Trafikudvalget 2009-10

TRU Alm.del Bilag 313

Offentligt

Infrastructure to 2030 :The Global Context forDenmarkCopenhagen12 April 2010Barrie StevensDeputy DirectorAdvisory Unit to the Secretary-GeneralOECD

Plan of the presentation• World economic outlook (the big picture)• Future freight and passenger flows• Opportunities• Infrastructure’s contribution• Denmark’s infrastructure in relation to theglobal outlook• Challenges to 2030 and beyond

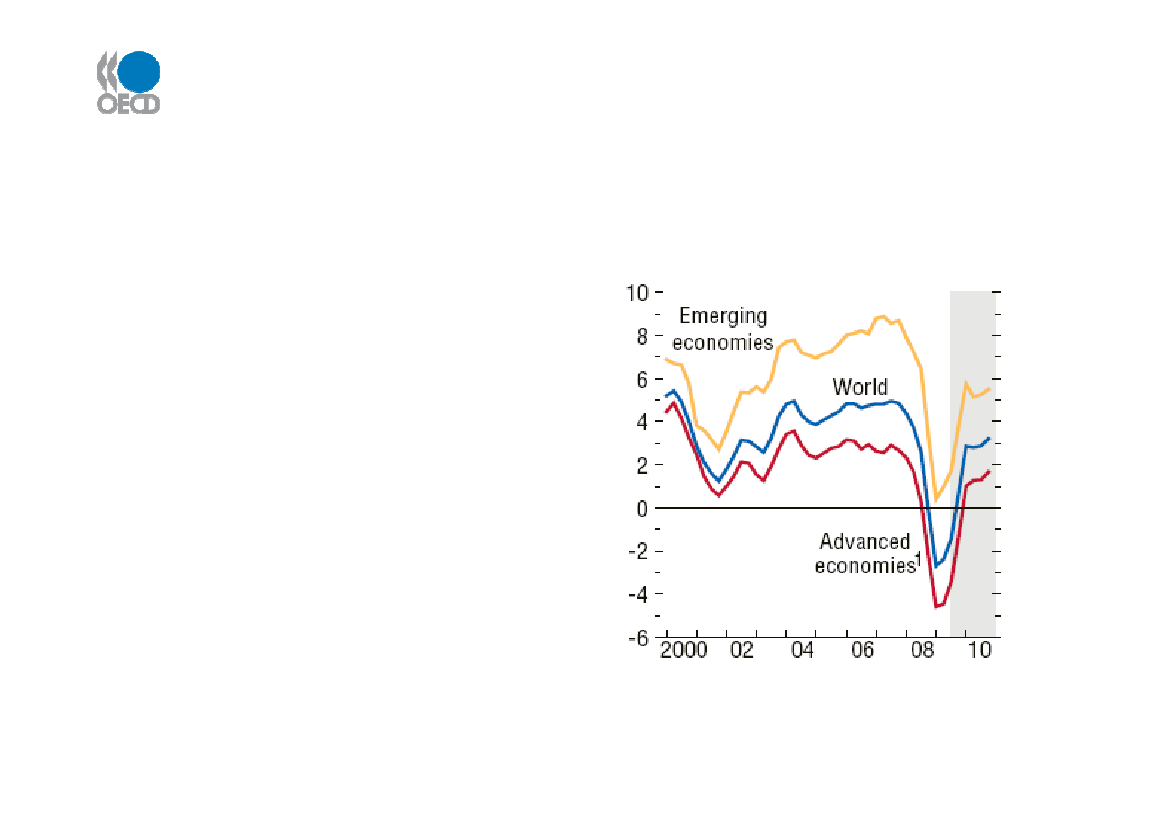

World economy – the big picture• Battered by one of theworst ever recessions• Deep contraction inadvanced economies in2008-09• Signs of recovery visible -fragile in OECD countries• Stronger growth in otherparts of world - notably inAsia and Latin AmericaSource: IMF October 2009

World GDP - % change

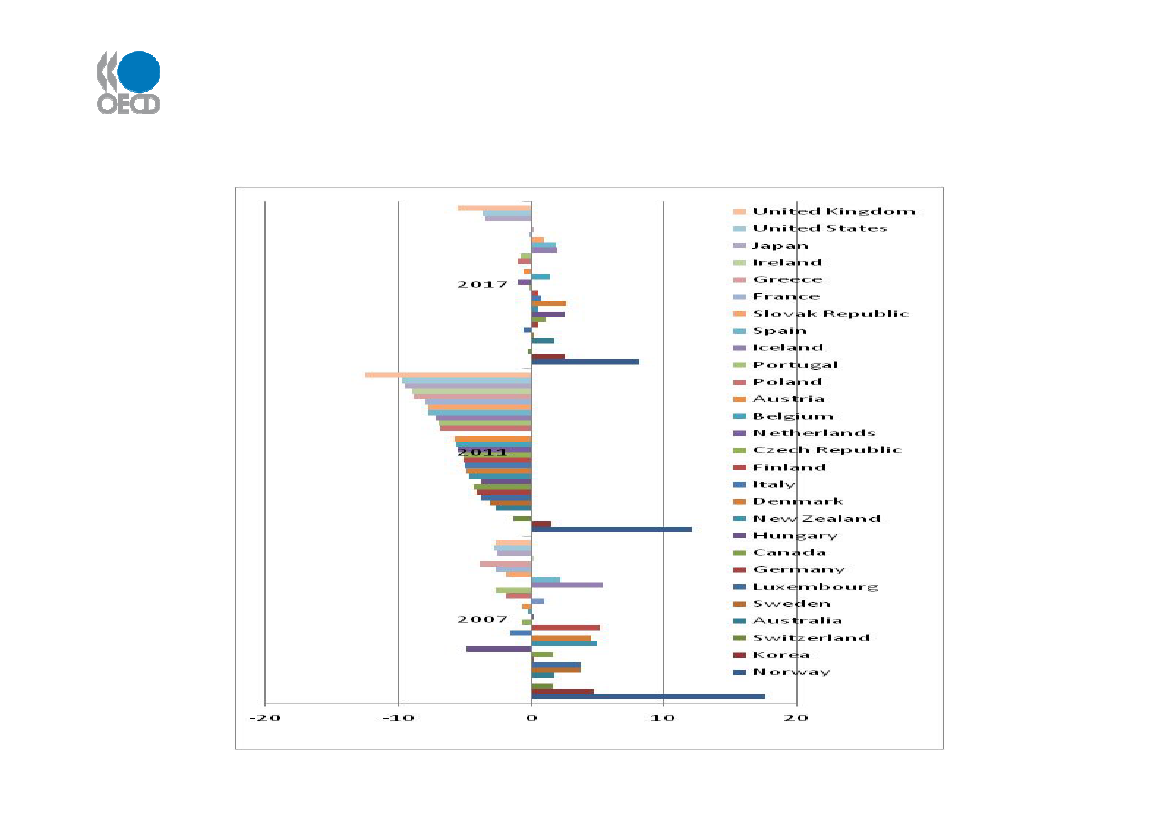

Fiscal Trends(general government fiscal surplus ordeficit as a % of GDP)Source: adapted from OECD Economic outlook, Nr 86

