Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

Potential growth andfiscal consolidation inthe medium termVisit of the Danish Parliament’s TaxCommittee,8 September 2010Sven BlondalMacroeconomic Policy DivisonEconomics DepartmentOECD

Organisation of presentation• How are potential growth rates likely toevolve in the medium term?• Can policy influence future potentialgrowth rates?• How will fiscal consolidation affect futurepotential growth?

2

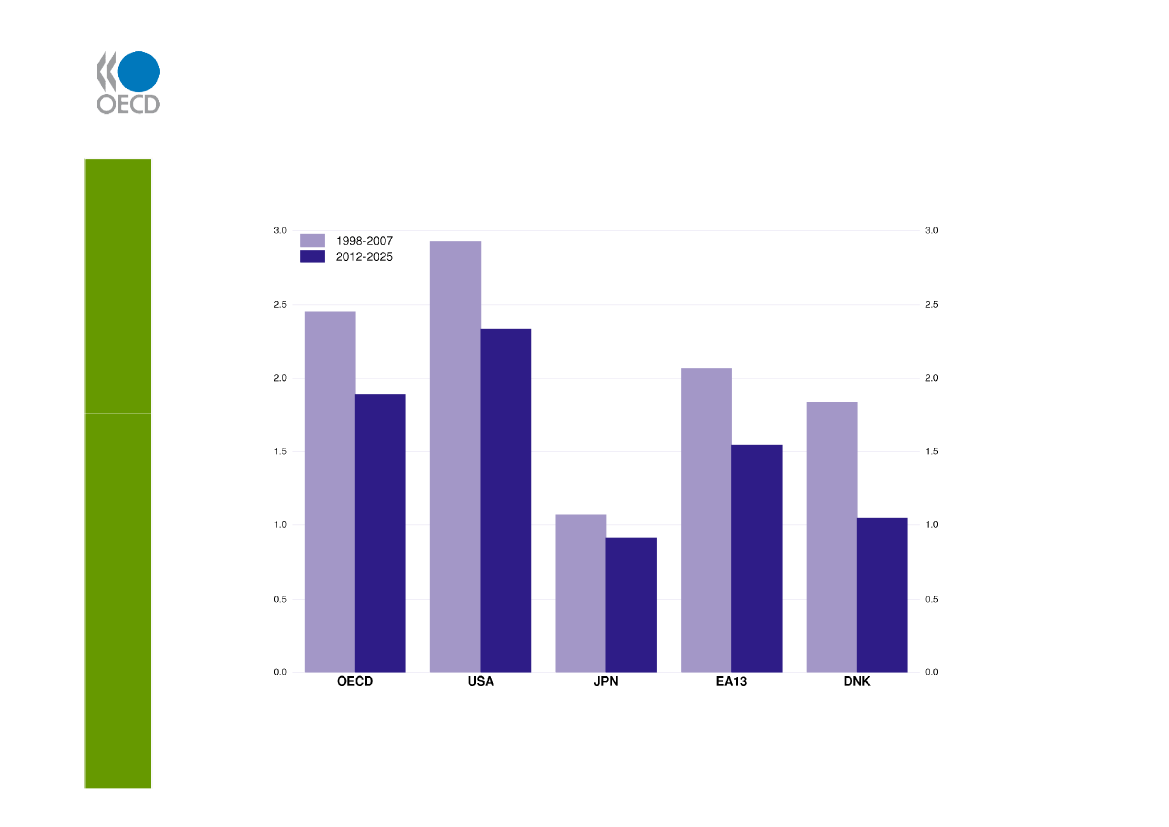

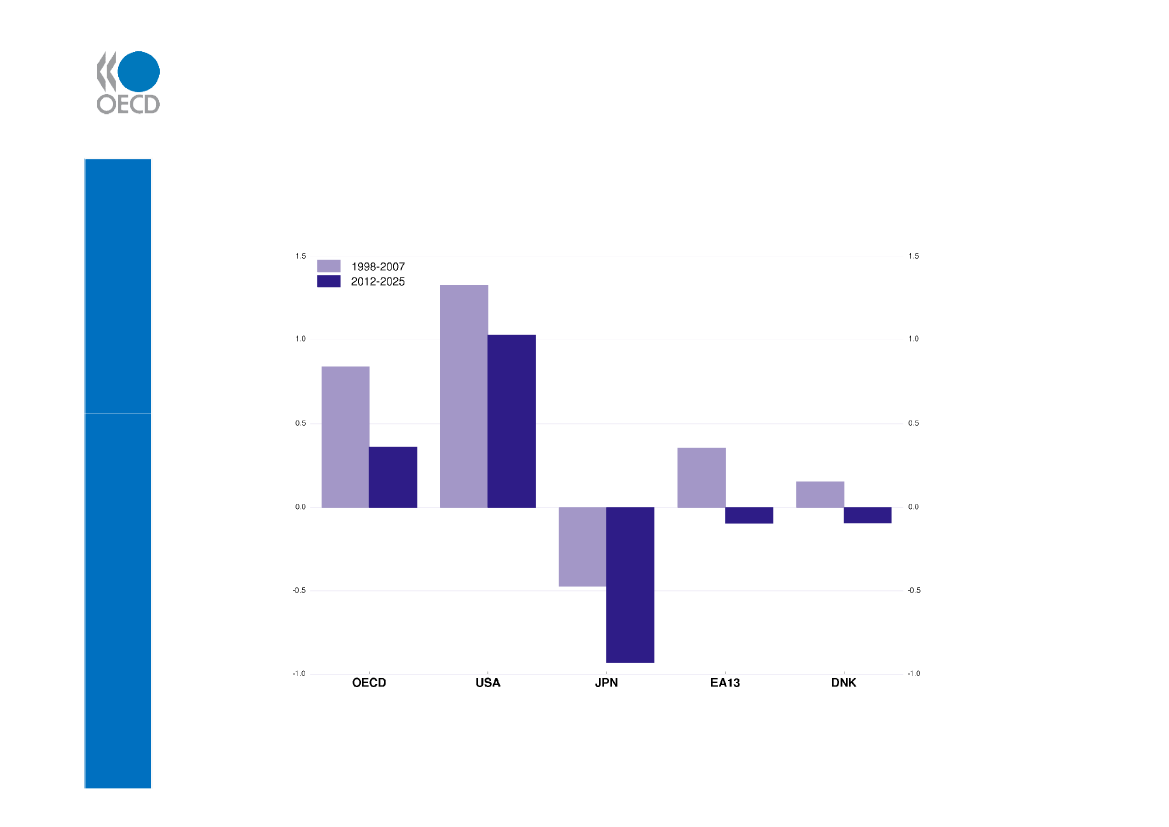

Potential growth rates will fall in themedium term …Average annual growth rate (%)

