Erhvervs-, Vækst- og Eksportudvalget 2011-12

ERU Alm.del Bilag 362

Offentligt

NOTE

14 September 2012

/cst-ekf

Danish comments to the draft Communication on short-termexport credit insuranceDenmark welcomes the new draft Communication, which we believe inmany ways accommodates the challenges Member States have experi-ence under the current Communication. However, Denmark is still con-cerned that the new Communication, if the current draft remains un-changed, will not eliminate some important issues associated with theexisting Communication and the Temporary Framework1.In the following, Denmark will first give some overall comments to thedraft Communication, followed by some concrete technical drafting pro-posals to the text.With regard to the Danish translation of the current draft, we have notedsome linguistic errors. Denmark stands ready to comment on the transla-tions in the final version of the Communication.DEMARCATION LINE FOR MARKETABLE RISKS

The demarcation of marketable risks presented in the draft Communica-tion does not correctly reflect the market reality faced by European ex-porters at this point in time, where the financial markets are weak andprivate market players are risk adverse.It is inconsistent that the draft Communication on the one hand identifiesthat a market gap for credits between 180 days and two years exists; goeson to specify a set of minimum conditions for the provision of cover forcredits between 180 days and two years, including minimum premiumsset above private market prices; but then concludes, on the other hand,that these risks are generally marketable, and requires prior demonstra-tion of “temporary non-marketability” in individual Member States.As stated in §4, one of the aims of the draft Communication is to “createa level-playing field among exporters”. Denmark fully supports minimumconditions as a mean to achieve a level-playing field. However combin-ing minimum conditions with a system that builds on individual evidencefrom the Member States is self-contradictory.1

OJ C 16, 22.01.2009

2/11

A system of individual notifications, where Member States must provenon-marketability would lead to excessive bureaucracy and added ex-pense for all parties involved. And this is especially so, when it has al-ready been concluded in the draft Communication that these risks arenon-marketable.Denmark proposes a demarcation line of non-marketability at 180 days.However, we recognise that markets change, and in order to meet thegoal of not distorting competition, we can support a demarcation line of 2years, provided that ex post reporting will replace ex ante notification.Ex ante notification should only be required when a Member State wishesto use a different set of conditions for cover other than the minimumstandards specified in the draft Communication. This approach would bein line with other EU state aid legislation, e.g. the “Commission Noticeon the application of Articles 87 and 88 of the EC Treaty to State aid inthe form of guarantees”2, which sets up a framework for conditions anddemands ex ante notifications, should these conditions not be met.ENSURING COMPETITIVE CONDITIONS FOR EUROPEAN

EXPORTERS

Denmark is concerned that the current draft Communication does notsufficiently consider the needs of European exporters in a global tradeperspective.A vast part of the European enterprises are relatively small and need sim-ple and practicable instruments to facilitate trade on a global scale. If thesystems become too obscure and bureaucratic, exporters are more likelyto just stop their trade3. In the present economic situation this is not desir-able and emphasises the need to underline the trade perspective in theCommunication.As the draft Communication also recognises, credit periods above 180days for single risk transactions cannot generally be considered market-able. Cover for credits between 180 days and 2 years are not regarded ascore business for the private operators. The product requiring single riskcredits between 180 days – 2 years are anomalies in the ST market anduntil that changes availability of cover is too uncertain. This leaves EUexporters with a financing gap and thus with a competitive disadvantagevis-à-vis non EU exporters.In the Danish market, whether a transaction is considered marketable isdecided by the type of transaction and the credit period. The Danish pri-

OJ C155, 20.6.2008, p.10This was, for example, brought forward at the short term workshop in Berlin this June“Perspektiven der Absicherung kurzfristiger Exportgeschäfte – Auswirkungen der ans-tehenden EU-Kommissionsmitteilung”3

2

3/11

vate insurance market – which is considered highly competitive4, andtherefore a good yardstick in a European context – covers an exporter’sportfolio of repetitive deliveries usually with credit terms of 30-90 daysand occasionally up to 180 days, while EKF covers exports of singletransactions to single buyers.Denmark recognizes that the current draft simplifies how ECAs can stepinto the market for credits between 180 days and 2 years. However, thiswill not lead to a level playing field between--EU exporters (since notifications are only valid for the notifyingcountry).EU exporters vs. non-EU exporters (since non-EU exporters canobtain cover from non-EU ECAs for credits between 0 days and 2years without time delays due to notification-procedures).

