Udvalget for Fødevarer, Landbrug og Fiskeri 2010-11 (1. samling)

FLF Alm.del Bilag 71

Offentligt

EUROPEAN PARLIAMENT

2009 - 2014

Special committee on the policy challenges and budgetary resources for asustainable European Union after 2013

26.10.2010

REFLECTION PAPERonthe implementation and financial management in the

multiannual financial frameworkRapporteur:Salvador GARRIGA POLLEDO

IntroductionArticle 317 of the TFEU1states thatthe Commission shall implement the budget incooperation with the Member States, in accordance with the provisions of theregulations pursuant to Article 322, on its own responsibility and within the limits ofthe appropriations, having regard to the principle of sound financial management.Member States shall cooperate with the Commission to ensure that the appropriationsare used in accordance with the sound financial management.The Part III of the IIA of 17 May 20062deals with the sound financial management ofEU funds, integrating the European Parliament's requests for improving thequalitative aspects of the implementation of EU budget. This new part III is at theorigin of the change in the title of the IIA, which also covers "sound financialmanagement". It addresses notably:the recognition of the need for more efficient controls and simplification ofrules, in particular in the context of shared management (annual summary,assessment of national management and control systems)the implementation of the budget in accordance with the principles of soundfinancial managementThe Financial Regulation (FR) applicable to the general budget of the EuropeanCommunities3sets, in its Title IV, the general rules for the implementation of the EUfunds.Sound financial management and controlThe principle of sound financial management is one of the budgetary principles, incompliance to which the budget shall be established and implemented. In accordancewith this principle, the budget shall be implemented by respecting the principle ofeconomy, efficiency and effectiveness4. The principle of economy requires that theresources used by the institutions for the pursuit of its activities shall be madeavailable in due time, in appropriate quality and quantity and at the best price. Theprinciple of efficiency is concerned with the best relationship between resourcesemployed and results achieved. The principle of effectiveness is concerned withattaining the specific objectives set and achieving the intended results.The budget shall be implemented in compliance with effective and efficient internalcontrol as appropriate in each management mode, and in accordance with the relevantsector-specific Regulations.The Court of Auditors examines the accounts of all revenues and expenditure of theUnion and provides the European Parliament and the Council with statement ofassurance as to the reliability of the accounts and the legality and regularity of theunderlining transactions5.

12

3

45

Ex-Article 274 TECInterinstitutional Agreement on budgetary discipline and sound financial management of 17 May2006, OJ 139/1 of 14.06.2006Council Regulation (EC, Euratom) No 1605/2002 of 25 June 2002 on the Financial Regulationapplicable to the general budget of the European Communities, OJ L 248 , 16.09.2002Article 27 of the Financial RegulationArticle 287 TFUE

2

Implementation MethodsIn accordance with Article 3 of the Financial Regulation, the Commission implementsthe budget in the following ways: on a centralised basis, by shared or decentralisedmanagement and by joint management with international organisations.Centralised managementWhere the Commission implements the budget on centralised basis, implementationtasks shall be performed ether directly by its departments or indirectly by delegatingto third parties its executive power (i.e. executive agencies, other specialisedCommunity bodies, such as EIB or EIF, national or international public sectorbodies).A regards the direct management, the operational implementation of the budget isdelegated by the College to the Directors-General, who as a 'authorising officers bydelegation", are responsible for the sound and efficient management of the resourcesand for ensuring adequate and effective control systems in their services. Directors-General report on the performance of their duties in the Annual activity reports, whichincludes a signed declaration of assurance focusing on their responsibilities andcovering the legality and regularity of financial transactions. On the basis of theassurance and reservations made in their annual activity reports, the Commissionadopts a Synthesis report6, assuming in this way its political responsibility for themanagement. It identifies key management issues to be addressed as a matter ofpriority and defines lines of action to address indentified weaknesses. Thus, theCommission focuses on issues such as simplification the legislation, integratedinternal control framework, strengthening of Commission's supervisory role in sharedmanagement of the EU funds.The Commission stresses in its Report on the management achievements of 2009 thatsignificant progress has been achieved in the management of the EU Funds thanks tofar-reaching changes to management and control system, working methods andculture. However, it also acknowledged that there are still areas which requireimprovement, for example in shared management, where member States executesome 80% of the budget.Shared managementWhen the Commission implements the budget by shared management,implementation tasks are delegated to the Member States. Without prejudice tocomplementary provisions in relevant sector specific Regulations, and in order toensure that the funds are used in accordance with the applicable rules and principles,the MSs shall take all legislative, regulatory and administrative or other measuresnecessary for protecting the Community's financial interests. To that effect, theMember States shall conduct checks and shall put in place an effective and efficientinternal control system and produce, on this basis, an annual summary at theappropriate national level of the available audits and declarations (Article 53 (b) ofthe Financial Regulation).The implementation of major EU policies is characterised by the shared managementof the Community budget, under which 80% of Community expenditure isadministrated by the Member States.The improvement of the financial management inthe Union must be supported by a close monitoring of progress in the Commission6

