Skatteudvalget 2011-12

SAU Alm.del

Offentligt

European CommissionTaxation and Customs Union

taxud.c.1(2011)759291 - EN

VAT RatesApplied in the Member Statesof the European Union

Situation at 1stJuly 2011

1049 Brussels - Belgium

CONTENTSI.II.LIST OF VAT RATES APPLIED IN THE MEMBER STATES.................................................................. 3APPLICATION OF REDUCED VAT RATES BY THE MEMBER STATES TO THE CATEGORIESOF GOODS AND SERVICES CONTAINED IN ANNEX III OF VAT DIRECTIVE 2006/112/EC......... 4APPLICATION OF THE PARKING RATE IN CERTAIN MEMBER STATES ...................................... 9LIST OF SUPER-REDUCED RATES (LESS THAN 5%) APPLIED IN THE MEMBER STATES ..... 11CASES WHERE THE ZERO RATE IS APPLIED TO CONSUMPTION IN THE LEGISLATION OFTHE MEMBER STATES (TITLE VIII, CHAPTER 4 OF THE VAT DIRECTIVE 2006/112/EC)........ 13VAT RATES GENERALLY APPLIED IN THE MEMBER STATES TO CERTAIN PRODUCTS ORSERVICES ........................................................................................................................................................ 15GEOGRAPHICAL FEATURES OF THE APPLICATION OF THE VAT IN THE EUROPEANUNION.............................................................................................................................................................. 21THE EVOLUTION OF THE VAT RATES APPLICABLE IN THE MEMBER STATES...................... 23

III.IV.V.

VI.

VII.

VIII.

N.B.:The purpose of this document is to disseminate information about the VAT rates in forcein the Member States of the European Union. The information has been supplied by therespective Member States, but part of it has not been verified by some of them yet. TheCommission cannot be held responsible for its accuracy or completeness, neither doesits publication imply any endorsement by the Commission of those Member States’ legalprovisions.

