Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

Organisation for Economic Co-operation and Development

Challenges in business taxationand tax havensPresentation to Danish ParliamentariansParis, 9 September 2010Jeffrey OwensDirector of the Centre for Tax Policy and AdministrationOrganisation for Economic Co-operation and Development[email protected]

Centre for Tax Policy and Administration

TRACE Project – Treaty Relief andCompliance Enhancement

•

••••2

New phase of work ongoing since 2006 to developstreamlined procedures for treaty relief on investmentincome, coupled with enhanced compliance through robustinformation reporting and automatic exchange ofinformation.Discussion drafts in 2009 and 2010 on best practices,documentation recommendationsKey focus – international harmonisation and workability.Strong CFA support, coordination with parallel EU work.Win-win-win for investors, financial intermediaries,governments.

Tax and Development

Monterrey:We reduce debt and increase aid; youmobilise domestic resources.OECD approach:– Give LDC access to TIEAs/TDA.– Get real consensus on transfer pricing.– Improve transparency of MNEs.– strengthen tax administration, increase statebuilding and governance and reduce aiddependency.

3

Moving from Tax Co-operation to Tax Co-ordination between Tax Administrations

•••••

Progress on the "Enhanced Relationship"Joint AuditsVoluntary Compliance InitiativesImproving Taxpayer ServicePutting Tax Compliance into the Boardroom