Synthesis of the Commission's management achievements in 2008 and 2009 (COM(2009)256 of 8June 2009 and COM(2010)281 of 2 June 2010)

3

and in the MSs, while the Member States should assume responsibility in themanagement of the EU Funds, ensuring the completion of the EU integrated controlframework with the aim of obtaining a positive Statement of Assurance (DAS)7.The main policies, implemented under shared management are agriculture and ruraldevelopment and cohesion policy. The cohesion policy, representing around 31% ofthe EU budget, remains the policy area with the highest error rate in the DAS 2008(11%) and is the only policy area still receiving a red light form the Court ofAuditors8. This is largely due to the ineffective functioning of the specificmanagement and control systems in some Member States9. The complexity of therules combined with implementation requirements, which differ from one MSs toanother and sometimes even between regions, remain the main problem of the 'sharedmanagement' policies. Despite the marked improvements in the management andcontrol systems introduced by the 2008 Commission action plan, which strengthenedthe Commission's supervisory role in the structural actions, only 31% of the systemswork well and more that 60% require improvement.In this context, the EP invites the Commission, in its supervisory role, to analyse thestrengths and weaknesses of each Member State's national system for administrationand control of the EU funds and to forward its comparative analysis to the EuropeanParliament, the Council and the Court of Auditors; to take this evaluation into accountwhile revising the Guidance Note concerning the annual summaries and to take theopportunity to include in the Guidance Note a framework for national managementdeclaration for those MSs that decide to introduce them to develop its incentive-basedapproach10.On the other hand, it stresses the need to strengthen the role of the Member States inthe upcoming review of the Financial Regulation as well as to improve the quality,homogeneity and comparability of the data provided by the MSs so as to ensure theadded value in the field of the control of EU Funds.Joint managementWhere the Commission implements the budget by joint management, certainimplementation tasks shall be delegated to international organisations11. External aid,development and enlargement, including the pre-accession and neighbourhoodpolicies count among policy areas with a significant level of irregularity inpayments12.In accordance with the European Court of Auditors' Special report n�15/2009, the EUassistance for development and humanitarian aid implemented through UnitedNations organisations increased form EUR 500 million in 2002 to over EUR 1 billion

7

8

9

101112

EP resolution on discharge in the respect of the implementation of the European Union generalbudget for the financial year 2008, Text adopted in Plenary on 05.05.2010,P7_TA(2010)0134Annual Report of the Court of Auditors on the implementation of the budget concerning thefinancial year 2008, together with the institutions’ replies, OJ C 269, 10.11.2009Communication form the Commission to the European Parliament, the Council and the Court ofAuditors, Synthesis of the Commission's management achievements in 2009, COM(2010)281 of2.06.2010idem, Points 40-46Article 53d of the Financial RegulationCourt of Auditors Annual Report concerning the financial year 2008, of 24 September 2009

