Trafikudvalget 2009-10

TRU Alm.del

Offentligt

post10

Ministry of Transport and Energy

Estimation of Revenues and Costs of differentScenarios of a HGV Charging System inDenmark

Final Report1.002.06.2006Report-Nr. 01 / MR/RYe/PMR

I-2

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

I-1

Table of Contents

Executive Summary12IntroductionApproach and MethodologyThe study has been conducted in 3 steps.Step 1: Scenario descriptionStep 2: Estimation of costs and revenues of the ScenariosStep 3: Evaluation of the Scenarios3High Level Description of the Scenarios3.1General3.1.13.1.23.1.33.1.4

113131313131314

3.2

3.3

Assumptions pertaining to all Scenarios17Legal status of the charge is a tax.17Vehicles subject to charge are HGV above 12 tonnes.18Tariff is modulated regarding the emission class.18Basically, the EFC system should able to differentiate in a further step regardingto the area/network or time of day183.1.5The charge depends on the number of axles in scenario 1A and B and on theregistered maximum permissible weight in scenario 2A and B183.1.6The scheme has to be compliant with NORITS (NORdic interoperable TollingSystem)193.1.7The scheme has to be EETS compliant.193.1.8The On Board Equipment (OBE) is mandatory.193.1.9It has to be a free-flow multi-lane tolling system.203.1.10 The central account is the master and comes with the only confirmed balance. 213.1.11 An anonymous use of the system is not possible.213.1.12 The driver and the vehicle holder share the liability regarding the HGV charge. 213.1.13 At the time of registration declared vehicle data are verified.213.1.14 The enforcement strategy will be based on a assessment of fraud.213.1.15 The OBE is in the ownership of the EFC operator.22Scenario Group 1: Charging of a Defined Road Network223.2.1Scenario 1A: Network Charging Using the GNSS/Cellular Network Technology 233.2.2Network Charging Using the DSRC Technology25Scenario Group 2: Area Charging273.3.1Scenario 2A: Distance Based Area Charging283.3.2Scenario 2B: Time Based Area Charging313434343536373737

4

Volumetrics4.1Road Network4.1.1Network charging4.1.2Area charging4.1.3Summary of network lengthsVehicle stock4.2.1Danish vehicles4.2.2Foreign vehicles

4.2

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

I-2

4.3

Traffic performance4.3.1Traffic counts4.3.2Odometer data4.3.3Estimation of traffic performance4.3.4Summary of traffic performance

383838394041414143434445464747484848484950505151515252535354545657

5

Issues Related to the Definition of the Road Network5.15.25.3Case of existing charging schemesSegmenting a non-motorway networkEquipping a non-motorway network5.3.1Case of physical gantries5.3.2Case of virtual gantriesIdentifying the chargeable networkDetour trafficFurther issuesSummary

5.45.55.65.76

Revenues6.1Approach to Revenue Estimation6.1.1Philosophy6.1.2Method6.1.3Road infrastructure cost allocated to HGV traffic by the COWI reportCost allocation for tariff calculation6.2.1Restriction to HGV > 12 tons6.2.2Restriction to chargeable network (scenarios 1A and 1B)6.2.3Exclusion of other charges levied on the ground of external costs6.2.4Inclusion of costs of charging system6.2.5Tariff calculationLimitation of tariff to trunk network levelEffective charging revenue6.4.1Traffic evasion6.4.2Unpaid charges6.4.3Enforced charges and penaltiesRevenues

6.2

6.36.4

6.57Costs7.2

7.3

7.4

7.1.1AssumptionsCapital Investment (Tender and Implementation Phase)7.2.1Charging Services7.2.2Enforcement Services7.2.3Central ServicesOperating Costs (Operational Phase)7.3.1Charging Services7.3.2Enforcement Services7.3.3Central ServicesCost Sensitivities7.4.1Cost sensitivity of number of tolling segments7.4.2Cost sensitivity of the number of permanent enforcement stations

575859596060606161626263

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

I-3

7.4.38

Cost sensitivity of OBE leakage - Cost Effect of EETS

63666666666668686969

Evaluation of the Scenarios8.18.2Key Figures at a GlanceBenchmarks8.2.1Benchmark figures of the four scenarios8.2.2Comparison with foreign HGV Charging schemes8.2.3Benchmark costs8.2.4Benchmark revenuesRisksConclusions and recommendations

8.38.4

Version History

VersionNumber0.10.20.30.40.50.60.71.0

Date26.01.0609.02.0602.03.0620.03.0630.03.0624.04.0631.05.062.06.06

Summary of ChangesDefinition of the structure of the document, initial draftRevision after a Rapp internal short reviewRevision and compilation of the draftInclusion of cost and revenue estimationRevision and compilation of the draft after workshop with TEMFinal editing and quality assuranceIntegration of comments from MTE from 19 mayFinal Report

AuthorsRYe, PMRRYe, MRRYeRYe, PMR,MRRYe, PMR,MRRYe, MRMR

AuthorsDr. Matthias Rapp, Project ManagerRobert YenDr. Peter M. Rapp

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

I-4

Definitions and AbbreviationsANPRASECAPBOTCENCESARECITSClearingCNDSRCEETSEFCGNSSHGVLOBULPNLSVANORITSOBEOBUOperatorRSERUCS&BTENTOBUTSPUserVASVATAutomatic number plate readingAssociation Européenne des Concessionnaires d’Autoroutes etd’Ouvrages à peageBuild, operate, transferComité Europeen de NormalisationCommon EFC System for ASECAP Road Tolling European SystemCentral IT SystemSettlement – Payment from issuer to operator for services provided bythe operator used by issuer’s customersCellular Network (e.g. GSM)Dedicated Short range CommunicationEuropean Electronic Tolling ServiceElectronic Fee CollectionGeographical Navigation Satellite System (e.g. GPS, Galileo)Heavy Goods Vehicle"Light" On Board UnitLicense plate numberSwiss heavy vehicle fee "Leistungsabhängige Schwerverkehrsabgabe"NORdic Interoperable Tolling SystemOn Board EquipmentOn Board UnitThe of the tolling systemRoad Side EquipmentRoad User ChargingSund & Baelt ASTrans European NetworkOBU for time based area chargingTransport Service ProviderThe person and/or the entity having an agreement with an operatorfor using the RUC liable road network/areaValue Added ServicesValue Added Tax

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

1

Executive SummaryThe Danish Ministry for Transport and Energy is investigating the possibilities of replacing theEurovignette with a distance based Heavy Goods Vehicle (HGV) charging scheme. Rapp Trans hasbeen assigned for estimating the financial effects on the costs and income of different EFC schemescorresponding to alternative charging scenarios. The work has been followed by an advisory groupwith representatives from the Ministry of Taxation, the Road Directorate and tolling experts fromSund&Bælt.The study has been conducted in 3 steps. In Step 1, four HGV charging scenarios have beendetermined and described based on the Client's task description. In Step 2, the financial estimateregarding the revenues and the infrastructural and operational costs of the scenarios was calculated inrelation to the traffic data and the defined tolling sections generated by the Danish Road Directorate.In Step 3, the scenarios have been evaluated and checked against benchmark figures from existingHGV charging schemes.4 Scenarios have been determined using two alternative technologies:Scenario Group 1: Network charging1A: Satellite positioning technology1B: Tag and beacon technologyScenario Group 2: Area charging2A: Distance charging based on Tachograph impulses2B: Charging based on driving time using motion sensorsScenario Group 1: Charging of a Defined Road NetworkHGV Charging on motorways and expressways can be done distance related or time based (i.e. daypass, monthly or yearly permit). This study only focuses on distance related network charging. It ispossible to execute distance charging by several available technologies.The road network should include :Roads with significant presence of HGV trafficRoads which offer alternatives to present itineraries if the present itineraries were subject tochargeRoads with important foreign HGV trafficRoads which connect the parts of the countryRoads which are a functional part of the international road network (European road namingscheme, Trans-European Road Network)Roads which complete the network to a whole connected entity.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

2

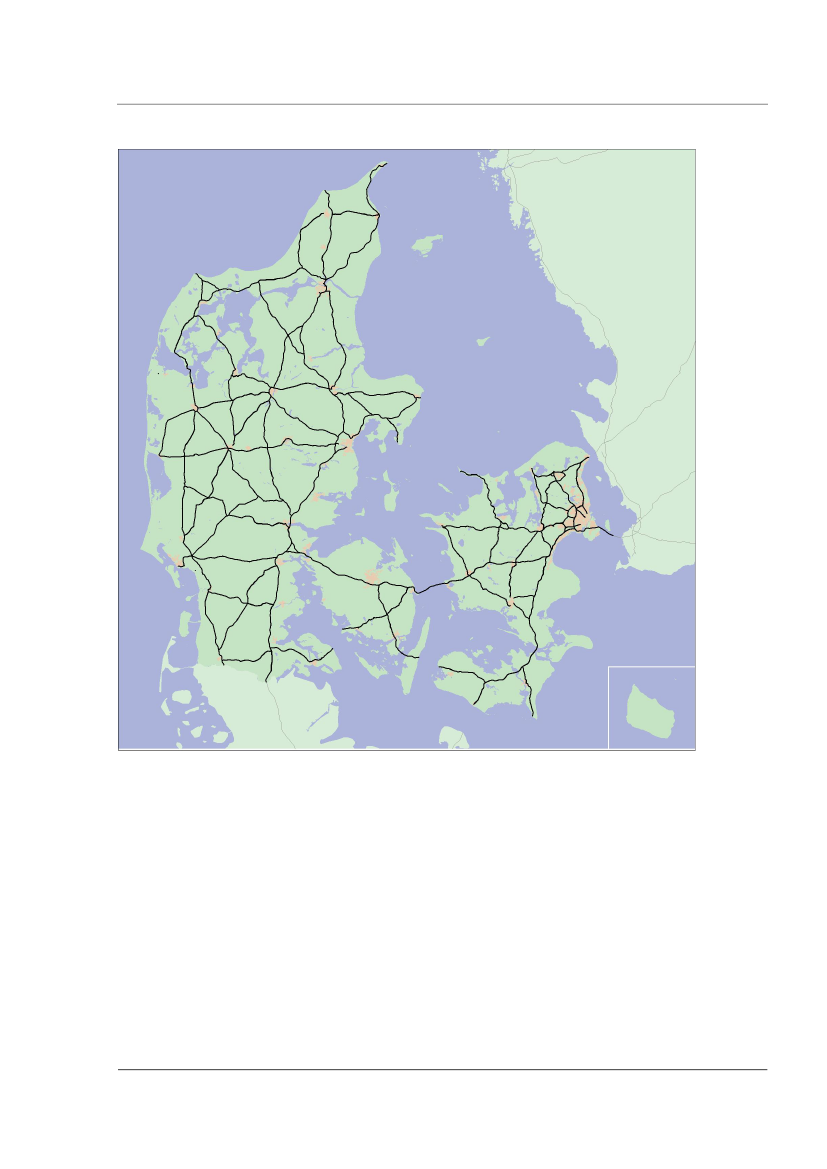

The Road Directorate, RD, is responsible for 985 km of motorways and Sund & Bælt for the 7 km longØresundsmotorway i.e. in total 992 km motorways. For the relevant road network approx. 2,500 kmof non-motorways are included, adding to a total of 3,500 km. The Greatbelt and Øresund links arenot a part of the relevant road network, since these links are already subject to fee collection.The inclusion of other roads than motorways into the network charging scenarios raises delicate issueswhich do not have proven solutions to this day, and which imply important reservations on theirfeasibility:Dividing a non-motorway network into chargeable segmentsPositioning of physical gantries on non-motorway network segmentsIdentification of the chargeable network by the userAvoiding detour traffic.

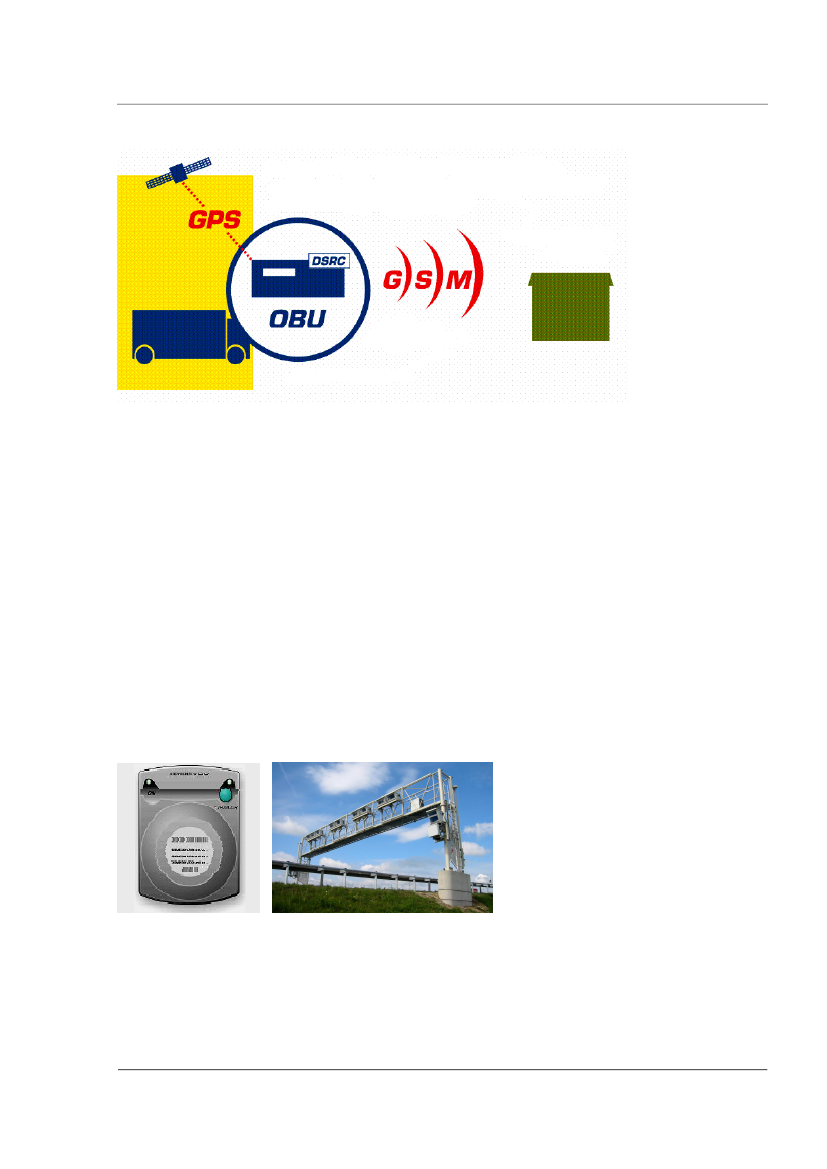

Scenario 1A: Network Charging Using the GNSS/Cellular Network TechnologyOne approved technology for network tolling is GNSS/CN. It uses two technologies adapted from otherapplications; namely, GNSS (Global Navigation Satellite System), whose satellites enable suitablyequipped vehicles to calculate their location accurately; and a two-way communication link (e.g.GSM/GPRS) based upon cellular telephone network. According to the position, the system recognises ifthe vehicle is driving on a toll road. In contrast to DSRC based systems GNSS/CN systems needpractically no roadside infrastructure. Due to the several limitation by using GNSS only (no GNSSsignal by shadowing effects, temporary system turn-off, etc.) the OBU is connected to or equipped byother sensors for localisation and distance measurement (tachograph, wheel sensors, gyrocompass,etc.).Two main designs of the overall system are technically possible. The one approach uses a high-endGNSS/CN OBU (so called “fat client”) which means all the intelligence for a single fee calculation isinside the OBU. This OBU transmits complete fee transaction data to a central system where they arecumulated and further processed for billing.This technology is operated by Toll Collect in the GermanLKW-Maut System. The other approach is a low-end GNSS/CN OBU (so called “thin client”). This OBUcollects only position data (GNSS position and time plus potential other sensors) and sends this to acentral IT system. Based on the position data received from the OBU the central system calculates thededicated fee. The map matching process and the tariff management run in the central system. Theinvestment and operating costs are much lower. This technology has been proposed by bidders in theUK Lorry Road User Charging project. Scenario 1A is based on the thin client architecture.Scenario 1B: Network Charging Using the DSRC TechnologyThe payment transaction takes place between an electronic On Board Units (OBU), which is fixed atthe windscreen of the car, and the toll road operator’s electronic road side equipment while the vehicleis in motion. The relevant information between the OBU and the roadside equipment is exchanged,using a standardised 5.8 GHz microwave communication. The DSRC technology implies that eachsection of a tolled road network is equipped by a beacon installed on a gantry. The OBU itself has asize of a credit card (but thicker) and has its own power supply (internal battery) with a lifetime of

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

3

usually 5 years. The cost savings of simple OBU come along with more extensive resources regardinginstallation of roadside equipment (gantries with DSRC beacons).Scenario Group 2: Area ChargingThis type of scheme applies to trips made within the borders of Denmark on all roads. Users of HGVwho wish to use their vehicles within Denmark would need to have an On Board Equipment whichmeasures distance or duration of vehicles usage. A key advantage for area charging is that there is noevasion of traffic to uncharged parallel roads. Main requirement of area charging is the existence ofwell defined borders with a limited number of border crossings. The charge in an area pricing schemeis assessed by the EFC operator based on the self-declaration of the vehicle holder. The OBU storesdefined events in a log file which is sent by the vehicle holder after the end of the declaration period tothe central service via chip card or via internet.For area charging, all roads on national territory are included:Motorways (Road Directorate)985Øresundsmotorway (Sund & Bælt)7Dual carriageways352Other roads70'872Total road network72'216kmkmkmkmkm

The Great Belt and the Øresund links (app. 40 km.) are excluded because HGV charging alreadyapplies on these links.

