Kommunaludvalget 2010-11 (1. samling)

KOU Alm.del Bilag 85

Offentligt

Henrik Christoffersen

The welfare coalition and compulsorymunicipal outsourcingMed dansk sammenfatning: Mønstre ikommunernes brug af udliciteringCEPOS arbejdspapir nr. 14

1

CEPOS’ publikationer er gratis tilgængelige for alleonline på www.cepos.dk, men kan også bestilles i tryktform gennem CEPOS forlaget,Landgreven 3, 3. sal, 1301 København KTelefon: 33 45 60 30 eller fax: 33 45 60 45E-mail: [email protected]� Copyright: 2010 CEPOS, Henrik Christoffersen ogKarsten Bo LarsenMindre uddrag, herunder figurer, tabeller og citater ertilladt med tydelig kildeangivelse. Skrifter, der omtaler,anmelder, citerer eller henviser til nærværende, bedessendt til CEPOS.1.udgave, 1. oplag� Omslagslayout: CEPOSTryk: CEPOS ForlagetForlag: CEPOS ForlagetOplag: 200ISBN nr.:978-87-92581-22-8

Maj 20112

Henrik Christoffersen

The welfare coalition and compulsorymunicipal outsourcingMed dansk sammenfatning: Mønstre ikommunernes brug af udliciteringCEPOS arbejdspapir nr. 14

3

ForordSideløbende med den kommunale strukturreform blev der indgået en aftale mellemregeringen og Kommunernes Landsforening om øgning af kommunernes anvendelseaf udlicitering som organisatorisk løsningsmåde. Aftalen var fireårig, og det er derfornu muligt at opgøre effekterne. Der er stor forskel på kommunernes anvendelse afudlicitering, og analyserne i dette arbejdspapir sætter fokus på, hvad der ligger bagde enkelte kommuners valg af udliciteringspraksis.Selve arbejdspapiret er engelsksproget. Baggrunden er, at det indgår i denalmindelige internationale forskningsudveksling. Det er således blevet antaget tilpræsentation på den årlige samling i det europæiske forskernet for forskere, sombeskæftiger sig med økonomisk teori om politiske og bureaukratiske systemer,European Public Choice Society. Arbejdspapiret indledes imidlertid med en dansksammenfatning.Det statistiske analysearbejde i forbindelse med papiret er udført af stud.polit.Jeppe Madsen. I øvrigt har jeg modtaget gode kommentarer til papiret fracand.polit. Karsten Bo Larsen.Juni 2011

Henrik Christoffersen

4

IndholdSammenfatning1. Municipal outsourcing as government policy2. A model explaining outsourcing3. The regressions4. A model explaining municipalities winning own tenders5. Discussion6. References

5

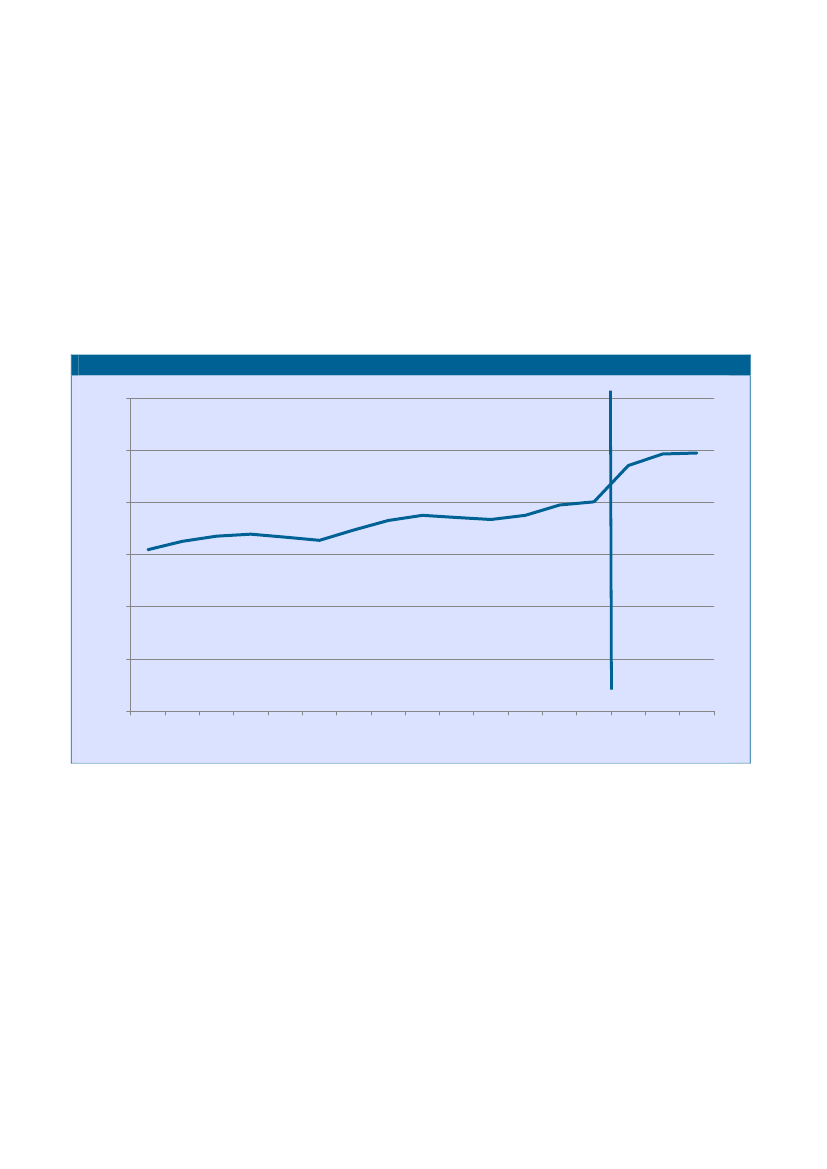

SammenfatningI sammenhæng med den kommunale strukturreform i 2007 blev der gjort foranstaltning tilat øge omfanget af udlicitering i de danske kommuner. Der blev således i 2006 medvirkning for de følgende fire år indgået en aftale mellem regeringen og KommunernesLandsforening om øgning af udliciteringsomfanget i kommunesektoren som helhed. I lysetaf denne aftale er anvendelsen af udlicitering faktisk øget. I figuren nedenfor er vistudviklingen i Indenrigsministeriets indikator for private leverandører, hvor løftet ianvendelse af udlicitering fremgår.Privat-leverandør indikator for hele landet fra 1993 til 200930%

