Skatteudvalget 2011-12

SAU Alm.del Bilag 177

Offentligt

Tax trends in OECD countries:The Slowdown in Economic Growth, HighUnemployment and Large Budget Deficits:How have Tax Policymakers Reacted?Bert BrysCentre for Tax Policy andAdministration

Structure of presentationI.II.How does the Danish tax system compare

Challenges for tax policy and backgroundeconomic information

to the tax system in other OECD countries?Trends in tax policies and tax revenues

III. Recent (2011-2012) developmentsIV. Tax policy issues for discussion

I. Challenges for tax policySlowdown in economic activityLarge budget deficits and rising debt ratiosHigh unemploymentGlobalisation and tax competition –capital mobility, emerging economies, etc.• Growing income inequality in manycountries• Population ageing• Climate change and the environment••••

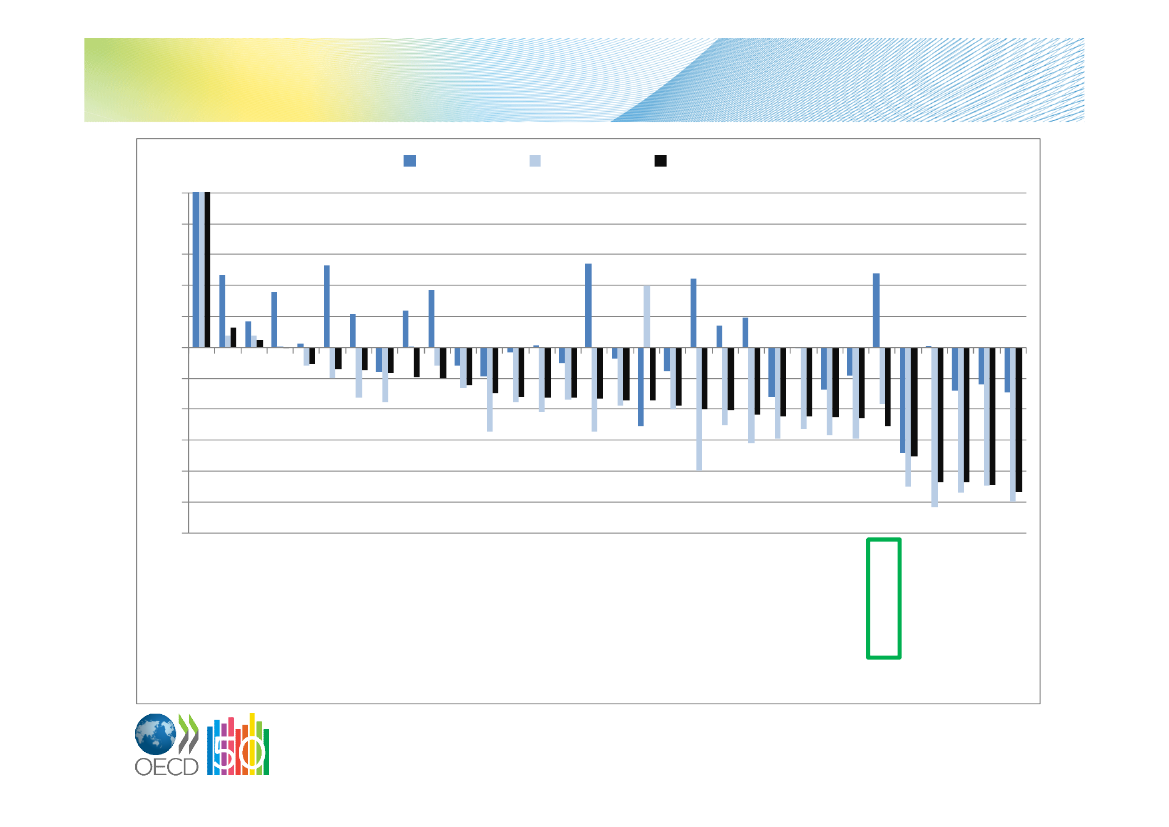

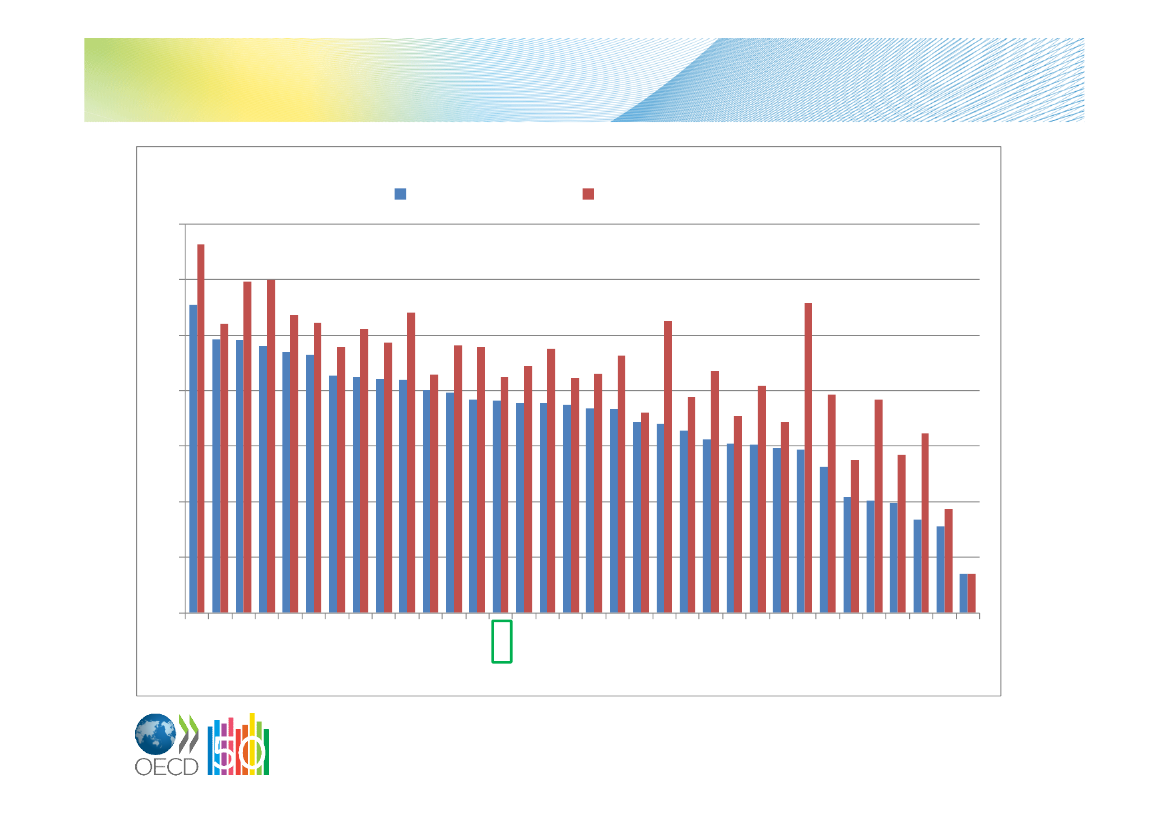

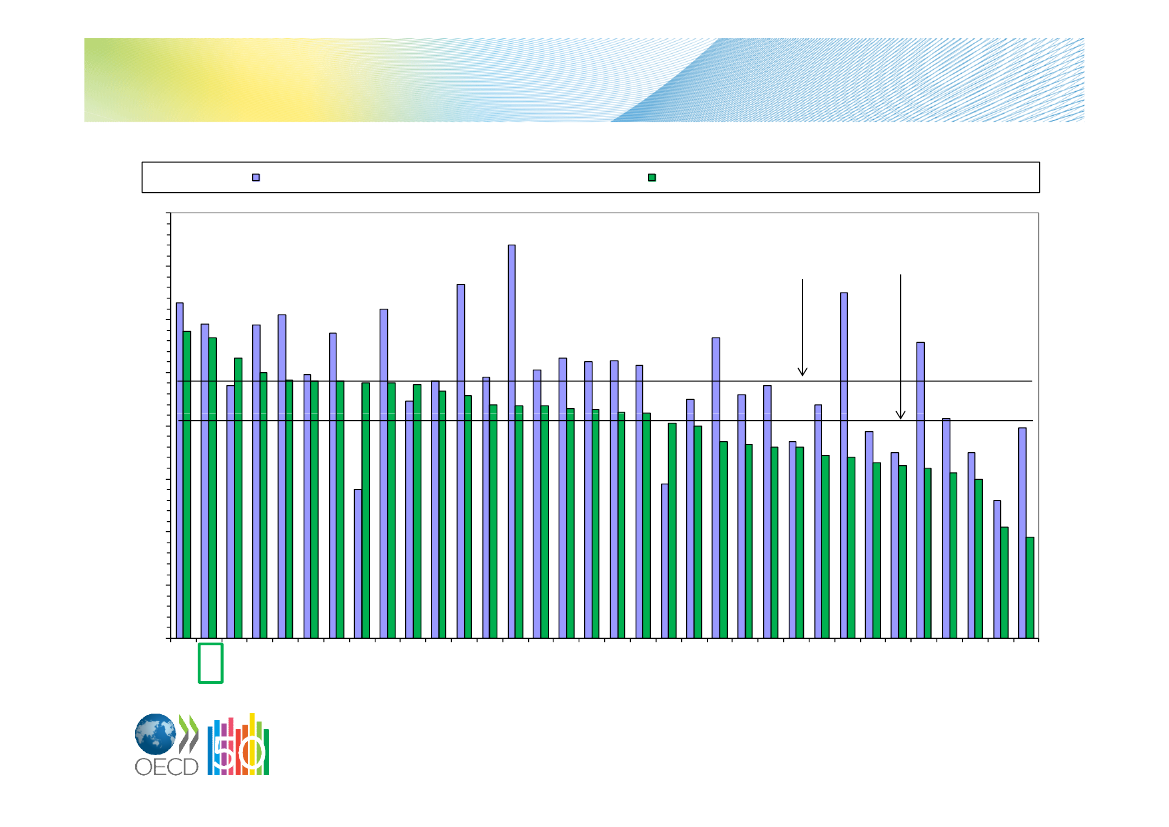

I. Large budget deficits in some countries20071086420-2-4-6-8-10-12Government net lending in 2007, 2011 and projection for 2012as a % of GDP (Economic Outlook December 2011)20112012 projection

Projection for Denmark: 5% deficit in 2012and 3% deficit in 2013NorwayKoreaSwitzerlandSwedenGermanyFinlandAustraliaItalyEstoniaLuxembourgTurkeyPolandBelgiumNetherlandsAustriaIcelandCzech RepublicHungaryIsraelNew ZealandCanadaSpainPortugalSloveniaFranceSlovak RepublicDenmarkGreeceIrelandUnited KingdomJapanUnited States

Sorted in data for 2012 projection; figures for Norway: +17.5% (2007), +12.5% (2011) and +11,5% (2012 projection)