Scenario 2A: Distance Based Area ChargingThe approach of distance based area charging is implemented by means of a permanently built in OBUwith a connection to the vehicle’s tachograph. Additional sensors (GPS, gyroscope, motion sensors)supervise the correctness of the measurement of the OBU. This technology is applied by the Swissdistance related HGV charging scheme (LSVA). Foreign occasional users are provided with a light OBU(LOBU) without a connection to the tachograph. The driver has to enter the km reading of thetachograph manually into the LOBU each time he enters or exit Denmark. For reasons of practicabilityno modulation of tariff regarding the type of road and regarding the time of day is included in thescenario.Scenario 2B: Time Based Area ChargingDifferent to the distance based area charging the time based area charge is based on the time periodduring which the road network in Denmark is used. A low-cost TOBU (Time based area charging OBU)is used containing a conventional 5.8 GHz DSRC tolling tag, a clock, vibration sensors capable ofdetermining whether the engine is switched on or off, and accelerometers capable of determiningwhether vehicle is moving or stationary. The TOBU logs the time when the vehicle is moving insideDenmark. A chip card or a USB stick is used for downloading the log file and the user declares hischarging parameters by sending in the chip card or via the Internet. With appropriate roadsideinfrastructure at the area boundary the charging data can also be automatic transmitted to theCentral System when a vehicle is entering and leaving Denmark. The key advantage of the time basedapproach of this scenario is that the TOBU is autonomous and can be self-mounted in the same way as

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

4

the DSRC tags of Scenario 1b. Therefore, there is no need for an manual declaration scheme for non-equipped users as in scenario 2A.VehiclesThe Danish vehicle stock is known through the car register. The following figures are from 2005.Lorries above 6 t gross weightSemitrailer trucks30'71013'021

Out of the 30,710 lorries above 6 tons, 28,640 are assumed to be above 12 tons. This ratio istransposed from the statistics on traffic performance per vehicle weight class. With these assumptions,the total Danish vehicle stock above 12 tons is 41,660.The relevant figure is the number of different foreign vehicles who use the Danish network within agiven period of time. These vehicles are cost-relevant since they need to be equipped with an OBUwhen they come into contact with the EFC system for the first time. No statistics are available on thissubject. Based on estimates from Sund & Bælt and the Danish Ministry of Transport and analogiesfrom HGV charging schemes in Austria and Switzerland the estimate is 100,000 different foreignvehicles per year, with a renewal rate of 30 % per year.Traffic performanceDepending on the scenario, the revenue-relevant figures are:Total distance travelled (vehicle-kilometres),Total driving time (vehicle-hours).

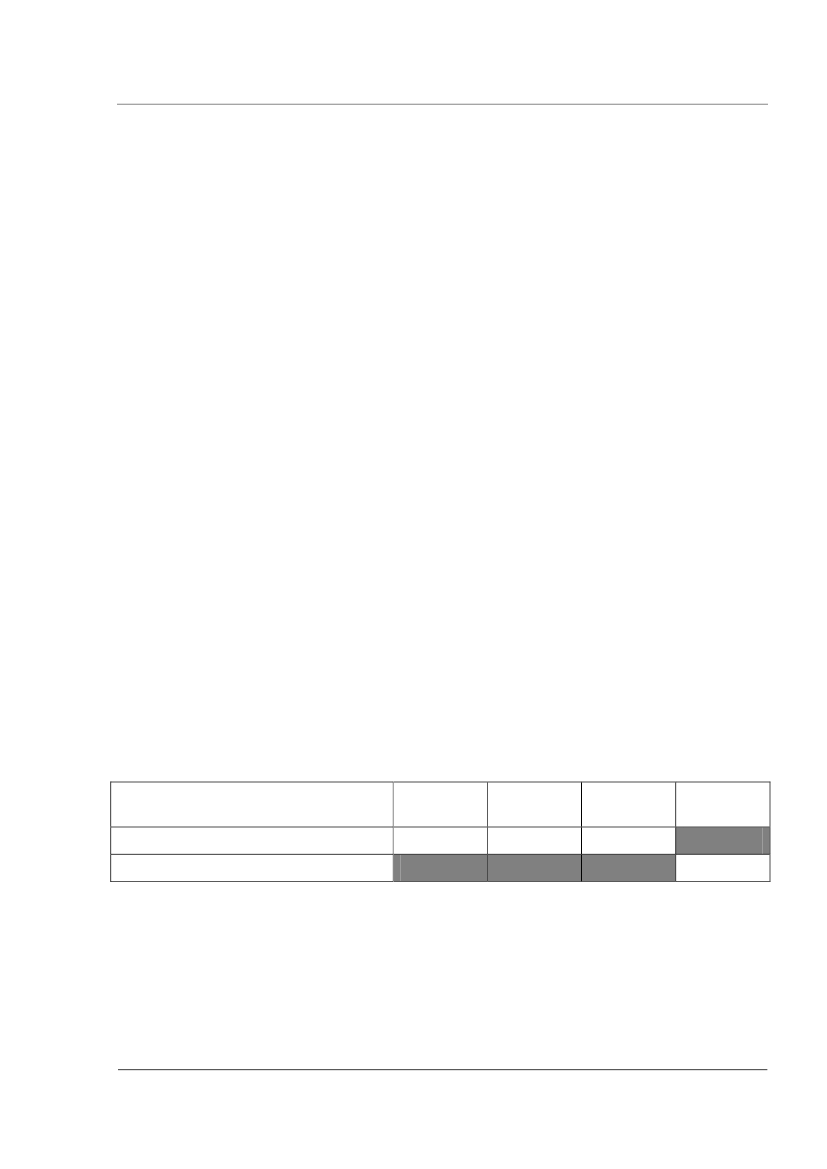

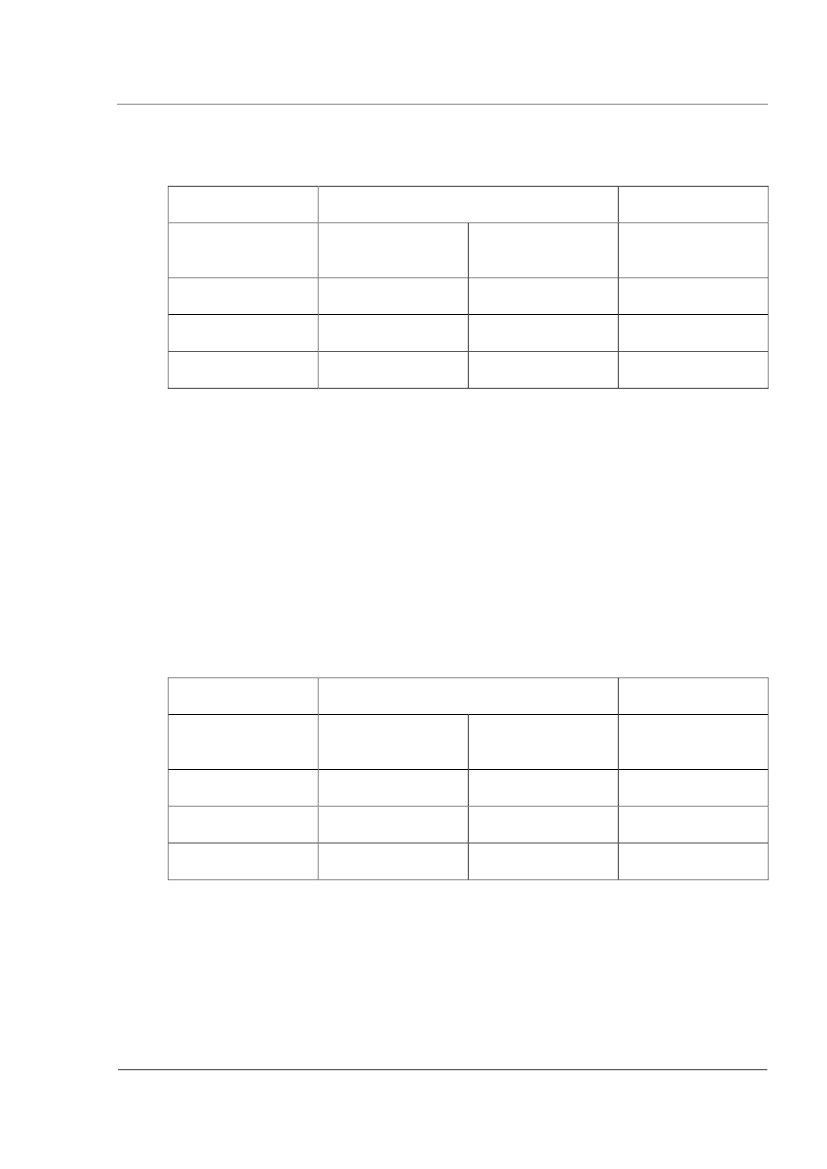

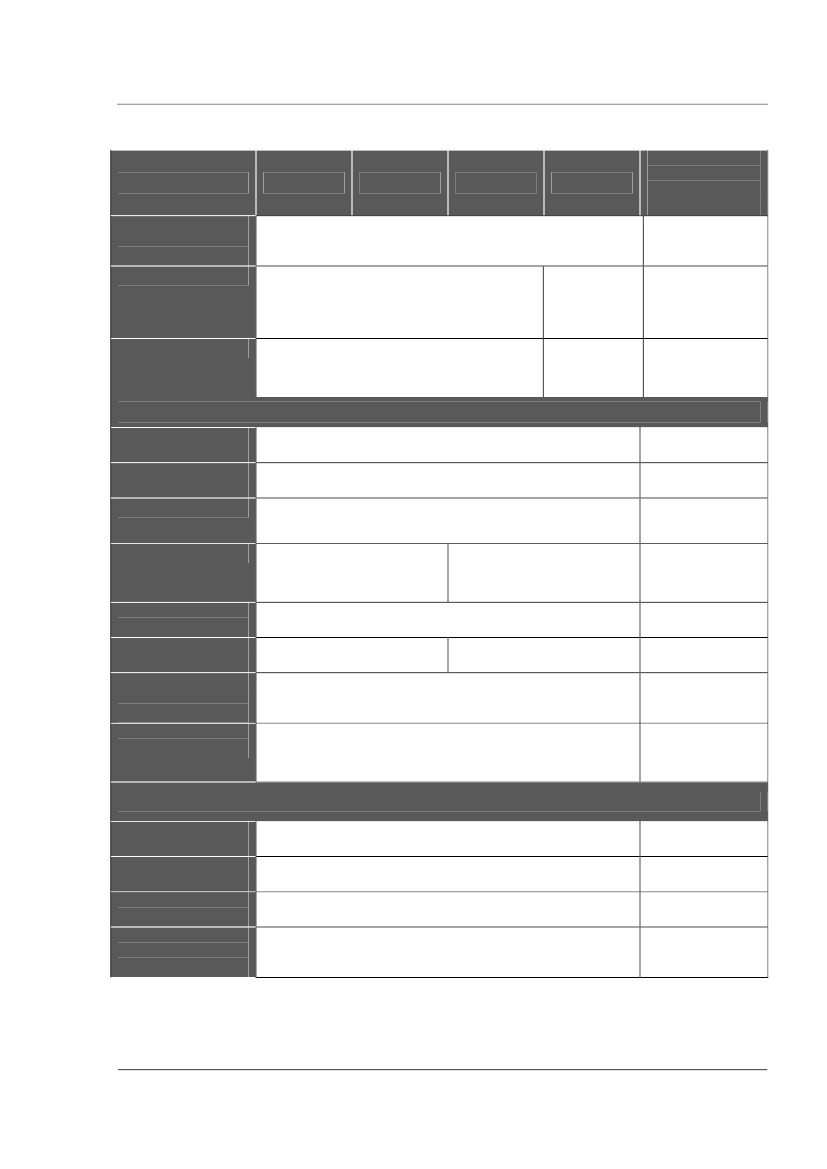

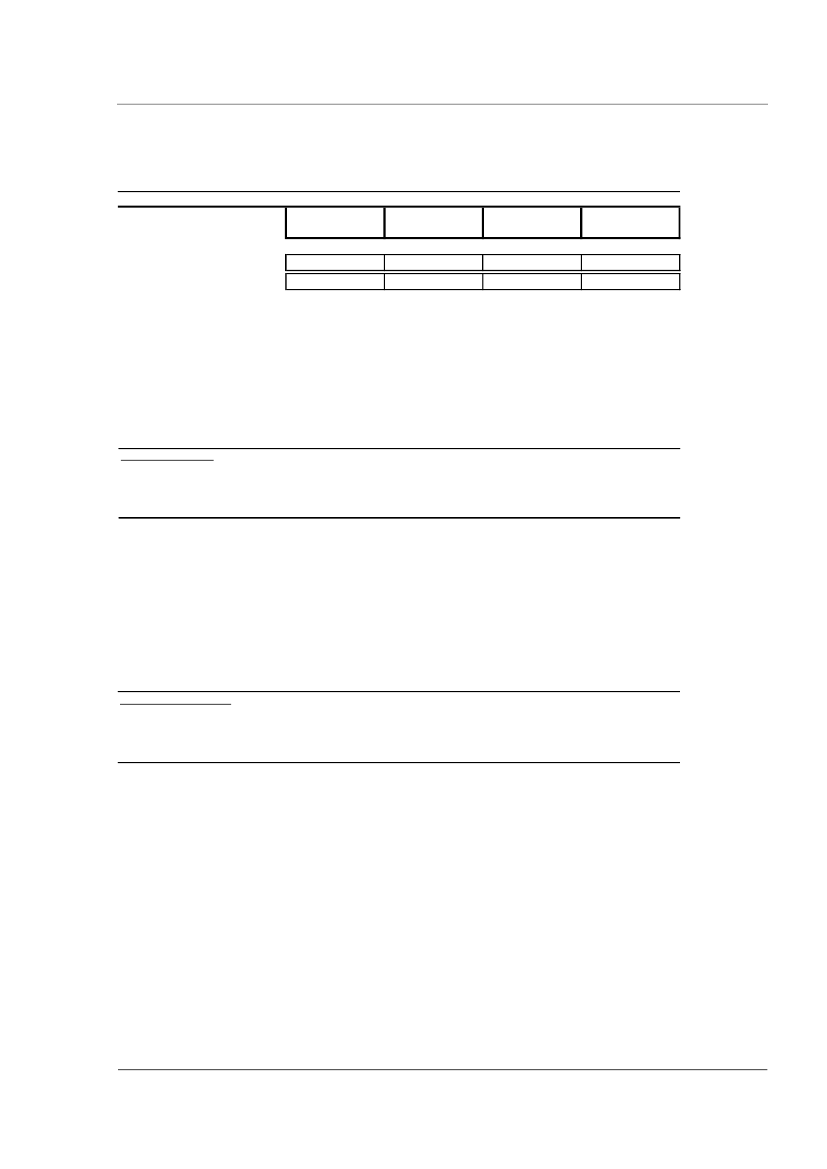

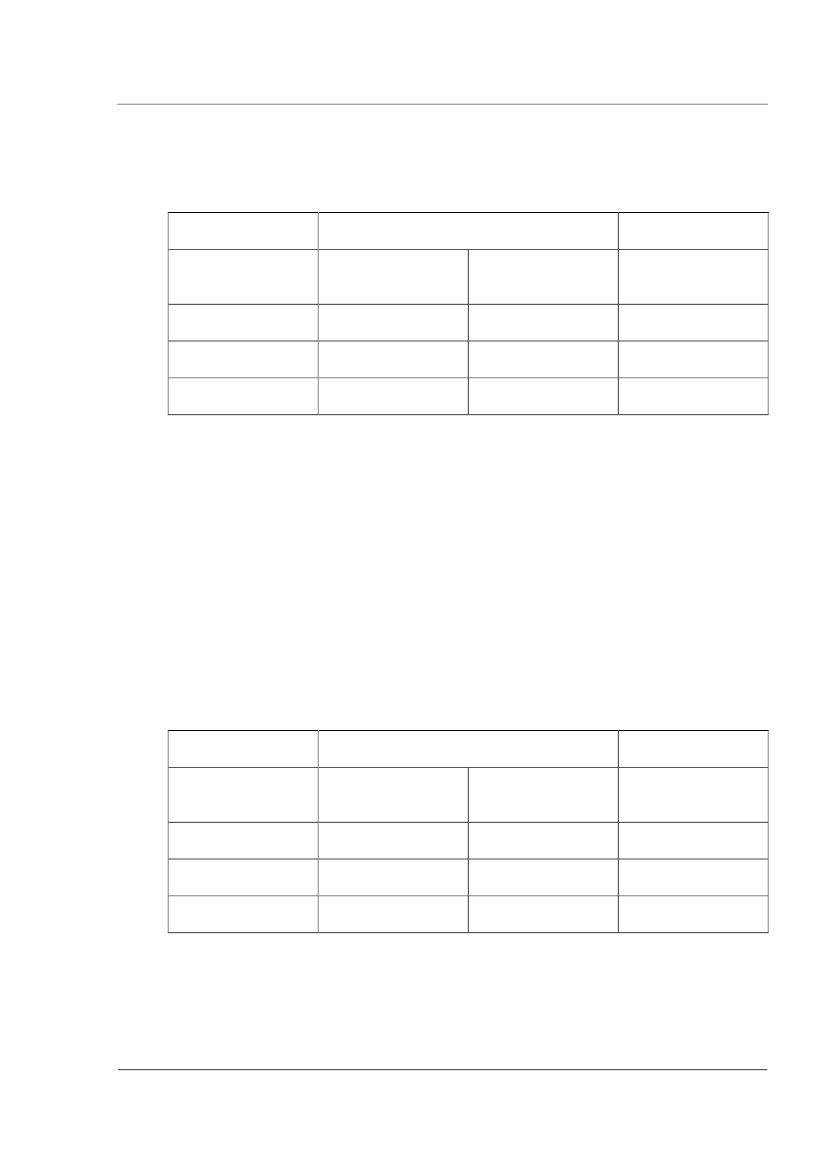

The Danish Ministry of Transport has provided an estimate of the total distance travelled by HGVabove 12 tons on the network on state roads and former county roads. Using extrapolations, and aconversion from total distance to total driving time based on assumptions of average speed, theresulting estimate is indicative of the order of magnitude.Traffic performance per year[million veh-km or million veh-min]Vehicle-km on chargeable roadsVehicle-minutes on chargeable roads1A1'6601B1'6602A2'4063'0202B

RevenuesThe revenue to be raised by the HGV charging scheme is intended to account for a determined shareof the external cost of road transport in Denmark in accordance with the approach of the Amendment

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

5

of the Eurovignette directive 1999/62/EC, which aims at a fair allocation of road transport costs totransport operators.1The estimated infrastructure cost allocated to HGV traffic are taken from a report from COWI.2It mustbe noted that the figures from the COWI report are being used without having been produced for thatpurpose. Therefore, the toll levels calculated in the present study are subject to some uncertainty andmust be studied further in a next step.The maximum potential revenue of the HGV charging scheme is assumed to be equal to theinfrastructure cost allocated to HGV which according to COWI is 2'733 million DKK per year forHGV>6t. If the cost allocation is limited to HGV >12 t it is 2'460 million DKK per year. By furtherrestricting the cost allocation, for each scenario, to the road network concerned and by adding thecosts of the charging system itself3, the total costs that can be allocated for each scenario aredetermined. For network charging, the tariff is determined by dividing the potential revenue by theannual kilometres driven on the network. For area charging, the tariff is limited to the tariffcorresponding to the Eurovignette approach on the trunk network. The effective revenue of thescheme is computed by taking the adjustments for traffic evasion and for non-payment of due chargesinto account, and by adding the revenue of enforced charges and penalties. These adjustments arescenario-dependent.