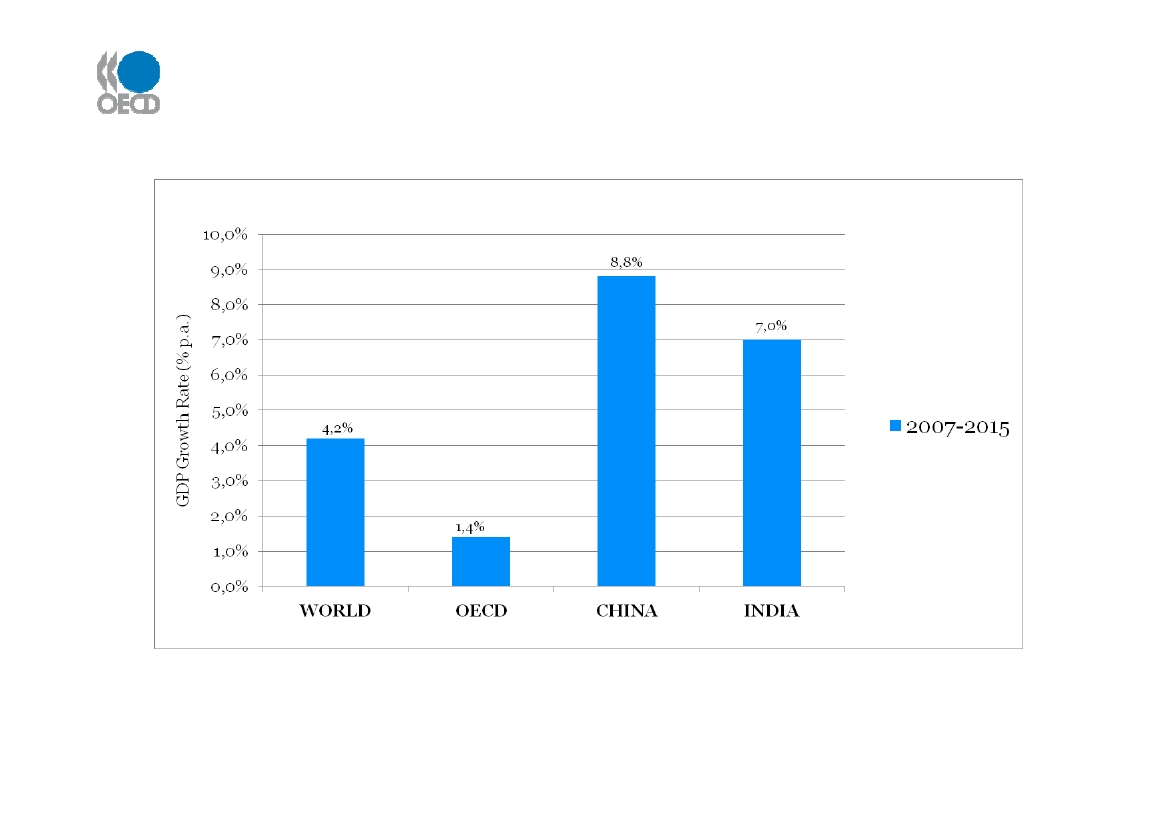

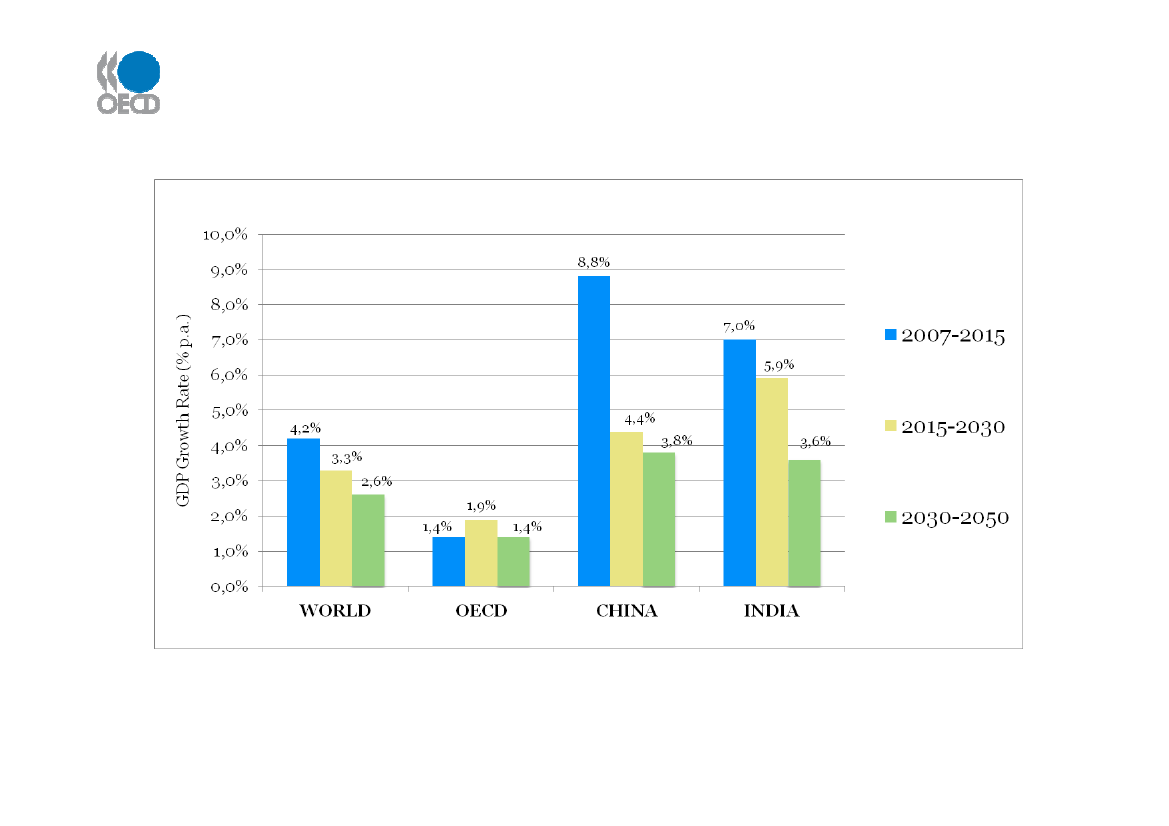

Period to 2015: Stronger growth, but differencesaround the globe

Source: IEA WEO (Nov 2009) for 2007 - 2015 - 2030; IEA ETP (June 2008) for 2030 - 2050

