Skatteudvalget 2010-11 (1. samling)

SAU Alm.del Bilag 124

Offentligt

table of Contents –3

Table of contents

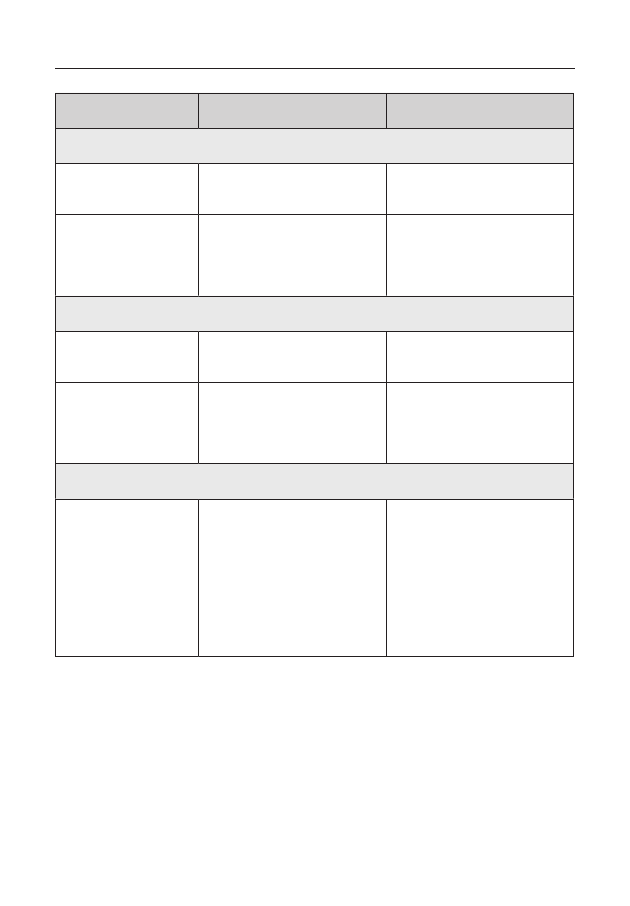

About the Global Forum� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 5Executive Summary� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 7Introduction� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �11information and methodology used for the peer review of denmark � � � � � � � � � �11overview of denmark � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 12General information on the legal system and the taxation system � � � � � � � � � � � 13recent developments � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �18Compliance with the Standards� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 19A. Availability of Information� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 19overview � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �a�1� ownership and identity information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �a�2� accounting records � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �a�3� banking information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �19204450

B. Access to Information� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 55overview � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 55b�1� Competent authority’s ability to obtain and provide information � � � � � � � � 56b�2� notification requirements and rights and safeguards� � � � � � � � � � � � � � � � � � 61C. Exchanging Information� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 63overview � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �C�1� exchange-of-information mechanisms � � � � � � � � � � � � � � � � � � � � � � � � � � � � �C�2� exchange-of-information mechanisms with all relevant partners � � � � � � � �C�3� Confidentiality � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �C�4� rights and safeguards of taxpayers and third parties� � � � � � � � � � � � � � � � � �C�5� timeliness of responses to requests for information � � � � � � � � � � � � � � � � � �636576788081

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

4– table of ContentsSummary of Determinations and Factors Underlying Recommendations� � � 87Annex 1: Jurisdiction’s Response to the Review Report� � � � � � � � � � � � � � � � � � 93Annex 2: List of All Exchange-of-Information Mechanisms in Force� � � � � � � 94Annex 3: List of all Laws, Regulations and Other Material Received� � � � � � 100Annex 4: People Interviewed During On-Site Visit� � � � � � � � � � � � � � � � � � � � � �103

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

about the Global forum –5

About the Global Forumthe Global forum on transparency and exchange of information for taxPurposes is the multilateral framework within which work in the area of taxtransparency and exchange of information is carried out by over 90 jurisdic-tions which participate in the Global forum on an equal footing�the Global forum is charged with in-depth monitoring and peer reviewof the implementation of the international standards of transparency andexchange of information for tax purposes� these standards are primarilyreflected in the 2002 oeCdModel Agreement on Exchange of Informationon Tax Mattersand its commentary, and in article 26 of the oeCdModelTax Convention on Income and on Capitaland its commentary as updated in2004, which has been incorporated in the unModel Tax Convention�the standards provide for international exchange on request of foresee-ably relevant information for the administration or enforcement of the domes-tic tax laws of a requesting party� fishing expeditions are not authorisedbut all foreseeably relevant information must be provided, including bankinformation and information held by fiduciaries, regardless of the existenceof a domestic tax interest or the application of a dual criminality standard�all members of the Global forum, as well as jurisdictions identified bythe Global forum as relevant to its work, are being reviewed� this process isundertaken in two phases� Phase 1 reviews assess the quality of jurisdictions’legal and regulatory framework for the exchange of information, while Phase 2reviews look at the practical implementation of that framework� some Globalforum members are undergoing combined – Phase 1 plus Phase 2 – reviews�the ultimate goal is to help jurisdictions to effectively implement the interna-tional standards of transparency and exchange of information for tax purposes�all review reports are published once approved by the Global forum andthey thus represent agreed Global forum reports�for more information on the work of the Global forum on transparencyand exchange of information for tax Purposes, and for copies of the pub-lished review reports, please refer towww.oecd.org/tax/transparency�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

exeCutive summary –7

Executive Summary1�this report summarises the legal and regulatory framework fortransparency and exchange of information in denmark as well as practi-cal implementation of that framework� the international standard, whichis set out in the Global forum’sTerms of Reference to Monitor and ReviewProgress Towards Transparency and Exchange of Information,is concernedwith the availability of relevant information within a jurisdiction, the compe-tent authority’s ability to gain timely access to that information, and in turn,whether that information can be effectively exchanged with its exchange ofinformation partners�2�denmark has a long history of developing the capacity and interna-tional linkages needed to engage in effective exchange of information for taxpurposes� it has an extensive network of bilateral agreements that providefor exchange of information in tax matters, currently comprising 23 taxinformation exchange agreements (tieas) and 70 double tax conventions(dtCs)� negotiation of agreements by denmark is underpinned by a strongco-operation mechanism involving denmark, the faroe islands, finland,Greenland, iceland, norway and sweden� denmark is also able to exchangeinformation with other eu member states1under theEU Council Directive1�the current eu members, covered by this Council directive, are: austria, belgium,bulgaria, Cyprus, the Czech republic, denmark, estonia, finland, france, Germany,Greece, hungary, ireland, italy, latvia, lithuania, luxembourg, malta, the netherlands,Poland, Portugal, romania, slovakia, slovenia, spain, sweden and the united kingdom�regarding Cyprus – note by turkey: the information in this document with reference to“Cyprus” relates to the southern part of the island� there is no single authority represent-ing both turkish and Greek Cypriot people on the island� turkey recognises the turkishrepublic of northern Cyprus (trnC)� until a lasting and equitable solution is foundwithin the context of the united nations, turkey shall preserve its position concerningthe “Cyprus issue”� note by all the european union member states of the oeCd andthe european Commission: the republic of Cyprus is recognised by all members of theunited nations with the exception of turkey� the information in this document relates tothe area under the effective control of the Government of the republic of Cyprus�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

8– exeCutive summary77/799/EECof 19 december 19772concerning mutual assistance by thecompetent authorities of the member states in the field of direct taxation andtaxation of insurance premiums and under theCouncil of Europe and OECDConvention on Mutual Administrative Assistance in Tax Matters�3�the 1989Nordic Mutual Assistance Convention on Mutual AdministrativeAssistance in Tax Matters,which is currently in force with respect to denmark,the faroe islands, finland, Greenland, iceland, norway and sweden, containsdetailed provisions on the exchange of information for tax purposes including:automatic and spontaneous exchange; simultaneous examinations; service ofdocuments; and presence and participation of representatives from requestingjurisdictions at examinations�4�denmark’s competent authority, located in the ministry of taxation(skatteministeriet), is sufficiently resourced with highly skilled staff� dueto the extensive information holdings of the ministry, including its access todenmark’s many registers, nearly half the responses to international requestsfor information in tax matters are provided by the competent authority with-out need to exercise information gathering powers� responses to exchangeof information requests are provided to requesting authorities in a timelymanner and processes are currently being developed which will ensure thatperiodic updates are provided by the danish competent authority to partieswhich have requested information from denmark�5�denmark’s institutional framework supports effective access to andprovision of information requested by competent authorities of other countries�over the last three years there have been no cases where denmark has notprovided information requested by eoi partners due to difficulties in obtainingrequested information� denmark’s tax authorities have broad powers to obtainbank, ownership, identity, and accounting information and have measuresto compel the production of such information� there are no statutory banksecrecy provisions in place that would restrict effective exchange of informa-tion� application of rights and safeguards (e.g. notification, appeal rights) indenmark do not restrict the scope of information that the tax authorities canobtain�6�the main business structures used in denmark are companies, part-nerships and foundations (commercial and non-commercial)� Public limitedcompanies in denmark can issue bearer shares up to the whole capital of thecompany and only limited mechanisms are in place to identify persons hold-ing bearer shares below a threshold of 5% of the capital or the voting rights�holding companies, which are a feature of the danish corporate sector, are2�this directive came into force on 23 december 1977 and all eu members wererequired to transpose it into national legislation by 1 January 1979� it has beenamended since that time�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

exeCutive summary –9

subject to all of the same requirements in terms of registration, submission oftax returns and keeping share registers which apply to other danish compa-nies� while trusts are not recognised under danish law, foreign trusts maybeadministered in or have a trustee in denmark�7�a good legal and regulatory framework for the maintenance of owner-ship and identity information is in place in denmark� this relies on a mixtureof requirements on the legal entities themselves and to maintain certain recordsand on financial institutions and professions to conduct customer due dili-gence, along with requirements to submit certain information to governmentauthorities� similarly, a good framework exists requiring adequate accountingrecords be kept, including underlying documentation, for a minimum of fiveyears� Comprehensive ownership information may not however be maintainedby companies with limited liability, associations with limited liability or co-operatives with limited liability� financial institutions are required to maintainrecords of individual transactions and, under anti-money laundering legislation,customer identification records are maintained for 5 years�8�overall, denmark has an excellent system for the exchange of infor-mation in tax matters� its laws are clear and ensure that the appropriate infor-mation is available and accessible to the ministry of taxation for internationalinformation exchange matters� this information can be exchanged with over100 other countries� denmark’s competent authority is clearly dedicated toperforming this role well, to support denmark’s national tax system, to pro-gress international tax matters and to fulfil its international obligations�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

introduCtion –11

Introduction

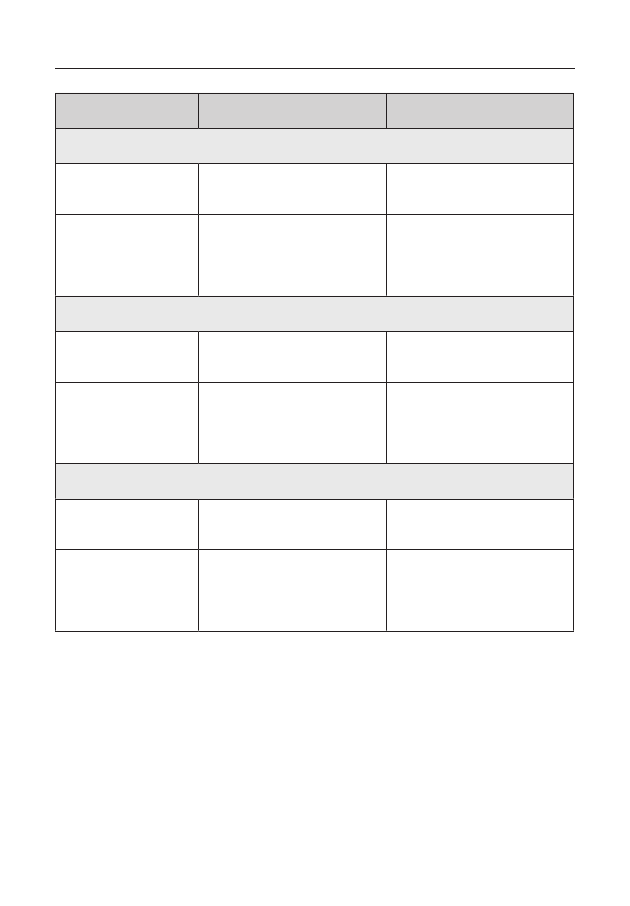

Information and methodology used for the peer review of Denmark9�the assessment of the legal and regulatory framework of denmarkand the practical implementation and effectiveness of this framework wasbased on the international standards for transparency and exchange ofinformation as described in the Global forum’sTerms of Reference,andwas prepared using theMethodology for Peer Reviews and Non-MemberReviews�the assessment was based on the laws, regulations, and exchange ofinformation mechanisms in force or effect as at early september 2010, otherinformation, explanations and materials supplied by denmark during theon-site visit that took place on 15-17 June 2010, and information supplied bypartner jurisdictions� during the on-site visit, the assessment team met withofficials and representatives of relevant danish public agencies, including theministry of taxation, the Commerce and Companies agency, the financialsupervisory authority and the Civil affairs agency (see annex 4)�10�theTerms of Referencebreaks down the standards of transparencyand exchange of information into 10 essential elements and 31 enumer-ated aspects under three broad categories: (a) availability of information;(b) access to information; and (C) exchange of information� this com-bined review assesses denmark’s legal and regulatory framework and theimplementation and effectiveness of this framework against these elementsand each of the enumerated aspects� in respect of each essential element adetermination is made regarding denmark’s legal and regulatory frameworkthat either:(i)the element is in place;(ii)the element is in place but certainaspects of the legal implementation of the element need improvement; or(iii)the element is not in place� these determinations are accompanied byrecommendations for improvement where relevant� in addition, to reflect thePhase 2 component, recommendations are also made concerning denmark’spractical application of each of the essential elements� as outlined in theNoteon Assessment Criteria,following a jurisdiction’s Phase 2 review, a “rating”will be applied to each of the essential elements to reflect the overall positionof a jurisdiction� however this rating will only be published “at such time as

