Europaudvalget 2011-12

EUU Alm.del Bilag 500

Offentligt

EIB LENDING PRIORITIES ASSOCIATED WITH A CAPITAL INCREASEA joint European Commission and European Investment Bank report to the European Council

Context and Principles for EIB interventionWhen the financial crisis struck the EU in the second half of 2008, at the request ofthe ECOFIN Council, the EIB contributed to the EU economic recovery plan with asignificant but temporary increase in its financing activity in 2009 and 2010. For theEIB to continue to play a countercyclical role in support of long-term growth, it isnecessary to strengthen its capital and financial flexibility. It is proposed that thecapital of the EIB be increased by EUR 10bn, which should allow the EIB toprovide up to EUR 60bn of additional financing in the next few years. Fromshareholders’ perspective a decision to increase the capital of the EIB should beseen from a “value for money” perspective. In other words what does the EIB offerfor the 10bn of capital support provided by its shareholders? Answering thisquestion is the purpose of this note.Before heading into the discussion of where and how additional lending would betargeted it is important to reaffirm that the increased activity should notcompromise the EIB’s fundamental AAA-based business model of financinglonger-term growth-enhancing capital supporting Europe 2020 Strategy. Theheavy reliance of the EIB for attractive funding on the capital markets would be putat risk if sound investment approach and sound banking are compromised. Hence,it is essential that all projects entering the Bank’s portfolio are of high quality interms of economic viability, policy support and credit risk profile. While EIB has acountercyclical role to play and is ready to do all it can to support growth and jobsat this difficult moment, the EIB cannot be seen as and should not become a crisis-management tool, nor a bailing-out instrument. By maintaining access toattractively priced long-term financing for robust projects, the EIB will contribute tothe effective implementation of structural reforms and fiscal consolidation atMember States level.EIB will maintain a sectoral approach to its operations in line with Europe 2020objectives, but given the widely different economic and financial conditionsthroughout the European Union, the EIB will develop in cooperation with MemberStates strategies that are properly tuned to regional and local circumstances. Thisis essential to ensure the maximum growth and job impact of EIB intervention.While the EIB has different valuable opportunities to expand its financing activity,available means will remain limited. It is therefore important for the EIB to developits catalytic role and foster cooperation with other providers of finance (nationalpromotional institutions and sovereign wealth funds, among others). Pooling