25%

20%

15%

10%

5%

0%19931994199519961997199819992000200120022003200420052006200720082009

6

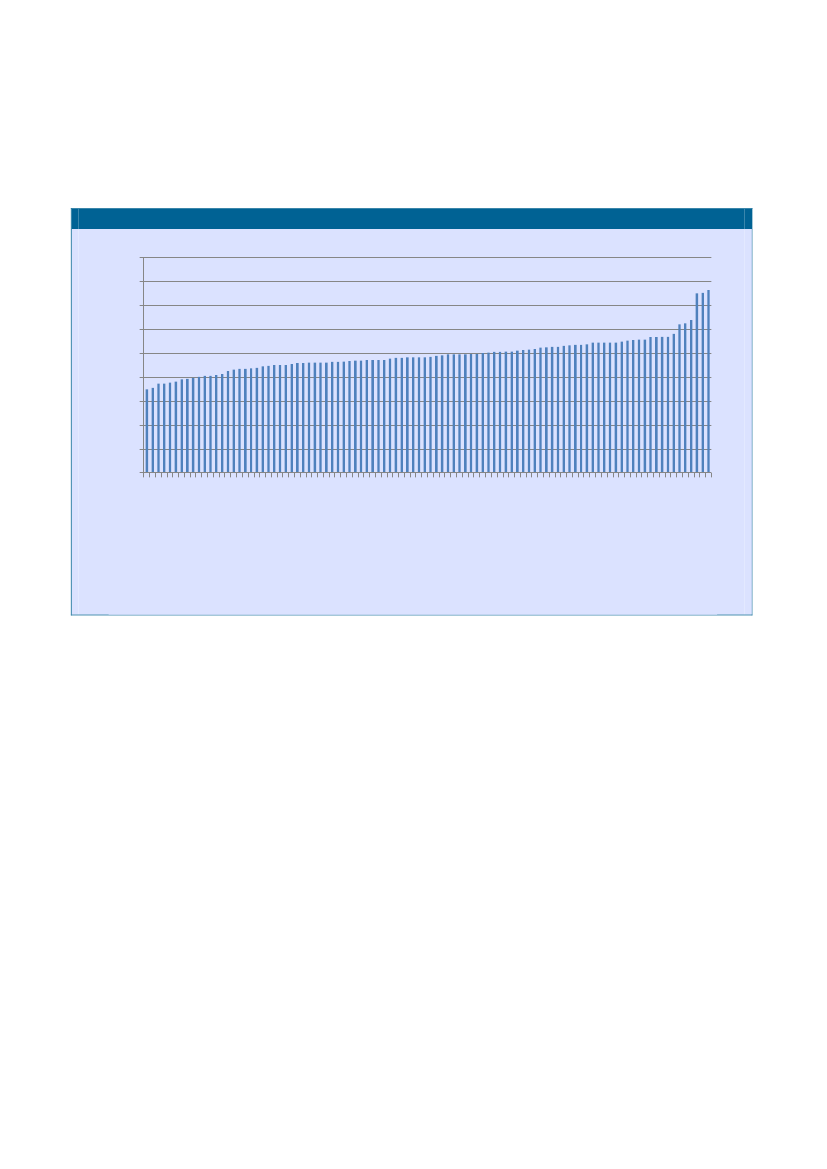

Aftalen om øget udlicitering kom til at gælde kommunesektoren under et. Der er dog storforskel på, hvor meget de enkelte kommuner gør brug af udlicitering. Privat leverandørindikatoren er vist for hver enkelt af de 98 kommuner i den følgende figur.Privat-leverandør indikator i 2009 på kommuneniveau sorteret efter indikatorstørrelsepct.454035302520151050NorddjursRødovreSvendborgAalborgKertemindeHvidovreHaderslevHjørringMariagerfjordHerningAabenraaHorsensFaaborg-MidtfynRingstedAssensLyngby-TaarbækRingkøbing-SkjernHøje-TaastrupMiddelfartSorøHelsingørHalsnæsStruerBrønderslevAllerødStevnsGreveVejenVesthimmerlandsKøbenhavnOdsherredLollandGribskov

I analysen i nærværende arbejdspapir undersøges, hvad der kan forklare de enkeltekommuners forskellige tendens til at anvende udlicitering. Der opstilles fem hypoteser om,hvad der forklarer anvendelsen af udlicitering:1. Økonomiske presfaktorer. Dels indkomstgrundlag i kommunen, dels udgiftsbehov2. Politik. Dels borgmesterens partitilhørsforhold, dels størrelsen af velfærdskoalitionen,hvilket vil sige andelen af vælgerne i kommunen, der er offentligt ansat3. Skala og grad af professionalisering. Kommunens indbyggertal4. Soliditeten i kommunens økonomi. Dels serviceniveau, dels skatteniveau5. Hidtidig praksis. Graden af udlicitering året forudI den regressionsanalyse, som gennemføres, viser det sig, at kun to hypoteser kanbekræftes. Det gælder hypotesen om, at kommuner med mange offentligt ansatte blandtvælgerne har særlig stor aversion mod udlicitering. Ligeledes gælder det hypotesen om, at

7

kommuner med stor økonomisk soliditet i form af relativt højt serviceniveau og relativt lavtbeskatningsniveau er særlig tilbøjelige til at anvende udlicitering.

