Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

Carbon Markets UpdateDanish Parliament Tax Committee8 September 2010, Paris

Christa ClappOECD Environment Directorate

1

Emission trading schemesMajority of OECD countries are participating in an ETS (EU ETS or others), or areengaged in the discussion/planning phase...but face considerable challenges.CountryEUNorwayNew ZealandETSEU ETS (2005)ETS (2005, linked to EU ETS 2008)National forestry sector (2008),Energy, Fishing, Industry, LiquidFossil Fuels (2010)Participation in EU ETS (2005; 2007for Bulgaria & Romania)Linked to EU ETS through EFTA(2008), also linked to Swiss tradingsystemRegional: RGGI (2009)Voluntary: CCX (2003)Voluntary: JVETS (2005)Regional: Tokyo ETS(2010)Voluntary: emissions trading (2008)Regional: NSW (2003)California (2012, but potential delays),WCI (2012-2020), Midwest Regional GHG ReductionAccord, National discussions (delayed)National discussions (delayed)Linking with EU ETSNational discussions (delayed)National scheme in addition to EU ETS (delayed)Regional: Alberta offset market (2007)National discussions (delayed),Linking with WCI (2012-2020)Six states observers to WCIDiscussions of how to acheive 2020 targetOther sectors planned: synthetic gas, waste (2013) andagriculture (2015)Planned/Discussions

Malta, Cyprus, Slovenia, Estonia,Latvia, Lithuania, Bulgaria, RomaniaLiechtenstein

US

JapanSwitzerlandAustraliaUKCanadaMexicoKorea

2

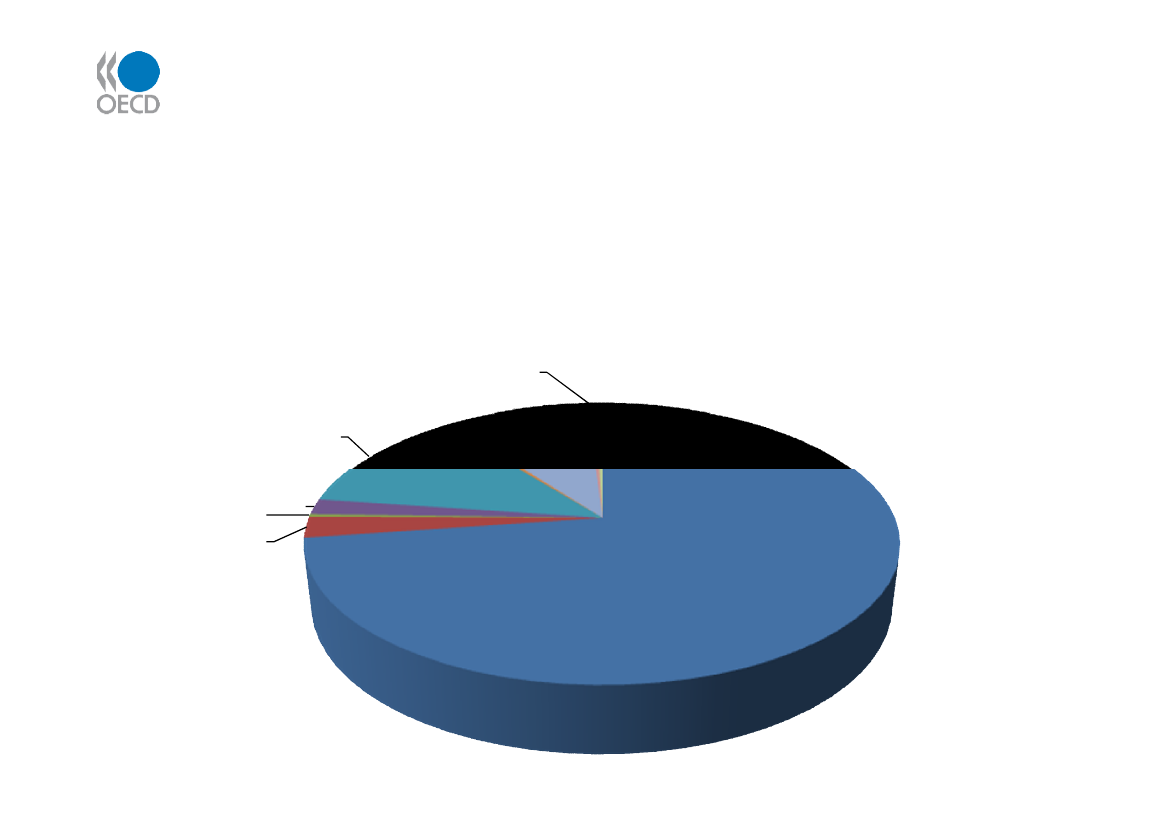

Existing carbon marketExisting carbon market in 2009:– Total value = 144 billion USD– Total volume = 8.7 GtCO2e (44% of 2005 Annex I emissions)

Share of carbon market volume in 2009CCX

0.5%

Spot & secondary

Kyoto offsets

12.1%

JI AAUs

1.8%

0.3%

CDM

2.4%

EU ETS

72.7%

NSW

0.4%

RGGI

9.3%

Voluntary

market

0.5%

Source: World Bank, State and Trends of the Carbon Market 2010

3