Strong and sustained economic growth in non-OECD countries over next 10+ years

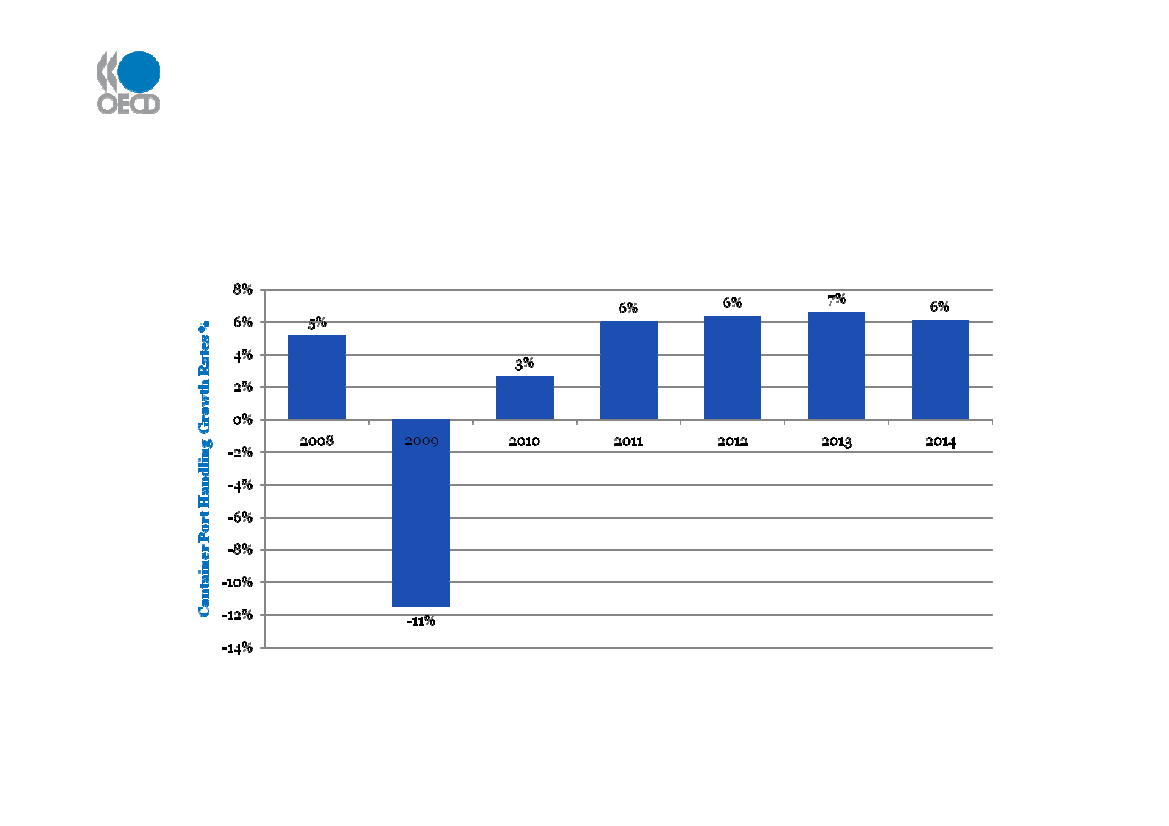

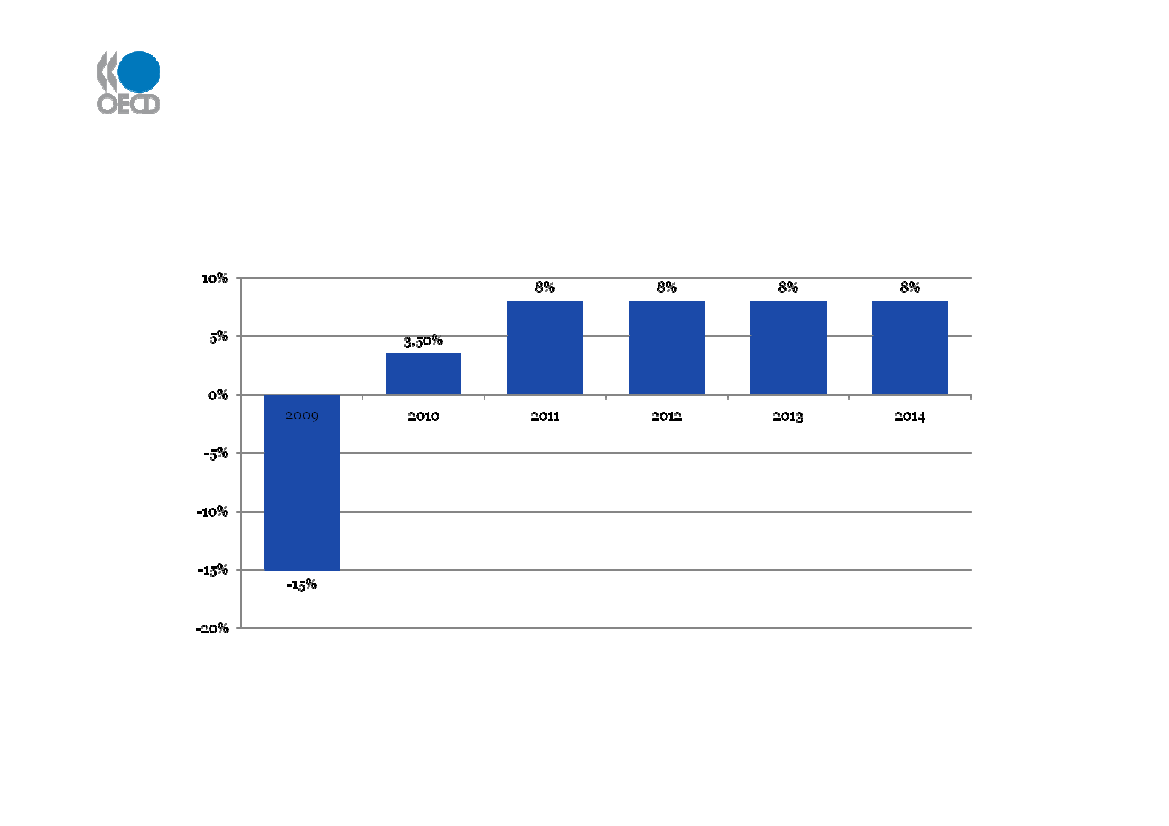

Maritime Outlook – Forecast growth in ContainerPort Handling to 2014World Container Port Handling - annual growth rates (%)

Source: Drewry, Container Market 2009-10, Oct 2009

Recovery from 2009 fall – but container growth rates below recent trend (>10% pa)