2

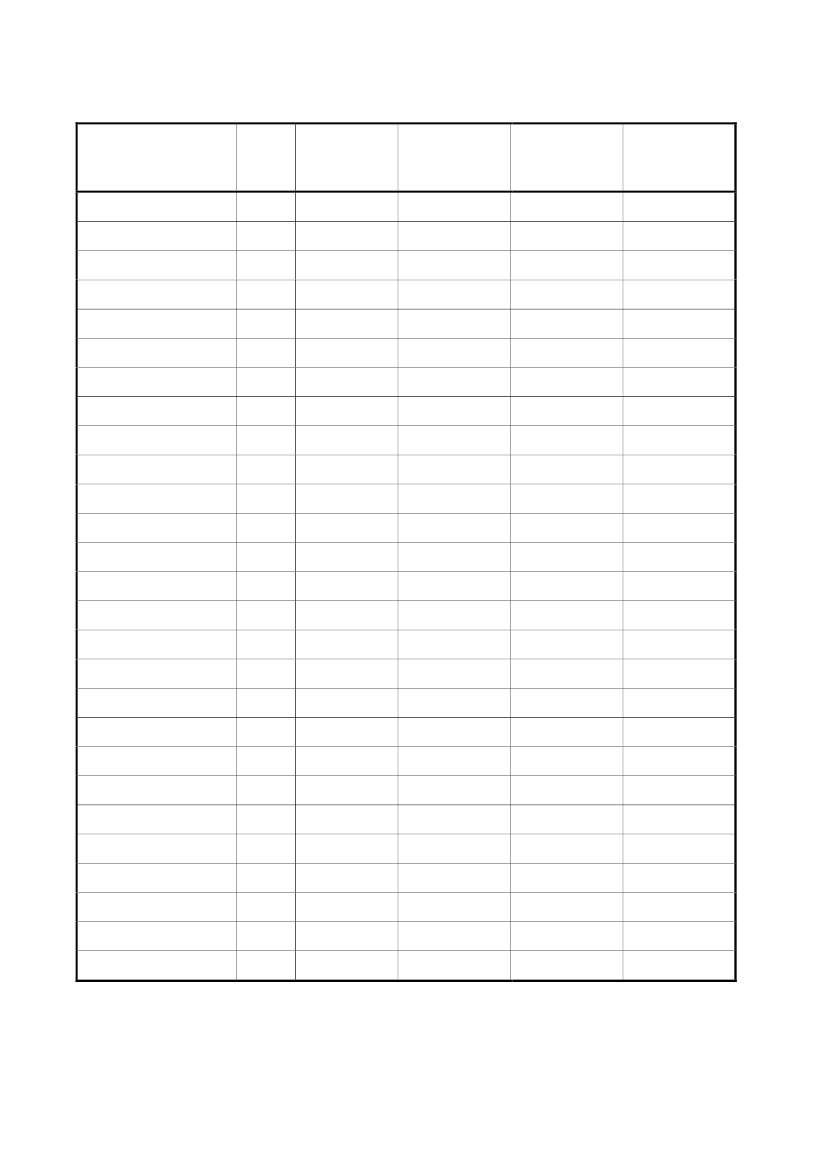

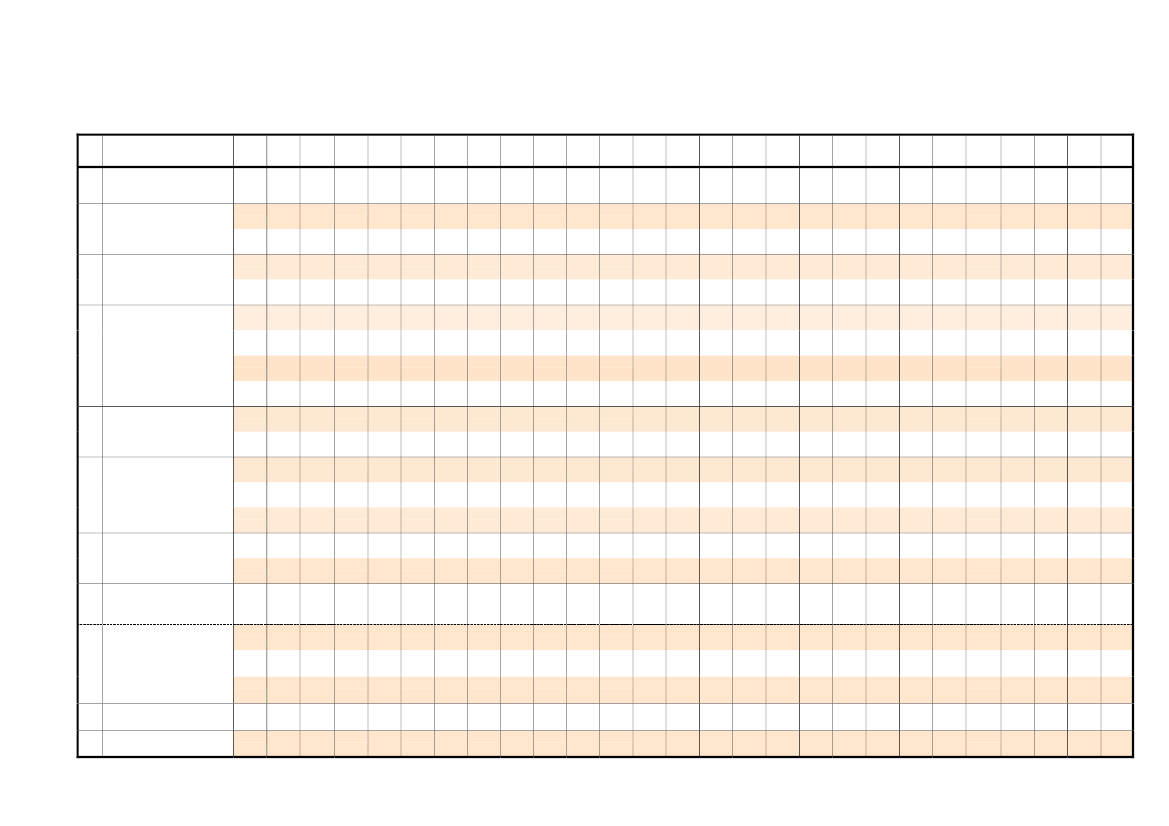

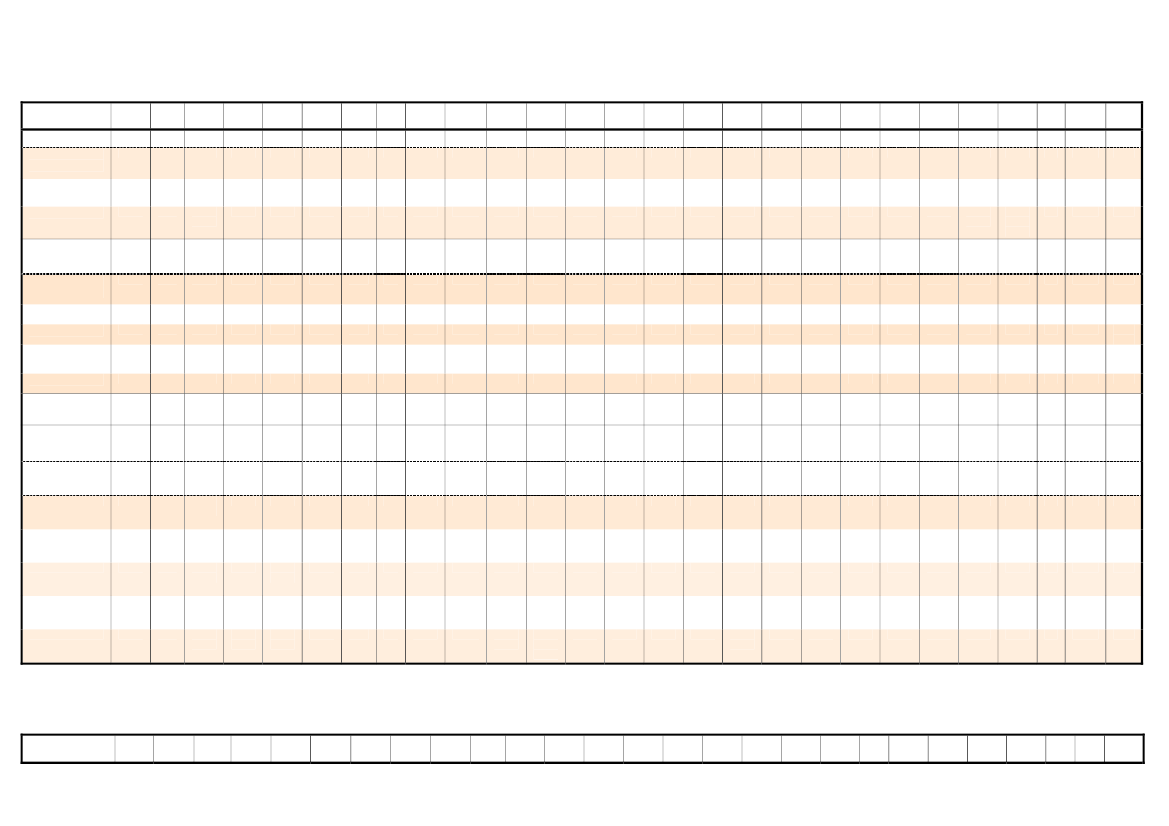

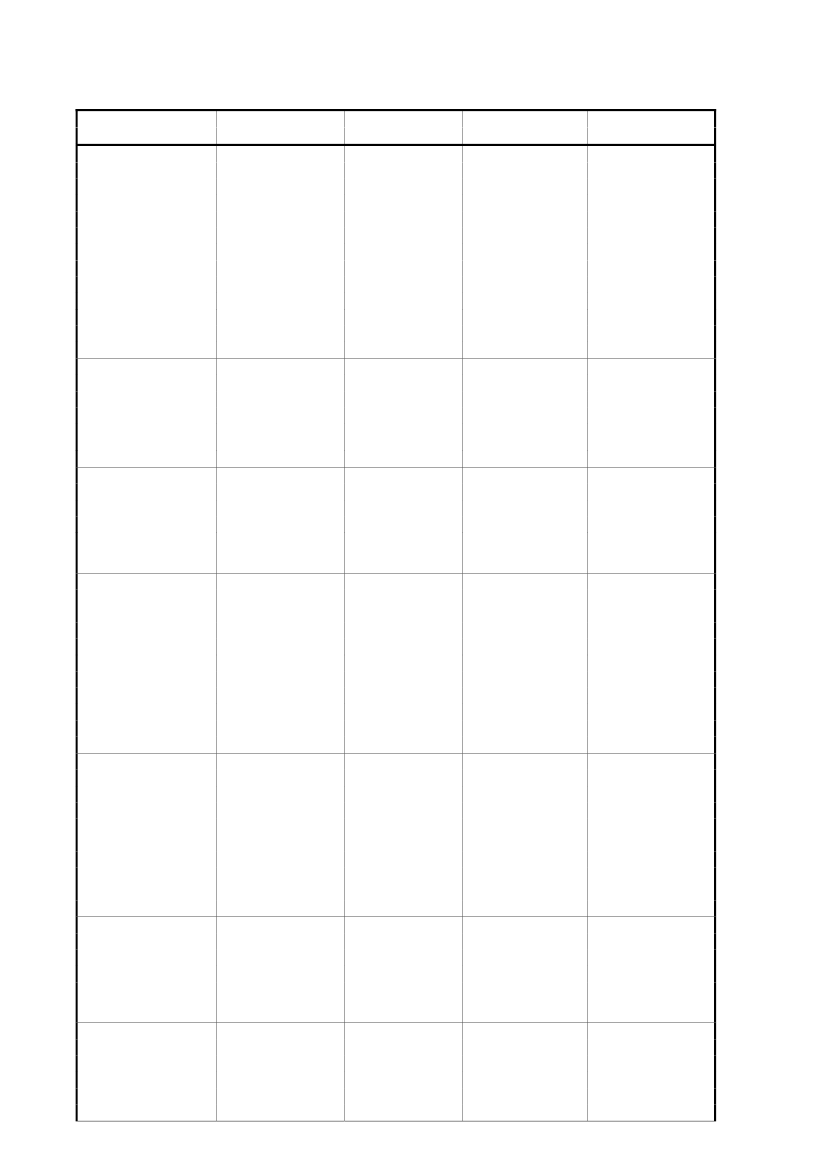

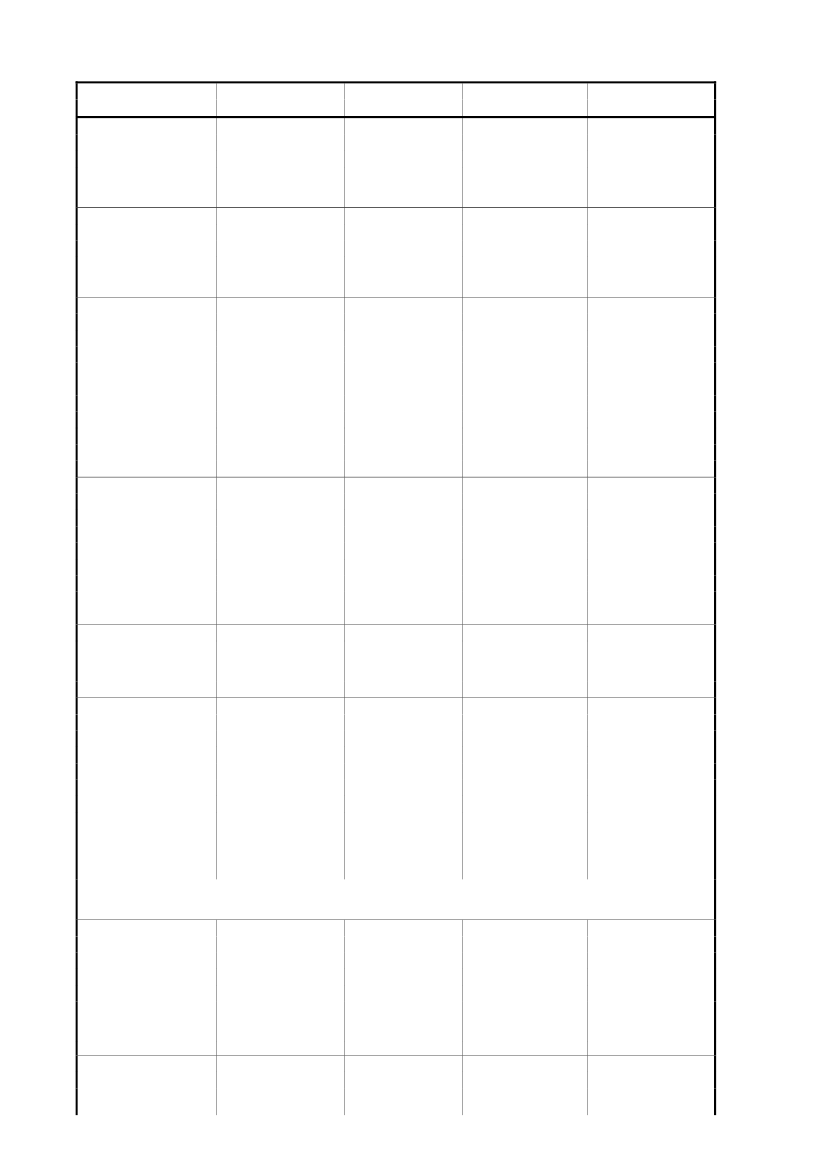

I. LIST OF VAT RATES APPLIED IN THE MEMBER STATESSuperReducedRate-

Member StatesBelgiumBulgariaCzech RepublicDenmarkGermanyEstoniaGreeceSpainFranceIrelandItalyCyprusLatviaLithuaniaLuxembourgHungaryMaltaNetherlandsAustriaPolandPortugalRomaniaSloveniaSlovakiaFinlandSwedenUnited Kingdom

CodeBEBGCZDKDEEEELESFRIEITCYLVLTLUHUMTNLATPLPTROSISKFISEUK

Reduced Rate6 / 129

StandardRate212020251920231819,6212015222115251819202323242020232520

Parking Rate12--------13,5----12---12-13------

-----42,14,84---3----

10-796,5/1385,59 / 13,5105/8125/96 / 125 / 185/76105/8

-

6 / 135/9

-----

8,5109 / 136 / 125

N.B.:Exemptions with a refund of tax paid at preceding stages (zero rates) are not included above (see section V)

3

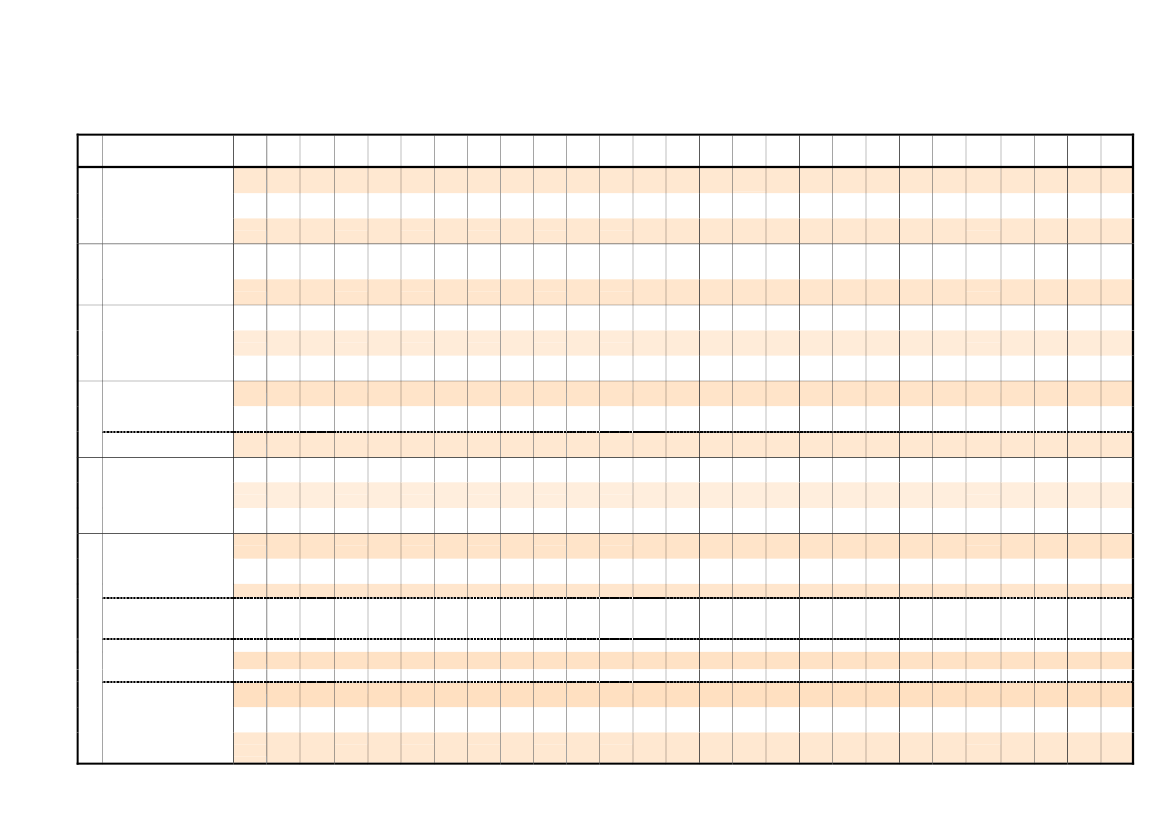

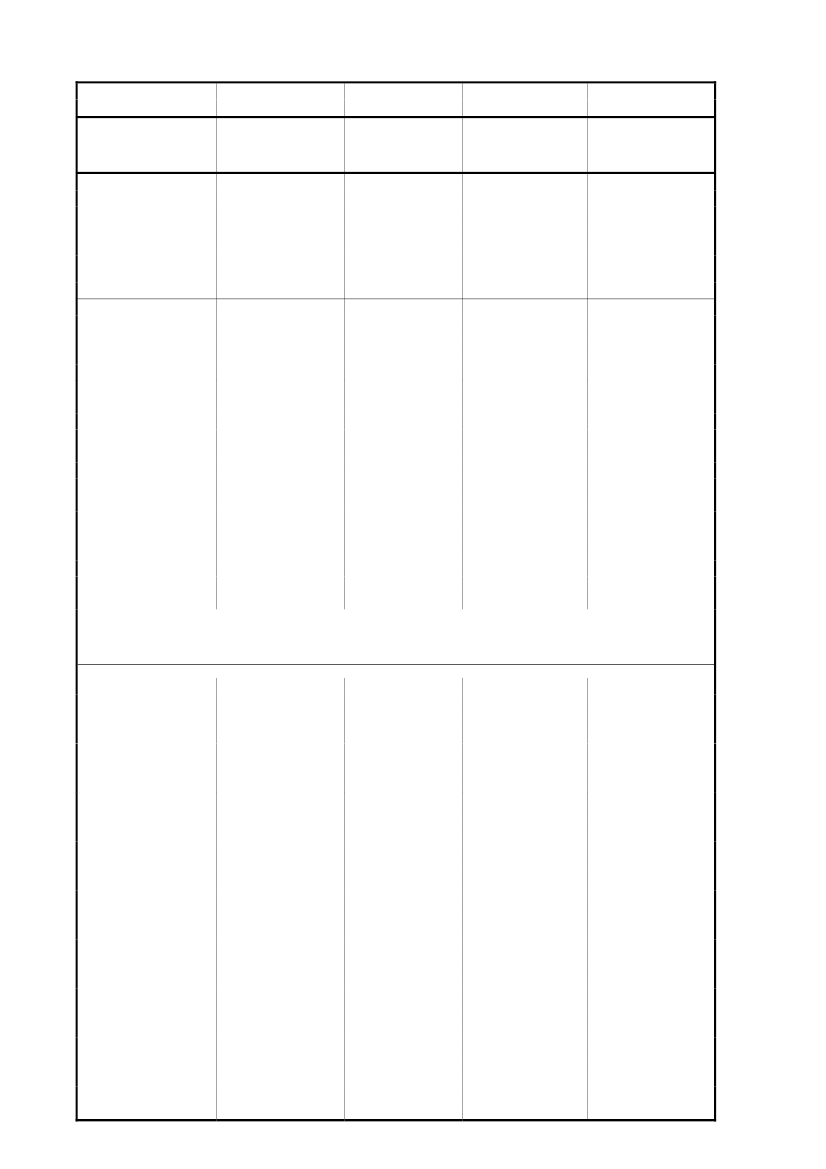

II. APPLICATION OF REDUCED VAT RATES BY THE MEMBER STATES TO THE CATEGORIES OF GOODS AND SERVICES CONTAINED INANNEX III OF VAT DIRECTIVE 2006/112/EC0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemptionCategory1. FoodstuffsBE61221

