Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATIONFOR TAX PURPOSES

A Background Information Brief18 August, 2010

For more information please contact:Jeffrey Owens, OECD Centre for Tax Policy and Administration Director ([email protected])orPascal Saint-Amans, Global Forum Secretariat ([email protected])HUUH

HU

UH

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES

1.Tax avoidance and tax evasion threaten government revenues throughout the world. TheUS Senate estimates revenue losses amount to 100 billion dollars a year and in many Europeancountries the sums run into billions of euros. This translates into fewer resources for infrastructureand affects the standard of living for all of us in both developed and developing economies.Globalisation generates opportunities to increase global wealth but also results in increased risks.The increase in cross-border flows that come with a global financial system require more effectivetax cooperation. Better transparency and information exchange for tax purposes are key to ensuringthat taxpayers have no safe haven to hide their income and assets and that they pay the right amountof tax in the right place. The OECD is the leading organisation in the area of tax cooperation and hasbeen working on the issues of transparency and exchange of information for over 15 years.2.Since the beginning of 2008 international tax evasion and the implementation of highstandards of transparency and exchange of information have been very high on the political agenda,reflecting recent scandals that have affected countries around the world and the spotlight that theglobal financial crisis has put on financial centres generally. Tax transparency was a key feature ofthe G20 Summits in Washington, London and Pittsburgh. In London, the G20 leaders stated that:

We agree to take action against non-cooperative jurisdictions, including tax havens. Westand ready to deploy sanctions to protect our public finances and financial systems. The eraof banking secrecy is over. We note that the OECD has today published a list of countriesassessed by the Global Forum against the international standard for exchange of taxinformation.3.In Pittsburgh they underscored the need for quick progress, stating that they “stand readyto use countermeasures” against jurisdictions that do not adopt the standards developed by theOECD and the Global Forum. The G 20 Finance Ministers and Central Bank Governors haveconstantly supported the work of the Global Forum and most recently in Pusan in June 2010. (SeeAnnex II for a history of G7/G8/G20 support for this work)4.In 2009, more progress toward full effective exchange of information has been made than inthe past decade. In the run up to the G20 summit held in London on 2 April 2009, the standards ontransparency and exchange of information developed by the OECD were endorsed by all key players,including jurisdictions which had so far been opposed to exchanging bank information. As a result,the standard of information exchange on request, including bank and fiduciary information, is nowuniversally endorsed and the UN has incorporated the OECD standard in the UN Model TaxConvention in October 2008. The OECD Secretary General stated “what we are witnessing is nothingshort of a revolution. By addressing the challenges posed by the dark side of the tax world, thecampaign for global tax transparency is in full flow. We have equipped ourselves with theinstitutional means to continue the campaign. With the crisis, global public opinion’s expectationsare high, their tolerance of non-compliance is zero and we must deliver”.5.Not only has the standard been universally endorsed but it is now being implemented ashundreds of information exchange instruments have been concluded over the past few months.Information exchange requires that jurisdictions do conclude such international agreements to be ina position to enter administrative assistance in all tax matters. Since 2009, almost 500 agreementswere signed by jurisdictions which were identified by the OECD as not substantially implementingthe standard in the progress report published on 2 April in conjunction of the G20. Since that date,18 August 20102