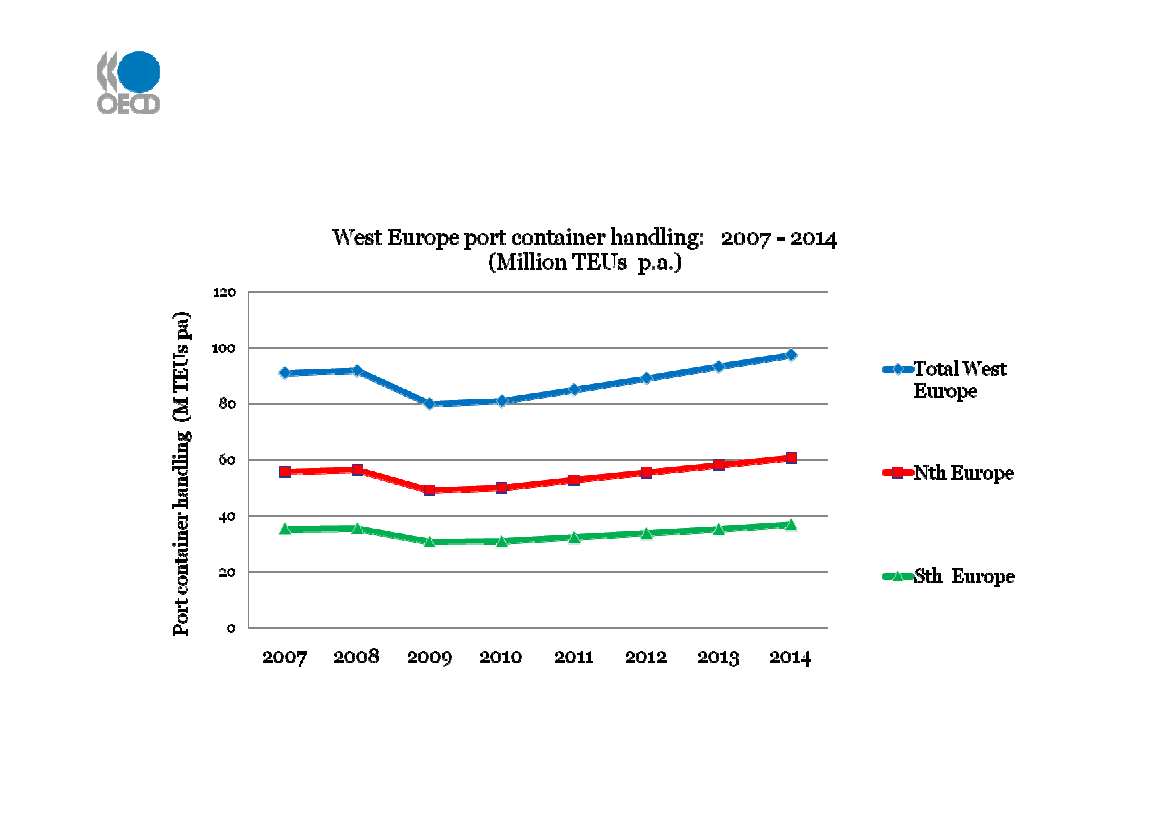

West Europe port container handling to 2014

Source: Drewry, Container Market 2009-10, Oct 2009

Growth in West Europe - a little stronger in Northern ports than in the South

Air cargo outlook - growth rates to 2014World air cargo – forecast annual growth rates (%)

Source: Airports Council International Aug 2009

Projected Air Freight growth well above av. annual rate of 3.8% p.a. (1999-2008)

Longer-term growth: differences lessening…

Source: IEA WEO (Nov 2009) for 2007 - 2015 - 2030; IEA ETP (June 2008) for 2030 - 2050

Strong and sustained economic growth in non-OECD countries over next 10+ years

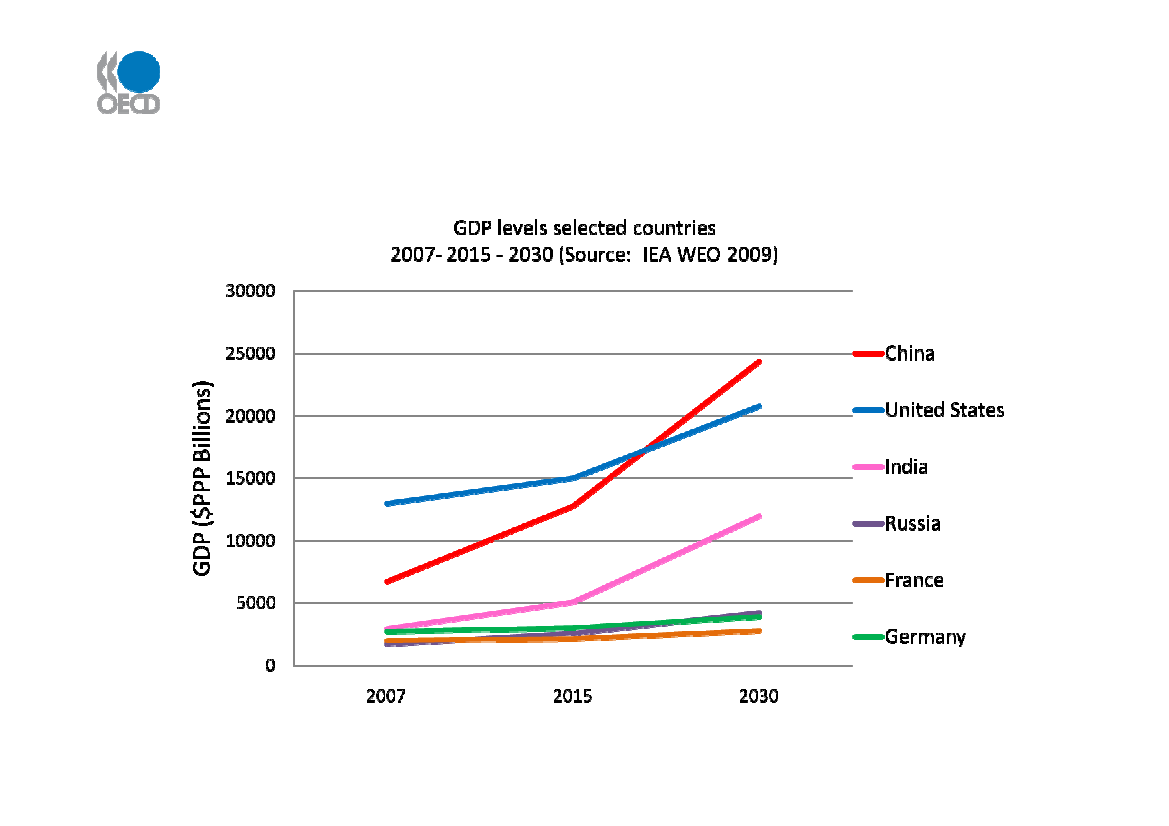

Centre of gravity of world economy shifting East

China’s GDP overtakes US’ before 2025 - with India and Russia growing strongly too

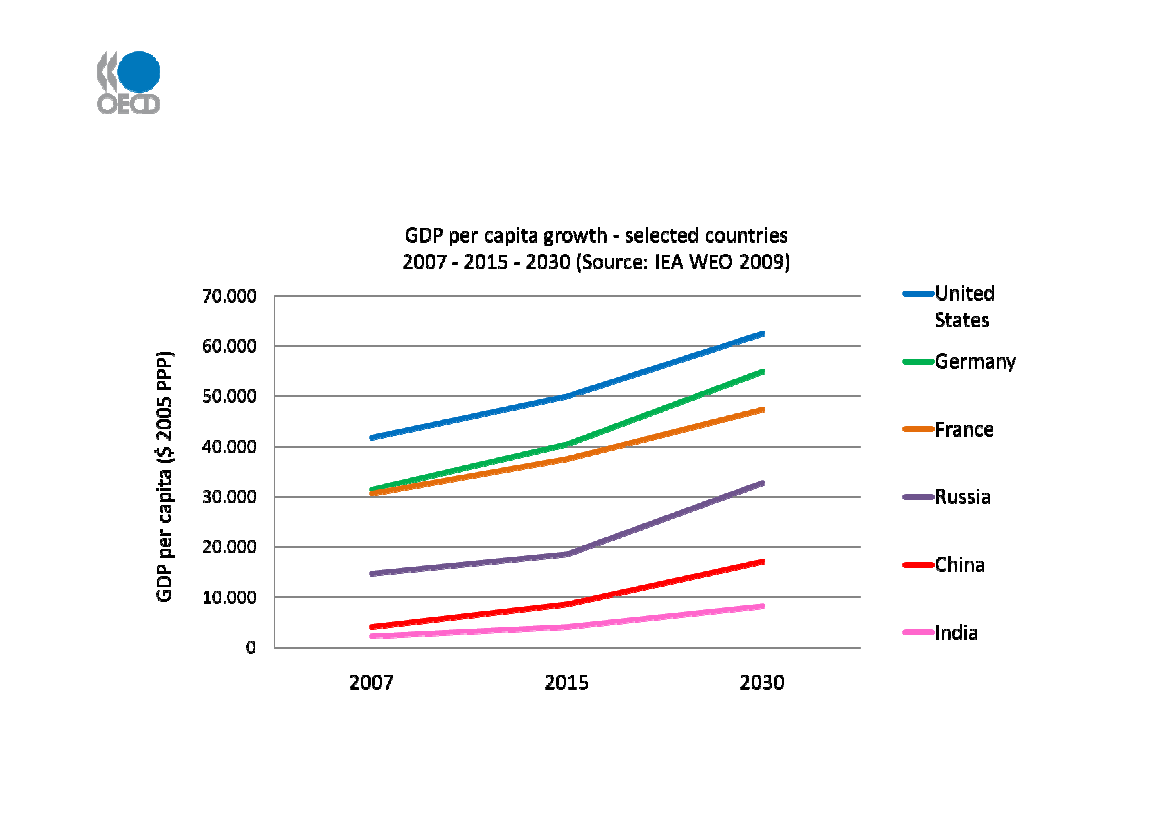

Per capita incomes – economic drivers offreight and passenger flows

Ongoing increases in GDP per capita in OECD countries. Growth rates highest in China

