Transportudvalget 2012-13

TRU Alm.del Bilag 133

Offentligt

Organization and Strategy ofAustrian Federal Railways

1

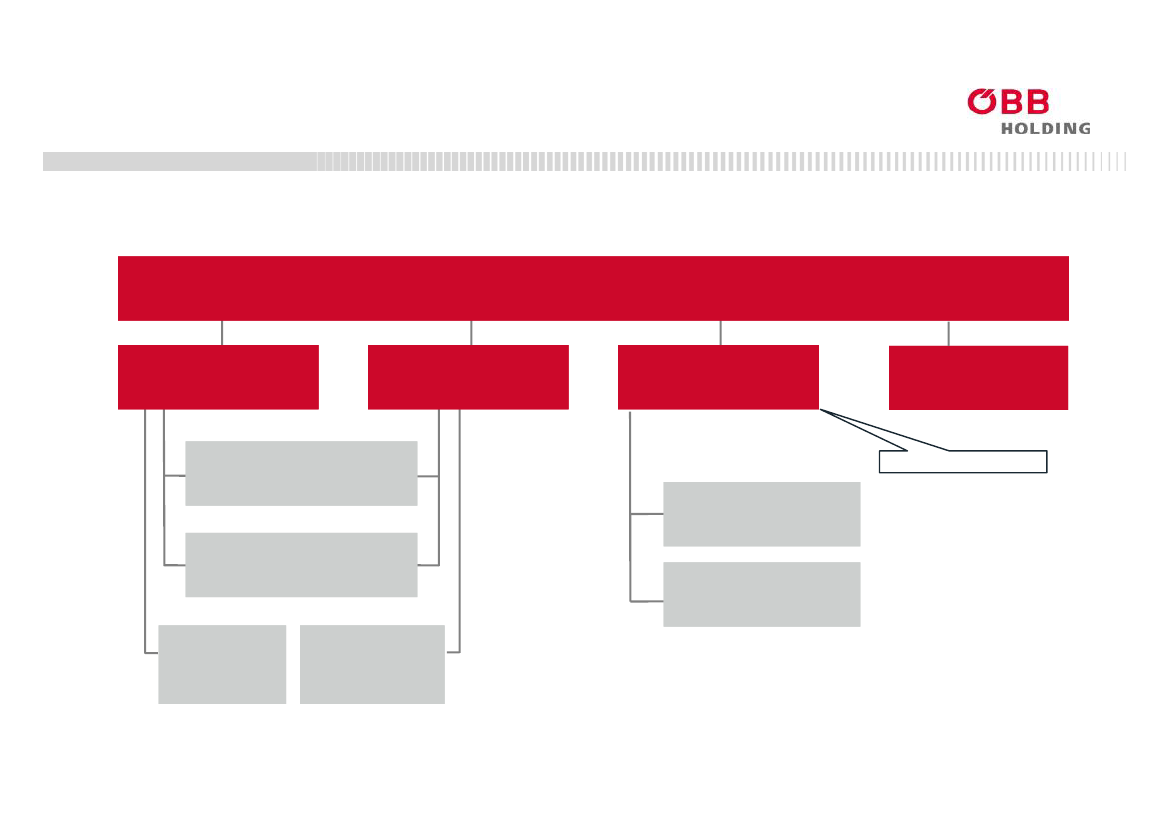

ÖBB is an integrated company with tractionand maintenance assets

ÖBB–Holding AGÖBB-Personen-verkehr AG(Passenger Transport)Rail Cargo AustriaAG(Freight Transport)ÖBB-Infrastruktur AG(InfrastructureManager)ÖBB-Shared ServiceCenter GmbH

ÖBB-Produktion GmbHÖBB-Immobilien-Management GmbHÖBB-Technische Services-GmbH

Includes Shunting

ÖBB-IKT GmbH

ÖBB-PostbusGmbH(Bus Operator)

Express InterfrachtInternational SpeditionGmbH (ForwardingBusiness)

*This organizational chart contains a selection of the most important ÖBB-companies2