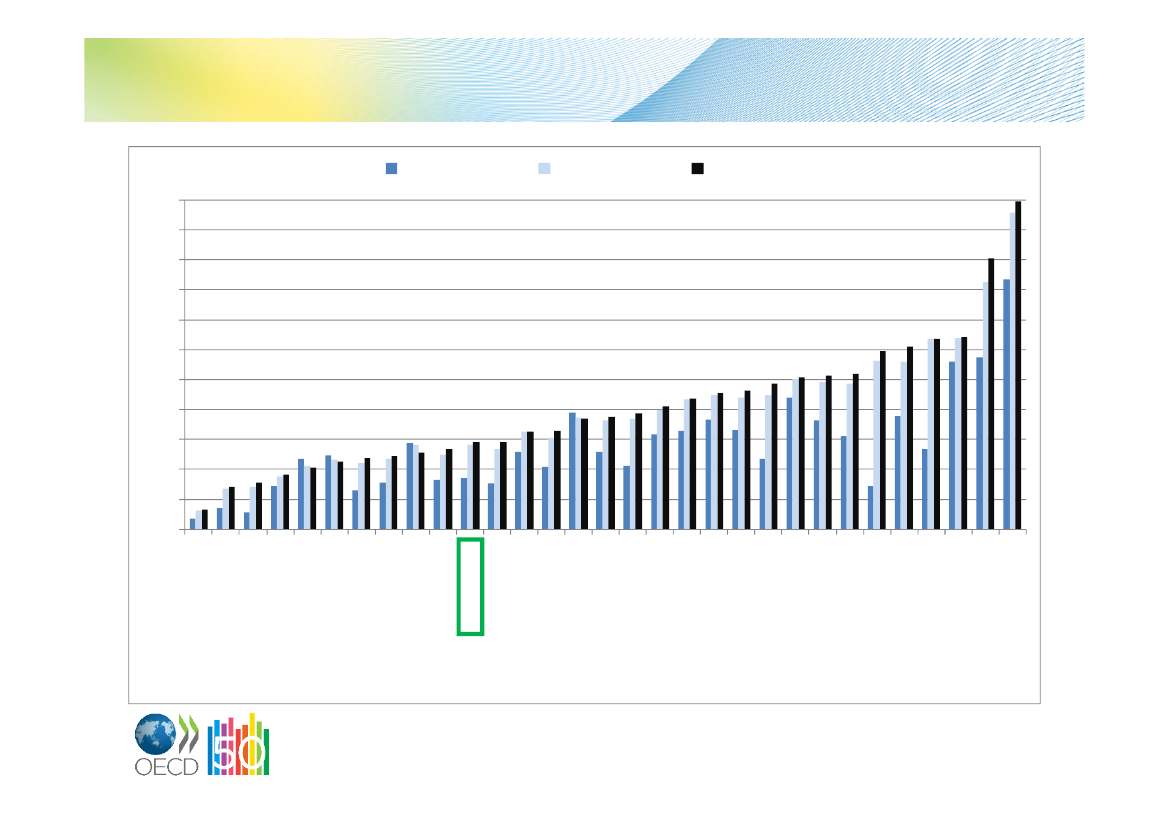

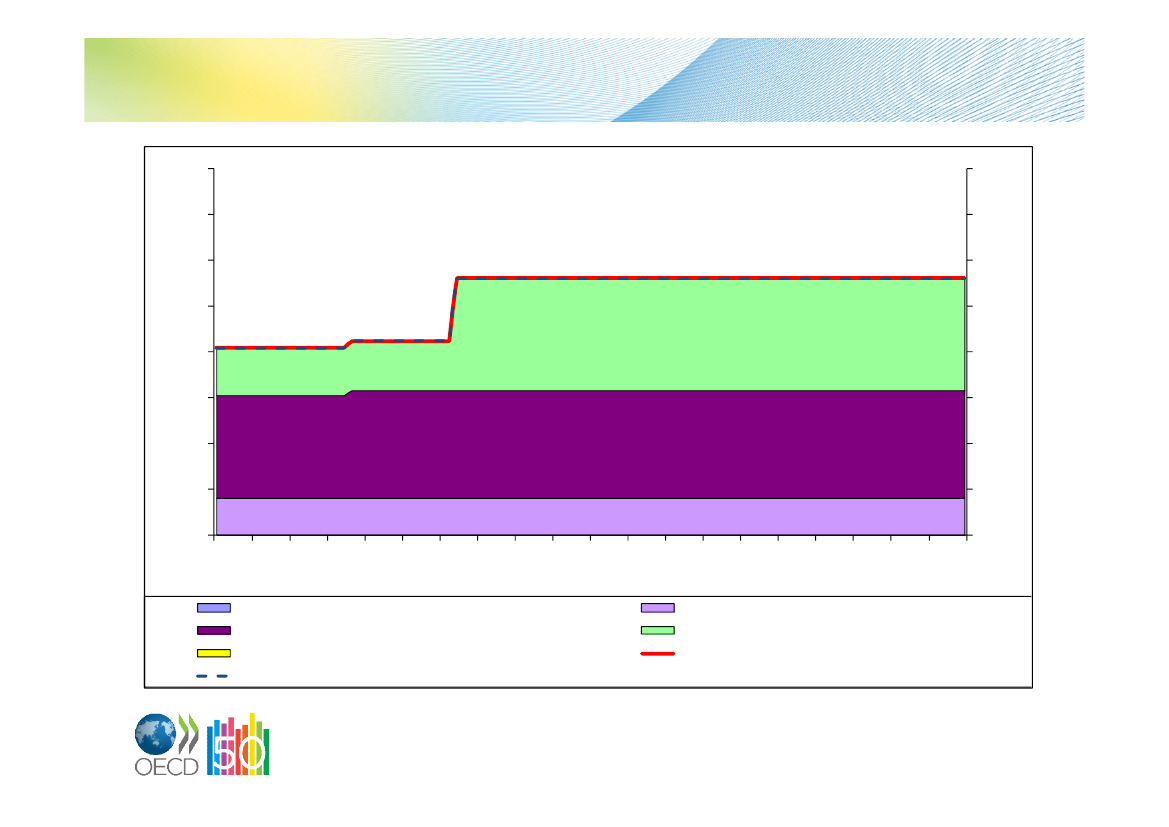

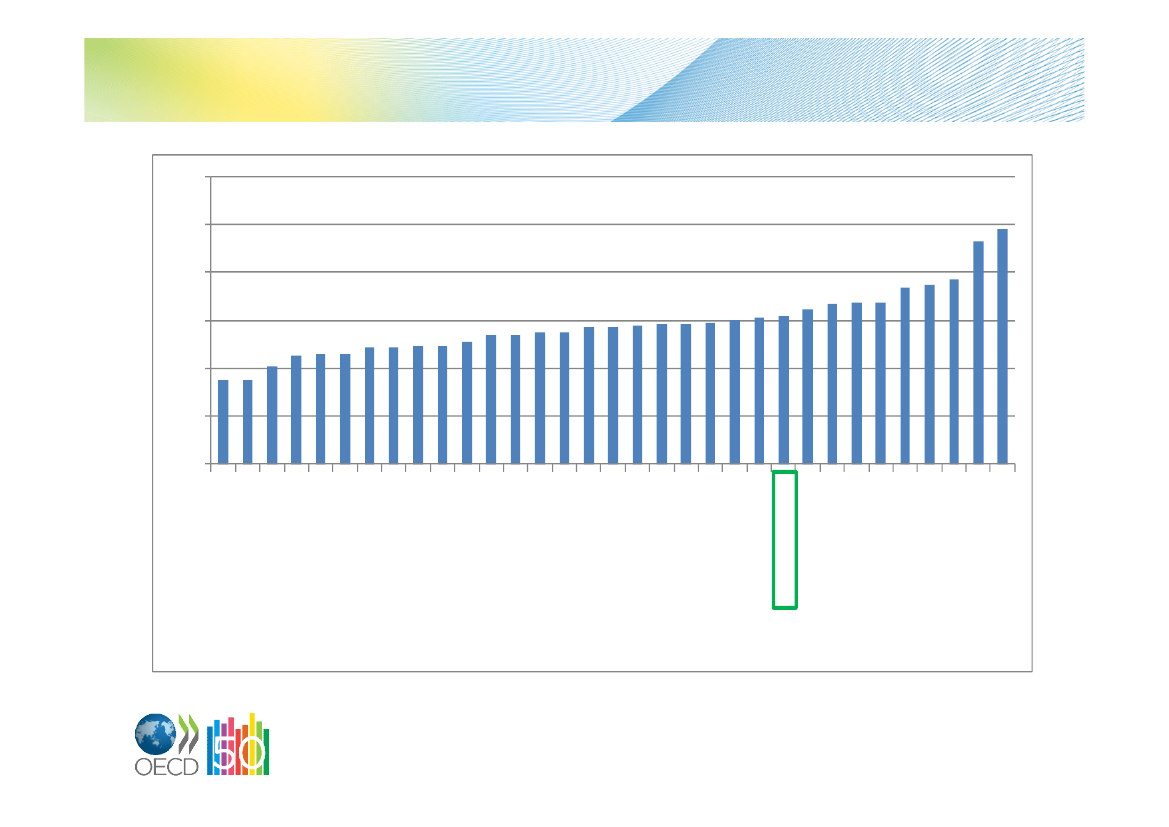

I. Strong increase in public debt2007220200180160140120100806040200EstoniaAustraliaLuxembourgKoreaSwitzerlandSwedenNew ZealandCzech RepublicNorwaySlovak RepublicDenmarkSloveniaPolandFinlandIsraelNetherlandsSpainAustriaGermanyHungaryCanadaUnited KingdomBelgiumFranceUnited StatesIrelandPortugalIcelandItalyGreeceJapan

2011

2012 projection

General government gross financial liabilities (as a % of GDP)(Economic Outlook December 2011)

