Finansudvalget 2009-10

FIU Alm.del

Offentligt

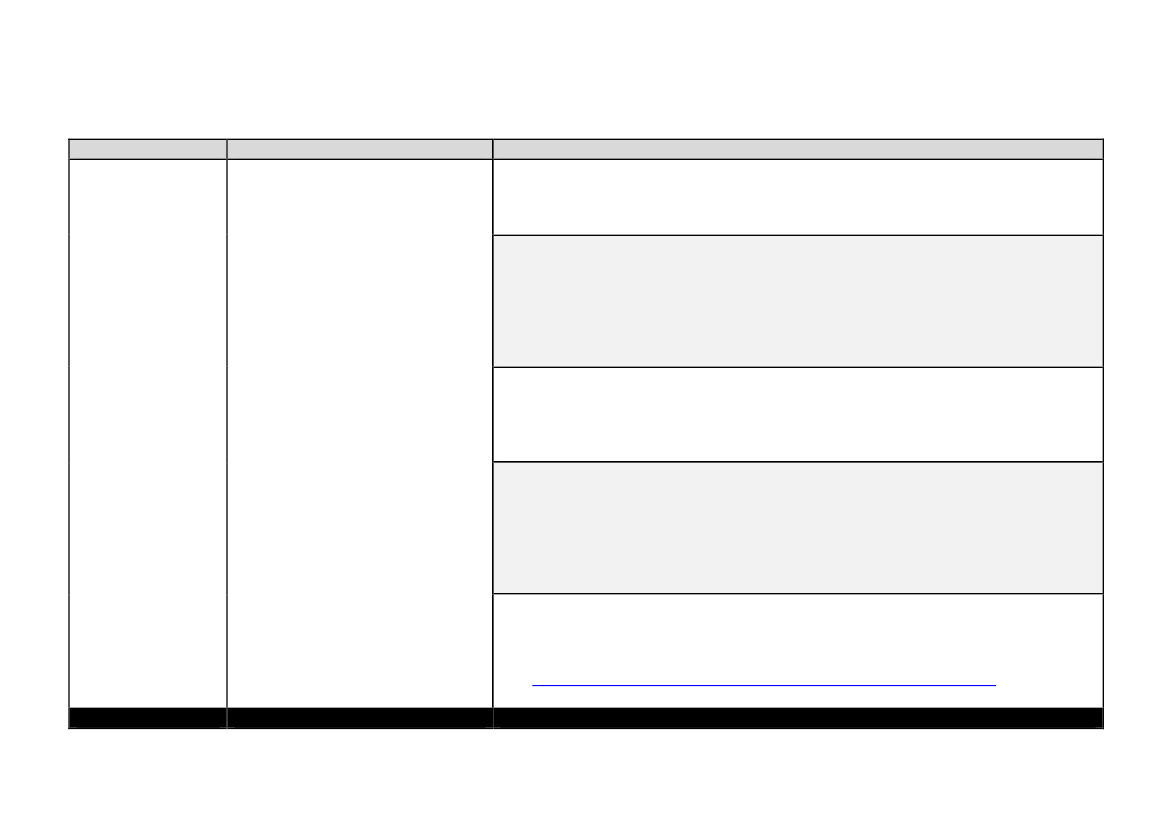

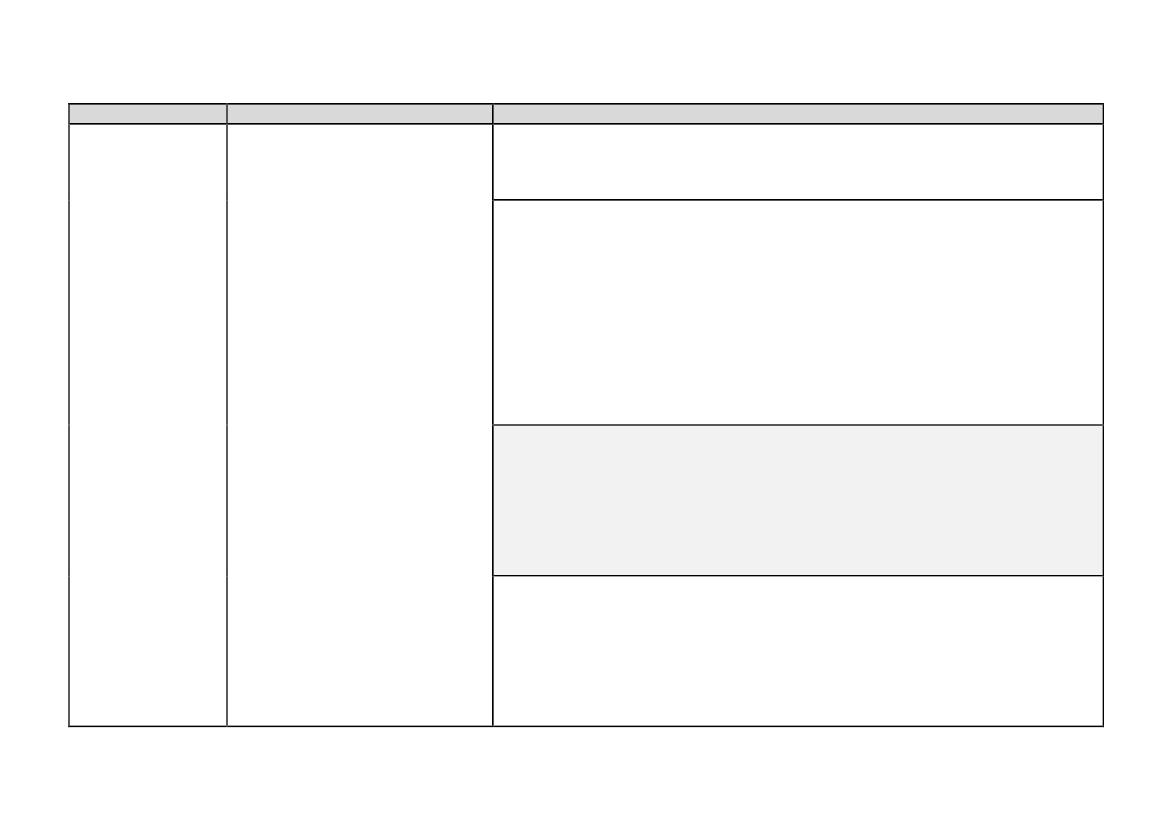

Side 1 af 29EmneSpørgsmålBesvarelse

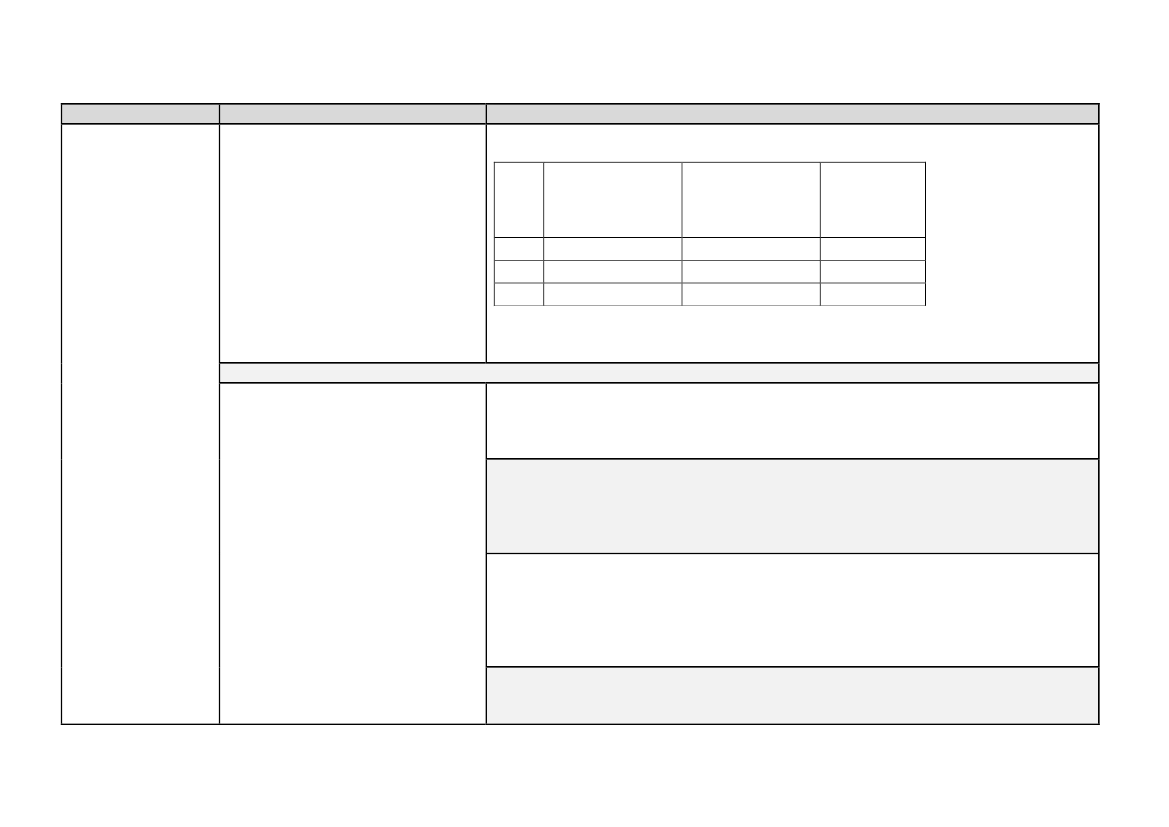

1. Losses ofcredit institutions/

A. “What was the total loss of creditSverigeinstitutions in 2008 and 2009The four major banks (ca. 80 % of the total )2008: 12.5 bn SEKrespectively? (amount in euro)”2009: 56.3 bn SEK

Bankernes faktisketab og tab ift. BNP

Norge2008: 1,029 billion EURO2009: 1,804 billion EURO

FinlandCredit institutions’ total profits (before taxes) were 2350 million euro in 2008 and 2036 millioneuro in 2009.

BelgienIn 2008, the aggregate loss amounted to EUR 19.5 billion.In 2009, the loss amounted to EUR 3.0 billion.

ØstrigDespite the crisis and the risk provisions and value adjustments it entailed, the consolidatedprofits of all Austrian banks reached EUR 0.6 billion in 2008. This is of course a sharp declinecompared with the record results of 2007 (6.8 bn) but must also be put into perspective of thelosses suffered by many large foreign banks. In 2009, Austrian banks improved theirconsolidated profits to EUR 1.5 billion.

HollandThis question is hard to answer unless one defines what counts as loss: the profit and loss as1

Side 2 af 29EmneSpørgsmålBesvarelsereported in the final lines of the annual reports (accumulated for all banks)? The net write-A. “What was the total loss of creditoffs/NPLs? The profit/loss before tax, value adjustments, depreciation and amortization?