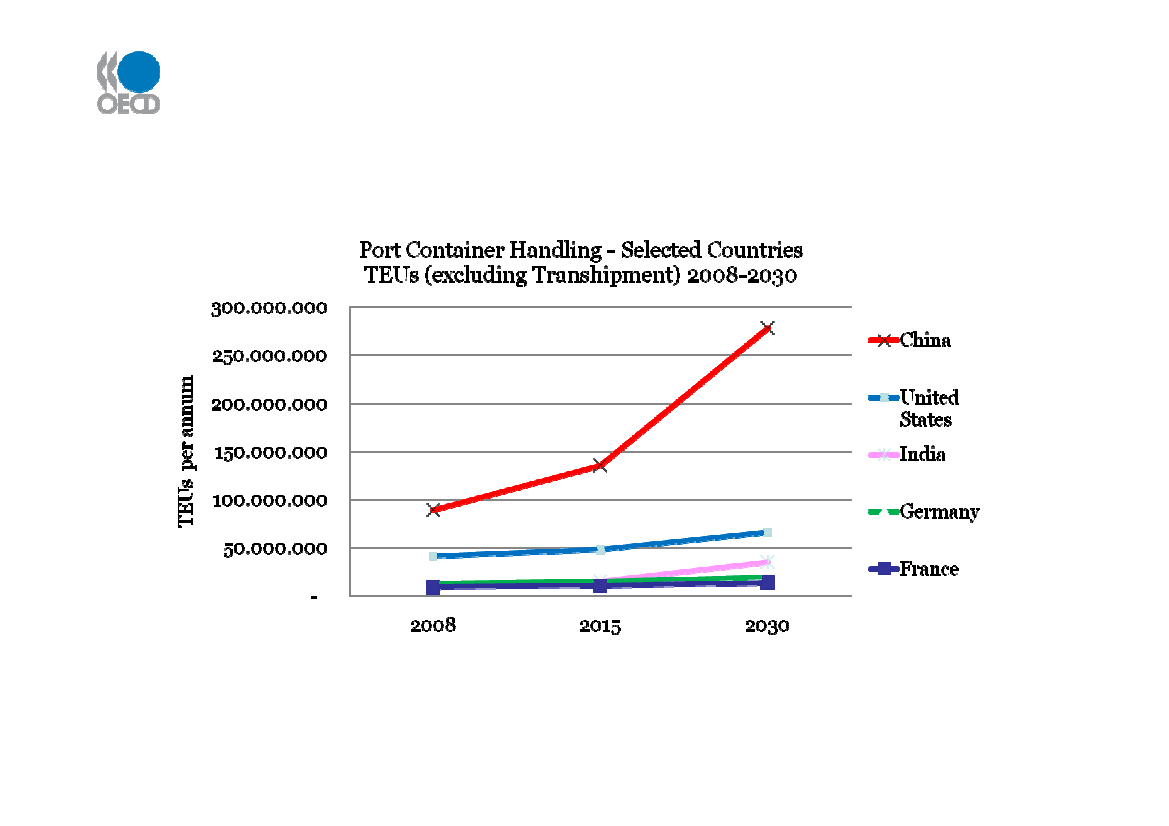

Maritime outlook – Trends in port containerhandling (TEUs p.a.) 2008-2030

Source: Drewry : Container Market 2009-10 Annual Review and Forecast (to 2015); Project estimates 2015 - 2030

Largest GDP-related volume increases in China followed by India and the US

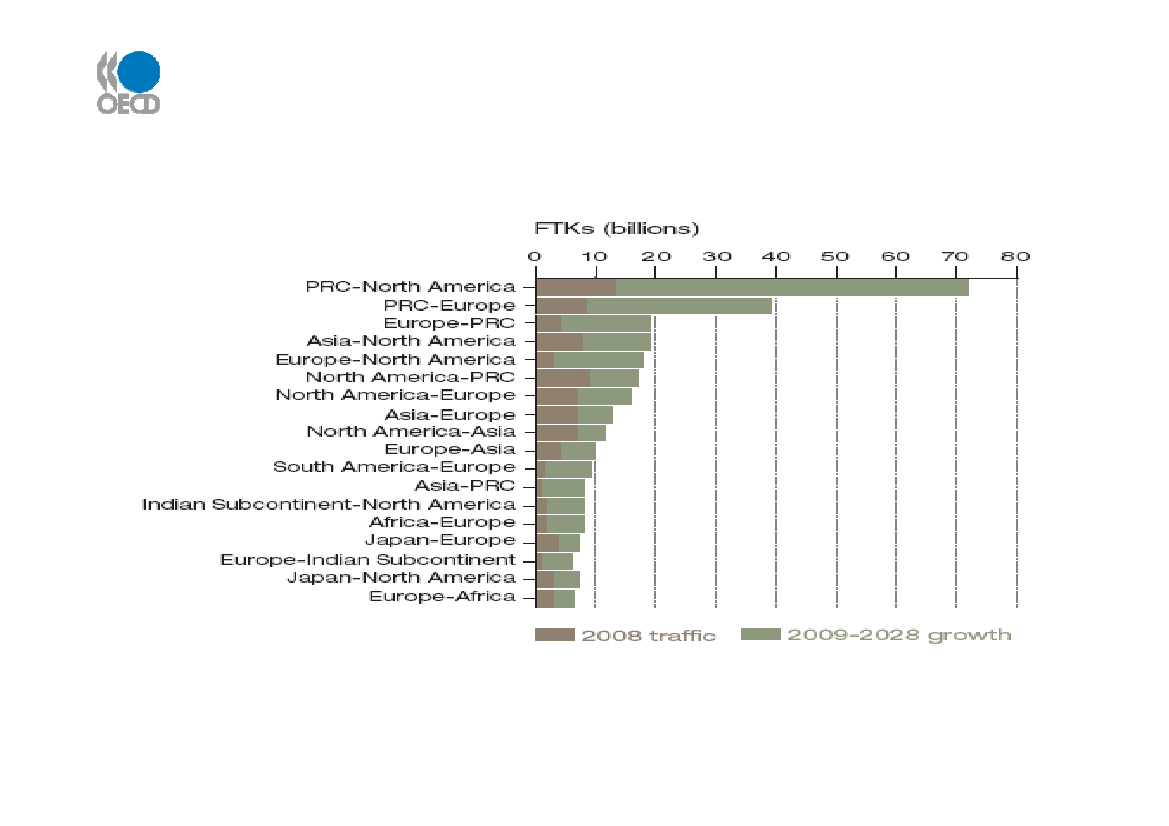

Longer term – air cargo flows & growthto 2028Airbus Projections – Largest air cargo routes / flows

