCHIG

16

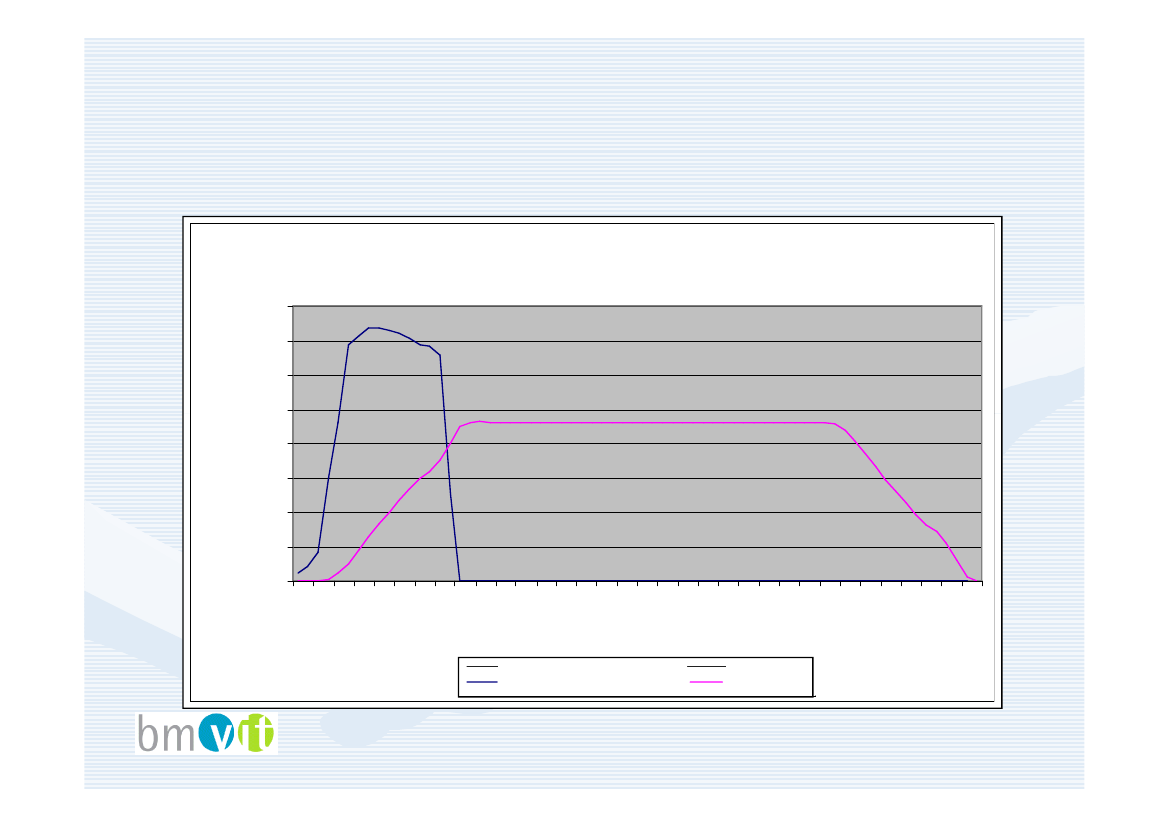

The Annuity Model (1)Example:Investment:1.000Own Contribution:-100Macro-Macro-Economic Investment.:900Annuity:appr.56interest rate: 5%

→Macro-Economic Investment ( 900 ) is not financed on a cashMacro-basis but on the basis of annuities (30 years).→ 30 years correspond with the average period of the life cycle ofthe infrastructure and the average depreciation period.

17

The Annuity Model (2)•The company bears the liability which has no effect on thebalance sheet because depreciation, interests and annuities areincluded.•Debts are refinanced by annuities over a long-term period.long-Effects of annuities on the company:•High debts on the liabilities side and assets (activatedinfrastructure investments) on the other side of the company´scompany´balance sheet (balance sheet extension).•The activated infrastructure investments are presented on theasset side of the company´s balance sheet.company´•On the liabilities side: slow reduction of debts.18

The Annuity Model (3)fiktives Beispielfictitious example400,0350,0300,0250,0

Mio €

200,0150,0100,050,00,0111110102030202030304040

1

10yearsJahre

20

30

Investitionsmittelabflussinvestment capital

Annuitätenannuities

19

The Annuity Model (4)Pros•Consonance of budget andfinancing•Macro-Economic user feeMacro-(refinancing by the nationalbudget according to theperiod of utilization)•Balanced income statement

ConsFor the enterprise:•Long-term liabilitiesLong-•The enterprise is permanentlyconfronted with debtsFor the national budget:•Long-term effect on theLong-budget

20

The Annuity Model (5)Effects of the new European System of Accounting(ESA) on the public budget:•Initially ÖBB Infrastructure corporation belonged to theprivate sector.→Only grants for annuities had an effect onAustrian deficit and debt•As from 2014 the entire ÖBB Infrastructure corporation willbe assigned to the public sector → relevant for Maastrichtcriteria → full effect on Austrian deficit and debt.

21

The Annuity Model (6)Two general aspects:•Steering mechanism: ÖBB Infrastructure corporation has theresponsibility for the investment, the financing and thefinancial outcome.•Off-balance financing: not possible any more as of 2014 (newOff-ESA)

22

The new Austrian accounting system (1)Type of accounting•Cash accountingBudget•Cash budgetCorresponds to…•Payments(cash flow statement)

•Accrual accounting•Accrual budget

•Result based onaccrual accounting(operating statement)

•Capital accounting•Statement offinancial position

•Balance sheet

23

The new Austrian accounting system (2)Budget Reform: Federal Organic Budget Act 2013•Accounting for the federal government on the basis of double-double-entry bookkeeping (accrual accounting).•Based on the International Public Sector Accounting Standards(IPSAS).•Information will be available to the administration, theparliament and the public as from 2013.Effects of the new Federal Budget Act on infrastructure finance:•Maastricht debts according to ESVG will be transparentlyrepresented in the accrual budget.

24