Udvalget for Fødevarer, Landbrug og Fiskeri 2011-12

FLF Alm.del Bilag 53

Offentligt

Milking the poor

How EU subsidies hurt dairy producers in Bangladesh

September 2011

3 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

ContentsIntroductionMilk production in Bangladesh– A way out of povertyThe problem of cheap importsArla foods:profiting from exports of subsidised milkThe root of the problem: EU subsidiesDenmark’s milk production: A cash cow?ConclusionAnnexEndnotespage 04page 05page 07page 10page 12page 20page 22page 23page 24

Milking the poorHow EU subsidies hurt dairy producers in BangladeshAuthored by Mark Curtis, www.curtisresearch.orgResearch by Danwatch, www.danwatch.dkPublished by ActionAidSeptember 2011This independently researched report was commissioned by ActionAid. The views in this report do not neces-sarily represent the views of the organisation. We are grateful for the work of Mark Curtis, who researched andwrote this report, and for additional writing, research and editing by Steve Tibbett. We thank Danwatch for fieldresearch and background material.Cover photo: CARE Bangladesh

4 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

5 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

Introduction“The rate we get for milk doesn’t suffice.” -Hossain Fakir, Bangladeshi farmer1For decades, European dairy farmers havebeen given massive subsidies under the Com-mon Agricultural Policy (CAP) of the EuropeanUnion (EU). This has enabled them to exportcheap milk powder, among other products, atprices lower than production costs. The EU’sdairy regime has routinely damaged developingcountries in three main ways: by underminingdomestic dairy producers, by depressing worldmarket prices, and by pushing developing coun-try exporters out of third markets.2In 2005, however, the EU decided to change thenature of those subsidies by ‘decoupling’ themfrom the production levels of farmers.The aim was supposedly to avoid distortinginternational trade and prices for agriculturalproducts. But the amount spent on subsidies re-mains the same; it is only the way they are giventhat has changed. The decoupled subsidies areplaced in what the World Trade Organisation(WTO) refers to as the ‘Green Box’, which aremeasures that have no, or at most minimal,trade-distorting effects on production. Howe-ver, this report shows that the EU’s decoupledsubsidies are continuing to hurt dairy farmers indeveloping countries.Looking at the case of Bangladesh, where mil-lions of poor people support their low incomesthrough milk production, the report reveals thatmilk imports are continuing to undermine poorfarmers, competing on unfair terms with locallyproduced milk and suppressing investment inthe dairy industry. It also shows that the giantDanish-Swedish dairy company, Arla Foods, isprofiting from EU-subsidised milk powder salesto Bangladesh which are harming Bangladeshimilk farmers.The report highlights the fact that many Euro-pean farmers - including Danish farmers - areselling below production costs and that somewould not even be able to maintain productionwithout EU subsidies, and thus those exportsare only possible thanks to the continuationof subsidies. At the same time, Denmark andthe European Commission (EC) are funding aidprogrammes in Bangladesh to reduce poverty,including those designed to support agriculturaldevelopment.The EU is preparing a comprehensive reform ofthe CAP, which is expected to come into force in2014. Most of the negotiations will take place inautumn 2011 and spring 2012, when Denmarkwill hold the presidency of the EU. According tothe United Nations Special Rapporteur on theRight to Food, the reform of the CAP offers a“unique opportunity” to take into account theimpact of the EU’s agricultural policies on theright to food in developing countries.3Indeed,CAP reform is the ultimate test of the EU’s wil-lingness to fulfil its treaty-bound obligations toensure that all its policies are coherently promo-ting development in poor countries.

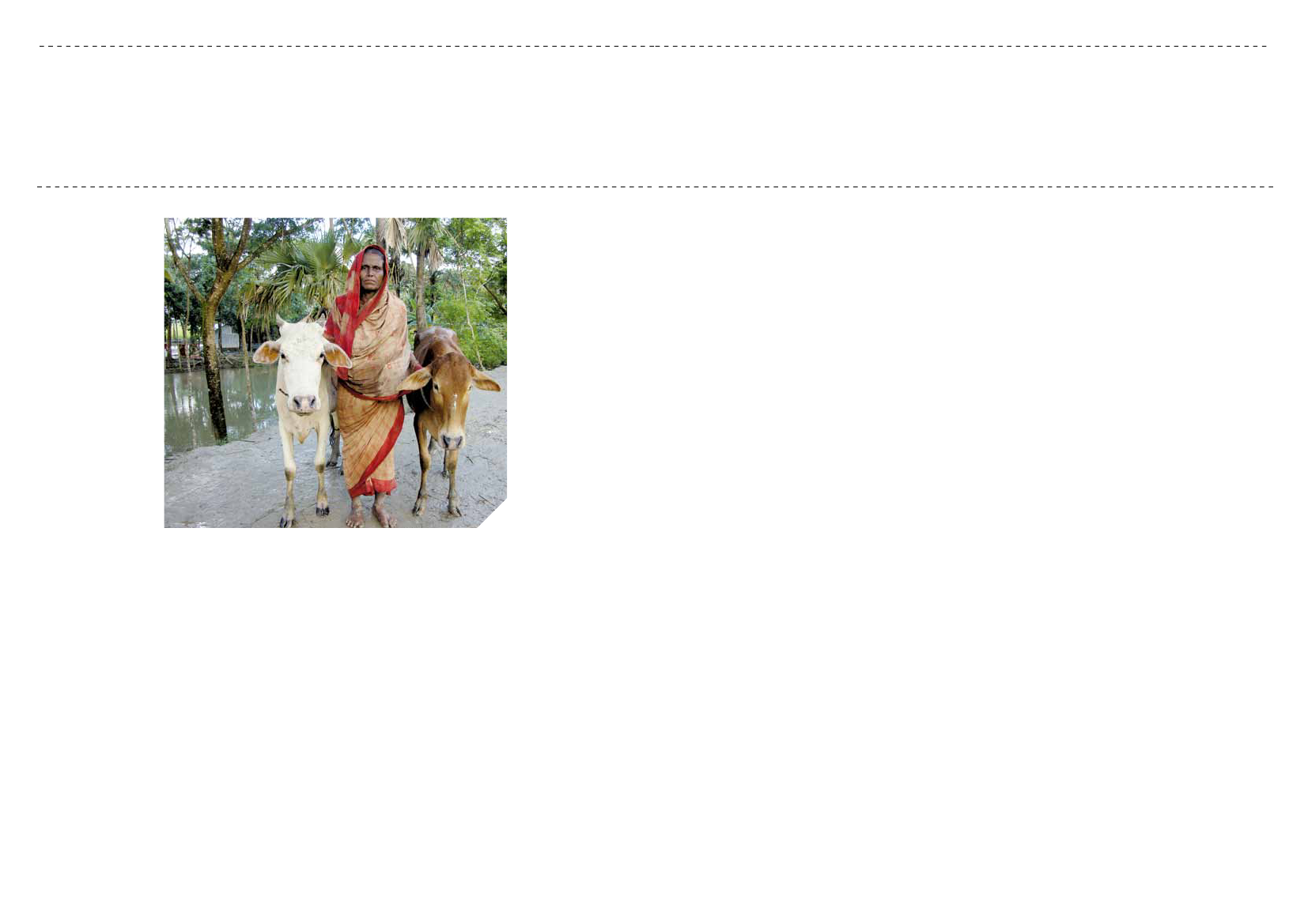

Milk production in Bangladesh– A way out of povertyAround 150 million farm households across theworld are involved in milk production, amountingto some 750 to 900 million people (or 12-14 percent of the world’s population)4. In Bangladesh,1.4 million family dairy farms, comprising around7 million people, work very small plots of landand typically own two cows. Amongst thesedairy farmers are some of the poorest and mostmarginalised women.5Amidst widespread poverty milk-producingcows are one of the most valuable assets ruralhouseholds can own. Cows can provide farmerswith a regular cash flow from milk sales, nutritio-nal milk for home consumption, draught powerand manure for fertiliser.6Milk, the source ofvital vitamins and minerals, is a crucial sourceof nutrition in a country which has one of thehighest rates of under-nutrition in the world; 48per cent of Bangladesh’s children are chronicallyundernourished and 30 per cent of the totalpopulation is below the minimum level of dietaryenergy consumption.7However, the incomes of most dairy farmers areextremely low, usually ranging from Taka 31 – 60(€ 0.30 - 0.59) per day.11Many dairy farmersboth consume and sell some of their milk,generating income for the family. More than 90per cent of small farmers’ milk is sold throughinformal channels, such as to neighbours or atthe local market; less than 10 per cent is sold toformal milk processing companies.12Dairy farming is a potential pathway out ofpoverty for millions of Bangladeshis. Indeed,the country has already developed successfulexamples of commercial dairy farming wherebytens of thousands of smallholders, organisedin hundreds of cooperatives, provide milk tocommercial enterprises which is then proces-sed and distributed throughout the country.By some estimates, tens of thousands of poorrural households have already graduated out ofpoverty as a result of such models.14Studiessuggest that dairy production, processing andmarketing in Bangladesh generate more regularcash income and employment per unit valuethan crop farming.15Bangladesh is also internationally well placedto produce milk - what some economists mightcall a ‘comparative advantage’. Along with manyother developing countries, Bangladesh is arelatively low cost producer of milk, in contrastto high cost producers in Europe and the US.17One recent analysis found that a typical farm inBangladesh (with two cows) produces milk 50per cent cheaper than a typical farm in Germany(with 31 cows.) The same study found that forevery million kg of milk produced by EU dairyfarmers, 7.6 jobs are created, but in Bangladeshthe number is 350 jobs – 46 times as many.18Indeed, the milk industry in Bangladesh also hasa huge potential for growth due to the growingdomestic demand for milk that comes with rising

Poverty inBangladeshBangladesh has apopulation of over 160million of whom 72 percent live in rural areas.Around half the ruralpopulation live belowthe poverty line8.More than half of ruraldwellers own less than0.5 acres and the po-orest 40 per cent pos-sess just 3 per cent ofthe land.9Agricultureemploys 70 millionpeople and accountsfor 20 per cent of thenational GDP.10