Facts & Figures 2011Total revenue: 6.3 bn. €All divisions operationally positiveWorkforce: 42,600Transport volume: 27,7 bn ton-kilometers mainlyin CEE/SEE450 million passengers per yearRail network in operation: 5,556 km~ 2 bn. EUR of investment in faster tracks,new railway stations, new trains and buses

3

ÖBB-Personenverkehr AG(Passenger Transport)Rail passenger services for commuter/regional andlong distance traffic1,2 million passengers per day450 million passengers per year (incl. bus)Regular interval timetables (two thirds of trains already)Design of products coordinated with neighbouringrail-operatorsHigh satisfaction of customers with regard to friendlynessand competence of our employees (confirmed by maketresearch)Modern rolling stock(Talent, Desiro, double deck trains, ICE, railjet…)4

4

ÖBB-Postbus (ÖBB bus operator)Seamless integration of bus & train servicesLinking tourist regions to the nearest publictransport hubApproximately 2,200 buses840 bus lines247 million passengersBusiness activities in the Czech Republic(Southern Bohemia)

5

5

Rail Cargo Austria AGAbout 60 share holdings in 25 countriesApproximately 29.000 freight wagonsTransport volume: 124 million tonnesTransport performance: 27 bn. ton-kilometres13 freight hubsProvider of complete transport and logisticsservices:-Single wagon services-Block train links-Container- & intermodal transport-Door-to-Door service

6

6

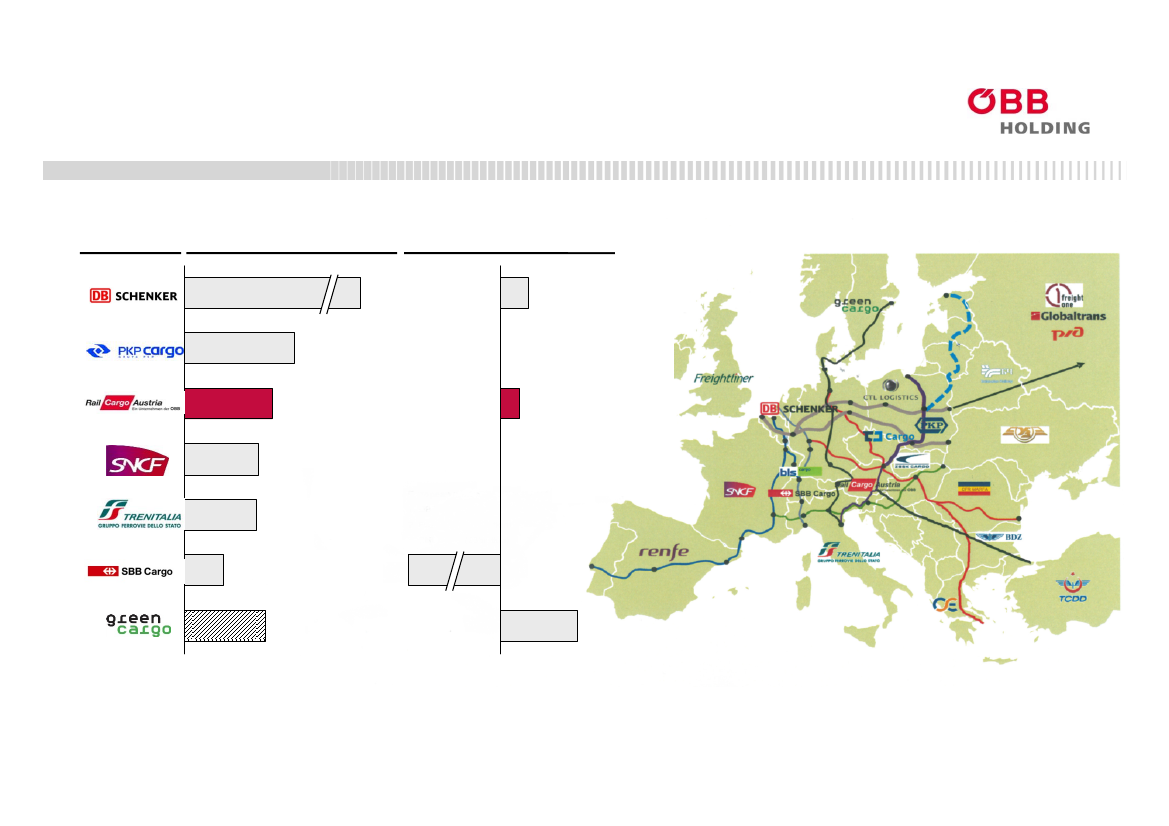

RCA third largest Rail Cargo Player in Europeby transport volumeRail CargoPlayerTransport volume,in net ton-km bn, 201111234

EBIT margin,in %, 20110,6

n.a.0,4

27

23

n.a.