Strongly increased but still low debtlevel in Denmark:�58%

Sorted in data for 2012 projection

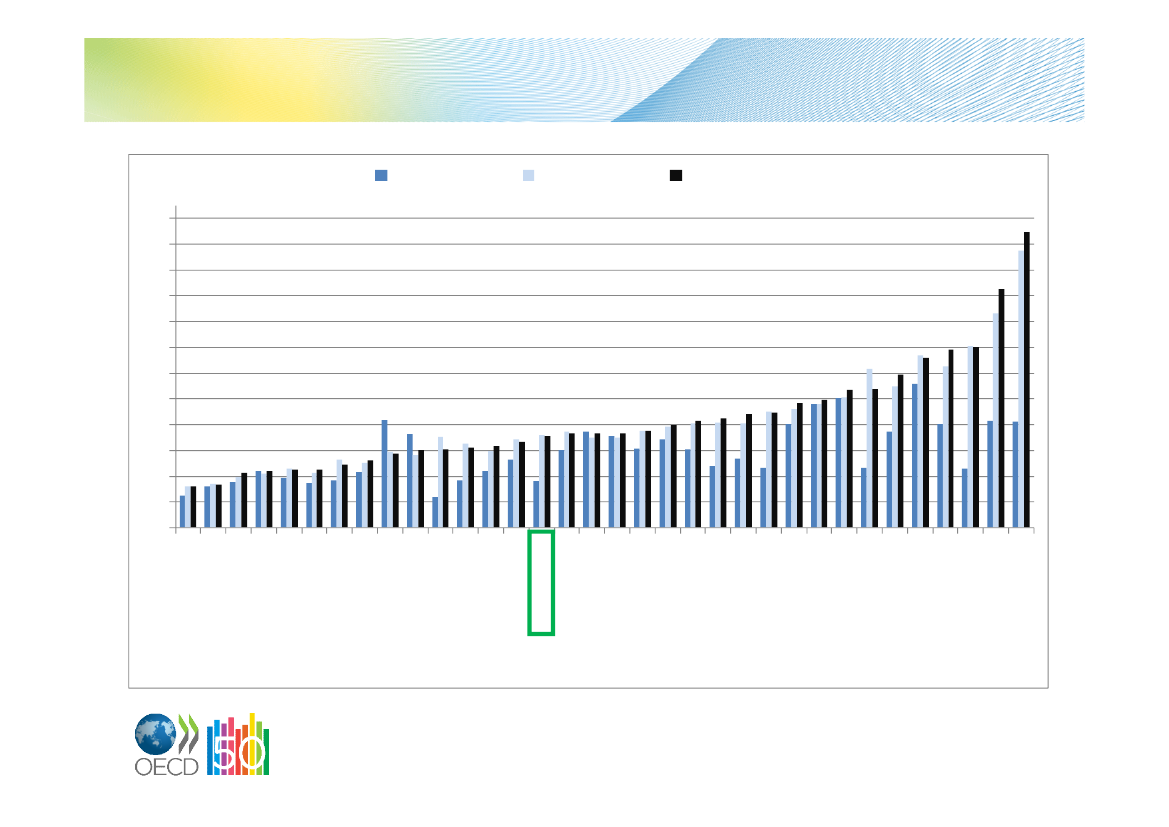

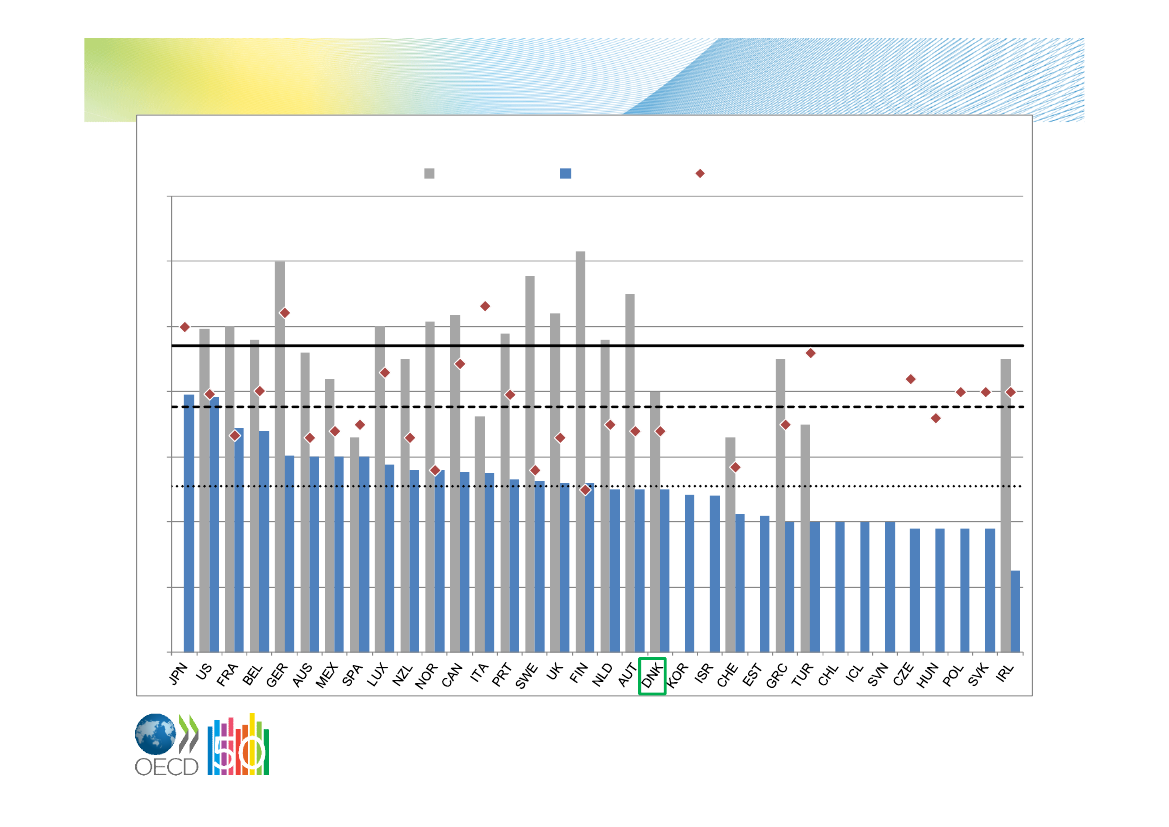

242220181614121086420

Denmark:�7%

2007

Sorted in data for 2012 projection20112012 projectionUnemployment rate; OECD average unemployment rate 5.7% in 2007,8% in 2011 and 8.1% projection in 2012(Economic Outlook December 2011)

I. Increasing rates of unemployment

NorwayKoreaSwitzerlandAustriaJapanNetherlandsMexicoAustraliaGermanyIsraelIcelandNew ZealandLuxembourgCzech RepublicDenmarkCanadaBelgiumChileSwedenFinlandItalySloveniaUnited KingdomUnited StatesFrancePolandTurkeyEstoniaHungarySlovak RepublicPortugalIrelandGreeceSpain

