Det Energipolitiske Udvalg 2010-11 (1. samling)

EPU Alm.del Bilag 64

Offentligt

A portfolio of power-trains for Europe:a fact-based analysis

The role of Battery Electric Vehicles, Plug-inHybrids and Fuel Cell Electric Vehicles

The following companies and organisations participated in this study:Car manufacturersBMW AG, Daimler AG, Ford, General Motors LLC, Honda R&D, Hyundai MotorCompany, Kia Motors Corporation, Nissan, Renault, Toyota Motor Corporation,VolkswagenOil and gasENI Refining and Marketing, Galp Energia, OMV Refining and Marketing GmbH,Shell Downstream Services International B.V., Total Raffinage MarketingUtilitiesEnBW Baden-Wuerttemberg AG, VattenfallIndustrial gas companiesAir Liquide, Air Products, The Linde GroupEquipment car manufacturersIntelligent Energy Holdings plc, PowertechWindNordexElectrolyser companiesELT Elektrolyse Technik, Hydrogenics, Hydrogen Technologies, Proton Energy SystemsNon-governmental organisationsEuropean Climate FoundationGovernmental organisationsEuropean Fuel Cells and Hydrogen Joint Undertaking, NOW GmbH

This document reflects the results of a fact-based study that has been preparedon behalf of the companies and organisations listed above. The information andconclusions contained in this document represent the collective view of the workinggroups of this study and not that of individual companies or organisations. Anyinformation and conclusions provided in this document are for reference purposesonly and are not intended, nor should they be used as a substitute for professionaladvice or judgement with respect to certain circumstances. None of the companiesand organisations listed above guarantee the adequacy, accuracy, timeliness orcompleteness of the document’s contents. Said companies and organisations thereforedisclaim any and all warranties and representations as to said contents, express orimplied, including any warranties of fitness for a particular purpose or use.McKinsey & Company, the management consultancy, provided analytical support to thestudy. Any recommendations or positions taken in this report are the responsibility of theauthors, not of McKinsey & Company.

ContentsEXECUTIVE SUMMARYINTRODUCTIONEU CO2reduction goal for 2050 requires 95% decarbonisation of road transport121111

Electric vehicles (BEVs, FCEVs and PHEVs) are necessary to achieve EU CO2reduction goal 12Technologically ready, FCEVs are now focused on commercial deploymentAll conclusions are based on proprietary industry dataMETHODOLOGYA balanced scenario for the electrification of passenger cars in the EU by 2050A combined forecasting and backcasting approach to maximise accuracyA balanced hydrogen production mix including a variety of technologiesAssumptions are robust to significant variationsINPUT DATAThe collection, benchmarking and validation of over 10,000 data pointsRESULTS1. BEVs and FCEVs have the potential to significantly reduce CO2and local emissions2. After 2025, the total cost of ownership of all the power-trains converge3. A portfolio of power-trains can satisfy the needs of consumers and the environment4. Costs for a hydrogen infrastructure are around 5% of the overall cost of FCEVs5. The deployment of FCEVs will incur a cost to society in the early yearsNEXT STEPSANNEXGLOSSARY121415161819242626282833444648525462

2

EXECUTIVE SUMMARYConventional vehicles alone may not achieve EU CO2reduction goal for 2050In September 2009, both the European Union (EU) and G81leaders agreed that CO2emissionsmust be cut by 80% by 2050 if atmospheric CO2is to stabilise at 450 parts per million2– andglobal warming stay below the safe level of 2�C. But 80% decarbonisation overall by 2050 mayrequire 95%3decarbonisation of the road transport sector.With the number of passenger cars set to rise to 273 million4in Europe – and to 2.5 billion5worldwide – by 2050, this may not be achievable through improvements to the traditional internalcombustion engine or alternative fuels: the traditional combustion engine is expected to improveby 30%, so achieving full decarbonisation is not possible through efficiency alone. There is alsouncertainty as to whether large amounts of (sustainably produced) biofuels - i.e. more than 50%of demand - will be available for passenger cars, given the potential demand for biofuels6fromother sectors, such as goods vehicles, aviation, marine, power and heavy industry.Combined with the increasing scarcity and cost of energy resources, it is therefore vital to developa range of technologies that will ensure the long-term sustainability of mobility in Europe.

A factual evaluation of BEVs, FCEVs, PHEVs and ICEs based onproprietary industry dataTo this end, a group of companies, government organisations and an NGO – the majority witha specific interest in the potential (or the commercialisation) of fuel cell electric vehicles (FCEVs)and hydrogen, but with a product range also spanning battery electric vehicles (BEVs), plug-inhybrids (PHEVs) and conventional vehicles with internal combustion engines (ICEs) includinghybridisation – undertook a study on passenger cars in order to assess alternative power-trainsmost likely to fulfil that need. Medium- or heavy-duty vehicles were not included.Electric vehicles (BEVs, FCEVs and PHEVs in electric drive) not only have zero tail-pipe emissions7while driving – significantly improving local air quality – they can be made close to CO2-free overtime and on a well-to-wheel basis, depending on the primary energy source used. Zero-emissionpower-trains therefore go hand-in-hand with the decarbonisation of energy supply, with thepotential to significantly reduce emissions from central power and hydrogen production by 2050.Electric vehicles have substantially lower pollution from noise, NO2and particles.It was considered particularly important to re-assess the role of FCEVs in the light of recenttechnological breakthroughs in fuel cell and electric systems that have now increased theirefficiency and cost-competitiveness significantly. Given satisfactory testing in a customerenvironment - with more than 500 cars covering over 15 million kilometres and 90,000 refuellings- the focus has now shifted from demonstration to planning commercial deployment so thatFCEVs, like all technologies, may benefit from mass production and the economies of scale.

123456

7

The Group of Eight industrial powers – Canada, France, Germany, Italy, Japan, Russia, the UK andthe United StatesCO2-equivalentMcKinsey Global GHG Abatement Cost Curve; International Energy Agency World Energy Outlook2009; US Environmental Protection Agency; European Environment Agency (EEA)Parc Auto Survey 2009, Global Insight 2010; study analysisEuropean Commission, April 2010The study makes the following assumptions: by 2020 biofuels are blended, delivering a 6%well-to-wheel reduction in CO2emissions for gasoline- and diesel-engined vehicles, in line with theEU Fuel Quality Directive. By 2050, biofuel blending increases but is limited to 24%, reflecting supplyconstraintsFCEVs emit water vapour only

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesExecutive summary

3

Over 30 stakeholders therefore came together in order to develop a factual evaluation of theeconomics, sustainability and performance of BEVs, FCEVs, PHEVs and ICEs across the entirevalue chain – many with an equal interest in all four power-trains.It meant providing confidential and proprietary data on an unprecedented scale8– includingvehicle costs (in this report, purchase price is used to refer to cost plus a standard hypotheticalmargin, equal for all cars within one segment), operating costs, fuel and infrastructure cost.In order to ensure a realistic outcome, it was agreed that:�The study should include a balanced mix of vehicle sizes (or segments) and ensure no biastowards any particular power-train, representing the majority of vehicles on the market9�While it is possible that breakthrough technologies could provide step changes in currentpathways to sustainable mobility, the study should only consider vehicle technologies that areproven in R&D today and capable of a) scale-up and commercial deployment and b) meetingthe EU’s CO2reduction goal for 2050�Average values should be taken, with no “cherry-picking” of the most favourable data�Input data provided by participating companies would be frozen before results were shared.

A balanced scenario for the electrification of passenger carsin the EU by 2050A combined forecasting and backcasting approach was then used to calculate the results: from2010 to 2020, global cost and performance data were forecasted, based on proprietary industrydata; after 2020, on projected learning rates(see Annex, Exhibit 42, page 54).In order to test the sensitivity of these data to a broad range of market outcomes, three European“worlds” for 2050 were defined, assuming various power-train penetrations in 2050:1. A world skewed towards ICE (5% FCEVs, 10% BEVs, 25% PHEVs, 60% ICEs)2. A world skewed towards electric power-trains (25% FCEVs, 35% BEVs, 35% PHEVs, 5% ICEs)3. A world skewed towards FCEVs (50% FCEVs, 25% BEVs, 20% PHEVs, 5% ICEs).

These three “worlds” were then backcasted to 2010, resulting in a development pathway for eachpower-train. As the impact of the different “worlds” on FCEV costs was found not to be significant(see page 18),this report focuses on results for the second “world” as having a balanced splitbetween the four power-trains (25% FCEVs, 35% BEVs, 35% PHEVs and 5% ICEs).

89

Over 10,000 data points were collected for the studyNo assumptions have been made on a potential shift in the composition of the car fleet from largerto smaller cars. An average ~30% fuel efficiency gain was included for the entire ICE fleet

4

Assumptions are robust to significant variationsTo test the robustness of results, all assumptions in the study’s vehicle and supply models werevaried to identify possible “tipping points”. However, this showed that the conclusions wererobust to significant variations in learning rates for the power-trains and the cost of fossil fuels(see page 24).The power supply pathway underlying this report is based on the European Climate Foundation’s“Roadmap 2050”, which was developed in corporation with the industry and describes a pathwayto decarbonise the EU power mix by 2050. In 2020, the expected share of renewable (RES)production capacity is approximately 34%. This is the minimum needed to meet the 20% EUrenewable energy target, as there is limited RES opportunity outside of the power sector.For the following results, a conventional hydrogen production mix is assumed to 2020, utilisingexisting assets – industrially produced hydrogen and centralised steam methane reforming(SMR) – with a growing proportion of distributed units (water electrolysis and SMR). After 2020,a balanced and economically driven scenario is assumed, including CO2Capture and Storage(CCS), water electrolysis (increasingly using renewable energy) and avoiding over-dependenceon any single primary energy source.An alternative production mix was also examined(see Exhibit 26, page 38),representing 100%electrolysis, with 80% renewable energy by 2050, which increases the total cost of ownership(TCO) of FCEVs by 5% by 2030 and 3.5% by 2050. However, both production scenarios achieveCO2-free hydrogen by 2050.The value of electric vehicles on balancing an (increasingly intermittent) power grid can besignificant and could amount to several billions of euros (ref. “Roadmap 2050”). This applies toBEVs (charging when power supply is available) as well as hydrogen cars (using stored hydrogento produce power when supply is short).

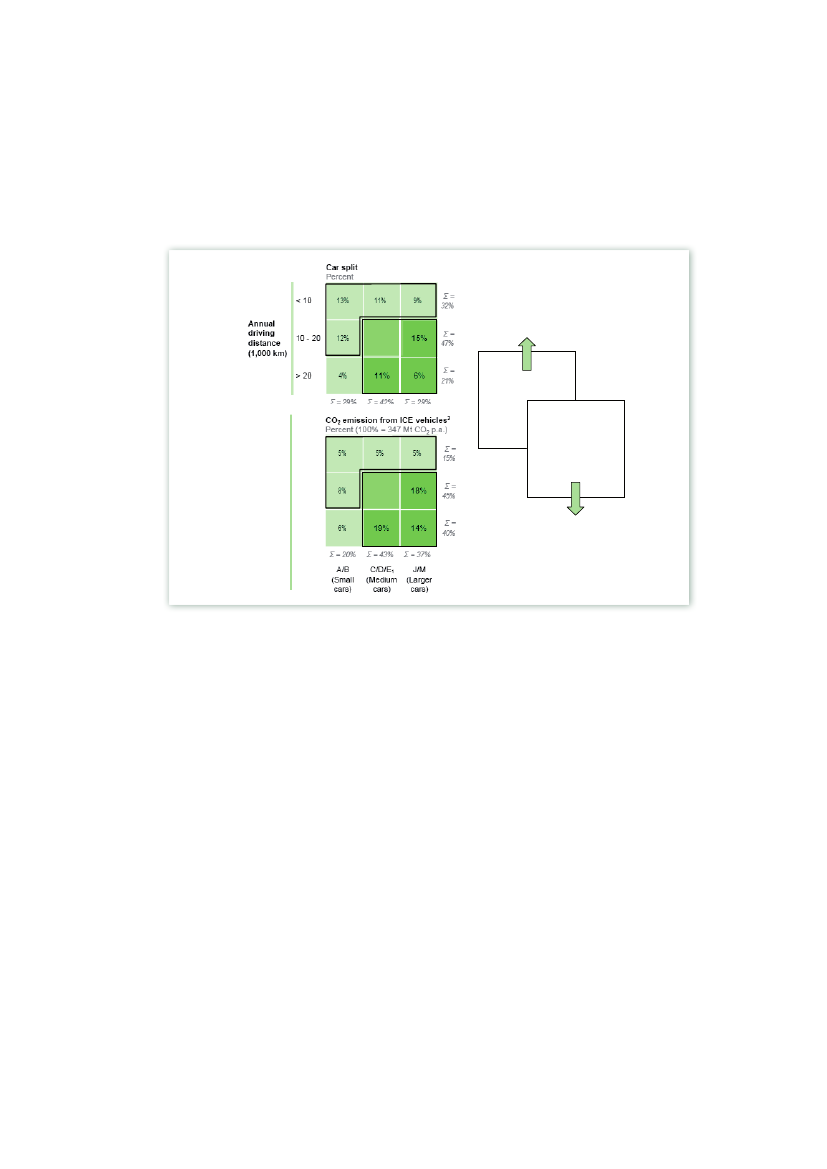

SUMMARY OF RESULTS1. BEVs, PHEVs and FCEVs have the potential to significantly reduce CO2and local emissionsElectric vehicles (BEVs, FCEVs and PHEVs in electric drive) can be fuelled by a wide variety ofprimary energy sources – reducing oil dependency and enhancing security of energy supply.Well-to-wheel efficiency analysis also shows that electric vehicles are more energy-efficient thanICEs over a broader range of primary energy sources.Owing to limits in battery capacity and driving range10(currently 100-200 km for a medium-sized car11) and a current recharging time of several hours,BEVsare ideally suited to smaller carsand shorter trips, i.e. urban driving (including new transportation models such as car sharing).With a driving range and performance comparable to ICEs,FCEVsare the lowest carbon solutionfor medium/larger cars and longer trips. These car segments account for 50% of all cars and75% of CO2emissions, hence replacing one ICE with one FCEV achieves a relatively high CO2reduction.10 The range chosen in the study for BEVs and PHEVs reflects the car manufacturers’ current view onthe best compromise between range, cost, and load bearing capacity for the vehicle11 For C/D segment cars this will increase to 150-250 km in the medium term

The role of Battery Electric Vehicles, Plug-in Hybrids Fuel Cell Electric VehiclesExecutive summary

5

With a smaller battery capacity than BEVs,PHEVshave an electric driving range of 40-60 km.Combined with the additional blending of biofuels, they could show emission reductions forlonger trips.ICEshave the potential to reduce their CO2footprint significantly through an average 30%improvement in energy efficiency by 2020 and the additional blending of biofuels. After 2020,however, further engine efficiency improvements are limited and relatively costly, while theamount of biofuels that will be available may be limited.BEVs, PHEVs and FCEVs have significant potential to reduce CO2and local emissions, assumingCO2reduction is performed at the production site. They play a complementary role, with BEVsideally suited to smaller cars and shorter trips and FCEVs to medium/larger cars and longertrips. PHEVs can reduce CO2considerably compared to ICEs on short trips or using biofuels,depending on availability. The energy and CO2efficiency of ICEs is expected to improve by 30%.Medium/larger cars with above-average driving distance account for 50% of all cars, and 75%of CO2emissions. FCEVs are therefore an effective low-carbon solution for a large proportion ofthe car fleet. Beyond 2030, they have a TCO advantage over BEVs and PHEVs in the largest carsegments(see below).

2. After 2025, the total cost of ownership (TCO) of all thepower-trains convergesIn the study, the economic comparison between power-trains is based on the total cost ofownership (TCO), as it describes the costs associated over their entire lifetime(see page 18).Inorder to ensure a like-for-like comparison, taxes are not included unless specifically stated.BEVs and FCEVs are expected to have a higher purchase price than ICEs (battery and fuel cellrelated) and a lower fuel cost (due to greater efficiency and no use of oil) and a lower maintenancecost (fewer rotating parts).The cost of fuel cell systems is expected to decrease by 90% and component costs for BEVs by80% by 2020, due to economies of scale and incremental improvements in technology. Around30% of technology improvements in BEVs and PHEVs also apply to FCEVs and vice versa. Thisassumes that FCEVs and BEVs will be mass produced, with infrastructure a key prerequisite tobe in place. The cost of hydrogen also reduces by 70% by 2025 due to higher utilisation of therefuelling infrastructure and economies of scale.PHEVs are more economic than BEVs and FCEVs in the short term. The gap gradually closes andby 2030 PHEVs are cost-competitive with BEVs for smaller cars, with both BEVs and FCEVs formedium cars and less competitive than FCEVs for larger cars.While the fuel economy of ICEs is expected to improve by an average of 30% by 2020, costs alsoincrease due to full hybridisation and further measures such as the use of lighter weight materials.The TCOs of all four power-trains is expected to converge after 2025 – or earlier, with taxexemptions and/or incentives during the ramp-up phase.For larger cars, the TCO of FCEVs is expected to be lower than PHEVs and BEVs as of 2030.By 2050, it is also (significantly) lower than the ICE. For medium-sized cars, the TCOs for alltechnologies converge by 2050. BEVs have a (small) TCO advantage over FCEVs in the smallercar segments.

6

PHEVs are more economic than BEVs and FCEVs in the short term. All electric vehicles areviable alternatives to ICEs by 2025, with BEVs suited to smaller cars and shorter trips, FCEVsfor medium/larger cars and longer trips. With tax incentives, BEVs and FCEVs could be cost-competitive with ICEs as early as 2020.

3. A portfolio of power-trains can meet the needs of consumersand the environmentBEVs have a shorter range than FCEVs, PHEVs and ICEs: an average, medium-sized BEV withmaximum battery loading cannot drive far beyond 150 km at 120 km/hour on the highway, if realdriving conditions are assumed (and taking expected improvements until 2020 into account)Charging times are also significantly longer: 6-8 hours using normal charging equipment. Fastcharging may become widespread, but the impact on battery performance degradation overtime and power grid stability is unclear. Moreover, it takes 15-30 minutes to (partially) recharge thebattery. Battery swapping reduces refuelling time; it is expected to be feasible if used once everytwo months or less and battery standards are adopted by a majority of car manufacturers. BEVsare therefore ideally suited to smaller cars and urban driving, potentially achieving ~80% CO2reduction by 2030 compared to today.FCEVs have a driving performance (similar acceleration), range (around 600 km) and refuellingtime (< 5 minutes) comparable to ICEs. They are therefore a feasible low-carbon substitute forICEs for medium/larger cars and longer trips, potentially achieving 80% CO2reduction by 2030compared to today.PHEVs have a similar range and performance to ICEs, but electric driving only applies to shorterdistances, while the amount of biofuels available for longer trips is uncertain. They represent anattractive solution, reducing CO2considerably compared to ICEs.Over the next 40 years, no single power-train satisfies all key criteria for economics, performanceand the environment. The world is therefore likely to move from a single power-train (ICE) to aportfolio of power-trains in which BEVs and FCEVs play a complementary role: BEVs are ideallysuited to smaller cars and shorter trips; FCEVs to medium/larger cars and longer trips; withPHEVs an attractive solution for short trips or where sustainably produced biofuels are available.

4. Costs for a hydrogen infrastructure are approximately 5% of the overallcost of FCEVs (€1,000-2,000 per car)For consumers who prefer larger cars and drive longer distances, FCEVs therefore have clearbenefits in a CO2-constrained world. This segment represents around 50% of cars driven andcan therefore justify a dedicated hydrogen infrastructure. The value of the FCEV over alternativepower-trains in terms of TCO and emissions (including the cost of the hydrogen infrastructure) ispositive beyond 2030. The economic gap prior to 2030 is almost completely determined by thehigher purchase price, not by the cost of the hydrogen infrastructure. It can therefore be assumedthat if this consumer segment prefers the FCEV, the cost of the infrastructure (5% of the TCO) willnot be prohibitive to its roll-out. Having said that, an orchestrated investment plan is required tobuild up the first critical mass of hydrogen supply.

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesExecutive summary

7

In order to develop a portfolio of power-trains, several supply infrastructure systems are required –not only for gasoline and diesel, but potentially new infrastructures for CNG, LPG, 100% biofuels,electricity and hydrogen. Early commercial deployment of BEVs and PHEVs is already happeningin several European countries: many car manufacturers have announced the introduction of newcommercial models between 2010 and 2014. This report therefore focuses on the commercialdeployment of FCEVs, which still needs to be addressed.One could argue that it is inefficient to build an additional vehicle refuelling infrastructure on topof existing infrastructures. However, the additional costs of a hydrogen infrastructure are relativelylow compared to the total costs of FCEVs and comparable to other fuels and technologies, suchas a charging infrastructure for BEVs and PHEVs. Costs for a hydrogen distribution and retailinfrastructure are around 5% of the overall cost of FCEVs – the vast majority lies in the purchaseprice. The attractiveness of the business case for FCEVs is therefore hardly affected by theadditional costs required for distribution and retail. In other words, if FCEVs make commercialsense – as demonstrated by this study – building a dedicated hydrogen infrastructure can bejustified.In the first decade of a typical roll-out scenario, supply infrastructure costs per car – especiallythose for a retail infrastructure – are initially higher, due to lower utilisation. Nevertheless, sufficientnetwork coverage must be available for consumers and initial investments required could amountto around €3 billion (covering hydrogen production, distribution and retail) for a region such asGermany. Although a single company would struggle to absorb the risk of such an investment,this is not the case at a societal level. This is confirmed by countries which have built up alternativeinfrastructures, such as LPG and CNG.The cost per vehicle for rolling out a hydrogen infrastructure compares to rolling out a charginginfrastructure for BEVs or PHEVs. The costs for hydrogen retail and distribution are estimatedat €1,000-2,000 per vehicle (over its lifetime), including distribution from the production site tothe retail station, as well as operational and capital costs for the retail station itself. Building aninfrastructure for 25% market share of FCEVs requires infrastructure investments of around €3billion in the first decade and €2-3 billion per year thereafter. Annual infrastructure investmentsin oil and gas, telecommunications and road infrastructure each amount to €50-€60 billon.12Additional investments required to decarbonise the power sector amount to €20-30 billionper year.13Current costs for an electric charging infrastructure range from €1,500 - €2,500 per vehicle. Thehigher end of the range assumes 50% home charging (investment of €200 - €400 per chargingstation) and 50% public charging at €5,000 for a charging station that serves two cars (€10,000in the first years). Potential additional investment in the power distribution networks are notincluded, but could be material, depending on the local situation. In contrast, once the territory iscovered, no further investment is needed in hydrogen infrastructure – regardless of the numberof cars – due to the fast refuelling time. As the number of FCEVs increase, it also benefits from theeconomies of scale.

