Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

Organisation for Economic Co-operation and Development

Tax Policy Trendsin OECD countriesPresentation to Danish ParliamentariansParis, 9 September 2010Jeffrey OwensDirector of the Centre for Tax Policy and AdministrationOrganisation for Economic Co-operation and DevelopmentJeffrey.owens@oecd.org

Jens Lundsgaard

Centre for Tax Policy and Administration

Top challenges following the crisis

Public debt has risen strongly following the crisis

fiscal consolidation required in some countries•The scale ofboth spending cuts and tax increases are necessarymeans that

Economic growth potential is weakened

•Tax reform might be part of the answer

2

2

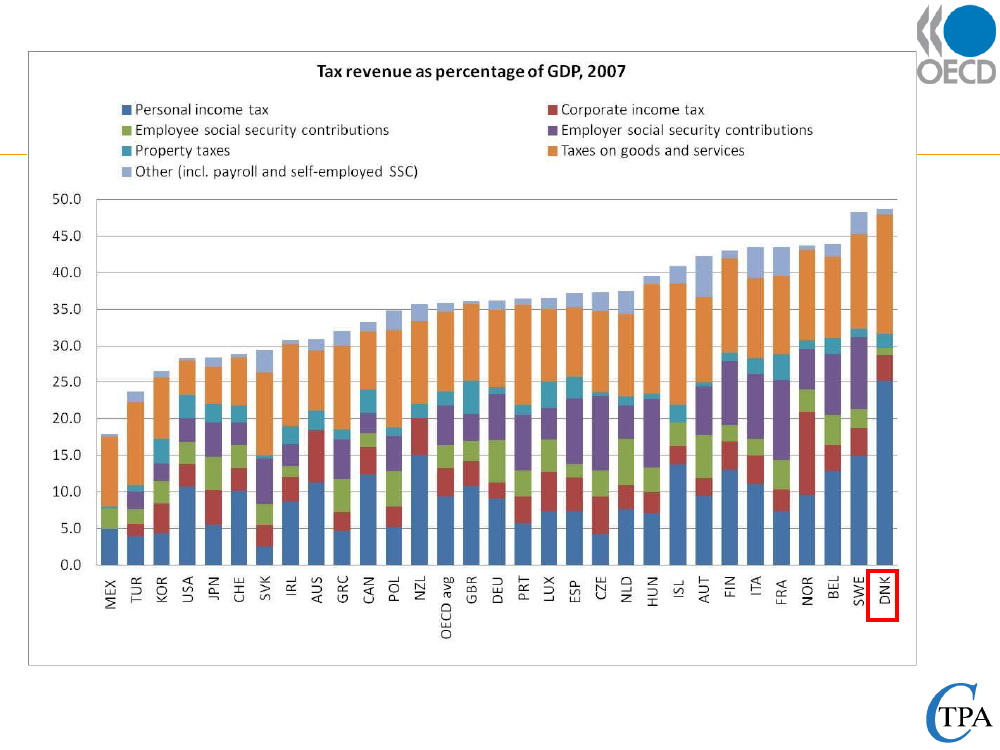

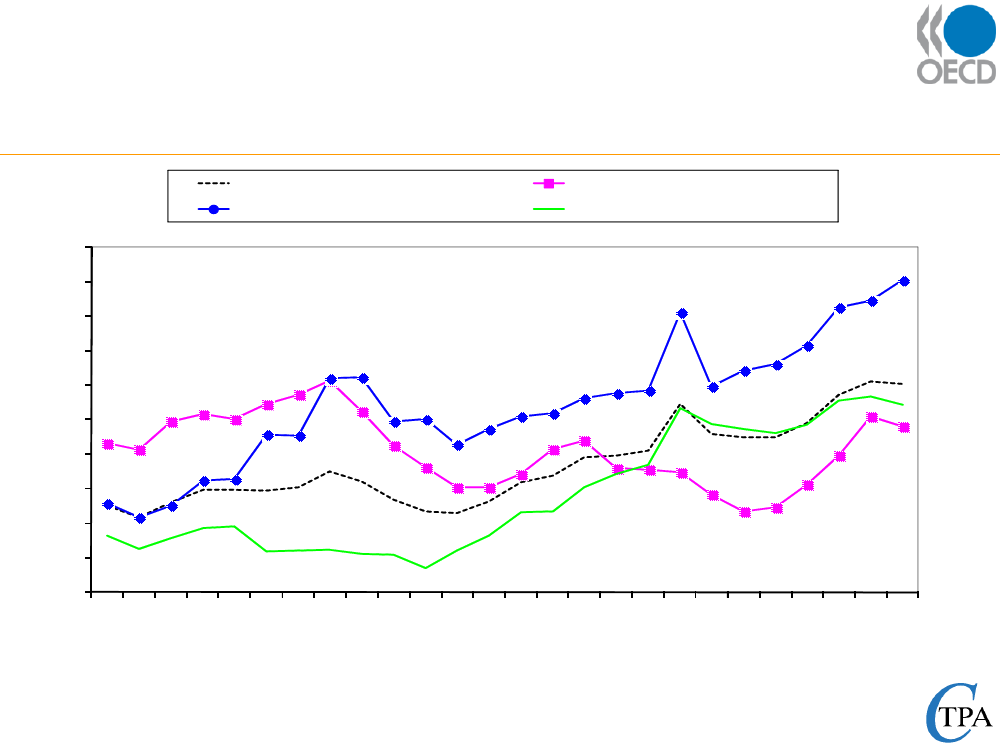

Tax-to-GDP ratios

3

Source: Revenue Statistics (OECD)4

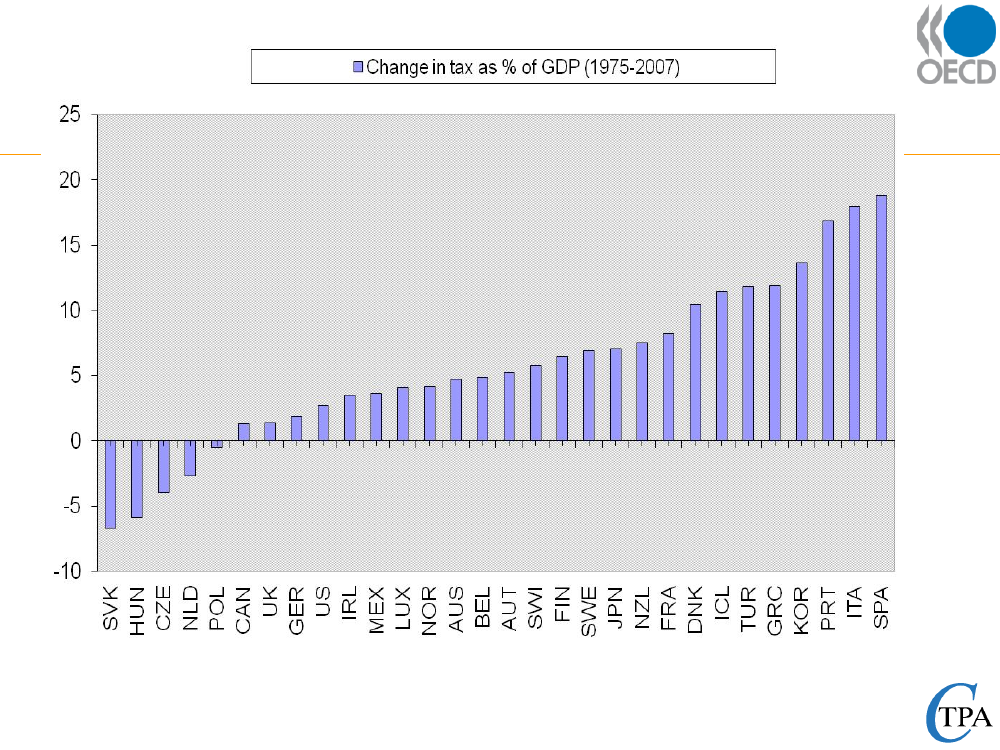

Earliest data available MEX: 1980; HUN-POL: 91; CZE: 93; SVK: 98Source: Revenue Statistics (OECD)5