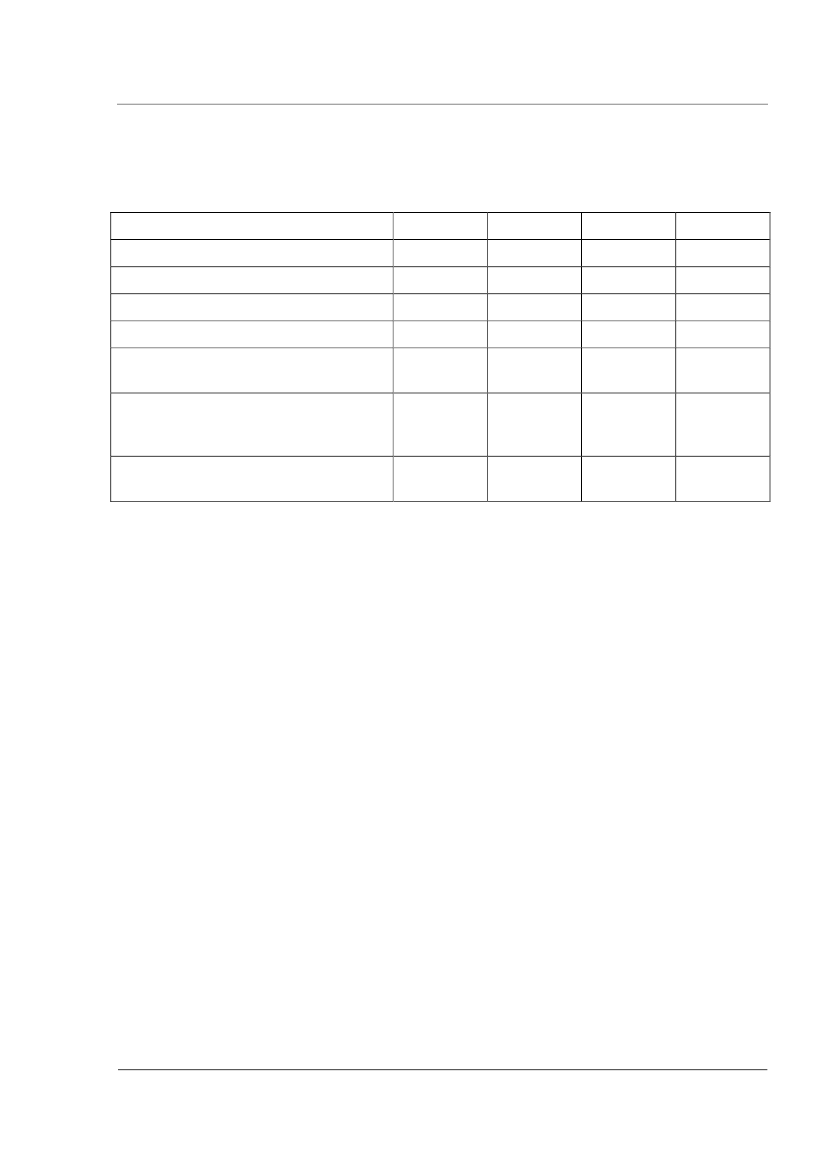

Revenue Summaryin million DKK/yearinfrastructure cost HGV>12 t assigned tochargeable networkcosts of HGV charging systemtotal assignable costsaverage tariff in DKK/veh-kmaverage tariff in DKK/veh-hourRevenue before adjustments based onaverage tariffAdjustments for charge evasion andpenaltiesEffective Charging RevenueScenario 1A Scenario 1B Scenario 2A Scenario 2B

9844861'4700.891'470-601'410

9845341'5170.911'517-611'456

2'4603992'8580.89

2'4603282'78741.31

2'126212'148

2'074212'094

1

Directive 2006/…/EC amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use ofCOWI, "Total external costs of road and rail transport in Denmark", 3rd Report, July 2004conformant to Annex II of the Directive 2006/…/EC amending Directive 1999/62/EC

certain infrastructures, PE-CONS 3682/05 (6 March 2006)23

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

6

CostsThe cost estimations are based on the following general assumptions:41,660 Danish vehicles above 12 t maximum permissible weight per year100,000 foreign vehicles above 12 t maximum permissible weight per yearon average: Every 12thtoll section is an enforcement section

Scenario-specific assumptions:Scenario 1A and 1B:1,571 toll sections430 points of sales20% OBU leakage per year for DSRC-OBU and GPS-OBU

Scenario 2A:18 system entry points (border crossing stations)90 points of sales6% OBU replacement per year of fixed mounted OBU30% OBU leakage per year of LOBU

Scenario 2B:18 system entry points (border crossing stations)90 points of sales20% OBU leakage per year for time based OBU

For all scenarios, it is assumed that all vehicles registered in Denmark and all foreign HGV travelling inDenmark must be equipped with an OBU. Potential cost savings from interoperability are not includedin the estimates.It is assumed that the EFC system is procured under a BOT arrangement. The capital investmentincludes the whole costs of the tender (12 months) and the implementation (18 months) phase as wellas the costs for external consulting within the first 6 months after start of operation.The investment and implementation costs include:Charging serviceson board equipment (OBU, LOBU)roadside equipment (gantries and beacons)integration of existing toll stations

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

7

Enforcement servicesfixed roadside enforcement stationsportable enforcement stationsmobile enforcement unitsbeacon and enforcement ITCentral servicespoints of sales, including POS softwarecentral IT systemcentral back officetest equipmenttraining equipmentpre sale activitiesmarketing and information incl. call centerproject management

The operating costs include:human resources costs Management Authorityhuman resources costs Service Providernew on board equipment (OBE leackage and system growth)maintenance costs (on board equipment, road side equipment, enforcment equipment, POS)IT maintenance and support, programme licencesmaintenance of test and training equipment

The costs per year include the operating costs plus the amortisation of the investments. Theamortisation costs are based on the estimated lifetime of the components. No interests or otherfinancing costs are included.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

8

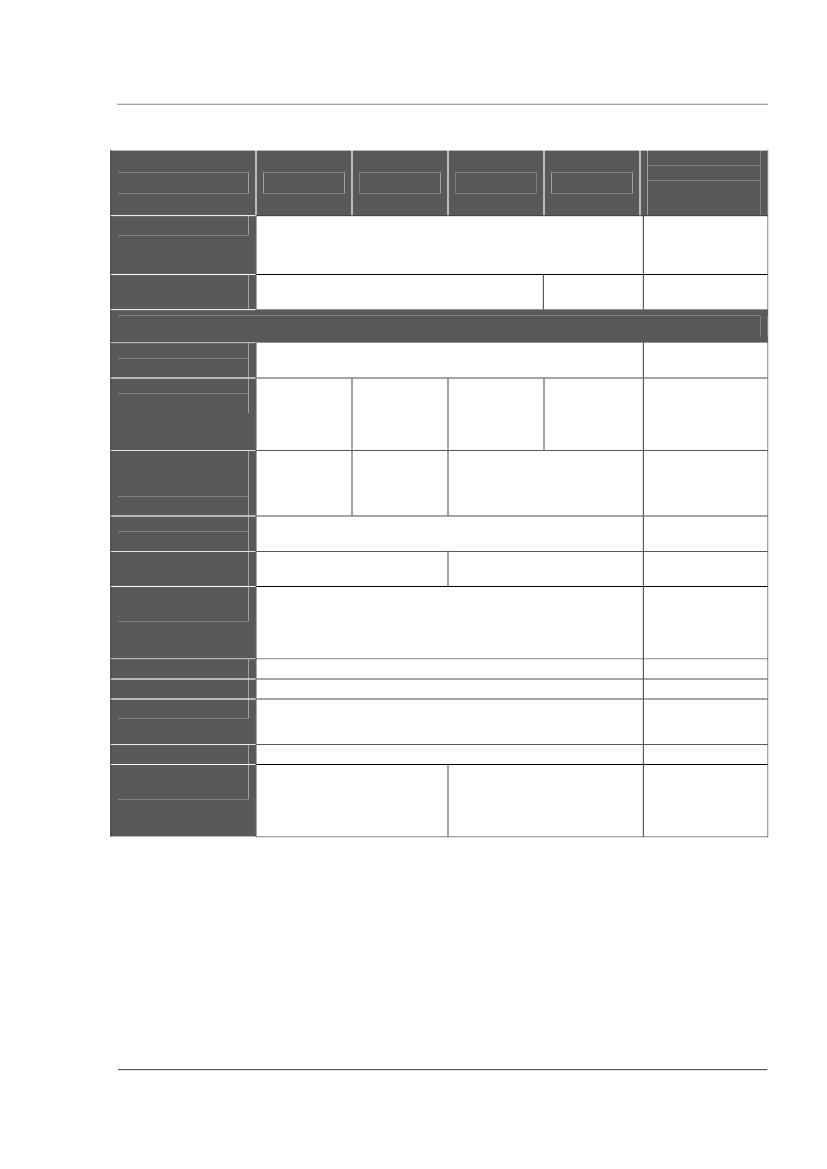

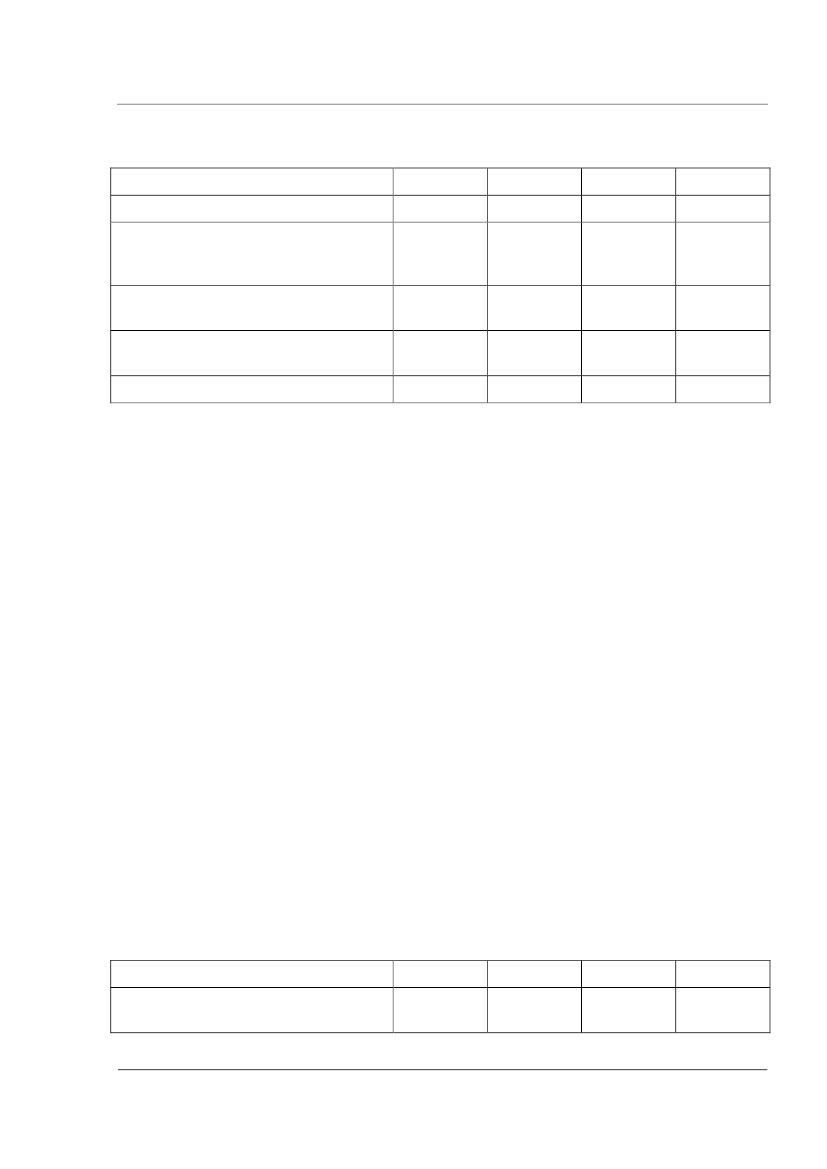

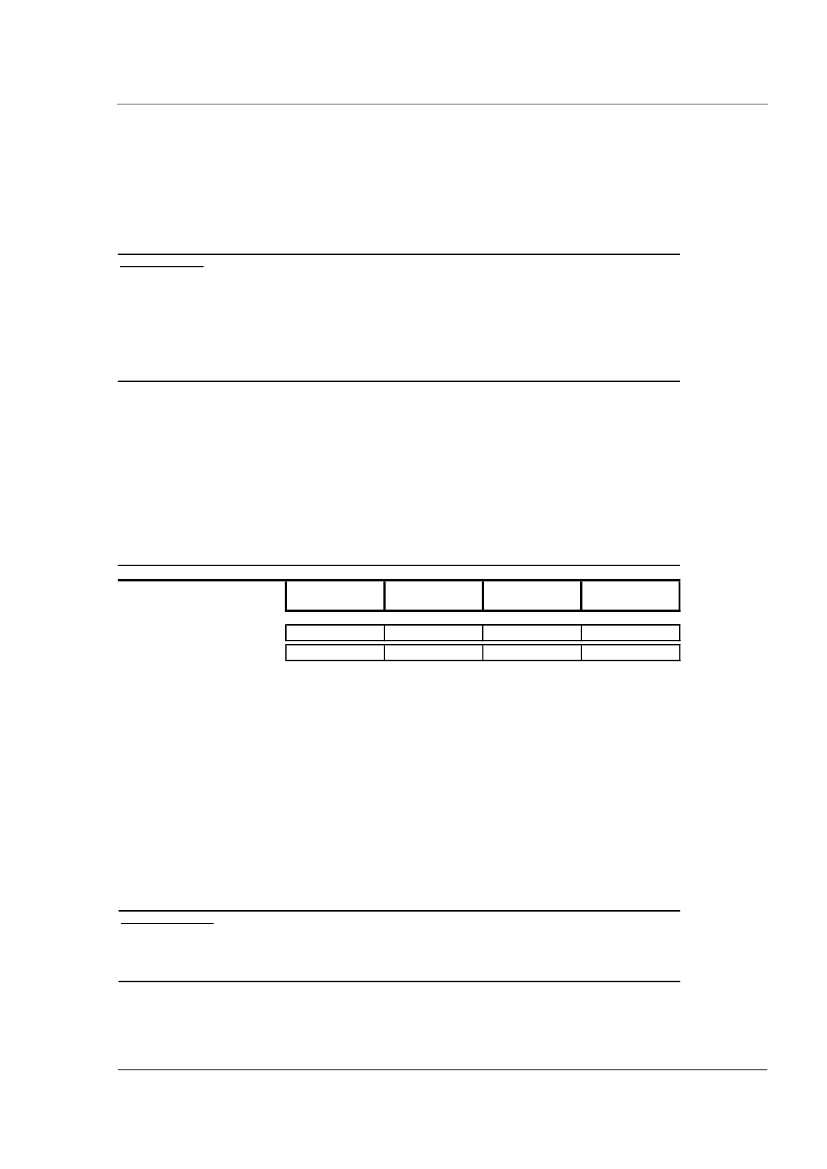

Cost SummaryCapital investments and implementation costsin million DKKcharging servicesenforcement servicescentral servicesTotal investment costsScenario 1A3502914351'076Scenario 1B1'9412884592'688Scenario 2A24260420723Scenario 2B85127406618

Costs per yearin million DKK/yearcharging servicesenforcement servicescentral servicesTotal costs per yearScenario 1A136182167486Scenario 1B197181155534Scenario 2A64138196399Scenario 2B26154147328

