Erhvervs-, Vækst- og Eksportudvalget 2011-12, Transportudvalget 2011-12

ERU Alm.del Bilag 270, TRU Alm.del Bilag 343

Offentligt

1

DFDS VIRKSOMHEDSBESØGFOLKETINGETSERHVERVSUDVALG &TRAFIKUDVALG

May 23, 2012

AGENDA

• Introduction to DFDS• Reasons for our success• The low sulphur challenge• Q&A

22

DFDS OVERVIEW

• DFDS founded 1866 byC. F. Tietgen• DFDS integrates sea andland transport services• DFDS operates NorthernEurope’s largestintegrated shipping andlogistics network

DFDS GROUPDFDS SEAWAYSSHIPPING DIVISIONRevenue 2011:DKK 7.5bn

DFDS LOGISTICSLOGISTICS DIVISIONRevenue 2011:DKK 4.5bn

The Logistics Division is a Top 3 customerof the Shipping DivisionShareholder structure:Lauritzen Foundation: 36%A. P. Moller - Maersk: 31%Listed on Copenhagen Stock Exchange

3

DFDS OVERVIEWVALUE PROPOSITION• DFDS operates the widest and most reliableintegratedsea transport and logistics network inEurope.• Our customers value the easy access and positiveexperience of our freight and passenger offerings.• The people of DFDS continue to deliver efficientand innovative transportation services for ourcustomers as they have done since 1866.COMPANY PROFILE• DFDS combinessea and landtransport to serveforwarders, hauliers and manufacturers of heavyindustrial goods across Northern Europe – 80% ofrevenue is generated by freight operations• DFDS transports passengers in combination withfreight – 20% of revenue is generated bypassengers• DFDS has 5,100 employees in 20 countries. Weemploy 1350 Danes of which 900 are seafarersand 450 are landbased personnel

SEA TRANSPORT – DFDS SEAWAYS4

LOGISTICS SERVICES – DFDS LOGISTICS

DFDS’ ROUTE NETWORK

DFDS -The shi ng & l st cs net orppiogi iw kEm ployees5.056Fr ght shieips38Com bined f ei and passenger shir ghtps11Passenger ships5Routes25Logi i ofist cs fces215

DFDS’ FOUR STRATEGIC PRINCIPLES1 EXPAND THE NETWORK••More services to customersMore scale and leverage of operating model