Source: Airbus GMF 2009

Air freight traffic is expected to triple in 20 years–growth rate 5.2% (cf. 3.8%1998-2008)

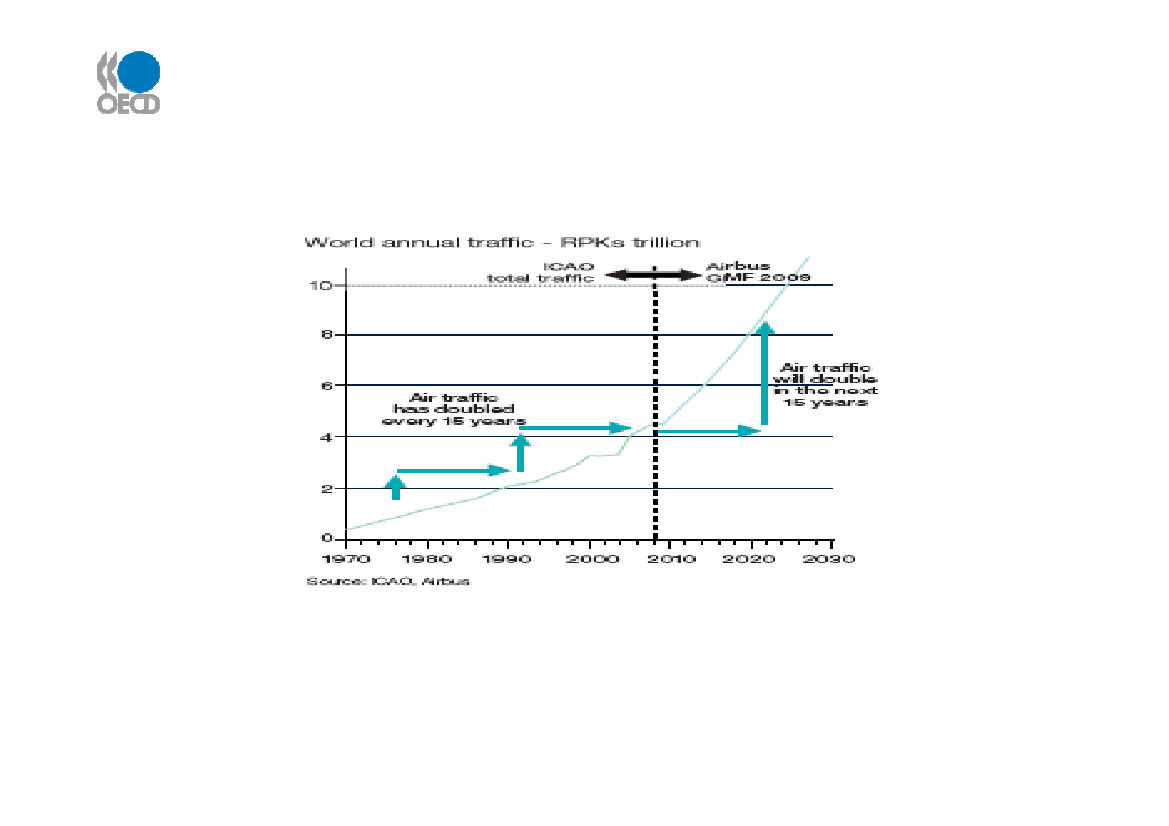

Air passenger outlook–trends & projections to 2030

Source: Airbus GMF, Oct 2009

Airbus projects air passenger traffic will double in 15 years – as it has in the past

Opportunities••---•----Increasing trade as global demand doubles 2030Growth opportunities include:Asia (China/India) and Latin AmericaRussian Federation, andresource-based growth in the Baltic /High NorthExport opportunities (subject tocompetitiveness)cruise and eco-tourism (with ageing population)transport services/container growth (eg Maersk)services / low carbon / ‘green growth’ industriesniche markets for high technology manufactures.

Quality Infrastructure - one of several key pillarsof competitiveness• Infrastructure- essential driver of competitiveness- critical for effective functioning of the economy- important for the location and kinds of activitiesor sectors that can develop.• Well-developed infrastructure reduces the effectof distance between regions, connecting it at lowcost to markets in other countries and regions.• The quality and extensiveness of infrastructurenetworks significantly impact economic growth