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

12– introduCtiona representative subset of Phase 2 reviews is completed”� this report there-fore includes recommendations in respect of denmark’s legal and regulatoryframework and the actual implementation of the essential elements, as wellas a determination on the legal and regulatory framework, but it does notinclude a rating of the elements�11�the assessment was conducted by a team which comprised twoassessors and a representative of the Global forum secretariat: ms aikokimura, national tax agency, Japan; mr aldo farrugia, inland revenuedepartment, malta; and ms rachelle boyle of the Global forum secretariat�the assessment team examined the legal and regulatory framework for trans-parency and exchange of information and relevant exchange-of-informationmechanisms in denmark�

Overview of Denmark12�the kingdom of denmark is a scandinavian nation in northerneurope which is home to just over 5�5 million inhabitants�3while thekingdom consists of three autonomous parts: denmark, the faroe islandsand Greenland, as the faroe islands and Greenland are completely independ-ent with respect to international tax matters (see further below), this reviewfocusses solely on denmark�13�while danish is the country’s only official language, both englishand German are widely spoken� denmark is separated from norway andsweden to the north by the north sea and the baltic sea and bordered tothe south by Germany� denmark is divided into five regions and 98 munici-palities� the regions were established in 2007, replacing the former countysystem (comprised of 13 counties), as part of a program of danish municipalreform� also as part of this reform, 207 municipalities were combined intotoday’s 98� unlike in the former county system, the regions are not allowedto levy taxes�14�danish Gross domestic Product (GdP) was slightly overusd 309 billion in 2009�4the services sector makes up 64�7% of GdP whilethe industrial sector represents 30�7%� denmark has considerable oil andnatural gas resources coming from the north sea and is a major exporter ofcrude oil� important industries include iron, steel, metals, chemical, textilesand clothing� denmark advocates free trade and neoliberal economic policies�the currency of denmark is the danish kroner (dkk) which is pegged tothe euro (dkk 7�4514792071 = eur 1 as at 6 august 20105)�3�4�5�2009 figures� statistics denmark,www.dst.dk�www.imf.org�www.xe.com.

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

introduCtion –13

15�as a country, denmark is characterised by its strong welfare-orientedprofile� it maintains an egalitarian ethos and has one of the lowest levels ofsocial inequality (Gini coefficient 22�5)6, with tax-paid education, universalwelfare insurance programs and comparatively large social benefits� surveyshave ranked denmark “the happiest place in the world”, based on standardsof health, welfare, and education�7in 2009, denmark was the second leastcorrupt country in the world according to the Corruption Perceptions index�8

General information on the legal system and the taxation system16�the kingdom of denmark is a constitutional monarchy� accordingto theConstitution,the monarch is sacrosanct and appoints and dismisses thePrime minister and other ministers� the monarch technically holds executivepower, but his/her role is strictly ceremonial�17�the head of the government is the Prime minister who appoints thecabinet, including a minister for taxation� the legislative branch in denmarkconsists of a 179-seat unicameral Parliament called the folketing whosemembers are directly elected by popular vote to serve four year terms� ofthe 179 seats, two members are from Greenland and two are from the faroeislands (both of which have self-ruling systems)� bills are presented to theParliament along with “explanatory notes”, which are recognised as a sourceof proper interpretation of the law and are used widely by the danish courtswhen interpreting the law, and then must pass through the statsrådet – a privycouncil headed by the monarch – before being validated by royal assent�18�the legal tradition in denmark is neither civil nor common law – itis commonly characterised as a combined scandinavian-Germanic civillaw system� Generally there is codification of the law, but customary law isrecognised� major sources of law in denmark include the 1953Constitution,acts, executive orders, regulations, precedent, and customary law� since 1973,denmark has been a member of the eu and a growing proportion of legisla-tion operative in denmark originates from the eu, though not legislationconcerning direct taxation� some of these laws apply directly, while othersmust be implemented in danish legislation before they can take effect�19�theConstitutionart�3 guarantees judges’ independence� a judgecan be removed from office only by order of the special Court of indictmentand revision� there is no formal division within the courts and all courts6�7�8�www.oecd.org/statisticsdata/0,2643,en_2649_34637_1_119656_1_1_37419,00.html�www2.le.ac.uk and http://worlddatabaseofhappiness.eur.nl/�w w w.t ran sparenc y.org/polic y _ re search/sur ve ys_ indice s/cpi/20 09/cpi_2009_table�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

14– introduCtioncan preside over civil and administrative disputes, criminal justice andconstitutional matters� the hierarchy of danish justice courts begins withthe højesteret (supreme Court) at the top, followed by 2 landsretten (highcourts) and 24 byretten (district courts)� denmark also has the Court ofimpeachment of the realm (rigsretten), which presides over cases broughtagainst ministers, and the special Court of final appeal (den særligeklageret), for cases brought against judges and for the retrial of criminalcases� the european Court of Justice may determine whether a danish law isin accordance with the eu treaty and with other eu legislation�

The tax system20�for tax purposes, Greenland and the faroe islands are regardedas separate jurisdictions� this means that danish tax legislation does notapply in these autonomous areas� tax treaties and the 1989Nordic MutualAssistance Convention on Mutual Administrative Assistance in Tax Mattersare in force between denmark and these jurisdictions�21�as a percentage of GdP, denmark has the highest taxes in the worldat 48�3%�9all income from employment/self-employment is levied a labourmarket contribution of 8% before income tax� individuals’ world-wide incomeis taxed on a progressive basis, while corporate tax is a flat rate� the value-added tax (vat) is the highest in the world at 25%� taxpayers consist of:• danish resident individuals are taxable on all income including: (1)personal income; (2) capital income; and (3) income from shares� theincome is taxed according to a progressive scale where the highestmarginal tax rate for personal income is 56�1%;non-resident individuals with income from danish sources,e.g.divi-dends or royalties and income from employment or a permanentestablishment in denmark;companies and foundations registered in or with effective manage-ment in denmark are subject to a corporate tax of 25% of taxableworldwide profit (except income from permanent establishmentsabroad), whether or not profits are distributed� no danish fran-chise tax or net wealth tax are levied on companies or branches indenmark; andnon-resident companies and foundations with income from danishsources,e.g.income from a permanent establishment in denmark ordividend, interest or royalty�

•

•

•

9�

www.oecd.org/ctp/revenuestats�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

