Udenrigsudvalget 2009-10

URU Alm.del Bilag 139

Offentligt

The World Bank Group

PARLIAMENT OF DENMARKFOREIGN AFFAIRS COMMITTEE

World Bank Group financing of RenewableEnergy and Access to Energy in DevelopingCountriesTowards a New Energy StrategyDirectorEnergy, Transport and WaterThe World Bank

Jamal Saghir

WORLD BANK NORDIC-BALTIC PARLIAMENTARY GROUPCopenhagen25 January 2010

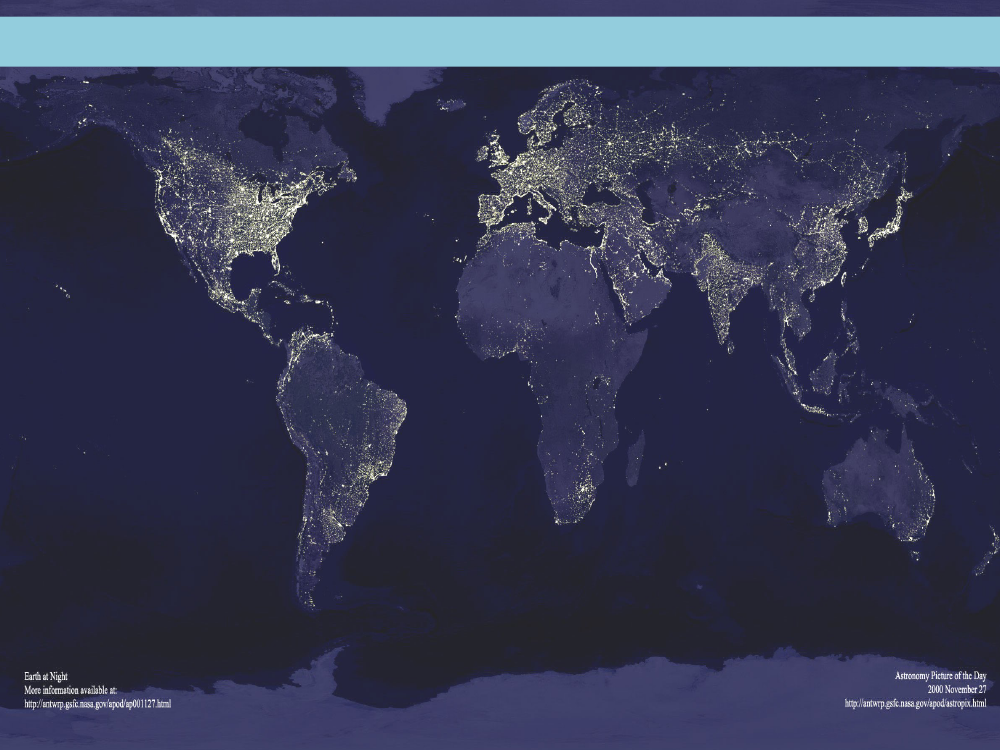

CHALLENGES

Energy Access and Energy PovertyThe world still has 1.5 billion people withoutaccess to electricity.Nearly 2.5 billion continue to use traditionalbiomass fuels for cooking and heating.In Sub-Saharan Africa, the number of peoplewithout access to electricity is projected torise from 590 million in 2008 to 700 millionin 2030.Electricity shortages in many developing countries are growing infrequency and intensity, limiting economic development and povertyreduction efforts.Cost of electricity shortages in Sub-Saharan Africa is estimated at over 2%of region’s GDP