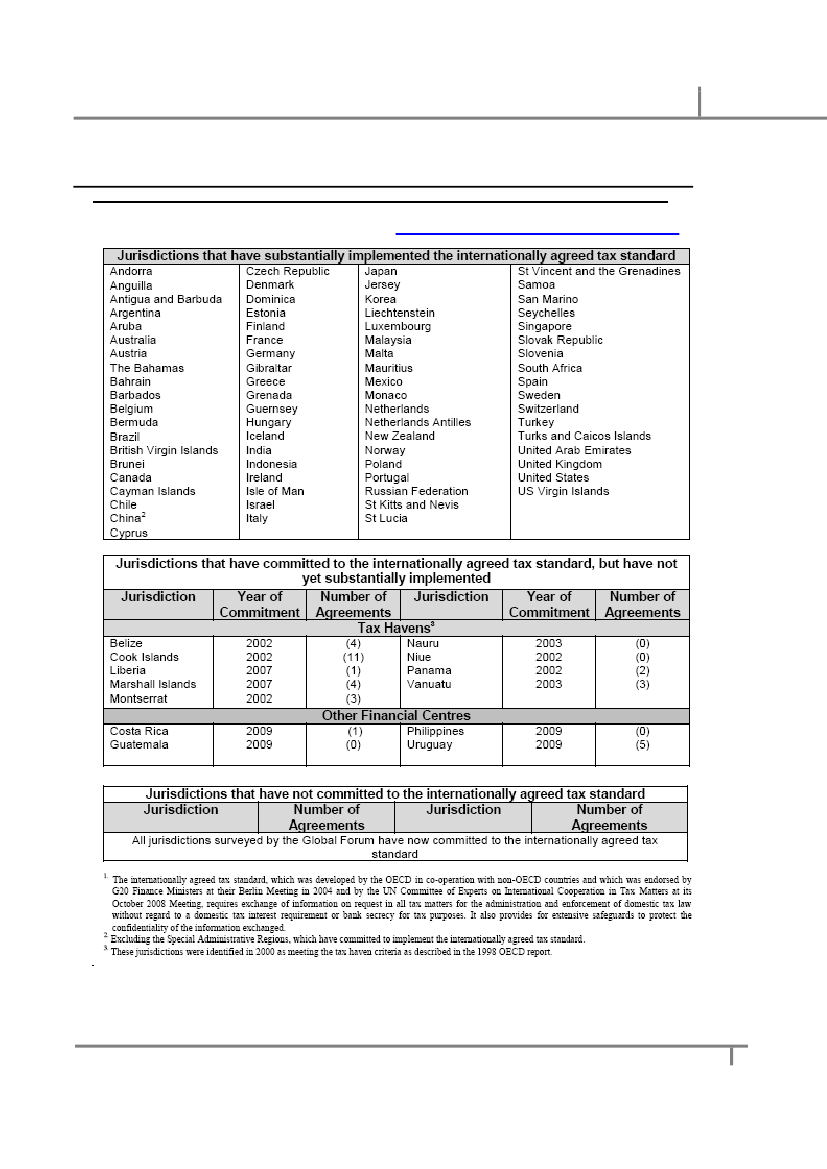

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES29 jurisdictions have been removed from that category for having signed at least 12 agreements tothe standards. Even though some offshore financial centres (OFCs) have signed agreements withother OFCs, the vast majority of agreements are with countries which have an interest in obtaininginformation for tax purposes. Also, many of the jurisdictions which have reached the threshold of 12agreements continue negotiating and signing more agreements.6.Signing agreements is a necessary step towards full implementation of the standard. It ishowever also necessary that these agreements enter into force and are effectively implemented. Inorder to monitor and trigger effective exchange, the Global Forum on Transparency and Exchange ofInformation for Tax Purposes was restructured and strengthened as decided at its Mexico meetingon 1-2 September 2009. The Global Forum now includes 95 members on an equal footing.Membership includes all G20 members, all OECD countries and all offshore jurisdictions. It has athree year mandate to peer review all the members and other jurisdictions which may requirespecial attention. The peer reviews will encompass two phases: Phase 1 will review the legal andregulatory frameworks while phase 2 will assess the practical implementation of the standard. Thereports will include recommendations to improve the situation in the reviewed jurisdictions.7.In fewer than 3 months, the Global Forum Secretariat has been established and is now fullyoperational. In February the Global Forum adopted Terms of Reference, a Methodology and a note onAssessment Criteria. A Schedule of Reviews has also been approved. All these documents areavailable on the Global Forum web site atwww.oecd.org/tax/transparency.8.As a result, the first set of peer reviews were launched on 1 March 2010. It covers a firstgroup of 18 jurisdictions: Australia, Barbados, Bermuda, Botswana, Canada, Cayman Islands,Denmark, Germany, India, Ireland, Jamaica, Jersey, Mauritius, Monaco, Norway, Panama, Qatar,Trinidad & Tobago. Eight review reports in the cases of Bermuda, Botswana, Cayman Islands, India,Jamaica, Monaco, Panama and Qatarwere adopted in the PRG Meeting on 20-22 July 2010 in TheBahamas and should be adopted at the Global Forum Meeting on 29-30 September 2010 inSingapore. The reviews are a first step in a three-year process approved in February by the GlobalForum in response to the call by G20 leaders at their Pittsburgh Summit in September 2009 forimproved tax transparency and exchange of information. A second set of twenty reviews will belaunched shortly.9.In addition, the G20 and the OECD have stressed the importance for developing countries tobenefit from the sea change in transparency and exchange of information. Already some emergingeconomies have entered into negotiations of tax information exchange instruments. It is in particularthe case of Argentina, China, India, and South Africa. The Global Forum membership is open todeveloping countries. The OECD has also amended the joint OECD Council of Europe Convention onAdministrative Assistance in order to bring it up to the standard and open it up for signatures to nonOECD countries. The protocol amending the Convention was signed by 15 countries at the OECDMinisterial Council Meeting on 27 May 2010. The original convention entered into force in 1995.Once 5 of these countries have ratified the Protocol economies in transition and developingcountries will be able to join the updated Convention. It currently groups 14 countries -- Azerbaijan,Belgium, Denmark, Finland, France, Iceland, Italy, Netherlands, Norway, Poland, Sweden, UnitedKingdom, United States, and Ukraine – with Canada, Germany and Spain having signed it but not yetratified it. Other OECD and Council of Europe members, including some that are G20 countries, arelooking at becoming parties to the convention, and it is now being opened up to other countries thatare not members of either the OECD or the Council of Europe members.