22

n.a.

12

-4,825*1,6

*Gross ton-km

7

ÖBB-Infrastruktur AG(Infrastructure Manager)4,825 km of rail network (of which 3,378 electrified)14,583 switches28,075 signals5,803 bridges222 tunnels3,972 level crossings108 shunting yards6,450 trains per day

8

Financing ÖBB

Market

Customers

Customers

Authorities

State

Federal States,Municipalities

Passenger

PassengerTransportServices

Public Services

PublicTransportContracts

Freight

FreightTransportServices

ÖBB

Public Services

Infra-structure

Track AccessCharges

Contribution § 42Austrian FederalRailways Act

State liabilityforinvestments1

1ÖBB

take out loans on the capital market for investments

9

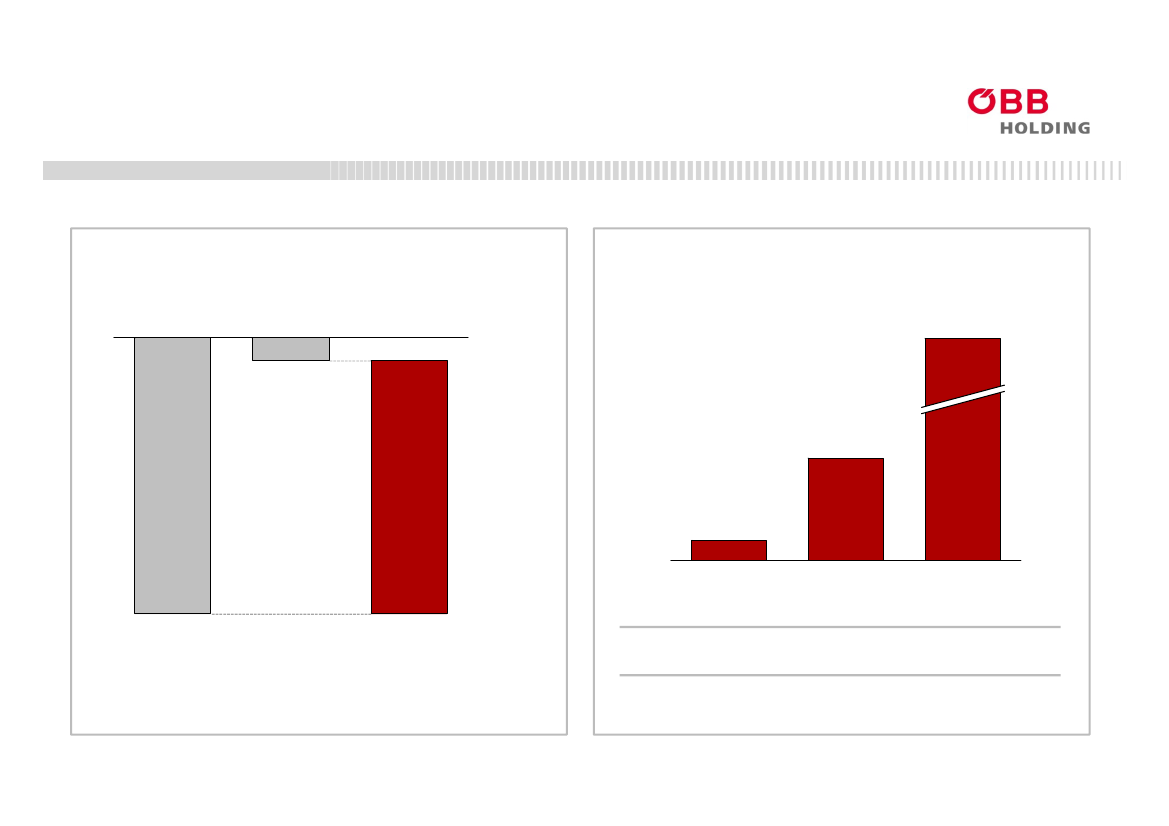

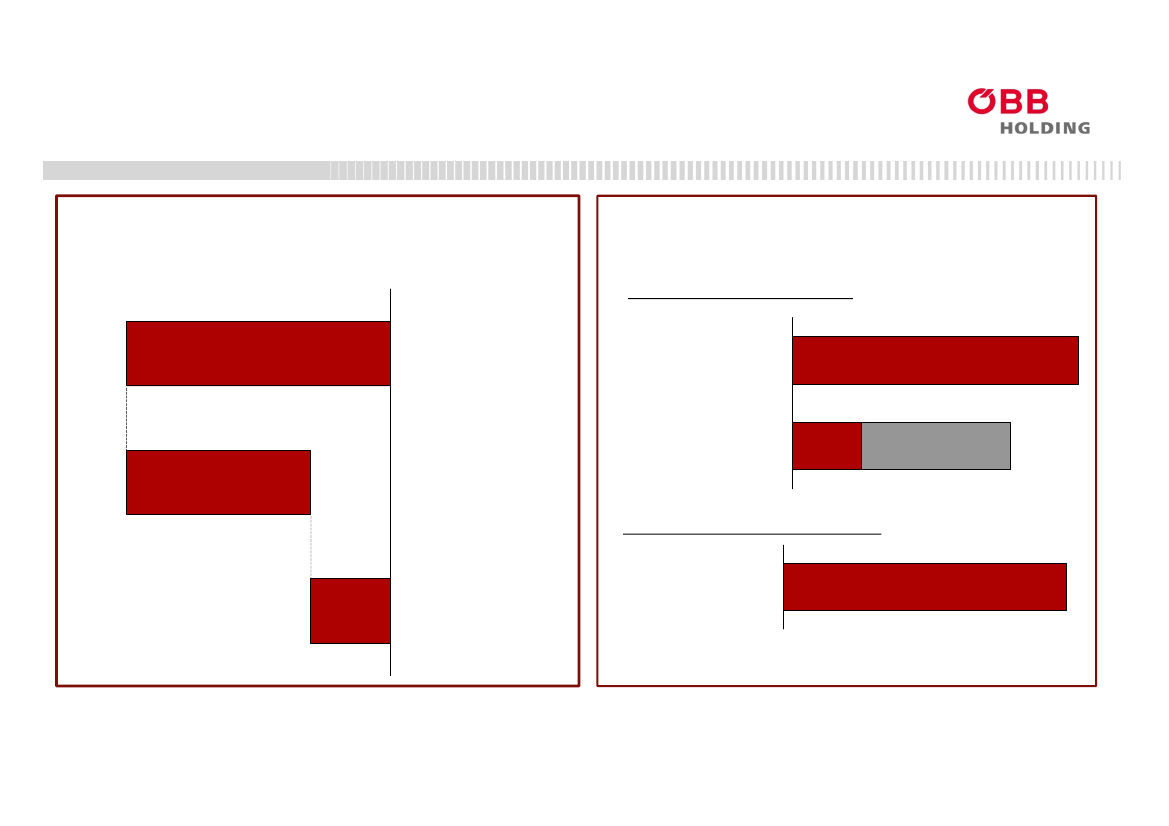

~300 million EUR increase in net profits vs. 2010,all divisions operationally positive