12 Global Insight13 http://www.roadmap2050.eu/attachments/files/Volume1_fullreport_PressPack.pdf

8

Under the key assumptions of the study (i.e. zero CO2from power by 205014), Europe mustachieve a significant penetration of electric cars by 2050, if it is to achieve its CO2reduction goal.Early commercial deployment of BEVs has already started in several European countries, butinfrastructure for FCEVs remains to be addressed.Over the course of the next decades, costs for a hydrogen distribution and retail infrastructure are5% of the overall cost of FCEVs (€1,000-2,000 per car) and comparable to rolling out a charginginfrastructure for BEVs and PHEVs (excluding potential upgrades in power distribution networks).The attractiveness of the business case for FCEVs is therefore hardly affected by the additionalcosts required for distribution and retail: if FCEVs make commercial sense – as demonstrated bythis study – building a dedicated hydrogen infrastructure can be justified.

5. The deployment of FCEVs will incur a cost to society in the early yearsThe benefits of lower CO2emissions, lower local emissions (NO2, particles), diversification ofprimary energy sources and the transition to renewable energy all come at an initial cost. Thesewill ultimately marginalise with the reduction in battery and fuel cell costs, economies of scale andpotentially increasing costs for fossil fuels and ICE specifications.A roll-out scenario that assumes 100,000 FCEVs in 2015, 1 million in 2020 and a 25% share of thetotal EU passenger car market in 2050 results in a cumulative economic gap of approximately€25 billion by 2020 – mainly due to the cost of the fuel cell system in the next decade, but alsoincluding around €3 billion for a hydrogen supply infrastructure. The CO2abatement cost isexpected to range between €150 and € 200 per tonne in 2030 and becomes negative for largercars after 2030.A hydrogen supply infrastructure for around 1 million FCEVs by 2020 requires an investmentof €3 billion (production, distribution, retail), of which €1 billion relates to retail infrastructure –concentrated in high-density areas (large cities, highways) and building on existing infrastructure.If only one energy company were to invest in hydrogen retail infrastructure, it faces a first-moverdisadvantage due to the initially low utilisation by a small number of FCEVs and the risk oftechnology delivery failure or delay. In the latter case it would result in a potential write-off in theorder of hundreds of millions per annum. The initial investment risk would be somewhat reducedif further companies also invest and even further if the roll-out is supported by adequate policymeasures and risk underwriting all one word by governments.Hydrogen manufacturers have an incentive – as soon as the economics work – to race to beattheir rivals. While financial incentives are required to persuade consumers to appreciate FCEVs,there is nothing to hold the hydrogen manufacturers back – as long as the retail infrastructure is inplace. Infrastructure providers, on the other hand, bear a first-mover risk, making a heavy upfrontoutlay to build a retail station network that will not be fully utilised for some years; the unit costreduces over time simply because the fixed capital expenditure is used by an increasing numberof FCEVs.The cumulative economic gap of around €25 billion for FCEVs up to 2020 is calculated on a globalcumulative FCEV production and is mainly due to a higher purchase price. If this is also only metby a few car manufacturers, they will each need to finance around €1 billion per annum. Bridgingthis gap could be facilitated by adequate government actions and global co-operation. After2030, it can be reasonably assumed that the majority of the consumers will be financially driven,making their choice of car in response to an established tax and legislative regime.14 The power supply pathway underlying this report is based on the European Climate Foundation“Roadmap 2050“, which was developed in cooperation with the industry and describes a pathway todecarbonise the EU‘s power mix by 2050 -See page 24

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesExecutive summary

9

Provided these are stable and clear, car manufacturers, hydrogen manufacturers andinfrastructure providers should all be able to make investments on the basis of well-understoodrisks and projected returns. A global roll-out would further reduce the economic gap for Europe.A strong case will be required to persuade governments as to the level of explicit subsidy needed.In subsequent steps, it will therefore be important to make proposals that show how industryis taking responsibility for all the risks that they can reasonably analyse, control and mitigate.Discussions with Member State and EU governments are likely to focus on sharing the costs andrisks between public and private sectors.The emerging FCEV market (2010-20) requires close value chain synchronisation and externalstimulus in order to overcome the first-mover risk of building hydrogen retail infrastructure.While the initial investment is relatively low, the risk is high and therefore greatly reduced ifmany companies invest, co-ordinated by governments and supported by dedicated legislationand funding. With the market established, subsequent investment (2020-30) will present asignificantly reduced risk and by 2030 any potentially remaining economic gap is expected to bedirectly passed on to the consumer.

SUMMARY OF NEXT STEPSInvestment cycles in energy infrastructure are long and BEV and FCEV infrastructure andscale-up should be initiated as soon as possible in order to develop these technologies asmaterial transportation options beyond 2020. In the short term, CO2emissions will therefore haveto be reduced by more efficient ICEs and PHEVs – combined with biofuels – while taking twoconcrete actions:

1. Study EU market launch plan for FCEVs and hydrogen infrastructureCar manufacturers have signalled that they are ready to mass-produce FCEVs, as demonstratedby the Letter of Understanding in 2009(see page 13).This study shows that FCEVs aretechnologically ready and can be produced at much lower cost for an early commercialmarket over the next five years. The next logical step is therefore to develop a comprehensiveand co-ordinated EU market launch plan study for the deployment of FCEVs and hydrogeninfrastructure in Europe(see pages 52-53).This consists of two phases:�An in-depth business case and implementation plan for a single Member State (i.e. Germany)in order to de-risk the commercialisation of technology and test the supply chain for the rest ofEurope, starting in 2015. At the same time, a series of subsidised FCEV demonstration projectsin other Member States should start to gain experience with the technology.�A potential staged roll-out plan – first, a market introduction in Member States that havedeveloped experience through the demonstration projects, followed by other Member States.The implementation plan should be fit for investment by companies and the public sector. Thisincludes addressing the risks associated with the plan, how hydrogen will be decarbonised andits impact on future CO2emissions from the transport sector.

10

The dynamics of setting up a hydrogen retail infrastructure are such that there is a limitedopportunity to gain “early mover” advantage, so the first player will not be able to compensate forany losses. Indeed, they will develop the market for all other infrastructure providers who will thenreap the benefits at a later stage. However, if several hydrogen retail infrastructure providers invest– or a market-based mechanism is developed to spread the risk between different infrastructureproviders – none will gain a ‘free ride’. The market launch plan must therefore go hand-in-handwith appropriate government policies.After the technology has been de-risked and achieved cost reductions in one Member State –and at the same time gained more experience with a series of demonstration projects in otherMember States – a staged roll-out plan for subsequent introductions in other Member States hasthen to be studied. This will address the supply constraints of car manufacturers and hydrogeninfrastructure providers; the primary energy resources of different Member States; and CO2reduction goals for the transport sector as a whole.

2. Co-ordinate roll-out of BEVs/PHEVs and battery-charging infrastructureA similar action would be helpful to support the roll-out of BEVs and PHEVs in the EU. Here, too,the risk of market failure exists. Although the investments per electric recharging point are low,the financial risk for infrastructure providers remains. As with hydrogen infrastructure, upfrontinvestment for public charging will be necessary in order to give customers appropriate access toinfrastructure from the start.In order to achieve a sound market introduction, the technology also needs to be commerciallyde-risked and programmes for BEVs currently exist in several European countries and atEU level, addressing issues such as technology, market introduction, funding schemes andstandardisation etc. A coherent approach to these activities would help to optimise developmentand support early market readiness.

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesExecutive summary

11

INTRODUCTIONEU CO2reduction goal for 2050 requires 95% decarbonisationof road transportIn 2009, both the European Union (EU) and G8 leaders agreed that CO2emissions must be cutby 80% by 2050 if atmospheric CO2is to stabilise at 450 parts per million15– and global warmingstay below the safe level of 2�C. But 80% decarbonisationoverallby 2050 requires 95%16decarbonisation of the road transport sector (Exhibit 1).Gt CO2e per yearEU-27 total GHG emissions1SectorPowerRoad transport-80%Air & sea transportIndustry31.20.10,10,40.600.20,1-0.32050 abated2BuildingsWasteAgricultureForestryTotalabatement95-100%95%50%40%95%100%20%-0.25 Gt CO2e

5,95.21.25.31.25.41.2

0,90,51.10.90.20.51990Source:2010

0,90,61.00.90.40.3

1,00,71.00.90.30.3

2030

2050

IEA forecasts

1 Large efficiency improvements are already included in the baseline based on the International Energy Agency, World Energy Outlook 2009,especially for industry2 Abatement estimates within sector based on Global GHG Cost Curve3 CCS applied to 50% of large industry (cement, chemistry, iron and steel, petroleum and gas, not applied to other industries)SOURCE: www.roadmap2050.eu

Exhibit 1: In order to achieve EU CO2reduction goal of 80% by 2050, road transport mustachieve 95% decarbonisationDecarbonisation may be achieved through efficiency, biofuels and electric power-trains (includinghydrogen). With the number of passenger cars set to rise to 273 million17in Europe – and to 2.5billion18worldwide – by 2050, full decarbonisation may not be achievable through improvementsin the traditional internal combustion engine or alternative fuels alone. A comprehensive analysiswould be helpful to determine the true global potential of biofuels and for which sectors andregions they may be most effectively used.Combined with the increasing scarcity and cost of energy resources, it is therefore vital to developarangeof technologies to ensure the long-term sustainability of mobility in Europe, with “ultralow-carbon electric power-trains and hydrogen fuel cells the most promising options”,19accordingto the European Commission. This study was therefore undertaken in order to compare theperformance and costs of alternative power-trains for passenger cars – fuel cell electric vehicles(FCEVs), battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) – with those of conventionalvehicles with internal combustion engines (known as ICEs). This included every step of the valuechain, or “well-to-wheel”.15 CO2-equivalent16 McKinsey Global GHG Abatement Cost Curve; International Energy Agency World Energy Outlook2009; US Environmental Protection Agency; European Environment Agency (EEA)17 Parc Auto Survey 2009, Global Insight 2010; study analysis18 European Commission, April 201019 COM(2010)186: A European strategy on clean and energy efficient vehicles, published April 2010

12

Electric vehicles (BEVs, FCEVs and PHEVs) are necessary to achieve EU CO2reduction goalThe benefits of electric vehicles (BEVs, FCEVs and PHEVs in electric drive) over ICEs are:�Electric vehicles have zero emissions while driving – significantly improving local air quality– and they can be made close to CO2-free, depending on the primary energy source used20.Zero-emission power-trains therefore go hand-in-hand with the decarbonisation of energysupply, with the potential to eradicate emissions from central hydrogen production completelyby 2050.�Electric vehicles can be fuelled by a wide variety of primary energy sources – including gas,coal, oil, biomass, wind, solar and nuclear – reducing oil dependency and enhancing energysecurity (e.g. through stabilising an increasingly volatile power grid).�While ICEs have the potential to reduce their CO2footprint considerably through improvedenergy efficiency, this is insufficient to meet the EU’s CO2reduction goal for 2050. Fulldecarbonisation through biofuels depends on their availability.

Technologically ready, FCEVs are now focused on commercial deployment30 stakeholders came together in order to develop a factual evaluation of the four power-trainsand their role in decarbonising road transport. It was also considered particularly important tore-assess the role of FCEVs in the light of technological breakthroughs in fuel cell and electricsystems that have now increased their efficiency and cost-competitiveness significantly(Exhibit 2). Previous studies21predicted that all technological challenges would be addressedsimultaneously within a few years. In reality this has happened sequentially, with a steady butsignificant improvement in all key areas:�With the implementation of 700 bar storage technology, hydrogen storage capacity hasincreased – without sacrificing volume – resulting in driving ranges that approach gasolineICEs. In general, safety concerns have been adequately addressed.�Cold start is down to -25�C, or even lower, due to the application of purging strategies at shut-down and new materials (e.g. metallic bipolar plates) which have optimised heat managementin the stacks.�With better understanding of the mechanisms affecting durability and the implementation ofcounter measures, such as enhanced materials (e.g. functionalised or nanostructured catalystsupports) and cell voltage management, durability (hence cost) has significantly improved.�With the development of CCS, an additional low-cost, low CO2hydrogen production routewould be made available.Common standards for hydrogen and FCEV equipment have also been agreed, further reducingtheir complexity and costs: standard connections, safety limits and performance requirementsfor hydrogen refuelling have been established by several SAE22and ISO22standards, while theelectric system is fully compliant with SAE and ISO safety standards.20 This is commonly illustrated by well-to-wheel emissions, integrating the CO2footprint of fuelproduction with its transformation by the power-train (see Annex, Exhibit 43, page 54)21 See Annex, Exhibit 44, page 5522 SAE International (formerly Society of Automotive Engineers), the recognised authority on standardsfor commercial vehicles, together with ISO (International Organization for Standardization)

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesIntroduction

13

With more than 500 passenger cars – both large and small – covering over 15 million kilometresand undergoing 90,000 refuellings,23FCEVs are therefore now considered to have beencomprehensively tested in a customer environment. The result: the focus has now shifted fromdemonstration to commercial deployment so that FCEVs, like all technologies, may benefit frommass production and the economies of scale.Heat management▪Current systems have reducedheat loss with remaining heatused for vehicle climate controlWater management▪Prototype systems have shownthat appropriate membranehumidity can be provided withoutexternal humidifierTemperature dependency▪Cold-weather performance testshave shown that cold start anddriving performance is equivalentto ICEEfficiency▪Fuel stack net efficiency hasincreased to 59%, with furtherimprovement leading to adownsized system at lower costDurability▪Durability tests have shown thatacceptable stack efficiency canbe maintained for the lifetimeof the vehicleSOURCE: Study analysis

Hydrogen storage▪Innovations in materials allowHydrogen storage at 700 bar forincreased driving range thatapproaches gasoline ICEs

Average and peak load▪Voltage range of stack hasimproved, with power batteryproviding additional bufferingcapacity for increased stackdurability and efficiencyPlatinum▪Catalyst requirement issignificantly reduced to 2-6times catalytic converterloading of conventional ICE.Platinum in fuel cells is alsohighly recyclableSize▪Current fuel cell systemsfit into vehicle withoutcompromising cargo volumeand vehicle weightMaterial cost▪Acceptable cost will beachieved by 2020 throughdesign simplifications,reduction of material use,production technology andeconomies of scale

Exhibit 2: With all technological hurdles resolved, the focus for FCEVs has now shifted fromdemonstration to commercial deploymentThis was clearly signalled in a Letter of Understanding issued by leading car manufacturers24in September 2009, in which they stated their goal to commercialise FCEVs by 2015, withhundreds of thousands of vehicles being rolled out worldwide shortly thereafter – assumingsufficient hydrogen refuelling infrastructure is in place. This was a catalyst for the in-depthevaluation of the four power-train technologies undertaken in this study.A public-private partnership called H2 Mobility was also established, which is now developinga business plan for building a hydrogen refuelling infrastructure in a single Member State (i.e.Germany) – complemented by a series of demonstration projects in other Member States – asessential first steps towards a full EU roll-out(see pages 52-53).The window of opportunity is short. If FCEVs are to achieve economies of scale within the time-frame necessary to meet EU CO2reduction goals, action must be taken as a matter of urgency.There is also a danger that Europe will lose its technological leadership as other internationalmarkets gain ground. The European Commission has confirmed that “the global trend towardssustainable transport shows that the European automotive industry can only remain competitiveby leading in green technologies”.2523 Study data24 Daimler AG, Ford Motor Company, General Motors Corporation/Opel, Honda Motor Co., Ltd.,Hyundai Motor Company, Kia Motors Corporation, the alliance Renault SA and Nissan Motor Co.,Ltd. and Toyota Motor Corporation25 European Commission, April 2010

14

The reality is that no transportation model can be changed overnight – it requires preparation andramp-up of production. A “knee-jerk” response to external factors, such as a rise in oil prices,supply constraints and the disastrous consequences of global warming will be too little, too late.

All conclusions are based on proprietary industry dataThis study represents the most accurate to date,26as conclusions are based not on informedspeculation, but on confidential, granular and proprietary data, provided by key industry players.This has allowed a true comparison of the power-trains, with all underlying assumptions clearlystated(see Methodology section, pages 15-25).In order to present an integrated perspective across the entire value chain, the study addressesfive key questions:1. On a well-to-wheel basis, how do BEVs, FCEVs and PHEVs compare to ICEs over the medium-to-long term on emissions, performance and costs?2. What are the key drivers by car size, miles driven, supply technology and over time?3. What are the potential market segments?4. How do fuels, electricity and hydrogen production, distribution and retail pathways compare?5. What is required at a high level to deploy electric vehicles (BEVs, FCEVs, PHEVs) at scaleso that they can benefit society by significantly reducing CO2emissions, enhancing energysecurity and improving air quality – without compromising its current expectations formobility?The positive effect of electric vehicles on public healthThe benefits of electric vehicles (BEVs, FCEVs and PHEVs in electric mode) go beyond thedecarbonisation of road transport and energy security to address the key issue of air pollutionin large, congested cities: the exhaust from ICEs not only emits CO2, but also local pollutants27such as carbon monoxide, hydrocarbons and nitrous oxides. Diesel vehicles also emit particlesreferred to as particulate emissions or “soots”. Although these emissions are mitigated bycatalytic converters, all pollutants that cannot be processed are released into the atmosphere,degrading air quality and reducing the ability of large cities to meet air quality targets.Electric vehicles, on the other hand, release zero emissions in their “tank-to-wheel” process, withemissions limited to the “well-to-tank” process – far removed from the vehicle itself. Emissionsalso depend on the primary energy source used and can be potentially reduced to zero. Finally,unlike ICEs, electric vehicles are virtually silent, also reducing noise pollution significantly.

