Finansudvalget 2009-10

FIU Alm.del

Offentligt

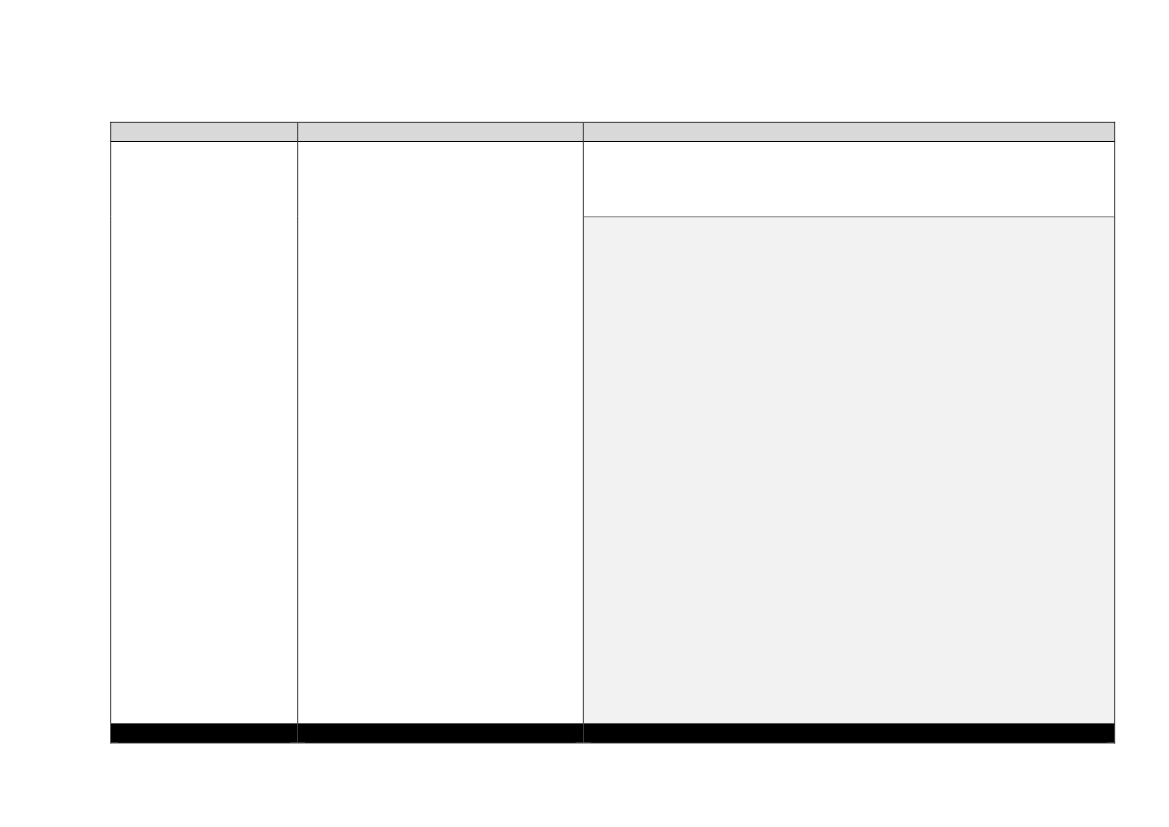

Side 1 af 8EmneSpørgsmålBesvarelseSpanienNoBelgienNo, but in some cases (ex. KBC) the institution can decide to reimburse the loan.England[Intet svar – se generelle bemærkninger for Englands besvarelse]

Has the governmentproposedanexitstrategy seeking to roll/back/end any supportschemesorotherExit-strategier,inkl. planer for extraordinarybankernestil- measures?bagebetaling afstatslige indskud.8. Exit strategies

SverigeThe Govt. has recently prolonged the Guarantee scheme until Dec 31th 2010. The conditions follow therecommendation by the EU Commission and prices are thus raised for certain credit categories. The Govtaims at phasing out the support gradually and do not see the market conditions as normal yet.The recapitalisation scheme has recently been prolonged until Feb 17th, 2011.NorgeThe swap agreements could be concluded for up to five years. There have not been announced anyauctions since December 2, 2009.The recapitalisation scheme is in principle perpetual, but there are mechanisms which make it favorablefor the credit institution to redeem the debt. There are also some limitations which make it interesting forthe institution to redeem the debt.Government funding to Eksportfinans: 5 years

Side 2 af 8EmneSpørgsmålBesvarelseFinlandgovernment

We have scaled down the guarantee scheme from the original 50 billion euro in 2009 to 17 billion for thisan

exit

year.