4

in 200813. The EU contribution to UN organisations represents about 6% of UNresources, and in 2006 and 2007 the Commission made over 700 separatecontributions to around 30 different organisations and spread over more than 90countries14.The Financial Regulation and the arrangements in the FAFA15, which applies to allfunding agreements between the Commission and the UN, provide the frameworkenabling the Commission to contract directly with UN organisations. The individualagreements concluded with international organisations to which implementation tasksare delegated shall contain detailed provisions for the implementation of the tasksentrusted. However, those implementation tasks are carried out in accordance with theinternational organisations' own accounting, audit, internal control and procurementprocedures, while the Commission remains responsible for the funds implementedthrough international organisations and accountable to the European Parliament.The Court of Auditors special report notes that the "procedures for joint managementwith UN organisations differ from those required for actions implemented throughNGOs, which generally involve competition and the use of Commission procedures"and concluded that the Commission does not convincingly demonstrate, beforedeciding to work with a UN organisation, that it has assessed whether the advantagesoffset any disadvantages" and that the "choice of a UN organisation is not based onsufficient evidence that this approach is more efficient and effective than other waysof delivering aid" (paragraphs 9 and III of the Special Report n�15/2009.On the basis of this report, the Court of Auditors issued one recommendation to theCommission as regard improved decision-making and four as regards more focus onthe achievement of results: to issue and ensure the implementation of practicalguidelines in order to improve the decision-making process for selecting theimplementing channel for the proposed task; to explore opportunities to rely on auditwork carried out by UN bodies and to ensure that the FAFA is applied so that anyissues of access to information are rapidly resolved; to ensure that UN reports provideadequate information on project performance and the achievement of results; toconsider whether it can built on its expertise with one UN agency by contribution in aless fragmented way, for example at country level, to other UN organisations withview a to engaging in a similar high-level dialogue enhancing the focus on theirperformance in achieving objectives.Improving the quality of implementation: economy, efficiency and effectivenessIn its opinion n�1/2010 "Improving the financial management of the EU: Risks andchallenges"16, the Court of Auditors brings together the main messages of its recentannual and special reports in order to identify the main risks and challenges toreducing further the level of irregularity as well as improving the quality of EUspending.In line with this opinion, the debate on how to improve implementation and financialmanagement of the EU budget could address the following issues:13

European Court of Auditors' Special report n�15/2009 - EU assistance implemented through UnitedNations organisations: decision-making and monitoring, point 1.14idem, points 4 to 515Financial and Administrative Framework Agreement (FAFA)16http://eca.europa.eu/portal/pls/portal/docs/1/4030745.PDF

5

Quality of the implementationsimplification and strengthening of delivery instrumentsstreamline within and across the policies (EAV, clear and quantifiableobjectives, improved eligibility criteria), develop synergies, clear repartition ofresponsibilities (notably in the area of shared management and developmentassistance);setting out of casual links between the funded activities and desired outcomesimprovements in monitoring and evaluation arrangementstransparency and accountabilitySimplification of rules and procedures could not only decrease the risk of errorbut can also reduce the control costsbetter balance between the cost of control and efficiency and benefit of such acontrolfurther improvement of Commission's internal financial management andcontrol systems

Reduce the irregularities

6

TECHNICAL ANNEXES:Annex 1.Implementation of EU budget for 2000-2010 period (in payments)compared with the MFF and own resources ceilings (1a/ in absolutefigures, 1b/ graphic presentation)Implementation of commitments and payments per MFF headings for2007-2010 (million EUR and %)EU budget surpluses from 2000 to 2010 - Comparative table***Annex 1a. Implementation of EU budget for 2000-2010 period (in absolute figures)Implementation of the EU budget compared to the ceilings in payment appropriations for 2000-2010 period(million EUR, current prices)

Annex 2.Annex 3.