1. Losses ofcredit institutions/Bankernes faktisketab og tab ift. BNP

institutions in 2008 and 2009Unfortunately, we do not have this data available on an aggregated level. An additionalrespectively? (amount in euro)”

complication is the turmoil in the Dutch market in 2008: one of our biggest bank ABN-Amro wassplit up in three parts: one went to RBS, another to Fortis and a third to Santander; Fortis waslater split up in a Dutch and Belgian part and nationalized by the respective governments (forthe Netherlands this meant that Fortis Netherlands and the Fortis share of ABN-Amro werenationalized). Data on the exact losses of the part of ABN Amro nationalized by the Dutchgovernment are unfortunately not publicly disclosed as the financial data of ABN Amro as awhole were until recently consolidated with those of RBS (the lead bank in the takeover of ABN-Amro). Hence, my suggestion to the researchers is, to look up the past annual reports of thethree/four biggest banks of the Netherlands: Rabobank, ING, (RBS)/ABN-Amro/Fortis (andpossibly NIBC and SNS which are minor in size but suffered some losses due to the crisis too) andlook up the data they need.

IrlandAllied Irish BanksBOIIrish Life & PermanentINBSEBSPostbankAnglo Irish BankTOTALS412

20082009€890m (€2,334m)€300m (€3,000m)€53m(€313m)(€321m) (€2,539m)(€37.8m) (€78.8m)(€21.2m) (€17.8m)1€765m2(€12.7bn)3€1,628m (€20,928.6m)

Unaudited result as Postbank extended its 200' year end until 31/5/2010Six months to end September 20083Fifteen months to end Sept 20094Guaranteed credit institutions only

2

Side 3 af 29EmneSpørgsmålBesvarelse

1. Losses ofcredit institutions/Bankernes faktisketab og tab ift. BNP

A. “What was the total loss of creditSpanieninstitutions in 2008 and 2009Der har ikke været tab i det samlede system hverken i 2008 eller i 2009, da man i begge perioderhar noteret fortjenester som anført nedenfor.respectively? (amount in euro)”I bankernes delsektor (iht. data fra Foreningen af Spanske Banker) beløb fortjenesterne i 2008sig til 11.876 millioner euro. Tal for 2009 foreligger ikke, men indtil september 2009 varfortjenesten på 6.087 millioner euro.For sparekassernes delsektors vedkommende (iflg. data fra Spansk Sparekasseforening) sluttede2008 med en fortjeneste (før skat) på 5.850 millioner euro, mens 2009 havde en fortjeneste på3.252 millioner euro.

England

3

Side 4 af 29EmneSpørgsmålBesvarelse

1. Losses ofcredit institutions/Bankernes faktisketab og tab ift. BNP

A. “What was the total loss of creditinstitutions in 2008 and 2009respectively? (amount in euro)”

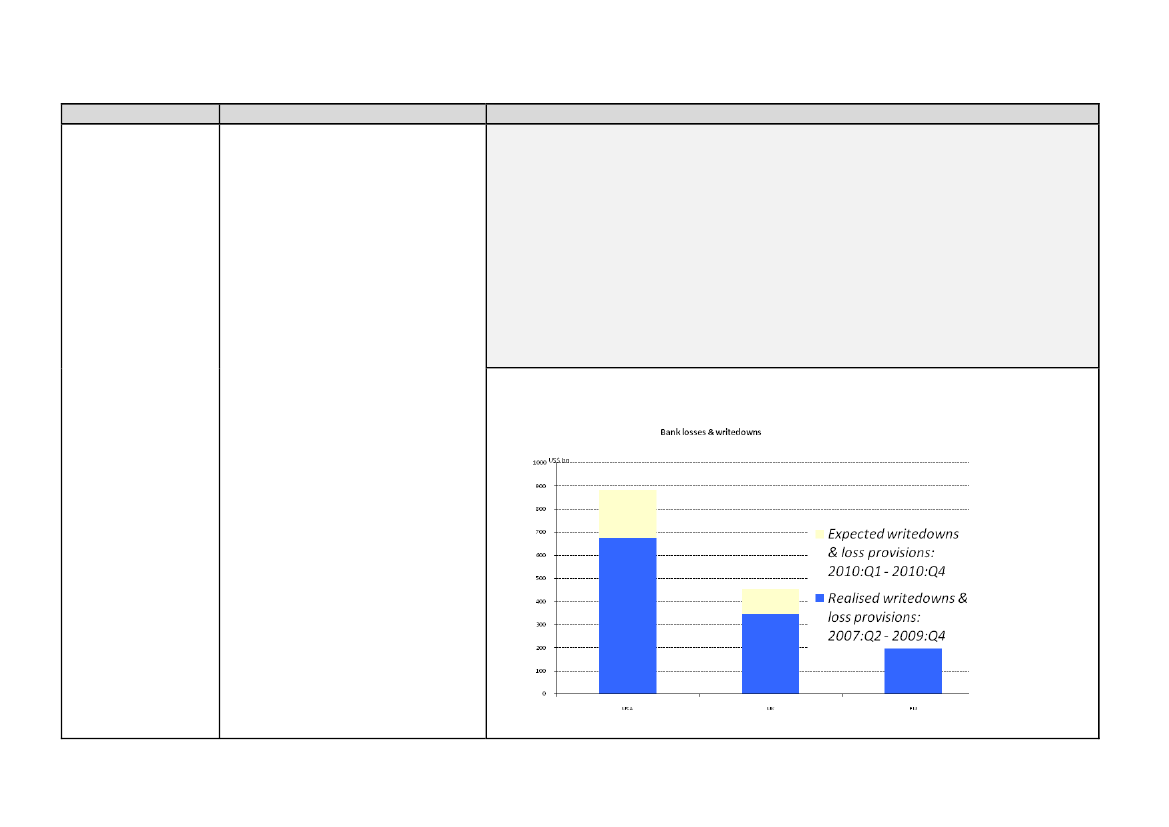

$bns

USAUKEU

Realisedwritedowns & lossprovisions:2007:Q2 - 2009:Q4677347413,6Source: IMF

Expected write-downs & lossprovisions:2010:Q1 - 2010:Q4208108251,4

Total write-downs &losses885455665

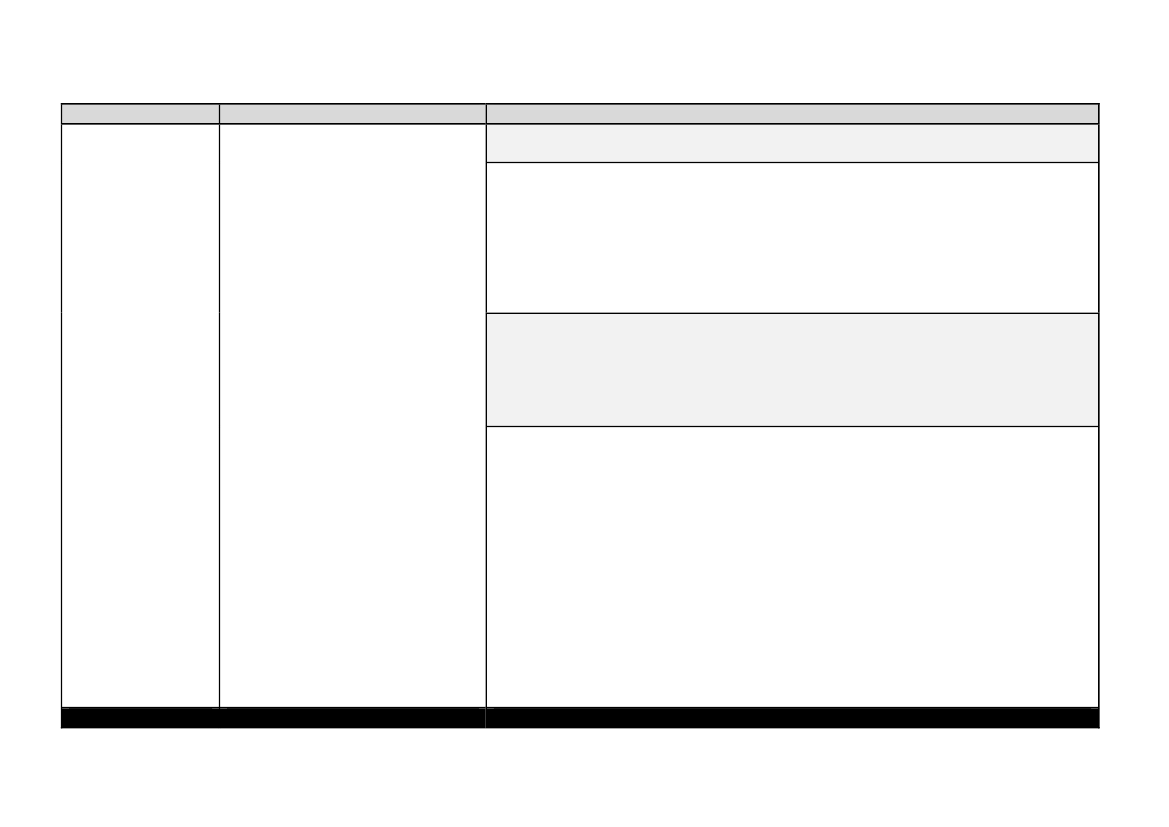

B. “What was the total loss of creditFinland, Østrig & Englandinstitutions in 2008 and 2009[intet svar]respectively as a proportion of GDP?(proportion in pct.)”Sverige2008: 0,4 %2009: 1,8 %

Norge2008: 0,32 per cent of GDP, 0,45 per cent of GDP mainland2009: 0,60 per cent of GDP, 0,78 per cent of GDP mainland

Belgien2008: 5.66%4

Side 5 af 29EmneSpørgsmålBesvarelse2009: 0.89%

1. Losses ofcredit institutions/Bankernes faktisketab og tab ift. BNP

B. “What was the total loss of creditinstitutions in 2008 and 2009respectively as a proportion of GDP?HollandThe Dutch GDP was:(proportion in pct.)”2008: € 596 Billion2009: € 573 Billion

Because no clear answer can be given to 1a, this question cannot be answered too.