Has the

proposed

/

strategy seeking to roll

back/end any support

Exit-strategier,

schemes

or

other

Østriginkl. planer for extraordinary

In line with the proposals of the European Commission, Austria has to increase its guarantee fees from 1stbankernes

til- measures?

July 2010 onwards in order to have the prolongation of its support scheme approved by the Europeanbagebetaling af

Commission.statslige indskud.

Regarding capital injections, a step-up clause is part of the individual agreements with banks as well as aconversion privilege in case that the scheduled repayment is not being met.IrlandIreland will be seeking the Commission’s agreement for a modified extension of the guarantee consistentwith a phasing out over a realistic period of time. In line with the State aid approval granted by theEuropean Commission on 20 November 2009 in respect of the Eligible Liabilities Guarantee Scheme, theCommission is due to undertake its six-monthly review of the Scheme on 1 June next.The timing and exact steps in the phasing out of the guarantee will be dependent on a range of factors,most notably the situation in global financial markets, the funding capacity available to Irish institutions,evolving EU policy on exit strategies for State support to the banking sector generally and from guaranteesin particular, and financial stability risks to the Irish banking sector.HollandYes, from Jan 1st 2010, the price of the guarantee scheme for bank debt has been raised. The capitalinjections contain incentives for institutions to pay them back as early as possible. The illiquid backupfacility will amortize over time. The nationalized institutions will be sold when financial stability hasreturned and market conditions are sufficiently favourable.Side 3 af 8EmneSpørgsmålBesvarelseNorge, Finland, Østrig & England[intet svar]SverigeRegarding loan guarantees an annual levy of 0,5 % of the guaranteed amount is charged on top of marketprices (for covered bonds 0,25 %) for borrowing less than one year. For securities with a duration of 1-5years a risk based fee is also added (according to the COM/ECB guidelines).Regarding capital support: loans are to be paid back within 5 years otherwise support is converted intoshares.BelgienNot really, but some instruments (funding Royal park Investments, hybrid loan to KBC) will definitely bepaid back. In the case of shares, the government itself could sell them at a given time.HollandThe prices that institutions have to pay for use of the support schemes are considered high enough toincentivize institutions not to use them or to pay them back when they no longer need them.IrlandGuarantees have a charge attached.SpanienAlle de igangsatte forholdsregler indebærer ikke direkte hjælp, hvorfor der ikke er tale om tilbagebetaling.De anvendte metoder har bestået i finansiering af de pengeinstitutter, der har ansøgt om det (FAAF ogFROB), hvorfor disse skal tilbagegives i henhold til angivne tidsfrister. Hvad angår kautioner tilpengeinstitutternes udstedelse har disse til dato ikke været benyttet og det har derfor ikke væretnødvendigt at gøre brug af offentlige midler til betaling. Af samme grund er der heller ikke tale om nogentilbagebetaling.