Significant increase in net profitsEBT ÖBB Group 2011, in million EUR

All divisions operationally positiveEBIT 2011, in million EUR544,0

-27,9

60,3

301,911,7

RCA-329,8

PV

Infra

2010

2011

EBT

-48,6

15,9

8,4

10

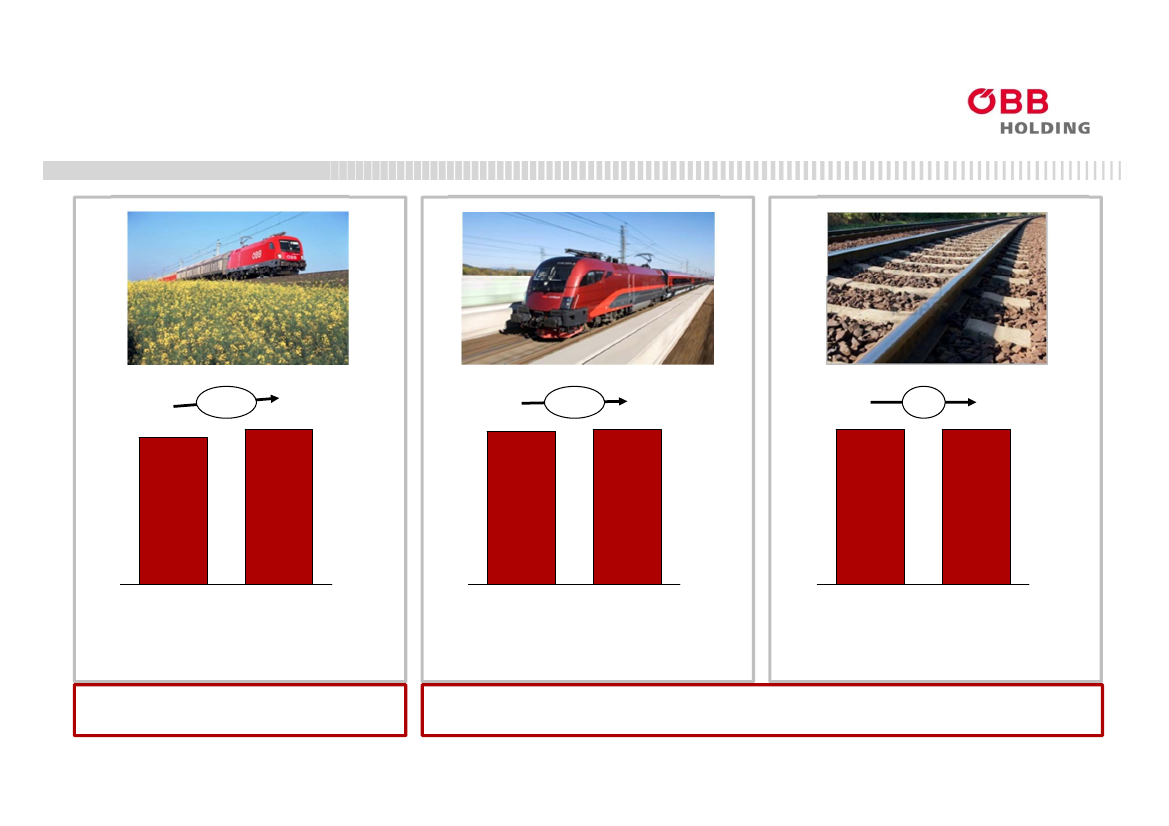

Key performance indicators by company

Cargo

Passenger

Infrastructure

+5%

+1%

0%

25.9

27.3

206.4

209.3

73.4

74.0

20102011Transport performancein bn tkm••Top-3 freight RU in EuropeAbove-average growth in 2011•

201012011Rail Passengersin m

201012011Transport performancein bn tkm

Average growth rates 2011due to transfer of secondary lines to regional authorities

1) Net of regional tracks sold to the state of Niederösterreich (3,4 m passengers, 100 m gross-tonne-km)