IrlandProportion (pct.):200820090.90% 12.83%

Spanien(jfr. 1A)

5

Side 6 af 29

Emne

Spørgsmål

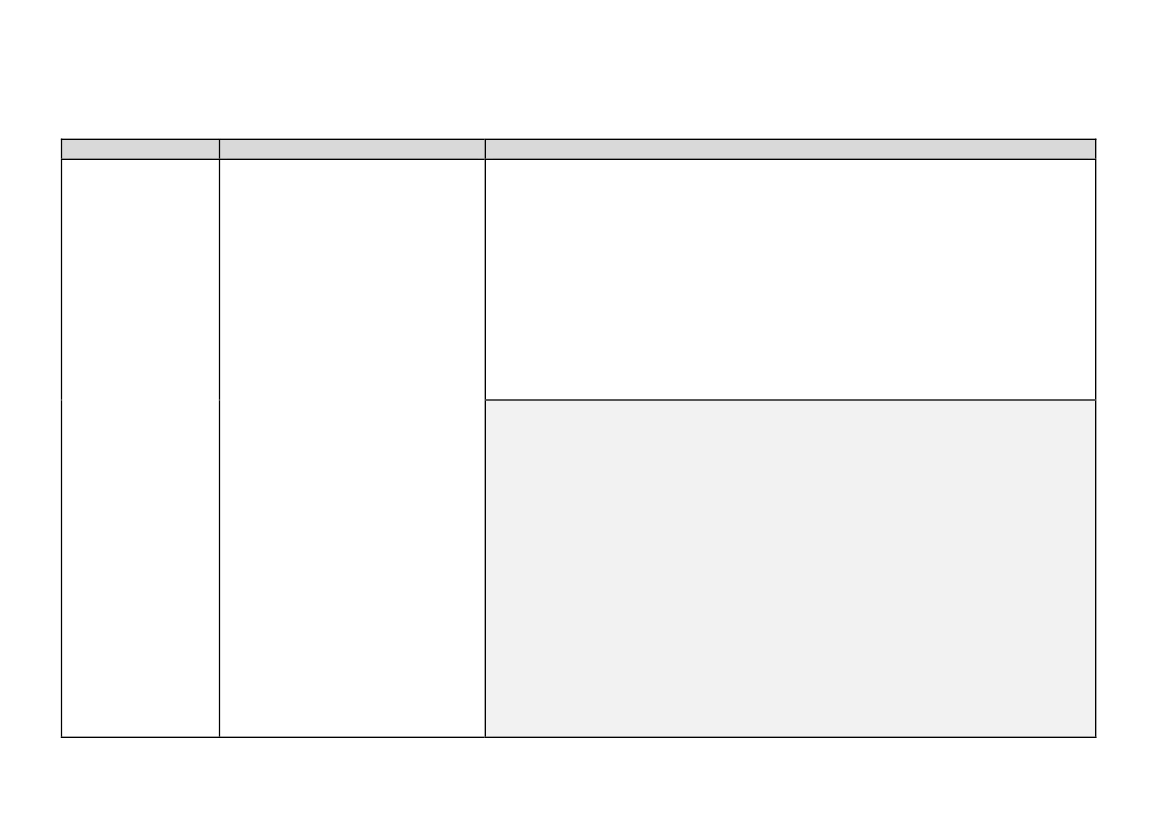

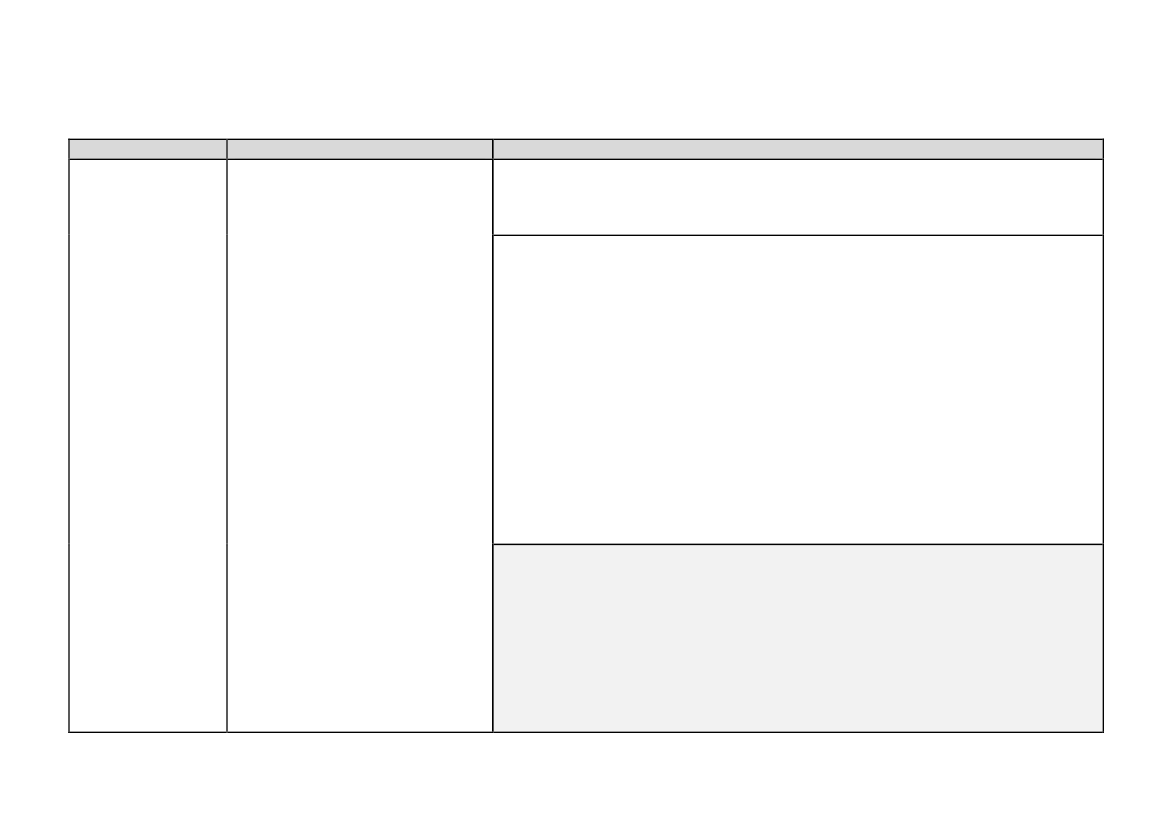

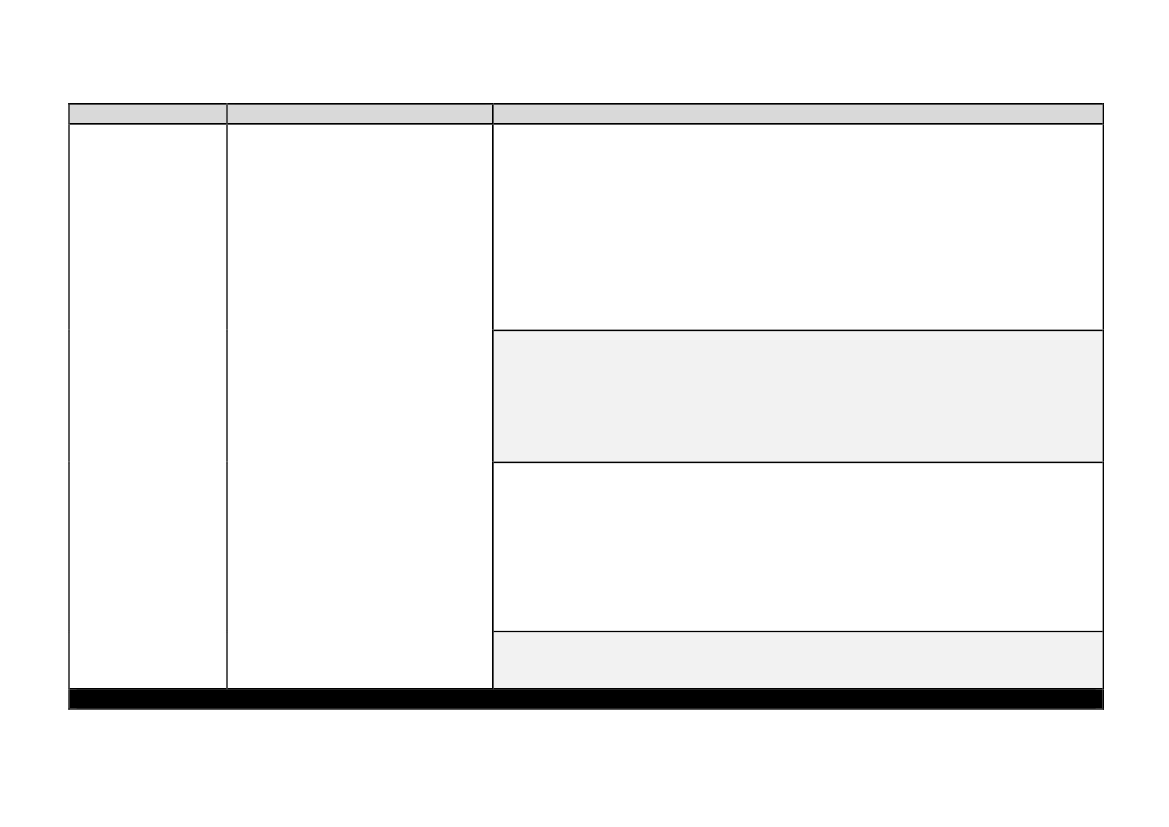

SpørgsmålSverigeA.Buying of shares: yes. Guaranteed loans: yes. Direct subsidies: no. Others: no.A recapitalisation scheme for solvent banks and other credit institutions. A Guarantee schemefor banks and other credit institutions for medium term borrowing (> 3 months to 5 years).B.Max amount 1500 bn SEK, current utilization 212 bn SEKMax amount 50 bn SEK, current utilization 5.6 bn SEKC.50 % of GDP

2. Bank support sch- A. Has the government initiatedsupport or guarantee schemes foremescredit institutions? If so what kindof scheme (Buying of shares,/guaranteed loans, direct subsidiesStatslige rednings- or others)pakker til bankerne:Indskudsform – ak- B. If yes, what is the total size of thetieopkøb, låneord- support scheme (amount in euro)ning eller andet.Faktiske beløb og C. If yes, what is the total size of thesupport scheme as a proportion ofandel ift. BNP.GDP? (proportion in pct.)

NorgeA.Buying of shares: yes. Guaranteed loans: no. Direct subsidies: no. Others: yes.Swap arrangement: exchange of government securities for covered bonds (liquidity scheme).Recapitalisation scheme for fundamentally sound banks. Government funding to EksportfinansASA for financing of export products that qualify under the CIRR scheme.B.Liquidity scheme: 350 billion NOK (approx. 43.75 billion euro)Used 230 billion NOK (28,8 billion EURO)Recapitalisation scheme: 50 billion NOK (approx. 6.25 billion euro)Used 4,1 billion NOK (0,5 billion EURO)C.Liquidity scheme: approx. 14.5 % of GDP (18,9 % of GDP mainland)Recapitalisation scheme: approx. 2 % of GDP (2,7 % of GDP mainland)(GDP in Norway in 2009 was approx. 2408 billions NOK - approx. 301 billion euro)

6

Side 7 af 29EmneSpørgsmålSpørgsmålFinlandA.Buying of shares: no. Guaranteed loans: yes. Direct subsidies: no. Others: no.Guarantee scheme for the credit institutions’ funding. No Finnish credit institution has so farapplied for a state guarantee. The scheme will expire at the end of 2010, although its relevancewill be assessed at the end of June. A state guarantee scheme for banks’ unsecured funding withmaturity 1 to 3 years and mortgage backed funding with maturity up to 5 years. 33% of thetotal amount of the scheme can be used for guarantees for maturities up to 5 years. The statecan subscribe to a capital loan issued by a deposit bank. The maximum of a loan is 25 per centof the capital requirement the bank in question. Strict conditions for management pay,distribution of banks funds, etc.B.At the moment 17 billion euro has been allocated to the guarantee scheme.Guarantee scheme 17 billion euro, in force at the moment until 30.6.2010 (18.12.2008-31.12.2009 the scheme was 50 euro). Capital injection scheme 4 billion euro (first scheme 1.1.-30.4.2010, will be prolonged until 31.10.2010)The bank has not made use of the schemes.C.As a proportion of 2009 GDP (171 billion euro) the scheme is close to 10 %.