The tax mix

6

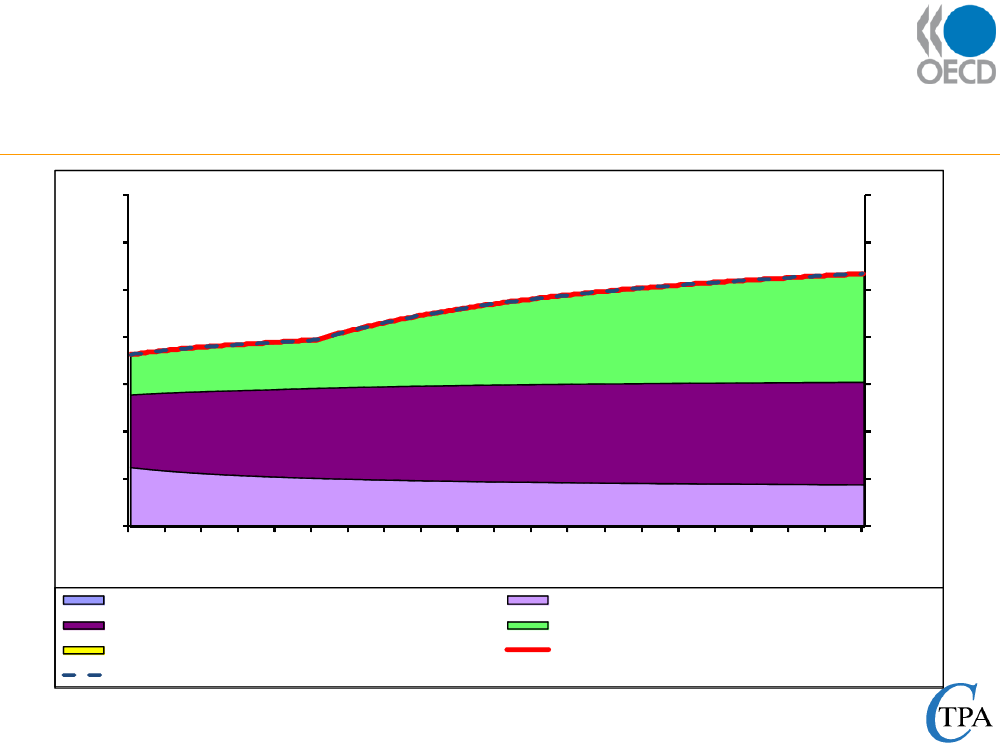

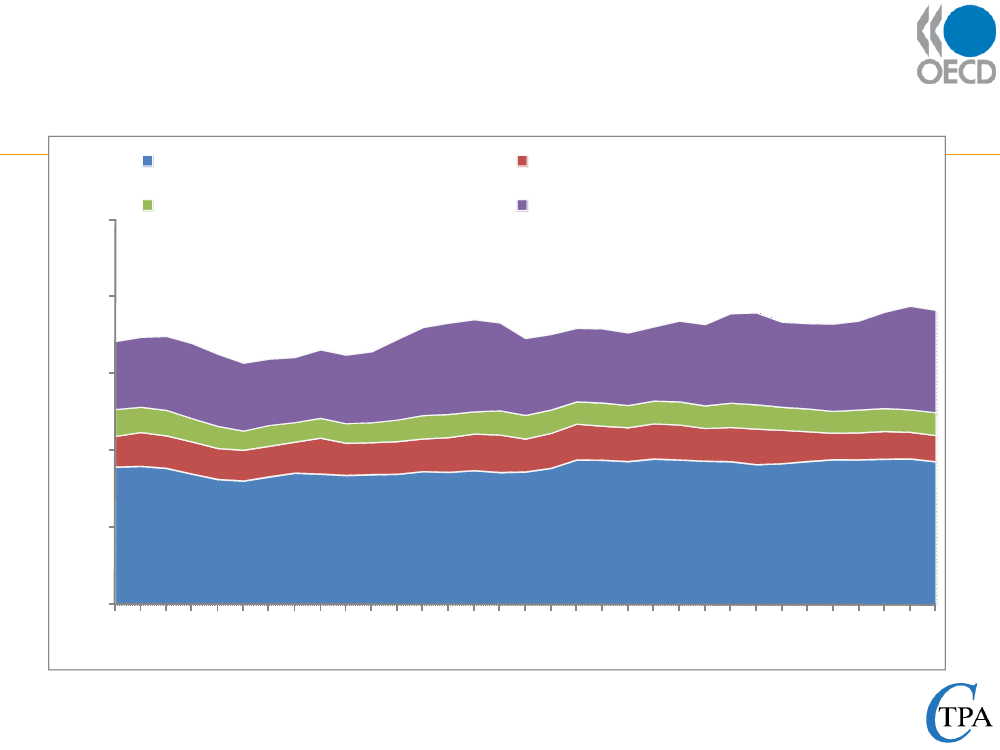

Revenue shares of major taxes in theOECD-area over time1965Personal income taxCorporate income taxSocial security contributions(employee)(employer)Payroll taxesProperty taxesGeneral consumption taxesSpecific consumption taxesOther taxesTotal7

