Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

CO2-differentiation in motor vehicle taxesPresentation for the Danish Parliament’s Tax Committee08.09.10

Nils Axel BraathenOECD, Environment Directorate

1

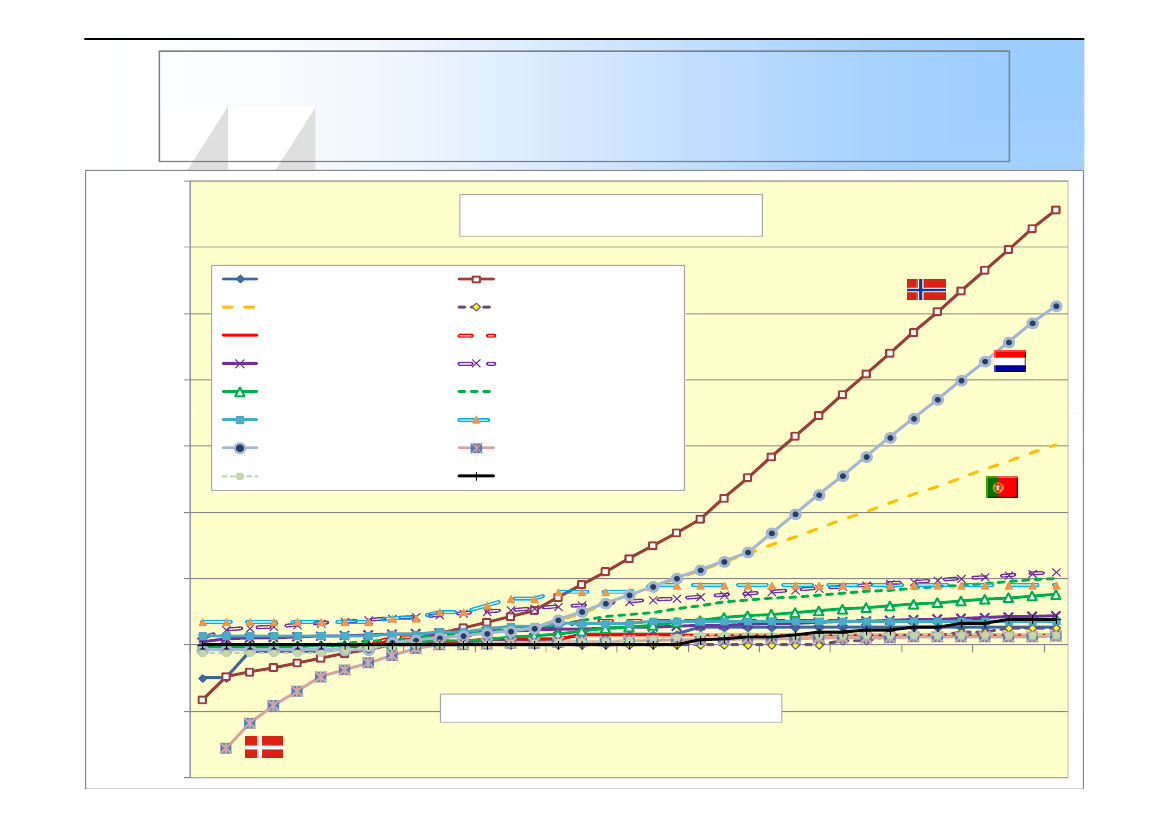

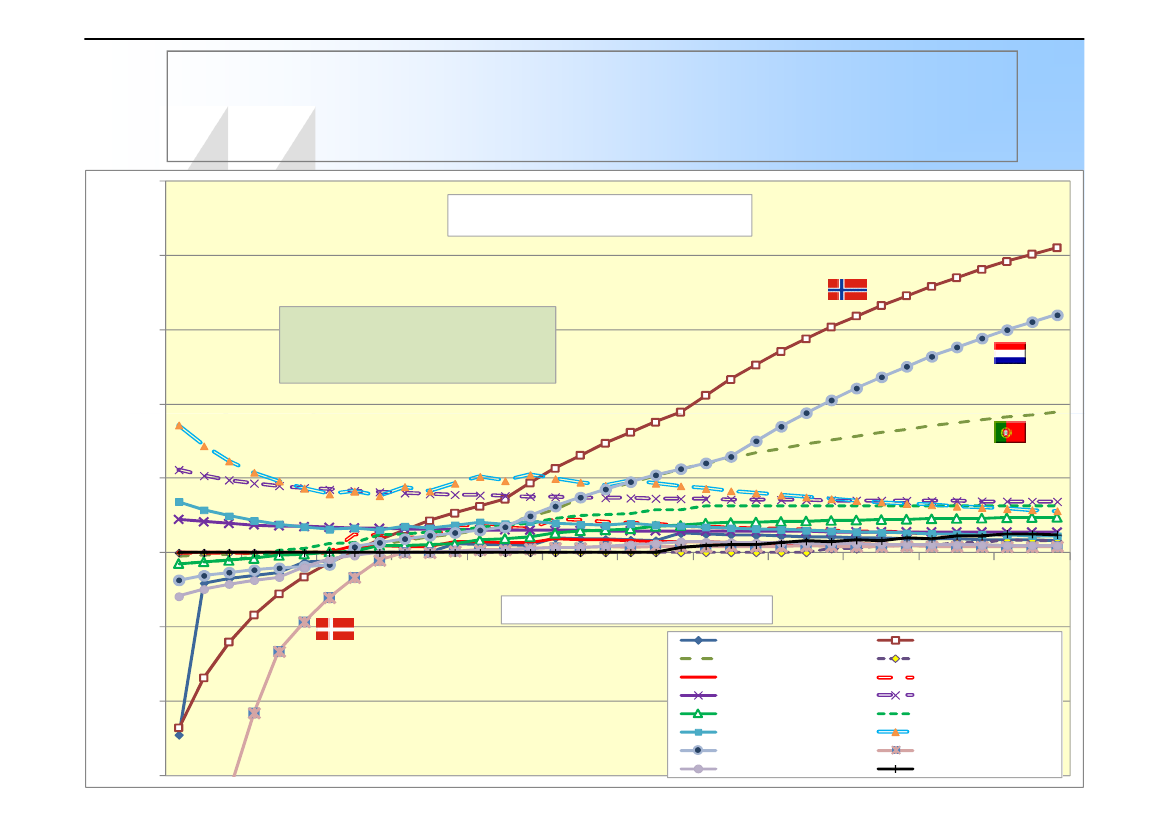

One-off taxes on motor vehicles€ per vehicle70,000

Petrol-driven vehicles60,00050,00040,000€ per vehicle30,00020,00010,0000

FrancePortugalSpain -- 10,000€Finland -- 10,000€Austria -- 10,000€Ireland -- 10,000€NetherlandsBelgium -- Wallonia

NorwayCanadaSpain -- 25,000€Finland -- 25,000€Austria -- 25,000€Ireland -- 25,000€DenmarkUSA