I hovedsagen har kommuner selv mulighed for at indgive bud, når de iværksætterudlicitering. Indenrigsministeriet opgør både, hvor stor en del af kommuners budget, derkonkurrenceudsættes, og hvor stor en del, der håndteres af private leverandører.Differencen mellem disse to størrelser udgør de udbud, som kommuner selv vinder.

I arbejdspapiret gennemføres en undersøgelse af, hvad der særligt kendetegner dekommuner, som vinder egne udbud. Denne undersøgelse gennemføres også som enregressionsanalyse i en model med samme hypoteser, som anført ovenfor. Her viser detsig, at kun en enkelt af de fem hypoteser kan finde statistisk bekræftelse. Det viser sig, atde kommuner, som i særlig ringe grad har anvendt udlicitering, til gengæld i særlig storgrad vinder deres egne udbud.

Dette resultat kan have flere forklaringer. En forklaring kan være, at kommuner, der kun iringe udstrækning anvender udlicitering, er særlig effektive, så der ikke er større gevinsterved at udlicitere. Det vil i givet fald fordre, at disse kommuner er endda særdeles effektivesammenholdt med de øvrige kommuner, for i den – ganske vist begrænsede - danskeforskningslitteratur om effekter af udlicitering findes ganske betydelige effekter på deopgaveområder, som er undersøgt. En anden forklaring kan være, at nogle kommuner medsærligt store velfærdskoalitioner, som påvist ovenfor, også er kendetegnet ved en særligstor aversion mod anvendelse af udlicitering. Når sådanne kommuner da i kraft af aftalenom øgning af den kommunale udlicitering udsættes for et pres for mere udlicitering, kanen reaktion være at udvise særlig iver efter at vinde udbud selv og derved undgå privateleverandører.

Resultatet af analysen giver derved anledning til at rejse spørgsmålet, hvorvidt der er sikreten fair konkurrence, når kommuner foranstalter udbud og selv optræder som byder. Detkommunale regnskabssystem muliggør ikke direkte en aflæsning af kommunensomkostninger ved produktion af bestemte serviceydelser, og det er derfor vanskeligt atsikre, at krydssubsidiering ikke forekommer.

8

AbstractIn this paper the outsourcing pattern in Danish municipalities is analyzed in the light of a structuralreform in 2007, which drastically reduced the number of municipalities, and after the introductionof a government policy in 2006 enforcing the municipal sector as a whole to increase the degree ofoutsourcing. It is shown that municipalities inclined to use outsourcing as an organizational formare generally characterized by offering their citizens a relatively high service level compared to thetax price collected. And secondly: Municipalities with a relatively large proportion of the votersbeing occupied in the public welfare sector seem to have a particularly strong aversion againstoutsourcing. Danish municipalities are themselves allowed to respond on their own invitations totenders. It is furthermore shown, that municipalities with limited use of outsourcing are stronglyinclined to win their own invitations to tenders.

JEL: H70, H77

Paper presented at the 2011 meeting in European Public Choice Society, April 28 to May 2 inRennes.

