Skatteudvalget 2009-10

L 202 Bilag 4

Offentligt

2010O

Overview of the ItalianRegulatory Frameworkfor Online GamingEvolution of the Italian Online GamingRegulation 2002-2009

MAGMarch 2010

Table of contentsExecutive Summary .................................................................................................. 41.2.Introduction ..................................................................................................... 7Overview of the Italian legal framework for online gaming........................... 92.1 Distinctive elements of the Italian system ........................................................ 92.2 The regulatory landscape for online gaming.................................................... 113.Public gaming licenses .................................................................................... 143.1 Which regulations serve as the basis for the gaming license system? ....................... 143.2 What licenses and for which products are currently active in Italy?........................ 143.3 What are the differences between online and physical regulation? ......................... 163.4 What are the requirements for becoming a licensee? ......................................... 173.5 Could existing lottery and betting operators acquire an online license with conditionssimilar to those of new entrants? ...................................................................... 203.6 Is there a distinction between the license requirements for online and physicaldistribution? ............................................................................................... 213.7 How many licenses have been awarded so far?................................................. 213.8 What is the cost of a license? ...................................................................... 223.9 What is the term of a license? ..................................................................... 233.10 What products are included in a license? ...................................................... 233.11 Why was the product portfolio extended over time? ....................................... 243.12 Are there additional restrictions on products? For instance is live betting allowed as aparticular mode of sports stakes? ...................................................................... 254.Consumer protection ...................................................................................... 274.1 How is the compulsive gaming prevented? ..................................................... 274.2 Who sets limits on the game? ..................................................................... 284.3 How are minors protected? ....................................................................... 284.4 What measures are in place to prevent money laundering and the manipulation of sportsevents? ..................................................................................................... 294.5 Is there an operator blacklist and if so, who manages it? ..................................... 304.6 Can licensees sponsor sports events? ............................................................ 31MAG | Table of contents2

4.7 What advertising standards must be followed? ................................................ 325.The penalty system.......................................................................................... 335.1 How are unlicensed operators prosecuted?..................................................... 335.2 How does AAMS ensure that only licensees have access to the Italian market? .......... 335.3 Do banks have a role in blocking gaming accounts? ........................................... 375.4 How does AAMS control the activities of licensees whose servers are located outside ofItaly? ........................................................................................................ 375.5 What is Italy’s experience with the illegal market? How big is it and how was it affectedby the regulation? ........................................................................................ 386.The taxation model ......................................................................................... 406.1 How does AAMS calculate the size of the gaming market? .................................. 406.2 How has taxation developed over the years? ................................................... 406.3 How did tax revenues develop over the past 5 years and what is the forecast for the nearfuture?...................................................................................................... 426.4 What is the tax calculation base and what rate is applied? ................................... 466.5 How are taxes calculated and who collects them? ............................................. 477.The gaming market regulator: AAMS ............................................................ 487.1 What is AAMS? ...................................................................................... 487.2 When and why was AAMS created, and what have been its functions since 2001? ..... 487.3 What is AAMS's organisational structure? ...................................................... 497.4 What are AAMS's roles and responsibilities? ................................................... 507.5 How is AAMS financed? ........................................................................... 527.6 Does AAMS cooperate with other European regulators? .................................... 538.9.Possible elements to be replicated ................................................................. 54The evolution of online gaming regulation ................................................... 55The first stage of the development of online gaming (1998-2002) .............................. 55The new gaming strategy (2003-2005)............................................................... 56The mature stage of online gaming regulation (2006-2008) ..................................... 58The completion of online gaming regulation (2009)............................................... 60APPENDIX: Specific laws and provisions for each remote gaming sector ........... 61Contact details ........................................................................................................ 69MAG | Table of contents3

Executive SummaryThe study provides a comprehensive overview of the Italian model for online gaming, its keyprovisions as well as its evolution into today’s format. It addresses the following areas:

Structure of the Italian regulatory frameworkThere is no single text regulating online gaming in Italy. The gaming sector is governed by acollection of single regulatory interventions – some of general (primary laws), other oftechnical or operational nature (secondary laws) – which succeeded each other over time.While the introduction of new games and their taxation is the prerogative of the Parliament,Italy’s Minister of Finances holds responsibility for issuing gaming regulations and the singlegaming authority AAMS is in charge of defining the implementing provisions. The latest, so-called “Community” law – which was adopted in 2009 and is expected to enter fully in force inthe course of 2010 – has removed some previously EU non-compliant provisions, including therequirement of Italy-based servers or operational headquarters/registered office, recognizinginstead location in one of the states of the European Economic Area.

Gaming licensesOrganisation and operation of online gaming in Italy is legally reserved to the state. However,the Italian Government has opted to entrust the management of online gaming to the approvedprivate operators via so-called concessions or licenses. In order to obtain a 9-year license,operators must meet strict technological requirements, prove their economic-financial stabilityas well as demonstrate their reliability, particularly as regards consumer protection. As oftoday, there are 1.023 functioning online gaming licenses and additional 200 may be issued(subject to the market needs) under the recent “Community” law. The latter will allow privateoperators to offer a complete portfolio of online games, including sports and horse racing bets,games of skill (such as poker) as well as casino games. The logic behind extending the onlinegaming portfolio over time has been to align the legal offer with the consumers’ demand so asto effectively prevent them from reverting to the black market to satisfy their needs.

Consumer protectionItalian regulatory framework lays down a number of limits to protect consumers and containcompulsive gaming, for instance by setting maximum allowed stakes and winnings. Under the“Community” law, the online gaming license holders are furthermore obliged to put in placespecific tools to enhance consumer protection such as possibility for the consumers’ self-MAG | Executive Summary4

limitation or self-exclusion. Operators must also assume an obligation to provide for toolsexcluding access by minors. Both the operators and AAMS can verify in real time informationentered for every new registration, including the tax ID which identifies the birth date. Italianrules also reflect on the potential of online gaming for a real time detection and an earlyanalysis of suspicious financial transactions and thus effective prevention of possible moneylaundering or manipulation of sports events. Hence for instance sponsorship and advertising areallowed, both by the private operators and AAMS.

The penalty systemAAMS closely monitors the Italian online gaming landscape in order to ensure that onlyauthorized operators can offer the games in its portfolio. Accordingly, the regulatory body cantake various measures to block the websites of unlicensed operators and impose monetary orcriminal sanctions. Current law provides for monetary fines as well as imprisonment for from3 months to a maximum of 3 years.

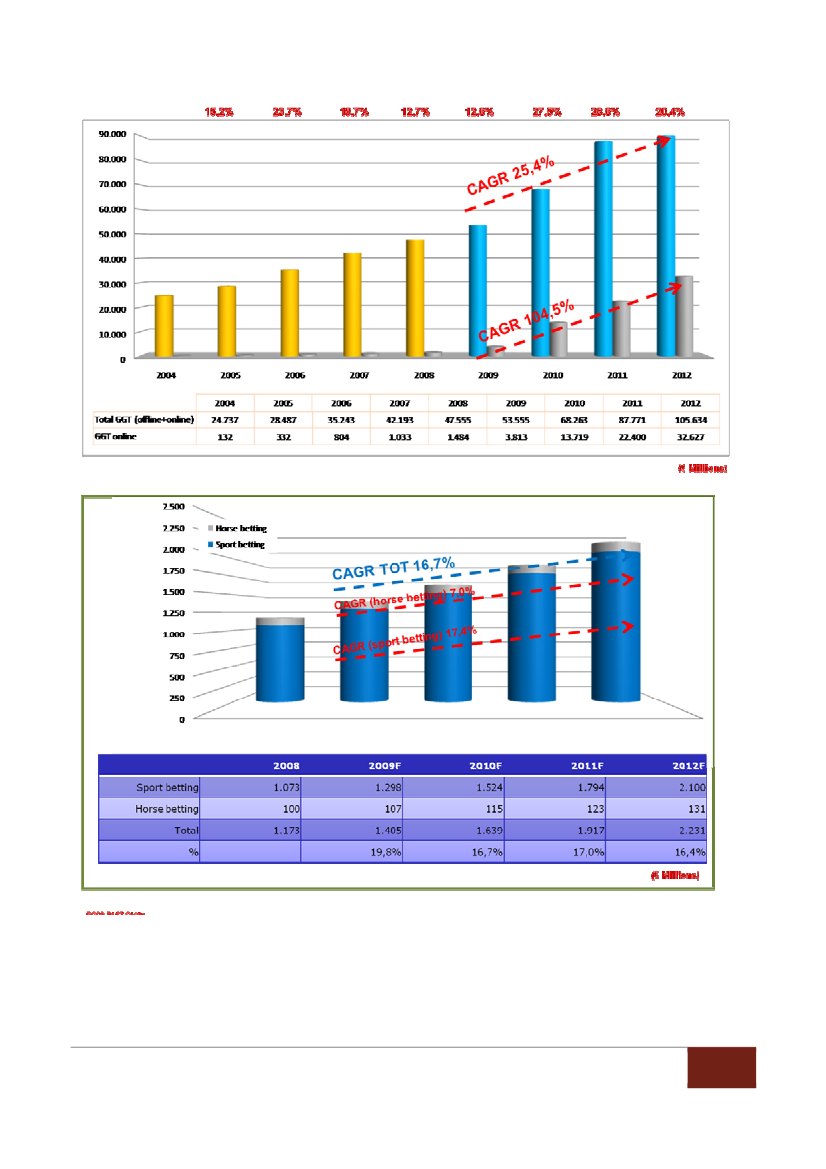

Taxation modelTwo bases for taxation are currently used in Italy. While sports betting is taxed between 2-5%on turnover (depending on the number of events), cash poker and casino games are taxed20% on Gross Gaming Revenue1to reflect their particularly high payout ratio2. These rates aresignificantly lower than the initially applied ones as the Government gradually made the linkbetween the decreasing tax rates and the growing gaming turnover in the country. At the sametime Italy also strived to align its taxation with international standards. Lower taxes boostedcompetitiveness of private online gaming operators and thus resulted in an attractive anddiversified online gaming offer that swayed players from the black market towards a legal one,whilst significantly inflating the state revenue. By reducing taxation, the Governmenteffectively managed to curtail the black market and consequently increase the level ofconsumer protection as well as the state income. As a result, Italy’s gaming turnover more thantripled from €15 billion in 2003 to over €54 billion at the end of 2009 which translated intomore than a 240% increase of the state budget, from €3.5 billion in 2003 to €8.8 billionin 2009.