1-10,000-20,000

71

101

131

161

191

221

251

281

311

341

3712

400

gram CO2emitted per km driven

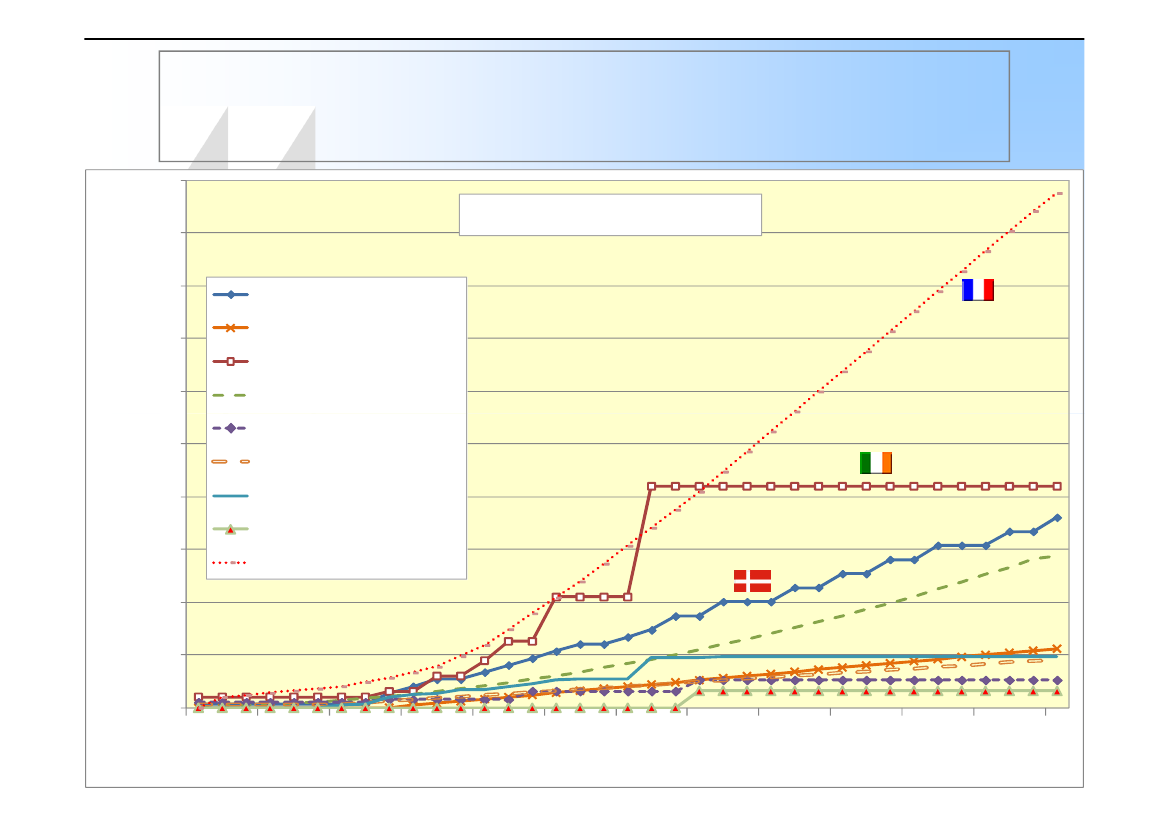

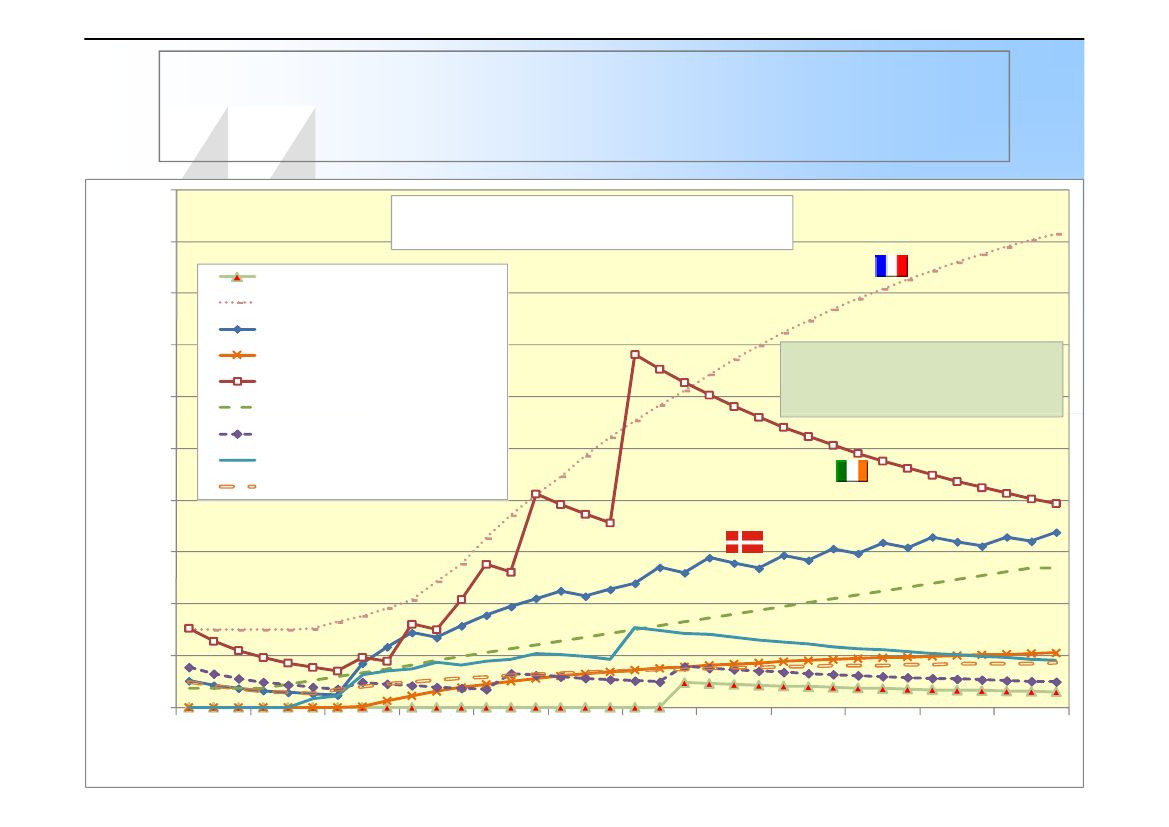

Annual taxes on motor vehicles€ per year5,0004,5004,0003,5003,0002,5002,0001,5001,0005000

Petrol-driven vehiclesDenmarkGermanyIrelandLuxembourgPortugalSwedenUKFrance (big polluters)France (company cars)

€ per year

1

71

101

131

161

191

221

251

281

311

341

3371

400

gram CO2emitted per km

Calculating tax per tonne CO2emittedover the lifetime of the vehicle

If one assumes that– all vehicles are driven 200,000 km during their lifetime– the lifetime of a vehicle is 15 years (for the annual taxes)

one can calculate the taxes expressed per tonneCO2that the vehicle will emit during its lifetime.

4

Calculating tax per tonne CO2emittedover the lifetime of the vehicleIIExample 1:

The Danish one-off tax for petrol-driven vehicles is reduced 4000DKK per km the vehicle can be driven per litre petrol, over andbeyond 16 km per litre – and it is increased by 1000 DKK per kmless than 16.16 km per litre ~ 6.25 litre per 100 km ~ 146 gram CO2per kmA car that goes 20 km per litre (5 litre per 100 km, ~117 gram CO2per km), gets a subsidy of 4*4000 DKK ~ 2150€200,000 * 117 = 23,400,000 gram = 23.4 tonne2,150€ / 23.4 ~92 €in subsidy per tonne CO2this vehicle will emitover its lifetime.This car will emit 5.8 tonne CO2lessthan a car that goes 16 km/l.2,150€ / 5.8 =371€ per tonne CO2“saved”.5