18 August 2010

3

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES10.Together with the Development Assistance Committee, the OECD Committee for FiscalAffairs are developing a technical assistance programme as well as exploring means to ensuredeveloping countries benefits fully of the recent changes. A Task Force on Tax and Development wasestablished and met on 11 May 2010 in Paris.Recent progress11.Progress in 2009 can be summarised as follows:In 2009, the standard has been universally endorsedas the four OECD countries (Austria,Belgium, Luxembourg and Switzerland) which were opposed lifted their reservation toArticle 26 of the OECD Model. The three non-cooperative tax havens which refused toendorse the standard finally did so in March (Andorra, Liechtenstein and Monaco). The fourGlobal Forum jurisdictions which had not committed to implement the standard on 2 Aprildid so soon after this date (Costa Rica, Malaysia, Philippines and Uruguay). Finally, all thenon-OECD countries which expressed a reservation to Article 26 withdrew their reservation,including Brazil, Chile and Thailand. As the UN also endorsed the new version of Article 26,the standard can now be considered as the internationally agreed standard.The standard is now being implemented by countries which were reluctant to commit to it:since 2009 more than 320 TIEAs were signed and 150 double taxation conventions (DTCs) orprotocols have been signed or brought up to the standard by countries which wereconsidered not to have substantially implementing the standard on 2 April. Altogether thesejurisdictions have now signed almost 360 TIEAs since 2000 with dozens more undernegotiation.Austria, Andorra, The Bahamas, Chile, Hong Kong, China, Liechtenstein, Macao, China,Malaysia, Panama, the Philippines, San Marino and Singapore have passed legislation aimedat implementing their commitments to the international tax standard.Costa Rica and Guatemala have initiated important legislative changes intended to allowthem to meet the international tax standards.Since the issuance of the 2nd April 2009 Progress Report 29 jurisdictions – Andorra, Anguilla,Antigua and Barbuda, Aruba, Austria, The Bahamas, Bahrain, Belgium, Bermuda, BritishVirgin Islands, Brunei, Cayman Islands, Chile, Dominica, Gibraltar, Grenada, Liechtenstein,Luxembourg, Malaysia, Monaco, Netherlands Antilles,St. Kitts and Nevis, St. Lucia, St. Vincentand the Grenadines,Samoa, San Marino, Singapore, Switzerland and the Turks and CaicosIslands – have moved to the category of jurisdictions having substantially implemented thestandard in the Progress Report.In addition, 2 jurisdictions - Brazil and Indonesia – have since joined the Global Forum,provided detailed information on their treaty networks. They have demonstrating that theyhave substantially implemented the internationally agreed tax standard.

12.These policy changes represent a very significant step toward a level playing field asregards exchange of information for tax purposes. However, these must now be followed up withswift and consistent implementation, which the OECD and the Global Forum will review and closelymonitor.

18 August 2010

4

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSESThe Standards of Transparency and Exchange of Information7B

13The standards of transparency and exchange of information that have been developed bythe OECD are primarily contained in the Article 26 of the OECD Model Tax Convention and the 2002Model Agreement on Exchange of Information on Tax Matters. The standards have been adopted bythe G20 Ministers of Finance at a meeting in Berlin (Germany) in 2004, Xianghe (China) in 2005 andby the UN Committee of Experts on International Cooperation in Tax Matters in October 2008. Theyserve as a model for the vast majority of the 3600 bilateral tax conventions entered into by OECDand non-OECD countries and are the international norm for tax co-operation.14The standards require:•••••Exchange of information on request where it is “foreseeably relevant” to theadministration and enforcement of the domestic laws of the treaty partner.No restrictions on exchange caused by bank secrecy or domestic tax interestrequirements.Availability of reliable information and powers to obtain it.Respect for taxpayers’ rights.Strict confidentiality of information exchanged.

15.These requirements strike a balance between privacy and the need for jurisdictions to enforcetheir tax laws. A jurisdiction requesting information must establish that the information is “foreseeably”relevant to the administration and enforcement of its tax laws, which rules out so-called “fishingexpeditions”. The scope of the information that may be requested, however, is extremely broad. Where theinformation requested is “foreseeably relevant”, then this will cover any and all information that relates tothe enforcement and administration of the requesting jurisdictions’ tax laws, including, informationrelating to interest, dividends or capital gains, bank information, fiduciary information relating to trusts, orownership information of companies.The Global Forum on Transparency and Exchange of Information9B

16Since 2000, the Global Forum has been the multilateral framework within which work inthis area has been carried out by both OECD and non-OECD economies. From 2006, the Global Forumhas published annual assessments of the legal and administrative framework for transparency andexchange of information in over 80 countries. The last update was published in September 2009 asTax Co-operation 2009: Towards a Level Playing Field – 2009 Assessment by the Global Forum onTransparency and Exchange of Information (www.oecd.org/ctp/htp/cooperation).Political attentionto the Global Forum’s work, and the urgency of ensuring that high standards of transparency andexchange of information are in place around the world, made it imperative to review the GlobalForum’s structure and mandate.17.The Global Forum met in Mexico on 1-2 September 2009 to discuss progress made inimplementing the international standards, and how to respond to international calls to strengthenthe work of the Global Forum. (For the outcomes of the Global Forum meeting see Annex I.)Participants agreed that the Global Forum should:

18 August 2010

5

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSESbe restructured to include all OECD, G20 and other jurisdictions covered by the 2009Assessment, as an organisation established under Part II of the OECD budget – this meansthat the Global Forum is funded by its members who each have an equal footing;establish a self-standing dedicated secretariat based in the OECD Centre for Tax Policy andAdministration;carry out an in-depth monitoring and peer review of the implementation of the standards oftransparency and exchange of information for tax purposes;develop multilateral instruments to speed up negotiations; andensure that developing countries benefit from the new environment of transparency.18.To fulfil this mandate, the Global Forum set up a 15 member Steering Group, chaired byAustralia with Vice-Chairs from China, Germany and Bermuda, to guide the work of the Global Forum.In addition, a 30 member Peer Review Group chaired by France and assisted by four Vice-Chairs –India, Japan, Singapore and Jersey. The Peer Review Group’s first task has been to develop themethodology and detailed terms of reference for a robust, transparent and accelerated process. Thefirst meetings of the Peer Review Group took place in October and December 2009 and delegateshave worked diligently to lay the foundations for the revie ws, which have begun in March 2010.19.All members of the Global Forum, as well as jurisdictions identified by the Global Forum asrelevant to its work, will undergo reviews of the implementation of their systems for the exchange ofinformation in tax matters. This will take place in two phases. Phase 1 reviews will assess the qualityof a jurisdiction’s legal and regulatory framework for the exchange of information, while Phase 2 willlook at practical operation of that framework. All jurisdictions will undergo Phase 1 reviews beforeJune 2012 and all Phase 2 reviews should be completed before June 2014. The reviews began inMarch 2010. A schedule of reviews has been published atwww.oecd.org/tax/transparencyso thatthe public can follow the Global Forum’s progress, and the outcome of the reviews will also bepublished once they are adopted by the Global Forum. In addition, a system of on-going monitoringhas been put in place to ensure that developments which occur after a review is complete areacknowledged and to make sure that the most complete and up-to-date information about all thejurisdictions covered by the Global Forum’s work is available to the public. This will include adatabase of information concerning transparency and exchange of information on the Global Forumwebsite.20.The next meeting of the Global Forum will be held in Singapore on 29-30 September 2010.