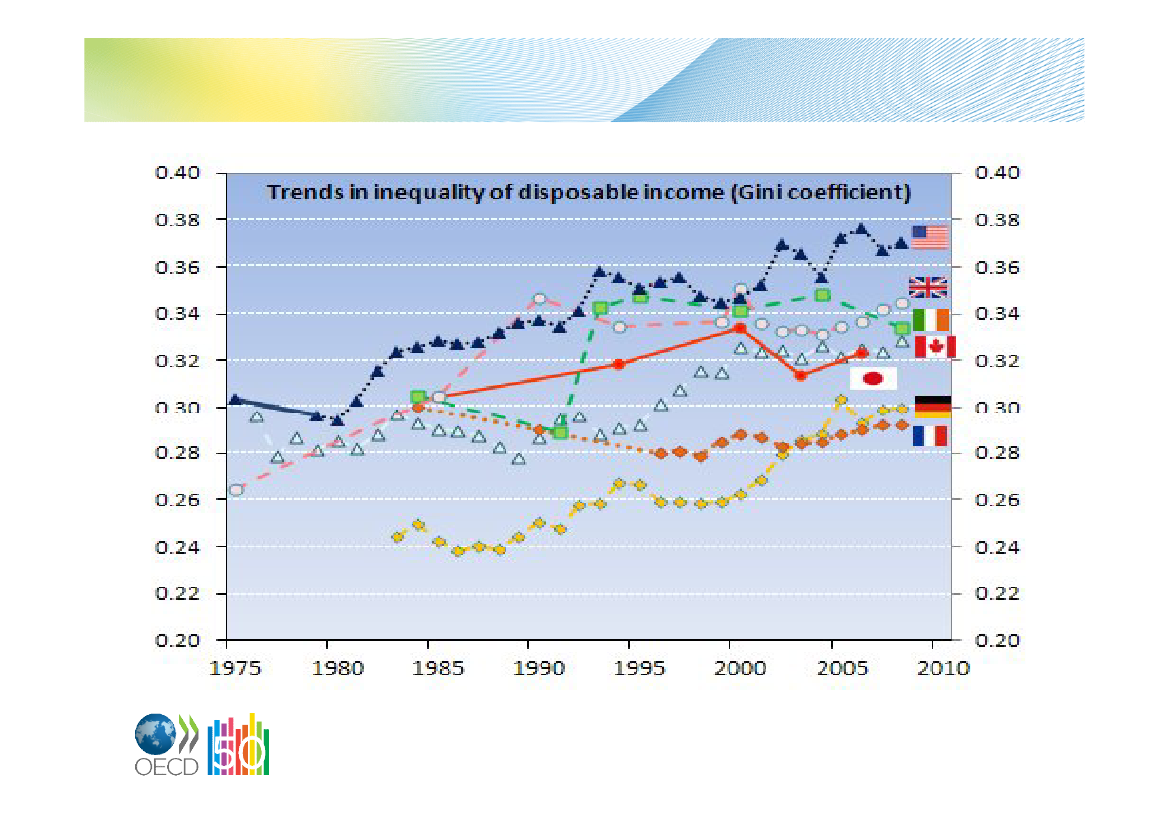

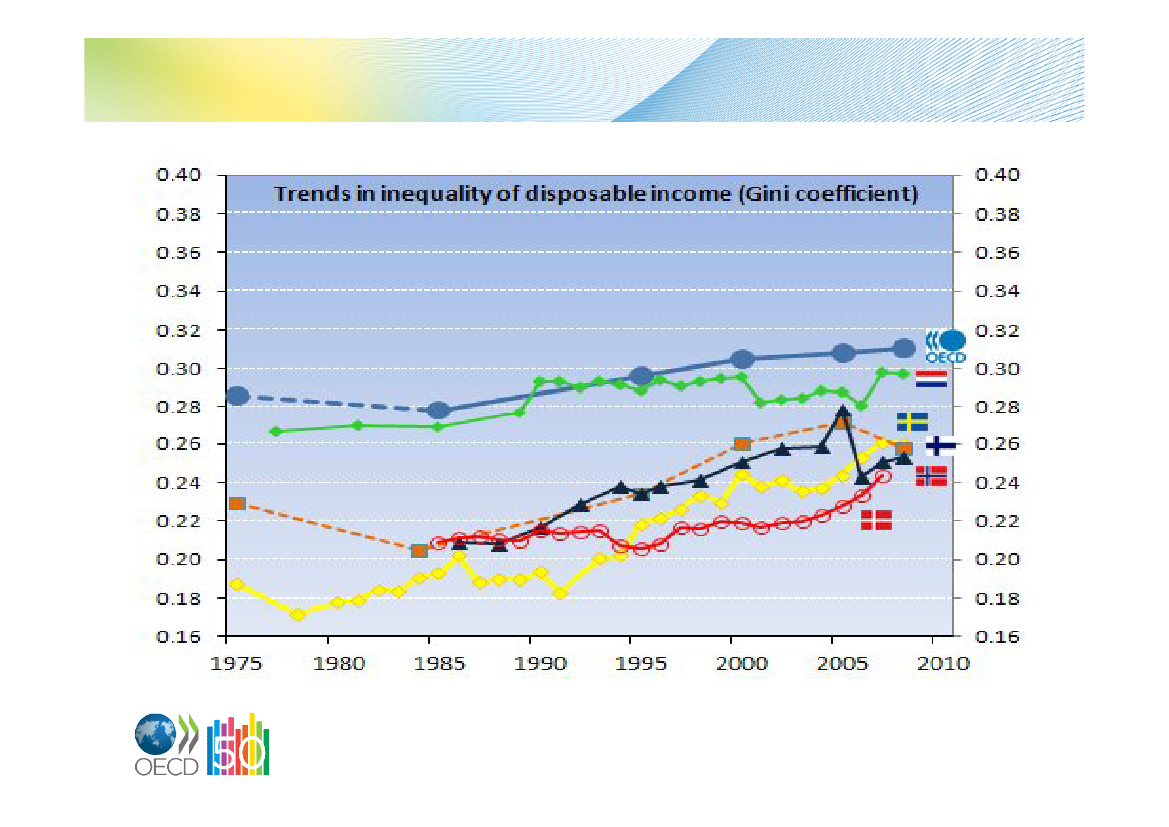

I. Income inequality increased in most OECD countries ...

Source: OECD 2011,Divided we Stand.

… and it increased in many low-inequality countries too

Source: OECD 2011,Divided we Stand.

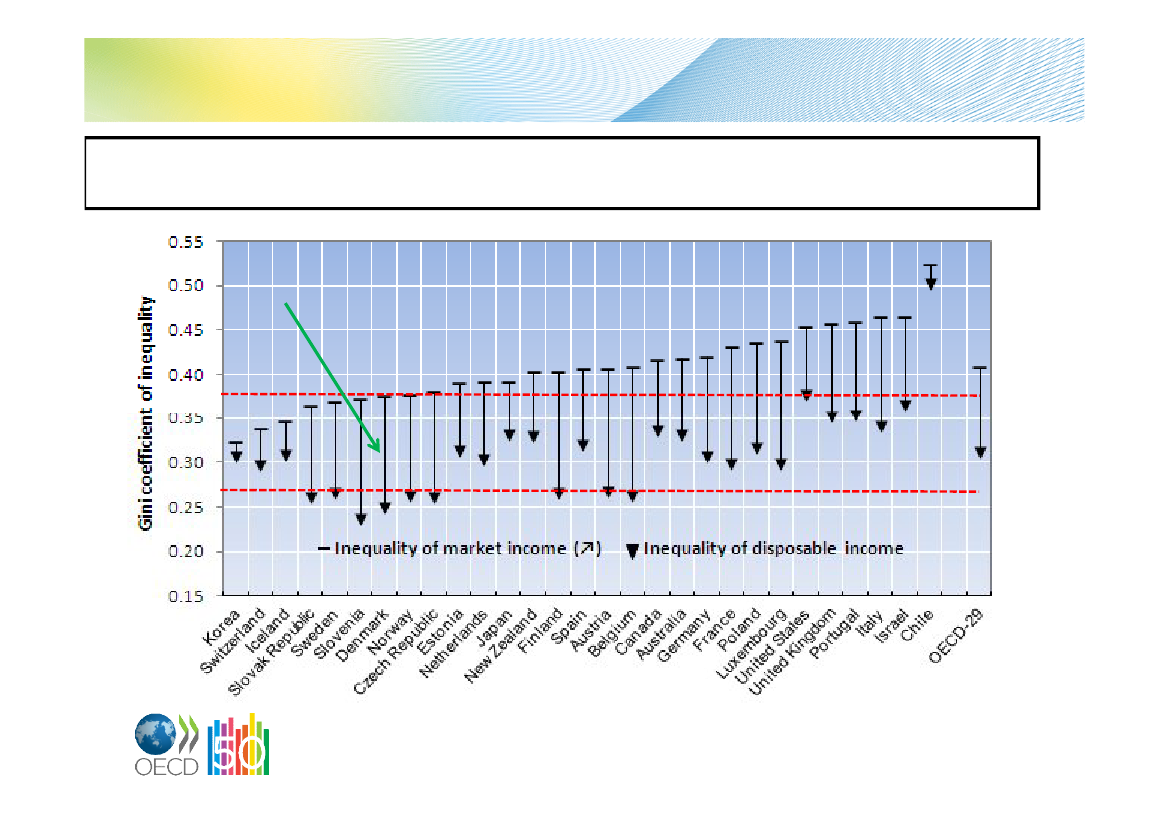

Redistribution through taxes and benefits plays an important roleMarket incomes are distributed more unequally than household net incomes: taxes andbenefits reduce inequality by a quarter

Source: OECD 2011,Divided we Stand.