4

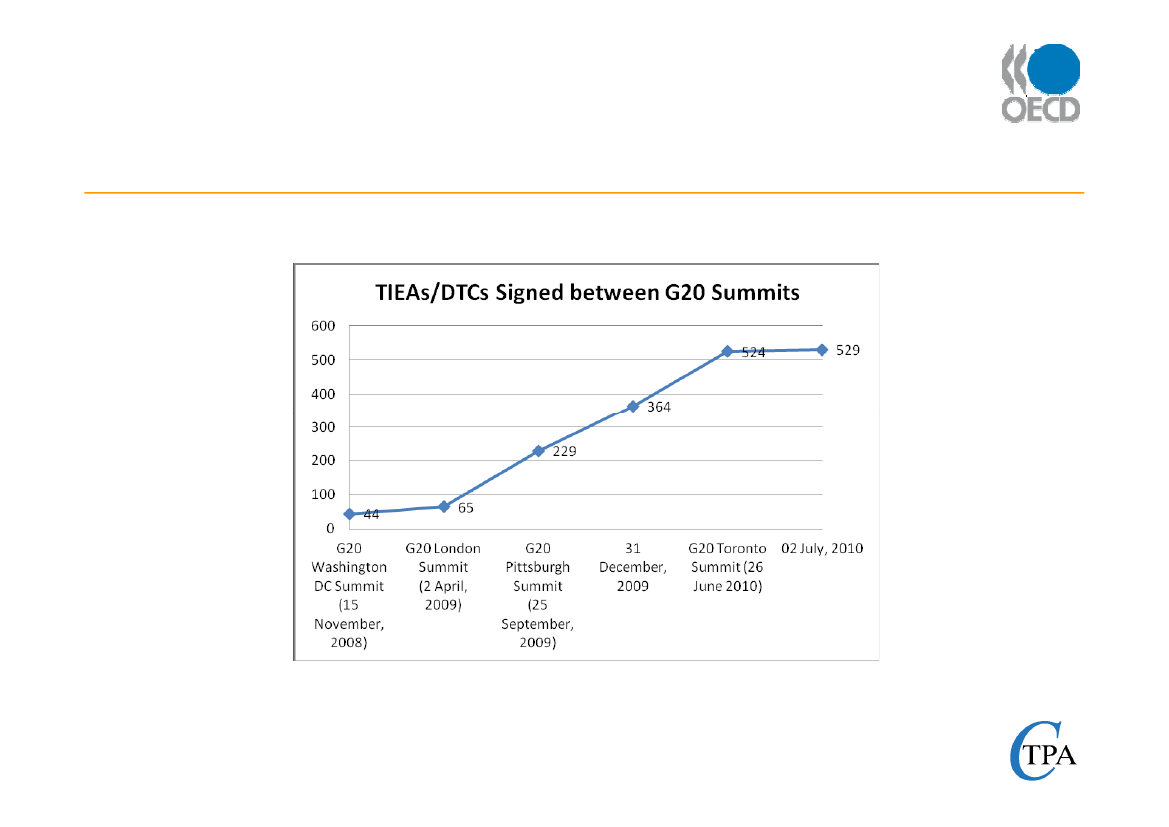

2009: A YEAR OF UNPRECEDENTEDPROGRESS

•••••5

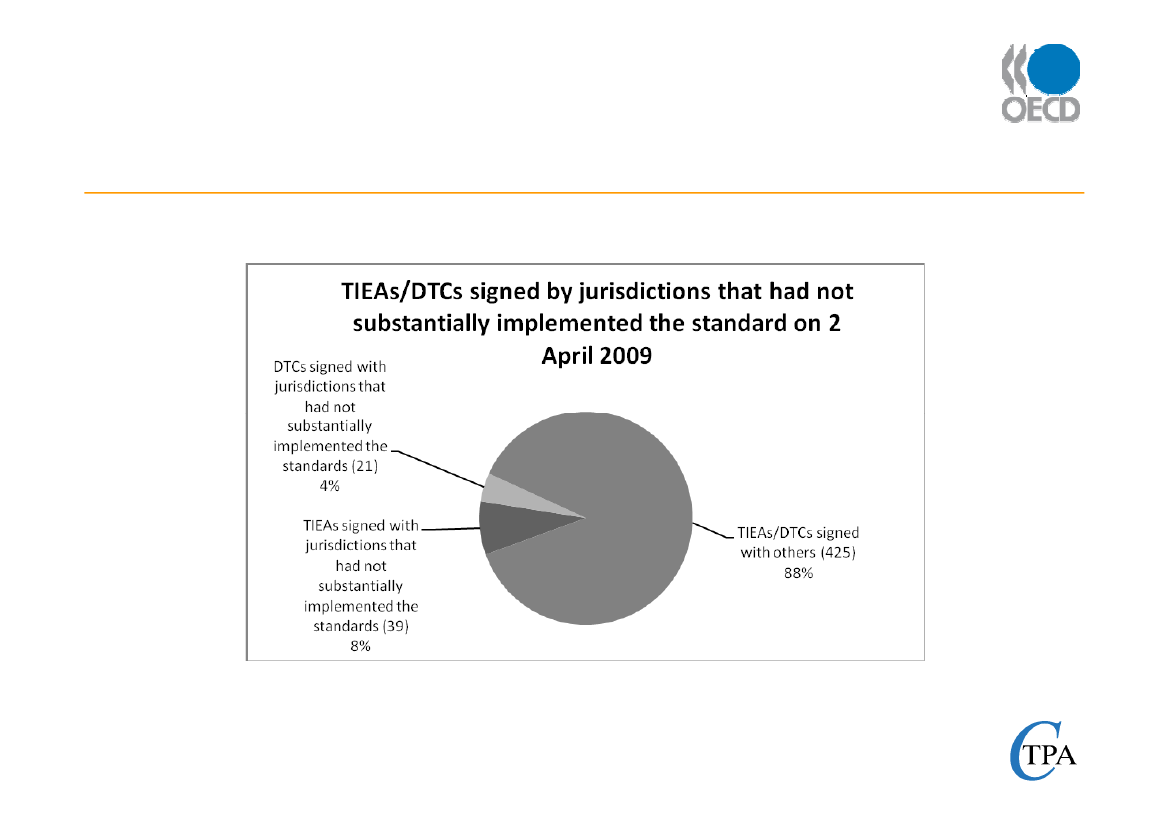

On 2 April 2009 the G20 agreed to take actionagainst non-cooperative jurisdictions, including taxhavens .OECD Secretariat publishes Progress Report onimplementing internationally agreed tax standard.OECD principles on transparency and exchangeof information now universally accepted.As stated by the G20 leaders “The era of banksecrecy (for tax purposes) is over”.A new era of transparency begins.

6

7

A PROGRESS REPORT ON THE JURISDICTIONS SURVEYED BY THE OECD GLOBALFORUM IN IMPLEMENTING THE INTERNATIONALLY AGREED TAX STANDARD1Progress made as at 2ndJuly 2010 (OriginalProgress Report 2ndApril 2009)Jurisdictions that have substantially implemented the internationally agreed tax standardAndorraAnguillaAntigua and BarbudaArgentinaArubaAustraliaAustriaThe BahamasBahrainBarbadosBelgiumBermudaBrazilBritish Virgin IslandsCanadaCayman IslandsChile2ChinaCyprusCzech RepublicDenmarkDominicaEstoniaFinlandFranceGermanyGibraltarGreeceGrenadaGuernseyHungaryIcelandIndiaIndonesiaIrelandIsle of ManIsraelItalyJapanJerseyKoreaLiechtensteinLuxembourgMalaysiaMaltaMauritiusMexicoMonacoNetherlandsNetherlands AntillesNew ZealandNorwayPolandPortugalRussian FederationSt Kitts and NevisSt LuciaSt Vincent and the GrenadinesSamoaSan MarinoSeychellesSingaporeSlovak RepublicSloveniaSouth AfricaSpainSwedenSwitzerlandTurkeyTurks and Caicos IslandsUnited Arab EmiratesUnited KingdomUnited StatesUS Virgin Islands