Potential growth prospects

3

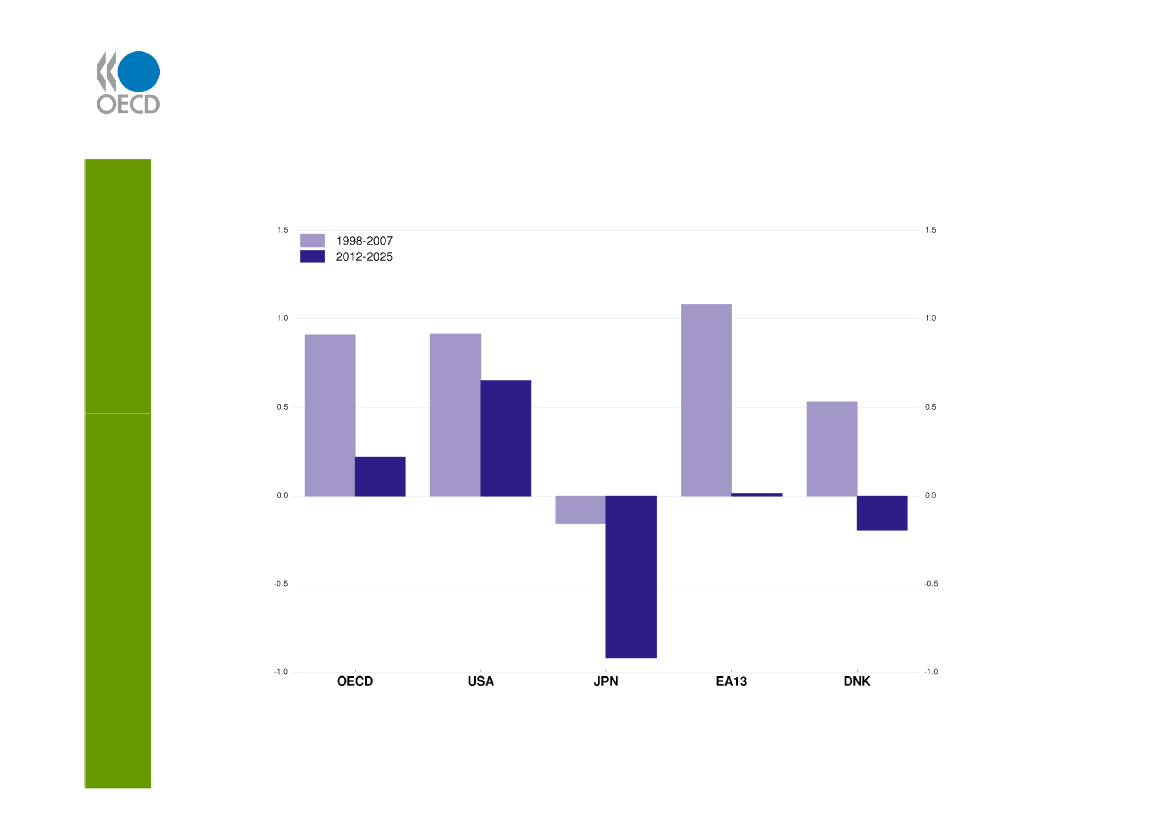

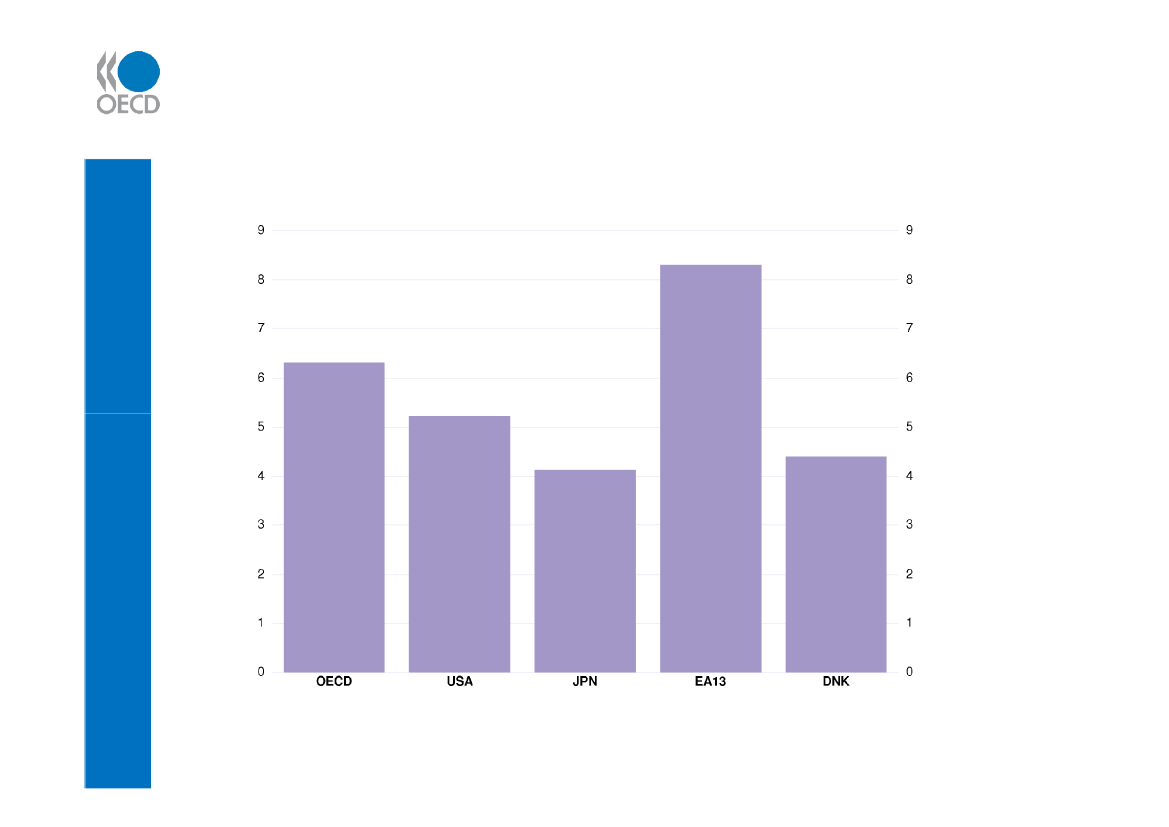

…because employment growth is likelyto fall …Potential employment, average annual growth rate (%)

