Erhvervs-, Vækst- og Eksportudvalget 2012-13

ERU Alm.del Bilag 204

Offentligt

Brazilian EconomyRio de JaneiroMarch, 2013

1

The Brazilian economy is able to reachsustainable growthDomestic market leading economic growthEconomic PolicyPolicies for social inclusionInflation targetingSound fiscal policyFloating exchange rate with reduced volatilityUse of financial and regulatory instrumentsMeasures to boost competitiveness

Good external solvency indicators

A robust banking sectorMany investment opportunities :Agribusiness, Oil & Gas, Logistics, Energy, Domestic MarketLed Investments, World Sport Events ...

Low unemployment rate with aconsistent job creation

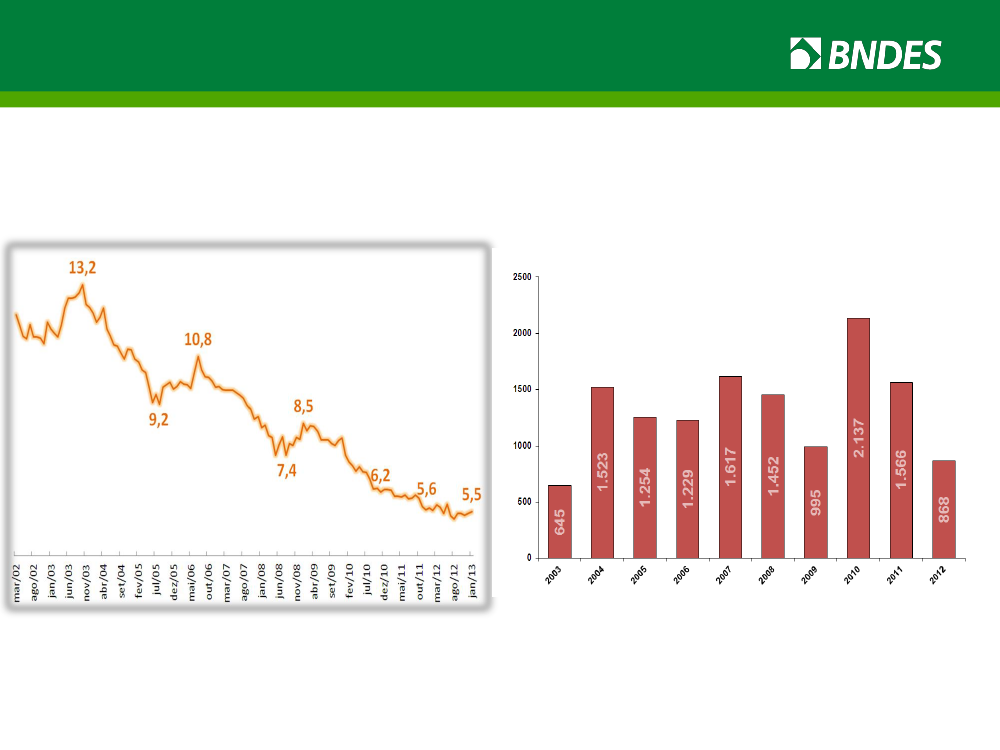

Unemployment Rate (%)

Net Jobs Creation(thous. of jobs)

(*) On 12 month basis up to Sept. ‘12

Source: IBGE.PME and Caged. Produced by APE/BNDES

3

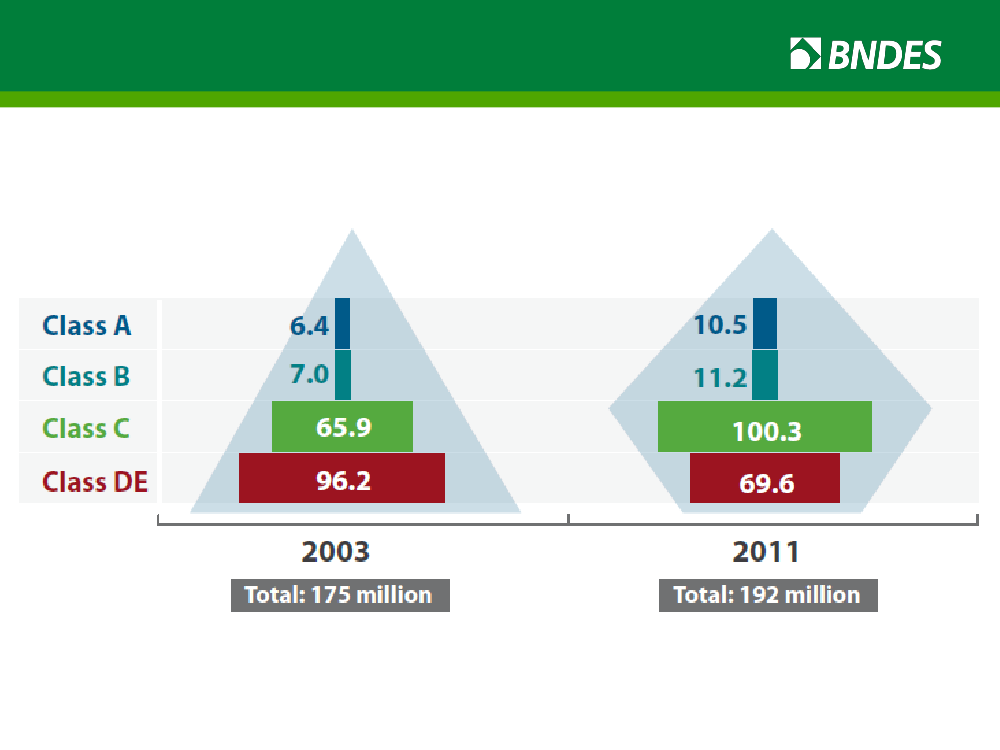

Economic inclusion creating a dynamic marketPopulation by income class strata (# of people)*