CHALLENGES

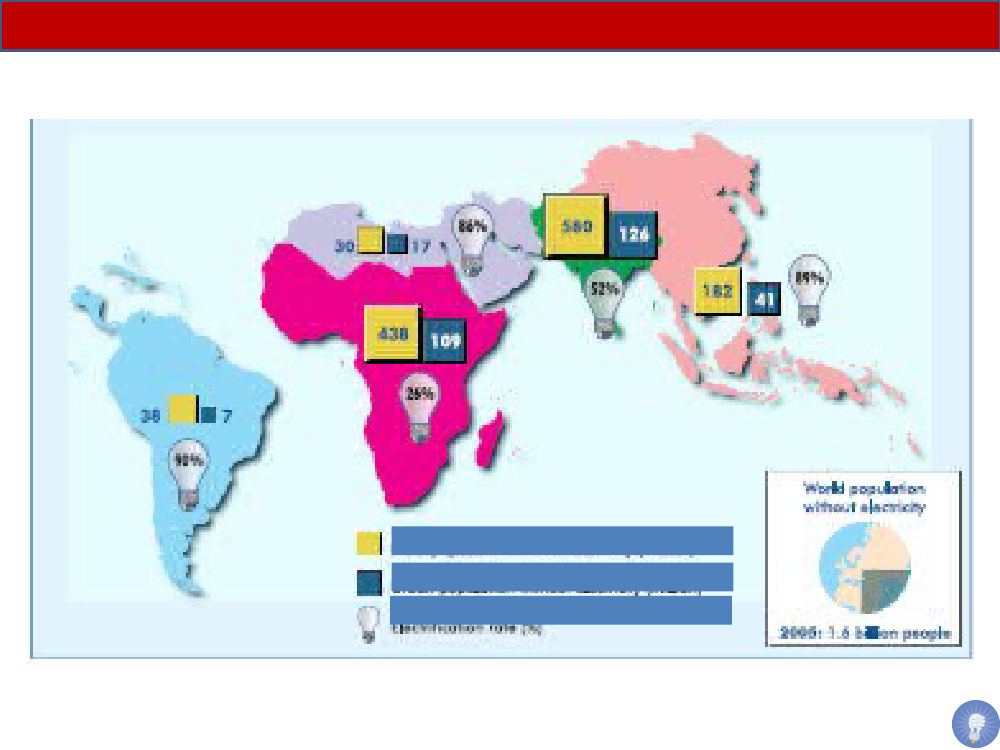

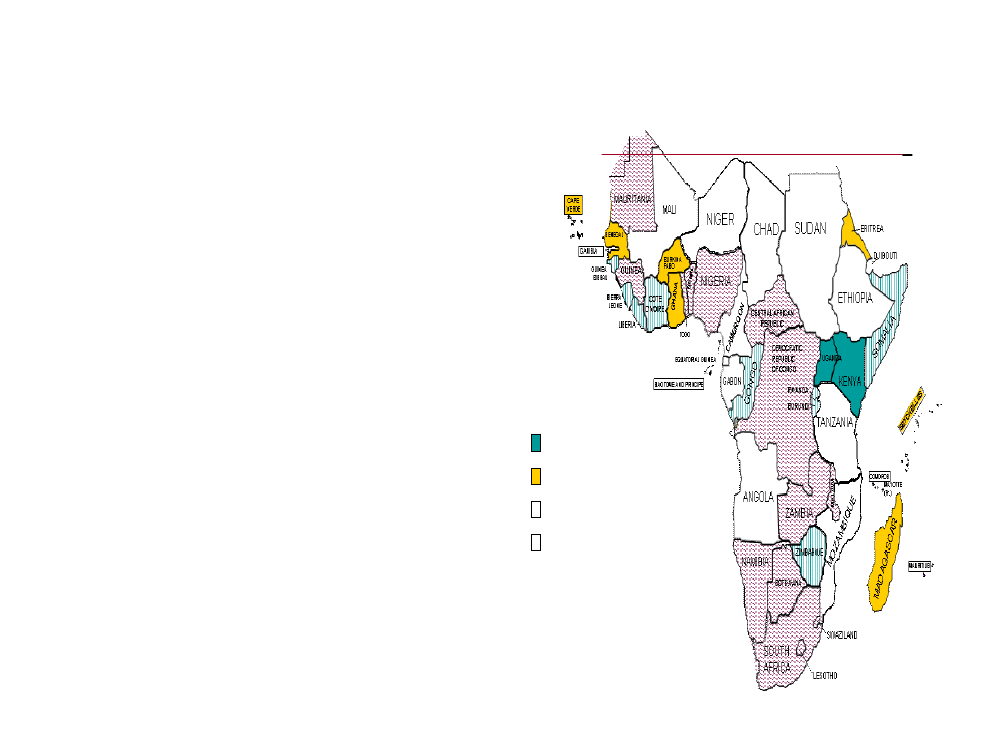

Energy Access Map

Rural population w/o access to electricity (m)Urban population w/o access to electricity (m)Electrification Rate (%)

•$165 billioninvestment needed annually in electricity sector in developing countries•$42 billionneeded in just Sub-Saharan Africa

Africa is characterized by exceptionally low energyaccess…Causes of Africa’s Power Supply Crisis

Installed generation capacity isextremely lowAt 39 MW per million population about atenth of levels in other low income regions

More than 30 countries faceoutages and load sheddingEconomic growth in half of SSA was over4.5% but generation capacity only grew by2.2%Shocks such as volatile oil prices and conflictare also contributing to the power crisis

Main Cause or TriggerNatural Causes (Droughts)Oil Price ShockSystem Disrupted by ConflictHigh Growth, LowInvestment/Structural Issues