introduCtion –15

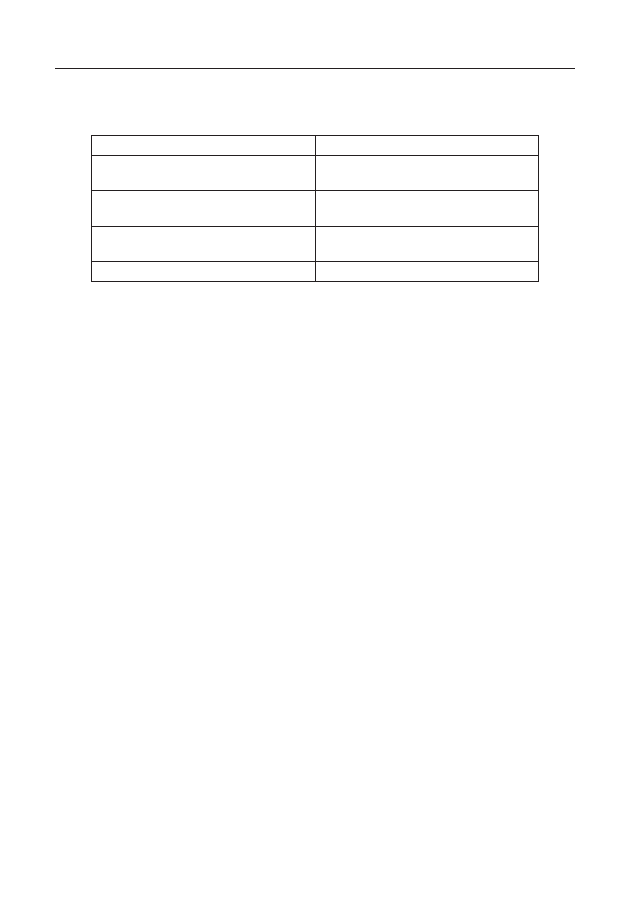

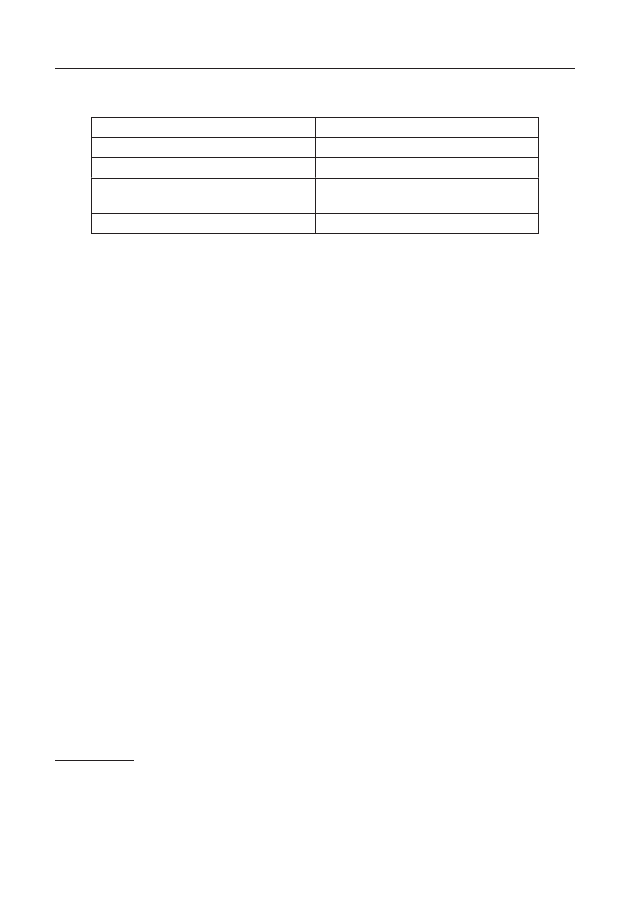

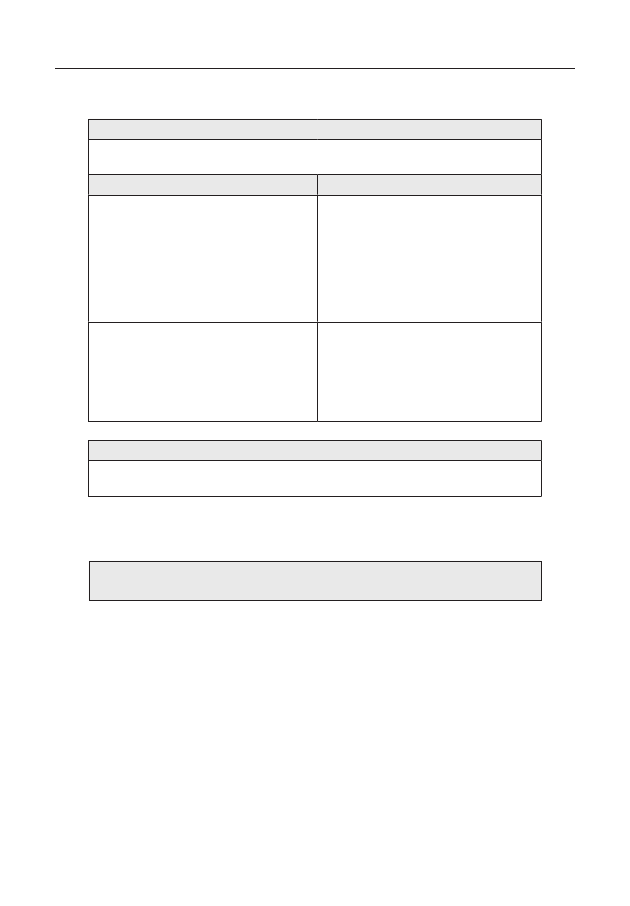

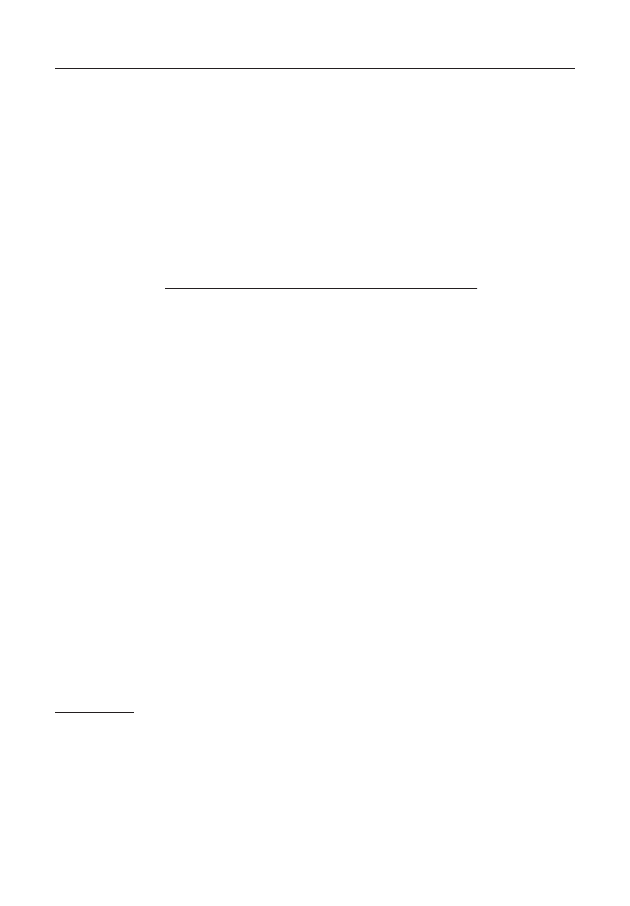

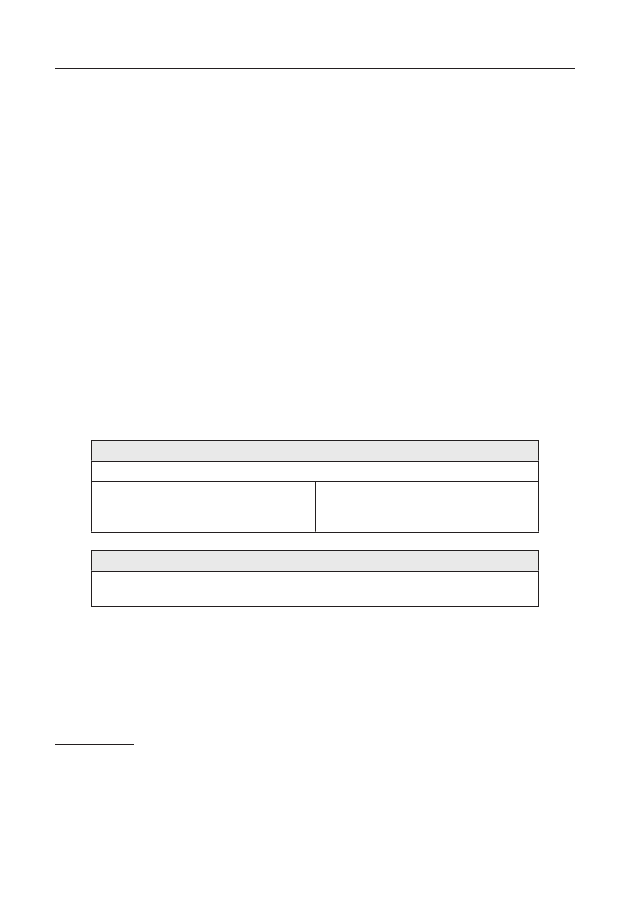

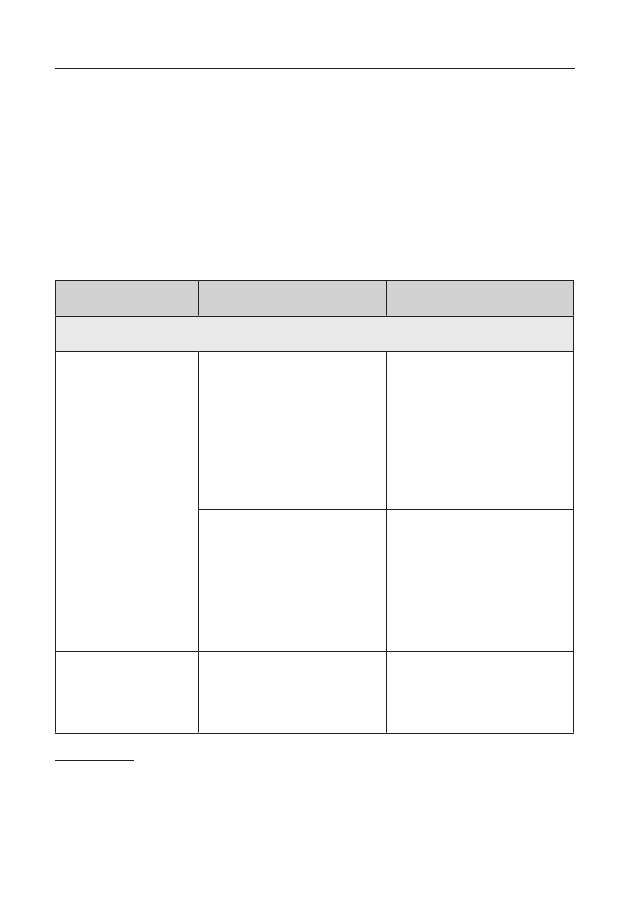

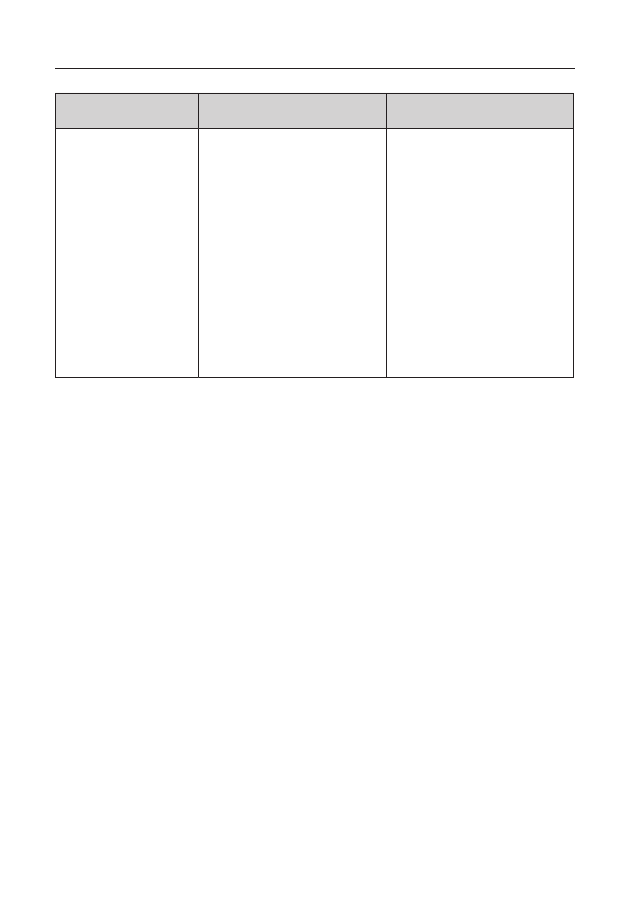

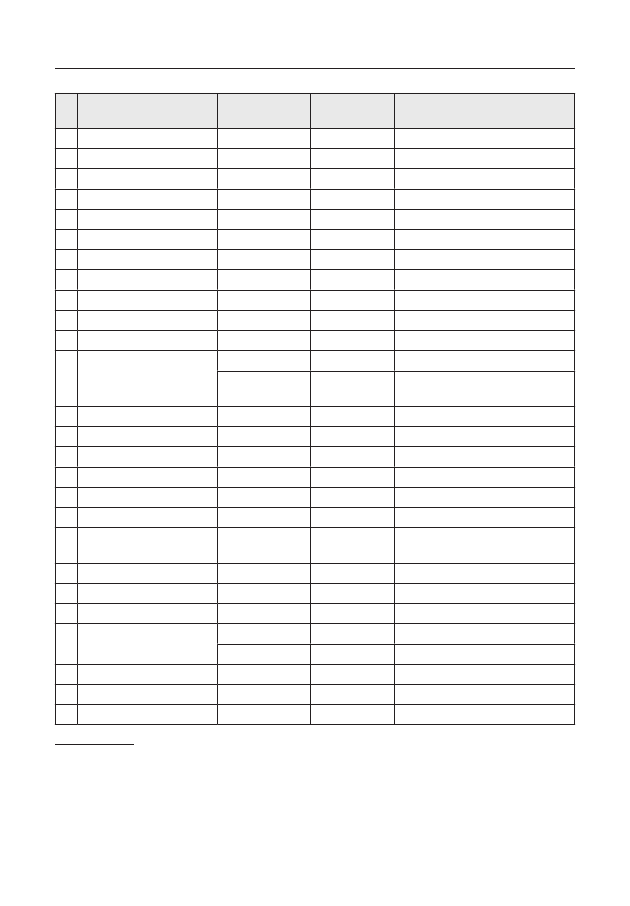

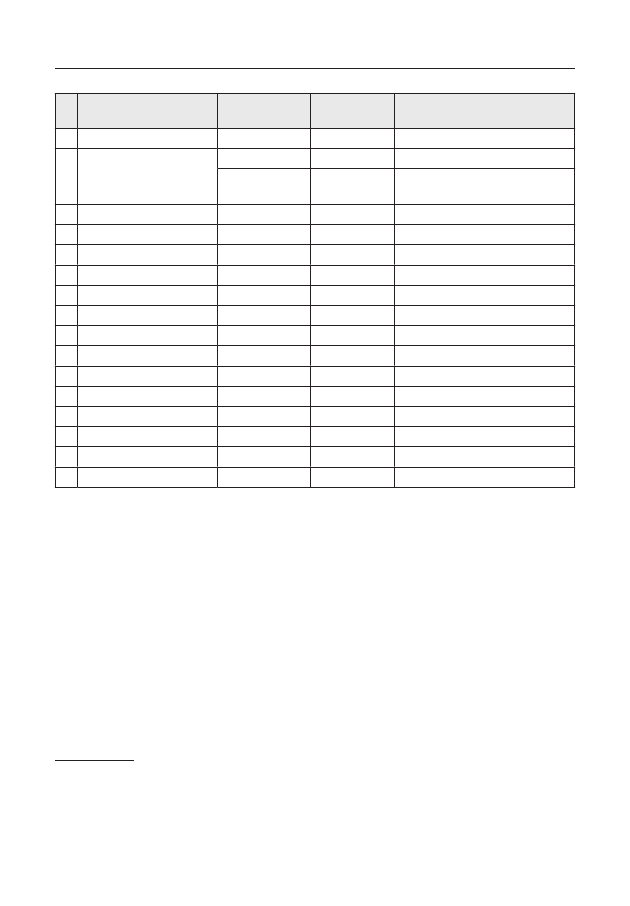

Key Danish legislation relevant to international exchange of tax informationAct on Certain CommercialUndertakings(lov om visseerhvervsdrivende virksomheder)Act on Commercial Foundations(lovom erhvervsdrivende fonde)Act on the Central BusinessRegister(lov om Det CentraleVirksomhedsregister (CVR))Act on Financial Business(lov omfinansiel virksomhed)Act on Financial Statements(årsregnskabsloven)Act on Measures to Prevent MoneyLaundering and Financing ofTerrorism(hvidvaskloven)Act on Security Trading(lov omværdipapirhandel)Bookeeping Act(bogføringsloven)Danish Act on Public and PrivateLimited Companies(Selskabsloven,DCA)Tax Assessment Act(Lov ompåligningen af indkomstskat til staten(Ligningsloven))Tax Control Act(Skattekontrolloven)

22�the oldest of denmark’s current network of international tax agree-ments is the bilateral double taxation convention signed with israel in 1966�denmark has a very large network of agreements allowing for exchange ofinformation for tax purposes, encompassing 93 jurisdictions� in additionto its 70 dtCs and 23 tieas, denmark is able to exchange informationin tax matters under theNordic Mutual Assistance Convention on MutualAdministrative Assistance in Tax Matters,theEU Council Directive 77/799/EECof 19 december 1977 concerning mutual assistance by the competentauthorities of the member states in the field of direct taxation and taxationof insurance premiums, and theCouncil of Europe/OECD Convention onMutual Administrative Assistance in Tax Matters�23�the minister for taxation has delegated the role of competent author-ity for international exchange of information for tax matters to the Customsand tax administration (ministry of taxation notice 1029/2005)� the com-petent authority in denmark is therefore the Customs and tax administration(Cta) – skatteministeriet – which is responsible for administration andcollection of direct taxation, vat, and other forms of indirect taxation andcustoms procedures�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

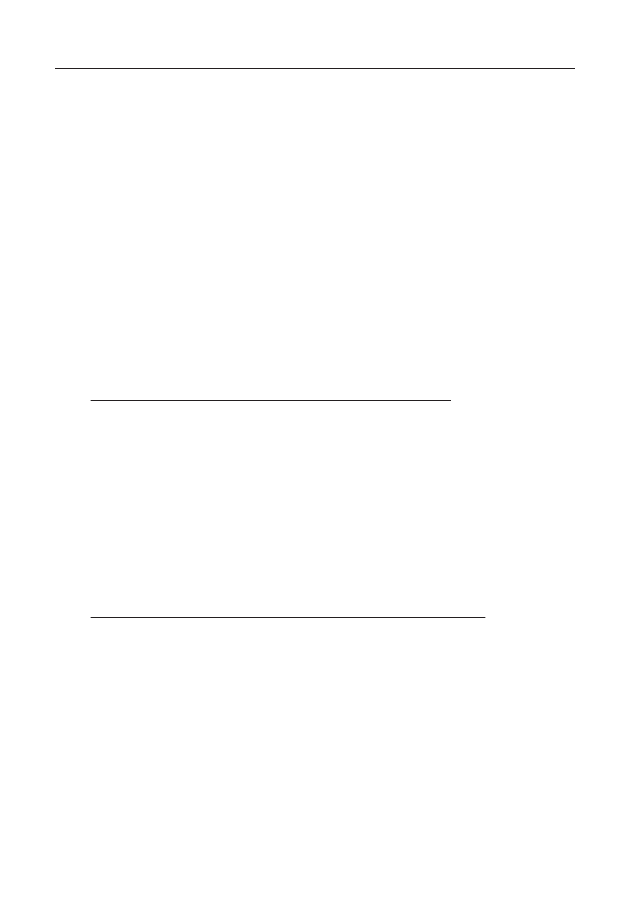

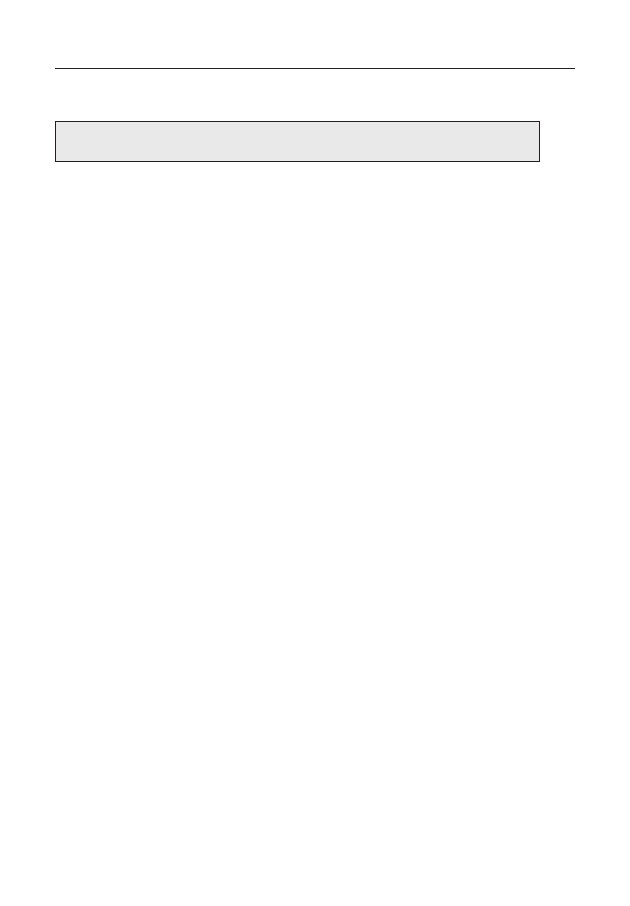

16– introduCtionKey authorities and professional bodies relevant to international exchangeof tax informationBar and Law Society (BLS)Customs and Tax Administration(CTA)Commerce and Companies Agency(CCA)Ministry of Justice (MJT)Ministry of Foreign Affairs (MFA)Money Laundering Secretariat(financial intelligence unit)