11

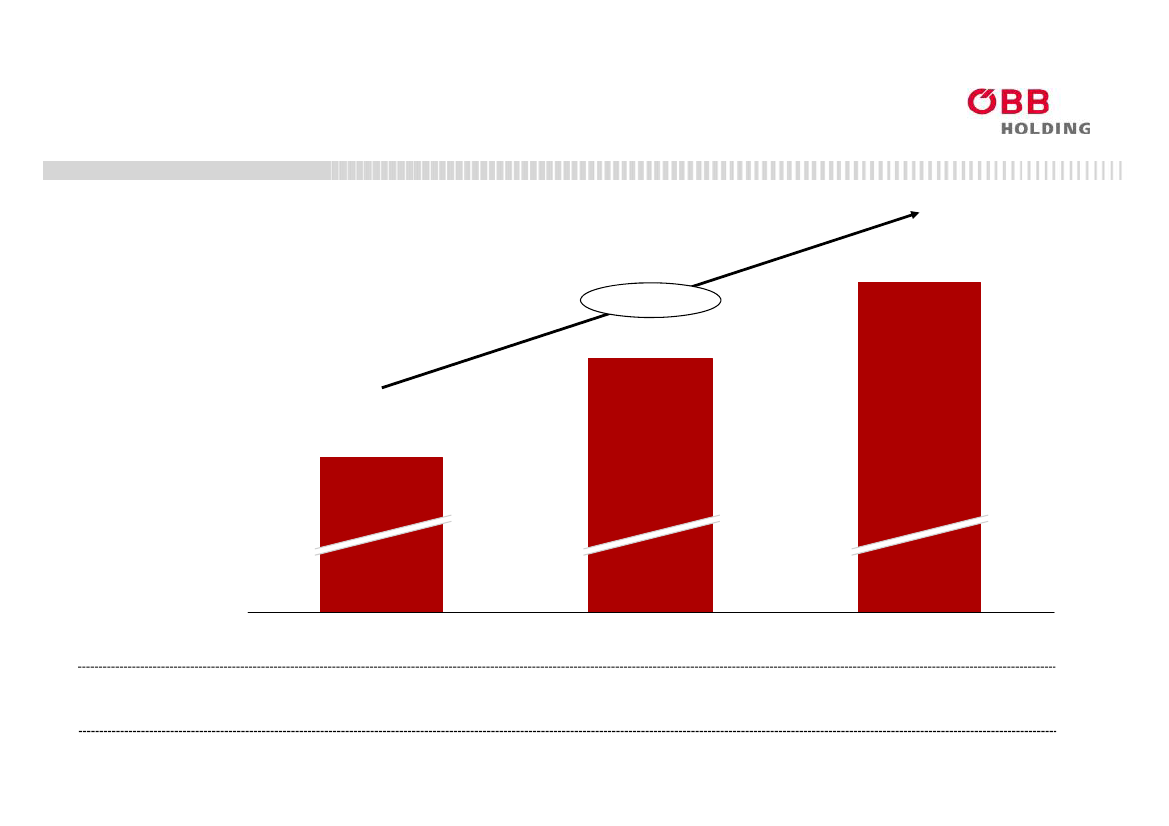

Sales Revenues at Record level, 6% annual growth since 2009

Sales Revenues1ÖBB Group, in million EUR3.329+6% p.a.3.163

2.949

2009Percentage ofSales Revenues61,1%

201061,6%

201163,1%

1) Sales Revenues = Revenues including free transport for pupils, less Public Transport Contracts / Public services and§42Austrian Federal Railways Act