4

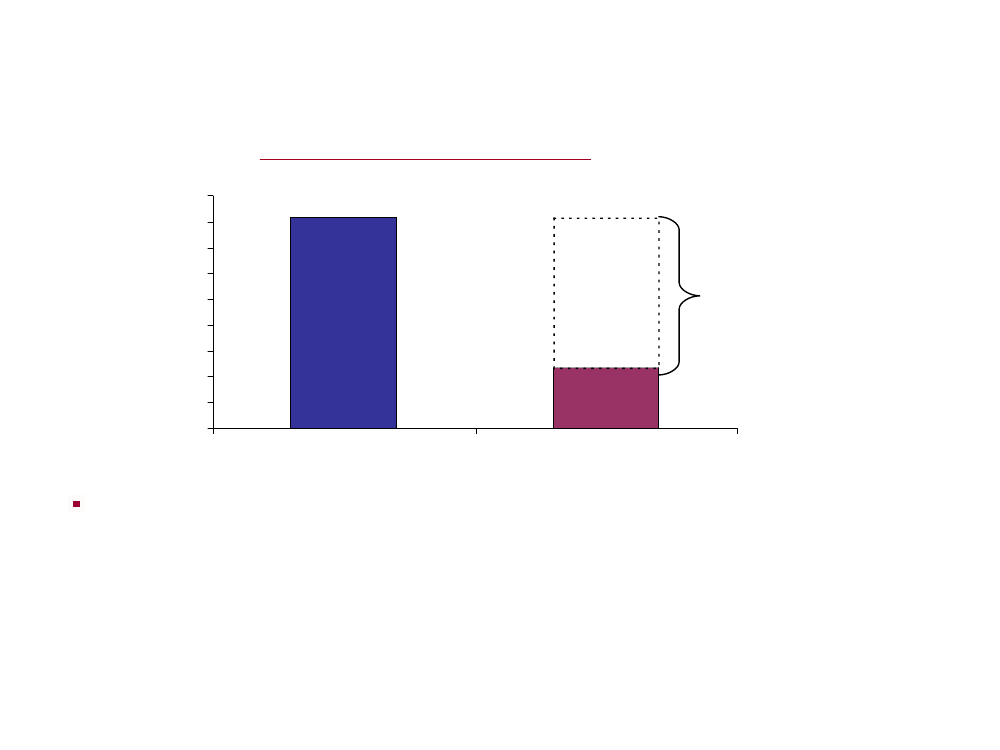

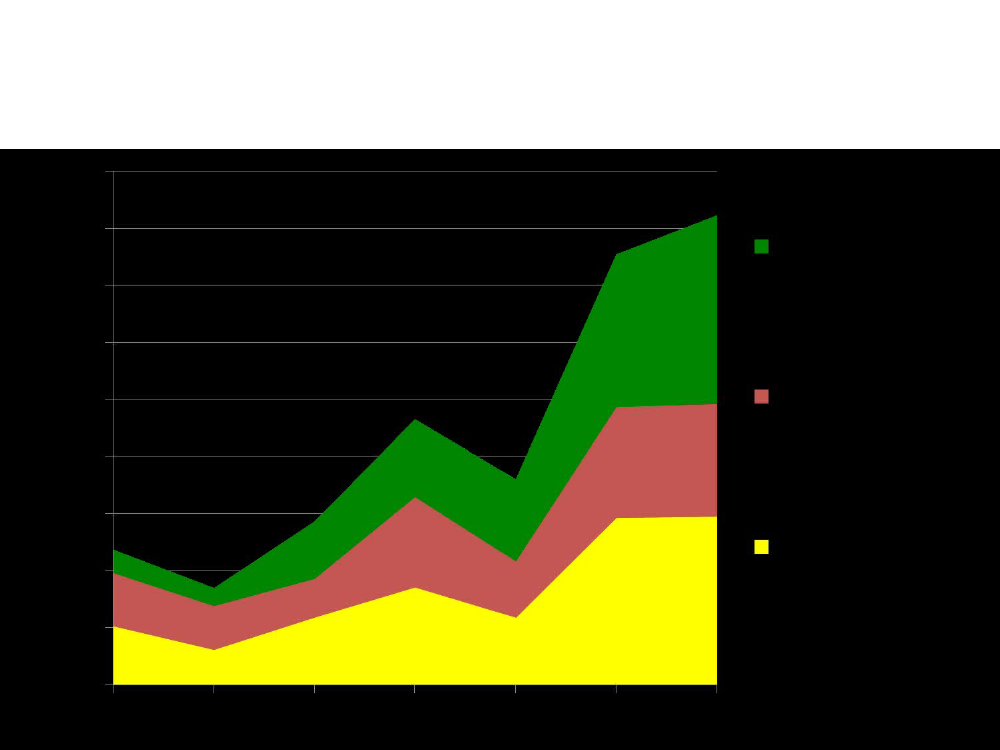

Africa’s power sector faces large financing gap…Africa Power Infrastructure Financing Gap454035302520151050Inves tm ent Requirem entCurrent Inves tm ents

Africa power infrastructure has huge refurbishment and expansion needs7GW of new generation capacity needed each year44.3GW out of 70.5GW needs to be refurbishedDistribution network needs to expanded to reach 6 million more people each year

Global economic crisis could reduce total power spending needs by at least 20%Existing spending is just over a quarter of what is actually requiredOnly $4.6 billion of this is for meeting long term investment needsChina is a major financierPrivate sector finance is growing but not sufficient to meet needs5

$ Billion

Annual Financing Gapof$30.9 billion

Current Energy Shortages

Source: energyshortage.org

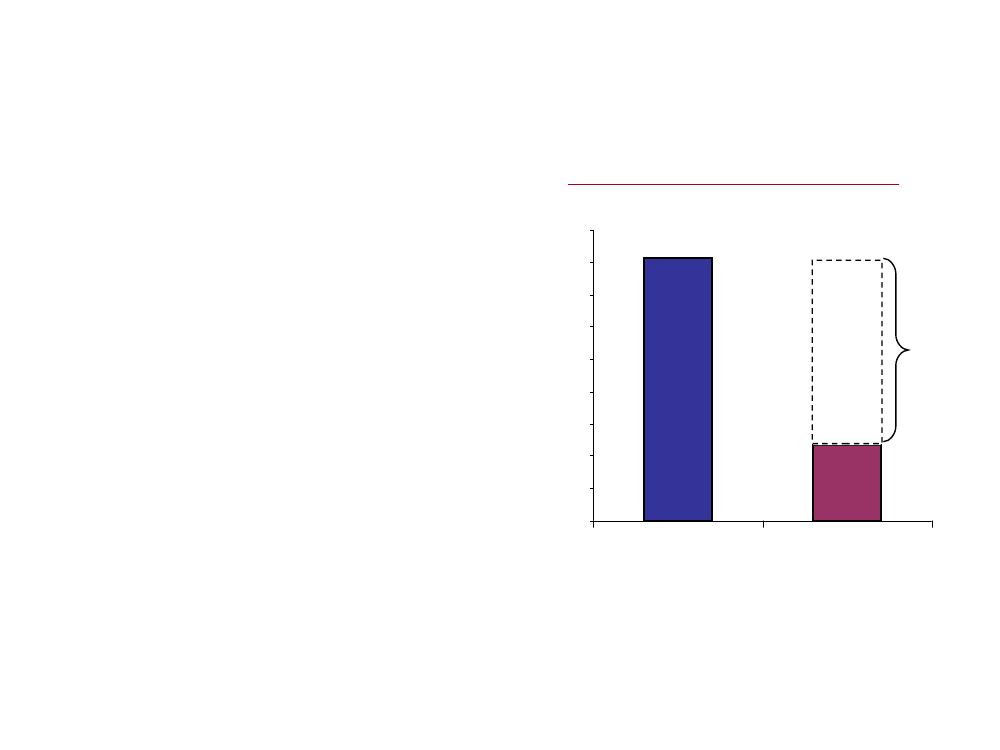

Current investment levels are inadequate…More than US$165 billioninvestment needed per yearfor the electricity sector in thedeveloping world andadditional around US$30billion to de-carbonise.US$42 billion investmentrequired in Africa alone.However, the sector faceslarge financing gaps7

