Skatteudvalget 2009-10

SAU Alm.del Bilag 291

Offentligt

Presentation to Danish ParliamentariansParis, 9 September 2010Jeffrey OwensDirector of the Centre for Tax Policy and AdministrationOrganisation for Economic Co-operation and Development[email protected]

Green taxes

Jens Lundsgaard

Examples of tax expenditures:production•Tax deductions for depletion of oil and gas fields and coal deposits:e.g. producers in US can deduct a fixed percentage of gross revenue;amounted to US$ 0.6 billion. Termination proposed in 2011 budget.

•

Accelerated tax depreciation allowances for capital equipment:depending on the royalty and tax regime for fossil fuel production, taxdeduction of depreciation at a faster rate than that at which equipmentbecomes economically obsolete can represent an indirect subsidy.e.g. for oil sands in Canada annual cost of tax advantage is 0.02% of GDP.Phased-out by 2015.

•

Tax exemption for fossil fuel producers’ own energy use:common in most OECD countries for coal mining, oil extraction, refineries, etc.e.g. in Germany estimated to be worth 0.01% of GDP.2

Examples of tax expenditures:consumption•Low tax rates or exemptions on diesel for agriculture & fisheries:US$ 8 billion for agriculture sector in OECD countriesUS$ 1.1 billion for fisheries sector in OECD countries

•

Reduced VAT rates and VAT exemptions, eg for heating fuels:e.g. Italy, Korea, UK

•

Automatic tax cuts and subsidies when fuel prices rise:in Mexico – with low oil prices, leads to net revenues, but with high oilprices in 2008 led to subsidies amounting to 1.8% of GDP.

•

Tax exemptions to fuel used by public sector:e.g. France had excise duty exemptions for natural gas used for heatingby public agencies and fuel used by military, but recently been stopped.3

