Erhvervs-, Vækst- og Eksportudvalget 2012-13

ERU Alm.del Bilag 204

Offentligt

= Confidential =

APMM Group & Latin America

Carsten Følbæk, RioApmRep

CF Dec 2012

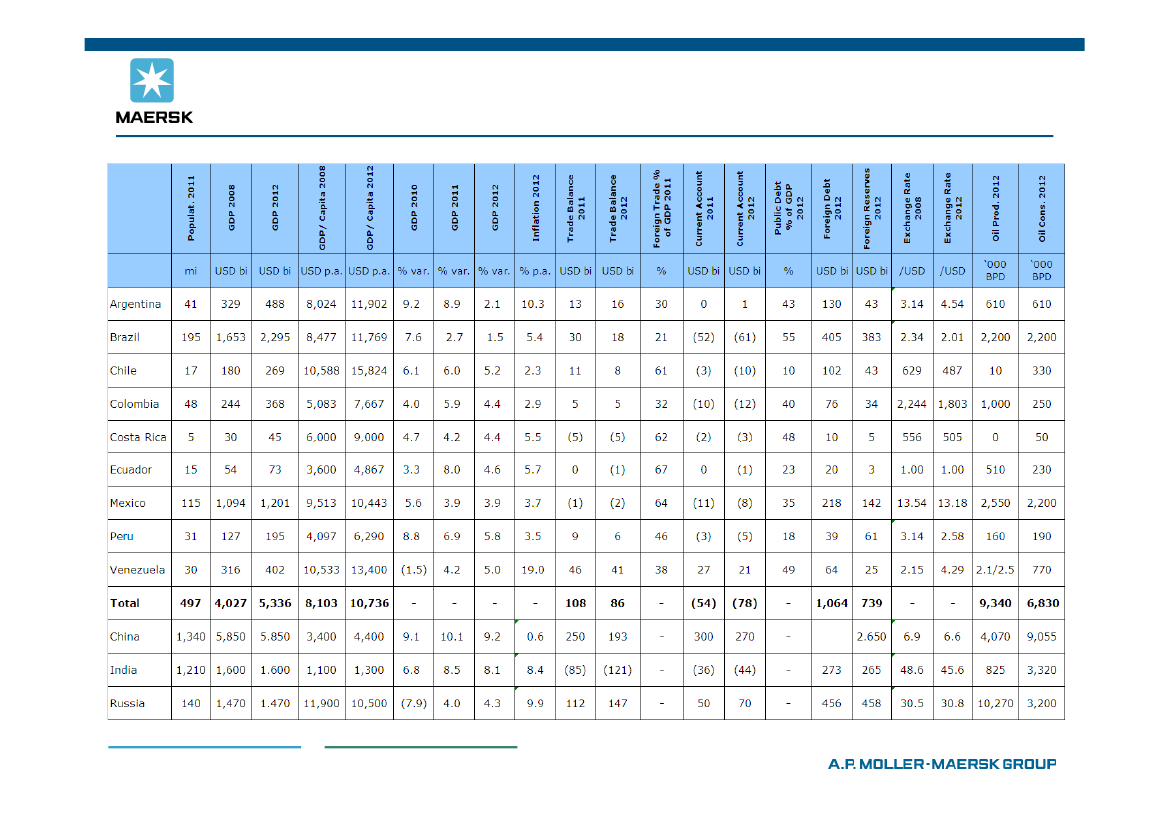

Latin America - 8 largest + Costa Rica

CF Dec 2012

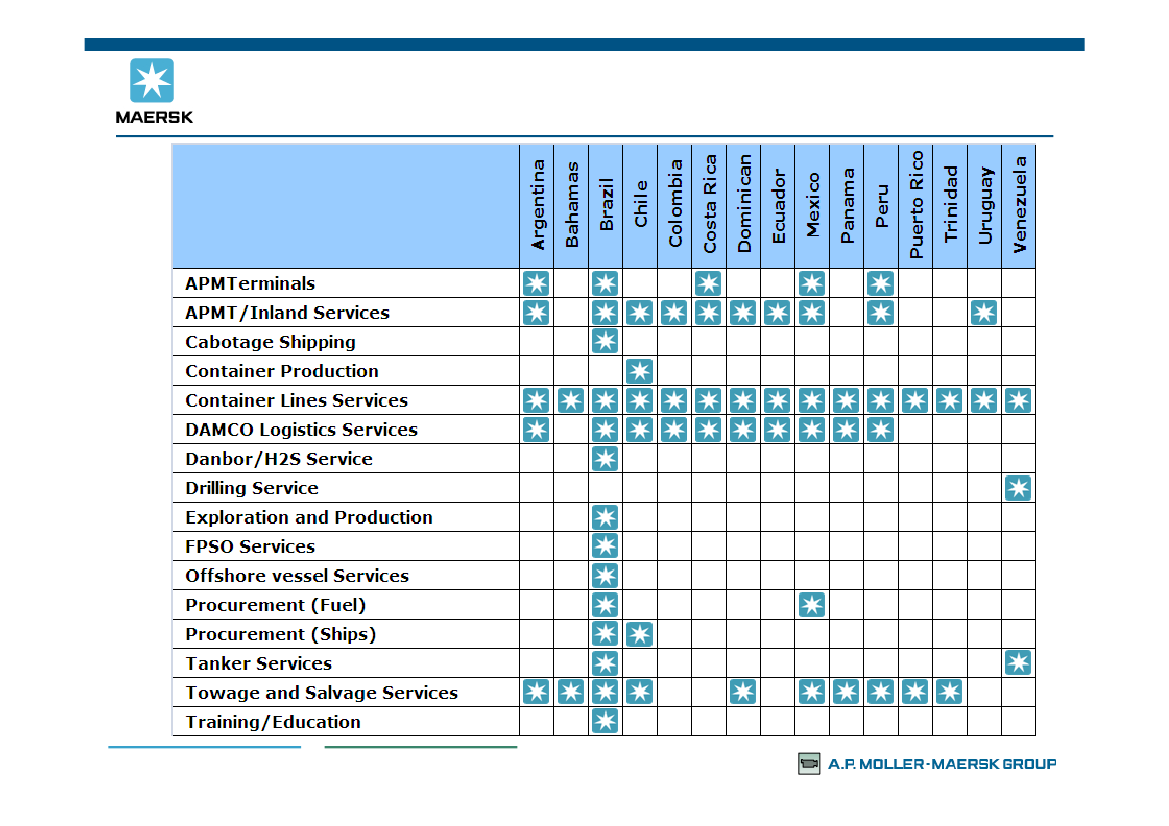

Present Areas of Lasting Activity

CF Dec 2012

March 2013 – The Business, Growth and Export Committee / APMM Group

Brazil Cluster

The APMM Group Container Business brands in Brazil

Maersk Line and Safmarine in Brazil

FACT BOX•220 employees•Freight turnover >1.1bn USD•14% Market Share (3rd)•Market leader on reefer exports•Operating the largest vessels in thecoast (8000 TEU)•6 dedicated strings to/from Brazil –Europe, Asia, Middle East, Americas•Key differentiators are:•Reliability•ease of business•global coverage and scale