The draft Communication’s strong focus on ensuring a level playing fieldfor the private credit insurers vis-à-vis the public credit insurers comes atthe expense of the European exporters.

TECHNICAL PROPOSALS

In order to obtain a more balanced approach Denmark has below pro-vided some concrete text proposals to the draft communication as well assome technical comments. These points follow the structure of the draftCommunication.DEFINITIONS (2.2)1. §9: The definition of “co-insurance”. As it stands in the currentdraft, the term seems to refer to “the uninsured portion”. “The un-insured portion” indicates the share of risk retained by the insured.The term “co-insurance” appears again in §24, where it does notcorrespond with the definition in §9. In §24 it rather refers to atype of reinsurance. As such, Denmark proposes to delete the defi-nition of “co-insurance”, and replace it with a definition of “quota-share” (see below)2. §9: The definition of “credit period” should specify that exportersnot only grant export credit to buyers, but banks do as well. Den-mark proposes the following wording:Marsh Report: “Do Danish SMEs exporting goods with credit terms between sixmonths and two years within OECD/EU have access to sufficient coverage from theprivate credit insurance market?”, January 2011

4

4/11

(i)

“Credit period”: The period of time the insured creditor ex-porter gives to the buyer to pay for the delivered goods.

3. §9: The definition of “export credit insurance” needs to be furtherclarified. At the moment it is uncertain whether Letters of Credit(L/Cs) are included in the scope of the draft Communication.The present definition of “Commercial risks” (as used in the defi-nition of “export credit insurance”) appears to concern solely thetraditional relationships between exporter and buyer, and does notconsider the risk of default of an issuer of irrevocable L/Cs. Guar-antees for L/Cs are generally not an area of business for the privateinsurers, and during the financial crisis, the need for public insur-ance of L/Cs has become particularly evident. It should be madeexplicit in the future definition of “export credit insurance” thatcover for L/Cs is not included.Furthermore, it should also be made clearer that the “trade transac-tion” in question should involve exports. Denmark proposes thefollowing wording:(i)“Export credit insurance”: an insurance product wherebythe insurer takes over the commercial and/or political risk,as defined in the Communication, of protracted default, in-solvency or bankruptcy of the buyer in an export tradetransaction. For the purpose of this Communication, com-mercial risks covered by irrevocable letters of credit are notincluded.

4. §9: The draft Communication lacks a definition of reinsurance inits standard form of “quota-share” as opposed to the reinsurancedealt with in §12f. Quota-share refers to cases where the insurer,for example, transfers 90% of its liability and premiums on everyrisk to the reinsurer, who must pay 90% of any loss sustained.Denmark proposes the following definition of “quota-share” basedon the EKF reinsurance model:(i)“Quota-share”: Automatic reinsurance that requires the in-surer to transfer, and the reinsurer to accept, a given per-centage of every risk within a defined category of businesswritten by the insurer.

As an alternative, ICISA uses the term “proportional reinsurance”,which could also be applied:

5/11

(i)

“Proportional reinsurance”:Proportional Reinsurancemeans that the Primary insurer and Reinsurer share liabili-ties (i.e. sums insured) in a clearly defined proportion asdescribed within the underlying treaty. Premiums andclaims are also split up according to the respective share ofthe risk (i.e. proportionally).