BG20

CZ10

DK25

DE719

EE20

EL13

ES48

FR5,519,6

IE04,813,521[ex]521

IT410

CY515

LV22123

LT21

LU3

HU18125

MT02

NL6

AT10

PL5823

PT613236

RO24

SI8,5

SK2010

FI13

SE1225

UK020

2. Water supplies

6

20

10

25

7

20

[ex]413

8

5,5

10

5

22

21

3

25

0

6

10

8

24

8,5

20

23

25

0

3. Pharmaceuticalproducts

6

20

10

25

19

9

6,513

4

2,15,5

0

10

5

12

56

3

5725

0

6

10

8

6

9

8,5

10

9

25

0

21

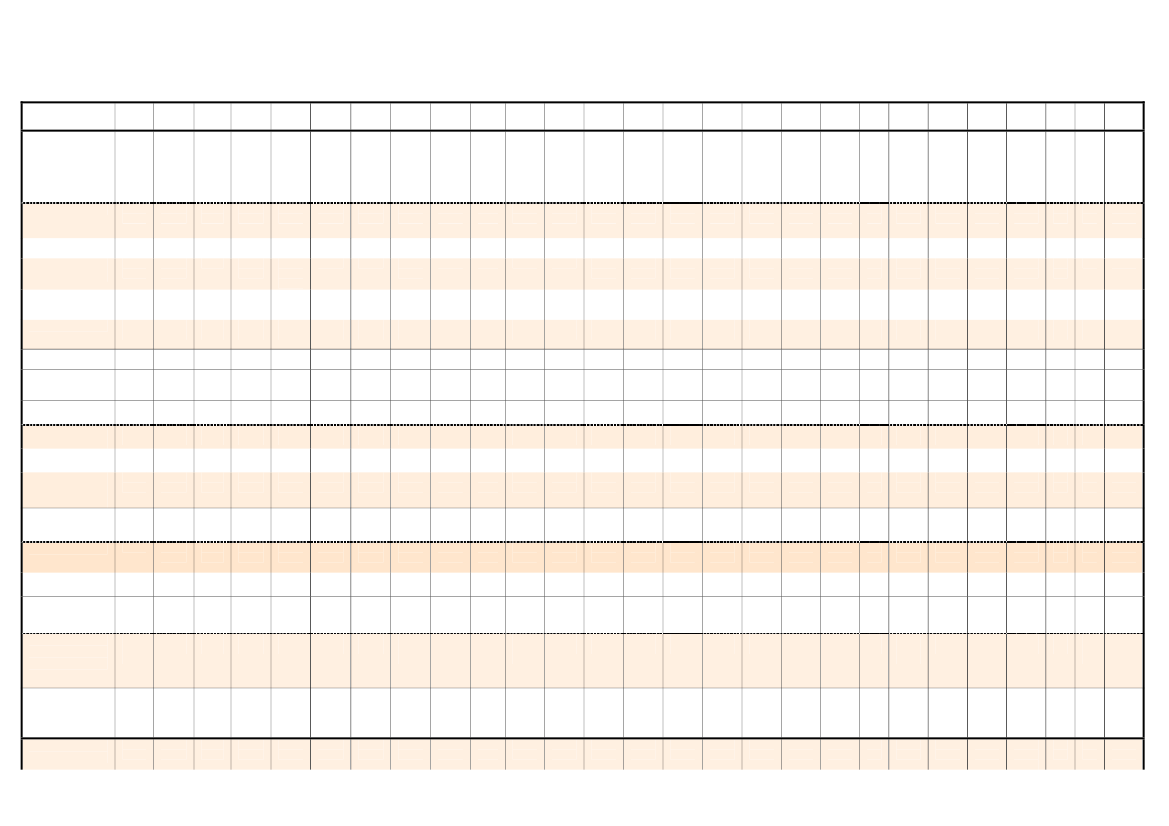

232010257913

188

19,65,5

21021

204202010[ex]558152212[ex]10212151256

1531515[ex]3525252518095

1961919[ex]619201088208

236988,51023[ex]662424208,520020239

025[ex]2560

200

4. Medical equipmentfor disabled personsChildren’s car seats5. Transport ofpassengers(+see n� VI)

6212160

2020

10100

25[ex]0

19719

20200

2313

188

19,65,5

13,5[ex]

50

6. Books

621

20

10

25

7

9

6,5

418

5,519,646

0

420

5

12

911

3

5

5

6

10

523

6

9

8,5

10

9

6

0

Books on otherphysical means ofsupportNewspapers

21

20

20

25

19

20

23

4

5,519,6462,119,62,119,6

21

447204

15

22

21

3

5

18

6

20

23

6

9

8,5

20

23

648256

049200

06210621

20

10

02525

7

912

6,5

418418

9

5

2213

21

3

5

5

6

10

823523

6

9

8,5

20

023023

Periodicals

20

10

7

912

6,5

9

420

5

2213

21

3

5

5

6

10

6

9

8,5

20

[ex]6

0

4

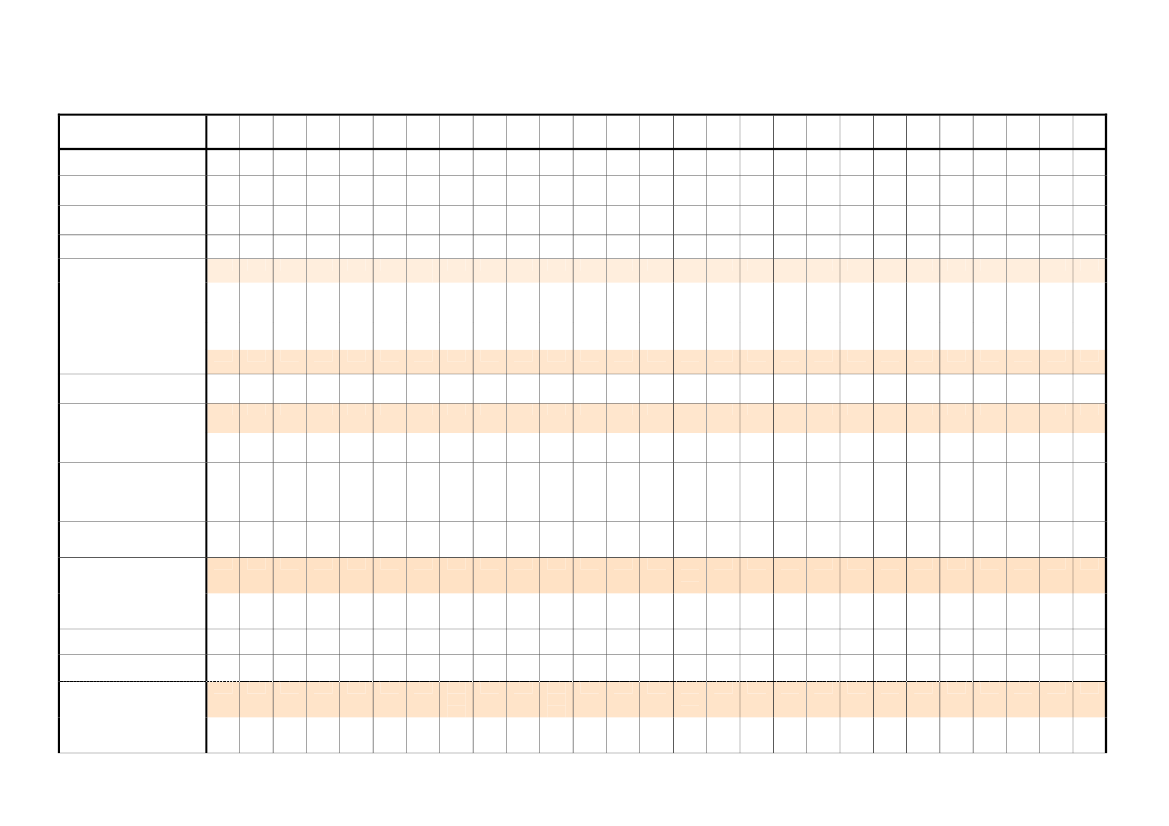

II. APPLICATION OF REDUCED VAT RATES BY THE MEMBER STATES TO THE CATEGORIES OF GOODS AND SERVICES CONTAINED INANNEX III OF VAT DIRECTIVE 2006/112/EC0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemptionCategory7. Admission to culturalservices (shows,cinema, theatre)Admission toamusement parks8. Pay TV/ cable TVBE[ex]66201025

BG20

CZ10

DK25

DE[ex]719

EE20

EL136,516

ES[ex]1488

FR5,519,65,51819,6

IE[ex]99

IT10

CY[ex]5

LV

LT

LU3

HU25

MT5

NL6

AT[ex]10

PL8

PT[ex]6

RO9

SI8,5

SK20[ex]

FI9

SE6

UK20

[ex] [ex]152217222121

20

13

20

5

3

25

18

6

10

8

619

9

8,5

20

9

25

20

122021

20

[ex]2120

25

19

20

[ex]1322

18

5,5

21

20

15

22

21

315

[ex]2522[ex]2522

18

19

10

82323

23

24

20

[ex]2021

23

25

20

TV licence

[-]

20

[ex]2120

25

[ex]

20

[ex]

18

2,1

[ex]

4

15

[-]

21

[ex]

[ex]

[ex]

10

23

6

24

[ex]2024

[ex]202120

9

[ex]

[ex]

9. Writers, composers, ...

621[ex]

20

10

[ex]

7

20

13

8

5,5

21

[ex]20

5

[ex]

21

3

25

18

619[ex]

2010

8

23[ex]

24

8,5

[ex]925

6

20

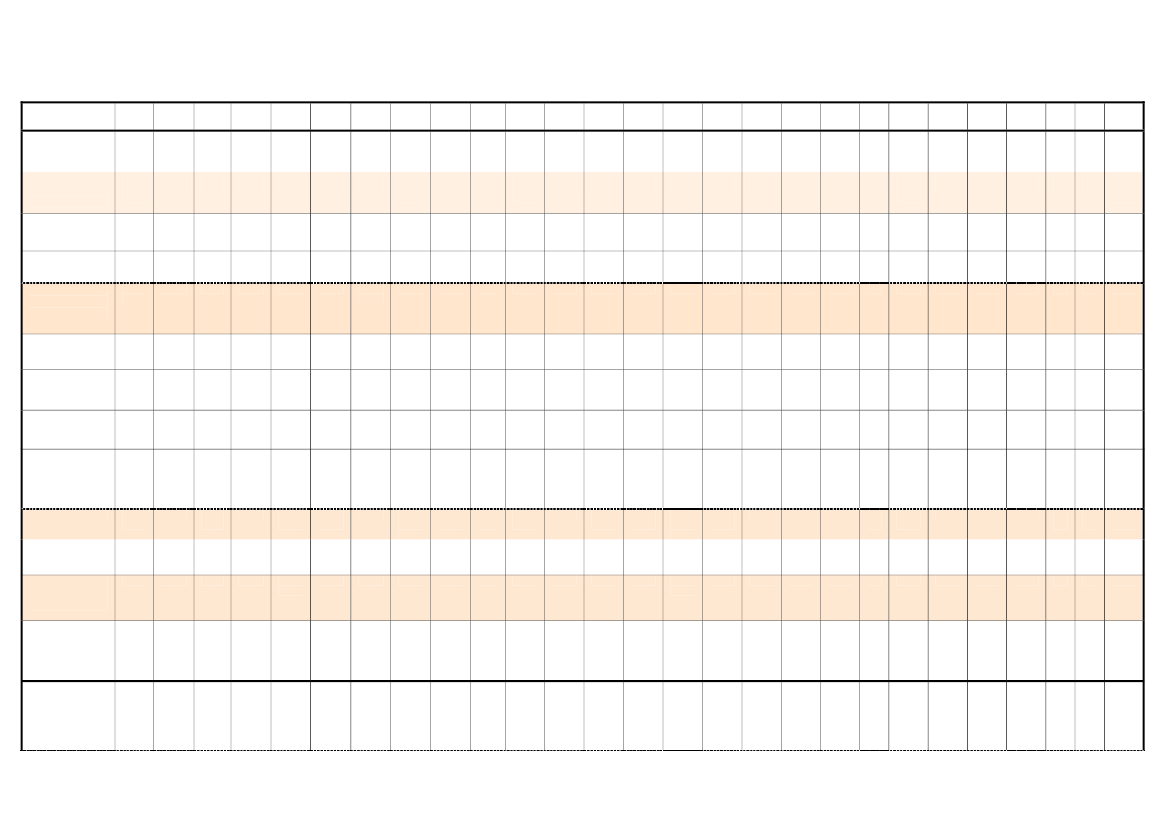

10. Social housing

1226

20

10

25

19

20

13[ex]