12

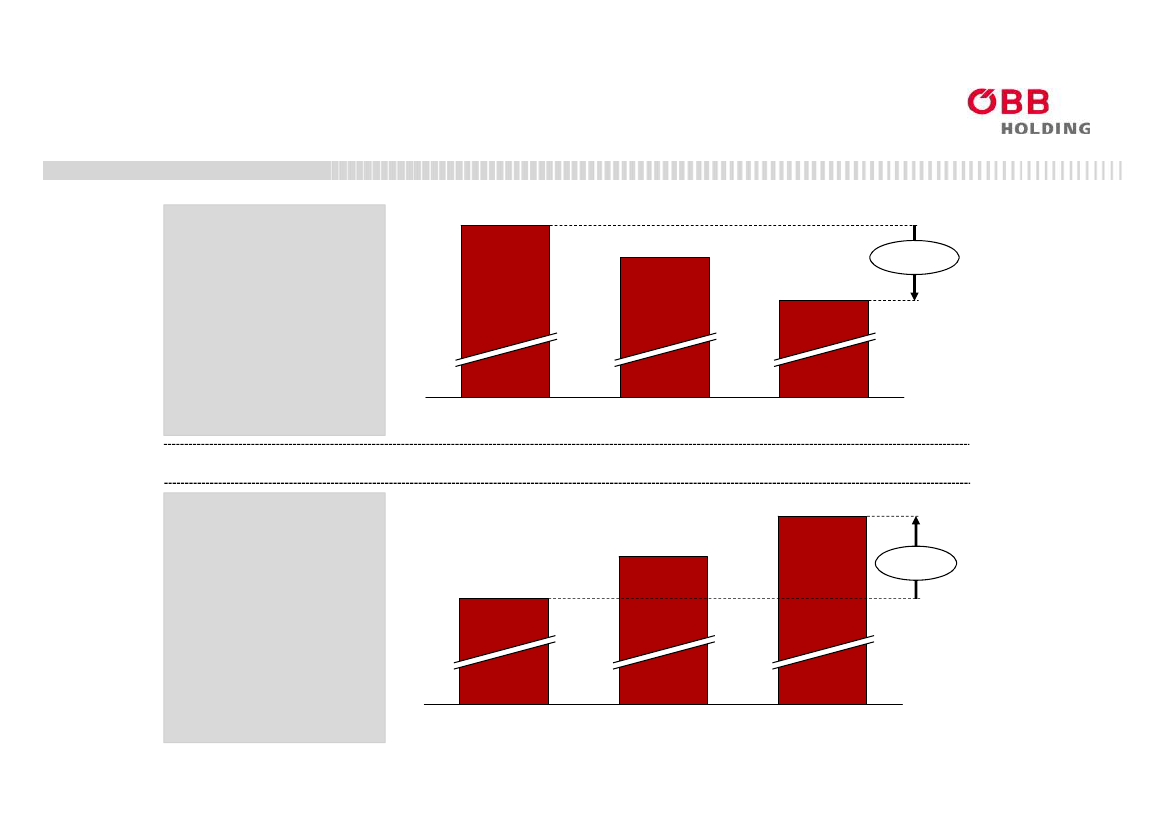

Headcount reduction of ~ 2,800 since end of 2009,labor productivity increased by ~ 21%43,605

Headcount ÖBBGroup 31.12.(excl. apprentices)

42,41940,832

-2,773

2009

2010

2011

ApprenticesLaborproductivity(in EUR/HC;excl. apprentices;based on marketrevenues1)

1,581

1,70674,566

1,74281,537+21%

67,630

20091) Market revenues = Revenues less government subsidies

2010

201113

Staff costs are key for ÖBB-reform : Political will to stop earlyretirement increases pressure to make workforce more flexibleOverhead reduction 2010 – 2012Employee mobility within ÖBBFigures 2011