EXCEPTIONS TO THE DEFINITION OF MARKETABLE RISKS(4.2)5. §18c: To fulfil the aims of the draft Communication (not distortingcompetition in the private market and ensuring a level playing field forexporters), state provision of single risk cover in so far as the statedconditions (premium levels, quality of cover and underwriting princi-ples) are met, should be allowed. Member States should inform theCommission and other Member States if this option is used within[one] month of its implementation. If a Member State wishes to pro-vide other conditions better than those stated in this Communication,this should be notified ex ante to the Commission.Denmark therefore proposes the following changes to the text:(i)§18: Notwithstanding the definition of marketable risks, com-mercial and political risks incurred on debtors established inthe countries listed in the annex, are considered non market-able: in the following situations:(a): in the situation that f the Commission decides to temporar-ily remove one or several countries from the list of marketablerisk countries defined in the annex by means of the mechanismdescribed in section 5.2, because the capacity of the private in-surance market in any of those countries is insufficient to coverall economically justifiable risks(b): if the Commission, on being notified by a Member State,decides that in the case that a Member State offers cover forthe risks incurred by small and medium-sized enterprises fal-ling within the relevant EU definition and having a total annualexport turnover not exceeding EUR 2 million under the condi-tions identified in section 4.3 and provided that the Commis-sion is informed of the scheme within one month of implemen-

6/11

tation in the Member State, are temporarily non-marketable inthe Member State concerned.(c): if the Commission, on being notified by a Member State,decides that the in the case that a Member State offers coverfor single risks cover with a credit period of between 1810days and two years risks under the conditions identified in sec-tion 4.3 and provided that the Commission is informed of thescheme within one month of implementation in the MemberState, are temporarily non-marketable in the Member Stateconcerned.(d): if the Commission on being notified by a Member State,decides that due to other factors, related in particularly to thesupply conditions of export credit insurance, certain risks aretemporarily non-marketable in the Member State concerned.(ii)§29: The risks specified in point 18(a), (b) and (c) can be cov-ered by export credit insurers operating for the account of orguaranteed by the State, subject to the conditions specified insection 4.3. In such cases the Commission does not have to benotified.§30: The risks specified in point 18(b), (c) and (d) can be cov-ered by export credit insurers operating for the account of orguaranteed by the State, subject to the conditions specified insection 4.3 and following notification to and approval by theCommission.5.3 Notification for exceptions in point 18(b) and (c) Proce-dural clarifications for exceptions in point 18 (b) and (c)§38: In the cases specified in points 18(b) and (c), the evidencecurrently available to the Commission suggests that there is amarket gap and that those risks are therefore non-marketable. Itmust be borne in mind that the extent of the market gap lack ofcover does not exist may vary in every Member States and thatthe situation could change over time, as the private sectormight become interested in this segment of the market. Stateintervention should only be allowed for risks which the marketwould otherwise not cover.

(iii)

(iv)

(v)

7/11

(vi)

§39: For these reasons, when a Member States wants to coverthe risks specified in point 18 (b) or (c), it may only do so un-der the conditions identified in section 4.3 and by informingthe Commission of its decision to do so within 1 month of im-plementation. If a Member State wishes to apply conditionsother than those identified in section 4.3 it must notify its intentto the Commission and it must demonstrate in its notificationthat it has contacted two major insurers in its country and giventhem an opportunity to provide evidence that cover for therisks concerned is available in the country. If the insurers con-cerned do not provide data, to the Member State or directly tothe Commission, within 30 days of receipt of request from aMember State, on the conditions of cover and insured volumesfor the type of risks the Member State wants to cover, theCommission will consider the risks unmarketable.

CONDITIONS FOR THE PROVISION OF COVER FOR EXEMPTEDMARKETABLE RISKS (4.3)6. §20 - §28: Denmark welcomes a set of specific conditions that must becomplied with when exempted marketable risks are covered. However,since these conditions are set at a level, to ensure that public ECAs donot crowd out the private insurers, notifications should not be neces-sary. Market developments could be followed through ex post report-ing.Instead of notifications, the focus should be on systematic reporting,which should be made publicly available. This would allow the privateinsurers to follow the business of public ECAs and possibly object,should they believe that public insurers are taking over private busi-ness.A system of reporting instead of notification would also increasetransparency and thus comparability between specific ECA transac-tions.7. §20: Denmark supports that whole turnover policies refused by privateinsurers, because they were not economically justified, should not becovered by public insurers as “single risks”. This should not mean,however, that quota-share reinsurance, where the private insurer re-tains part of the risk under new conditions, is not allowed.