9

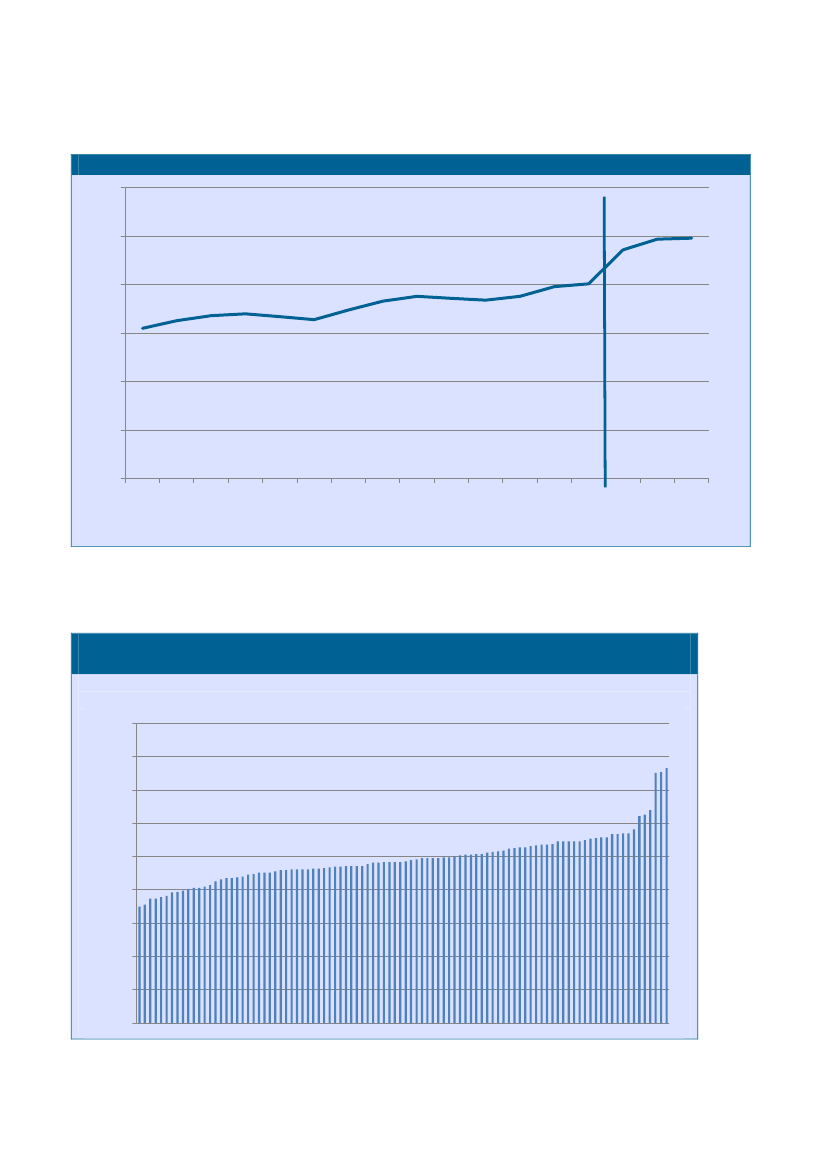

1. Municipal outsourcing as government policyChristoffersen and Paldam (2003) showed that Danish municipalities generally hesitateoutsourcing the production of welfare services to be allocated to the citizens in themunicipality, and that important differences in the degree of outsourcing could beexplained as a result of three factors: Municipalities with modern economic structureswere especially in favor of outsourcing and the use of outsourcing was then spread toneighbor municipalities. On the other hand, municipalities with a large proportion of thelocal voters belonging to the “welfare coalition”, having their full income from tax financedsources as public servants or receivers of public transfer payments, had an aversion againstoutsourcing. In this paper the outsourcing pattern in Danish municipalities is analyzed inthe light of changed basic conditions in two respects.First, a structural reform in 2007 reduced the number of municipalities drastically from 271to 98 and moved several tasks from the regional municipal level to the local level.Second, the national government introduced in 2006 a policy for enforcing the municipalsector as a whole to increase the degree of outsourcing. This policy was drawn up as anagreement between the National Union of Local Authorities, KL, and the Minister ofFinance saying, that the proportion of the municipal service production organized asoutsourcing to private producers should be raised during a four year period from 2006 to2010. This agreement has, as can be seen in figure 1, resulted in a slight raise in theproportion of the service production produced by private producers.The important municipal differences in degrees of outsourcing have continued after theabove mentioned changes in conditions. Figure 2 shows the proportion of serviceproduction organized as outsourcing in the 98 municipalities existing after 2007. A fewmunicipalities are characterized by visible aversion against outsourcing and other fewmunicipalities are especially for outsourcing as an organizational form.

10

Figure1: Private supplier indicator in Danish municipalities, 1993 to 200930%

25%

20%

15%

10%

5%

0%

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

Note: A municipal structural reform took place in 2007 reducing the number of municipalities from 271 to 98 andincreasing the number of municipal tasks.

Figure 2: Private supplier indicator for 2009 in the 98 Danish municipalities ranked afterindicator-size

45%40%35%30%25%20%15%10%5%0%

11

2009

2. A model explaining outsourcingSeveral different explanations can eventually work at explaining the important differencesin the use of outsourcing as an organizational form between the 98 municipalities. Fourhypotheses concerning the size of the private supplier indicator in 2009, as described infigure 2, will be tested in section 3. These hypotheses are listed in figure 3 as model a.

Figure 3: The HypothesesHypotheses and variablesExplained variablesa. Outsourcing tendency (model a)b. Priority to efficiency through outsourcingover high tax level (model b)c. Ability to win own tenders (model c)Private supplier indicatorPrivate supplier indicator / Percentage municipal incometaxation(Indicator for tasks under competition – Private supplierindicator) / Indicator for tasks under competitionDefinition of variables

Explaining variablesHypothesis 1: Economic press factorsH:1.1: Income for taxation per inhabitant(model a, b og c)Total tax base per inhabitant

H:1.2: Socio economy(model a, b og c)Hypothesis 2: Political explanationsH:2.1: Mayors political party (model a, b og c)H:2.2: Welfare coalition (model a, b og c)

Socio economic indexDummy for Liberal or Conservative mayorNumber of citizens employed as municipal, regional orstate civil servant

Hypothesis 3: Scale of production andprofessionalizationH:3.1: Number of inhabitants (model a, b og c)H: 4.1: Service level (model a, b og c)H:4.2: Level of municipal income tax (model a,b og c)Hypothesis 5: Past dependencyH: 5.1: Outsourcing in 2008 (model c)

Number of inhabitants (1.000)Municipal expenditures / Needs as measured in the blockgrant systemMunicipal tax rate for income taxation in 2009

Hypothesis 4: The solidity of the municipal economy

Private supplier indicator in 2008

12

Hypothesis 1 states that economic pressure will establish an incentive to increase the useof outsourcing. There are only few Danish empirical studies of the effect of outsourcing inthe municipal sector. Blom Hansen (20xx) finds that the production costs in roadmaintenance are about 20 percent lower when outsourcing is chosen as an organizationalsolution compared to production in traditional municipal form. Christoffersen, Paldam andWürtz (200X) find that school cleaning standardized for differences in quality and foreconomies of scale are produced at 30 percent lower costs when outsourced compared totraditional municipal organization. Christoffersen, Milhøj and Westergaard-Kabelmann(2009) construct a macro model estimating the potential if all Danish municipalitiesdecided outsourcing to the same extend as the municipality with the highest value of theprivate supplier indicator in 2009. The potential such defined was estimated at between 6and 7 percent of total municipal consumption expenditures. As the Danish empiricalliterature points out a significant economic potential in increased municipal outsourcing, itcould be expected that municipalities not able to deliver average service level to averagetax level would be especially inclined to savings through outsourcing. In H:1.1 a specialneed for money arises from a weak tax base, and in H:1.2 a special need of money isgenerated by factors indicating weak social structures among the citizens in themunicipality.

Hypothesis 2 expresses a belief in politics. Two explaining variables are here introduced:understanding politics respectively as party politics and as stakeholder interests. In H:2.1municipalities dominated by right wing political parties are expected to be more orientatedtowards outsourcing than other municipalities. In H:2.2 stakeholder interests are expectedto work so that voters employed in the public welfare sector have special preferences foravoiding organizational forms establishing a pressure for efficiency.

Hypothesis 3 is an economies of scale hypothesis. This hypothesis is not trivial becauseeconomies of scale can exist as well in the production of municipal services as inadministration of outsourcing itself. Economies of scale in production can makeoutsourcing especially relevant for small municipalities. Economies of scale inadministration of outsourcing can make outsourcing especially relevant for largemunicipalities.

Hypothesis 4 is a hypothesis that municipalities which offer their citizens a worse servicepackage than other municipalities will be pressed by the voters to increase efficiency. H:4.1expresses a worse service package in the sense that the citizens must accept a poorerquality. H:4.2 expresses that the citizens have to pay a higher tax price.