2. Bank support sch- A. Has the government initiatedemessupport or guarantee schemes forcredit institutions? If so what kind/of scheme (Buying of shares,guaranteed loans, direct subsidiesStatslige rednings- or others)pakker til bankerne:Indskudsform – ak- B. If yes, what is the total size of thetieopkøb, låneord- support scheme (amount in euro)ning eller andet.Faktiske beløb og C. If yes, what is the total size of theandel ift. BNP.support scheme as a proportion ofGDP? (proportion in pct.)

BelgienA.Buying of shares: yes. Guaranteed loans: yes. Direct subsidies: no. Others: yes.The government has become a shareholder (Fortis Bank Belgium, Royal Park Investments,Dexia, Ethias), has subscribed to hybrid securities (KBC), and has funded institutions with debt(Royal Park Investments). It has guaranteed loans (Dexia), and issued guarantees on someportfolios of toxic assets (Dexia FSA, KBC, Fortis).B.The federal government has intervened for EUR 20.2 billion.7

Side 8 af 29EmneSpørgsmålSpørgsmålC.5.86%

2. Bank support sch- A. Has the government initiatedsupport or guarantee schemes foremescredit institutions? If so what kindof scheme (Buying of shares,/guaranteed loans, direct subsidiesStatslige rednings- or others)pakker til bankerne:Indskudsform – ak- B. If yes, what is the total size of thetieopkøb, låneord- support scheme (amount in euro)ning eller andet.Faktiske beløb og C. If yes, what is the total size of thesupport scheme as a proportion ofandel ift. BNP.GDP? (proportion in pct.)

ØstrigA.Buying of shares: yes. Guaranteed loans: yes. Direct subsidies: no. Others: yes.Based on decisions on the stabilization of financial markets at the European level, Austria hasadopted a comprehensive and sustainable package of measures to protect the savings depositsand to strengthen the banks and insurance companies. The package entered into force on 27October 2008 and was modified in August 2009.The central aspects of the Austrian package of measures encompass:1. Stimulation of the interbank‐marketThe objective of the Interbankmarktstärkungsgesetz (Interbank Market Support Act – IBSG) is toreinvigorate the interbank market and thereby to strengthen the banks’ confidence in theinterbank market. To this end, the banks established a clearing bank, for which the FederalGovernment can accept liabilities and which acquires funds on the interbank market andaccordingly forwards them to other banks. Furthermore, federal guarantees can also beprovided for bond issues of credit institutions. For all these measures an amount of 65 bn € isavailable.2. Equity‐strengtheningmeasures for individual banksWhilst the objective of the Interbankmarktstärkungsgesetz (Interbank Market Support Act –IBSG) is to restore the functioning of the interbank market, the measures of theFinanzmarktstabilitätsgesetz (Financial Market Stability Act‐ FinStaG) puts focus on theindividual institutes. The Act enables the Federal Minister of Finance in accordance with theFederal Chancellery to take recapitalization measures on credit institutions and insurancecompanies. This could be by means of state guarantees for potential credit loss or by means ofprovision of capital, especially participation capital. A further form of recapitalization is thepurchase of bank/insurance companies’ shares by the Federal Government. For these measuresan amount of 15 bn € is available.8

Side 9 af 29EmneSpørgsmålSpørgsmål3. Restoring confidence in financial marketsAs a third pillar of the package, natural persons� deposits were guaranteed in full in order tostrengthen confidence. This unlimited guarantee existed until 31 December 2009 and is limitedto an amount of EUR 100,000 from 1 January 2010 onwards. Furthermore bank deposits ofenterprises are guaranteed up to 50,000 €. Coverage of deposits, exceeding the amount of50,000 Euro, will be guaranteed directly by the state. For this measure 10 bn € are available inthe package.4. Strengthening supervisionFinally, the Financial Market Authority has the right to prohibit “naked short selling” and tosanction violations accordingly.5. Act Strengthening Enterprise LiquidityUnder the Unternehmensliquiditätsstärkungsgesetz (Act Strengthening Enterprise Liquidity‐ULSG), which entered into force on 25 August 2009, the Federal Government assumes liabilitiesfor loans to enterprises in order to facilitate their access to funding. The guarantees areavailable for companies with more than 250 employees, an annual turnover of more than 50 m€ and a sound economic base before the crisis, which means before 1 July 2008. For thesemeasures an amount of 10 bn € is available.B.100 bn EuroC.36% of GDP

A. Has the government initiated2. Bank support sch- support or guarantee schemes foremescredit institutions? If so what kindof scheme (Buying of shares,/guaranteed loans, direct subsidiesor others)Statslige rednings-pakker til bankerne: B. If yes, what is the total size of theIndskudsform – ak- support scheme (amount in euro)tieopkøb, låneord-ning eller andet. C. If yes, what is the total size of theFaktiske beløb og support scheme as a proportion ofandel ift. BNP.GDP? (proportion in pct.)

HollandA.Buying of shares: yes. Guaranteed loans: yes. Direct subsidies: no. Others: no.There was an amount of €20 Billion reserved for recapitalization of banks, of which €13,75Billion has been used (this excludes the nationalization of Fortis/ABN-Amro). There is also a9

Side 10 af 29EmneSpørgsmålSpørgsmål€200 Billion guarantee scheme for bank liabilities, of which about €50 Billion has been used (theA. Has the government initiatedlast time it was used was, however, in November 2009).Further, the Dutch part of Fortis was nationalized including its share of ABN-Amro.In addition, there was an illiquid back-up facility (a 90% guarantee with upward potential for a$28,8 Billion package of American alt-A mortgages held by ING).Finally, the guarantee on bank deposits by the deposit guarantee scheme was raised to€100.000 (which will be the European standard from 1st of January 2011).B.As guarantees, capital injections and full nationalisation are very different measures, thedifferent amounts reserved for these measures cannot be added and composed into ameaningful number of “the total size of the support scheme” (I.e., as guarantees make up thebiggest part of support provided in most EU member states, the total number created by simpleaddition of the different schemes would stem predominantly from the guarantees).C.See for GDP numbers question 1b.

2. Bank support sch- support or guarantee schemes forcredit institutions? If so what kindemesof scheme (Buying of shares,guaranteed loans, direct subsidies/or others)Statslige rednings-pakker til bankerne: B. If yes, what is the total size of theIndskudsform – ak- support scheme (amount in euro)tieopkøb, låneord-ning eller andet. C. If yes, what is the total size of theFaktiske beløb og support scheme as a proportion ofGDP? (proportion in pct.)andel ift. BNP.

IrlandA.Buying of shares: yes. Guaranteed loans: yes. Direct subsidies: no. Others: yes.100% guarantee scheme (Covered Institutions Financial Support Scheme) to 29 September 2010;100% Guarantee scheme for certain liabilities after that (Eligible Liabilities Guarantee Scheme);The National Asset Management Agency (NAMA) established to buy loans from participatinginstitutions at a discount;Government has committed to provide capital in the form of ordinary equity to institutionswhere it cannot be sourced from the private sector;Government has acquired interests in or taken control of the five NAMA participants.B.€376bn covered by Guarantee as reported to EU€11bn recapitalisation to date with further amounts to be made available ifrequired.10

Side 11 af 29EmneSpørgsmålSpørgsmål

A. Has the government initiatedC.GDP 2008 € 181,825m 6.05 %2009 € 163,542m 6.73 %2. Bank support sch- support or guarantee schemes forcredit institutions? If so what kindemesof scheme (Buying of shares,guaranteed loans, direct subsidiesEngland/Special Liquidity Scheme (SLS)- The SLS was introduced by the Bank of England in April 2008 toor others)improve the liquidity position of the banking system by allowing eligible banks and buildingStatslige rednings-societies to swap their quality mortgage backed and other securities for UK Treasury-Bills. Thepakker til bankerne: B. If yes, what is the total size of theterm of this facility to such banks and building societies is for one year from drawdown andIndskudsform – ak- support scheme (amount in euro)renewable for up to three years. In nominal terms £185bn of Treasury Bills had been swappedtieopkøb, låneord-for £287bn high quality private sector assets when the scheme closed for a new drawdown onning eller andet. C. If yes, what is the total size of the30 January 2009. HM Treasury have indemnified the Bank of England against any losses theyFaktiske beløb og support scheme as a proportion ofmay suffer under the SLS. The scheme will run until the end of January 2012 before itterminates.GDP? (proportion in pct.)andel ift. BNP.Credit Guarantee Scheme (CGS)- CGS was announced as part of the Government’s actions tosupport the banking sector in October 2008. It made available, to eligible institutions, agovernment guarantee of new debt issuance of up to three years’ maturity. The drawdownwindow for initial issuance closed in February 2010, though institutions will be able to continueto roll over debt for years to come. The final maturity date is 9 April 2014. Outstanding debtissued under the scheme stood at £125bn as of 24 March 2010.Nationalisations– The Government remains sole shareholders in Northern Rock and Bradford &Bingley. Northern Rock was restructured into two separate companies from 1 January 2010:Northern Rock plc and Northern Rock (Asset Management) plcThe Government has provided support to the two companies in the form of: a loan (currentoutstanding balance of £23 billion) to Northern Rock (Asset Management) plc; an equity injectionof £1.4 billion into Northern Rock plc; and a Working Capital Facility of up to £2.5 billion toNorthern Rock (Asset Management) plc to support the company’s business plan. Certainwholesale deposit guarantees remain in place but notice has been given of the intention to liftthe retail deposit guarantee from 24 May. Given the financial position of both companies it is11

Side 12 af 29Spørgsmålexpected that all of this money will be returned to the taxpayer. The Government has alsoA. Has the government initiatedprovided support to Bradford & Bingley in the form of a Working Capital Facility (currently the2. Bank support sch- support or guarantee schemes forcommitment is up to £11.5 billion) and certain deposit and capital guarantees. Given the level ofemescredit institutions? If so what kindloss absorbing capital of Bradford & Bingley the Government expects to recover all of this money.EmneSpørgsmål