* Source: IPEA, based on PNAD/IBGE data. Prepared by Ministry of Finance

4

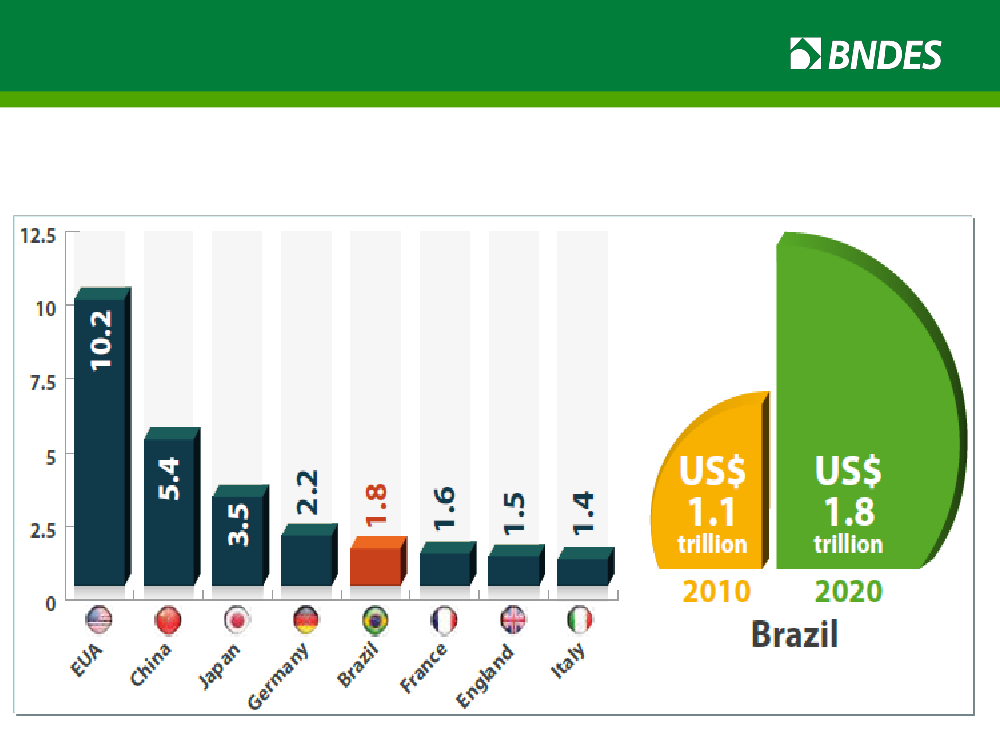

Brazil will be the fifth largestglobal market in 2020Global Consumer Market(US$ trillion)

Source: McKinsey.

5

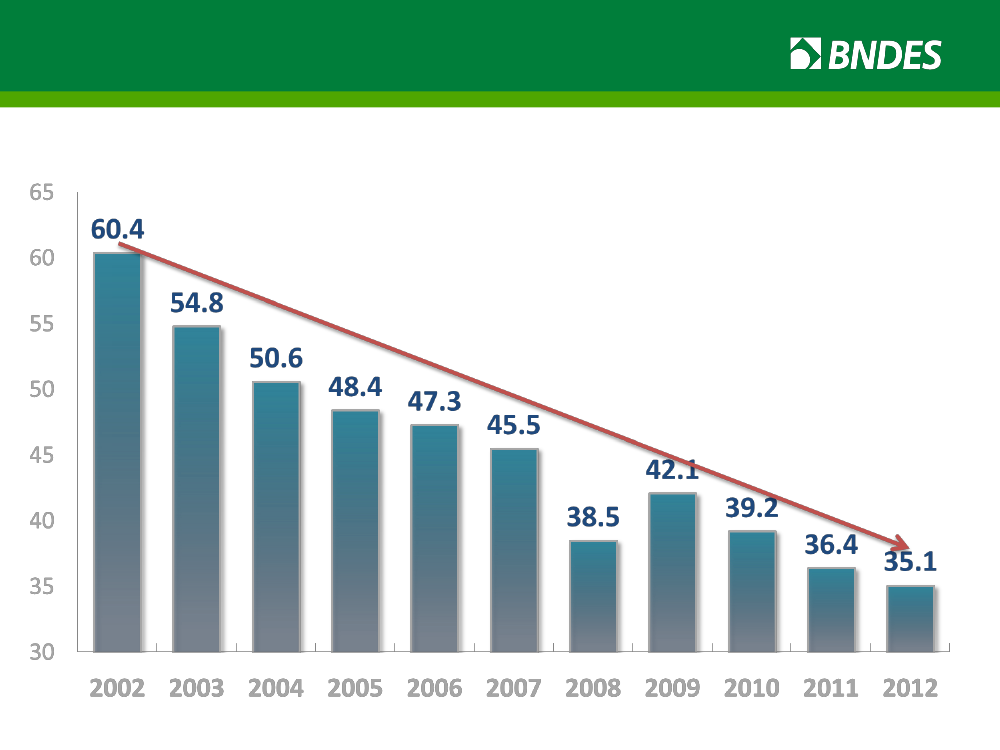

Sound macroeconomic fundamentals:Declining Net Public Debt/GDPConsolidated Public Sector Net Debt(% of GDP)

Source: Brazilian Central Bank.