4

5,519,6

13,5

410

15

22

21

32715

25

[ex]

19

20

8

[ex]6

5

8,5

20

23

25[ex]

2050

6

10a Renovation andrepairing of privatedwellings (*)10b Window cleaning andcleaning in privatehouseholds11. Agricultural inputs

2128

20

10

25

19

20

1329

830

5,531

13,5

10

5

22

21

15

25

18

632

20

8

6

24

8,5

20

23

25

533

21

20

10

25

19

20

23

18

5,5

13,5

20

15

22

21

6

25

18

19

20

23

23

24

8.5

20

23

25

20

61221

20

1020

25

7

20

13

8

5,5

13,5

41020

515

22

21

315

25

18

6

10

5823

61323

24

8,5

20

2313

25

20

12. Hotel accommodation

6

9

10

25

7

9

6,5

8

5,5

9

10

8

12

913

3

1836

7

6

10

8

6

9

8,5

20

9

12

20

12a Restaurant andcatering services

5

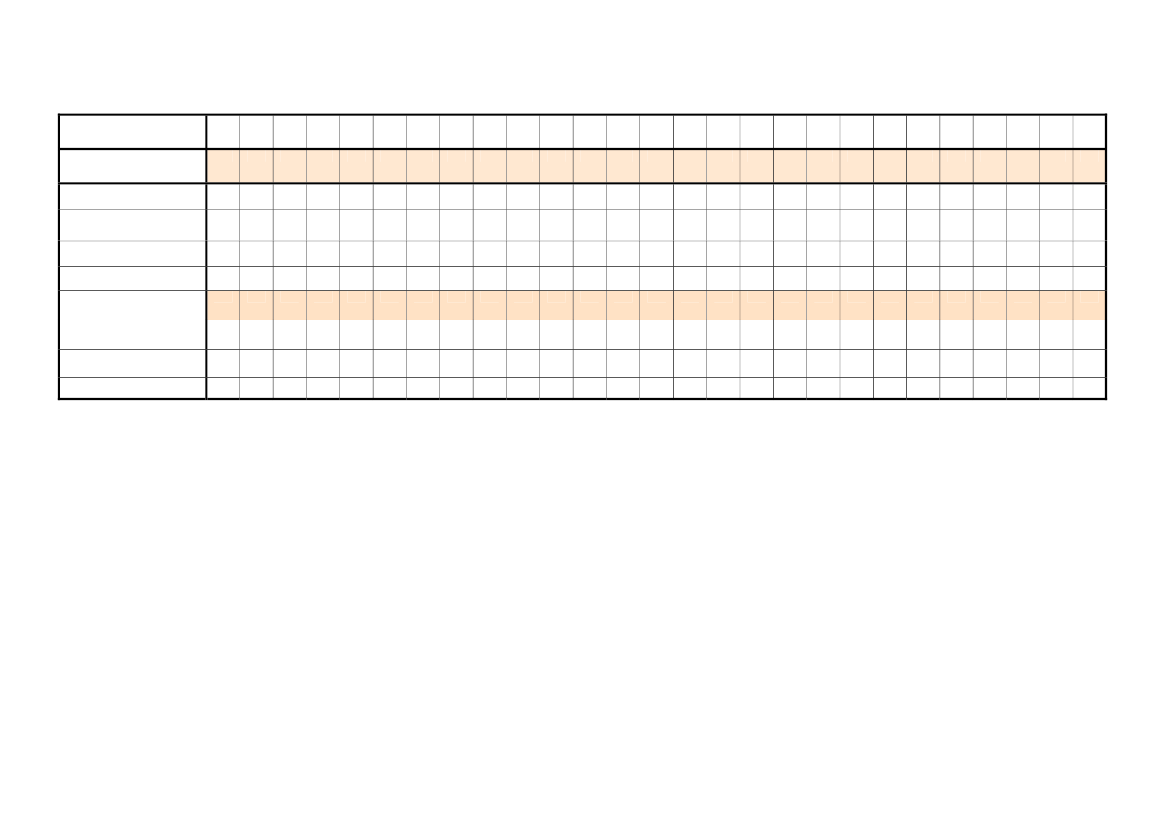

II. APPLICATION OF REDUCED VAT RATES BY THE MEMBER STATES TO THE CATEGORIES OF GOODS AND SERVICES CONTAINED INANNEX III OF VAT DIRECTIVE 2006/112/EC0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemptionCategoryRestaurants

BE12386[ex]6[ex]6

BG2020

CZ2010

DK25[ex]25

DE19719[ex]197

EE2020

EL133713

ES8818

FR5,519,6

IE938[ex]50[ex]

IT101020

CY85

LV2222

LT2121

LU33[ex]

HU2525

MT1818

NL6376

AT103920

PL8378

PT136

RO2424

SI208,5408,5

SK2020

FI139[ex]

SE25[ex]66[ex]

UK2020

13. Admission tosporting events14. Use of sportingfacilities15. Social services

20

10

[ex]25

20

23

[ex]18

19,6

9

20

15

22

21

3

25

18

6[ex]

20

8

23

24

8,5

20[ex]

9

2017.5[ex]

20

[ex]10

25

[ex]

13[ex]

8

19,6

[ex]

[ex]41020

[ex]

[ex]

[ex]

3

[ex]

[ex]

19

[ex]

[ex]

623

[ex]

20[ex]41

20[ex]

[ex]

[ex]

21[ex]

15[ex]5222132518[ex]

10

[ex]

25

16. Supplies byundertakers andcremation services17. Medical anddental care

62121[ex]

20

10

[ex]

19

20

13

818

19,6

21[ex]

[ex]

20

8

[ex]

24

8,5

20

[ex]

[ex]

[ex]

20

[ex]10

[ex]

7[ex]

[ex]

13[ex]

8

[ex] [ex]51[ex]13,5

[ex]

[ex]

[ex]

3[ex]

[ex]

[ex]

[ex]19

[ex]

[ex]8

[ex]6

[ex]

[ex]

[ex]

[ex]

[ex]

[ex]

18. Collection of domesticwaste and streetcleaning, ...19.Minor repairing(including mendingand alteration) of:BicyclesShoes and leathergoodsClothing and householdlinen20.Domestic care services(**)21.Hairdressing

21

20

201043

25

[-]19

20

13[ex]44

8

19,65,5

13,5

10

5

22

21

3

25

18

1942

10

8

[ex]6

24

8,5

20

23

25

020

2135213521352121

2020202020

2020201020

2525252525

1919191919

2020202020

1313131323

181818188

19,619,619,65,519,6

13,513,513,5[ex]9

202020[ex]20

151515155

2222222222

2121212121

666

252525

555518

666196

2020202020

888238

232323623

2424242424

8.58.58.58.58.5

2020202020

934934953423934

2525252525

2020202020

[ex]2515 [ex]45625

6

II. APPLICATION OF REDUCED VAT RATES BY THE MEMBER STATES TO THE CATEGORIES OF GOODS AND SERVICES CONTAINED INANNEX III OF VAT DIRECTIVE 2006/112/EC0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption(*)excluding materials which form a significant part of the value of the supply(**) e.g. home help and care of the young, elderly, sick or disabled

(1)(2)(3)(4)(5)(6)(7)(8)(9)(10)(11)(12)(13)(14)(15)(16)(17)(18)(19)(20)(21)(22)(23)(24)(25)(26)(27)(28)(29)(30)(31)(32)

HU: As of 1 July 2009 a reduced rate of 18% applies to: milk and milk products (excluding mother’s milk); Dairy products; Flavoured milk;and products containing cereals, flour, starch, or milk.MT: Some confectionery is at 5%LV: Products for infantsEL: When the water is provided by public authoritiesIE: When the water is provided by local authoritiesLT: 5% VAT rate is applicable only to the supply of pharmaceuticals and medical aids to persons who have the right to the total or partialreimbursement of the acquisition expenses of these goods in accordance with the Law on Health Insurance until 31 December 2011 and 21%from then onwardsHU: only human medical productsRO: Supply of orthopaedic products and prostheses of any type and accessories to them, with the exception of dental prosthesesMT: Transport of passengers by the Scheduled Public Bus Service. Other transport of passengers, e.g. a taxi service, is at 18%LV: Transport of schoolchildren conducted by carriers licensed specially for this reasonLT: Only books and non periodical informational publications are subject to 9% rate of VATEE: Newspapers and periodicals containing mainly publicity, private advertisements or erotic/pornographic material are at 20%LT: 9% until 31/12/2011ES: Supplied by bodies governed by public law or by other organisations recognised as charitable by the Member State concernedLT: Supplied by non-profit making legal personsEL: Only for the theatreLV: Admissions to cinema (film shows)FR: Amusement parks which do not illustrate any cultural topic are liable to the standard rate of 19.6%PT: Porn shows, arcade games and gambling are excluded and are liable to the standard rate of 23%BE: only for pay or digital radio and TV broadcastingCZ and SK: public radio and TV broadcasting, excluding those of a commercial nature, are exempt;EL and HU: Services provided by public radio and public TV are exemptedPL: Services connected with video tapes and with all advertising and promotion movies, and operation of information agenciesSI: Public radio and TV broadcasting, excluding those of a commercial nature, are exemptFI: Copyright royalties collected by copyright organisationsBE: Provided that all the conditions are fulfilledLU: Houses used as a principal dwellingBE: 6% on renovation and repairing of private dwellings completed more than 5 years ago until 30/06/2011EL: Only for old private dwellingsES: Bricklaying work for the repair of private dwellingsFR: Renovation and repairing of private dwellings completed at least 2 years agoNL: Painting and plastering services for the renovation and repairing of private dwellings more than 15 years old7

II. APPLICATION OF REDUCED VAT RATES BY THE MEMBER STATES TO THE CATEGORIES OF GOODS AND SERVICES CONTAINED INANNEX III OF VAT DIRECTIVE 2006/112/EC0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption(33)(34)(35)(36)(37)(38)(39)(40)(41)(42)(43)(44)(45)(46)(47)(48)(49)(50)UK: For the Isle of Man onlyFI: 9% until 31/12/2011BE: 6% until 30/06/2011HU: In force as of 1.07.2009EL, FR, NL and PL: Alcoholic beverages are subject to the standard rateBE, IE: all beverages are excludedAT: 10% on food, 10% on milk and chocolate, 20% on coffee, tea and other alcoholic or not alcoholic beveragesSI: VAT rate of 8,5% applies to the preparation of mealsSI: Social security services, provided as a public service or by other non-profit-making organisations, deemed to be charitable, disabledorganisations or self-help organisations, are exemptedNL: Collection of domestic waste and street cleaning is a service that is carried out by the public authorities. A levy will only be imposed onservices which are carried out by a private enterprise which is called in by the public authorities. There will be no levy imposed towardcitizensCZ: Cleaning and draining of waste water, collection of domestic wasteEL: When these services are supplied by public authoritiesHU: Social services, with the exception of social cateringFR: books which have a pornographic character or which may incite violenceIT: books in Braille and on cassettes or other magnetic support for the blind or persons with impaired visionSE: the reduced VAT rate of 6% also applies to goods that make information available to people with reading disablements through signlanguage or BrailleUK: zero rate for supplies of talking books for the blind and handicapped but only when supplied to charitiesIE: Catering services supplied to patients in a hospital or students at their school (51)IE: Dental care is exempt

8

III.