/Statslige rednings-pakker til bankerne:Indskudsform – ak-tieopkøb, låneord-ning eller andet.Faktiske beløb ogandel ift. BNP.

of scheme (Buying of shares,Deposit guarantee- The repayment and recovery of financial support provided to protect retailguaranteed loans, direct subsidiesdepositors. As part of the resolution of a number of financial institutions during the crisisor others)(Bradford & Bingley, Dunfermline Building Society, London Scottish Bank, Kaupthing Singer &

B. If yes, what is the total size of theloans and other financial support in order to protect retail depositors. The outstanding amountsupport scheme (amount in euro)totals £27 billion. The majority of this is repayable from the Financial Services Compensation

Friedlander, Heritable Bank and the payout to Icesave depositors) the Government provided

Scheme through recoveries from the resolved institutions and, if necessary, levies on theC. If yes, what is the total size of thefinancial industry. HM Treasury also has claims to proceeds from the winding-up of the relevantsupport scheme as a proportion ofinstitutions and continues to expect full repayment of the loan to the Icelandic DepositorCompensation Scheme and is continuing to discuss the terms of the repayment with theGDP? (proportion in pct.)Icelandic authorities;Recapitalisation- The Government injected £20bn for Royal Bank of Scotland (RBS) and £17bnfor Lloyds/HBOS in 2008. Additional £25.5bn has been provided for RBS in Nov 2009, as well asestablishing £8bn of contingent capital. Subscription to Lloyds Banking Group (LBG) rights issuein December 2009 cost £5.8bn. HMT made profits from the sale of preference shares of £2.56bnand also receive £0.32bn annually in contingent capital fees from RBS. In addition, HMT havereceived £0.54bn in rights issue underwriting fees.Asset Protection Scheme (APS)- The first agreement under the APS was announced in Feb 26,2009, covering £325 billion in RBS assets. The scheme serves to insure banks against largefurther losses on troubled assets, by limiting their exposure to the losses. According to therevised terms of the Scheme RBS will participate with an asset pool of £282bn. The bank willbear an initial loss of up to £60bn and 10% of losses thereafter. Therefore, the maximum liabilityof HMT under the guarantee is £200bn. In return RBS are committed to paying fees of £700mfor the first 3 years and £500m annually thereafter - for which they have already paid the firsttwo years. LBG have paid £2.5bn in APS exit fees.12

Side 13 af 29EmneSpørgsmålSpørgsmål

A. Has the government initiated2. Bank support sch- support or guarantee schemes foremescredit institutions? If so what kindof scheme (Buying of shares,/guaranteed loans, direct subsidiesor others)Statslige rednings-pakker til bankerne: B. If yes, what is the total size of theIndskudsform – ak- support scheme (amount in euro)tieopkøb, låneord-ning eller andet. C. If yes, what is the total size of theFaktiske beløb og support scheme as a proportion ofandel ift. BNP.GDP? (proportion in pct.)

SpanienA.Man har ikke foretaget nogen af de nævnte initiativer, men andre lignende.Hvad angåropkøb af aktier- en ualmindelig forholdsregel, der, selvom den er taget ibetragtning, endnu ikke er benyttet og som indgår i den forpligtigelse som stats- ogregeringschefer fra euro-zonen aftalte ved deres møde den 12. oktober 2008 om anvendelse afde nødvendige midler med henblik på at sikre det finansielle systems stabilitet i koordinationmed den Europæiske Centralbank. Man bemyndiger således Økonomi- og Finansministeriet til atbeordre opkøb af værdipapirer udstedt af kreditinstitutter med adresse i Spanien, som måttehave behov for at forstærke deres egen pengebeholdning og som anmoder herom (incl.præferenceaktier og indehaverbeviser, efter forudgående rapport fra Spanske Nationalbank).Indtil dato har man ikke foretaget tiltag med henvisning til denne aftale.Andre foranstaltninger:Fond til opkøb af finansielle aktiver(Fondo de Adquisición de Activos Financieros,FAAF),enmekanisme der skal imødekomme midlertidig mangel på likviditet på de internationalekapitalmarkeder og som, til en vis grad, har til hensigt at erstatte denne finansieringskilde afkreditinstitutter. I den henseende gives der halvlange lån (under alle omstændigheder mere endet år) til kreditinstitutterne gennem køb (i fast regning eller ved samtidige operationer) af højkvalitet værdipapirer, der forhandles eller skal forhandles på regulerede markeder.Der vil kun blive opkøbt høj kvalitet værdipapirer med kvalifikation AAA til køb i fast regning ogAA til samtidig køb/salg, tildelt af mindst et af de mest velanskrevne risikoanalyse bureauer.Dette, sammen med det forhold at aktiverne skal være udstedt efter den 1. august 2007 for såvidt angår de samtidige køb og efter 15. oktober 2008 for fast regning, udelukker de såkaldte”værdiforringede aktiver” (”toxic assets”) fra de aktiver, der er receptive til at blive opkøbt afFonden. Fonden havde en begyndelseskapital på 30.000 millioner euro med mulighed for atblive forøget til maksimum 50.000 millioner euro, og de debiteres statsbudgettet i form afstatsgældsbeviser.13

Side 14 af 29EmneSpørgsmålSpørgsmålI de to sidste måneder af 2008 gennemførte Fonden til opkøb af finansielle aktiver to auktioner,i hvilke staten havde investeret mere end 9.300 millioner euro i høj kvalitet aktiver fraherværendekreditinstitutter.Dennesærligefinansieringskanalhartilladtfinansieringsselskaberne at opnå finansiering på konkurrencevenlige betingelser og med langløbetid.

A. Has the government initiated2. Bank support sch- support or guarantee schemes forcredit institutions? If so what kindemesof scheme (Buying of shares,guaranteed loans, direct subsidies/Den tredje auktion fandt sted den 21. januar 2009 med køb af aktiver på en værdi af 4.000or others)millioner euro. Ved den fjerde auktion, der blev holdt den 30. januar 2009, blev der købt aktiverStatslige rednings-for 6.002 millioner euro. Fondens totale investering har således beløbet sig til 19.301 millionerpakker til bankerne: B. If yes, what is the total size of theeuro.Indskudsform – ak- support scheme (amount in euro)tieopkøb, låneord-Kaution for udstedelser:Denne forholdsregel har til hensigt at udstyre pengeinstitutterne medning eller andet. C. If yes, what is the total size of theen sikringsmekanisme bekræftet gennem en statskaution for nye halvlange gældsudstedelser,Faktiske beløb og support scheme as a proportion ofhvorved kreditkvaliteten af disse forstærkes samtidig med at der opnås bedreadgangsbetingelser til engroskreditmarkederne for vore banker og sparekasser. DeGDP? (proportion in pct.)andel ift. BNP.pengeinstitutter, der gør brug af denne mekanisme, skal betale en pris for risikoen ved dekautioner som staten påtager sig i hver operation. Indtil den 12. januar 2012 har mankautioneret for mere end 144 udstedelser på en værdi der overstiger 47.000 millioner euro. Dennævnte mekanisme vil give vore pengeinstitutter mulighed for at anvende statsgarantien forudstedelser indtil den 26. juni 2010 og op til et maksimalt tillægsbeløb på 57.400 millioner euro.

Fond for lovbestemt omstrukturering af bankvæsen(Fondo de Reestructuración OrdenadaBancariaFROB).Dens funktion vil være at garantere finansieringssystemets stabilitet ved atstøtte en omstrukturering af de finansieringsinstitutter, der er ramt af krisen.FROBagerer kunnår man ikke har kunnet finde private løsninger gennem Fonden for Indskudsgarantier, der kanfinansieres gennemFROB.To væsentlige mål opfyldes således:Forestå finansieringsinstitutternes omstruktureringsproces ved opkøb af aktier ellerindehaverbeviser samt deltage i en ændring af pengeinstituttets administration.Medvirke til at forstærke egne ressourcer i integrationsprocesserne ved opkøb afværdipapirer udstedt af de integrationsramte pengeinstitutter med løfte fraudstedernes side om at genkøbe disse når muligt.14

Side 15 af 29EmneSpørgsmålSpørgsmålMed henblik på indførelsen af disse tiltag vil et beløb på 9.000 millioner euro blive stillet tilrådighed, hvoraf 2.250 millioner kommer fraFonden til opkøb af finansielle aktiver.B.Startkapital:FAAF: 30.000 mio. euro, som kan forøges til 50.000.Kautioner: 104.400 mio. euro.FROB: 9.000 mio. euro, som kan forøges.I alt: 143.400 mio. euro, som kan forøges.Faktisk anvendt:FAAF: 19.300 mio. euroKautioner: 47.000 mio. euroFROB: 2.155 mio. euroI alt: 68.455 mio. euroC.Af startkapital (143.400 mill.): 13,6%Af det faktisk anvendte (68.455 mill.), incl. kautioner: 6,5%Af de faktisk anvendte (21.455 mill.), uden kautioner: 2,0%

A. Has the government initiated2. Bank support sch- support or guarantee schemes foremescredit institutions? If so what kindof scheme (Buying of shares,/guaranteed loans, direct subsidiesor others)Statslige rednings-pakker til bankerne: B. If yes, what is the total size of theIndskudsform – ak- support scheme (amount in euro)tieopkøb, låneord-ning eller andet. C. If yes, what is the total size of theFaktiske beløb og support scheme as a proportion ofandel ift. BNP.GDP? (proportion in pct.)