6

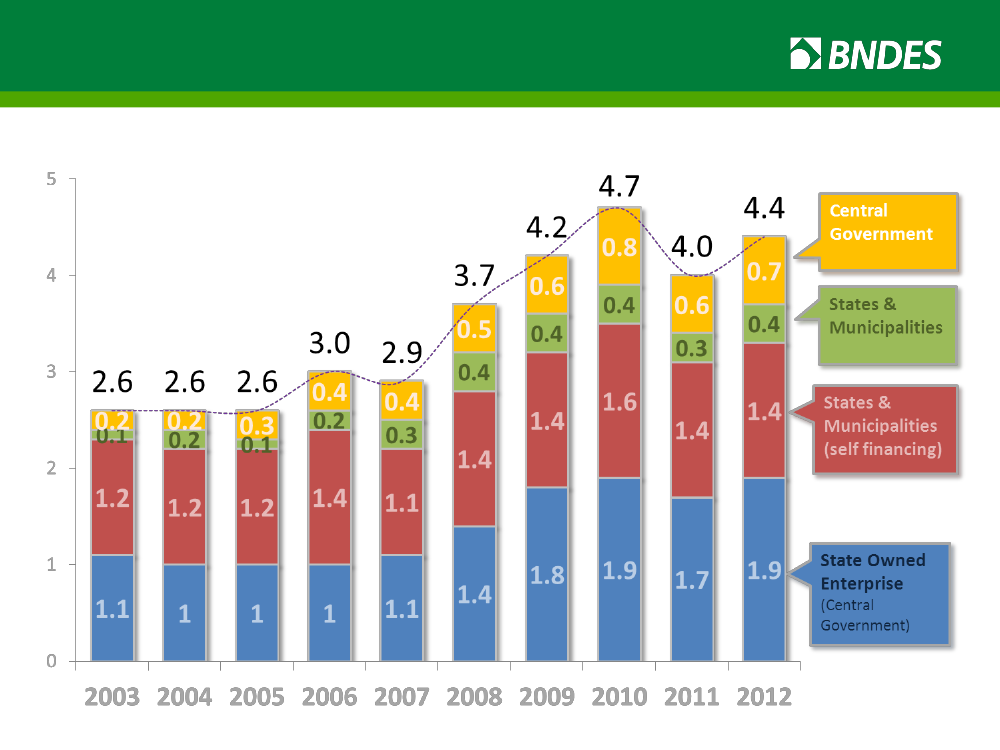

Increasing public sector investmentsPublic Sector Investments(% of GDP)

Source: IPEA.

7

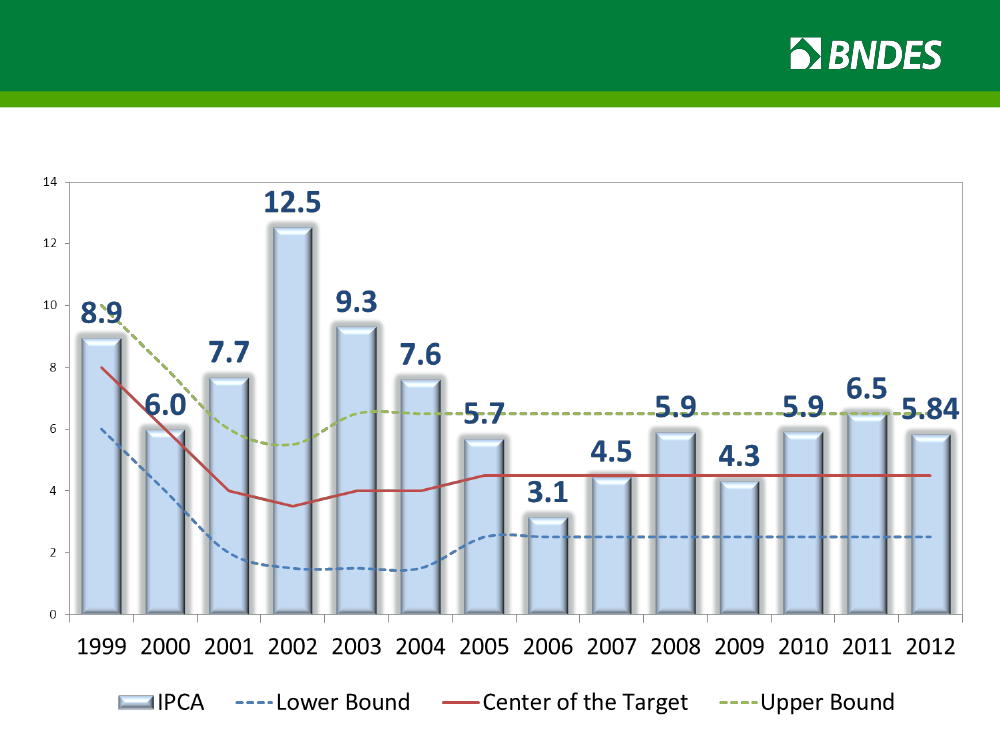

Sound macroeconomic fundamentals:Inflation under controlCPI Inflation(IPCA index, % YoY)

Source: IBGE.