8/11

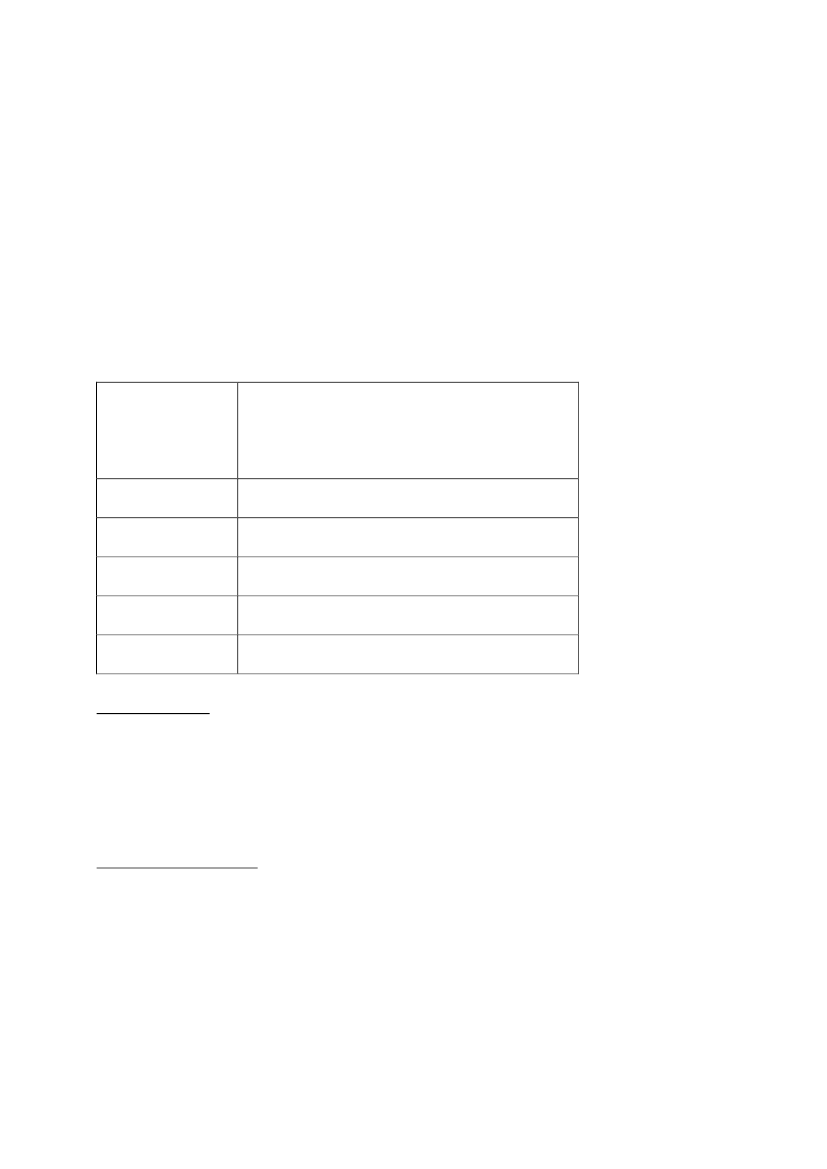

8. §23: Denmark welcomes the introduction of a fixed set of minimumpremiums. As we understand it, the ranges provided are intended forsingle risk cover as well as for whole turnover policies.Denmark is concerned that the curve from the “Excellent” risk cate-gory to the “Weak” risk category is too steep, meaning that the bestrisks are priced too low, and worst risks are priced to high. Based onthe Danish premium levels, we would suggest the following modifica-tions to the table:Risk Category

Annual Risk Premium

(Single risk cover: percentage of insured vol-ume, linear rate)(Whole turnover policies: percentage of turn-over in relevant risk period)0,5% – 0,7%0,7% – 0,8%0,8% – 1,0%1,1% – 1,4%-