Enterprise and Construction Authority State Prosecutor for Serious(ECA)Economic CrimeFinancial Supervisory Authority (FSA)

24�in 2006, denmark established the money laundering forum to co-ordinate and exchange information in order to enhance efforts by the authori-ties and fulfil international commitments regarding the prevention of moneylaundering and financing of terrorism�

Overview of the financial sector and relevant professions25�the danish financial sector is deep (total assets are close to five timesGdP) and sophisticated� since the deregulation of the 1970–1980s, while it is stillprohibited to carry on some financial activities in the same company (for exam-ple, commercial banking and insurance activities), it is possible to set up holdingcompanies and inter-company ownership among financial institutions� the twolargest banks account for approximately 75% of the total assets of all banks andprovide more than 50% of commercial bank lending� the danish financial sectoris characterised by a large number of banks, most of them small banks�26�Compared to other countries, denmark has a well-developed andmature insurance industry with 174 insurance companies and 37 pensionfunds offering a broad range of high-quality insurance and pension productsto personal and corporate customers� in 2004, the five largest life insurancecompanies accounted for 88% of gross premiums� since 1 January 2000,insurance intermediaries have been regulated by theInsurance MediationAct�the fsa licenses and registers brokers in a public register, which isaccessible on the fsa web-site�27�the securities sector is diverse and comprises a large number of asso-ciations as well as securities dealers and brokers, who are covered by the term“investment companies”� danish investment companies range from smallsingle proprietorships to large companies, with 10 holding licenses to provideservices internationally� 959 foreign investment companies have licenses intheir home countries to carry out activities in denmark, 5 of which haveestablished branches in denmark�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

introduCtion –17

28�there are slightly more than 5 000 lawyers (advokat) practicing indenmark� lawyers typically engage in legal advisory services and legal rep-resentational services before the courts and public authorities and also pro-vide economic and other advisory services in connection with their primarybusiness� all lawyers practicing in denmark are members of the danish barand law society and are subject to its disciplinary functions� in denmark,notaries do not provide services for clients� there are no other independentlegal professionals in denmark�

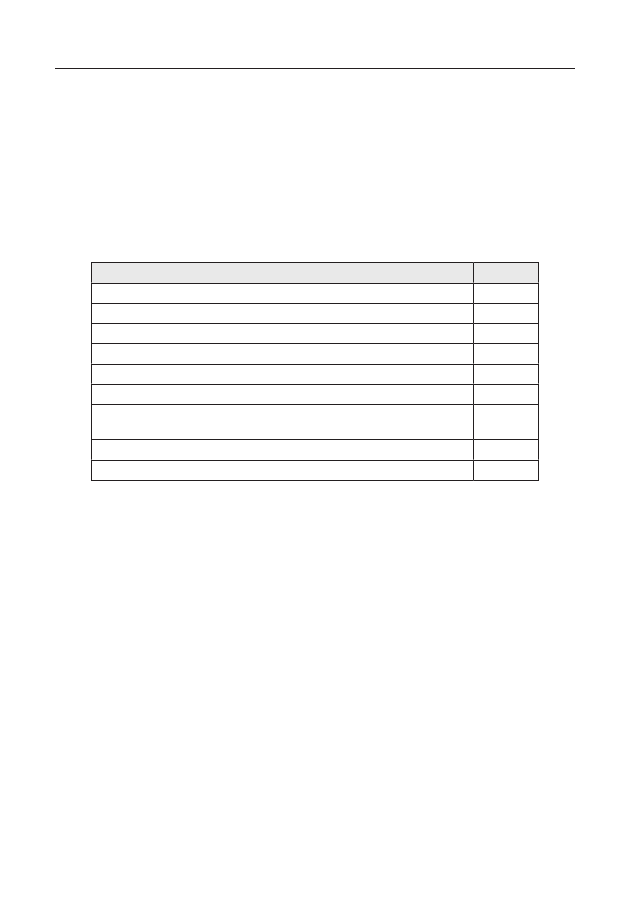

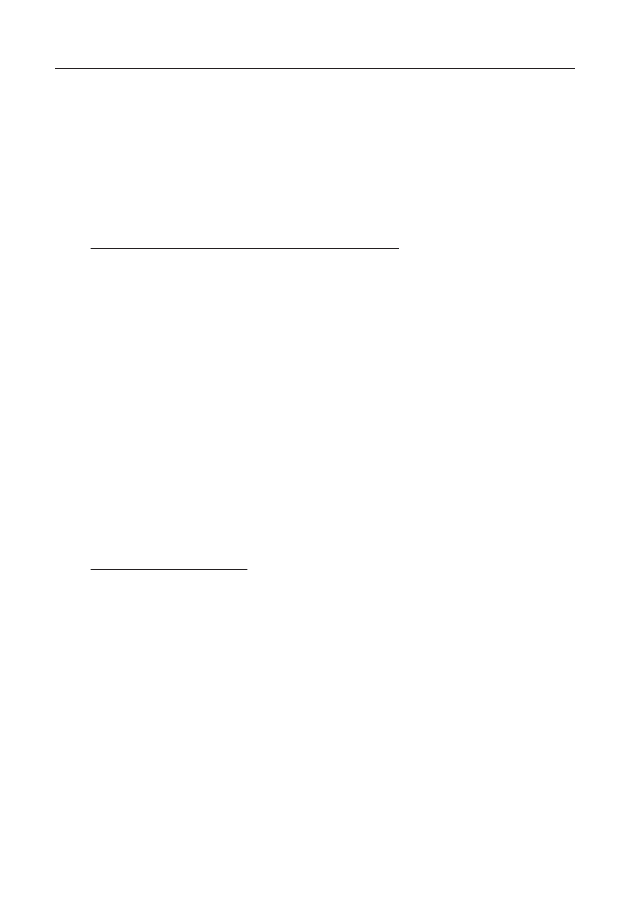

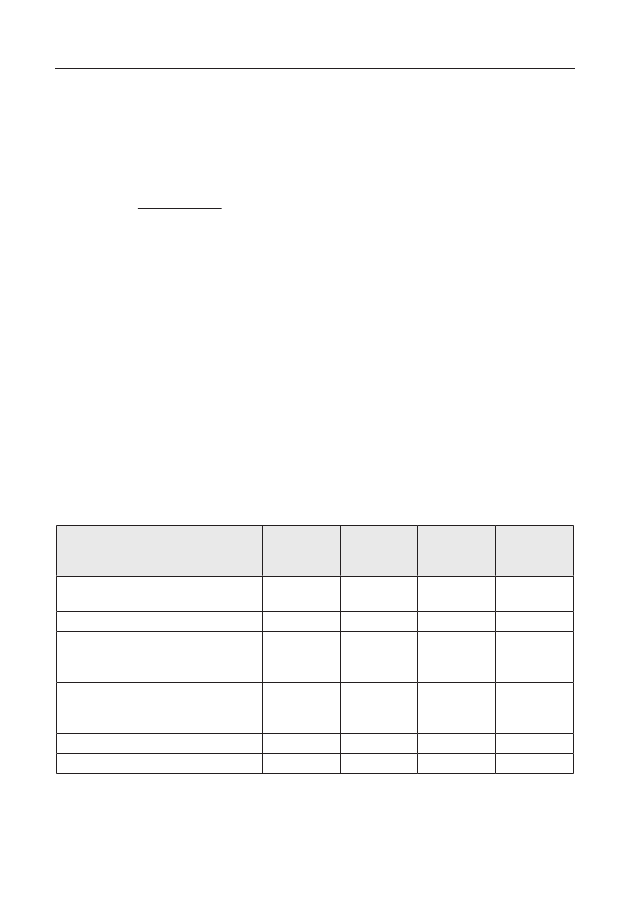

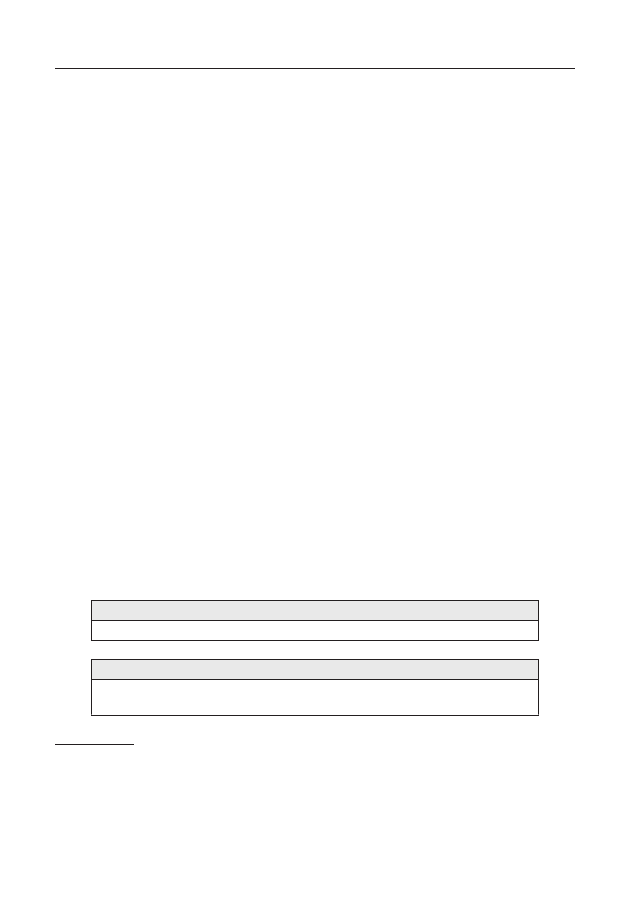

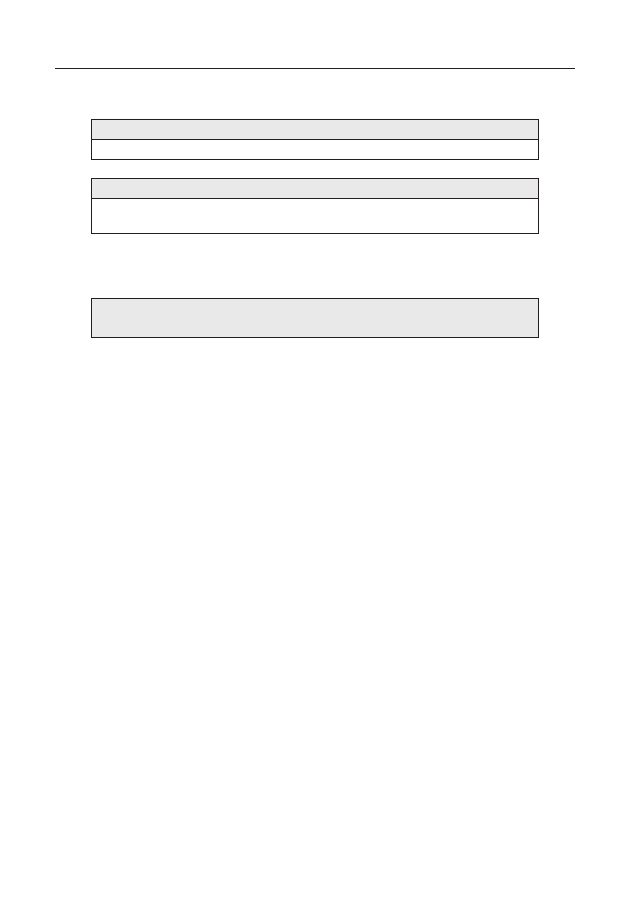

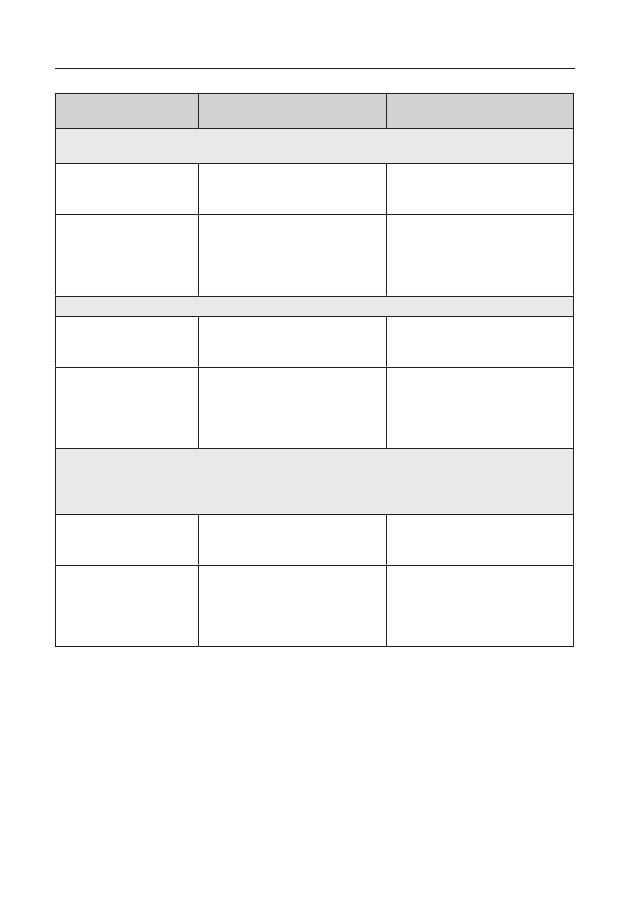

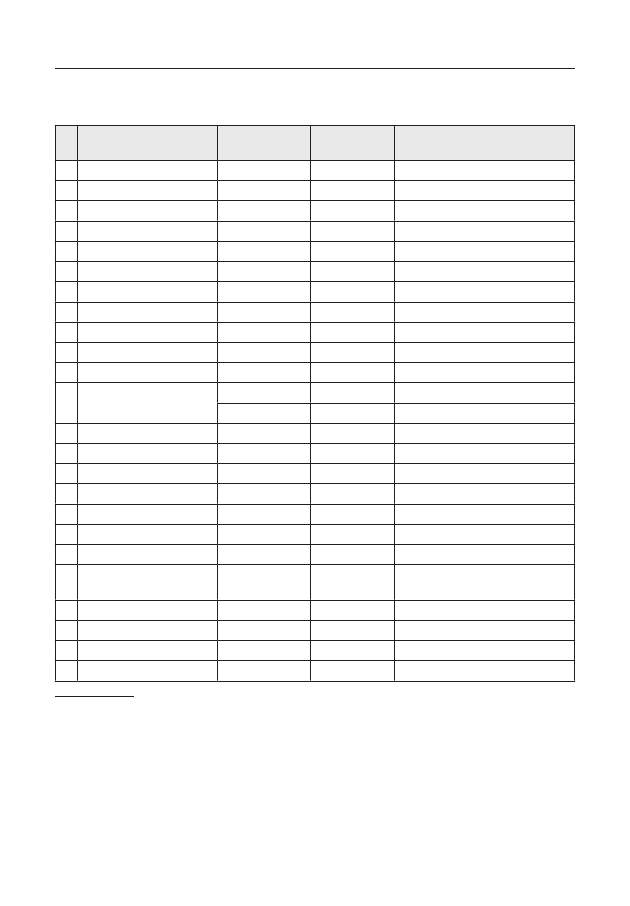

The financial sector (2008 figuresa)TypeBanksMortgage-credit institutionsInsurance companiesShip financing institution (skibsfinansieringsinstitut)Company pension funds (firmapensionskasser)National pension plansbAssociations: Investment, special-purpose, approved restrictedand hedgeSecurities dealersInvestment management companiesa� Provided by the ministry of taxation, may 2010�b� arbejdsmarkedets tillægspension (atP), lønmodtagernes dyrtidsfond (ld),arbejdsmarkedets erhvervssygdomssikring (aes) and den særlige pensionsopsparing(sP-ordningen)�Number138817413741174515

29�denmark has nearly 3 000 registered public accountants and 2 000registered state-authorised public accountants� only approved accountantsare permitted to audit companies’ (limited liability) accounts according to theAct on Financial Statements�there are also accountants in denmark who arenot registered or licensed� their work opportunities are limited, for example,they cannot conduct most audit activities�30�in denmark, trust and company service providers are not recognisedor registered as a separate business area or profession� lawyers and account-ants normally provide these services� according to theAct on Measures toPrevent Money Laundering and Financing of Terrorism 2009,providers oftrust and company services are registered with and supervised by the CCa�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

18– introduCtion

Recent developments31�in 2009, the parliament approved the newCompanies Act,whichreplaces thePublic Companies Actand thePrivate Companies Actandchanges the current regulation of limited liability companies significantly�the main part of theCompanies Actentered into force in march 2010 and theremainder will come into effect during 2010 and 2011� the reason for the latercommencement is that the remaining parts of the act require customisation ofthe CCa’s it systems�32�tax reforms called “forårspakke 2�0” were adopted by parliamentin may 2009 and will come into force during 2010-2019� the changes aim toreduce the marginal income tax rates for all people actively participating onthe labour market�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –19

Compliance with the StandardsA. Availability of InformationOverview33�effective exchange of information requires the availability of reliableinformation� in particular, it requires information on the identity of ownersand other stakeholders as well as information on the transactions carried outby entities and other organisational structures� such information may be keptfor tax, regulatory, commercial or other reasons� if such information is notkept or the information is not maintained for a reasonable period of time, ajurisdiction’s competent authority10may not be able to obtain and provide itwhen requested� this section of the report describes and assesses denmark’slegal and regulatory framework on availability of information� it also assessesthe implementation and effectiveness of this framework�34�a good legal and regulatory framework for the maintenance of owner-ship and identity information is in place in denmark and denmark’s exchangeof information partners report that responses to requests for exchange of owner-ship information have been satisfactorily delivered� this relies on a mixture ofrequirements on the legal entities themselves and to maintain certain records andon financial institutions and professions to conduct customer due diligence, alongwith requirements to submit certain information to government authorities�35�the main business structures used in denmark are companies,partnerships and foundations� holding companies, which are a feature of thedanish corporate sector, are subject to all of the same requirements in terms ofregistration, submission of tax returns and keeping share registers which applyto other danish companies� while trusts are not recognised under danish law,foreign trusts maybe administered in or have a trustee in denmark�10�the term “competent authority” means the person or government authority des-ignated by a jurisdiction as being competent to exchange information pursuantto a double tax convention or tax information exchange�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

20– ComPlianCe with the standards: availability of information36�information on all businesses is contained in the Central businessregister (Centrale virksomhedsregister (Cvr)) maintained by the Commerceand Companies agency (CCa)� the registration requirements, which don’talways involve submission of ownership information, are complemented byobligations to submit information in annual tax returns and obligations tosubmit information to the financial supervisory authority (fsa) and theCustoms and tax administration (Cta)� these, plus requirements on theentities themselves to maintain records and detailed customer due diligence(Cdd) conducted by financial undertakings under theAML/CFT Act,meanthat ownership and identity information is available to the competent authori-ties for a significant proportion of the relevant entities� information maynot however be available on the owners of companies, associations and co-operatives with limited liability�37�Public limited companies in denmark can issue bearer shares up tothe whole capital of the company� the extent of issuance of bearer shares indenmark is not known� denmark has not established a custodial arrangementwith a recognised custodian or other similar arrangement to immobilize suchshares� some limited mechanisms are in place to identify the persons holdingbearer shares, notably if the voting right conferred on the shares reaches 5%of the capital and in advance of the company’s general meeting in order toexercise shareholder’s rights at the meeting�38�all entities must maintain a full range of accounting records, includ-ing underlying documentation, for a minimum of five years� in addition,financial institutions are required to maintain records of individual transac-tions for five years and anti-money laundering law requires that customeridentification records are maintained for five years�

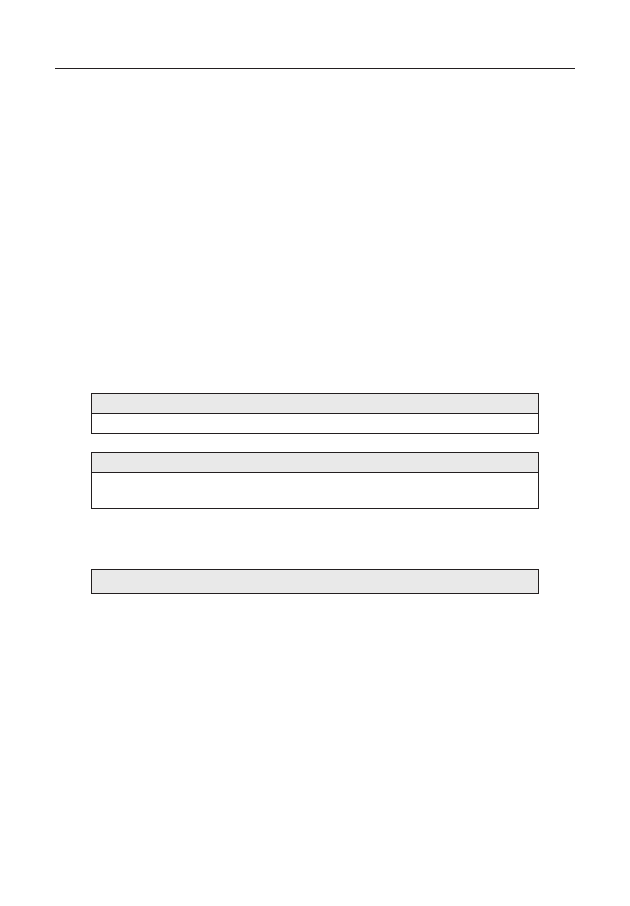

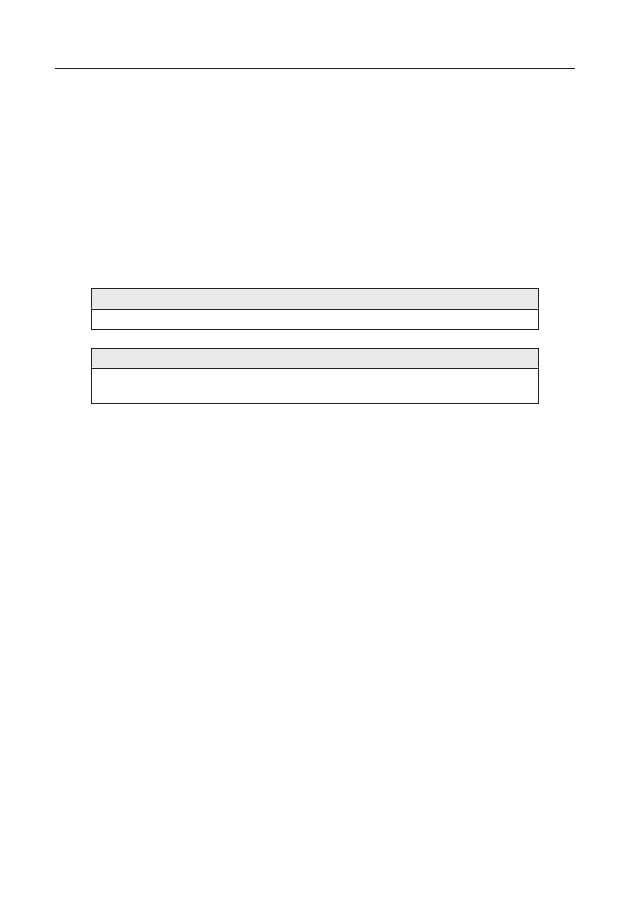

A.1. Ownership and identity informationJurisdictions should ensure that ownership and identity information for all relevantentities and arrangements is available to their competent authorities.

Companies(ToR A.1.1)39�danish legislation allows for the formation of the following types ofcompanies:• public limited companies (aktieselskaber, a/s): the structural andorganisational requirements of an a/s are outlined in theCompaniesAct�it must have a minimum share capital of dkk 500 000(eur 67 050);

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –21

•

private limited companies (anpartsselskaber, aps): incorporationrequirements are similar to those provided for an a/s except that theshare capital minimum is dkk 80 000 (eur 10 728) (CompaniesAct);companies or associations with limited liability (selskaber og fore-ninger med begrænset ansvar, smba and fmba): while thesecompanies are subject to the general provisions of theAct on CertainCommercial Undertakings,there is no specific regulation of compa-nies and associations with limited liability;limited liability co-operatives (andelsselskaber, amba): the objectsof a limited liability co-operative must be to promote the commoninterests of the members through business activities and whoseprofit is either distributed among the members in proportion to theirshare of the turnover or is undistributed (Acton Certain CommercialUndertakings);andeuropean Companies (se): european Companies are regulated byCouncil regulation (eeC) no�2157/2001 onStatute for a EuropeanCompany and the Danish Act on Administration of the Regulationwhich permits the creation and management of companies with aeuropean dimension, free from the territorial application of nationalcompany law�

•

•

•

40�a large number of international companies have taken advantageof danish tax rules related to holding companies (including an exemptionfrom withholding tax on dividends forbeneficial owners of 10% or more ofthe capital where exemption provisions are contained in the relevant doubletaxation agreement or the eu parent/subsidiary directive)�11holding compa-nies are not defined in danish legislation as a separate type of entity, but canbe any of the five types of companies noted above� holdingcompanies aresubject to all of the same requirements in terms of registration, submission oftax returns and keeping share registers described below which apply to otherdanish companies of each type�41�inapril 2010 there were slightly over 43 500 public limited compa-nies (a/s) and 181 000 private limited companies (aps) in denmark� in addi-tion, there were 6 700 businesses subject to theAct on Certain CommercialUndertakings(i.e. partnerships, and companies with limited liability11�on 7 June 2010, the Copenhagen Post reported that at least 500 holding com-panies have been established in denmark by danish and foreign corporationsin the past two years� “offshore holdings Companies face tax Probe”www.cphpost.dk/news/national/88-national/49165-offshore-holding-companies-face-tax-probe.html�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

22– ComPlianCe with the standards: availability of information(smba), associations with limited liability (fmba) and co-operatives withlimited liability (amba))�42�Companies with limited liability (smba) have become an attractivetype of business for smaller companies� as at august 2010, there were 1 776smbas in denmark� they are taxed in the same way as traditional limitedliability companies if they are registered in denmark or have effective placeof management in denmark, but there is no capital requirement�smbashave to register with the CCa and are obliged to submit annual accounts or,alternatively, statements of exception, to the CCa�

Ownership information companies held by government authoritiesinformation reported to the danish Commerce and Companies agency (CCa)43�information on all businesses is available in the Central businessregister (Centrale virksomhedsregister (Cvr))� the purpose of the Cvr isto (Acton the Central Business Registers�2):