4 FOCUS••Constant focus on quality and efficiencyEfficiency and improvement projects

2 INTEGRATED SOLUTIONS••Supply chain solutions across divisions/BUCombine freight and passengers

3 SECURE VOLUMES••Own transport/logistics operations adds cargocontrolStrategic port access

6

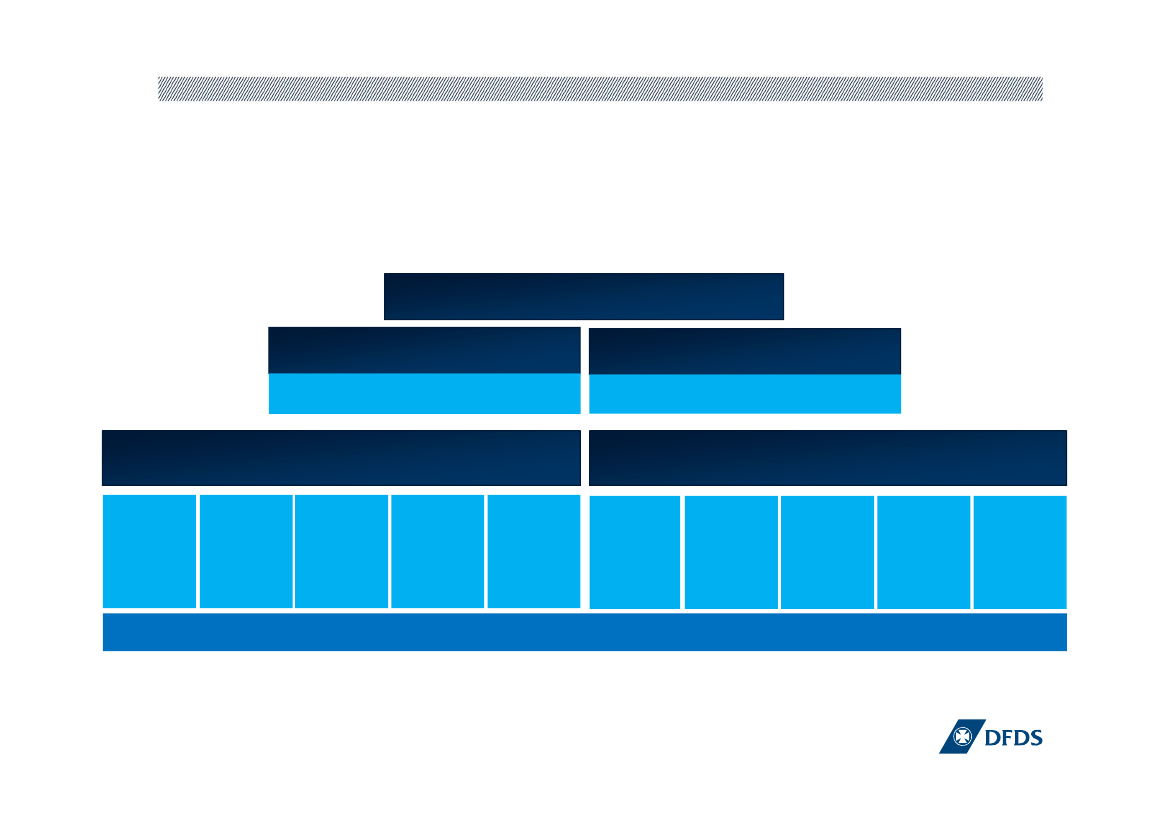

DFDS’ BUSINESS STRUCTURE

CEOPeople and ShipsHRCrewingTechnicalSupply ChainFinanceITFinance

LOGISTICS DIVISIONNordicTransportContinental EuropeanTransport ContractIntermodalNordicContractNorth Sea

SHIPPING DIVISIONBaltic SeaIrish Sea*EnglishChannelPassenger

Freight Sales Solutions

7* Irish Sea operations were closed end January 2011

SEA TRANSPORT - DFDS SEAWAYSPROFILE• Freight transport for forwarders and hauliers23%• Direct customer relations with industry• Combined passenger and freight transport• Port terminal operations13%17%47%North SeaBaltic SeaChannelPassenger

Revenue per BU, FY 2011

North Sea9 routes17 ro-ro ships1 ro-pax5 port terminalsCustomers: Hauliers,forwarders, producers ofheavy industrial goods• Lanemetres: 10.8m•••••

Baltic Sea••••8 routes9 ro-pax ships2 ro-ro shipsCustomers: Hauliers,forwarders, producers ofheavy industrial goods,passengers travelling by carand foot• Lanemetres: 3.3m• Pax: 0.4m

Channel2 routes5 ro-pax ships1 port terminalCustomers: Hauliers,forwarders, passengerstravelling by car• Lanemetres: 7.0m• Pax: 2.5m••••

Passenger3 routes4 passenger ships1 ro-pax ship1 port terminalCustomers: passengerstravelling by car, mini cruise,conferences, hauliers,forwarders• Lanemetres: 0.6m• Pax: 1.4m•••••

8

IMMINGHAM TERMINAL

LOGISTICS SERVICES - DFDS LOGISTICSPROFILE• Trailer operations supporting route network• Contract logistics & contract management• Intermodal solutions & paper logisticsRevenue per BU, FY 2011

10% 14%25%32%19%

Nordic TransportContinental TransportEuropean ContractIntermodalNordic Contract

NordicTransport

ContinentalTransport

EuropeanContract• Main activities:UK/Ireland domestic,UK-Cont, Belfast retail,Seafood distribution,warehousing• 750 trailers, 70 tractorunits• Customer segments:Temperature controlled,seafood