APPLICATION OF THE PARKING RATE IN CERTAIN MEMBER STATES

BELGIUMParking rate of 12% applicable to:1. Certain energy products such as:- coal and solid fuel obtained from coal- lignite and agglomerated lignite (except for jet)- coke and semi-coke from coal, lignite and peat- uncharred petroleum coke used as fuel.2. Certain tyres and inner tubesIRELANDParking rate of 13.5% applicable to:1. Energy for heating and light2. Movable property used in the construction and maintenance of immovable property3. Supply of immoveable property4. Services consisting of the routine cleaning of immoveable property5. Repair and maintenance of movable property6. Services relating to the care of the human body7. Certain specific tourist services8. Services relating to photography9. Services supplied by jockeys10. Works of art and antiques11. Short-term hire (less than 5 weeks) of:- motor vehicles designed for the conveyance of persons by road- ships, boats and other vessels not exceeding 15 tonnes gross designed for theconveyance of passengers- sports and pleasure craft, including yachts, cabin cruisers, dinghies, canoes, skiffsand racing boats- caravans, mobile homes, tents and trailer tents.12. Driving schools13. Professional services supplied by veterinary surgeonsLUXEMBOURGThe parking rate of 12% applies to:1. Certain wines2. Solid mineral fuels, mineral oils and wood intended for use as fuel, with the exceptionof wood for heating3. Washing and cleaning products4. Printed advertising matter, commercial and similar catalogues; tourism publications5. Heat, air conditioning and steam, with the exception of heat provided by heatingnetworks6. Safe custody and administration of securities7. Administration of credit and credit guarantees by a person or organisation other thanthat granting the creditAUSTRIAThe parking rate of 12% applies to:1. Wine from farm production carried out by the producing farmerPORTUGALThe parking rate of 13% applies to:

9

III.

APPLICATION OF THE PARKING RATE IN CERTAIN MEMBER STATES

1. Wine2. Appliances, machinery and other equipment designed exclusively or mainly for thefollowing purposes:(a) Collection and use of solar energy, wind energy, or geothermal energy;(b) Collection and use of other forms of alternative energy;(c) Production of energy by the incineration or modification of detritus, garbage,and other waste;(d) Exploration of and search for oil and/or development of the discovery of oiland natural gas;(e) Avoidance or reduction, by measuring and controls, of any form of pollution.3. Agricultural tools and utensils, mobile silos, tractors, pumps and other machinerydesigned exclusively or mainly for the purpose of agriculture, cattle breeding orforestry.4. Heating oil and diesel for the agriculture