12

stakes minus winnings that the operators pay out to the customers; also referred to as GGRwinnings paid to customers

MAG | Executive Summary5

AAMSAAMS is Italy’s single gaming authority responsible for the regulation and control of the entiregaming sector. It issues licenses to reliable private operators, defines the final gaming productline-up and its distribution, as well as the criteria for tax collection. Having a constant access tothe servers of private operators, AAMS controls all gaming operations in real time.

Possible elements to be replicatedThe study recognizes the following key elements which underline the success of the Italianmodel and could possibly be replicated in other European countries:•licensing model, particularly if a single license covers the complete gaming portfolio toprovide private operators with economic certainty and a stable business horizon;•clear regulatory definition of the games to protect consumers and the market itself;•integrated regulatory model, with a primary law being complemented by intermediatesecondary decrees which allow for speedy legislative refinement;•single point for the organisation and regulation of gaming;•mixed taxation model adapted to the type of game and the need for control, whichensures stable tax revenues;•interaction with gaming operators.

Evolution of the Italian gaming regulationSince the first mention of online gaming in 1998, Italy’s regulatory framework needed to becompletely reworked in order to reflect the technological developments and consumers’demand but also to address several critical aspects which initially remained unregulated.Maturing over the years – in particular since a comprehensive strategy outlined in 2002 –the online gaming regulation was completed in 2009. Beyond the full market opening for anentire range of online games, the Government also seized the occasion to address the concernsexpressed by the EU, namely by eliminating several pre-existing restrictions and strengtheningdispositions concerning consumer protection, as mentioned above.In the appendix, the study also provides detailed information about specific laws and provisionsfor each online gaming sector.MAG | Executive Summary6

1. IntroductionSince 1998, Italy has fundamentally reformed the national legal framework for gaming so as toadjust it to technological developments (the Internet as a new distribution channel) as well asthe demands of the population. Italy realized from an early stage that the state could not fulfillits obligations to protect the citizen from gaming addiction but also from fraud andmanipulation by prohibition alone. The majority of consumers played outside of state controlon the so-called black market. The official gaming offer was so unattractive in comparison toillegal gaming that gamblers turned to non-licensed offers which for instance generated around€20 billion in 2001, according to statistical sources.Faced with this situation, the Government set itself an objective to reduce the illegal market asquickly as possible, namely by improving and expanding the legal offer, while at the same timeallowing private providers to enter the market officially. The new laws and regulations thustook account of the large demand for online gaming. Since 2006, a licensing model exists inItaly for online sports and horse racing betting (in addition to the physical offer3) as well as foronline poker and online casino games. Lottery games remain under the control of a monopolybut are sold by private retailers (similar to German lottery sellers) as Italian legislators considera separate regulation of lotteries to be the most suitable model. Since 2006, numerous Italianand foreign companies have applied for and received a license – a total of 1,023 were granted,including those previously given for remote games. With the implementation of the new legalframework ("Community licenses"), additional 200 online licenses may be granted, includingthose that will be merely extended.Every legal gaming product is under the control of the Government agency AAMS(Autonomous Administration for State Monopolies). This body approves all products,distribution channels, circulations and even types of games in advance, and monitors thecontrolling and taxation system for online gaming. Italian legislators in a way introduced adivision of labour: legal gaming is offered by the state (AAMS) which however "delegates" theoperation of the games and the bets to state and private providers. The state has thusmaintained control of the gaming market, while nonetheless leaving room for companies tointroduce new products and carry out advertising (for poker, casino and games of skill).This system allowed the state to effectively implement consumer protection measures since alllicensees4were obliged – under threat of prosecution – to enforce them. For instancea permanent connection between the licensee's server and the AAMS must be ensured so thatthe authority can monitor all transactions and gaming activities in real time. The server mustnot necessarily be based in Italy but can be located in another EU Member State. All licenseesmay carry out advertising and sponsoring as long as they conform to the valid regulatorystandards.34

i.e. land-based gaming, especially in casinosholder of a license or a so-called concession, also referred to as concessionnaire

MAG | Introduction7

As for the taxation, different types of games are taxed differently. A taxation rate of between2 and 5 % on the turnover – depending on the number of events – is applied to online sportsbets. Peer-to-peer as well as cash poker bets and casino games are taxed at a rate of 20 % onthe Gross Gaming Revenue5.The levels of taxation were continually reduced over the recent years since the initial tax rateswere too high and therefore unattractive, thus discouraging providers from applying forlicenses. The current taxation model should instead guarantee the competitiveness of the legaloffer in comparison to illegal gaming and make licenses more attractive.All licensees accepted the taxation and hence contributed to the Italian state with a tax revenuefrom gaming which amounted approximately to €8.8 billion in 2009, compared to only€3.5 billion in 2003. The largest proportion of this revenue has been generated in the physicalmarket6– and by the slot machine industry in particular – followed by lottery games and finallyby sports and horse racing stakes.

56

stakes minus winnings that the operators pay out to the customers; also referred to as GGRi.e. land-based

MAG | Overview of the Italian legal framework for online gaming8

2. Overview of the Italian legal framework for online gaming2.1 Distinctive elements of the Italian systemIn the Italian legal system, online gaming is defined as “gaming with remote participation” andincludes the sale of games in the public portfolio via the Internet, interactive TV as well asfixed and mobile telephones.The current regulation of online gaming in Italy is part of the overall systemregulating public gaming with money prizeswhose primary legal source is article 1 ofLegislative Decree No. 496 of March 14, 1948.In general terms,this system establishes that the operation of all gaming –for which“onepays any type of compensation and participation in which requires the payment of a stake in money”–are exclusively reserved to the state,specifically to the former Ministry of Finance(today the Ministry of the Economy). Since 2001, all administrative responsibilities related togaming have been assigned to an agency of the Ministry of the Economy, the “AmministrazioneAutonoma dei Monopoli di Stato” (AAMS, Autonomous Administration for State Monopolies).Consequently, the offer of any game that provides for the distribution of cash winnings afterthe payment of a price to participate in it must be authorized by the state. By issuing specificregulatory provisions, the state defines the requirements of the game, the methods of its offer,the characteristics of the distribution network and points of sale as well as the criteria forallocating the turnover between the various operators in the supply chain.The only exceptions are the games with cash winnings offered in the four Italian casinos inVenice, Campione d’Italia, Saint-Vincent and San Remo which are regulated by special laws.The defined legal framework is based on the principle that gaming for cash winnings is anactivity that is generally prohibited for reasons of public order and health. The European Courtof Justice has ruled that this situation is compatible with article 49 of the EC Treaty on thefreedom to provide services. The reasons the Court put forward to justify this legislation arethe need to avoid that gaming “becomesa source of individual profit”in circumstances whichinvolve “highrisks of criminality and fraud”and which “constitutean incitement to spending that couldhave damaging individual and social consequences”.Hence one can conclude that gaming for cash winnings is generally prohibited in Italy except inthose cases explicitly regulated by the law. In such cases, the exercise of gaming only occurs inthe form and manner defined by the legislative framework (laws or regulations) of the Italianstate which regulates its supply.

MAG | Overview of the Italian legal framework for online gaming9

Gaming regulation in Italy follows the logic of the so-called “typicality”, meaning that it mustprecisely identify and regulate:•the objects, aspects and operating mechanisms of the game;•the methods for allocating turnover among the subjects involved in the supply chain invarious capacities (state, licensees, resellers and consumers);•the categories and amounts of the prizes;•the characteristics (objective and subjective requirements) of the operators allowed todistribute the game;•the forms and minimum content of communication to consumers in order to ensuretransparency and full awareness of the rules.Moreover, the regulations ensure that each game has the necessary limitations for the correctconduct of the game. These limitations are imposed so as to protect consumers as well aspublic order and safety. Depending on the game, these may concern the hours of supply,maximum stakes and winnings, the timing for paying out the winnings, the possession ofspecific public safety licenses by the operators, the safety requirements (for consumers andemployees) that the places where the game is provided must possess, and similar.The operation of gaming – offered by private parties through a license – is open to all operatorsthat meet certain requirements of reliability. It must be exercised exclusively in conformitywith the specific regulations for each game to protect consumers as well as public order andsafety. The Italian state has always been guided by these general principles and regulation ofonline gaming is no exception. The result is an online gaming system that has been considered asuccess for several years. The model has been – and continues to be – a source of inspirationfor many studies of the regulation of this economic sector in various countries of the EuropeanUnion.There are a number of reasons underlying the success of the Italian model of online gamingregulation. However, we identified four distinctive elements of the model which demonstrateits positive effects and which could be replicated in other countries that are currentlypondering the regulation of the online gaming market.First of all, there is the pragmatism of the legislation due to Italy's objective toquickly and effectively reduce illegal and irregular gaming.It was decided to allowoperation of online gaming immediately, with the adoption of many transitional rules – oftenmodified after a brief time in effect – rather than through a comprehensive regulatory designthat would certainly have required a long time to prepare and approve. This strategy proved tobe successful as the economic operators in the sector saw that legislative interventions were fastand reliable, and hence began to trust the Italian state and cooperate in the development of theMAG | Overview of the Italian legal framework for online gaming10