8

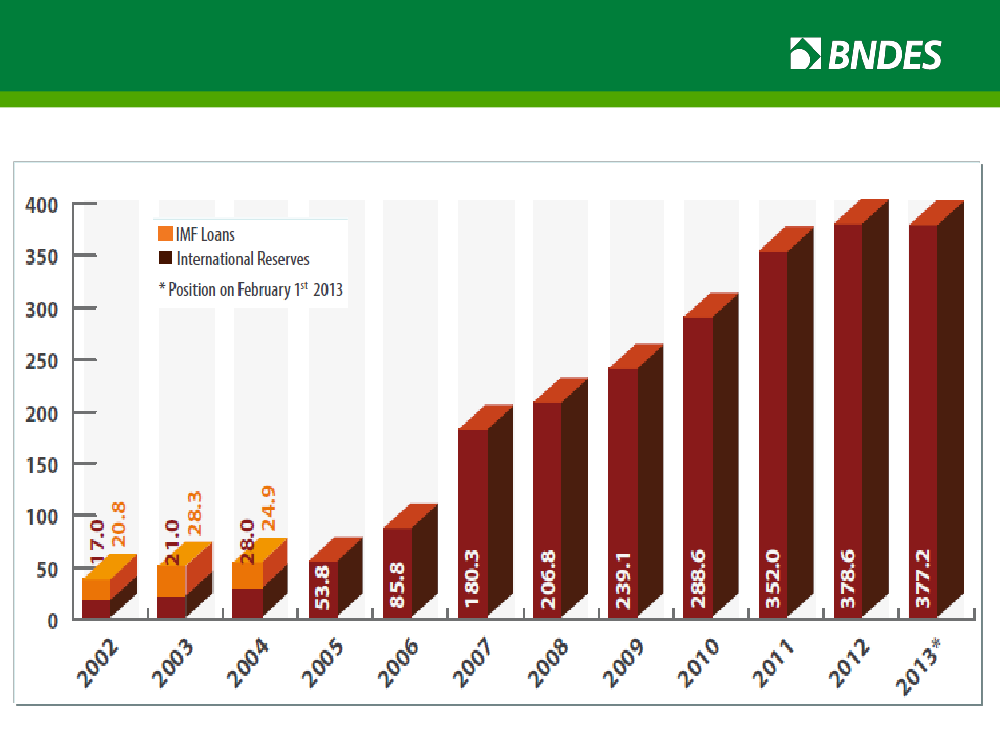

Sound macroeconomic fundamentals:Strength of the external sectorInternational Reserves(US$ billion)

Source: Brazilian Central Bank

9

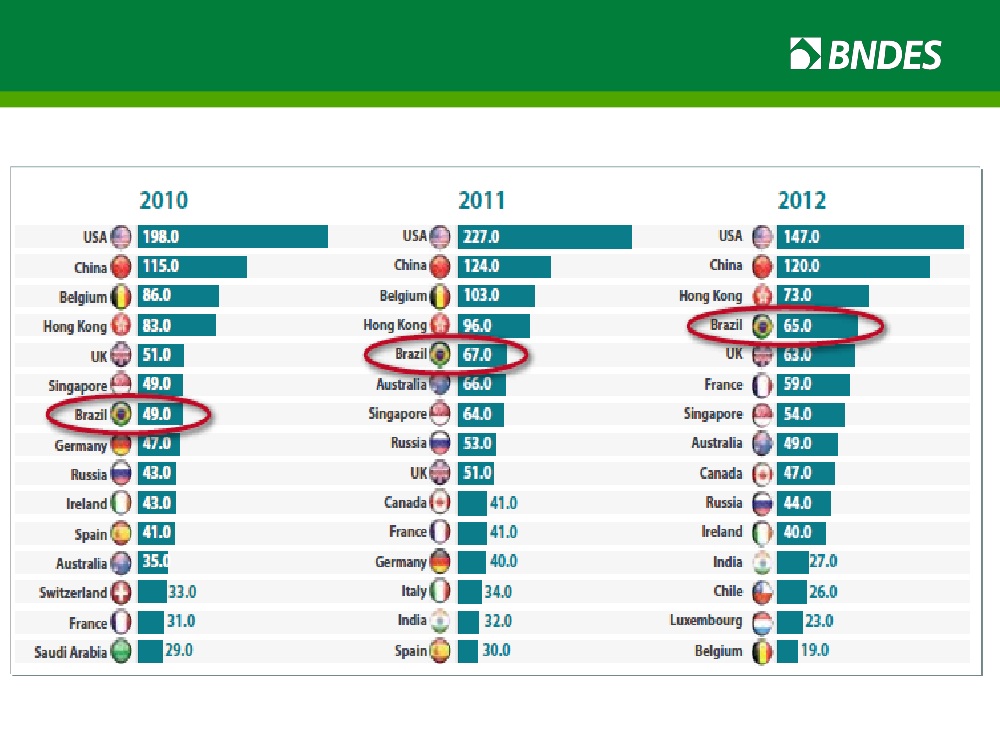

FDI at highest levelsForeign Direct Investment - FDI(US$ billion)