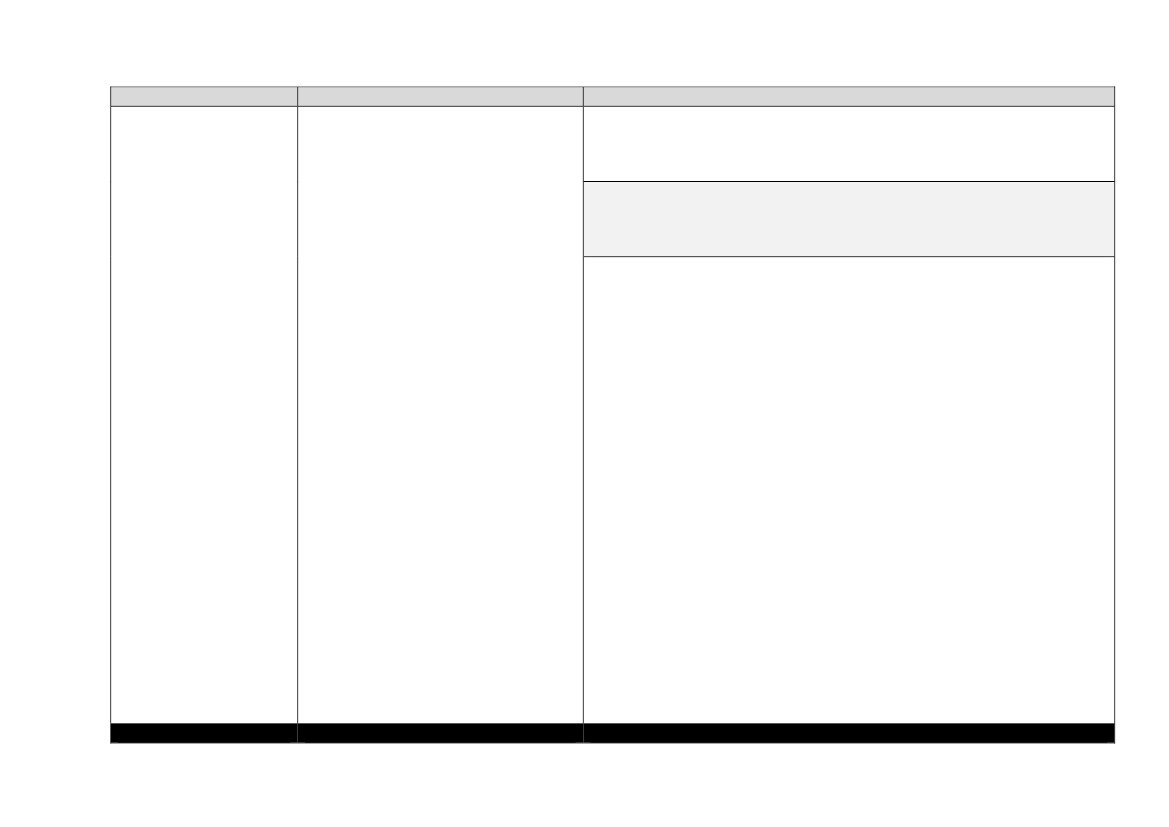

Has the governmentstated that support/

schemes including publicloans/subsidies shouldExit-strategier,

be paid back by financialinkl. planer for

institutions? If so, how isbankernes

til-

this to be done?bagebetaling af

statslige indskud.

Side 4 af 8

Emne

Spørgsmål

Besvarelse

9.1. Separation of finan- Has the government proposed changesSverige, Norge, Finland, Belgien, Østrig, Holland, Irland & Spaniencial institutionsto national regulations with the aim ofNosplitting up large financial institutions//financial conglomerates?Opsplitning af finansiel-le virksomheder.England[Intet svar – se generelle bemærkninger for Englands besvarelse]