regulations. This approach proved to be particularly suitable for a sector which is constantlyand quickly evolving, and in which regulations tend to rapidly become obsolete and supersededby the speed of technological and marketing developments.Only in 2009 – when the sector became more developed and the Italian legislature hadaccumulated a great deal of experience – was it decided to issue a comprehensive lawregulating the sector. The law defined the general framework for issuing licenses for onlinegaming which took account of the positions adopted by the European Commission and theEuropean Court of Justice. Laws No. 88 from July 2009 ("Community Law") and No. 77 fromJune 2009 – which expanded the provision of online gaming – concluded the interim phase ofthe online gaming regulation. The regulatory authorities thought it more prudent to define atthe legislative level only general rules and the requirements for economic operators in order toenter the sector. The definition of all technical aspects and commercial effects was left toadministrative decrees which are easily modifiable. The regulations concerning the CommunityLaw were passed directly by the AAMS and are expected to enter into effect in 2010.Secondly, the high quality and prudence of the regulatory interventions must beemphasizedas it affected the key points of the online gaming model. The regulatoryauthorities abstained from imposing other than functional limitations and prescriptions in orderto protect the player and safeguard public order.Thirdly, the regulatory agency paid particular attention to creating anatmosphere of reciprocal trust with gaming operatorswhich progressively adhered tothe regulatory regime. This process was at the same time accompanied by the active restriction– although at a price of too restrictive interpretation of several Community principles – ofunauthorized gaming providers established in several other EU Member States.Finally, there was an open attitude towards rapidly decreasing the tax burden ongaming transactions.With the increases in turnover, the taxes imposed on the legal gamingsector were decreased in order to ensure the legal providers’ competitiveness againstunauthorized providers.

2.2 The regulatory landscape for online gamingGaming in Italy is not governed by a single text but rather by numerous regulations which intheir entirety control the sector. The current system for gaming is the result of multipleregulatory interventions made by a variety of Italian institutions at several levels, including theParliament, the Minister of the Economy and Finance and the Director of AAMS.Thesebodies followed the objective of opposing illegal gaming through theprogressive adaptation of gaming products to match the actual demand, whilealigning the offering methods to the evolution of technologies connected togaming.MAG | Overview of the Italian legal framework for online gaming11

Italian law defines the following:a) The introduction of new games and their taxation is the prerogative of the Parliamentand hence requires a primary law.b) The issuing of gaming regulations is the prerogative of the Minster of Finance. Theseregulations lay down “themethods and times of play as well as the payment of commissions, feesand compensation due for any reason”,together with “theamount of total taxation”.Theyfurther establish the rules for defining the money prizes and define the extent ofregulation at the administrative level, while specifying its limits.c) AAMS is in charge of defining the provisions for implementing the games on the termsindicated by the primary and secondary laws.Hence the regulation of remote gaming in Italy today includes several provisions of a generalnature (regarding gaming as such) and other provisions stipulate technical regulation ofindividual games and control the operation of licenses.The regulatory interventions have succeeded one another since 1998 on the basis of a pre-existing system concerning games distributed through the physical network. The result is anonline gaming model that is partly conditioned by the need for standardization with respect topre-existing situations concerning the operation of licenses for several physical games. On theother hand, the system is connected with rights acquired by licensees that in several importantcases will only end in the second half of the next decade (i.e. with the full implementation ofthe Community Law in 2010). Nevertheless, it is possible to identify several basic principles onwhich the Italian model for gaming with remote participation is based today. These elementsare:a) the completeness and ampleness of the range of gaming products offered throughremote channels (currently the only game that remains excluded is the lottery due tostrong resistance from the physical distribution network);b) authorization to operate a game granted exclusively to owners of licenses with thecreation of monopolies (identifying a single licensee) for lottery games (Lotto, numericnational pari-mutuel games and lotteries in the strict sense, although for this lattermarket segment a procedure is being tested for the selection of more licensees) andmulti-licensee offering systems for all the other types of games;c) adoption of a named gaming account – managed by the licensee – for all the remotegames in the AAMS portfolio;d) for games whose license is assigned to a mono-trustee, the possibility of remotecollection by all licensees enabled to offer remote gaming (in order to enable all gamingaccounts to purchase such games, thus creating the necessary liquidity for theMAG | Overview of the Italian legal framework for online gaming12

development of the game). Centralized organisation of the game is entrusted to thesingle licensee (to preserve the unitary nature of the “lottery”). So as to avoid possibleabuses of the dominant position held by the mono-trustee, AAMS is required to approvethe contract between the mono-trustee and the other licensees who fulfill role ofresellers. No online lottery is to be offered;e) the possibility of acquiring licenses to operate games exclusively through the remotechannel (online products only).The portfolio of online public games in Italy today can be considered among the most completeat an international level – both as regards the types of products offered and the completeness ofthe distribution channels used for collection. Most games introduced in Italian law areendowed with a complete regulatory set. Games that have been introduced more recently arestill waiting for regulations and implementing provisions by AAMS in 2010. The portfolio ofpublic games is organized into eight distinct macro product categories (the so-called gamingsectors) that can be offered through all remote selling channels. These products can be offeredon all remote distribution channels, i.e. Internet, interactive television, as well as telephoneand mobile phones.The following is a list of the individual sectors:a) fixed-odds numeric games (i.e. Lotto and connected games);b) national pari-mutuel numeric games (i.e. SuperEnalotto and connected games);c) lotteries (both for deferred drawing and instantaneous drawing);d) games based on sports events or on events other than horse racing (including poolbetting sports events, pari-mutuel stakes, fixed-odds stakes, fixed-odds stakes withdirect action between individual consumers and pari-mutuel) and fixed-odds stakes onsimulated events;e) games based on horse races, including pari-mutuel and fixed-odds horse racing stakes onsimulated events, bet formulas on Italian horse races and pool betting based on horseraces;f) bingo;g) games of skill, including card games (poker etc.);h) fixed-odds games of chance (casino games).For each of type of game, the appendix contains the remote gaming regulations currently inforce.

MAG | Overview of the Italian legal framework for online gaming13

3. Public gaming licenses3.1 Which regulations serve as the basis for the gaming license system?As stated above, Legislative Decree No. 496 of April 14, 1948, provides the exclusive rightsfor the organisation and operation of public gaming to the state, in particular the Ministry ofthe Economy. Since 2001, all administrative responsibilities concerning gaming have beenassigned to AAMS.At present, the state does not directly manage the individual games in theportfolio but has outsourced their management to third parties.In fact, there is anumber of businesses – both Italian and foreign (some of a particularly large size) – thatoperate in the public gaming market and to which the state has entrusted the management ofthe activities needed for offering the various games, via granting licenses. Unlike otherEuropean countries that allow gaming (such as Malta, Gibraltar etc.), Italy operates through alicensingsystem.The state uses the license to entrust private legal subjects with the management of all or part ofthe activities connected with the offer of the single games in its portfolio. In administrative law,the license is effectively a provision whereby the public administration confers new active legalpositions on the recipient, expanding thus the legal sphere.Licenses are generally granted following a public tender procedure. In the context of thegames, the state can only start proceedings to assign licenses for specific gaming sectors after ithas issued a primary law.

3.2 What licenses and for which products are currently active in Italy?The following types of licenses are operational as of today:a)the so-called “historic”licenses allowed by Law No. 488 of December 23, 1999(the 2000 Budget Law), which disjointedly authorized the offering of sports stakes or horseracing stakes through the physical and remote channels;b)licenses for the monopolistic offering of games in the sectors of fixed-oddsnumerical games, national pari-mutuel numeric games and lotteries;c)licenses for theoligopolistic provision – exclusively through the physical channel –of games through entertainment machines(10 licenses are currently active but theirnumber is expected to grow with the launch of video-lottery games on the market);

MAG | Public gaming licenses14

d)licenses– in a limited number –for the offering of in-hall bingo;e)licenses for the offering of stakes only through the physical channeldefined bythe implementation of article 38 of Legislative Decree No. 233, of July 4, 2006, ratified byLaw 248 of August 4, 2006, which are of two types:•licenses/rights that authorize the opening of sports betting sales points, including bothgame sales points whose principle activity is the sale of stakes (agencies) as well as pointswhere the sale is only an accessory activity (corners);•licenses/rights that authorize the opening of agencies or betting points for horse racestakes.f)licenses for the right to offer remote gaming, issued solely in implementationof the above-mentioned article 38.These licenses – which require offering of all thegames that are part of the online portfolio (although conformity to this provision has neverbeen effectively verified by AAMS) – are of two types:•“sports” licenses that allow the offering of all remote games with the exception of fixed-odds and pari-mutuel horse race stakes similar to those made in horse racing agencies (aswell as the other games linked to horse racing which may yet be introduced);•“horse racing” licenses that allow offering all the remote games with the exception offixed-odds sports stakes.The licenses in points “e” and “f” are henceforth referred to as “Bersani licenses”, named afterthe Minister of the Republic who proposed the law that introduced them.In the course of 2010, AAMS is expected to issue regulations that will allow further expansionof the number of licenses under of the Community Law. AAMS will thus be able to issueadditional licenses – up to a maximum of 200 – depending on the effective needs of themarket.These licenses provide exclusively for the right to offer remote games and will allow theoffering of all the regulated online games, while removing the distinction between the twotypes of “Bersani licenses” for remote gaming. Existing licensees will be able to apply for the“Community” licenses free of charge. However, new licenses will not change the naturalexpiration of the original license.Hereinafter we will exclusively refer to the “historic” licenses, the “Bersani” licenses and the“Community” licenses which are to be issued in 2010. For the specific online offering of thenumeric games (fixed-odds and pari-mutuel), we will also refer to the licenses issued to thetwo monopoly licensees. However, we will not refer to licenses for bingo and entertainmentMAG | Public gaming licenses15

machines which – by their very nature – do not offer possibility for remote gamingdistribution.