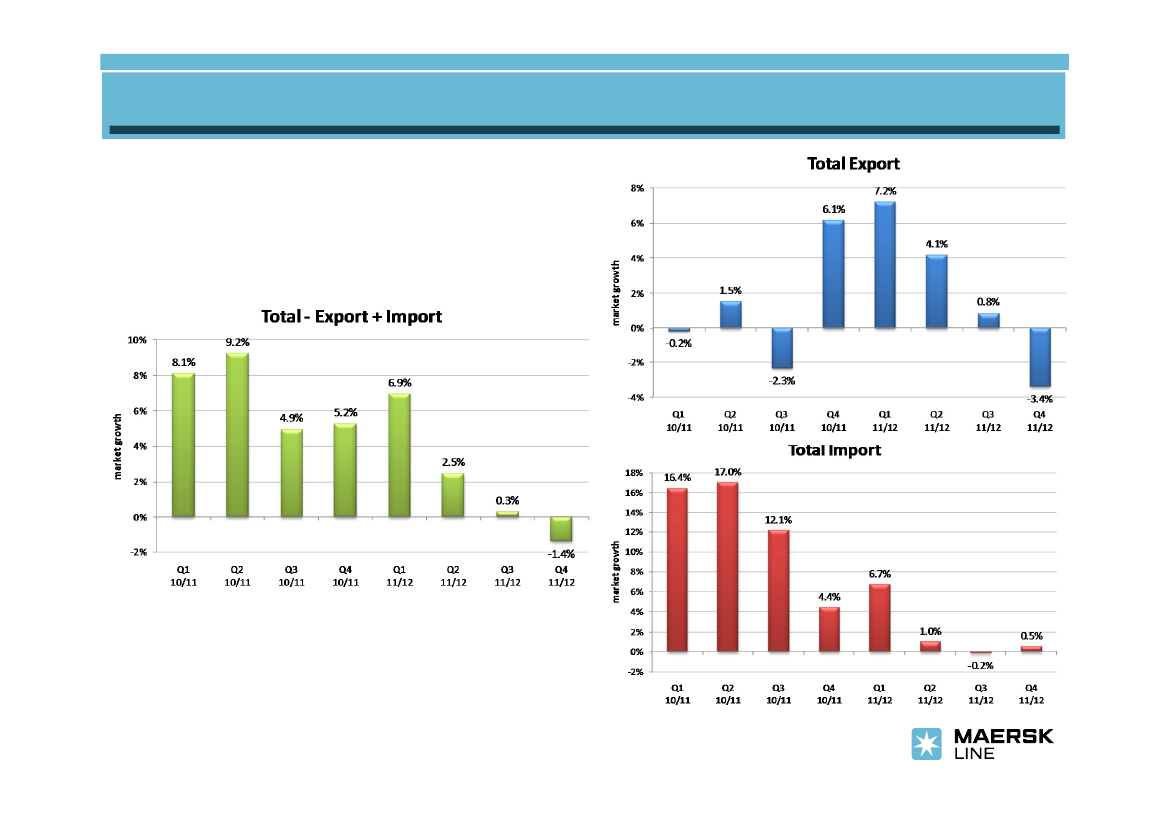

Container trade indicates a difficult environment....

Brazil’s container export to Denmark in 2012....

Market ShareCarrierCMA-CGMMSCHAMBURG-SUDSAFMARINEMAERSK LINE#N/A#N/AOTHERSMAERSK + SAFMARINE19.3%23.8%20111219.3%9.6%28.0%17.5%6.3%20120113.3%6.6%32.8%10.0%16.6%#N/A#N/A20.7%26.6%20120229.7%29.7%2.2%6.1%17.2%#N/A#N/A15.1%23.3%20120322.3%25.9%16.6%11.6%5.0%#N/A#N/A18.6%16.6%20120422.5%5.2%9.4%8.8%12.5%#N/A#N/A41.6%21.3%20120537.8%17.5%16.6%9.1%8.1%#N/A#N/A10.9%17.2%20120657.1%4.7%11.4%9.4%3.5%#N/A#N/A13.8%13.0%20120723.0%25.7%20.4%16.8%8.9%#N/A#N/A5.2%25.7%20120813.5%29.1%27.9%8.6%9.8%#N/A#N/A11.1%18.4%20120919.1%22.3%20.5%12.9%20.9%#N/A#N/A4.3%33.8%20121014.6%45.0%15.5%14.6%7.8%#N/A#N/A2.6%22.3%20121112.6%34.5%24.9%5.4%10.0%#N/A#N/A12.6%15.3%