197530822( 7)( 14)1613182100

198530822( 7)( 13)1516162100

199527825( 8)( 14)1618133100

2007251125( 9)( 15)1619113100

26918( 6)( 10)1812242100

Capital income taxation atcorporate and personal level

8

9

10

20

30

40

50

60

70

0

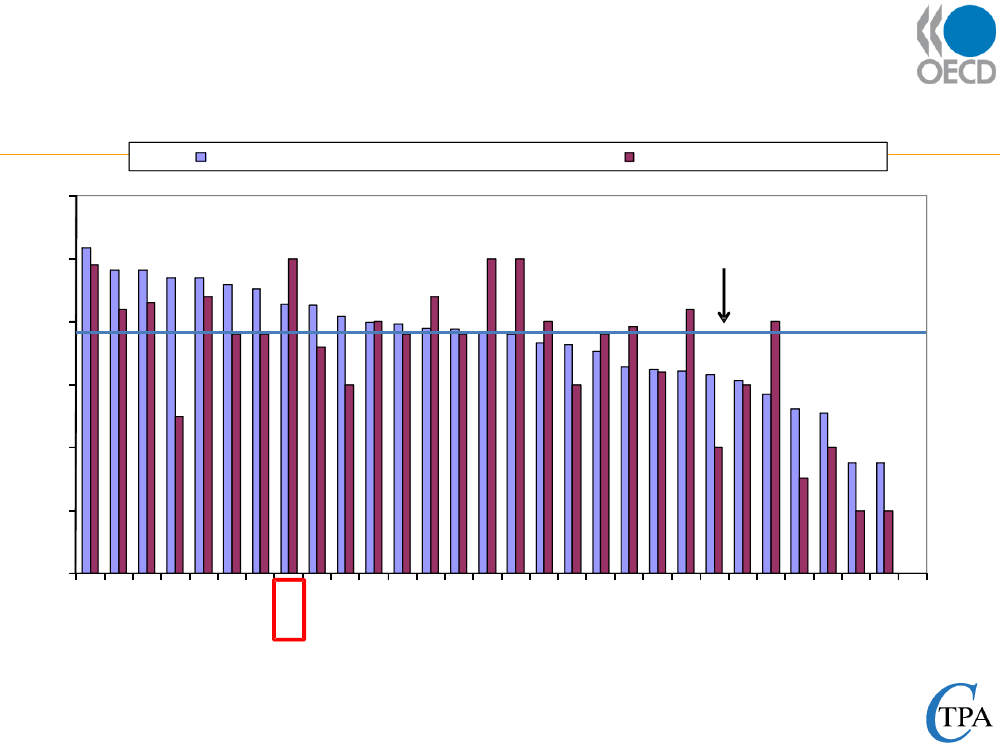

NPJSUARFLEBREGSUAXEMLZNAPSNACXULRONKUATITRP20101981

EWSNIFDLNTUAKNDROKCRGIWSRUTEZCNUHLOPKVSLHCLCILRI

Corporate income tax rate1994

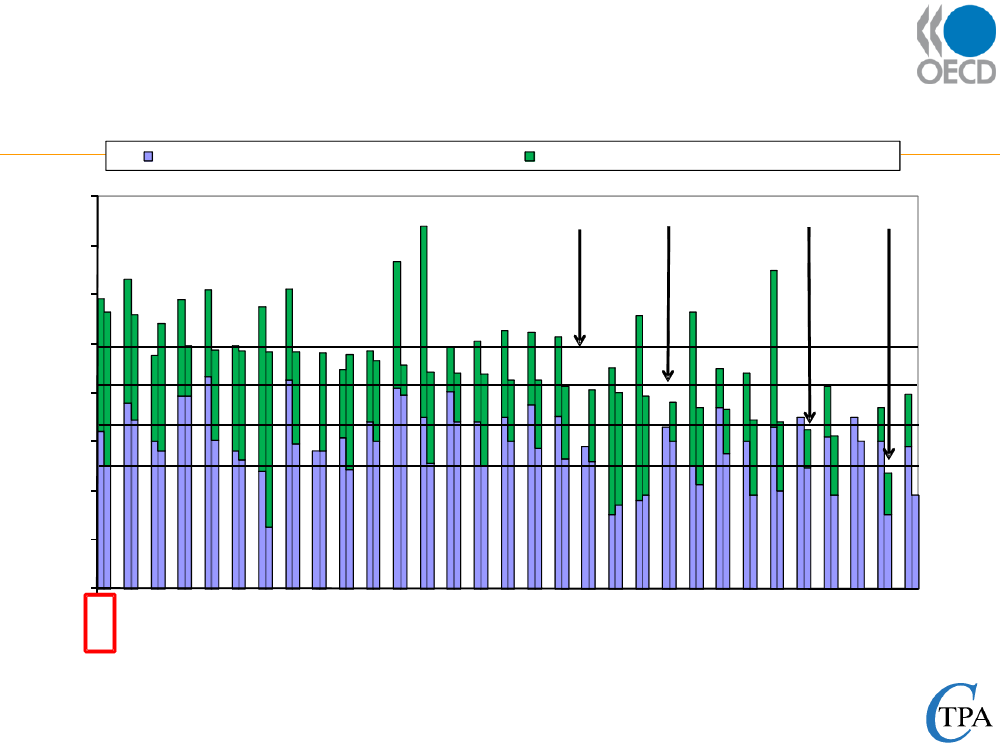

Corporate tax rates and GDP across theOECDStatutory corporate income tax rate2000Large-sized OECD countriesUS-JPN-GER-UK-FRA-ITA

200436.0

200735.9

201033.1

39.5

Medium-sized OECD countriesCAN-SPA-KOR-MEX-AUS-NLD

35.7

33.1

29.9

28

Small-sized OECD countriesBEL-SWI-TUR-SWE-AUT-POLNOR-GRC-DNK-IRL-FIN-PRTCZE-HUN-NZL-SVK-LUX-ICL

30.9

26.6

24.1

22.7

OECD Total

33.6

29.8

27.6

25.9

10

Taxes on corporate incomeas % of total tax revenueOECD TotalMedium-sized OECD countriesLarge-sized OECD countriesSmall-sized OECD countries

1514131211109876528913891489158916891789189189109191291391491591691791891910210202302402502602702