Jurisdictions that have committed to the internationally agreed tax standard, but have notyet substantially implementedJurisdictionYear ofNumber ofJurisdictionYear ofNumber ofCommitment AgreementsCommitment AgreementsTax Havens3BelizeCook IslandsLiberiaMarshall IslandsMontserratBruneiCosta RicaGuatemala20022002200720072002200920092009(4)(11)(1)(3)(3)(9)(1)(0)NauruNiuePanamaVanuatu2003200220022003(0)(0)(2)(2)

Other Financial CentresPhilippinesUruguay20092009(0)(5)

Jurisdictions that have not committed to the internationally agreed tax standardJurisdictionNumber ofJurisdictionNumber ofAgreementsAgreementsAll jurisdictions surveyed by the Global Forum have now committed to the internationally agreed taxstandard1.

8

The internationally agreed tax standard, which was developed by the OECD in co-operation with non-OECD countries and which was endorsed byG20 Finance Ministers at their Berlin Meeting in 2004 and by the UN Committee of Experts on International Cooperation in Tax Matters at itsOctober 2008 Meeting, requires exchange of information on request in all tax matters for the administration and enforcement of domestic tax lawwithout regard to a domestic tax interest requirement or bank secrecy for tax purposes. It also provides for extensive safeguards to protect theconfidentiality of the information exchanged.2.Excluding the Special Administrative Regions, which have committed to implement the internationally agreed tax standard.3.These jurisdictions were identified in 2000 as meeting the tax haven criteria as described in the 1998 OECD report.

NEW CARDS, NEW GAME, NEW GLOBALFORUM!

•

Mexico, September 2009, more than 70 delegations agreedto:Restructure and expand the OECD Global Forum: Nowcomprises 90+ countries including all OECD and G20members.Establish an in-depth peer review process to monitorprogress towards full and effective exchange ofinformation: peer reviews commenced in March 2010.Identify mechanisms to speed-up the negotiation ofagreements and enable developing countries to benefitfrom the new, more cooperative tax environment:multilateral negotiations, updated COE/OECDConvention.

•••

9

Convention on Mutual AdministrativeAssistance in Tax Matters upgraded

•The exchange covered by the 1988 Convention was•Response to G20 calls: upgrade the Convention to bring itin line with the standard on exchange of information andopen it up for signature to non-members.subject to limitations existing in domestic laws of thesignatories.

•OECD and CoE Secretariat worked together in a co-•

operative spirit, at times recognizing difference inapproach and perspective.Role of PACE, and of PACE Rapporteur, instrumental infinding consensus on thorny issues.

10

Tax information exchange agreements:the international standard

The international standard on EOI is set out in:

othe 2002 OECD Model Agreement on Exchange ofInformation on tax matters, and its Commentary.oArticle 26 of the OECD Model Tax Convention on Incomeand on Capital, and its 2005 Commentary.

The standard requires :

oexchange of information on request where “forseeablyrelevant” to administration or enforcement of all tax matters.owithout regard to a domestic tax interest, bank secrecy, ordual criminality.owith safeguards to protect taxpayers rights andconfidentiality.