YearOwn Resourcesceiling*MFF ceilingAdopted budgetFinal budget**Implementation***

2000105,88491,32287,94589,44080,449

2001109,54294,73092,56993,78080,558

2002113,435100,07895,65595,65685,766

2003114,948102,76797,50392,52589,377

2004126,319111,38099,724101,80799,934

2005131,527114,060106,300105,684104,000

2006137,169119,112111,970107,378105,809

2007151,354122,190115,497113,846110,049

2008152,446129,681120,347115,771110,449

2009144,014120,445116,096113,035109,055

2010147,194134,289122,937122,93787,301

* Based on a yearly established GNI figure multiplied by 1,24% (and 1,23% for 2010)** Including subsequently adopted amending budgets (except or 2010)*** 2010 data based on the latest provisional figures from 27 September 2010

Source: European Commission, provided by Policy Department D

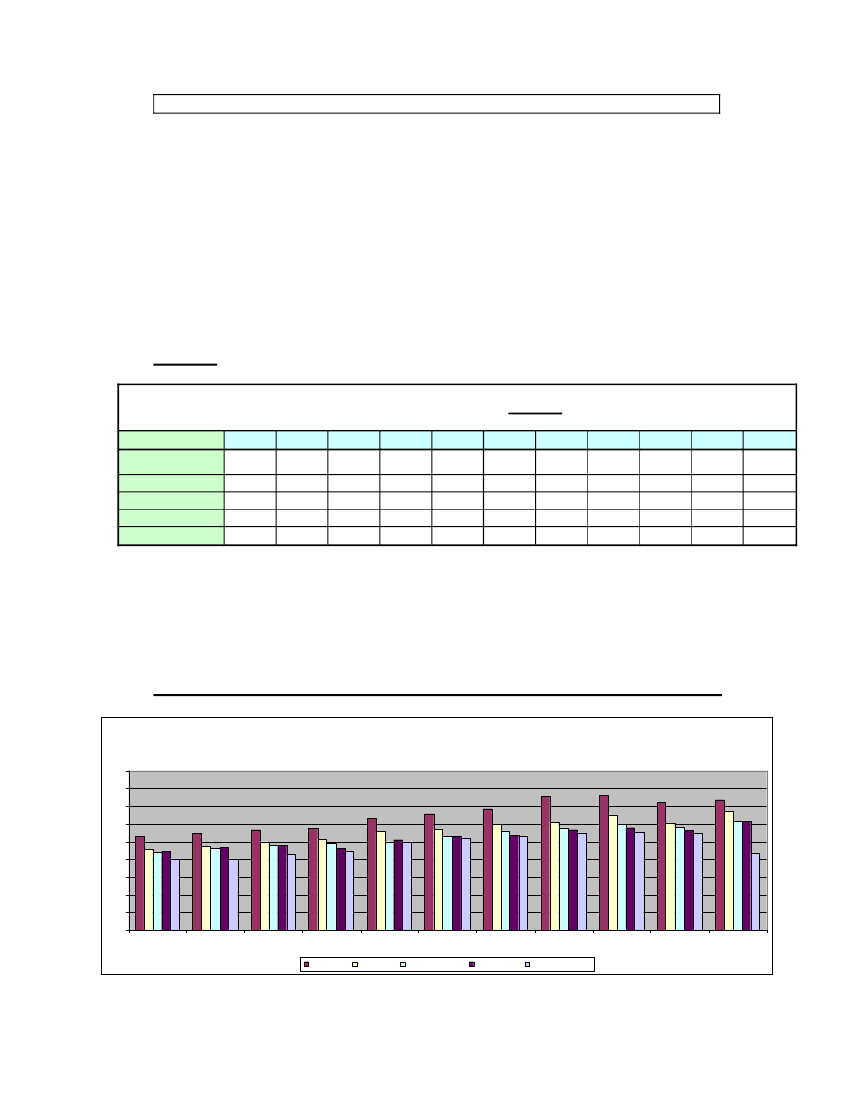

***Annex 1b. Implementation of EU budget for 2000-2010 period (graphic presentation)Implementation of the EU budget compared to the ceilings in payment appropriations for 2000-2010 period(million EUR, current prices)1801601401201008060402002000200120022003OR ceiling2004FP ceiling2005Adopted budget2006Final budget2007Implementation200820092010