Source: Revenue Statistics11

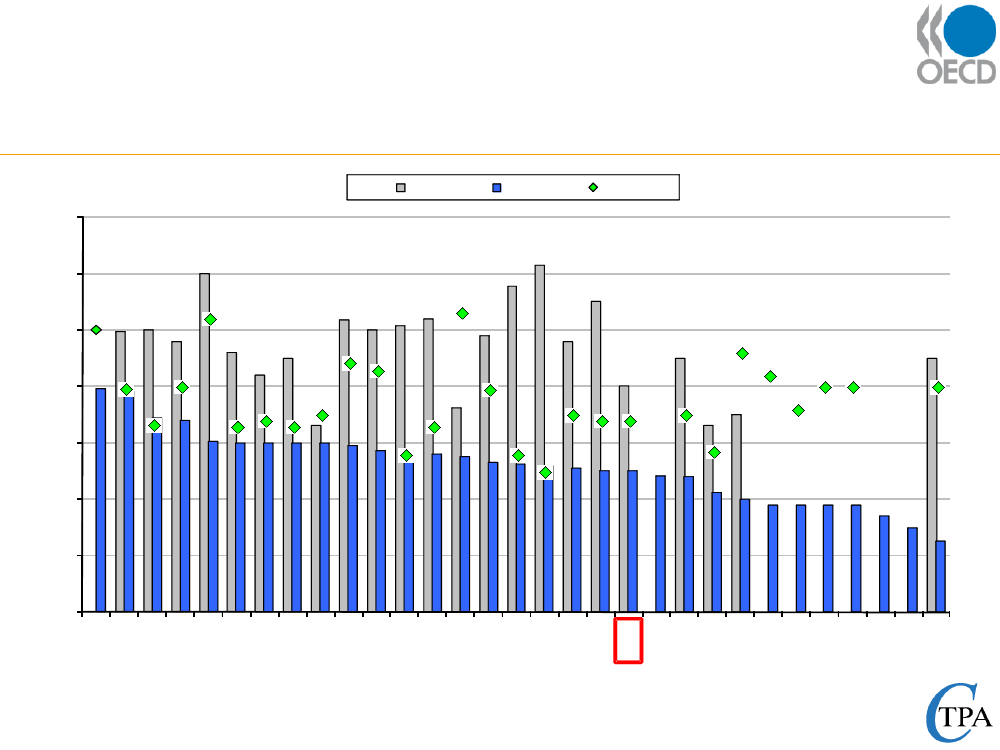

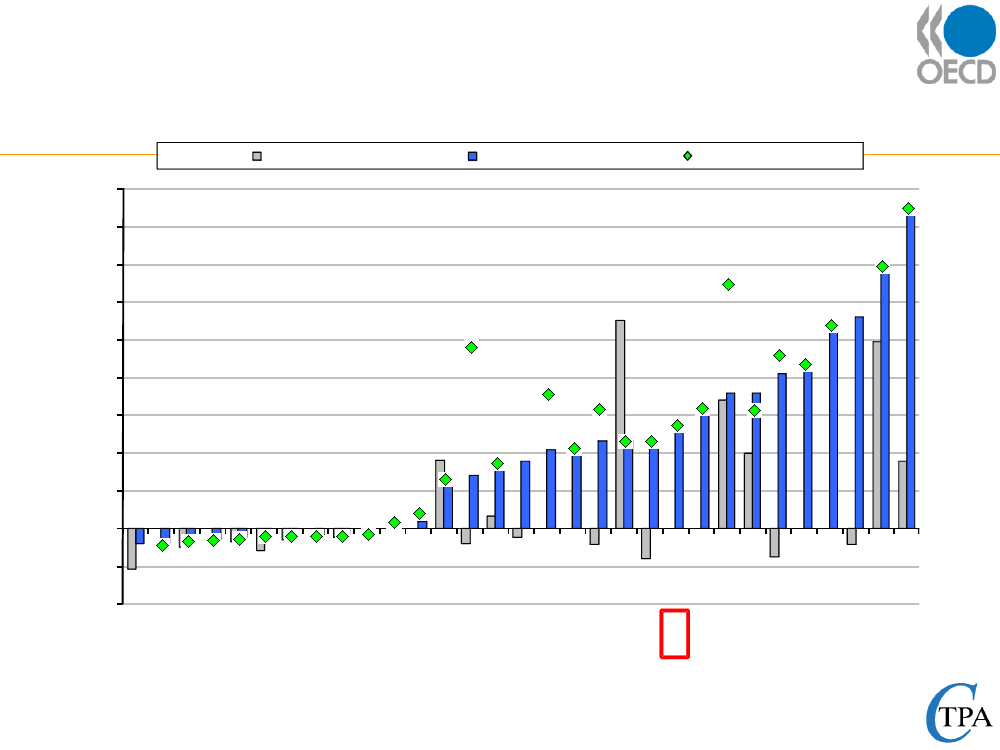

Top statutory marginal tax rates on dividend incomePart of CIT in overall tax rate on dividendsPart of PIT in overall tax rate on dividends

80706050403020100KU

Overall statutory tax rate on dividend income in 2000 and 2010; CIT part in 2000 and 2010