26 Other studies taken into consideration include “Hydrogen Highway”: www.hydrogenhighway.com;Roads2HyCom project www.roads2hy.com; “On the road in 2035”, published 2008; “The HydrogenEconomy”, published 2009; “Hydrogen Production Roadmap: Technology Pathways to the Future”,published 201027 This would also apply even if using 100% biofuels

15

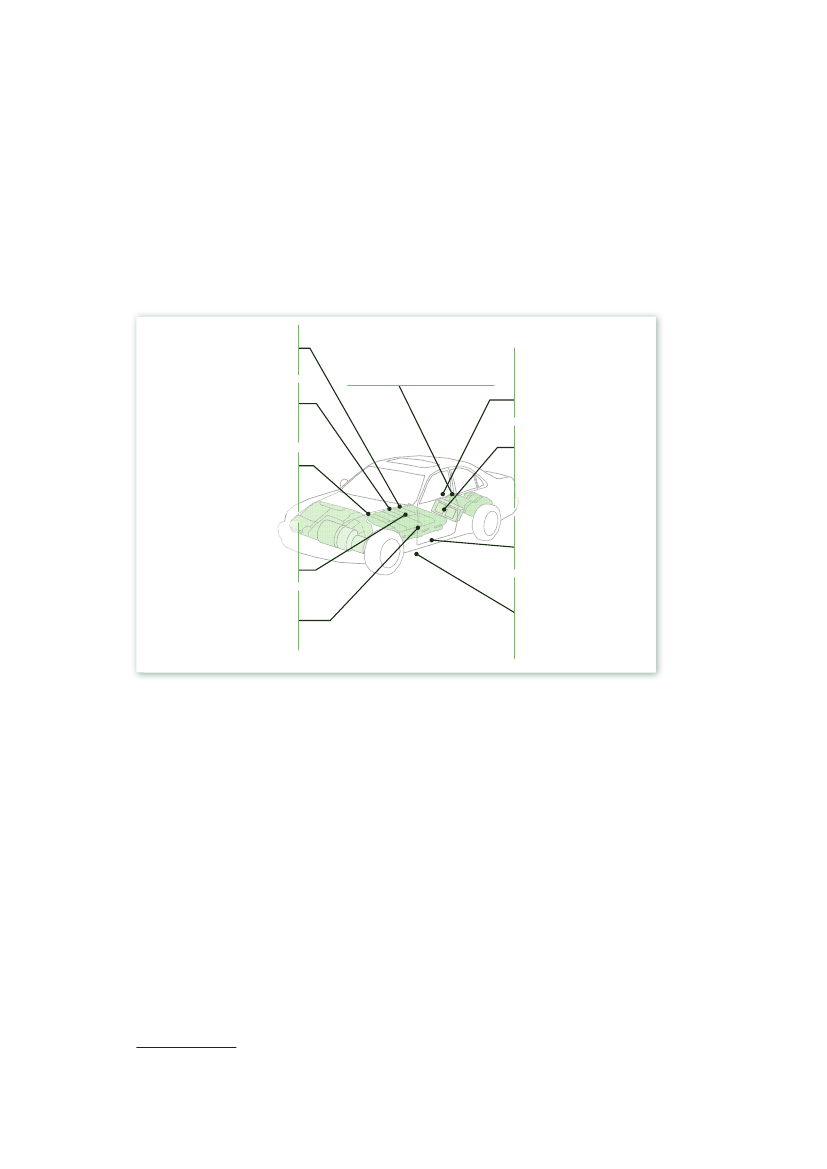

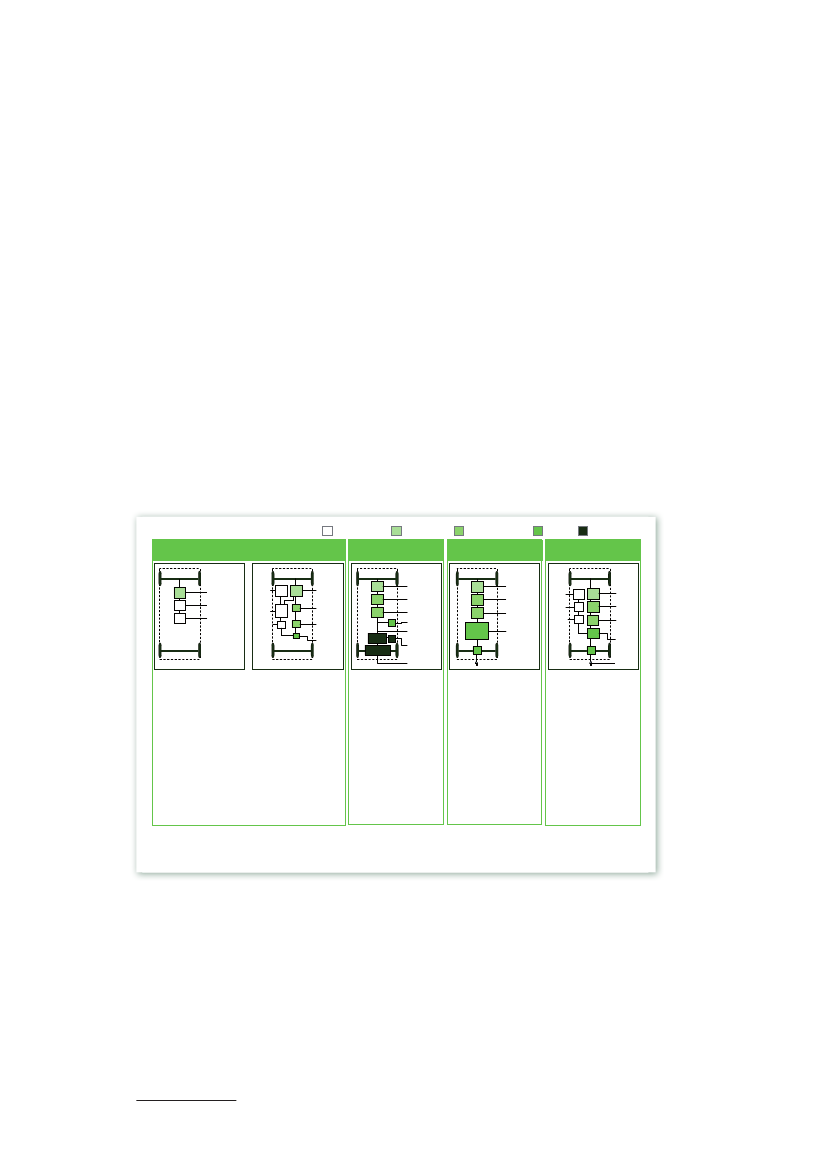

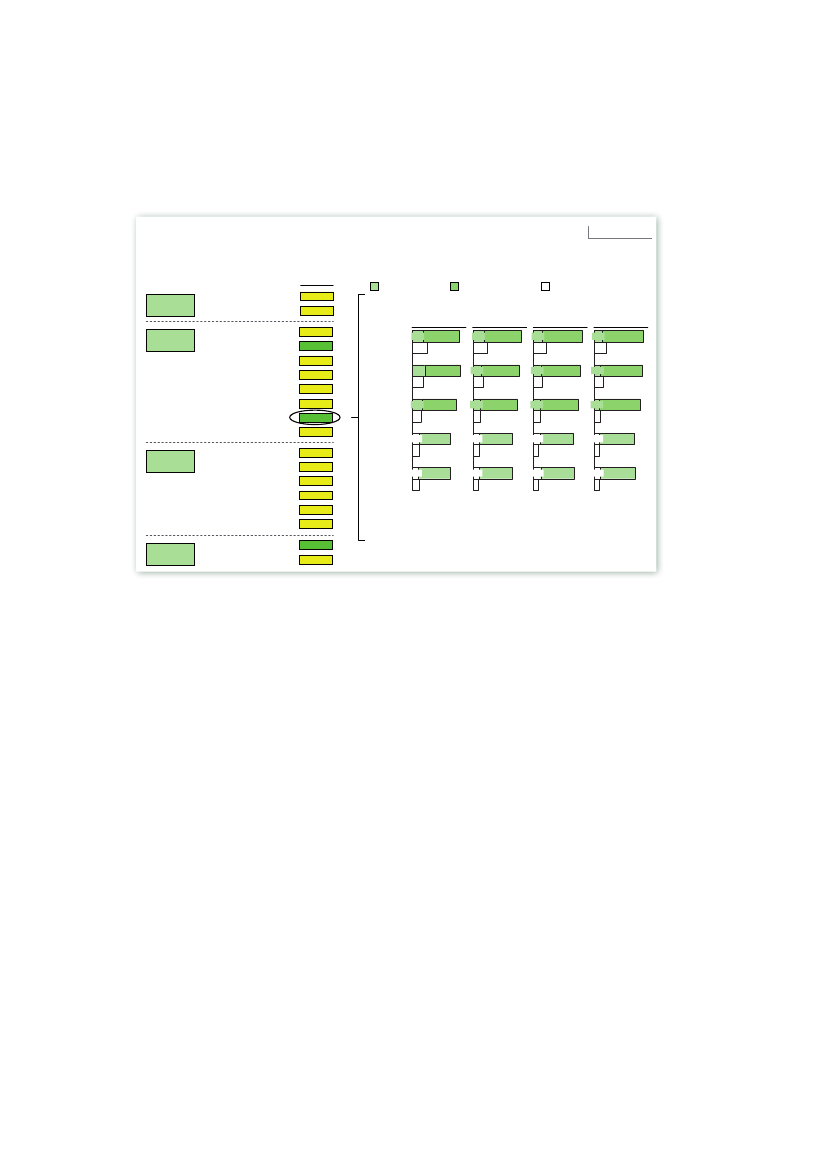

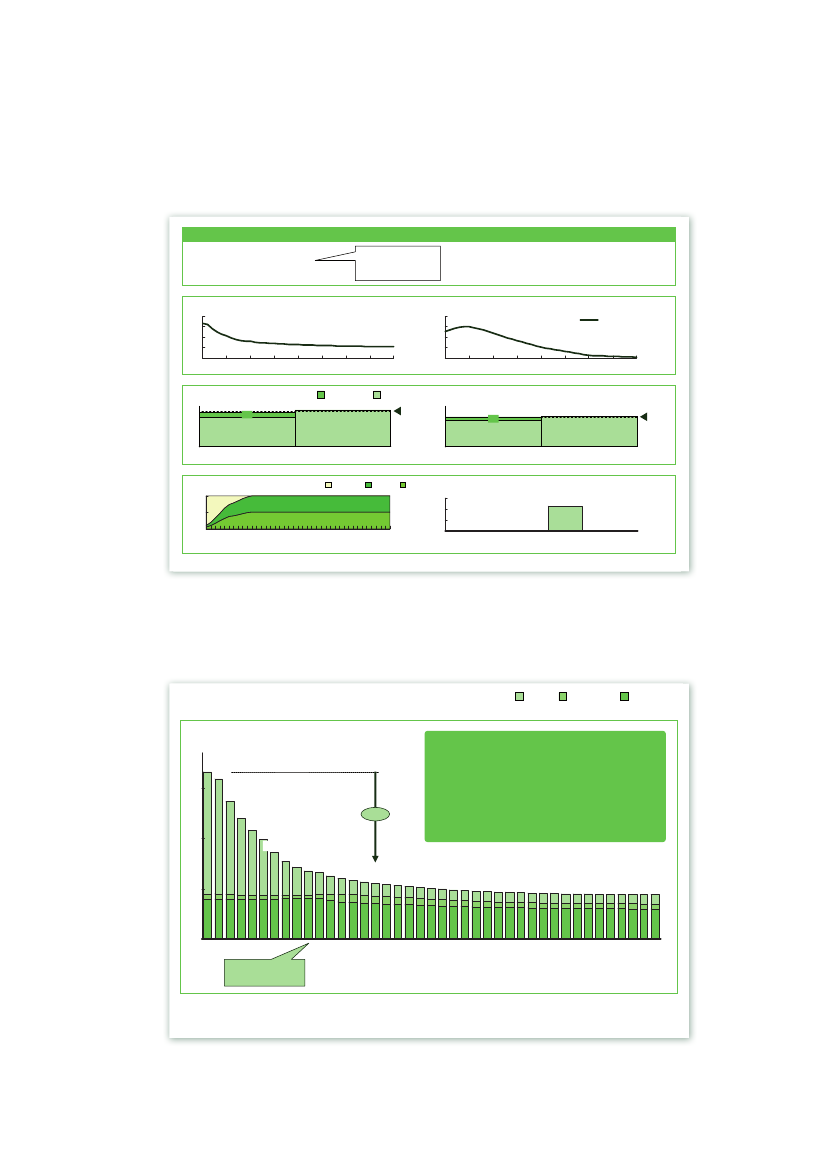

METHODOLOGYThis study provides a factual comparison of four different power-trains (Exhibit 3) – BEVs,FCEVs, PHEVs and ICEs – on economics, sustainability and performance across the entire valuechain1between now and 2050, based on confidential and proprietary industry data. This waspossible due to the central role of an independent consultancy and a strict division between theconsultancy’s “Clean Team” responsible for input gathering and the “Analysis Team” responsiblefor output generation.Data was submitted, challenged and, where necessary, benchmarked and validated for everystep of the value chain – including purchase price, operating costs, fuel, as well as infrastructure.While it is possible that breakthrough technologies could provide step changes in currentpathways to sustainable mobility, the study only considered vehicle technologies that areprovenin R&D today – and in many cases demonstrated – and therefore capable of a) scale-up andcommercial deployment and b) meeting the EU’s CO2reduction goal for 2050.To ensure a realistic outcome, it was agreed that all conclusions should be based onaverage values derived from the range provided, with no “cherry-picking” of the mostfavourable data.ICE power-trainTransmissionElectric power-trainBatteryFC power-train

Internal combustion engine (ICE) vehicleCurrent technology (2010) Advanced (2015/20)

Fuel cell electric vehicle(FCEV)

Battery electric vehicle(BEV)Trans-missionE-motorPowerelectronicsEnergybattery

Plug-in hybrid electricvehicle (PHEV)

Trans-missionICETank

Tank

Trans-missionE-motorPowerelec-tronicsPowerbattery

Trans-missionE-motorPowerelectronicsPowerbatteryFC stackBOPTank

TankICEGene-rator

Trans-missionE-motorPowerelec-tronicsEnergybatteryPlug-incharger

ICEGene-rator

Plug-incharger

▪Conventionalinternalcombustion engine

▪Parallelhybrid

▪No dependencyon

electric infrastructureand exhaust emissions800-1200 km

▪High fuel consumption▪High range:typically

configuration of electricand ICE drive; also knownas hybrid electric vehicle(HEV)of the vehicle with supportfrom small electric motorby the ICE

▪Seriesconfiguration of fuel▪Purely electricdrivecell system and electric▪Large battery capacity,drive

▪Series hybrid

▪Fuel cell stackbased onPEM technology

Li-ion technology

configuration of electricand ICE drive3than BEV, (Li-ion)

▪Only charging of batteryfrom the gridwhilestationary1

▪Smaller battery capacity▪Vehicle can beplugged-into charge from the grid

▪ICE is primary mover

▪Hydrogen tank pressuretypically 350 or 700 bar400-600 km

▪Small batterycharged▪Fully electric driving only▪Better fuel economyatlow speedforsmallerdistances(<5 km)than conventional ICE

▪Medium range:typically

▪Short range:typically

150-250 km (based onbattery weight of70-180 kg2)

▪Small ICE-based

generator for larger range(‘range extender’)40-60 km) electric driving.(based on battery weightof 20-80 kg2)

▪Short range:typically

1 Exchange of battery pack is possible, but not considered in this study2 2020 values averaged over A/B, C/D and J segments – a ~50% decrease over 2010. Although considerable cost improvements in battery technologyare considered in the study, it is not expected to achieve significantly lower specific volumes or weights beyond 20203 Other configurations are possibleSOURCE: Study analysis

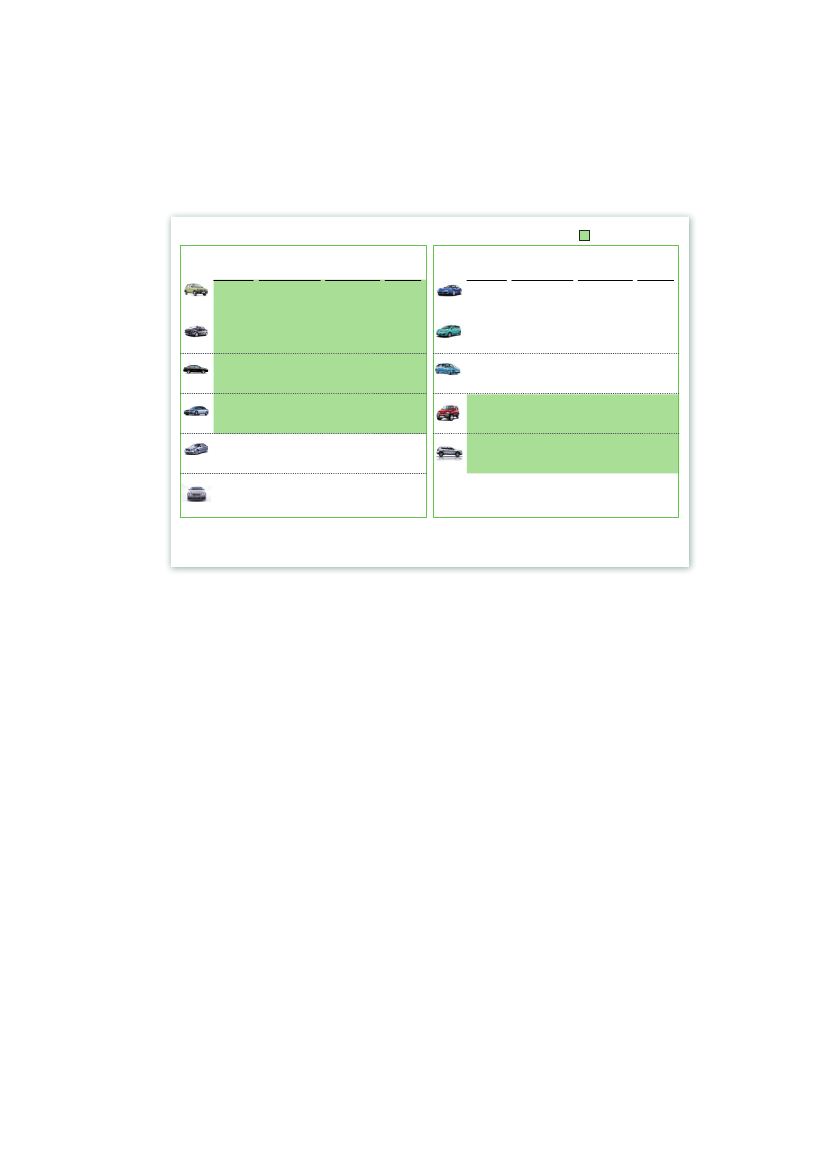

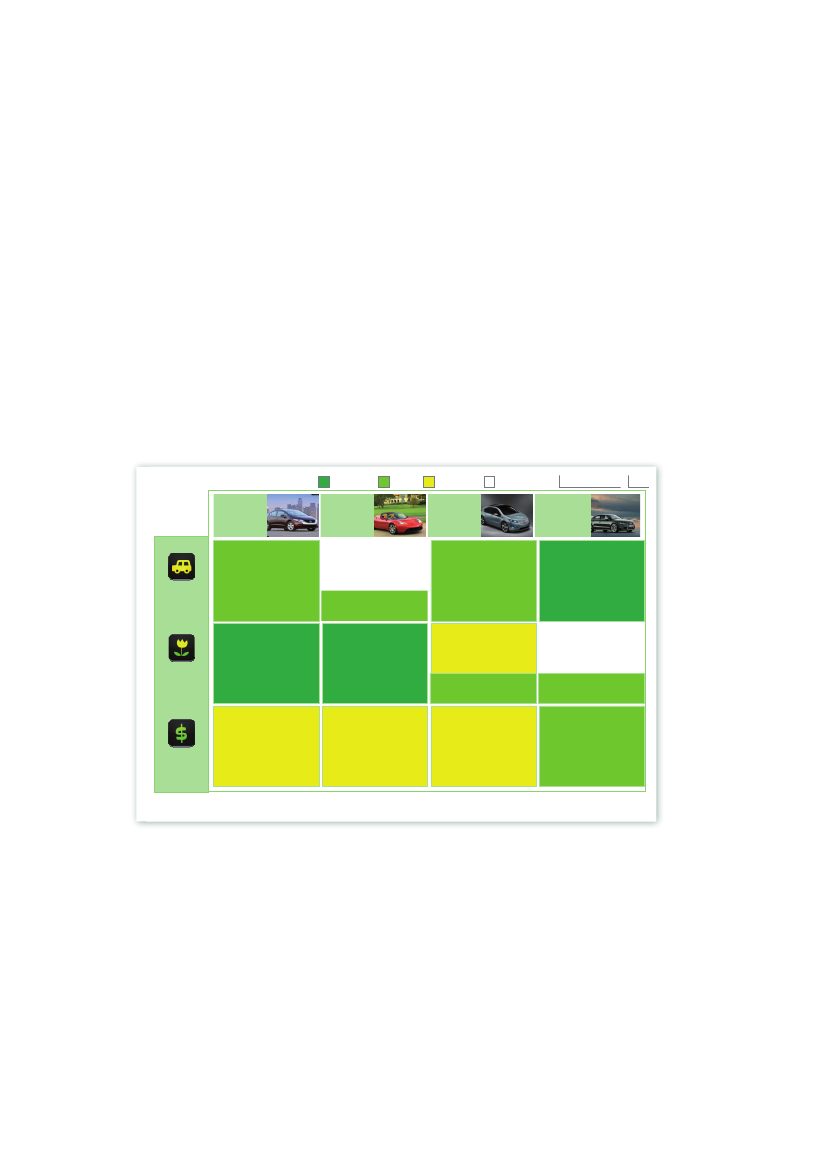

Exhibit 3: The study focused on a portfolio of power-trains: BEVs, FCEVs, PHEVs and ICEs,taking into account significant advances in ICE technology between now and 2020In order to ensure no bias towards any particular power-train, the study included a balanced mixof car sizes (known as “segments”), representing the majority of vehicles currently on the marketand with high data availability among study participants (Exhibit 4). Average values for fleets, asopposed to specific cars, were taken.