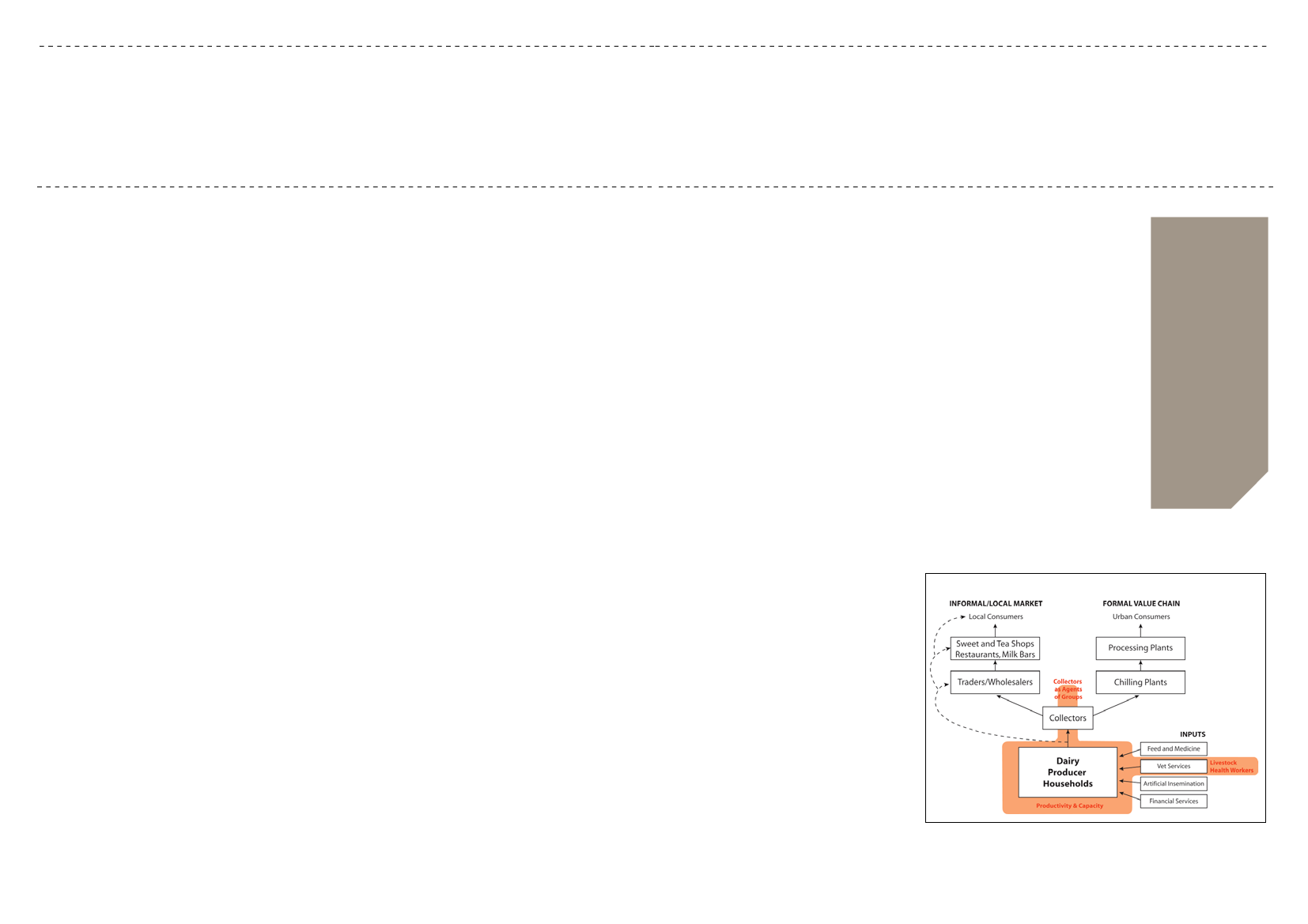

The supply chain of milk in Bangladesh13

6 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

7 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

The problem of cheap importsDairy Farming: A powerful tool for reducing povertyA recent study by the UN’s Food and Agriculture Organisation (FAO) notesthat small-scale milk production not only improves the food security ofmilk-producing households but also helps to create numerous employ-ment opportunities throughout the dairy chain, such as in small-scale ruralprocessing and intermediary activities. The strengths of smallholder dairysystems include low production costs, relative resilience to rising feedprices and low liabilities. The study also notes that the overall profitabilityof milk production appears to be higher in developing countries than inindustrialised countries, mainly because of the lower costs of feed andthe overall ‘low-tech’ approach. It argues that, if they are well-organised,smallholder producers should be able to compete with large-scale, capitalintensive and ‘hightech’ dairy farming systems in industrialised countries.Smallholder dairy farming has been shown to be successful in a numberof countries, notably in India and Kenya. However the study finds that onethreat to this potential is from policy support for (and competition from)dairy farmers in OECD country governments for their farmers. Other chal-lenges to small producers include access to technical knowhow, supportservices and credit, and poor milk quality.16

milk22, and the growth rate of livestock is lessthan 4 per cent.23Yields can also be increased.They are currently low and largely variablebecause of poor feed resources and the breedof cattle typically owned.24Among small produ-cers, a typical cow yields 721 kg per year,25farless than cows in neighbouring countries suchas Pakistan and India.26Bangladeshi milk pro-ducers also face many other challenges, notablythe lack of availability of appropriate feed at lowprices and livestock health care.27The potential for increased production is shownin the 16 per cent spike in production in 2007/8,which coincided with a ‘melamine scare’ – thefear that a potentially toxic chemical compoundwas present in some brands of powdered milkfrom China. This caused some consumers ofpowder milk to shift to raw or pasteurized milkcreating. The scare created a temporary extrademand for fresh milk.28Private sector entrepreneurs have already ventu-red into the growing market of the dairy sector,supporting small farms with improved dairybreeds, quality input supplies, as well as marke-ting facilities for milk products.29With higher milkprices, private participation in the developmentof the sector can be anticipated to increase.30In its ’Poverty Reduction Strategy Paper’ of2009, the Bangladeshi government states thatit is striving to be self-sufficient in food by 2013,taking all possible measures to ensure foodsecurity for all its citizens. One of the identifiedrequirements to reach this goal is to create “alevel playing field to compete with others andreap the benefits of a globalized world”31. Thegovernment recognises that it is important tosupport the milk sector and has taken severalsteps to do so in recent years.

A key factor undermining Bangladesh’s milkindustry is imported milk powder. Whole milkpowder is imported and marketed directly toconsumers, and skimmed milk powder is im-ported and used for production of dairy pro-ducts. For one thing, this is a massive cost tothe country. In 2007-08, 41,000 tonnes of milkpowder were imported at a cost of Taka 10.5billion (€ 102.5 million).32Overall, Bangladeshimports around 27 per cent of its milk consump-tion needs33and between 20 and 50 per centof imports of skimmed milk powder have comefrom the EU in recent years.34With the right support and further developmentof the dairy sector, these imports could havebeen produced by Bangladeshi farmers them-selves. Not only do imports cost a lot, they oftenenter Bangladesh at prices competitive withdomestic milk and are heavily marketed andbranded, undercutting local producers of freshmilk and domestic processors of milk powder.Importers have considerable market power,especially in urban markets.35In Bangladesh, the price of fresh milk is alsoinfluenced by milk powder prices because milkpowder is a substitute for fresh milk. Local milkprocessors will increase their use of skimmedmilk powder instead of fresh milk if the price ofimports, including tariffs, falls below the localmilk price.36

The EU exported 378,000 tonnes of skim-med milk powder around the world in 2010,up 63 per cent from 2009; a further 11 percent increase is projected for 2011.44EU milkpowder exports go mainly to developing coun-tries, particularly in Africa and the Middle East.Indeed, the EU supplies around 70 per cent ofsub-Saharan Africa’s dairy imports.45Imports ofskimmed milk powder are the greatest concern

Cheap imports with devastating effectsIn 2009, the Bangladeshi media reported that prices of imported milkpowder fell close to US$ 2,000 (€ 1,510) a tonne from more than US$4,500 (€ 3,398) in 2008. The retail price of a litre of milk fell from Taka33 (€ 0.32) at the beginning of 2009 to around Taka 26 (€ 0.25) bymid-year.37This price fall inspired sweet makers, who buy much of themilk produced in Bangladesh, to shift from purchasing milk producedby local farmers to purchasing imported milk powder.38In April 2009,hundreds of dairy farmers poured milk onto highways to protest againstfalling prices and cheap imports.39Both large and small dairy farmerssuffered and many said that the price they received was now below thecosts of production. Some farmers saw their incomes from milk fall by40 per cent.40

incomes and changing diets. Current consump-tion of milk and milk products in Bangladesh islow; the average Bangladeshi consumes 42 mlof milk per day – mainly for drinking in tea.19This is significantly less than the average fordeveloping countries (120 g) and well belowthe 280 g per day recommended by the FAOand the World Health Organisation (WHO)20.However, milk demand in Bangladesh is alreadygreater than the current production of 2.7 milliontonnes of milk a year, with one estimate being ashigh as 7.2 million tonnes.21Recent figures citedby Community-based Dairy Veterinary Founda-tion suggest that in order to be self-sufficientin milk production by 2021, Bangladesh has toproduce 17.9 million tonnes of milk, and to meetgrowing customer demand, the industry wouldhave to grow by more than 10 per cent.Domestic production can indeed be increased.Currently, only 3.5 million cattle out of a totalcattle population of 24 million actually produce

The problem with importingEU milk powder“The availability of EU powdered milk on theworld market remains unfair competition, limitingthe growth of the dairy sector in developingcountries and undermining the incentives forfarmers to boost local production to keep trackwith the growing demand.” (Recent analysis byTrinity College Dublin43)

8 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

9 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

Noorjahan, a dairy farmer41Dairy farmer Noorjahan lives in a small house with her daughter andone cow close to Sirajganj city in central Bangladesh. The cow givesher milk, which she sells to the dairy company, Milk Vita, for Taka 30 (€0.29) per litre. The income from the milk covers most of her householdcosts and enables her to pay for her daughter’s preparation classesfor college. But Noorjahan argues that dairy processors like Milk Vitashould pay a larger share of the retail price to farmers. Noorjahanthinks she should get at least 40 taka (€ 0.39) per litre. Currently, thefarm gate price of milk does not leave much profit after the costs ofrearing the cows are met.

to milk producers in the African, Caribbean andPacific (ACP)46states with whom the EU hasformal trade and aid agreements. Even relativelysmall volumes of EU exports to smaller ACPmarkets can have an impact on the local dairysector, given the volume of EU exports relativeto national ACP market demand. Increased milkpowder imports can reduce both demands for,and prices of, locally produced milk, disruptingthe development of local supply chains.47NGOshave long shown the devastating impacts ofcheap dairy imports in Africa and the Caribbean,as a result of the CAP.48In Bangladesh, the Bangladesh Milk ProducersCooperative Union, known as Milk Vita, had vir-tually collapsed by the mid-1980s, with problemattributed to unfair competition from importsflooding in from subsidised over-production inEurope.49At Milk Vita, the gap between milksupply and demand was originally met by re-combining butter oil and skimmed milk powder(that DANIDA and the EU provided) into liquidmilk. By the end of the 1970s, village coop-eratives had been established and annual milkcollection from some 36 000 smallholders hadbeen built up to 15 million litres. But by the mid1980s, Milk Vita had virtually collapsed, collec-ting less than 3 million litres of milk a year. Thecollapse was attributed to unfair competitionfrom imports flooding in from subsidized over-production in Europe. At this time whole milkpowder was retailing at less than 20 percent ofits cost price in Europe and one-third of the costof milk production in Bangladesh.50A counter-argument put forward by some isthat the EU milk powder imports increase theavailability of dairy products, particularly inurban areas, and benefit consumers who mightnot otherwise be able to afford them. In manyAfrican countries, for example, domestic supplycannot keep up with the growth in domestic de-

mand. In Bangladesh, the domestic supply can-not meet the demand because of the continuedunderdevelopment in the sector. In addition tothis, the middle and upper class tend to prefermilk powder due to its practicality, reliability andmarketing. The poorer sections of the populationtend to avoid consumption of milk due to limitedavailability and high prices. Increased domesticproduction and availability of fresh quality milkwould help solve these problems.Milk powder imports increase competition withdomestic milk producers and reduced incentivesfor domestic investment and expansion andalso deter small producers from producing moremilk to satisfy local demands. Looking at recentprices it is important to note that although localmilk is currently slightly cheaper than importedmilk, imported milk powder is not only compa-rable in terms of price, but also more intensivelymarketed than local milk.To support dairy farmers the Bangladeshigovernment has imposed a certain level of tradetariffs on imported milk powder. Tariffs have fal-len in recent years from as high as 75 per cent in2007 to a proposal in the last budget to reducethem to as low as 5 per cent.53This promptedprotests from local milk producers for whom ta-riffs are their only protection against competitionfrom developed countries’ milk powder brands,including subsidised EU milk.A local entrepreneur in the dairy sector said:“The local dairy industry is not getting mom-entum because of the government’s excessiveliberal policy”.54Domestic milk prices are no longer controlled,and the government eliminated direct subsidiesto farmers in 1996 and only temporarily rein-stated smaller subsidies in 2002 before soondiscontinuing them.55The government providessubsidies only to Milk Vita in the form of low

Milk Prices in supermarkets Dhaka-Bangladesh– July 201151Local Fresh Milk:Milk Vita 1 liter = 52 TakaAarong (BRAC) 1 liter = 52 TakaPowder Milk:(400 g of powder makes 3.1 litres of milk)52400g Aarong 180 Taka (local)400g Starship 180 Taka (Australia)400g Marks 195 Taka (New Zealand)400g Farmland 200 Taka (New Zealand)400g Dano 210 Taka (Denmark)400g Red Cow 215 Taka (New Zealand)400g Diploma, 220 Taka (New Zealand/Australia)400g Anchor 245 Taka (New Zealand)500g Milk Vita 210 Taka (local)500g Aarong 240 Taka (local)500g Pran 240 Taka (local)500g Dano 257 Taka (Denmark)Note: During Ramadan and Eid, fresh milk prices tend to rise to 70Taka per litre.