Denmark’s infrastructure in the globalcontext

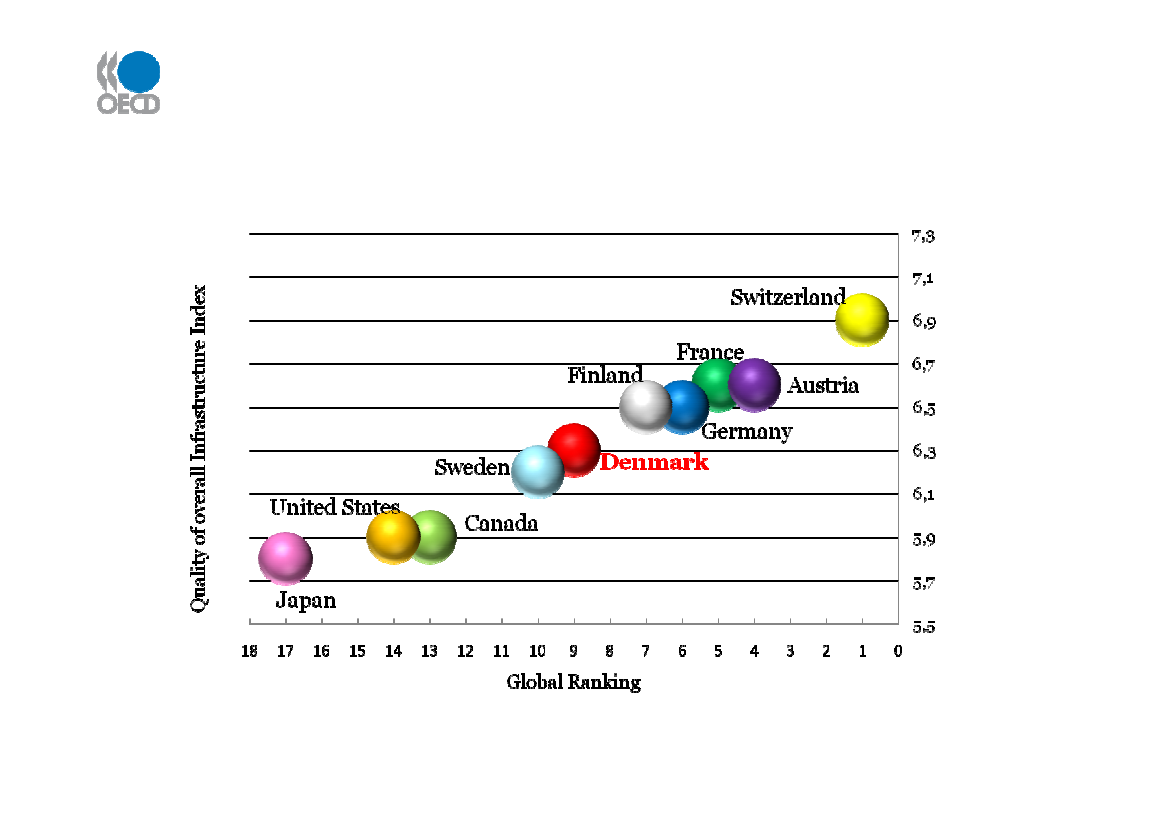

Overall infrastructure qualityDenmark’s global ranking – 9th

Source: Global Competitiveness Report 2009-10, World Economic Forum, 2009

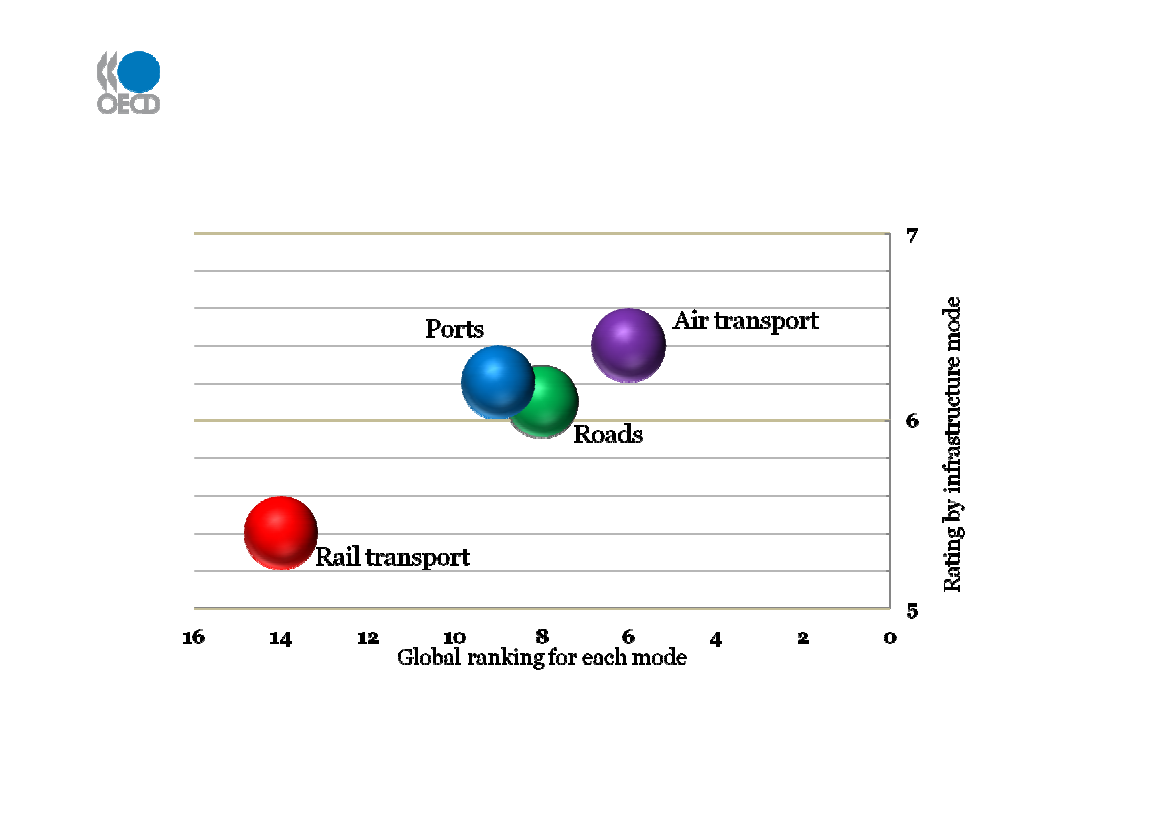

Denmark’s infrastructure quality by mode

Source: Global Competitiveness Report 2009-10, World Economic Forum, 2009

Fit for the long run?• Investment programme to 2020 – historicallyhigh levels- Fehmarn Belt - bridge and related rail links- New Metro Circle Line- Modernisation of rail network and new railcorridors- Expansion of most congested road corridors inCopenhagen Region and East Jutland• But numerous challenges beyond 2020…..

How to improve competitiveness in a higher resource cost /low carbon / “green growth” environment?

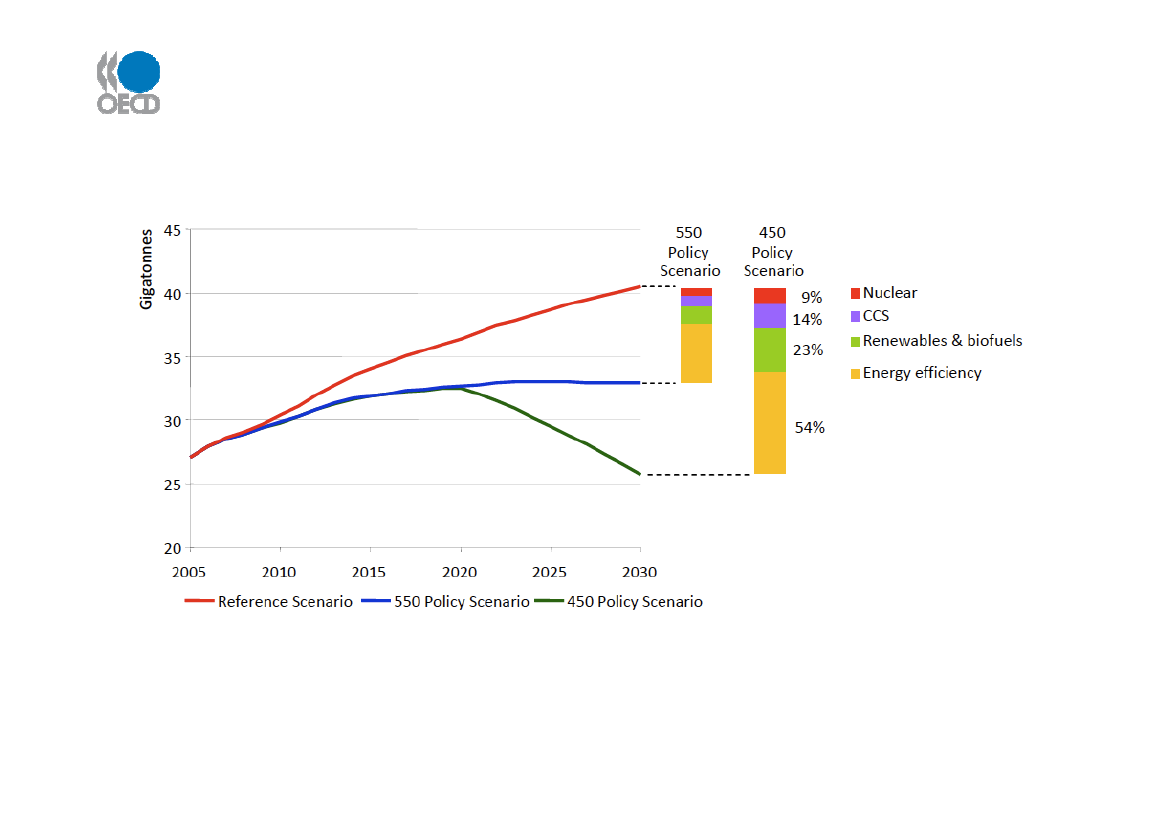

About 25% of world-wide CO2 emissions are attributable to transport. Transport CO2 emissions

are projected to increase by nearly 40% by 2030 – and more than 80% by 2050… Efficiency gains

and deployment of existing low carbon energy account for most of the savings.