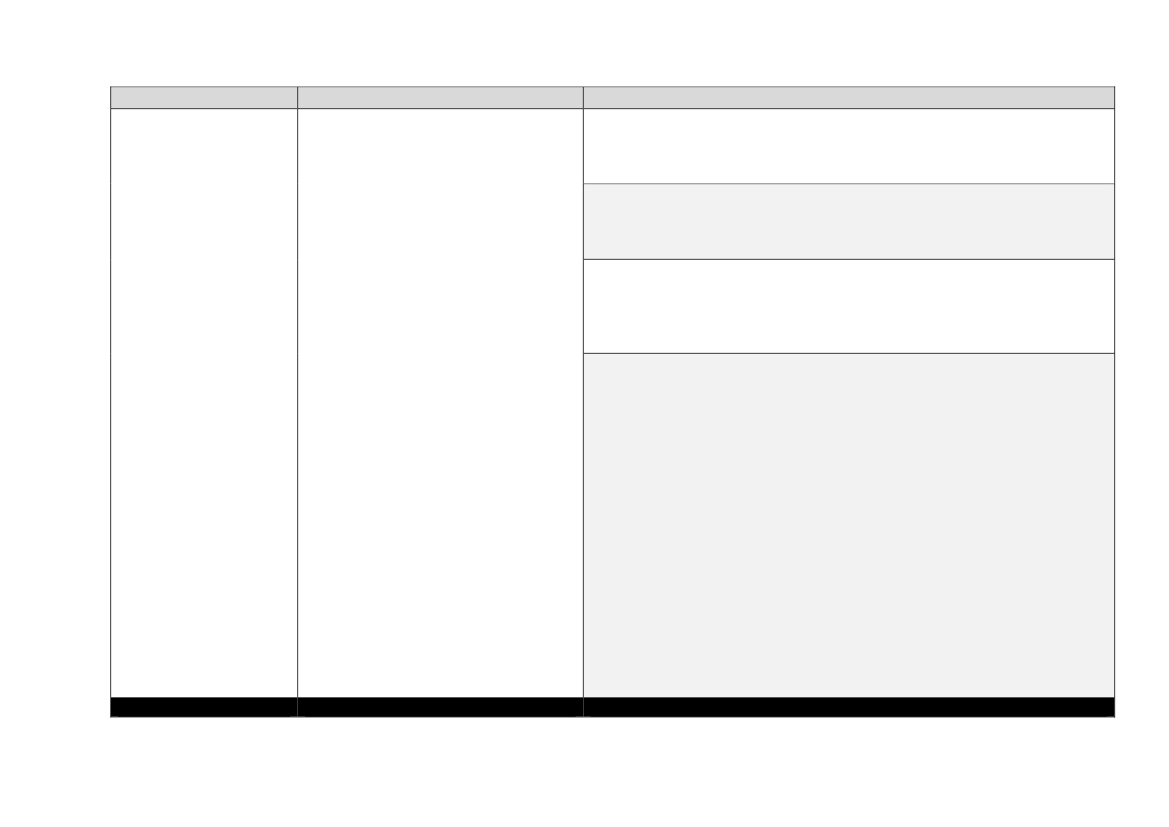

Side 5 af 8EmneSpørgsmålBesvarelseSverige, Norge, Finland, Belgien, Østrig, Holland & IrlandNoEngland[Intet svar – se generelle bemærkninger for Englands besvarelse]SpanienNej. De eneste forholdsregler der er til debat er dem, der p.t. er til nærmereovervejelse i EU-regi. Den spanske regering har ikke taget noget initiativ i denhenseende.

9.2. Limitation of invest- Has the government proposed changesto national regulations in order to limitmentsthe ability of credit institutions tomake certain types of investments/(ban on proprietary trading, ban onBegrænsninger ift. ban- operation of hedge funds, ban onkernes investeringsmu- handling of private equity or others)?ligheder.

Side 6 af 8EmneSpørgsmålBesvarelseSverige, Norge, Finland, Belgien, Holland & SpanienNoEngland[Intet svar – se generelle bemærkninger for Englands besvarelse]ØstrigYes. Austria is thinking about introducing a stability fee for the financial sector.Currently these plans are being evaluated.IrlandTax on bonuses: no. Tax on financial transactions: no. General tax as repayment ofsubsidies: no. Others: yes.The Government has taken action to restrict the amount of a NAMA participatinginstitution’s taxable trading income which can be reduced by losses carriedforward, including losses arising from the NAMA process. This differs from thetreatment applicable to companies, generally, who would be allowed to use all oftheir trading income arising in an accounting period to absorb losses of the sametrade carried forward from previous accounting periods. The legislation limits theamount of trading income of a participating institution and all other participatinginstitutions in the same group against which losses forward may be set off in anyaccounting period to 50 per cent of such income.The NAMA Act 2009 also provides for a levy to be introduced by way of taxsurcharge on the participating credit institutions should NAMA make an eventualloss over its lifetime.

10. Taxation

Has the government proposed changesto national regulations regarding/taxation of financial institutions (taxon bonuses, tax on financialÆndret beskatning af transactions or general tax asden finansielle sektor.repayment of subsidies)?