10

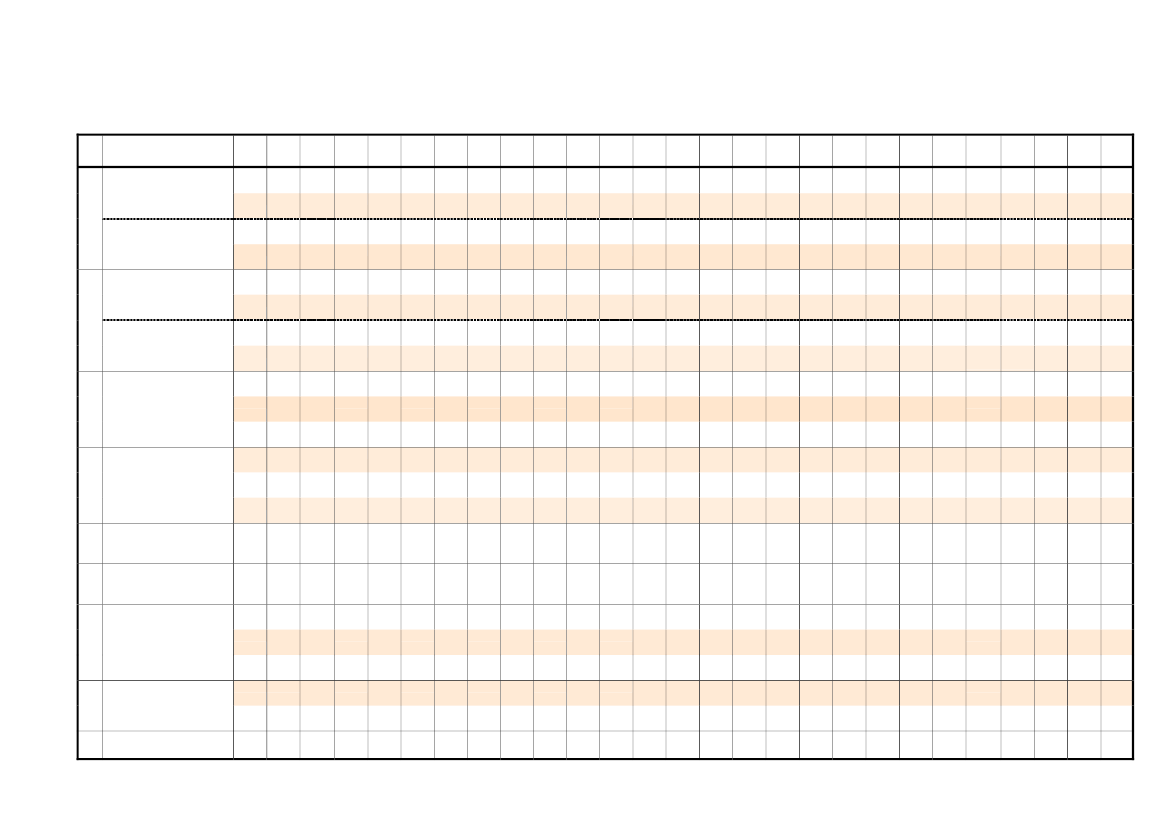

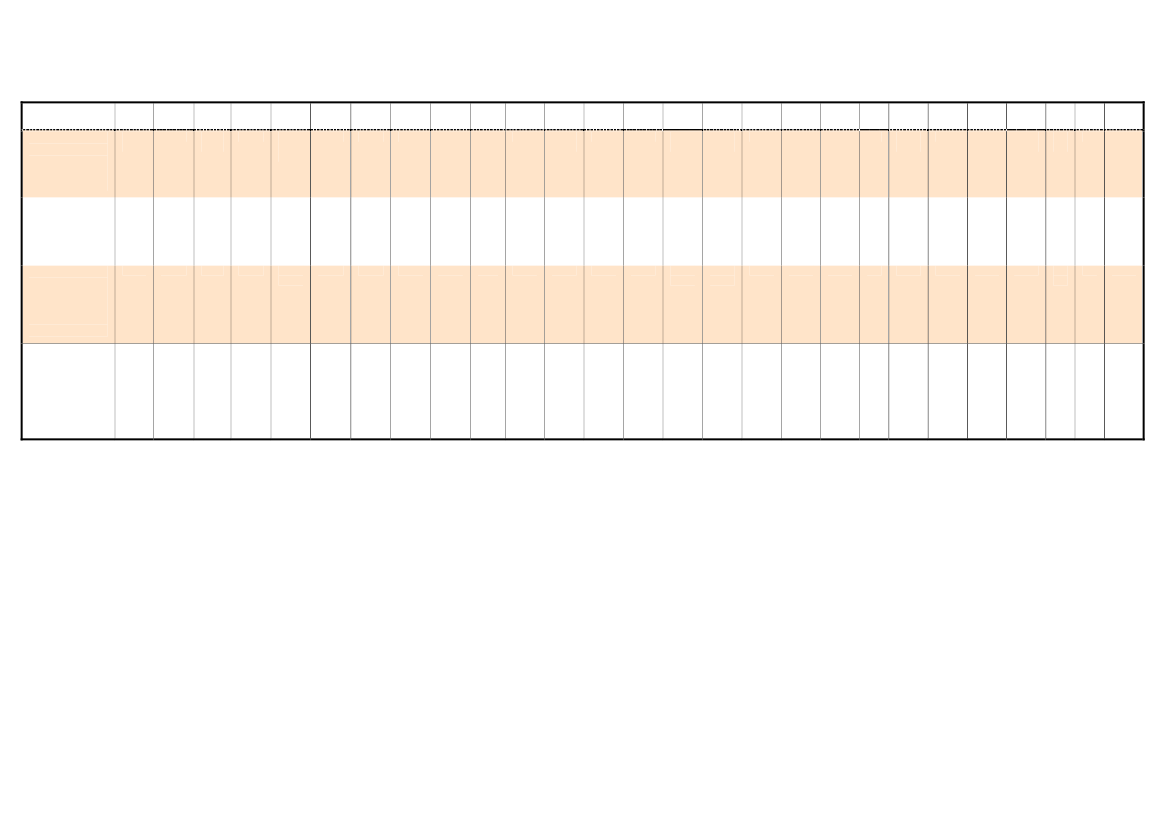

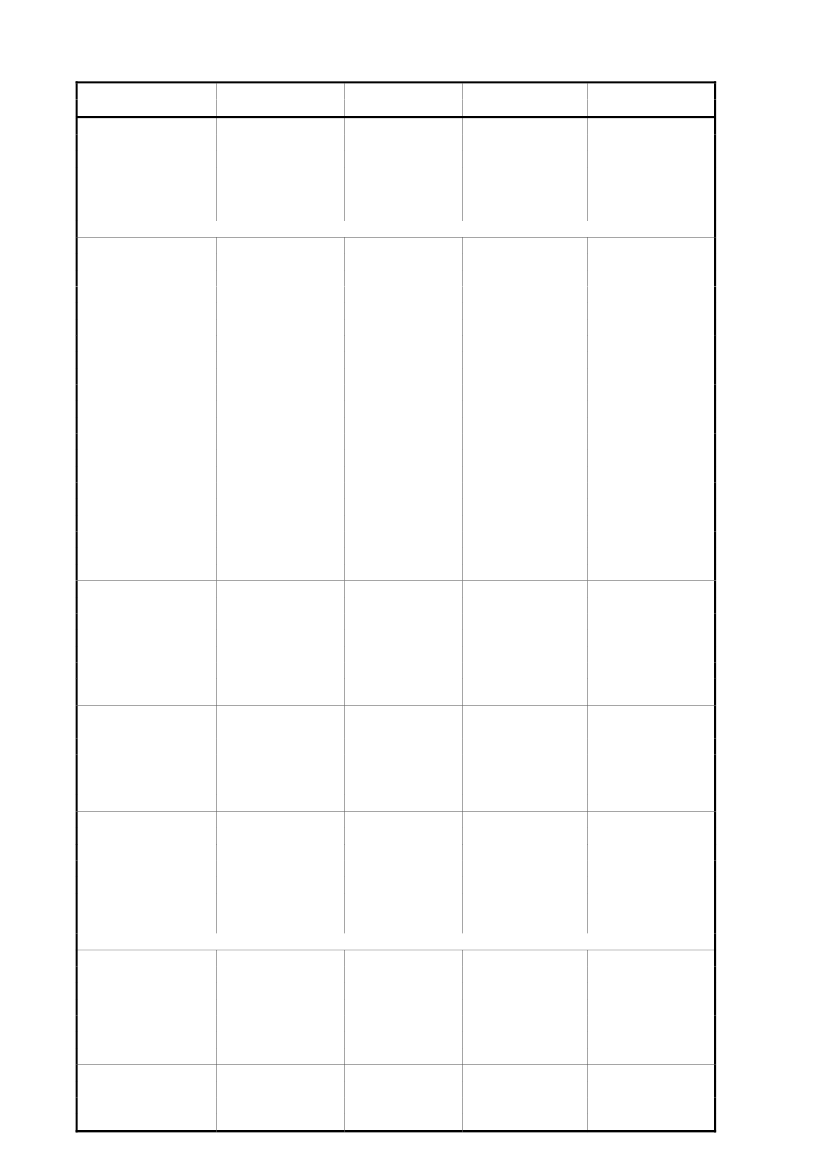

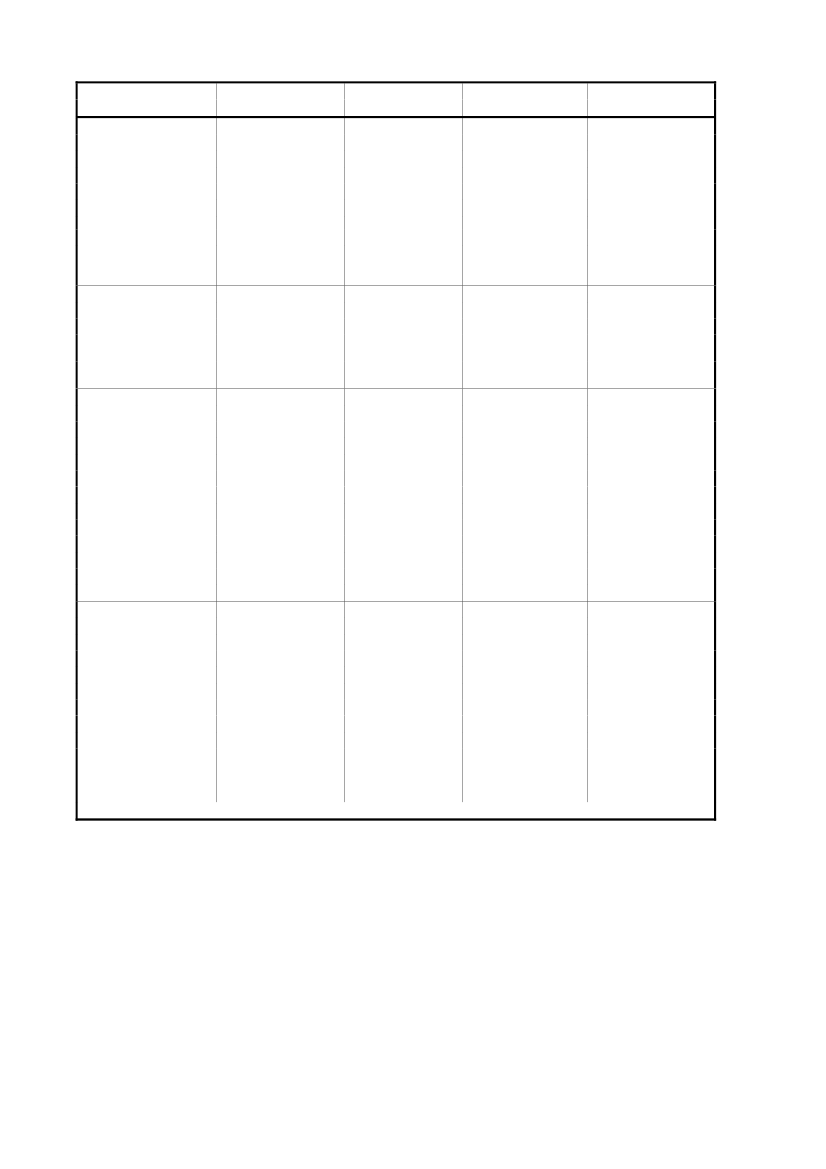

IV. LIST OF SUPER-REDUCED RATES (LESS THAN 5%) APPLIED IN THE MEMBER STATES(N.B.: The list is not exhaustive)GOODS andSERVICESFood productsBeverages: Mineralwater/lemonadeClothing and footwearfor childrenPharmaceuticals- Books- Books on otherphysical means ofsupport- Newspapers- PeriodicalsTelevision licence fees- Hotels- RestaurantsAdmission to culturalservices, shows(cinema, theatre,sports)Use of sportsinstallations- Treatment of wasteand waste water- Collection ofhousehold wastePassenger transportProperty sector:- Supply of newbuildings- Renovation andrepairs44443233

BE BG

CZ DK DE

EE EL

ES FR IE44,8

IT CY4

LV LT LU333

HU MT

NL AT PL

PT RO

SI SK

FI SE

UK

4414

2,1445

333

44

2,12,12,1

444

33

333

3333

11

IV. LIST OF SUPER-REDUCED RATES (LESS THAN 5%) APPLIED IN THE MEMBER STATES(N.B.: The list is not exhaustive)GOODS andSERVICES- Construction work onnew buildingsRoyaltiesMedical equipment fordisabled personsWater distributionSocial services- Cut flowers andplants- Pesticides, naturaland artificial fertilizersRaw woolAgricultural inputs44

BE BG

CZ DK DE

EE EL

ES FR IE4

IT CY44

LV LT LU32333

HU MT

NL AT PL

PT RO

SI SK

FI SE

UK

433

(1)(2)(3)(4)(5)

ES: Including free supplementLU: Only houses assigned to the principal dwellingLU: Only substantial works on housing constructed more than 20 years prior to the start of the worksIT: Only for first housingIT: Books in Braille and on cassettes or other magnetic support for the blind or persons with impaired vision

12

V. CASES WHERE THE ZERO RATE IS APPLIED TO CONSUMPTION IN THE LEGISLATION OFTHE MEMBER STATES (ARTICLE TITLE VIII, CHAPTER 4 OF THE VAT DIRECTIVE2006/112/EC)

BELGIUM−−Supplies of daily and weekly newspapers of general informationSupplies of certain recovered materials and by-products

DENMARK−Sales of newspapers normally published at a rate of more than one issue per month

IRELAND−−−−−−−−−−−−Supplies of books and pamphlets (excluding newspapers, periodicals, catalogues,diaries, etc.)Supplies of food and drink intended for human consumption (excluding certainproducts such as alcoholic beverages, manufactured beverages, ice-cream andconfectionery)Supplies of seeds, plants, trees, etc. used for food productionSupplies of certain fertilisers in units of not less than 10 kgSupplies of animal feeding stuffs (excluding pet food)Supplies of orally administered medicines for human consumptionSupplies of orally administered medicines for animal consumption (excluding thosefor pets)Supplies of certain articles of feminine hygieneSupplies of medical equipment such as wheelchairs, crutches, orthopaedic appliancesand other artificial parts of the body (excluding false teeth)Supplies of articles of clothing and footwear for children of average size under theage of ten (excluding clothes made of fur or skin and articles of clothing andfootwear not marked with the size or age)Supplies of wax candles (plain, white and undecorated)Certain services provided by the Commissioners of Irish Lights

ITALY−Supplies of land not capable of being used as building land

MALTA−−−−−−Supplies of food products for human consumption, except for supplies of pre-cookeddishes and certain highly processed products, such as ice-cream, chocolates,manufactured beverages or beverages subject to excise duty, and pet foodsSupplies of seeds or other means of propagation of plants classified under the aboveparagraphSupplies of live animals of a type generally used as, or yielding or producing, food forhuman consumptionSupplies of water by a public authority other than water for enterprises, distilled ormineral water;Supplies of pharmaceuticals, medicines only where prescribedSupplies of goods where the supply is connected with and essential to the provisionof care or medical or surgical equipment in hospitals or institutions officiallyapproved, or for the supply of welfare services in institutions falling within theprescribed parameters.

FINLAND−−Newspapers and periodicals provided that they are sold on subscription for a periodof at least one monthPrinting services for membership publications of non-profit making organisations13

V. CASES WHERE THE ZERO RATE IS APPLIED TO CONSUMPTION IN THE LEGISLATION OFTHE MEMBER STATES (ARTICLE TITLE VIII, CHAPTER 4 OF THE VAT DIRECTIVE2006/112/EC)SWEDEN−−Services with regard to production (basically printing services) of membershipperiodicals, staff periodicals and periodicals issued by non-profit organisations,including services related to such production, such as distribution servicesMedicine supplied on prescription or sold to hospitals or imported into the country tobe supplied on prescription or sold to hospitals

UNITED KINGDOM−−Supplies of books, newspapers, periodicals, sheet music, maps, etc.Supplies of food products for human or animal consumption, except for supplies ofpre-cooked dishes and certain highly processed products such as ice-cream,chocolates, manufactured beverages or beverages subject to excise duty and petfoodsSupplies of seeds or other means of propagation of plants classified under the aboveparagraphSupplies of live animals of a type generally used as, or yielding or producing, food forhuman consumptionSupplies of water other than water for enterprises, distilled or mineral waterSupplies of pharmaceuticals, medicines only where prescribedSupplies of medical and surgical instruments, aids only to handicapped persons(excluding hearing aids, dental prostheses, spectacles, etc.)Supplies of children’s clothing and footwearConstruction of buildings for residential purposes; approved alterations to listedbuildingsSupplies of certain materials by a person supplying the above-mentioned services,excluding maintenance and repair workSupplies for and by charity organisations of goods donated with a view to being soldSupplies of magnetic tape and tape recorders , etc. to the Royal National Institute forthe BlindSupplies to a charity organisation of radio receivers for free loan to blind personsSewage servicesThe transport of passengers in any vehicle, vessel or aircraft carrying at least 12passengers; or by the Post Office; or by any scheduled serviceThe transport of passengers or freight from or to a place outside the United KingdomSupplies of certain caravans and houseboatsSupplies of boots and helmets for industrial useSupplies of motor-cycle and cycle helmetsThe issue of bank notes

−−−−−−−−−−−−−−−−−−

14

VI.

VAT RATES GENERALLY APPLIED IN THE MEMBER STATES TO CERTAIN PRODUCTS OR SERVICES

0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption; [m] = taxation on the margin; [-] =out of scopeGOODS andSERVICESBeveragesSpiritsWineBeerMineral waterLemonadeFruit juicesClothingAdultsChildrenFootwearAdultsChildrenTobaccoHifi-VideoCD/ CD-ROMHouseholdelectricalappliancesFursJewelsEnergyProductsNatural gasElectricityFirewood21212121212120202020202020202020202025252525252519191919191920202020202023232323232318181818181819,619,619,619,619,619,621021212121202020202020151515151515222222222222212121212121153151515152525252525251818181818181919191919192020202020202382323232323232323232324242424242420202020202020202020202023232323232325252525256225200202020202121202020202525191920202323181819,619,621020201515222221211532525181819192020238231

BE

BG

CZ

DK

DE

EE

EL

ES

FR

IE

IT

CY

LV

LT

LU

HU

MT

NL

AT

PL

PT

RO

SI

SK

FI

SE

UK

212121666

202020202020

202020101010

252525252525

191919191919

202020202020

232323131313

181818888

19,619,619,65,55,55,5

212121212121

202020202020

1515151555

222222222222

212121212121

151215333

252525252525

181818181818

191919666

20201220202020

23232323238

231323666

242424242424

2020208,58,58,5

202020202020

232323131313

252525121212

202020202020

2323

2424

2020

2020

2323

2525

200

2121

2020

2020

2525

1919

2020

2323

1818

19,619,6

2121

2020

1515

2222

2121

1515

2525

1818

1919

2020

2323

2323

2424

2020

2020

2323

2525

2020

21216

202020

202010

252525

19197

202020

131313

181818

19,65,519,65,55,5

13,5313,5313,53

101010

151515

222222

212121

666

252525

[-]185518

191919

202010

23238

6623

242424

202020

202020

232323

252525

5520

Timber forindustrial useTelecommunication

21

20

20

25

719

20

23

18

19,6

21

20

15

22

21

15

25

18

19

1020

23

23

24

20

20

23

25

20

15

VI.

VAT RATES GENERALLY APPLIED IN THE MEMBER STATES TO CERTAIN PRODUCTS OR SERVICES

0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption; [m] = taxation on the margin; [-] =out of scopeGOODS andSERVICESservicesPhone/ fax/telex/etc.Pay TV/ cableTVTV licencePetroleumproductsPetrol(unleaded)Diesel fuelLPGHeating oilLubricantsMotorvehiclesPassengertransportDomestictransport:Air620101120N/A[ex]19201385,5[ex]101512213250191086248,52096021212121212169[m]20202020202020202020202025252525252519191919191920202020202023232323232318181818181819,619,619,619,619,619,621212113,532121202020202020410[m]15151515151522222222222221212121212115156121515252525252525181818181818191919191919202020202020232323232323231323231323232424242424242020202020202020202020202323232323232525252525252020205852020212020[ex]620[ex]620251920231819,6212015222115251819202323242020232520BEBGCZDKDEEEELESFRIEITCYLVLTLUHUMTNLATPLPTROSISKFISEUK

1221[-]

2020

2525

19[ex]

2020

13[ex]

1818

5,52,1

21[ex]

204

1515

22[-]

2121

315[ex]

2525

18[-]

19[ex]

1010

82323

236

24[ex]624

20[ex]720

20[ex]20[ex]

239

25[ex]

20[ex]

Sea

6

20

[ex]

197[-]197197197

20

13

8

5,5

[ex]

10

8

12

21

N/A

N/A

0

6

N/A

8

6

24

8,5

N/A

9

6

0

Inland waterway

6

20

101120101120101120

[ex]

20

13

8

5,5

[ex]

10

15

12

21

3

25

N/A

6

10

8

6

24

8,5

20

9

6

0

Rail

6

20

[ex]

20

13

8

5,5

[ex]

10[ex]10[ex]

N/A

12

21

3

25

N/A

6

10

8

6

24

8,5

20

9

6

0

Road

6

20

[ex]25

20

13

8

5,5

[ex]

5815

12

21

3

25

018

6

10

8

6

24

8,5

20

9

6

0

GOODS andSERVICES

BE

BG

CZ

DK

DE

EE

EL

ES

FR

IE

IT

CY

LV

LT

LU

HU

MT

NL

AT

PL

PT

RO

SI

SK

FI

SE

UK

16

VI.