•Source: UNCTAD

•Fonte: UNCTADElabora§ão: Ministério da Fazenda10

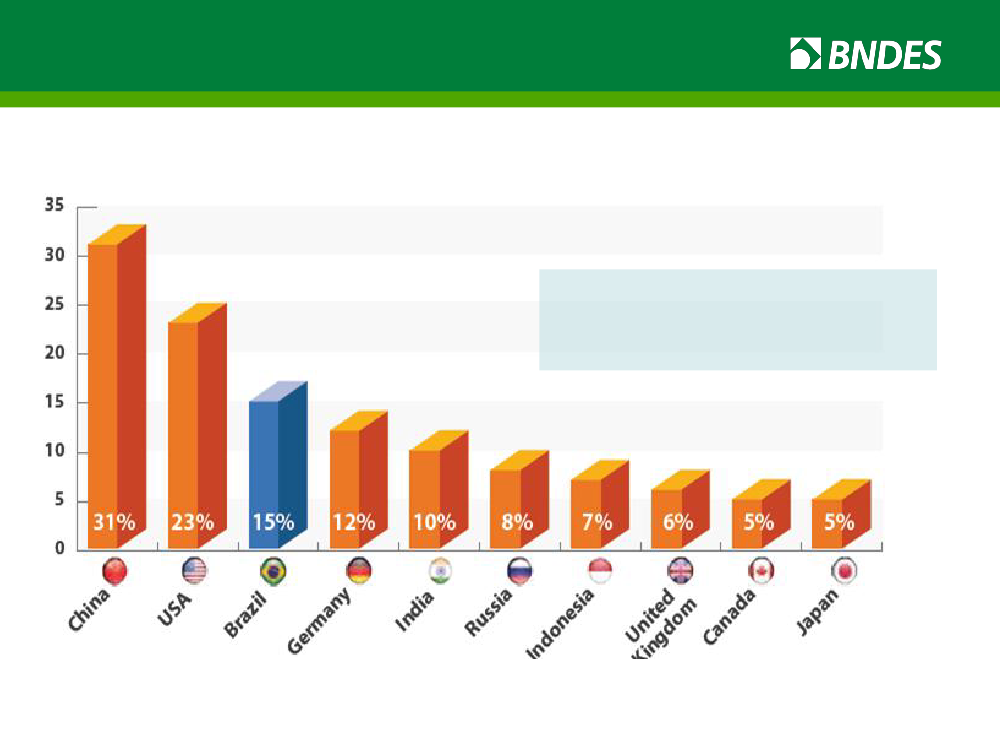

Expected business growthCountries where companies expect to expand their business(% of total answers)

Brazil:the third most mentionedcountry for expanding businessover the next 12 months

* “Dealing with disruption, adapting to survive and thrive”, (survey with more than 1,300 CEOs*)PricewaterhouseCoopers, 16th Annual Global CEO Survey, January 2013, p.12.

11

BNDES

12

BNDES HighlightsFounded on June 20th, 1952100% state-owned company under private lawKey instrument for implementation of FederalGovernment’s industrial and infrastructure policiesMain provider of long-term financing in BrazilEmphasis on financing investment projectsSupport to micro, small and medium-sized companiesBrazilian Export Bank13

The BNDES role in Brazilian developmentCountry challengesInvestment growing ahead of GDP

The Role of the BNDESSupport for new capacity, especially in hightechnology sectors and innovation

Continuity and expansion of investment ininfrastructureExpansion of exportsLabor force skills strengtheningDevelopment of a private, long-termfinancing industryImprovement of the governance in publicand private organizationsModernization of public institutionsPromotion of long-term planning and projectpreparation

Credit, project finance and guaranteesFinancing –supplier's creditFinancingSupport for bond markets; introduction of newfinancing instruments, technical supportTechnical supportFinancingTechnical support and financing14