1

Commonly referred to as “well-to-wheel”

16

Defined reference segmentsEU vehicleproduction2008, %EU vehicleproduction2008, %

VehiclesegmentA – City

Typicalcharacteristics

Example

VehiclesegmentS – Sport

Typicalcharacteristics

Example

▪<3,800 mm▪3 door hatchback▪€8k-15k▪3,700-4,200 mm▪5 door hatchback▪€10k-20k▪4,000-4,500 mm▪5 door hatchback▪€15k - 25k▪4,400-5,000 mm▪4 door sedan▪€25k-45k▪4,700-5,100 mm▪4 door sedan▪€40k-120k▪2/4 door sedan▪> €100k

▪Hyundai i10▪Smart

6

▪2 door coupe▪>€30k

▪Mercedes CLK▪Nissan 370Z

<1

B – Super-mini

▪Toyota Yaris▪Mercedes A

23

M1 – SmallMPV

▪3,900-4,400 mm▪5 door MPV▪€10k - 30k▪>4,400 mm▪5 door MPV▪€25k-50k▪3,700-4,000 mm▪5 door 4x4▪€10k-30k▪4,000-5,100 mm▪5 door 4x4▪€25k-75k

▪Mercedes B▪Renault Scenic

12

C – Medium

▪Honda Civic▪Ford Focus

23

M2 – LargeMPV

▪Mercedes R

9

D – Uppermedium

▪Renault Laguna▪Honda FCX▪Mercedes C▪Mercedes E/S▪Lexus GS

13

J1 – SmallSUV

▪Hyundai▪Toyota RAV4▪ToyotaTucson

5

E – Large

5

J2 – LargeSUV

▪Ford Explorer

Highlander

3

F – Luxury

▪Maybach

<1

SOURCE: HIS Global Insight 2010; study participants

Exhibit 4: The study focuses on the vehicle segments that represent the majority of the EUcar fleet (75%) – selected small (A/B), medium (C/D) and larger (SUV) cars

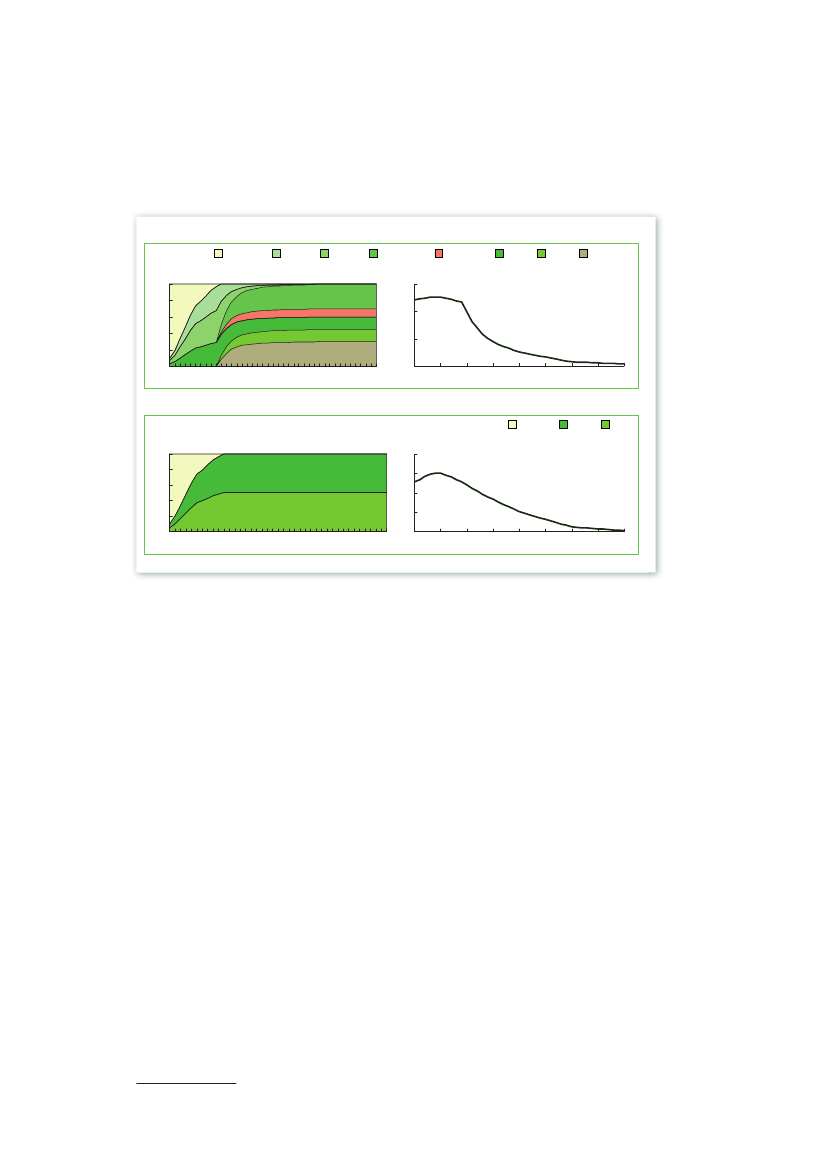

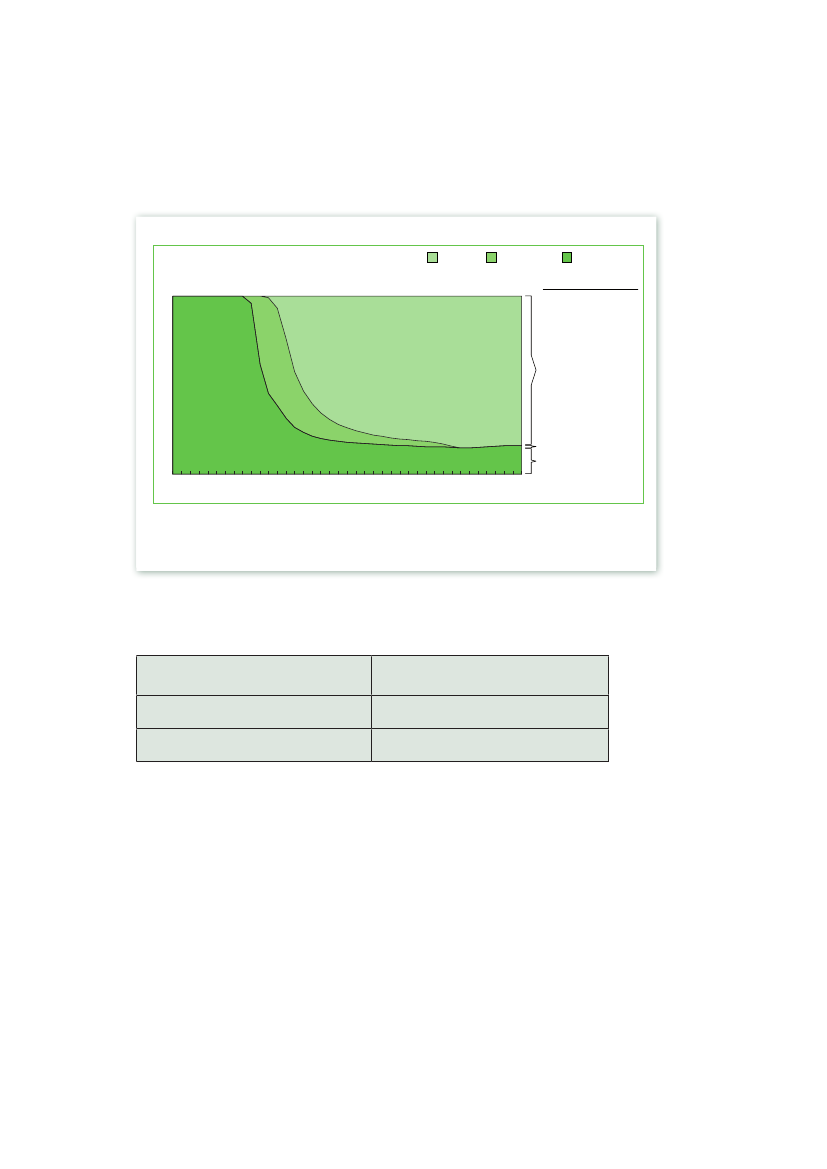

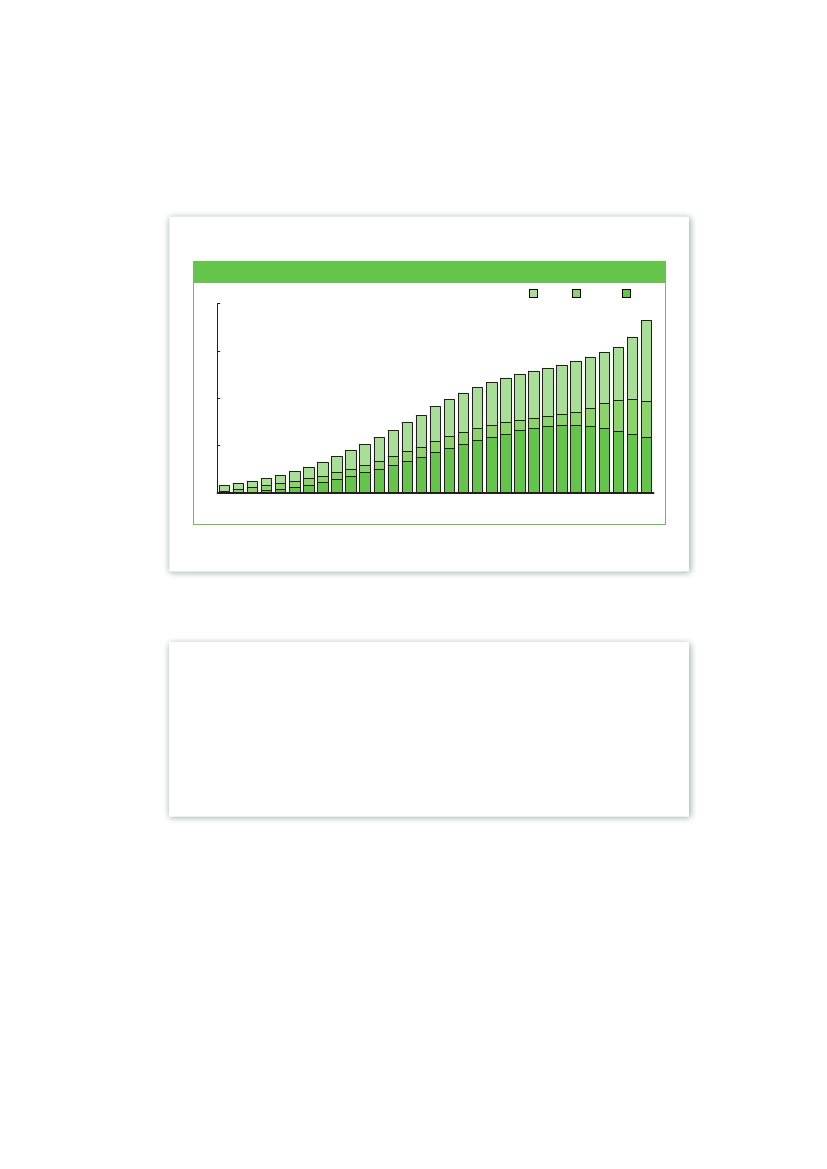

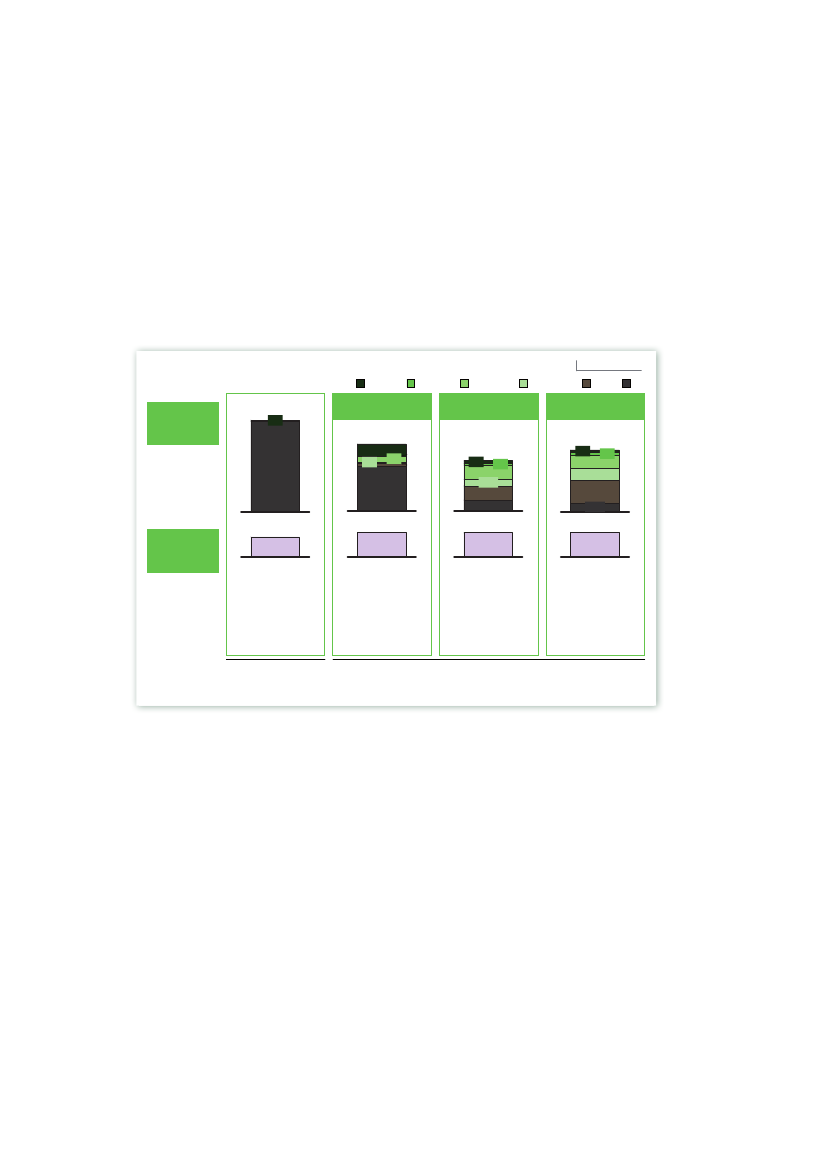

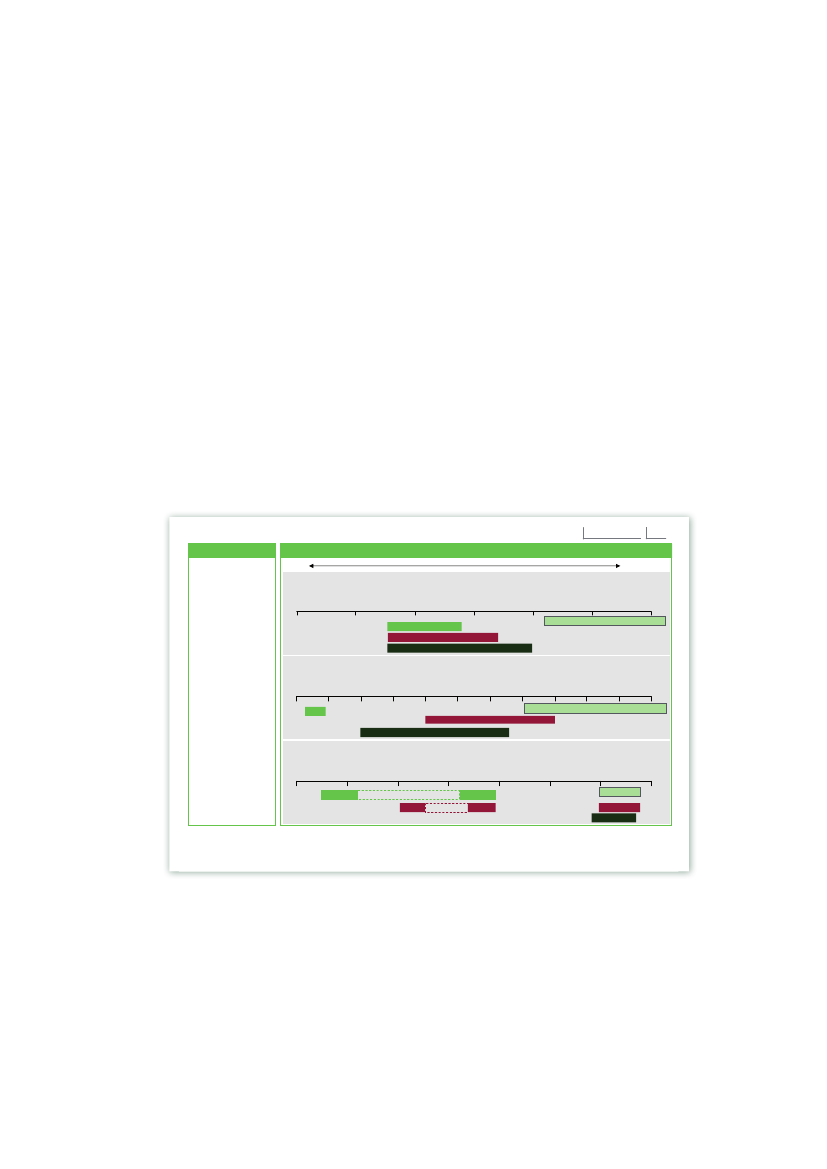

A balanced scenario for the electrification of passenger cars in theEU by 2050In order to test the sensitivity of the economics to a broad range of market outcomes, the studyenvisioned three “worlds” with varying degrees of BEV, FCEV and PHEV penetration (Exhibit 5).These cover:a. The full spectrum of expected futures for hydrogen, electricity and primary energy sourcesb. Market shares and segment penetration rates for the different power-trainsc. Coverage area and availability of hydrogen.All “worlds” assume 273 million passenger cars in the EU in 2050, with a hydrogen retail networkinfrastructure starting in the most densely populated areas (i.e. large cities) and growing to meetthe needs of expanding vehicle clusters, leading to mass market roll-out. The car fleet is built upby introducing BEVs, FCEVs and PHEVs where they are most competitive with ICEs (Exhibit 6).

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesMethodology

17

1Non-zero emission –Conventional2010-2020

2Zero-emission –Electric vehicle dominated

3Zero-emission –FCEV dominated

▪

For all worlds, coverage grows to include 10% of Europe’s most metropolitan area and 20%of European motorways (>50% of cars)ICE60%FCEV25%BEV35%PHEV35%ICE5%FCEV50%BEV PHEV ICE25%20% 5%

FCEV penetration2050Percent

FCEV BEV PHEV10%5%25%

▪▪▪

FCEV with moderate adoptionafter 2020FCEVs sold in C+ segments,but with limited market sharesFCEV coverage area increasesonly to~1/4of the EU29 area1,(75 % cars)2020: 0.362030: 0.602040: 0.842050: 1.08

▪▪▪▪▪▪▪▪

BEVs achieve a higherpenetration than FCEVsFCEVs mainly sold in C+segments with high sharein J, M, DFCEVs are used in all countrieswith some rural exceptionsCoverage is~3/4of the EU29area1, (97% cars)2020: 0.362030: 1.32040: 2.32050: 3.3

▪▪▪

FC is the dominant power-traintechnology by 2050 so networkcoverage develops fastFCEVs sold in all segments withmajor shares in large segmentsAll over Europe, FCEVs are soldand driven. Coverage is equal totheentireEU29 area1(9 km2020: 0.362030: 1.72040: 3.02050: 4.3

Coverage end state2050

average distance between stations)