SU

LRI

ATI

NIF

XUL

IWS

NPJ

LZN

LEB

LOP

APS

ARF

DLN

TUA

TRP

LHC

SUA

RUT

EZC

LCI

EWS

RON

Source: OECD Tax Database: www.oecd.org/ctp/taxdatabase12

CRG

XEM

REG

ROK

KND

NAC

NUH

KVS

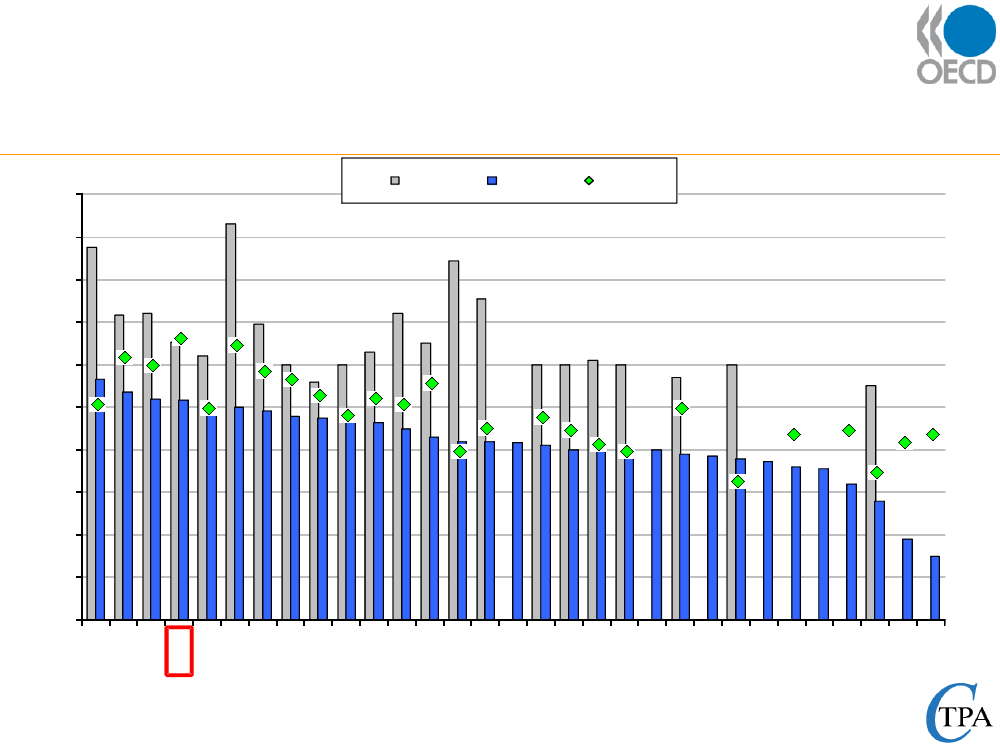

Trend towards more R&D tax incentiveslarge firms 1990large firms 2008SMEs 2008

0.450.400.350.300.250.200.150.100.050.00-0.05-0.10SULCIKULRINIFLZNIWSXULLOPNPJLEBATILHCDLNTUAEZCTRPAPSEWSXEMSUAREGCRGROKKNDNUHNACRONRUTARFKVS

13

Labour income taxation

14

15

100

10

20

30

40

50

60

70

80

90

0EWSLEBDLNKNDTUANPJNIFARFREGSUANACATIAPSTRPSU20091981

IWSLRICRGRONKULHCXULROKLZNLCINUHRUTLOPXEMKVSEZC

Top statutory personal income tax rates1994

Average tax wedge for single workers without childrenin Denmark (income from 50-250% of the AW) in 200970%60%50%40%30%20%10%0%050607080901010210310410510610710810910201202032042052

70%60%50%40%30%20%10%0%

em ployer SSC as % of total labour costsaverage local incom e tax as % of total labour costsfam ily benefits as % of total labour costsnet personal average tax rate as % of gross wage earnings

em ployee SSC as % of total labour costsaverage central incom e tax as % of total labour costsaverage tax wedge (sum of the com ponents)

16

Consumption taxes

17

VAT revenues (2007) and rates (2009)VAT revenue as % of total tax revenues (2007)VAT standard rate (2009)

302520151050KULCILRINIFATIIWSLZNLOPTRPDLNTUAEZCRUTARFXULAPSEWSXEMREGROKKNDSUAKVSNPJLEBCRGNUHRONNACSU

OECD average VAT revenue as % of totaltax revenue (net of US) in 2007: 18.6%

Source:18

Revenue Statistics (OECD)OECD Tax Database: www.oecd.org/ctp/taxdatabase

Property taxesrecurrent taxes on immovable property2.5%estate, inheritance and gift taxesrecurrent taxes on net wealthtaxes on financial and capital transactions

2.0%

1.5%

1.0%

0.5%

0.0%579167917918791791089189128913891489158916891789189189109191291391491591691791891910210202302402502602702