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

9

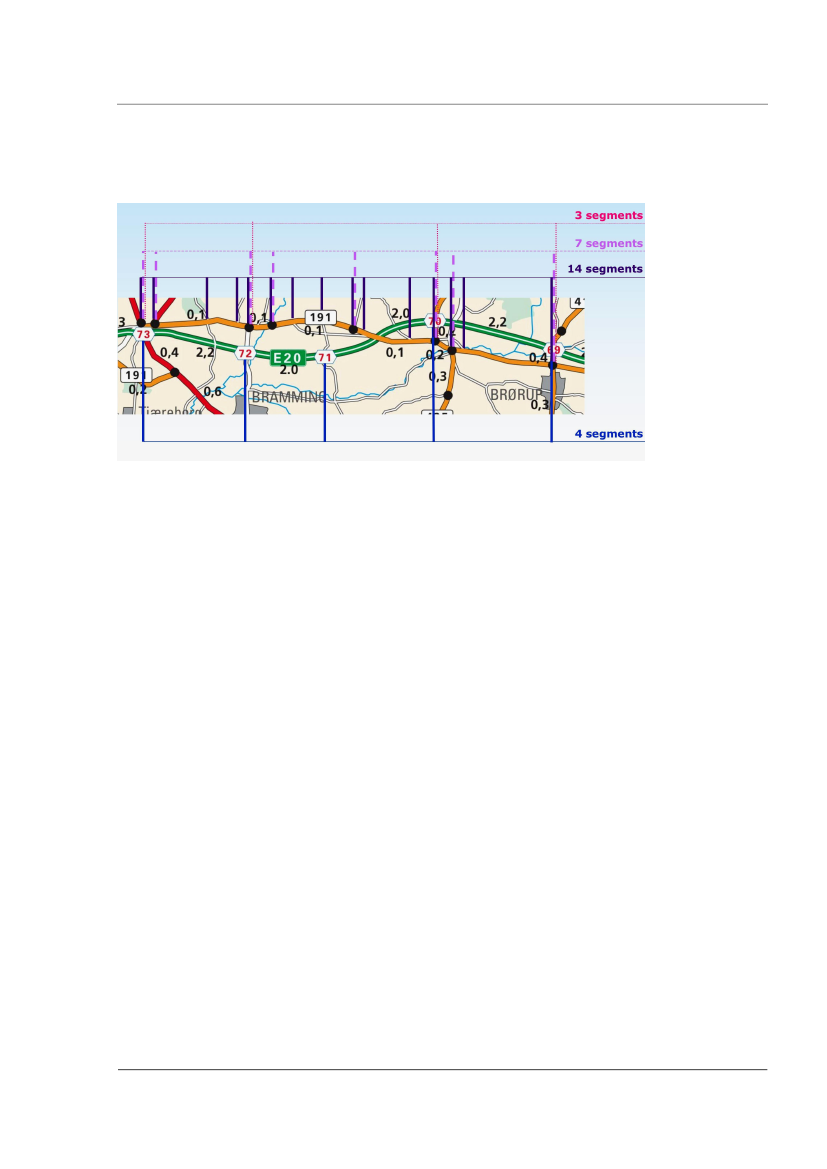

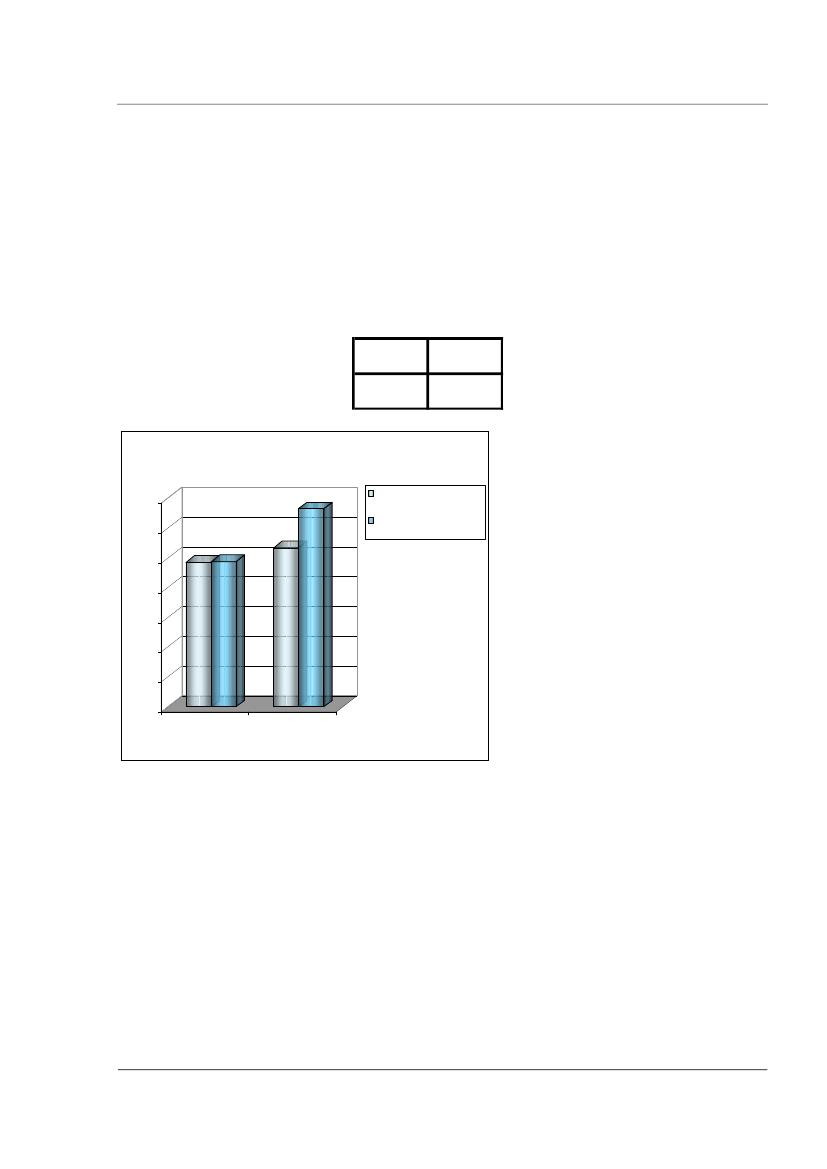

Sensitivity analysisSeveral sensitivity analyses have been conducted. They show the following:Gantry density: the cost estimates are based on the assumption that the average segmentlength on the non-motorway network is 4.4. km similar to the motorway network. If thenumber of segments is doubled, the total annual cost of Scenario 1A remain approximately thesame whereas they increase in Scenario 1B by 24%.If the density of enforcement stations is increased from 1 enforcement gantry out of 12gantries to 1 enforcement gantry out of 7 gantries the total annual costs increase for Scenario1A by 6% and for Scenario 1B by 4%.The OBU leakage (= percent of new OBUs that must be issued to occasional users) is assumedto be significantly less with the HGV charging schemes in Austria and Switzerland due to amore stable clientele of foreign trucks passing through Denmark. If the leakage ratios werethe same than in Austria and Switzerland, Scenario 1A would become significantly moreexpensive (75% increase of OBU cost, 8% increase of total annual cost). The other scenariosmuch less sensible to OBU leakage.

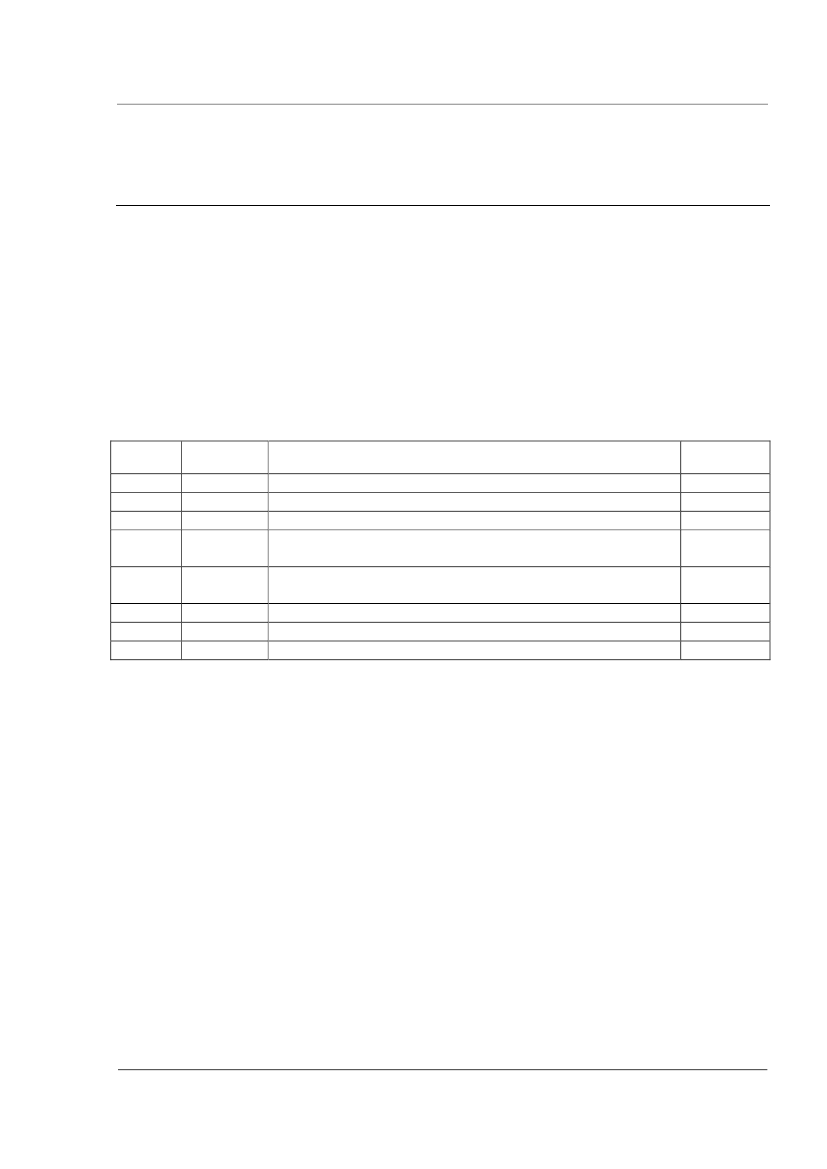

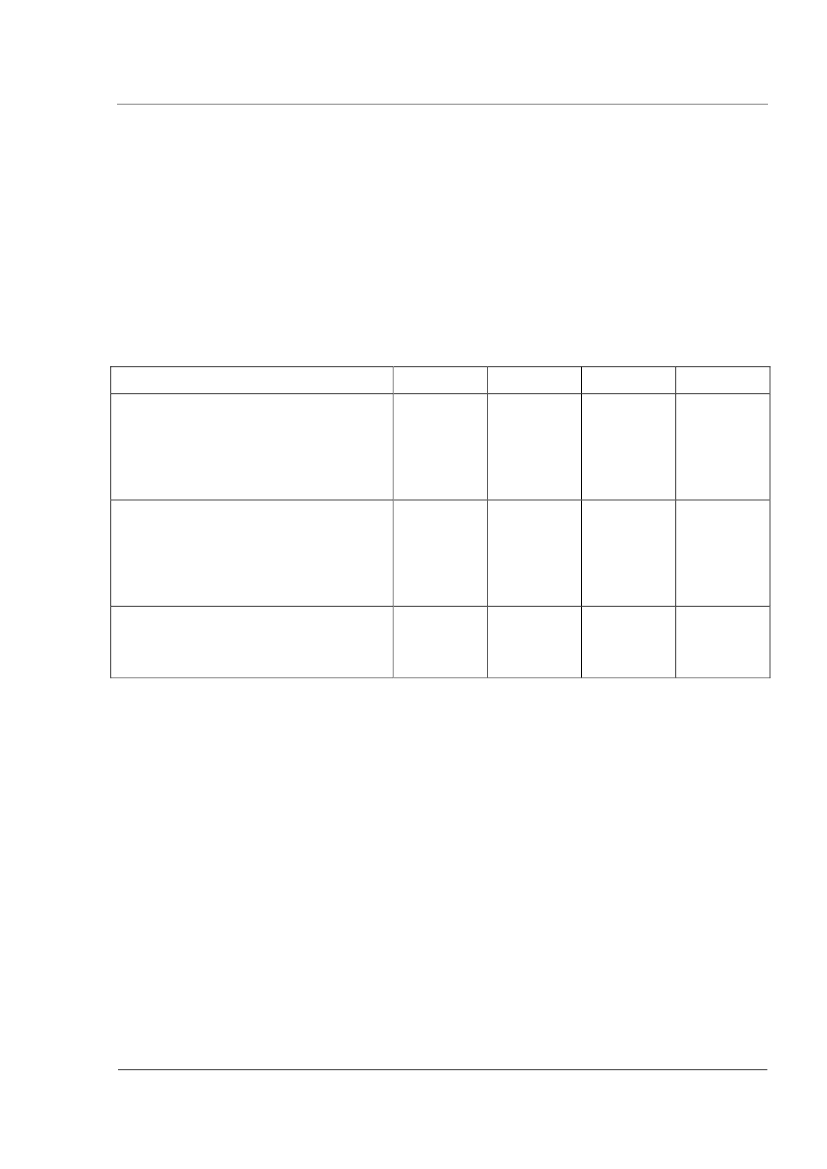

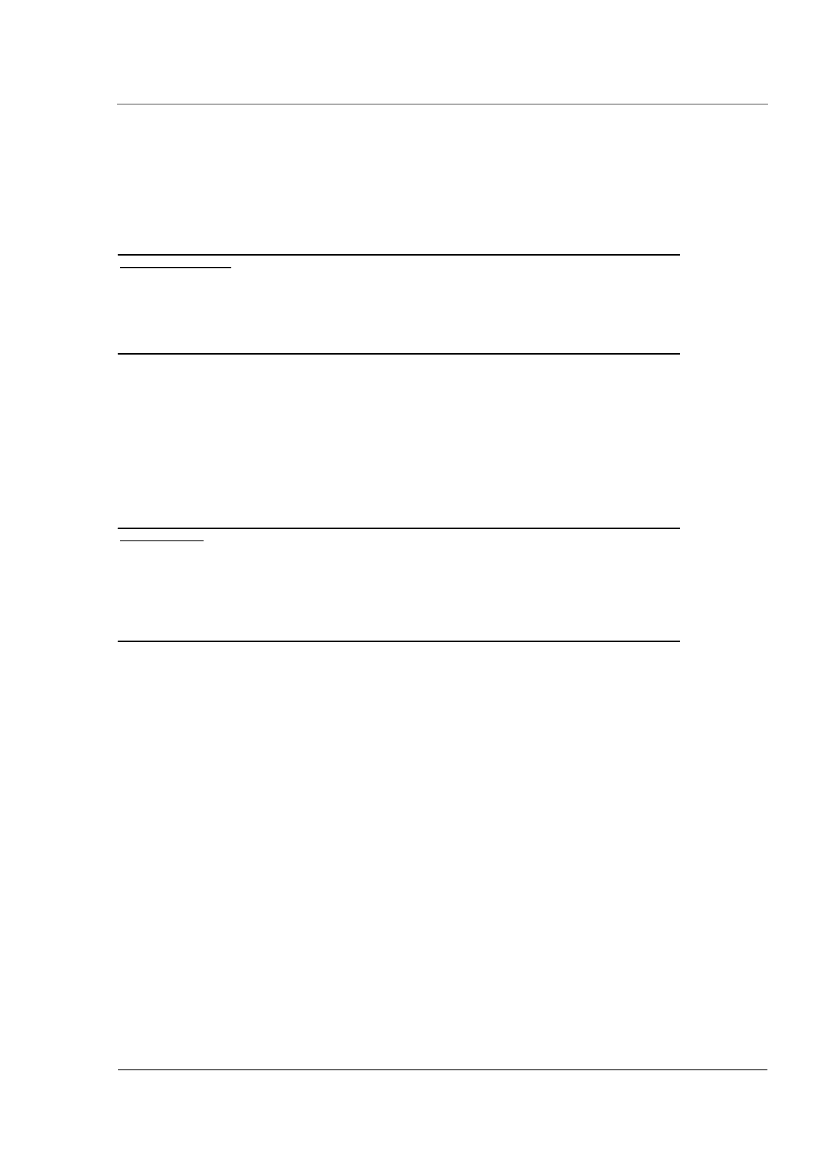

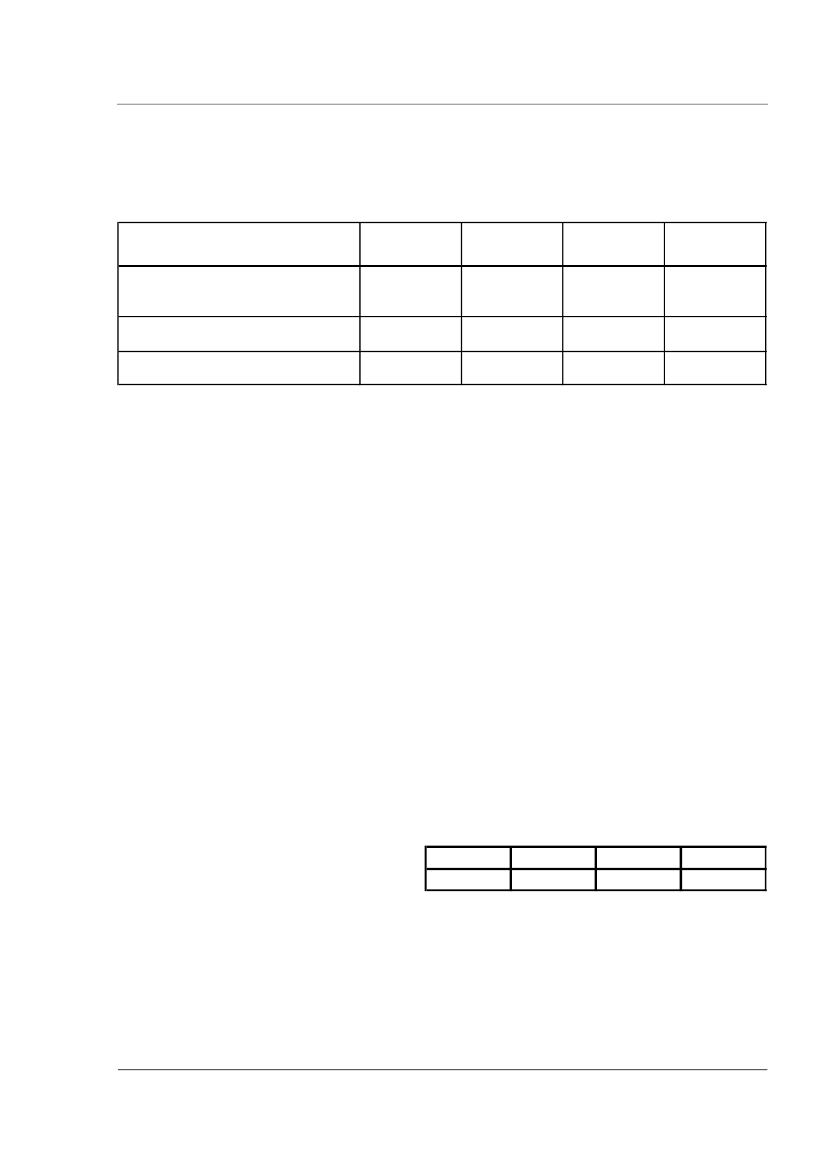

BenchmarksScenario 1A Scenario 1B Scenario 2A Scenario 2BVehicle kilometers per year (mio km)Total costs per year in mio. DKKEffective charging revenue per year in mio DKKEffective charging revenue per vehicle kilometer inDKKTotal costs per vehicle kilometer in DKKNet revenue per vehicle kilometer in DKK1'6604861'4100.850.290.561'6605341'4560.880.320.562'4063992'1480.890.170.732'4063282'0940.870.140.73

All scenarios show that an important part of the revenues are consumed by the operating costs. Thearea charging scenarios show significantly lower charging system costs and higher revenues than thenetwork scenarios.In addition to comparing the scenarios against each other, the cost and revenue estimates of thescenarios 1A, 1B, and 2A have been benchmarked against figures from the functionally correspondingHGV charging schemes in Europe.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

10

Benchmark costs:ScenarioEFC Costs per vehicle kilometreDenmarkDKK1A1B2A0.290.320.17Foreign schemeDKK0.200.220.23Country

GermanyAustriaSwitzerland

The reasons for the comparatively higher costs of the network schemes in Denmark are:compared to Germany: scale effects with the Danish scheme being much smaller. The highOBU costs penalise the comparatively small territory of Denmark because much lesskilometers are registered per OBU than in Germany.compared to Austria: inclusion of the non-motorway segments. If the Danish scheme wasreduced to motorways only, the DSRC gantry infrastructure costs would be significantly lower.