Africa Power Infrastructure Financing Gap

454035302520151050Investment RequirementCurrent InvestmentsAnnualFinancingGap of$30.9billion

CHALLENGES

Climate ChangeIn a ‘business-as-usual’ scenario, energy -related carbon dioxide emissions willalmost double by 2050Meeting the energy needs of developingcountries and arresting climate changewill require global action andcooperation.Energy-saving policies and energy withlow lifecycle GHG emissions will beimportant for meeting future energyneeds sustainably.

CHALLENGES

Managing UncertaintiesThe oil price fluctuations during2004-08 demonstrated theimportance of diversifying theenergy portfolio, pursuing measuresto conserve energy and improveenergy efficiency, and being betterprepared for high energy pricevolatility and possible future shocks.The global financial crisis has alsoincreased uncertainty ininvestments, while reducingavailable resources for developmentassistance and investment flows.

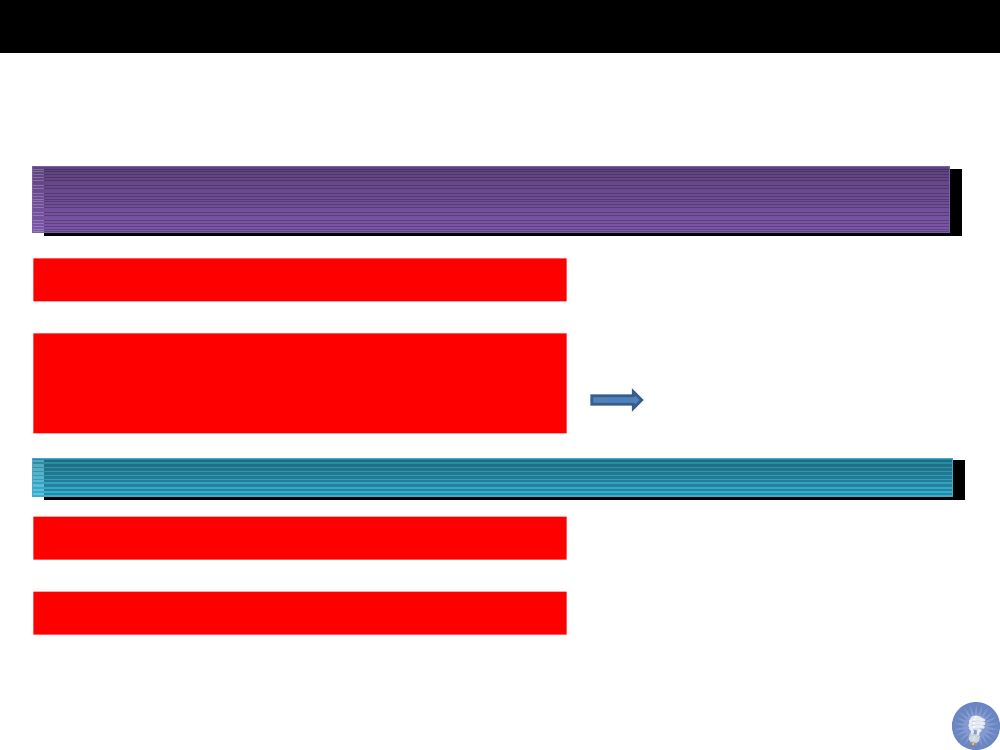

The challenge is to balance the twin objectivesof greater access and sustainability…

Improveaccess andreliability

Facilitateshift tosustainable(low-carbon)energydevelopment

WORLD BANK GROUP’S ROLE IN ENERGY

Energy Sector MilestonesNew Energy Sector Strategy -2011

Strategic Framework for Developmentand Climate Change (SFDCC) –2008(Climate Investment Funds)

2009–Investment exceeds Bonnpromise by over three times

2005–Clean Energy Investment Framework (CEIF) developedat G-8’s request

2004–Bonn RE Conference (commitment of 20% annualincrease between 2005 and 2009)

Key InstrumentsProject Investments-- Development Policy LendingFinancial Intermediation -- Technical Assistance