11

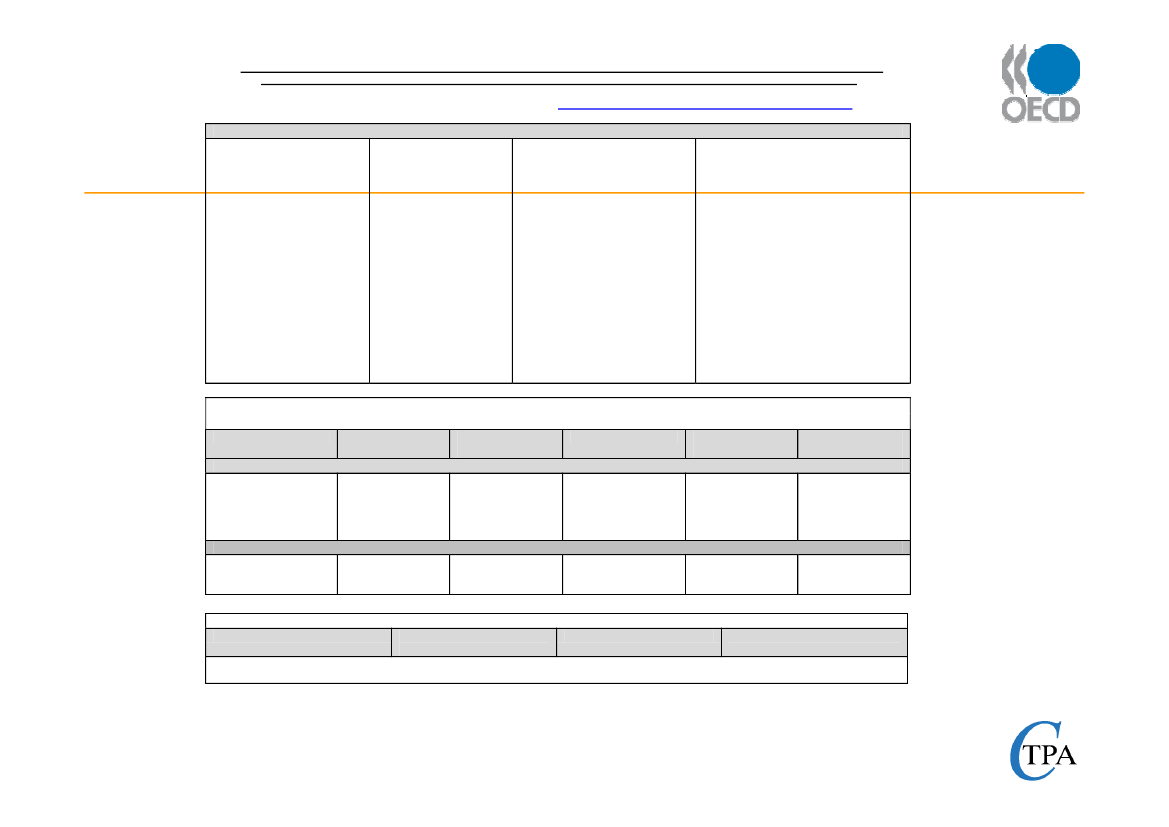

Future development: from signing toimplementation: PEER REVIEW

Will shift focus from signing agreements to actualimplementation.Will take account of quality of agreements and relevance ofpartners (not a numbers game).Will identify impediments to effective exchange ofinformation through robust, transparent and fair peerreview mechanism.Peers reviews launched on 1stMarch 2010.

12

PEER REVIEW

2 Phases of peer review:

Phase 2 includes an on-site visit.All jurisdictions covered by 2009 assessmentwill be subject to peer review, as well as otherrelevant jurisdictions.

oPhase 1 will focus on legal framework;oPhase 2 will focus on practical implementation.