3.3 What are the differences between online and physical regulation?As of today, there are two key differences in Italy between the regulation of stakes offeredthrough physical channels and those offered through remote channels:a) a license that enables gaming through physical channels authorizes the holder to offer gamesin a circumscribed territory, while a remote license obviously enables offering stakesthroughout the country;b) a license that enables gaming through physical channels authorizes the offer of games in asingle sector (sports or horse racing), while a remote license allows offering in severalsectors (a “Community” license will provide for all the games over remote channels).Regarding the first point,it should be clarified that the licenses issued for the offering ofstakes through the physical sales network (agencies and corners) define a territorial monopolythat authorizes their holders to offer gaming within a specific municipality. In addition, itrequires respecting minimum distances between the various points of the distribution networkwithin the same municipality.The legislature's decision was particularly oriented towards the creation of a distributionnetwork that was on the one hand sufficiently dispersed – to meet a demand for betting whichwas particularly diffuse – and on the other hand large enough to guarantee each sales pointadequate levels of income and profit.In the course of the tender offers to identify new sports and horse racing sales points,AAMS prepared a territorial development plan for the physical network to ensure a balanceddistribution by province/municipality ofrights for 16.300 new sales points.These weredivided into 500horse racing stores,9.500horse racing points,1.900sports gamestoresand 4.400sports betting points.The locations of thesales pointsby province were determined using a methodology whichensured that the amount of sales points was coherent with the resident population. The analysisalso took into account the territorial location of the pre-existinghorse racing and sportsagencies.It should be noted that before the sales network was completely operational(i.e. during the first quarter of 2009), it was not possible to detect areas of inefficiency in thenetwork. Once this has been done, a process of rationalization of the sales points was initiated.Its extent and limitations, however, are not yet possible to document accurately.Moreover, there are cases in which the resident population is not representative of the actualnumber of persons present and passing through. This mainly concerns airports, shoppingMAG | Public gaming licenses16

centers, tourist resorts and municipalities which naturally concentrate much broader customerbase. In order to guarantee necessary provision also in these areas, a reserve of rights wasestablished which was not associated with a specific municipality. This reserve represented5% of alllicenses allocated for betting sales points.Regarding rights to offer gaming over remote channels, the regulation provides that the holdersof licenses for online games can offer their products to all Italian players but it is illegal to offerthem to foreign players. This decision is implicit in the very tools used for bet acceptance(Internet, TV and telephone) that make it practically very difficult to impose territorialrestrictions and segmentations between players located in different areas outside of Italy.Regarding the second point,it should be highlighted that the Italian legislature – andrecently also the European Parliament – has pushed for the progressive definition of licensesfor the “complete” offering of online gaming that would authorize their holders to offer all thegames that can be provided over remote channels. This decision exceeds the model introducedby the Bersani Law which distinguishes between remote “sports” and “horse racing” stakes.The legislature furthermore wanted to guarantee the maximum breadth of the range ofproducts so as to ensure that the licensee could define the mix of offers that was mostfunctional for achieving the income objectives. The income is considerably more modest in theonline than in the physical market whose current turnover volumes are significantly greater. Byway of example, the physical market achieved a turnover of €5.2 billion in 2008, while theonline market recorded only €1.15 billion.The exception are games offered by monopolies which is the case of lotteries. Online offer ofthese games remains – until the expiry of the license – the competence of the monopoly.However, in addition to its own sales channels, the monopoly operator is obliged to use thechannels of other licensees entitled to offer online gaming, should they demand it.7

3.4 What are the requirements for becoming a licensee?Requirements for obtaining a Bersani (sports or horse racing) license in 2007As stated previously, the last public tender offer for the selection of new betting licensees washeld in 2007 in the framework of implementation of the Bersani Law.To participate in a tender,interested subjects had to demonstrate on the one handspecific requirements of reliability and experience, and on the other hand the

It should be noted that in the past, a delay in providing tools for the online distribution of a game product by themonopoly licensee – as in the case of Sisal SuperEnalotto – has been considered an abuse of its dominant position,triggering a fact-finding investigation by the Italian Antitrust Authority.

7

MAG | Public gaming licenses17

technical-organisational requirements guaranteeing their effective ability tomanage the activities that were the object of the tender.The conditions to be satisfied concerned in particular:1. possession of the requirements of reliability required by the general law on tender offersand licenses;2. being a gaming operator, i.e. operating – on the basis of an authorization issued by thecompetent authority in the state in which the game operator has its registered office oroperational headquarters – at least one type of game from among those making up thegaming portfolio managed by AAMS;3. having achieved specific sales of at least €1.500.000 in the years 2004-2005 as a gamingoperator for types of products similar to those in the portfolio managed by AAMS;4. having a dedicated computer system for the operation of gaming activities andguaranteeing the full conformity of the technological equipment to the requirements ofthe technical specifications – together with their functionality, efficiency and quality – forthe entire term of the license.In addition to the possession of the requirements defined above, the awarding ofa license was subordinate to satisfying several conditions ensuring thecandidate's economic-financial reliability.These requirements involved issuing:a) a temporary security deposit – in cash or Italian Government bonds or by means of a banksurety bond – to cover the obligations assumed with the submission of an application toparticipate which equaled €300.000 in case of a request to obtain an online gaming license;b) a definitive security deposit – requested to be paid at the time of signing the agreement – toguarantee the correct fulfillment of the licensee obligations (payment of winnings andtaxes, correct supply of game services etc.); the amount of the security deposit amountedto €100.000 for the activation of the remote network and since the beginning 2008 was alsomade proportional to the level of income.Additional condition for obtaining the license was a one-time payment of €300.000 whichcovered the entire term of the license.Finally, it should be noted that for subjects resident in other states, becoming a licenseerequired establishing a stable operational headquarters in Italy – if one did not have one already– within 90 days from signing the license.

MAG | Public gaming licenses18

With regard to the collection of online stakes, a stable operational headquarters did not meanopening a physical point for the acceptance of bets or the establishment of an Italiancorporation. It referred solely to a headquarters through which the non-resident businessexercised its activities in the whole territory or in a part of the Italian state. In other words,offering remote games required that:a)the Data Processing Center (DPC) and relative game server were installed in Italy;

b) an office was created with a representative equipped with the necessary powers;c)separate books were kept for the Italian division.

On the other hand, company departments dealing with the structure of the shareholders, theentire risk management and strategic branding/marketing were allowed to be located abroad.The requesting operator's possession of a license issued by another country – whether inside oroutside the European Economic Area – only qualified the owner as a gaming operator butprovided no other advantages in terms of obtaining a license.However, it should be noted that there is one subject present in Italy which operates sportsbetting through a physical network and which holds a proper license obtained in anothercountry of the European Union. This subject opened betting sales points, claiming in anadministrative court that its license allowed it to operate in any EU Member State. Despite thespecific provisions of the Bersani Law, this operator has so far benefited from favourableadministrative rulings in several lawsuits filed.Requirements for the acquisition of a Community licenseCommencing in 2010, Italy will make additional licenses available which will allow thebusinesses that acquire them to operate all the remote games until 2019. The only exceptionswill be the lotteries and pari-mutuel numeric games which will remain the reserve of thecurrent monopoly holders until the expiry of the relative licenses that however give eachlicensee distribution rights.The acquisition of the license will have different requirements depending on whether therequesting juridical subject is a gaming operator or not.A gaming operator submitting an application will need to meet the following requirements andconditions:a) having operated and managed gaming collection in one of the states of the EuropeanEconomic Area on the basis of a license issued by the state in which such activities areexercised, with total sales of not less than €1.5 million realized over the last two fiscal yearsbefore the submission of the application;MAG | Public gaming licenses19

b) establishment of a limited liability company with registered office in one of the states of theEuropean Economic Area before the issuance/signing of the license;c) need for the company’s president, directors and proxies to meet the requirements ofreliability and professionalism set out in the Bersani Law;d) the location of the technological infrastructure – hardware and software – dedicated to theactivities that are the object of the license in one of the states of the European EconomicArea;e) payment to AAMS of one-time contribution to expenses for the technical andadministrative management of monitoring and control activities.In the absence of the status of gaming operator, the requesting legal subject will – instead ofthe requirement in preceding letter a) – be required to possess adequate technical andinfrastructural capabilities as well as to provide a bank or insurance company surety bond, withpayment upon first request and for a two-year term of not less than €1.500.000.In short, the main innovations of the new “Community” license concern:a) the possibility that even businesses not operating in the gaming market can obtain a licenseby presenting a surety bond;b) the elimination of the requirement for an operational headquarters/registered office inItaly, allowing setting up an office in one of the states of the European Economic Area;c) the possibility of installing the gaming servers in the European Economic Area and notexclusively in Italy.However, licenses obtained in other countries are still not recognized for the facilitatedacquisition of a license to operate in Italy.

3.5 Could existing lottery and betting operators acquire an onlinelicense with conditions similar to those of new entrants?When selection began to award the “Bersani” licenses, legal persons that were already licensees(previous licenses for offers through the physical network, monopolistic licensees for thenumeric games, licensees for the entertainment machine sector and bingo licensees) were ableto participate in the process of acquiring rights to offer remote games in Italy on the same basisas new operators under the condition that they met the necessary requirements.In the future – when the process of issuing licenses in implementation of the Community Lawwill have begun – legal persons who already are licensees (not necessarily for remote games)MAG | Public gaming licenses20

can participate in the acquisition of new licenses with conditions similar to those of newentrants.

3.6 Is there a distinction between the license requirements for onlineand physical distribution?The requirements of the Bersani Law distinguished between candidates interested in acquiringlicenses for the offer of games through the physical channels, remotely or over both channels.The differences concerned only the acquisition costs and the requirements forinformation/computer systems for managing the game.