¶ contain core data on legal entities that engage in business or areemployers, and the production entities associated with them;¶ implement clear and unambiguous numbering of the legal entitiesand associated production entities contained within the registry (theCvr number); and¶ make the core data available to public authorities and institutions aswell as to private parties�44�the Cvr is operated by the CCa, within the ministry of economicand business affairs� the CCa works closely with the ministry of labour,the denmark bureau of statistics and the Cta to manage the register� thisco-ordination is particularly necessary because registration requirements forestablishing companies are in several pieces of legislation� the Cvr collectsand centralises all the data contained in the other registers� the data enteredin the Cvr is available to the authorities and the public (Acton the CentralBusiness Registers�17 and s�18)�12Government authorities, including theCta, have extensive access to the information holdings of the CCa, beyondthat available to the public�

12�

atwww.virk.dk/cvr�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –23

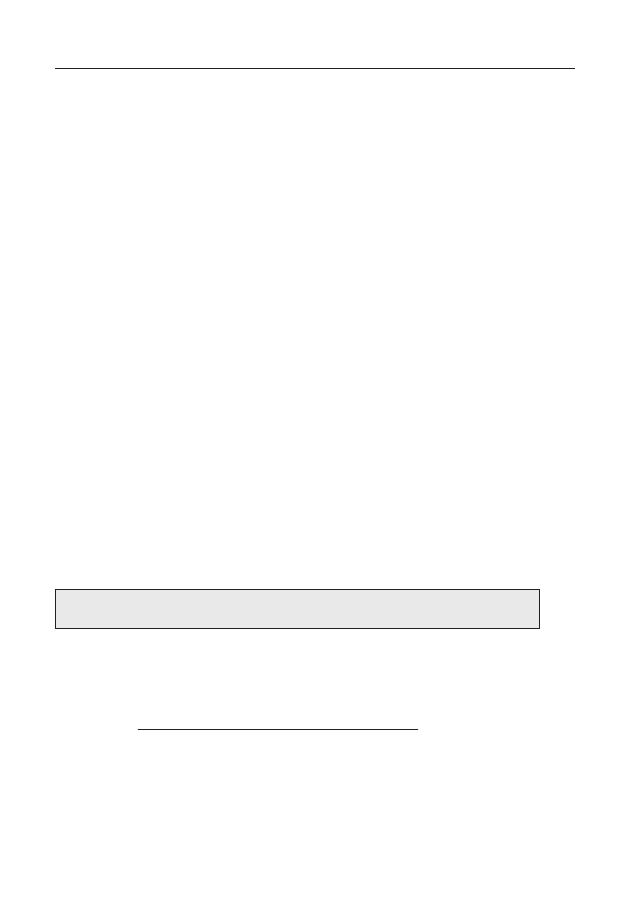

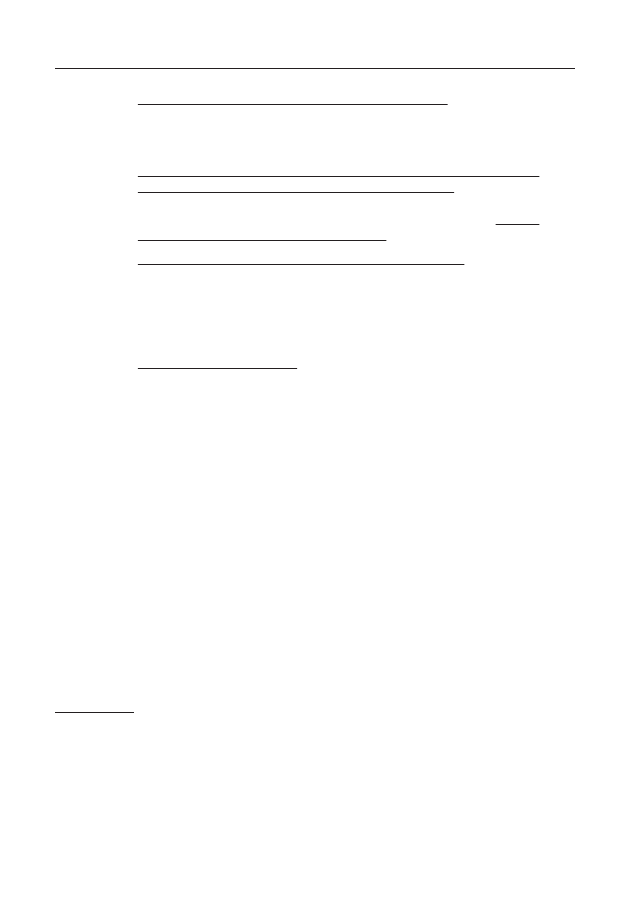

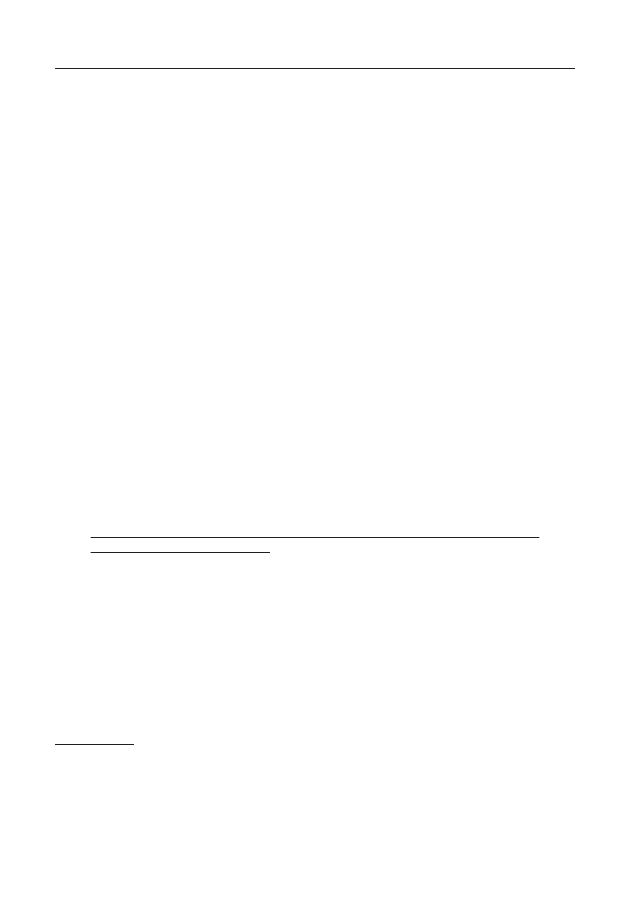

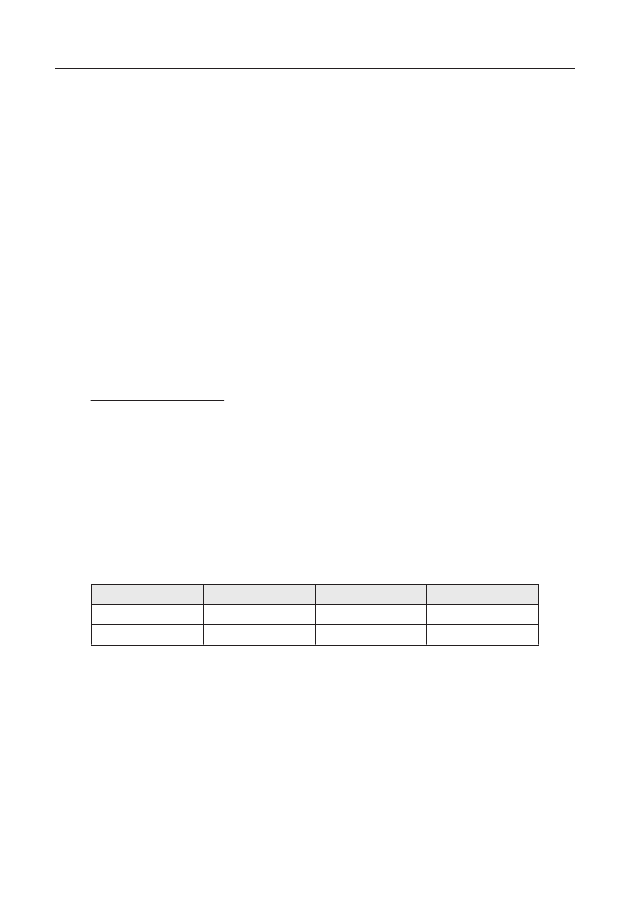

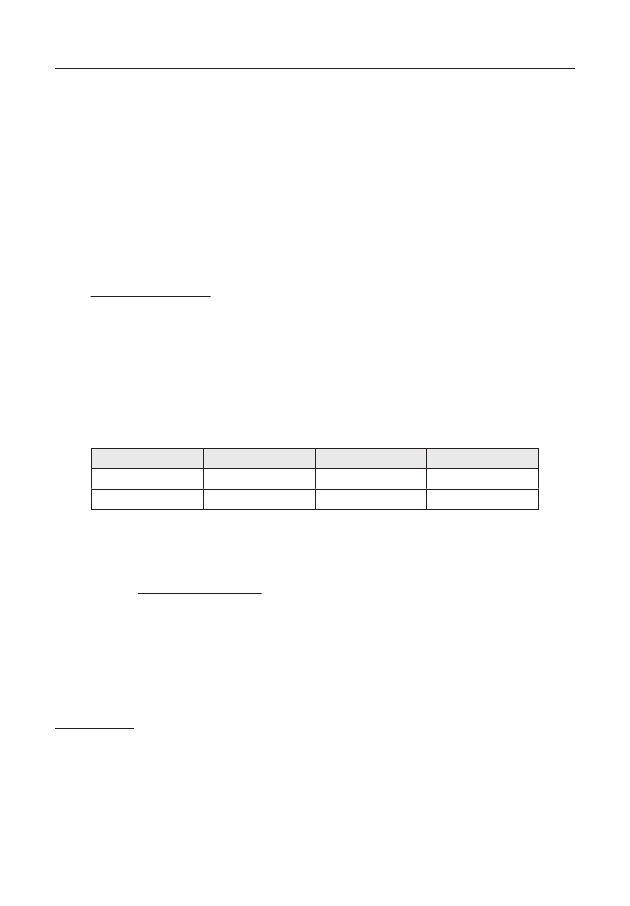

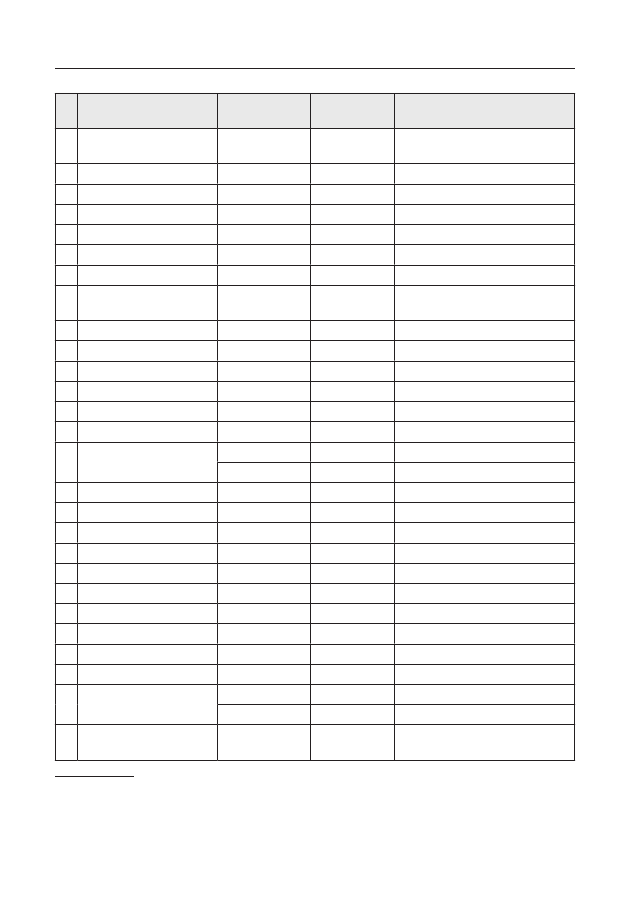

Registration requirements managed by the CCAPublic limited companiesPrivate limited companiesLimited partnerships on sharesCertain commercial undertakingsCommercial foundationss.40 Companies Acts.40 Companies Acts.40 and s.358 Companies Acts.8 Act on Certain CommercialUndertakingss.5 Act on Commercial Foundations

45�the information contained in the Cvr comprises, amongst otherthings (Acton the Central Business Registers�10 and s�11); the entity’s Cvrnumber, form of business organisation, commencement date and (if relevant)termination date, business name and business address, the number of employ-ees, and the type of business activity and types of sub-activities, if any� noownership information is thus disclosed via the Cvr�46�the requirements for registration are of a similar nature for all typesof companies�13as part of registration, information must be submitted iden-tifying each of the founders (who are likely to be some but not necessarilyall of the company’s owners), members of the management board, the boardof directors, and the Chairman� if the registered information is subject toa change, the company must report the change within 2 weeks�14however,limited information regarding the owners of danish companies is providedas part of registration in the Cvr�47�foreign companies can have representative offices or branch officesin denmark� there are no registration requirements for representative offices,however the activities which such offices can carry out are extremely limited(no commercial activities and no issuance of invoices)� denmark is host toapproximately 800 registered branches of foreign companies� a branch officecan be established in denmark if the parent company is registered in the eu,eea, australia or the usa� if the parent company is not registered in thesecountries, the branch office may still be established if the parent companysends a statement of reciprocity to the CCa with the registration form�48�branches of foreign companies similar to danish public limitedcompanies (a/s) and private limited companies (aps) are subject to therequirements of theCompanies Act,Chapter 19� the establishment of abranch must be registered with the CCa (s�349)� branches of other foreigncompanies with limited liability must also be registered with the CCa (Acton Certain Commercial Undertakingss�8(2))� basic information about the13�14�www.virk.dk�it is possible to register changes online:www.webreg.dk�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