19

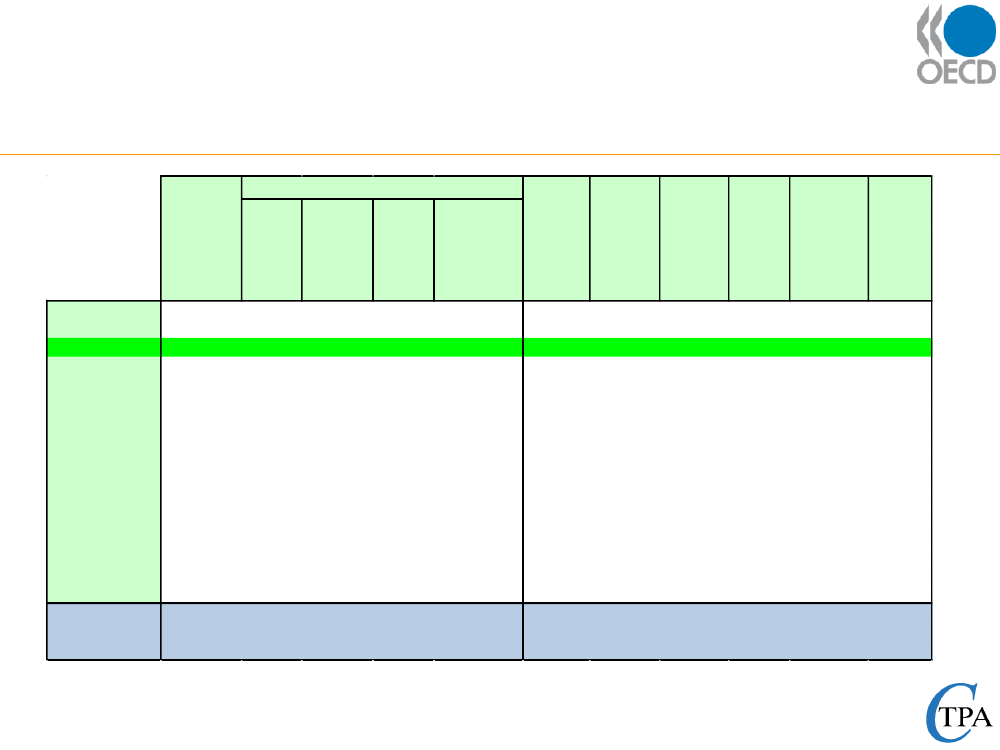

How does Denmark compare to otherOECD countries: overviewTopTop% OF TOTAL TAX REVENUESStatutory CorporateTAX / GDP Personal Corporate Social ConsumptionPersonal IncomeIncomeSecurityTaxTaxesIncome Tax RateTaxContrib.Tax Rate2008200720072007200720092010provisionalBelgiumCanadaDenmarkFinlandFranceGermanyIrelandItalyJapanNetherlandsNorwaySpainSwedenSwitzerlandUnited KingdomUnited StatesOECD averageG7 averageEU15 average

AverageEffectiveTaxCorporate W edgeTax Rate200526.428.4--20.725.431.510.926.031.725.124.226.120.925.123.929.0--28.0--200955.230.839.442.449.250.928.646.529.238.037.438.243.229.332.529.436.438.441.6

Top Rate StandardonVATDividendsRate20102009

44.332.248.342.843.136.428.343.228.3 (**)37.5 (**)42.133.047.129.435.726.935.8 (**)35.1 (**)39.7 (**)

29.337.451.730.317.025.128.425.619.620.422.119.830.935.330.138.125.327.625.5

8.211.07.49.06.86.110.98.816.88.726.012.47.910.69.411.010.810.09.0

31.014.42.027.737.036.615.430.036.436.220.832.626.123.318.423.425.228.028.2

25.223.633.630.124.729.336.125.218.029.928.425.526.622.629.216.630.923.829.5

53.746.451.649.147.847.541.044.950.052.040.043.056.541.750.0 (*)41.941.545.546.5

34.029.525.026.034.43 (#)30.212.527.539.5425.5 (#)28.030.026.321.228.0 (**)39.226.2 (#)32.6 (#)26.9 (#)

43.921.048.25.056.525.040.522.055.9 (#)19.648.619.048.421.536.620.045.65.044.125 (#)19.048.225.042.616.048.425.036.97.654.020.0(***)49.5-41.7 (#)17.648.3 (#)13.945.3 (#)19.9

20