15

201212 Last 12 Months25.9%24.4%33.9%23.3%6.9%16.6%20.8%11.1%5.8%10.5%#N/A#N/A#N/A#N/A6.6%14.1%26.6%21.5%

Volume in FFECarrierCMA-CGMMSCHAMBURG-SUDSAFMARINEMAERSK LINE#N/A#N/AOTHERSMAERSK + SAFMARINETOTAL

2

3

4

5

6

7

8

9

10

11

12

13

14

14

2011123216472911

3240166

201201168401220#N/A#N/A2532121

20120242423924#N/A#N/A2133140

201203343925188#N/A#N/A2825151

201204379161521#N/A#N/A6935165

2012056128271513#N/A#N/A1828160

20120673615125#N/A#N/A1817127

201207222520169#N/A#N/A52596

2012081736341112#N/A#N/A1423122

2012092731291829#N/A#N/A647139

2012102370242312#N/A#N/A435155

201211174533713#N/A#N/A1720131

201212 Last 12 Months364014738310272291828172#N/A#N/A#N/A#N/A9232371373541,641

Brazil’s container import from Denmark in 2012....

Market ShareCarrierHAMBURG-SUDMAERSK LINESAFMARINECMA-CGMHAPAG LLOYD#N/A#N/AOTHERSMAERSK + SAFMARINE29.6%18.9%20111241.8%15.1%3.8%2.5%7.2%20120130.5%23.9%3.8%5.0%18.9%#N/A#N/A17.9%27.7%20120219.0%13.8%3.4%8.9%10.1%#N/A#N/A44.8%17.2%20120312.7%16.7%23.9%16.0%15.7%#N/A#N/A15.0%40.5%20120414.8%22.6%12.1%17.1%12.8%#N/A#N/A20.6%34.6%20120532.1%18.1%11.1%10.7%10.7%#N/A#N/A17.3%29.2%20120638.5%14.0%9.1%11.4%5.1%#N/A#N/A21.9%23.1%20120735.0%17.9%12.9%3.9%8.1%#N/A#N/A22.1%30.8%20120826.4%18.4%7.5%10.9%8.4%#N/A#N/A28.4%25.9%20120939.6%17.3%1.2%16.9%12.9%#N/A#N/A12.2%18.4%20121030.2%14.8%18.8%10.2%6.3%#N/A#N/A19.7%33.6%20121133.6%11.4%18.9%7.6%6.3%#N/A#N/A22.2%30.3%