Intermodal

Nordic Contract

• Main traffics: S-UK, DK- • Main traffics: NL-UK, B-UK, full/part loadUK, B-S, full/part load• 800 trailers• 1,800 trailers, 100• Customer segments:tractor unitsIndustrials, automotive, • Customer segments:consumer goodsHigh value goods, partload, temperaturecontrolled10

• Container: N-Cont,• Sideport: N-IRL, N-Ireland-ContUK/Cont, N-• Rail: Nordic-I, UK-I,UK/Cont/Spainwarehousing• 5 sideport ships• 4 container ships, 4,000 • Customer segments:containers, 1,000 swaps Paper industry• Customers segments:Trading companies,contract management,paper industry

DFDS – RECENT MILESTONES2011A clear path of continuous improvements, valuecreation and network expansion, in order toserve our customers more effectively• Integration ofNorfolklinecontinuing• Exit from Irish Seacompleted by close-down of two routesand sale/circulationof ships• Sale of non-coreasset, DFDS CanalTours, terminal inMaasvlakte &Norwegianchartering• Project LightCrossing• BSL acquired• Bid submitted forSeafrance

2010• Thoroughintegration planning• Acquisition ofNorfolklinecompleted July• Integration initiated• Synergies upgraded• Project Headlight –turnaround ofLogistics• Sale of two Irishroutes• Result among bestin sector

200920082007• New CEO• New strategy• New transparentbusiness structureRevenue 2006:EUR 1.0bnPTP: EUR 54m11

• Go Forward Plan –group wideimprovement andefficiency plan• Project Lighthouse– turnaround ofPassenger• Adapation tomarket downturninitiated• Implementationenvironmental plan

• Continuedadapation tomarket downturn• Project Lightship –more efficient shipoperations• New CFO• Acquisition ofNorfolklineannounced• Result among bestin sector

+60%+85%

Revenue 2011:EUR 1.6bnPTP: EUR 100m

AN IMPORTANT ACQUISITIONDFDSKey operationalEmployeesVesselsRoutesPort terminalsLogistics officesWarehousesPassengers, thsLanemetres, ths3.924492381301.7009.2002.25016105263

Norfolkline

Combined6.174633112

133984.60025.200

82.90016.000

Note 1: Adjusted for two vessels chartered out to Norfolkline by DFDSNote 2: Adjusted for two routes out of Esbjerg via a space charter agreement between DFDS and NorfolklineNote 3: Not including six external offices with employees from Norfolkline permanently located at customers’ premises