Please consult the Global Forum’s website atwww.oecd.org/tax/transparencyfor more information.Enabling All Countries to Benefit from the New Transparency Environment21.Emerging economies are already drawing benefits from international changes in favour ofmore transparency and exchange of information. Argentina, China and India have recently concludeda number of TIEA or DTCs, including Article 26 of the OECD Model Convention. Major non-OECDcountries, including some within the G20, have withdrawn their positions on the exchange ofinformation provision of the OECD Model Tax Convention (Brazil, Chile, Malaysia, Romania, Serbiaand Thailand). Today all of the 30 non-OECD countries which have formally set out their positions onthe OECD Model have removed their objections to the international standard on exchange ofinformation incorporated into Article 26.18 August 20106

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES22.Developing countries often lack the resources and capacity to build effective taxadministration and although there have been improvements in revenue raising efforts over the lastfew years, half of sub Saharan African countries still mobilise less than 17% of their GDP in taxrevenues, as against an average of around 35% in OECD countries. The external environment alsoposes new challenges. The global shift away from tariffs has added to the problems of domesticrevenue-raising and striking the right balance between an attractive tax regime for investment andgrowth, and securing the necessary revenues for public spending, is a key policy dilemma.Globalisation exacerbates these fiscal problems, as internationally mobile capital becomes moredifficult to tax.23.Offshore financial centres, broadly defined, reduce revenue available to developingcountries where they act as a destination for income streams and wealth protected by a lack oftransparency and show a refusal or inability to exchange information with revenue authorities whomay have taxing rights in respect of that income or those assets. Data on revenues lost bydeveloping countries from offshore non compliance is unreliable. Most estimates, however, exceedby some distance the level of aid received by developing countries—around USD 100 billion annually.24.A key issue now is how developing countries can best be supported to take advantage of themore transparent international environment, and to strengthen their tax systems. Internationalorganisations and bilateral donors can help developing countries to:Enter into exchange of information agreements for tax purposes, including throughmultilateral mechanisms where possible in order to ensure quick implementation;Create administrative structures to implement exchange of information mechanisms andto protect the confidentiality of information exchanged;Strengthen administrative capacity including audit mechanisms to enable developingcountries to request and use information obtained under agreements efficiently and in away which significantly increases the legitimate enforcement of their tax legislation;In broader terms such support also can help develop and restructure tax systems;Fighting corruption and enhancing integrity within tax administrations.

These issues are currently being discussed both within the OECD and the Global Forum, as well as inco-ordination with other international organisations that have an interest in this work.Speeding up the Process25.The OECD is currently pursuing important strategies to help accelerate the development ofadequate exchange of information networks. One stream is a process of multilateral negotiationstoward bilateral agreements for the exchange of information. The OECD has initiated three pilotprojects, two in the Caribbean and one in the Pacific All of the pilot projects have been successfulMore than 100 agreements have already been signed or are currently being concluded as a result ofthe initiative. The initiative has allowed a number of smaller jurisdictions such as Antigua andBarbuda, the Cook Islands, Samoa and the Turks and Caicos Islands to quickly put in place asignificant network of agreements with OECD countries. It has also allowed some of thesejurisdictions to move into the “substantially implemented” category in the Progress Report. Theseexperiments have been extended to Costa Rica and Liberia. More than 100 agreements have beensigned so far from these initatives. It is being considered to extend this to developing countries.

18 August 2010

7

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES26.The second strand was to update the OECD – Council of Europe Convention on MutualAdministrative Assistance in Tax Matters so that it ensures exchange of information in accordancewith the standards and allows jurisdictions that are not members of either the OECD or Council ofEurope to become a party to it. The steps necessary to revise the convention are almost complete. Itseffect is to align the convention to the international standard on information exchange for taxpurposes by allowing for the exchange of bank information. This initiative responds to a call by G20leaders at their April 2009 summit for proposals as to ways to help developing countries secure thebenefits of the new cooperative tax environment.27.Finally, the2002 Model Agreement on Exchange of Information on Tax Matters sets out twooptions: a bilateral and a multilateral TIEA. The multilateral model TIEA does not provide for a“multilateral” agreement in the traditional sense. Instead, it provides the basis for an integratedbundle of bilateral treaties, so that a party to it would only be bound by the Agreement vis-à-vis thespecific parties with which it agrees to be bound. Perhaps due to the novelty of the multilateralapproach, the Model has to date only been implemented in its bilateral form. The OECD hasdeveloped a protocol designed to facilitate the implementation of the multilateral approach.The OECD’s Harmful Tax Practices Project1