One-off taxes on motor vehicles€ per tonne CO2emitted over the lifetime of the vehicle1,000

Petrol-driven vehicles€ per tonne CO2emitted during the vehicle's lifetime

800

600

The calculations assumethat each vehicle is driven200 000 km over its lifetime

400

200

0

51

81

111

141

171

201

231

261

291

321

351

381

-200

gram CO2emitted per kmFrancePortugalSpain -- 10,000€Finland -- 10,000€Austria -- 10,000€Ireland -- 10,000€NetherlandsBelgium -- WalloniaNorwayCanadaSpain -- 25,000€Finland -- 25,000€Austria -- 25,000€Ireland -- 25,000€6DenmarkUSA

-400

-600

Calculating tax per tonne CO2emittedover the lifetime of the vehicleIIIExample 2:A petrol-driven passenger car able to go between 9.1 and 10.0km per litre petrol is in Denmark taxed 6480 DKK per year ~870€ per year.870€ * 15 = 13,050 € in tax payments over the lifetime.Assuming it goes exactly 10 km per litre, it emits ~234 gramCO2per km driven.200,000 km * 234 g CO2/km ~ 46.8 tonne CO2emitted over thelifetime.13,0510 / 46.8 =279 € per tonne CO2emitted over the lifetime.7

Annual taxes on motor vehicles€ per tonne CO2emitted over the lifetime of the vehicle1,000€ per tonne CO2emitted over the vehicle's lifetime

9008007006005004003002001000

Petrol-driven vehiclesFrance (big polluters)France (company cars)DenmarkGermanyIrelandLuxembourgPortugalUKSwedenThe calculations assume thateach vehicle is driven 200 000 kmover a lifetime of 15 years.