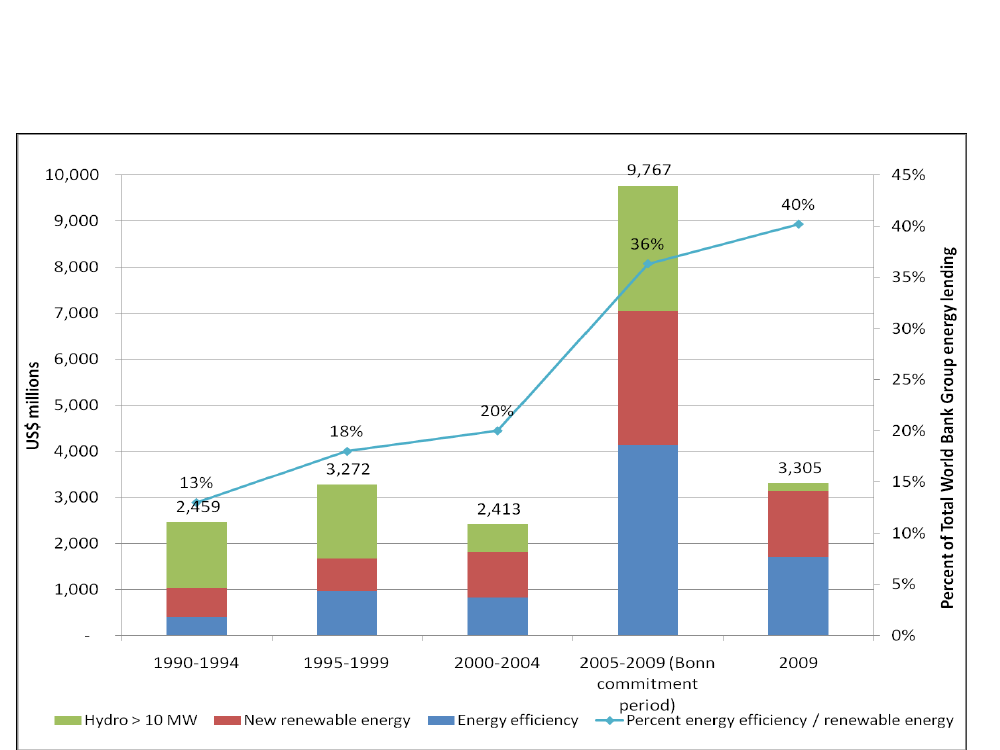

The World Bank Energy portfolio is growing fast, but our low carbon lending is growing faster•40%

energy lending was for RE/EE in FY09 -- a24%increase from FY08$4.5 billion invested in programs directly dealing with energy accesscommitment of 20% annual increase exceeded by twice

•Nearly•Bonn

Record High Renewable Energy and Energy EfficiencyInvestments; the WBG lends US$ 3.3 billion in FY2009