VAT RATES GENERALLY APPLIED IN THE MEMBER STATES TO CERTAIN PRODUCTS OR SERVICES

0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption; [m] = taxation on the margin; [-] =out of scopeGOODS andSERVICESIntra-communityandinternationaltransport:AirSeaInlandwaterwayRailRoadHotelsTake awayBars and cafésBars and cafésNight clubsAlcoholicbeveragesCut flowersand plantsDecorative useFoodproductionImmovablepropertySocial Housing(category 10/Annex III)Renovation andrepairing(category 10a/Annex III)Building land662020101025257720201313885,55,513,501010155222221216325251818619610108823624248,58,52020231325252002121212020202020202525251919192020201323238885.5175.51719,613,521211020101515152222222121213332525251818186619202020232323131313242424202020202020232323252525202020000000000000000000000000000BEBGCZDKDEEEELESFRIEITCYLVLTLUHUMTNLATPLPTROSISKFISEUK

06

00

00

0

070

00

013

08

05,5

0

00

0N/A

00

00

N/A0

N/A0

0N/A

06

N.A.20

00

00

00

0N/A

N/A0

00

00

0

6666

00920

001010

002525

19719777

00920

13136,513

8888

05,5[ex]5,55,5

00913,5

001010

N/A08513

002222

0092721

0033

00181825

N/AN/A718

6666

2020101014

0888

00613

002424

08,58,5208,515

002020

00913

001212

002002016

612

20

10

25

19

20

13

48

5,519,6

13,5

410

15

22

21

31815

25

[ex]

19

20

8

[ex]6

5

8,5

20

23

25[ex]

200

61921

20

10

25

19

20

1320

821

5,52219,6

13,53

10

5

22

21

32315

25

18

62419

20

823

623

24

8,5

20

23

25

20525

[ex]

20

20

[ex]

[ex]

20

[ex]

18

19,6

[ex]13,54

20

[ex]

[ex]

21

[ex]

25

[ex]

19

[ex]

23

[ex]

24

20

20[ex]26

[ex]

[ex]

[ex]20

17

VI.

VAT RATES GENERALLY APPLIED IN THE MEMBER STATES TO CERTAIN PRODUCTS OR SERVICES

0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption; [m] = taxation on the margin; [-] =out of scopeGOODS andSERVICESSupplies of newbuildingsConstructionwork on newbuildingsTravelagenciesAgriculturalInputsPesticides andplant protectionmaterialsFertilisersTreatment ofwaste andwaste waterCollection ofhouseholdwaste, …Arrangementsfor thetaxation ofgoldIngots and barsCoins(currency)Jewellery, goldplate, medals,toolsServicessupplied bylawyers[ex]21[ex]21212020[ex]20[ex]2020[ex][ex][ex]19197[ex]197[ex]20[ex][ex][ex][ex]018[ex]01818[ex]19,6[ex]19,619,6[ex]21[ex][ex]20[ex]2020[ex][ex][ex]4122[ex]412222[ex]21[ex]2121[ex]15[ex]1515[ex]25[ex]25250[ex]190[ex][ex]2020[ex]23[ex]2323[ex]23[ex]2323[ex]2420[ex][ex][ex]23023023[ex]25[ex]25252002002012312120202519201385,53219,6212052221152518192086248,520232520BE21BG20CZ20DK[ex]DE[ex]EE20EL23ES81848FR19,6IE13,53IT428102042810CY15LV2229LT21LU[ex]HU25MT[ex]NL19AT[ex]2020PLPT[ex]RO24SI20308,53320308,512SK20FI[ex]SE[ex]UK020200

2323

6122121[m]

20

20

25

19

20

23

19,6

13,53

15

22

21

31815

25

18

19

623

24

20

23

25

20[m]

20[m]

[ex]

19[m]

20[m]

23[m]

18[m]

19,6[m]

21[m]

20[m]

15[m]

22[m]

21[m]

15[m]

25[m]

18[m]

[ex]

20[m]

23[m]

23[m]

24[m]

20[m]

20[m]0

23[m]

25[m]

20[m]0

12312121

20

20

25

1934

20

13

8

5,5

03521[-]13,5[-]13,5

436

5

22

21

337

25

18

19

10382010

8

6

24

8,5

20

23

25

20

20

10203910

25

[-]19[-]19

20

13

8

5,519,619,6

10 20

5

22

21

3

25

18

19

8

236[-]6

24

8,5

20

23

25

20020

21

20

25

20

13

8

10

5[-]

22

21

3

25

18

[-]1940

10

8

24

8,5

20

23

25

20

25

20

23

21

15

18

19

24

20

20

[ex]

20

20

25

19

20

23

18

19,65,542

21

20

15

22

21

15

25

18

19

20

23

23643

24

20

20

23

25

20

Taxation ofworks of art,collector’sitems andantiques

18

VI.

VAT RATES GENERALLY APPLIED IN THE MEMBER STATES TO CERTAIN PRODUCTS OR SERVICES

0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption; [m] = taxation on the margin; [-] =out of scopeGOODS andSERVICESWorks of art,collector’sitems andantiques“Normal” rateRate onimportation(Article 103 ofthe Directive2006/112/EC)Supplies bycreators andoccasional sales(Article 103(2)of the Directive2006/112/EC)E-books(supply of thedigitisedcontent ofbooks over theinternet or anelectronicnetwork)BE21[m]BG20CZ20[m]DK2544DE74519[m]EE20EL23ES18FR19,6IE13,54621IT20CY15[m]LV22LT21LU15HU25[m]MT5NL19AT20[m]PL23PT62347RO24SI20[m]SK20[m]FI23[m]SE25UK20

6

20

10

2544

74519[m]

20

13

8

5,5

13,5

1048

542

22

21

6

25

5

6

10

8

62347

24

8,5

20

923

12

5

6

20

20

2544

74519

20

13

8

5,5

13,5

1048

N/A

22

21

6

25[-]49

5

6

10

8

6

24

8,5

20

9

12

20

21

20

20

25

19

20

23

18

19,6

21

20

15

22

21

15

25

18

19

20

23

23

24

20

20

23

25

20

(1) PL: Reduced rate of 8% is applicable to all babies' clothing(2) SE: CDs which reproduce the sound of contents printed on paper (e.g.: a book)(3) IE: Parking rate(4) IE: building land that has been subjected to development (5) MT: If supplied by Public Authority: outside the scope; in cylinders: 18%(6) CZ and RO: Public radio and TV broadcasting, excluding those of a commercial nature(7) SI: Public radio and TV broadcasting, excluding those of a commercial nature(8) UK: For domestic heating and deliveries of less than 2300 litres(9) BE: invalid cars(10) IT: 4% on vehicles for the use of the disabled persons; the margin scheme applies to second-hand cars(11) CZ: 10% applies only on regular transport(12) SL: Construction, renovation and alteration of residential housing as part of a social policy; renovation and repairing of private households(13) CY: VAT rate of 8% applies to restaurant services and other catering services, with the exception of alcoholic beverages, beer and wine, which are taxedat 15%(14) AT: 10% on food, 10% on milk and chocolate, 20% on coffee, tea and other alcoholic or not alcoholic beverages(15) SI: VAT rate of 8,5% applies to the preparation of meals(16) UK: 20% if bought on catering premises, 0% if bought elsewhere(17) FR: Supplies of alcoholic beverages are subject to the standard rate of 19.6%(18) LU: Houses used as a principal dwelling(19) BE: Renovation and repairing of private dwellings completed more than 5 years ago19

VI.

VAT RATES GENERALLY APPLIED IN THE MEMBER STATES TO CERTAIN PRODUCTS OR SERVICES

0 = zero rate (exemption with refund of tax paid at preceding stage); [ex] = exemption; [m] = taxation on the margin; [-] =out of scope(20)(21)(22)(23)(24)(25)(26)(27)(28)(29)(30)(31)(32)(33)(34)(35)(36)(37)(38)(39)(40)(41)(42)(43)(44)(45)(46)(47)(48)(49)EL: For old private dwellingsES: Bricklaying work for the repair of private dwellingsFR: Renovation and repairing of private dwellings completed at least 2 years agoLU: Only substantial works on housing constructed more than 20 years prior to the start of the worksNL: Painting and plastering services for the renovation and repairing of private dwellings more than 15 years oldUK: For the Isle of Man onlySK: If building land is supplied together with construction which is exempt from VATLT: 9% until 31/12/2011IT: 4% only for first housingLV: To the first supply of new buildingSI: Supply of construction and maintenance work for residential housing not provided as part of a social policy; supply and construction work on newnon-residential buildingsBE: Reduced rate of 12% only on phytopharmaceutical products recognised by the Ministry of AgricultureFR: Reduced rate of 5.5% only on phytopharmaceutical products recognised by the Ministry of AgricultureSL: Supplies of new residential housing as part of a social policyDE: Reduced rate of 7% on biological (not chemical) fertilizersIE: 0% on supplies of certain fertilisers in units of not less than 10 kgIT: Reduced rate of 4% on organisms used in organic agricultureLU: Reduced rate of 15% on phytopharmaceutical products under the TARIC code 38.08, whereas super reduced rate of 3% to fertilisers under theTARIC codes 31.01 to 31.05AT: Reduced rate of 10% applies to animal or vegetable fertilisers (except guano), whether or not mixed together (but not chemically treated)CZ: Reduced rate of 10% applies to cleaning and draining of waste waterNL: If the collection concerns industrial waste, both private enterprises and public authorities ought to charge a rate of 19%LV: Supplies to the Bank of LatviaCY: Importation of goods of archaeological value, CN code 9706 00 00PT: Supplies within the framework of legal aid or the appointment of a lawyer of its own motion; automatic designation; supplies relating to the labourlawDK: In respect of Article 123 Denmark reduces the taxable amount to 20% to which the 25% rate is applied, resulting in an effective rate of 5% forimports of both works of art and antiques. Similarly, the taxable amount in respect of supplies by creators is reduced by 20% to which the 25%rate applies, resulting in an effective rate of 5%DE: The reduced rate applies on works of art and collector’s itemsIE: 13.5% applies on works of art and on antiquesPT: The reduced rate applies only on works of art. In Madeira and Azores, the standard rate is 16% and the reduced rate is 4%IT: “Occasional sales” are taxable at the standard rateHU: On occasional basis

20

VII. GEOGRAPHICAL FEATURES OF THE APPLICATION OF VAT IN THE COMMUNITY

CZECH REPUBLICThere are no regions within the Czech Republic where special VAT rates are applied.DENMARKThe Faeroe Islands and Greenland are not part of the European Union; consequently, VAT(according to the VAT Directive 2006/112/EC) is not applicable on these territories.GERMANYFor VAT purposes, the country does not include the island of Heligoland or the territory ofBüsingen.GREECEFor the departments of Lesbos, Chios, Samos, the Dodecanese and the Cyclades, and on theAegean islands of Thassos, the Northern Sporades, Samothrace and Skiros, the rates of6,5%, 13% and 23% have been reduced by 30% to 5%, 9% and 16% respectively. Theserates apply to imports, intra-Community acquisitions, supplies of goods and services effectedmaterially in total on these islands by persons established on them and supplies of goodsfrom other areas of Greece to persons established on these islands. This preferential systemdoes not, however, apply to tobacco products and means of transport.Mount Athos is excluded from the scope of VAT.SPAINFor VAT purposes, the country does not include the Canary Islands, Ceuta and Melilla.FRANCESpecial rates apply in Corsica and the overseas departments (DOM):a) CORSICA0.90%: certain theatrical shows and circuses, sales of live meat and charcuterieanimals to persons not liable to pay tax;2.10%: goods supplied in Corsica to which the reduced rates are applicable in mainlandFrance;8%:certain work on immovable property, agricultural equipment and sales forconsumption on the premises, sales of electricity supplied at low voltage;13%:petroleum products;The standard rate applicable in Corsica is the same as in the rest of the country: 19.6%.b) DOMIn the overseas departments, but not French Guiana, a reduced rate of 2.10% and astandard rate of 8.5% are applicable.c)MONACOGoods and services supplied to or from the Principality of Monaco are regarded as havingbeen supplied to or from France.

ITALYThe following territories are excluded from the scope of VAT: Livigno, Campione d’Italia andthe territorial waters of Lake Lugano.