28.Another key aspect of the OECD’s work on promoting the standards of transparency andexchange of information has been its harmful tax practices project, which was launched in 1996 at thebehest of the G7. This initiative is carried out through the Forum on Harmful Tax Practices, a subsidiarybody of the Committee on Fiscal Affairs (CFA), and has consistently garnered the support of theinternational community. The first major output of the Forum on Harmful Tax Practices was the 1998Report, Harmful Tax Competition: An Emerging Global Issue1. The publication of this report initiated aperiod of intense dialogue aimed at eliminating preferential tax regimes within OECD member states2,identifying “tax havens” and seeking their commitments to the principles of transparency and effectiveexchange of information and encouraging other non-OECD economies to associate themselves with theharmful tax practices work. Between 2000 and 2002 the OECD worked with these jurisdictions to securetheir commitment to implement the OECD’s standards of transparency and exchange of information.3Thisdialogue with non-OECD members ultimately transformed into the Global Forum on Transparency andExchange of Information, and many of these jurisdictions now play active roles on its Steering Group andPeer Review Group (Bermuda, British Virgin Islands, Cayman Islands, Isle of Man, Jersey, Malta,Mauritius, St. Kitts and Nevis, Samoa and The Bahamas).Access to Bank Information for Tax PurposesB

29.In parallel with the work on harmful tax practices, the OECD’s Committee on Fiscal Affairs(CFA) is examining the extent to which OECD Member countries and observer countries have accessto bank information for tax purposes. In 2000,Improving Access to Bank Information for Tax Purposeswas published. The report set out an ideal standard of access to bank information, namely, that “allMember countries should permit access to bank information, directly or indirectly, for all tax12

Luxembourg and Switzerland abstained in the approval of the report.

The project has been very successful. By 2004, all but one of the preferential tax regimes identified within theOECD had been abolished, amended or found not to be harmful. The only outstanding regime was theLuxembourg 1929 holding company regime. In December 2006 Luxembourg enacted legislation to abolish theregime by the end of 2010.SeeTowards Global Tax Co-operation: Progress in Identifying and Eliminating Harmful Tax Practices(2000) fora detailed history of the tax haven criteria and the development of these lists.3

18 August 2010

8

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSESpurposes so that tax authorities can fully discharge their revenue raising responsibilities and engagein effective exchange of information with their treaty partners”. The CFA has been closely monitoringthe progress made in implementing this standard and has issued two progress reports, in 2003 and2007. With the announcements in 2009 by Austria, Belgium, Luxembourg and Switzerland, all OECDcountries now endorse this standard.Improving Compliance1B

30.The CFA also investigates how member governments can co-operate to minimise the extentof tax evasion and avoidance. In this regard it has mandated a focus group to study the role that noor nominal tax jurisdictions play in tax evasion. This work is intended to both identify particularchallenges that these jurisdictions pose for tax administrations and to help administrations adoptbest practices. The CFA is also about to publish a study on the effectiveness of offshore complianceinitiatives launched by OECD and non-OECD countries.31.Another important aspect of compliance work is carried out through the OECD’s Forum onTax Administration (FTA), established by the CFA in 2002, which brings together tax commissionersfrom over 40 countries to promote cooperation between revenue bodies and to develop good taxadministration practices. Over the last few years the FTA has examined a wide range of issues in theareas of compliance risk management, taxpayer services, and use of modern technology.At Seoul,Korea in September 2006, the FTA agreed to work together on ways to improve tax administrationand to address the significant and growing problem of international non-compliance with nationaltax requirements. The Seoul Declaration (www.oecd.org/ctp/ta/seouldeclaration) issued inconjunction with that meeting identified four areas in which the tax administration heads planned tointensify existing work or initiate new work under the auspices of the OECD, including:HUUH

further developing a directory of aggressive tax planning schemes to assist member countriesidentify trends and measures to counter such schemes; andan examination of the role of tax intermediaries in relation to the promotion of unacceptabletax minimization arrangements.32.At their subsequent meeting in January 2008 in Cape Town, South Africa -- the outcomes ofwhich are set out in theCape Town Communiqué-- the FTA Commissioners endorsed theconclusions and recommendations of the Study into the Role of Tax Intermediaries. The scope of thisstudy was widened following the Seoul meeting to examine the tripartite relationship between largebusiness taxpayers, revenue bodies and tax intermediaries on the basis that taxpayers representedthe demand side of ‘’unacceptable tax minimisation arrangements’’. The Commissioners also notedthe further progress with the development of the directory of aggressive tax planning schemes. Inaddition, responding to a recommendation of tax intermediaries' study, they commissioned furtherfollow-up studies involving the tax planning activities of high-net-worth individuals and banks.These studies were finalised and published in June 2009.HUUH

33.The FTA Commissioners have recently endorsed a work programme for 2010 which willcontinue to focus on unacceptable tax minimisation arrangements. Commissioners will be examining (1)the range of initiatives used to encourage those taxpayers who have used tax havens to hide their incomeand gains to come forward to regularise their tax affairs and (2) as how to best leverage from the recentadvances in exchange of information through greater use of joint audits of taxpayers operating in multiplejurisdictions, exploring the linkages between good corporate governance and tax compliance. Theoutcomes of this work will be discussed at the FTA meeting in Istanbul in September 2010.18 August 20109