II.How does the tax system inDenmark compare to the taxsystem in other OECDcountries?+Trends over time

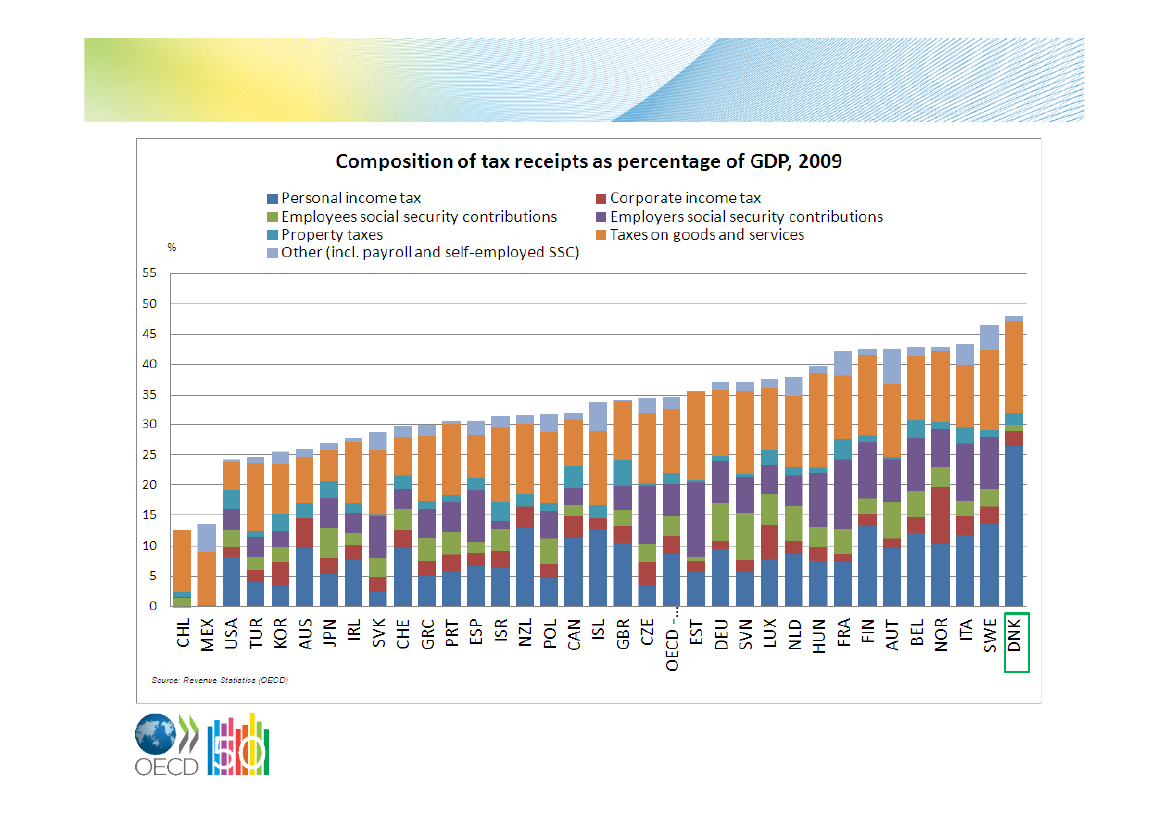

Tax-to-GDP ratio

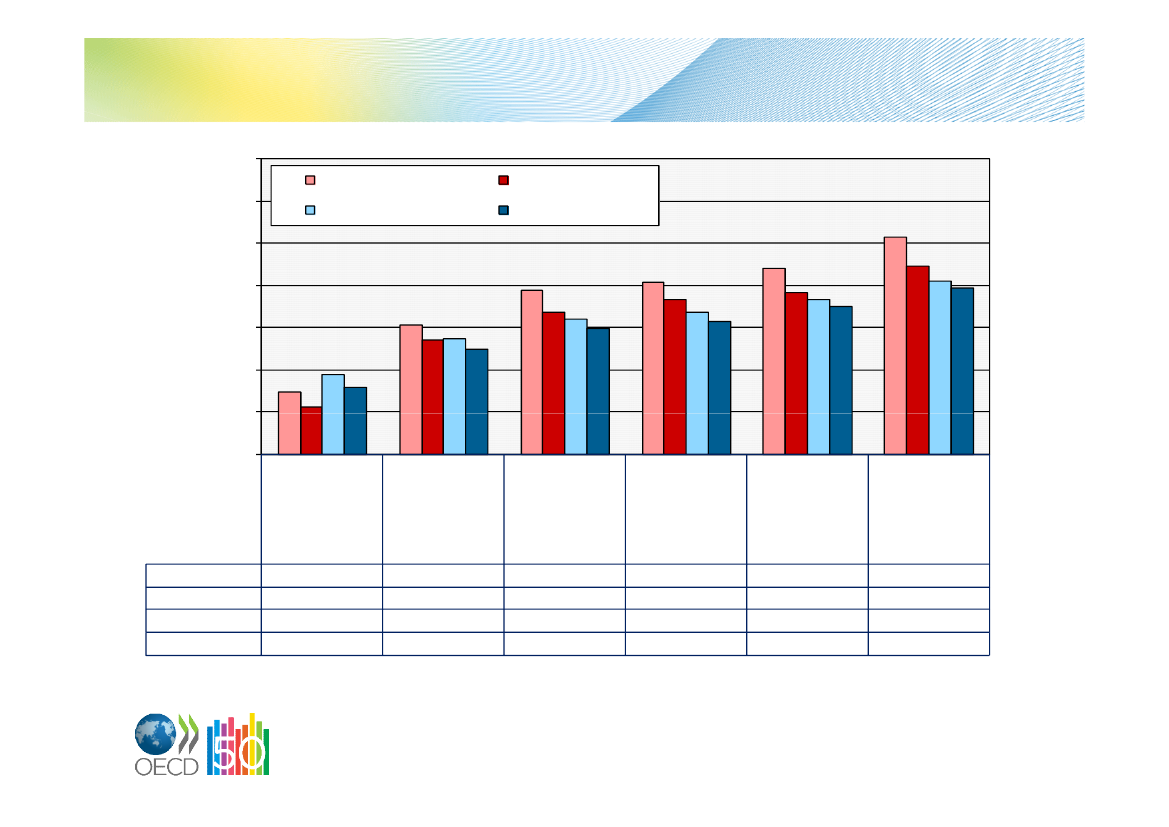

Average tax burden on labour income in Denmark compared tothe OECD on average (2000 and 2010)70%

Denmark 200060%50%40%30%20%10%0%Lone parent2 children67% ofaveragewageDenmark 2000Denmark 2010OECD 2000OECD 201014.7%11.0%18.8%15.8%One-earnercouple2 childrenaveragewage30.7%27.1%27.4%24.8%

Denmark 2010OECD 2010

OECD 2000

Two-earnercouple2 children100% + 67%of averagewage38.7%33.7%32.0%29.8%

Single67% ofaveragewage40.8%36.7%33.5%31.3%

Singleaveragewage44.1%38.3%36.7%34.9%

Single167% ofaveragewage51.4%44.5%41.1%39.4%

Average and marginal tax wedges for single workers ataverage earnings (2010)Average and marginal tax wedges for a single worker earning the average wage, 2010%

Average tax wedge

Marginal tax wedge

706050403020100BELFRADEUAUTITAHUNSWESVNCZEFINESTESPNLDDNKSVKPRTTURNORGRCPOLLUXGBRISLJPNCANUSAIRLAUSCHEISRKORNZLMEXCHLSource:OECD (2011), Taxing Wages 2010. The tax wedge is calculated as follows: (income tax + employee SSC + employer SSC)/(gross wage earn ings + employer SSC);where SSC = social security contributions.