Compared to the LSVA scheme in Switzerland the Danish scheme compares favourably due to the factthat Denmark has only very few system entry points (18 in Denmark versus 120 in Switzerland).Benchmark revenues:ScenarioNet revenue per vehicle kilometreDenmarkDKK1A1B2A0.560.560.73Foreign schemeDKK0.741.863.05Country

GermanyAustriaSwitzerland

The network scenarios compare unfavourably with the motorway HGV charging schemes in Austriaand Germany. The reasons are the relatively low tariffs of the Danish system (based on lowinfrastructure costs that can be attributed) and the comparatively smaller HGV traffic volume than themotorways-only networks in Germany and Austria. The benchmark with the Swiss LSVA shows thatthe Swiss have a much higher tariff yielding a significantly higher net revenue despite the higher costof their system.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

11

The benchmarks are a result of the assumptions on which the Danish study is based. Theseassumptions need to be reviewed in further studies. The present estimates give correct orders ofmagnitude.RisksIntroducing a nationwide EFC system for HGV charging carries high risks. In Germany, theintroduction of the scheme was delayed by 15 months, and in the UK the implementation of the LorryRoad User Charging scheme has been halted. On the other hand, the schemes in Switzerland andAustria went life on time and are running smoothly.The major risks are:political risk of implementing a system without the necessary acceptance from the hauliersand the publicmaking the system too complex with functional requirements that are too demanding. Suchrequirements could be:differentiating road types other than all motorwaysdifferentiating time of day or traffic conditionsdifferentiating vehicle categories that cannot be easily detected by automatic road sideequipment (e.g. exempting HGV or special tariffs on the ground of trip purpose)complex repayment or rebate schemesmixing added value services with a tax-like charging systemrelying too much on technology to meet complex functional requirements and therebyneglecting usability aspects (e.g. unpractical fall-back options in case of equipment failure)relying too much on the industry to come up with answers instead of clear functionalspecifications and a firm leadership from governement.insufficient experience of industry operating a tax-like systemlegal challenges of the system if the scheme is inequitable for some user groupslack of interoperability with the future EETS (whatever the EETS specifications may be)unwanted traffic reactions such as detour traffic or HGV parking problems at POS.

Conclusions and recommendationsThe results of the present study must be interpreted with caution. The costs are based on those of EFCsystems that were procured some time ago reflecting the particular competitive prices of the particularsituation. The revenues rest on assumptions regarding the infrastructure costs that could be allocatedto HGV>12t on different networks based on figures of a study which has not been produced for thisparticular purpose. Nevertheless, the results certainly indicate a probable order of magnitude and theyallow to show the trends between the different scenarios.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

12

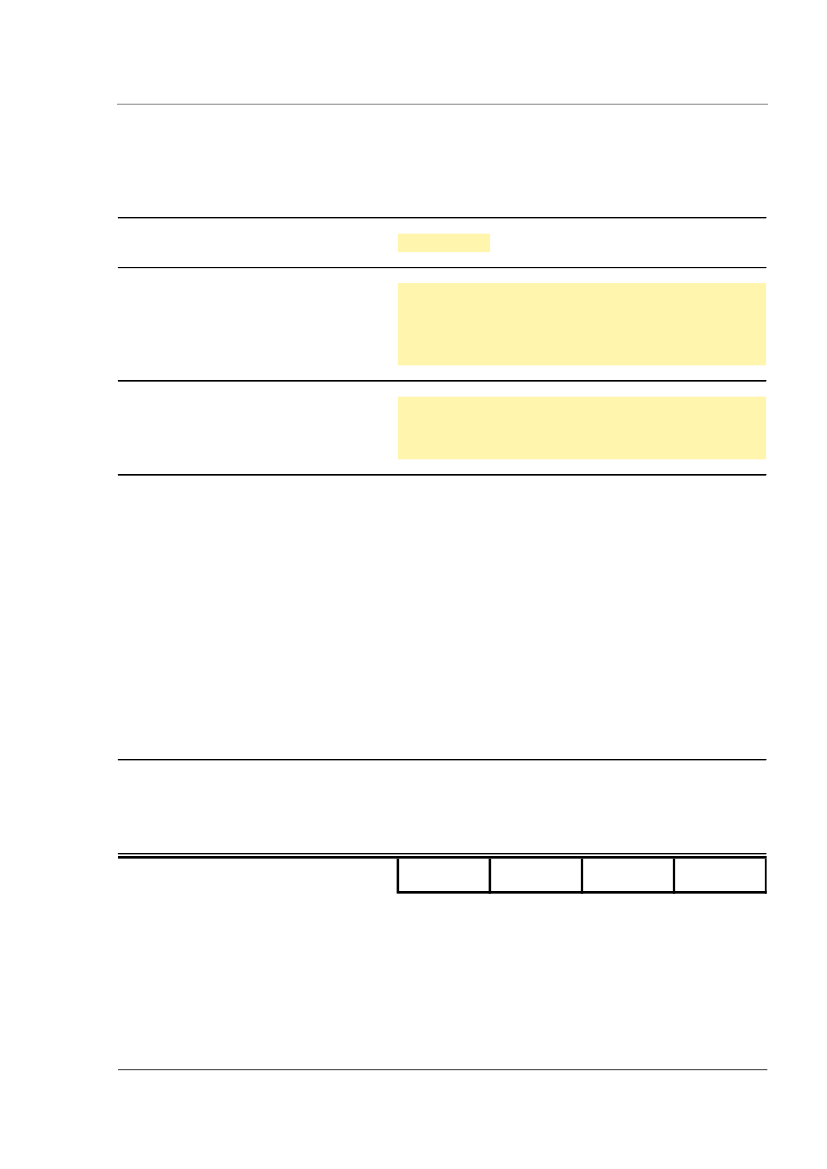

Key figures of the scenarios:

Scenario 1A Scenario 1B Scenario 2A Scenario 2Bin million DKK in million DKK in million DKK in million DKKEffective Charging RevenueCosts per yearNet Revenue per yearCosts in % of effective chargingrevenue1'41048692434%1'45653492237%2'1483991'74919%2'0943281'76716%

Under the present assumptions none of the scenarios show a satisfying cost effectiveness. Thereasons arethe low tariff resulting from the comparatively low infrastructure costs upon which thepotential charging revenues are based, andfor the network charging scenarios the extent of the network resulting from the inclusion of alarge part of the trunk roads. Including non-motorways is particularly penalising for the DSRCtechnology.the assumption, that all HGV travelling in Denmark must be equipped with a Danish OBU andthere are no cost savings from interoperability.

The situation regarding the European Electronic Tolling System (EETS) is yet too unclear for allowingto estimate the cost effects in the present study. We recommend to review the estimates as soon asthe EETS specifications have been settled by the relevant European bodies. The cost reduction frominteroperability is likely to be the highest with scenario 1A.Notwithstanding possible interoperability benefits in Scenario 1A, the area charging scenarios arelikely to remain significantly more cost-effective than the network scenarios as long as non-motorwaysare included. The geography and network topology of Denmark favour area charging over networkcharging more than in any other European country.It is difficult to answer the question if the cost difference of 18% between driving time related areacharging and distance related area charging is big enough to engage in a discussion for this entirelynovel approach to road user charging with the EU. We assume that the debate on the subject ofdriving time related charging will rather be taken up for light vehicles than for HGV.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

13

1

Introduction

The Danish Ministry for Transport and Energy is investigating the possibilities of replacing theEurovignette with a distance based HGV charging scheme. Rapp Trans has been assigned forestimating the financial effects on the costs and income of different EFC schemes corresponding toalternative charging scenarios. The work has been followed by an advisory group with representativesfrom the Ministry of Taxation, the Road Directorate and tolling experts from Sund&Bælt.The assignment is described in the “Task description concerning the preparation of a financial estimatefor the implementation and operation of an electronic system for the collection of road tolls for HGVs(Heavy Goods Vehicles) in Denmark”. The project has been started 23 January 2006 and the targetdate was end of April 2006 when the draft final report was delivered.To have a realistic estimation of costs Rapp Trans has used confidential data from other schemesoriginating from operators and industries. Therefore, the detailed calculations cannot be published butare part of the confidential annex. The summary figures of the cost and revenue estimations are partof this report and can be published.

2

Approach and Methodology

The study has been conducted in 3 steps.Step 1: Scenario descriptionBased on the “Task description concerning the preparation of a financial estimate for the implement-tation and operation of an electronic system for the collection of road tolls for HGVs (Heavy GoodsVehicles) in Denmark”4four scenarios have been determined and described. The characteristics of thescenarios were further developed and discussed in detail in the first Workshop with the Working Groupof the Danish Ministry of Transport and Energy.Step 2: Estimation of costs and revenues of the ScenariosIn relation to the traffic data and the defined tolling sections generated by the Danish RoadDirectorate, the financial estimate regarding the revenues and the infrastructural and operationalcosts of the scenarios was calculated. The costs are structured into the following groups:

Charging ServicesEnforcement ServicesCentral Services

Step 3: Evaluation of the ScenariosThe financial evaluation of the scenarios is based on benchmarks. The key benchmark figure used isthe total EFC system costs per vehicle kilometres travelled on the charged network by chargeablevehicles.The evaluation includes a risks and issues list for each of the four scenarios.

4

Sund & Bælt, Note dated 21 December 2005

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

14

3

High Level Description of the Scenarios

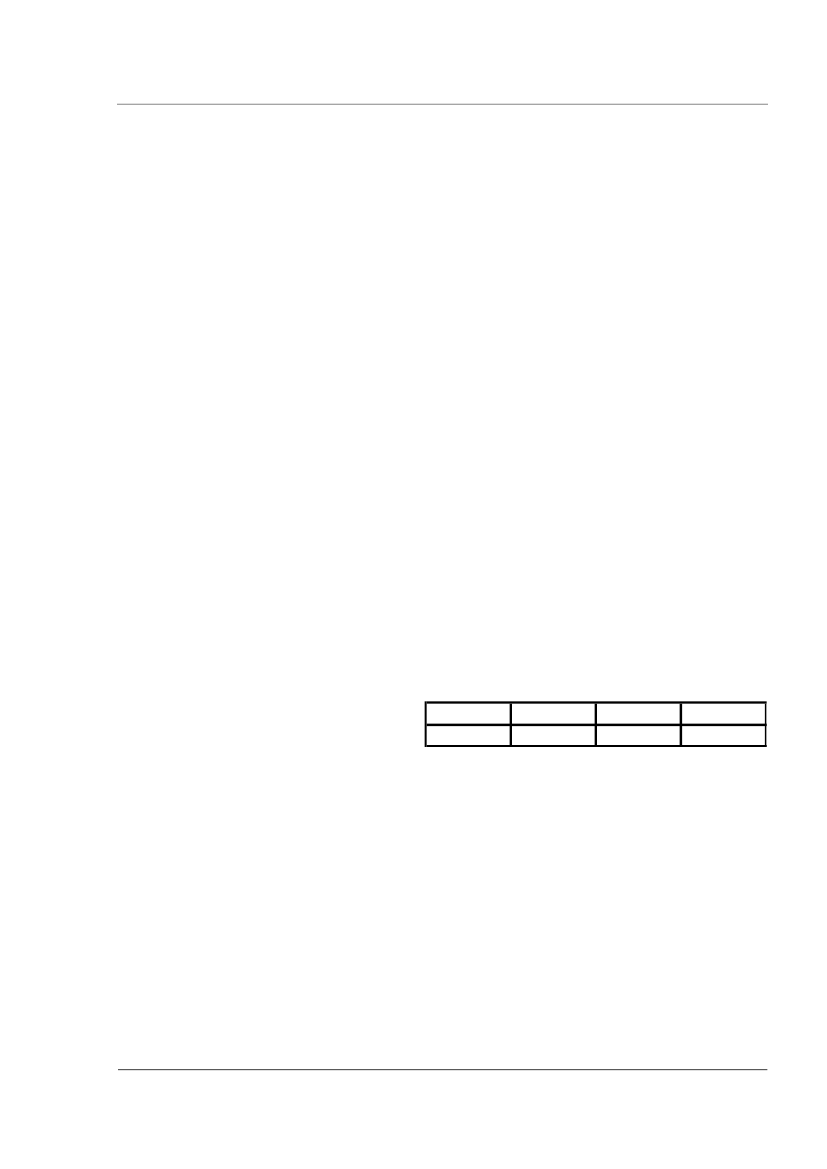

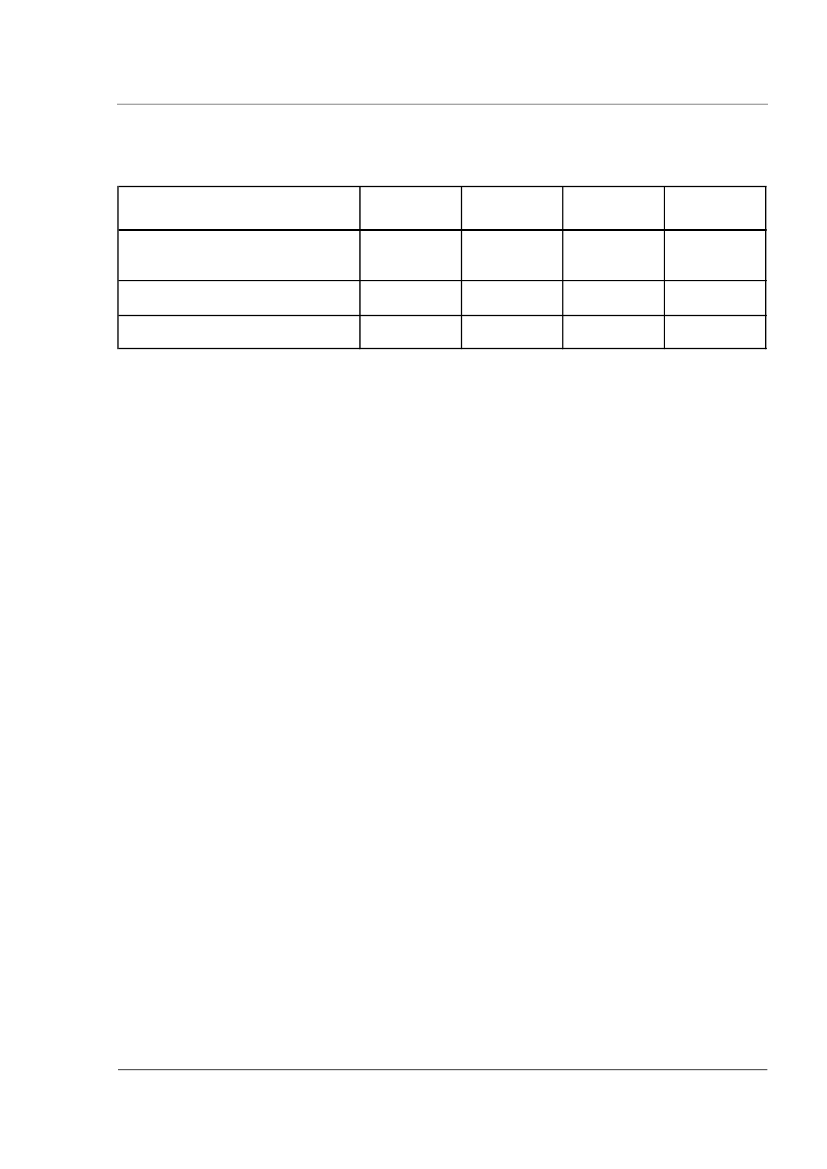

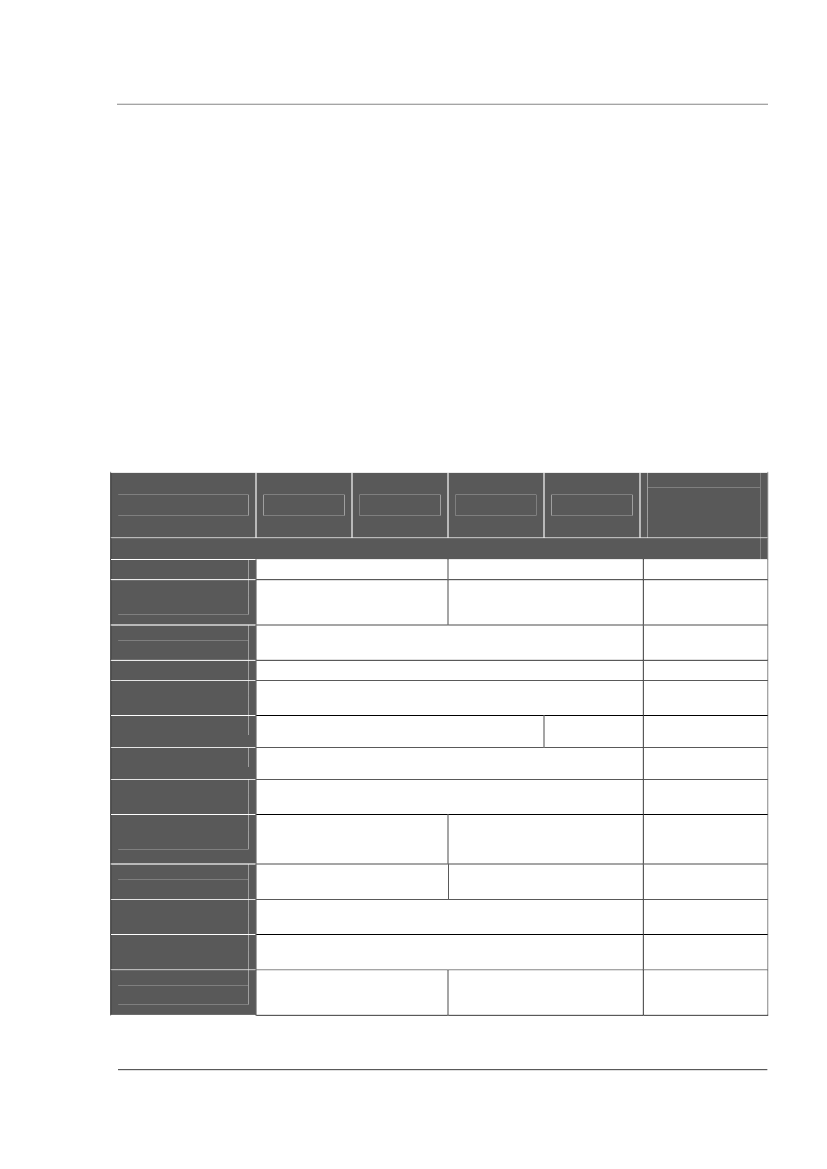

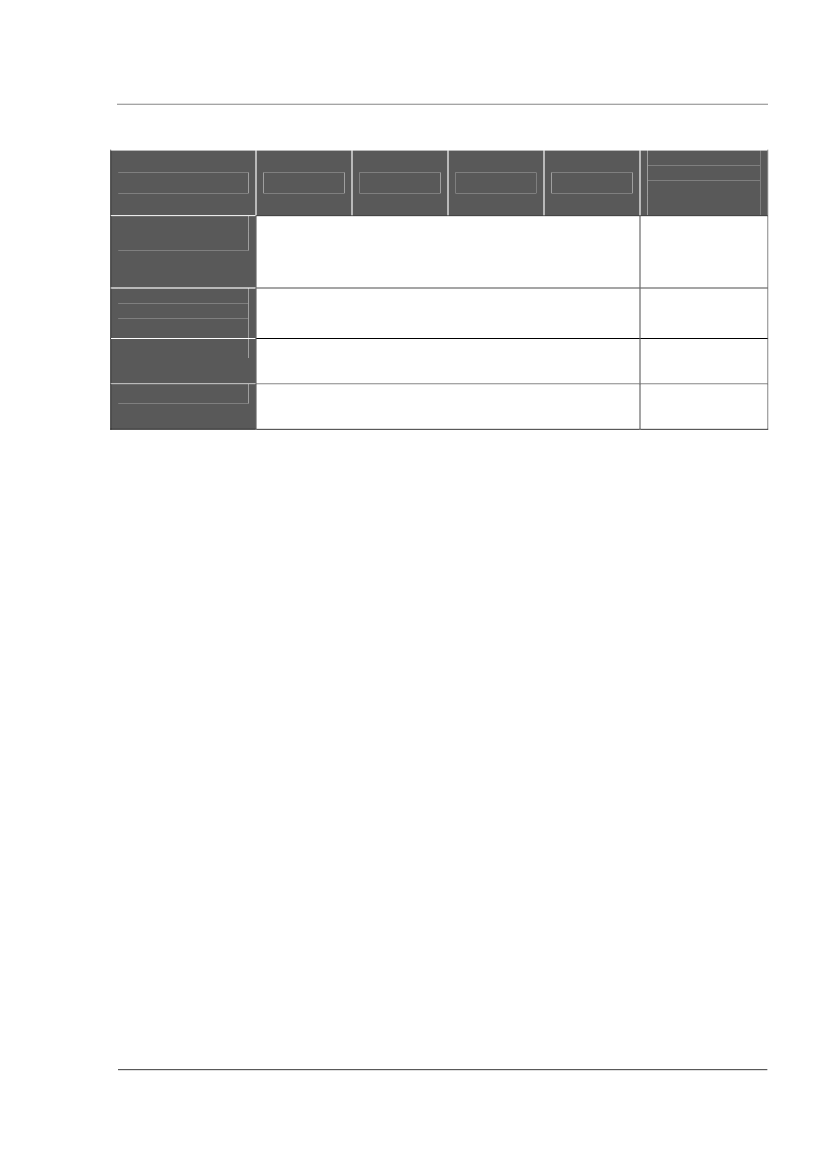

4 Scenarios have been determined using two alternative technologies each:Scenario Group 1: Network charging1A: Satellite positioning technology1B: Tag and beacon technologyScenario Group 2: Area charging2A: Distance charging based on Tachograph impulses2B: Charging based on driving time using motion sensorsThe table below shows the detailed charactersitics of the 4 scenarios.