Waz Ali, a dairy farmer42Waz Ali is a dairy farmer in Sirajganj, a major dairy hub, who owns 23cows producing 100 litres of milk a day – a relatively large farmer forBangladesh. He said that his income fell from Taka 24,000 (€ 234) aweek before the price was cut to Taka 18,000 (€ 176) a week after. “Isold one of my cows last month to pay micro credit instalment as myweekly income from milk sales dropped by Tk 6,000 (€ 59) because ofthe price cut”, said Waz Ali.

interest loans, grants and project funds – usefulsupport to the company but which preventsother milk processing firms from competing inthe market.56The dairy industry’s contributionto the national GDP is around 2.7 per cent, yetthe government’s budget allocation to the sectoris ten times less, at just 0.27 per cent.57Thus,the government in Bangladesh should seek toemploy a comprehensive strategy to ensure thatits dairy farmers are supported and invest in thedairy sector so that it develops its potential andcompetitiveness.

10 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

11 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

Arla Foods: Profiting fromexports of subsidised milkOne of the biggest exporters of milk powder toBangladesh is the Danish-Swedish dairy giantArla Foods, which has supplied between 3.700and 6,000 tonnes of milk powder to Bang-ladesh per year in recent years.58Arla Foodsmanufactures the leading foreign milk powderbrand in Bangladesh – Dano, which has recentlyaccounted for over 20 per cent of all milk salesin the country.59Dano milk powder is mainlyexported as bulk and repacked into consumerbags at a plant in Bangladesh that employsaround 50 people.60The box below61shows that Arla has been alarge exporter of milk to Bangladesh for manyyears and that a fall in Arla’s exports coincidedwith the melamine scandal in 2008. Since then,exports have started to pick up again.Arla has received nearly one billion Euros insubsidies from the EU since 200062, allowing itto establish a strong position in the Bangladeshidairy market. Although direct EU support to Arlahas reduced in recent years, the farmers supply-ing Arla continue to receive substantial subsidies.Arla Foods’ literature does not mention theadverse impacts that its milk powder exportsmight have on Bangladeshi dairy farmers. Bycontrast, the most recent press release (from2007) mentioning Dano on Arla Foods’ websiteis entitled ‘Dano sales are booming in Bangla-desh’, and notes that “Dano milk powder is areal hit with Bangladeshi consumers”. In 2006,they drank 240 million glasses of the product.”We’ve succeeded in doubling sales over nineyears, a result we’re very proud of,” a companyspokesperson was quoted as saying.63The trade is certainly profitable. Arla Foods’milk powder for consumers64, which is exportedprimarily to developing countries, generatedrevenues of DKK 831 million (€ 112 million) in2010 (1.7 per cent of total company revenues).65According to Arla Foods, sales of milk powderin developing countries generate more earningsthan sales of high quality cheese to Danishconsumers.66Around 15 per cent of Arla Foods’whole milk powder exports go to Asia, but thecompany does not provide figures on how muchprofit it makes from sales in Bangladesh.67ethical business practices.71Arla Foods statesthat it:“has a responsibility for society, the environmentand the people who interface with our pro-ducts and production...Arla Foods addressesethical and quality matters in a sustainable andresponsible manner, in order to safeguard thecompany’s reputation and profitability. Our ob-jective is to develop our business on a founda-tion of long-term perspectives with respect for,and in harmony with, our surroundings.72”In the company’s code of conduct - called ’OurResponsibility’ - Arla Foods states:“We support competition on equal terms... Weinteract with local communities and contribute totheir development... In the markets in which weare a major player, we have the added responsi-bility of not abusing our position.73”Some of these claims - e.g. that Arla Foodscontributes to the development of local commu-nities - are questionable in light of Arla Foods’subsidised milk powder exports to Bangladesh.Arla Foods’ only CSR project in Bangladesh iscalled “Children for Life”, which provides oneglass of milk a day to around 800 children in threecountries – Vietnam, the Dominican Republic andBangladesh. The project costs DKK 1 million (€134,228), which amounts to 0.08 per cent of thecompany’s net profits in 2010. In Bangladesh, theproject begun in 2010 and “provides teaching,food and milk” for 235 pupils at a school in theslum area of Korali on the outskirts of Dhaka.74Arla Foods’ primary donation in the project isArla’s own imported milk powder. Yet, a 2007study for the FAO states: “School milk feedingschemes based on imported pre-packed milkare seen as counter-productive to sustainablesmallholder dairy development”.75

Arla FoodsArla Foods is a global dairy company and a co-operative owned mainly byDanish and Swedish dairy farmers, plus a small number of German far-mers. Arla Foods has a virtual monopoly on milk and dairy production inSweden and Denmark and is Scandinavia’s biggest producer of milk pow-der, which it manufactures in two factories in Denmark and its newest onein Sweden68. It has production facilities in 13 countries and sales officesin a further 20, with more than 16,000 employees. Its best known brandsinclude Arla, Lurpak and Castello, which it sells to over 100 countries.Arla Foods’ largest market is the UK, where it is the second largest dairycompany; it is currently building the world’s largest milk dairy in London.69In 2010 the company’s turnover was DKK 49 billion (€ 6.6 billion); and itsnet profit was DKK 1.27 billion (€ 170 million).70

Corporate social responsibilityArla Foods Exports of Milk Powder toBangladesh 1988-2008

Arla Foods says it is a socially responsiblecompany and produces an annual corporatesocial responsibility (CSR) report. Since 2008,Arla Foods has also been linked to the GlobalCompact, a UN voluntary initiative to promote

Furthermore, the company’s CSR report is ex-plicit in stating that this CSR project is intimatelyrelated to its sales strategy. Its 2010 report sta-tes: “The Children for Life project was conceived...by the department responsible for sales of milkpowder across the world”. It also states: “Apartfrom the three countries in which the Childrenfor Life project is currently running, Nigeria andChina are also important markets for Arla Foods’milk powder. For this reason, there are plans toset up similar projects there”.76

12 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

13 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

The root of the problem:EU subsidiesAt the root of the problem of cheap milk powderimports in Bangladesh are the massive subsi-dies given to European dairy farmers.77Thesesubsidies contrast with the plight of Bangladeshimilk producers, who, as noted, receive no directsupport from their government:• The ‘single payment’ scheme of decoupledpaymentsdelivers a massive € 5 billion peryear to EU dairy farmers. This level of sup-port has risen from around € 2.75 billion in2005 and € 4.5 billion in 2007.78• In addition, EU dairy farmers are protected by highEU import tariffs,which effectivelyclose the EU market to dairy imports fromthird countries (apart from the limitedvolumes which enter under quota arrange-ments and preferential agreements).79• The EU also maintains a policy of directinterventionto buy farmers’ outputs at acertain period of the year to maintain marketprices.• In addition, the EU has in recent years initiated major‘safety-net’ supportprogrammesfor dairy farmers to sustainmilk production in the face of price declines.In 2009, for example, the EU spent anadditional € 600 million on top of the € 5billion in direct payments in responseto low prices at the time.• The EU also pays farmers an exportsubsidy(or ‘refund’) at times whenEurope an dairy prices are higher thanworld prices to enable them to accessworld markets. During 1996 to 2006, EUexport subsidies on dairy products werehigh, ranging from € 475 million to € 1.8billion.80Overall, export subsidies have beenreduced in recent years and, since theend of 2009, have been set at zero.They were revoked for the first time in40 years in 2007, but revived in January2009 to help the industry cope with a globalprice slump.81At this point, the EU beganoffering subsidies of up to 50 per cent onits milk powder, butter and cheese exports.82At the 2005 WTO negotiations, it wasagreed that all export subsidies should endby 2013, provided that a full multilateraltrade agreement had been reached,but these negotiations are still ongoing.260 (€ 35) per 100 kg,94and corresponds to15 per cent of the export price, meaning thatwithout the subsidies, Arla Foods would havehad to raise the export price 15 per cent to earnthe same income. This cost was covered byEuropean taxpayers.

‘Decoupled’ payments increaseproduction and reduce world pricesProponents of decoupled payments claim thatafter having switched from traditional subsidiesthat increased as production rose, the newsystem has no impact on production or interna-tional trade flows. Yet, several recent academicstudies show the opposite, that decoupledpayments do indeed increase production in theEU and help to reduce international prices, andthus may inflict economic injury upon third coun-tries.96Similarly, a 2010 report by the DanishEconomic Council, states that the CAP ”leadsto a higher level of production compared to afree market situation” and that Danish agricultu-ral production, for example, would fall if the EUsubsidies were phased out.97The effect on prices is serious in that low pricesfor milk sales is a major problem faced by Bang-ladeshi milk farmers, evidenced in the recentprotests noted above. In a 2008 survey of dairyfarmers in northern Bangladesh by CARE-Bang-ladesh, low price was identified as the majorchallenge, mentioned by 42 per cent of thosesurveyed.98

The EU as a milk producer and exporter86The EU with its 27 member countries is the world’s biggest producerof milk, accounting for around a quarter of the world total, ahead of theUnited States and India.87The EU is also the world’s second largestexporter of milk (after New Zealand), and accounted for 26 per cent ofwhole milk powder exports and 27 per cent of skimmed milk powderexports in 2010.88There are over one million milk producers in the EU.89

Export subsidies and Arla FoodsWhen dairy prices fell in early 2009, the EUreintroduced both export ‘refunds’ and milk pre-miums for farmers based on the amount of milkproduced: an aid package of € 280 million for EUdairy farmers was agreed on and € 600 millionbudgeted for market measures.90In Denmark,4,300 milk producers received DKK 73.3 million(€ 9.8 million) in milk premiums.91Danish milkprocessed by Arla Foods in 2009/10 was sup-ported with approximately DKK 64.1 million(€ 8.6 million).92Export subsidies were alsoreintroduced in Denmark. All of this was in ad-dition to the normal subsidies granted to farmers.In the first nine months of 2009, Arla Foodsexported 1.5 million kg of milk powder toBangladesh at the price of DKK 26 million (€ 35million).93This was subsidised at a rate of DKK

The Common Agricultural Policy (CAP)The CAP was one of the first policies of the European Community inthe 1950s – aimed at making Europe self-sufficient in food by ensuringa stable supply of food for European citizens at a low price, and a rea-sonable selling price for farmers. Although the level of farm subsidieshas reduced since the 1950s, the CAP remains the biggest item onthe EU budget, accounting for 40 per cent of the total EU budget in2011.83In 2010 the CAP budget amounted to € 43.8 billion.84Directfarm subsidies are by far the largest expenditure of the CAP. Studiesshow that many of the recipients of CAP subsidies are not smallfarmers but large landowners and agribusiness, over 1,000 of whomhave become ‘farm subsidy millionaires’.85

EU export subsidies alsoreduce world pricesThe EU’s export subsidies, by encouragingproduction and export, have also tended tolower world market prices for milk. Without thesubsidies, the EU would produce less and havefewer goods to export at low prices, whichwould increase world market prices, and shiftthe balance of trade towards third countries.102