51

81

111

141

171201231261291gram CO2emitted per km

321

3518381

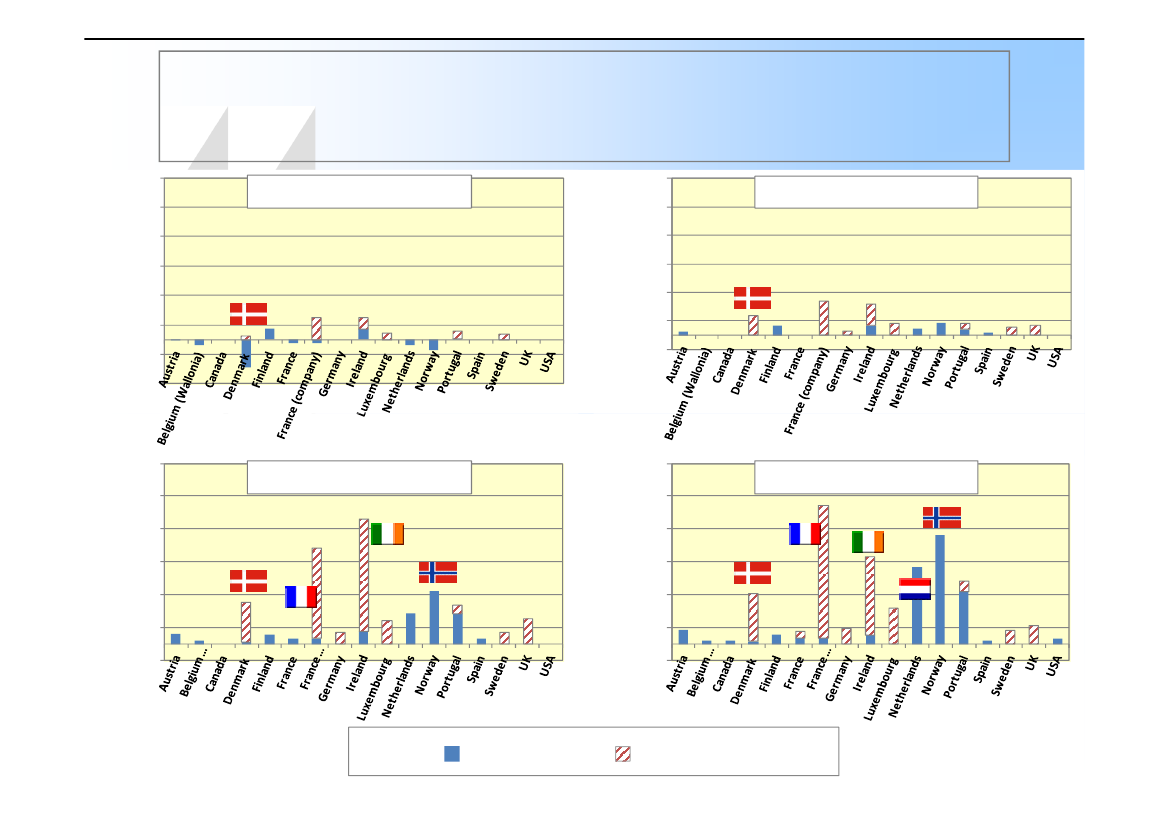

Total tax per tonne CO2emitted over avehicle’s lifetime1,100€ per tonne CO2emitted over the vehicle lifetime€ per tonne CO2emitted over the vehicle lifetime

900700500300100-100-300

100 gram CO2per km

1,100900700500300100-100

180 gram CO2per km

1,100€ per tonne CO2emitted over the vehicle lifetime

900700500300100-100

€ per tonne CO2emitted over the vehicle lifetime

230 gram CO2per km

1,100900700500300100-100

330 gram CO2per km

9