1

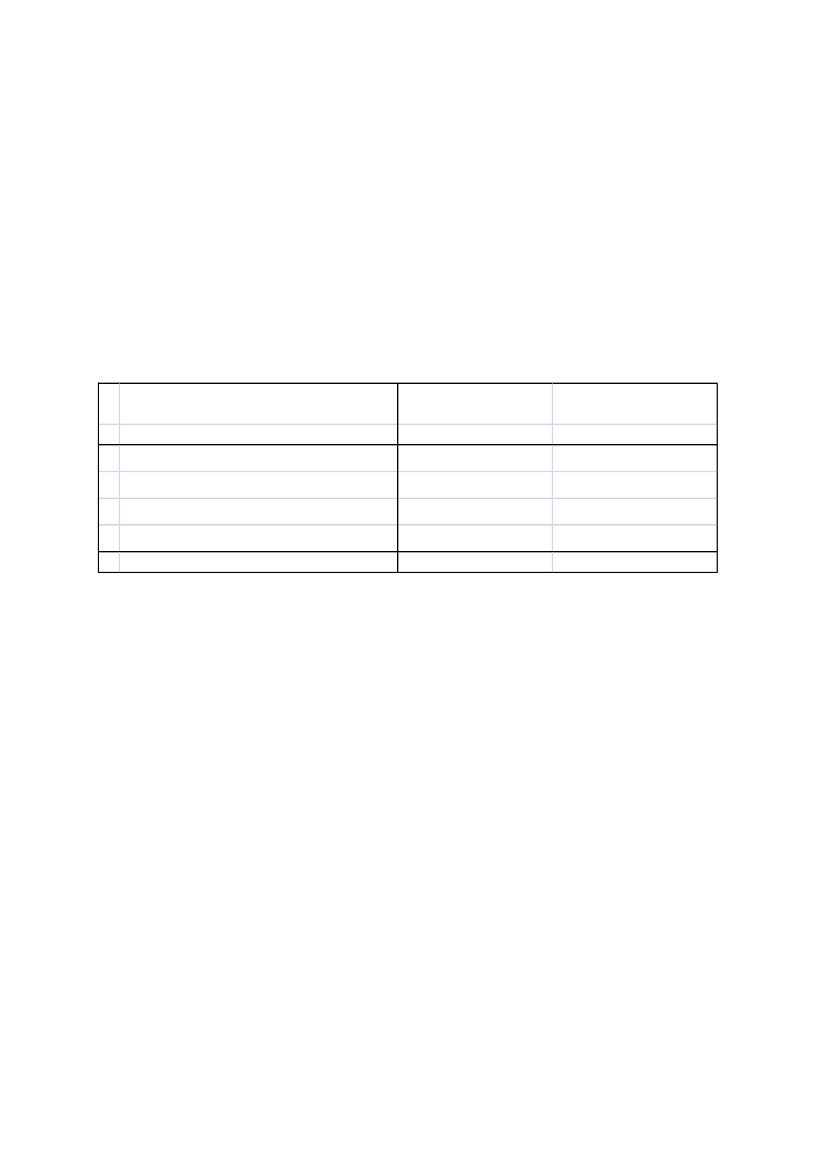

resources with other financial partners will enlarge the means available to supportinvestment in the real economy in the European Union.An EIB Growth and Employment FacilityThe capital increase would target four focal areas for additional EIB action andwould provide up to EUR 60 billion of additional financing covering all MemberStates including support to less developed regions in accordance with Article 309of the Treaty. Within the overall lending objective to boost growth and jobs, the EIBwould respond to the requirements of each of the focal areas so as to obtain thelargest impacts on the EU economy. The table below summarizes the indicativeEIB financing volumes that are considered. The EIB Growth and EmploymentFacility would be additional to the current EIB lending plans of about EUR 50bnper year.€ billion1 EU Innovation and skills initiative2 EU SME Access to finance initiative3 EU Resource efficiency initiative4 EU Strategic infrastructure initiativeTotalAdditional EIB loansover 3-4 years10-1510-1515-2010-15up to 60Additionalinvestmentsover 3-4 yearsup to 40up to 40up to 50up to 50up to 180

TheEU Innovation and Skills Initiativewould target high technology industries,including the areas of key enabling technologies, life sciences (pharmaceutical,biotechnology and medical technology), clean vehicles, green energy equipmentas well as communications and semiconductors. Investment in research andinnovation is essential for maintaining and expanding job opportunities and thecompetitiveness of the European Union. At a time of high and risingunemployment, especially among younger people, support for training andeducation to facilitate return to employment and for educational and trainingfacilities to improve Europe’s human capital would also be targeted.At a time when the European banking sector is under severe difficulties, firms mostreliant on banks are more and more at risk. Transitory liquidity difficulties canquickly translate into broader problems, putting a larger number of workers out ofwork and destroying a valuable capital stock. A permanent reduction of the growthpotential of the European economy would result. In order to support theemployment potential of European enterprises, including though their internationaldevelopment, theEU SME Access to Finance Initiativewould aim to maintainaccess to finance for solvent SMEs and Mid-Caps, including via a widening ofcounterparts for EIB lending and an expansion of EIF support.TheEU Resource Efficiency Initiativewould target the environment, e.g. waterand waste-management, agro-industries and bio-based products, climate changeand renewable energies, especially innovative wind power, as well as theinfrastructure and equipment required to connect new generation capacities to the2

transmission grid. In addition, the initiative would also support financing for energyefficiency improvements (renovation of the existing capital base) and adaptation ofinnovation to reduce energy and resource consumption (“smart” meters and grids).TheEU Strategic Infrastructure Initiativewould target the development andexpansion of modern broadband networks, for both comprehensive coverage aswell as high-speed access. In addition the initiative would also focus on themissing links in cross-border transport systems and improvement of inter-modaltransport networks, two sectors that have particularly suffered from the financialcrisis. It will also focus on energy transmission infrastructure with cross-borderimpact, which are essential to improve Europe’s security of supply and enableEurope to meet its 2020 energy and climate change targets. These and otherinternational links are all critical for the long-term improvement of the growthpotential and competitiveness of Europe.In addition, lack of finance is only one potential barrier to investment in manyplaces in the European Union. Poor administrative and project managementcapacity often delay investment implementation. Tackling these constraints offerspotentially large pay-offs in terms of jobs. EIB is ready to expand further itsprovision oftechnical and financial advice,an efficient means to help projectdelivery and speed up disbursements and real investment. Technical and financialadvice increases the absorption capacity of Structural Funds in the Member Statesand supports a faster and more effective use of Structural Funds, boosting jobsand growth.Cooperation with EU budgetIn recent years the Commission and the EIB have developed a number of jointfinancial instruments where EIB Group financing is blended with risk-sharing EUbudgetary resources. Joint financial instruments are either supported by theMember States within Structural Funds co-financed programmes or by central EUbudgetary resources. This could be developed further, already under the currentMultiannual Financial Framework (MFF), supporting the financing capacity of theEIB and/or the EIF.The development of additional joint risk sharing instruments funded by thecentrally managed EU budget is constrained by the limited amount of available(unspent) EU resources in the current MFF, while they will benefit from increasedfocus in the next MFF. Additionalrisk sharing instruments supported throughStructural Funds co-financed programmescould leverage EIB lending andallow EIB support higher risk – higher value added activities, notably in countriesencountering difficulties.

3