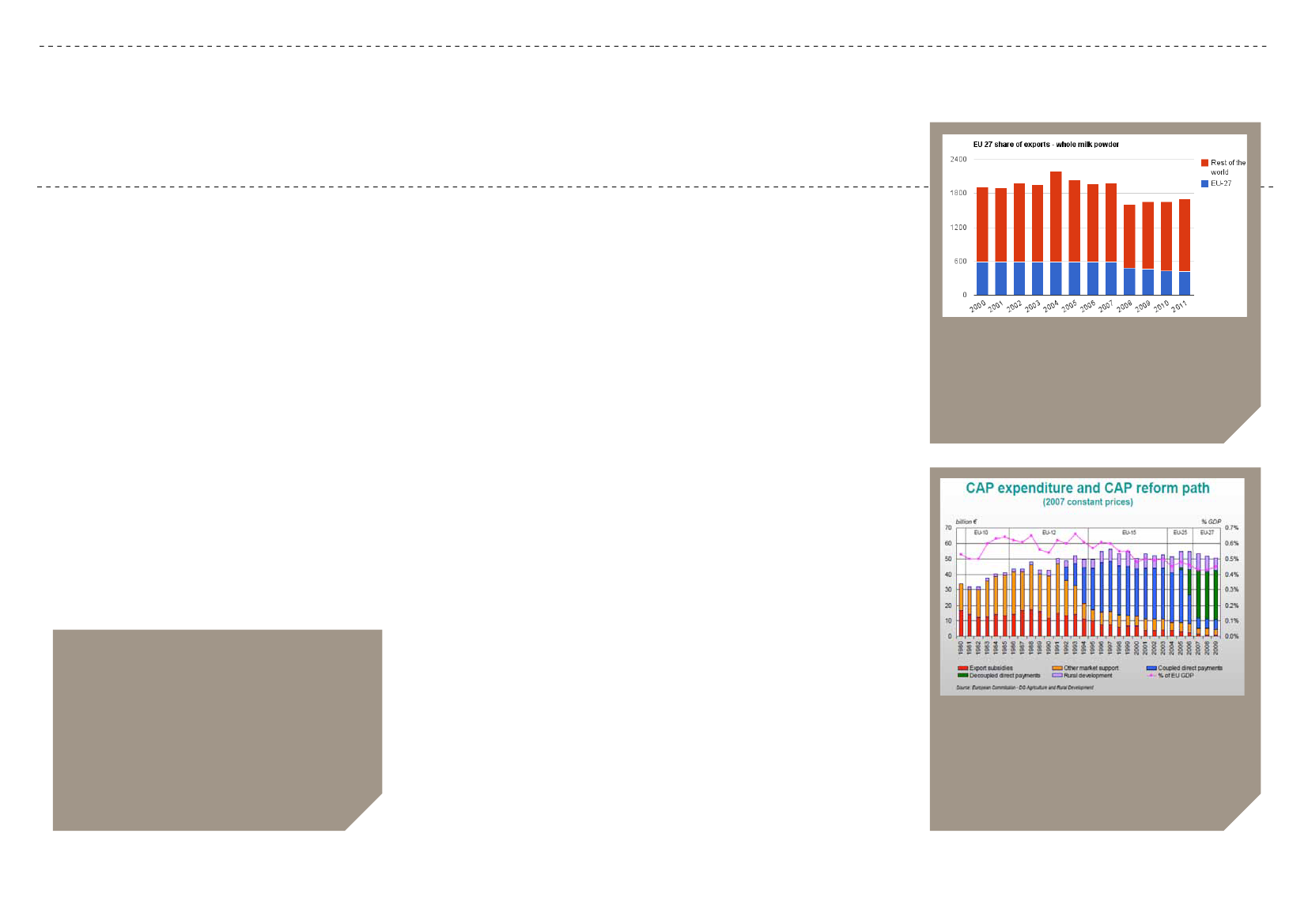

CAP Expenditure and CAP Reform

95

While the form of subsidy has moved away from coupled payment andexport subsidies, the overall level of farm subsidies is still comparablewith the level of the early 1980s in terms of the proportion of EU GDPit represents. Overall - in part due to the expansion of the EU - the levelof support has increased. As well as undermining developing countries’milk producers by promoting cheap imports, these EU subsidies alsodepress world market prices.

14 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

15 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

33

tA b l e1

‘Green Box’ subsidies can be trade-distortingSince the EU argues that decoupled payments have no impact onproduction or international trade flows, they are placed in what theWTO refers to as the ‘Green Box’ in international trade discussions. Yetthe ‘Green Box’ designation is disputed by several actors. Some arguethat subsidies in the form of decoupled payments allow for “effectson farmers’ ability to cover fixed and/or variable costs; ... isolates thefarmer from market signals and reduces risks, etc”. It is also arguedthat, out of all the ‘Green Box’ direct payments, ‘decoupled’ incomesupport programmes distort trade the most.99A study by researchers at Humboldt university in Berlin found thatdecoupled payments are not production neutral, but act to stimulateproduction and investment in agriculture compared to a situationwith no subsidies. In particular, decoupled EU farm subsidies providefunding to producers, reduce risk and generate the expectation onthe part of the recipients that future changes in agricultural policiesmay also be based on past production, as they currently are. All of thisensures that farmers maintain production at a higher level than withoutsuch subsidies.100Similarly, a recent analysis by the International Centre for Trade andSustainable Development in Geneva concludes that “evidence … sug-gests that the sheer volume of subsidies provided may have risk/insu-rance effects on production - even if such support is provided throughrelatively decoupled policies.” It also notes that “existing studies showthat Green Box subsidies encourage agricultural production by creatinga guaranteed income stream and a lower perceived risk for farmers,which raises the potential for overproduction”.101

price would lead to a loss of income for a typicalBangladeshi dairy farm of Taka 3,425 (€ 36) peryear – a reduction in dairy income of 43 per centand a loss in overall household income of 7–16per cent. Around 7 million people would be af-fected by these income losses.104