15

Side 16 af 29

Emne

Spørgsmål

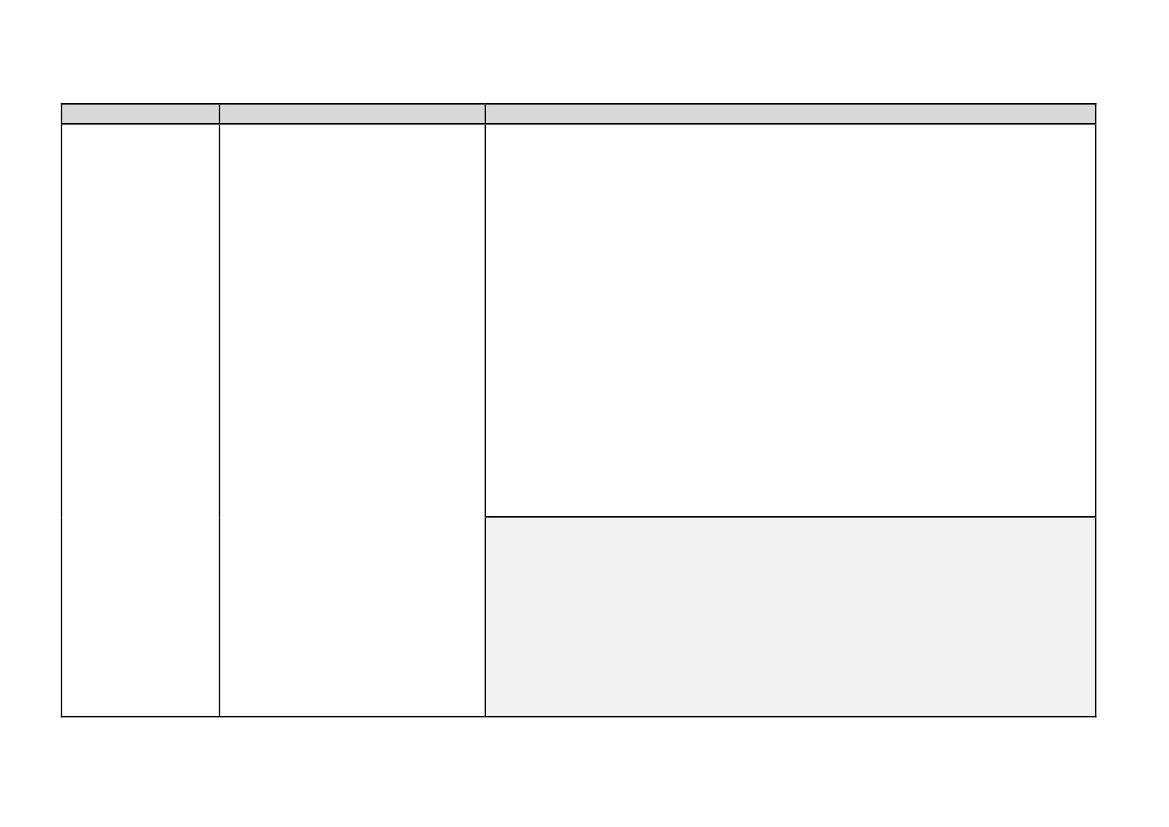

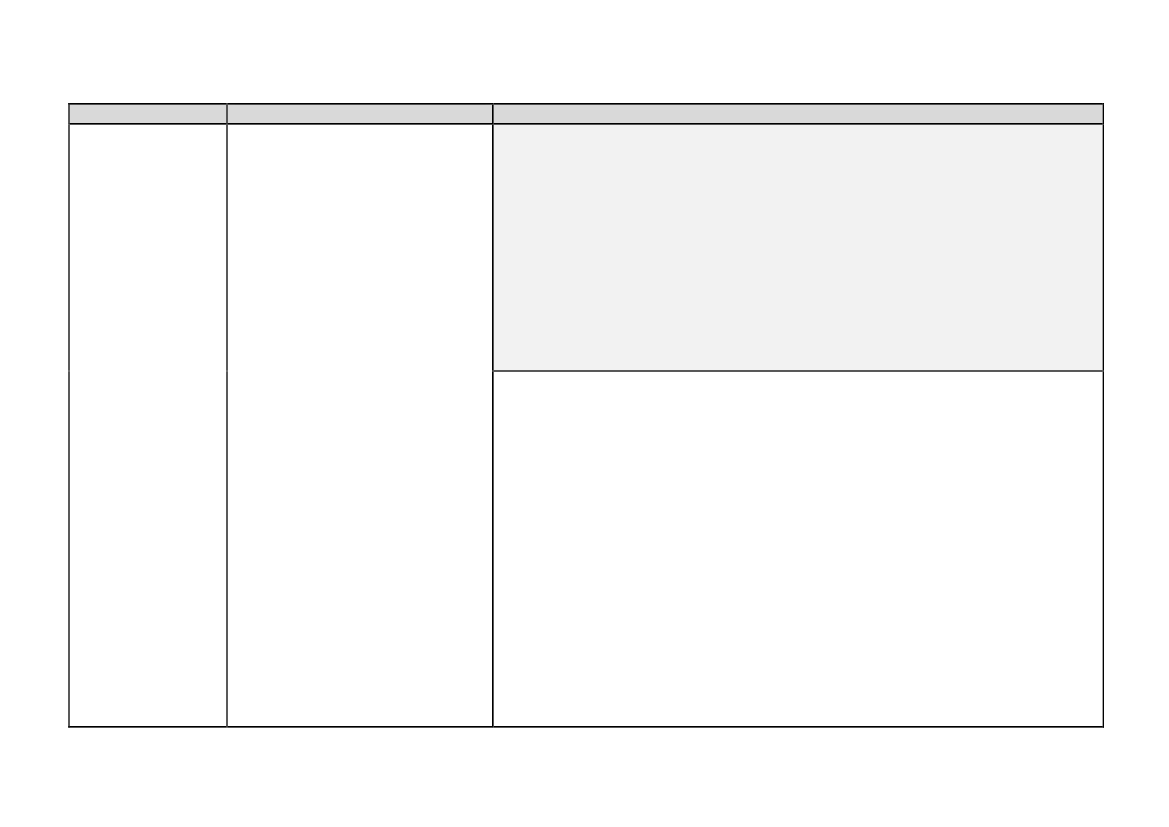

BesvarelseSverige, Finland, Belgien, Østrig & SpanienNo

Has the government proposedchanges to national capitalrequirements for credit institutions(Required amount of core capital,/solvency requirements, limits toÆndrede krav til tiers of capital, leverage ratio orothers)?kapitalgrundlag:Ændrede krav tilkernekapitalpro-cent, solvensgrad,Tier-kapitalmax,max-udlånsgearingeller andet.3. Capitalrequirements

NorgeNo. FSA has put forward a proposal to Ministry of Finance on CRD II and CRD III. Norway isconsidering to implement the proposal for new liquidity requirements (Internationalframeworkfor liquidity risk measurement, standards and monitoring)1,5 - 2 years before they come intoforce by end 2012.

HollandNo extra national measures. (I.e., measures taken internationally such as those of Basel/CRDare excluded in this answer).

IrlandNo. Capital requirements for credit institutions is a matter for the Financial Regulator ratherthan the Government. The Financial Regulator has specified a level of 8% of core tier 1 capitalfor Irish banks is to be applied. This level of capital must be met after taking account of allfuture losses, from both NAMA and non-NAMA portfolios. This capital will be principally in theform of equity - a 7% equity requirement.EnglandGovernment is supporting changes via the Basel forum. In addition to this the Financial ServicesAuthority has issued improved guidance for firms liquiddity positions. The rules are availablehere:http://www.fsa.gov.uk/pages/Library/Communication/PR/2009/132.shtml

16

Side 17 af 29

Emne

Spørgsmål

BesvarelseSpanien & BelgienNo

A. Has the government proposedchanges to national requirementsconcerning remuneration of finan-/cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus aspakker til direktion proportion of base salary, clawog andre risikota- back, tax on bonuses or other)?gende medarbejde-re: Aktieoptioner, B. If yes, do any of these changesgolden parachutes, apply only to top level managementvariable lønandeles or to employees in risk takingstørrelse ift. grund- positions as well?løn og lignende. Derønskes en oversigt C. If yes, do any of these changesbåde ift. de banker, apply only to credit institutionsder har fået støtte which have been included in aog generelle stram- national support scheme (see abo-ninger ift. finansielle ve) or to financial institutions ingeneral?virksomheder.4. Remuneration

SverigeA.Yes. The following applies to the 5 leading directors with the highest total remuneration:- fixed salary not to exceed the level decided before 20 oct 2008 (loan guaranty) and 9 feb 2009(capital support)- flexible remuneration not to be decided during the agreement period (loan guaranty) or duringthe period 9 feb 2009 to 31 dec 2011(capital support)- remunerations to board members to be fixed at the level of 20 oct 2008 (loan guaranty) or 9feb 2009 (capital support)The EU recommendations on remuneration policy has been implementedB.(se A)C.only to institutions included in support schemes

NorgeA.Yes and no. FSA has put forward a proposal to Ministry of Finance that will be sent out on ahearing to the financial institutions beginning of May. The rest of the answers are based on thisproposal.Share-options: yes. Golden parachutes: yes. Size of bonus as proportion of base salary: yes. Clawback: yes. Tax on bonuses: no. Other: n/a.The proposed changes are in line with CRD III proposal regarding remuneration. Size of bonuses17

Side 18 af 29EmneSpørgsmålBesvarelseare not fixed as a proportion of base salary, but fixed and variable components of totalremuneration should be appropriately balanced and the fixed component must represents asufficiently high proportion of the total remuneration to allow the operation of a fully flexiblepolicy on variable remuneration components, including the possibility to pay no variableremuneration component.

4. Remuneration

A. Has the government proposedchanges to national requirements/concerning remuneration of finan-cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus asB.The changes apply to risktakers whose professional activities have a material impactpakker til direktion proportion of base salary, clawon the institutions risk profile and senior managementog andre risikota- back, tax on bonuses or other)?gende medarbejde-C.In general the proposal apply to all credit institutions with more than 30bn NOK in assets,re: Aktieoptioner, B. If yes, do any of these changesand investment firms, but there are some exceptions to the rules for investment firms.golden parachutes, apply only to top level managementvariable lønandeles or to employees in risk takingstørrelse ift. grund- positions as well?løn og lignende. DerFinlandønskes en oversigt C. If yes, do any of these changesA.Share-options: yes. Golden parachutes: no. Size of bonus as proportion of base salary: no.både ift. de banker, apply only to credit institutionsClaw back: no. Tax on bonuses: no. Other: yes.der har fået støtte which have been included in aog generelle stram- national support scheme (see abo-The proposed changes will be compliant with the binding regulation in the Capital Requirementsninger ift. finansielle ve) or to financial institutions inDirective (including Annex specifying the principles to be applied in the remuneration systems).We have as yet no plans to enhance the regulation included in the CRD. Also, in thevirksomheder.general?

implementation, we will respect the guidance expressed in the CRD-recital no. (7): “theremuneration principles should be without prejudice to the ----- general principles of contractand labour law, applicable legislation regarding shareholders rights--- general responsibilities ofthe administrative bodies of the institution concerned. The changes in Finnish regulation,resulted by the CRD will be implemented in the a) Act on Credit Institutions, and by reference inthe b) Act on Investment Firms.The Annex V of the new CRD is likely to be implemented as a Ministry of Finance Regulation(Finansministeriets förordning).Others include (included in the CRD Annex V)18

Side 19 af 29EmneBesvarelse- deferral (ia)A. Has the government proposed- prohibiton to use personal hedging mechanisms (ib)B.We will follow the CRD, formally only to employees affecting the risk position, but in therecitals (motiv) we are likely to note that top management qualify as a rule to such persons.C.There are certain provisions in the scheme concerning for example remuneration. However,as stated above, no institution has thus far applied for state support. We have separate, specificregulation regarding credit institutions, who have received state aid. These will be on top of theCRD requirements.Spørgsmål

4. Remuneration

changes to national requirements/concerning remuneration of finan-cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus aspakker til direktion proportion of base salary, clawog andre risikota- back, tax on bonuses or other)?gende medarbejde-re: Aktieoptioner, B. If yes, do any of these changesgolden parachutes, apply only to top level managementvariable lønandeles or to employees in risk takingstørrelse ift. grund- positions as well?løn og lignende. Derønskes en oversigt C. If yes, do any of these changesbåde ift. de banker, apply only to credit institutionsder har fået støtte which have been included in aog generelle stram- national support scheme (see abo-ninger ift. finansielle ve) or to financial institutions invirksomheder.general?