ANNEX I:CHRONOLOGY OF G7/G8/G20 SUPPORT FOR THE OECD’S WORK ONTRANSPARENCY AND EXCHANGE OF INFORMATION3B

G 20 Leaders’ StatementToronto, Canada 26-27 June 2010“We fully support the work of the Global Forum on Transparency and Exchange ofInformation for Tax Purposes, and welcomed progress on their peer review process, andthe development of a multilateral mechanism for information exchange which will beopen to all interested countries. Since our meeting in London in April 2009, the numberof signed tax information agreements has increased by almost 500. We encourage theGlobal Forum to report to Leaders by November 2011 on progress countries have madein addressing the legal framework required to achieve an effective exchange ofinformation. We also welcome progress on the Stolen Asset Recovery Program, andsupport its efforts to monitor progress to recover the proceeds of corruption. We standready to use countermeasures against tax havens.”G20 Communiqué: Meeting of Finance Ministers and Central Bank GovernorsWashington D.C., U.S. 23 April 2010“We also welcomed the report by the Global Forum on Tax Transparency and Exchange ofInformation, the launch of the peer review process, and the development of amultilateral mechanism for information exchange which will be open to allcountries.”G20 Leaders’ StatementPittsburgh, U.S. 25 September 2009“We are committed to maintain the momentum in dealing with tax havens…We standready to use countermeasures against tax havens from March 2010.”G-8 Declaration: Meeting of Heads of GovernmentL’Aquila, Italy 8 July 2009“[A]ll jurisdictions must now quickly implement their commitments. We cannot continueto tolerate large amounts of capital hidden to evade taxation.”Statement of G8 Finance MinistersLecce, Italy, 13 June, 2009“It is also essential to develop an effective peer-review mechanism to assesscompliance…delivered by an expanded Global Forum.”G20 Communiqué: The Global Plan for Recovery and ReformLondon, U.K. 2 April 2009

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES

[W]e agree…to take action against non-cooperative jurisdictions, including taxhavens…We note that the OECD has today published a list of countries assessed bythe Global Forum against the international standard for exchange of taxinformation…G20 Declaration:Strengthening the Financial SystemLondon, U.K. 2 April 2009

“We stand ready to take agreed action against those jurisdictions which do not meetinternational standards in relation to tax transparency.”“We are committed to developing proposals, by end 2009, to make it easier fordeveloping countries to secure the benefits of a new cooperative tax environment.”G20 Working Group on Reinforcing International Cooperation and Promoting Integrity inFinancial Markets (WG2), Final Report: 27 March 2009“Weurge the international bodies responsible for prudential and regulatory standards,anti money laundering and terrorist financing, and tax matters - the FSF, the FATF andthe OECD - to accelerate their work of identifying uncooperative jurisdictions anddeveloping a toolbox of effective countermeasures against these jurisdictions...”G20 Declaration of the Summit on Financial Markets and the World EconomyWashington, D.C. 15 November 2008“theOrganization for Economic Cooperation and Development (OECD), should continueefforts to promote tax information exchange. Lack of transparency and a failure toexchange tax information should be vigorously addressed.”G-8 Communiqué: Meeting of Heads of GovernmentHokkaido Japan 9 July 2008“We urge all countries that have not yet fully implemented the OECD standards oftransparency and effective exchange of information in tax matters to do so withoutfurther delay, and encourage the OECD to strengthen its work on tax evasion and reportback in 2010.”G-8 Communiqué: Meeting of Finance MinistersOsaka Japan 14 June 2008“In view of the recent developments, we urge all countries that have not yet fullyimplemented the OECD standards of transparency and effective exchange of informationin tax matters to do so without further delay. We welcome the efforts of the OECD in thisregard, and ask the OECD to strengthen its work on tax evasion.”G20 Communiqué: Meeting of Ministers and Governors in Melbourne18-19 November 2006

18 August 2010

11

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES“Further progress is needed and we encourage continuing implementation efforts andcall on those countries and territories that have not yet implemented high standards oftransparency and exchange of information to do so.”G20 Communiqué: Meeting of Finance Ministers and Central Bank GovernorsXianghe, Hebei, China, 15-16 October 2005“[W]e welcome the efforts of the OECD Global Forum on Taxation to promote highstandards of transparency and effective exchange of information for tax purposes.”G8 Communiqué on AfricaGleneagles, UK 14 July 2005“We will continue to support Financial Stability Forums ongoing work to promote andreview progress on the implementation of international standards, particularly the newprocess concerning offshore financial centres that was agreed in March 2005, and theOECD’s high standards in favour of transparency and exchange of information in all taxmatters.”G20 Statement on Transparency and Exchange of Information for Tax PurposesMeeting of Finance Ministers and Central Bank GovernorsBerlin, Germany 20–21 November 2004“The G20 therefore strongly support the efforts of the OECD Global Forum on Taxation topromote high standards of transparency and exchange of information for tax purposesand to provide a cooperative forum in which all countries can work towards theestablishment of a level playing field based on these standards.”G7 Economic Communiqué: Making a success of globalization for the benefit of allLyon, France 28 June 1996“We strongly urge the OECD to vigorously pursue its work in this field, aimed atestablishing a multilateral approach under which countries could operate individuallyand collectively to limit the extent of these practices. We will follow closely the progresson work by the OECD, which is due to produce a report by 1998.”