Size of coverageareamillion km2

▪▪▪▪

▪▪▪▪

1 EU29 defined to include EU27 + Norway and SwitzerlandSOURCE: Study analysis

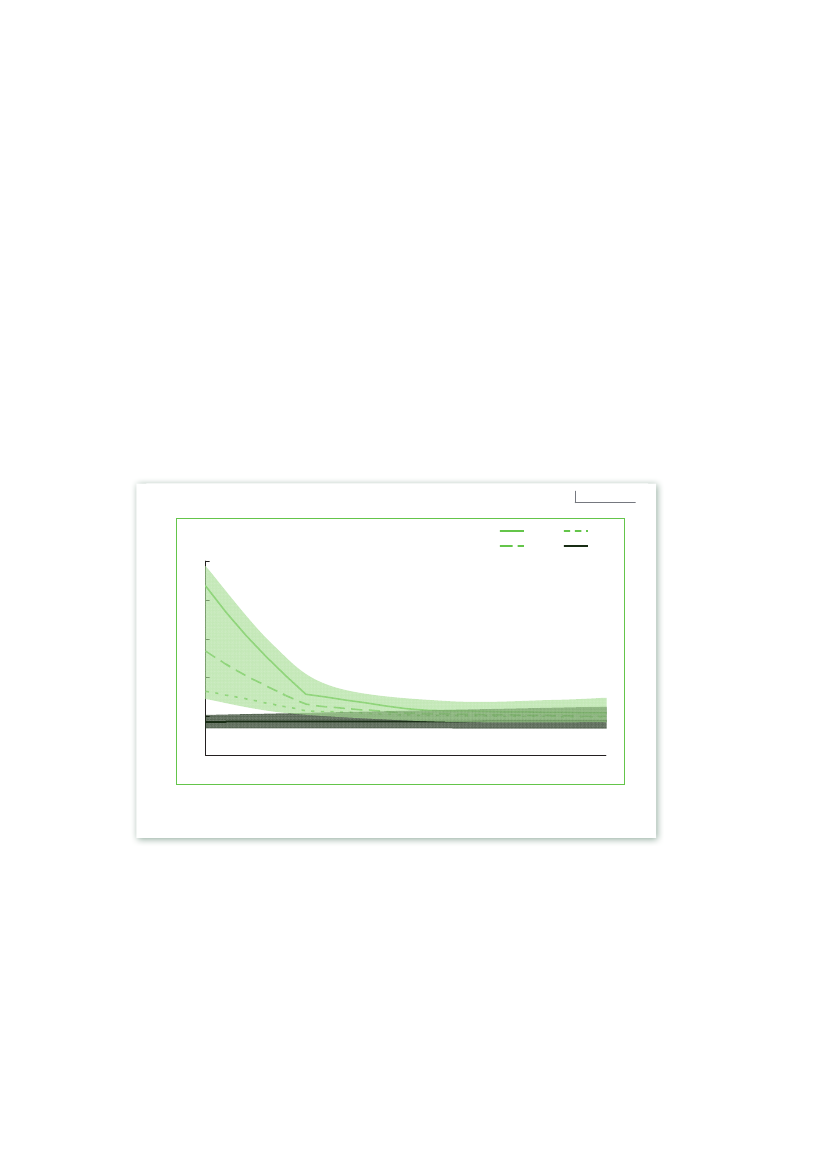

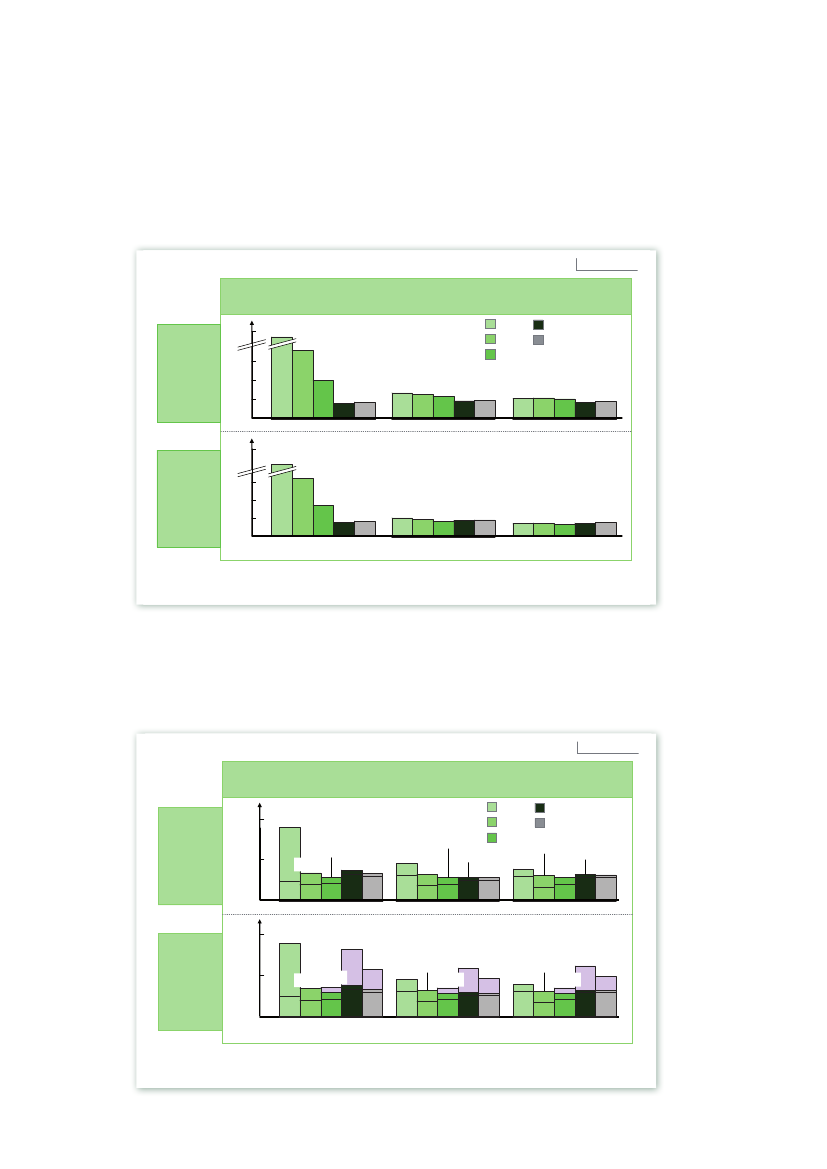

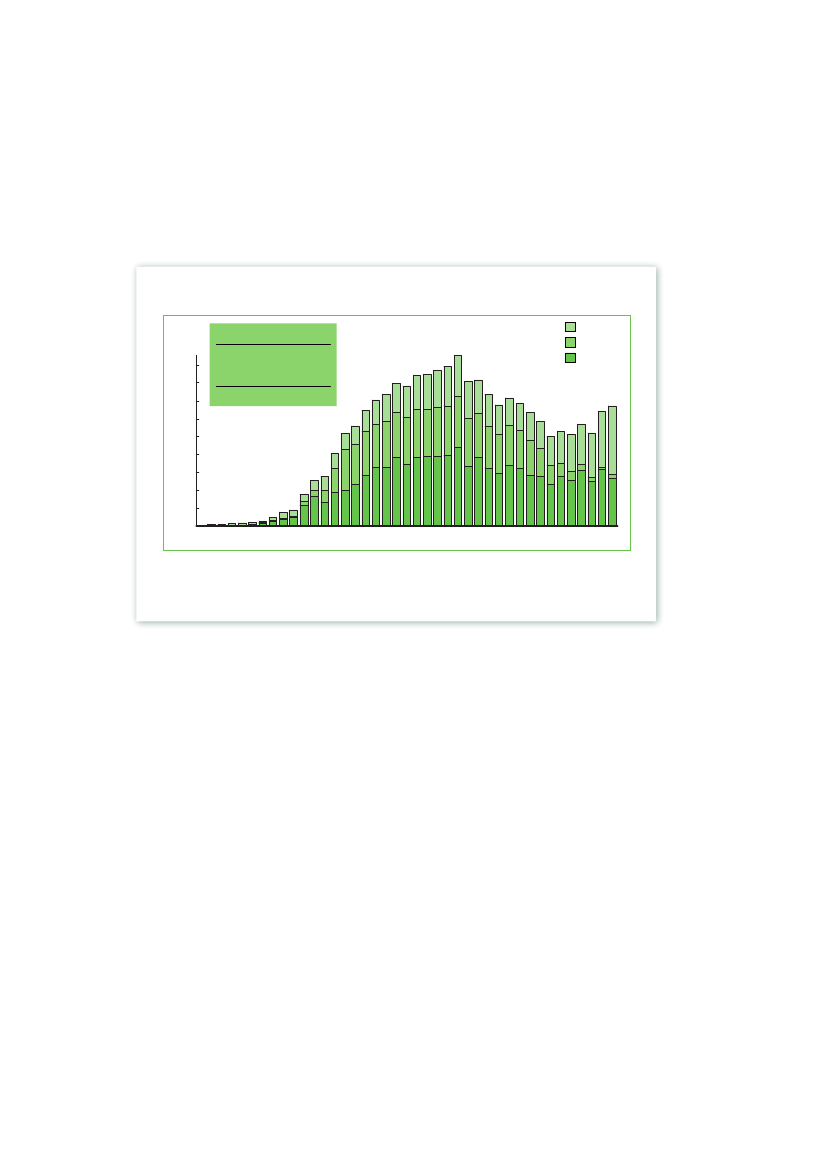

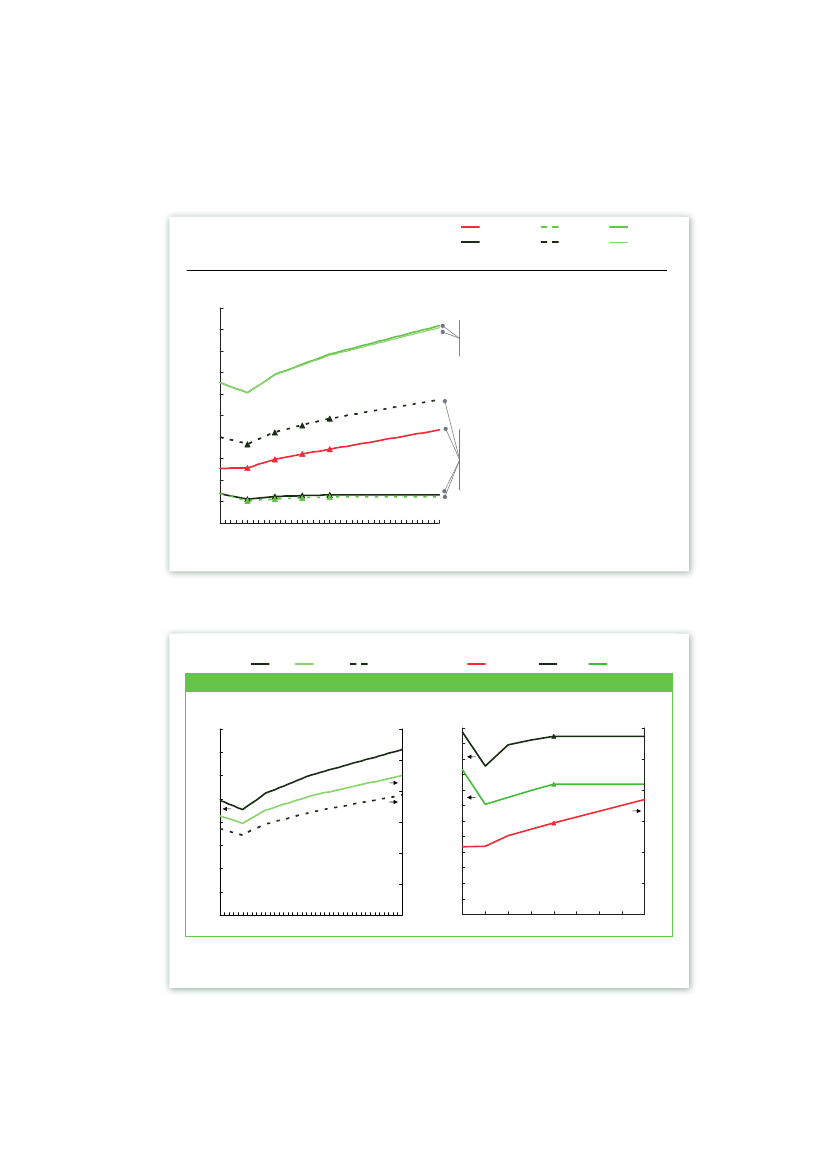

Exhibit 5: Assumptions for the three “worlds”, each showing a different penetration scenariofor BEVs, FCEVs, PHEVs and ICEs in the EU in 2050Total EU car fleet, million vehiclesICE gasolineICE dieselFCEVBEVPHEV

1Non-zero emission –Conventional

2Zero-emission –Electric vehicle dominated

3Zero-emission –FCEV dominated

2802602402202001801601401201008060402002010

2020

2030

2040

2050

2802602402202001801601401201008060402002010

2020

2030

2040

2050

2802602402202001801601401201008060402002010

2020

2030

2040

2050

SOURCE: Study analysis

Exhibit 6: For all three “worlds”, the car fleet is built up from 2010 to 2050 byintroducing BEVs, FCEVs and PHEVs where they are most competitive with ICEs

18

A combined forecasting and backcasting approach to maximise accuracyIn order to ensure conclusions were as accurate as possible, both a forecasting and backcastingapproach was then used: from 2010 to 2020, all cost and performance projections are based onproprietary industry data; after 2020, on projected learning and annual improvement rates.These forecasted data were then backcasted from the envisioned penetration of power-trainsin the EU in 2050, as described above. The results showed that the impact on costs for varyingFCEV penetrations is not significant2(see Annex, Exhibit 45, page 55):�5% penetration of FCEVs might be expected to be uncompetitive, but this is not the case:—Whilea Europe-wide highway infrastructure is deployed, clustering of vehicles in higherpopulation density regions could keep fuel costs from escalating significantly—FocusingFCEV deployment on the medium/larger car segments where FCEVs are morecompetitive helps offset the lower economies of scale and increased vehicle costs—Comparing5% to 25% FCEV penetration in 2050 on a “like-for-like” basis, a C/D segmentFCEV has a 6.1% higher purchase price and 17.4% higher fuel costs, resulting in a 7.3%increase in TCO�No significant improvements in economies of scale exist that improve the economics of FCEVsor hydrogen infrastructure between 25% and 50% penetration.The study therefore focused on the “world” with a penetration of 25% FCEVs, 35% BEVs,35% PHEVs and 5% ICEs as a balanced scenario for the penetration of electric vehicles in the EU.Total cost of ownership (TCO)In the study, the economic comparison between power-trains is based on the total cost of ownership (TCO), as well aspurchase price (see Annex, Exhibit 46, page 56 for a sample TCO calculation for an FCEV).Consumers buy cars for a wide variety of reasons, including purchase price, new vs. second-hand, depreciation rate, styling,performance and handling, brand preference and social image. The cost of driving the same vehicle when new is also greaterthan that for the next owner. Calculating the TCO of the power-trains is therefore important because it describes the costsassociated over their entire lifetime – on top of which individual customer criteria are applied. TCO includes:

▪Purchase price: the sum of all costs to deliver the assembled vehicle to the customer for a specific power-train and segment▪Running costs:–Maintenance costs in parts and servicing specific to each vehicle type and power-train combination–Fuel costs based on the vehicle fuel economy and mileage, including all costs to deliver the fuel at the pump/chargepoint and capital repayment charges on investments made for fuel production, distribution and retail; or forBEVs/PHEVs, for charging infrastructure

N.B. There is no discounting of cash flows over the years and no residual value after 15 years. Time value of money has notbeen taken into account. All taxes on vehicles and fuel (including VAT) are set to zero to ensure that comparisons reflect thetrue costs of driving and are revenue-neutral to governments.TCO equationTCO=Purchase price=Parts cost+Assembly cost+SG&A+Margin+Running cost=Maintenance cost+Fuel cost(incl. infrastructure & fuel costs)

2

The TCO of BEVs and PHEVs is constant over the three worlds due to the fact that their learningrates are defined on a yearly basis, not on an increase in capacity.

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesMethodology

19

A balanced hydrogen production mix including a variety of technologiesN.B. Assumptions on power generation are in line with the European Climate Foundation’s“Roadmap 2050”, which describes a realistic scenario for all power-trains(see page 24 andAnnex, Exhibit 47, page 56).In this report, well-to-wheel emissions do not incorporate indirect emissions resulting fromfeedstock exploration and the associated infrastructure build-up (e.g. Exploration platforms,mining activities, power plant build-up), nor so-called CO2equivalent green-house gases. If theseindirect emissions are taken into account, the well-to-wheel emissions of the different power-trains will change over time, depending on the production and supply pathway. In future analysis,it would be useful to take these into account as well.The study consists of two business models – the vehicle model (generic for all power-trains)and the supply model (more detailed for hydrogen as the electricity supply chain already largelyexists). In each “world” scenario, the demand for each fuel in each year is set by the annual drivingand fuel economy of the power-trains on the road.1. The vehicle model(see Annex, Exhibit 48, page 57)calculates the purchase price, operatingcost, TCO and CO2emissions based on the cost of electricity and hydrogen and the CO2footprint calculated from the supply model. It also includes key assumptions agreed amongparticipating car manufacturers (Exhibit 7).

Parameter

Proposed value

▪▪▪▪▪▪▪

Average vehicle lifetimeAverage annual distance drivenCombined fuel economySales taxVehicle assembly cost as %of ICE purchase price1,2SG&A (including distribution) costas % of ICE purchase price1,2Return on investment as % of ICEpurchase price1,2

▪▪▪▪▪▪▪▪▪

15 years12,000 kmDistance weighted averageof ECE-15 and EUDC cyclesTax-free base model run13.5%13.5%2% - A/B segment7% - C/D segment8.5% - J segment

1 Assumed to be similar across reference segments, with the exception of profit assumption, since margins vary significantly between vehicle segments2 Percentage will be applied to ICE purchase price per reference segment; same absolute cost will then be applied to all power-trains in the segmentSOURCE: Euromonitor, Polk, EU MVEG, Credit Suisse, Goldman Sachs Global Investment Research report, study analysis

Exhibit 7: Key assumptions for the vehicle model were agreed among participating carmanufacturers2.The supply model(for FCEVs) then calculates the CO2footprint, the cost of deliveredhydrogen and investment required, based on cost and performance data received for thethree components of hydrogen infrastructure – production, distribution and retail.

20

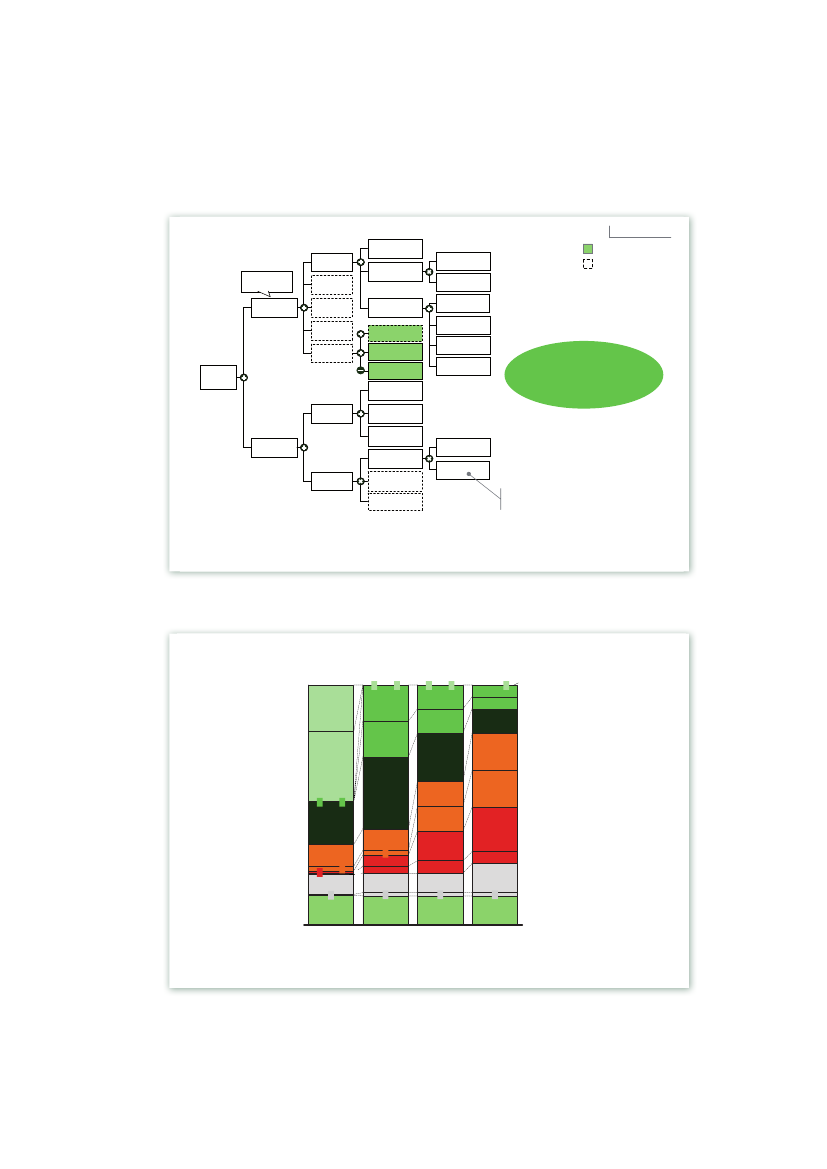

Key assumptions included:�Each year, based on hydrogen demand for vehicles, components are added to meet newdemand and replace components that are at the end of their life�With the exception of retail infrastructure and delivery trucks, utilisation is set to 95% (80%for distributed production) due to rapid increase in hydrogen demand, allowing installedequipment to achieve full utilisation within a few years(see Annex, Exhibit 49, page 57).�Shifting from small to medium to large installation size depends on the annual hydrogencapacity added each year, i.e. small components are built when hydrogen demand is low, largecomponents when demand is high.a. ProductionNine major production pathways were considered for hydrogen, representing all the maintechnologies with the potential for rapid, large-scale deployment in Europe (Exhibit 8). Based onthese production pathways, many different production mixes are possible.Among other options, the study examined two hydrogen production mixes: a balanced andeconomically driven production mix with CCS; the other without CCS, representing 100%electrolysis with 80% renewable energy by 2050. Both, however, lead to CO2-free hydrogenproduction by 2050 (Exhibit 9). While the production of hydrogen from SMR with CCS remainsthe lowest-cost scenario, the 100% electrolysis production mix only increases the TCO of FCEVs(C/D segment) by 5% by 2030 and 3.5% by 2050.N.B. All the results in this report are based on the first balanced and economically drivenproduction mix described below

TechnologySMRSteam MethaneReforming

ProcessMethaneSteamH2CO2

Governing reaction1CH4+ 2H2O4H2+ CO2

Variations

▪▪▪

On-site SMRCentral SMRCentral SMR + CCS

WEWaterElectrolysis

WaterElectricity3

H2O2

2H2O2H2+ O2

▪▪▪▪▪▪

On-site WECentral WE

CG/(IGCC)Coal Gasification/IntegratedGasificationCombined Cycle

Coal2Steam

H2CO2

C + 2H2OCO2+ 2H2

CGCG + CCSIGCCIGCC + CCS

1 Simplified reaction2 Includes co-firing with biomass3 100% CO2 reduction from power by 2050: www.roadmap2050.euSOURCE: Study analysis