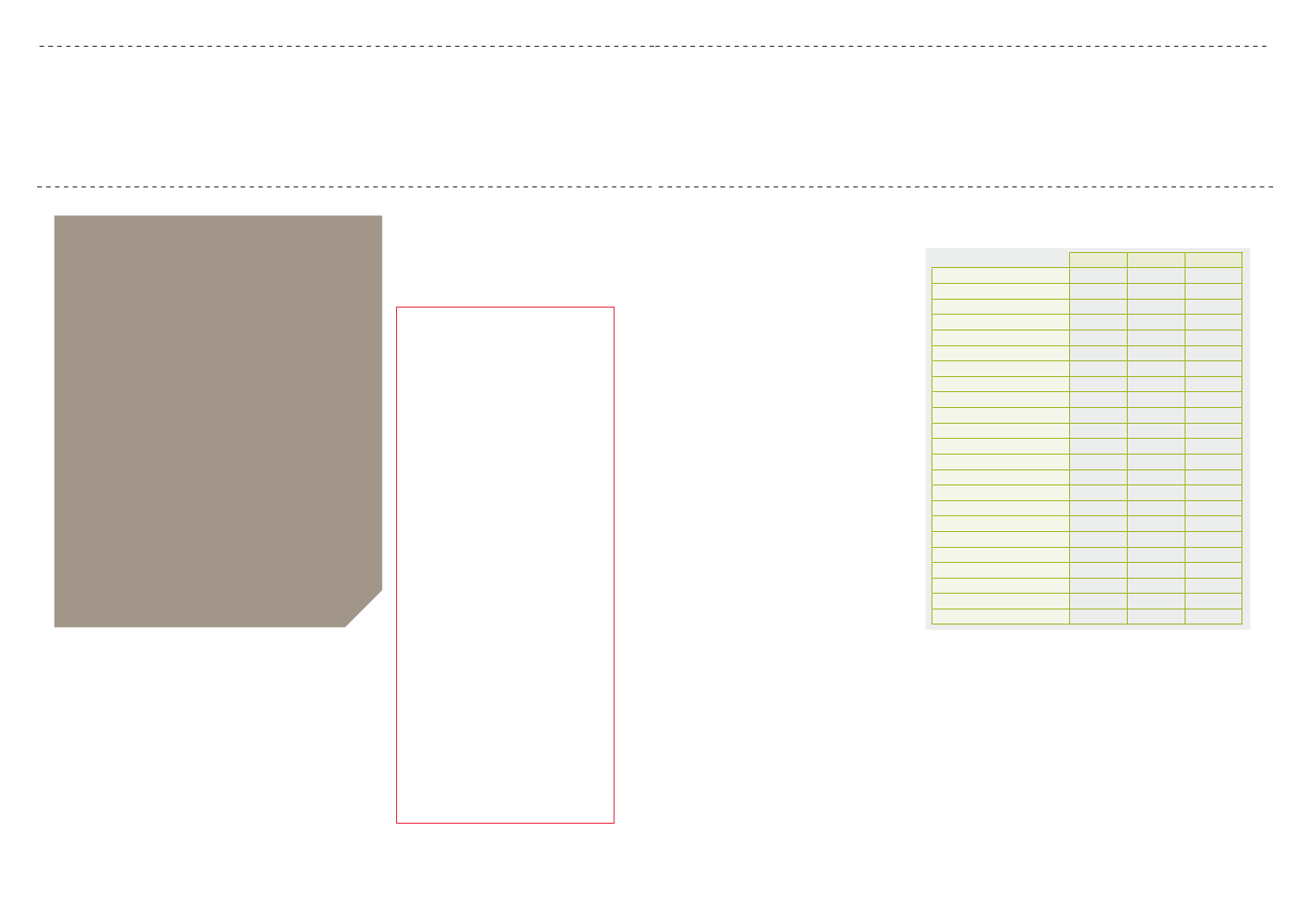

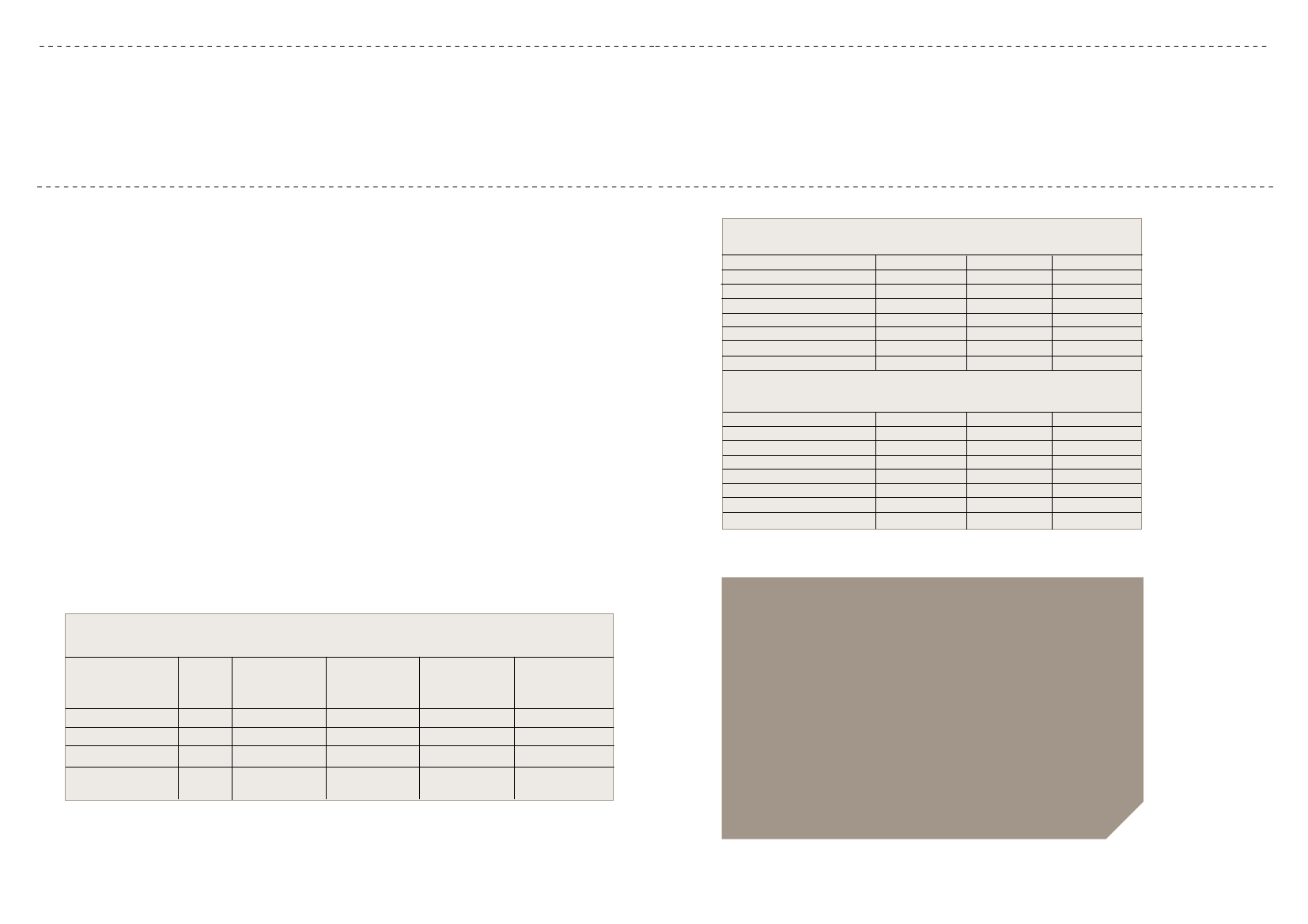

Farmers surviving only by subsidies“European producers [of basic milk productssuch as butter and milk powder] have only beencompetitive on world markets when prices havebeen high. Outside these periods, they can onlyexport with the assistance of the Communitybudget.”106As the above quote from the European Courtof Auditors suggests, many EU dairy farmerswho are effectively competing with, and under-mining, their Bangladeshi counterparts, couldnot survive without subsidies. Other evidencesupports this view. A recent study by academicsat Humboldt University in Berlin, for example,found that during 2004-08, the returns to dairyfarmers in Germany amounted to just 49-59 percent of their costs. Thus “the Common Agricul-tural Policy has enabled and continues to enablefarmers to sell below cost”.107The table shows the proportion of dairy farmers’gross income accounted for by subsidies paidto them. The figures range from a massive 77per cent in Finland to 16 per cent in Italy for2006. In Denmark, 31 per cent of dairy far-mers’ gross income was made up of subsidypayments in 2006 – a proportion that has risenconsiderably since 2000.Other sources suggest that many EU farms(not just dairy farms) would simply close downwithout subsidies. The EU figures show that theshare of direct payments and total subsidies inagricultural factor income is 28 per cent and 40per cent, respectively, for the EU-27, suggestingthat much EU agricultural production would notbe economically sustainable in the absence ofthis support.109In 2005/06, only 35 per centof farms in EU-25 were able to cover all costs.This was especially the case for small farms.The share of profitable large farms was only justabove 62 per cent.110

s u b s i d i e s A s A s h A r e o f G r o s s i n co m e o f d A i ry fA r m stAX e s Aase v i e (gross income of2006 )Subsidiesn dalsharesof2000, 2004 A n ddairy farmsbefore taxes and levies (2000, 2004 and 2006)1082000BelgiumCzech RepublicDenmarkGermanyGreeceSpainEstoniaFranceHungaryIrelandItalyLithuaniaLuxembourgLatviaNetherlandsAustriaPolandPortugalFinlandSwedenSlovakiaSloveniaUnited Kingdom16 %18 %72 %36 %4%32 %31 %15 %10 %22 %18 %18 %14 %5%12 %32 %33 %42 %22 %11 %35 %43 %58 %12 %44 %22 %27 %73 %41 %43 %37 %23 %11 %200419 %44 %28 %31 %200628 %60 %31 %36 %46 %17 %43 %40 %41 %36 %16 %37 %46 %63 %23 %42 %35 %37 %77 %56 %65 %37 %34 %

According to the Agritrade:“While the EU routinely cuts export refundlevels for dairy commodities when worldmarket prices rise, it is the oppositetrend, of increasing export refund levelswhen world market prices fall, which isthe major source of concern in Africa.While the export of milk powder as rawmaterials for use in newly establishedAfrican dairies can enhance capacity utili-sation and financial viability while dome-stic supplies are built up, this requires acarefully conceived import-managementpolicy linked to a national dairy-sectordevelopment, if unregulated dairy importsare not to undermine local investorconfidence in the returns which can beobtained from dairy-sector investments.This is the principal concern regardingthe impact of EU dairy-sector policies....The EU’s active use of a range of supportmeasures to sustain and promote dome-stic EU dairy production, many of whichhave important external implications ...,by insulating EU milk producers from theworst effects of price declines, sustainEU milk production and subsequentexports at levels which would simply notbe the case in the absence of this rangeof safety-net interventions. Being unableto benefit from similar support measures,dairy producers in ACP countries wouldhave to bear the full risk of severe dairy-market price volatility, particularly duringperiods of declining prices.”105

Although export subsidies are currently set at zero,they can be reimposed, as they were in 2009.In a 2009 study, the International Farm Compa-rison Network (IFCN) estimated that the removalof EU export subsidies would increase worlddairy prices by 16.7 per cent.103Its analysis alsoshowed that an EU export subsidy of € 5 per100 kg of milk – which prevailed in 2009 whenthe EU reintroduced export subsidies – redu-ces the world market price by € 2.5 per kg. InBangladesh, the impact on family farm income issignificant. Such a reduction in the world market

S ource:fadn gross farm income before taxes, levies and vat = gross farm income(se 410) — the balance of current farm subsidies and taxes (se 600) + total farmsubsidies (se 605).

special report no 14/2009 – Have the management instruments applied to the market in milk and milk products achieved their main objectives?

special report no 14/2009 – Have the management instruments applied to the market in milk and milk products achi

50

24002200

16 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh40EUR / 100 kg milk ECM3530252015BDT / 100 kg milk ECM

45

200018001600140012001000800600

17 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

1050

Quota costsOpportunity costsCost P&L - non milk returnsMilk price4002000Jan. 06Feb. 06Mrz. 06Apr. 06Mai. 06Jun. 06Jul. 06Aug. 06Sep. 06Okt. 06Nov. 06Dez. 06Jan. 07Feb. 07Mrz. 07Apr. 07Mai. 07Jun. 07Jul. 07Aug. 07Sep. 07Okt. 07Nov. 07Dez. 07Jan. 08Feb. 08Mrz. 08Apr. 08Mai. 08Jun. 08Jul. 08Aug. 08Sep. 08Okt. 08Nov. 08Dez. 08Jan. 09Feb. 09Mrz. 09Apr. 09Mai. 09Jun. 09

Opportunity costsCost P&L - non milk returnsMilk price

Income from dairy farming

30114

1400

25

1200

20EUR / 100 kg milk ECMBDT / 100 kg milk ECM

1000

15

800

10

600

5

400

0

Jan. 06Feb. 06Mrz. 06Apr. 06Mai. 06Jun. 06Jul. 06Aug. 06Sep. 06Okt. 06Nov. 06Dez. 06Jan. 07Feb. 07Mrz. 07Apr. 07Mai. 07Jun. 07Jul. 07Aug. 07Sep. 07Okt. 07Nov. 07Dez. 07Jan. 08Feb. 08Mrz. 08Apr. 08Mai. 08Jun. 08Jul. 08Aug. 08Sep. 08Okt. 08Nov. 08Dez. 08Jan. 09Feb. 09Mrz. 09Apr. 09Mai. 09Jun. 09

-5

Decoupled payments f. govermentDairy farm incomeDairy farm income + decoupled paymentsFamily living requirements*

200Dairy farm incomeFamily living requirements*0Jan. 06Feb. 06Mrz. 06Apr. 06Mai. 06Jun. 06Jul. 06Aug. 06Sep. 06Okt. 06Nov. 06Dez. 06Jan. 07Feb. 07Mrz. 07Apr. 07Mai. 07Jun. 07Jul. 07Aug. 07Sep. 07Okt. 07Nov. 07Dez. 07Jan. 08Feb. 08Mrz. 08Apr. 08Mai. 08Jun. 08Jul. 08Aug. 08Sep. 08Okt. 08Nov. 08Dez. 08Jan. 09Feb. 09Mrz. 09Apr. 09Mai. 09Jun. 09

Index: Dairy income vs. Family living needs

260240Index family living requirements = 100Index family living requirements = 1002202001801601401201008060260240Indeed, as the UN Special Rapporteur on the220200Right to Food, Olivier de Schutter, has recently180noted, “Without these various forms of support,160the EU producers would not be in a position tocompete on world markets, since the social and140environmental conditions under which they ope-120111rate would not allow them to be competitive”.10080

Currently, many European dairy farmers are in-60curring losses. In December 2010, for example,4040Dairy farm income + decoupled paymentsDuringDairy farm incomescandal, when consump-the melaminethe UK National Farmers’ Union claimed there2020Family living requirements*Family living requirements*tion of imported milkpowder was low, farmers inwas a gap between the price paid for milk and00Bangladesh had an income well above living re-the costs of producing it of some £ 330 millionquirements. At other times the price was around(€ 389.4 million), with British farmers losing anMethod assumptionsthe same level as living requirementsaverage of 3 pence (€ 0.35)112, on every litre ofCalculations done based on the farm economics figures for calender year 2008. To show monthly farm economics for 2006-6/2009 the milk price have been changed proportionally to national milk prices2006-6/2009. Purchase feed costs have been changed proportionally toThis poor financialAll other cost and returns have been adjusted by inflation.or even below.milk they produced.national feed prices 2006-6/2009.situationJan. 06Feb. 06Mrz. 06Apr. 06Mai. 06Jun. 06Jul. 06Aug. 06Sep. 06Okt. 06Nov. 06Dez. 06Jan. 07Feb. 07Mrz. 07Apr. 07Mai. 07Jun. 07Jul. 07Aug. 07Sep. 07Okt. 07Nov. 07Dez. 07Jan. 08Feb. 08Mrz. 08Apr. 08Mai. 08Jun. 08Jul. 08Aug. 08Sep. 08Okt. 08Nov. 08Dez. 08Jan. 09Feb. 09Mrz. 09Apr. 09Mai. 09Jun. 09

* Familiy living requirments: Share of dairy farm income on household income multiplied with basic family living requirements. Example: DE-31: 90% * 33000 Euro/year), Bd-2: 16%* 50.000 BDT/year)

is attributed to ”the huge increase in feed andbedding costs” and the absence of a ”fair” milkprice.113

Jan. 06Feb. 06Mrz. 06Apr. 06Mai. 06Jun. 06Jul. 06Aug. 06Sep. 06Okt. 06Nov. 06Dez. 06Jan. 07Feb. 07Mrz. 07Apr. 07Mai. 07Jun. 07Jul. 07Aug. 07Sep. 07Okt. 07Nov. 07Dez. 07Jan. 08Feb. 08Mrz. 08Apr. 08Mai. 08Jun. 08Jul. 08Aug. 08Sep. 08Okt. 08Nov. 08Dez. 08Jan. 09Feb. 09Mrz. 09Apr. 09Mai. 09Jun. 09

Jan. 06Feb. 06Mrz. 06Apr. 06Mai. 06Jun. 06Jul. 06Aug. 06Sep. 06Okt. 06Nov. 06Dez. 06Jan. 07Feb. 07Mrz. 07Apr. 07Mai. 07Jun. 07Jul. 07Aug. 07Sep. 07Okt. 07Nov. 07Dez. 07Jan. 08Feb. 08Mrz. 08Apr. 08Mai. 08Jun. 08Jul. 08Aug. 08Sep. 08Okt. 08Nov. 08Dez. 08Jan. 09Feb. 09Mrz. 09Apr. 09Mai. 09Jun. 09

Income from dairy farming

Index: Dairy income vs. Family living needs

The graph above covering a three-and-a-halfyear period show that only for a few shortmonths did the EU dairy farmers receive anincome above their living requirements withoutneed for a subsidy. For the rest of the time,farmers’ incomes were only above living re-quirements thanks to decoupled subsidies. Thisclearly shows that the EU farmers are for themost part selling below production costs.