ScenarioCharging policyCharging principleRoad networkchargedLegal status ofchargeVATVehicles subject tochargeTariff baseTariff levelCompensationstrategyTariff modulation –type of roadTariff modulation –vehicle classTariff modulation -trailersTariff modulation –emission classTariff modulation –time of day

1A

1B

2A

2B

Alternativecharacteristicsnot included inthe scenarios

Network chargingMotorway network and mainroad network (3,500 km)TaxNo VATHGV>12tDistance based

Area chargingEntire road network incl.private roads and yards(approx. 72,000 km)Motorway networkonlyFeeVATHGV>3.5 tDriving timebasedFull inclusion of theexternal costs

Eurovignette proposalNot to be consideredNone /separate cost estimate for roadtype differentiationRegistered weight or number ofaxlesNoneRegistered maximumpermissible weight of road train

NonEURO normNone /separate estimate for time ofday differentiationNone

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

15

ScenarioExemptions

1A

1B

2A

2B

Alternativecharacteristicsnot included inthe scenariosExempted trippurposes orexemptedindividual journeys

Exempted vehicle categories

Interoperabilitystrategy

EETS compliant

Only one-wayinteroperability

TechnologySystem foroccasional usersTechnology forcapturing usageThe On Board Equipment (OBE) is mandatoryVirtualgantries & tollsectionidentificationGNSSTachographimpulsessupervised byGNSS

Physicalgantries DSRC

Movementsensors

Technology fortransmittingcharging data tocentral systemTraffic flow atcharge pointsOpen or closedsystemClassificationmethod

GSM/GPRS

DSRC

Smartcard (domestic users) /DSRC (foreign users)Toll plazas withsingle lanesClosed systemClassificationparametersmeasured by road-side sensingequipmentPre-paymentManual paymentand automaticpayment

Free-flow multi-laneOpen system--- (does not apply to areacharging)

Classification parameters stored in OBU and transmitted to RSE

AccountingPayment modePayment methodPayment meansRegistration method(first time users)

CentralGuaranteed payment/Post-paymentElectronic paymentCash/ Credit cards / Petrol cards / central accountManned POS at borders,manned and unmanned POSand fax in inlandManned POS at borders(occasional user) andregistration data providedautomatically by the vehicleregistration database

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

16

ScenarioRegistration datastored in centralsystemDistribution of OBU

1A

1B

2A

2B

Alternativecharacteristicsnot included inthe scenarios

Vehicle account, contract number, vehicle data (e.g. LPN,emission class et.) and account of guaranteed paymentManned POS at entry points of chargingnetwork, manned POS and postal expedition ininlandManned POSat borders(occasionaluser) andcertified fittersSelf mounting(occasionaluser) andcertified fitters

Certified fitters

Mounting of OBUSelf mounting

Certified fitters

EnforcementResponsibility fordeclarationLegal determinationof vehicle dataData used for proofEnforcement meansJoint several liability of driver and vehicle holder/ownerDeclarationPhotographic picture of license plate plus overviewFixed and portableenforcement gantries andextensive mobile patrolsFixed enforcement gantriesand strong OBU andenforcement at charging areaboundary, few mobile patrolsHolder/owner onlyobservationIn addition: picturefor identifyingdriver

Progressivity ofsanctionsAccess to chargeevadersVerification ofregistration datasupplied by userEnforcementstrategy

Distinction between administrative fee for retarded payment andfineMobile patrol and mailMail and enforcement atcharging area boundaryBarriersAt enforcementchecksBased oncost/benefit ofenforcementactivities

At time of registration

Risk profiling

Organisational and institutional characteristicsManagementauthorityEFC systemprovider/operatorEnforcementoperatorScope of EFCsystem providercontractUnit of national governmentPrivate company or public authorityPublic agency or privat EFC operatorSupply of EFCsystem components

Build and operate EFC system

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

17

ScenarioRemuneration ofEFC system provider

1A

1B

2A

2B

Alternativecharacteristicsnot included inthe scenariosDepending ofcharging revenuesor depending ofchargeable trafficvolume

Fixed

Responsibility forcharging incomelost by evasionOwnership of OBUCharge for OBU

National governmentUser ormanagementauthorityNo deposit ordeposit covering fullOBU cost

EFC operatorDeposit (according to draft Eurovignette directive) not coveringfull OBU cost

3.1

General Assumptions pertaining to all Scenarios

In this chapter the main general assumptions regarding to the table of scenarios are characterised.3.1.1Legal status of the charge is a tax.

The Danish tax freeze makes it difficult to conclude whether a road charge should be implemented asa tax or as a fee. It requires a political decision to choose the legal status of the charge. However, thisreport assumes that the legal status will be a tax in all of the scenarios, since it is necessary to makethe same assumption identical in all scenarios in order to be able to perform comparative studiesacross the scenarios.A tax is a charge where only a governmental authority has the fiscal sovereignty to collect it. A tax isnormally a charge that does not give a right to a certain service. Taxes are simply instruments forfinancing the governmental budget.In contrast a fee is normally a charge directly related to the usage of a service. A fee can be collectedby a public authority or a private entity on behalf on it.For taxes usually strict national regulations apply. In most countries, only public authorities canoperate the collection system. Toll charges with a tax status often also rely on a user declaration ofthe road usage and the technical equipment is only considered a tool to help the declaration. Withfees, the freedom in system design is higher since the environment is less regulated.If a road usage charge is legally considered a tax, it is not subject to Value Added Tax (VAT). If acharge is considered a fee, VAT normally applies. The VAT is an issue of handling and processing thepayments, but not an issue for the RUC scheme in itself. It is also an issue for procedural andcontractual interoperability.An other advantage of a tax is the governmental source of power to execute the enforcement.Enforcement of a tax is much more effective then the enforcement of a fee. A private company has in

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

18

most cases no access to the official vehicle registration database and no possibility to hinder the roaduser to continue his trip.However, in the Danish tax system taxes can also be subject to VAT. Furthermore, not only the publicauthorities can operate the collection system and third parties are in these cases well equipped withthe power to execute the enforcement of collection. Often the system is established in this way,because third parties are regarded as better executers than the authorities, since they possess moreinformation to screen the customers with respect to payment credibility. To keep things as simple aspossible it is assumed in this report that the road charge is a tax not subject to VAT.The contractual interoperability between EFC systems where the charge is a fee are commonly simplerto handle than if the charge is a tax. The issues of a taxes that are being collected by (foreign) thirdparties must be explored.3.1.2Vehicles subject to charge are HGV above 12 tonnes.

Denmark is currently participating in the Eurovignette scheme. All Heavy Goode Vehicles (HGV)heavier than 12 tons have to be registered at the Eurovignette database for paying their fee. SinceGermany contracted out of the agreement of the Eurovignette scheme in 2004, the discussions aboutthe possible end of Eurovignette scheme started. The introduction of a Road User Charge for vehiclesabove 12 t could be understood as succession of the Eurovignette using current technologies.Therefore it could get a higher acceptance in the haulier trade than a 3.5 t limit.3.1.3Tariff is modulated regarding the emission class.

A tariff related to the emission class has a significant impact on the status of the vehicles fleet of acountry (e.g. in the Swiss LSVA scheme the modulation of tariff regarding the emission class had asignificant impact on the renovation of the hauliers’ fleets). The emission class is part of the masterdata and can not be manipulated at the OBU by the user. The tariff could be differentiated dependingto the EURO norm emission classes (EURO 1 to 5).3.1.4Basically, the EFC system should able to differentiate in a further step regarding tothe area/network or time of day

In scenarios (1A, 1B, 2B) it is possible to modulate the tariff regarding the zone of an area or the roadnetwork and the time of day. In case of an area charging additional DSRC roadside equipment andseveral adaptations at the central IT system are necessary.In case of a distance based area charging (scenario 2A) the time related tariff is only in combinationwith a defined road network (e.g. motorways) or zones (e.g. inner part of a citiy) possible since thereis the need for passing a DSRC gantry which triggers a logfile entry.3.1.5The charge depends on the number of axles in scenario 1A and B and on theregistered maximum permissible weight in scenario 2A and B

The simplest way of taking the vehicle weight in to account of charging is to use the maximumpermissible weight of the road train. The charge would be the same for full and empty HGV and fortractor vehicles pulling a trailer or not, thereby incentivising a maximum utilisation of the loadingcapacity and a most efficient use of road capacity of road goods transport. However, this approach isconsidered being unfair by the road haulage industry. Compromises are the use of the number of

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

19

axles for classification ore the use of the registered maximum permissible weight of the pulling unitwith separate declaration of the trailer weight.3.1.6The scheme has to be compliant with NORITS (NORdic interoperable Tolling System)

NORITS is a service offered to all users of toll collection systems in the Scandinavian countries. Theservice makes it possible for any user to pay his road user charge in all Scandinavian schemes withthe OBE he has received from his local toll operator. Therefore it was necessary to create astandardised transaction (technical interoperability), common procedures (procedural interoperability)and a common contractual framework (contractual interoperability). Every new scheme withinScandinavia has to be compliant with this NORITS framework.3.1.7The scheme has to be EETS compliant.

The Directive 2004/52/EC on the interoperability of electronic road toll systems in the communitydefines the technologies of electronic toll systems brought into service after the 1stJanuary 2007.They shall, for carrying out electronic toll transactions, use one or more of the following technologies:satellite positioning;mobile communications using the GSM GPRS standard;5,8 GHz microwave technology.

Interoperability shall be achieved by On Board Units which work in all systems and not by harmonisingthe national systems. The specifications for the European Electronic Tolling System EETS are not yetdetermined. Nevertheless, the assumption is that the Danish HGV Charging Operator will acceptcustomers who want to pay the charge by using an EETS OBE linked to an EETS contract. This isliterally meant in all four scenarios possible. But since the European discussions and the directiveabout EETS emanate a distance based RUC it is not possible to act on the assumption that a timebased area charge is EETS compliant. However a one directional interoperability will be possible.3.1.8The On Board Equipment (OBE) is mandatory.

The handling of occasional users strongly determines the overall design of a charging system solution.If a technical solution for tolling requires the usage of special On Board Equipment (OBE) then it canbe assumed that frequent users will equip themselves with such a device to take part at the scheme.But according to the UN Convention on Road Traffic and to the EU non discrimination logic (e.g. Treatyof Nice), frequent and occasional users must be admitted to the charged road network in the samenon-discriminatory fashion. Especially occasional users will not be prepared to equip themselves withpermanent equipment.If the technical solution is based on a complex OBE with high effort for integration in the vehicle, e.g.installation time of several hours and only in certified workshops, then a second solution must beoffered to cover the needs of occasional users. This second technical solution must ensure that theunequipped or occasional users can have access to the system in an easy way and with minimal effort,e.g. with a ticket based solution or with an OBE that can be obtained and mounted by the driver in amatter of minutes.In charging, equal treatment especially means that all user groups pay the same when using the sameroads under the same conditions. System design must therefore ensure that users with permanently

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

20

fitted equipment pay the same as non-equipped or temporarily equipped users. It is questionablewhether users with permanently fitted equipment can be offered better tariffs or whether occasionalusers can be treated with a simplified charge.From this it follows that even the most sophisticated technical charging solution is limited in itscharging flexibility (flexible tariffs, flexible extensibility of charging area, etc.) to the capabilities of thetechnical solution for the occasional users. Only what can be done for the occasional or unequippedusers can also be done for the frequent or equipped users.For charging systems, the requirement “no barrier to free trade” especially means that foreign users,which are often occasional or unequipped ones, must have easy access to the charged road network.It is not allowed that the charging solution takes a lot of time or requires high deposits to be paid inadvance.One solution to the problem of occasional and foreign users is to construct the road user charge as anational tax which foreign users do not have to pay. The Netherlands had been planning such asystem for all vehicles for several years. The system was planned as a distance dependent charge onall roads and required the installation of an on-board unit in all vehicles. The intention was to replacethe taxes on vehicle use (annual vehicle tax, petrol taxes, etc.) with a distance dependent tax that hasdemand management aspects (differentiation of the fee according to time of day and according totype of road). Since the fee was constructed as a national tax, subsidiarity applies and theNetherlands had maximum freedom in system design, e.g. there would have been no obstacles tointroduce a mandatory on-board unit in every vehicle as a kind of “tax meter”.Since the OBE which is used to measure the distance in a distance based area charging scheme likethe Swiss LSVA needs an electrical connection to the tachograph (installation of the OBE needs morethen an hour). This requirement makes it necessary to develop an alternative solution for occasionalusers. Therefore the Swiss LSVA uses ticketing machines where the user enters his mileage and gets aticket. At the end of his trip in Switzerland the user declares his new mileage at the moment of exit onthis ticket and gives it to the custom officer. A more comfortable solution for this functionality could bea self mountable, autonomous DSRC Low use OBU (LOBU) with a display and a keypad to enter themileage. At the border crossing the user has to enter the mileage of his vehicle and the vehicleconfiguration into the LOBU. Passing the border the data will be transmitted to a central IT system viaDSRC.One main cost driver regarding OBE is the so-called OBE leakage: loss of OBE mainly through foreignusers who enter Denmark rarely or just one single time, and through the high number of newregistered vehicles. The experiences of the Austrian and the Swiss scheme show that 140,000 newOBE per year are distributed in Austria on top of the 400,000 OBE at the start of operation. 90,000new vehicles per year are registered at the Swiss border.3.1.9It has to be a free-flow multi-lane tolling system.