Source: European Commission, provided by Policy Department D

7

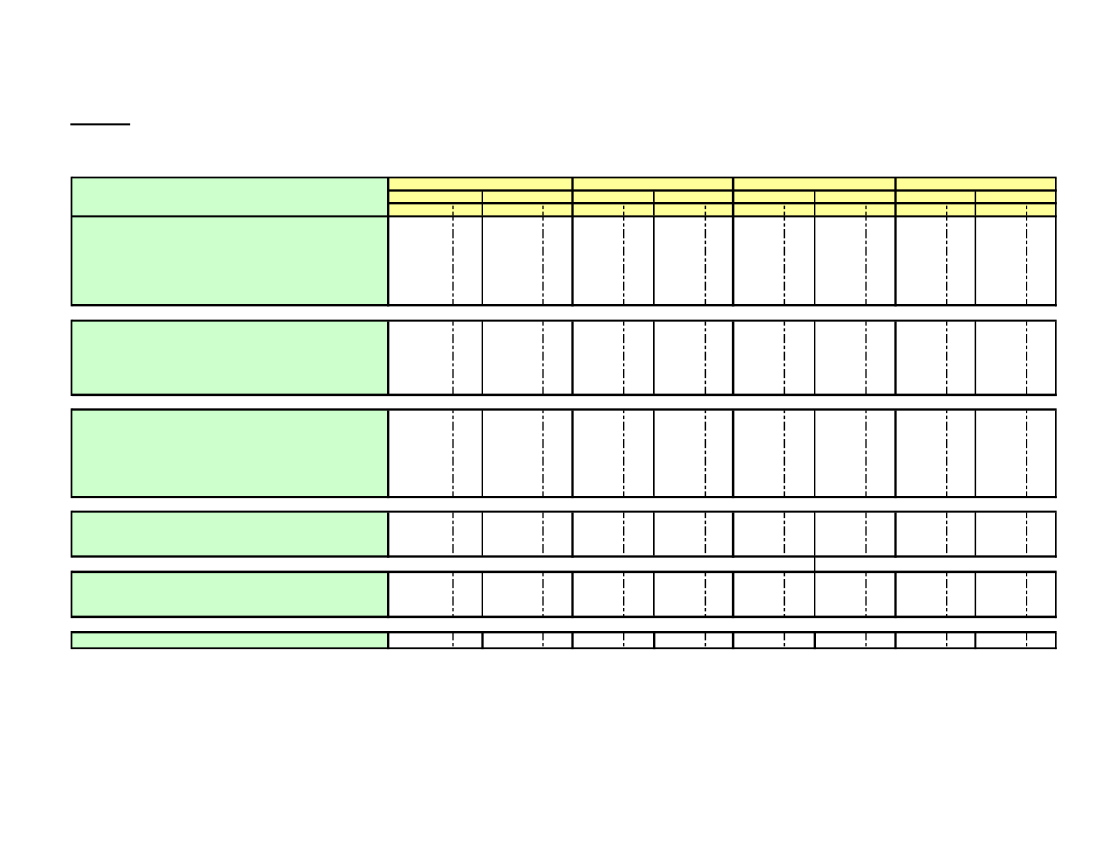

***Annex 2. Implementation of commitments and payments per MFF headings for 2007-2010 (million EUR and %)IMPLEMENTATION OF COMMITMENTS AND PAYMENTS PER MFF HEADINGS FOR 2007-2010 (million EUR and %)2007HEADINGCAAMOUNT%