According to Agritrade, it is precisely the EU’sdirect aid payments – which currently amount to3.4 euro cents per litre of milk produced - which

11

18 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

19 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

Bangladesh is also one of the main recipientsof Danish development aid. In 2010, the DanishInternational Development Agency (DANIDA)spent DKK 471 million (€ 63 million) in Bangla-desh.119Agriculture is one of DANIDA’s priorityareas, and agricultural development is identifiedas essential for poverty reduction in Bangladesh.In the 1970s, DANIDA supported the establish-ment of the Bangladesh Milk Producers Co-ope-rative Union Limited (BMPCUL) which producesmilk under the trade name Milk Vita.120DANIDA correctly notes that increasing agri-cultural production and income improves foodsecurity, reduces vulnerability of farming house-holds and reduces malnutrition and mortalityamongst children.121In 2004, before decouplingof subsidies, Carsten Staur, Chief of DANIDAstated: “It is clearly a problem that agriculturalsubsidies are contributing to maintain a produc-tion in the world, which is not appropriate on thebasis of an idea of the global division of labour.We are maintaining a production in Europe,which is not competitive.”122EU milk powder imports also undermine aiddirected specifically to Bangladeshi milk powderproducers. It was announced in June 2011 thatthe International Finance Corporation (IFC), theprivate sector lending arm of the World Bank, isproviding a € 5.3 million loan to PRAN Group –the largest food processing company in Bangla-desh - to expand its local dairy procurement andprocessing capacity.The IFC says this will help increase the incomesof about 17,000 Bangladeshi dairy farmers andcontribute to the country’s food security. It alsonotes that “Bangladesh has one of the lowestper capita milk consumption levels in the worldand imports milk powder to meet 15 per centof its dairy demand”. IFC’s investment will helpPRAN raise processing capacity across its

product range, including ultra-heat-treated milk,pasteurised milk, and milk powder, and increaseraw milk procurement from local dairy farmers.“PRAN’s expansion will help increase the localsupply of value-added dairy products, contribu-ting to food security in Bangladesh,” said an IFCspokesperson.123In the 2005 “European Consensus on De-velopment”, the issue of Policy Coherence forDevelopment was identified by the EU as apioneering concept for achieving the MillenniumDevelopment Goals. The EU has committeditself to ensuring that its various policies do notundermine social and economic progress indeveloping countries. Article 208 of the 2009Lisbon Treaty states that: “Union developmentcooperation policy shall have as its primaryobjective the reduction and, in the long term, theeradication of poverty. The union shall take ac-count of the objectives of development coopera-tion in the policies that it implements which arelikely to affect developing countries.”In the spring of 2010, the EC conducted apublic hearing online, and in the Commis-sion’s summary, it states: “The EU should avoiddamaging the economies or food productioncapacities of developing countries.”124However,in the Commission’s communication on the CAPpost-2013, published in November 2010, noreference is made to the effect of the CAP ondeveloping countries, except in the context offood security, where it is stated that EU agricul-ture should contribute to world food demand bymaintaining and improving production capacity,while respecting EU commitments in interna-tional trade and Policy Coherence for Develop-ment.125As this report shows, it is preciselythe high production level that has a damagingeffect on agricultural development in developingcountries.

are sustaining UK milk farmers in business,despite the losses they are incurring.115

Agritrade notes:“In the absence of direct aid payments, it islikely that a significant number of EU dairyfarmers who currently face losses on the marketprice received for their milk would review theirongoing engagement in dairy production. Thiswould not be immediate, but would occur whenreinvestment decisions need to be taken, andwould be likely to reduce overall levels of EUmilk production. Given that around 5 per centof EU dairy production is exported, even a smallreduction in overall EU milk production wouldcarry important implications. This is particularlythe case for lower-value dairy products, such asskimmed milk powder. With more EU milk beingused for higher-value products, production ofskimmed milk powder and other bulk dairy com-

modities would be likely to decline most dra-matically. There have been numerous reports ofEU exports of milk powder undermining effortsto promote local dairy production to meet localmarket needs in Africa, particularly in West andCentral Africa.”116

Giving with one hand, taking withanother: The EU’s incoherenceThe EU and Denmark are supporting Bangla-desh through aid while simultaneously under-mining it through trade policy. While EU milkpowder imports are harming Bangladeshi dairyfarmers, the EC is, for example, funding a Natio-nal Food Policy Capacity Strengthening Pro-gramme (to the tune of € 3.3 million117) helpingthe Bangladeshi government promote a nationalfood policy.118

20 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

21 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

Denmark’s milk productionThe farmers that own and deliver milk to ArlaFoods are direct beneficiaries of EU subsidiesunder the CAP. The following Table 2 showsan example of a typical Danish dairy farmerreceiving over DKK 330,000 (€ 44,295) a yearin subsidies. Some farmers, however, receive asmuch as € 500,000.126This is not the sum total of EU support toDanish dairy farmers. The dairy sector issupported through a range of other measures,such as a premium for male animals (of DKK735-1174 (€ 99-158)) depending on the agewhen slaughtered and whether the animal issteered),128support for school milk schemes,support for storing of butter and aid for thedisposal of skimmed milk.129Our analysis in the previous section suggestedthat although subsidies have been decoupledfrom production, they enable otherwise loss-making EU milk producers to stay in business.Below, we calculate the costs and cost-effectiveness of Danish dairy farmers.130Table3 shows that, without subsidies, Danish dairyfarming was unprofitable for both large (+200cows) and small (0-100 cows) farms in 2009.The value of production covered only 88 percent of costs for small farms. In 2008 only largefarms were profitable, and only by a margin of 4per cent of costs.Moreover, as Denmark is the country withhighest yield per cow in the EU and Danish farmsare bigger than in most other EU countries131,many farmers in other countries are also likely tomean even more farmers would be loss-making.Thus EU subsidies that enable these otherwiseloss-making dairy farmers to continue exportingin ways that undermine many milk producers inpoorer parts of the world.

Cost effectiveness of dairy production, 2008 and 20091322008Milk production, kg per cowValue of milk productionValue of manureTotal costsNet profitReturns in per cent of costsSmall farms8,114DKK per cow203365622342-195091.3Large farms8,775DKK per cow2199213221179945104.5All farms8,659DKK per cow217028821878-8899.6

2009(Detailed presentation of cost for 2009 is provided in annex A on page 21)Small farmsLarge farmsMilk production, kg per cow7,9568,979DKK per cowDKK per cowValue of milk production1715019355Value of manure256252Total costs1968220166Net profit-2276-559Returns in per cent of costs88.497.2

All farms8,810DKK per cow1899121320195-99195.1

Danish farmers and subsidies133Example of subsidies to a milk producer with milk production of 500 tons, 92 hectares of tilledfields, 8 hectares of fallow land and 8 hectares of permanent grazing fields127Type of area withpayment entitlementArea in ha Base rate perpayment entitle-ment (DKK)928823002300500Milk addition perpayment entitle-ment 2006 (DKK)9650965Total subsidies perpayment entitle-ment 2006 (DKK)326523001465Subsidiesgrantedin 2006 (DKK)3003801840011720DKK330500(€44362)The Danish dairy farmer Niels Kristian Jørgensen has 230 cows. He receives DKK 739,000(€ 99,195) in EU subsidies, and says that the price he gets for his produce does not coverhis costs. He explains that, without the subsidies, consumers would pay three times thecurrent price for one litre of milk. When asked if he could keep farming if the subsidies wereabolished, he answers: “Not unless the prices go up significantly and the costs are keptsteady - and I consider this a utopia!”Henning Skov Andersen runs a farm with 95 cows and 85 hectares. He says that with thehigh costs of production in Denmark, the DKK 300,000 (€ 40,268) he receives in subsidiesare needed to make ends meet. Without the subsidies, he would have a deficit every year,and in the end he would need to close down the farm.Michael Kristensen, with 160 cows and 140 hectares, receives subsidies worth DKK480,000 (€ 64,430) every year, and says he could not keep farming without them. He thinksthat the farm subsidies should have never been introduced in the first place.

Tilled fieldsFallow landPermanent grazing fieldsTotal

22 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

23 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

ConclusionFor decades, European dairy farmers have beengiven massive subsidies under the EU’s CAP.This has enabled them to export cheap milkpowder, among other products, on internationalmarkets at low prices. In 2005, however, the EUdecided to change the nature of those subsidiesby ‘decoupling’ them from the production levelsof farmers. However, this report shows that theEU’s decoupled subsidies are continuing todamage dairy farmers in Bangladesh, where mil-lions of poor people support their low incomesthrough milkproduction.At the root of the problem of cheap milk powderimports in Bangladesh are the massive subsi-dies given to European dairy farmers. Europeanand Danish taxpayers are continuing to fundEU farmers to harm the livelihoods of poor dairyfarmers in Bangladesh, at the same time asfunding aid programmes designed to help them.Whilst the EU has committed itself to promotingPolicy Coherence for Development - ensuringthat its various policies do not undermine socialand economic progress in developing countries- this aim is being undermined by cases such asthe one illustrated in this report.The EU is preparing a comprehensive reform ofthe CAP, which is expected to come into force in2014. Much of the negotiations will take place inearly 2012, when Denmark will be hold the pre-sidency of the EU. This represents an importantpolitical opportunity to reform the CAP in a waythat ends all damaging subsidies and will bea test of the EU’s willingness to ensure that itspolicies are coherently promoting developmentin poor countries.

AnnexAnnex ACosts of production, Danish dairy farmers, 2009Costs of milk production( DKK per cow)Operating (variable) costsInseminationFeedVeterinary and medicineOther operating costsMachinery costsEnergyInterest on operating inputsPartially variable costsHired and opportunity costs of labourMaintenance of equipmentDepreciation of equipmentInterest on equipmentFixed costsReal estate tax and energy levyInsuranceMaintenance and depreciation, buildingsInterest on buildingsOther fixed costsTotal costs2009Small farms11544258829569673168946441059144068820793234222454133738956344196822009Large farms11982293857266493761848441453092753850129441228756210910691363273201662009All farms120122858542712907660486421549331058551166367269061117962125030020195