13

The inclination towards use of outsourcing as an organizational form can also findexpression in strategic decisions among relevant alternatives. Municipalities facingeconomic unbalance can decide to raise taxes or raise efficiency if not to reduce theservice deliveries to the citizens. In model b defined in figure 3 the ratio “Private supplierindicator / Percentage municipal income taxation” is used to express this strategic choicein the municipalities. The four hypotheses introduced in model a are also included inmodel b.

14

3. The regressionsModel a explaining the private supplier indicator is tested in the regression in table 1.

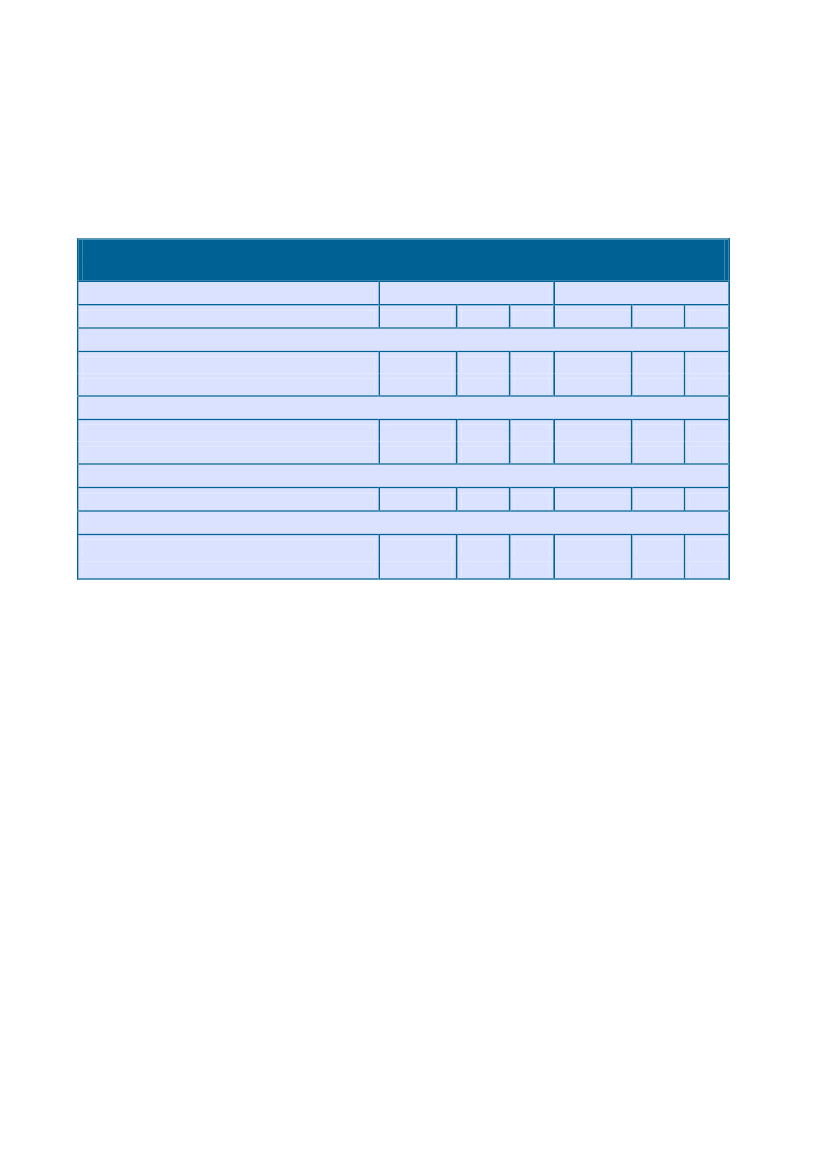

Table 1: The full and reduced model explaining the private supplier indicator in Danishmunicipalities in 2009(model a)Full modelCoefficientHypothesis 1: Economic press factorsH: 1.1: : Income for taxation per inhabitantH: 1.2: Socio ecomonic indexHypothesis 2: Political explanationsH: 2.1: Liberal or Conservative mayorH: 2.2: Welfare coalitionHypothesis 3: Scale of production and professionalizationH: 3.1: Number of inhabitantsHypothesis 4: The solidity of the municipal economyH: 4.1: Service levelH: 4.2: Level of municipal income tax22,74-0,592,51-1,060,010,2922,40-0,832,870,01-1,93 0,0570,010,940,35---1,33-16,191,76-2,030,080,05--14,42--1,98-0,050,011,630,390,980,700,33------Reduced modelt-value P>|t|t-value P>|t| Coefficient

Two of the four hypotheses seem to be confirmed by the regression. Municipalitiesinclined to use outsourcing as an organizational form are generally characterized byoffering their citizens a relatively high service level compared to the tax price collected.And secondly: Municipalities with a relatively large proportion of the voters being occupiedin the public welfare sector seem to have a particularly strong aversion againstoutsourcing.

If the level of municipal income tax H:4.2 is excluded, the welfare coalition H:2.2 will nolonger be significant. It indicates, as can also be seen in the correlation matrix in table 3, arather high correlation between welfare coalition and tax level. Also, the effect of thewelfare coalition H:2.2 decreases, if the two municipalities with the highest welfarecoalition (Two suburbs to Copenhagen) are excluded from the regression.

The test of model b in table 2 produces results very much similar to the results from modela. The municipalities giving priority to outsourcing compared to holding a high local taxlevel are generally characterized by a high service level compared to the local tax level, and15

these municipalities furthermore are to a slight extent populated by voters being occupiedin the public welfare sector and blocking for municipal outsourcing.