18 August 2010

12

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSESANNEX II:2009 –2010 YEARS OF THE G20: IMPACT ON IMPLEMENTATION4B

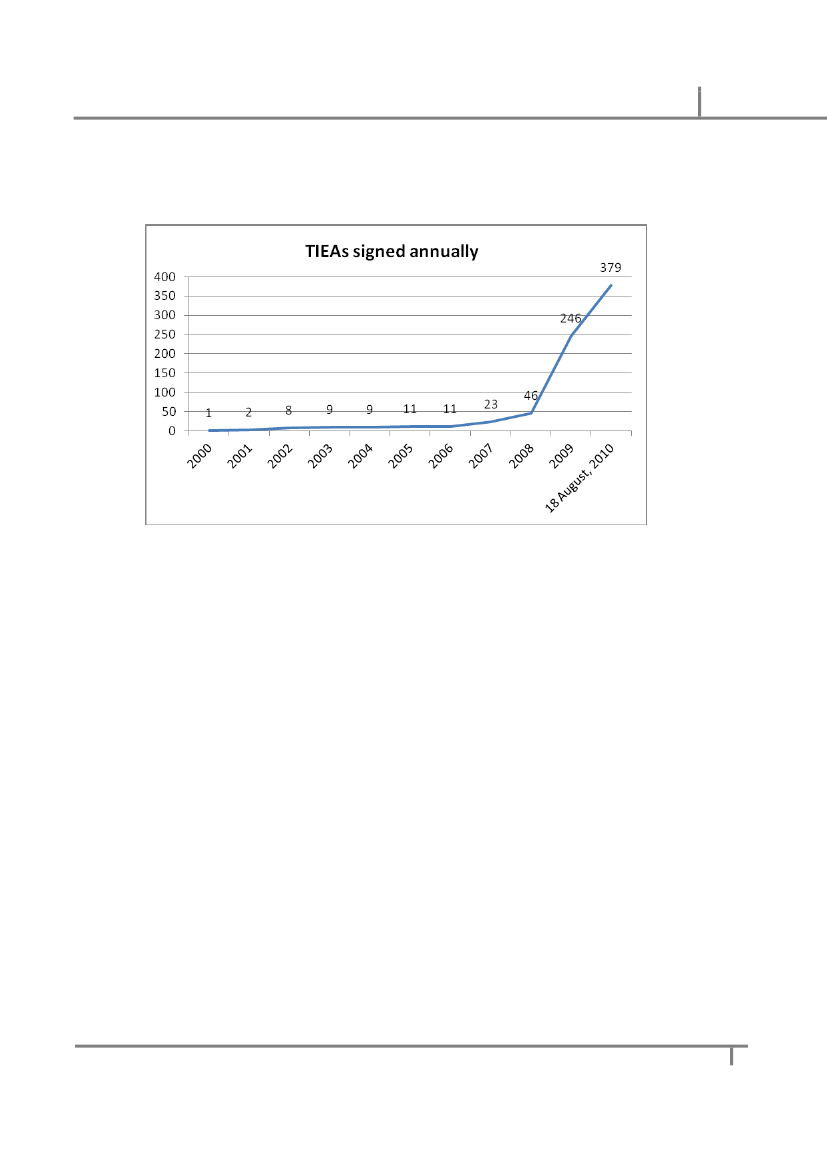

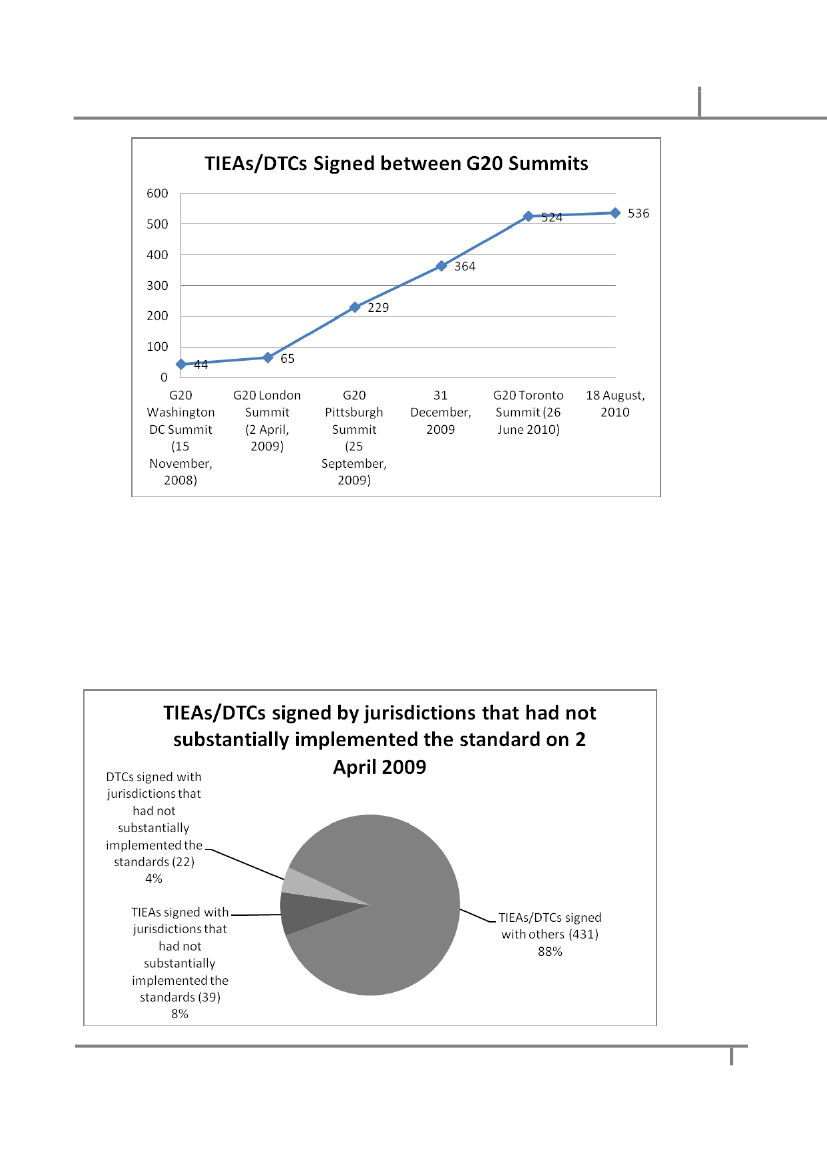

Up to the G20 Washington Summit on 15 November 2008 a total of 44 tax information exchangeagreements (TIEAs) had been signed. Very few of the jurisdictions identified as not havingsubstantially implemented the internationally agreed tax standard in the Progress Report issued inconjunction with the G20 Summit in London on 2 April had signed any double taxation conventions(DTCs) that met the standard. The 23 TIEAs agreed in 2008 were double the total number ofagreements that had been signed since the Global Forum began in 2000. Following the G20 summit inWashington and in the run-up to the London Summit in April 2009 TIEA signings skyrocketed, aswell as the negotiation of new DTCs or protocols to existing DTCs that incorporated the standard onexchange. A further 21 TIEAs/DTCs were agreed in just four months, and between the LondonSummit and the G20 meeting in Pittsburgh in September 164 more agreements were in place. Thepace continued and by the end of the year a total of 36 jurisdictions working to substantiallyimplement the standard had signed 200 TIEAs and upgraded 118 DTCs. Since January 2010, 133TIEAs and upgraded 40 DTCs have been signed.