Potential growth prospects

4

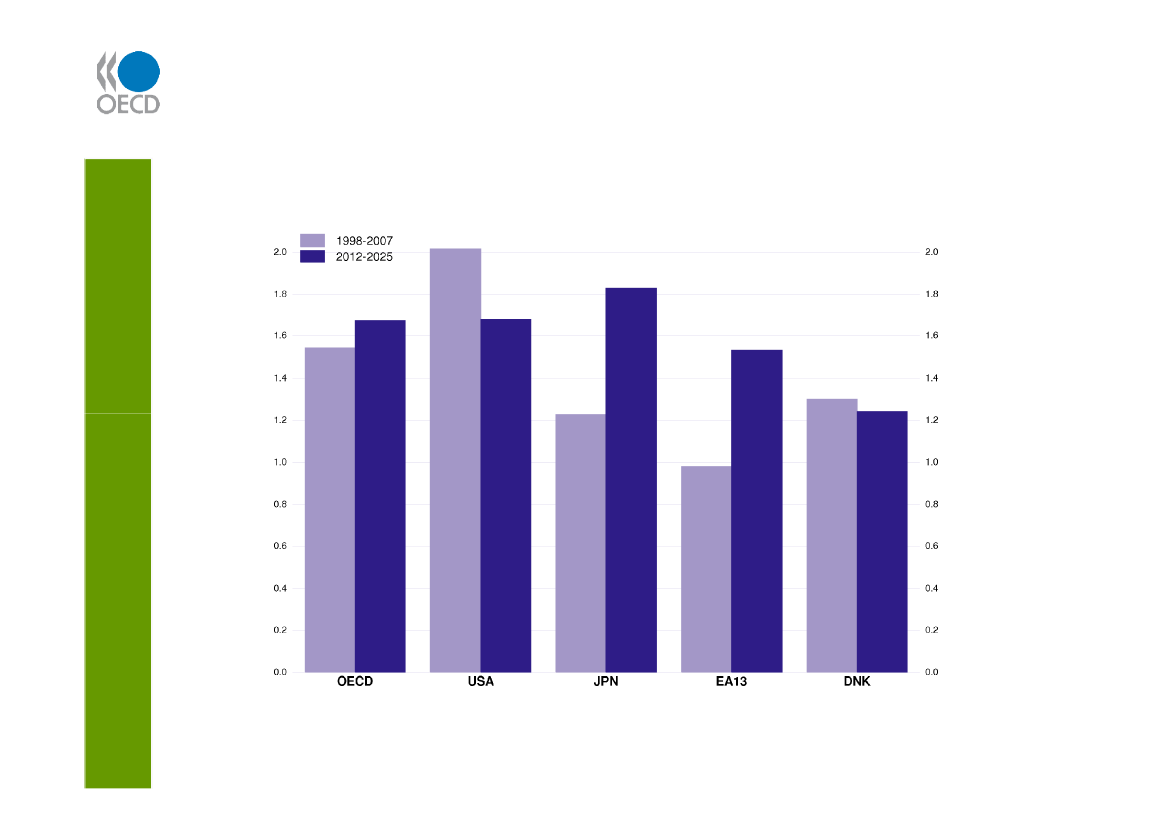

…while labour productivity growth couldincrease in some countries/areasOutput per employed person, average annual rates