WORLD BANK GROUP’S ROLE IN ENERGY

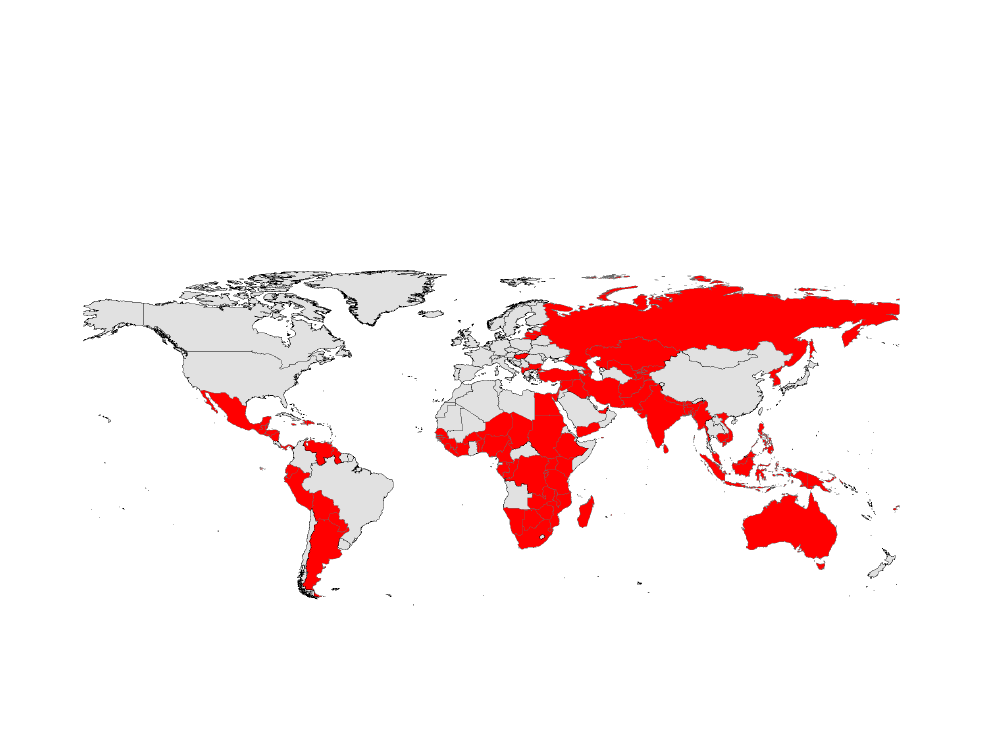

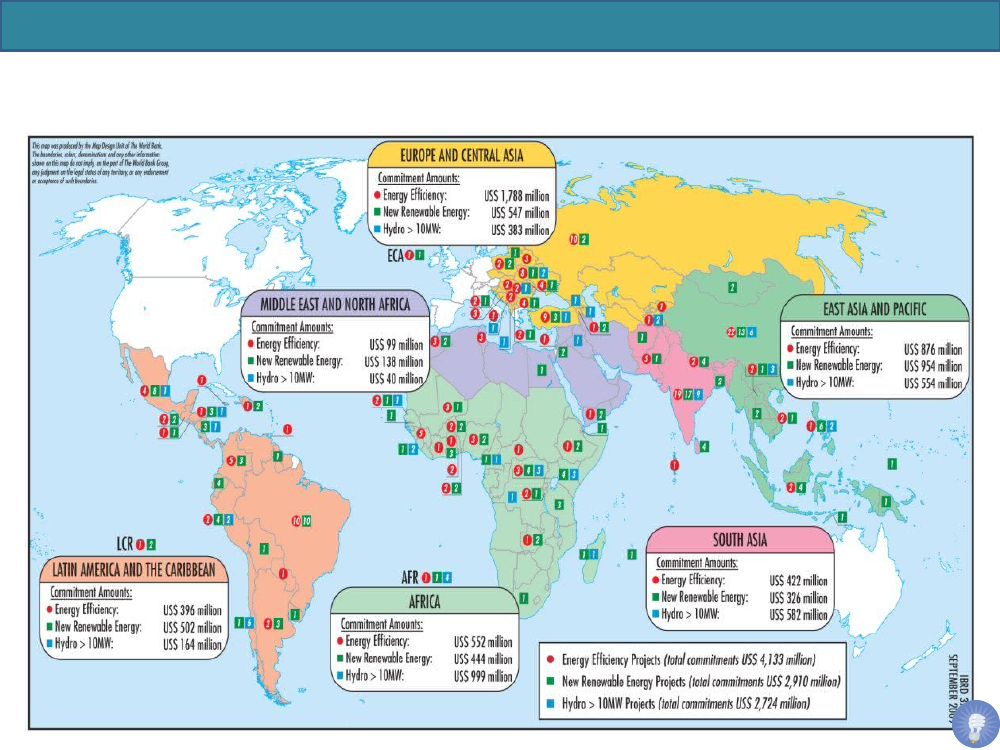

RE/EE Project Distribution (FY2004-09)

Key Lessons Learned by WBG from Renewable EnergyInvestments••••••••Money alone will not bring changeGovernments must be market enablersPrivate sector engagement is necessaryIncreased coordination imperative to avoid duplication ofprogramsFinancial and economic viability is of paramount importanceCapital investments must be linked with committing resourcesand capacity building to ensure sustainabilityInnovation in technology, business model and financing isnecessaryGood intentions alone are not sufficient15

WORLD BANK GROUP’S ROLE IN ENERGY

Observations and Lessons LearnedAn efficient, reliable, and low-cost energysector is critical for equitable economicdevelopmentSound operational and financialperformance is essentialImproved capacity and governance areneeded for better sector performanceand ability to address climate changeFor the very poor, the most importantdeterminant of access to and use ofmodern energy is their cash income

PROGRAM CASE STUDY 1

Energy Access in MaliOnly 7% of Mali’s rural populationhas access to electricity.WB Rural Access Project started in2003 with support of GEF and Maligovernment (Budget - $44.4 m)2350 solar home systems wereinstalled in 40 communities636 public institutions werepowered by solar PV — including 40schools and 48 health centers

Solar energy provides access to remote rural communitiesfar away from the grid

PROGRAM CASE STUDY 2

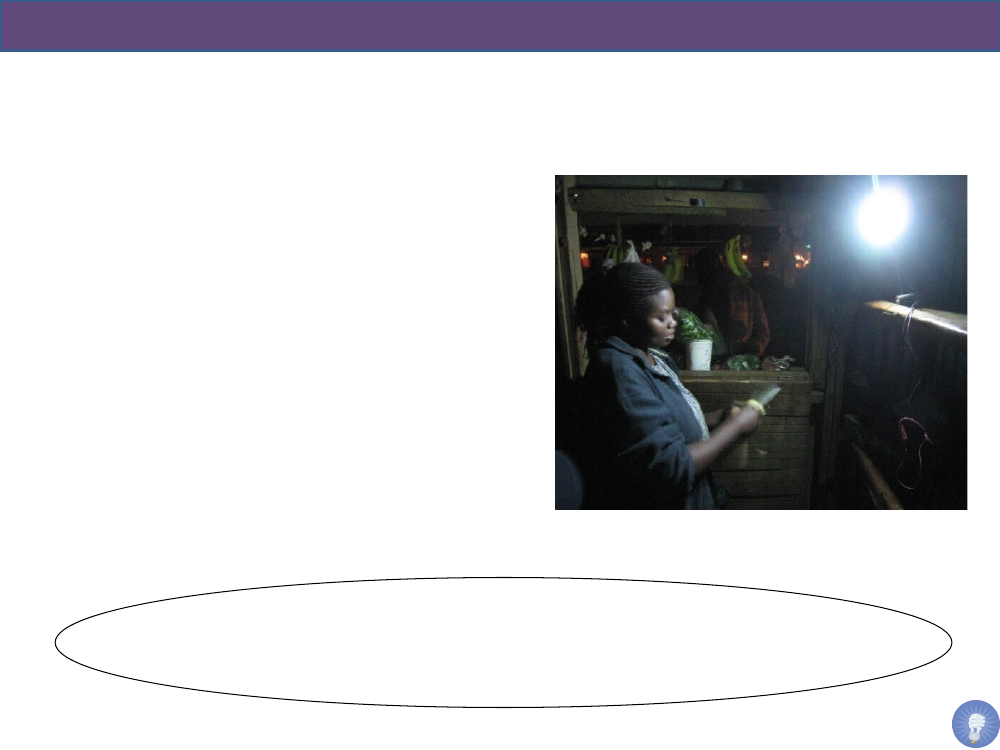

Lighting AfricaWB-IFC joint initiative to mobilize theprivate sector to develop anddisseminate modern lighting solutionsusing LED and other technologiesProgram target is to facilitate sales of500,000 off-grid lighting products by2012 serving over 2.5 million peopleTechnical assistance and seed funding ismade available to entrepreneurs todevelop low-cost, high quality lightingproductsLighting Africa’s vision is to build a commercial platform forlighting sector that can serve 250 million people in Sub-SaharanAfrica by 2030