There should be no barriers for the traffic resulting out of the charging procedures. After registrationof the vehicle and haulier or payment data and if necessary after installation of the OBE in the vehiclethe user has not to stop trip anymore because of the tolling system. Independent of the number oflanes and traffic conditions charging has to be possible.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

21

3.1.10 The central account is the master and comes with the only confirmed balance.In an area charging system, the self declaration principle is the only effective way to obtain thecharging data of vehicles that never or seldom leave the area. Self declaration does not allowinforming the user about the used charge since the assessment for HGV charge is based on the usersdeclaration by the back office of the charging system operator. Therefore a prepayment solutioncomprising an on board account is not applicable. The user may be offered the possibility to check thelog file entries informing him about the used distance and the declared weight. Based on thisinformation he can estimate the charge, but the system cannot give him any assurance for theamount before the declaration has been accepted.Neither a thin client GPS/CN scenario which is not as costly as a fat client GPS/CN scenario has thepossibility to provide a on board account. Since in this case the map matching and the calculation ofthe tariff is done in the central IT system, the actual balance of the charge is not online available.Within a certain time it is possible to transmit the balance from the central IT system to the thin clientOBE.Only a DSRC OBE could easily provide an on board account, since the receipt including the tariff of thetoll section is part of the DSRC transaction and is stored in the OBE.3.1.11 An anonymous use of the system is not possible.Every vehicle using the charged network or area has to be registered. Therefore at least a vehicleaccount has to be opened, a contract number has to be generated, the license plate number and othervehicle data (like emission class etc.) have to be stored and a payment mean has to be authorized.3.1.12 The driver and the vehicle holder share the liability regarding the HGV charge.Primarily liable for the HGV charge is the vehicle holder. He is responsible for the payment of thecharge. The driver can be enforced by the mobile enforcement officers in case of not executing hisobligation to co-operate.3.1.13 At the time of registration declared vehicle data are verified.To register the vehicle for the road user charge (RUC) the user has to show his vehicle registrationcertificate. Based on the vehicle registration certificate the employee of the point of sales (POS) hasthe possibility to verify the declared vehicle data. During the introduction of the charging system(some moth before and after the start of operation) there should be the possibility to register vehiclesby fax or letter. The vehicle holder has to attach photocopies of the vehicle registration certificates tothe declared vehicle data as a proof. The fact that there are no unassured vehicle data in the systemdata base takes a huge burden off from the enforcement system.3.1.14 The enforcement strategy will be based on a assessment of fraud.Enforcement is one of the main cost drivers of a charging system. The frequency of fraud dependsfrom the density of enforcement (the more enforcement the less fraud). But after a certain point theimpact of enforcement on fraud decrease and the operating costs increase strongly. Therefore it isnecessary to assess the risk and frequency of fraud. Based on this fraud assessment there will be anestimation of the best density of enforcement/operating costs ratio for each Scenario. The followingparameters have influence on the density of enforcement:

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

22

the number of toll sectionsthe number of operating fix and portable enforcementstationsthe geographical and stratigic location of fix and portable enforcementstations (at all areas ofa road network and at points with the most traffic)the frequency of mobile enforcement especially regarding foreign users

The following parameters have influence on the operating costs of enforcement mainly on the need ofmanual post processing:the number of operating fix and portable enforcementstationsthe quality of the automatic number plate recognitionnot readable LPNwrong read LPNthe quality of vehicle classificationwrong classification regarding the liabilitywrong classification regarding the vehicle class (incl. trailer)

3.1.15 The OBE is in the ownership of the EFC operator.Especially the more sophisticating on board units should not be out of control of the EFC operator forreasons of security. The ownership of the OBE allows the EFC operator an easier handling regardingthe operation and the maintenance of the OBE. Since the RUC should be a tax the acceptance of thecharging system is necessary for the political decision finding process. Additional costs for the roaduser regarding the OBE will not be accepted, especially if the costs are high like in the case of adistance based area pricing scheme.3.2Scenario Group 1: Charging of a Defined Road Network

HGV Charging on motorways and expressways can be done distance related or time based (i.e. daypass, monthly or yearly permit). This study only focuses on distance related network charging. It ispossible to execute distance charging by several available technologies (DSRC, ANPR, GNSS/CellularNetwork, ). In some schemes like the one in Austria, the motorway and expressway toll is combinedwith a corridor pricing for tunnels and bridges, which are part of the motorway network. In manyEuropean countries (e.g. France, Spain, Italy, Portugal, Slovenia, Austria, , Germany, Hungary) HGVare charged on motorways. In all of these countries, the toll is well accepted by hauliers.One of the main problems of motorway and expressway charging is the evasion of traffic to unchargedparallel roads particularly by occasional (foreign) users. To solve this problem, there are intentions toexpand the tolling liability on certain parallel (not tolled) roads, especially in Germany.EnforcementThe level of enforcement in a network charging scheme depends on the number of enforcement points(permanent installations or mobile units) relative to the length of the network. The Austrian HVcharging scheme comprises 120 permanently installed enforcement stations, 20 portable enforcementstations and 40 mobile enforcement units which are 7 days 24 hours active on a 2,000 km roadnetwork with 800 toll sections. The German HGV charging scheme covers 12,000 km of road networkwith 5,500 toll sections. The German enforcement system is based on 300 permanent enforcement

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

23

stations and 280 mobile enforcement units. Only a limited number of enforcement stations and mobileenforcement units are in operation at any time to decrease the operating costs of enforcement sinceevery picture of a potential enforcement case has to be checked manually.

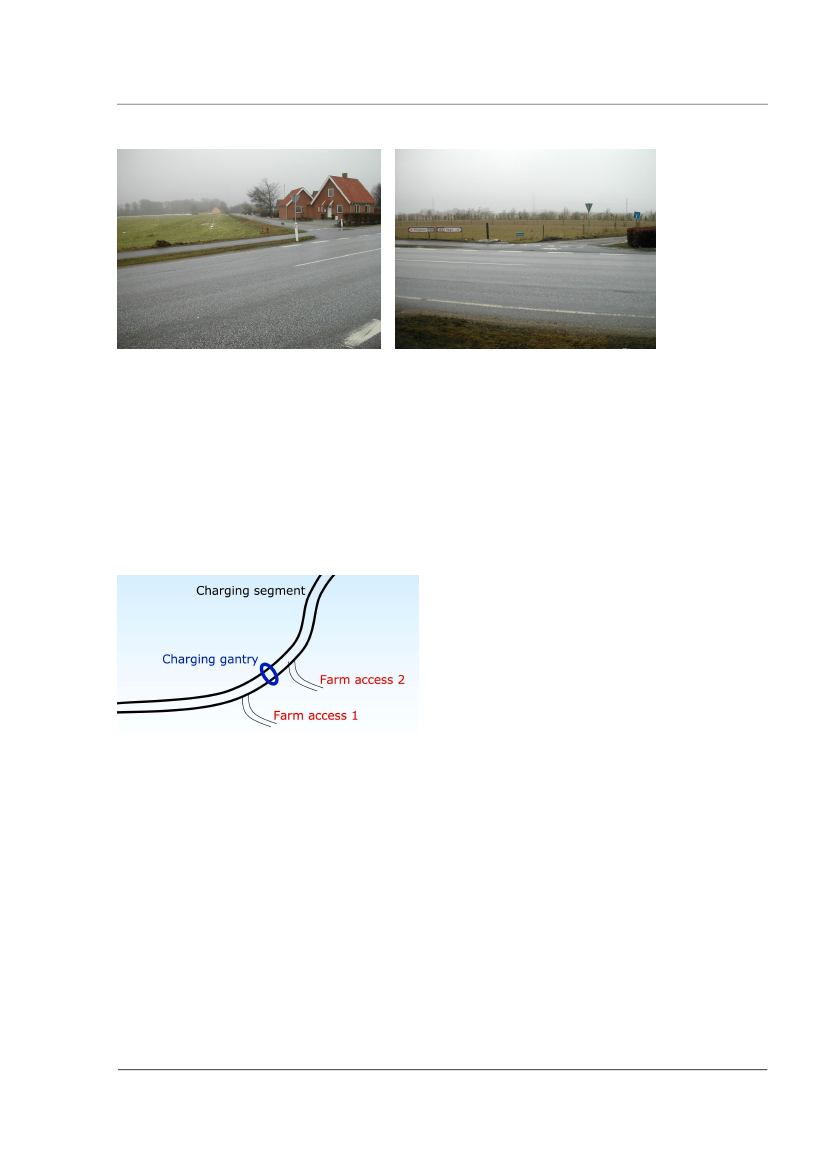

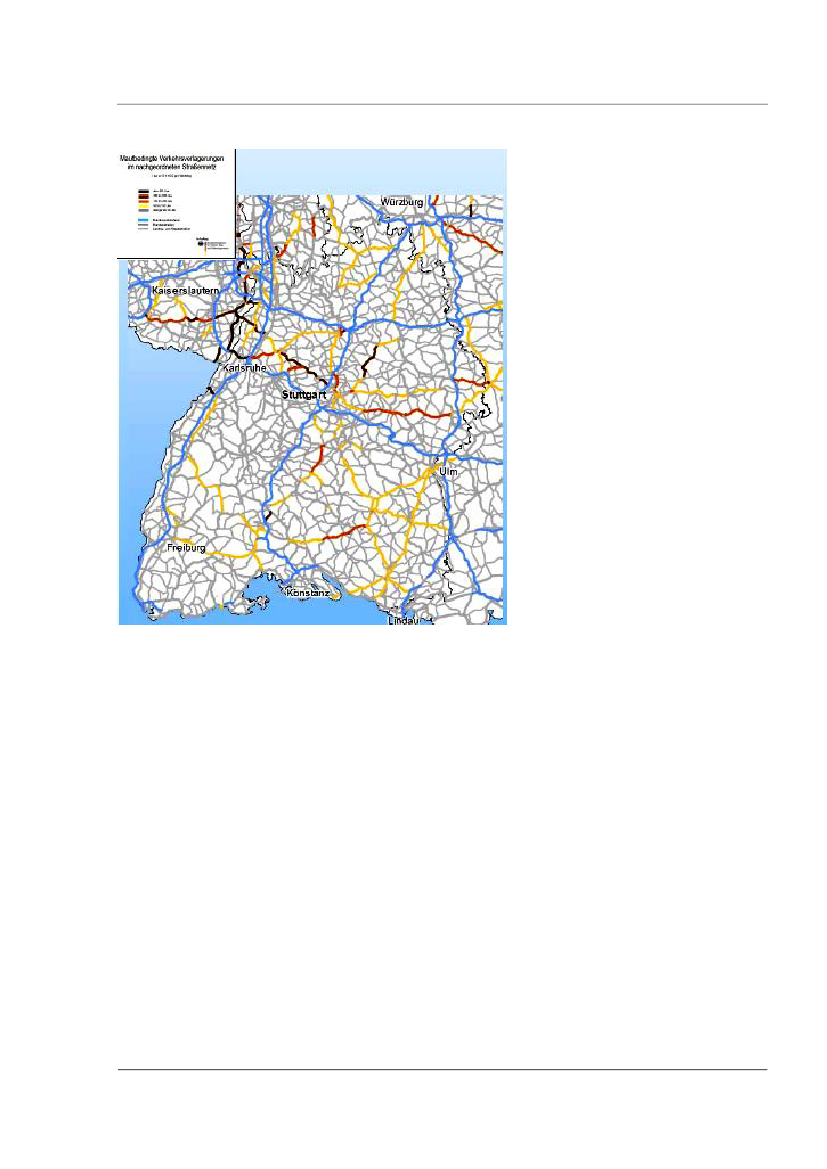

Figure 1: Mobile enforcement executed by the BAG (Germany) and ASFINAG (Austria)

Registration and distribution of OBUBefore using the charged road network the user has to register his vehicle at a manned or unmannedpoint of sales (POS) or via fax (see chapter 3.1.13) or on the internet. After registration he gets hisOBU which is personalized via CN in case of a GNSS/CN scheme and via DSRC at the POS in case off aDSRC scheme. The OBU is mounted in both cases by the user/driver himself.3.2.1Scenario 1A: Network Charging Using the GNSS/Cellular Network Technology

One approved technology for network tolling is GNSS/CN. It uses two technologies adapted from otherapplications; namely, GNSS (Global Navigation Satellite System), whose satellites enable suitablyequipped vehicles to calculate their location accurately; and a two-way communication link (e.g.GSM/GPRS) based upon cellular telephone network. According to the position, the system recognises ifthe vehicle is driving on a toll road. In contrast to DSRC based systems GNSS/CN systems need only afew, if any, roadside infrastructure (gantries). Due to the several limitation by using GNSS only (noGNSS signal by shadowing effects, temporary system turn-off, etc.) the OBU is connected to orequipped by other sensors for localisation and distance measurement (tachograph, wheel sensors,gyrocompass, etc.).Two main designs of the overall system are technically possible. The one approach uses a high-endGNSS/CN OBU (so called “fat client”) which means all the intelligence for a single fee calculation isinside the OBU. This OBU transmits complete fee transaction data to a central system where they arecumulated and further processed for billing. The OBU recognizes by itself whether it is on a toll sectionor not and if yes what tariff applies and when. This implies that an application with map matching

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

24

algorithm and tariff handling must run on the OBU. If the properties of the charged network change,e.g. new tolled sections or tariff, the OBU software must be updated over the CN interface. This kindof system architecture was implemented by the German toll operator Toll Collect. The fat clientarchitecture is highly sophisticated and has to be mounted by certified garages because of thenecessary connection to the antennas and other sensing equipment and power supply. Therefore, thecapital investment and the operating costs of fat client architecture are relatively high. Since the mapmatching and the calculation of tariff is executed by the OBU, the liability of the road network and theactual charge can be displayed online to the driver. This technology is applied for the German LKWMaut system by Toll Collect.The other approach is a low-end GNSS/CN OBU (so called “thin client”). This OBU collects only positiondata (GNSS position and time plus potential other sensors) and sends this to a central IT system.Based on the position data received from the OBU the central system calculates the dedicated fee. Themap matching process and the tariff management run in the central system. The needed OBUsoftware updates are limited, because the fee calculation process is done by the central system. Incurrent discussions about architecture of GNSS/CN EFC systems, the thin client architecture isfavoured by the industry. The complexity of the OBU is less than in a fat client architecture and can behandled easier. In spite of higher communication rates via CN (since the localisation is not done in theOBU) the investment and operating costs are much lower. Regarding the main current Europeaninteroperability projects the EETS OBU could be a thin client. This technology has been proposed forthe UK Lorry Road User Charging project. Scenario 1A is based on the thin client architecture.At the time when the tender of the German “LKW Maut” was prepared, telematics platforms integratedinto the vehicles to provide different value added services (VAS) beside EFC were in the expert’sminds. The concept was to create an OBU which is able to run different applications using a singlehardware platform. This telematics platform should include technical components processing thelocalisation of the vehicle and communication equipment to transfer data to the different serviceproviders. The German OBU should be such a telematics platform running different applications andproviding VAS. After the start of operation of the German LKW Maut was postponed, the prioritychanged. First priority became the start of operation of the German HGV charge. Currently Toll Collectis not allowed providing VAS. The German OBU is a very complex multi application device which runsonly one application to collect RUC. The hype of VAS provided in the vehicle has cooled off. There is noreason anymore to invest a lot of money into a device which is able to provide several services in thevehicle which are not demanded by the market.The thin client architecture does not provide the same potential to implement Value Added Services(VAS). On the other hand, there are less implementation risks and lower cost than with a fat. TheGerman fat client concept was originally designed to act as a general telematics platform in thevehicle. Only when the problems of delivery of the systems became obvious a new policy was adoptedto only implement the charging function and to abstain from offering VAS.The power consumption of a GNSS/CN OBU is much higher than with a DSRC OBU. This comes fromthe current drain of the GNSS module itself and from the higher computing power. The power supplyof such an OBU usually can not be provided internally (by battery) for a sufficient time, therefore it isnecessary to have connection to the power supply of the vehicle (permanent power supply connection- fat client; power supply to recharge the battery – thin client).

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

25

Collection of geographicalsensor data by OBULocalisation of the vehicle.calculation of tariff and datastorage and processing inthe central IT system

Transmission of sensor data tothe central IT system via CN

Figure 2: Key-functionality of a GNSS/CN charging system (thin client architecture)

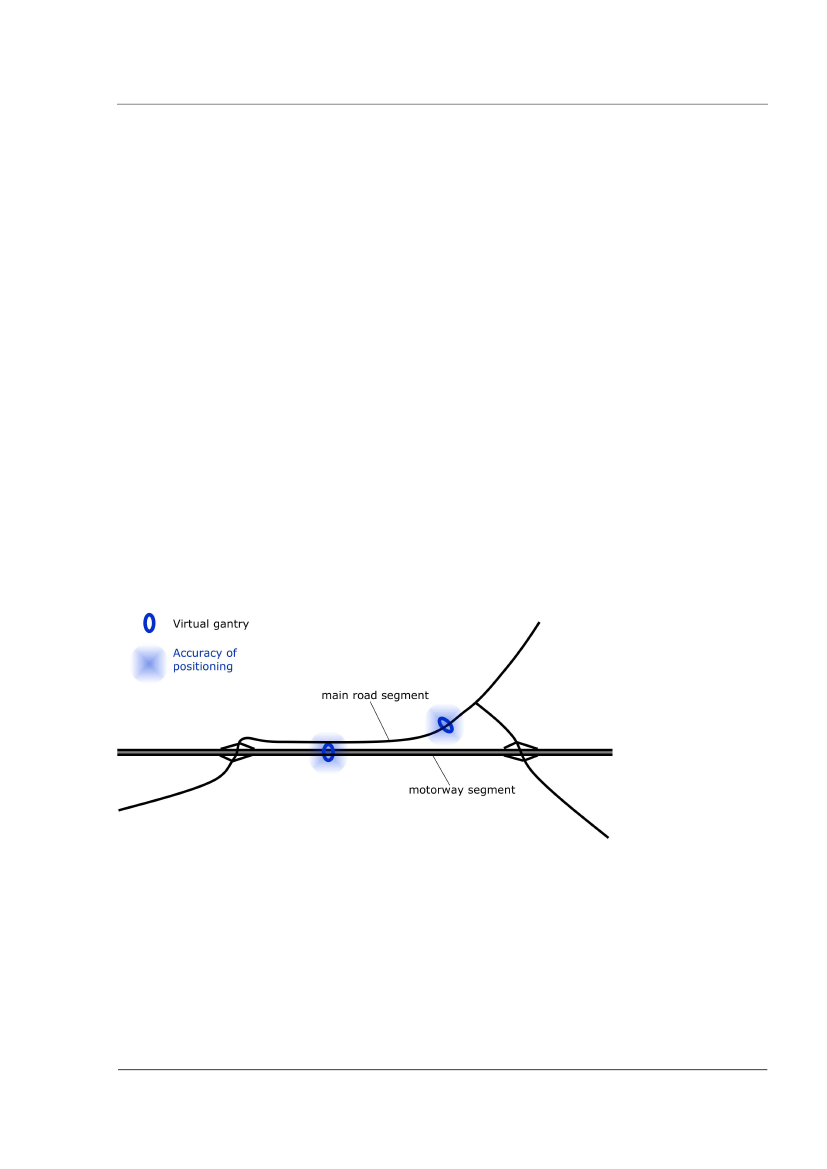

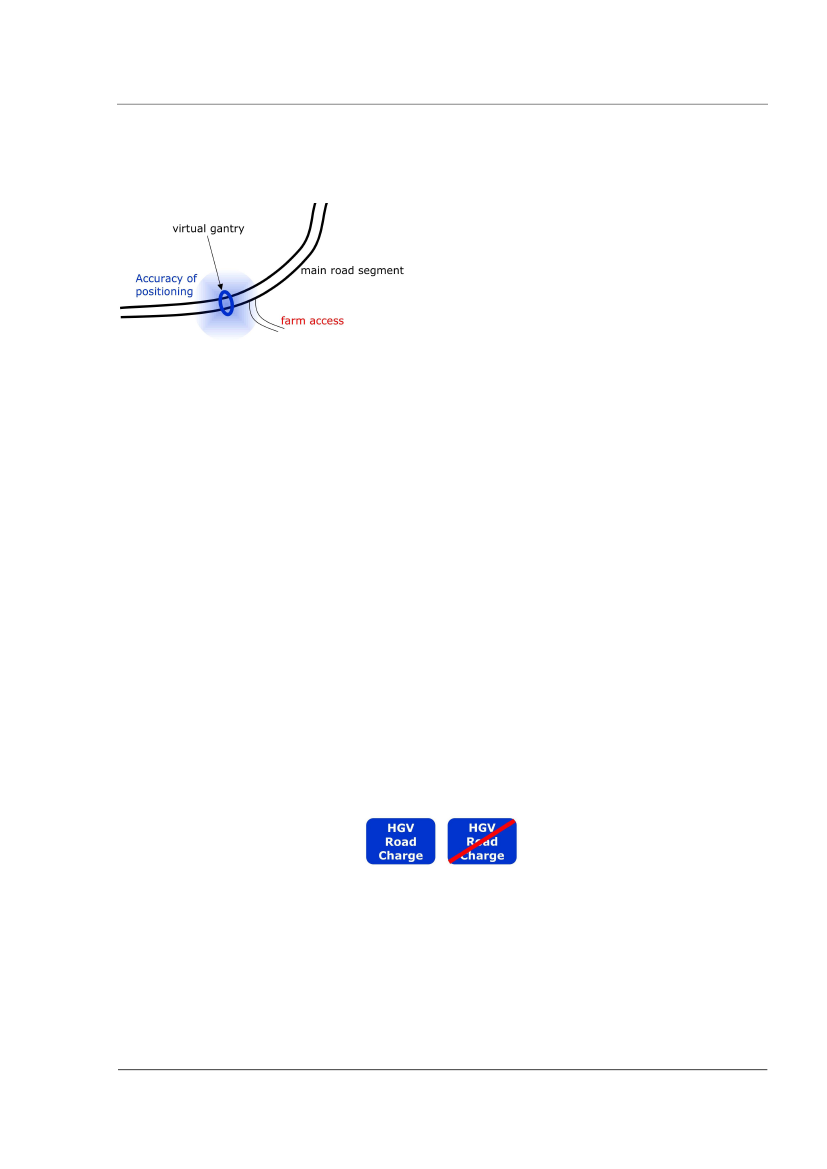

Virtual gantries and toll section identification via GNSS and map matchingCurrently there are two different ways to charge a toll section in a GNSS/CN charging systems. Firstthere is the German Toll Collect approach which allows the identification of a certain point (small area)at a road network and with it a particular toll section. Passing this particular point the vehicle ischarged for the corresponding toll section. The other approach identifies a toll section by recognition ofpattern based on different geoposition data. The localisation is done via map matching. In the thinclient architecture the geographical data are collected by the OBU and transmitted to a central ITsystem which is processes the map matching and calculates the tariff. Regarding the capitalinvestment it is to consider that both approaches are patented. It is to emanate that potential supplierof such a technology will be able to come with a corresponding license.Communication between OBU and central IT system via cellular networkThe communication between the OBU and the central IT system like the transmission of geographicaldata will be proceeded by a public cellular network (CN) for instance a GSM/GPRS network. Tominimize the communication costs a flat fee for a certain time (e.g. day) has to be negotiated with thesupplier of the CN.