Marginal tax wedges for single workers at differentearnings levels (2010)80%70%60%50%40%30%20%10%0%5060708090100120130140150160170180190200210220230240110

80%70%60%50%40%30%20%10%0%

marginal employer SSCmarginal local income taxmarginal family benefitsnet personal marginal tax rate

marginal employee SSCmarginal central income taxmarginal tax wedge (sum of the components)

Corporate income tax ratesCorporate income tax rates198170

2011

1994

60

50

OECD AVG 1981 - 47.1

40

OECD AVG 1994 - 37.7

30OECD AVG 2011 - 25.5

20

10

0

CIT rates by size of countryStatutory corporate income tax rate2000Larger OECD economiesUS-JPN-GER-UK-FRA-ITA

200436.0

200735.9

201132.8

39.5

Medium-sized OECD economiesCAN-ESP-KOR-MEX-AUS-NLD

35.4

32.8

29.6

27.8

Smaller OECD economiesAUT-BEL-CHE-CHL-CZE-DNK-EST-FIN-GRC-HUN-ISL-IRL-ISR-LUX-NOR-NZL-POL-PRT-SVK-SVN-SWE-TUR

29.9

26.4

23.9

22.8

OECD Average

32.6

29.2

27.0

25.5

Top tax burden on dividends (2000, 2011)Overall top tax rate on dividend income 2000Overall top tax rate on dividend income 2011

80

70

OECD average in 2000 (49.1%) and 2011 (41%)

60

50

40

30

20

10

0DNKNORGRCBELCHLCANPOLAUTPRTNZLSWECZEFRASPAMEXGERKORHUNAUSSVNTURSVKNLDJPNSWIFINESTUKUSIRLLUXISRICLITA

0.00

0.20

0.40

0.60

0.80

1.00

1.20

VAT revenue ratio (2010)

TUR KEYM EXIC OITALYGR EEC EUNITED KINGD O MSPAINB ELGIUMFR ANC EAUSTR ALIAPO LANDPO R TUGALIC ELANDSLO VAK R EPUB LICGER M ANYIR ELANDNO R WAYHUNGAR YFINLANDSW ED ENUnweig hted avera g eC Z EC H R EPUB LICNETH ER LAND SAUSTR IAD ENM AR KKO R EAJAPANISR AEL*SLO VENIAC ANAD AC H ILESW ITZ ER LANDLUXEM B O UR GNEW Z EALAND

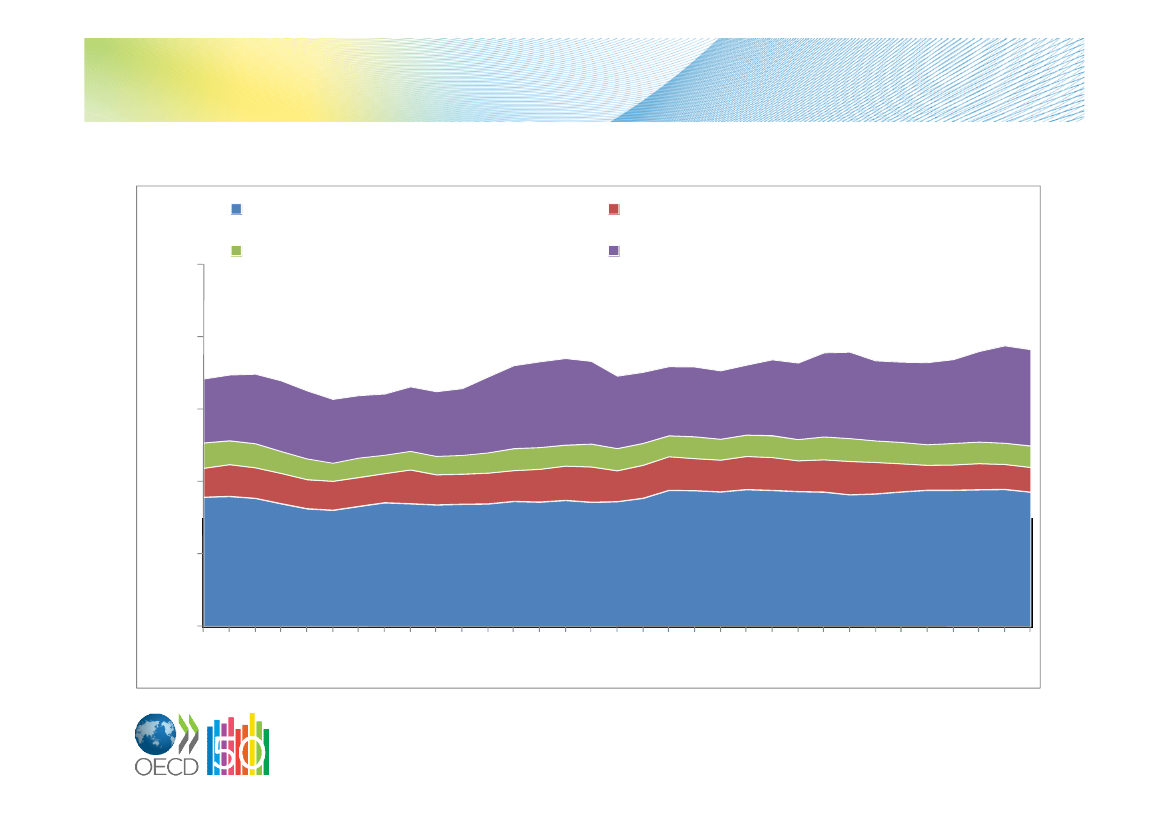

Property taxes (as a percentage of GDP) overtime in the OECD on averagerecurrent taxes on immovable property2.5%estate, inheritance and gift taxesrecurrent taxes on net wealthtaxes on financial and capital transactions

2.0%

1.5%

1.0%

0.5%

0.0%197519761977197819791980198119821983198419851986198719881989199019911992199319941995199619971998199920002001200220032004200520062007