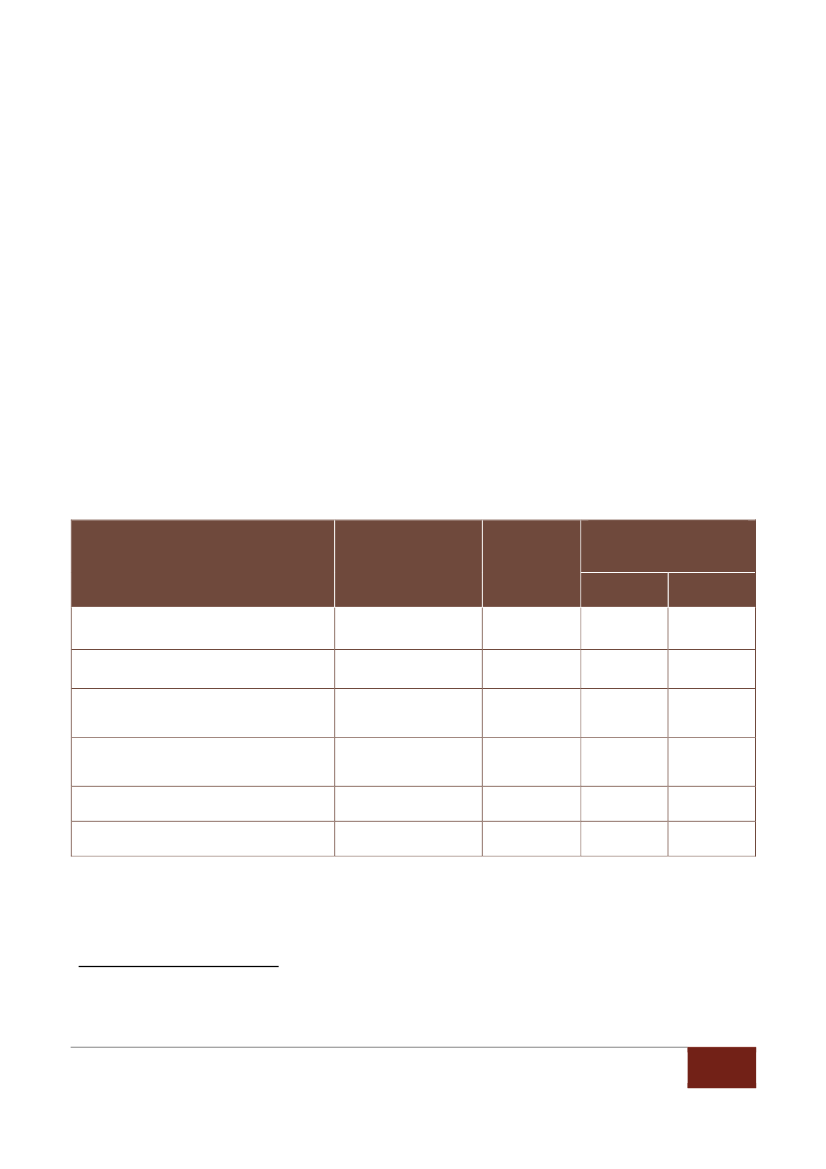

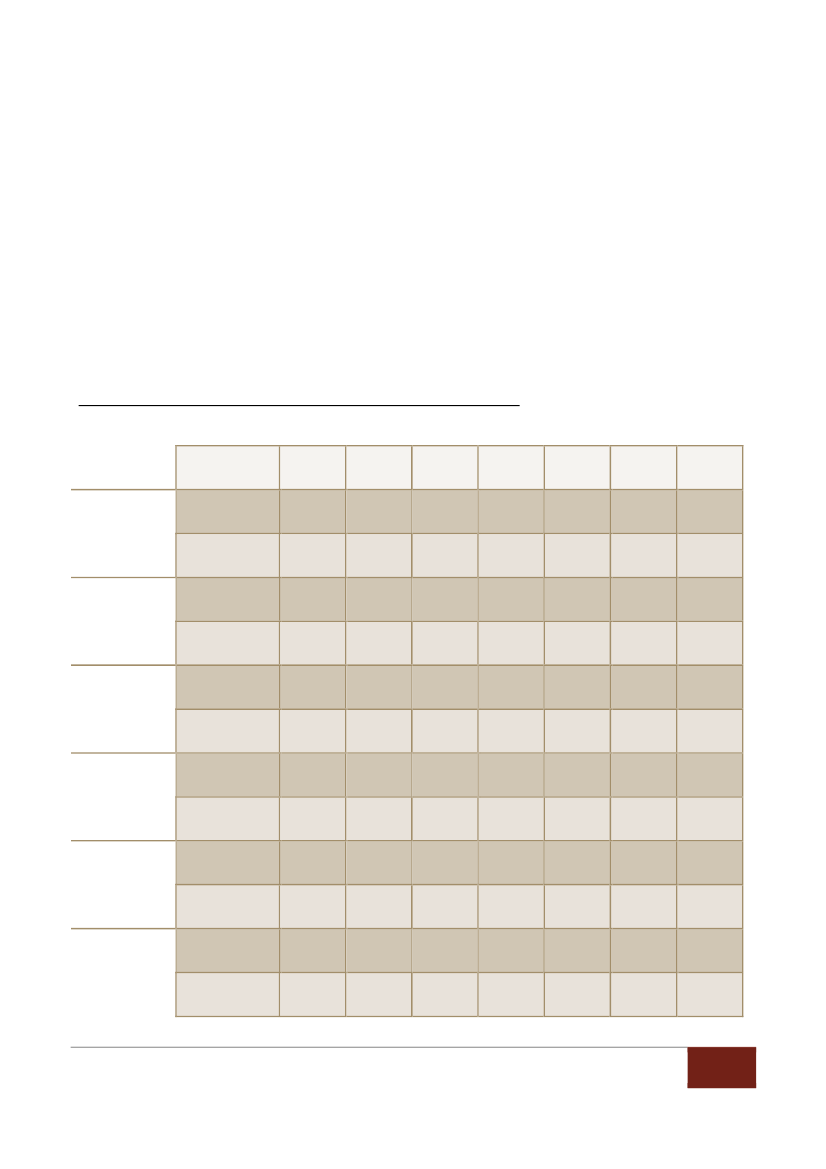

3.7 How many licenses have been awarded so far?The table below summarizes the licenses awarded in Italy for the offer of both sports and horseracing stakes.License typeLaw authorizing itsissueNumber oflicensesApproved distributionchannelsPhysical1. Historic sports licenses2. Historic horse racing licenses3. “Bersani” sports licenses84. “Bersani” horse racing licenses95. Remote “sports” licenses6. Remote “horse racing” licenses2000 Budget Law2000 Budget LawBersani LawBersani LawBersani LawBersani Law6253595,6218,065318XXXXXXOnlineXX

Source: AAMSThere is a total of 1.023 active licenses in Italy today (39 “Bersani” licenses and 984 “historic”licenses) that directly enable remote gaming. In 2010, these licenses will be supplemented byIncluding game sales points having the sale of sports-based games as their main activity (agencies) or accessory activity(corners).9Including game sales points having the sale of horse racing-based games as their main activity (agencies) or accessoryactivity (corners).8

MAG | Public gaming licenses21

licenses issued in implementation of the Community Law. As previously mentioned,a maximum of 200 new licenses can be issued, as established by the law itself. This alsoincludes existing licenses that will be extended.

3.8 What is the cost of a license?TheBersani licenses for activating remote sports or horse racing gamingnetworks were assignedto subjects in possession of the requirements in precedingparagraph 3.4upon payment of a price of €300.000.For the acquisition of therights to collect stakes through physical points, the price depended on the outcome of thecompetitive bidding, i.e. the concrete offers submitted for each territory in which the rightcould be exercised.The requirement of a payment to acquire the right to operate online gaming derives from afundamental reason of fairness. Since there is a cost to acquire the right to collect stakesthrough physical points, there must also be one for online collection, otherwise it could resultin an unjustified distortion of the market in favour of remote operators.In addition, the height of the payment was determined using market fairness criteria. It was setat approximately 50% of the average acquisition cost of a license for the remote collection ofsports stakes (licenses required by the 2000 Budget Law) in 2005 and the first few monthsof 2006.The decision to cut the average cost by 50% was primarily based on two considerations: (i) thepotentially unlimited number of new licenses for remote collection; (ii) the reducedattractiveness of the market for subjects taking over these licenses in the future. The fulleconomic sustainability of the one-time investment required was verified – among other ways– through the development of simulated business plans.Regardingthe licenses that will be issued in implementation of the CommunityLaw,it is required that:a) new licensees pay to AAMS a sum of €300.000 plus VAT10in order to acquire the right toremotely offer all regulated games, with the exception of bingo – if the operator also wantsto offer the latter game, it will have to pay additional €50.000 plus VAT;b) the “historic” licensees – i.e. those holding Bersani licenses for the right to operate remote(sports or horse racing) games – pay €50.000 if they also want to offer bingo; they will notneed to make additional payments to be allowed to offer the other games but will only haveto request the conversion of their license;10

value-added tax

MAG | Public gaming licenses22

c) all other licensees pay €350.000 (except for those holding a bingo license who will only berequired to pay €300.000).

3.9 What is the term of a license?All licenses issued by the Italian state for the management of public games have a term of nineyears, commencing from the date the license is signed.For this reason, the betting licenses active today have different expiry dates, depending on thedate they were issued.The table below indicates the month and year of expiry for each type of license.Name1. Historic sports licenses2. Historic horse racing licenses3. “Bersani” sports licenses4. “Bersani” horse racing licenses5. Remote “sports” licenses6. Remote “horse racing” licensesExpiryJune 2012June 2012June 2016June 2016June 2016June 2016

The new “Community” licenses will also have a term of nine years from the signing of therelative license agreement. The terms of original licenses that are converted into Communitylicenses will not change.