PROGRAM CASE STUDY 3

Rural Electrification in BangladeshWB launched the Rural Electrification andRenewable Energy Development (RERED)program in 1997Over 350,000 solar home systems installedsince 2002, with a monthly installationrate of 15,000 systemsSeveral factors contributed to RERED’ssuccess:Innovative financing schemes involvingmicro-credit institutionsStrict quality control of technical standardsfor the equipmentStreamlined follow-up maintenanceFocus on consumer awarenessRERED second phaseprogram aims to installone million home systemsby 2012 and promotebiogas and PV waterpumping

PROGRAM CASE STUDY 4

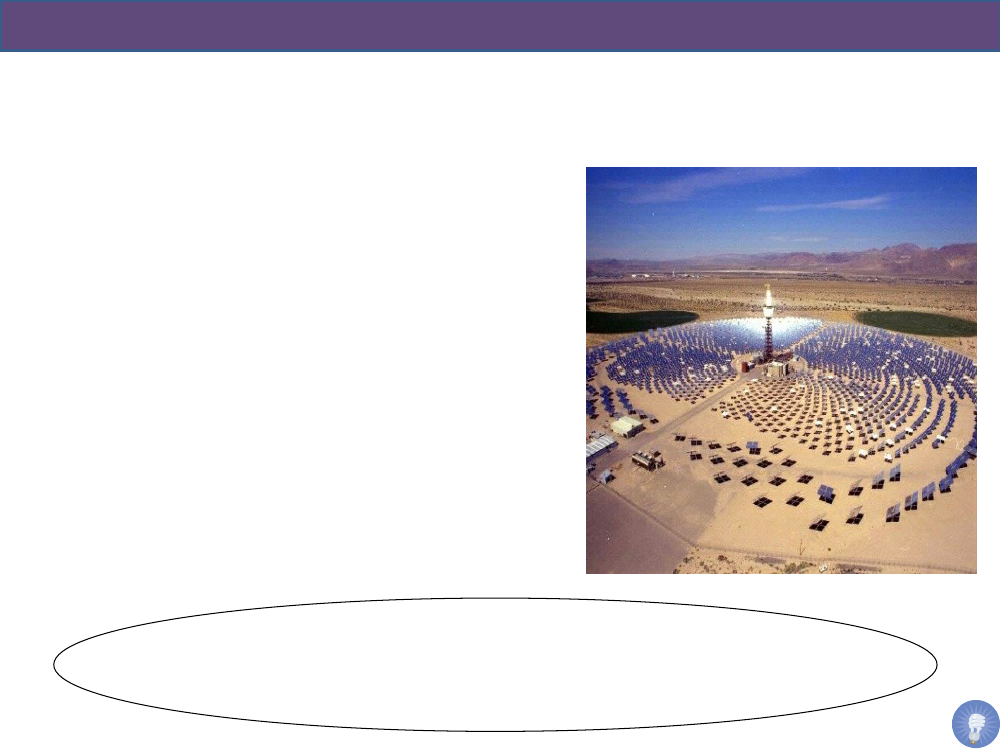

Large-scale Solar PowerThe World Bank is scaling up supportfor large-scale solar thermal and PVsystems in a number of countries.In Egypt and Morocco, WB supporteddemonstration projects on integratedsolar combined cycle power generation(ISCC) technology.WB is mainstreaming PV deploymentfor off-grid rural electrification. (e.g.Carbon Finance project in Bangladeshdeploying over one million solar homesystems)WB is developing a large scale program in MNA regionfor CSP (Concentrating Solar Power) technology using CTFand other instruments

TOWARDS A NEW ENERGY STRATEGY

Strategic Framework on Development and ClimateChange (SFDCC)SFDCC (2008) provides the overall guidance and support forWBG’s operational response to climate change challenges andpromoting clean energy (RE/EE) investmentsWBG has adopted a pro-active approach in assisting countriestoward a low carbon growth path.WBG has undertaken to increase the share of low carbonenergy projects to 50% of its total energy portfolio (FY09-11)

