Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

Taxation and EconomicGrowthStudy for WP1, March 2008Joint work between the Economics Departmentand the Centre for Tax Policy andAdministration, OECD

1

Aims of the OECD study

Does the tax structure, as opposed to thelevel of taxes, matter for GDP per capita?- Overall tax levels reflect societal choices about the level and structureof public spending.- Investigating which tax structures are likely to be least costly for growthis a key issue for tax policy making.

To what extent do different tax provisionsaffect investment and productivity (TFP)?Does the industry/firm structure matter forthe impact of taxes?22

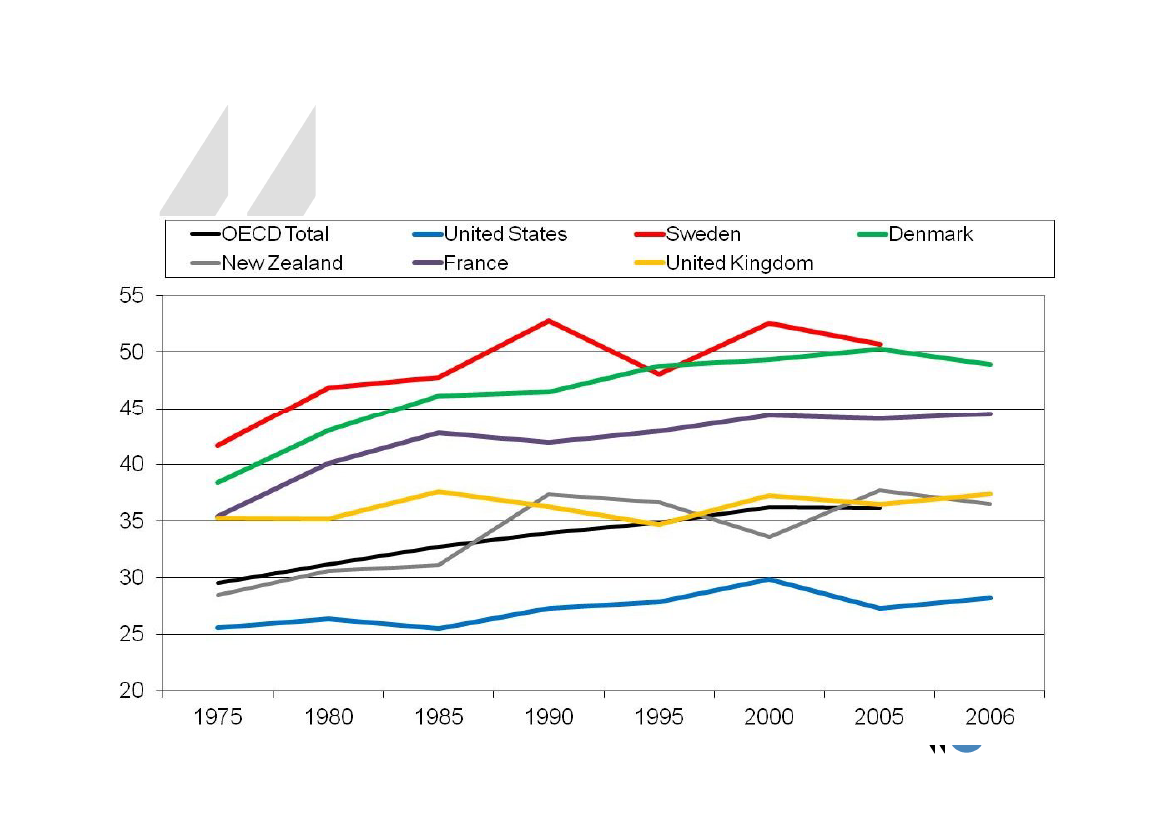

Increase in tax to GDP ratio

3

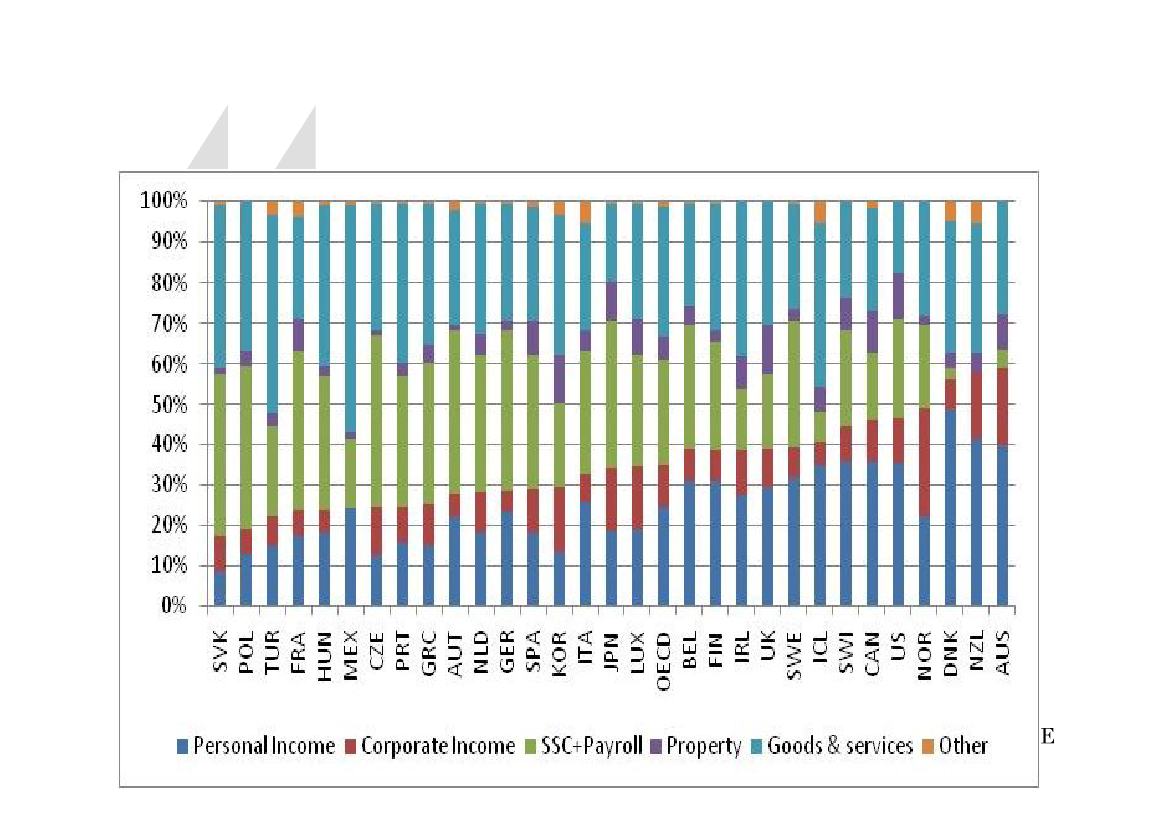

3 main sources of tax revenues: income taxes, SSCand consumption taxes, but large variation.

4

Do differences in tax structures matter for growth?

Why is it important to get the mix and the design oftaxes right?The distortionary effects of collecting revenue from differentsources can be very different.Re-designing taxation within the broad categories could insome cases also ensure sizeable efficiency gains.

1.

2.

1.2.

Empirical strategy:Cross-country analysis of the effect of tax structure on growthCloser look at underlying mechanisms by using firm andindustry data and analyse the effects of taxes on productivityand investment.5

Cross-country findings: Broad tax structure

The evidence suggests a “taxand growth ranking”with property taxes (particularly recurrent taxes onresidential property) being the least harmful tax interms of reducing long-run GDP per capita, followedby consumption taxes, personal income taxes andcorporate income taxes.Progressivityin personal income taxes seems toreduce GDP per capita.

6

6

Taxes and productivity

Corporate (statutory/effective) taxestend to impactproductivity negatively and seem to matter more inhighly profitable/risky industries.Statutory corporate taxes seem to have asmallernegative impact on productivity growth in firms thatare bothyoung and small.- large share of start-ups with zero/low profits for which corporate taxesdoesn’t matter much.

Statutory corporate taxes seem to have astrongernegative impact on productivity growth in‘dynamic’/fast-growing firms,that are profitable andexperiencing rapid productivity growth.77

Taxes and productivity

R&D tax incentivesseem to increase productivity andseem to matter more in R&D intensive industries,although the effect is moderate.High top marginal personal income tax ratesreduceproductivity growth, especially in industriescharacterised by high entry rates of newfirms/entrepreneurial activity