24 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

25 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

Endnotes1Interview by Danwatch, June 201122002. ‘Milking the CAP: How Europe’s Dairy Regime is DevastatingLivelihoods in the Developing World’. Oxfam Briefing Paper, 34.Available at: http://www.oxfam.org.uk/resources/policy/trade/downloads/bp34_cap.pdf, p. 16.3Office of the United Nations High Commissioner for Human Rights.2011. The Common Agricultural Policy towards 2020: The Role of theEuropean Union in Supporting the Realization of the Right to Food,Comments and Recommendations by the United Nations Special Rap-porteur on the Right to Food, 17 June, p.1.4Hemme, T. & Otte, J.. 2010. Status and Prospects for Smallholder MilkProduction: A Global Perspective. Rome: FAO, p.6.; Trinity College Dublin.2010. ‘EU dairy policy reform and developing countries’. Available at:http://www.tcd.ie/iiis/policycoherence/eu-agricultural-policy-reform/dairy-case-study.php.5Siddiquee, N.A. & Southwood, R. 2011. ’Strengthening the dairy ValueChain in Bangladesh’. Slideshow presented at the Gender and MarketOriented Agriculture (AgriGender 2011) Workshop, Addis Ababa, Ethiopia,31 January–2 February. Available at: http://www.slideshare.net/ILRI/strengthening-the-dairy-value-chain-in-bangladesh-changing-lives-for-dairy-farmers.6CARE. n.d. ‘Strengthening the Dairy Value Chain Project: Bangladesh’.Available at: http://edu.care.org.7CARE. n.d. ‘Strengthening the Dairy Value Chain Project: Bangladesh’.Available at: http://edu.care.org.8FAO. n.d. Bangladesh Country Profile. Accessed: 28/07/11.9http://www.ruralpovertyportal.org/web/guest/country/home/tags/bang-ladesh10Embassy of Denmark, Bangladesh, http://www.ambdhaka.um.dk/en/menu/DevelopmentIssues/Businesstobusiness%28B2B%29Programme/B2B+Bangladesh+as+a+Partner+Country/Economic+Overview; availableat: https://www.cia.gov/library/publications/the-world-factbook/geos/bg.html.11International Farm Comparison Network. 2009. Dairy Policy Impactson Bangladesh & EU 15 Dairy Farmers’ Livelihoods, p.2, 5; CARE Bang-ladesh. 2008. ‘Pro-Poor Analysis of the Dairy Value Chain’, p. 20; Dairyfarming provides an average of around 16 per cent of family income, therest provided by other farming activity and off-farm income.12International Farm Comparison Network. 2009. Dairy Policy Impactson Bangladesh & EU 15 Dairy Farmers’ Livelihoods, p.2.13Siddiquee, N.A. & and Southwood, R. 2011. ’Strengthening the dairyValue Chain in Bangladesh’. Slideshow presented at the Gender andMarket Oriented Agriculture (AgriGender 2011) Workshop, Addis Ababa,Ethiopia, 31 January–2 February. Available at: http://www.slideshare.net/ILRI/strengthening-the-dairy-value-chain-in-bangladesh-changing-lives-for-dairy-farmers.14Haque, S.A. 2007. Lessons Learned Study: Bangladesh – SmallholderMilk Producers, Nutrition, Incomes, Jobs. Rome: FAO, p.13.15Shamsuddin, M. et al. 2006. ‘A Survey to Identify Economic Opportu-nities for Smallholder Dairy Farms in Bangladesh’. Journal of Tropical Ani-mal Health and Production, 38(2), p. 131-140.; The livestock sub-sectorcontributes only 3 per cent of Bangladesh’s GDP but provides employ-ment to around 20 per cent of the rural population by some estimates,and is one of the most important economic activities in the country;PRAN-RFL Group. 2007. Report on the Development of Dairy Industry inBangladesh, p.2.16Hemme, T. & Otte, J. 2010. Status and Prospects for Smallholder MilkProduction: A Global Perspective. Rome: FAO, p. 6-7.17Trinity College Dublin. 2010. ‘EU dairy policy reform and developingcountries’. Available at: http://www.tcd.ie/iiis/policycoherence/eu-agricul-tural-policy-reform/dairy-case-study.php.18International Farm Comparison Network. 2009. Dairy Policy Impactson Bangladesh & EU 15 Dairy Farmers’ Livelihoods, p. 2, 4.; A 2004 studyfound that dairy farms costs in Bangladesh were around 20 per cent lowerthan the costs of production in the EU. Hemme, T. et al. ‘A Review of Milkproduction in Bangladesh with Particular Emphasis on Small-Scale Pro-ducers’. PPLPI Working Paper No.7. Kiel: International Farm ComparisonNetwork (IFCN), p. 3.19Hannan, M.M. et al. 2010. ‘Household demand for dairy products inBangladesh: An Application of AIDS Model’. Journal of Bangladesh Agri-cultural University, 8 (1), p. 121–6.20FAO/IDF. 2003. Dairy Development Newsletter. August, Issue no. 7.Available at: http://www.fao.org/ag/againfo/themes/en/dairy/documents/newsletters/newsletter-7-English.pdf.21‘Dairy industry seeks greater policy support’, Independent (Bangla-desh), 20 June 2011.22Katherine Barker and Michael Hinsch, ‘Tetra Pak in Bangladesh: Part-nering to Improve Nutrition and Develop the Dairy Industry’, undated23‘Dairy industry seeks greater policy support’, Independent (Bangla-desh), 20 June 201124Hemme,T. et al. 2002. ‘A Review of Milk Production in Bangladeshwith Particular Emphasis on Small-scale Producers’. Available at: http://www.fao.org/ag/againfo/programmes/en/pplpi/docarc/execsumm_wp07.pdf.25Hemme, T. Et al. 2009, ‘Dairy Policy Impacts on Bangladesh & EU 15dairy farmers’ livelihoods: Dairy Case Study’. Kiel: IFCN.26Hemme,T. et al. 2002. ‘A Review of Milk Production in Bangladeshwith Particular Emphasis on Small-scale Producers’. Available at: http://www.fao.org/ag/againfo/programmes/en/pplpi/docarc/execsumm_wp07.pdf.27CARE Bangladesh.2008. ‘Pro-Poor Analysis of the Dairy Value Chain’,p.18.28Ministry of Finance. 2010. ‘Bangladesh Economic Review, 2009’.Dhaka: Government of Bangladesh.29Government of Bangladesh. 2009. ’Steps Towards Change’, p.32.Available at: http://www.lcgbangladesh.org/prsp/docs/PRS%20Bangla-desh%202010%20final.pdf.30Ministry of Fisheries and Livestock Government. 2005. ’LivestockPolicy And Action Plan’. Dhaka: Government of Bangladesh.31Government of Bangladesh. 2009. ’Steps Towards Change’, p.29.Available at: http://www.lcgbangladesh.org/prsp/docs/PRS%20Bangla-desh%202010%20final.pdf.32Bhuiyan, E.R. ‘US$150 million for milk powder import’, Financial Ex-press, 18 February 2010.33CARE. n.d. ‘Strengthening the Dairy Value Chain Project: Bangladesh’.Available at: http://edu.care.org.34IFCN. 2009. Dairy Policy Impacts on Bangladesh & EU 15 Dairy Far-mers’ Livelihoods, p. 2.35CARE. n.d. ‘Strengthening the Dairy Value Chain Project: Bangladesh’.Available at: http://edu.care.org.36Hemme, T. Et al. 2009, ‘Dairy Policy Impacts on Bangladesh & EU 15dairy farmers’ livelihoods: Dairy Case Study’. Kiel: IFCN.37Parvez, S. & Jibon, G.M. ‘Dairy farmers hurt by low-cost milk powder’,Daily Star, 15 May 2009.38‘Bangladesh dairy farmers spill milk in price protest’, Reuters, 12 April2009.39Ibid.40Hemme, T. Et al. 2009, ‘Dairy Policy Impacts on Bangladesh & EU 15dairy farmers’ livelihoods: Dairy Case Study’. Kiel: IFCN.41Interview by local researcher in Bangladesh hired by Danwatch, 8 June2011.42Parvez, S. & and Jibon, G.M, ‘Dairy farmers hurt by low-cost milkpowder’, Daily Star, 15 May 2009.43Trinity College Dublin. 2010. ‘EU dairy policy reform and developingcountries’. Available at: http://www.tcd.ie/iiis/policycoherence/eu-agricul-tural-policy-reform/dairy-case-study.php.44Agritrade. 2011.‘USDA review of EU dairy sector development’,Agritrade News Update, July, http://agritrade.cta.int/en/Commodities/Dairy-sector45Agritrade. 2011. ‘Farm-gate milk prices lag behind rising dairy com-modity prices’, Agritrade News Update, May. Available at: http://agritrade.cta.int/en/Commodities/Dairy-sector.46The EU has made special trade and development agreements with theACP states through the Lomé Conventions and the Cotonou Agreement.47Agritrade. 2011. ‘Farm-gate milk prices lag behind rising dairy com-modity prices’, Agritrade News Update, July. Available at: http://agritrade.cta.int/en/Commodities/Dairy-sector.48See, for example: Green, D. & Griffith, M. 2002. Dumping on the Poor:The Common Agricultural Policy, the WTO and International Development.Cambridge: Catholic Fund for Overseas Development (CAFOD).; Oxfam.2002. ‘Milking the CAP: How Europe’s Dairy Regime is Devastating Live-lihoods in the Developing World’. Oxfam Briefing Paper, 34. Available at:http://www.oxfam.org.uk/resources/policy/trade/downloads/bp34_cap.pdf.49FAO. 2009. ‘Smallholder dairy development: Lessons learned in Asia’.Bangkok: FAO Regional Office for Asia and The Pacific. Available at: ftp://ftp.fao.org/docrep/fao/011/i0588e/i0588e00.pdf.50Haque, S.A. 2007. Lessons Learned Study: Bangladesh – SmallholderMilk Producers, Nutrition, Incomes, Jobs. Rome: FAO.51Price checks in Bangladeshi supermarkets in May and July 2011.52100 litre whole milk equals 13 kg whole milk powder: Pearce, K.N.”Milk Powder”. Food Science Section, New Zealand Dairy Research Insti-tute. Available at: http://www.nzic.org.nz/ChemProcesses/dairy/3C.pdf.53Government of Bangladesh. 2010, ‘BUDGET 2010-11, Ministry ofFinance, Budget Speech’ by Abul Maal Abdul Muhith, Minister of Finance;‘Bangladesh dairy farmers spill milk in price protest’, Reuters, 12 April2009.54‘Govt urged not to cut tariff on milk powder import’, Daily Star, 19 June2010. Available at: http://www.thedailystar.net/story.php?nid=143261.;‘Dairy Farm Owners’ Assoc opposes budget proposal’, Financial Express,20 June 2010. Available at: http://www.thefinancialexpress-bd.com/more.php?news_id=103607.55PRAN-RFL Group. 2007. Report on the Development of Dairy Industryin Bangladesh. Available at: http://www.undp.org.bd/library/policypapers/Dev%20of%20Dairy%20Indus(English).pdf, p.6.56PRAN-RFL Group. 2007. Report on the Development of Dairy Industryin Bangladesh. Available at: http://www.undp.org.bd/library/policypapers/Dev%20of%20Dairy%20Indus(English).pdf, p.2, 6.57‘Dairy industry seeks greater policy support’, Independent (Bangla-desh), 20 June 2011.58Statistics Denmark. http://www.statistikbanken.dk, Search on Rev4-SITC: 02222; ‘Dano sales are booming in Bangladesh’. Arla PressRelease, 29 June 2007. Available at: http://www.arla.com/press/archive/dano-sales-are-booming-in-bangladesh/.59Our calculations for 2008 is based on Statistics Denmark (http://www.statistikbanken.dk, Search on Rev4- SITC: 02222) and FAOSTAT.; Merrett,N. ‘Bangladesh success reflects Arla’s Asian ambition’, Dairy Reporter,3 July 2007; ‘Bangladesh ponders production: the Bangladeshi dairycommunity is awaiting investment in domestic milk supply in order toexpand production’, Dairy Industries International, 1 January 2008.60‘Arla opens packing plant in Bangladesh ‘. Arla Press Release. 23December, 2004. Available at: http://www.arla.com/press/archive/arla-opens-packing-plant-in-bangladesh/.61Figures from Statistics Denmark.62http://farmsubsidy.org.63‘Dano sales are booming in Bangladesh’. Arla Press Release, 29 June2007. Available at: http://www.arla.com/press/archive/dano-sales-are-booming-in-bangladesh/.64Not for industrial use65Correspondence with Arla Foods, 16 June 201166‘Mælkepulver mere værd end Klovborgost’, Landbrugsavisen, 11March 201167‘Mælkekonserves’, Landbrug og Fødevarer, 2010, http://www.lf.dk/~/media/lf/Talper cent20ogper cent20analyser/Aarsstatistikker/Mejeristatistik/2009/7per cent20maelkekonserves.ashx68‘New Milk Powder Factory in Vimmerby, Sweden’, Arla website acces-sed 1st August 201169Arla Foods, Annual Report 2010, p.670http://www.arla.com/about-us/our-company/71http://www.arla.com/our-responsibility/our-responsibility1/arla-and-global-compact/72http://www.arla.com/our-responsibility/our-responsibility1/preface/73Arla Foods. 2009. ‘Our Responsibility - Arla Foods’ corporate socialresponsibility - Code of conduct’, p.22, 23, 25. Available at: http://www.arla.com/Upload/Arla%20COM/Sustainability/CoC_UK.pdf.74Arla Foods. 2009. ‘Our Responsibility - Arla Foods’ corporate socialresponsibility - Code of conduct’, p.32-33. Available at: http://www.arla.com/Upload/Arla%20COM/Sustainability/CoC_UK.pdf.75Haque, S.A. 2007. Lessons Learned Study: Bangladesh – SmallholderMilk Producers, Nutrition, Incomes, Jobs. Rome: FAO, p. 13.76Arla Foods. 2009. ‘Our Responsibility - Arla Foods’ corporate socialresponsibility - Code of conduct’, p.32-33. Available at: http://www.arla.com/Upload/Arla%20COM/Sustainability/CoC_UK.pdf.77Agritrade. 2011. ‘USDA review of EU dairy sector development’,Agritrade News Update, July. Available at: http://agritrade.cta.int/en/Com-modities/Dairy-sector.78European Court of Auditors. 2009. ‘Have the Management InstrumentsApplied to the Market in Milk and Milk products Achieved Their MainObjectives?’. Special Report No.14, para II.79Trinity College Dublin. 2010. ‘EU dairy policy reform and developingcountries’. Available at: http://www.tcd.ie/iiis/policycoherence/eu-agricul-tural-policy-reform/dairy-case-study.php.80IFCN. 2009. Dairy Policy Impacts on Bangladesh & EU 15 Dairy Far-mers’ Livelihoods, p. 3.