Exhibit 8: Nine major production pathways were assessed

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesMethodology

21

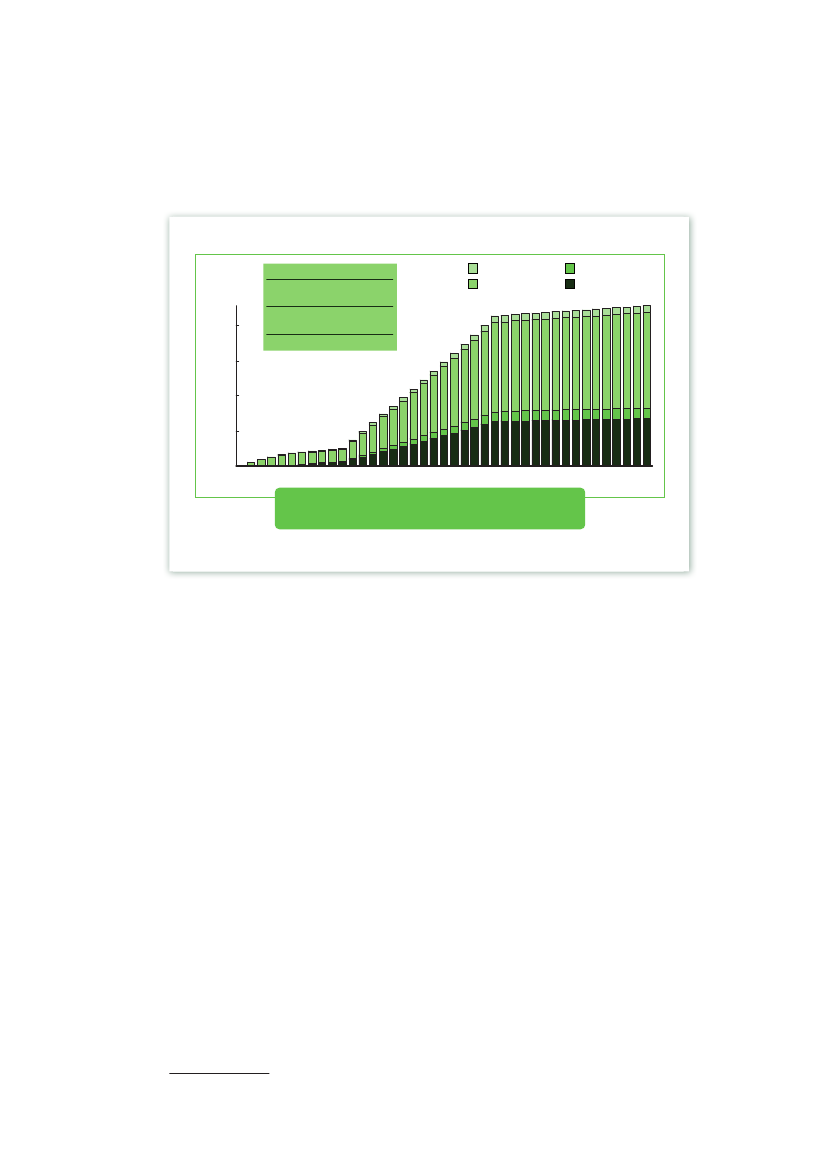

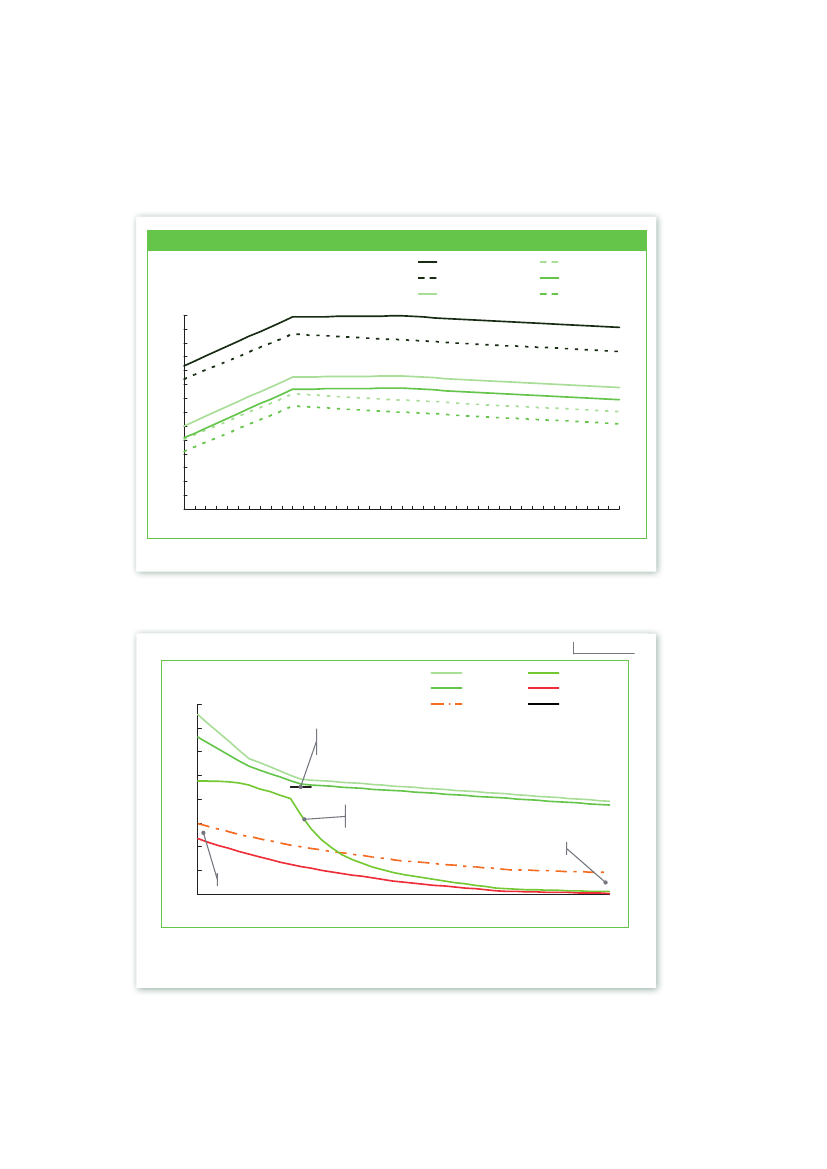

Balanced and economically driven production mix scenarioByproductDSMRCSMRSMR w/CCSCG w/CCSDWECWEIGCC w/CCS

Fraction of production method,Percent10080604020020102020203020402050

CO2well-to-tank emissions,kg CO2/kg H2

1510502010 2015 2020 2025 2030 2035 2040 2045 2050

100% water electrolysis production scenarioExistingDWECWE

Fraction of production method,Percent1008060402002010202020302040

CO2well-to-tank emissions,kg CO2/kg H2

2015105020502010 2015 2020 2025 2030 2035 2040 2045 2050

SOURCE: Study analysis

Exhibit 9: The study examined two hydrogen production mixes, both of whichlead to CO2-free hydrogen by 2050As total hydrogen demand for FCEVs is comparatively low up to 2020, a conventional productionmix is assumed, utilising excess hydrogen from existing assets (industrial sites and centralisedSMR), with a growing proportion of distributed units (water electrolysis and SMR).Beyond 2020, when hydrogen demand for FCEVs increases rapidly, a balanced andeconomically driven scenario is assumed, reflecting the diversity of resources available indifferent parts of Europe and including new sources of clean and green hydrogen.3This scenarioavoids over-dependence on any single primary energy source and provides the most cost-effective means of decarbonising hydrogen supply.In summary:�Before 2020, utilising existing production assets, Central Steam Methane Reforming (CSMR)has 40% and Distributed Steam Methane Reforming (DSMR) and Distributed Water Electrolysis(DWE) each have 30% share of new production.�After 2020, CSMR and Integrated Gasification Combined Cycle (IGCC) each have 30%, coalgasification has 10% and Central Water Electrolysis (CWE) and DWE each have 15% share ofnew production.�In line with the “Roadmap 2050” study, it is assumed that the share of renewable energy in thepower mix increases steadily (important for electrolysis) –see Annex, Exhibit 47, page 56.�CO2Capture and Storage (CCS) is applied to all new CSMR, IGCC and coal gasificationcapacity starting in 2020 and coal is co-fired with 10% biomass, which costs three times theIEA4estimate to account for pre-treatment required prior to gasification.34“Clean hydrogen” refers to the use of CCS; “green hydrogen” to renewable energyInternational Energy Agency

22

�Coal, natural gas, clean electricity and biomass are all important for hydrogen production.Both water electrolysis and IGCC could play a key role in supporting the electricity grid:electrolysis for demand management; IGCC for dispatchable power, i.e. for storage or export.Both technologies are also compatible with providing load balancing services, which will be inhigh demand in an electricity grid which includes a high percentage of renewable energies.The role of biofuelsThere is still uncertainty as to the amount of (sustainably produced) biofuels that will be available for passenger carsin the medium and long term in Europe. The study takes the following assumptions: by 2020 biofuels are blended,delivering a 6% well-to-wheel reduction in CO2emissions for gasoline and diesel engined vehicles, in line with the EUFuel Quality Directive; by 2050 this increases to 24% to reflect growing supplies.It also reflects the fact that this market will face increasing competition from other sectors – especially goods vehicles,aviation, marine, electric power and heavy industry to meet the needs of these sectors and a global passenger carfleet of 2.5 billion cars in 2050. A comprehensive analysis on the true global potential of biofuels is needed todetermine both their availability and for which sectors and regions they may be most effectively used.

b. DistributionA range of distribution methods was included in the study (Table 1).Distribution methodTonnes of hydrogen/day

Liquid trucksGaseous trucksPipelines

3.50.4 (250 bar), 0.8 (500 bar)1, 2.5, 10, 100

Table 1: An overview of distribution methods included in the studyIndustry data were then used to calculate the distribution costs5for different volumes anddistances, with the least expensive distribution method chosen for the required deliverydistance.A wide variety of distribution infrastructures may be considered, according to hydrogen volumes,distances and local specificities. This study assumes a distribution roadmap where gaseoustrucks are initially the most important method, with liquid trucks bridging the gap to pipelines,6which will result in a significant reduction in delivery cost and CO2emissions (Exhibit 10).

56

Delivered cost = production cost + distribution cost + retail cost (each cost comes from theweighted average cost of all operating components using current feedstock and electricity prices).Components already built are assumed to continue operating for their lifetime until retiredPrivate companies in Europe already own and operate the world’s largest hydrogen pipeline networkcovering ~1600 kilometres in France, Germany and the Benelux countries. Smaller pipelines are alsooperating in Italy and Sweden.

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesMethodology

23

Annual H2distributionPercent

Pipeline

Liquid Truck

Gaseous Truck

100%Method

Pipeline

Liquid TrucksGaseous Trucks2010202020302050

SOURCE: Study analysis

Exhibit 10: The hydrogen distribution mix assumed for the studyc. Retail stations

Small station (70-100 cars per day)Medium station (150-250 cars per day)Large station (450-600 cars per day)

2 dispensers, 0.4 tonnes of hydrogen/day4 dispensers, 1 tonne of hydrogen/day10 dispensers, 2.5 tonnes of hydrogen/day

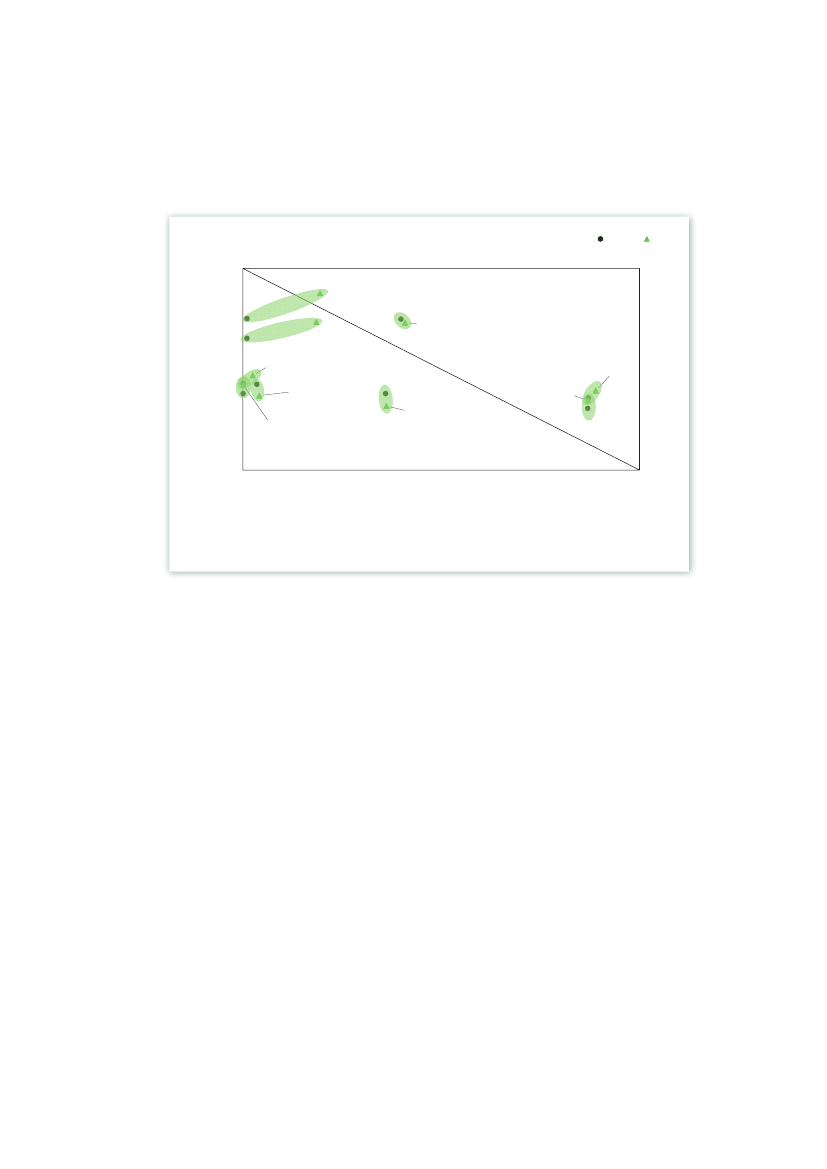

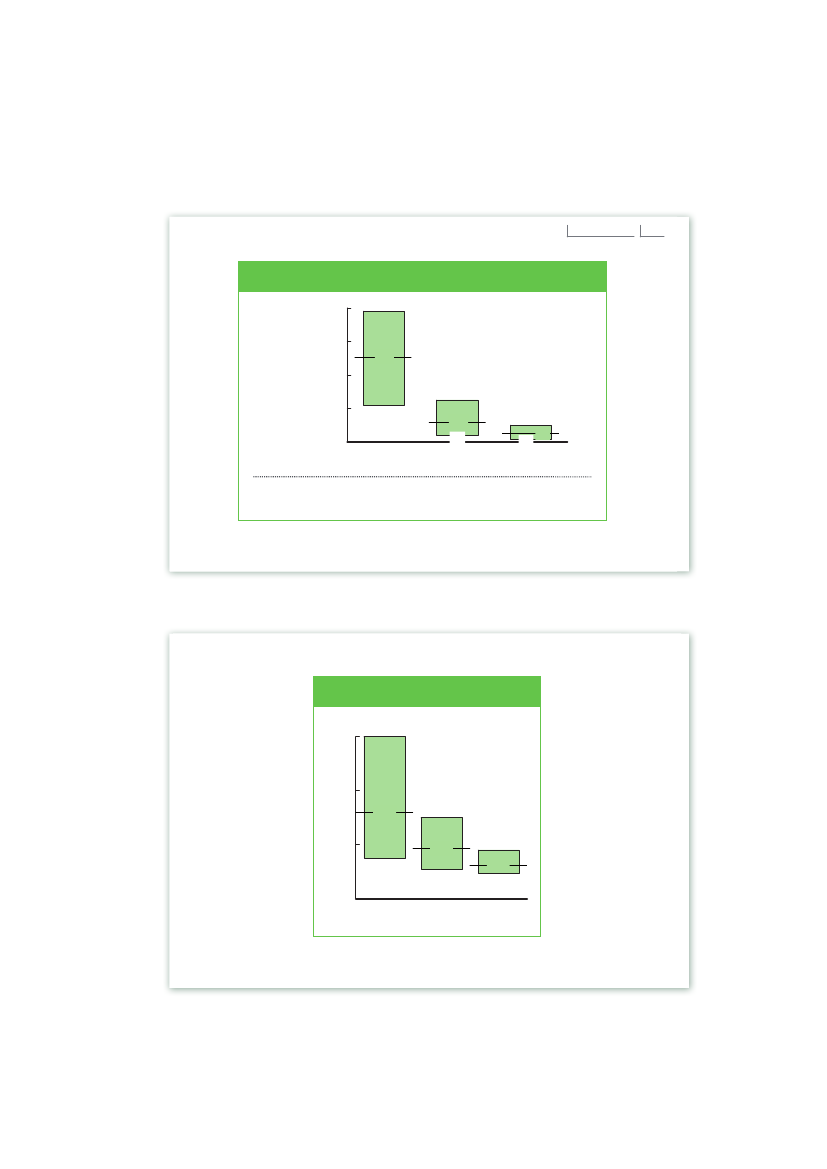

Table 2: An overview of retail stations included in the studyThe size of retail stations added was determined by hydrogen demand and coverage area: whencoverage expands faster than demand, new retail stations are small; when demand grows fasterthan the coverage area, larger retail stations are added etc.In the first decade, utilisation of retail stations is low, resulting in higher costs, but by 2020 itachieves 80% of the designed capacity, based on industry experience in fuels retail(see Annex,Exhibit 49, page 57).As expected, large retail stations have better economics than small andmedium stations.For the simulation in all “worlds”(see pages 16-18),the number of retail stations grows from aninitial cluster of four in 2010 to 198 in 2015 and 755 in 2020; for the electric vehicle-dominated“world”, Exhibit 11 shows a breakdown of retail stations from 2020 to 2050.

24

Thousand retail stations in EU29

25% FCEV penetration in 2050 (hydrogen retail network covers 75% of EU29, giving local access to 97% of all cars)20SmallMediumLarge

18.2

1512.1109.1

13.9

52.30.80

5.1

2020

2025

2030

2035

2040

2045

2050

Note Small stations have maximum capacity of 400 kg H2/day, medium have 1 tonne H2 /day and large have 2.5 tonnes H2 /daySOURCE: Study analysis

Exhibit 11: The number of hydrogen retail stations from 2020 to 2050in theelectric vehicle-dominated“world”

Key assumptions

▪WACC (Weighted average cost of capital) of 7% in nominal terms (post corporate tax), with no additional margin▪An asset lifetime of 20 years (30 years for pipelines)▪Oil, gas and coal prices are assumed from the IEA (see Annex, Exhibits 50-52, pages 58-59)▪Key raw material prices (e.g. metals) are taken from industry consensus analysisThe power supply pathway underlying this report is based on the European Climate Foundation “Roadmap 2050”,which was developed in cooperation with the industry and describes a pathway to decarbonise the EU’s power mix by2050. In 2020, the expected share of renewable production capacity is approximately 34%. This is the minimumneeded to meet the 20% EU renewable energy target, as there is limited RES opportunity outside of the power sector(see Annex, Exhibit 47, page 56). This ensures that the treatment of the power sector is consistent with the EU CO2reduction goal of 80% by 2050 (i.e. zero CO2from power by 2050) and draws a self-consistent set of electricity tariffsfor wholesale, industrial and retail use, together with CO2emissions from power generation.