8

8

Taxes and investment

Corporate (statutory/effective) taxes affectinvestmentnegatively bydecreasingthe after-taxreturn to investment projects.The effect of corporate taxes on reducinginvestment seems to bestronger in older firms.

-younger firms are less profitable than older; young firms benefit formtargeted exemptions or reduced rates.

9

9

Policy implications of the findings: Broad structure

Broad simplistic implication for the tax structure:Revenue neutral shift towards more use ofconsumption and property taxes (particularlyresidential) and less income taxes, needs to be put intoperspective of each country’s tax system. Distributionalconcerns can be an obstacle: consumption taxes lessprogressive than income.Reducing income tax progressivity: Trade off betweenenhancing GDP per capita and increasing net wageinequality1010

Policy implications of the results: Corporate taxes

Cutting corporate taxes could positively affectinvestment. It is possible that product marketregulations and large administrative burdens on firmscan make investment decisions less responsive totaxes.Cutting corporate taxes may also promoteproductivity growth.Exemptions for small/young firms may not beefficient in raising investment and productivity.Effect on equity is hard to assess.1111

Policy implications of the results: Personalincome taxes

Countries with a large share of industries with highentrepreneurial activity/turnover rates (or wishing tomove in this direction) may gain from reforming theirtop marginal tax schedule. However, this could increaseinequality.

12

12

Key policy issues from the literature

Broadening the base of consumption taxes is better forgrowth than increasing the rate.There is limited scope to improve growth by usingmultiple consumption tax rates, and their equity effectsare best achieved by other means.Lower average labour taxes could help raiseparticipation rates while lower marginal tax rates may bepreferable for increasing hours worked.In-work tax credits can promote growth by increasingparticipation rates, but care is needed to contain costsand minimise adverse effects on hours worked.13

Conclusions

GDP per capita can be increased, by shifting awayfrom income taxesRecurrent taxes on immovable property are the leastharmful to growthIt is necessary to design individual taxes well inorder to benefit most from any tax shiftThere is likely to be a trade-off between growth andequity.

14

Full report: ‘Tax and Economic Growth’, EconomicsDepartment Working paper No. 620.

http://www.oecd.org/dataoecd/58/3/41000592.pdf

Overview chapter in Going for Growth, 2009.

15