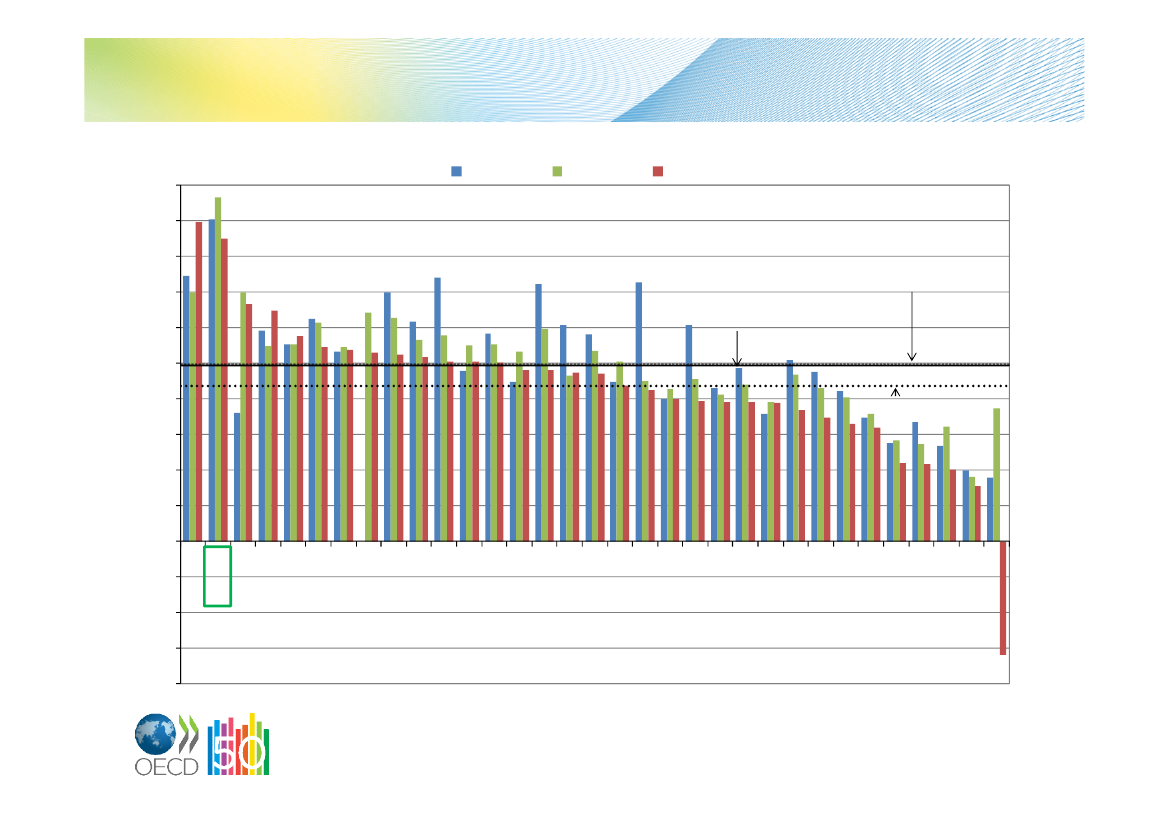

Environmentally related taxesRevenues from Environmentally Related Taxation as Percentage of GDP5.0 %4.5 %4.0 %3.5 %3.0 %2.5 %2.0 %1.5 %1.0 %0.5 %0.0 %-0.5 %-1.0 %-1.5 %-2.0 %

1996

2002

2008

OECD AVG 2002 - 2.49%OECD AVG 1996 - 2.47%

OECD AVG 2008 - 2.18%

NLDDNKTURISRHUNFINCZESVNPRTSWEITAKORLUXAUTNORIRLGBRDEUGRCCHEISLSVKBELPOLAUSFRAESPJPNNZLCANCHLUSAMEX

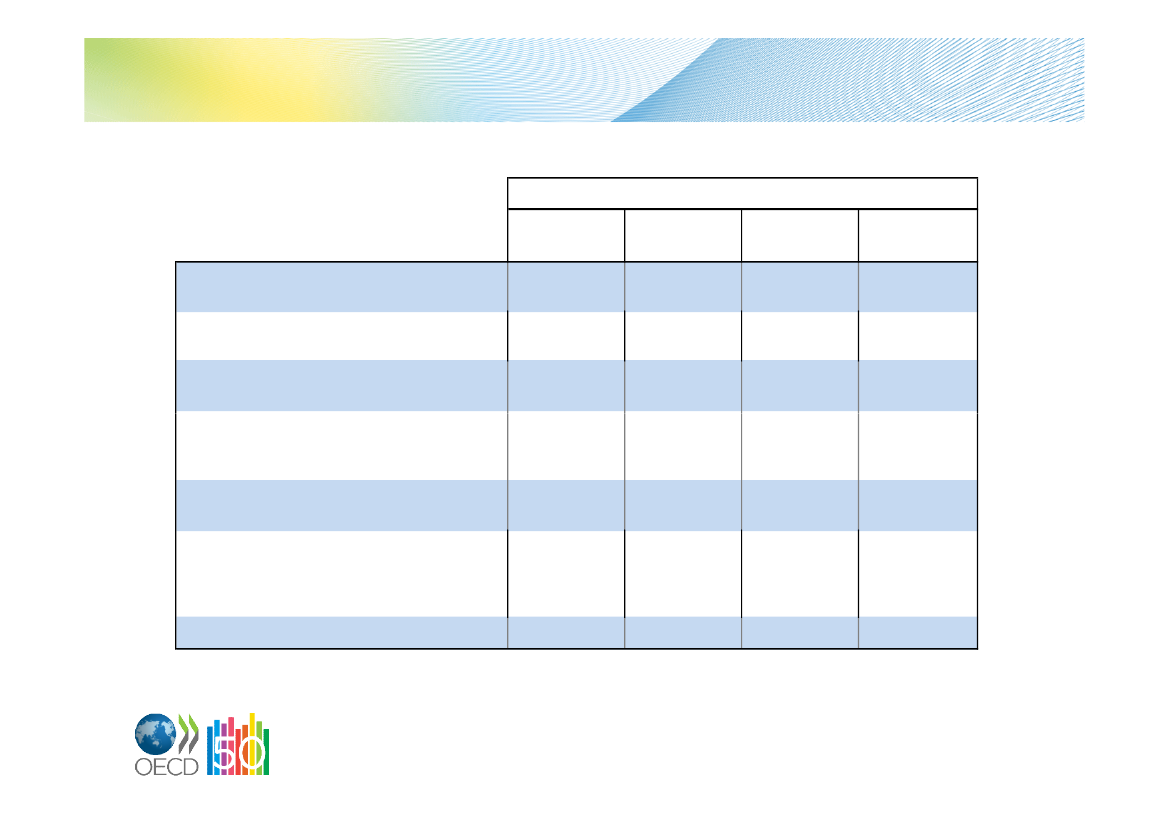

Summary tableTAX / GDPRATIO% OF TOTAL TAX REVENUESPersonal CorporateIncome TaxTax20092009SocialSecurityContrib.2009TopTopStatutory CorporateTop rate onStandardConsumption Personal Income Tax Tax Wedge dividends VAT RateIncome Tax Rate on 1on 1 JanuaryTaxesRate(2)January200920102011201020112011

2010(Provisional)

2009

BelgiumCanadaDenmarkFinlandFranceGermanyItalyJapanNetherlandsNorwaySwedenUnited KingdomUnited StatesOECD averageG7 average

43.831.048.242.142.936.343.0n.a.n.a.42.845.835.024.8n.a.n.a.

43.232.048.142.642.437.343.426.938.242.946.734.324.133.834.4

283655311725272023242931342527

611553471052268787

33162303939324136232420272730

252432312530241931282929193324

53.746.452.248.945.847.544.950.052.040.056.050.041.941.746.6

34.027.625.026.034.430.227.539.525.528.026.326.039.225.432.1

55.430.338.342.049.349.146.930.538.436.842.732.729.734.938.3

43.948.056.540.557.848.636.645.643.848.248.452.752.141.148.8

21.05.025.023.019.619.020.05.019.025.025.020.0-18.514.8

III.RECENT (2011-2012) tax policydevelopments

Recent (2011/12) developments• Budget deficits fell in 2011, helped by economicrecovery and reversal of earlier tax cuts anddiscretionary fiscal consolidation in some countries• Emphasis on fiscal consolidation increasing in 2012,notably in the Euro area•Wide variationin how countries are raisingadditional revenues• Fundamental reformsthe exception rather thanthe rule,but many are seeking to make structuralimprovements• Importance offairness

Recent (2011/12) developments• Consumption taxes– 14 countries have increased their standard rate of VAT since2010– Most of these countries also increased reduced rates–But rare to move goods and services from reduced tostandard rate

• PIT and SSCs–Some rate risesbut exception not rule– Some reductions in tax expenditures, butmortgage interestrelief remains a ‘no go’ area– Personal tax rates on capital income have slightly increased(fairness concerns) butfundamental reform of savingstaxation seems not on the agenda

Recent (2011/12) developments• CIT–Reductions in statutory rates in a few countries,despite budgetary pressures; ACE in Italy– Many measures to protect revenues, e.g.restrictions onthe use of losses– Changes intax depreciation allowanceshave tendedto be more generous forSMEs

• Other taxes–Few changes to property taxes.– High crude oil prices have discouraged governments fromincreasing road fuel duties or other fossil fuel/ energytaxes– Some countries have introducednew bank levies orstability fee schemes

IV Some issues for discussion•Denmark knows how to make tax reform

happen!

•Further reduce the tax burden on labour

income (especially low earnings)?

•Focus on skills formation and upgrading

•Broadening the VAT base would be pro-

growth and strengthen equity

•Tax immovable property as other saving

vehicles

•“Fat tax” implementation issues