12

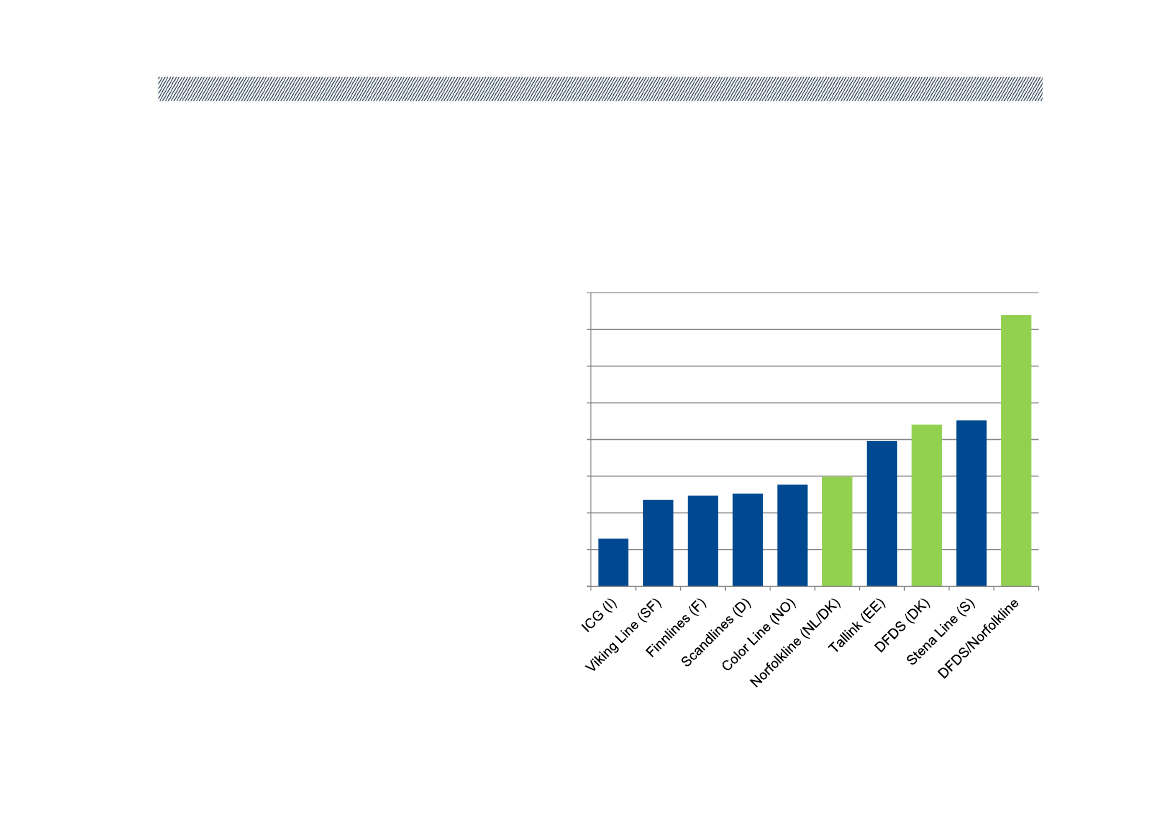

DFDS IS NEW MARKET LEADER INNORTHERN EUROPERevenue 2009: Top nine North European passengerand freight shipping companies1.600

EUR mill.

Norfolkline acquisitionincreases DFDS' revenuesby almost 70% on pro forma2009 figures

1.4001.2001.000800600400

Consolidated pro forma 2009revenues for DFDS andNorfolkline was DKK 11.0billion (EUR 1.5 bill.)13

2000

Note: Revenue for P&O Ferries and Cobelfret is not accessible. P&OFerries’ and Cobelfret’s revenues are estimated to be among the tenlargest passenger and freight shipping companies in Northern Europe.

THREE MAIN REASONS FOR THE DFDS SUCCESS1. Relevant strategy, hard work, track record and some luck2. Good and stabile “Rammebetingelser” for the industrya) Constructive dialogue between politicians and industryb) Jointly high ambitionsc) Competitive DIS/Tonnage tax3. Support from shareholders and banks,

Continued investments, growth and expansion:• Baltic Line, Alvsborg Terminal, Seafrance, reflagging Swedish shipsto Danish flag1414

MAXIMUM PERMITTED SULPHUR CONTENT INBUNKERS5,0IMO ANNEX VI4,54,03,5Sulphur content, %3,02,52,01,51,00,50,02009juli 2010SECAGlobalt201220152020