1. Between companies-1.385TotalpotentialJob-Changeswithin ÖBBPlacement byJob PlacementService*

716716174373

-970

2010/2011

174permanent temporary

2. Change of job functionsNumber ofchangestransferred within the company14

-415

Plan 2012

1.669

*Internal Job Market: civil servants can be retrained and

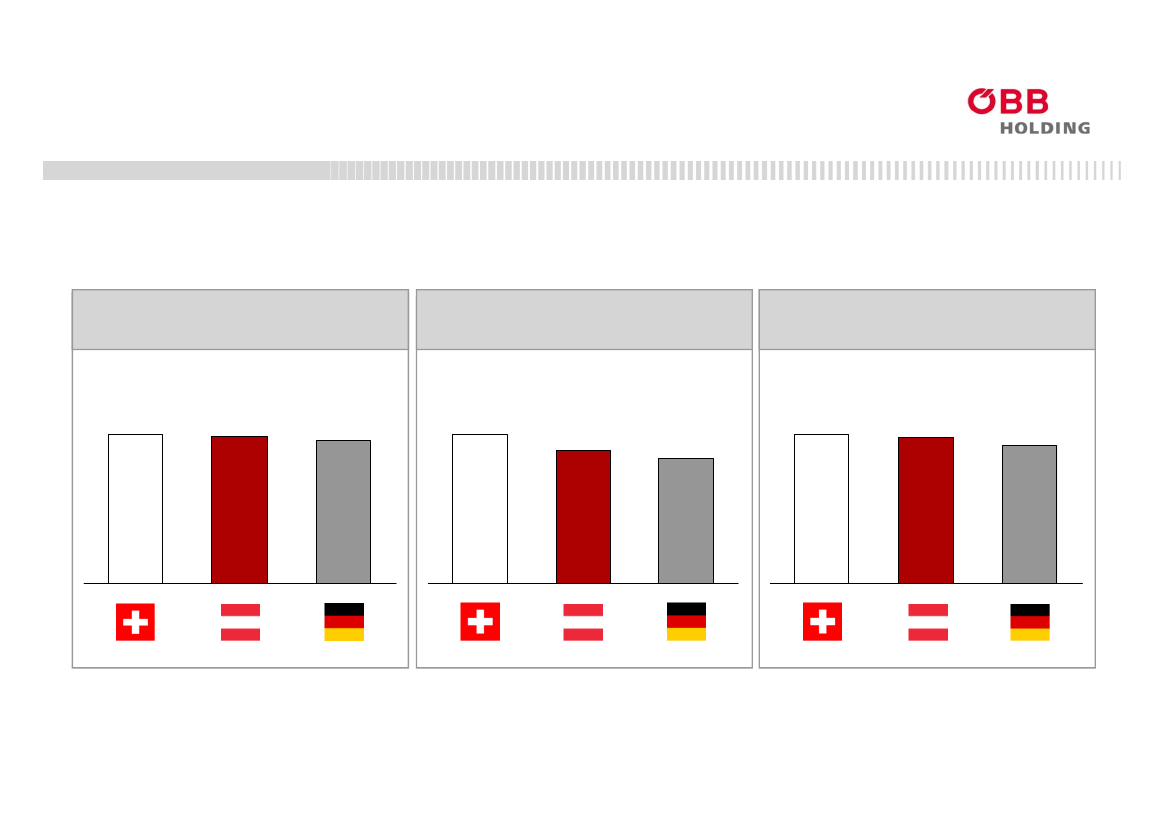

In parallel large scale service improvements in thepassenger company

Punctuality at anall time high97,396,692,9

Major success of newticket model„SparSchiene“

Improved cateringservice on trains

Better rolling stockand more comfort onthe train

SBB

ÖBB

DB

ÖBB passengercompany amongtop RU´swithrespect topunctuality

Pricing systembased on airlinesmodel –cheapertickets forcustomers andbetter trainutilization800,000 ticketssold sinceSeptember

Railjet RestaurantRefurbishmentstartedNew cateringfrom April 2012Nespresso-Trolleys

WIFIon Railjetand in stationloungesRailjeton Austriansection of Baltic-Adriatic-Corridor

15

PRODUKTION / TECHNIK / SICHERHEIT – Benchmark Pünktlichkeit

On the way to operating excellence through…… significant improving of punctuality in 2011Punctuality in % (Delay≤ 5 Minutes)

Commuter Services+ 1,8%,Long Distance Services+ 11,3%,Freight Traffic+ 1,8%Passenger Service TotalPassenger Long DistancePassenger Commuter Services

97,3%

96,6%

92,9%

95,7%

87,0%

98,6%80,0%

97,0%

93,2%

16

Railways have a bright future

Traffic forecastsBy 2025 passenger and cargo traffic will have increasedsignificantly in Austria▪~ 25% more passengers▪~ 33% more train-km, ~ 29% more trains▪~ 55% more ton-kilometers

Regulatory boundary conditionsVisionary goals on European and Austrian level▪BMVIT1: "Bahn als Verkehrsmittel der Zukunft"▪EU „White Paper on Transport“ with clear targets to shiftmodal share towards rail

Goal set by

owner and

management

Transport morepassengers andcargo atsustainableprofitability levels in2015CompetitionContinuing market liberalization▪Results in opportunities abroad (esp. Cargo in CEE/SEE)▪Leads to increased service-, innovation and productivity levels inour home market and therefore makes rail more attractive▪Fair level playing field as precondition1Federal

Ministry of Transport, Innovation and Technology

17