26 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

27 Milking the poor - How EU subsidies hurt dairy producers in Bangladesh

81Merrett, N. ‘EU export subsidies revoked as dairy prices rocket’, TheDairy Reporter, 18 June 2007; Chaffin, J. ‘EU revives dairy export subsi-dies’, Financial Times, 16 January 2009.82Palmer, D. ‘EU subsidies a threat to Aussie dairy: Opposition’, Austra-lian Food News, 30 January 2009. Available at: http://www.ausfoodnews.com.au/2009/01/30/eu-subsidies-a-threat-to-aussie-dairy-opposition.html.83EU Budget 2011. Available at: http://ec.europa.eu/budget/figu-res/011/2011_en.cfm.84 Civitas Institute for the Study of Civil Societies. 2010. ‘Common Agri-cultural Policy’. Available at: http://www.civitas.org.uk/eufacts/download/AG.3.CAP.pdf.85See www.farmsubsidy.org; Jack Thurston, ‘ EU boots farm subsidymillionaires by more than 20 per cent in 2009’, http://capreform.eu/2009-data-harvest/; Heather Stewart, ‘Who’s creaming off EU subsidies?’,Observer, 21 May 200686United States Department of Agriculture (USDA) Foreign AgriculturalService. http://www.fas.usda.gov/psdonline/psdQuery.aspx search onexports of ’Dairy, Dry Whole Milk Powder’.87USDA Foreign Agricultural Service. 2010. ’Cows Milk Production andConsumption: Summary For Selected Countries’.88European Court of Auditors. 2009. ‘Have the Management InstrumentsApplied to the Market in Milk and Milk products Achieved Their MainObjectives?’. Special Report No.14, para 38.89European Court of Auditors. 2009. ‘Have the Management InstrumentsApplied to the Market in Milk and Milk products Achieved Their MainObjectives?’. Special Report No.14, para 1.90EC. 2010. Report from the Commission to the European Parliamentand the Council: Third Financial report on the European Agricultural Gua-rantee Fund 2009 Financial year. Available at: http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2010:0502:FIN:EN:PDF.91Danish Ministry of Food, Agriculture and Fisheries, personal communi-cation, 4 April 2011.92Calculated as DKK 0.015 per litre milk (according to Danish Ministry ofFood, Agriculture and Fisheries, Correspondence, 4 April 2011), multipliedwith an estimation of Arla Foods’ processed Danish milk calculated in thequota year 09/10 as: � of the 4253 mill. litres milk received from Danishfarmers in 2009 and � of the 4345 mill. kg milk received from Danishfarmers in 2010 (according to Arla Foods’ financial report 2009)93Statistics Denmark, search on rev5 sitc 02222.94DKK 2.60/kg of milk powder according to Arla Foods; http://www.arla.dk/da/Arla-Forum/Spoergsmaal-svar/Arla-Foods/Virksomheden/Arlas-handelssamarbejde-med-U-lande/. Converted to US dollars at the 2009rate of 5.36 DKK/$.95Waite, R. 2011. ’CAP Reform across Europe – A view from the Euro-pean Commission’ Available at: http://www.eblex.org.uk/documents/con-tent/publications/nc_roger_waite_eu_commission_view_of_cap-2011_04.pdf.96See von Witzke, H. et al. 2010. ‘Decoupled Payments to EU Farmers,Production and Trade: An Economic Analysis for Germany’, HumboldtUniversity Berlin Working Paper, Number 90/2010, which reviews otherstudies and conducts its own analysis.97De Økonomiske Råd. 2010. ’Økonomi og Miljø (Economy and Environ-ment)’, p. 465. Available at:http://www.dors.dk/graphics/Synkron-Library/Publikationer/Rapporter/Milj%F8_2010/Milj%F8%202010/Hele%20pub.pdf.

98CARE Bangladesh. 2008. ‘Pro-Poor Analysis of the Dairy Value Chain’,p. 20.99ICSTD. 2007. ‘Agricultural subsidies in the WTO ’Green Box: Anoverview of the key issues from a sustainable development viewpoint’.Available at: http://ictsd.org/downloads/2008/07/a1.pdf.100von Witzke, H. et al. 2010. ‘Decoupled Payments to EU Farmers,Production and Trade: An Economic Analysis for Germany’. HumboldtUniversity Berlin Working Paper, Number 90/2010, p. 18.101International Centre for Trade and Sustainable Development (ICTSD).2009. ‘Agricultural Subsidies in the WTO Green Box: Ensuring Coherencewith Sustainable Development Goals’, Information Note, No.16. Availableat: http://ictsd.net/downloads/2009/10/green-box-web-1.pdf.102See von Witzke, H. et al. 2010. ‘Decoupled Payments to EU Farmers,Production and Trade: An Economic Analysis for Germany’. HumboldtUniversity Berlin Working Paper, Number 90/2010, p. 22.103IFCN. 2009. Dairy Policy Impacts on Bangladesh & EU 15 DairyFarmers’ Livelihoods, p.5.; Previous studies, undertaken when the levelof export subsidies was much higher than currently - for example by theAustralian government in 2001 - showed that a halving of EU and US sub-sidised dairy exports would cause world prices to rise by between 17 and35 per cent. Oxfam. 2002. ‘Milking the CAP: How Europe’s Dairy Regimeis Devastating Livelihoods in the Developing World’. Oxfam Briefing Paper,34. Available at: http://www.oxfam.org.uk/resources/policy/trade/down-loads/bp34_cap.pdf, p. 16.104IFCN. 2009. Dairy Policy Impacts on Bangladesh & EU 15 DairyFarmers’ Livelihoods, p.5.105Agritrade. 2010. ‘Farm-gate milk prices lag behind rising dairy com-modity prices’, Agritrade News Update, May. Available at: http://agritrade.cta.int/en/Commodities/Dairy-sector.106European Court of Auditors. 2009. ‘Have the Management Instru-ments Applied to the Market in Milk and Milk products Achieved TheirMain Objectives?’. Special Report No.14, para 71.107von Witzke, H. et al. 2010. ‘Decoupled Payments to EU Farmers,Production and Trade: An Economic Analysis for Germany’. HumboldtUniversity Berlin Working Paper, Number 90/2010, p. 18.108European Court of Auditors. 2009. ‘Have the management instru-ments applied to the market in milk and milk products achieved their mainobjectives?’. Special Report no. 14.109Matthews, A. ‘Developing country impacts of the next CAP reform’,CAP Reform Blog, 5 February 201. Available at: http://capreform.eu/developing-country-impacts-of-the-next-cap-reform.110EC Directorate-General for Agriculture and Rural Development. 2010.‘EU Farm Economics Overview: Farm Accountancy Data Network 2007’.Available at; http://ec.europa.eu/agriculture/rica/pdf/report_2007.pdf.111Office of the United Nations High Commissioner for Human Rights.2011. The Common Agricultural Policy towards 2020: The Role of theEuropean Union in Supporting the Realization of the Right to Food,Comments and Recommendations by the United Nations Special Rap-porteur on the Right to Food, p. 3-4.112When nothing else is stated, British pounds are converted to Euro atthe rate of 1,18 GBP/€, calculated based on average of exchange rates2010 according to OECD Financial Indicators (MEI): Exchange Rates(http://stats.oecd.org/Index.aspx?DataSetCode=MEI_FIN).113Agritrade. 2011. ‘Farm-gate milk prices lag behind rising dairy com-modity prices’, Agritrade News Update, May. Available at: http://agritrade.cta.int/en/Commodities/Dairy-sector

114Hemme, Torsten & Uddin Mohammad Mohi, 2009, ‘Dairy PolicyImpacts on Bangladesh & EU 15 dairy farmers livelihoods: Dairy CaseStudy’, International Farm Comparison Network115Agritrade. 2011. ‘Farm-gate milk prices lag behind rising dairy com-modity prices’, Agritrade News Update, May. Available at: http://agritrade.cta.int/en/Commodities/Dairy-sector116Agritrade. 2011. ‘Farm-gate milk prices lag behind rising dairy com-modity prices’, Agritrade News Update, May. Available at: http://agritrade.cta.int/en/Commodities/Dairy-sector117EU delegation to Bangladesh. n.d. ‘Food security projects’. Availableat: http://www.eudelbangladesh.org/en/projects/foodsecurity_projects.htm#6.118FAO. n.d. Bangladesh Country Profile. Available at: http://www.fao.org/countries/55528/en/bgd/.; According to the National Food Policy,increasing production in the livestock and fisheries sub-sectors is conside-red as one of the important frontiers towards augmenting overall food pro-duction in the country, ensuring food security as well as foreign exchangeearnings: Ministry of Food and Disaster Management. 2006. ‘NationalFood Policy’. Available at: http://www.nfpcsp.org/agridrupal/sites/default/files/National_Food_Policy_2006_English_Version.pdf.119DANIDA. 2011. ’DANIDA Årsberetning 2010’, p. 113. Availableat: http://www.netpublikationer.dk/um/11063/pdf/Danidas_aarsberet-ning_2010.pdf.120Haque, S.A. 2007. Lessons Learned Study: Bangladesh – Smallhol-der Milk Producers, Nutrition, Incomes, Jobs. Rome: FAO.121Ministry of Foreign Affairs of Denmark. 2005. ’BANGLADESH-DEN-MARK PARTNERSHIP Strategy for development cooperation 2005-2009’.Copenhagen: Government of Denmark, p.20f. Available at: http://www.netpublikationer.dk/um/5751/pdf/87-7667-263-8.pdf.122Ministry of Foreign Affairs of Denmark. 2004. ’På bistandsområdet erDanmark ikke en småstat’. Available at: http://www.afghanistan.um.dk/NR/rdonlyres/AF83FFFB-93BF-422B-8A33-E728FF92FEC0/0/CarstenIn-terviewdoc.PDF.123‘IFC Loan Helps PRAN Group Expand, Contributing to Food Securityin Bangladesh’, IFC Press Release, 22 June 2011. Available at: http://www.ifc.org/ifcext/media.nsf/content/SelectedPressRelease?OpenDocument&UNID=E1CB9B548A0AB4FC852578B70052A0D9.124EC. 2010. ‘The Common Agricultural Policy alter 2013 – Publicdebate: Executive Summary of Contributions’, p.4. Available at: http://ec.europa.eu/agriculture/cap-post-2013/debate/report/executive-summa-ry_en.pdf.125EC. 2010. ‘The CAP towards 2020: Meeting the food, natural resour-ces and territorial challenges of the future’. Available at: http://ec.europa.eu/agriculture/cap-post-2013/communication/com2010-672_en.pdf.126http://farmsubsidy.org, personal communication, 16 May 2011, Da-nish dairy farmer Bøje Pedersen received € 588,616 in 2010.127Landbrugsrådgivning på Fyn, http://www.fsps.dk/artikler/driftsana-lyse2003-2004/fire_typer.htm#eksempel. The example is based on 2006forecasts, and sums are converted from DKK at the 2006 conversion rateof DKK 5.94 DKK/$1128Ministry of Food, Agriculture and Fisheries, 2011. ’245,4 mio. kr. ihandyrpræmier’. Available at: http://ferv.fvm.dk/Default.aspx?ID=17142&M=News&NewsID=8193.129Ministry of Food, Agriculture and Fisheries, personal correspondence,4 April 2011.130These tables are based the model developed in von Witzke, H. et