15

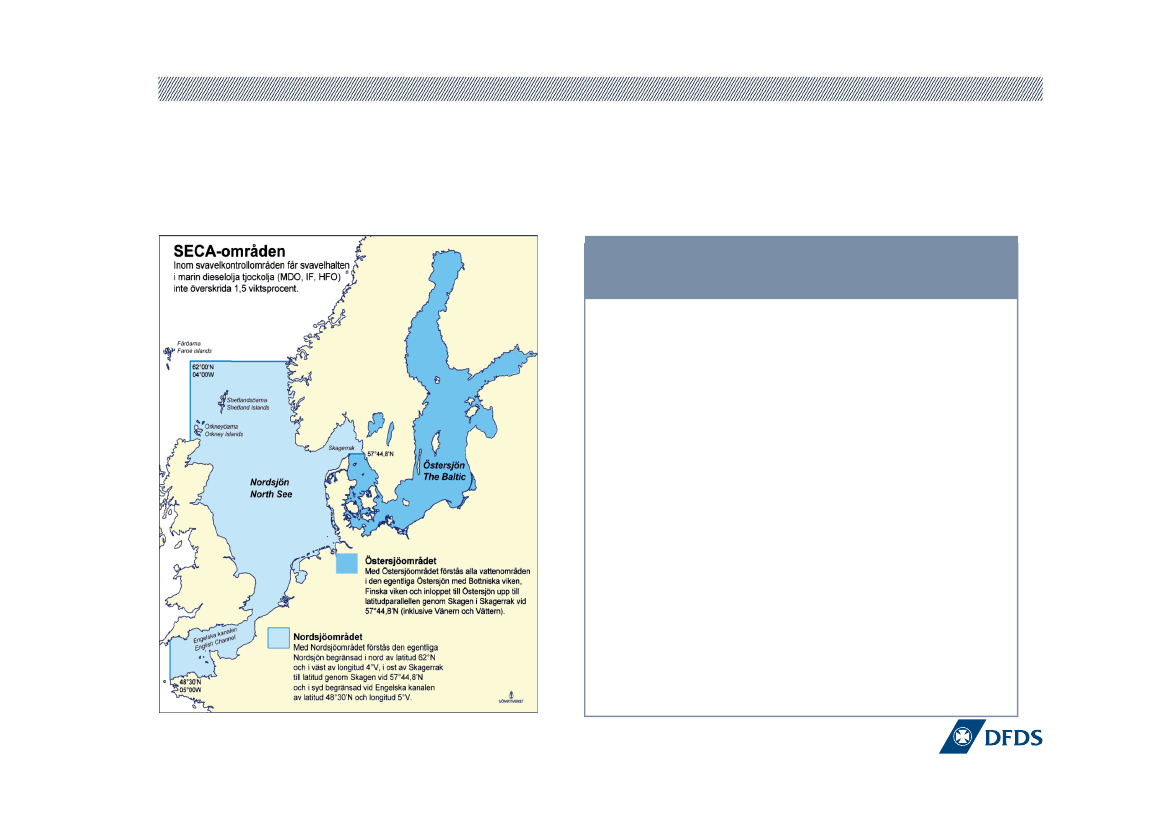

SECA. Sulphur Emission Control Areas

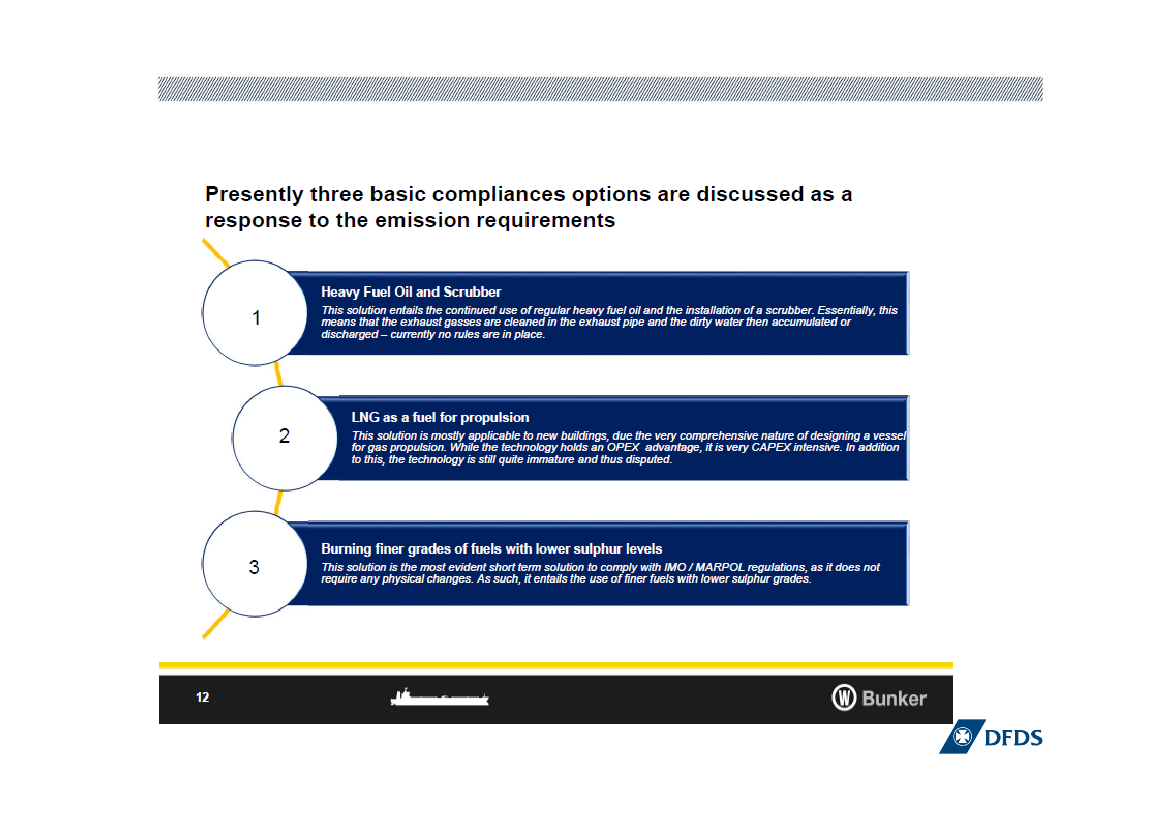

WHY IS 0,1 % IN 2015 A PROBLEM TO SHIPPING ANDTHE INDUSTRY IN NORTHEN EUROPE?Due to concerns on:Highprice of Marine Gas Oil(MGO)40-50% moreexpensiveAvailabilityof sameModalbackshift (from Water toLand, Road, and Rail)Lossof competitiveness byindustries in the ECA areasInabilityto pass on the costincrease of the bunker16Tokyo Bay is anticipated to invoke an ECA zoneEntire North America becomes an ECA in 2012

Immatureabatementtechnologies

HOW DOES THE BUNKER INDUSTRY VIEW THE SITUATION?

17

FICARIA SEAWAYSTHE WORLD’S LARGEST SCRUBBER ON A SHIP

3 years joint development betweenAalborg Boilers, MAN and DFDS, started in 2009

19

SECA. Sulphur Emission Control Areas

SCRUBBER INSTALLATIONON FICARIA SEAWAYS

IMPACT OF 0.1% SULPHUR IN 2015• We support a reduction in sulphur content, however in a pragmatic approach. Giventhe options today we and the short sea shipping industry have a huge challenge• DFDS annual bunker cost today is DKK 1.900 mio. and a cost increase for MGO of40% will increase the annual cost by DKK 760 mio. equal to entire pretax profit in2011• If we try and push say a 1/3 of extra cost to the customers, we will see a modal shiftback to the roads (where this is an option) and still have an extra cost of DKK 500mio.• The technology is under way but still a number of issues (not suitable for all ships,age, space, weight constraints) and legislative issues remain (open/closed loop,waste products etc)• Limited impact of our dialogue with EU/IMO and politicians during the past 3 years2020and the industry is deeply concerned over impact and consequences.

IMPACT OF 0.1% SULPHUR IN 2015•Our challenge:

• Estimated cost per installed scrubber 6 MEUR or DKK 45 mio. For 2/3 of our fleet or36 ships total investment equals DKK 1.600 mio.• What if technology does not work entirely as planned, or better solutions emerge in 3-5 years?• How do less solid companies finance this “uncertain” investment• What if exemptions are given after huge modal back shift of trucks and route closures• Little incentive in being “first mover”• We are willing to consider a offensive approach, to lead the industry in partnershipwith manufacturers and ship yards, but we need support from governments and EUon the implementation, interim solutions, legislation and funding (Example:2121MarcoPolo, T-Ten etc.)

22

Q&A