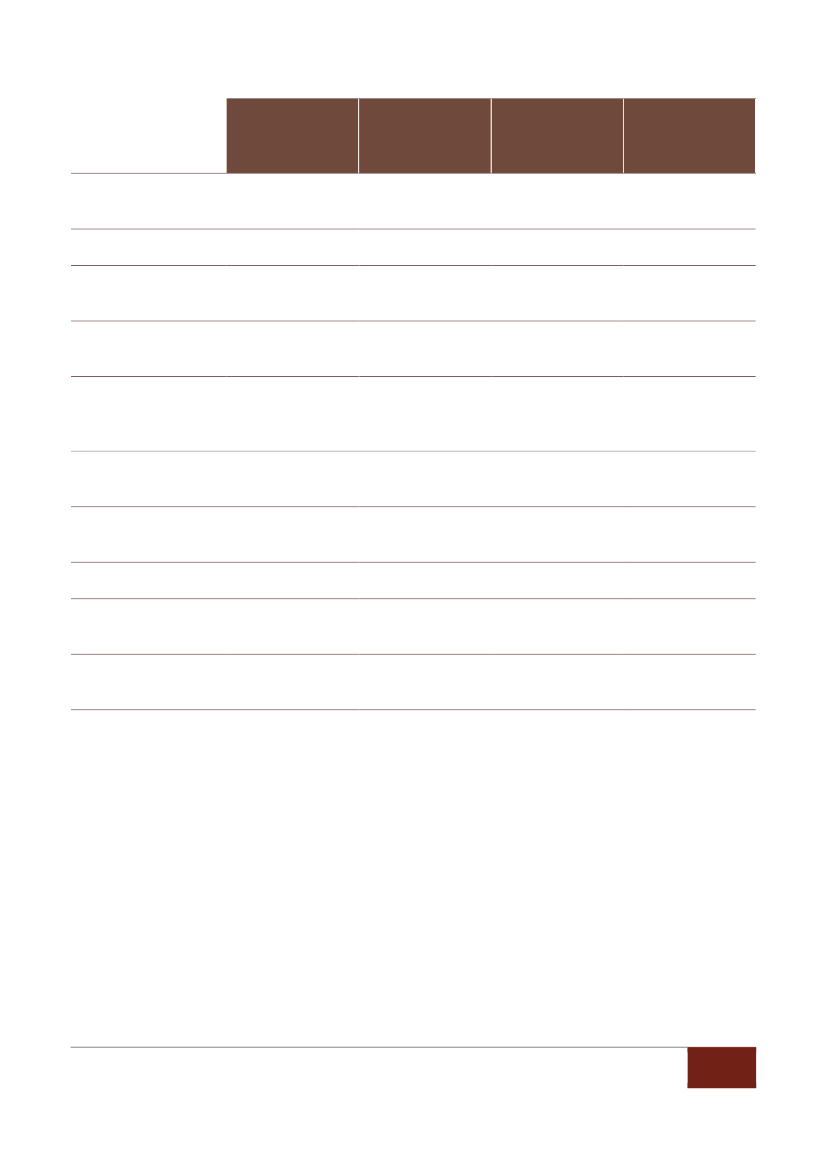

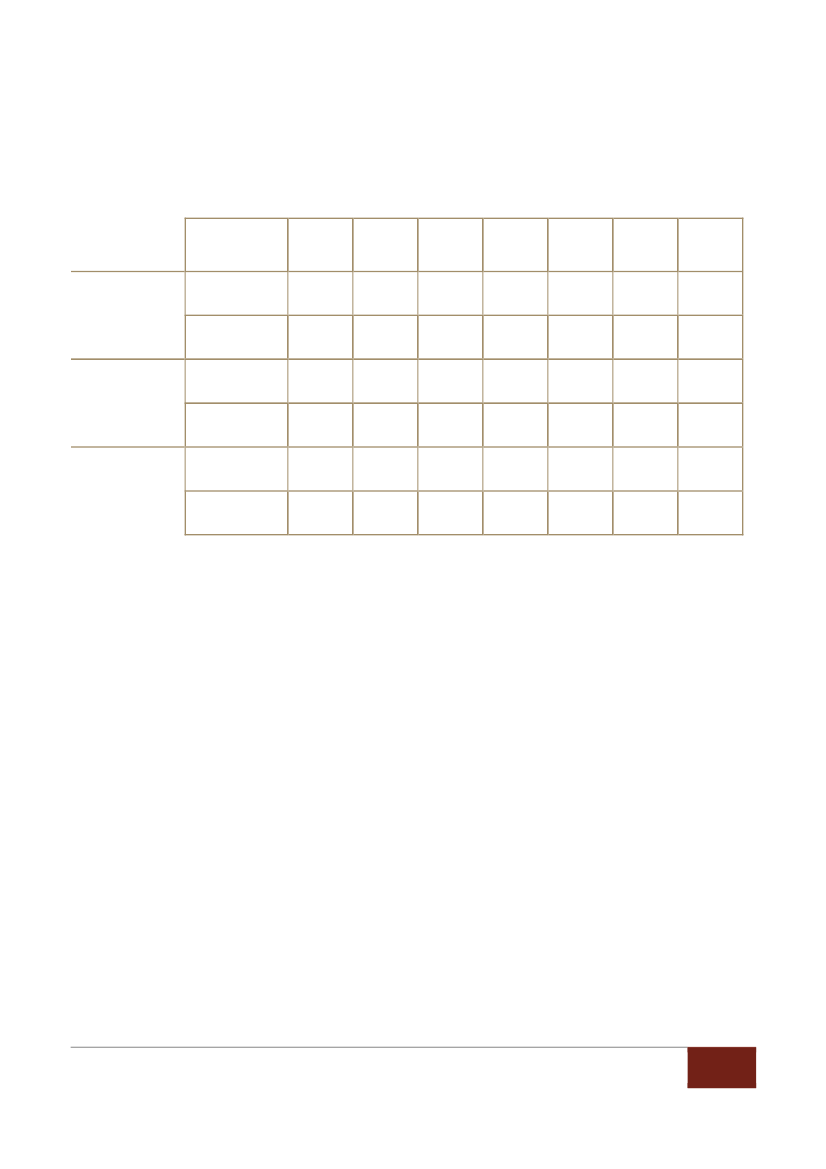

3.10 What products are included in a license?As previously mentioned, licenses for the remote offer of betting which currently operate inItaly were issued in different years (2000 and 2007), in function of the progressive expansionof market demand for games through the Internet, TV and telephone channels. These licensesauthorize the legal persons that hold them to offer different product ranges.For each currently operating license, the table shows the set of products that the licensee isauthorized to sell.

MAG | Public gaming licenses23

Historic sportslicensesFixed-odds sportsstakesPool bettingPari-mutuel sportsstakesAgency horse racingstakesItalian andinternational horseracingV7 (horse racinggame)Skill games and cardgames (Poker, etc.)Instant lotteries (*)National pari-mutuelnumeric games (*)Fixed-odds games ofchance (casino games)Virtual betting andother remote games,when availableX

Historic horseracing licenses

Remote sportsgame licenses

Remote horseracing gamelicenses

XXXXXX

XXXXXX

X

X

X

XXXXX

XXXXX

XXXXX

XXXXX

X

X

X

X

(*) For these games, the holders of bet licenses play the role of resellers since they have been awarded as part of thelicense to the monopolist operators.

The new “Community” licenses will allow offering of all the online products in AAMS'sportfolio as well as distributing the instantaneous drawing lotteries and national pari-mutuelnumeric games (SuperEnalotto) which are presently offered by monopolies.

3.11 Why was the product portfolio extended over time?One of the objectives pursued by the legislature in the process of reforming the Italian gamingmarket was to guarantee an adequate alignment of the gaming offer to the demand. ThisMAG | Public gaming licenses24

process was defined in the belief that only a legal offer of similar breadth could effectivelycompete with the illegal offer.In a modern version of Gresham's law, one could say that regulated gaming is “driving out”illegal gaming. In the presence of a regulated offer, the public automatically turns to it. Theabsence of a regulated offer – on the other hand – creates spaces for the illegal offer to grow,with considerable risks for the consumer.Against the backdrop of this reasoning, the Italian state progressively expanded its portfolio ofonline products, while gradually including new types of games whose demand was satisfied onillegal gaming sites. At the same time, the extension of the portfolio has encouragedinternational operators – who initially doubted the profitability of regulated markets – torequest a remote gaming license, thus effectively reducing the illegal offer.

3.12 Are there additional restrictions on products? For instance is livebetting allowed as a particular mode of sports stakes?The principle of “typicality” of public games means that the characteristics of the games whichcan be offered are determined solely through precise laws and regulations.In this sense, the remote games in the Italian portfolio are not identical to those offered on theinternational .com sites. However, they all have peculiarities relative to the content of theproduct and its management.Below we list the main general and specific limitations of the principal remote games in Italy.General limitations•Only players who possess an Italian tax ID may play.•Each bet is tracked by AAMS's computer systems through a connection with the licensee'sgaming systems which is regulated by a specific communications protocol.Specific limitations: Sports stakes•In Italy, bets can be placed on all sports and non-sports events identified by AAMS. If a givenevent is not listed in the AAMS sportsbook, any bets collected on it are illegal.•This principle also applies to live betting. Live bets can only be offered if provided for in theAAMS sportsbook.•AAMS directly certifies the outcomes of sports events in the sportsbook.MAG | Public gaming licenses25

Specific limitations: Poker•There are limitations on the minimum payout.•There are limitations on the minimum and maximum value of the right of participation(buy-in) as well as the maximum value of the sums of money that can be brought to the table(bets).Specific limitations: Bingo•There are limitations on the game formulas and the payout.•The game (the drawing of the numbers) is conducted via AAMS's central systems to whichthe licensee's system connects.