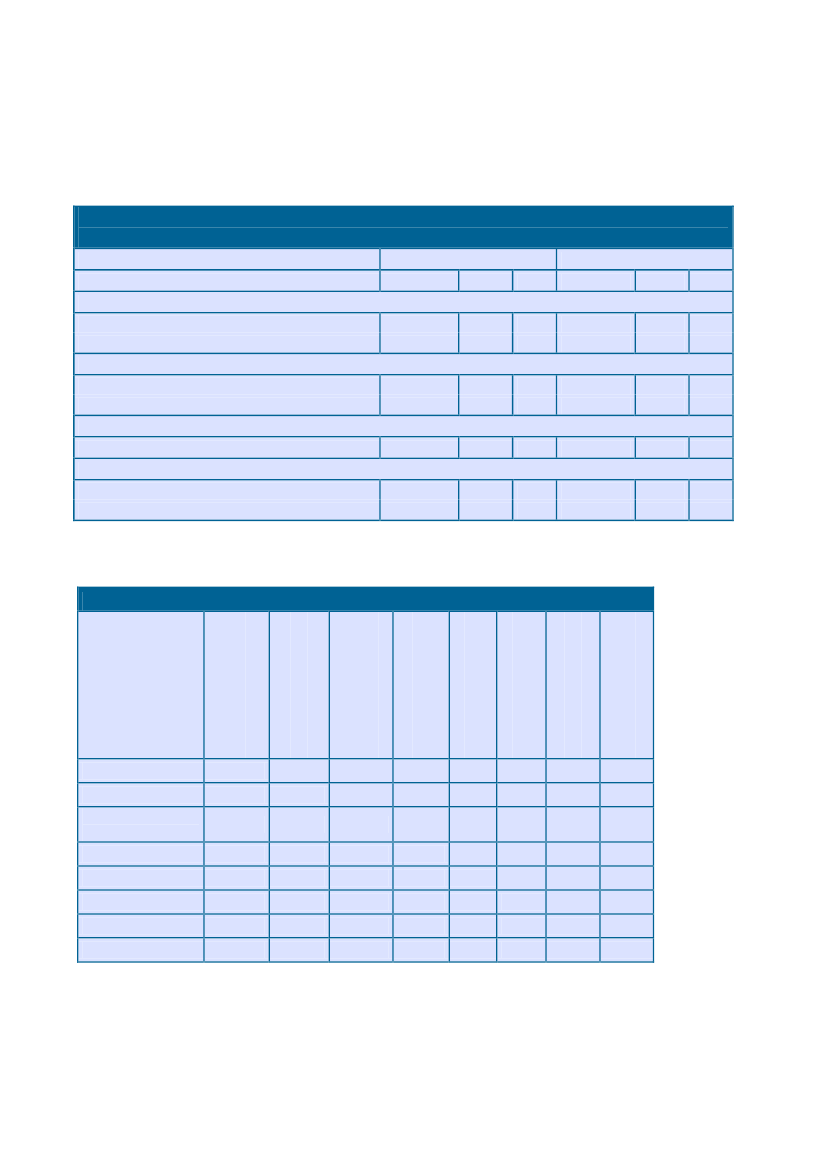

Table 2: The full and reduced model explaining the priority to efficiency through outsourcingover high tax level (model b)Full modelCoefficientHypothesis 1: Economic press factorsH: 1.1: Income for taxation per inhabitantH: 1.2: Socio economic indexHypothesis 2: Political explanationsH: 2.1: Liberal or Conservative mayorH: 2.2: Welfare coalitionHypothesis 3: Scale of production and professionalizationH: 3.1: Number of inhabitantsHypothesis 4: The solidity of the municipal economyH: 4.1: Service levelH: 4.2: Level of municipal income taxNote: As table 1.0,000,89-0,060,992,47-2,790,330,020,01-0,90-0,07-2,88-4,24-0,010,000,000,070,05-0,65t-value P>|t|0,501,041,78-2,050,620,300,080,04Reduced modelCoefficient----0,57t-value P>|t|----1,97---0,05

Table 3: Korrelation matrix for explaining variables in model a, b and c.Number inhabitantsLiberal orConservative mayor

Income levelSocio economyLiberal orConservativeWelfare coalitionNumber inhabitantsService levelLocal tax levelOutsourcing 2008

1,000-0,3250,1490,142-0,0370,393-0,5480,2931,000-0,1470,3030,202-0,0780,074-0,0441,000-0,161-0,134-0,027-0,0990,1901,0000,2730,062-0,273-0,1151,000-0,143-0,234-0,0131,0000,0440,2921,000-0,1821,000

16

Outsourcing 2008

Welfare coalition

Socio economy

Local tax level

Income level

Service level

4. A model explaining municipalities winning own tendersWhen the Danish liberal-Conservative government in 2006 introduced a policy programenforcing the municipalities to increase the use of outsourcing as organizational form, itbecame a necessity for the municipal sector as a whole to come up with an increase in theindicator of tasks under competition measuring the proportion of the total service budgetwhich relates to activities where invitations to tenders have been brought into use. On theother hand it was obvious that there still existed a certain resistance in the municipalsector against increased use of outsourcing. It was therefore to be expected, that not allmunicipalities had preferences for reacting in the same way. On the other hand theNational Association of Local Authorities, KL, had to obtain from the member-municipalities, that the municipal sector as a whole was able to keep the agreement whichthe organization has entered into to hinder a loss of credibility. Furthermore it wasnecessary for KL to ensure, that all municipalities contributed to fulfilling the agreement. Ifnot, KL was taking the risk that the outsourcing member municipalities would protest anddemand solidarity. To some degree, a pressure was therefore established on themunicipalities, which was strongest against increasing the use of outsourcing.

The Danish national regulation of the municipalities is open for municipalities respondingthemselves on their own invitations to tenders. The regulation contains rather detailedcompulsory directions for calculating the production costs in municipal production in ownmunicipal production units to avoid cross subsidizing the tasks under competition.Nevertheless this regulation has become very controversial, and the Danish lobbyorganizations representing industry and commerce have protested sharply against thepossibility for municipalities to respond on their own invitations to tenders. Theorganizations argue that the regulation does not in practice prevent cross subsidizing andmunicipal offers to themselves to (?) dumping prices. It has, however, not been possiblefor the liberal conservative minority government to find support in the Danish Parliamentfor banning municipal offers to themselves.