18 August 2010

13

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES

28 jurisdictions have been moved to the category of those jurisdictions having substantiallyimplemented the standards for having signed at least 12 agreements to the standards. Eventhough some offshore financial centres (OFCs) have signed agreements with other OFCs, thevast majority of agreements are with countries which have an interest in obtaining informationfor tax purposes. The chart below shows that only a very small percentage (12%) of theagreements signed since the November 2008 G20 Summit have been entered into betweenjurisdictions that had not substantially implemented the standards on 2 April 2009.

18 August 2010

14

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES

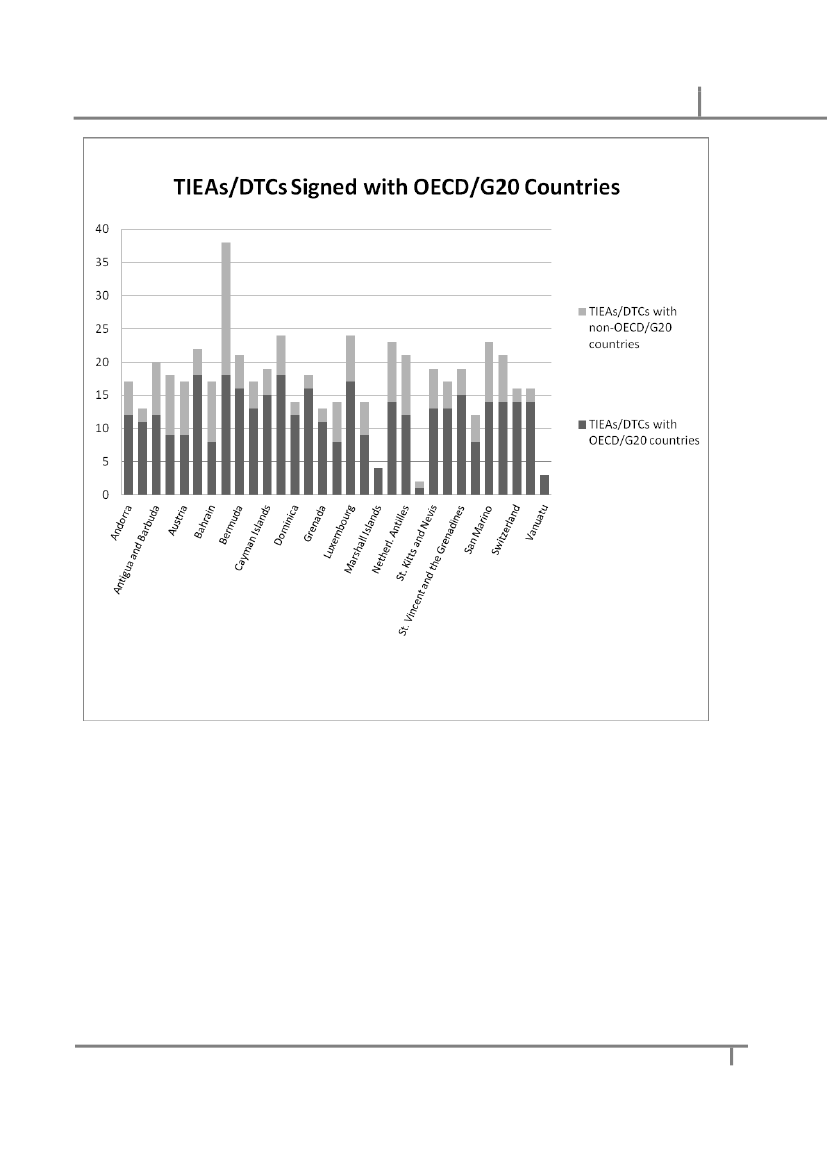

Virtually all of the 28 jurisdictions which have reached the threshold of 12 agreements continuenegotiating and signing more agreements.

18 August 2010

15

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSES

18 August 2010

16

PROMOTING TRANSPARENCY AND EXCHANGE OF INFORMATION FOR TAX PURPOSESANNEX V: OECD PROGRESS REPORTA PROGRESS REPORT ON THE JURISDICTIONS SURVEYED BY THE OECD GLOBALFORUM IN IMPLEMENTING THE INTERNATIONALLY AGREED TAX STANDARD1Progress made as at 18thAugust, 2010 (OriginalProgress Report 2nd

April 2009)

18 August 2010

17