MAG | Public gaming licenses26

4. Consumer protection4.1 How is the compulsive gaming prevented?The new Community Law specifically obliges licensees to adopt tools for the automaticlimitation or automatic exclusion of consumers from play in the case where spendingmaximums are exceeded.Before the Community Law was enacted, the law did not make specific reference to theadoption of measures to prevent compulsive gaming. However, the overall regulatoryframework provided for clear limits within which an authorized licensee can offer betting.These limits were set to protect consumers and to restrict compulsive gaming behaviours.The law states the following:a) the types of stakes allowed are those defined by the state, while avoiding the presence ofstakes that are too risky for the consumers;b) the list of events on which one can bet is established by the state, hence eliminating thepossibility of bets on events that could be subject to illegal sports activities;c) bets that would lead to winnings greater than €10.000 are not allowed, thus limiting thepropensity to gamble and making it difficult to sell the types of bets with higher winningmultipliers in which the risk is objectively much higher than the player’s skills;d) the declaration of the outcomes of each bet is made exclusively by the state which thusprovides reliable rules for all the subjects involved;e) the registration percentages are currently free but can be re-established by AAMS decree ifthe licensees are found to be colluding to the detriment of consumers;f) maximum limits are set on the amounts that can be brought to the poker table – maximumbuy-in at poker tournaments is €100, maximum bet in poker cash games is €1.000.These measures create barriers to compulsive gaming without placing excessive limitations onthe licensee's management.Finally, it should be highlighted that AAMS – in cooperation with other institutional players –supports and promotes initiatives aiming to reduce the risks of compulsive gaming, while alsosustaining organisations that deal with gaming addictions. These actions are being intensifiedover time as the portfolio of remote games is being extended.

MAG | Consumer protection27

Moreover, in May 2006 AAMS launched a so-called “Gioco Sicuro” (Safe Play)communications campaign with the aim of promoting the public gaming based on clear rules.The campaign highlights that the production and distribution of the games are monitored bythe state, and that the operators are reliable because they are selected and controlled by AAMS.The purpose of this campaign – emblematically summarized by the “Gioco Sicuro” logo – is tomake products easily recognizable as legal and guaranteed by the state.

4.2 Who sets limits on the game?When signing the license agreement, the holders of the new “Community” licenses mustassume several obligations including the implementation of tools to automatically limit play(see above).Moreover, at the time of registration, each player must define his/her own grid of maximumamounts played per time period (day, week, month etc.). This will guarantee theimplementation of a self-defined blocking mechanism which the licensee is required to respect.

4.3 How are minors protected?The AAMS's institutional policy is not only to combat illegal gaming – by means of variousmethods provided for by the legislature – but also to act in the context of legal gaming. It doesso namely by guaranteeing the maximum transparency of its activities, the clarity of the rules toplayers and likewise by searching for instruments suitable for eliminating or at least reducingthe dangers of gaming – which can translate into compulsive gaming – as well as for excludingparticipation by minors.Regarding the protection of minors, the legislature has provided for criminal sanctions withextra penalties for those who – in committing the crime of illegal gaming – allow theparticipation of minors below the age of 18 (article 719 of the Italian Penal Code).The legislature's great concern of not exposing minors to any risks has led – in a civil lawcontext – to the express identification of exceptions to the general rule of incapacity inarticle 2 of the Italian Civil Code, recognizing the value of the manifestations of a minor's willin the cases expressly established and regulated.From the foresaid general rule it follows that minors cannot validly conclude any gamingcontract – even if guaranteed by the state – since they are not able to understand, fully evaluateand accept the contractual clauses as well as the possible legal and psychological consequencessince they do not possess a mature capacity to act. In several cases, the legislature has moreoverconsidered it necessary to repeat this rule by expressly requiring a prohibition against gamingby minors in certain situations. This concerns the case of the devices referred to in paragraph 6MAG | Consumer protection28

of article 110 of the TULPS (the consolidated public safety law) or the game of bingo withdispositions that prohibit minors from entering or remaining in the hall and requiring that IDsbe checked to ensure respect of the prohibition (article 3, paragraph 1 of the DirectorialDecree of January 18, 2007).In addition, with reference to the remote operation and collection of legal games, in article 24,paragraph 17, letter e), the Community Law established that subjects that intend to becomelicensees must assume the obligation to adopt or make available tools and techniques for theexclusion of access to games by minors as well as to visibly display the relative prohibition inthe virtual environments managed by the licensee.With the same objective, a centralized registry of gaming accounts wasestablished within AAMS's central systems. The registry allows for real timecontrol of the information entered for every new registration in order to verifythe truthfulness of the data – also as regards the Tax ID – which identifies thedate of birth.However, the legislature's limits and prohibitions are not always sufficient to exclude theparticipation of minors in gaming offered by the illegal market. Consequently, the sensitivity ofthe subject requires additional initiatives to protect minors from future risks of addiction and tocontain their propensity to gamble.AAMS in the past adopted several initiatives to encourage the protection of minors by thelicensees through specific penalties for the failure to prevent minors from gaming. It alsocarried out communications campaigns directed towards young people to promulgateinformation about the prohibition against gaming below the age of majority as well as about therisks of compulsive gaming.At the same time, AAMS developed the above-mentioned communications campaign “GiocoSicuro” whose objective is to create a culture of responsible gaming. As part of its intensivepromotion, AAMS resorted to the potential offered by the web and created awareness-raisingareas on the websites of the major licensees and sector operators as well as on the principalsocial networking sites (Facebook, YouTube etc.), among other places. Finally, in the contextof the institutional campaign aimed at promoting responsible gaming and the protection ofminors, AAMS created a TV spot addressing these topics.

4.4 What measures are in place to prevent money laundering and themanipulation of sports events?In addition to ensuring the high levels of protection explained above, the recording of all betsin the pari-mutuel system currently also allows for in-depth controls aimed at protecting publicorder and safety.MAG | Consumer protection29

In practice, it is possible to detect and analyze in real time every suspect movement of moneymade at the level of the single agency or single licensee that collects bets online. By way ofexample, it is possible to monitor:a) “anomalous play”, i.e. abnormal concentrations of money on a single event which indicatepossible illegal sports activities;b) a sudden increase in collection by an agency which indicates possible money launderingphenomena;c) a sudden, abnormal change in the odds of a bet which possibly indicates either a tax evasionor a disguised payment of sums due for another reason;d) excessively high amounts of bets in a single gaming account which indicate possiblefraudulent illegal betting (brokerage phenomenon) or “pathological approach” to betting bysingle consumers.It should be emphasized that on the basis of this data, AAMS can impose policies to protectconsumers which are much more effective than anachronistic and easily circumventiveindividual spending limits.In other words, the policies of the national legislature in Italy are orientedtowards the need to regulate and govern illegal phenomena. This orientation wasdetermined by the need to direct consumers towards state-controlled games.

4.5 Is there an operator blacklist and if so, who manages it?There is currently no blacklist of operators who conduct illegal gaming in Italy. However,AAMS controls and monitors the situation on the Italian territory as well as on the Internet inorder to make sure that only authorized operators can offer the games in its portfolio on themarket. Control is also performed with the contribution of the Guardia di Finanza (TreasuryPolice) and other Italian police agencies.If illegal situations are detected, the AAMS:a) acts to terminate the offer;b) applies the available administrative sanctions (cf. paragraph 5.1);c) notifies the competent authorities in the case of criminal activity.

MAG | Consumer protection30

In the area of online games, AAMS manages a blacklist of sites that offer gaming illegally andtakes action to block them (cf. paragraph 5.2).In addition to protecting consumers, blocking illegal sites protects the authorized licenseesagainst unfair competition from those who want to offer the same product, while avoiding tofollow the rules.However, it should be noted that blocking is not irreversible. Those who conform to the rulesare immediately removed from the blacklist, and their sites are fully unblocked and added tothe list of operators authorized to offer remote gaming (which is available on the sitewww.aams.it).

4.6 Can licensees sponsor sports events?Licensees can advertise and thus also sponsor events, in conformity with the limits imposed bythe Italian communications authority (AGCOM) and the antitrust authority.Within these general limits which affect both state businesses and licensees, there are noadditional restrictions on sponsoring sports events – whether as regards those operating in thesports domain (teams etc.) or the sponsorship of specific events.In this sense – unlike in the French gaming proposal – no payments are required to be made tothe organizers of sports events in exchange for the possibility of accepting bets on those events.In Italy, AAMS can also sponsor sports events directly. In broad terms, AAMS's sponsorship ofsports and non-sports events - as well as its advertising/promotion in general – is intended toraise awareness about:a) the brands of the games in its portfolio;b) AAMS's role as the government agency responsible for legal, safe and responsible gaming.In conformity with article 12 of Law 241/1990 (which requires that government agenciespublish their selection criteria before granting any subsidies and economic advantages to thepublic and private organisations), AAMS annually defines the criteria it will follow inevaluating the sponsorship requests that it receives.In general terms, these criteria can be summarized as follows:a) in the choice of subjects to sponsor, those playing an active role in gaming are evaluatedthrough the prism of their credibility and authoritativeness as well as any social objectives;

MAG | Consumer protection31

b) in the choice of the single events to sponsor, the contribution of the initiatives to theachievement of social objectives with public benefits is evaluated, as well as:•the possibility of AAMS to promote its own role through the diffusion of messages thatrepresent its institutional mission;•the impact of the sponsorship on public opinion (uniqueness of the event, approval ofthe government institutions, continuity of the initiative)•the initiative's potential to allow participants to immediately and simply make use ofinformation about AAMS.There are no specific limitations on sponsorships – and on the advertising and promotion ofgames in general – by licensees, except as regards:a) the advertising and/or promotional content used which must not conflict withregulations on the subject of protecting minors as well as the promotion of legal,responsible, conscious and moderate gaming;b) the use of AAMS's trademarks, in particular “Gioco Sicuro” (by way of an inexhaustiveexample, the logos are to be placed on the websites of licensees, providers andoperators – namely on the home page or on the introduction/launch page – and mustalso contain a link to the AAMS website and its “Gioco Sicuro” section).