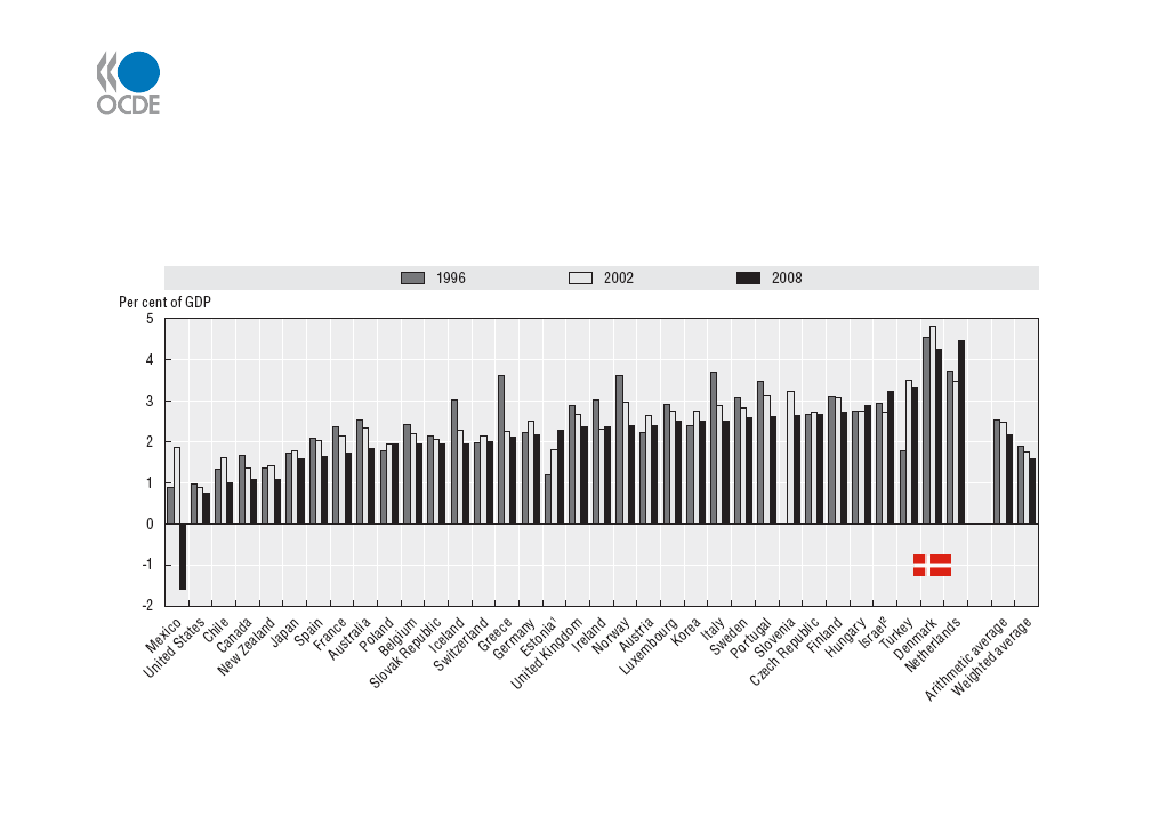

High Danish revenues fromenvironmentally related taxes …

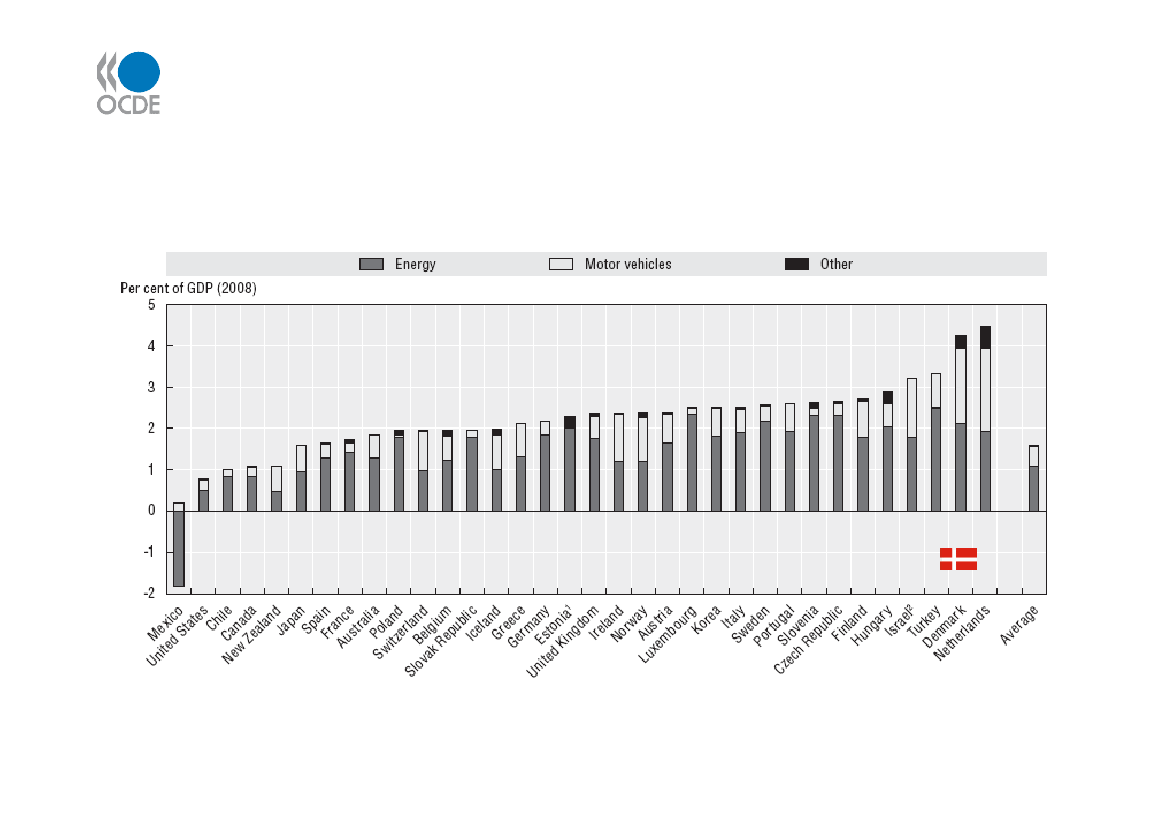

… but most is due tohigh taxes on motor vehicles

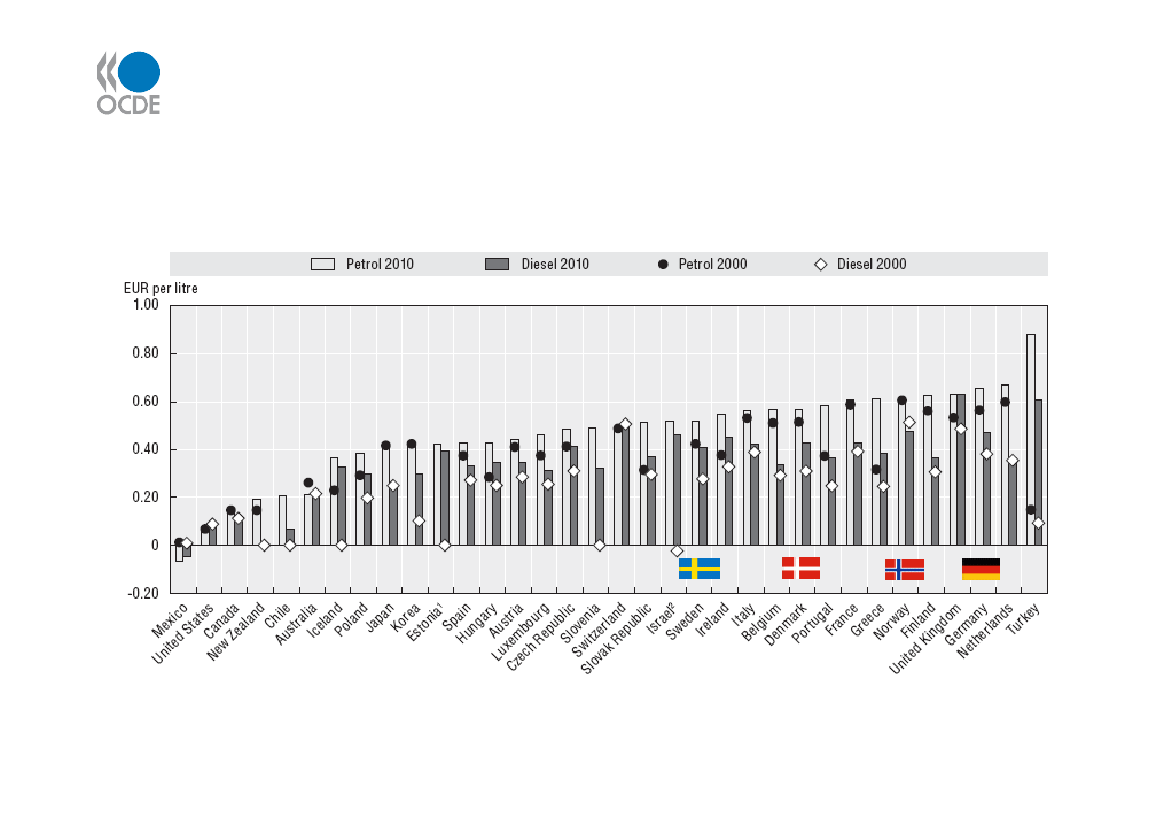

Tax rates on petrol and dieselsimilar to neighbouring countries

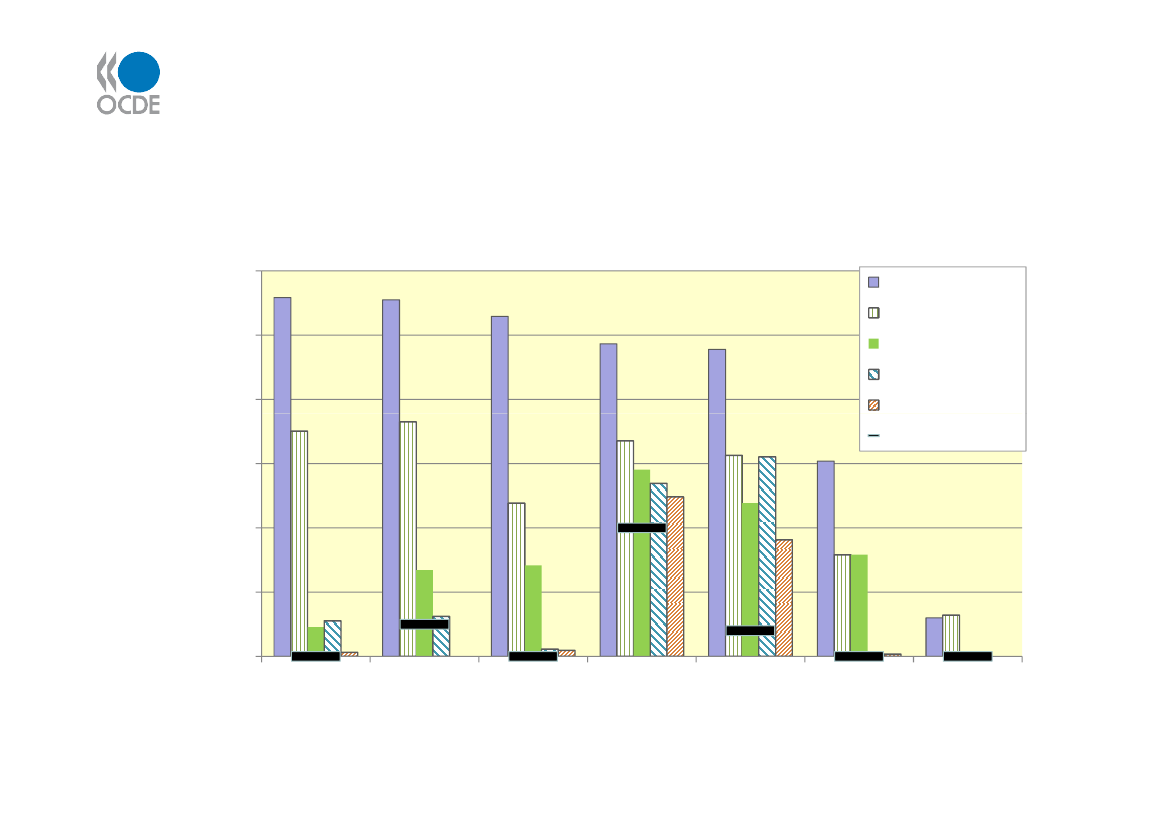

Total tax on CO2emissions– from explicit CO2taxes andfrom CO2taxes and excise duties combined300250200PetrolDieselHeating oilNatural gasCoalOnly carbon tax150100500GermanyNorwayBelgiumSwedenDenmarkJapanU.S.

€ per tonne CO2

The Post-Copenhagen Tax Agenda•A renewed interest in CO2Taxes•Tax implications of Tradable Permits•Using tax measures to promoteenvironmentally friendly innovation•Reviewing fossil fuel subsidies“GREEN” and “GROWTH”

can be COMPATIBLE