2008PAAMOUNT%

2009PACA%AMOUNT%

2010*PACA%AMOUNT%

CAAMOUNT%

PAAMOUNT%

AMOUNT

AMOUNT

1. SUSTAINABLE GROWTH1a. Competitiveness for growth and employment1b. Cohesion for growth and employment

53.723,38.821,844.901,5

97,994,198,7

43.178,06.203,336.974,6

98,792,699,8

57.919,110.558,747.360,4

99,095,399,9

45.057,09.502,235.554,8

98,1 61.649,794,3 13.242,399,2 48.407,4

99,196,199,9

43.994,810.062,233.932,6

96,996,297,2

61.419,612.070,249.349,3

95,581,099,9

29.852,77.003,222.849,4

61,460,461,6

2. PRESERVATION AND MANAGEMENT OF NATURAL RESOURCES52.563,2of which CAP expenditure42.148,4

94,299,6

54.016,542.096,4

99,299,5

56.767,940.948,9

99,799,8

52.266,940.752,6

98,0 56.037,9

99,5

50.424,2

99,499,8

57.142,441.382,1

95,794,4

48.843,441.086,8

84,093,9

99,6 41.046,5 100,0 40.907,8

3. CITIZENSHIP, FREEDOM, SECURITY AND JUSTICE3a. Freedom, security and justice3b. Citizenship

1.368,3567,2801,1

97,696,198,7

1.010,7199,5811,2

82,959,391,8

1.521,4640,9880,6

93,687,898,3

1.261,7380,0881,8

91,085,693,5

2.201,1932,51.268,6

99,499,199,6

1.930,5666,61.263,9

94,690,496,9

1.282,4769,5512,9

76,676,576,7

895,3454,9440,4

63,761,566,1

4. THE EUROPEAN UNION AS A GLOBAL PARTNER

6.478,5

95,1

7.091,0

94,8

7.352,9

96,1

7.190,5

90,1

8.309,8

99,2

7.786,3

91,8

6.683,1

82,4

4.059,7

51,7

5. ADMINISTRATION

4.329,9

98,4

4.308,4

90,2

4.510,7

97,9

4.466,7

90,1

4.739,8

98,9

4.710,8

91,3

4.730,3

95,6

3.650,7

68,8

GRAND TOTAL*Based on the latest provisional figures from 27 September 2010

118.907,9

96,1

110.049,1

98,2 128.278,7 99,1 110.449,5 97,0 133.147,3 99,3 109.055,7 97,4 131.257,7 94,6

87.301,8

71,9

***

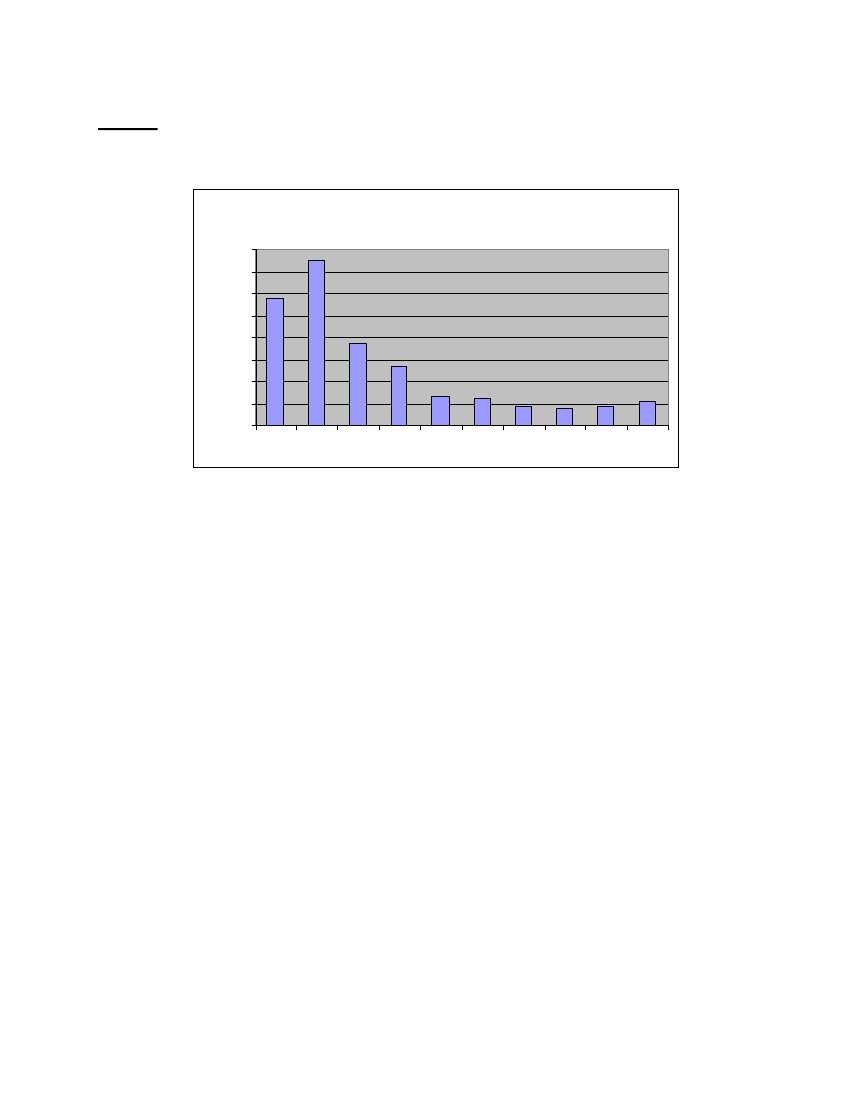

Annex 3. EU budget surpluses from 2000 to 2010

EU budget surplus, € million16.00014.00012.00010.0008.0006.0004.0002.00002000200120022003200420052006 200720082009

Source: European Commission, provided by Policy Department D

LINKSGeneral RulesIIA of 17 May 2006 on budgetary discipline and sound financial managementhttp://ec.europa.eu/budget/library/documents/multiannual_framework/2007_2013/comm_2010_0073_en.pdf