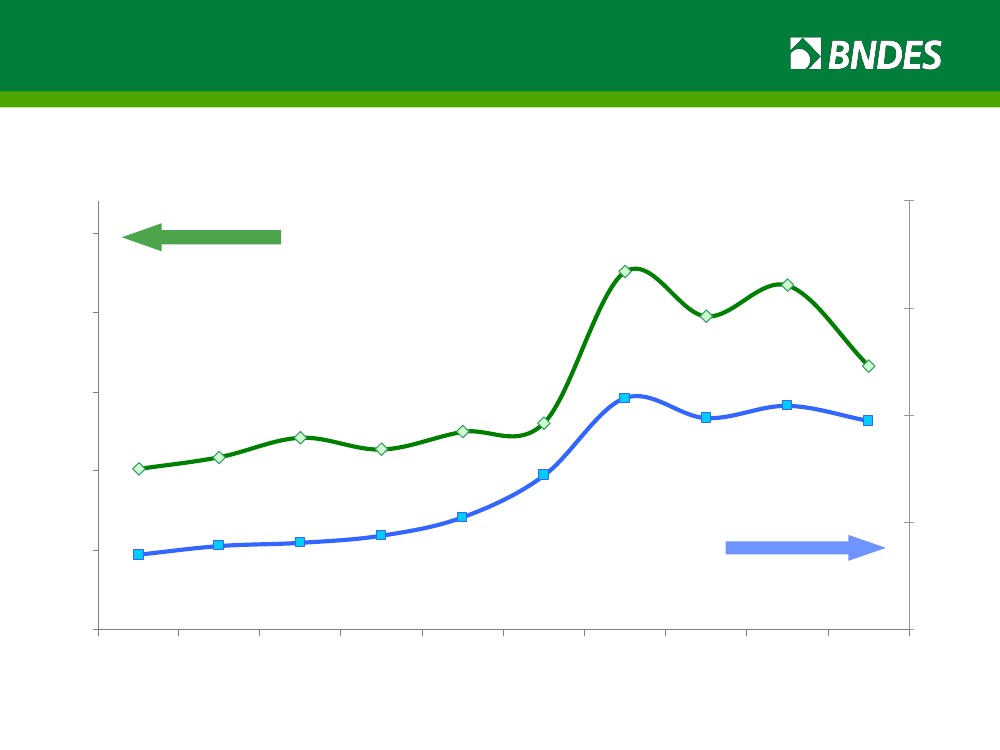

Supporting Employment and InvestmentsInvestments supported and jobs created due to the BNDES20%25%Investiments supported by the BNDES /Total national investment (GFCF)20%

22,6%19,7%

21,7%15%

16,7%15%

10,8%

12,1%10,1%10%

10,9%

11,4%

12,5%

13,0%7,2%

9,9%

10,5%

9,8%

10%

5,3%5%

3,5%

3,9%

4,1%

4,4%

5%

Jobs created or maintained due to the BNDES /Total registered employment at the end of the year

0%

0%

2003Source: BNDES* BNDES Forecast

2004

2005

2006

2007

2008

2009

2010

2011

2012*15

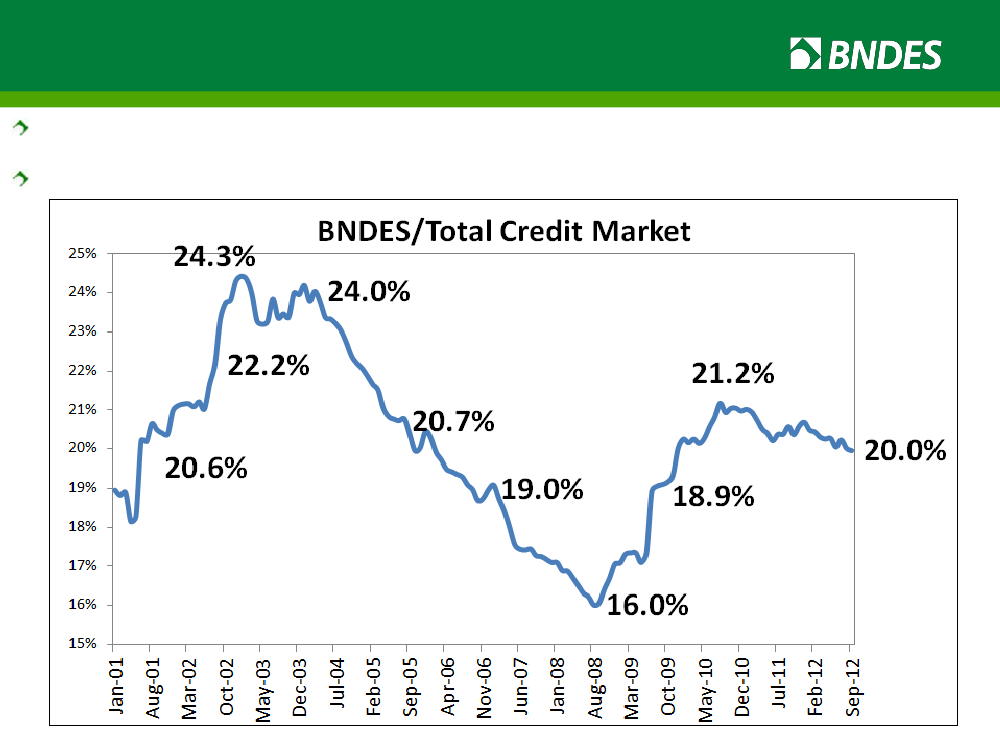

An important counter-cyclical role in theBrazilian economyBNDES’ share in the Brazilian credit market was 20% in 2012.The private sector’s was 54.6% and other State-owned banks, 25.4%