The Danish Ministry of the Interior produces statistics offering data for tasks undercompetition, as well as private supplied goods for each municipality (www.noegletal.dk).The residual between these two indicators represents the extent to which municipalitiesare winning their own invitations to tenders. In figure 3 a model is formulated, whichintends to explain the pattern of winning own invitations to tenders. The model, indicatedin the figure as model c, adds an additional hypothesis to the four hypotheses in model aand b. The new hypothesis is a past dependency hypothesis, saying that municipalitiesbeing averse in relation to outsourcing are characterized by a low historical level ofoutsourcing, and that such municipalities will be especially inclined to win their own

17

invitations to tenders now that they are under pressure for setting production tasks undercompetition.

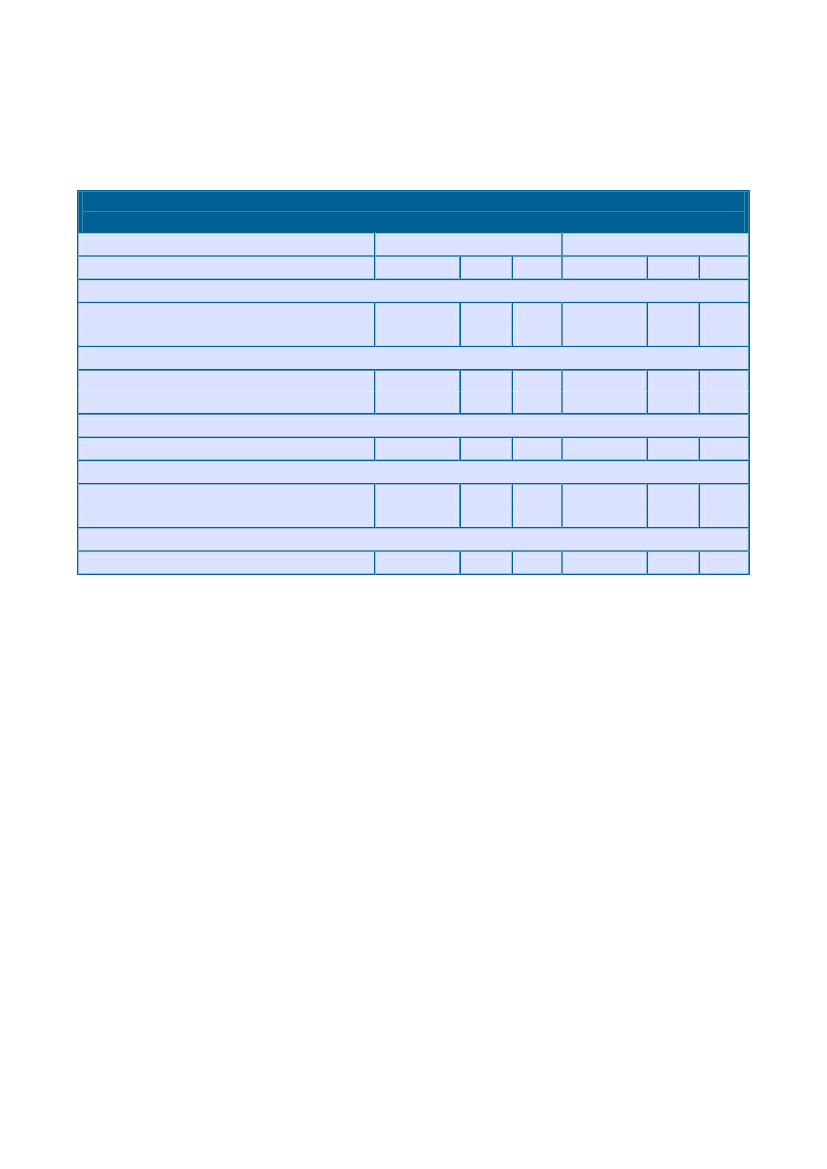

The results of the regression are shown in table 4. The first observation to do is that theexplanations working in model a and b do not work in model c. Municipalities winning theirown invitations to tenders are not especially under economic pressure. Neither are thesemunicipalities characterized by having an especially strong welfare coalition among thelocal voters. Only one explanation can find confirmation, namely, the past dependencyexplanation. The variable used here, the private supplier indicator for 2008, is significant,and the sign is negative indicating, that municipalities with limited use of outsourcing arestrongly inclined to win their own invitations to tenders.

When municipalities are winning their own invitations to tenders, it can indicate that thesemunicipalities are working very efficiently, so that no private suppliers are able to come upwith corresponding, equally efficient offers. On the other hand, the Danish literature findsas an average, as stated in section 2, that municipalities producing in own production unitshold significantly higher costs than municipalities outsourcing their production. So theefficiency interpretation would presuppose a special behavior in some municipalities.Another interpretation of the results says that municipalities, as postulated by the lobbyorganizations for industry and commerce, are able to manipulate the calculated cost pricesin own production and to cross subsidize production tasks threatened by privatecompetitors. And that especially municipalities characterized by aversion againstoutsourcing, are in favor of engaging in such cross subsidizing.

18

Table 4: The full and reduced model explaining the own winning of tenders compared to totaloutsourcing in 2009Full modelCoefficientHypothesis 1: Economic press factorsH: 1.1: Income for taxation per inhabitantH: 1.2: Socio economic indexHypothesis 2: Political explanationsH: 2.1: Liberal or Conservative mayorH: 2.2: Welfare coalitionHypothesis 3: Scale of production and professionalizationH: 3.1: Number of inhabitantsHypothesis 4: The solidity of the municipal economyH: 4.1: Service levelH: 4.2: Level of municipal income taxHypothesis 5: Past dependencyH: 5.1: Outsourcing 2008-0,15-2,880,01-0,10-2,090,040,070,001,44-1,120,150,27------0,000,110,91---0,00-0,05-0,07-1,090,950,28------0,00-0,010,37-0,790,710,43------t-valueP>|t|Reduced modelCoefficientt-valueP>|t|

19

5. DiscussionThe Danish municipalities have increased their use of outsourcing as an organizationalform after the municipal structural reform in 2007 and after the introduction of agovernment policy programme for increasing municipal outsourcing in 2006. Importantdifferences in the use of this organizational form do, however, still exist despite theempirical literature pointing out important cost reduction potential in outsourcing.