24– ComPlianCe with the standards: availability of informationparent company, its articles of association, objects, share capital, accountingyear and authorised officer(s) must be submitted as part of registration� inaddition the CCa must be informed of the name of the branch, its address indenmark, its objects, and the names and addresses of the persons with powerof attorney who can sign for the branch�49�information on ownership of the foreign company is not registeredwith the CCa� however, theTax Control Acts�3a, described below, appliesto foreign companies formed under the laws of another jurisdiction, but taxresident in denmark due to effective management in denmark�50�the CCa conducts random checks on the information submitted aspart of registration and also verifies details if it has reason to suspect theremay be an error� during 2008 and 2009 there were slightly over 1% of regis-trations which contained inaccurate information� in 2010 (to July), 627 of the65 152 registrations (less than 1%) contained one or more element of inac-curate data� these very low levels of error derive from the strong complianceculture in denmark and also from the constructive relationships establishedby the CCa with the private sector�information reported to the Customs and tax administration51�according to theTax Control Acts�3a, a/s, aps and other limitedliability companies whose profit is distributed in proportion to the paid-upcapital must in their income tax returns provide information on all legalowners who during the income year own 25% or more of the capital in thecompany or control 50% or more of the voting rights in the company�52�while this threshold is very high – allowing for identification of onlya small proportion of the most significant shareholders – the calculation ofnumber of shares owned must include all securities belonging to the share-holder’s spouse, parents, grandparents, children and grandchildren and theirspouses, and securities owned by companies over which these persons has acontrolling interest�information reported to the financial supervisory authority (fsa)53�a securities dealer trading on a regulated market is obliged to reportthe details of all securities transactions to the fsa as soon as possible andno later than by the closing time on the relevant market the day after comple-tion of the transaction� a securities dealer is further obliged to maintain allrelevant information about transactions with financial instruments for a mini-mum of five years after carrying out the transaction (Acton Security Trading,s�33)� in addition, anyone who holds shares in a publicly-traded company isobliged to notify the fsa, and the company itself, of the details of the share-holding when (s�29(2)):

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –25

•

the voting right conferred on the shares represents no less than 5% ofthe share capital’s voting rights or their nominal value accounts forno less than 5% of the share capital;a change of previously notified holding results in limits at intervalsof 5, 10, 15, 20, 25, 50 or 90% and limits of 1/3 or 2/3 of the sharecapital’s voting rights or nominal value being reached or no longerbeing reached�

•

54�a direct or indirect purchase of a qualified portion (10% or moreof the capital or the voting rights) in a financial undertaking requires priorapproval from the fsa (Acton Financial Businesss�61)� “financial undertak-ings” are defined as banks, mortgage-credit institutions, investment compa-nies, investment management companies and insurance companies� the sameobligation applies to an increase in the qualifying interest which, after theacquisition, results in the interest equalling or exceeding a limit of 20%, 33%or 50% of the share capital or voting rights� similarly, when a natural or legalperson is planning to dispose of a qualifying interest, or reduce a qualifyinginterest in a financial undertaking, such that the disposal entails that the limitof 20%, 33% or 50% respectively of the company capital or voting rights isno longer achieved, the person is obliged to notify the fsa of this in writingin advance, stating the size of the planned future holding (s�61b)�55�banks and other financial companies are obliged to annually reportownership information on persons who own a qualified portion of the finan-cial company to the fsa (s�61c(2))� due to the annual nature of this report-ing, particularly where there has been a period of interest in a company, theownership information held by the fsa can be up to one year out of date�Companies and associations with limited liability, limited liability co-opera-tives and european companies56�Companies or associations with limited liability (smba, fmba) andlimited liability co-operatives (amba) are obliged to submit information tothe CCa when the company is founded� these submissions include informa-tion on the founders of the company, but not necessarily all of the ownersof the company� this information is used only to decide whether the entitymeets the requirement of the relevant legislation, though it is kept by the CCaand could be accessed if needed�57�Companies with limited liability (smbas) which are registered indenmark or have effective management in denmark are also required tosubmit tax returns to the Cta� for some smbas,15the tax returns must15�since a march 2010 amendment to theAct on Certain Commerical Undertakings,all new registered s�m�b�a�s are not required to submit ownership informationin tax returns�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

26– ComPlianCe with the standards: availability of informationcontain information on those legal owners who during the year owned 25%or more of the share capital or held 50% or more of the voting rights (TaxControl Acts�3a)� associations with limited liability (fmbas) and limitedliability co-operatives (ambas) which are registered in denmark or haveeffective management in denmark are also required to submit tax returns,however they are not required to submit ownership information (s�3a)�58�the same requirements apply to european Companies (se) as forpublic limited companies (a/s) (CouncilRegulation on SE,article 10)�the newCompanies Actprovisions (not yet in force)59�under the newCompanies Actprovisions, companies will also berequired to promptly report the changes to shareholdings on the websiteof the CCa, which will be accessible by the public (s�58)� a change to theTax Control Acts�3a will come into force at the same time as the new s�58�limited liability companies other than public and private companies willbe obliged in the income tax return to provide information on owners, whoduring the income year own 5% or more of capital in the company or control5% or more of the voting rights in the company� as a result of this change,individual shareholders will no longer in the calculation include securitiesbelonging to the shareholder’s family or securities owned by companies ofwhich the family has a controlling interest�60�it is anticipated that these requirements will come into force in thenext two to three years� they will also apply to companies formed underthe laws of another jurisdiction, but tax resident in denmark due to place ofeffective management in denmark�

Ownership information held by companiesPublicly-traded companies61�anyone who holds shares in a publicly-traded company is obliged tonotify the company, and also the fsa, of the details of the shareholding when(Acton Security Tradings�29(2)):• the voting right conferred on the shares represents no less than 5% ofthe share capital’s voting rights or their nominal value accounts forno less than 5% of the share capital;a change of previously notified holding results in limits at intervalsof 5, 10, 15, 20, 25, 50 or 90% and limits of 1/3 or 2/3 of the sharecapital’s voting rights or nominal value being reached or no longerbeing reached�Companies must publish such notifications (s�29)�

•

62�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –27

Public and private limited companies63�similarly, s�55 of the newCompanies Actrequires anyone holdingshares in a public or private company to give notice to the company, withintwo weeks, informing it of such holding, in exactly the same circumstancesas outlined in s�29(2) of theAct on Security Trading.64�Public and private limited companies must keep shareholder registersrecording the names of the holders of registered shares (CompaniesActs�50)�the register may be held somewhere other than the company’s registeredoffice, including in another eu/efta member state (CompaniesActs�51)� ifthe register is not held at the registered office, this must be specified in thearticles of association� the register of shareholders must in any case be opento inspection by public authorities (CompaniesActs�51(1))�65�if the registered share changes hands, the new shareholder mustwithin two weeks inform the company and request that his/her/its name isentered in the shareholders register, upon proof of title (s�52(1))� identityinformation must include name, address and CPr-number (a 10 digit identi-fication code for individuals) or Cvr-number of the shareholder� if an indi-vidual does not have a CPr number, the information must include birth date�if the shareholder is a foreign national or a foreign legal person, the notice tothe company must be accompanied by other documentation ensuring unam-biguous identification of the new shareholder�66�the purchaser of a registered share cannot exercise his rights as ashareholder until his name is recorded in the shareholder register or he hasnotified the company of the acquisition and proven the title (s�49); though thisdoes not apply to the right to receive dividend or any other disbursements�67�Public limited companies must disclose each of these registeredshareholders in the annual report, giving the full name, address and, if rel-evant, the registered office (Acton Financial Statements,s�74)�16Companies and associations with limited liability, limited liability co-opera-tives and european companies68�even though it would be maintained for management of the affairsof the company/association/co-operative, there is no specific obligation forcompanies or associations with limited liability (smba, fmba) and limitedliability co-operatives (amba) to maintain ownership and identity informa-tion, such as through a register of the owners� while this has not limited anyof denmark’s international exchange of information for tax purposes to date,it has the potential to do so at some time�16�this section will be deleted when s58 of the newCompanies Actcomes intoforce�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

28– ComPlianCe with the standards: availability of information69�the same requirements apply to european Companies (se) as forpublic limited companies (a/s) (CouncilRegulation on SE,article 10)�

Ownership information held by directors and officers70�directors and members of the management board are not required bylaw to maintain ownership information beyond that in the register of share-holders, noted above, though in the large majority of cases they would haveinformation on the company’s ultimate owners as part of their assignments�there is no requirement that companies have directors or officers resident indenmark�

Ownership information held by nominees and service providers71�it is accepted in practice that in denmark a nominee can hold shareson behalf of a shareholder in a public company� in such cases there is norequirement that the share register note which of the recorded shareholdersare nominees� nor is there a requirement that the share register record whothe real owners of the shares are� danish government authorities are notaware of the amount of nominee activity occurring in the country�72�the previously mentioned requirements in theCompanies Act(s�55)and theAct on Security Trading(s�29) for anyone who holds shares in a pub-licly-traded company to notify the company and the fsa of the details of theshareholding when they have 5% of the voting right or 5% of the share capitalor there is a change in a previously notified shareholding, apply equally topersons who own shares through nominees�73�all entities covered by theAct on Measures to Prevent MoneyLaundering and Financing of Terrorism(AML/CFTAct)are supervised byeither the fsa (financial institutions), the CCa (non-financial businesses andprofessions) or the bls (lawyers) (sections 31, 34 and 34a)� financial entitiescovered byAML/CTF Actannex 1 must register with the fsa in order tocarry out their activity (at october 2010, 83 such entities were registered, notincluding money remitters)� entities that commercially carry out activitiesinvolving currency and service providers are required to register with theCCa (s�31)�17Compliance with this registration requirement is closely super-vised and generally good; 38 firms conducting company formation businesswere ordered to stop their activities during 2008-2009�74�this registration obligation specifically applies to natural andlegal persons who are “acting as or arranging for another person to act as17�the requirements for registration with the CCa are described in orderno�1197/200�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –29

a shareholder for a third party, unless this is an undertaking the ownershipinterestsetc.of which are traded on a regulated market” and thus applies toall of the businesses and individuals acting on a commercial basis as nomi-nees� the customer due diligence (Cdd) requirements under this act are suchthat the obliged entity must know the identity of his/her clients, including;name, address and id-number (s�11-s�15)�75�this identification requirement involves establishing the identity ofthe client and the ultimate beneficial owners of the client� beneficial owneris defined in s�3, according to the definition included inthethird eu anti-money laundering directive�18with reference to funds, according to thewording of s�3�4(b), the beneficial owner is the “[p]ersonwho otherwise exer-cise control over the management of a company”�such definition, however,is not considered to be exhaustive� Pursuant to theAML/CFT Act,s�12�3og,if the client is an undertaking, then proof of identity includes name, address,business registration number (Cvr: if the undertaking does not have a Cvrnumber, similar documentation may be provided)� the ownership and controlstructure of the undertaking must be clarified and the beneficial owners ofthe undertaking must provide proof of identity�76�obliged entities must store Cdd and accounting material for noless than five years after the customer relationship has ceased� if the obligedentity ceases business or is dissolved, the last acting management mustensure that this information is stored in accordance with the act� if it is dis-solved through the intervention of the bankruptcy court, the bankruptcy courtmay decide that persons other than the last acting management are to storethe accounting material (AML/CFTActs�23)� as noted in section b�1 of thisreport, information held by nominees can be obtained by the Cta by exerciseof its powers under s�6 and s�6a of theTax Control Act�18�Directive 2005/60/EC of the European Parliament and of the Council of 26October 2005 on the Prevention of the use of the Financial System for thePurpose of Money Laundering and Terrorist Financing.with respect to com-panies that directive defines“beneficial owner” (s�6) to mean “the naturalperson(s) who ultimately owns or controls the customer and/or the natural personon whose behalf a transaction or activity is being conducted�” it goes on to indi-cate that “the beneficial owner shall at least include:(a)in the case of corporateentities:(i)the natural person(s) who ultimately owns or controls a legal entitythrough direct or indirect ownership or control over a sufficient percentage ofthe shares or voting rights in that legal entity, including through bearer shareholdings, other than a company listed on a regulated market that is subject todisclosure requirements consistent with Community legislation or subject toequivalent international standards; a percentage of 25% plus one share shall bedeemed sufficient to meet his criterion;(ii)the natural person(s) who otherwiseexercises control over the management of a legal entity�”

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

30– ComPlianCe with the standards: availability of information

Ownership information held by other persons77�theAML/CFT Actapplies to an extensive range of financial under-takings and persons including all types of financial institutions, financialbusinesses and professionals engaged in providing financial services forclients (s�1)� as noted previously with respect to nominees and service pro-viders, these financial undertakings and persons are obliged to conduct Cddwhich will result in them obtaining and maintaining information on the iden-tity of their clients�

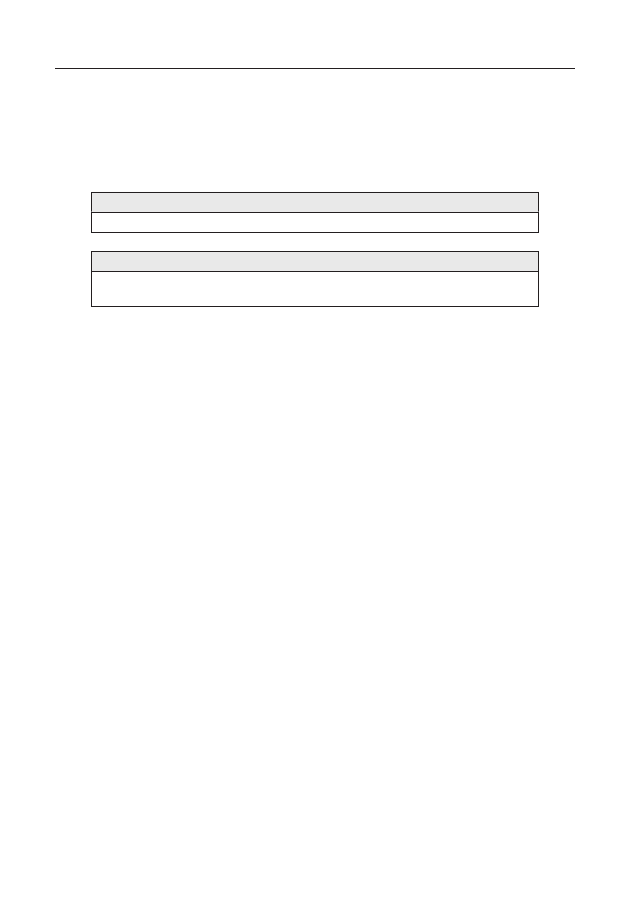

Documentation retention requirements78�there are no specific time-limits for information kept by govern-ment authorities� the CCa keeps all information that is in its possession inelectronic form indefinitely� automatic updates are performed by the CCaof details of the information in their system,e.g.changes of address, for allnatural and legal persons associated with registered entities (CompaniesActs�18 andAct on Certain Commercial Undertakingss�15d)� these updates ofthe personal information cease 10 years after the person in question ceasesto be active in the company� information kept by the Cta is covered by theOrder on State Accounting,according to which accounting material, includ-ing underlying documentation, must be kept for a minimum of five years�for retention requirement purposes, tax returns are considered accountingmaterial� the practice of the Cta, however, is that tax returns are kept forat least 10 years if the taxpayer is an employee and for at least 20 years if thetaxpayer is a company or a self-employed person�79�information on large shareholders (more than 5%) which must bedisclosed in public limited companies’ annual reports (Acton the FinancialStatements�74), is considered to be accounting information and this must be keptfor five years from the end of the accounting period the records or books concernaccording to theBookeeping Acts�10, described in section a�2 of this report�80�there is no set period of time for which information must be main-tained by the companies themselves,e.g.the shareholder register� there isno obligation to keep the information if the company is liquidated, unless aservice provider (liquidator) is involved in the liquidation� in such cases, theliquidators have an obligation to keep the information for 5 years�81�sometimes requests from foreign competent authorities for informa-tion in tax matters concerns ownership information related to a companywhich does not exist anymore and it has been difficult for the danish com-petent authority to obtain the information requested� the new system beingestablished under theCompanies Act,coupled with the fact that the CCakeeps its information indefinitely, means these difficulties are likely tobecome increasingly infrequent�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –31

Bearer shares(ToR A.1.2)82�only danish public limited companies (a/s) can issue bearer shares,and such shares may be issued up to the whole capital of the company� as atapril 2010, there were 43 451 public limited companies (a/s) in denmark,43 236 of which were not publicly listed on the stock exchange� the CCadoes not have statistics on the extent of use of bearer shares in denmark�83�denmark has not established a custodial arrangement with a recognisedcustodian or other similar arrangement to immobilise such shares� there is norequirement to keep bearer shareholders’ names in share registers; serial num-bers are sufficient (CompaniesActs�54(1))� some measures are however in placewhich require identification of persons holding bearer shares� anyone holdingbearer shares is obliged to notify the company of this shareholding if (s�55):• the voting right conferred on the shares represents no less than 5% ofthe share capital’s voting rights or their nominal value accounts forno less than 5% of the share capital; ora change of a holding already notified entails that limits at intervals of5, 10, 15, 20, 25, 50 or 90% and limits of 1/3 or 2/3 of the share capital’svoting rights or nominal value are reached or are no longer reached�

•

84�in addition, a bearer shareholder has to identify himself one week inadvance of the company’s general meeting in order to exercise shareholder’srights at the meeting (s�84(1))� a holder of bearer shares has to demonstratethat he has title to dividends though this does not have to be registered in thecompany’s book of owners�85�while these mechanisms do allow for identification of owners of bearershares in certain circumstances, they are insufficient, particularly consideringthe large number of companies which may be issuing bearer shares in denmark�that said, foreign competent authorities have not reported cases where denmarkhas not provided information requested due to difficulties in obtaining informa-tion about bearer share holdings�

Partnerships(ToR A.1.3)86�• denmark has four types of partnerships:Partnerships limited by shares (P/s): these may also be called partnercompanies� a partner company is a limited partnership where oneor more of the limited partners in the partnership are public limitedcompanies� the limited partners have contributed capital, which isdivided into shares� a partner company must have a minimum capital ofdkk 500 000� a P/s is regulated by theCompanies Act;Chapter 21� the

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

32– ComPlianCe with the standards: availability of informationrules on public limited companies (a/s) apply to P/s with the necessaryadjustments�• limited partnerships (k/s): in a k/s, one or more members – thegeneral partners – are personally, jointly and severally liable, withoutlimitation, for the debts and obligations of the undertaking, whileone or more limited partners have limited liability for the debts andobligations of the undertaking� the k/s is formed by an agreementbetween the participants, regulated by the general law on con-tracts� a k/s is covered by parts of theAct on Certain CommercialUndertakings�there were 3 328 k/s in denmark in august 2010�General partnerships (i/s): in an i/s, all members are personally,jointly and severally liable, without limitation, for the debts andobligations of the undertaking� the i/s is formed by an agreementbetween the participants, regulated by the general law on con-tracts� an i/s is covered by parts of theAct on Certain CommercialUndertakings�there were 622 i/s in denmark in august 2010�european economic interest groupings (eeiG): an eeiG is regu-lated by Council regulation (eeC) no�2137/85 of 25 July 1985 onthe european economic interest Grouping (eeiG) and the danishAct on Administration of the EEC Regulation introducing EuropeanEconomic Interest Groupings�an eeiG must be formed by at leasttwo parties, which do not themselves have limited liability, compa-nies or natural persons, who carry out any industrial, commercial,craft or agricultural activity or who provide professional or otherservices in the european economic Community�

•

•

Ownership information held by government authorities87�Partnerships are transparent for income tax purposes; most partner-ships do not themselves submit tax returns� rather, the income from the part-nership is included proportionately in each of the partners’ tax returns� thetax return forms do not require identification of the other partners involvedin the partnership, though the Cta can search its databases of all informa-tion related to the individuals’ tax returns and thus compile the informationrelated to a partnership� the exception to this is partnerships which havemore than 10 partners and some of the partners do not participate activelyin the business must submit a tax return on behalf of the partners (TaxAssessment Acts�29)�88�all partnerships are registered in the Cvr, including partner com-panies, limited partnerships and general partnerships� for partnerships, theregister contains, amongst other information, the name, address, position, andCPr/Cvr number of each full-liability partner (Acton the Central Business

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –33

Registers�11 andAct on Certain Commercial Undertakingss�2)� this appliesin the case of businesses that are in the form of full liability partners, such aslimited partnerships (k/s) or general partnerships (i/s)�89�further, k/s and i/s where all of the general partners/partners areundertakings with limited liability must be registered with the CCa inaccordance with theAct on Certain Commercial Undertakings,s�2(3)� theinformation that must be made available for registration is similar to theinformation that companies must report�19the information and subsequentchanges are registered at the CCa and available to the public� the registrationalso establishes an obligation for these partnerships to submit their annualreports to the CCa�90�Changes to the full liability partners for limited partnerships andgeneral partnerships have to be reported to the CCa and registered within 2weeks� (s�2(3) and s�10(1) of theAct on Certain Commercial Undertakings)�information on all partners must also be submitted by a partnership if itneeds to register for vat purposes� there is no ownership information sub-mitted to the CCa on the limited partners in a limited partnership which doesnot need to register for vat�91�european economic interest Groupings are obliged to register with theCCa� the registration, amongst other things, includes provision of (CouncilRegulation,articles 5-7) the name, address, legal form and CPr/Cvr num-bers for each member; and a copy of the partnership agreement/contract/memorandum underpinning the formation of the partnership� any amendmentto the partnership agreement must be notified to the CCa within 2 weeks ofthe change (Acton Certain Commercial Undertakingssections 38-39)�92�ownership information is submitted to the Cta with respect to for-eign partnerships that have a permanent establishment in denmark, thoughthis may not fully cover all foreign partnerships which:(i)have income,deductions or credits for tax purposes in denmark;(ii)carry on business indenmark� since partnerships do not normally have to submit a tax return(unless there are more than ten partners and some of the partners do not par-ticipate actively in the business:Tax Assessment Acts�29), each of the part-ners in a foreign partnership with permanent establishment in denmark hasto specify in their tax returns which income derives from their involvementin the partnership�

19�

obligations on companies to provide information on capital do not apply topartnerships�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

34– ComPlianCe with the standards: availability of information

Information held by service providers93�service providers hold the same information on partnerships as theyhold on companies in accordance with theAML/CFT Act(see earlier descrip-tion in section a�1�1)� essentially, a range of financial institutions, financialbusinesses and professionals involved in providing services for their clientsare obliged to conduct Cdd and must therefore know the identity of his/herclients, including; name, address and id-number� beneficial ownership of theclients is explored as part of Cdd�

Information held by the partnership and by partners94�in the normal course of business information on the partners wouldbe maintained for the management of the affairs of the partnership itself�when founded, limited partnerships must create a memorandum of asso-ciation which details, amongst other things the names, addresses and Cvrnumbers, if applicable, of the fully liable partners (CompaniesActs�360(1))�other forms of partnerships are not required to maintain information onthe partners� there is no obligation for an individual partner, in any type ofpartnership, to maintain identity information on the partners� there is norequirement to have resident partners�

Document retention requirements95�while there are no specific time-limits for information kept by gov-ernment authorities, the CCa keeps the information in its possession indefi-nitely� Pursuant to theOrder on State Accounting,the Cta keeps taxpayerinformation which is considered “accounting information” for five years� asa matter of practice, tax returns are kept for 10 or 20 years, depending on thetype of taxpayer�96�there is no set period of time specified in theCompanies Act,theAct on the Central Business Registeror theAct on Certain CommercialUndertakingsfor which information must be maintained by the partnershipsthemselves� under theAML/CFT Act,obliged entities must store Cdd mate-rial for no less than five years after the customer relationship has ceased� ifthe obliged entity ceases business or is dissolved, the last acting managementor others, as determined by a bankruptcy court, must ensure that this infor-mation is stored in accordance with the act (s�23)�Trusts

(ToR A.1.4)97�danish law does not include the concept of trust, and trusts cannot beset up under danish law� foreign trusts can however operate in denmark anddanish individuals and legal persons can however act as trustees, adminis-trators or protectors for foreign trusts� a foreign trust operating in denmark

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –35

may need to be registered by the danish tax authorities for tax or vat pur-poses� in such cases the trusts are registered under “other foreign firm” inthe Cvr (described previously in section a�1�1), a category which includesall types of legal bodies unknown in danish law� while the laws related tothis registration do not clearly specify that information on settlors, trusteesand beneficiaries be provided to the CCa, such detail is required as a matterof practice from all trusts registering as “other foreign firm”�98�danish trustees are required to register with the CCa (AML/CFTActsections 1 and 31)� these requirements for registration are described in orderno�1197/2008 “notice of filing and registration of money transfer companies,exchange offices and providers of services to companies in the Commerceand Companies agency register”�20under that act, trustees are obliged aspart of registration to provide the CCa with the same information as otherpersons or entities covered by the act and they must submit details to theCCa within two weeks of a change (s�2 to s�4 of the order)�99�Cdd obligations apply under theAML/CFT Actto a wide range ofbusinesses and professions, notably including legal or natural persons whocarry out specified activities on a commercial basis, including (s�1):• • forming companies;acting as or arranging for another person to act as a member of themanagement of an undertaking, or as partner of a partnership, or asimilar position for other companies;provides a domicile address or another address, which is similarlysuitable as contact address and related services, for an undertaking;acting as or arranging for another person to act as a trustee or admin-istrator of a fund or another similar legal arrangement; oracting as or arranging for another person to act as a shareholder fora third party which does not have its shares traded on a regulatedmarket�

• • •

100�all of the professional persons in denmark who act as trustees oradministrators of foreign trusts fall within these categories� the obliged enti-ties covered by this act must identify customers if they suspect a transactionis associated with financing of terrorism or money laundering (s�11)� whereno such suspicion arises, the obliged entities should identify customers whoare natural persons by obtaining; name, address, national registration number(CPr number) or similar documentation if the person in question does nothave a CPr number (s�12(2))� for legal persons, the obliged entity shouldobtain; name, address, Cvr number (business registration number) or similar20�as amended by order no�420/2010�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

36– ComPlianCe with the standards: availability of informationdocumentation if the undertaking does not have a Cvr number� reasonablesteps need to be taken to ascertain the undertaking’s ownership and controlstructure and the undertaking’s beneficial owners must be identified (s�12(3))�the extent of the steps to be taken to obtain proof of identity may be deter-mined by the level of money laundering or terrorist financing risk related tothe individual customer or business relation, the product or the transaction(s�12(7))�

Document retention requirements101�there are no specific time-limits for information kept by governmentauthorities� the CCa keeps the information that is in its possession indefi-nitely� the Cta keeps most of its taxpayer information for five years� undertheAML/CFT Act,obliged entities must store Cdd material for no less thanfive years after the customer relationship has ceased (s�23)�

Foundations(ToR A.1.5)102�there are two types of foundations that can be formed under danishlaw: non-commercial foundations (fond); and commercial foundations (erh-vervsdrivende fond)� foundations are separate legal entities� there is nocomplete statutory definition of “foundation”, but the foundation must be selfstanding entity and it must have:• • • one or more objectives;its own capital, definitively and irrevocably separated from thefounder;21anda board that is independent ofe.g.the founder and beneficiaries�

103�foundations are governed by separate laws, notably theFoundationsActand theCommercial Foundations Act�both kinds of foundations aretaxable entities under theAct on Foundations Taxation�the Civil affairsagency (Caa), in the ministry of Justice, is the authority responsible forall non-commercial foundations and, as a general rule, the CCa is theauthority responsible for all commercial foundations� however, the Caa isalso responsible for foundations with mixed purposes,e.g.commercial andphilanthropic activities which fall within the responsibilities of the ministryof Justice� the Caa currently supervises around 14 000 non-commercialfoundations and 220 commercial (mixed-purpose) foundations�21�the capital of a commercial foundation must be at least dkk 300 000 (eur 40 000)�non-commercial foundations must have assets of at least dkk 250 000(eur 33 300)�

Peer review rePort – Combined Phase 1 and Phase 2 rePort – denmark – � oeCd 2011

ComPlianCe with the standards: availability of information –37