ØstrigIn line with the Austrian support scheme to overcome the financial crisis, the Minister of Financedetermined in accordance with the Austrian chancellor by regulation specific requirements andobligations for the provision of equity capital, also concerning remuneration systems.Section 4 of the Ordinance enacted by the Federal Minister of Finance for the purpose ofdetermining the details of the conditions and obligations imposed for measures taken pursuantto the Financial Market Stability Act (Finanzmarktstabilitätsgesetz, "FinStaG") and the InterbankMarket Support Act (Interbankmarktstärkungsgesetz, "IBSG") reads as follows:“(1) The beneficiary shall be obliged to commit itself to examine the systems of remunerationwith regard to their incentive effect and appropriateness, and to ensure, within the scope of thepossibilities provided Federal Law Gazette Part II - Published on October 30, 2008 - No. 382 Page2/ 4 by civil law, that they do not constitute temptations to take inappropriate risks and thatthey are transparent and geared towards long-term, sustainable objectives.(2) The beneficiary shall be obliged to commit itself, within the scope of the possibilitiesprovided by civil law, to calculate the amount of the remuneration paid to the members of itsexecutive bodies, employees and principal vicarious agents in accordance with the followingprinciples:19

Side 20 af 29EmneSpørgsmålBesvarelse1. The employees and principal vicarious agents shall not be paid any inappropriateremuneration, remuneration components and bonuses and they shall not receive any otherinappropriate benefits, either.2. The remuneration of the members of the beneficiary's executive bodies and of its executivestaff members shall be limited to an appropriate amount; particular attention shall be paid tothe following aspects:a) the contribution provided by the person in question to the economic situation of thebeneficiary, particularly his/her role with regard to the former business policy and to riskmanagement, andb) the necessity of offering a remuneration that is in conformity with market conditions, in orderto be able to employ persons who are specially qualified and suitable to ensure a sustainableeconomic development.3. Furthermore, the beneficiary shall not be entitled to subsequently amend existing targetagreements, regulations in connection with share option programs and other regulationsconcerning success-related remuneration components for the benefit of the members of itsexecutive bodies, employees and principal vicarious agents. Within the scope of the possibilitiesprovided by civil law, share option programs for the benefit of the members of its executivebodies or the principal vicarious agents shall be suspended for the period during which thecompany in question is making use of the benefits from the instruments according to sec. 2para. 1 sub-para. 3, 2nd instance, sub-paragraphs 4 to 6 of the Financial Market Stability Act(FinStaG).(3) The beneficiary shall also be obliged to commit itself, within the scope of the possibilitiesprovided by civil law, to reclaim, to an appropriate extent, remuneration already received by themembers of its executive bodies and senior staff who have contributed significantly to thebeneficiary's adverse economic situation by their activities in the context of the beneficiary'sformer business policy and its risk management, provided such remuneration would have been20

A. Has the government proposedchanges to national requirements/concerning remuneration of finan-cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus aspakker til direktion proportion of base salary, clawog andre risikota- back, tax on bonuses or other)?gende medarbejde-re: Aktieoptioner, B. If yes, do any of these changesgolden parachutes, apply only to top level managementvariable lønandeles or to employees in risk takingstørrelse ift. grund- positions as well?løn og lignende. Derønskes en oversigt C. If yes, do any of these changesbåde ift. de banker, apply only to credit institutionsder har fået støtte which have been included in aog generelle stram- national support scheme (see abo-ninger ift. finansielle ve) or to financial institutions invirksomheder.general?

4. Remuneration

Side 21 af 29EmneSpørgsmålBesvarelseinappropriate according to the provisions of paragraph 2 and the amounts were objectivelysignificant. The beneficiary may waive its right to reclaim such amounts if a repayment wouldconstitute an unreasonable hardship in view of the economic situation of the person in questionor the reclamation would be uneconomical for the beneficiary due to the legal hopelessness orthe duration of the proceedings, or the resulting costs. Such a waiver of the right of reclamationshall be communicated to the Federal Minister of Finance and prima-facie evidence of thecircumstances giving rise to the waiver shall be provided.”

A. Has the government proposedchanges to national requirements/concerning remuneration of finan-cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus aspakker til direktion proportion of base salary, clawog andre risikota- back, tax on bonuses or other)?In line with Section 4 of the Ordinance, the individual agreements with banks oblige banks togende medarbejde-revise their remuneration policy. Additionally, for certain years bonus payments of managingre: Aktieoptioner, B. If yes, do any of these changesdirectors of banks which received capital injections are prohibited.golden parachutes, apply only to top level managementvariable lønandeles or to employees in risk takingB.See above (B)størrelse ift. grund- positions as well?løn og lignende. DerC.These measures apply only to credit institutions which have been included in the nationalønskes en oversigt C. If yes, do any of these changessupport scheme.både ift. de banker, apply only to credit institutionsder har fået støtte which have been included in aog generelle stram- national support scheme (see abo-Hollandninger ift. finansielle ve) or to financial institutions inA.Share-options: yes. Golden parachutes: yes. Size of bonus as proportion of base salary: yes.Claw back: yes. Tax on bonuses: no. Other: no.virksomheder.general?Numerous measures have been taken regarding remuneration (apart from the FSB/CRDmeasures), and some are still in development. Best known are the principles in the Code Banken(selfregulation by banks), such as variable payment maximized at 1 annual salary, remunerationof board members below the median in the sector, and a claw back for bonuses which wereunreasonable in retrospect.The Dutch supervisors have also formulated their own principles regarding remuneration. Theseprinciples focus primarily on avoiding excessive risk taking.B.Primarily to the top level, although some measures of the supervisors also apply to forinstance traders.21

4. Remuneration

Side 22 af 29EmneSpørgsmålBesvarelseC.Most of the measures apply to all institutions. For 2009 board members of state supportedinstitutions will forego variable payment. In addition, the government has installed a memberin the supervisory board of financial institutions that have received capital injections that canveto decisions on remuneration (for instance when the remuneration is not significantly lowerthan the median in the sector or in line with the Code banken). With the supervisory board ofnationalized institutions similar measures have been agreed upon.

4. Remuneration

A. Has the government proposedchanges to national requirements/concerning remuneration of finan-cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus aspakker til direktion proportion of base salary, clawog andre risikota- back, tax on bonuses or other)?gende medarbejde-re: Aktieoptioner, B. If yes, do any of these changesgolden parachutes, apply only to top level managementvariable lønandeles or to employees in risk takingstørrelse ift. grund- positions as well?løn og lignende. Derønskes en oversigt C. If yes, do any of these changesbåde ift. de banker, apply only to credit institutionsder har fået støtte which have been included in aog generelle stram- national support scheme (see abo-ninger ift. finansielle ve) or to financial institutions invirksomheder.general?

IrlandA.Share-options: no. Golden parachutes: no. Size of bonus as proportion of base salary: no.Claw back: no. Tax on bonuses: no. Other: yes.-Changes to remuneration practices at Covered Institutions arise, generally, from theCovered Institution Remuneration Oversight Committee (CIROC) report and the relevantterms of the Recapitalisation Packages for Ailied Irish Bank (AIB)& Bank of Ireland (BoI).CIROC reported on 3 March 2009, recommending reductions in prevailing base salary, bonusand pension levels for Chief Executives, Chairs and ordinary board members that itconsidered to be, in many cases, markedly excessive. The Government accepted the CIROCrecommendations regarding bonuses, pensions, long term incentive plans and board sub-committees as appropriate but decided that remuneration terms should be lower thanthose recommended by CIROC. This resulted in a salary cap of €500,000 or the amountrecommended by CIROC, whichever is the lesser with any deviation from this only takingplace in very exceptional circumstances and with the agreement of the Minister for Finance.Subscription agreements with the recapitalised banks – AIB & BoI - also imposed furtherconditions concerning remuneration, such as the requirement to reduce aggregateremuneration of senior executives by 33% in 2009 and all non-executive directors' fees to bereduced by 25% in 2009. Also performance bonuses or salary increases were not to bepaid/made for these senior executives in relation to 2008 and 2009.22

-

-

Side 23 af 29EmneSpørgsmålBesvarelseThe Department of Finance has asked the Financial Regulator(FR) to implement the CommissionRecommendation of 30 April 2009 on remuneration policies in the financial services sector inIreland in respect of institutions that it regulates. The policy seeks to “ensure that financialundertakings establish, implement and maintain a remuneration policy which is consistent withand promotes sound and effective risk management and which does not induce excessive risk-taking.” The FR is currently preparing a detailed policy on remuneration for regulatedinstitutions, having regard to the contents of the Recommendation.

4. Remuneration

A. Has the government proposedchanges to national requirements/concerning remuneration of finan-cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus aspakker til direktion proportion of base salary, clawog andre risikota- back, tax on bonuses or other)?B.See reply to B above – in general at Senior Executive and Director level.gende medarbejde-In general most of the covered institutions are retrenching in terms of employmentre: Aktieoptioner, B. If yes, do any of these changesopportunities with its knock-on effects on remuneration at all levels. The actions taken to dategolden parachutes, apply only to top level managementby them (though not exclusively and not in all institutions) would include options such as:variable lønandeles or to employees in risk takingNon payment of National Wage Agreement increases;Non payment of bonuses except in limited circumstances such as honouring pre-existingstørrelse ift. grund- positions as well?contractual commitments;løn og lignende. DerNon filling of posts as they become vacant;ønskes en oversigt C. If yes, do any of these changesNon renewal of temporary contracts;både ift. de banker, apply only to credit institutionsIncentivised career breaks;der har fået støtte which have been included in aSeverance packages;og generelle stram- national support scheme (see abo-Adjustments to pensions schemes and conditions; &ninger ift. finansielle ve) or to financial institutions inReduction in other payroll costs, e.g. overtime.virksomheder.general?

C.CIROC recommendations apply to the 7 respective Covered Institutions.Measures from the Recapitalisation Packages apply to AIB & BoI only.The Commission Recommendation of 30 April 2009 on remuneration policies in the financialservices sector in Ireland applies to institutions regulated by the FR.The other measures listed above at C1 would have relevant applicability across all levels ofremuneration.

23

Side 24 af 29EmneSpørgsmålBesvarelseEnglandA.Yes. In the Pre-Budget Report 2009 on 9 December, it was announced that where bankemployees are awarded discretionary bonuses above £25,000 in the period from 9 Decemberuntil 5 April 2010, the banks paying these bonuses will pay an additional payroll tax of 50% onthe excess bonus over £25,000. This is the level of median earnings in the UK.