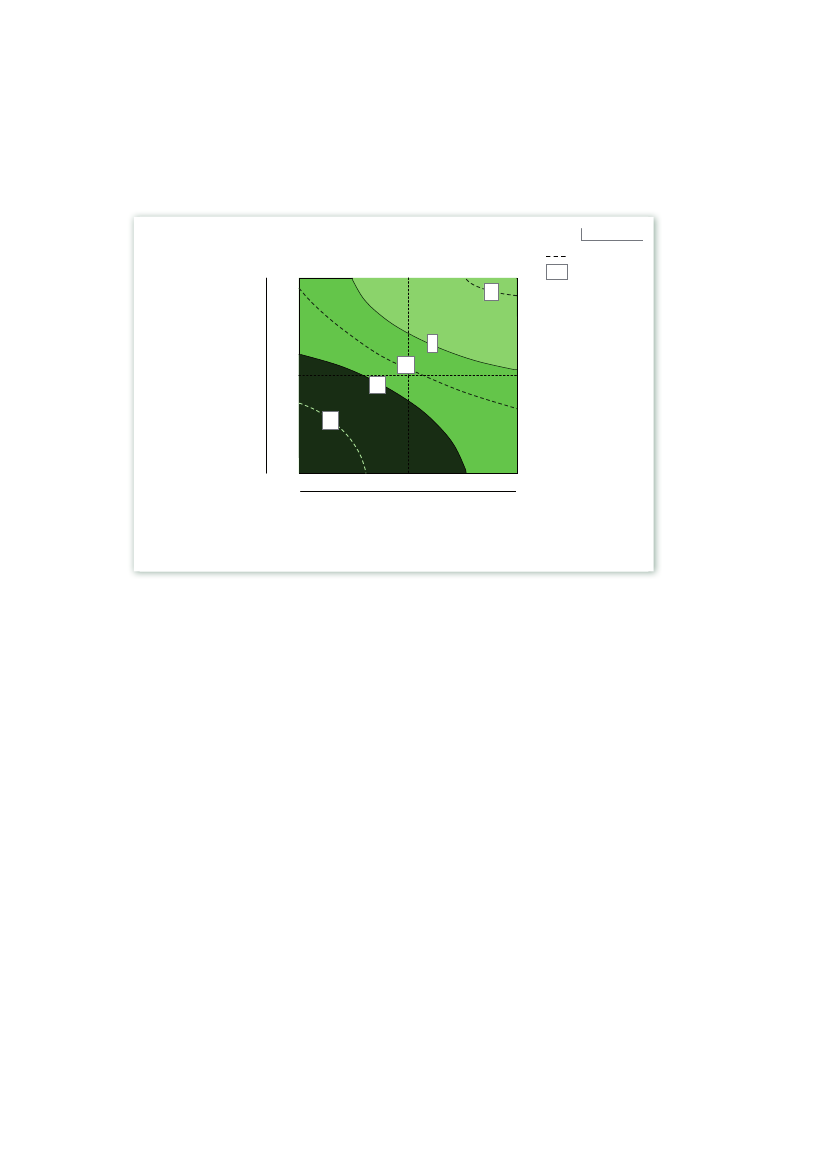

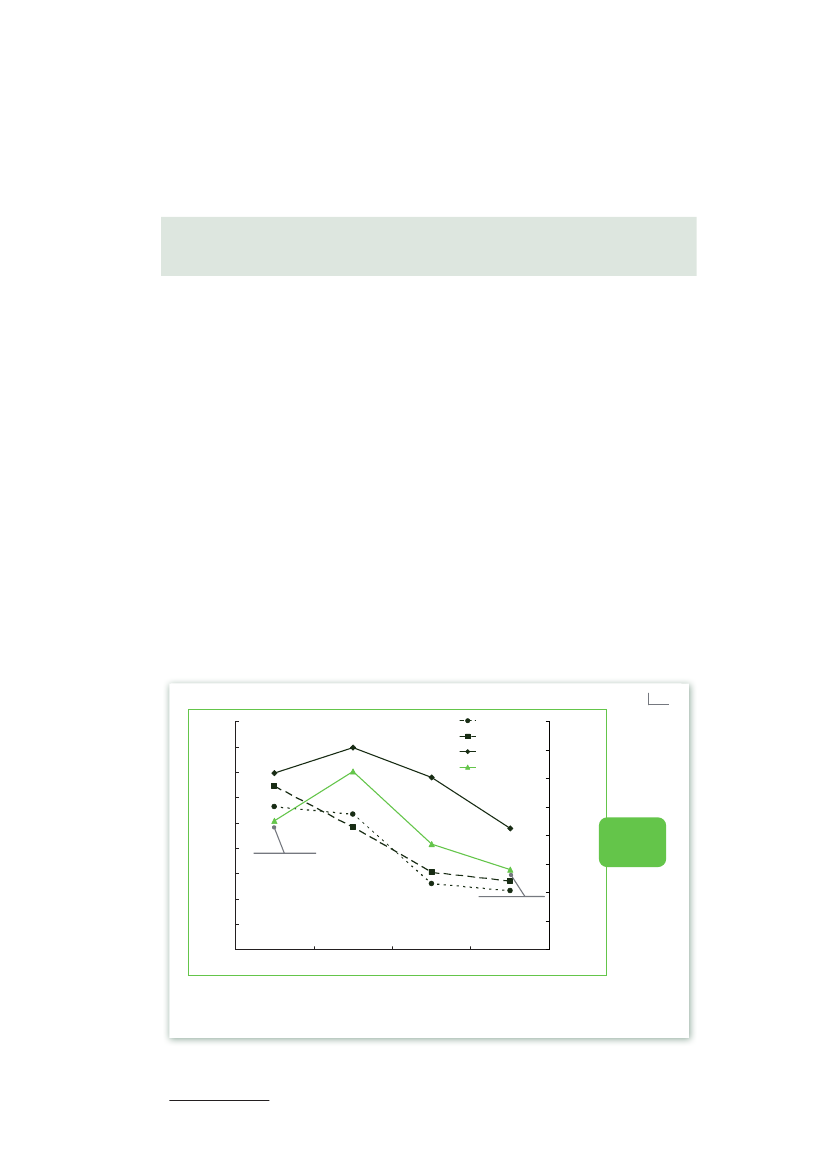

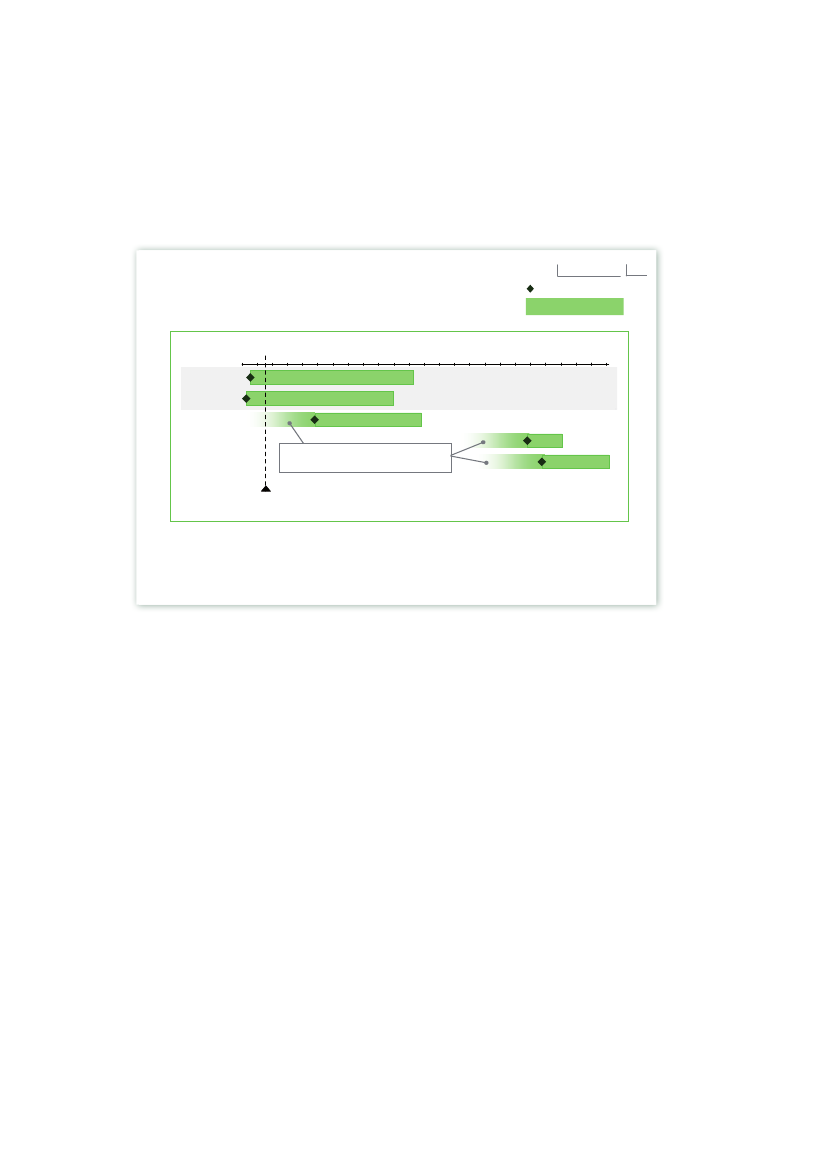

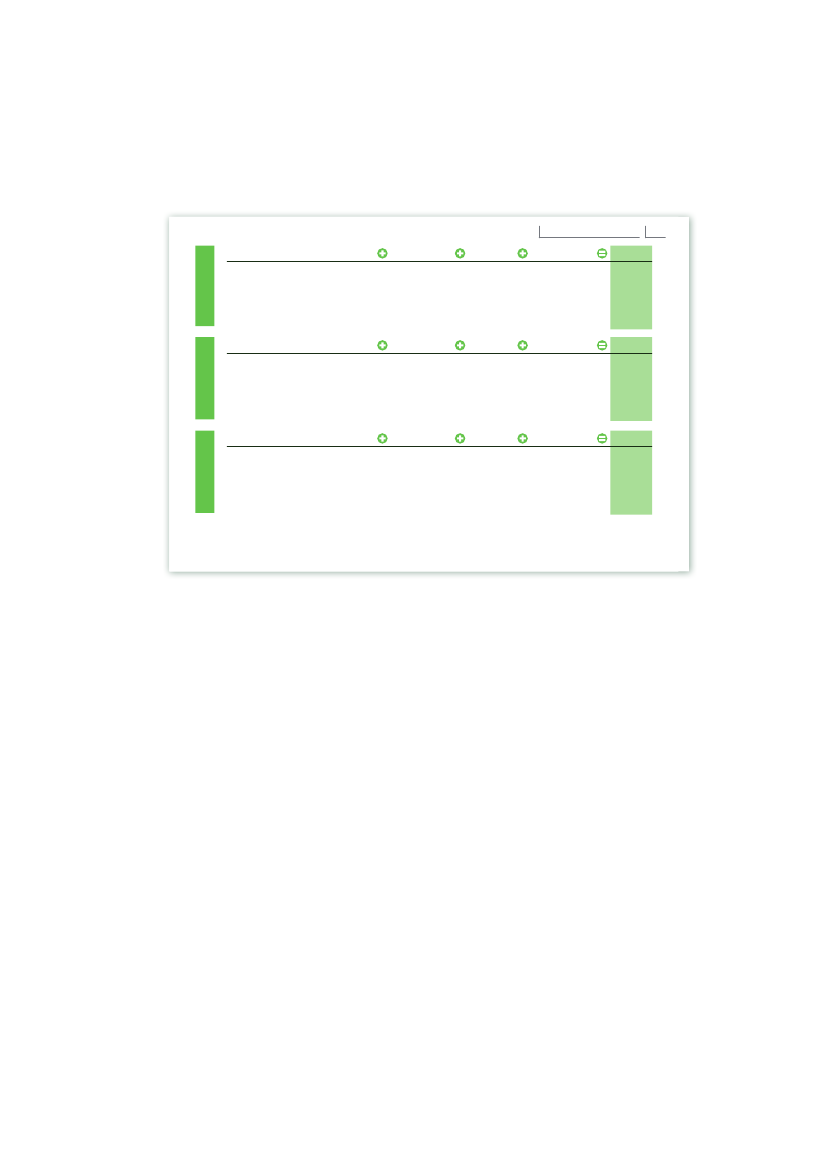

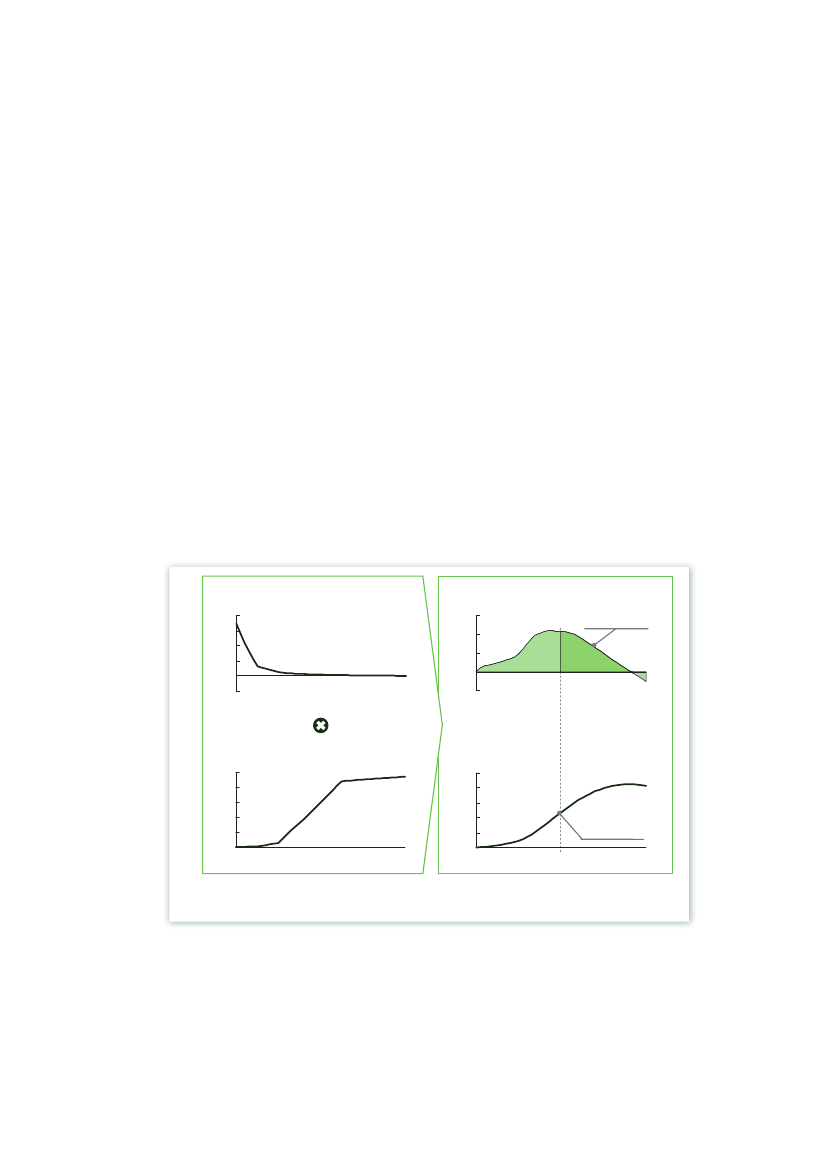

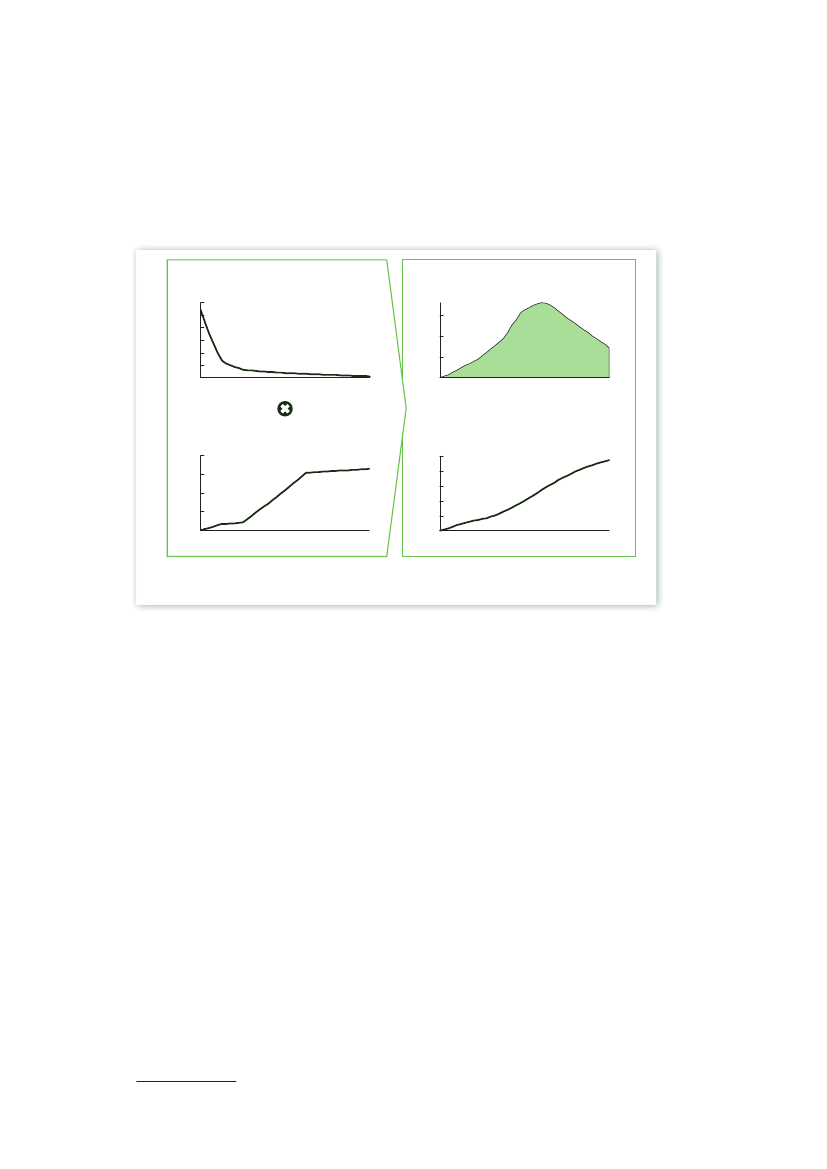

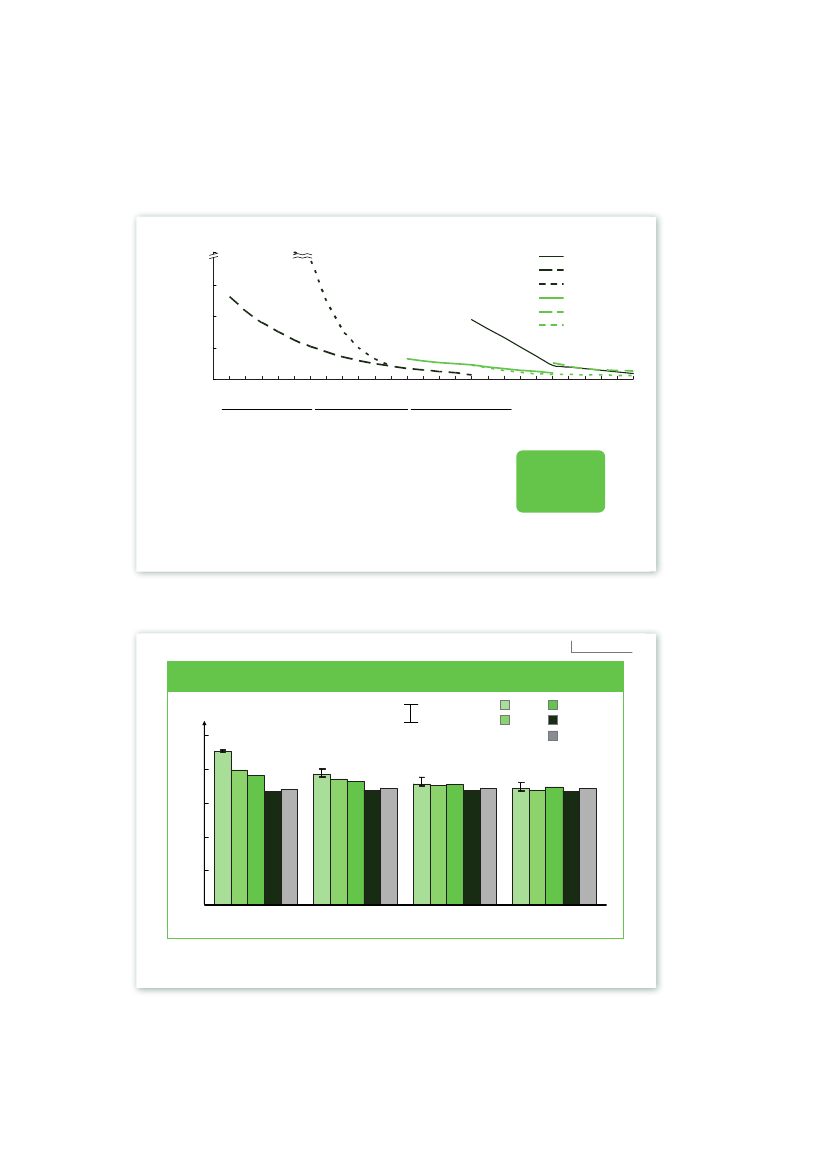

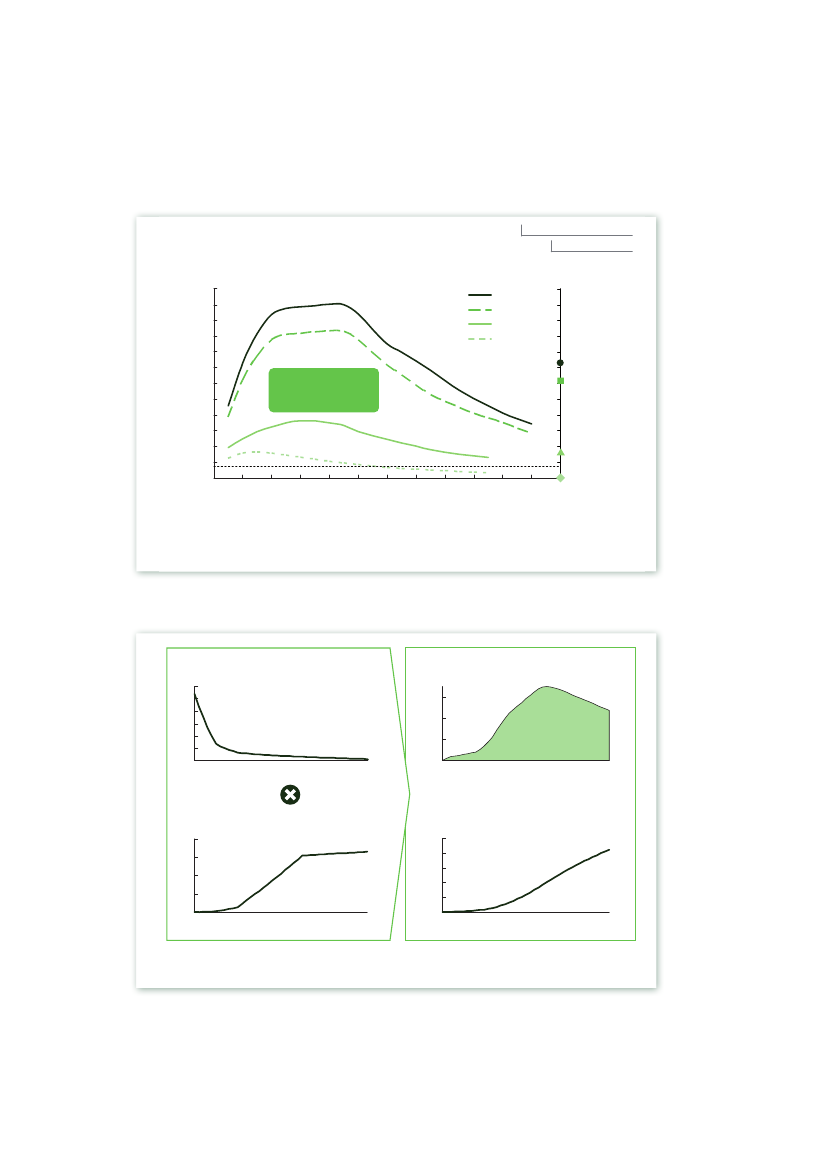

Assumptions are robust to significant variationsProjected cost reductions are based on years of experience of conventional vehicles – ICEs –including learning rates, the simplification of systems and economies of scale achieved by scalingup to larger production lines. The introduction of hybrid electric vehicles (HEVs), on the otherhand – with millions now on the road – has given a deep insight into the pace of cost reduction forinnovative power-trains and components over the last 10 years.Nevertheless, all conclusions are robust to significant variations in learning rates and the cost offossil fuels; and by 2030, there is only a small difference of –1 to +3 cents per kilometre (based ona pre-tax cost of 18 cents per kilometre), even with variations of +/– 50% (Exhibit 12).