4.7 What advertising standards must be followed?Regarding the standards that businesses operating in the gaming market are required to followin the advertising/promotion of games, we refer you to the preceding paragraph 4.6.It should also be noted that for some games – namely those provided by monopolies – thelicense or contract that regulates relations between AAMS and the licensee business preciselydefines the total value of the annual budget for the advertising and promotion of the game.

MAG | Consumer protection32

5. The penalty system5.1 How are unlicensed operators prosecuted?The penalty framework in the case of operating illegally or not in conformity with the Italianregulations is regulated by Law 401/1989 as well as the recent Community Law which partlysupplements the content of Law 401/1989 relative to games provided over remote channels.Current law provides for monetary fines as well as for imprisonment from 3 months toa maximum of 3 years, depending on the offense. In particular, current regulations criminallypunish:a) illegal operation of the game of Lotto, stakes and pool betting reserved to the state orlicensees;b) illegal stakes or pool betting on sports activities managed by CONI (the Italian OlympicCommittee) and UNIRE (the Italian Horse Breeding Union);c) illegal operation of public betting on other human or animal competitions or games of skill;d) the sale of tickets for the lotteries or other similar chance events of foreign states in Italy,without authorization from AAMS;e) participation in the operations referred to in letter d) through the collection of bet bookingsand crediting the relative winnings, and promoting and advertising them by any means;f) any kind of publicity given to the illegal operation of stakes, games and pool betting;g) the mere participation in illegally-operated betting, games and pool betting;h) the illegal offer of remote gaming or an offer – even with a regular license – that does notconform to the technical rules defined by the regulator.

5.2 How does AAMS ensure that only licensees have access to theItalian market?AAMS constantly monitors the offer of gaming over the Internet and makes specific requests toInternet Service Providers (ISPs) to block the sites of operators that are not authorized to offerremote gaming in Italy, in conformity with the Decree by the Director General of AAMSof January 2, 2007, regarding the removal of unauthorized offers over the Internet of games,lotteries, stakes or pool betting with cash winnings.MAG | The penalty system33

The blocking prevents unauthorized operators from offering games through ISPs which – onAAMS's request – interrupt:a) connection to the Internet or other remote computer or telecommunications networks byunauthorized operators;b) the hosting of unauthorized operators;c) the services of content providers to unauthorized operators.Without affecting the powers of the authorities and the judicial police – where a crime hasbeen committed – AAMS reports the sites to be inhibited to ISPs or operators of other remotecomputer or telecommunications networks. Alternatively, these might also be reported tooperators which offer remote or telecommunications services for an offer of games, stakes orpool betting with cash winnings without a license or another authorization in violation of thelaw, regulations, limits or prescriptions defined by the AAMS itself.The recipients of these notifications are obliged to prevent the use of the networks theyoperate – or for which they provide services – for the operation of games, stakes or poolbetting by adopting the technical methods established by AAMS for that purpose.Using the powers assigned to them by Legislative Decree No. 68 of March 19, 2001, the Postaland Telecommunications Police and the Treasury Police cooperate with AAMS according tothe criteria and methods established by AAMS.With a monthly – and occasionally also fortnightly – frequency, AAMS's website publishesa list of blocked URLs, i.e. the sites that technology suppliers have blocked upon AAMS'sspecific request.The technical monitoring will be explained in detail below. This control takes place by meansof an exchange of information between the licensee's systems (gaming system and customermanagement system) and those managed by the technical partnerSogei(sole property of theMinistry of Economics).The exchange of information takes place in real time by means of a technical communicationsprotocol which is issued by AAMS as an attachment to the provisions that regulate the rules ofthe games. The currently used communications protocols comprise:•Fixed-odds bets (oddset);•Horse racing and pari-mutuel bets;•Games of skill (including poker and casino games);•Online bingo.MAG | The penalty system34

The technical communications protocols define the construction of the messages through whichthe exchange of information between the systems of the licensee and those of the AAMS takeplace. At the same time, they define the information content, the transmission rules of themessages and the performance level guaranteed by the AAMS systems.It should be noted that only those games are recognized as valid for which a message witha record of receipt has been received from AAMS's information system and for which there is aclear identification code. Other games with money prizes cannot be recognized and cannot becarried out by the licensee, otherwise the latter will risk losing the license.Communication takes place via a "point-to-point" dedicated line that guarantees a high level ofreliability and security. Its costs depend on the distance from the connecting points.With regard to the communications architecture between the information systems, twodifferent models are used, depending on the situation:a) the games system (with its different hardware and software components) is hosted andmanaged directly by AAMS via Sogei;b) the games system is hosted and managed by the licensee.

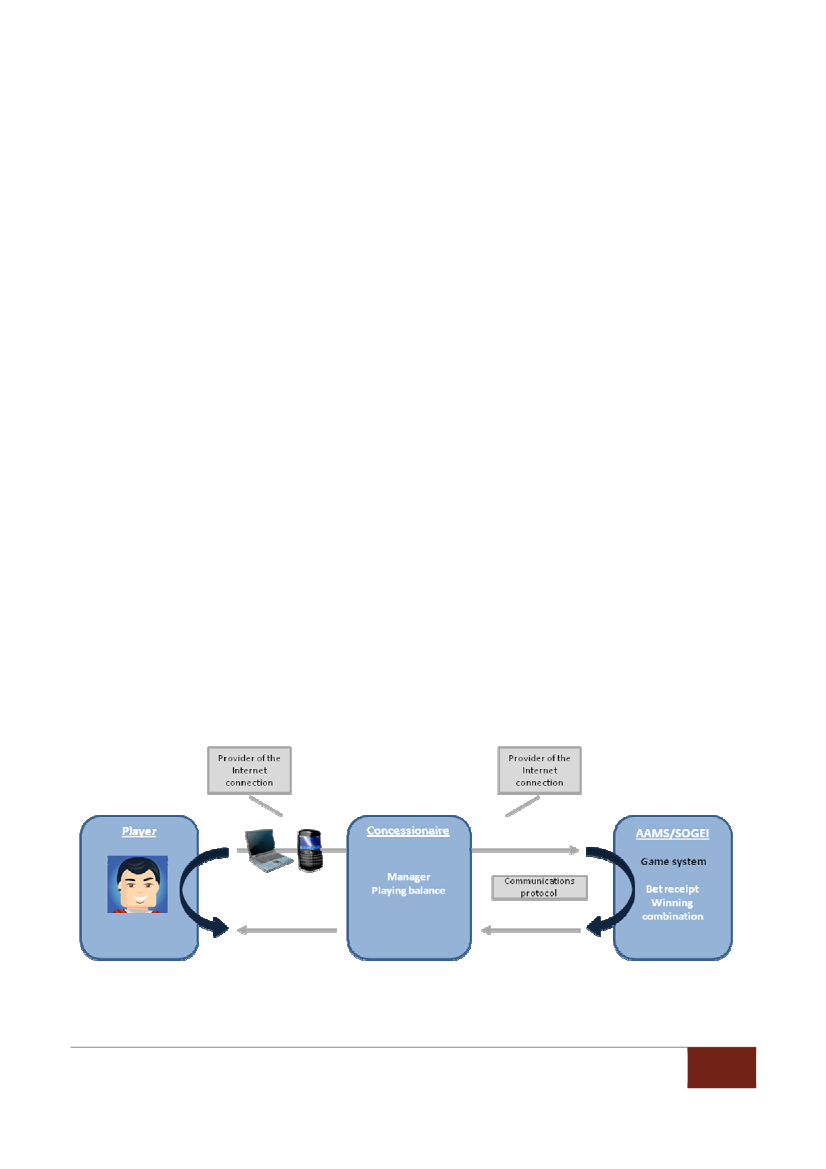

Model a)The first model is used for the management of all types of fixed-odds and pari-mutuel bets forsporting and non-sporting events as well as in bingo games. The functional scheme of this gamemanagement model can be seen in the following graphic, whereby the defined informationflows and the exchange of information are highlighted.

MAG | The penalty system35

In this case, the licensee's (or concessionaire’s) system – which functions as an interface –transmits a game request (with the help of a specific communication protocol) to the centralsystem of AAMS/Sogei that issues the virtual betting slip.After the event has taken place in the case of bets or after the winning combination wasestablished by means of a random draw in the case of bingo, this system communicates theresults of the game to the licensee's system which then reports it to the player.

Model b)The second model is used for all other remote participation games (poker, games of skill etc.).In this case, it is the licensee (concessionaire) that manages the gaming system. Nevertheless,the licensee must transmit pre-programmed messages about the gaming transactions to thecontrol system of AAMS/Sogei in order to enable AAMS to carry out all the controlsnecessary for a correct functioning of the system.The entire model is shown in the following graphic.

With poker, the information content for instance concerns the following:•the buy-in;•the jackpot and its distribution to the winners;•the progress of the individual games;•the result of the tournament.

MAG | The penalty system36

In both models, the AAMS/Sogei system is responsible for setting the tax owed on the bettingsums. This tax sum is reported ad-hoc to the individual licensee for the levy of taxes.

5.3 Do banks have a role in blocking gaming accounts?The current gaming legislation does not foresee a role for the banks – whether when it comesto blocking gaming accounts or the possible blocking of gaming account deposits, recharges orwithdrawals through bank payment tools.