Figure 3: GNSS/CN OBU: possible solution of a thin client and a German enforcement station using IR beacons

3.2.2

Network Charging Using the DSRC Technology

Instead of using cash or payment cards, the payment transaction takes place between an electronicOn Board Units (OBU), which is fixed at the windscreen of the car, and the toll road operator’s

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

26

electronic road side equipment while the vehicle is in motion. During a split of a second, the relevantinformation between the OBU and the roadside equipment is exchanged, using a standardised 5.8 GHzmicrowave communication. In Europe commonly two standardized types of 5.8 GHz DSRC links areused. One is the DSRC link according to the approved CEN standard, which is the most common, andthe other one is the DSRC link according to the Italian UNI standard.

Personalised OBU transmits vehicle data to thebeacon

Communication zone of a DSRC gantry wheretransactions are generated

Point of saleswhere the OBU ispersonalised and thevehicle is registeredCentral IT system where all dataare proceeded and storedFigure 4: Key-functionality of a DSRC charging system

In a DSRC system the data exchange necessary for tolling happens between the OBU installed in thevehicle and a beacon installed roadside usually on a gantry. If the vehicle is passing underneath sucha gantry the relevant data for tolling (e.g. vehicle data, contract data, etc.) are provided by the OBUto the beacon. Having received this information the beacon calculates the fee based on its additionalinformation like time and section tariff. The OBU gets a receipt from the beacon including thisinformation. The data from all the beacons installed on the network are collected in a central systemfor further processing (billing etc.). From the central system the beacons are provided with data whichare subject to change, like tariffs, lists etc. This happens normally by using leased lines. The DSRCtechnology implies that each section of a tolled road network is equipped by a beacon installed on agantry. The OBU itself has a size of a credit card (but thicker) and has its own power supply (internalbattery) with a lifetime of usually 5 years. The cost savings of simple OBU come along with moreextensive resources regarding installation of roadside equipment (gantries and beacons). It isassumed that the DSRC system would be conformant to NORITS interoperability (technical,operational and contractual interoperability).

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

27

Figure 5: DSRC gantries and OBU in Austria (left: DSRC only, right: DSRC and enforcement).

3.3

Scenario Group 2: Area Charging

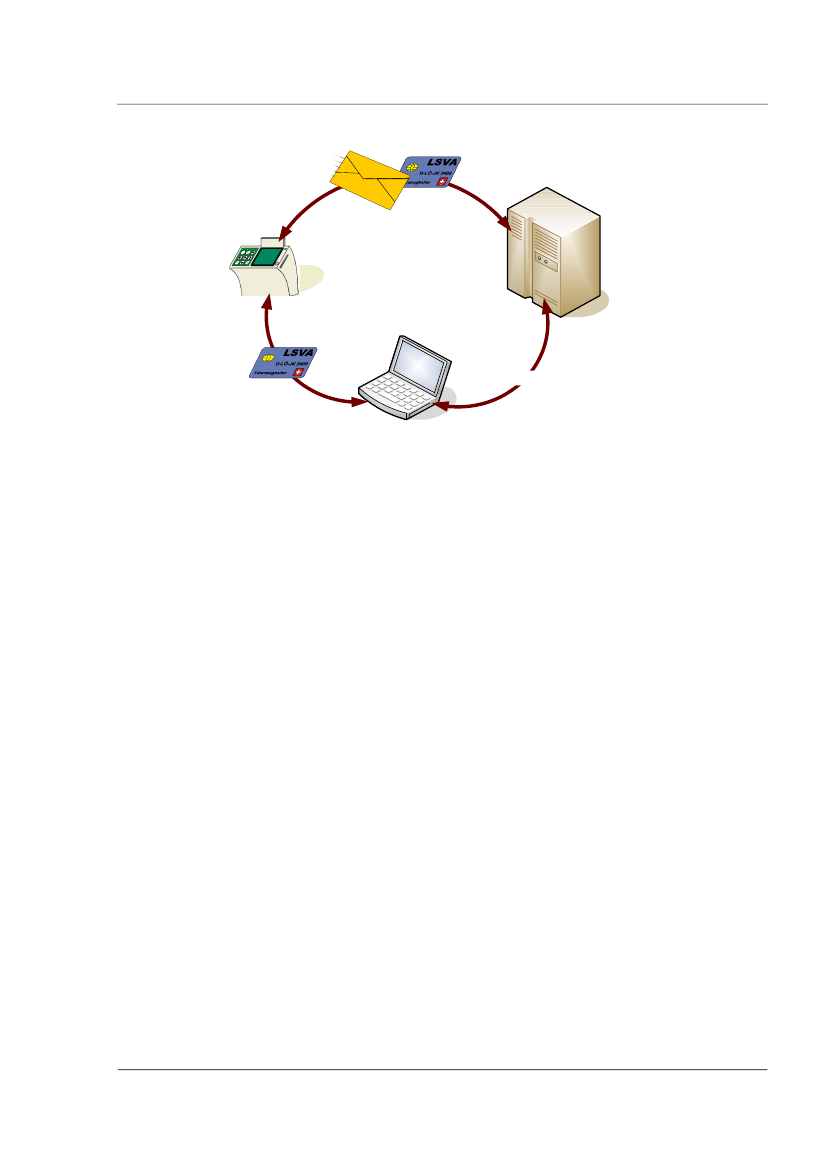

This type of scheme applies to trips made within a defined area – in our case the area within theborders of Denmark. Users of HGV who wish to use their vehicles within Denmark would need to havean On Board Equipment which measures distance or duration of vehicles usage. A key advantage forthis type of pricing mechanism is that there is no evasion of traffic to uncharged parallel roads. Theexperience with the Swiss HGV Fee (LSVA) shows that this kind of area charging allows having asignificant impact on traffic. Main requirement of area charging is the existence of well defined borderswith a limited number of border crossings. Regarding the geographical position of Denmark, there areperfect conditions for such a system.Self-declaration principleDifferent to road network charging schemes like the Austrian and the German one which proceed thecharging of a vehicle automatically without intervention by the user beside the declaration of thevehicle class at the OBU, the charge in an area pricing scheme is assessed by the EFC operator basedon the self-declaration of the vehicles holder. Therefore the vehicle holder is responsible for thedeclaration of the charge. The OBU stores defined events (e.g. start of trip, declaration of trailer,crossing of border etc.) in a log file. This log file is sent by the vehicle holder after the end of thedeclaration period (one month) to the central service via chip card or via internet. In the case of OBUerrors or the break down of the OBU the user has the obligation to enter his mileage/time and hisweight/vehicle class regarding the different events into a formula until the OBU is repaired by acertified garage. Regarding the operating costs the experience of the Swiss LSVA shows thatapproximately 80% of the RUC assessment is done automatically by the central IT system and 20% ofthe RUC assessment has to be proceeded manual.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

28

Mailing of the smart card withthe declaration respectivelyapplication dataOBU where themovement data aregenerated and thevehicle configuration isstoredCentral IT system (CIS)where all data areproceeded and storedTransmission of thedeclaration data betweenOBU and vehicle holdersoftware via smart cardTransmission of thedeclaration databetween vehicle holdersoftware and central ITsystem via WANWAN

Reading the declaration data commingfrom the OBU and writing of theapplication data comming from the centralIT system by the vehicle holder softwarefor RUC declaration

Figure 6: Key-functionality of an area charging scheme

3.3.1

Scenario 2A: Distance Based Area Charging

This approach is based on the principle of fee payment for using the road network in a defined areaaccording to the driven distance. That means the every type of road in this area is subject to a fee.With the possibility to have different tariffs for different vehicles on different roads, as was planned inthe UK for the Lorry Road User Charging Programme (LRUC), or with one tariff for a dedicated vehicleon all roads, like the Heavy Goods Vehicle Fee (LSVA) in Switzerland. The first approach has theadvantage for better traffic management by varying the tariff for the road categories. But this has ahuge impact on the technical complexity for implementing such a system. The second approach aimsmore on the general reduction of driven mileage in a defined area by a dedicated vehicle group andthe change of the modal split – e.g. transferring goods from road to rail like with the LSVA inSwitzerland. This approach is technically easier to implement as the first one. But nevertheless thetechnical solution is just a derivation from the overall political and financial objective of the scheme. InScenario 2A there will be no modulation of tariff regarding the type of road and regarding the time ofday.The approach of distance based area charging especially for HGV postulates, if seriously handled, aconnection to the vehicle’s tachograph as the only certified source for distance measurement.Additional sensors can supervise the correctness of the operation of the OBU. The access to the pricedarea must be clearly recognized by the OBU, most suitable by redundant way.Registration, installation and initiation of the OBUIf a vehicle is registered at the Danish vehicle registration the database automatically provides thedata set to the central IT system of the EFC operator. The user receives a confirmation for theinstallation and initiation of the OBU at a certified garage. Foreign users which would like to use theDanish road network should have the possibility to apply for the installation of an OBU.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

29

Figure 7: OBU of the Swiss HGV Fee (LSVA)

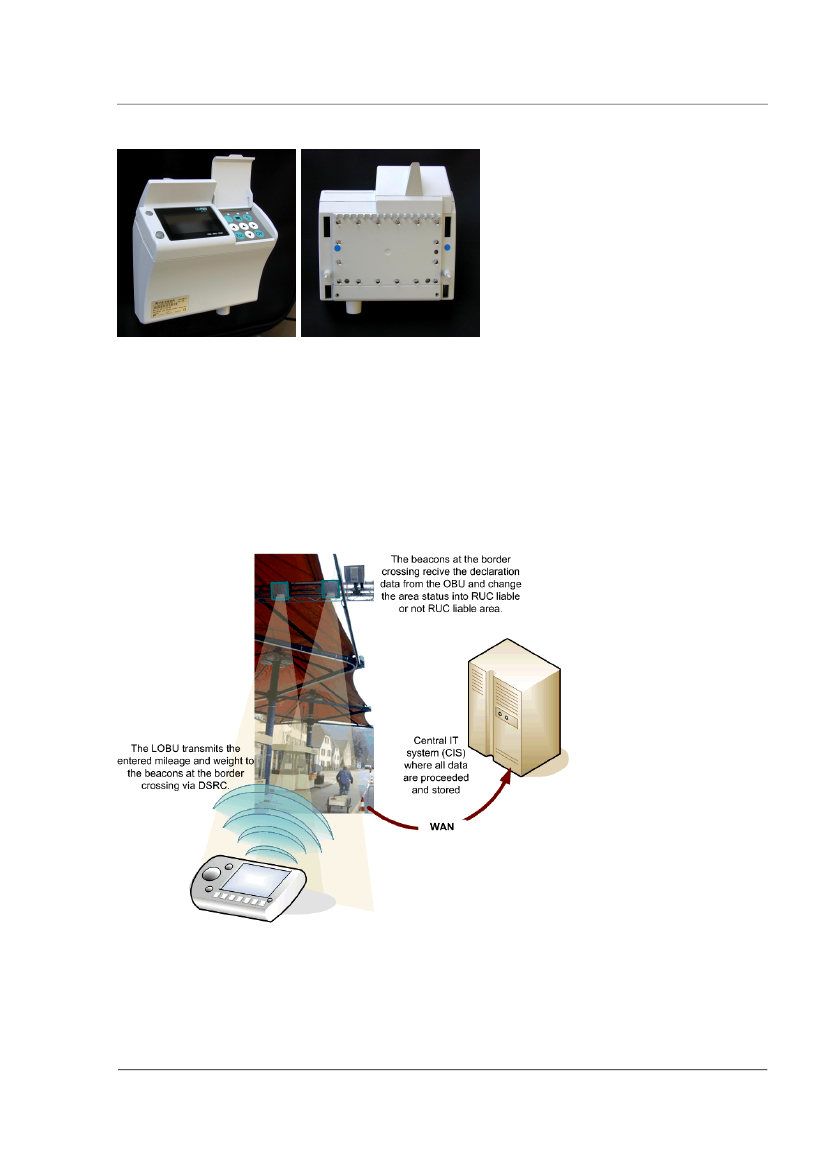

Registration and OBE of occasional usersVehicles which are registered in another country have to be registered regarding the RUC at the entrypoint to the charging area the first time they enter into Denmark. After registration at a manned POSthey get a personalized LOBU which stores the mileage and weight at the area entry point, themileage and new weight at the moment of change of the vehicle configuration and the mileage andweight at the area exit. All those data are entered by the user/driver at the keyboard of this LOBU.Passing the area boundary the LOBU transmits all those data via DSRC to the central IT system. TheTAG is mounted at the windscreen by the user himself.

Figure 8: Key-functionality of distance based area charging for occasional users using a LOBU

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

30

DSRC

Optical display

KeypadAcousticalbeeper

ClockDetector ofphys. fixing

Processor / Memory

Battery

Figure 9: Architecture of the LOBU (light OBU)

EnforcementThe self declaration principle requires that the OBU must store the driven distance of the vehicle andthe declaration of a trailer (number of axles of the road train or additional weight). It must be ensuredthat the OBU is in the assigned vehicle and in operation independent of the vehicle infrastructure. Thepermanent enforcement stations are focusing primarily on the foreign vehicles equipped with a LOBUand on the detection of trailers. For vehicles fitted with a permanent OBU, the OBU accomplishes themonitoring tasks autonomously and permanent enforcement stations are less critical. Since in thescenario 2A the vehicle classification is done regarding the registered maximum permissible weight ofthe road train, it is possible to mix the permanent and portable enforcement. For LOBU users thedriven distance is based on tachograph readings and it is entered manually by the driver. The entryand exit mileage is spot-checked at the border on the one hand, on the other hand the driven distancecan be verified to with a distance matrix (entry/exit/passages at enforcement sites). In Switzerlandthere are 18 automatic enforcement stations, 1 mobile non-stop enforcement unit and about 80border crossings for HGV. The permanent enforcement and particularly the portable enforcement of atime based area charging are focussing on two tasks: (1) the detection of not equipped vehicles and(2) the monitoring of correct trailer declaration.

Figure 10: LSVA enforcement station and tachograph camera to check the mileage of vehicles without OBU

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

31

3.3.2

Scenario 2B: Time Based Area Charging

By definition the movement of vehicles is a function of distance and time. This means that in theorydistance and/or time could be used as the basis of usage based road pricing. Different to the distancebased area charging the time based area charge is charged according to the time period the roadnetwork in a certain area is used. Similar to the cordon pricing like in Stockholm there is a clearlydefined boundary round the RUC liable area. The area will be identical to the territory of Denmark butsmall adjustments of the boundary for practical purposes may be considered in co-operation withneighbouring states.5Instead of charging the entering into this area (cordon pricing) the time ofmovement inside of the boundary is charged.A low-cost TOBU is used containing a conventional 5.8 GHz DSRC tolling tag, a clock, vibration sensorscapable of determining whether the engine is switched on or off, and accelerometers capable ofdetermining whether vehicle is moving or stationary. The TOBU logs the time when the vehicle ismoving inside Denmark. A chip card or a USB stick is used for downloading the log file and the userdeclares his charging parameters by sending in the chip card or via the Internet. With appropriateroadside infrastructure at the area boundary the charging data can also be automatic transmitted tothe Central System when a vehicle is entering and leaving Denmark. The key advantage of the timebased approach of this scenario is that the TOBU is autonomous and can be self-mounted in the sameway as the DSRC tags of Scenario 1b. Therefore, there is no need for an manual declaration schemefor non-equipped users as in scenario 2A. The EFC system is much less complex than with distancebased charging and the capital investment and the operating costs are low due to the absence oflocalisation technology on board or at the roadside excepting the installations at the boundary.Since there is currently no scheme using this technology regarding the requirements of a time basedarea charging, the proposed solution is not validated. Two problems could arise during thedevelopment phase:accuracy of the determination whether the engine is switched on or off by the vibration sensorthe power supply by batteries

Both points would change the concept in its fundamental advantages (e.g. the distribution conceptwith a self mountable TOBU would not be possible with the need of connection with the vehicles powersupply).

5

For the Swiss LSVA such adjustments have been agreed with France, Germany and Liechtenstein.

MTE_Denmark v1.0_final_02jun2006.doc

RappTrans

32

Trailer buttonDetector ofphys. fixingClockMovementsensor(s)

Optical display

Smartcard I/O

DSRC

Processor / Memory

Battery

Figure 11: Architecture of the TOBU for time based area charging