16Sources: Brazil's Central Bank. Produced by APE/BNDES

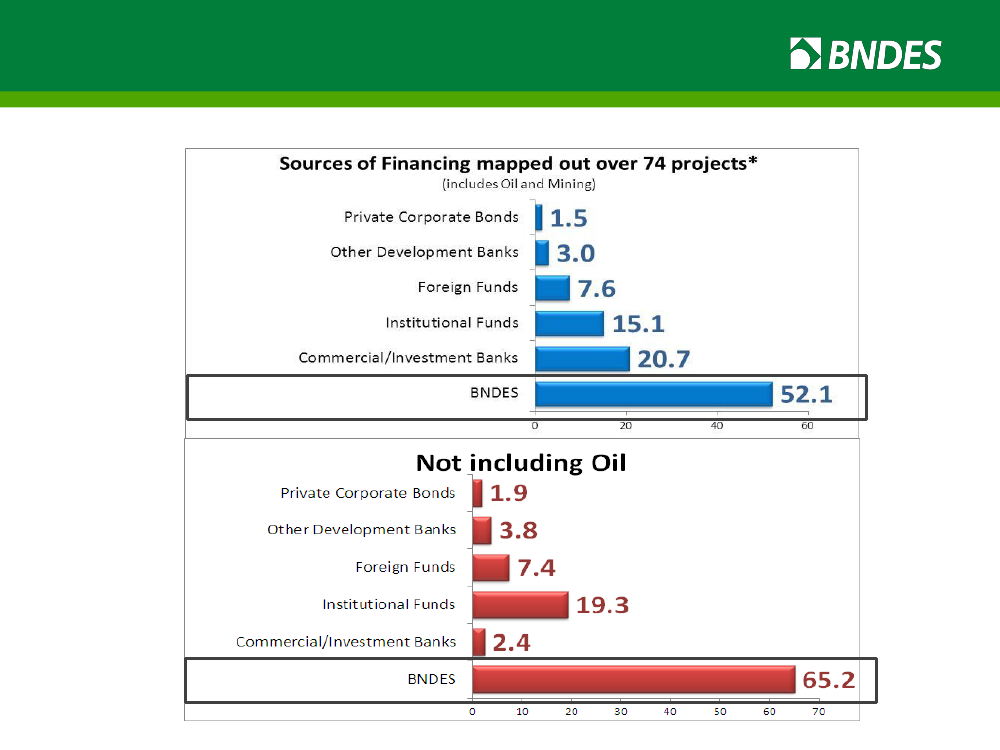

BNDES has been the main source offinancing for infrastructure projectsSources of Resources in infrastructure and oil projects (2011)

Source: ANBIMA. *Example includes projects for roads, ports, SHS, Wind Parks and Oil Prospecting

17

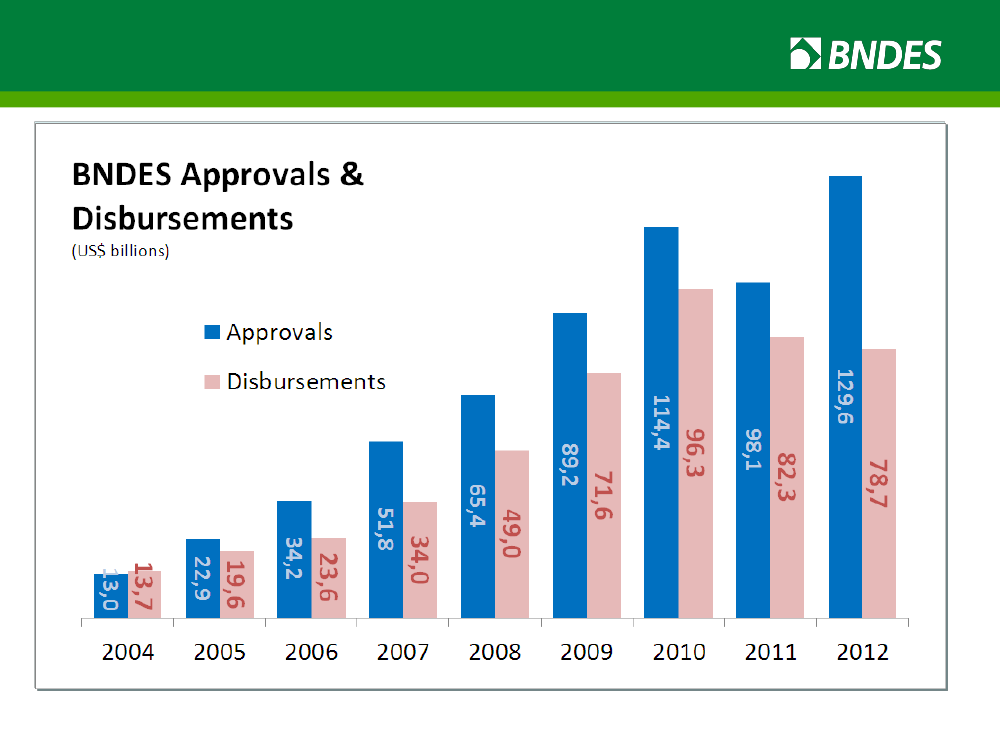

BNDES Disbursements will increase

Source: BNDES

18

A strong demand for financing infrastructureBNDES Approvals & Disbursement for Infrastructure(US$ billions)

25.1

ApprovalsDisbursements10.98.93.24.41.7200720082009201020112012

11.79.34.8

13.2

14.911.713.0

9.4

2.72.42005

2006

For 2013 is expected a total disbursement of US$ 15 bi – an increase of 16%Source: BNDES19