21

VII. GEOGRAPHICAL FEATURES OF THE APPLICATION OF VAT IN THE COMMUNITY

CYPRUSTransactions originating in, or intended for, the United Kingdom Sovereign Base Areas ofAkrotiri and Dhekelia are treated as transactions originating in or intended for the Republic ofCyprus.The application of the acquis is suspended in those areas of the Republic of Cyprus in whichthe Government of the Republic of Cyprus does not exercise effective control.AUSTRIAA special rate of 19% applies in Jungholz and Mittelberg.PORTUGALSpecial rates apply in the Azores and Madeira:4%: reduced rate;9%: reduced rate / parking rate;16%: standard rate.FINLANDThe Åland Islands are excluded from the scope of VAT.UNITED KINGDOMGoods and services supplied to or from the Isle of Man are regarded as having been suppliedto or from the United Kingdom.22

VIII.

THE EVOLUTION OF VAT RATES APPLICABLE IN THE MEMBER STATES

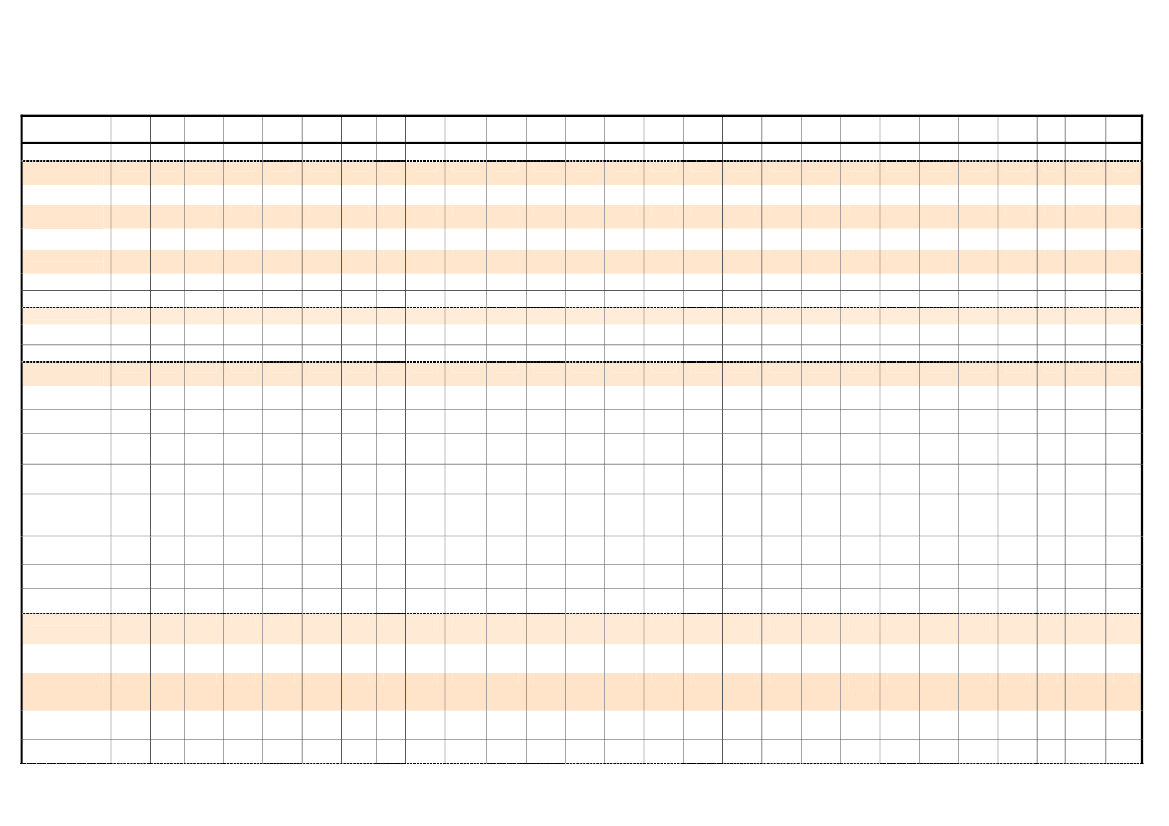

MEMBER STATESAND DATESBelgium1/01/19711/01/19781/12/19801/07/19811/09/19811/03/19821/01/19831/04/19921/01/19941/01/19961/01/2000Bulgaria1/04/19941/07/19961/01/19991/01/20071/04/2011Czech Republic1/01/19931/01/19951/05/20041/01/20081/01/2010Denmark3/07/19671/04/196829/06/197029/09/19751/03/19763/10/19771/10/197830/06/19801/01/1992Germany1/01/19681/07/19681/01/19781/07/19791/07/19831/01/19931/04/19981/01/2007Estonia19911993-…2000-20081/01/20091/07/2009Greece1/01/19871/01/198828/04/19908/08/19921/04/2005

REDUCED RATE

STANDARDRATE1816161717171919,520,52121

INCREASEDRATE2525| 25+5| 25+5| 25+8| 25+8| 25+8----

PARKING RATE

666661|61|61 | 6 | 121 | 6 | 121 | 6 | 126| 12

2525252525

14-----17-121212

---79

1822202020

-----

-----

555910

2322191920

---

---

---9,25-----

1012,51515151820,252225

---------

---------

55,566,57777

1011121314151619

-------

-------

--599

1018181820

-----

-----

3|63|64|84|84,5 | 9

1816181819

363636--

-----

23

VIII.

THE EVOLUTION OF VAT RATES APPLICABLE IN THE MEMBER STATESREDUCED RATE5 | 105,5 | 116,5 | 13

MEMBER STATESAND DATES15/03/20101/07/20101/01/2011Spain1/01/19861/01/19921/08/19921/01/19931/01/19951/07/2010

STANDARDRATE212323

INCREASEDRATE---

PARKING RATE---

6663|64|74|8

121315151618

332828---

------

France1/01/1968(1)61/12/1968(1)71/01/19707,51/01/197371/01/197771/07/1982(2)4 | 5,5 | 71/01/19864 | 5,5 | 71/07/19862,1 | 4 | 5,5 | 7 | 1317/09/19872,1 | 4 | 5,5 | 7 | 131/12/19882,1 | 4 | 5,5 | 7 | 131/01/19892,1 | 5,5 | 138/09/19892,1 | 5,5 | 131/01/19902,1 | 5,5 | 1313/09/19902,1 | 5,5 | 1329/07/19912,1 | 5,51/01/19932,1 | 5,51/08/19952,1 | 5,51/04/20002,1 | 5,5(1) Up to 1.1.1970, the VAT rates were applicable to arates apply to prices net of tax.(2) 4% rate 1.7.1982 to 1.1.1986 was provisional.

16,6620131925152333,3317,62033,3317,617,633,33-18,633,33-18,633,33-18,633,33-18,633,332818,628-18,628-18,625 | 28-18,625-18,622-18,622-18,6--20,6--19,6--price inclusive of VAT itself. As from 1.1.1970, the VAT

Ireland1/11/19723/09/19731/03/19761/03/19791/05/19801/09/19811/05/19821/03/19831/05/19831/07/19831/05/19841/03/19851/03/19861/05/19871/03/19881/03/19891/03/19901/03/19911/03/19921/03/19931/01/19961/03/19971/03/19981/03/19991/03/20001/01/2001

1 | 5,261 | 6,75101 | 101 | 101,5 | 151,8 | 182,3 | 232,3 | 5 | 182 | 5 | 182 | 5 | 8 | 182,2 | 102,4 | 101,7 | 101,4 | 5 | 102 | 5 | 102,3 | 102,3 | 10 | 12,52,7 | 10 | 12,52,5 | 12,52,8 | 12,53,3 | 12,53,6 | 12,54 | 12,54,2 | 12,54,3 | 12,5

16,3719,520202525303523 | 3523 | 3523 | 35232525252523212121212121212120

30,2636,7535 | 40-----------------------

11,1111,11----------------1612,512,512,512,512,512,512,5

24

VIII.

THE EVOLUTION OF VAT RATES APPLICABLE IN THE MEMBER STATESREDUCED RATESTANDARDRATE2121212121,52121

MEMBER STATESAND DATES

INCREASEDRATE-------

PARKING RATE12,513,513,513.513.513.513.5

1/03/20024,3 | 12,51/01/20034,3 | 13,51/01/20044,4 | 13,54.8 | 13.51/01/20054.8 | 13.51/12/20084.8 | 13.51/01/20104.8 | 9(1)| 13.51/07/2011(1) 9% reduced rate applies until 31/12/2013Italy1/01/19731/01/197518/03/197610/05/197623/12/19768/02/19773/07/19801/11/19801/01/19815/08/198219/04/198420/12/19841/08/19881/01/198913/05/19911/01/19931/01/199424/02/19951/10/1997Cyprus1/07/19921/10/19931/07/20001/07/20021/01/20031/08/2005Latvia1/05/19951/01/20031/05/20041/01/20091/01/2011Lithuania1/05/19941/08/19941/01/19971/05/20001/01/20011/01/20091/09/2009Luxembourg1/01/19701/01/19711/07/19831/01/19921/01/1993Hungary1/01/19881/01/19931/08/1993-9510126666|91|3|6|91 | 3 | 6 | 9 | 122|81 | 2 | 3 | 6 | 9 | 122|82 | 8 | 10 | 152 | 8 | 10 | 152|92|94|94 | 9 | 124|94|94 | 104 | 10

12121212121415141518181819191919191920

1830303030353535353830 | 3830383838----

-18181818181815 | 18182020----121316-

--5555|8

5810131515

------

------

1818182122

-----

-----

-9-55|95|95|9

18181818181921

-------

-------

42|53|63|63|6

810121515

-----

----12

0 | 150|610

252525

---

---

25

VIII.

THE EVOLUTION OF VAT RATES APPLICABLE IN THE MEMBER STATESREDUCED RATE0 | 125 | 155 | 1555 | 18

MEMBER STATESAND DATES1/01/19951/01/20041/01/20061/09/20061/07/2009Malta1/01/19951/01/19991/01/20041/01/2011Netherlands1/01/19691/01/19711/01/19731/01/19761/01/19841/10/19861/01/19891/10/19921/01/2001Austria1/01/19731/01/19761/01/19781/01/19811/01/19841/01/19921/01/1995Poland8/01/19934/09/20001/01/2011Portugal1/01/19861/02/198824/03/1992(1)1/01/19951/07/19965/06/20021/07/20051/07/20081/07/20101/01/2011

STANDARDRATE2525202025

INCREASEDRATE--

PARKING RATE--

5555|7

15151818

----

----

444456666

12141618192018,517,519

---------

---------

88813 | 8101010

16181818202020

--303032--

--303032-12

73|75|8

222223

---

---

555566

8855| 12| 12| 12| 12| 13| 13

16171617171921202123

303030-------

-----1212121313

(1) On 24 March 1992 Portugal abolished the zero rate. All goods and services previously zero-rated are nowtaxed at 6%.Romania1/07/19931/01/19951/02/19981/01/20001/01/20041/12/20081/07/2010Slovenia1/07/19991/01/2002

-911-95 |95 |9

18182219191924

-------

-------

88,5

1920

--

--

26

VIII.

THE EVOLUTION OF VAT RATES APPLICABLE IN THE MEMBER STATESREDUCED RATESTANDARDRATE232523232019191920

MEMBER STATESAND DATESSlovak Republic1/01/19931/08/19931/01/19961/07/19991/01/20031/01/20041/01/20071/05/201001/01/2011Finland1/06/19941/01/19951/01/19981/10/20091/07/2010Sweden1/01/19691/01/19711/06/19778/09/198016/11/19811/01/19831/07/19901/01/19921/01/19931/07/19931/01/1996United Kingdom1/04/197329/07/197418/11/197412/04/197618/06/19791/04/19911/04/19941/01/19951/09/19971/12/20081/01/20104/01/2011

INCREASEDRATE---------

PARKING RATE

5661014-106 | 1010

---------

12 | 517 | 12 | 617 | 812 | 813 | 9

2222222223

-----

-----

6,38 | 2,049,89 | 3,0911,43 | 3,5412,87 | 3,9511,88 | 3,6712,87 | 3,9513,64 | 4,17182121 | 126 | 12

11,1117,6520,6323,4621,5123,462525252525

-----------

-----------

-------85555

108881517,517,517,517,51517.520

--2512,5--------

------8-----

27