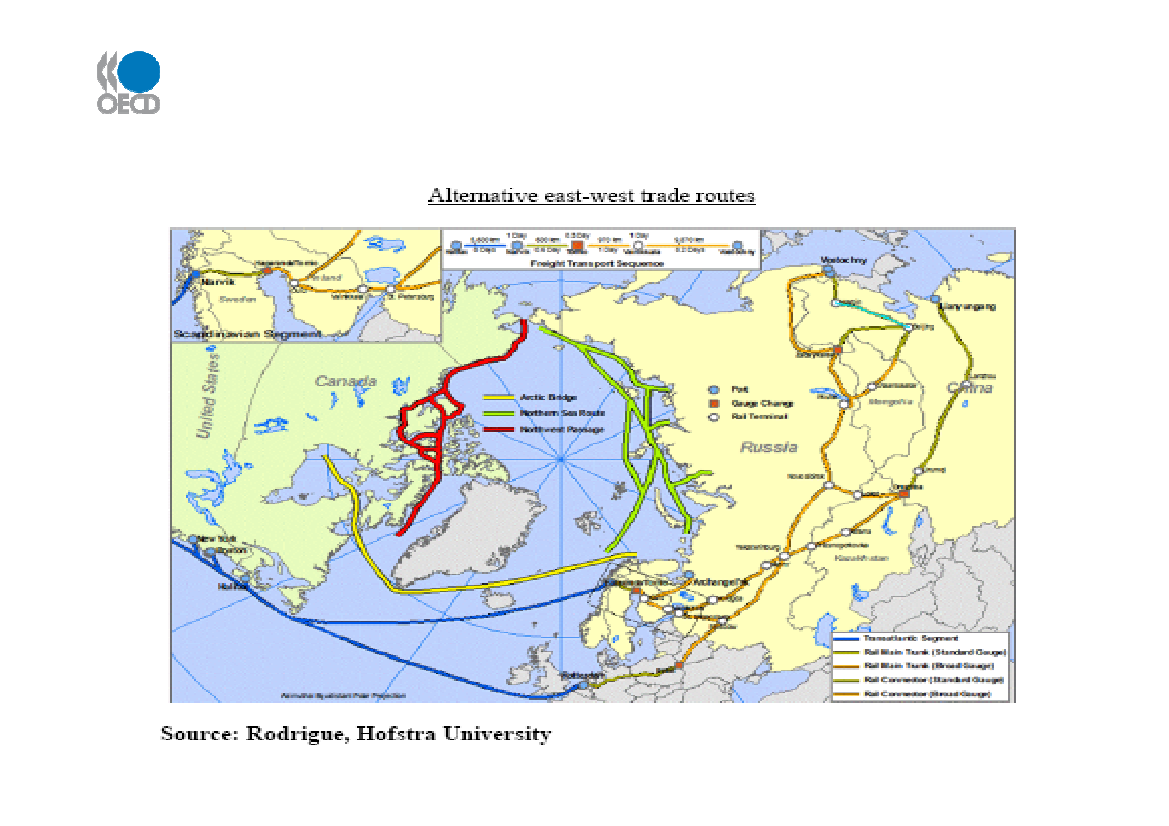

Source: IEA World Economic Outlook November 2009; IEA Transport Energy and CO2 October 2009.Emergence of new trade routes: what impact on tradeflows, gateways and infrastructure requirements?

What scope for more use of intelligent transportsystems on existing infrastructures?Pushing the frontiers further in:• Programmes that keep the road network atmaximum/optimal capacity during peak periods• Road network pricing..setting incentives?• Intelligent ICT-driven public transport managementschemes• Enhanced signalling and improved freight rail cargocapacity• Use of GIS codes to facilitate life-cycle management ofinfrastructure assets…• Etc.

What scope for more innovative approaches to finance?••Fiscal consolidation to 2017…?Growing expenditures on health, pensions, long-term care to 2050…

Options:••Diversify and expand traditional revenue-raising sources?Make greater use of user charges for funding infrastructures.?Theyshould be designed to signal prices, reflect real costs and contribute todemand management.Engage the private sector?Encourage public private partnerships (PPPs) as a means of raisingadditional financing for infrastructure investment and diversifyingbusiness models?Encourage the investment of pension funds and other large institutionalinvestors in infrastructures.?

••

•

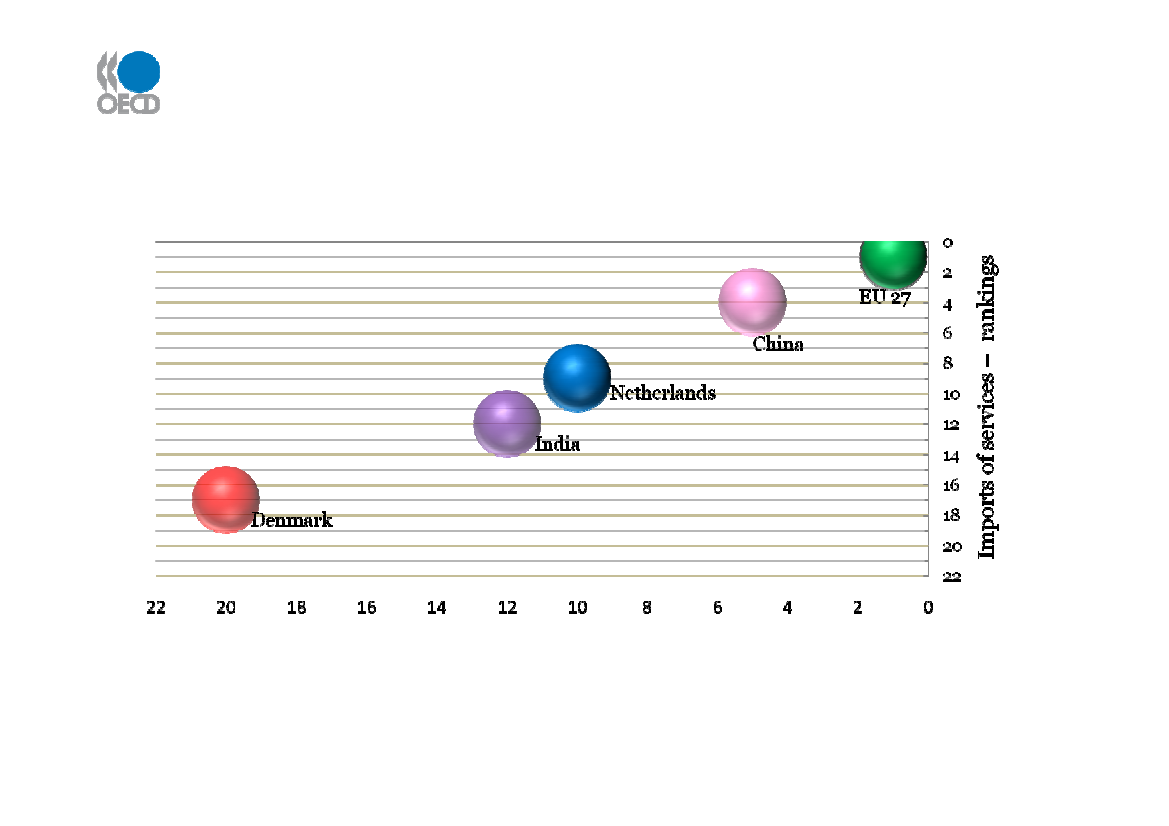

How to maintain export competitiveness as othercountries and regions develop more rapidly?(Worldtrade in commercial services –country rankings)

Exports of commercial services – country rankingsSource: UN World Trade Organization, March 2010

Thank you