A. Has the government proposedchanges to national requirements/concerning remuneration of finan-cial institutions? (share-options,Stramninger ift. løn- golden parachutes, size of bonus asIn return for taxpayer support provided, both RBS and Lloyds have agreed: not to paypakker til direktion proportion of base salary, clawdiscretionary cash bonuses in relation to 2009 performance to any staff earning above £39,000;og andre risikota- back, tax on bonuses or other)?and executive board members will defer bonus payments due for 2009 until 2012.gende medarbejde-re: Aktieoptioner, B. If yes, do any of these changesDraft regulations which will require banks to disclose information in narrow salary bands thangolden parachutes, apply only to top level managementstarting with remuneration packages at £500,000.variable lønandeles or to employees in risk takingB.They apply to all employees earning over a certain amount.størrelse ift. grund- positions as well?løn og lignende. DerC.Some measures apply to all banks others only to those which have received state aid.ønskes en oversigt C. If yes, do any of these changesbåde ift. de banker, apply only to credit institutionsder har fået støtte which have been included in aog generelle stram- national support scheme (see abo-ninger ift. finansielle ve) or to financial institutions invirksomheder.general?

4. Remuneration

24

Side 25 af 29

Emne

Spørgsmål

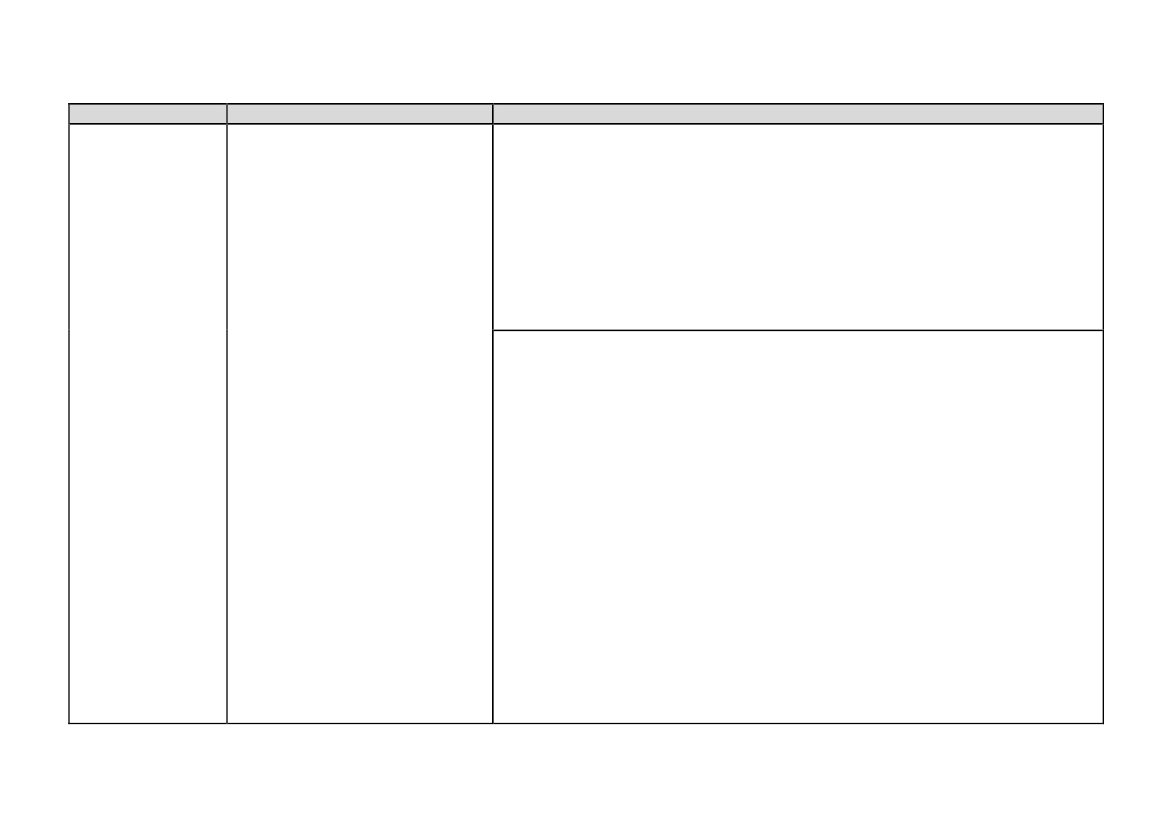

BesvarelseEngland[Intet svar – se generelle bemærkninger for Englands besvarelse]

5. Governance

Has the government proposedchanges to national regulations/concerning governance of financialinstitutions (election of board mem-Stramninger ift. be- bers, education of board members,styrelsesmedlem-fit and proper requirements ormers valg, uddan- other)?nelse og virke.

Sverige, Norge, Finland, Belgien, Østrig & SpanienNo

HollandElection of board members: yes. Education of board members: yes. Fit and properrequirements: yes. Other: no.According to the new “Code Banken” board members and members of the supervisory boardwill have to follow permanent education; in their annual report banks have to discloseaccording to the “comply-or-explain” principle whether they have complied or not with this.The form and content of the permanent education is, however, not prescribed. The “fit andproper”requirements are currently being updated by the supervisors and have become morethorough; in addition, they will in all likelihood not only look at “fit and proper requirements” atthe level of the individual, but also at that of the board as a whole.

IrlandElection of board members: no. Education of board members: no. Fit and proper requirements:yes. Other: no.A statutory fitness and probity regime to be applied by the Central Bank is included in theCentral Bank Reform Bill 2010.The key elements of the provisions include:25

Side 26 af 29EmneSpørgsmålBesvarelseEnabling the Bank to prescribe functions which are to be “controlled functions” and tosuspend persons performing such functions pending an investigation into whether theyshould be prohibited from performing such functions on the basis that they are not a fitand proper person to perform them;The Suspension of a person for a maximum period of 2 months where the Head ofFinancial Regulation, or his nominee, is of the opinion that there is sufficient reason tosuspect that a person is not a fit and proper person;Powers for the Bank to prohibit a person from carrying out controlled functions with theOrder being contingent on, among other things, the Governor of the Bank, or hisnominee, forming a reasonable opinion that the person is not a fit and proper person;Powers for the Bank to apply to the High Court for an order prohibiting a person fromperforming a controlled function in the event that a direction by the bank is notcomplied with;Enabling the Bank to prescribe a subset of controlled functions which allow the personconcerned to exercise a significant influence on the conduct of a regulated financialservice provider. In respect of these functions, the prior approval of the Bank is requiredbefore persons are appointed to perform them; andEnabling the Bank to issue standards of fitness and probity in respect of controlledfunctions and prohibiting regulated financial service providers from permitting peoplewho do not satisfy these standards from performing controlled functions

Has the government proposedchanges to national regulations/concerning governance of financialinstitutions (election of board mem-Stramninger ift. be- bers, education of board members,styrelsesmedlem-fit and proper requirements ormers valg, uddan- other)?nelse og virke.

5. Governance

26

Side 27 af 29EmneSpørgsmålBesvarelseSverige, Finland, Belgien, Irland, Østrig & SpanienNo

6. Counselling and A. Has the government proposedchanges to national regulationscomplaintsconcerning advice of customers/counselling in relation to invest-/ments, banking etc?Stramningerift.kunderådgivning og B. If yes, has the governmentproposed changes to nationalklagemuligheder.regulations concerning possibilitiesof redress/complaints from con-sumers?

NorgeA.Yes. New rules regarding taping of telephone conversations were adopted in December 2009,and will come into effect 1 July 2010. The amended rules can be found athttp://www.lovdata.no/for/sf/fd/xd-20091216-1556.html. Under the new rules the investmentfirms’ obligation to tape telephone conversations is extended to amongst others conversationsregarding investment advice. The new rules were proposed by FSA in August 2008, and are notadopted as a direct consequence of the financial crisis.B.No

HollandA.No.B.No, but just before the crisis the regulations concerning consumer protection had beentightened.

EnglandThe FSA is consulting on raising the standards for all investment professionals. A full review isavailable here:http://www.fsa.gov.uk/pages/Library/Communication/PR/2009/173.shtml

27

Side 28 af 29EmneSpørgsmålBesvarelseSverige, Norge & SpanienNo

7. SupervisionStramninger ift. fi-nansielle tilsyn, her-under direkte ind-greb ift. direktionerog bestyrelser.

Has the government proposedchanges to the powers of financialsupervisory authorities (direct inter-vention in relation to directors andboards, administrative fines or ot-hers)

FinlandDirect intervention in relation to directors and boards: no. Administrative fines: no. Others: yes.Pls. see above Remuneration, point 4. Financial Supervision will review remuneration policies inthe future, as required by the CRD.The powers of the FSA to close a branch are proposed to be strengthened by stating it explicitlythat the branch can be forbidden to continue its business in cases, where the FSA cannot besatisfied that the liquidity of the credit institution is adequately supervised by the homesupervisor.

BelgienDirect intervention in relation to directors and boards: no. Administrative fines: no. Others: yes.Belgium will move towards a ‘Twin peaks’ model whereby the National Bank will perform theprudential supervision of the institutions, and the Banking and Finance Commission (theregulator) will retain the oversight on the financial markets.

ØstrigDirect intervention in relation to directors and boards: no. Administrative fines: no. Others: yes.The Financial Market Authority (FMA) has been given the right to prohibit “naked short selling”and to sanction violations accordingly.Additionally, a more flexible approach regarding the FMA’s possibility to require capital add-ons28

Side 29 af 29EmneSpørgsmålBesvarelsehas been implemented. The FMA got the right to require capital add-ons to banks by aproposedsimplified procedure:If a credit institution or a group of credit institutions doesn’t provide an adequatelimitation of risks arising from banking transactions and banking operations and theadequate assessment and limitation of risks can’t be expected on a short-term basis, FMAis authorized to require capital add-ons.The FMA is also authorized to require capital-add-ons if other measures under theBanking Act are not expected to provide an adequate limitation and assessment of risksor the legal provision can’t be reached.

7. SupervisionStramninger ift. fi-nansielle tilsyn, her-under direkte ind-greb ift. direktionerog bestyrelser.

Has the governmentchanges to the powers of financialsupervisory authorities (direct inter-vention in relation to directors andboards, administrative fines or ot-hers)

HollandDirect intervention in relation to directors and boards: no. Administrative fines: no. Others: yes.None, except for the authority of the supervisor to ban (naked) short selling in certain stock for acertain period of time.

IrlandYes. The Central Bank Reform Bill 2010 proposes a number of changes, including theestablishment of a statutory fitness and probity regime for key office holders in the financialservices sector, and some additional powers to regulate the making of certain loans by CreditUnions. Substantial additional proposals for changes to regulatory powers are expected later2010.England[Intet svar – se generelle bemærkninger for Englands besvarelse]

29