Christoffersen and Paldam (2003) showed that the outsourcing pattern before thestructural reform and before the introduction of the government outsourcing programme,was characterized by three signicant working explanations, namely modern economicstructures, diffusion from modern to traditional municipalities and the size of the welfarecoalition. The model in Christoffersen and Paldam is not replicated in the present context.The reason is, that the structural reform amalgamated modern and traditionalmunicipalities to a degree so that any comparison lacks grounds. Therefore the modernstructure-hypothesis and the diffusion-hypothesis are excluded from the models in figure3. The welfare coalition is on the other hand shown to still be working, indicating that thecompulsory outsourcing programme has not succeeded in including the aversion-municipalities fully. Furthermore, the present analysis shows that municipalitiescharacterized by aversion against outsourcing are willing to accept a higher local tax levelas a strategy rather than to extent the use of outsourcing.

The compulsory outsourcing programme introduced by the government in 2006 is definedfor the municipal sector as a whole, but it is likely that the programme has established apressure on all municipalities and also on the municipalities characterized by aversion inrelation to outsourcing. The result that municipalities with limited use of outsourcing arestrongly inclined to win their own invitations to tenders can clearly be seen as a reactionpattern at the outsourcing-averse municipalities in relation to the government outsourcingprogramme.

Such a reaction pattern is possible because the municipalities are, to some degree, able tocross subsidize production activities organized in their own municipal organization. Themunicipal budget- and accounting system is a standardized system developed by theMinistry of the Interior in cooperation with the National Union of Local Authorities, KL. Thissystem is, however, designed so that it is not possible directly to read the production costsof the municipal goods produced. Therefore the ministry has developed special calculationrules for municipalities giving in offers related to own invitations to tenders to avoid crosssubsidies. This special regulation is not, however, necessarily so precise that cross

20

subsidies are ruled out. In the long run, it is a basic problem that the municipal budget- andaccounting system is designed so that production costs are not visible. Re-designing thesystem therefore seems necessary. In the short run, it seems to be problematic thatmunicipalities are allowed to respond themselves on their own invitations to tenders.

21

6. ReferencesBlom-Hansen, Jens. (2003):Is Private Delivery of Public Services Really Cheaper? Evidencefrom Public Road Maintenance in Denmark,Public Choice,vol. 115, nos. 3-4.Christoffersen, Henrik, Anders Milhøj and Thomas Westergaard-Kabelmann (2009): Detøkonomiske potentiale ved øget udlicitering i de danske kommuner. (The economicpotential in outsourcing in Danish municipalities).Nationaløkonomisk Tidsskrift,Bd.147/Nr.1. (DanishJournal of Economics).Christoffersen, Henrik and Martin Paldam (2003): Markets and municipalities: A study ofthe behavior of the Danish municipalities.Public Choice,volume 114, nos. 1-2.Christoffersen, Henrik, Martin Paldam and Allan Würtz (2007):Public versus privateproduction.Public Choice,vol. 130, pp. 311-328.Ministry of the Interior (annually): Municipal statistics. www.noegletal.dk.

22

Tidligere udgivne CEPOS arbejdspapirer:

Arbejdspapir nr. 1 - Udgiftsbehov og udgifter i kommunerneArbejdspapir nr. 2 - Sammenhængen mellem kommuners udgifter til skoledriftog skolens undervisningsresultaterArbejdspapir nr. 3 - Omkostningsniveauet i offentlig og privat produktion afsygehusydelserArbejdspapir nr. 4 - Multikulturalisme og integrationArbejdspapir nr. 5 - Municipal budget expansion seen through the glasses ofthe welfare coalitionArbejdspapir nr. 6 - Budgetdisciplin i kommunerneArbejdspapir nr. 7 - Den fysiske tilstand af folkeskoler og privatskolersbygningerArbejdspapir nr. 8 - Kommunale skatteforhøjelserArbejdspapir nr. 9 - Kommunernes udgifter til folkeskolen – hvad får borgernefor pengene, når de betaler mereArbejdspapir nr. 10 - Kommunalt selvstyreArbejdspapir nr. 11 - Udgiftsniveauet i kommunerneArbejdspapir nr. 12 - Kommuner i nødArbejdspapir nr. 13- Kvalitet og pris i offentlige og private skolerArbejdspapirerne kan findes påwww.cepos.dk

23

Center for Politiske Studier

CEPOS er en uafhængig tænketank, der fremmer et Danmark baseret påfrihed, ansvar, privat initiativ og en begrænset statsmagt.CEPOS er stiftet af fremtrædende danske erhvervsfolk, tænkere ogkulturpersonligheder og indledte sit arbejde den 10. marts 2005.CEPOS ønsker at bidrage til mere personlig og økonomisk frihed,retsstat og demokrati samt sunde borgerlige institutionersom familie, foreninger og kulturliv.CEPOS vil omlægge og begrænse direkte og indirekte støtte fra detoffentlige til befolkningen. Støtten skal komme de svage til gavn ogafskaffes for personer, der kan klare sig selv.CEPOS går ind for fri konkurrence og frie markeder, og er tilhænger afglobal frihandel og imod statsstøtte til erhvervslivet.CEPOS udfører ikke opgaver på begæring af noget politisk parti, nogen myndighed,erhvervsvirksomhed, organisation eller privatperson

24

CEPOS forlaget - Landgreven 3, 3. sal - 1301 København K – www.cepos.dk

25