15

201212 Last 12 Months41.7%29.8%11.4%16.4%17.9%12.1%10.3%10.4%6.8%9.7%#N/A#N/A#N/A#N/A11.9%21.6%29.3%28.5%

Volume in FFECarrierHAMBURG-SUDMAERSK LINESAFMARINECMA-CGMHAPAG LLOYD#N/A#N/AOTHERSMAERSK + SAFMARINETOTAL

2

3

4

5

6

7

8

9

10

11

12

13

14

14

20111267246412

4730159

20120149386830#N/A#N/A2944159

201202312361517#N/A#N/A7328163

2012032026372524#N/A#N/A2362153

2012041929162217#N/A#N/A2645128

2012053922141313#N/A#N/A2136122

201206682516209#N/A#N/A3941176

201207633223715#N/A#N/A4055179

2012085840172419#N/A#N/A6357220

201209512222217#N/A#N/A1624128

2012106532412214#N/A#N/A4373216

2012116723381513#N/A#N/A4460198

201212 Last 12 Months7760421332332451921113197#N/A#N/A#N/A#N/A22437541855772,025

3 March, 2013The Business, Growth andExport Committee

APM Terminals – Latin America & BrazilPorts and Infrastructure

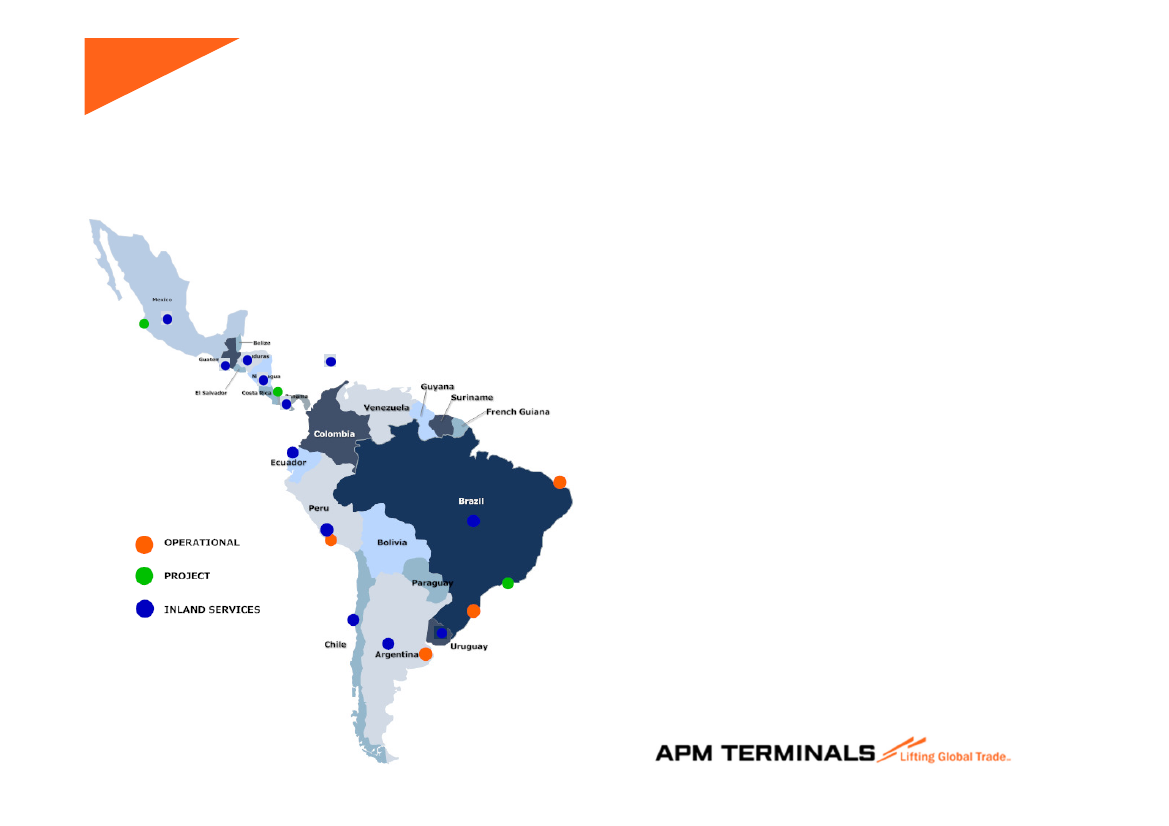

APMT in Latin America

Strong commitment to investDominican

Three major projects ongoingDoubling the port portfolio by 2016APMT presence in 12 countries

APMT in Brazil

PECEM

ITAJAI

SANTOS

INLAND SERVICESFive locationsItajai, Itapoa, Paranagua,Rio Grande, and Santos

Be prepared for doing Business in Brazil•Highly complex environment•The World Bank ranks Brazil 127 out of 183 countries in ‘easeof doing business’•Rules and legislations are many; high barriers and hidden costs•Protectionism and high taxes•Historical lack of a clear regulation that encourages privateinvestment

Infrastructure business in Brazil•Great opportunities•Bottlenecks in the highway and rail access to ports•Ports are underdeveloped by global standardsReorganization of the ports' legal and regulatory structurePublic investments of some USD 25 billion

Three simple reasons for investing in Santos

•Largest port in South America•25% of Brazil’s trade goes through Santos•Highly congested and lacks capacity

Facts about the Santos Project

•Investment USD 1 billion•Remediation USD 150 million; excess of 1 million ton of soil•Area 490,000 m2•Quay length 1,108 meters•8 ship-to-shore cranes; expansion to 12•Static capacity 34,600 / 20’ containers