Financial Regulation applicable to the general budget of the European Communitieshttp://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:32002Q1605:EN:HTML

Financial Regulation Triennial revisionhttp://ec.europa.eu/budget/library/documents/sound_fin_management/financial_regulation/comm_2010_260_en.pdf

Budget ReviewCommunication form the Commission to the European Parliament, the Council, the EuropeanEconomic and Social Committee, the Committee of Regions and National Parliaments on the EUBudget Reviewhttp://ec.europa.eu/budget/reform/library/com_2010_700_en.pdf

Discharge for the implementation of the EU budget2008 Dischargehttp://www.europarl.europa.eu/document/activities/cont/201005/20100511ATT74395/20100511ATT74395EN.pdf

2007 Dischargehttp://www.europarl.europa.eu/document/activities/cont/200905/20090519ATT56154/20090519ATT56154EN.pdf

Commission's ReportsSynthesis of the Commission's management achievements in 2009http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2010:0281:FIN:EN:PDF

Synthesis of the Commission's management achievements in 2008http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2009:0256:FIN:EN:PDF

Court of Auditors ReportsAnnual Report of the Court of Auditors on the implementation of the budget concerning thefinancial year 2008, together with the institutions’ replieshttp://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:C:2009:269:0001:0256:EN:PDF

Annual Report of the Court of Auditors on the implementation of the budget concerning thefinancial year 2007, together with the institutions’ replieshttp://eca.europa.eu/portal/pls/portal/docs/1/1569525.PDF

Special Report No 15/2009: EU assistance implemented through United Nationsorganisations: decision-making and monitoringhttp://eca.europa.eu/portal/pls/portal/docs/1/3632657.PDF

Opinion No 1/2010: Improving the financial management of the European Union budget:Risks and challengeshttp://eca.europa.eu/portal/pls/portal/docs/1/4030745.PDF

10