Potential growth prospects

5

Can structural policies influencepotential growth rates?Policy and potential growth• Can structural policies affect potentialemployment growth?– Working-age population– Participation rates– Structural unemployment rates– Average hours worked

• Can such policies affect productivity growth?– Investment and capital intensity– “Underlying” productivity growth6

Policy cannot affect growth of the working-agepopulation in the medium termWorking-age population, annual average growth rate (%)

Policy and potential growth

7

Policy can influence structural unemploymentrates …% of the labour force, 2009

Policy and potential growth

8

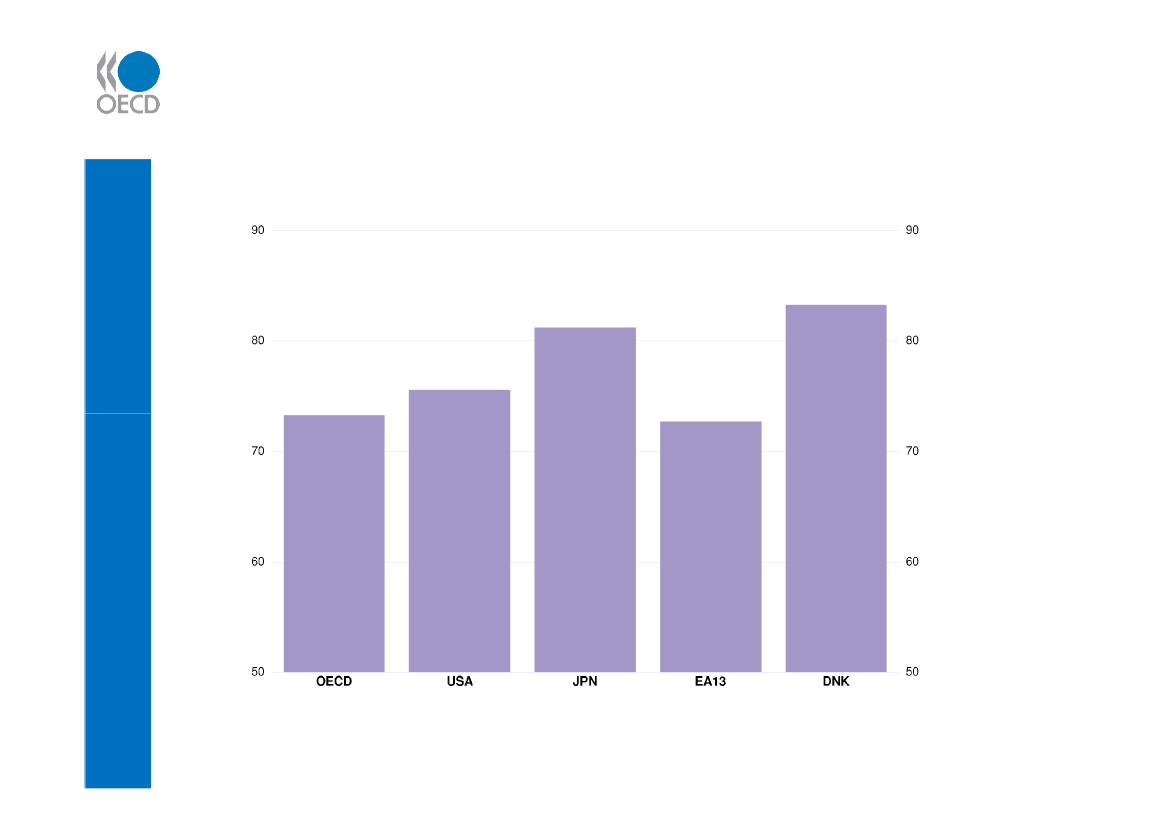

… labour-force participation rates …% of working-age population, 2008

Policy and potential growth

9

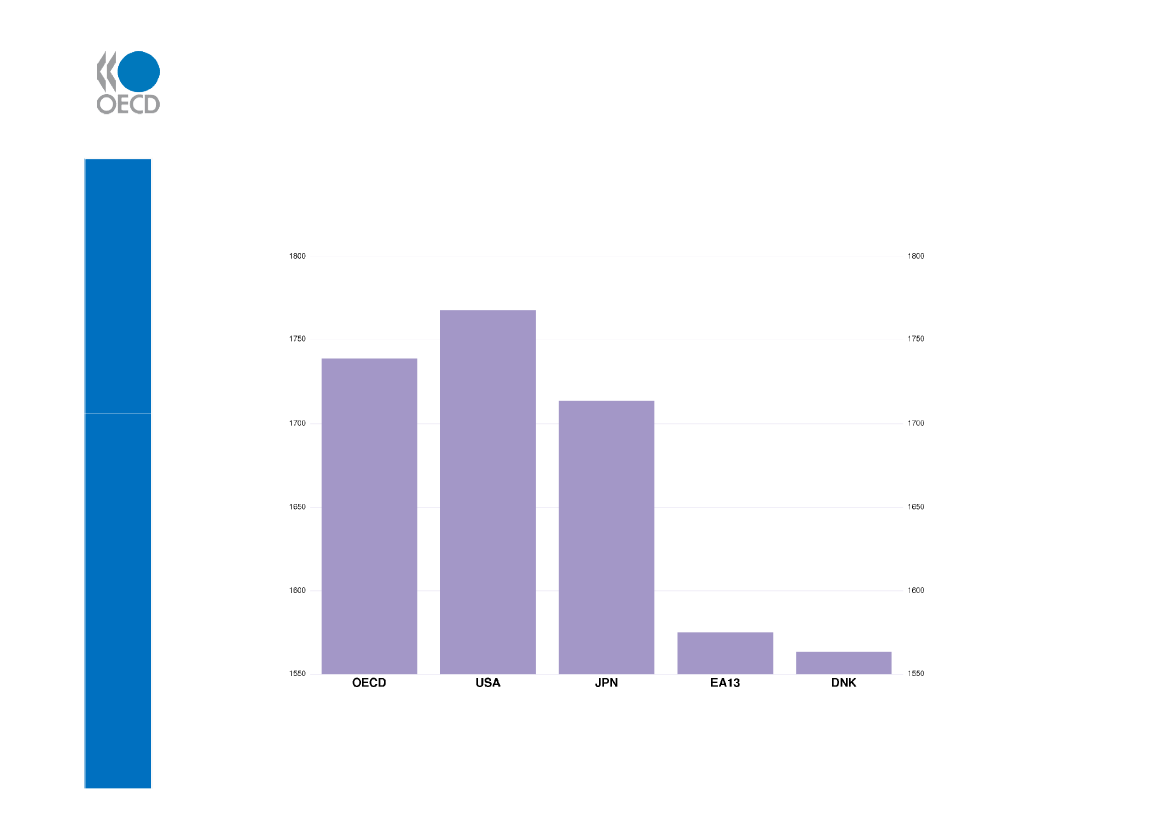

… and average hours worked per personAverage annual hours worked per employed person, 2008

Policy and potential growth

10

Policies to raise productivity growth in themedium termPolicy and potential growth• Easing of competition-restraining regulationsin product markets.• Reform of education policies can strengthenhuman capital accumulation.• Tax policies can influence the cost of capitaland entrepreneurship.