Excellent

Good

Satisfactory

Weak

Bad

Single risk coverIt should be made explicit that the minimum premiums are linear ratepremiums, meaning that no compounding should be included in thecalculation of premiums for credit periods over 1 year. The premiumfor a credit period of 18 months should thus be calculated as: insuredvolume x premium rate x 1,5.Whole turnover policiesIt should be made explicit that premium ranges are percentages of thetotal turnover under the policy in the relevant risk period. That is tosay that premium ranges can be split down to the risk period in ques-tion (for a risk period of 6 months, premium ranges should be dividedby 2, etc.).In the case of whole turnover policies, a downgrading of the premiumlevels in the draft Communication to the levels suggested above wouldbe imperative. It should be noted that for export credits for wholeturnover policies, the premium is established with regard to various

9/11

inherent mitigants and not established over a full exposure, meaningthat premium levels for whole turnover policies are generally lower.The experience from the Danish reinsurance scheme clearly showsthat premium levels at 2% for the worst risks are prohibitively high. Itproved necessary to adjust this to a maximum level of 1,4%.9. It would be more appropriate to use the term “quota-share” in §24 in-stead of “co-insurance”. §24 should then read:(i)For co-insurance, direct reinsurance, quota-share and top-upcover, pricing is considered adequate if the premium chargedis at least [20%] higher than the premium for the originalcover.

10. §25: Denmark does not support an introduction of compulsory admini-stration fees. §24 states that pricing is considered adequate if the pre-mium charged is at least 20% higher than the premium for originalcover. This price-level should be considered adequate to prevent pub-lic ECAs in taking over the business of private insurers. An added ad-ministration fee would set price levels at more than 20% above privatelevels and result in prohibitive premiums. Today, a number of ECA’sas well as private insurers are not operating with administration fees,and any such fees should continue to be voluntary and fixed by the in-dividual ECA.11. §29 - §30: See point 5 (modifications to §18c)MODIFICATION OFCOUNTRIES (5.2)THELISTOFMARKETABLERISK

12. §33(a): The proposed 12 month observation period is too long andmay give a misleading result.The two indicators described in 33(a) will likely prove to be contradic-tory and give the wrong picture since both indicators (a decrease in in-sured amount and decrease in acceptance ratios) have to be met at thesame time.According to the Danish experience, a decrease in insured amountsand a decrease in acceptance ratios went hand in hand at the beginningof the financial crisis. This led to a smaller basis consisting of betterbuyers on which to measure acceptance ratios. This meant that at thesecond review of the indicators, the insured amounts were still de-

10/11

creasing but acceptance ratios were increasing. In conclusion, if bothindicators in 33(a) have to be met at the same point in time in a 12month period, the conclusion drawn might incorrectly be that marketsare performing better.A 12 month period is not suitable when taking into consideration thatthe vast part of ST credit terms are less than 6 months. It should betaken into consideration that the current financial crisis has lasted al-most 5 years.Discussions with the private insurers have revealed that the reductionsin acceptance ratios witnessed in the beginning of the crisis were toosevere and based on decisions influenced by panic more than rationale.In the future, decreases of the same magnitude are not likely to be ob-served.Based on Denmark’s experience under the on-going crisis, the levelsof decrease suggested in the draft Communication are simply too high.Denmark proposes a decrease in insured amounts and acceptance ra-tios to the following:(i)“Contraction of private credit insurance capacity: in particular,the withdrawal of a major international insurer from a specificmarket, a significant decrease (of more than 10%) in total in-sured amounts* and a significant decrease (of between 10%and 12%) in acceptance ratios** for a market detected in oneMember State.* Insured amounts observed in the latest quarter should becompared with an average of at least 2 to 3 non-crisis years forthat same market.** Acceptance ratios observed in the latest quarter should becompared with an average of at least 2 to 3 non-crisis years forthat same market.

13. §31: 5 Countries are excessive. Instead request from 3 countriesshould suffice.

14. §36: The validity of insurance policies signed during the period acountry is considered non-marketable should be 6 months instead of90 days.

11/11

15. §38 - §39: See point 5 (modifications to §18c)ANNEXIt should be specifically stated whether EU “grey zone” countries such asMonaco, the Faroe Islands and others are within the scope of the draftCommunication.