13

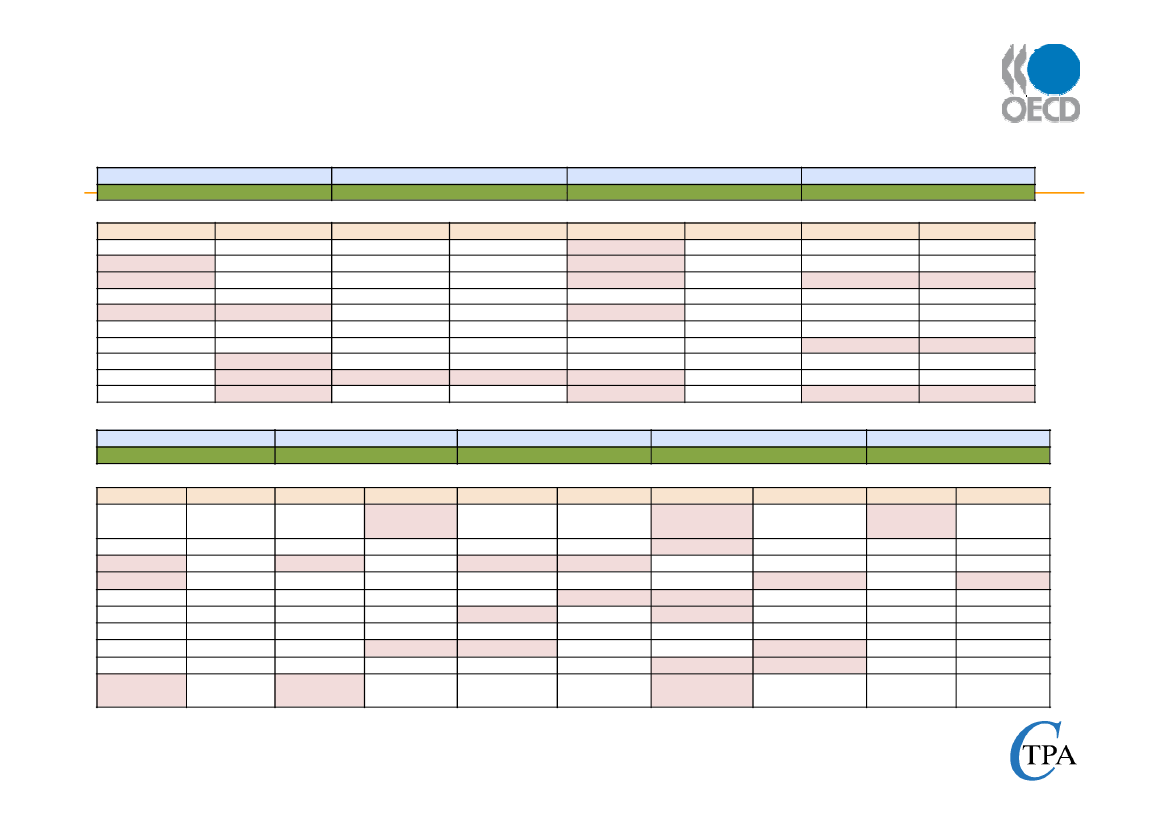

SCHEDULE OF PEER REVIEWS20101stHalf20102ndHalf20111stHalf20112ndHalfPhase 1AustraliaBarbadosBermudaBotswanaCayman IslandsGhanaIrelandMauritiusNorwayQatarPhase 1CanadaDenmarkGermanyIndiaJamaicaJerseyMonacoPanamaSeychellesTrin. and TobagoPhase 1BelgiumFranceIsle of ManItalyLiechtensteinNew ZealandSan MarinoSaudi ArabiaThe BahamasUnited StatesPhase 1BahrainEstoniaGuernseyHungaryJapanPhilippinesSingaporeSwitzerlandArubaUnited KingdomPhase 1AnguillaAntigua and BarbudaTurks and CaicosAustriaBritish Virgin IslandsIndonesiaLuxembourgNetherlandsNetherlands AntillesSaint Kitts and NevisPhase 1AndorraBrazilBruneiHong Kong, ChinaMacao, ChinaMalaysiaSpainUnited Arab EmiratesUruguayVanuatuPhase 1ChileChinaCosta RicaCyprusGibraltarGreeceGuatemalaKoreaMexicoMontserratPhase 1Cook IslandsCzech RepublicGrenadaLiberiaMaltaRussian FederationSaint LuciaSlovak RepublicSouth AfricaSt. Vincent and the Gren.

20121stHalf

20122ndHalf

20131stHalf

20132ndHalf

20141stHalf

Phase 1SamoaArgentinaBelizeDominicaIsraelMarshall IslandsNauruNiuePolandUS Virgin Islands

Phase 1TurkeyPortugalFinlandSwedenIcelandSlovenia

Phase 2BelgiumBermudaCayman IslandsCyprusGuernseyMaltaQatar

Phase 2

Phase 2

Phase 2MalaysiaSamoaSlovak RepublicSloveniaU. S. Virgin IslandsVanuatuIndonesia

Phase 2AnguillaAntigua and BarbudaChileChinaCosta RicaGuatemalaKoreaMexicoMontserratTrinidad and Tobago

Phase 2AndorraBotswanaGhanaGrenadaIsraelLiberiaRussian FederationSaint Kitts and NevisSaint LuciaSt. Vincent and the Gren.

Phase 2BelizeDominicaMarshall IslandsNauruNiueSaudi ArabiaCook IslandsPortugalUruguayAruba

Phase 2Czech RepublicGibraltarHungaryNetherlands AntillesPoland

British Virgin Islands Bahrain, Kingdom ofAustriaHong Kong, ChinaIndiaLiechtensteinLuxembourgMonacoPanamaSwitzerlandEstoniaJamaicaPhilippinesArgentinaTurks and CaicosUnited Arab EmiratesBarbadosBruneiMacao, China

Phase 2BrazilSeychelles

San MarinoSingaporeThe Bahamas

14

Want to know more?

•Visit the OECD stand at IFA•Look at the CTPA Brochure•Visit our websitewww.oecd.org/tax

15