Side 7 af 8EmneSpørgsmålBesvarelse

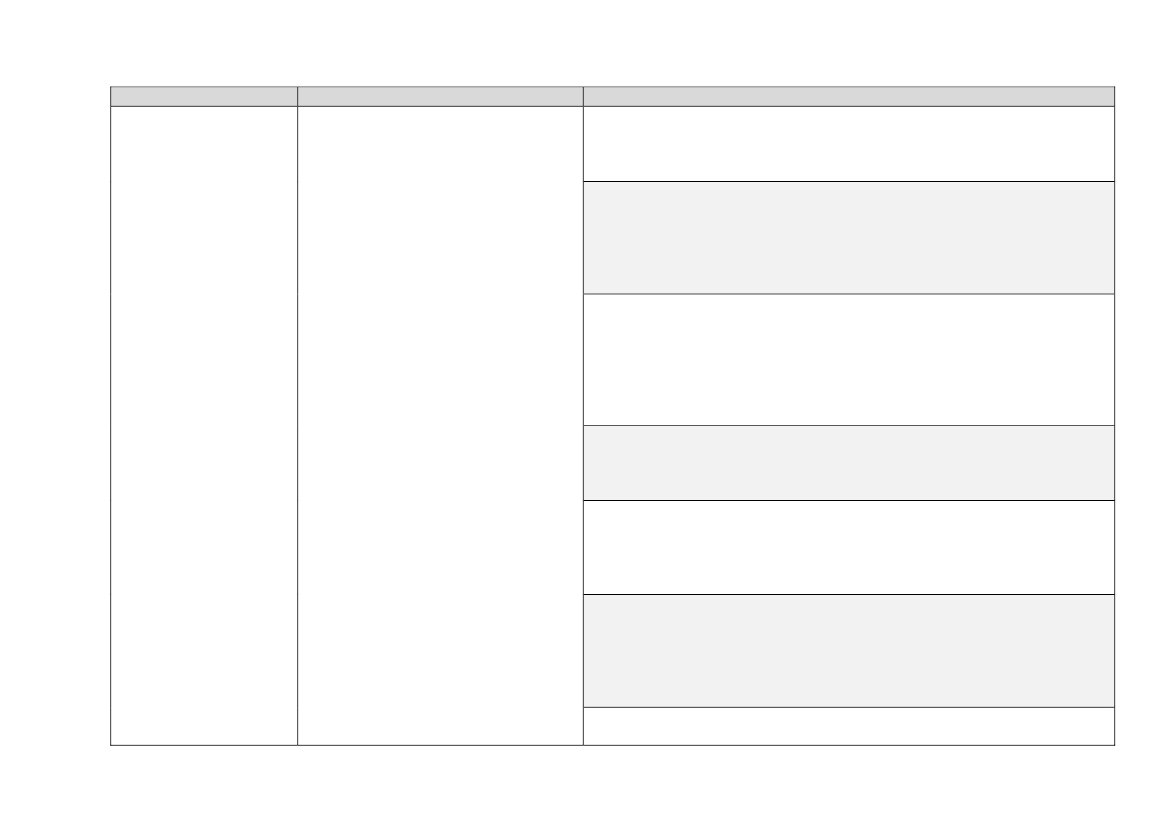

11. Crisis resolution fund

Has the government made proposalsNorge, Belgien & Østrigto set up a crisis fund in order toNo/support future government inter-ventions in the banking sector? If yes,FinlandOpbygning af krisefonde how is such a fund to be financed?No. We are now in a process of contemplating various options including a stabilitytil fremtidige rednings-fund financed by the credit institutions. The matter is currently under considera-aktioner i den finansielletion.inkl. finansieringsgrund-lag.HollandNo. Since long before the crisis there has been a deposit guarantee scheme; it isproposed, though, to finance this scheme ex ante instead of ex post (the schemeitself is financed by the banks without financial support from the government). Thisis probably not the kind of crisis fund this question refers to, though.England[Intet svar]SverigeYes. An annual levy of 0,036 % on an institution´s liabilities (excluding the Tier 1capital base)IrlandYes. Funding will be sourced from the existing National Pension Reserve Fund anddirectly from the Exchequer.

Side 8 af 8EmneSpørgsmålBesvarelseSpanienFROB betyder til en vis grad hjælp til de pengeinstitutter, der har behov for atstyrke deres solvens forud for en fusion. Til uddybelse af denne mekanisme henvisestil det under spørgsmål 2A anførte.

Has the government made proposals

to set up a crisis fund in order to

/

support future government inter-

ventions in the banking sector? If yes,

Opbygning af krisefonde how is such a fund to be financed?

til fremtidige rednings-

aktioner i den finansielle

inkl. finansieringsgrund-

lag.

11. Crisis resolution fund