InvestmentOutlook

20

Investments will reach at least US$ 1.9 trillion inthe coming 4 yearsBrazil’s Investment Outlook (2013-16)(US$ billion - Constant prices)

SectorsIndustryInfrastructureHousingAgriculture and ServicesTotalSource: BNDES

2008-2011

2013-2016

Δ (%)

CAGR %

434,4184,1305,6589,21.513,3

529,7257,1394,9776,11.957,8

21,939,729,231,729,4

4,06,95,25,75,3

(*) Note : The BNDES research on the investment outlook for 2013-2016 covers 66% of the total industrial investments, and 100% of investments ininfrastructure, totalizing about 58% of the investments in the economy (excluding residential construction). Agriculture and Services investments are21based on queries to Sectorial entities and/or econometric forecast.21

Investments in logistics will increase 123% inthe coming 4 years(US$ Billion)

SectorsInfrastructureElectricity*Power GenerationTransmissionDistribution

2008-2011

2013-2016

Δ(%)

184.182.252.56.922.8

257.191.357.213.620.5

39.711.09.097.1-10.020.124.971.8182.6150.1170.9

TelecommunicationsSanitationHighwaysRailwaysPortsAirports

43.517.420.514.05.01.7

52.221.735.239.412.54.7

Logistics

*It represents an expansion of80,4of power capacity and 23,600 Km123,044.5 GWTransmission LinesLogística179,2

41.2

91.9

123.022

Source: BNDES

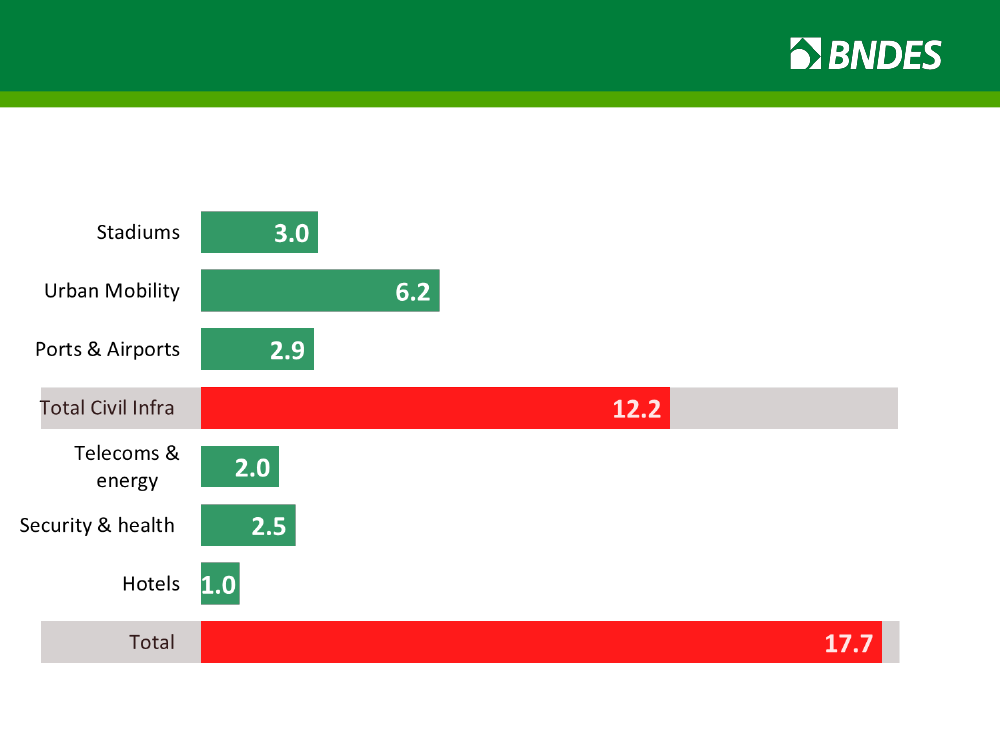

Investments in the World Cup also stand apartInvestments: 2014 World Cup(US$ billion)

Source: Ministry of SportsElaborated by: Ministry of Finance

23

2013-2016: BNDES’ Investment Surveyat its highest levelInvestment Outlook 4 years ahead(Comparable Sectors - US$ billion - 2012)5505305104904704502008-20112009-20122010-20132011-20142013-2016

535,92012-2015

512,3475,4439,1

441,12007-2010

430410390370350

419,8

391,1

2006

2007

2008

2009

2010

2011

2012

Base year of BNDES SurveySource: BNDES Investment Survey

24

Fostering investments

Monetary easing(SELIC rate down 525 bsp since Aug. ‘11)Reduction in the long-term interest rate (TJLP)Falling energy costsTax cuts(relieffor employers’ payroll contributions, reform of VAT, IPI reduction)Public investment acceleration(PAC and My House, My Life)New concessions to private sector in logisticshighways, railways, ports, airports

25

Long-term challenges

Eradicate poverty and create opportunities for social mobility

Raise domestic saving ratesDiversify long-term financing sources

Improve Brazilian industry competitivenessFoster innovation and sustainabilityIncrease labor productivity and income

More investments on infrastructure26

Brazilian EconomyMar, 2013

27