11

Going for Growth recommendations forDenmark• Reduce marginal taxeson labour income.• Reform sickness leaveand disability benefitschemes.• Enhance thecompetition framework.• Improve the efficiencyof the education system.• Reduce housingsubsidies and abolishrent regulation12

Policy and potential growth

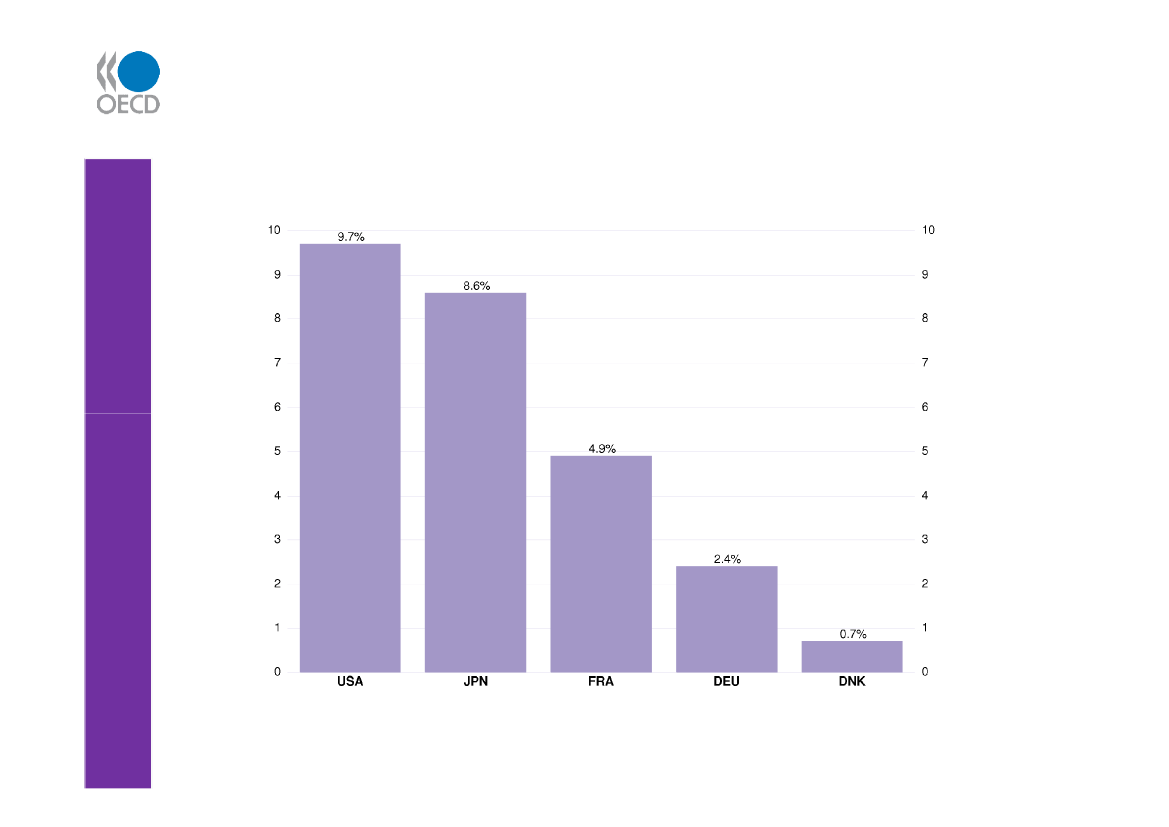

Budget consolidation requirementsConsolidation and potential growthCumulative budget tightening to stabilise debt ratios by 2025,per cent of potential GDP

13

Slow consolidation may raise interest ratesConsolidation and potential growth• Stabilising public debt ratios only very gradually wouldimply additional increases in debt levels and possiblyhigher interest rates could in turn depress privateinvestment and productivity growth.• Bringing debt ratios back to pre-crisis levels wouldimply very strong consolidation in the short term andcould lower interest rates, and thus raise investmentand productivity growth, but at the cost of a weakereconomy in the short run.

14

The composition of consolidationConsolidation and potential growth• Spending cuts or tax increase? There are practical andfundamental reasons for relying on spending cuts, buttax increases may also have a role to play.• Composition of spending cuts:– Public consumption: Cuts will be necessary. However, avoidreducing outputs of growth-friendly public services byexploiting scope for efficiency improvements.– Public transfers: Remove subsidies to businesses unless theyare efficiency improving and exploit scope to reduce socialbenefit spending without compromising equity objectives.– Public investment: Avoid reducing investment that isprofitable on the basis of cost-benefit analysis.

• Composition of tax increases: Next presentation.15

16