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesMethodology

25

C/D SEGMENT

TCO delta between FCEV andEURct/km, 2030+50%

ICE-gasoline1-2

iso TCO linesNegative numbersrelate to a TCOAdvantage ofFCEV over ICE

-1

0FossilOil 0.58 EUR/litre,Gas 39 EUR/MWhCoal 88 EUR/ton+3fuel2+1+2

-50%-50%0% - 15%3Learning rates after 20201 Assuming 15 year lifetime and annual driving distance of 12,000 km2 No taxes included, e.g. excise tax, CO2 tax, VAT3 Fuel cell membranes: 15% pdc (per doubling of capacity); non-platinum catalyst: 15% pdc; FC structure: 15% pdc, EV-specific parts: 4.0%/1.5% p.a.;FC periphery 4.0%/1.5% p.a.; glider cost (FCEV & ICE): 0%; ICE basic power-train parts: 0%; technology packages: 1.5% p.a.SOURCE: Study analysis

+50%

Exhibit 12: All conclusions are robust to significant variations in learning rates and the cost offossil fuels

26

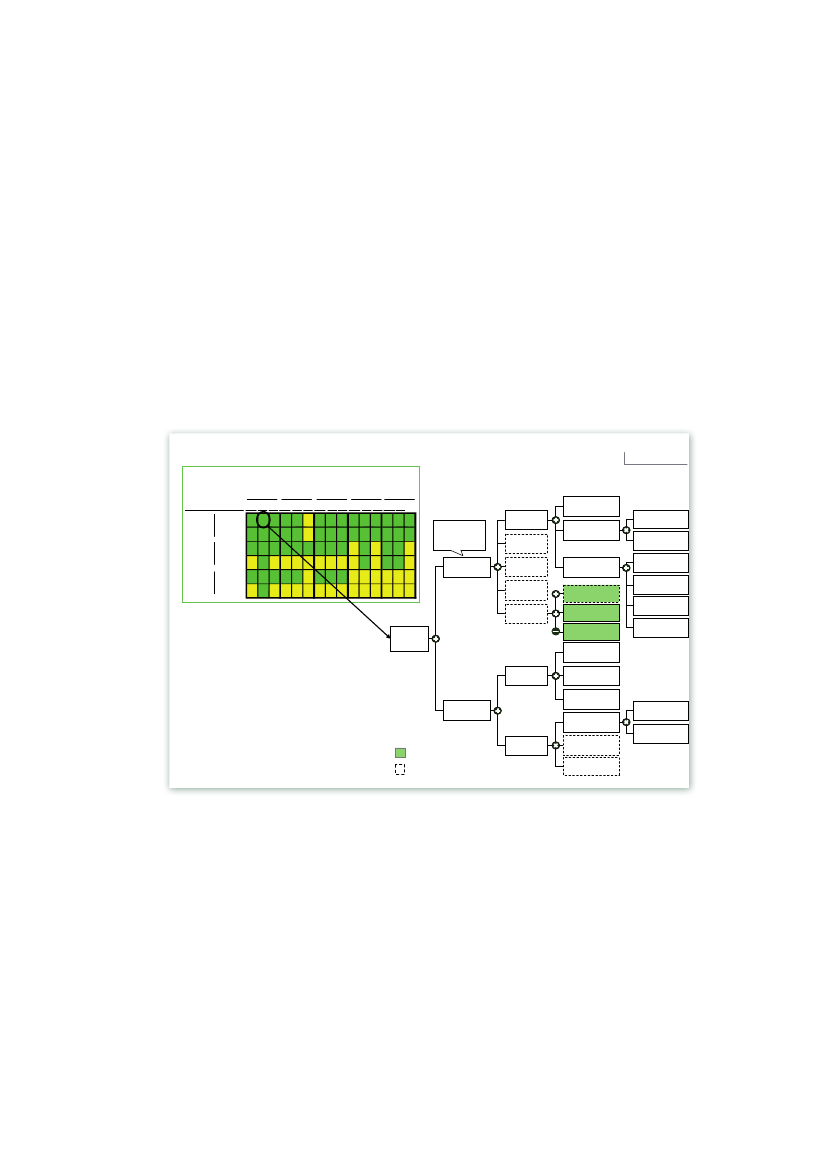

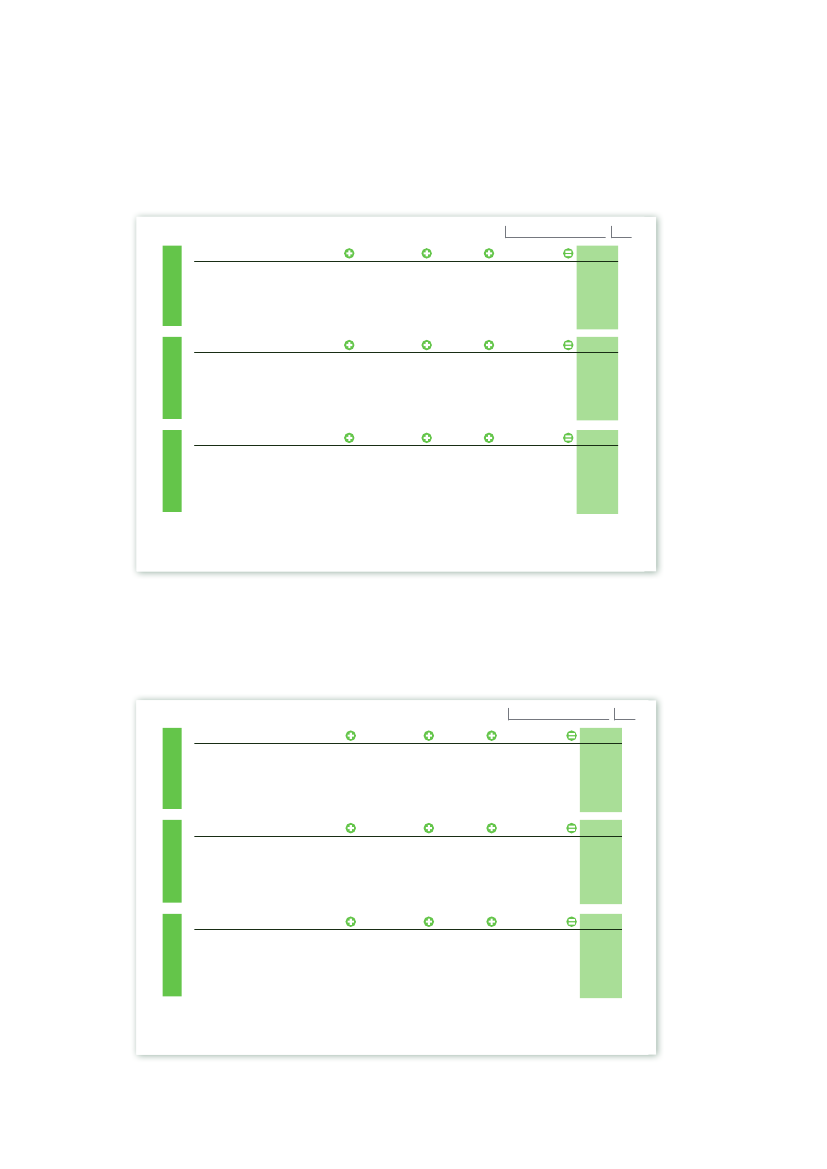

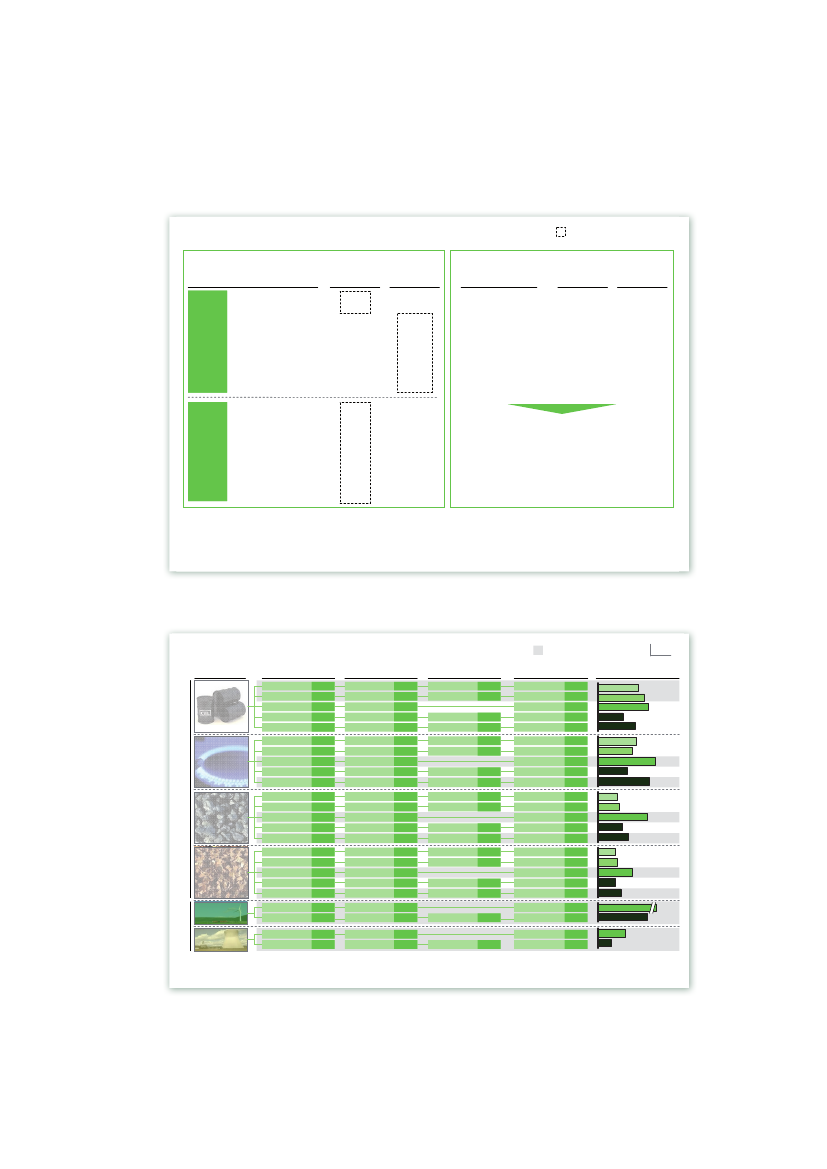

INPUT DATAThe collection, benchmarking and validation of over 10,000 data pointsThe process of collecting and sanitising data from participating companies was both methodicaland rigorous:1. The independent consultancy and participating companies together defined precisely thedata to be collected in order to evaluate the four power-trains on a well-to-wheel basis.2. The consultancy’s “Clean Team” then sent out detailed data requests on economics(Exhibit 13), sustainability and performance for all four power-trains (BEV, FCEVs, PHEVs andICEs), including the following supply chains: Gasoline and diesel, Electricity, and Hydrogen

ILLUSTRATIVECollected data sets for all drive trains in the segments A/B, D, JFCVData pointsCost20102015,20FueleconomyPerfor-mance20102015, 2020102015,20A/B DBEVJ A/B DPHEVJ A/B DICE –DieselJ A/B DICE – GasJ A/B DAssumingcompletedepreciation overvehicle lifetimePurchase priceEUR/vehicleParts costEUR/vehicleAssembly costEUR/vehicleSG&AEUR/vehicleMarginEUR/vehicleTaxesEUR/vehicleTotal cost ofownershipEUR/vehicle

Example of cost calculation – FCEV D segment – 22 data pointsConventional partscostEUR/vehicleFuel cell cost1EUR/vehicle

8 8 8 6 5 4 5 5 5 6 6 6 6 6 68 8 8 6 5 4 5 5 5 6 6 6 6 6 68 8 8 7 6 5 6 6 6 4 5 4 5 5 43 7 4 4 3 3 3 3 3 4 5 4 5 5 48 8 8 7 6 4 6 6 6 3 4 3 4 4 33 7 4 4 3 4 4 4 4 4 4 4 4 4 4

Fuel cell powerkW/vehicleCost per kWEUR/kWFC periphery costEUR/vehicleFC battery costEUR/vehicleH2 tank costEUR/vehicleEV-specificparts costEUR/vehicle

FCV-specific partscost (other than FC)EUR/vehicleSales taxEUR/vehicleCO2 taxEUR/vehicleSubsidyEUR/vehicleICE-specific partsEUR/vehicle

MaintenancecostEUR/vehicle

Fuel cellEUR/vehicleOther FCV partsEUR/vehicleHydrogen costEUR/km

Running costEUR/vehicle

HydrogenconsumptionkgH2/kmHydrogen priceEUR/kg

Not included in the studyAssumptions pre-definedwith participating companies

Fuel costEUR/vehicle

Vehicle lifetimeyearsTravelled distancekm/year

Exhibit 13: An example of cost data collected for a FCEV3. The Clean Team collected the data and assessed whether they were of theappropriate quality.4. The Clean Team reviewed the submitted data in order to understand the differences betweenthe data sets of the various companies, asking them to preside correct data, where necessary.5. Individual output data were submitted to relevant companies for sign-off (Exhibit 14)

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesInput data

27

ILLUSTRATIVECollecteddata setsH2 supplychainGeneralLearning ratesGreenfield capex; footprintDistributed SMRCentral SMRCCS / SMRCoal Gasification (CG)CCS for CGBiomass Gasification (BG)Water Electrolysis (WE)IGCCDistribution pipelineTransmission pipelineLiquid H2 TrucksLiquefierGas H2 TrucksCompressorRetail station 700 barRetail station 350 bar444/65/64/63/63/61/67/73/610 tonne/day4/44/43/53/53/54/56/74/7100 tonne/day2.5 tonne/dayx.xx1 tonne/dayx.xxz.zzy.yyx.xxy.yyx.xxy.yyz.zzy.yyz.zzx.xxy.yyx.xxz.zzx.xxy.yyx.xxx.xxy.yyz.zzy.yyx.xxz.zzy.yyx.xxy.yyz,.zzy.yy0.4 tonne/day

Fixed operation cost

Variable operational cost

Capital cost

An example of cost output data for water electrolysis – 60 data pointsEUR/kg H220102015y.yyz.zzx.xxy.yyz.zz2020x.xxy.yyz.zz2050x.xxy.yyz.zz

Production

x.xx

z.zzx.xxy.yy

z.zzx.xxy.yyz.zz

z.zzx.xxy.yy

z.zzx.xxz.zzy.yy

z.zzx.xxz.zzy.yy

Distribution

z.zz

Retail

Exhibit 14: An example of cost output data for water electrolysisAfter all the output data had been signed off, it was then considered frozen and the analysis of thepower-trains began.

28

RESULTSThe following conclusions are not forecasts, but one possible outcome – the result of abackcasting exercise based on a penetration of 25% FCEVs, 35% BEVs, 35% PHEVs and 5% ICEsin the EU by 2050(see pages 16-18).

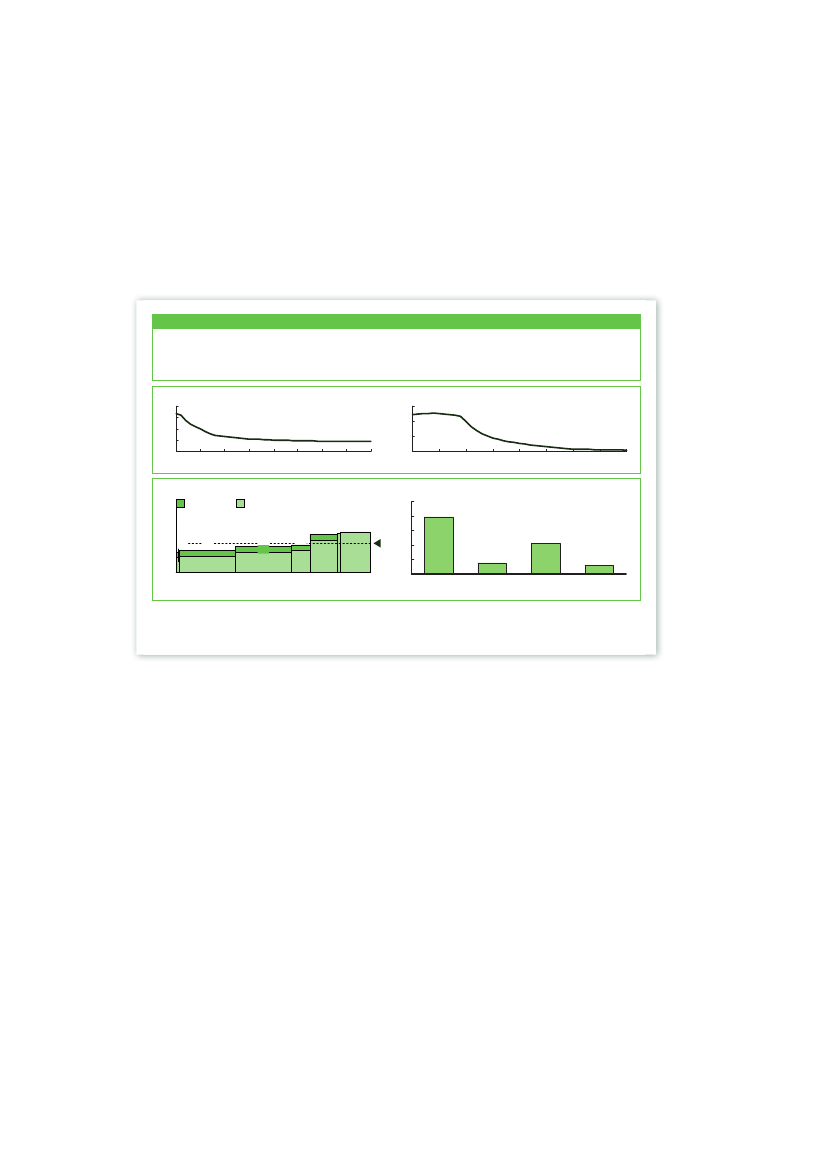

1. BEVs and FCEVs have the potential to significantly reduce CO2and local emissionsBEVs: given their limited energy storage capacity and driving range (150-250 km1) – and a currentrecharging time of several hours – BEVs are ideally suited to smaller cars and shorter trips, i.e.urban driving.FCEVs: with a driving range and performance comparable to ICEs, FCEVs are the lowest-carbonsolution for medium/larger cars and longer trips.PHEVs: with a smaller battery capacity than BEVs, electric driving for PHEVs is restricted to shorttrips (40-60 km). Combined with the additional blending of biofuels(see page 2),they also showemission reductions for longer trips, but uncertainty remains as to the amount of sustainablyproduced biofuels that will be available for this market. Nevertheless, they are an attractivesolution, reducing emissions considerably compared to ICEs.ICEs: ICEs also have the potential to reduce their CO2footprint significantly through improvedenergy efficiency and biofuels. After 2020, however, further engine efficiency improvements arelimited and relatively costly, while the availability of biofuels may also be limited.a. Electric vehicles are more energy efficient than ICEs over a broader range offeedstocks2020

0,90,8Well-to-wheel efficiency, km/MJ

ICE gasolineICE dieselBEVFCV

3.22.8Well-to-wheel efficiency, km/kWh2.42.01.6

0,70,60,50,40,30,20,10OilGas2Coal3FCEV and BEVefficiency can befurther improved

1.20.8Biomassefficiency heavilydependent ontype of biomass

Comparisonincludes CCSfor BEV andFCEV

0.40

Biomass

1 All power-trains have different performance criteria and therefore different driving missions2 CNG used in gasoline ICE; diesel production from natural gas through Fischer-Tropsch process3 Gasoline and diesel production from coal-to-liquids transformation through Fischer-Tropsch processSOURCE: CONCAWE-EUCAR JEC-WTW study; study analysis

Exhibit 15: The well-to-wheel efficiency of FCEVs is comparable to ICEs, while BEV remainsthe most efficient power-train1For C/D segment cars in the medium term

The role of Battery Electric Vehicles, Plug-in Hybrids and Fuel Cell Electric VehiclesResults

29

In the energy- and carbon-constrained world in which we now live, the efficient use of primaryenergy resources is essential.Exhibit 15 shows the well-to-wheel efficiency of the different power-trains using different types ofprimary energy sources. BEVs are the most efficient solution. FCEVs are more efficient than ICEon gas and coal. On oil and biofuels, the difference between ICE and FCEVs is small(see Annex,Exhibit 43, page 54, for a more detailed analysis).EU29 WTW energy consumption for passenger car transport, percentBiofuel1BiomassElectricity2Natural gasNOT A FORECASTCoalOil

Primary energyconsumptionTWh

100% = 1,9001%

Non-zero emission -conventional100% = 1,35018%0%2% 8% 4%68%

Zero-emission –xEV dominated

Zero-emission –FCEV dominated100% = 1,2504% 4%22%18%38%14%3.4

99%

100% = 1,0506% 3%28%13%27%22%3.4

2.8Distance driventrillion km

3.4

▪▪▪

Transportation notdecarbonisedLarge volume ofbiofuels neededAverage~30%efficiency improve-ment in ICEs

▪▪

Mix of primary andsecondary energy(not “like-for-like”)Reduced energyconsumption dueto high share ofelectric vehicles2050

▪▪