TOWARDS A NEW ENERGY STRATEGY

Timeline for Development of Strategy

Oct

Feb-Jun

Jul-Sept

Nov–Dec

Feb orMarch

EnergyStrategyApproachPaperavailableon-line

First RoundConsultations•web-based•face-to-face

Drafting ofStrategy

SecondRoundConsultations•Web-basedBoard ofExecutiveDirectors

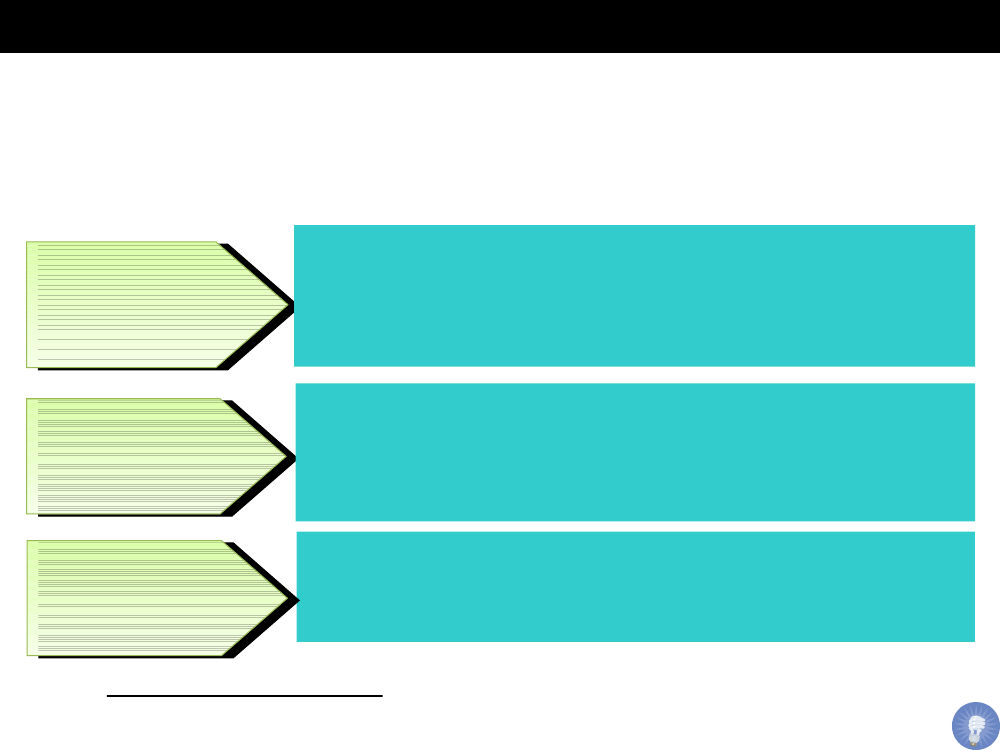

PROPOSED APPROACH

Continuing to Help Countries . . .

Improve accessand reliability ofenergy supply

Facilitate shift tomore environmentallysustainable energysector development

PROPOSED APPROACH

Across All CountriesPolicy and institutional reformsCross-border energy trade and regionalintegrationIncreased investment in hydropowerprojects, renewable energy, and energyefficiencyTransmission and distributionThermal generation in accordance with theconditions outlined in SFDCCDevelopment projects in extractiveindustries

PROPOSED AREAS OF ENGAGEMENT

Low-Income, Fragile, Post-Conflict, and Middle-IncomeCountries with Low AccessExpand supply capacity, enhance reliability,and increase access. Access to reliablemodern energy services will remain the toppriority.High cost of power outages slowing downeconomic development, including some30 Sub-Saharan African countries withfrequent load sheddingCross-border trade particularly importantfor small countriesHydropower with focus on integratedwater resources management

PROPOSED AREAS OF ENGAGEMENT

Low-Income, Fragile, Post-Conflict, and Middle-IncomeCountries with Low AccessContinue focus on areas with low accessin middle-income countriesImprove affordability by increasingsupply efficiency and passing efficiencygains to consumersExplore all options: off-grid, cooperatives,pro-poor financing methods, affordablelifeline ratesHelp build capacity to access financing tomake low-carbon alternatives affordable

PROPOSED AREAS OF ENGAGEMENT

Middle-Income CountriesHelp address local and emerging globalchallenges and increase support toinnovation and transformationSupport commercial-scale renewableenergy, supply-and demand-side energyefficiency, and emerging cleantechnologies and related infrastructurefacilitiesHelp leverage climate finance, privatesector financing, and other financingopportunities

FINANCIAL INSTRUMENTS

Climate Investment FundsJointly run by MDBs to provide grants and concessional financing todeveloping countries to address urgent CC challengesClean Technology Fund (CTF) ~ $5.2 bStrategic Climate Fund ~ $1 b-- Scaling up RE in Low Income Countries

SREP -- Access Issues

Carbon Finance10 Carbon Funds ~ $2.2 b (200 projects)Carbon Partnership Facility (CPF)

FINANCIAL INSTRUMENTS

RE/EE Financing through Clean Technology Fund (CTF)Three programs endorsed with a total envelope of US$1.05 billion, leveraging on average10 times of investmentMexicoEnergy Efficiency -Replacing inefficient lighting and appliances; expectedemissions reductions of 4 million tons of CO2 per yearUrban Transport -20 bus rapid transit corridors with low-carbon busesRenewable EnergyProposed CTF » $500 millionleverages» $6.2 billionRenewable Energy- Implementing "intelligent" grid management and controlsystems to support large-scale integration of wind powerRenewable Energy and Energy Efficiency- Promoting private sectordevelopment through credit lines to local development banksProposed CTF » $250 millionleverages» 2.1 billionWind Power- From <1,000 MW to 2,500 MW of electricity from windUrban Transport- Six bus rapid transit corridors and five light rail routeProposed CTF » $300 millionleverages» $1.9 billion

Turkey

Egypt

Other CTF programs endorsed:Ukraine, Morocco, South Africa, Thailand, Vietnam,Philippines and MNA Regional CSP Program

FINANCIAL INSTRUMENTS

Scaling up Renewable Energy Program (SREP)Special fund “to demonstrate low carbon pathways in the energysector by creating new economic opportunities and increasingenergy access through the use of renewable energy”Financing for new renewable energy technologies (solar, wind,bioenergy, geothermal, and small hydro of up to 10 MW)Complementary technical assistance (planning and pre-investment,policy development, legal and regulatory reform, businessdevelopment and capacity building)Current envelop of $260m expected to finance 5-6 demonstrationpilotsEligibility limited to IDA only countries (and similar RDB equivalents)

CONCLUSION

Questions for Energy Strategy1.2.3.Where is the help of WBG in the energy sector in developing countries mostneeded?Does the proposed approach adequately address the needs of the poor andmarginalized? If not, how could it be strengthened?Does the proposed approach strike the right balance between meeting theneeds and priorities of low-income countries and those of middle-incomecountries?Where there are trade-offs between meeting the local energy needs ofindividual countries and reducing global greenhouse gas emissions, whatprinciples should the World Bank Group follow in resolving the trade-offs?What should be the role of the World Bank Group in promoting newtechnology and/or helping to transfer existing technologies to new markets,and how much weight should the Bank Group give to each?

4.

5.

And to Keep in mind always: 1.5 Billion Poor Are Without Access to Modern Energy

Thank you

http://www.worldbank.org/energy